Reverse Charge Mechanism CA Sachin Kasliwal CA Aditya

- Slides: 40

Reverse Charge Mechanism CA Sachin Kasliwal CA Aditya Shinde 10/29/2021

Rational Behind RCM • 1) Large no of assessees with small payment of tax from each assessee: – Eg: - Insurance Agents are more than 1 Cr. But Insurance companies are less than 30 -50 – Less revenue as each agent might not get more than 20 lacs per year • 2) Jurisdiction: – Imports of services • 3) Difficulty in collection of tax : – GTA 10/29/2021

Section Covering RCM • Section 9(3)/5(3): • “The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both” • Specified RCM 10/29/2021

Section Covering RCM • Section 9(4)/5(4): • “The State tax/integrated tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both” • URD RCM 10/29/2021

Section Covering RCM • Section 9(5)/5(5): • Electronic Commerce Operator RCM. • EC RCM 10/29/2021

Updates till date • • Notification no 4 CGST ( cashew Nuts Etc) Notification no 5 CGST (100% RCM, No Reg) Notification no 8 CGST (5000/- Exemption) Notification on 10 CGST (Second hand goods) Notification no 13 CGST (RCM category) Notification no 10 IGST (RCM Category) Press Release for GOLD/Second hand bottles 10/29/2021

Formalities to be done • Account for Liability • Issue an “TAX Invoice” • Mention payment under reverse Charge • Issue an “Payment Voucher” 10/29/2021

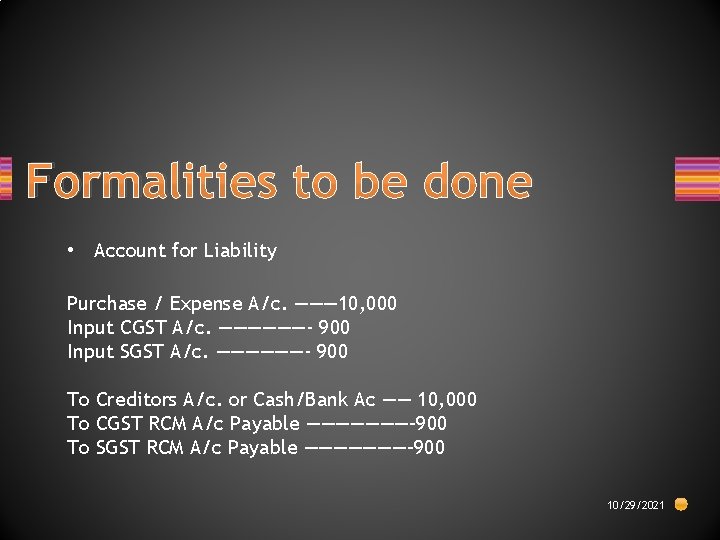

Formalities to be done • Account for Liability Purchase / Expense A/c. ——— 10, 000 Input CGST A/c. ——————- 900 Input SGST A/c. ——————- 900 To Creditors A/c. or Cash/Bank Ac —— 10, 000 To CGST RCM A/c Payable ———————– 900 To SGST RCM A/c Payable ———————– 900 10/29/2021

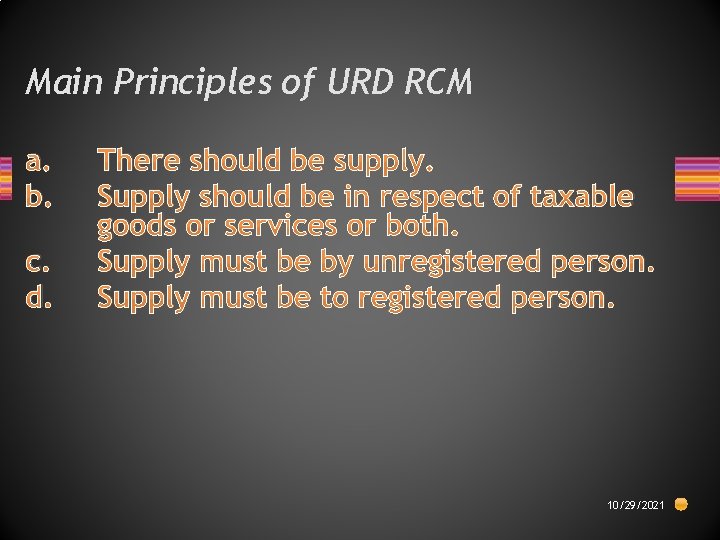

Main Principles of URD RCM a. b. c. d. There should be supply. Supply should be in respect of taxable goods or services or both. Supply must be by unregistered person. Supply must be to registered person. 10/29/2021

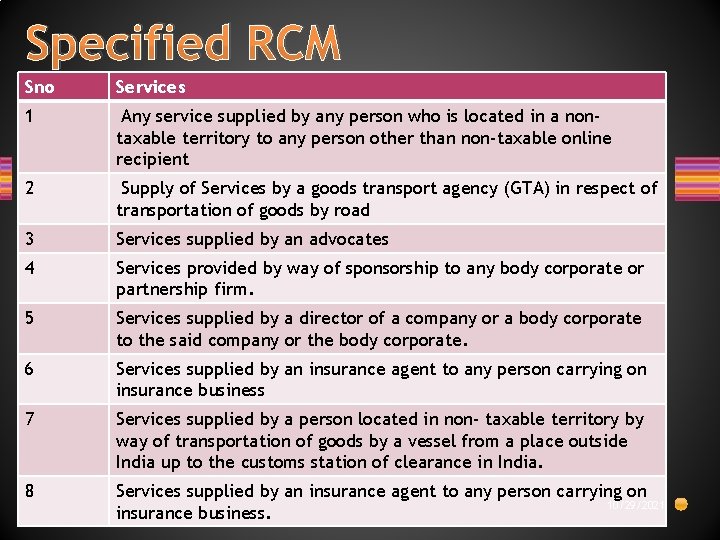

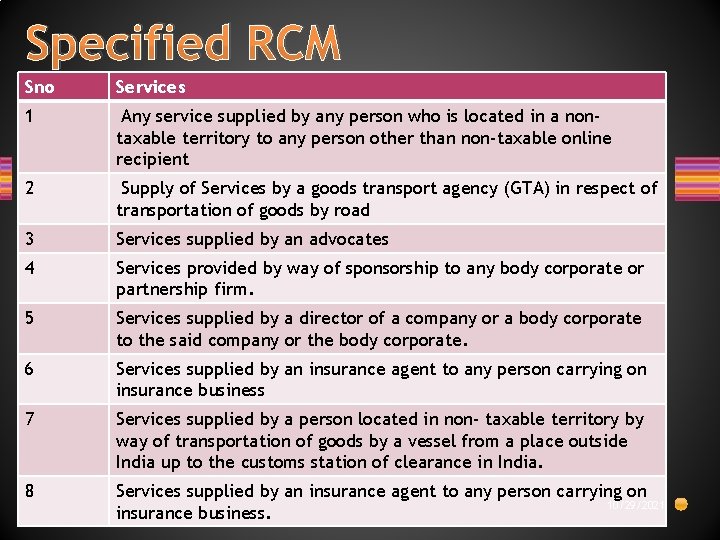

Specified RCM Sno Services 1 Any service supplied by any person who is located in a nontaxable territory to any person other than non-taxable online recipient 2 Supply of Services by a goods transport agency (GTA) in respect of transportation of goods by road 3 Services supplied by an advocates 4 Services provided by way of sponsorship to any body corporate or partnership firm. 5 Services supplied by a director of a company or a body corporate to the said company or the body corporate. 6 Services supplied by an insurance agent to any person carrying on insurance business 7 Services supplied by a person located in non- taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India. 8 Services supplied by an insurance agent to any person carrying on 10/29/2021 insurance business.

10/29/2021

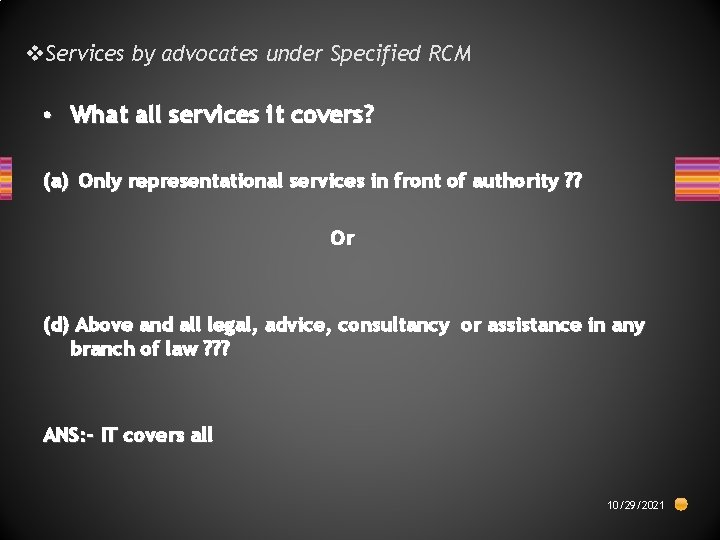

v. Services by advocates under Specified RCM • What all services it covers? (a) Only representational services in front of authority ? ? Or (d) Above and all legal, advice, consultancy or assistance in any branch of law ? ? ? ANS: - IT covers all 10/29/2021

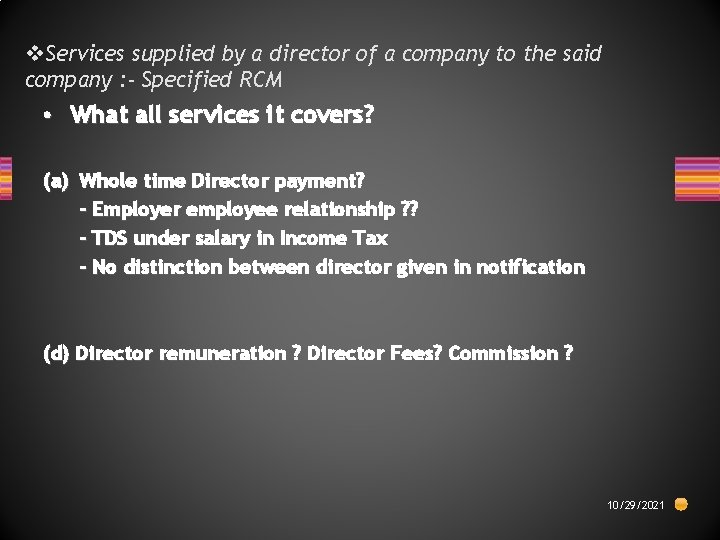

v. Services supplied by a director of a company to the said company : - Specified RCM • What all services it covers? (a) Whole time Director payment? - Employer employee relationship ? ? - TDS under salary in Income Tax - No distinction between director given in notification (d) Director remuneration ? Director Fees? Commission ? 10/29/2021

Do we need to raise TAX INVOICE for every transaction • YES But facility of one invoice per month is given But only for URD taxation. Not for specified RD RCM. 10/29/2021

Credit of Rs. 10, 000/RCM Liability Rs. 5000/Can it be adjusted? ? ? • NO RCM liability needs to be paid in cash 10/29/2021

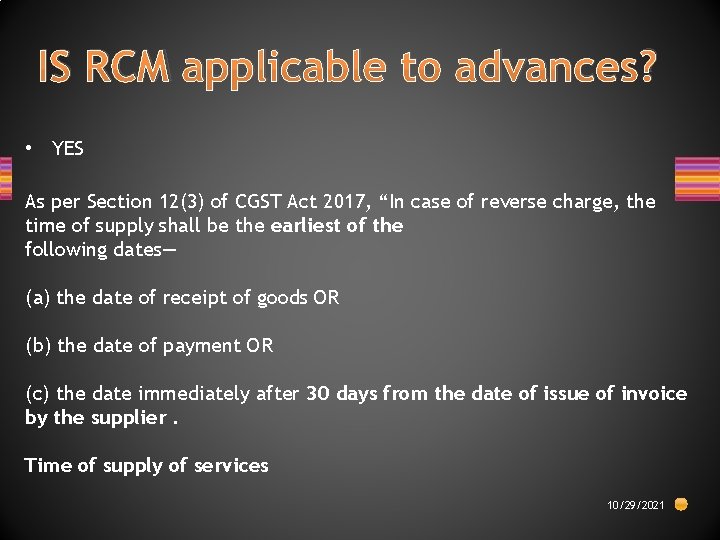

IS RCM applicable to advances? • YES As per Section 12(3) of CGST Act 2017, “In case of reverse charge, the time of supply shall be the earliest of the following dates— (a) the date of receipt of goods OR (b) the date of payment OR (c) the date immediately after 30 days from the date of issue of invoice by the supplier. Time of supply of services 10/29/2021

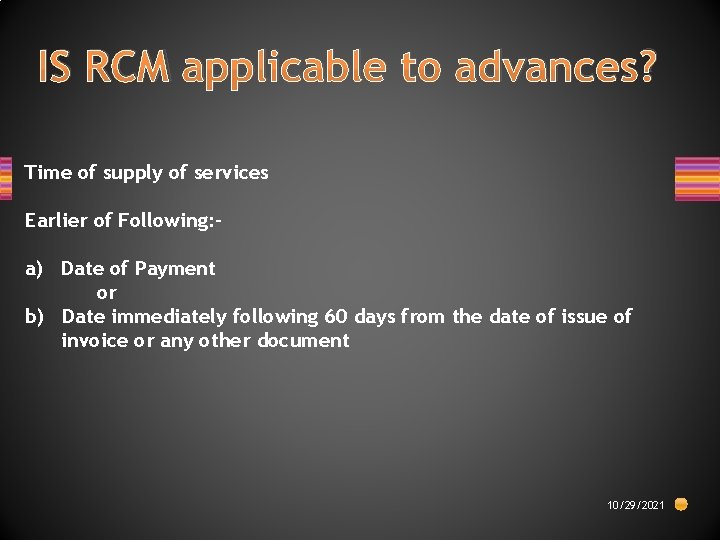

IS RCM applicable to advances? Time of supply of services Earlier of Following: - a) Date of Payment or b) Date immediately following 60 days from the date of issue of invoice or any other document 10/29/2021

Payment of Rs. 6000/- p. m. to URD, Will RCM be applicable? What if rent agreement is per day basis? ? ? 10/29/2021

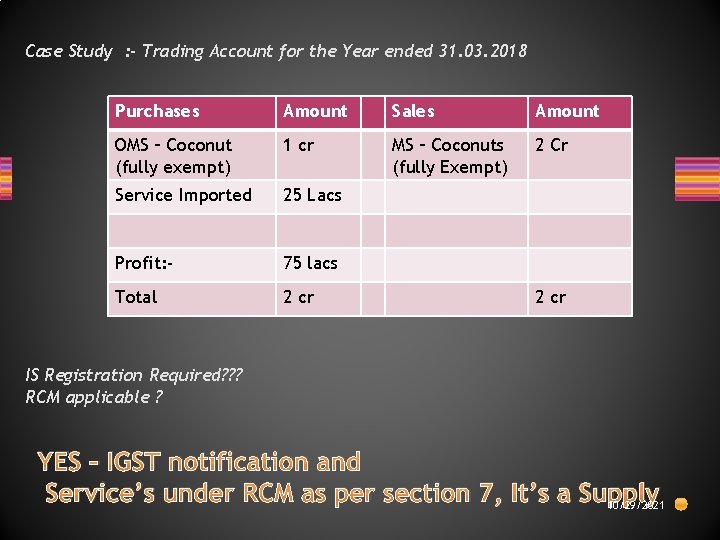

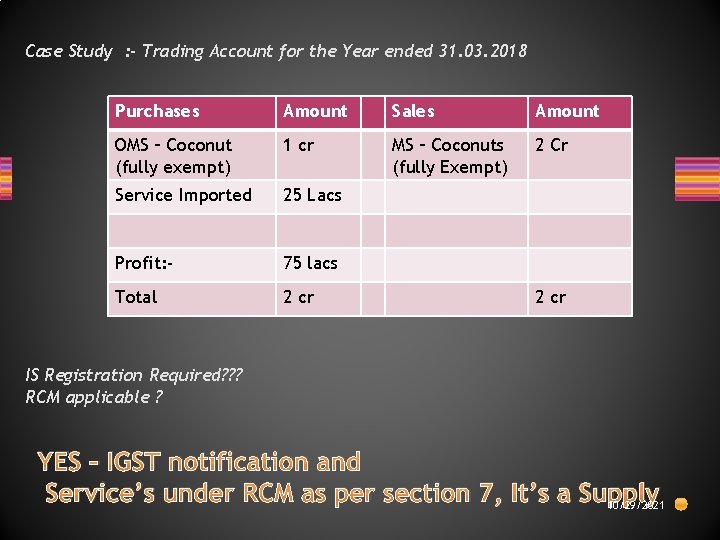

Case Study : - Trading Account for the Year ended 31. 03. 2018 Purchases Amount Sales Amount OMS – Coconut (fully exempt) 1 cr MS – Coconuts (fully Exempt) 2 Cr Service Imported 25 Lacs Profit: - 75 lacs Total 2 cr IS Registration Required? ? ? RCM applicable ? YES – IGST notification and Service’s under RCM as per section 7, It’s a Supply 10/29/2021

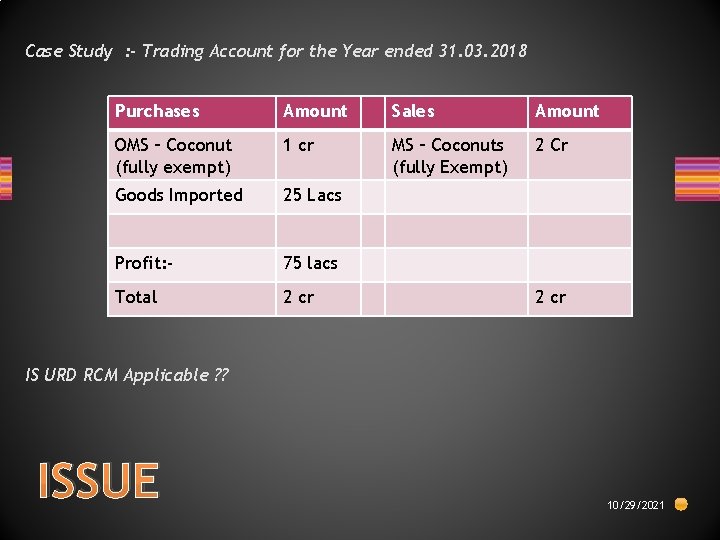

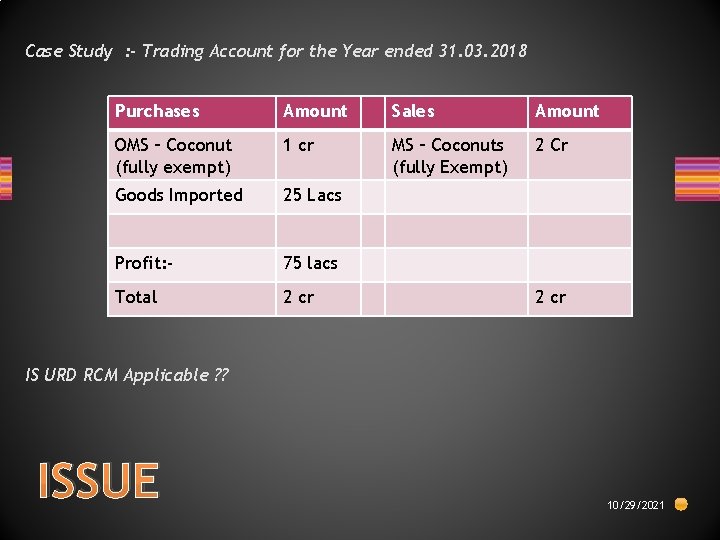

Case Study : - Trading Account for the Year ended 31. 03. 2018 Purchases Amount Sales Amount OMS – Coconut (fully exempt) 1 cr MS – Coconuts (fully Exempt) 2 Cr Goods Imported 25 Lacs Profit: - 75 lacs Total 2 cr IS URD RCM Applicable ? ? ISSUE 10/29/2021

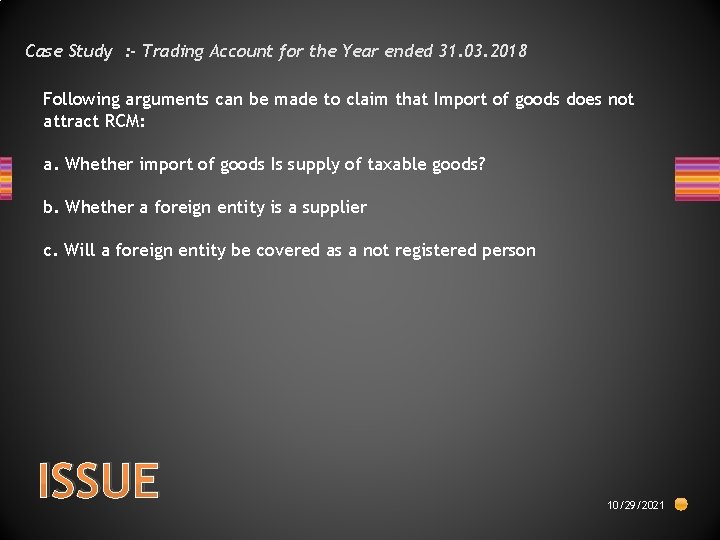

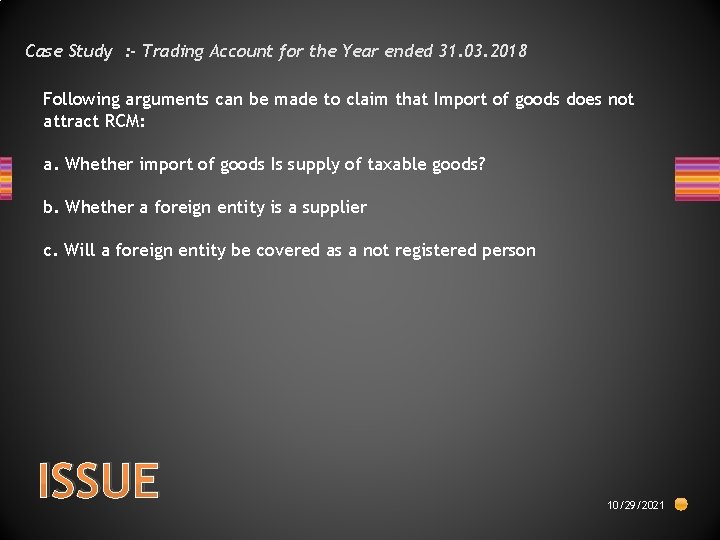

Case Study : - Trading Account for the Year ended 31. 03. 2018 Following arguments can be made to claim that Import of goods does not attract RCM: a. Whether import of goods Is supply of taxable goods? b. Whether a foreign entity is a supplier c. Will a foreign entity be covered as a not registered person ISSUE 10/29/2021

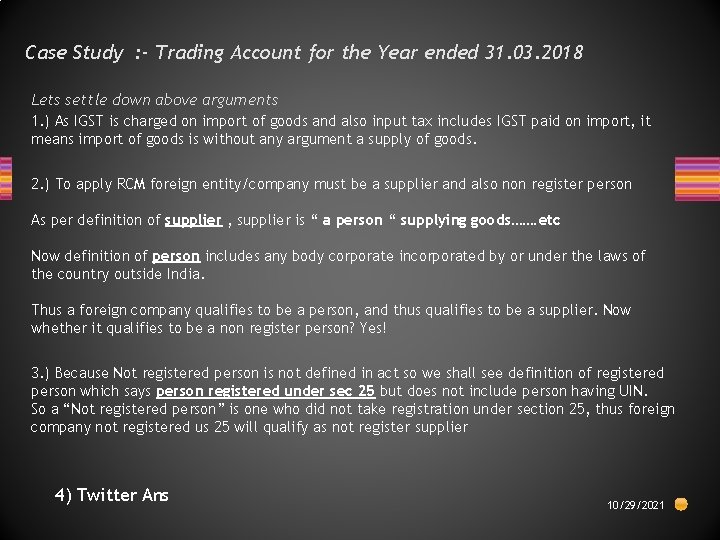

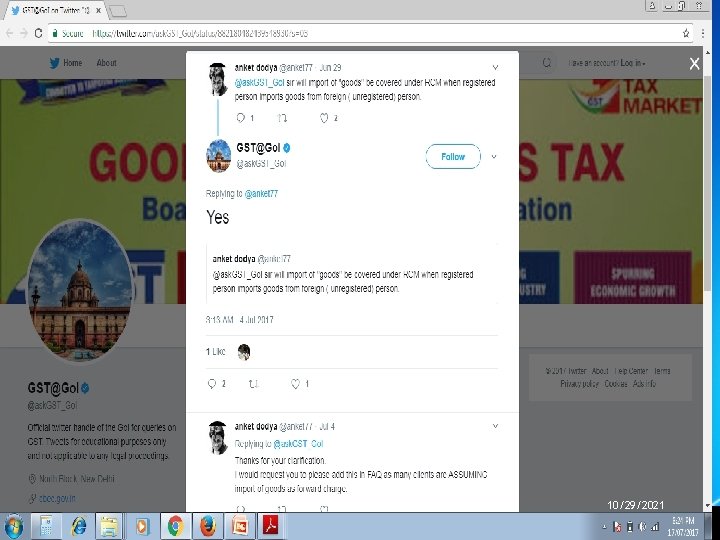

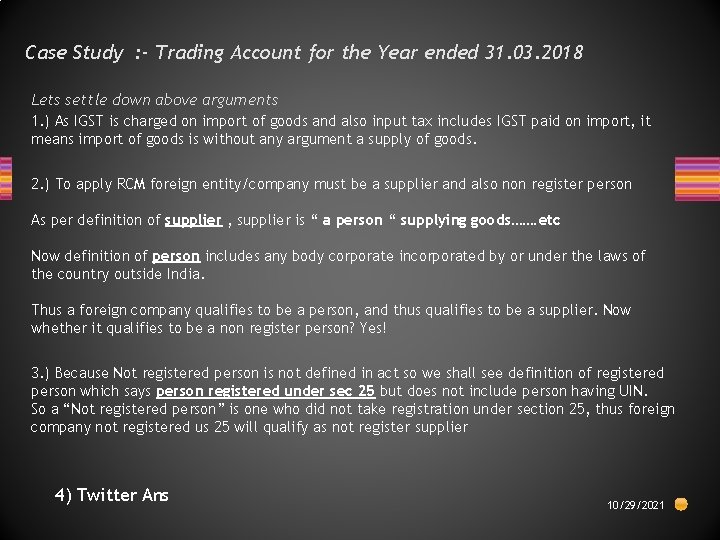

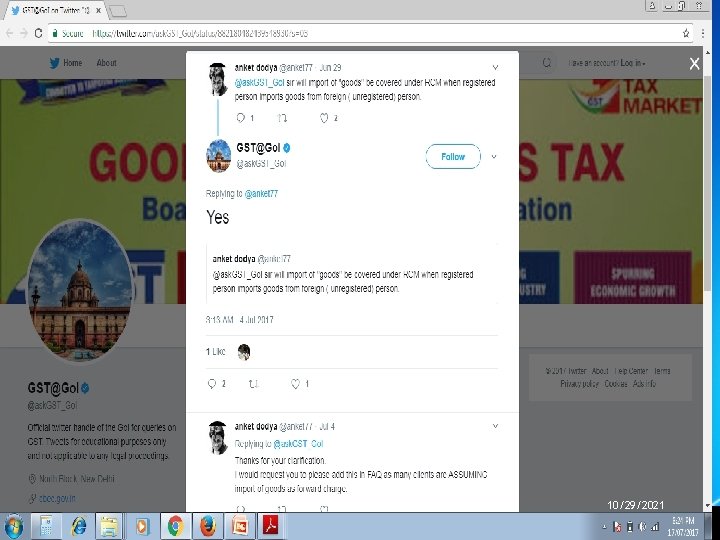

Case Study : - Trading Account for the Year ended 31. 03. 2018 Lets settle down above arguments 1. ) As IGST is charged on import of goods and also input tax includes IGST paid on import, it means import of goods is without any argument a supply of goods. 2. ) To apply RCM foreign entity/company must be a supplier and also non register person As per definition of supplier , supplier is “ a person “ supplying goods……. etc Now definition of person includes any body corporate incorporated by or under the laws of the country outside India. Thus a foreign company qualifies to be a person, and thus qualifies to be a supplier. Now whether it qualifies to be a non register person? Yes! 3. ) Because Not registered person is not defined in act so we shall see definition of registered person which says person registered under sec 25 but does not include person having UIN. So a “Not registered person” is one who did not take registration under section 25, thus foreign company not registered us 25 will qualify as not register supplier 4) Twitter Ans 10/29/2021

Case Study : - Trading Account for the Year ended 31. 03. 2018 Lets settle down above arguments 1. ) As IGST is charged on import of goods and also input tax includes IGST paid on import, it means import of goods is without any argument a supply of goods. 2. ) To apply RCM foreign entity/company must be a supplier and also non register person As per definition of supplier , supplier is “ a person “ supplying goods……. etc Now definition of person includes any body corporate incorporated by or under the laws of the country outside India. Thus a foreign company qualifies to be a person, and thus qualifies to be a supplier. Now whether it qualifies to be a non register person? Yes! 3. ) Because Not registered person is not defined in act so we shall see definition of registered person which says person registered under sec 25 but does not include person having UIN. So a “Not registered person” is one who did not take registration under section 25, thus foreign company not registered us 25 will qualify as not register supplier 4. ) Twitter ANS 10/29/2021

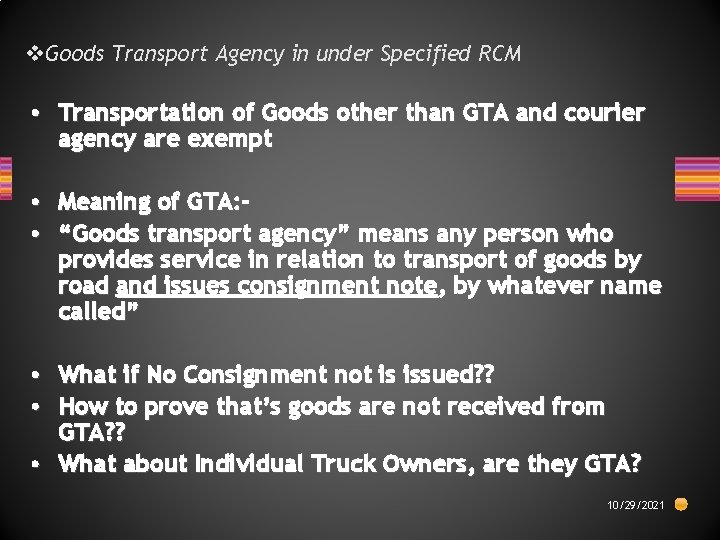

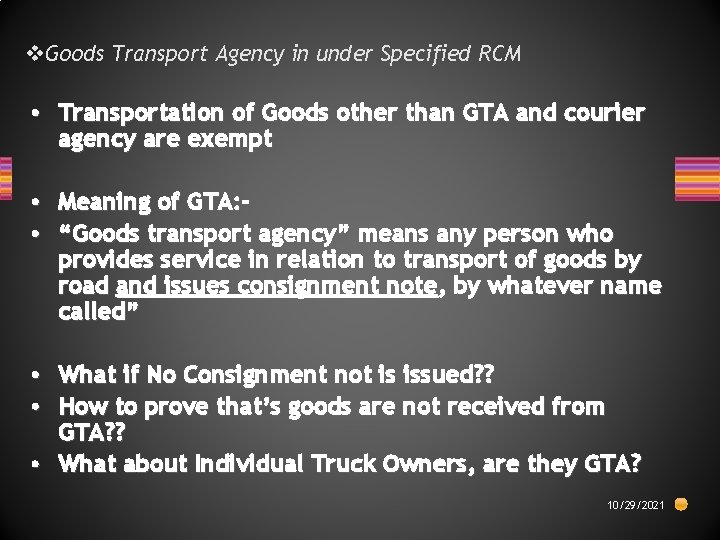

v. Goods Transport Agency in under Specified RCM • Transportation of Goods other than GTA and courier agency are exempt • Meaning of GTA: • “Goods transport agency” means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called” • What if No Consignment not is issued? ? • How to prove that’s goods are not received from GTA? ? • What about Individual Truck Owners, are they GTA? 10/29/2021

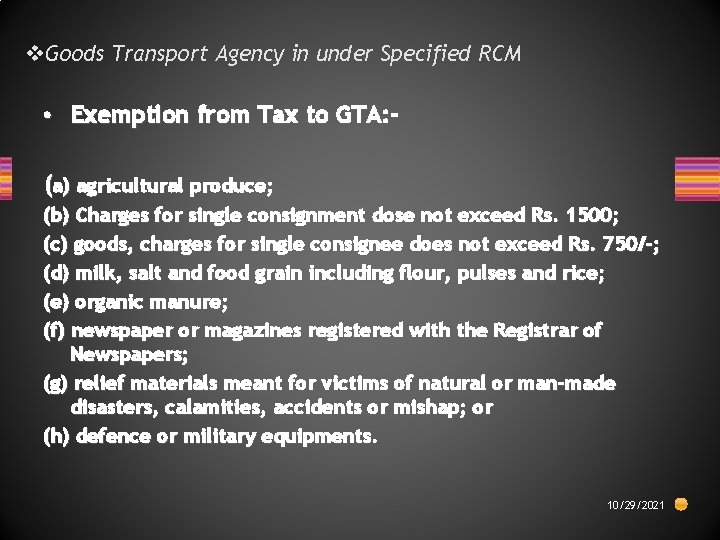

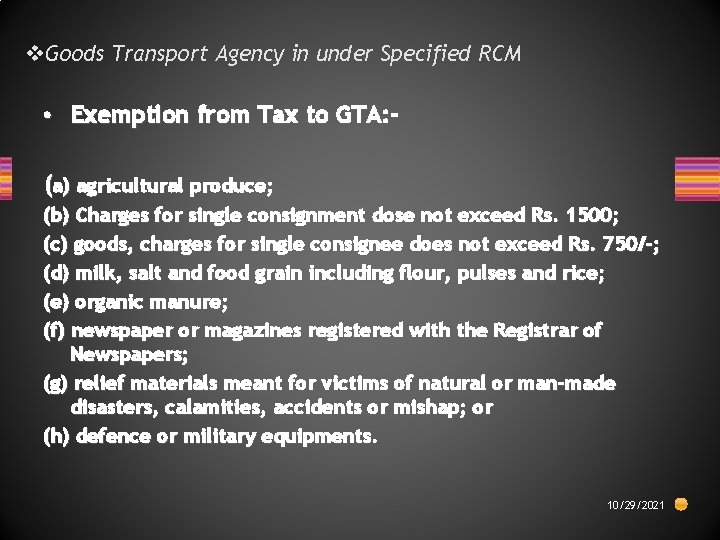

v. Goods Transport Agency in under Specified RCM • Exemption from Tax to GTA: (a) agricultural produce; (b) Charges for single consignment dose not exceed Rs. 1500; (c) goods, charges for single consignee does not exceed Rs. 750/-; (d) milk, salt and food grain including flour, pulses and rice; (e) organic manure; (f) newspaper or magazines registered with the Registrar of Newspapers; (g) relief materials meant for victims of natural or man-made disasters, calamities, accidents or mishap; or (h) defence or military equipments. 10/29/2021

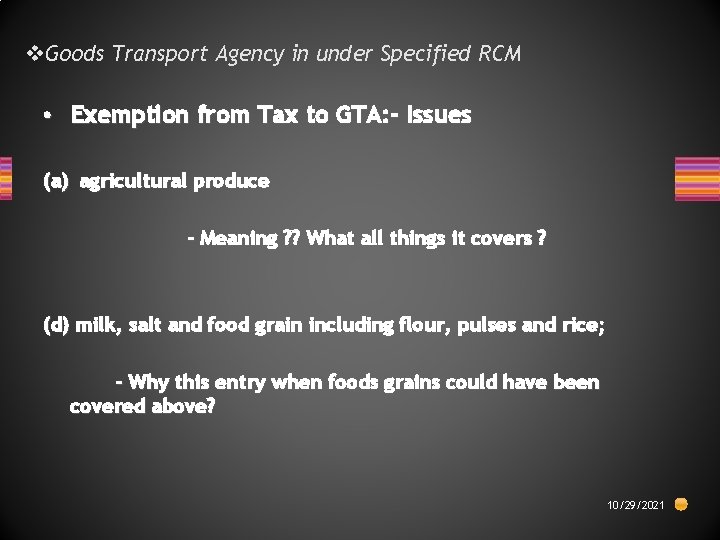

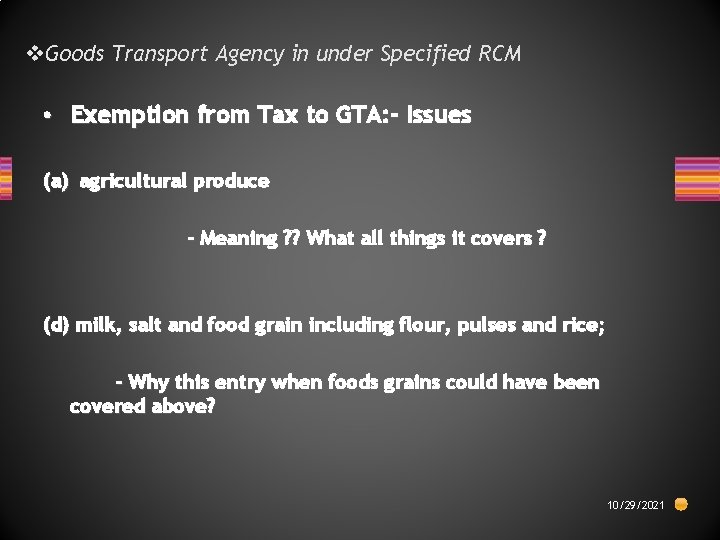

v. Goods Transport Agency in under Specified RCM • Exemption from Tax to GTA: - Issues (a) agricultural produce – Meaning ? ? What all things it covers ? (d) milk, salt and food grain including flour, pulses and rice; - Why this entry when foods grains could have been covered above? 10/29/2021

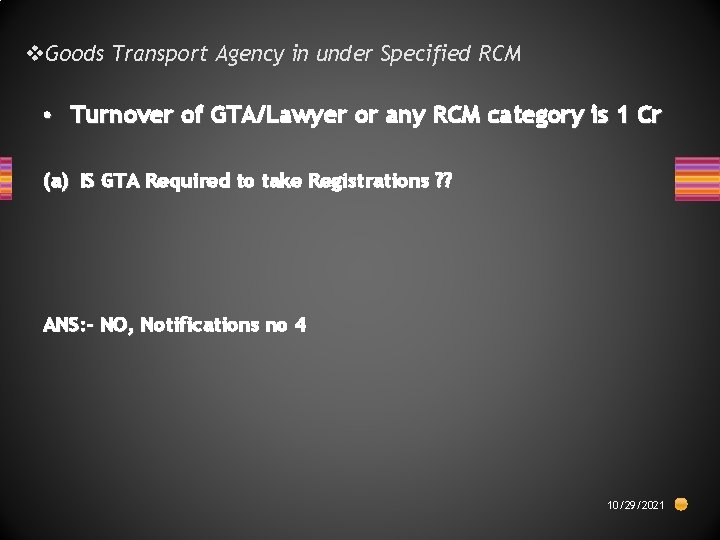

v. Goods Transport Agency in under Specified RCM • Turnover of GTA/Lawyer or any RCM category is 1 Cr (a) IS GTA Required to take Registrations ? ? ANS: - NO, Notifications no 4 10/29/2021

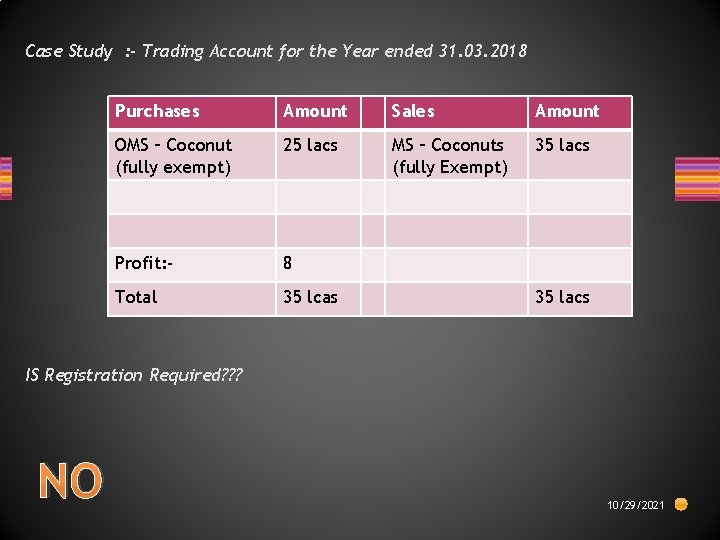

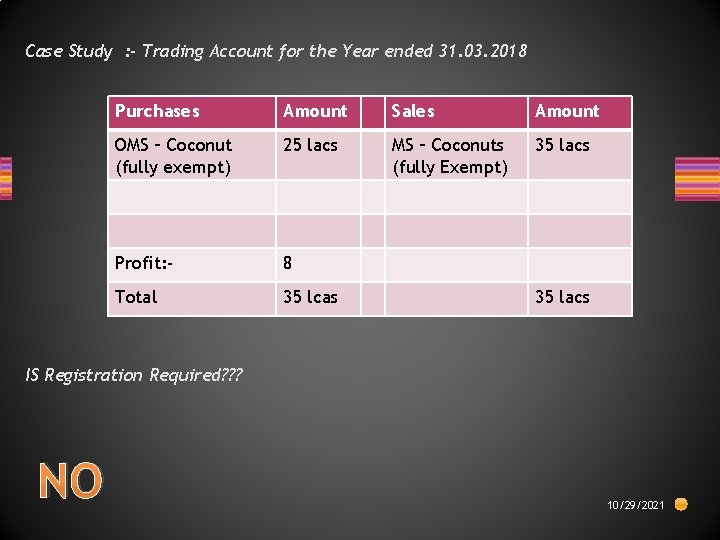

Case Study : - Trading Account for the Year ended 31. 03. 2018 Purchases Amount Sales Amount OMS – Coconut (fully exempt) 25 lacs MS – Coconuts (fully Exempt) 35 lacs Profit: - 8 Total 35 lcas 35 lacs IS Registration Required? ? ? NO 10/29/2021

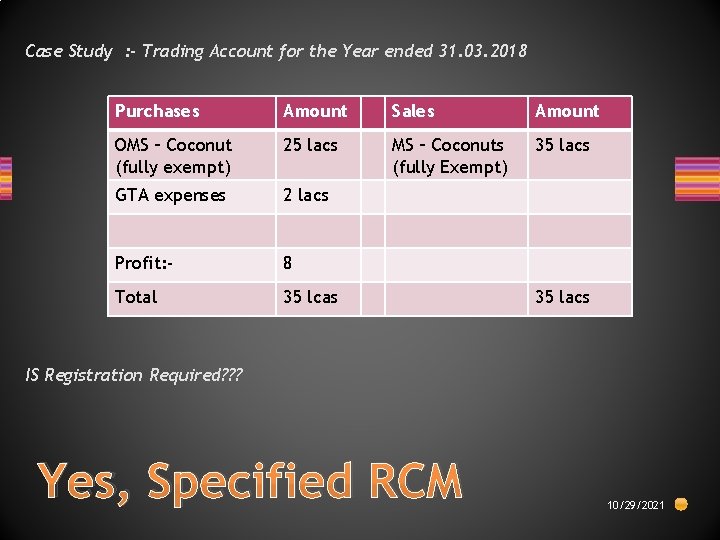

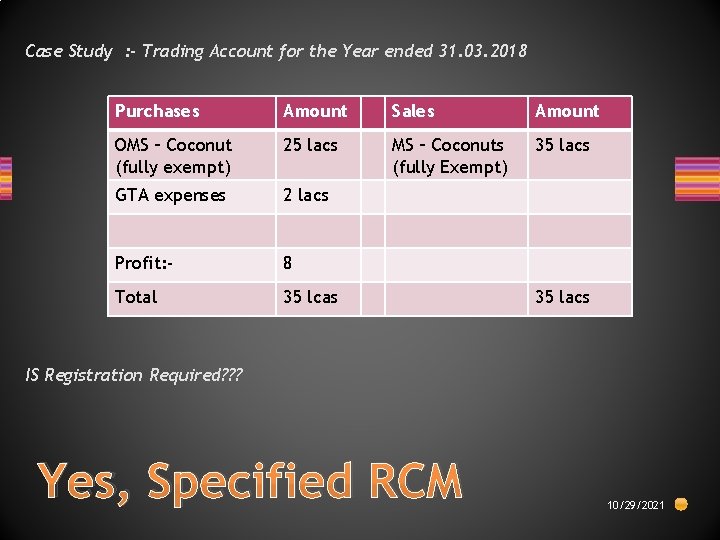

Case Study : - Trading Account for the Year ended 31. 03. 2018 Purchases Amount Sales Amount OMS – Coconut (fully exempt) 25 lacs MS – Coconuts (fully Exempt) 35 lacs GTA expenses 2 lacs Profit: - 8 Total 35 lcas 35 lacs IS Registration Required? ? ? Yes, Specified RCM 10/29/2021

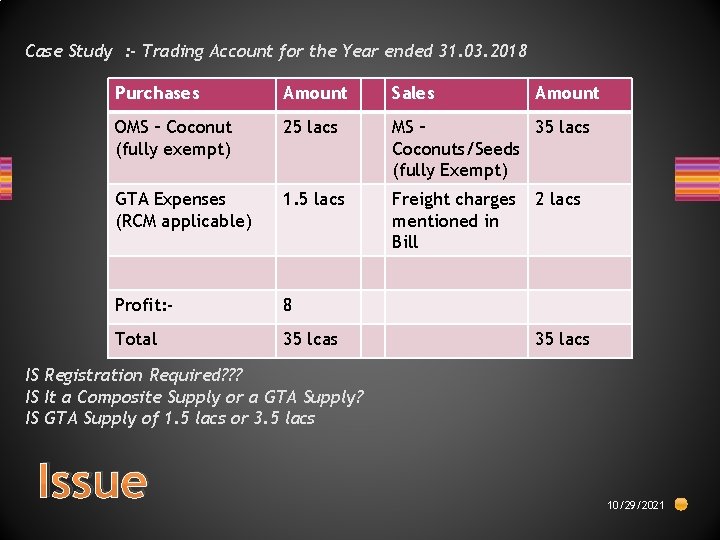

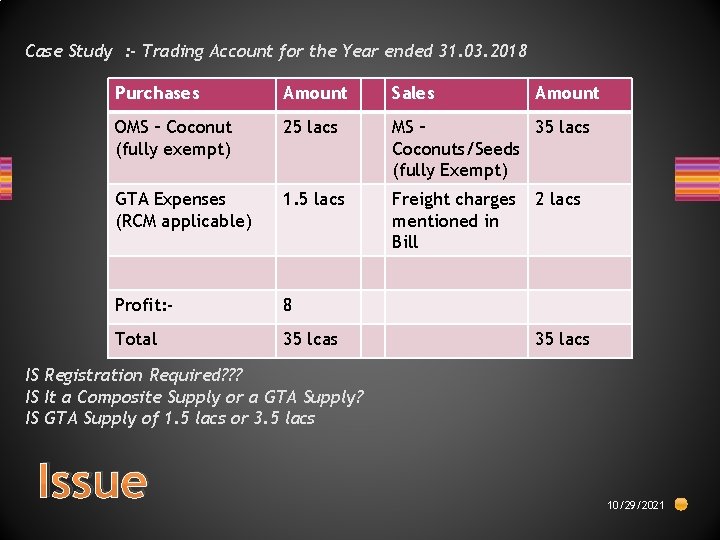

Case Study : - Trading Account for the Year ended 31. 03. 2018 Purchases Amount Sales Amount OMS – Coconut (fully exempt) 25 lacs MS – 35 lacs Coconuts/Seeds (fully Exempt) GTA Expenses (RCM applicable) 1. 5 lacs Freight charges mentioned in Bill Profit: - 8 Total 35 lcas 2 lacs 35 lacs IS Registration Required? ? ? IS It a Composite Supply or a GTA Supply? IS GTA Supply of 1. 5 lacs or 3. 5 lacs Issue 10/29/2021

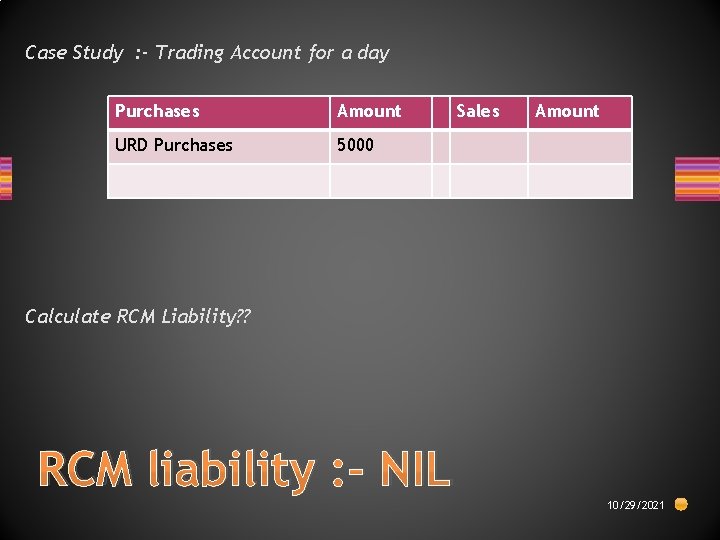

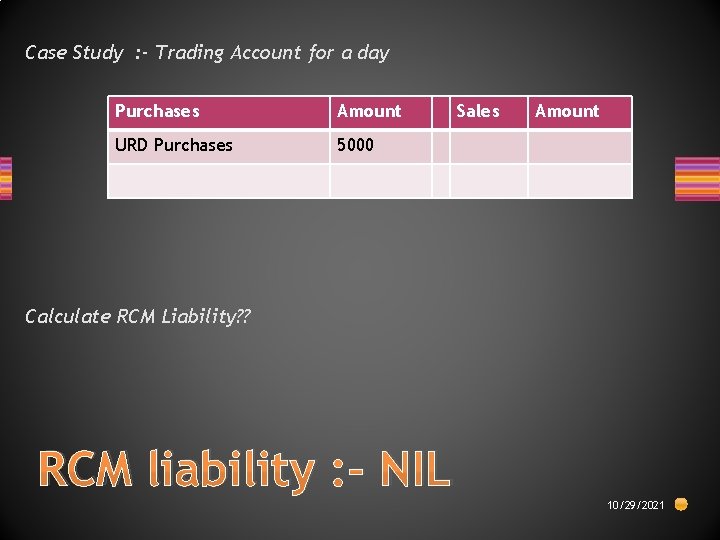

Case Study : - Trading Account for a day Purchases Amount URD Purchases 5000 Sales Amount Calculate RCM Liability? ? RCM liability : - NIL 10/29/2021

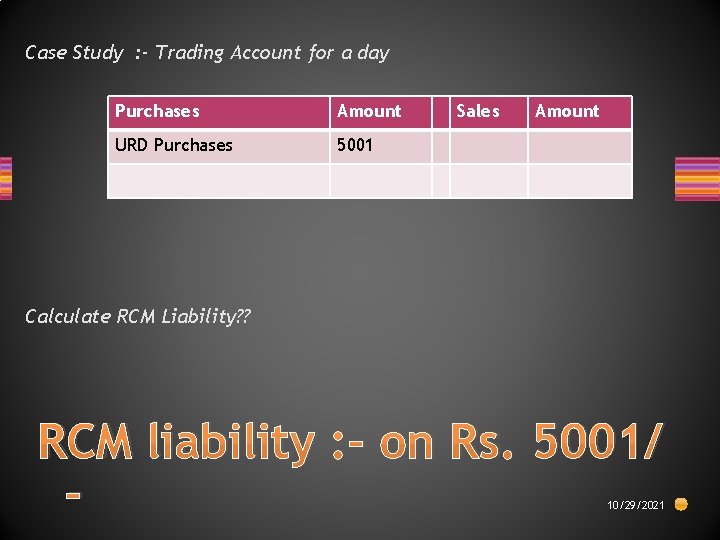

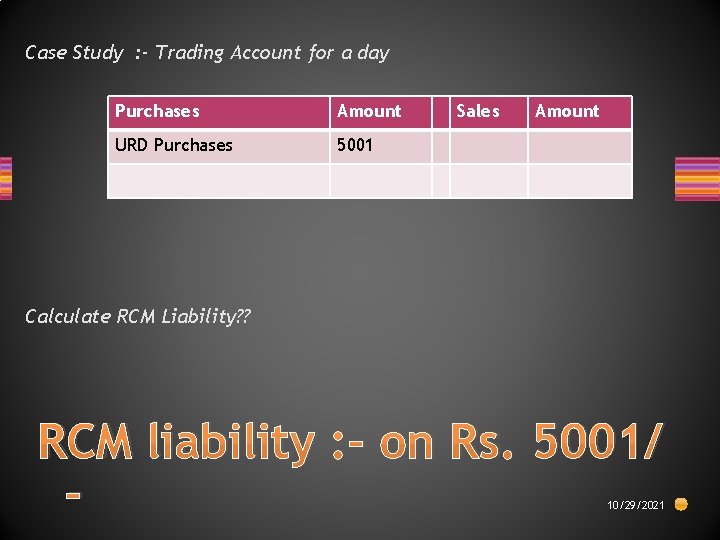

Case Study : - Trading Account for a day Purchases Amount URD Purchases 5001 Sales Amount Calculate RCM Liability? ? RCM liability : - on Rs. 5001/ - 10/29/2021

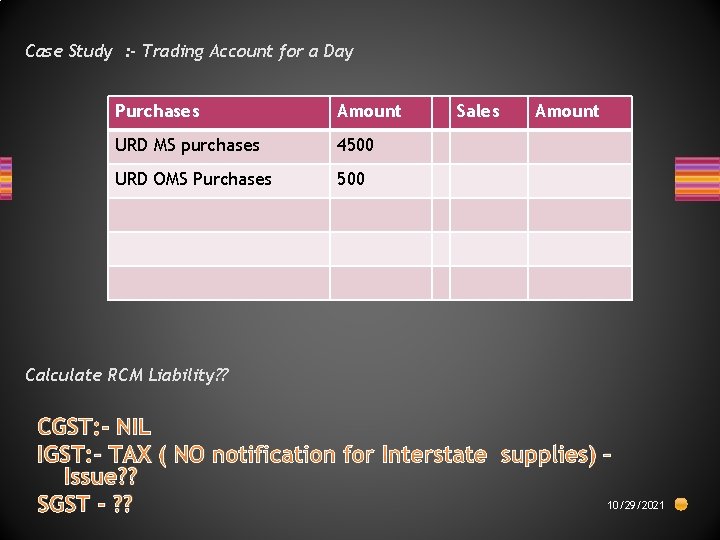

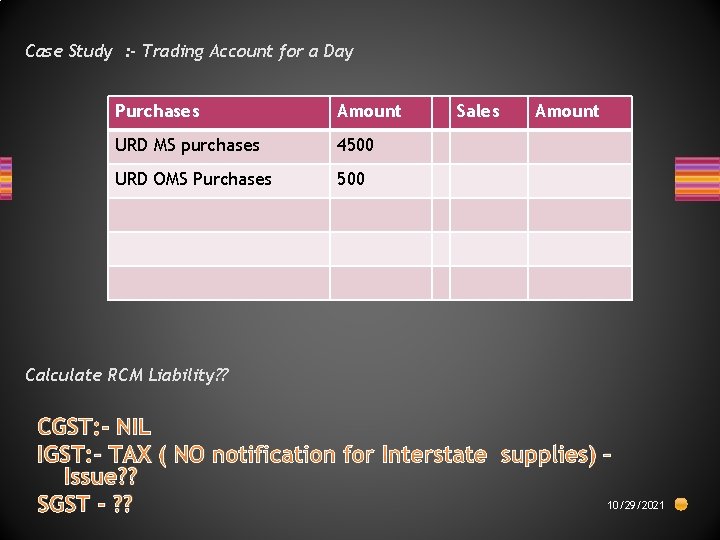

Case Study : - Trading Account for a Day Purchases Amount URD MS purchases 4500 URD OMS Purchases 500 Sales Amount Calculate RCM Liability? ? CGST: - NIL IGST: - TAX ( NO notification for Interstate supplies) – Issue? ? 10/29/2021 SGST - ? ?

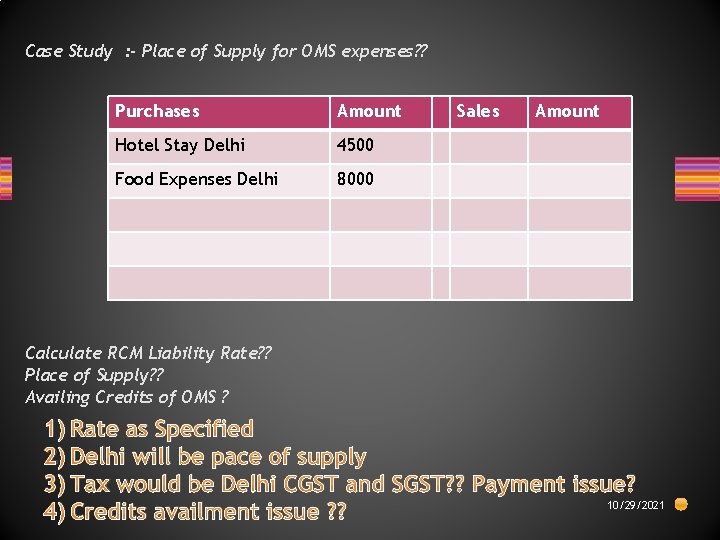

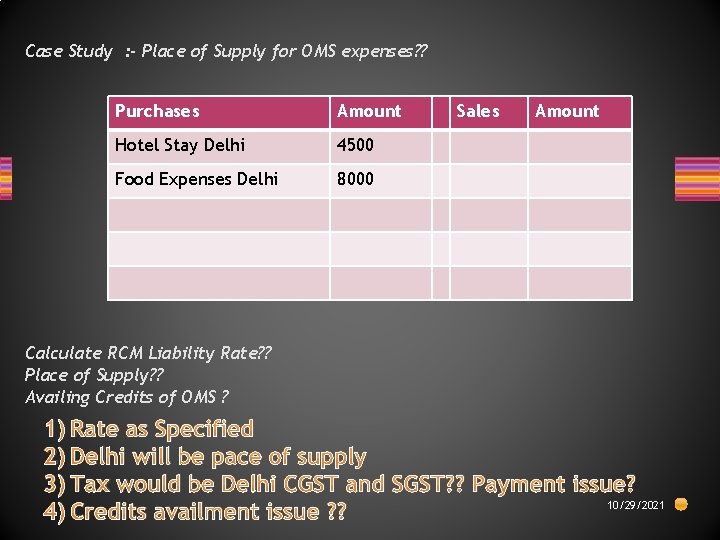

Case Study : - Place of Supply for OMS expenses? ? Purchases Amount Hotel Stay Delhi 4500 Food Expenses Delhi 8000 Sales Amount Calculate RCM Liability Rate? ? Place of Supply? ? Availing Credits of OMS ? 1) Rate as Specified 2) Delhi will be pace of supply 3) Tax would be Delhi CGST and SGST? ? Payment issue? 10/29/2021 4) Credits availment issue ? ?

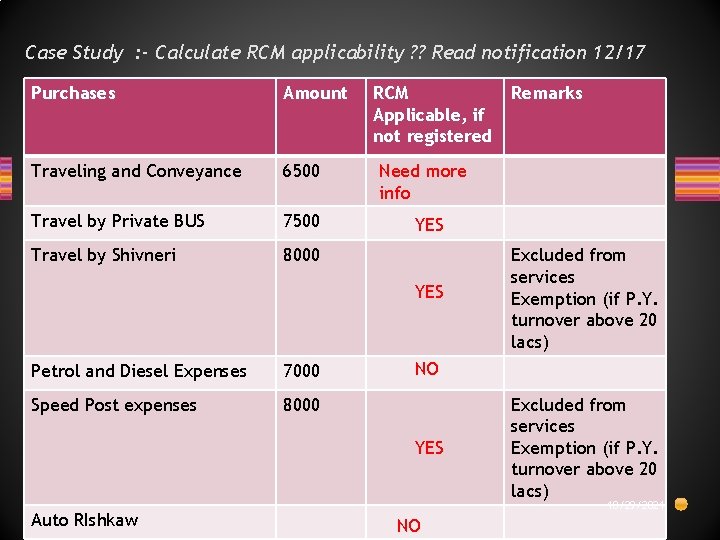

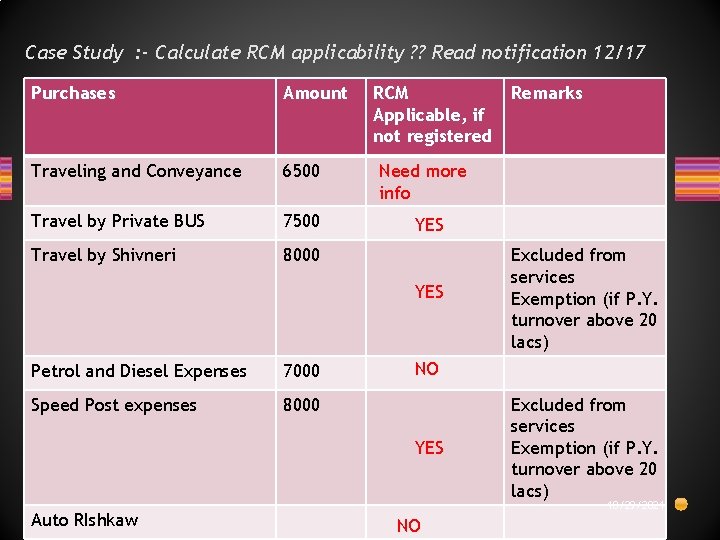

Case Study : - Calculate RCM applicability ? ? Read notification 12/17 Purchases Amount Traveling and Conveyance 6500 Travel by Private BUS 7500 Travel by Shivneri 8000 RCM Applicable, if not registered Need more info YES Petrol and Diesel Expenses 7000 Speed Post expenses 8000 Excluded from services Exemption (if P. Y. turnover above 20 lacs) NO YES Auto RIshkaw Remarks Excluded from services Exemption (if P. Y. turnover above 20 lacs) 10/29/2021 NO

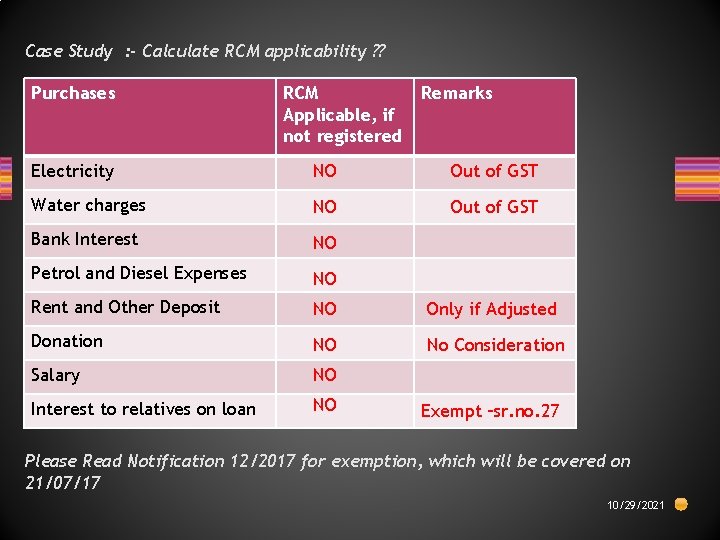

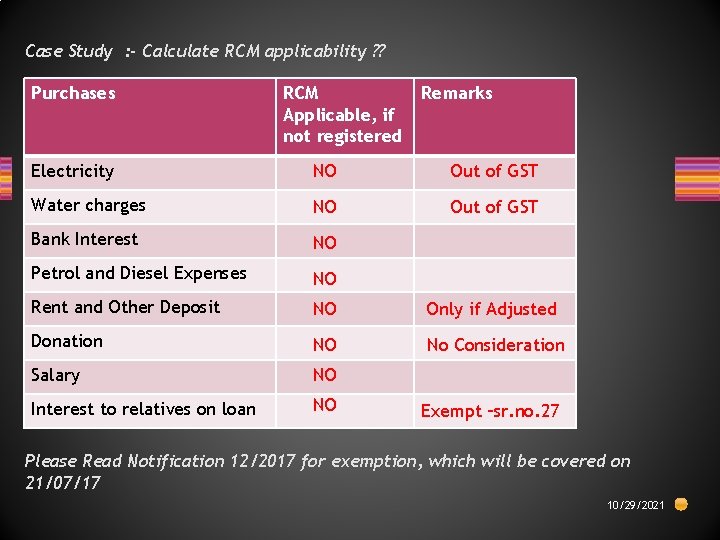

Case Study : - Calculate RCM applicability ? ? Purchases RCM Applicable, if not registered Remarks Electricity NO Out of GST Water charges NO Out of GST Bank Interest NO Petrol and Diesel Expenses NO Rent and Other Deposit NO Only if Adjusted Donation NO No Consideration Salary NO Interest to relatives on loan NO Exempt –sr. no. 27 Please Read Notification 12/2017 for exemption, which will be covered on 21/07/17 10/29/2021

IF RCM not paid by Receiver , Will service provider be liable for tax? ? • NO , No Power given in section. • Obligation only to receiver 10/29/2021

What happens in Assessment when no RCM Paid Conditions for Claiming ITC 10/29/2021

Double Taxation in case of URD dealer asked to pay tax 1) 2) Can Government take tax twice on the same transaction Constitutional Validity 10/29/2021

10/29/2021