THE UGANDA TEA STORY June 26 TH 28

- Slides: 25

THE UGANDA TEA STORY June 26 TH – 28 TH 2019 Kampala, Uganda BY: ADRINE KOBUSINGYE CHAIRPERSON BOD – IGARA GROWERS TEA FACTORY

Contents 1. Self-introduction 2. Uganda Tea Industry Cyclic Growth 3. Uganda Tea sub-sector setup 4. Tea in Uganda’s economy 5. Uganda Tea Uniqueness 6. Challenges, Opportunities and room for improvement in the tea sector.

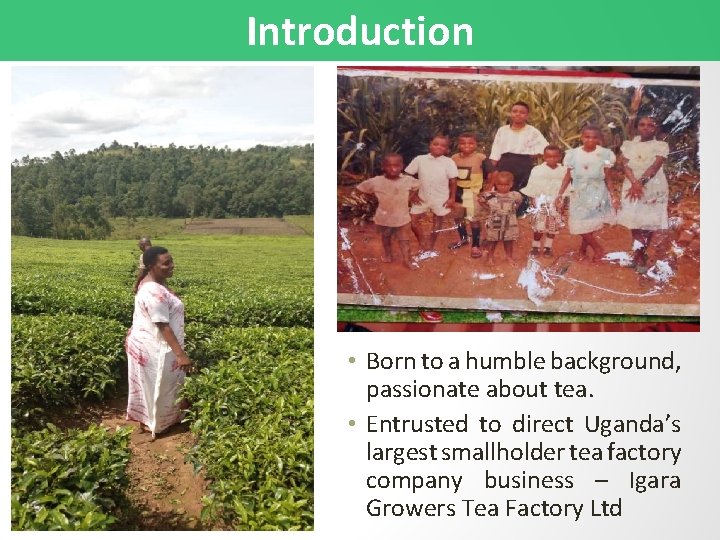

Introduction • Born to a humble background, passionate about tea. • Entrusted to direct Uganda’s largest smallholder tea factory company business – Igara Growers Tea Factory Ltd

Background of Tea Growing in Uganda Tea seeds were imported by the British government from India through the Royal Botanical Gardens in England planted at the Botanical Gardens, Entebbe in 1900. Tea became an important crop in Uganda from 1945 onwards as large private tea estates were developed by Europeans and Asians. In 1960 s, smallholders started to grow tea Gov’t established factories under Agricultural Enterprises in early 1960 s.

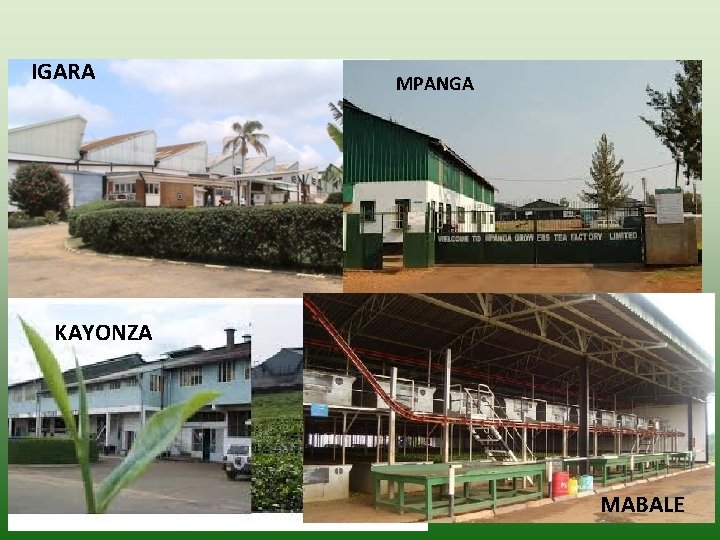

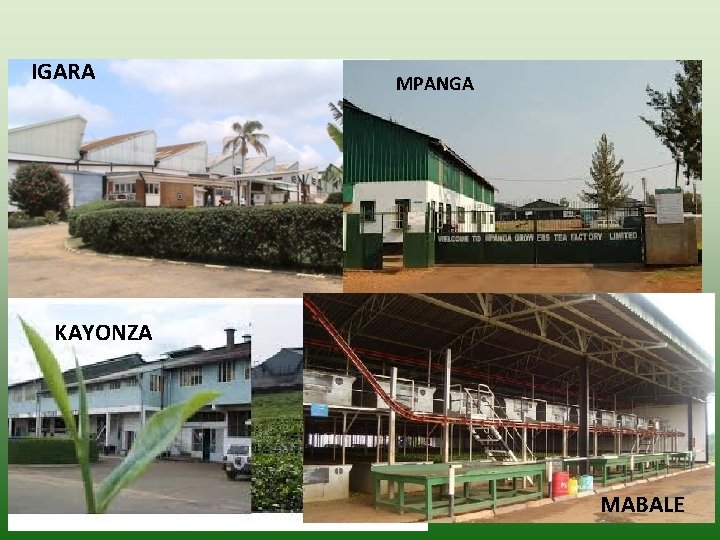

Background of Tea Growing in Uganda In 1966 Uganda Tea Growers Corporation (UTGC) was established to develop and expand tea production among the smallholders. UTGC later established 4 factories for the Smallholders; q. Igara q. Kayonza. q. Mpanga, q. Mabale, With privatization, these factories were ultimately sold to respective farmers in 1990 s and UTGC was wound up.

IGARA MPANGA KAYONZA MABALE

Tea Industry Cyclic Growth Tea production suffered a significant decline in the 1970 s due to general political & economic situation in Uganda. . Smallholders and the government owned factories suffered the most decline. Tea production collapsed from 23, 000 metric tones in 1972 to 1, 533 metric tones by 1980. Late 1980 s and early 1990 s, the industry was brought back by the current Government - NRM which instituted the emergency Tea Rehabilitation project to revamp tea production From 1989 to 1994, the Smallholder Tea Rehabilitation project funded by the European Union was instituted to rehabilitate smallholder factories.

Tea Industry Cyclic Growth From 1995 to 2000 gov’t divested all smallholder tea factories to tea farmers in their respective locations and communities. New planting kicked off and was supported by government through supplying free planting materials to farmers

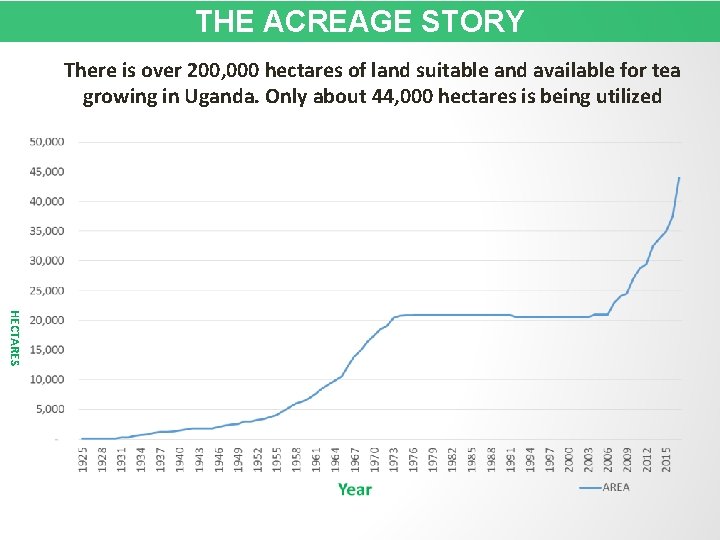

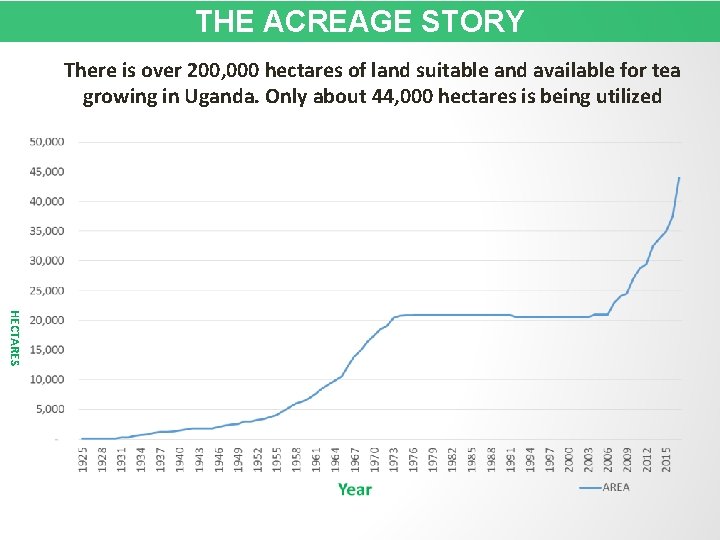

THE ACREAGE STORY There is over 200, 000 hectares of land suitable and available for tea growing in Uganda. Only about 44, 000 hectares is being utilized HECTARES

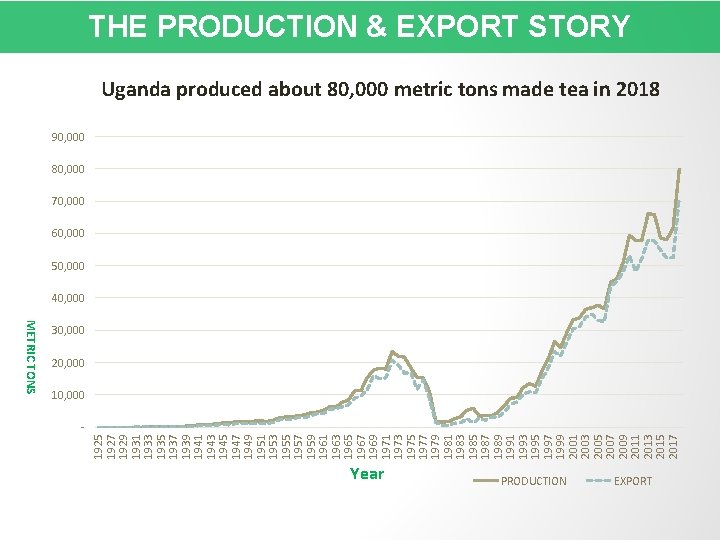

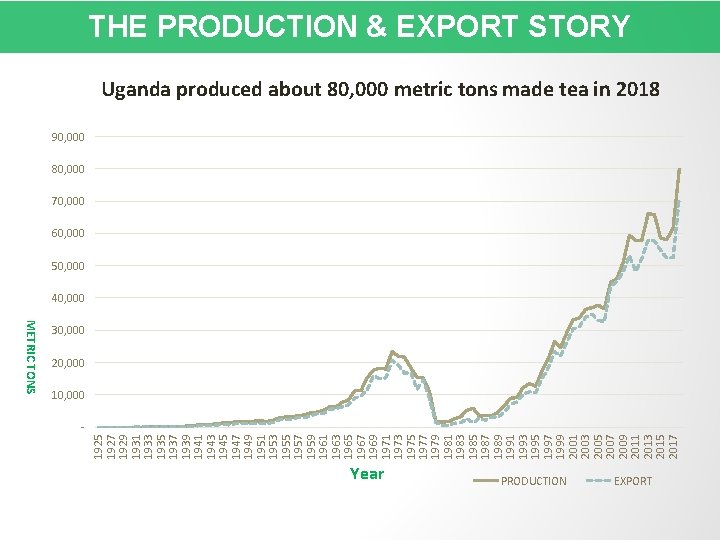

METRIC TONS 1925 1927 1929 1931 1933 1935 1937 1939 1941 1943 1945 1947 1949 1951 1953 1955 1957 1959 1961 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 THE PRODUCTION & EXPORT STORY Uganda produced about 80, 000 metric tons made tea in 2018 90, 000 80, 000 70, 000 60, 000 50, 000 40, 000 30, 000 20, 000 10, 000 - Year PRODUCTION EXPORT

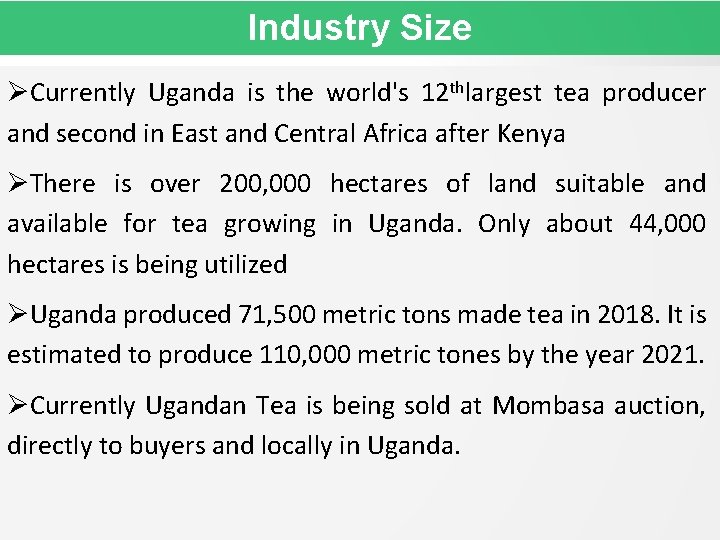

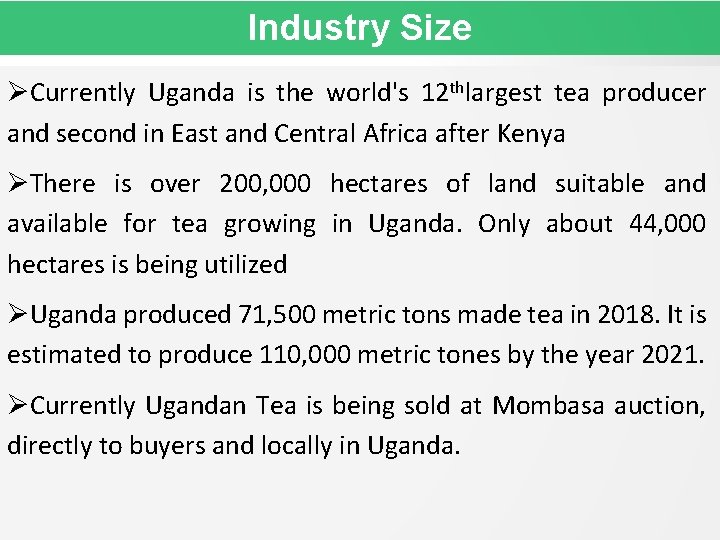

Industry Size Currently Uganda is the world's 12 thlargest tea producer and second in East and Central Africa after Kenya There is over 200, 000 hectares of land suitable and available for tea growing in Uganda. Only about 44, 000 hectares is being utilized Uganda produced 71, 500 metric tons made tea in 2018. It is estimated to produce 110, 000 metric tones by the year 2021. Currently Ugandan Tea is being sold at Mombasa auction, directly to buyers and locally in Uganda.

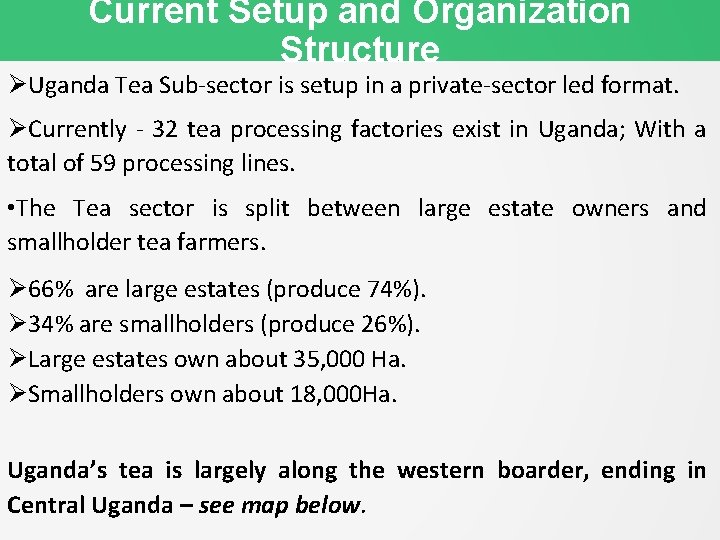

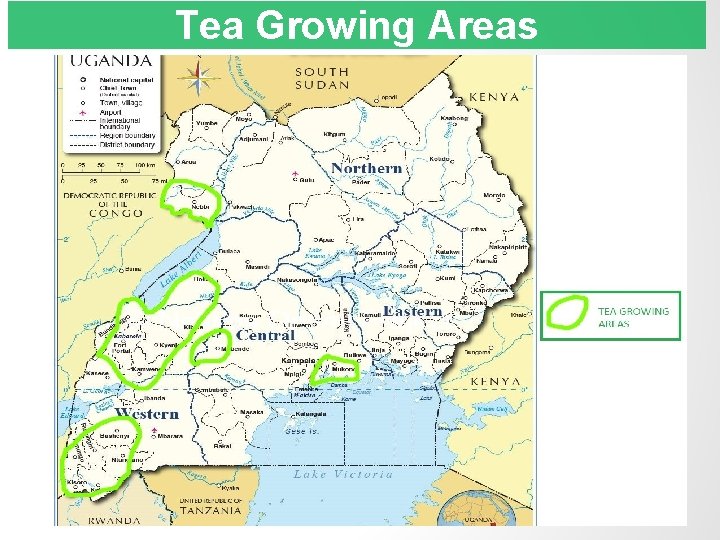

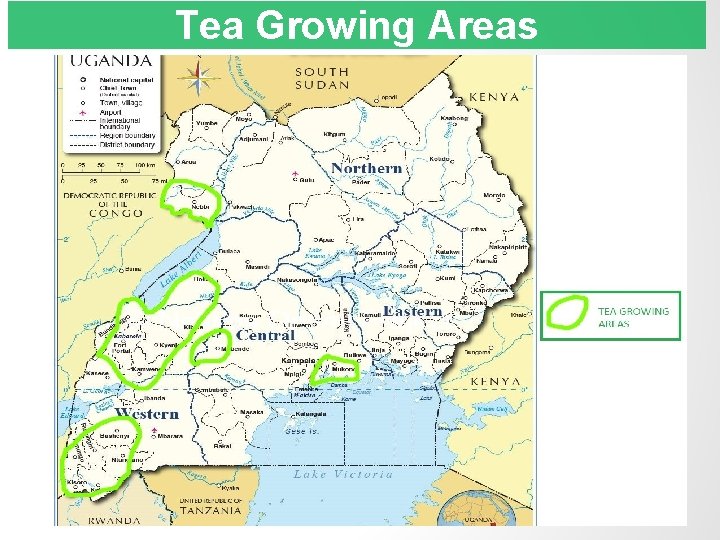

Current Setup and Organization Structure Uganda Tea Sub-sector is setup in a private-sector led format. Currently - 32 tea processing factories exist in Uganda; With a total of 59 processing lines. • The Tea sector is split between large estate owners and smallholder tea farmers. 66% are large estates (produce 74%). 34% are smallholders (produce 26%). Large estates own about 35, 000 Ha. Smallholders own about 18, 000 Ha. Uganda’s tea is largely along the western boarder, ending in Central Uganda – see map below.

Tea Growing Areas

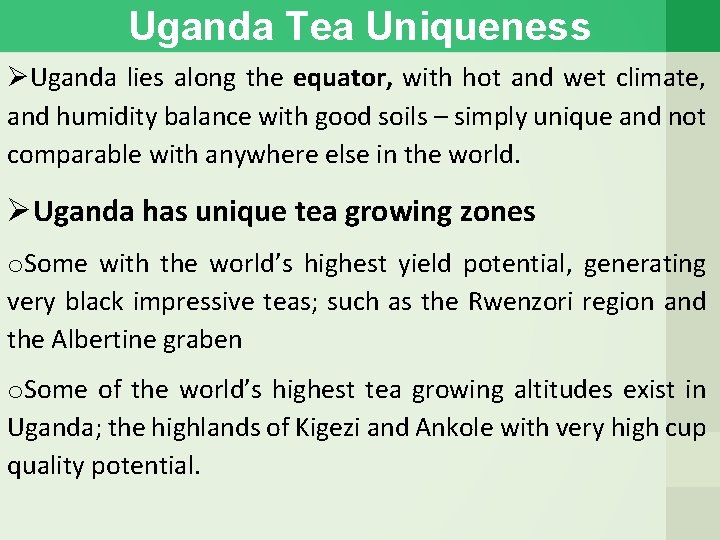

Uganda Tea Uniqueness Uganda lies along the equator, with hot and wet climate, and humidity balance with good soils – simply unique and not comparable with anywhere else in the world. Uganda has unique tea growing zones o. Some with the world’s highest yield potential, generating very black impressive teas; such as the Rwenzori region and the Albertine graben o. Some of the world’s highest tea growing altitudes exist in Uganda; the highlands of Kigezi and Ankole with very high cup quality potential.

Factors favoring Tea Industry Growth Political Environment: • Uganda has enjoyed political stability and democratic progress over the last 30+ years under the NRM government. • Gov’t through Ministry of Agriculture and NAADS has provided free seedlings to tea farmer Economic Environment: Specific policies and special exemptions to investors have been put in place to promote a conducive environment for doing business.

Factors favoring Tea Industry Growth Technological Environment: • Rudimentary processing methods and machines have been replaced with modern ones. • Use of drones in profiling farmers’ gardens

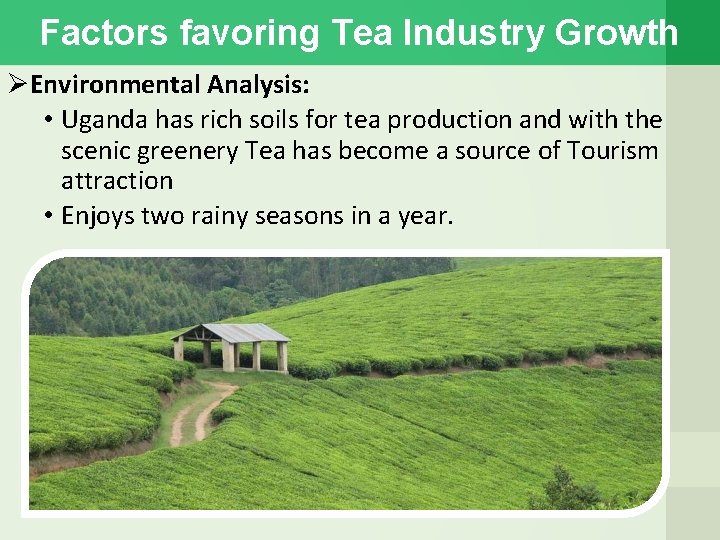

Factors favoring Tea Industry Growth Environmental Analysis: • Uganda has rich soils for tea production and with the scenic greenery Tea has become a source of Tourism attraction • Enjoys two rainy seasons in a year.

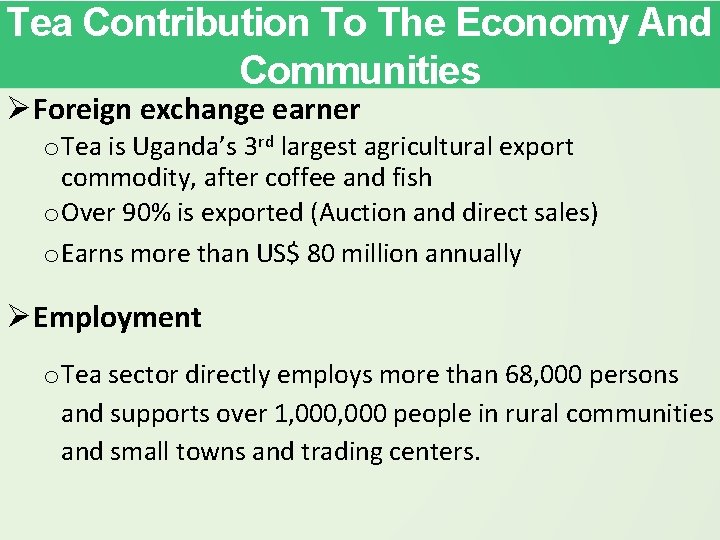

Tea Contribution To The Economy And Communities Foreign exchange earner o Tea is Uganda’s 3 rd largest agricultural export commodity, after coffee and fish o Over 90% is exported (Auction and direct sales) o Earns more than US$ 80 million annually Employment o Tea sector directly employs more than 68, 000 persons and supports over 1, 000 people in rural communities and small towns and trading centers.

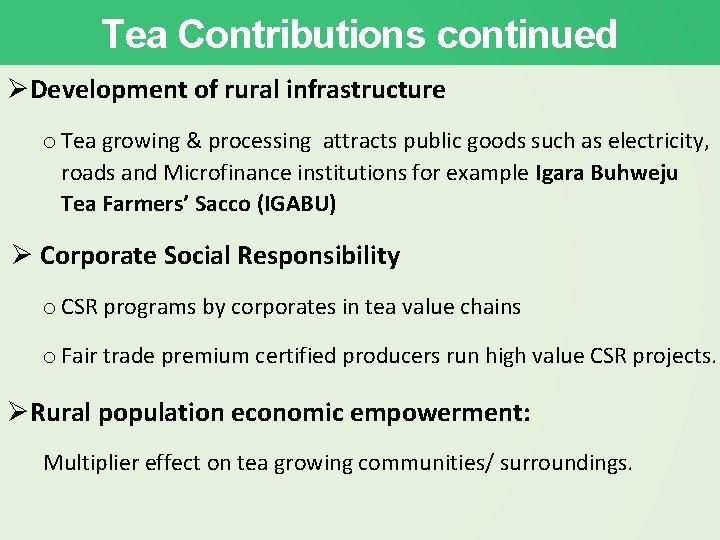

Tea Contributions continued Development of rural infrastructure o Tea growing & processing attracts public goods such as electricity, roads and Microfinance institutions for example Igara Buhweju Tea Farmers’ Sacco (IGABU) Corporate Social Responsibility o CSR programs by corporates in tea value chains o Fair trade premium certified producers run high value CSR projects. Rural population economic empowerment: Multiplier effect on tea growing communities/ surroundings.

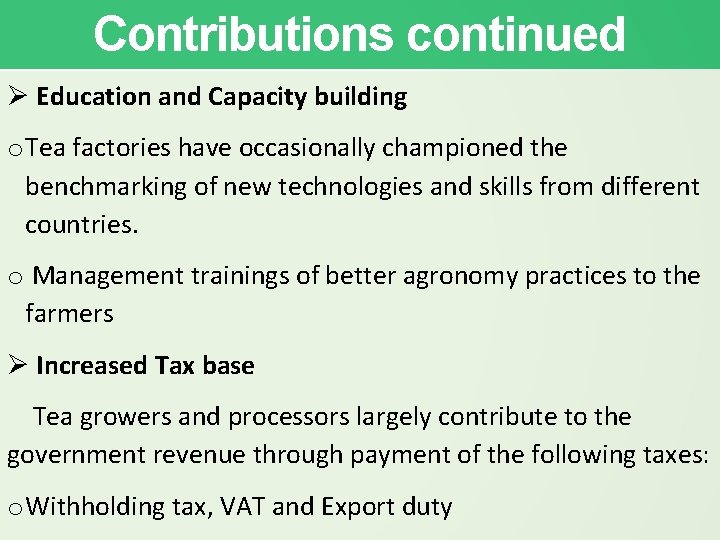

Contributions continued Education and Capacity building o Tea factories have occasionally championed the benchmarking of new technologies and skills from different countries. o Management trainings of better agronomy practices to the farmers Increased Tax base Tea growers and processors largely contribute to the government revenue through payment of the following taxes: o Withholding tax, VAT and Export duty

The Beauty of Tea growing

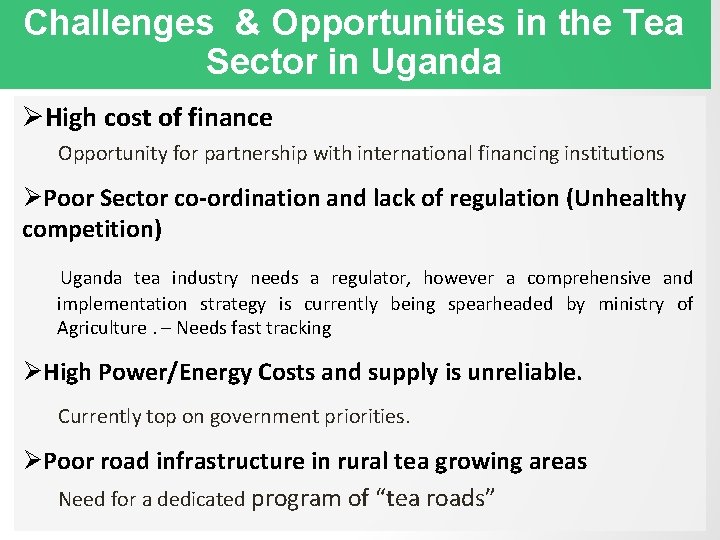

Challenges & Opportunities in the Tea Sector in Uganda High cost of finance Opportunity for partnership with international financing institutions Poor Sector co-ordination and lack of regulation (Unhealthy competition) Uganda tea industry needs a regulator, however a comprehensive and implementation strategy is currently being spearheaded by ministry of Agriculture. – Needs fast tracking High Power/Energy Costs and supply is unreliable. Currently top on government priorities. Poor road infrastructure in rural tea growing areas Need for a dedicated program of “tea roads”

Challenges & Opportunities in the Tea Sector in Uganda High cost of inputs for use in tea production. Opportunity for manufacturers and other value chain actors to make inputs cheaply available. Ever depreciating shilling continues to increase costs of production. Gov’t to continue tightening macroeconomic measures to ensure stability Climate change impacts on production Opportunities for use of irrigation technologies in tea production.

In Summary Uganda tea industry had a cyclical growth for over a century and the current growth rate is exponential. All stakeholders here should join hands to harness this growth. Tea industry is a very important component of Uganda’s economy and it deserves support from everyone passionate about community development. Uganda tea is unique and any shortfalls masking this uniqueness must be eliminated to unveil the treasure.

THANK YOU ================ Adrine

Tea growing in uganda

Tea growing in uganda East african tea trade association

East african tea trade association Community policing in uganda

Community policing in uganda Marine insurance act uganda

Marine insurance act uganda Uganda red cross society headquarters kampala

Uganda red cross society headquarters kampala Udbbetter uganda

Udbbetter uganda Nche quality assurance framework

Nche quality assurance framework Uganda aids rate

Uganda aids rate Islamic microfinance in uganda

Islamic microfinance in uganda Kajmansi o. vs canada

Kajmansi o. vs canada Uganda skills development project

Uganda skills development project Sinotrans air huawei

Sinotrans air huawei Examples of class c drugs in uganda

Examples of class c drugs in uganda Burmese tiger pit

Burmese tiger pit Malaria in uganda facts

Malaria in uganda facts Public sector notes

Public sector notes Ministry of east african community affairs uganda

Ministry of east african community affairs uganda Challenges of budget implementation in uganda

Challenges of budget implementation in uganda Uganda cooperative transport union limited

Uganda cooperative transport union limited Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Tư thế worms-breton

Tư thế worms-breton ưu thế lai là gì

ưu thế lai là gì Tư thế ngồi viết

Tư thế ngồi viết Cái miệng nó xinh thế

Cái miệng nó xinh thế Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Cách giải mật thư tọa độ

Cách giải mật thư tọa độ