Offshore Wind Market Overview Gaps and opportunities for

- Slides: 22

Offshore Wind Market Overview – Gaps and opportunities for indigenous supply Opportunities in Offshore Renewables for Scottish SMEs (Oil & Gas) ~ ETP Workshop 26 January 2015 Robert Gordon University

Agenda Contents Selected clients • The UK market and key considerations • Scottish supply chain analysis • Gaps and opportunities for Scottish suppliers • Pre-requisites for entering OSW • Final comments and recommendations BVG Associates • Market and supply chain • Analysis and forecasting • Strategic advice • Business and supply chain development • Economics • Technology • Socioeconomics and local benefits • Engineering services • Technology and project economic modelling • Due diligence • Policy and local content assessment • Strategy and R&D support © BVG Associates 2015

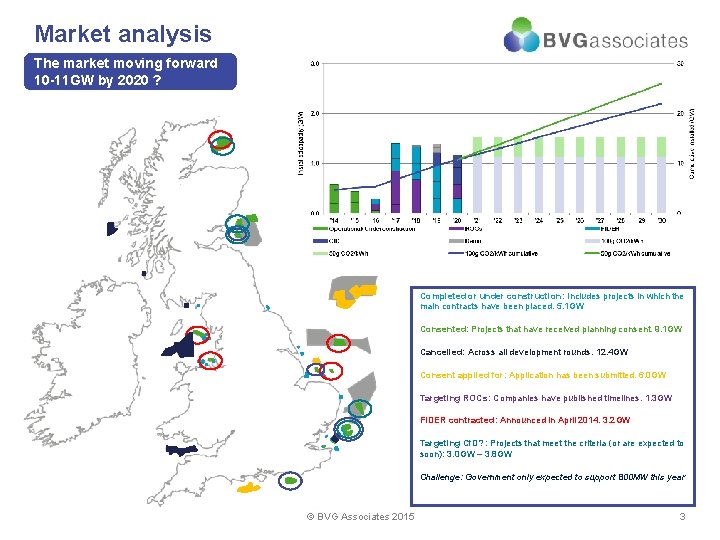

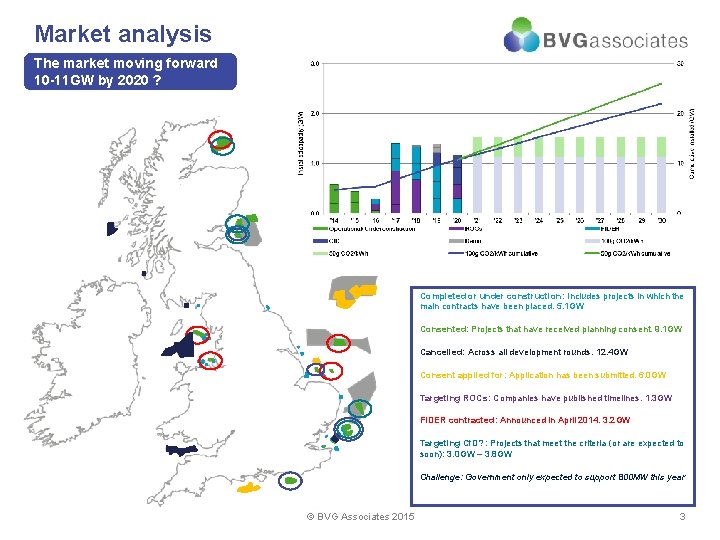

Market analysis The market moving forward 10 -11 GW by 2020 ? Completed or under construction: Includes projects in which the main contracts have been placed. 5. 1 GW Consented: Projects that have received planning consent. 9. 1 GW Cancelled: Across all development rounds. 12. 4 GW Consent applied for: Application has been submitted. 6. 0 GW Targeting ROCs: Companies have published timelines. 1. 3 GW FIDER contracted: Announced in April 2014. 3. 2 GW Targeting Cf. D? : Projects that meet the criteria (or are expected to soon): 3. 0 GW – 3. 8 GW Challenge: Government only expected to support 800 MW this year © BVG Associates 2015 3

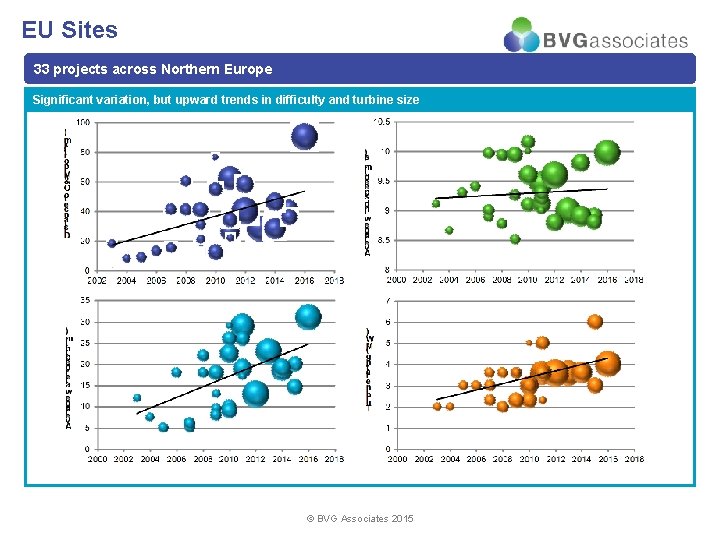

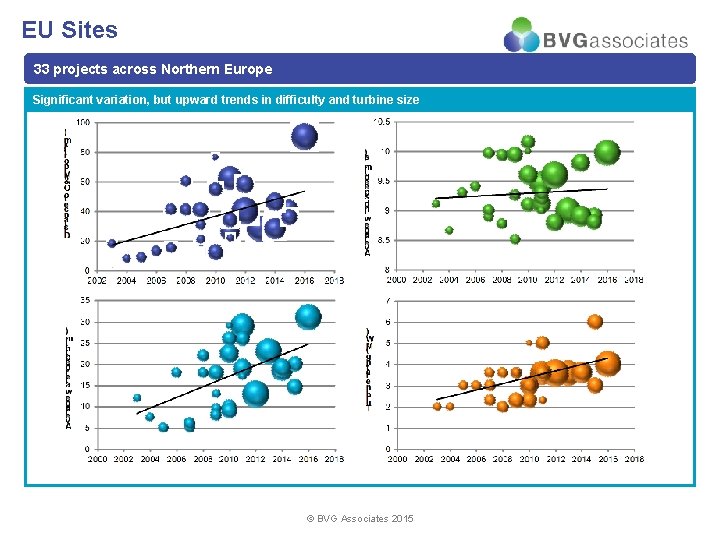

EU Sites 33 projects across Northern Europe Significant variation, but upward trends in difficulty and turbine size © BVG Associates 2015

Offshore wind – runners and riders Cost Technology Deployability Scalability Job potential © BVG Associates 2015

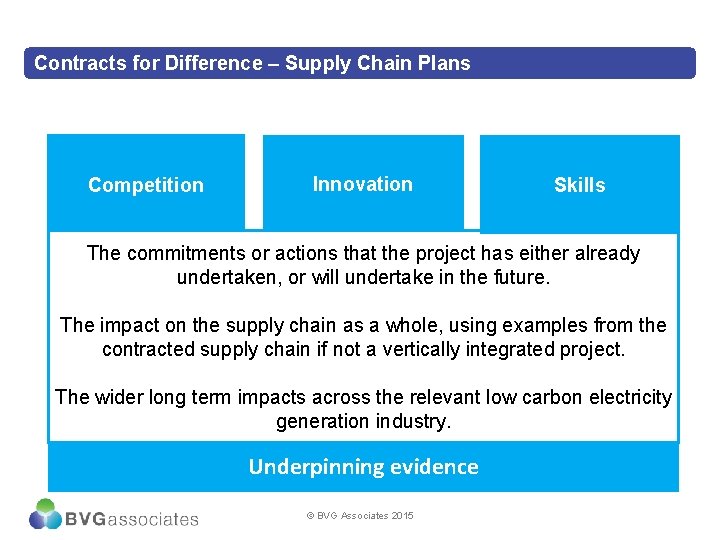

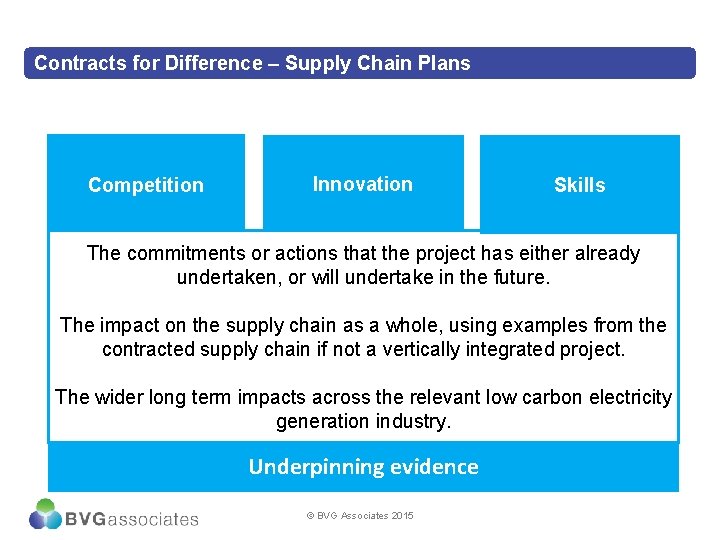

Contracts for Difference – Supply Chain Plans Competition Innovation Skills The commitments or actions that the project has either already undertaken, or will undertake in the future. The impact on the supply chain as a whole, using examples from the contracted supply chain if not a vertically integrated project. The wider long term impacts across the relevant low carbon electricity generation industry. Underpinning evidence © BVG Associates 2015

Government balancing act – push or pull ? Competition + innovation + skills = lower cost of energy UK content = procurement bias + low track record risk = higher cost of energy? © BVG Associates 2015

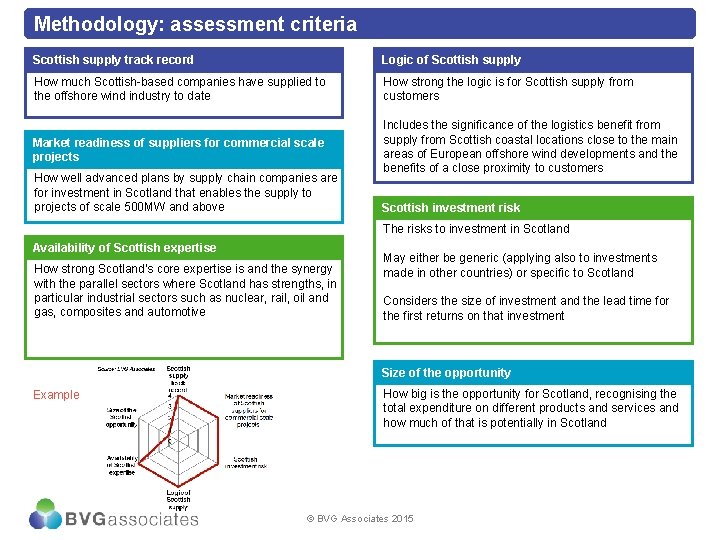

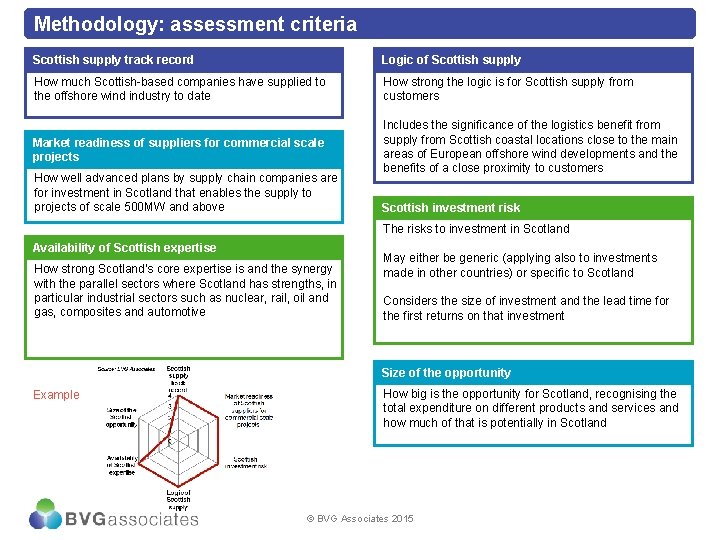

Methodology: assessment criteria Scottish supply track record Logic of Scottish supply How much Scottish-based companies have supplied to the offshore wind industry to date How strong the logic is for Scottish supply from customers Market readiness of suppliers for commercial scale projects Includes the significance of the logistics benefit from supply from Scottish coastal locations close to the main areas of European offshore wind developments and the benefits of a close proximity to customers How well advanced plans by supply chain companies are for investment in Scotland that enables the supply to projects of scale 500 MW and above Scottish investment risk The risks to investment in Scotland Availability of Scottish expertise How strong Scotland’s core expertise is and the synergy with the parallel sectors where Scotland has strengths, in particular industrial sectors such as nuclear, rail, oil and gas, composites and automotive May either be generic (applying also to investments made in other countries) or specific to Scotland Considers the size of investment and the lead time for the first returns on that investment Size of the opportunity Example How big is the opportunity for Scotland, recognising the total expenditure on different products and services and how much of that is potentially in Scotland © BVG Associates 2015

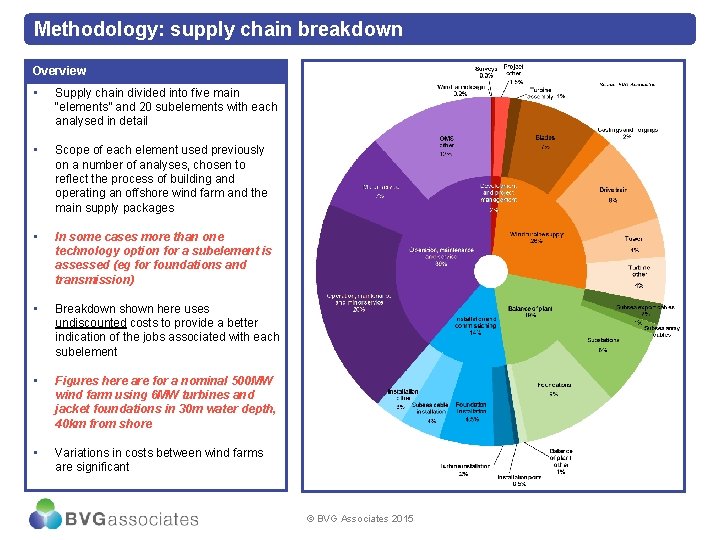

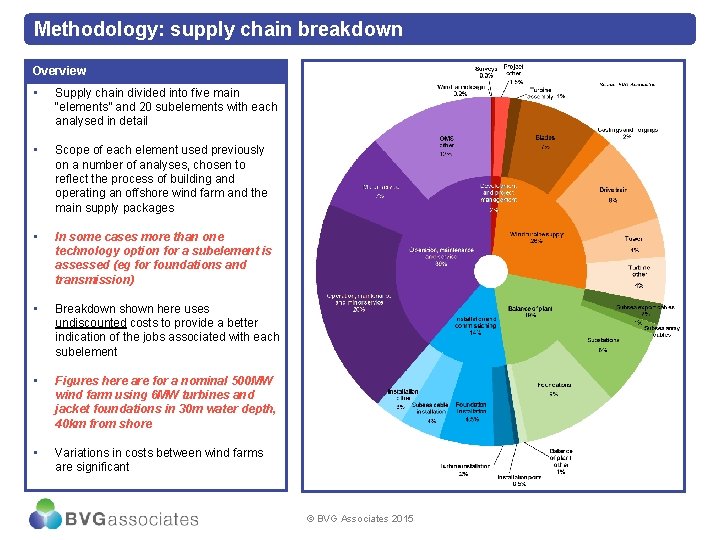

Methodology: supply chain breakdown Overview • Supply chain divided into five main “elements” and 20 subelements with each analysed in detail • Scope of each element used previously on a number of analyses, chosen to reflect the process of building and operating an offshore wind farm and the main supply packages • In some cases more than one technology option for a subelement is assessed (eg for foundations and transmission) • Breakdown shown here uses undiscounted costs to provide a better indication of the jobs associated with each subelement • Figures here are for a nominal 500 MW wind farm using 6 MW turbines and jacket foundations in 30 m water depth, 40 km from shore • Variations in costs between wind farms are significant © BVG Associates 2015

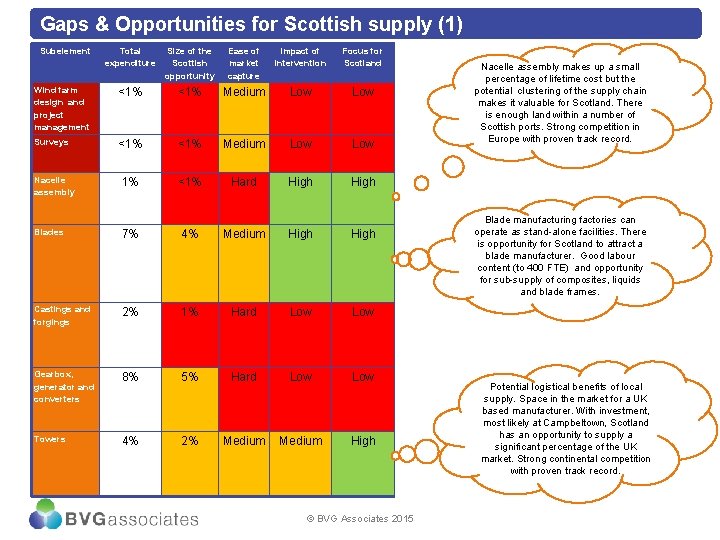

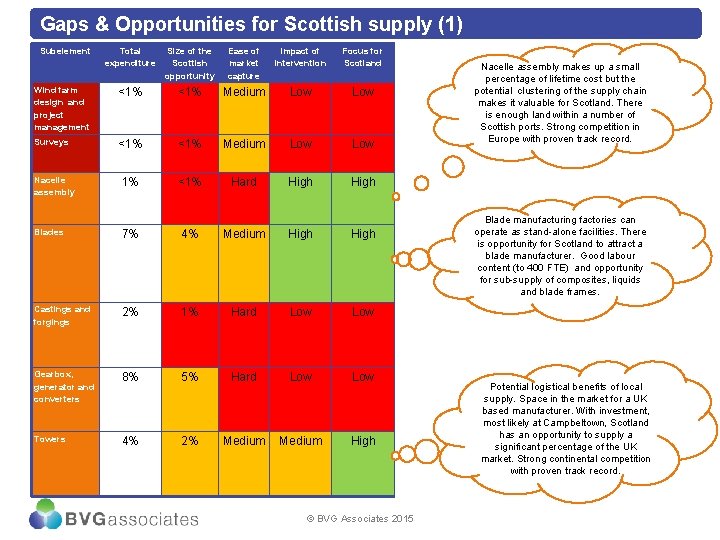

Gaps & Opportunities for Scottish supply (1) Subelement Total expenditure Size of the Scottish opportunity Ease of market capture Impact of intervention Focus for Scotland Wind farm design and project management <1% Medium Low Surveys <1% Medium Low 1% <1% Hard High Nacelle assembly Blades 7% 4% Medium High Castings and forgings 2% 1% Hard Low Gearbox, generator and converters 8% 5% Hard Low Towers 4% 2% Medium High © BVG Associates 2015 Nacelle assembly makes up a small percentage of lifetime cost but the potential clustering of the supply chain makes it valuable for Scotland. There is enough land within a number of Scottish ports. Strong competition in Europe with proven track record. Blade manufacturing factories can operate as stand-alone facilities. There is opportunity for Scotland to attract a blade manufacturer. Good labour content (to 400 FTE) and opportunity for sub-supply of composites, liquids and blade frames. Potential logistical benefits of local supply. Space in the market for a UK based manufacturer. With investment, most likely at Campbeltown, Scotland has an opportunity to supply a significant percentage of the UK market. Strong continental competition with proven track record.

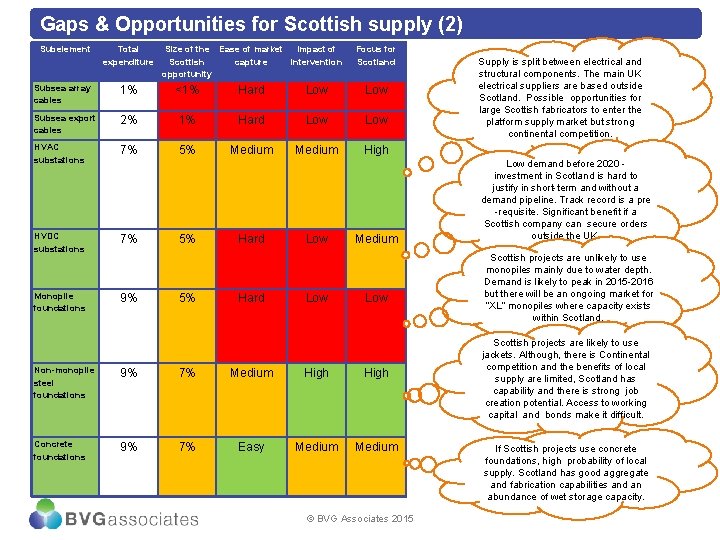

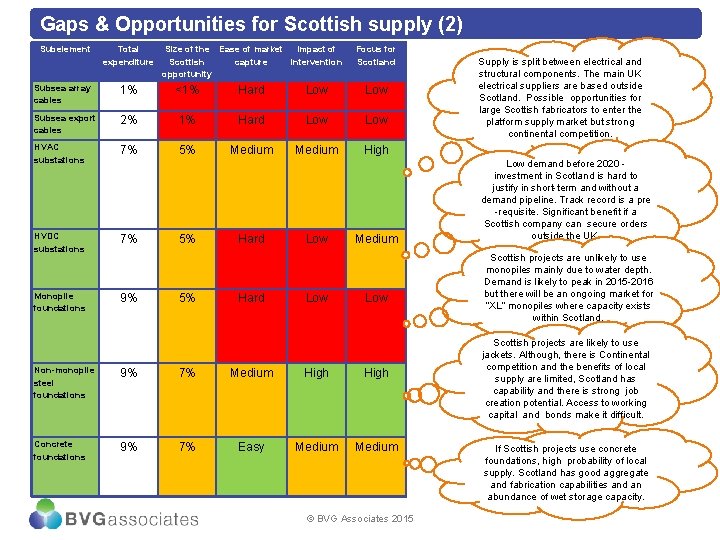

Gaps & Opportunities for Scottish supply (2) Subelement Total expenditure Size of the Ease of market Impact of Scottish capture intervention opportunity Focus for Scotland Subsea array cables 1% <1% Hard Low Subsea export cables 2% 1% Hard Low HVAC substations 7% 5% Medium High HVDC substations 7% Monopile foundations 9% 5% 5% Hard Low Medium Low Non-monopile steel foundations 9% 7% Medium High Concrete foundations 9% 7% Easy Medium © BVG Associates 2015 Supply is split between electrical and structural components. The main UK electrical suppliers are based outside Scotland. Possible opportunities for large Scottish fabricators to enter the platform supply market but strong continental competition. Low demand before 2020 investment in Scotland is hard to justify in short-term and without a demand pipeline. Track record is a pre -requisite. Significant benefit if a Scottish company can secure orders outside the UK. Scottish projects are unlikely to use monopiles mainly due to water depth. Demand is likely to peak in 2015 -2016 but there will be an ongoing market for “XL” monopiles where capacity exists within Scotland. Scottish projects are likely to use jackets. Although, there is Continental competition and the benefits of local supply are limited, Scotland has capability and there is strong job creation potential. Access to working capital and bonds make it difficult. If Scottish projects use concrete foundations, high probability of local supply. Scotland has good aggregate and fabrication capabilities and an abundance of wet storage capacity.

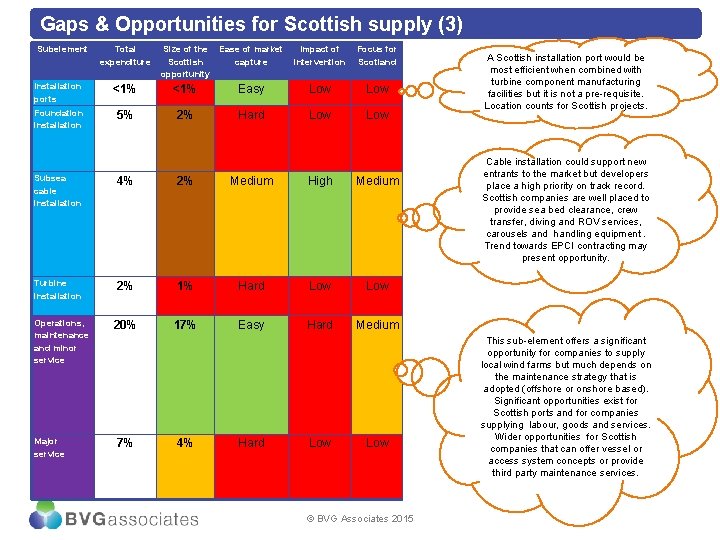

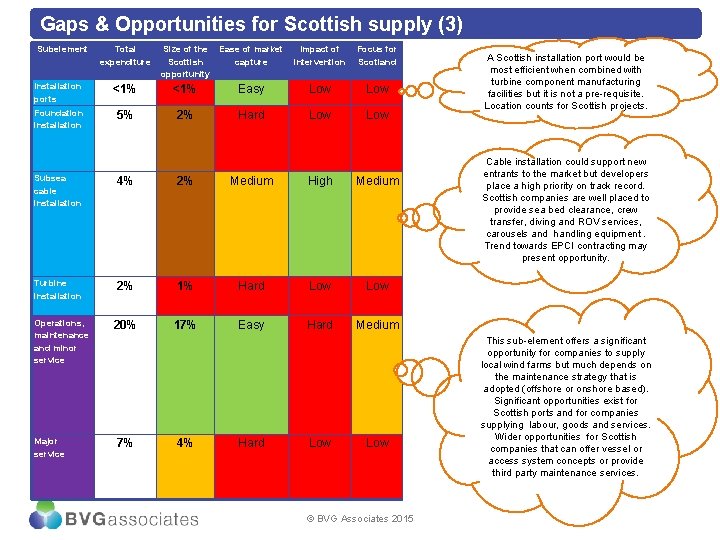

Gaps & Opportunities for Scottish supply (3) Subelement Total expenditure Size of the Ease of market Scottish capture opportunity Impact of intervention Focus for Scotland Installation ports <1% Easy Low Foundation installation 5% 2% Hard Low Subsea cable installation 4% 2% Medium High Medium Turbine installation 2% 1% Hard Low 20% 17% Easy Hard Medium Operations, maintenance and minor service Major service 7% 4% Hard Low © BVG Associates 2015 A Scottish installation port would be most efficient when combined with turbine component manufacturing facilities but it is not a pre-requisite. Location counts for Scottish projects. Cable installation could support new entrants to the market but developers place a high priority on track record. Scottish companies are well placed to provide sea bed clearance, crew transfer, diving and ROV services, carousels and handling equipment. Trend towards EPCI contracting may present opportunity. This sub-element offers a significant opportunity for companies to supply local wind farms but much depends on the maintenance strategy that is adopted (offshore or onshore based). Significant opportunities exist for Scottish ports and for companies supplying labour, goods and services. Wider opportunities for Scottish companies that can offer vessel or access system concepts or provide third party maintenance services.

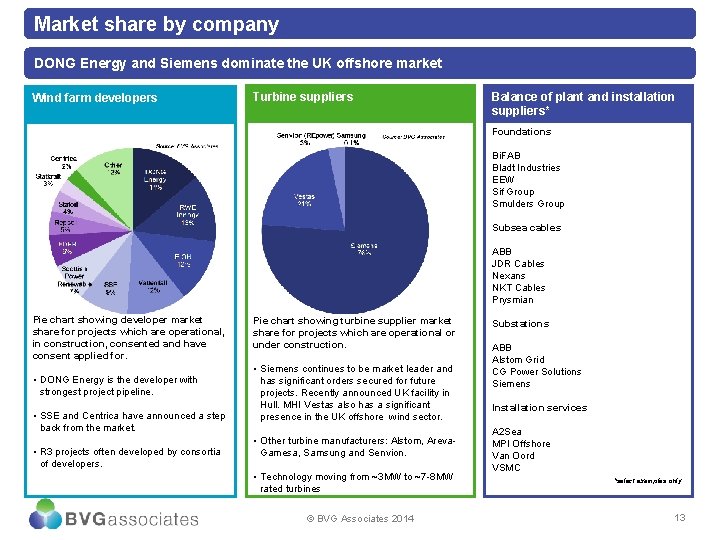

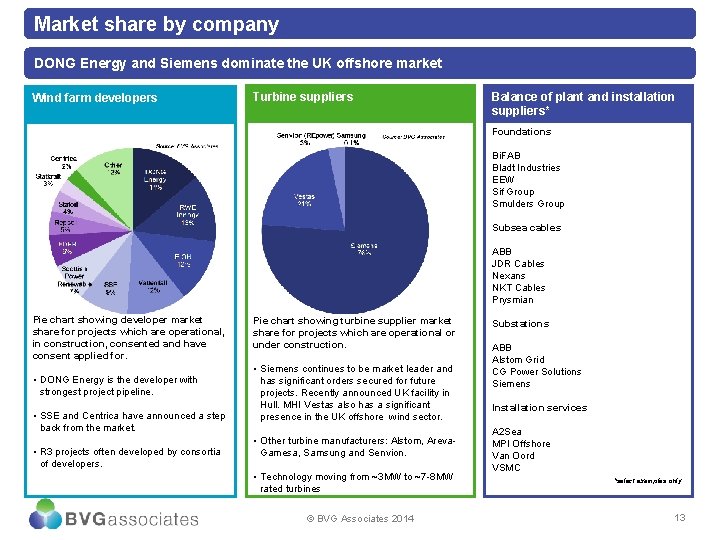

Market share by company DONG Energy and Siemens dominate the UK offshore market Wind farm developers Turbine suppliers Balance of plant and installation suppliers* Foundations Bi. FAB Bladt Industries EEW Sif Group Smulders Group Subsea cables ABB JDR Cables Nexans NKT Cables Prysmian Pie chart showing developer market share for projects which are operational, in construction, consented and have consent applied for. • DONG Energy is the developer with strongest project pipeline. • SSE and Centrica have announced a step back from the market. • R 3 projects often developed by consortia of developers. Pie chart showing turbine supplier market share for projects which are operational or under construction. • Siemens continues to be market leader and has significant orders secured for future projects. Recently announced UK facility in Hull. MHI Vestas also has a significant presence in the UK offshore wind sector. • Other turbine manufacturers: Alstom, Areva. Gamesa, Samsung and Senvion. • Technology moving from ~3 MW to ~7 -8 MW rated turbines © BVG Associates 2014 Substations ABB Alstom Grid CG Power Solutions Siemens Installation services A 2 Sea MPI Offshore Van Oord VSMC *select examples only 13

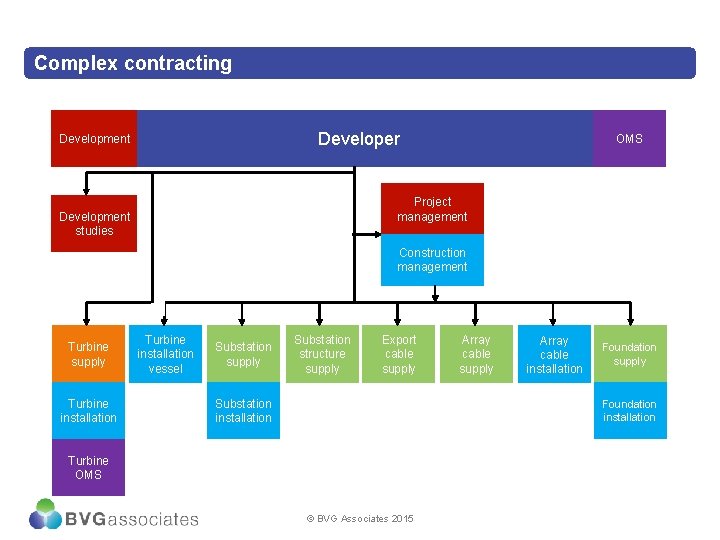

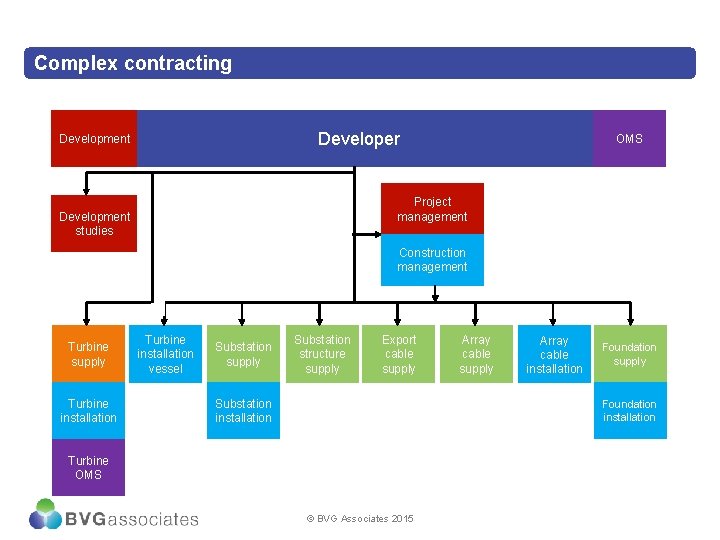

Complex contracting Developer Development OMS Project management Development studies Construction management Turbine supply Turbine installation vessel Substation supply Substation structure supply Export cable supply Substation installation Array cable supply Export Array Cable cable installation Foundation supply Foundation installation Turbine OMS © BVG Associates 2015

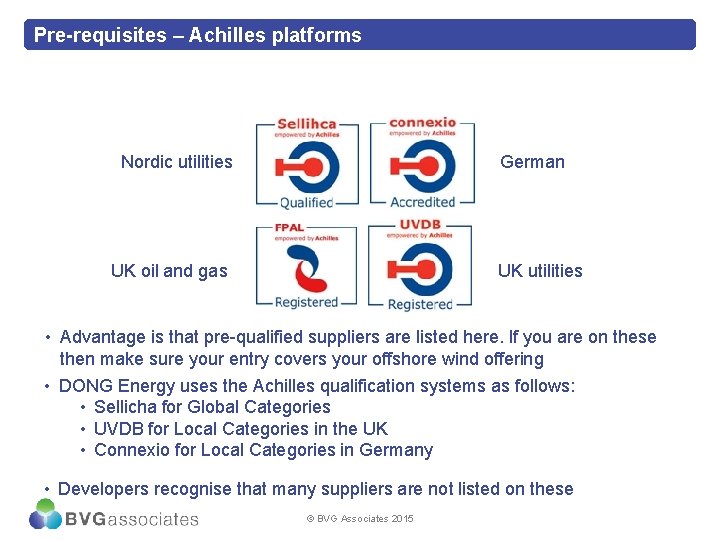

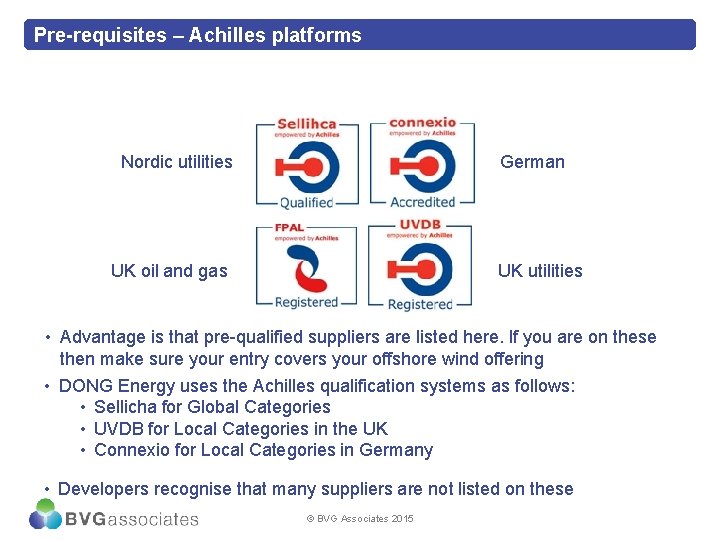

Pre-requisites – Achilles platforms German Nordic utilities UK oil and gas UK utilities • Advantage is that pre-qualified suppliers are listed here. If you are on these then make sure your entry covers your offshore wind offering • DONG Energy uses the Achilles qualification systems as follows: • Sellicha for Global Categories • UVDB for Local Categories in the UK • Connexio for Local Categories in Germany • Developers recognise that many suppliers are not listed on these © BVG Associates 2015

Final thoughts…. • OMS is the single biggest opportunity for Scotland (over 40% of total lifetime cost). Blades, towers, HVAC substations, foundations and subsea cable installation show logical opportunities. • Offshore wind, in many cases, is competing with oil and gas for supplier capacity. Can lower margins be compensated by the creation of a secure pipeline and the opportunity to standardise and produce in volume ? • Areas of focus should be determined by a holistic consideration of the logic of supply – is proximity to wind farms a distinct advantage for you commercially and logistically ? Can you displace the existing supply chain ? • Developers and potential inward investors benefit from a detailed understanding of your capabilities – make it clear what you can do. • The UK will continue to lead the world for offshore wind installation to 2030 : significant opportunities for Scottish suppliers to export expertise. • The ‘Saudi Arabia of Renewables’ tagline has damaged short term credibility: however, no other industry offers Scotland such an opportunity to lead the world for the next 20 – 30 years…. • Trend towards project rather than balance sheet financing by developers is likely to lead to less work packages (interface risk) – emergence of more EPCI contracting ? • Supply consortiums will continue to pervade the sector – Scottish companies should seek to partner with existing industry players to gain track record in return for local presence. • To displace the incumbent supply chain, Scottish companies will need to demonstrate hunger - can you afford to accept lower margins for prototyping ? • This is not a short term job play – concentrate on participating in a global supply chain from THE world leading market. © BVG Associates 2015

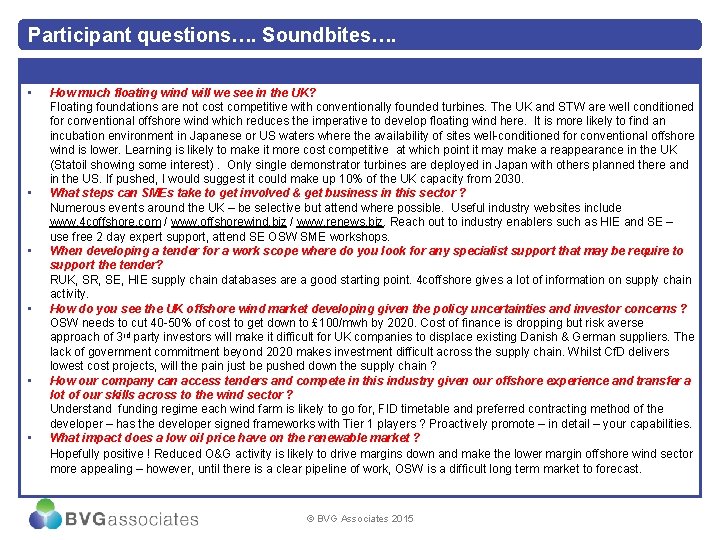

Participant questions…. Soundbites…. • • • How much floating wind will we see in the UK? Floating foundations are not cost competitive with conventionally founded turbines. The UK and STW are well conditioned for conventional offshore wind which reduces the imperative to develop floating wind here. It is more likely to find an incubation environment in Japanese or US waters where the availability of sites well-conditioned for conventional offshore wind is lower. Learning is likely to make it more cost competitive at which point it may make a reappearance in the UK (Statoil showing some interest). Only single demonstrator turbines are deployed in Japan with others planned there and in the US. If pushed, I would suggest it could make up 10% of the UK capacity from 2030. What steps can SMEs take to get involved & get business in this sector ? Numerous events around the UK – be selective but attend where possible. Useful industry websites include www. 4 coffshore. com / www. offshorewind. biz / www. renews. biz. Reach out to industry enablers such as HIE and SE – use free 2 day expert support, attend SE OSW SME workshops. When developing a tender for a work scope where do you look for any specialist support that may be require to support the tender? RUK, SR, SE, HIE supply chain databases are a good starting point. 4 coffshore gives a lot of information on supply chain activity. How do you see the UK offshore wind market developing given the policy uncertainties and investor concerns ? OSW needs to cut 40 -50% of cost to get down to £ 100/mwh by 2020. Cost of finance is dropping but risk averse approach of 3 rd party investors will make it difficult for UK companies to displace existing Danish & German suppliers. The lack of government commitment beyond 2020 makes investment difficult across the supply chain. Whilst Cf. D delivers lowest cost projects, will the pain just be pushed down the supply chain ? How our company can access tenders and compete in this industry given our offshore experience and transfer a lot of our skills across to the wind sector ? Understand funding regime each wind farm is likely to go for, FID timetable and preferred contracting method of the developer – has the developer signed frameworks with Tier 1 players ? Proactively promote – in detail – your capabilities. What impact does a low oil price have on the renewable market ? Hopefully positive ! Reduced O&G activity is likely to drive margins down and make the lower margin offshore wind sector more appealing – however, until there is a clear pipeline of work, OSW is a difficult long term market to forecast. © BVG Associates 2015

Thank you for your attention & good luck…. Alan Duncan UK adu@bvgassociates. co. uk BVG Associates Ltd. The Blackthorn Centre Purton Road Cricklade, Swindon SN 6 6 HY England, UK tel +44 1793 752 308 The Boathouse Silversands Aberdour, Fife KY 3 0 TZ Scotland, UK tel +44 1383 870 014 4444 Second Avenue Detroit, MI 48201 USA tel +1 206 459 8506 info@bvgassociates. co. uk @bvgassociates www. bvgassociates. co. uk This presentation and its content is copyright of BVG Associates Limited - © BVG Associates 2015. All rights are reserved. You may not, except with our express written permission, commercially exploit the content.

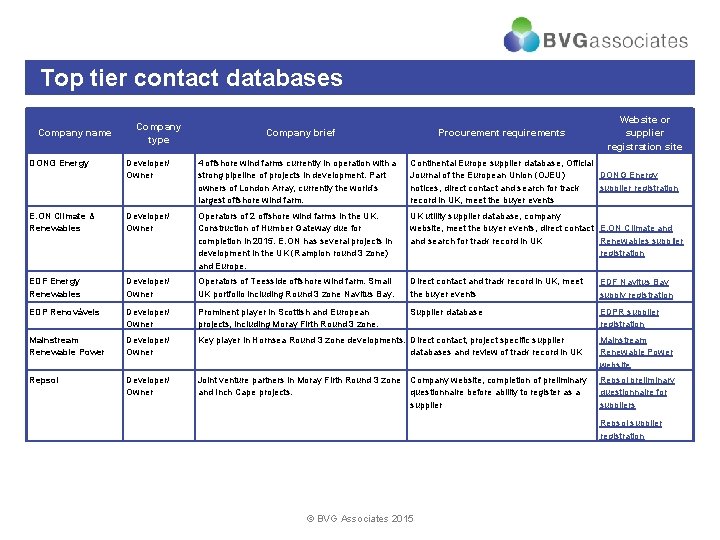

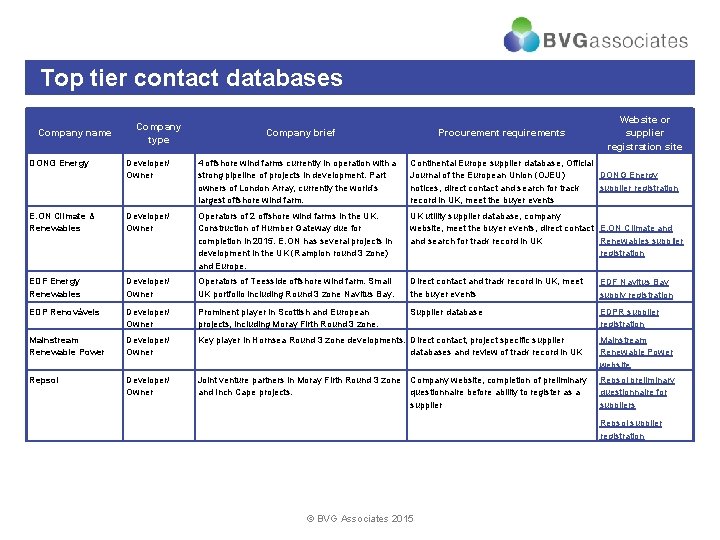

Top tier contact databases Company name Company type Company brief Procurement requirements Website or supplier registration site DONG Energy Developer/ Owner 4 offshore wind farms currently in operation with a strong pipeline of projects in development. Part owners of London Array, currently the world’s largest offshore wind farm. Continental Europe supplier database, Official Journal of the European Union (OJEU) DONG Energy notices, direct contact and search for track supplier registration record in UK, meet the buyer events E. ON Climate & Renewables Developer/ Owner Operators of 2 offshore wind farms in the UK. Construction of Humber Gateway due for completion in 2015. E. ON has several projects in development in the UK (Rampion round 3 zone) and Europe. UK utility supplier database, company website, meet the buyer events, direct contact E. ON Climate and search for track record in UK Renewables supplier registration EDF Energy Renewables Developer/ Owner Operators of Teesside offshore wind farm. Small UK portfolio including Round 3 zone Navitus Bay. Direct contact and track record in UK, meet the buyer events EDF Navitus Bay supply registration EDP Renováveis Developer/ Owner Prominent player in Scottish and European projects, including Moray Firth Round 3 zone. Supplier database EDPR supplier registration Mainstream Renewable Power Developer/ Owner Key player in Hornsea Round 3 zone developments. Direct contact, project specific supplier databases and review of track record in UK Mainstream Renewable Power website Repsol Developer/ Owner Joint venture partners in Moray Firth Round 3 zone and Inch Cape projects. Repsol preliminary questionnaire for suppliers Company website, completion of preliminary questionnaire before ability to register as a supplier Repsol supplier registration © BVG Associates 2015

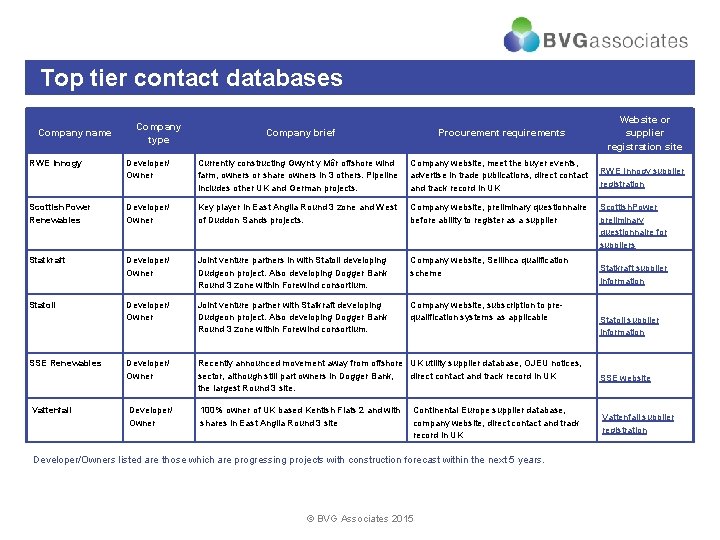

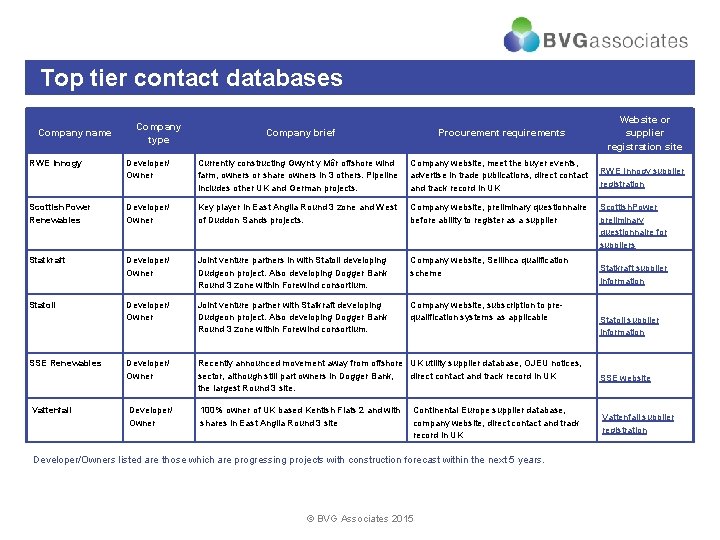

Top tier contact databases Company name Company type Company brief Procurement requirements RWE Innogy Developer/ Owner Currently constructing Gwynt y Môr offshore wind farm, owners or share owners in 3 others. Pipeline includes other UK and German projects. Company website, meet the buyer events, advertise in trade publications, direct contact and track record in UK Scottish. Power Renewables Developer/ Owner Key player in East Anglia Round 3 zone and West of Duddon Sands projects. Company website, preliminary questionnaire before ability to register as a supplier Statkraft Developer/ Owner Joint venture partners in with Statoil developing Dudgeon project. Also developing Dogger Bank Round 3 zone within Forewind consortium. Company website, Sellihca qualification scheme Statoil Developer/ Owner Joint venture partner with Statkraft developing Dudgeon project. Also developing Dogger Bank Round 3 zone within Forewind consortium. Company website, subscription to prequalification systems as applicable Developer/ Owner Recently announced movement away from offshore UK utility supplier database, OJEU notices, sector, although still part owners in Dogger Bank, direct contact and track record in UK the largest Round 3 site. Developer/ Owner 100% owner of UK based Kentish Flats 2 and with shares in East Anglia Round 3 site SSE Renewables Vattenfall Continental Europe supplier database, company website, direct contact and track record in UK Developer/Owners listed are those which are progressing projects with construction forecast within the next 5 years. © BVG Associates 2015 Website or supplier registration site RWE Innogy supplier registration Scottish. Power preliminary questionnaire for suppliers Statkraft supplier information Statoil supplier information SSE website Vattenfall supplier registration

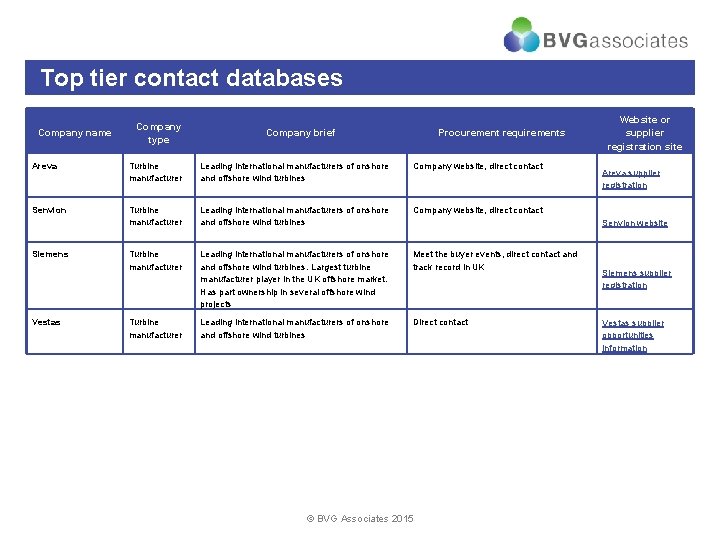

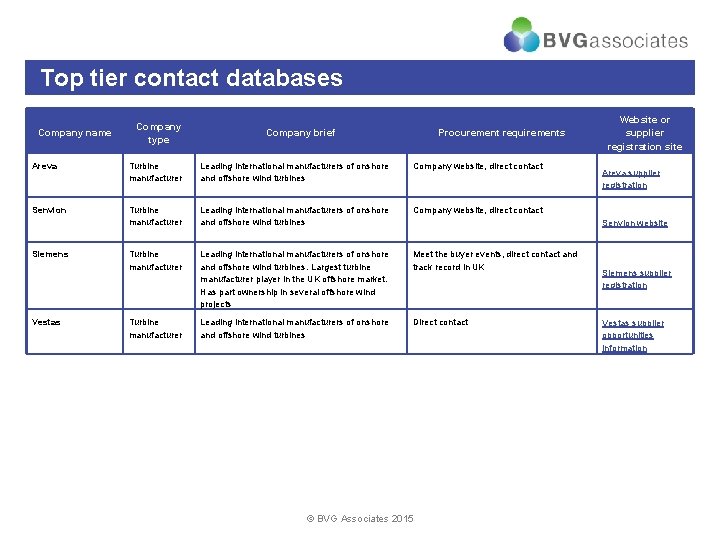

Top tier contact databases Company name Company type Company brief Procurement requirements Areva Turbine manufacturer Leading international manufacturers of onshore and offshore wind turbines Company website, direct contact Senvion Turbine manufacturer Leading international manufacturers of onshore and offshore wind turbines Company website, direct contact Turbine manufacturer Leading international manufacturers of onshore and offshore wind turbines. Largest turbine manufacturer player in the UK offshore market. Has part ownership in several offshore wind projects Meet the buyer events, direct contact and track record in UK Turbine manufacturer Leading international manufacturers of onshore and offshore wind turbines Direct contact Siemens Vestas Website or supplier registration site Areva supplier registration Senvion website © BVG Associates 2015 Siemens supplier registration Vestas supplier opportunities information

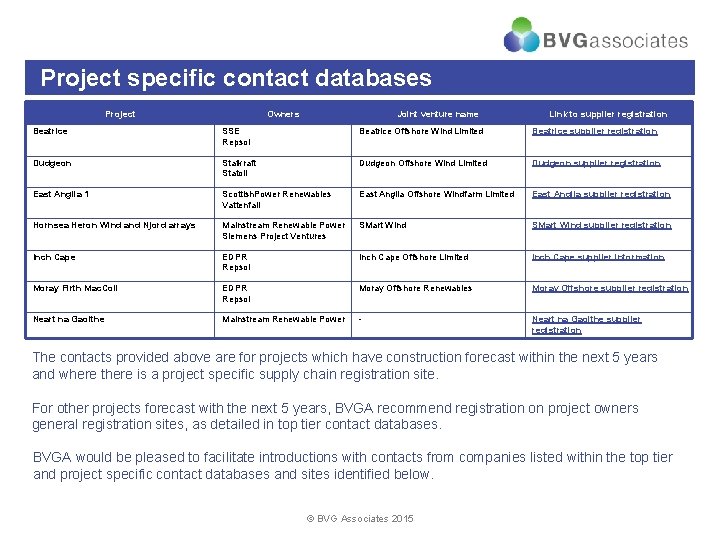

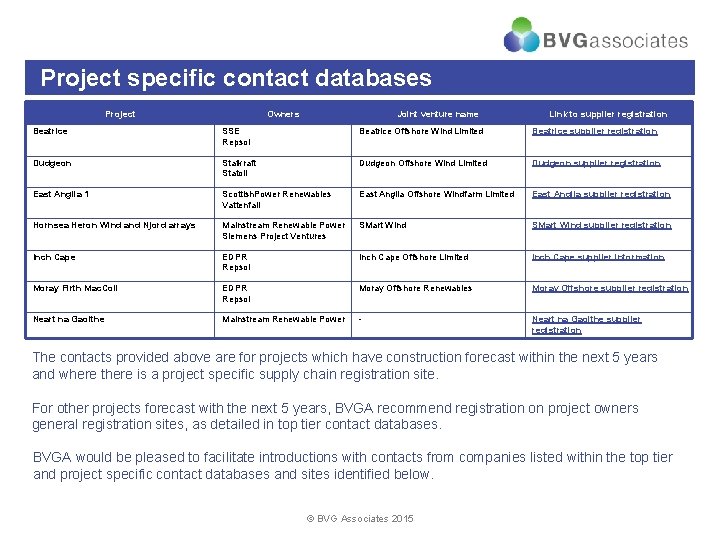

Project specific contact databases Project Owners Joint venture name Link to supplier registration Beatrice SSE Repsol Beatrice Offshore Wind Limited Beatrice supplier registration Dudgeon Statkraft Statoil Dudgeon Offshore Wind Limited Dudgeon supplier registration East Anglia 1 Scottish. Power Renewables Vattenfall East Anglia Offshore Windfarm Limited East Anglia supplier registration Hornsea Heron Wind and Njord arrays Mainstream Renewable Power Siemens Project Ventures SMart Wind supplier registration Inch Cape EDPR Repsol Inch Cape Offshore Limited Inch Cape supplier information Moray Firth Mac. Coll EDPR Repsol Moray Offshore Renewables Moray Offshore supplier registration Neart na Gaoithe Mainstream Renewable Power - Neart na Gaoithe supplier registration The contacts provided above are for projects which have construction forecast within the next 5 years and where there is a project specific supply chain registration site. For other projects forecast with the next 5 years, BVGA recommend registration on project owners general registration sites, as detailed in top tier contact databases. BVGA would be pleased to facilitate introductions with contacts from companies listed within the top tier and project specific contact databases and sites identified below. © BVG Associates 2015