NONRESIDENT ALIEN TAXPAYERS Instructions for Tax Year 2019

- Slides: 44

NON-RESIDENT ALIEN TAXPAYERS Instructions for Tax Year 2019 This information is provided for information purposes only. Your personal circumstances may dictate other filings.

Recent News Coverage on Tax Payment Extension • The federal government recently extended the deadline to pay your taxes to July 15, 2020. • This is only a deadline to PAY your taxes – you must still FILE BY APRIL 15, 2020. • If you do not file by April 15, 2020 you will still be charged penalties and interest if you owe more tax. • If you cannot file by April 15, 2020, you can request one automatic 6 -month extension by filing form 4868. • MUST file form 4868 by April 15 to be considered a valid extension request. • You can file form 4868 at irs. gov.

Getting Started • You must postmark your federal and state tax returns by 11: 59 pm on Wednesday, April 15, 2020. • The sooner you file your tax returns, the sooner you will receive any refund for which you may be eligible. • Make all letters and numbers very clear and legible on your tax returns. • Use pen, not pencil, to prepare your returns. • Staple a copy of your W 2 and/or 1042 S to your federal 1040 NR or 1040 NR-EZ.

Getting Started • Be sure to use the exact name and social security number or taxpayer identification number that appears on your social security card or ITIN notice. • Your must sign your tax returns before you mail them to the IRS, Michigan Department of Treasury, and City of East Lansing. An unsigned tax return is not a valid return. You are signing your tax return under penalties of perjury, so it important to be honest in your preparation of your return. • Always make a copy of your tax returns and supporting documents before you mail them. • Keep these copies as part of your personal records for six years in case the IRS, Michigan Department of Treasury, or City of East Lansing has questions about the returns you filed. It’s not a bad idea to keep them for an even longer period of time. • Make sure you put proper postage on the envelope containing your tax return. A return sent with insufficient postage will not be delivered to the IRS, Michigan Department of Treasury, or City of East Lansing

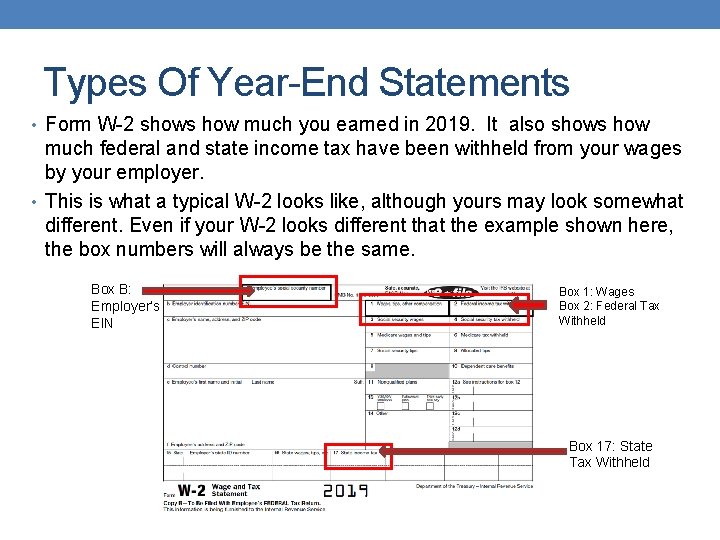

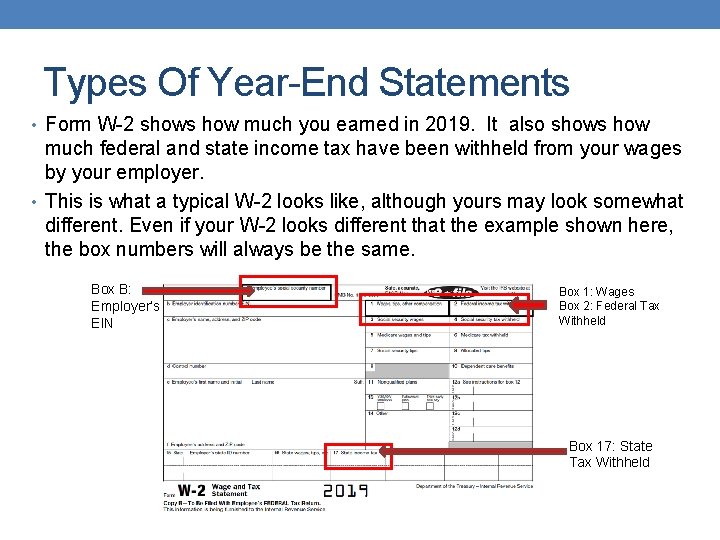

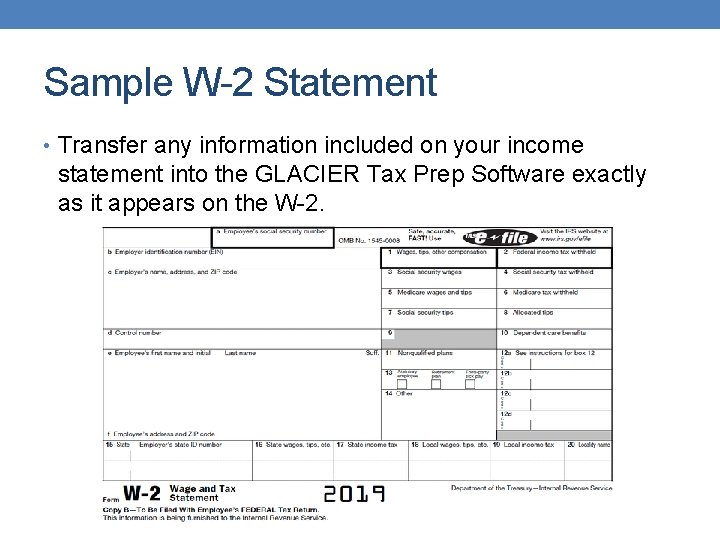

Types Of Year-End Statements • Form W-2 shows how much you earned in 2019. It also shows how much federal and state income tax have been withheld from your wages by your employer. • This is what a typical W-2 looks like, although yours may look somewhat different. Even if your W-2 looks different that the example shown here, the box numbers will always be the same. Box B: Employer’s EIN Box 1: Wages Box 2: Federal Tax Withheld Box 17: State Tax Withheld

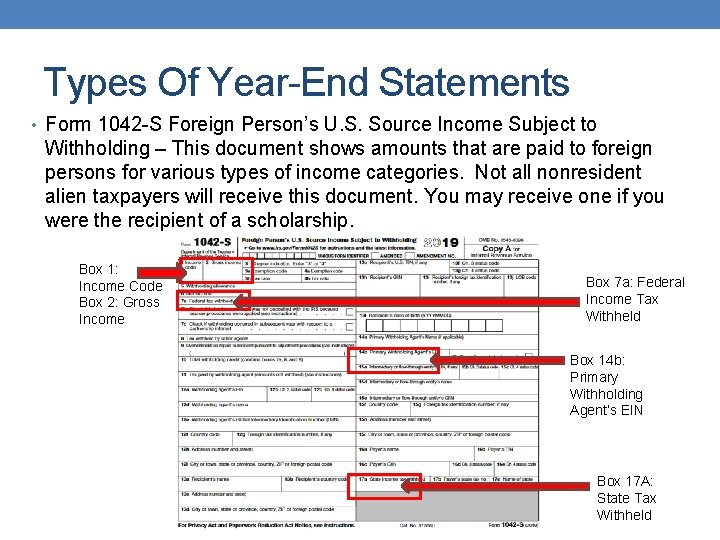

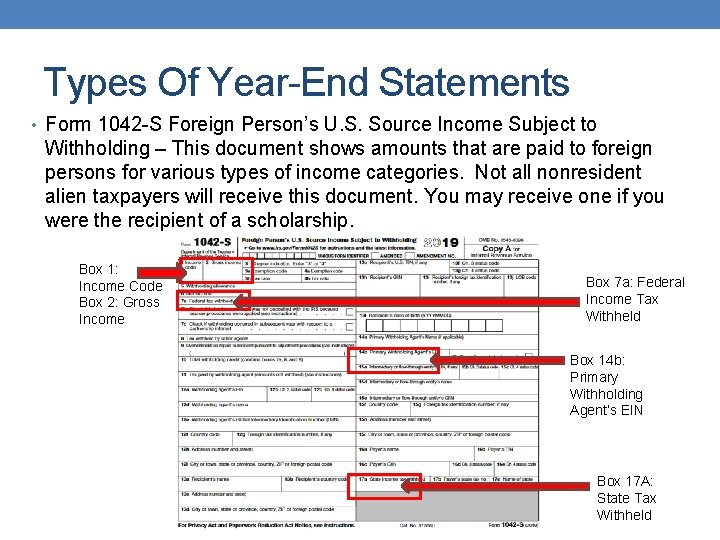

Types Of Year-End Statements • Form 1042 -S Foreign Person’s U. S. Source Income Subject to Withholding – This document shows amounts that are paid to foreign persons for various types of income categories. Not all nonresident alien taxpayers will receive this document. You may receive one if you were the recipient of a scholarship. Box 1: Income Code Box 2: Gross Income Box 7 a: Federal Income Tax Withheld Box 14 b: Primary Withholding Agent’s EIN Box 17 A: State Tax Withheld

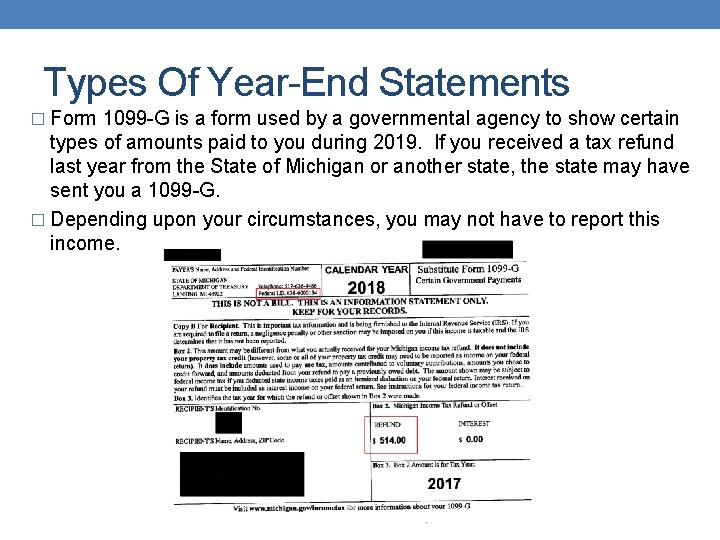

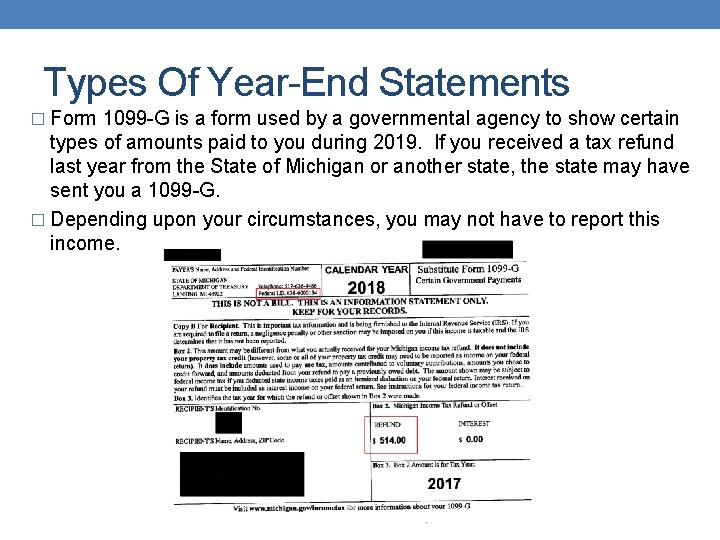

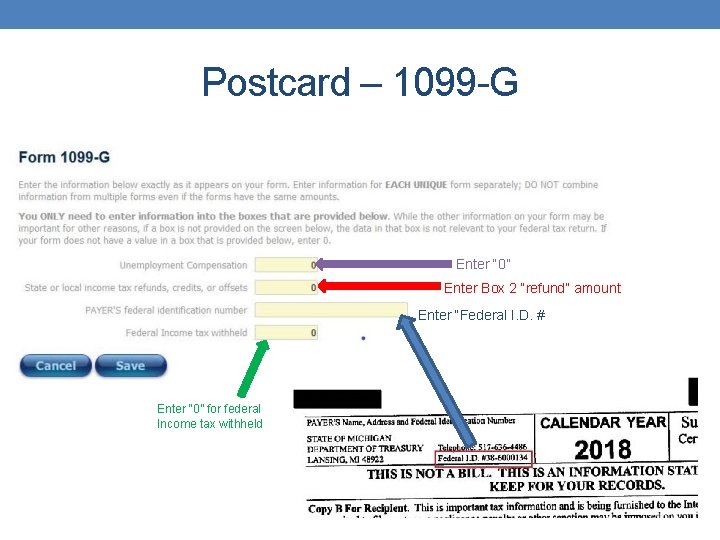

Types Of Year-End Statements � Form 1099 -G is a form used by a governmental agency to show certain types of amounts paid to you during 2019. If you received a tax refund last year from the State of Michigan or another state, the state may have sent you a 1099 -G. � Depending upon your circumstances, you may not have to report this income.

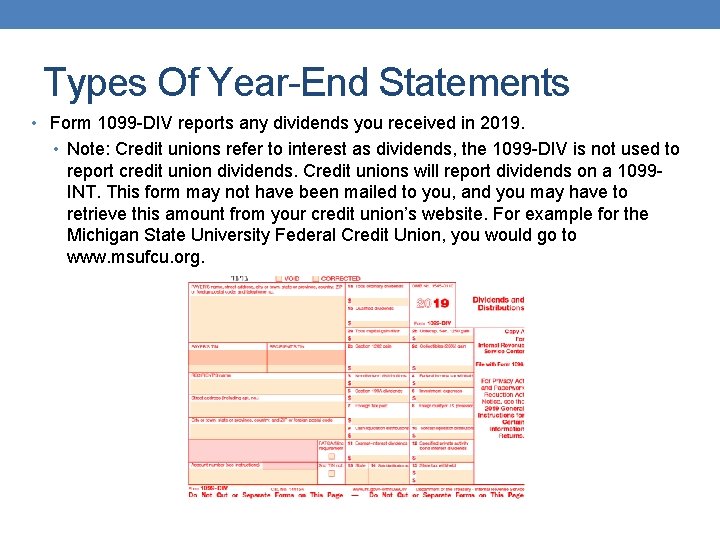

Types Of Year-End Statements • Form 1099 -DIV reports any dividends you received in 2019. • Note: Credit unions refer to interest as dividends, the 1099 -DIV is not used to report credit union dividends. Credit unions will report dividends on a 1099 INT. This form may not have been mailed to you, and you may have to retrieve this amount from your credit union’s website. For example for the Michigan State University Federal Credit Union, you would go to www. msufcu. org.

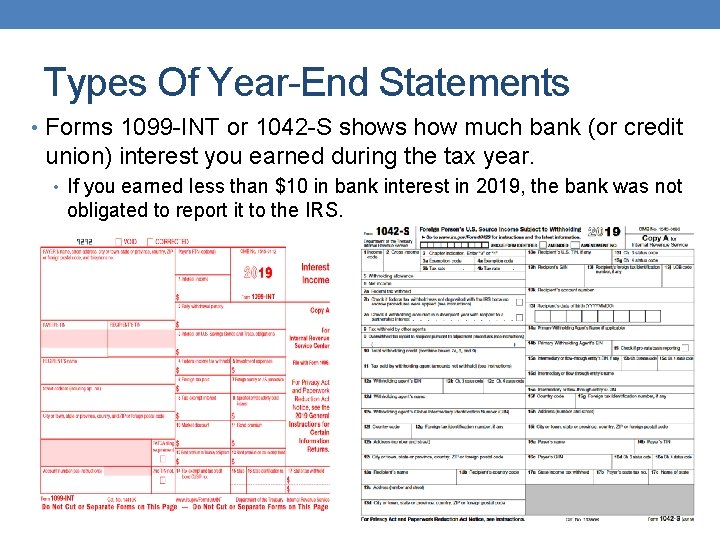

Types Of Year-End Statements • Forms 1099 -INT or 1042 -S shows how much bank (or credit union) interest you earned during the tax year. • If you earned less than $10 in bank interest in 2019, the bank was not obligated to report it to the IRS.

Types Of Year-End Statements • Form 1099 -MISC is used to show any miscellaneous income you may have received from work or other parties. If you are an independent contractor and not an employee, payments made to you for your services are reported on a 1099 -MISC. You may also have received this form for amounts paid for attendance at or travel to a conference.

Types Of Year-End Statements • Form 1098 -T is used by an educational institution to report qualified tuition payments you made in 2019. A 1098 -T is used by resident alien taxpayers to claim an education credit as well as to substantiate an educational deduction. • A non-resident alien taxpayer is not eligible to claim a federal education credit.

Types of Year-End Statements • Form 1095 -A, B, or C is used to report health coverage as required by the Affordable Care Act. Nonresident aliens are not subject to the Affordable Care Act and will not need this form to complete their tax return.

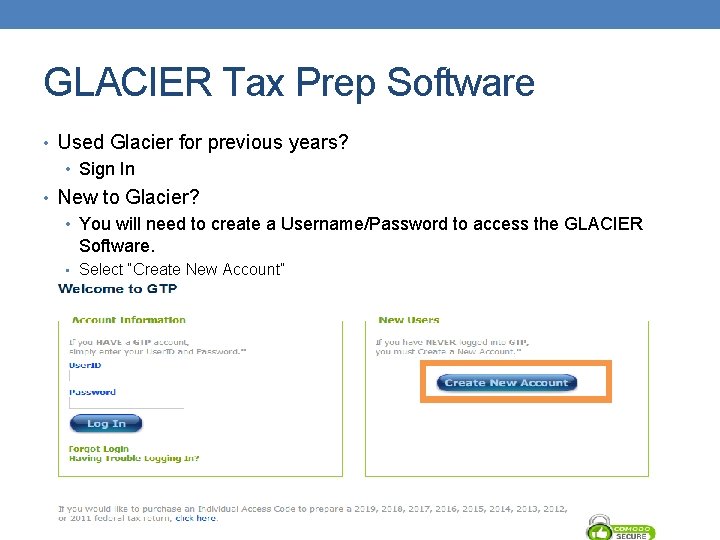

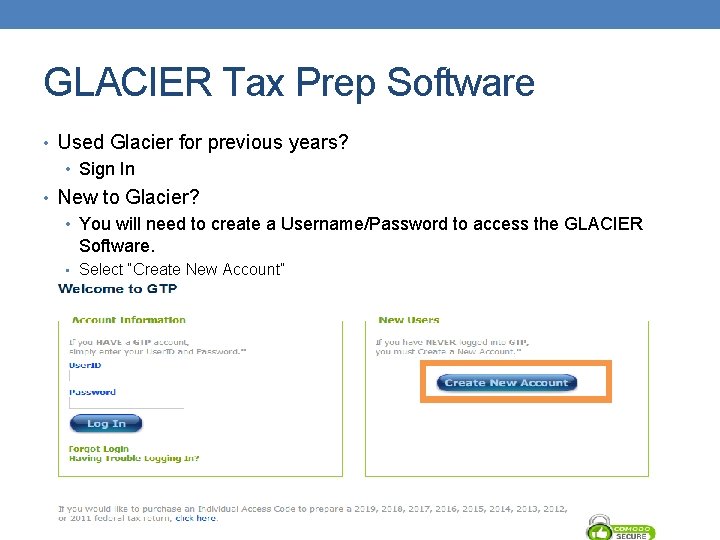

GLACIER Tax Prep Software • Used Glacier for previous years? • Sign In • New to Glacier? • You will need to create a Username/Password to access the GLACIER Software. • Select “Create New Account”

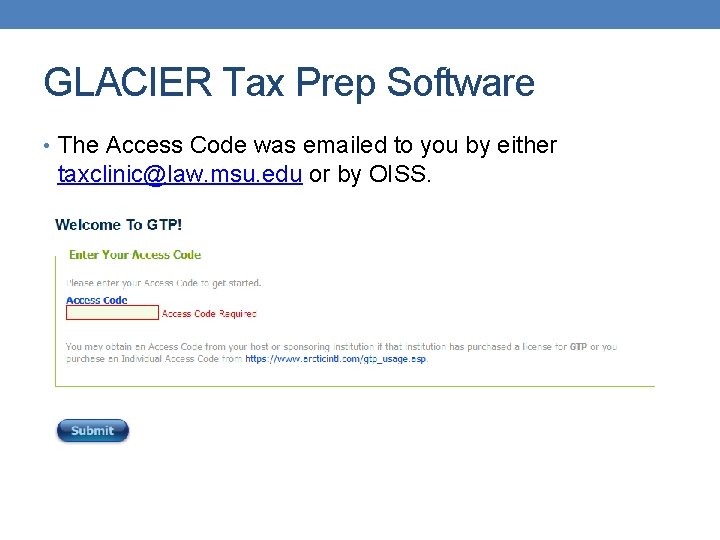

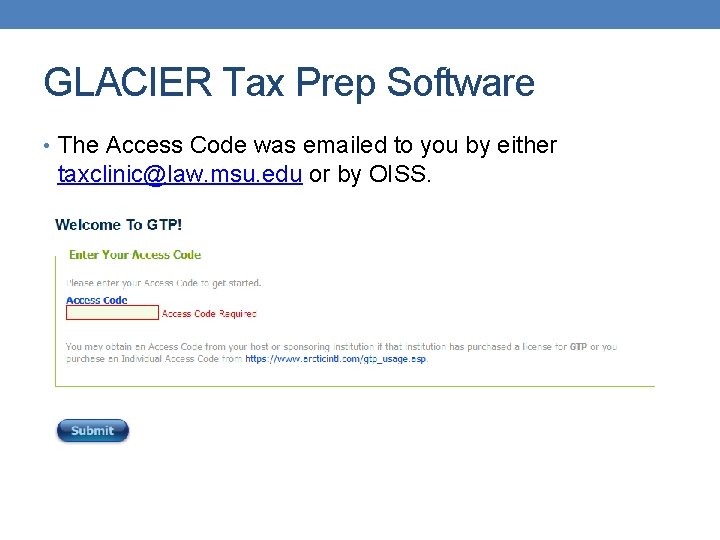

GLACIER Tax Prep Software • The Access Code was emailed to you by either taxclinic@law. msu. edu or by OISS.

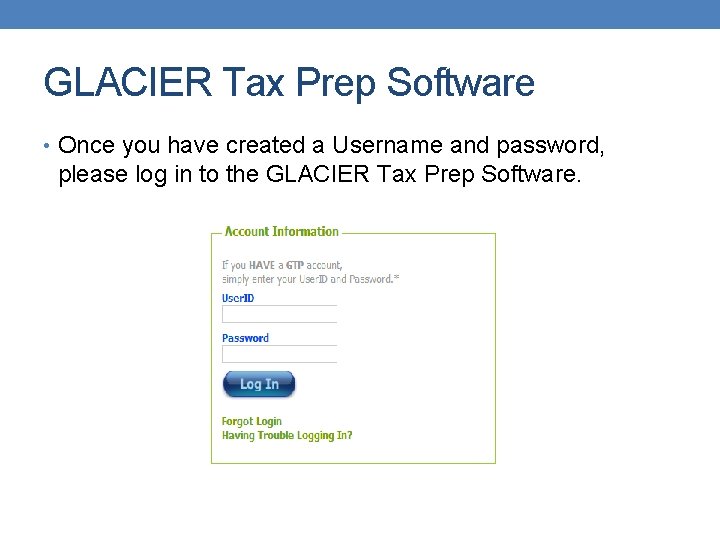

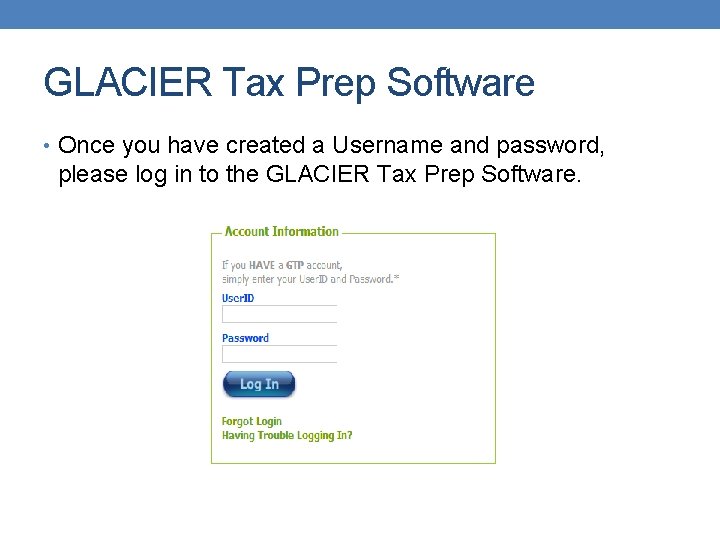

GLACIER Tax Prep Software • Once you have created a Username and password, please log in to the GLACIER Tax Prep Software.

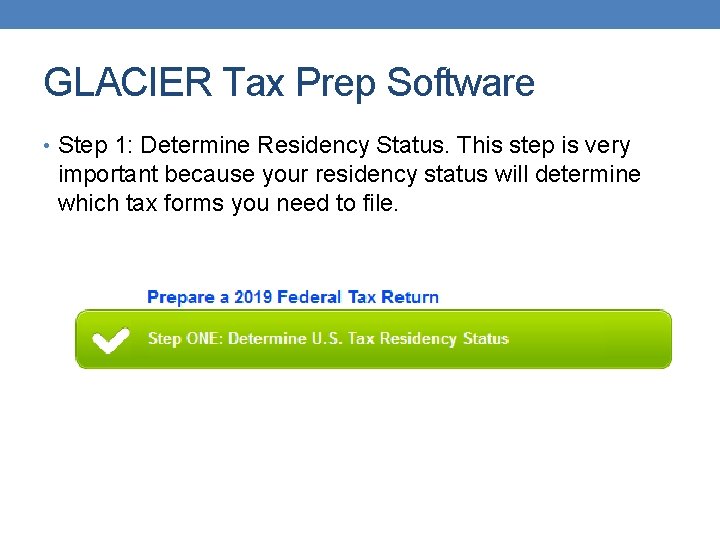

GLACIER Tax Prep Software • Step 1: Determine Residency Status. This step is very important because your residency status will determine which tax forms you need to file.

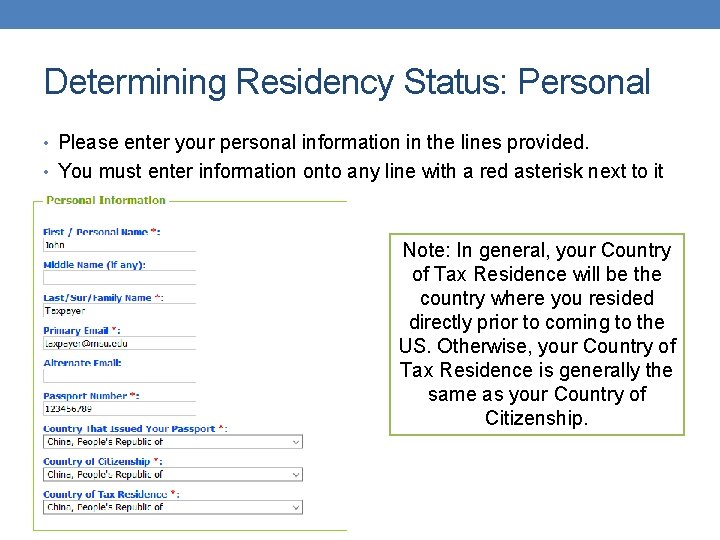

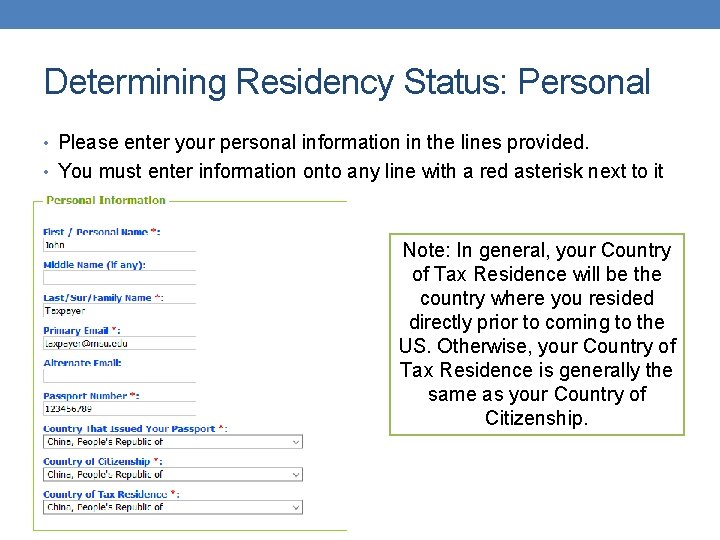

Determining Residency Status: Personal • Please enter your personal information in the lines provided. • You must enter information onto any line with a red asterisk next to it Note: In general, your Country of Tax Residence will be the country where you resided directly prior to coming to the US. Otherwise, your Country of Tax Residence is generally the same as your Country of Citizenship.

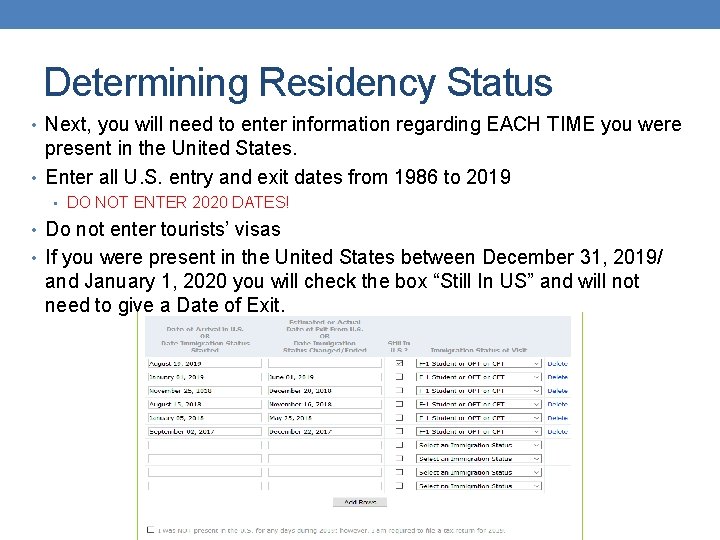

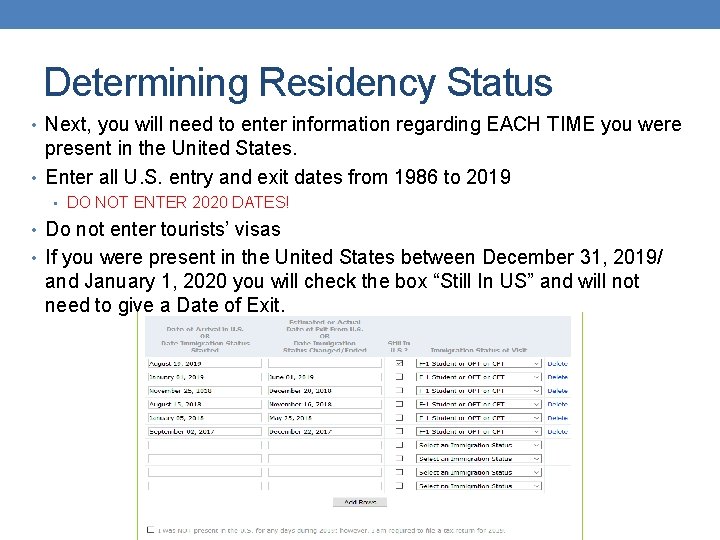

Determining Residency Status • Next, you will need to enter information regarding EACH TIME you were present in the United States. • Enter all U. S. entry and exit dates from 1986 to 2019 • DO NOT ENTER 2020 DATES! • Do not enter tourists’ visas • If you were present in the United States between December 31, 2019/ and January 1, 2020 you will check the box “Still In US” and will not need to give a Date of Exit.

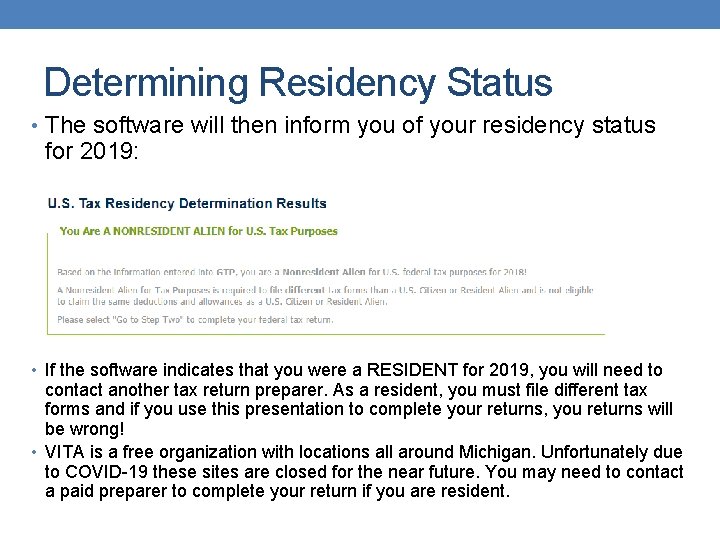

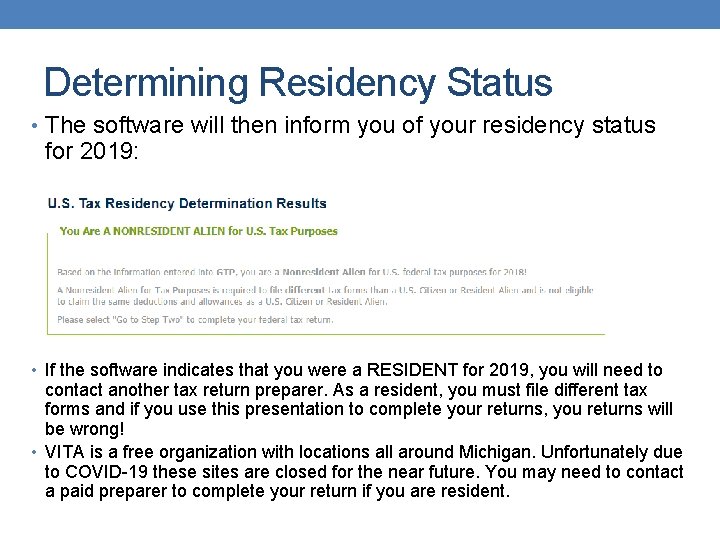

Determining Residency Status • The software will then inform you of your residency status for 2019: • If the software indicates that you were a RESIDENT for 2019, you will need to contact another tax return preparer. As a resident, you must file different tax forms and if you use this presentation to complete your returns, you returns will be wrong! • VITA is a free organization with locations all around Michigan. Unfortunately due to COVID-19 these sites are closed for the near future. You may need to contact a paid preparer to complete your return if you are resident.

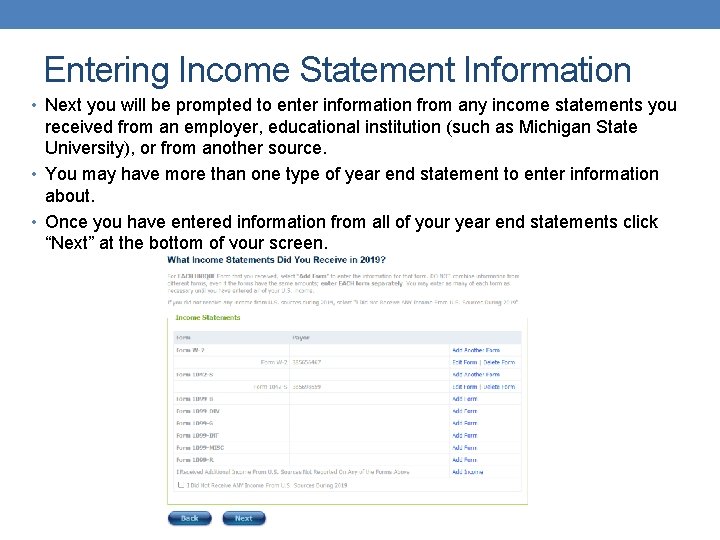

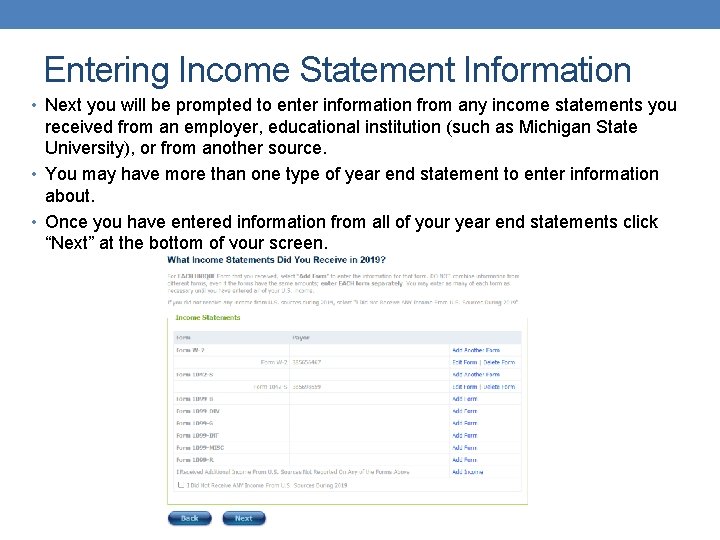

Entering Income Statement Information • Next you will be prompted to enter information from any income statements you received from an employer, educational institution (such as Michigan State University), or from another source. • You may have more than one type of year end statement to enter information about. • Once you have entered information from all of your year end statements click “Next” at the bottom of your screen.

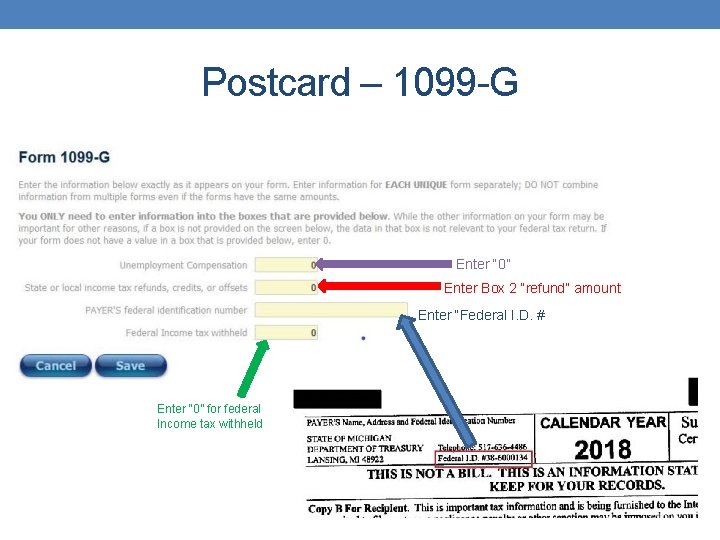

Postcard – 1099 -G Enter “ 0” Enter Box 2 “refund” amount Enter “Federal I. D. # Enter “ 0” for federal Income tax withheld

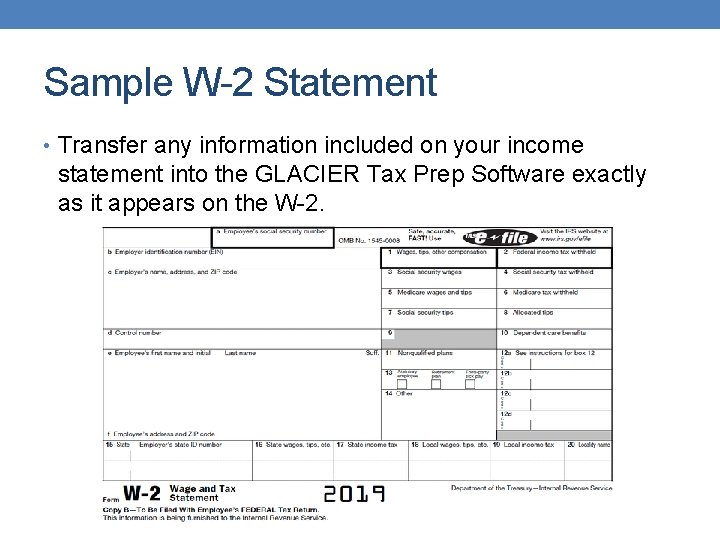

Sample W-2 Statement • Transfer any information included on your income statement into the GLACIER Tax Prep Software exactly as it appears on the W-2.

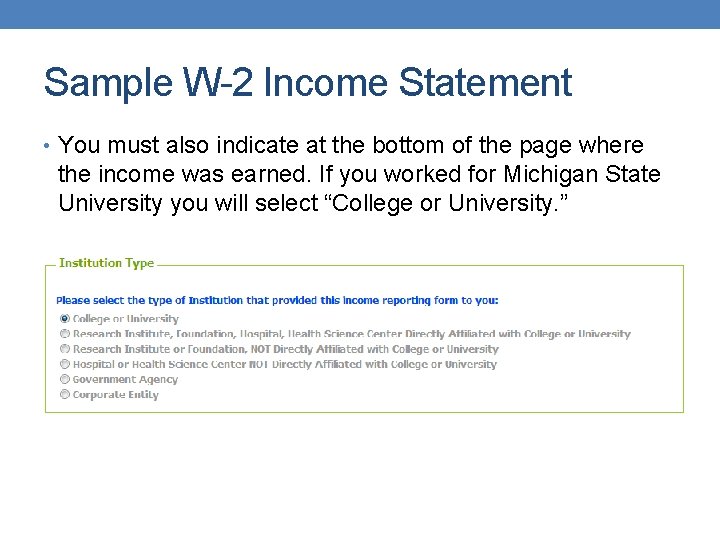

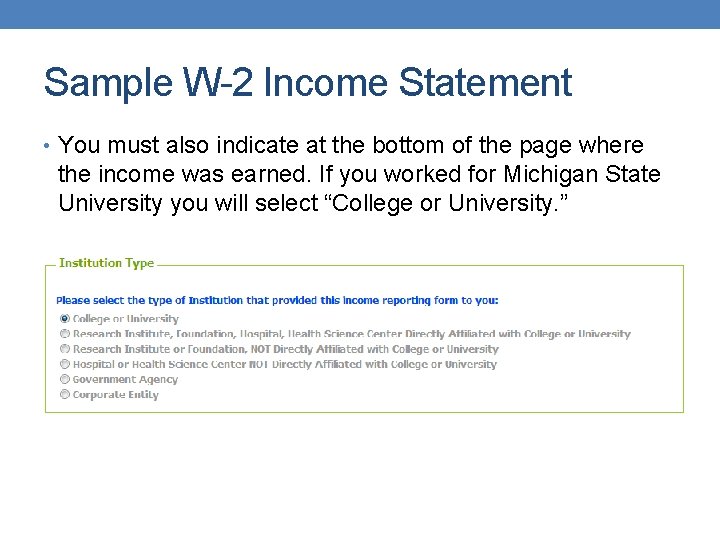

Sample W-2 Income Statement • You must also indicate at the bottom of the page where the income was earned. If you worked for Michigan State University you will select “College or University. ”

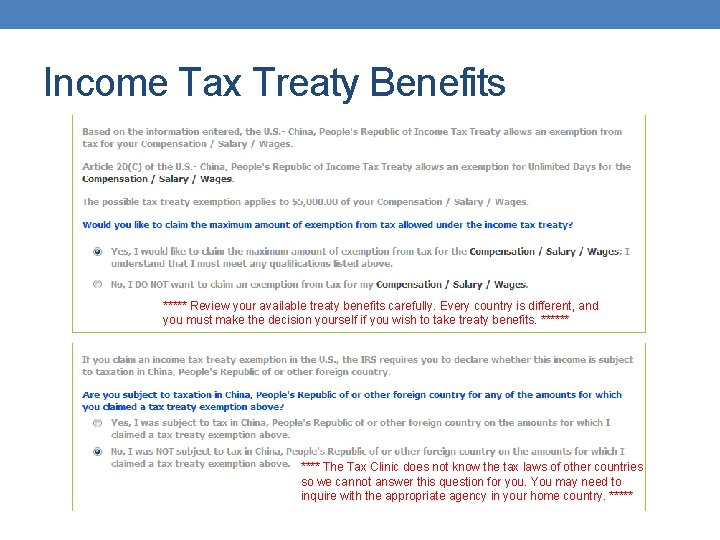

Income Tax Treaty Benefits • The GLACIER Tax Prep Software will let you know if you are eligible for benefits under an Income Tax Treaty. • When you click “Next” at the bottom of the page, you will see a summary of Total Income from US Sources – if this information appears to be correct, please click “Go To STEP THREE” at the bottom of the page.

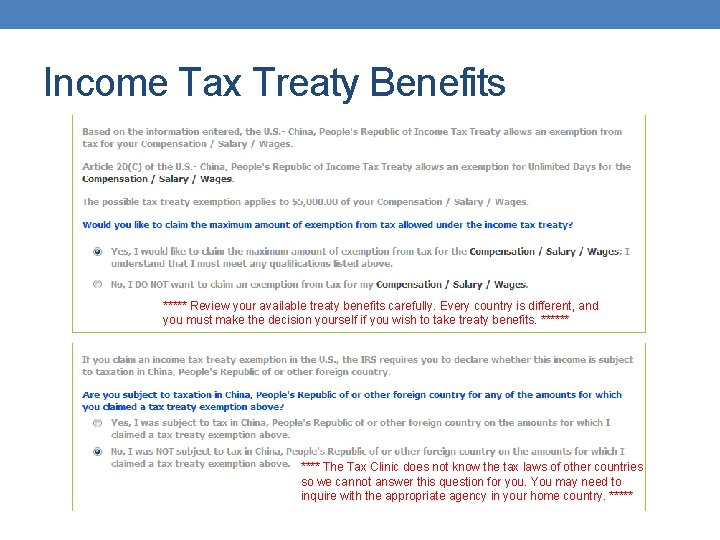

Income Tax Treaty Benefits ***** Review your available treaty benefits carefully. Every country is different, and you must make the decision yourself if you wish to take treaty benefits. ****** The Tax Clinic does not know the tax laws of other countries so we cannot answer this question for you. You may need to inquire with the appropriate agency in your home country. *****

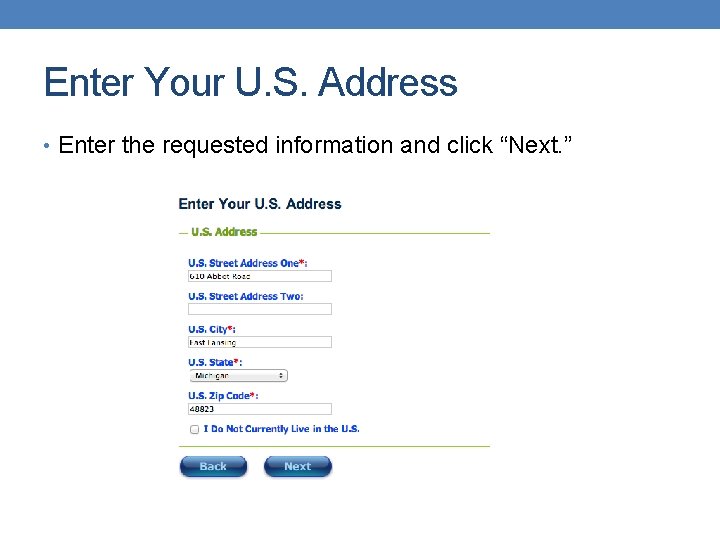

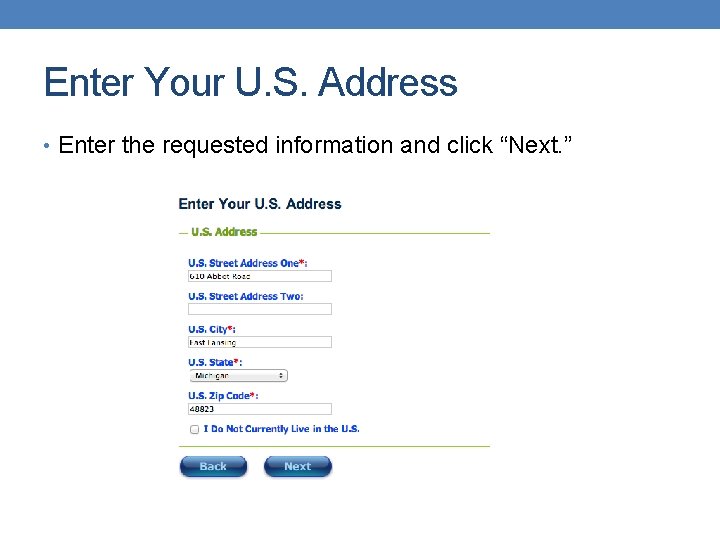

Enter Your U. S. Address • Enter the requested information and click “Next. ”

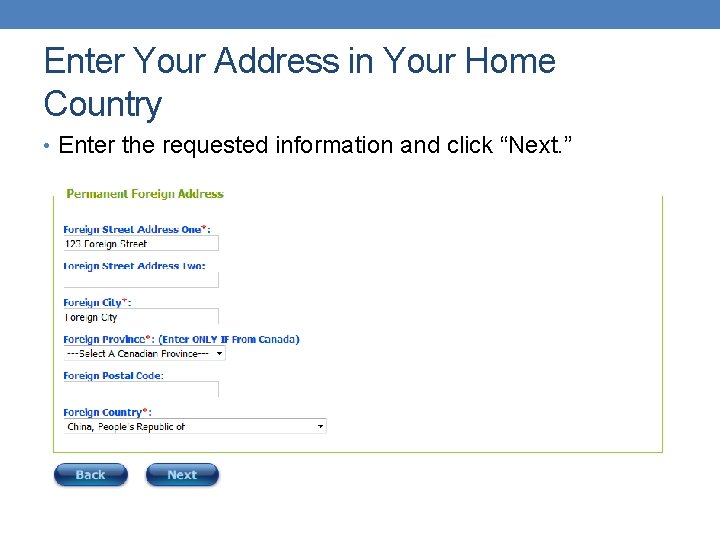

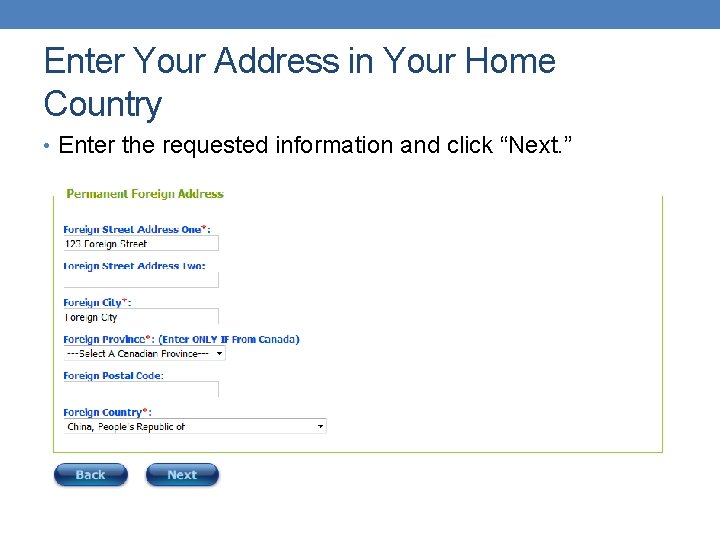

Enter Your Address in Your Home Country • Enter the requested information and click “Next. ”

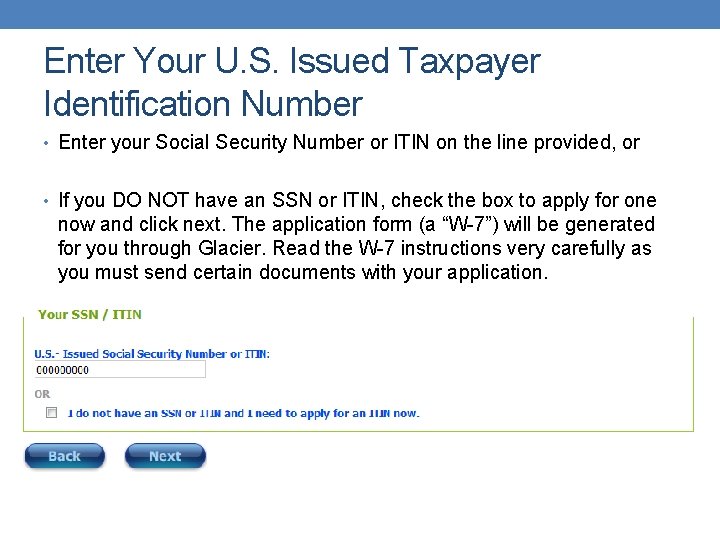

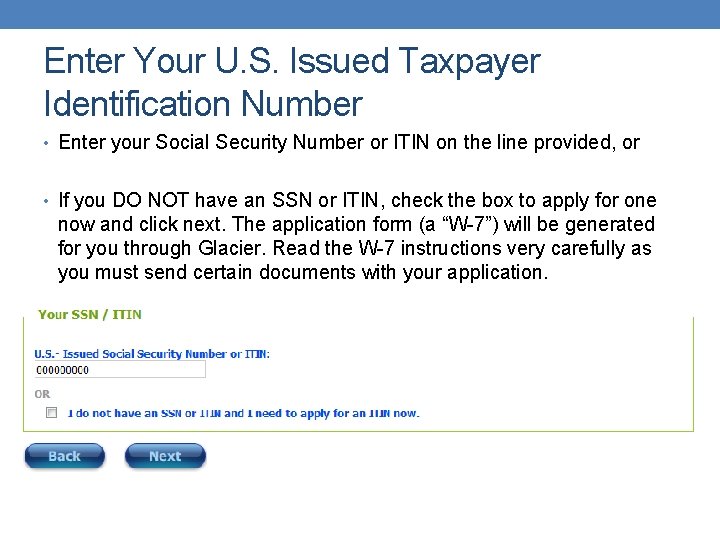

Enter Your U. S. Issued Taxpayer Identification Number • Enter your Social Security Number or ITIN on the line provided, or • If you DO NOT have an SSN or ITIN, check the box to apply for one now and click next. The application form (a “W-7”) will be generated for you through Glacier. Read the W-7 instructions very carefully as you must send certain documents with your application.

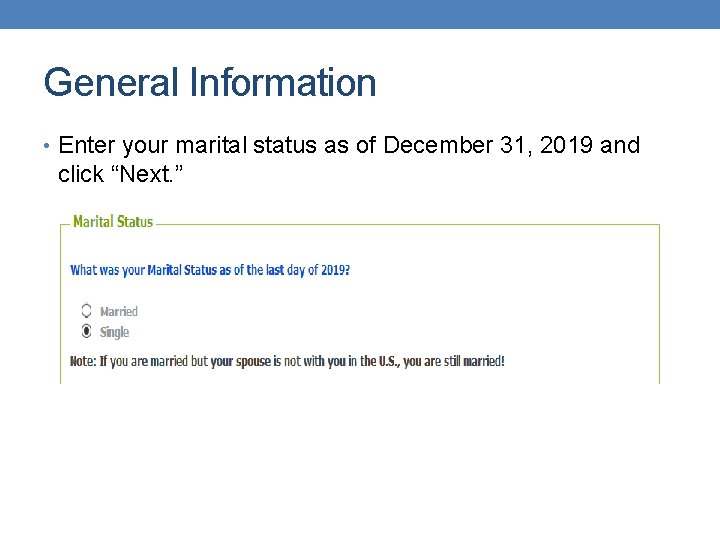

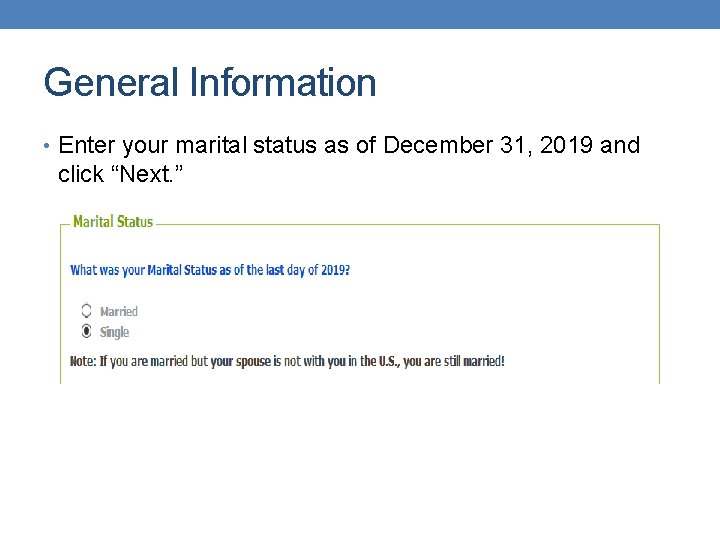

General Information • Enter your marital status as of December 31, 2019 and click “Next. ”

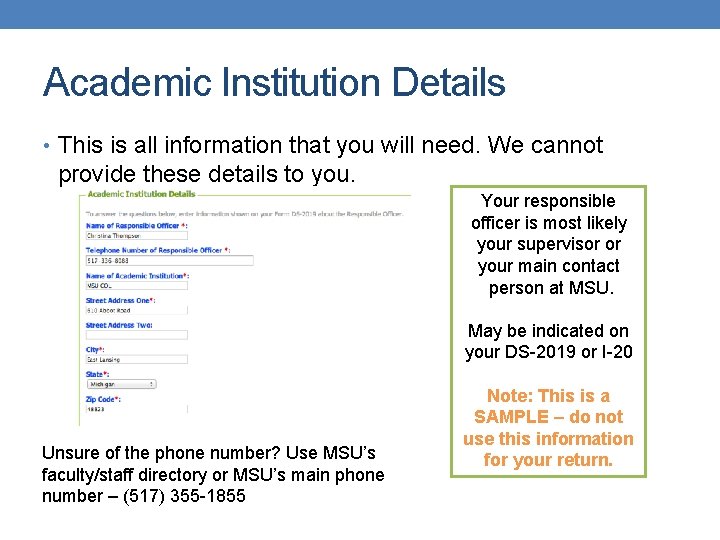

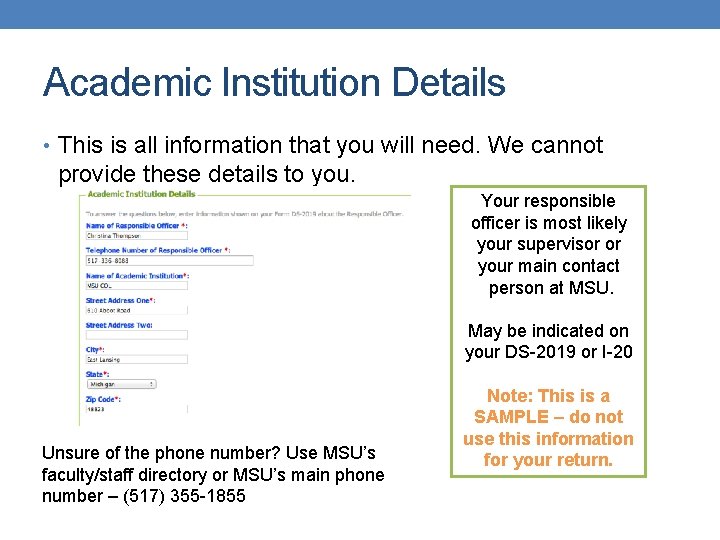

Academic Institution Details • This is all information that you will need. We cannot provide these details to you. Your responsible officer is most likely your supervisor or your main contact person at MSU. May be indicated on your DS-2019 or I-20 Unsure of the phone number? Use MSU’s faculty/staff directory or MSU’s main phone number – (517) 355 -1855 Note: This is a SAMPLE – do not use this information for your return.

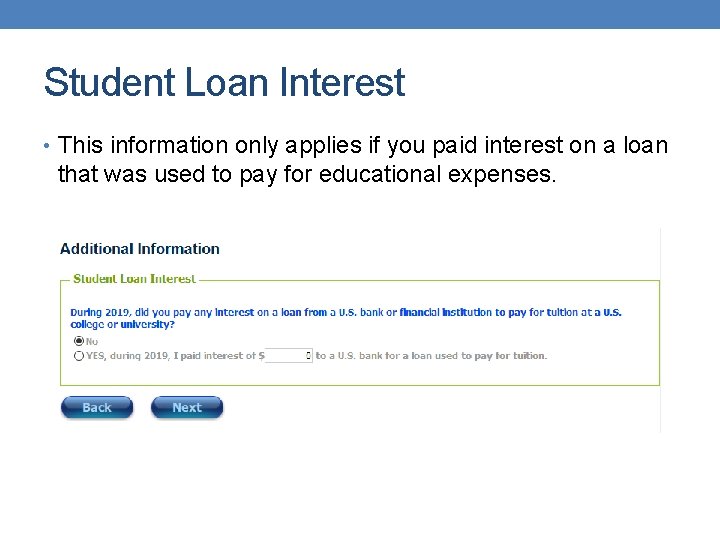

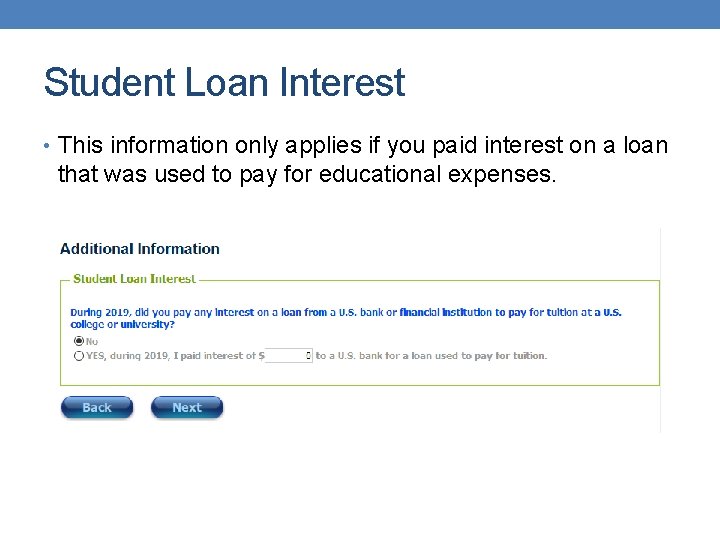

Student Loan Interest • This information only applies if you paid interest on a loan that was used to pay for educational expenses.

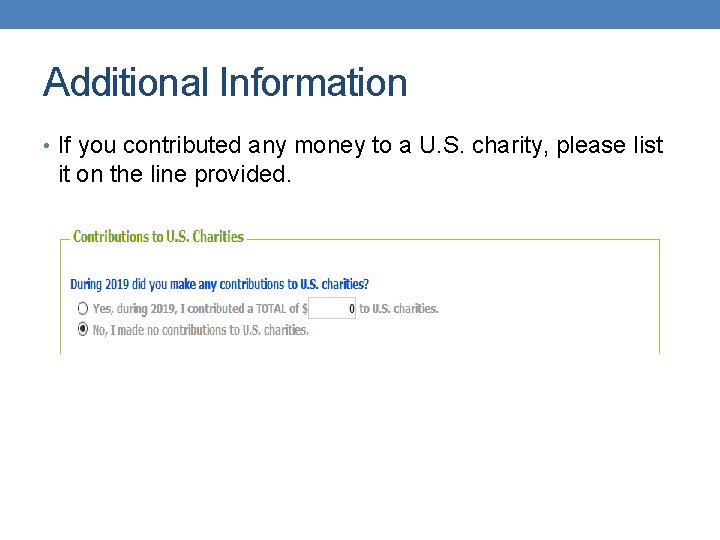

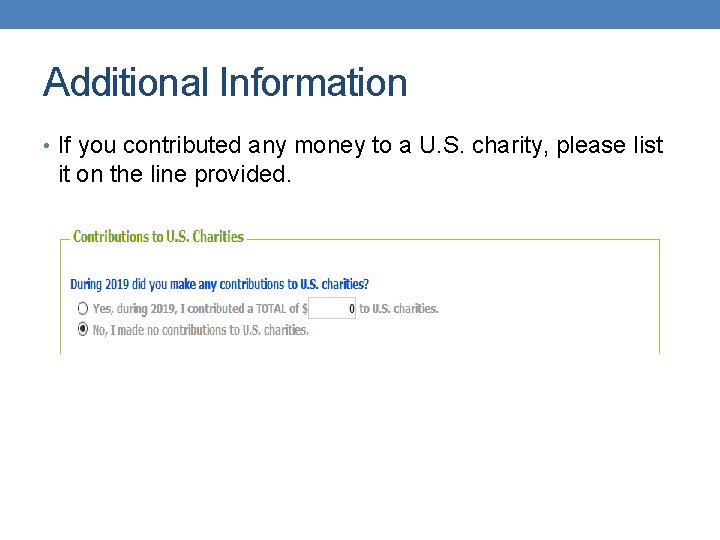

Additional Information • If you contributed any money to a U. S. charity, please list it on the line provided.

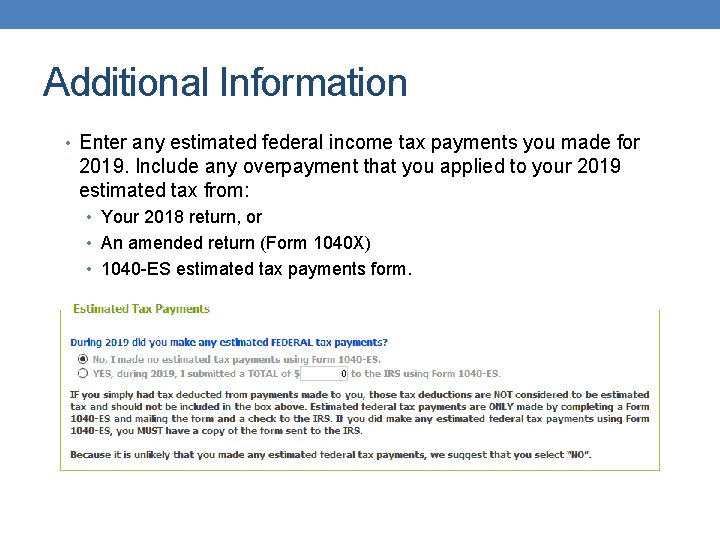

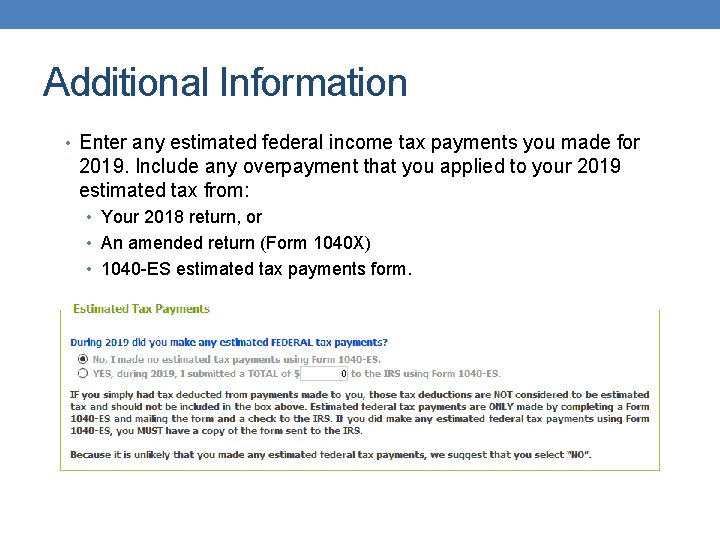

Additional Information • Enter any estimated federal income tax payments you made for 2019. Include any overpayment that you applied to your 2019 estimated tax from: • Your 2018 return, or • An amended return (Form 1040 X) • 1040 -ES estimated tax payments form.

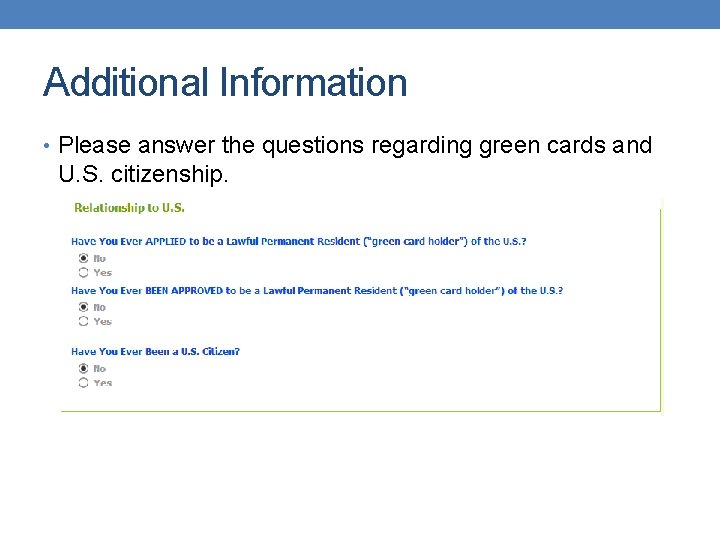

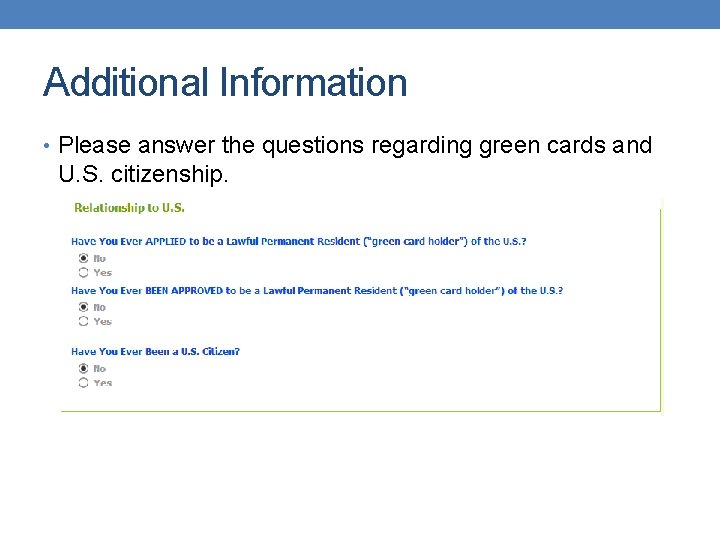

Additional Information • Please answer the questions regarding green cards and U. S. citizenship.

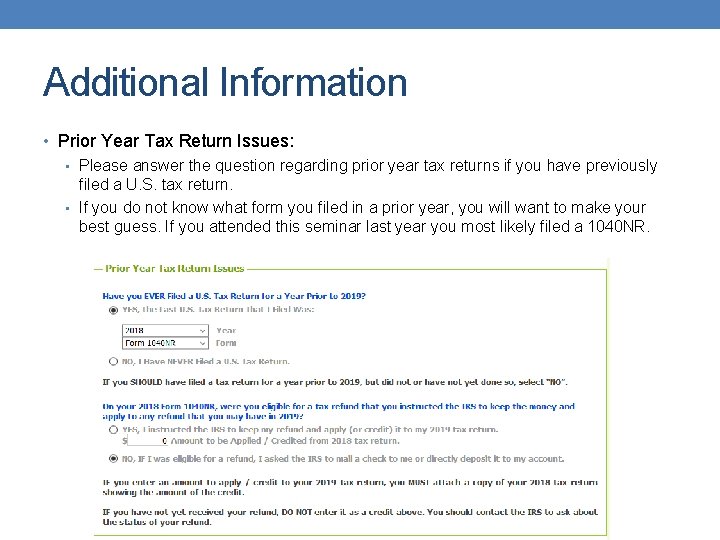

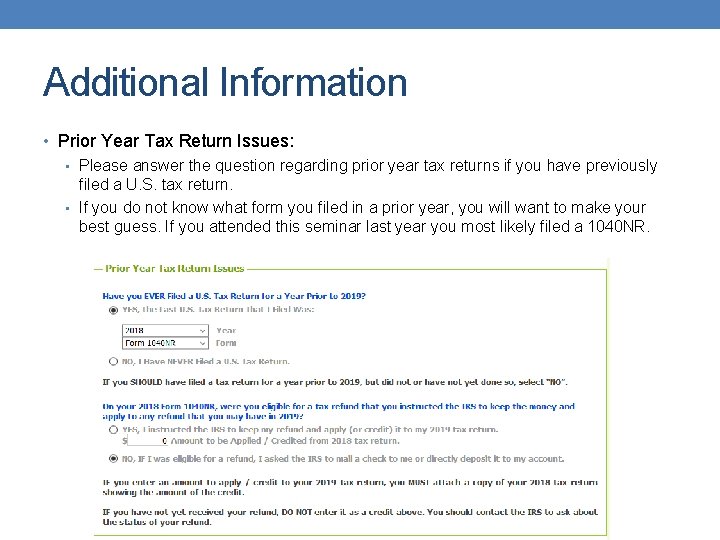

Additional Information • Prior Year Tax Return Issues: • Please answer the question regarding prior year tax returns if you have previously filed a U. S. tax return. • If you do not know what form you filed in a prior year, you will want to make your best guess. If you attended this seminar last year you most likely filed a 1040 NR.

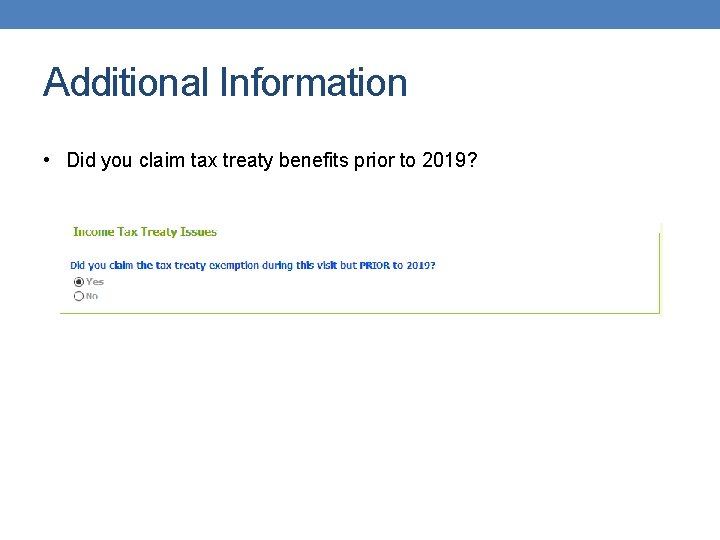

Additional Information • Did you claim tax treaty benefits prior to 2019?

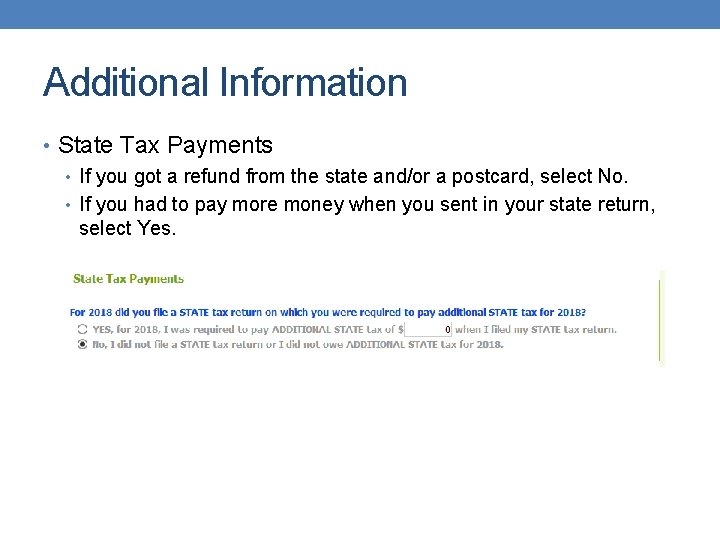

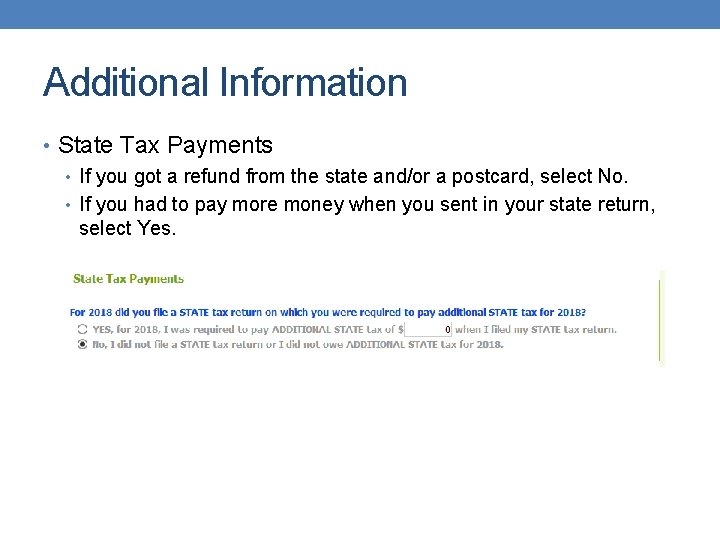

Additional Information • State Tax Payments • If you got a refund from the state and/or a postcard, select No. • If you had to pay more money when you sent in your state return, select Yes.

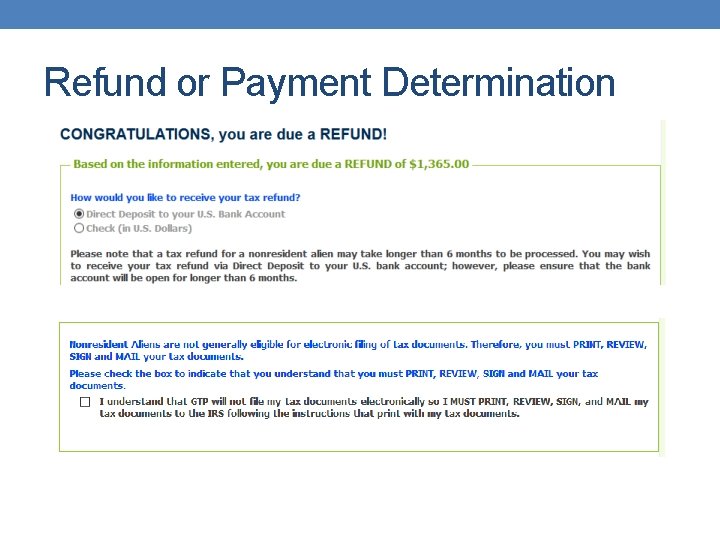

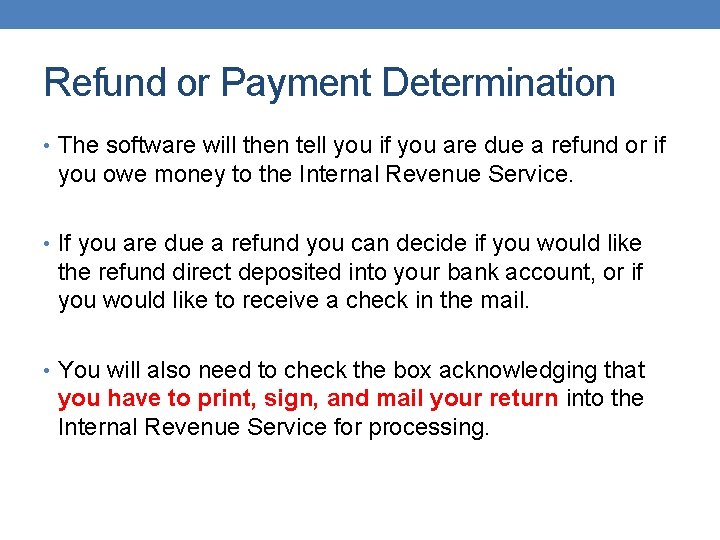

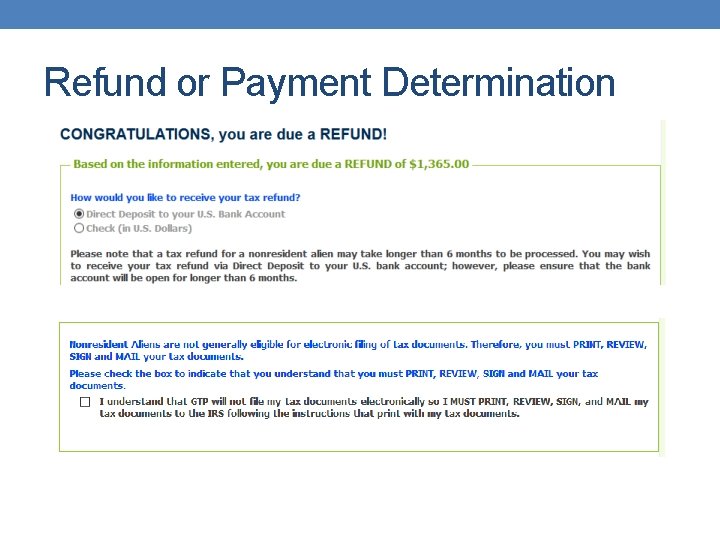

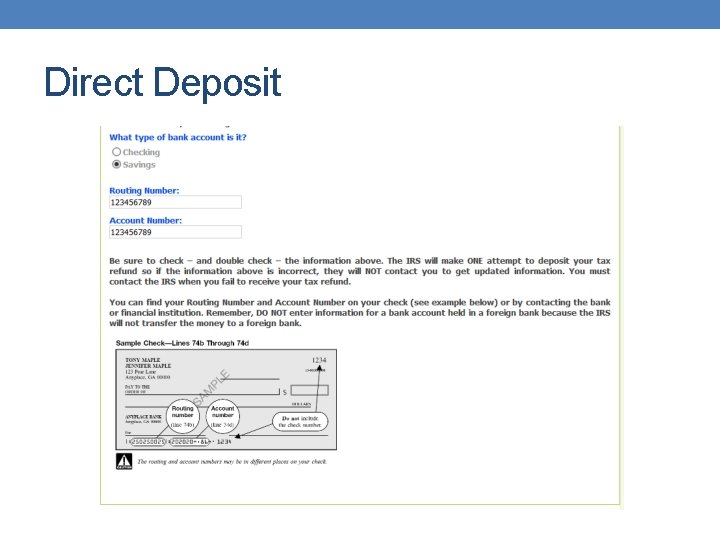

Refund or Payment Determination • The software will then tell you if you are due a refund or if you owe money to the Internal Revenue Service. • If you are due a refund you can decide if you would like the refund direct deposited into your bank account, or if you would like to receive a check in the mail. • You will also need to check the box acknowledging that you have to print, sign, and mail your return into the Internal Revenue Service for processing.

Refund or Payment Determination

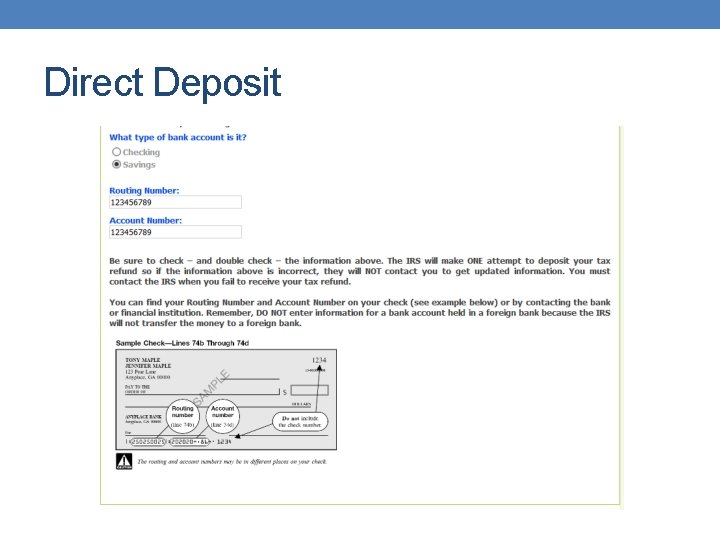

Direct Deposit • Fill in direct deposit information if you want your refund to be deposited directly into your bank account. Be accurate! • Neither the IRS nor your financial institution will confirm bank account information before depositing. If you put down the wrong account number, it will be deposited into someone else's account and can be very difficult to get back!

Direct Deposit

Payment Determination • If you owe the IRS money, you need to follow the instructions provided by Glacier and mail a check to the appropriate address. Glacier will often provide the mailing address but, if not, we will have a link to the correct payment address at the end of this federal tax presentation. • In some cases you will not owe and you will not be entitled to a refund. In that case, you just need to sign your documents and mail them to the IRS by the filing deadline (April 15, 2020).

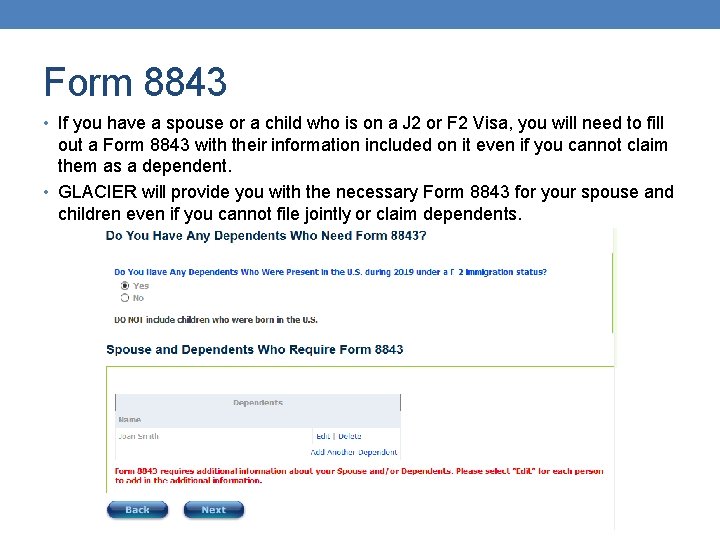

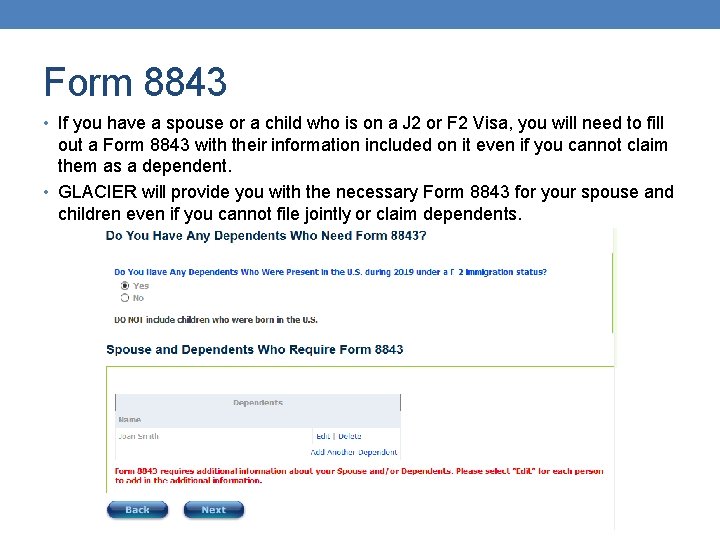

Form 8843 • If you have a spouse or a child who is on a J 2 or F 2 Visa, you will need to fill out a Form 8843 with their information included on it even if you cannot claim them as a dependent. • GLACIER will provide you with the necessary Form 8843 for your spouse and children even if you cannot file jointly or claim dependents.

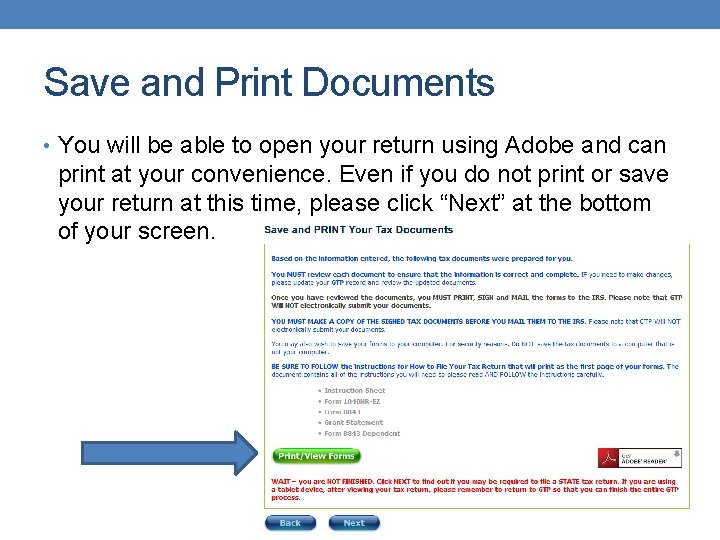

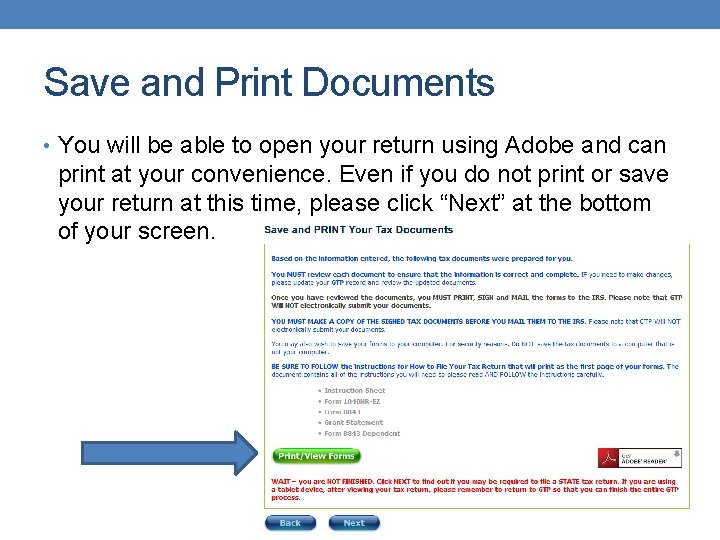

Save and Print Documents • You will be able to open your return using Adobe and can print at your convenience. Even if you do not print or save your return at this time, please click “Next” at the bottom of your screen.

Coalition of sensible taxpayers

Coalition of sensible taxpayers Texas taxpayers and research association

Texas taxpayers and research association Conclusion on gst

Conclusion on gst Find the local tax deducted: $456 biweekly, 2 1/2 % tax.

Find the local tax deducted: $456 biweekly, 2 1/2 % tax. 2019 tax brakets

2019 tax brakets Year 6 sats 2019

Year 6 sats 2019 Year 5 naplan 2019

Year 5 naplan 2019 Year 6 sats papers 2019

Year 6 sats papers 2019 Eerie nouns and adjectives

Eerie nouns and adjectives Bowland maths alien invasion

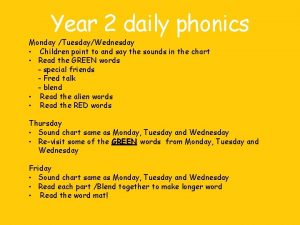

Bowland maths alien invasion Nurse with a purse phonics

Nurse with a purse phonics Alien technology

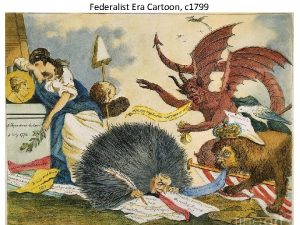

Alien technology Alien and sedition acts political cartoon

Alien and sedition acts political cartoon Legal alien poem

Legal alien poem Alien weed definition

Alien weed definition What so

What so Alien words guide

Alien words guide The rubbish tip alien

The rubbish tip alien Transamerica estate planning foreign nationals

Transamerica estate planning foreign nationals Alien h460

Alien h460 An alien periodic table

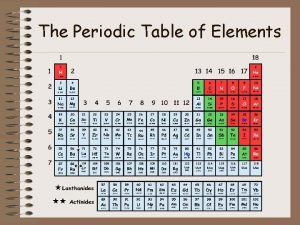

An alien periodic table Dewey and the alien

Dewey and the alien A alien

A alien Breakout edu answer key alien

Breakout edu answer key alien What measures were contained in the alien and sedition acts

What measures were contained in the alien and sedition acts An approved candidate of the alien flight student program

An approved candidate of the alien flight student program Counter migration ap human geography

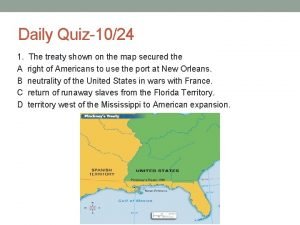

Counter migration ap human geography Summary of alien and sedition acts

Summary of alien and sedition acts Illegal alien

Illegal alien Alien word mat

Alien word mat Alien squiggle

Alien squiggle Alien and sedition acts political cartoon

Alien and sedition acts political cartoon Kron the alien freedom fighter

Kron the alien freedom fighter Elements in period 2

Elements in period 2 Alien & sedition acts definition

Alien & sedition acts definition Leavers poem from teacher

Leavers poem from teacher Presentera för publik crossboss

Presentera för publik crossboss Debattartikel struktur

Debattartikel struktur Var 1721 för stormaktssverige

Var 1721 för stormaktssverige Sju principer för tillitsbaserad styrning

Sju principer för tillitsbaserad styrning Tobinskatten för och nackdelar

Tobinskatten för och nackdelar Tack för att ni lyssnade bild

Tack för att ni lyssnade bild Hur ser ett referat ut

Hur ser ett referat ut Haiku dikt exempel

Haiku dikt exempel Lågenergihus nyproduktion

Lågenergihus nyproduktion