LETTER OF CREDIT CITD SEMINAR Tuesday June 22

- Slides: 29

LETTER OF CREDIT CITD SEMINAR Tuesday, June 22 nd, 2004

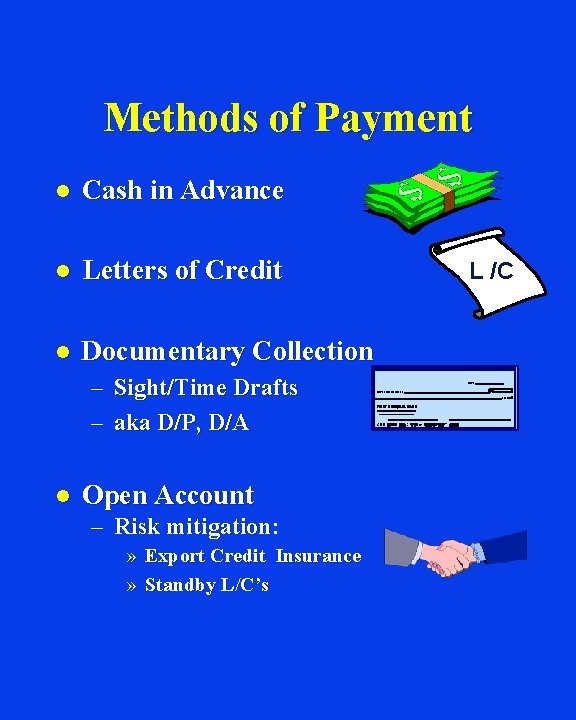

Methods of Payment

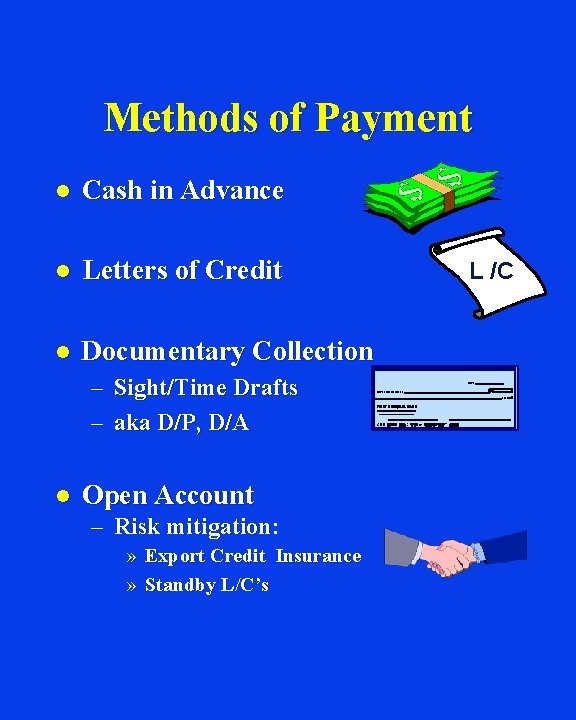

Methods of Payment l Cash in Advance l Letters of Credit l Documentary Collection – Sight/Time Drafts – aka D/P, D/A l Open Account – Risk mitigation: » Export Credit Insurance » Standby L/C’s L /C

Cash in Advance Importer pays Exporter prior to shipment Goods Exporter l l l Importer Exporter has no risk of non-payment or non-acceptance Importer has risk that exporter will not ship the goods as ordered Used occasionally for small amounts, new customers, one-time sales

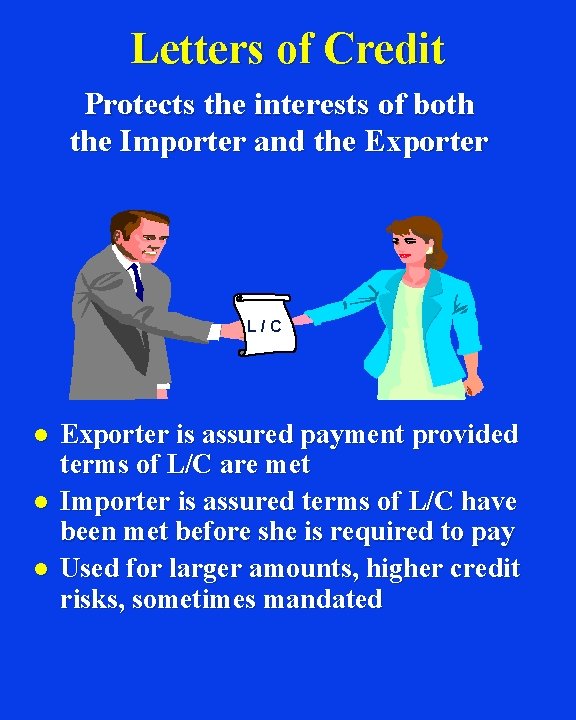

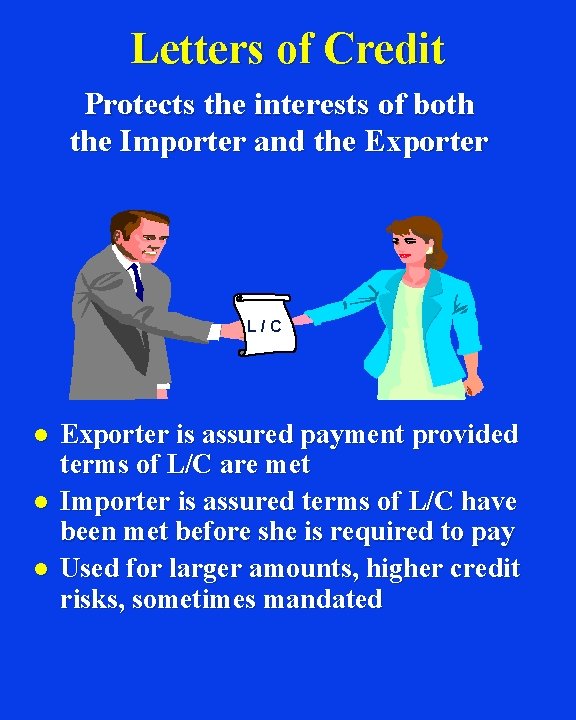

Letters of Credit Protects the interests of both the Importer and the Exporter L/C l l l Exporter is assured payment provided terms of L/C are met Importer is assured terms of L/C have been met before she is required to pay Used for larger amounts, higher credit risks, sometimes mandated

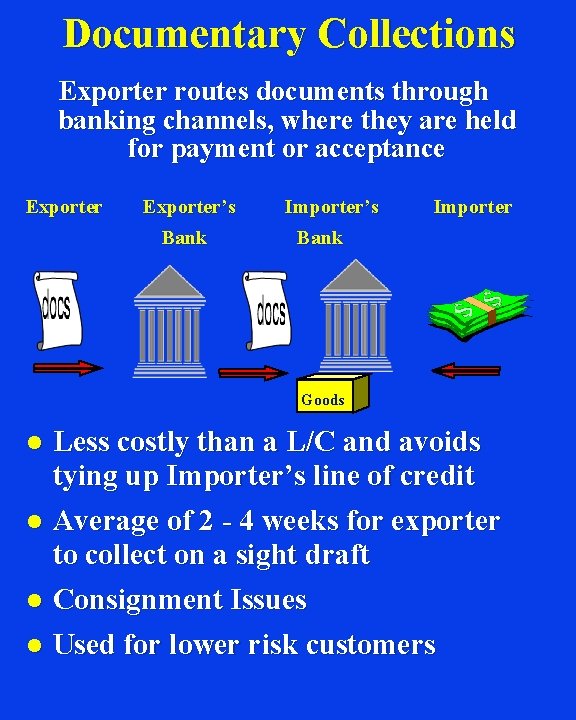

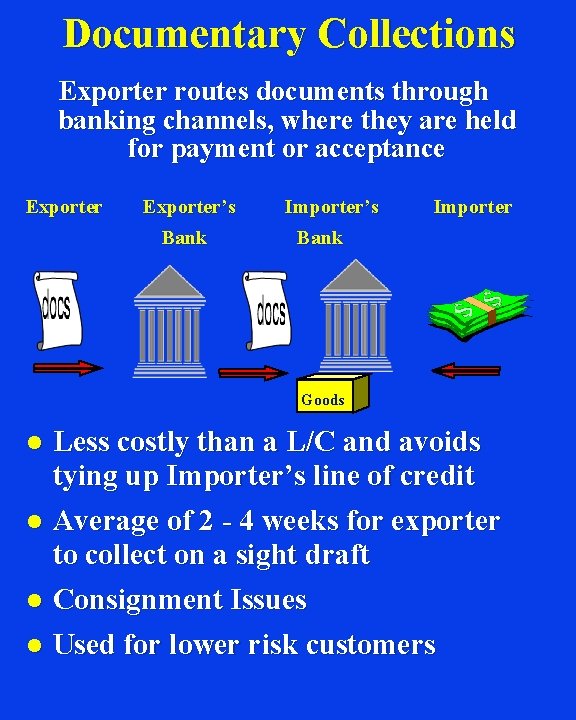

Documentary Collections Exporter routes documents through banking channels, where they are held for payment or acceptance Exporter’s Bank Importer’s Importer Bank Goods Less costly than a L/C and avoids tying up Importer’s line of credit l Average of 2 - 4 weeks for exporter to collect on a sight draft l Consignment Issues l Used for lower risk customers l

Open Account Exporter ships goods and bills the importer for payment at sight or at a future date Invoice net 30 l l Goods Importer has use of funds, no product risk Exporter has risk of non-payment Risk can be shifted through credit insurance, standby L/C’s Used for well-established customers with good credit

Letters of Credit

Types of Letters of Credit l Trade – Import – Export l Standby

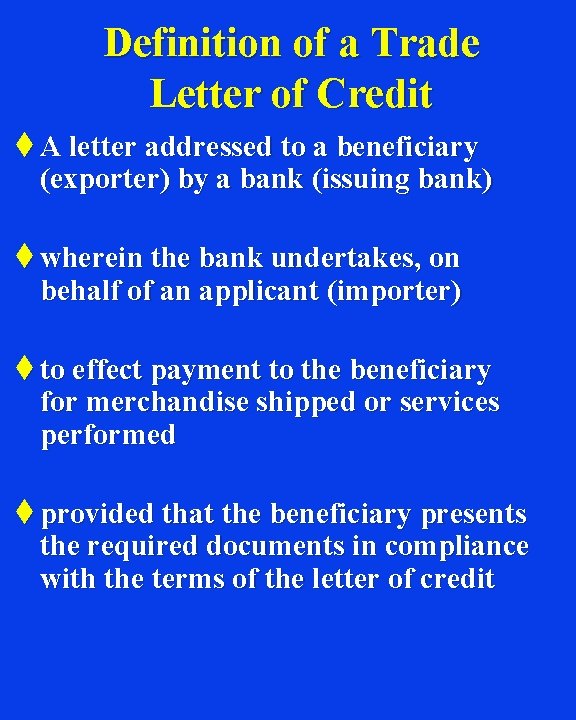

Definition of a Trade Letter of Credit t A letter addressed to a beneficiary (exporter) by a bank (issuing bank) t wherein the bank undertakes, on behalf of an applicant (importer) t to effect payment to the beneficiary for merchandise shipped or services performed t provided that the beneficiary presents the required documents in compliance with the terms of the letter of credit

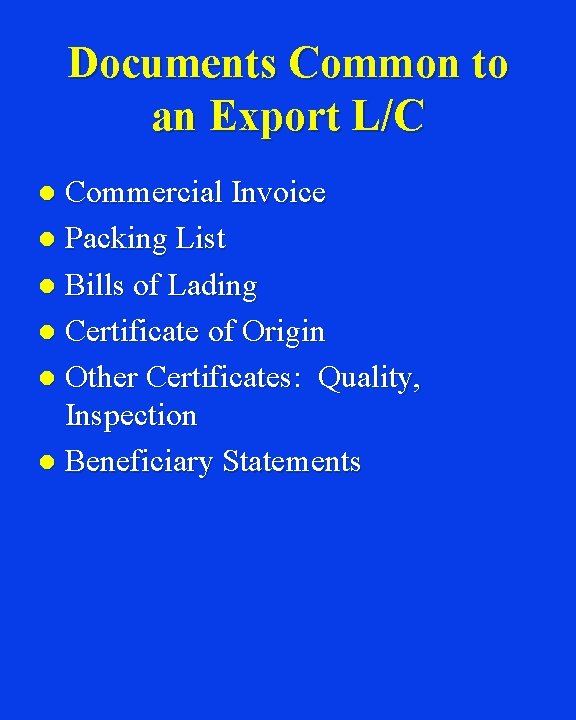

Documents Common to an Export L/C Commercial Invoice l Packing List l Bills of Lading l Certificate of Origin l Other Certificates: Quality, Inspection l Beneficiary Statements l

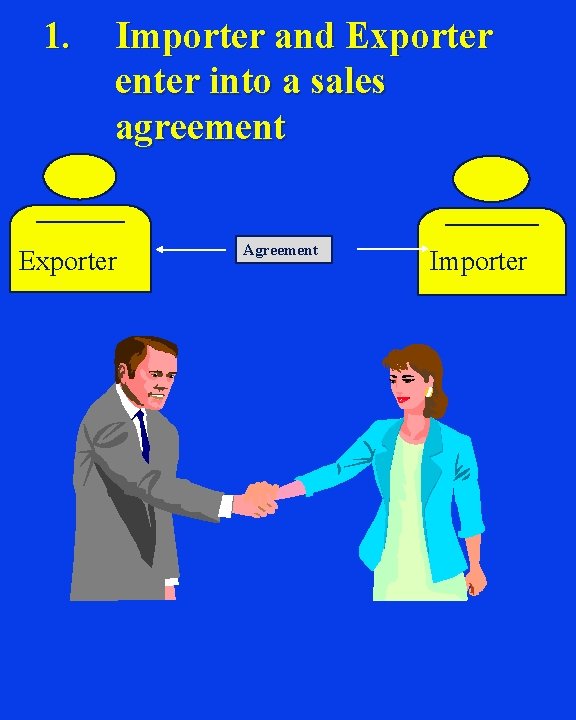

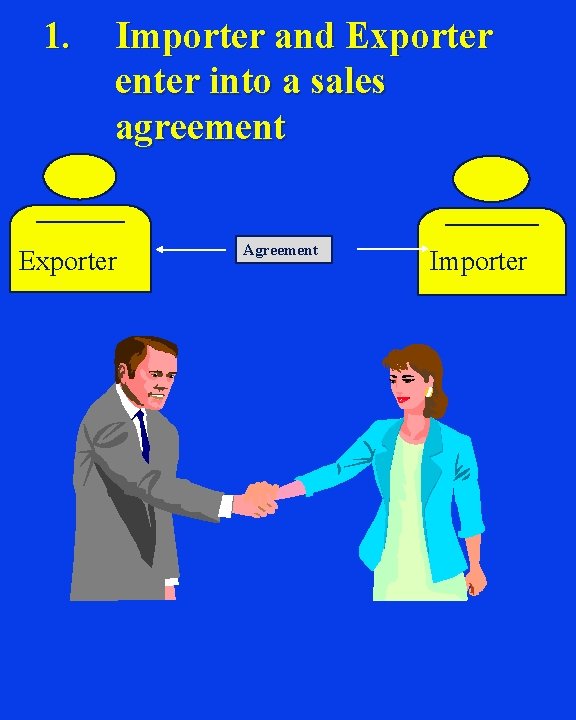

1. Importer and Exporter enter into a sales agreement Exporter Agreement Importer

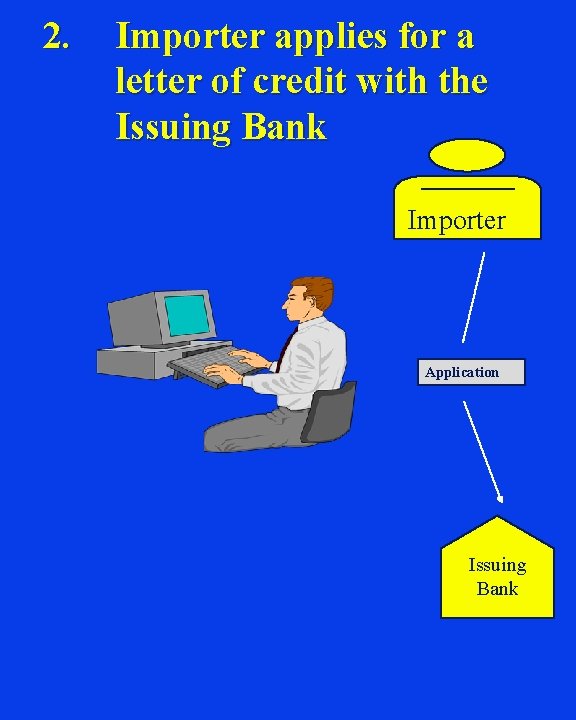

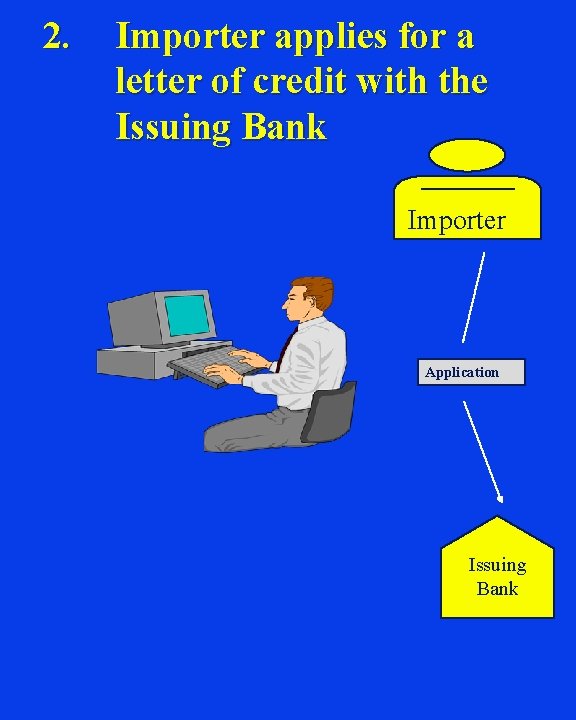

2. Importer applies for a letter of credit with the Issuing Bank Importer Application Issuing Bank

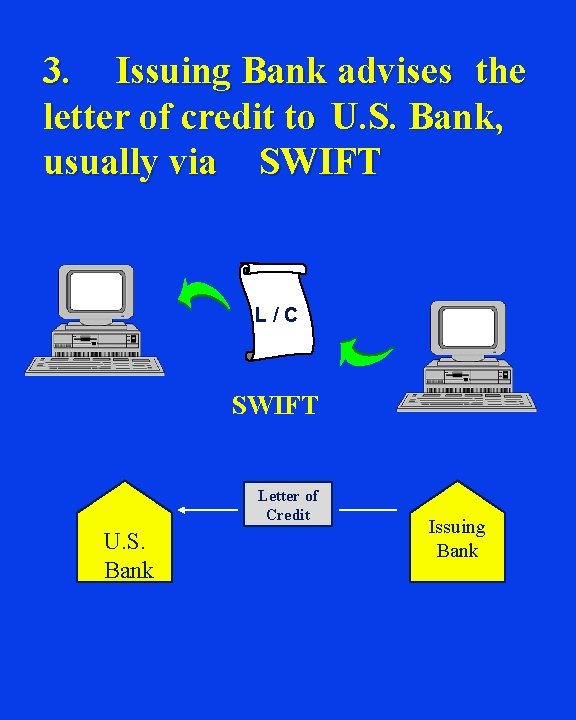

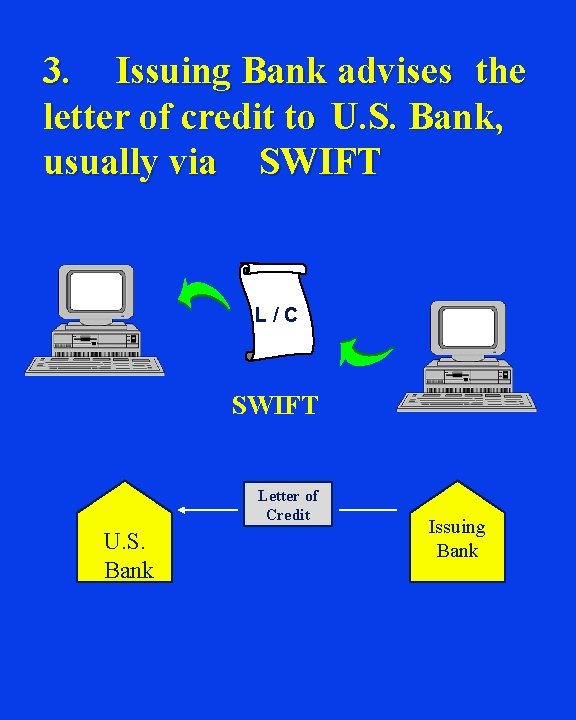

3. Issuing Bank advises the letter of credit to U. S. Bank, usually via SWIFT L/C SWIFT Letter of Credit U. S. Bank Issuing Bank

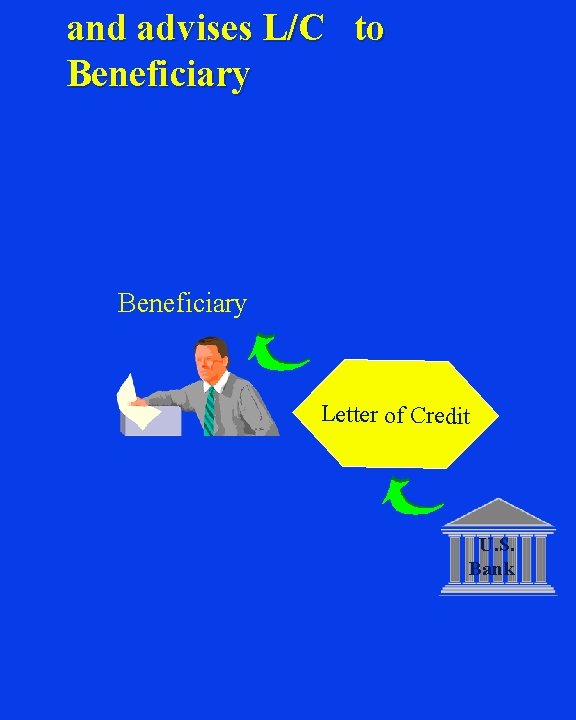

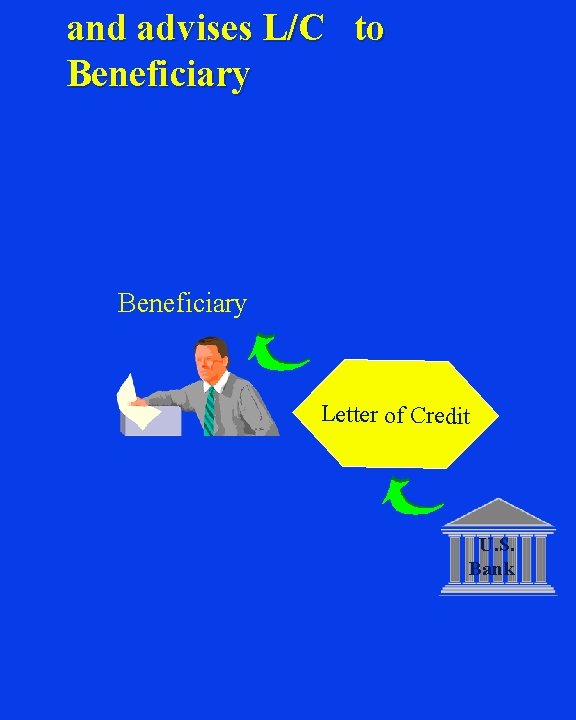

and advises L/C to Beneficiary Letter of Credit U. S. Bank

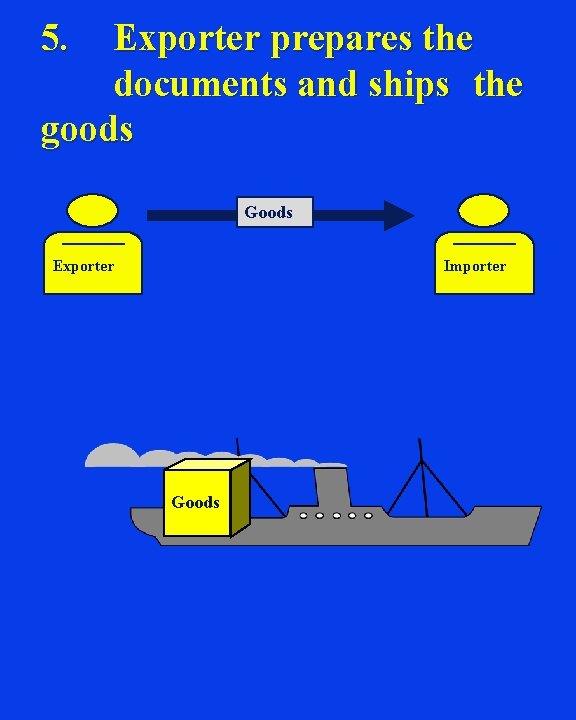

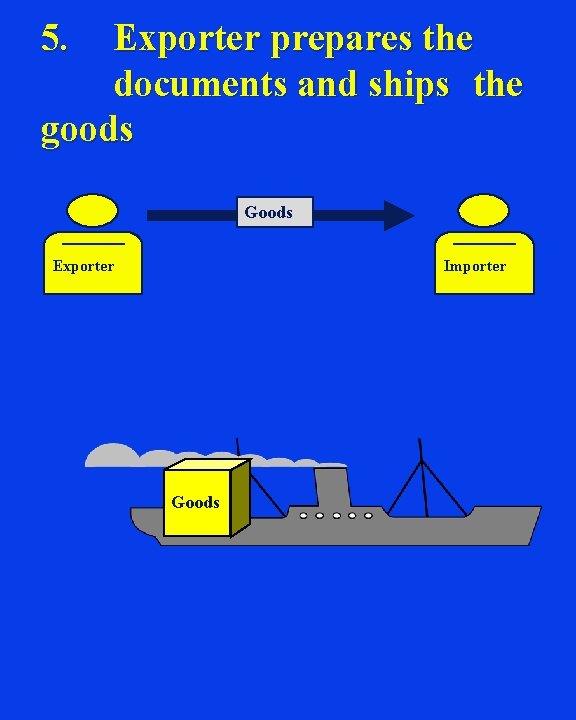

5. Exporter prepares the documents and ships the goods Goods Exporter Importer Goods

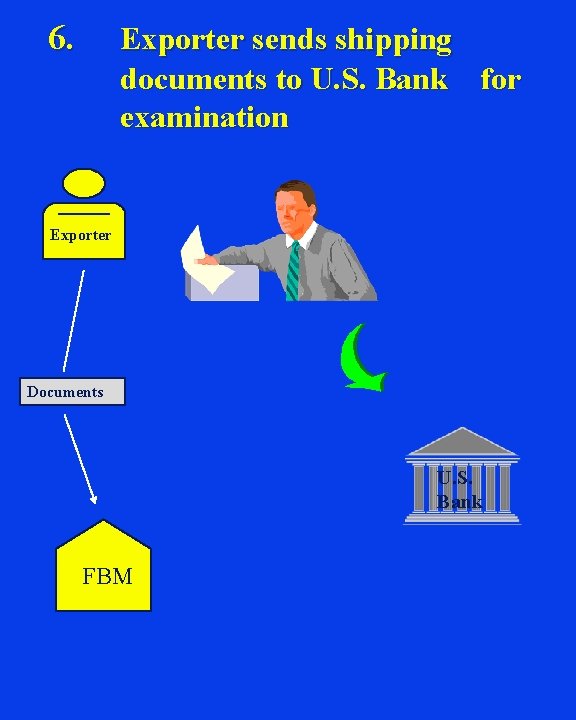

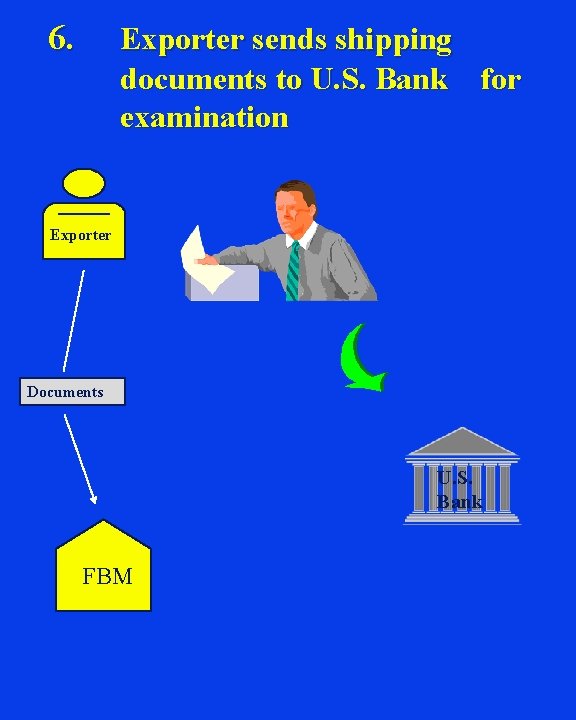

6. Exporter sends shipping documents to U. S. Bank for examination Exporter Documents U. S. Bank FBM

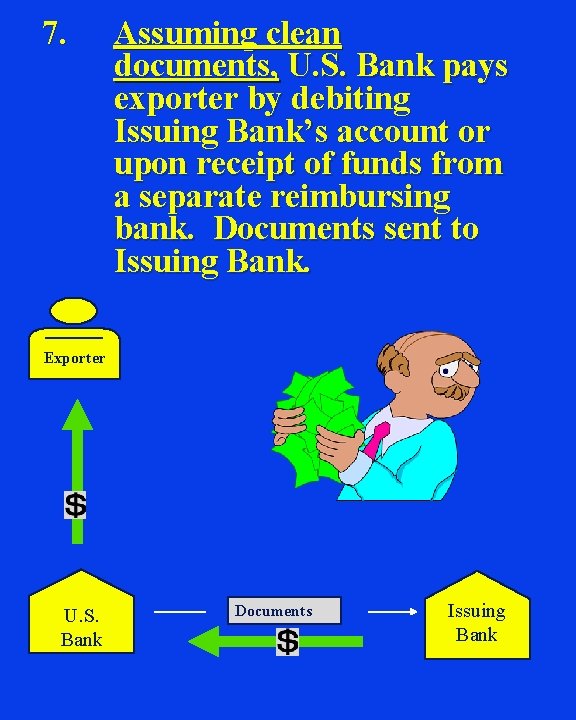

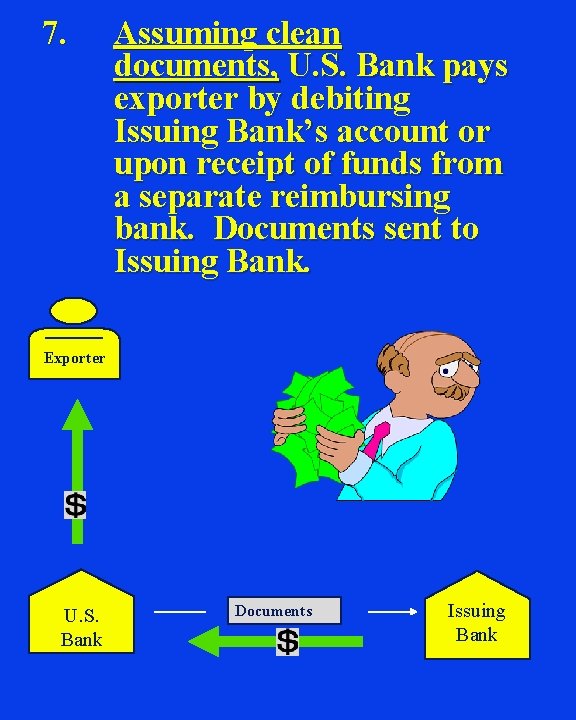

7. Assuming clean documents, U. S. Bank pays exporter by debiting Issuing Bank’s account or upon receipt of funds from a separate reimbursing bank. Documents sent to Issuing Bank. Exporter U. S. Bank Documents Issuing Bank

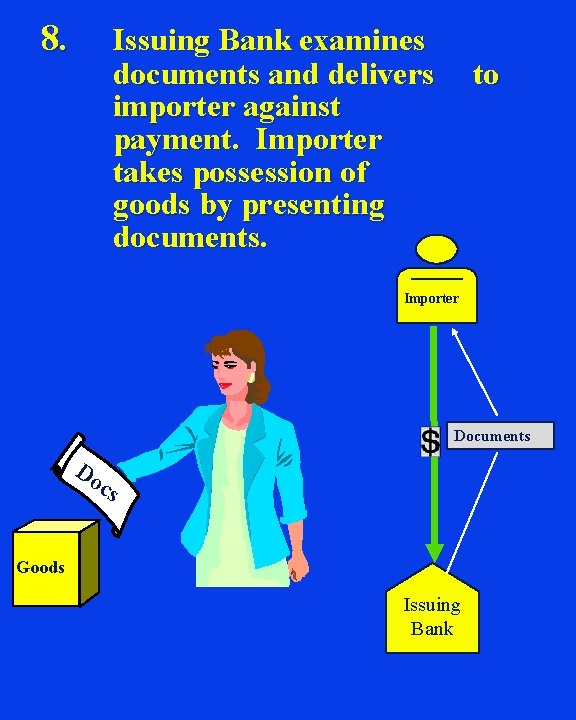

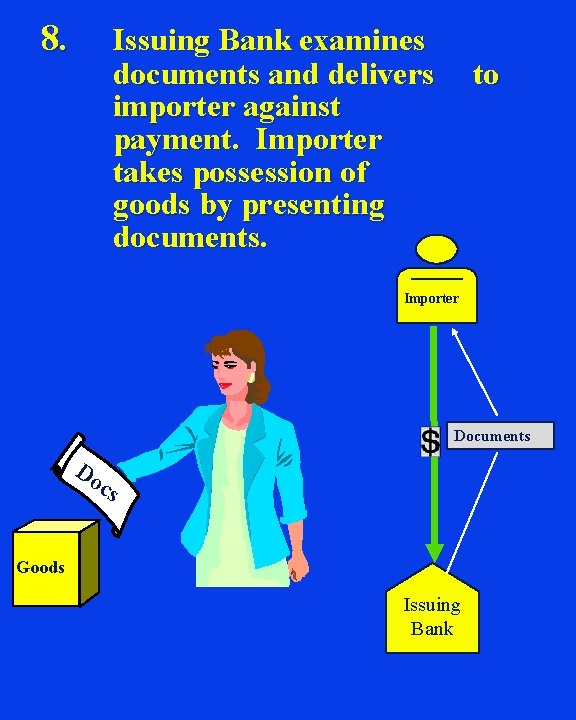

8. Issuing Bank examines documents and delivers importer against payment. Importer takes possession of goods by presenting documents. to Importer Documents Do c s Goods Issuing Bank

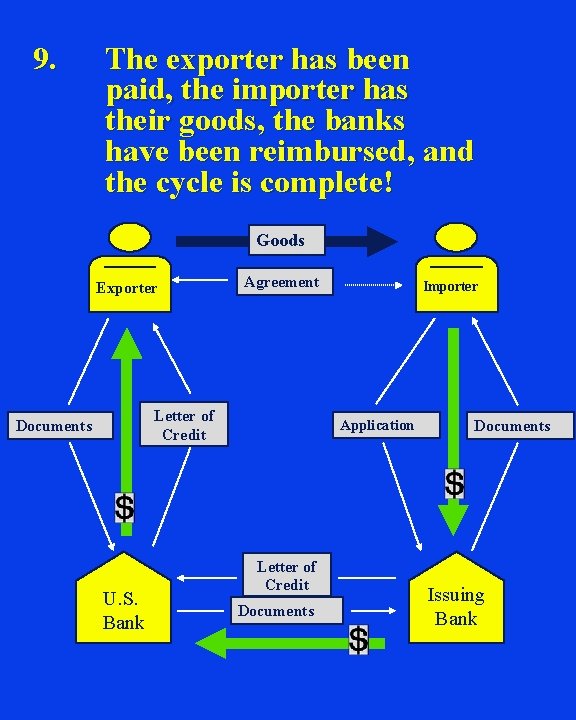

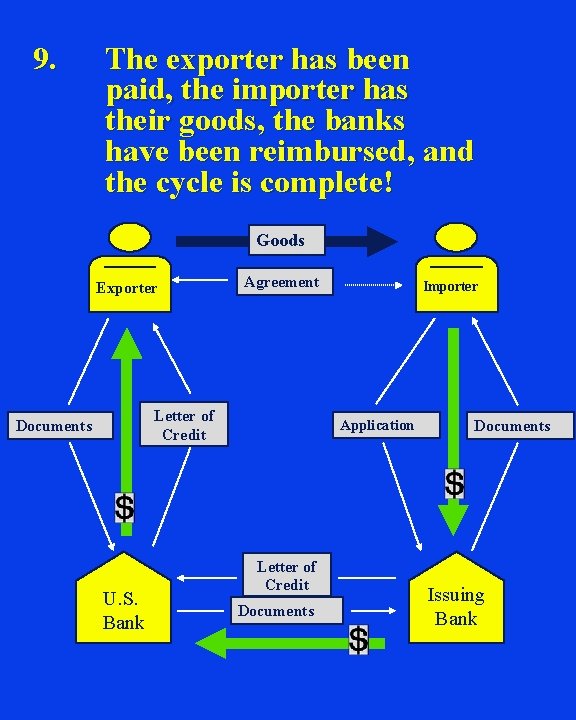

9. The exporter has been paid, the importer has their goods, the banks have been reimbursed, and the cycle is complete! Goods Exporter Agreement Letter of Credit Documents U. S. Bank Importer Application Letter of Credit Documents Issuing Bank

Special Uses of Letters of Credit

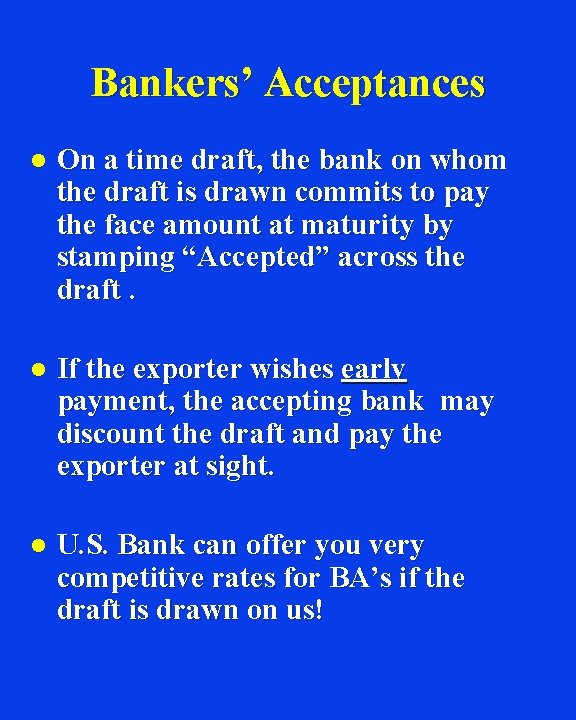

Bankers’ Acceptances l On a time draft, the bank on whom the draft is drawn commits to pay the face amount at maturity by stamping “Accepted” across the draft. l If the exporter wishes early payment, the accepting bank may discount the draft and pay the exporter at sight. l U. S. Bank can offer you very competitive rates for BA’s if the draft is drawn on us!

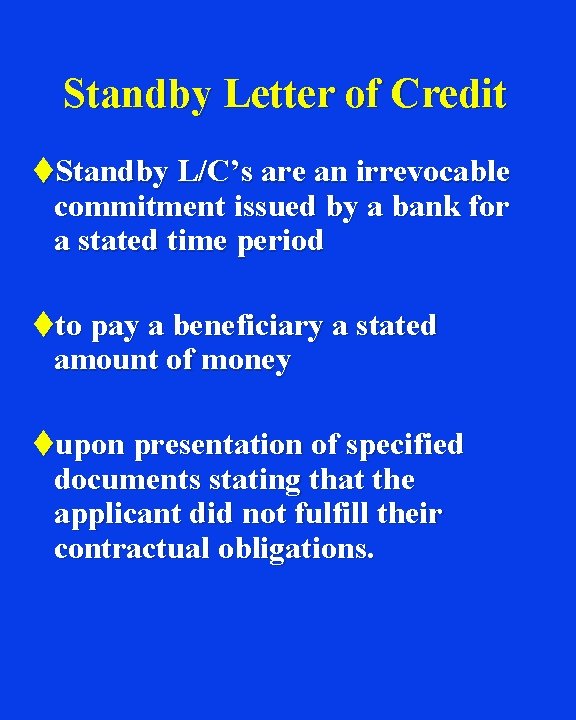

Standby Letter of Credit t. Standby L/C’s are an irrevocable commitment issued by a bank for a stated time period tto pay a beneficiary a stated amount of money tupon presentation of specified documents stating that the applicant did not fulfill their contractual obligations.

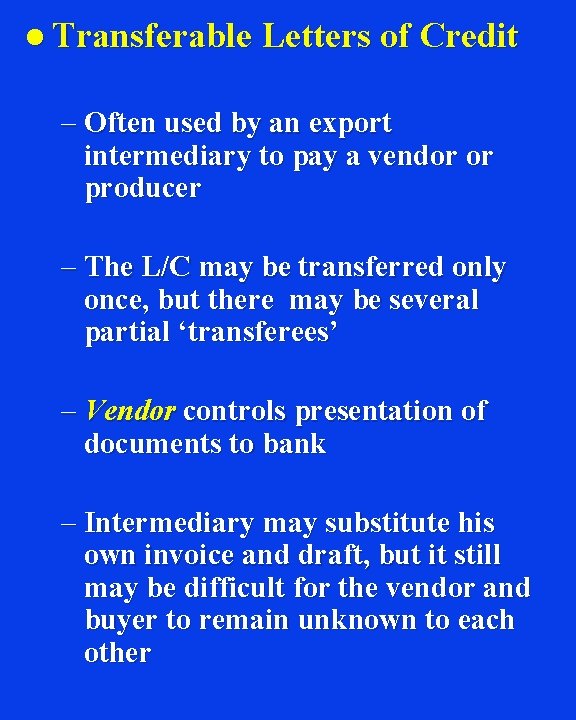

l Transferable Letters of Credit – Often used by an export intermediary to pay a vendor or producer – The L/C may be transferred only once, but there may be several partial ‘transferees’ – Vendor controls presentation of documents to bank – Intermediary may substitute his own invoice and draft, but it still may be difficult for the vendor and buyer to remain unknown to each other

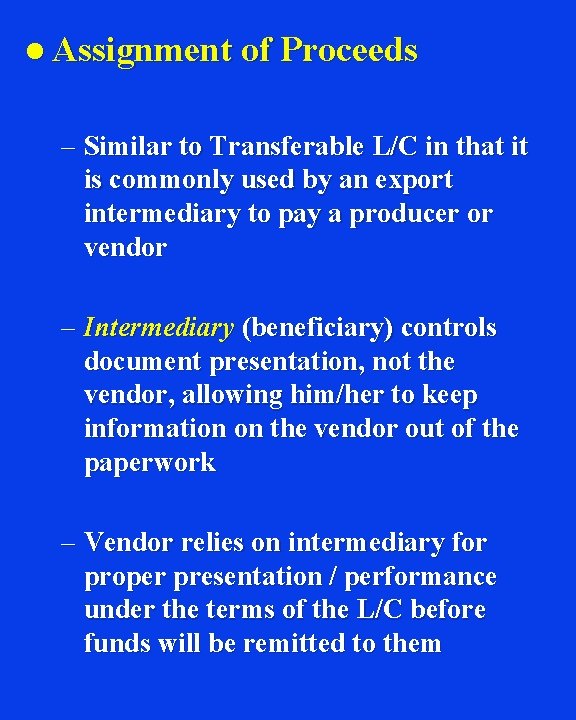

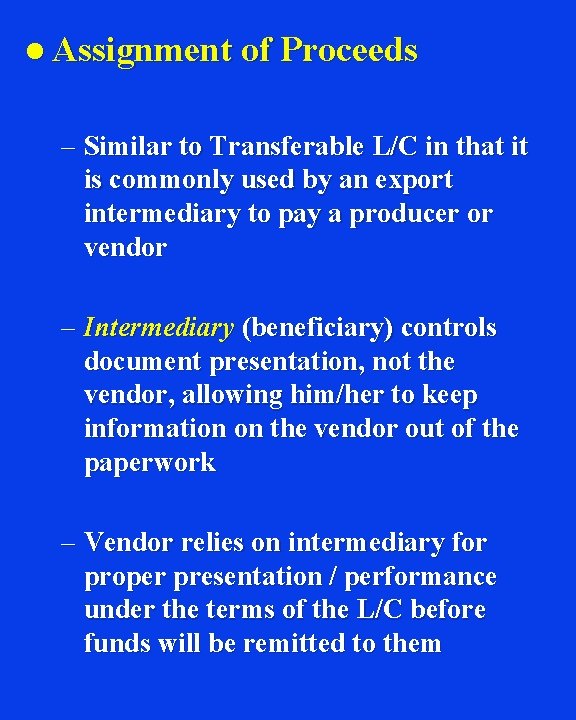

l Assignment of Proceeds – Similar to Transferable L/C in that it is commonly used by an export intermediary to pay a producer or vendor – Intermediary (beneficiary) controls document presentation, not the vendor, allowing him/her to keep information on the vendor out of the paperwork – Vendor relies on intermediary for proper presentation / performance under the terms of the L/C before funds will be remitted to them

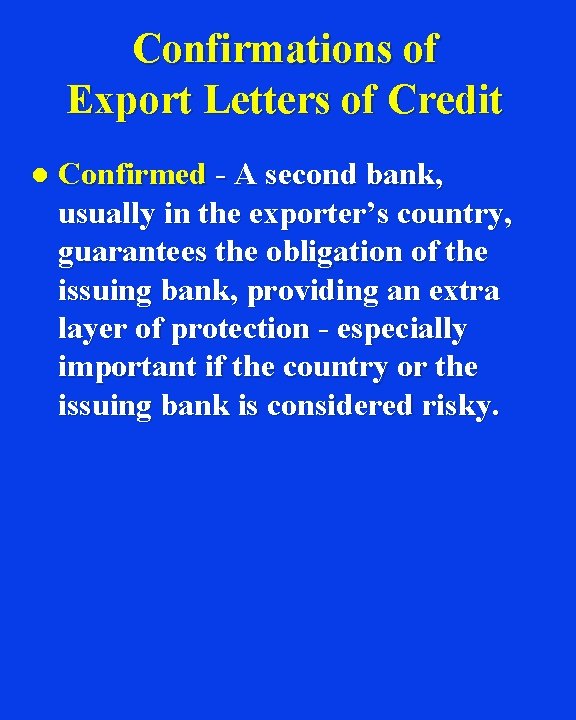

Confirmations of Export Letters of Credit l Confirmed - A second bank, usually in the exporter’s country, guarantees the obligation of the issuing bank, providing an extra layer of protection - especially important if the country or the issuing bank is considered risky.

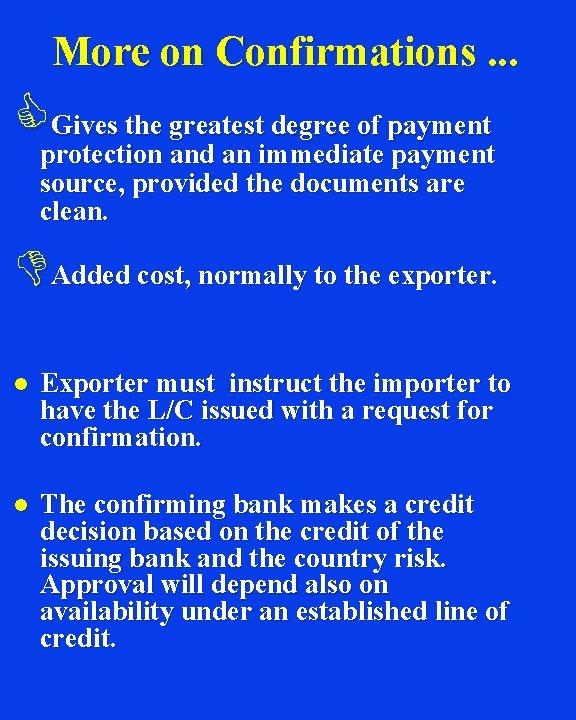

More on Confirmations. . . CGives the greatest degree of payment protection and an immediate payment source, provided the documents are clean. DAdded cost, normally to the exporter. l Exporter must instruct the importer to have the L/C issued with a request for confirmation. l The confirming bank makes a credit decision based on the credit of the issuing bank and the country risk. Approval will depend also on availability under an established line of credit.

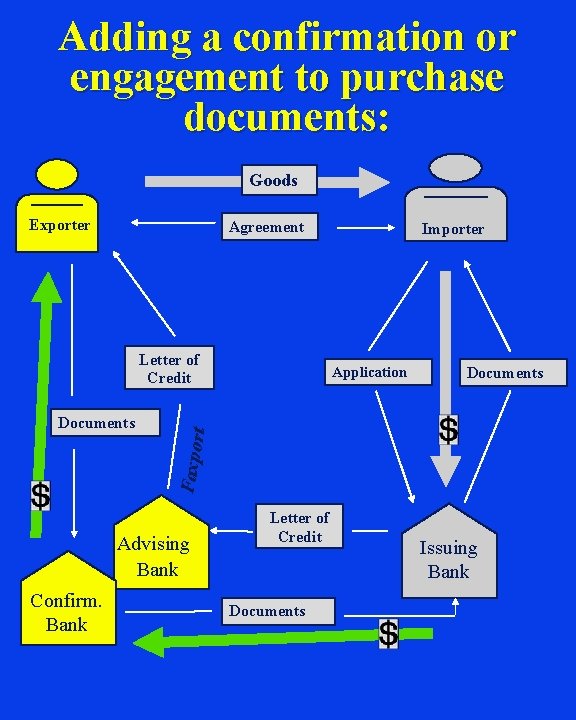

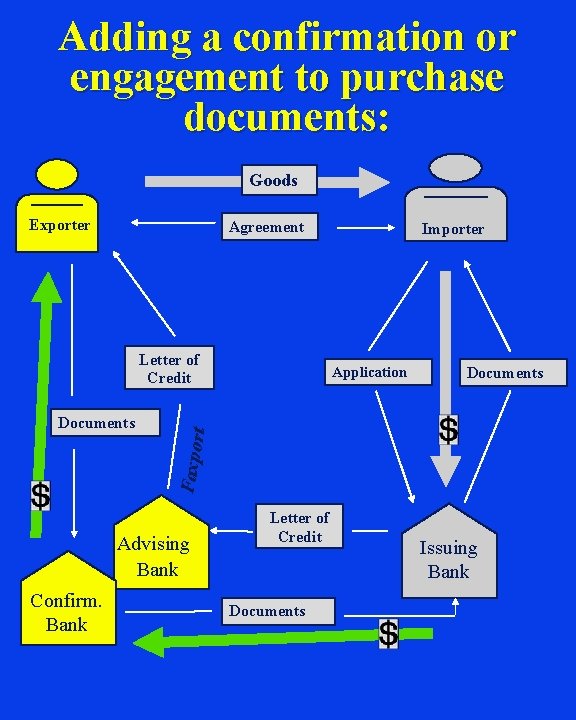

Adding a confirmation or engagement to purchase documents: Goods Exporter Agreement Letter of Credit Documents t Application Faxpor Documents Importer Advising Bank Confirm. Bank Letter of Credit Documents Issuing Bank

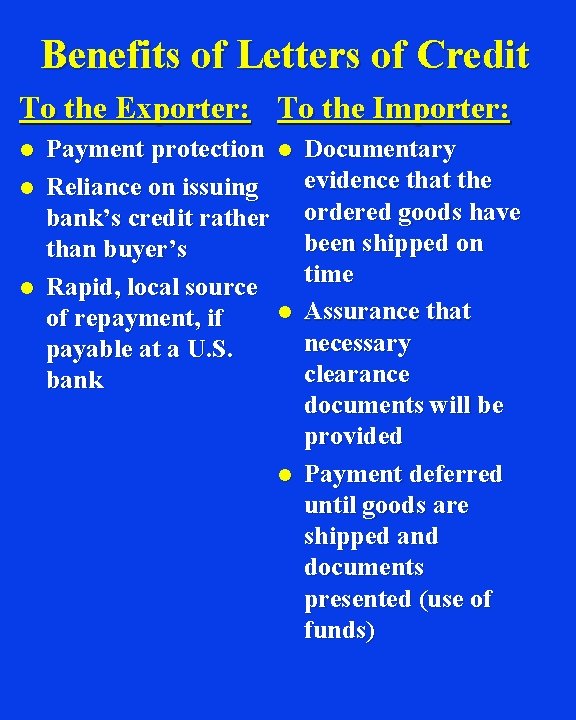

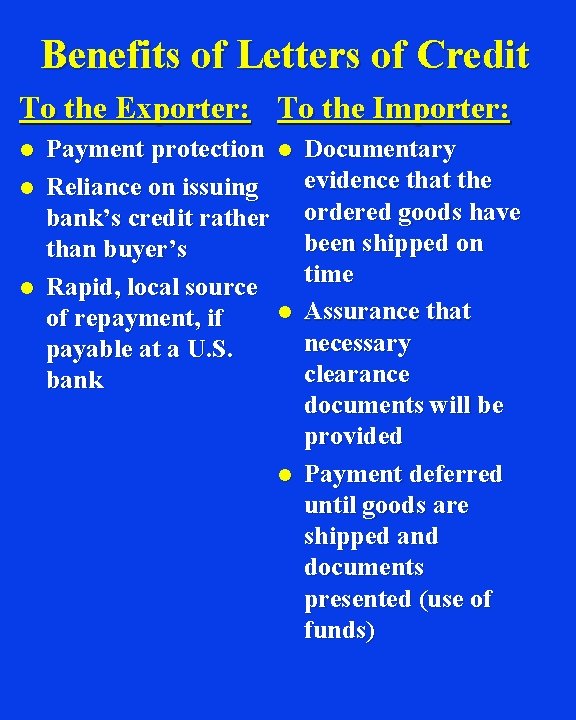

Benefits of Letters of Credit To the Exporter: To the Importer: l l l Payment protection l Reliance on issuing bank’s credit rather than buyer’s Rapid, local source l of repayment, if payable at a U. S. bank l Documentary evidence that the ordered goods have been shipped on time Assurance that necessary clearance documents will be provided Payment deferred until goods are shipped and documents presented (use of funds)

This can be avoided by giving credit where credit is due.

This can be avoided by giving credit where credit is due. Sky grass root letters

Sky grass root letters World connection question examples

World connection question examples Letter of credit

Letter of credit Letter of credit example

Letter of credit example Cash flow in credit management

Cash flow in credit management Inland letter of credit

Inland letter of credit Letter of credit

Letter of credit Letter of credit

Letter of credit What is letter of credit in export

What is letter of credit in export Letter of credit

Letter of credit Credit and status enquiries letter

Credit and status enquiries letter Tuesday morning prayer

Tuesday morning prayer Tuesday evening prayer

Tuesday evening prayer Good morning tuesday stay safe images

Good morning tuesday stay safe images Sunday moday

Sunday moday Monday tuesday wednesday thursday friday saturday sunday

Monday tuesday wednesday thursday friday saturday sunday Aphorisms in tuesdays with morrie

Aphorisms in tuesdays with morrie Due tuesday

Due tuesday Great stock market crash 1929

Great stock market crash 1929 Monday=621 tuesday=732 wednesday=933

Monday=621 tuesday=732 wednesday=933 Tuesday the 6th

Tuesday the 6th Th adjectives for thursday

Th adjectives for thursday Toeic exam

Toeic exam Factors affecting solubility

Factors affecting solubility Marvelous monday terrific tuesday wonderful wednesday

Marvelous monday terrific tuesday wonderful wednesday Tuesday dua

Tuesday dua Tuesdays class

Tuesdays class Tuesday morning prayer gif

Tuesday morning prayer gif Tuesday lobsang rampa

Tuesday lobsang rampa