EMPLOYEES ENROLLMENT CAMPAIGN 2017 Notification No 3121 Dated

- Slides: 18

EMPLOYEES’ ENROLLMENT CAMPAIGN 2017 Notification No. 3121, Dated 30 -12 -2016

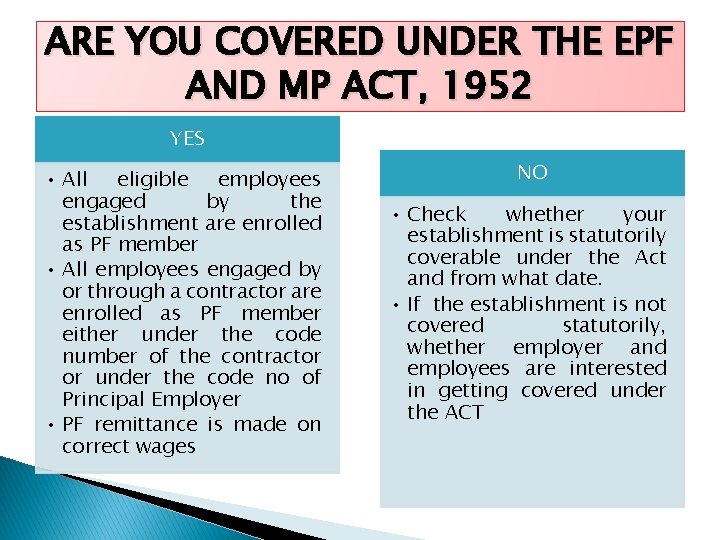

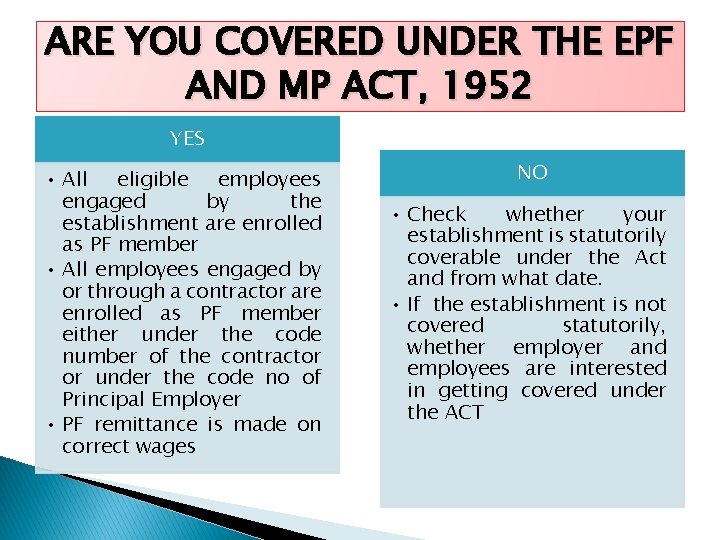

ARE YOU COVERED UNDER THE EPF AND MP ACT, 1952 YES • All eligible employees engaged by the establishment are enrolled as PF member • All employees engaged by or through a contractor are enrolled as PF member either under the code number of the contractor or under the code no of Principal Employer • PF remittance is made on correct wages NO • Check whether your establishment is statutorily coverable under the Act and from what date. • If the establishment is not covered statutorily, whether employer and employees are interested in getting covered under the ACT

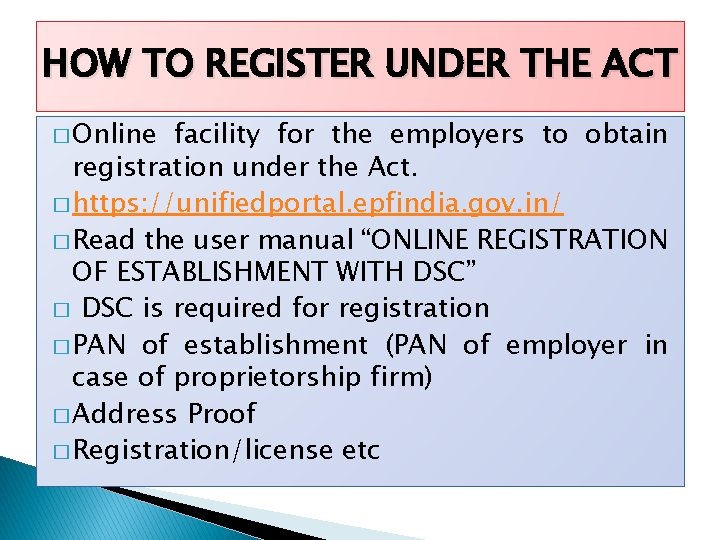

HOW TO REGISTER UNDER THE ACT � Online facility for the employers to obtain registration under the Act. � https: //unifiedportal. epfindia. gov. in/ � Read the user manual “ONLINE REGISTRATION OF ESTABLISHMENT WITH DSC” � DSC is required for registration � PAN of establishment (PAN of employer in case of proprietorship firm) � Address Proof � Registration/license etc

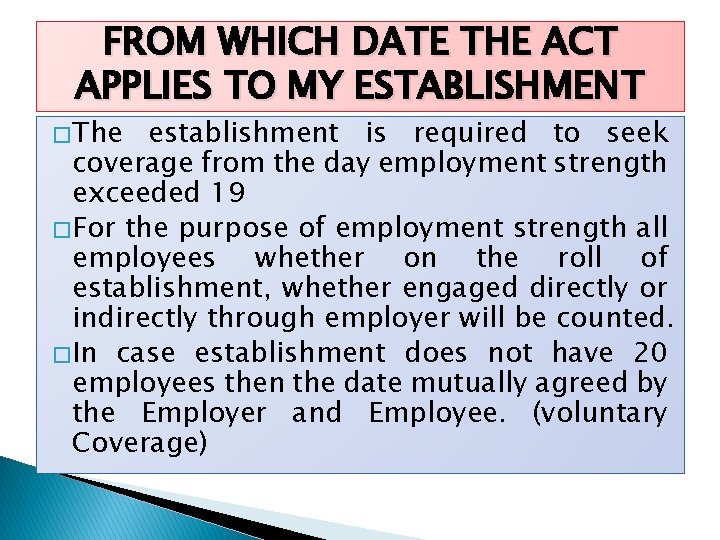

FROM WHICH DATE THE ACT APPLIES TO MY ESTABLISHMENT � The establishment is required to seek coverage from the day employment strength exceeded 19 � For the purpose of employment strength all employees whether on the roll of establishment, whether engaged directly or indirectly through employer will be counted. � In case establishment does not have 20 employees then the date mutually agreed by the Employer and Employee. (voluntary Coverage)

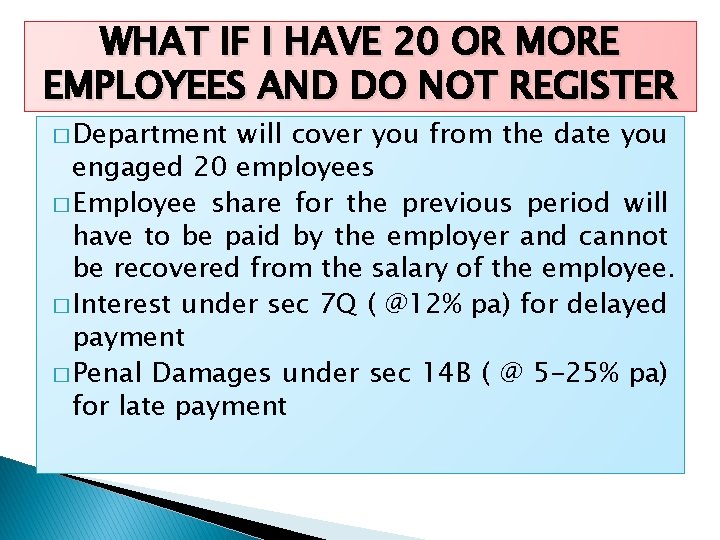

WHAT IF I HAVE 20 OR MORE EMPLOYEES AND DO NOT REGISTER � Department will cover you from the date you engaged 20 employees � Employee share for the previous period will have to be paid by the employer and cannot be recovered from the salary of the employee. � Interest under sec 7 Q ( @12% pa) for delayed payment � Penal Damages under sec 14 B ( @ 5 -25% pa) for late payment

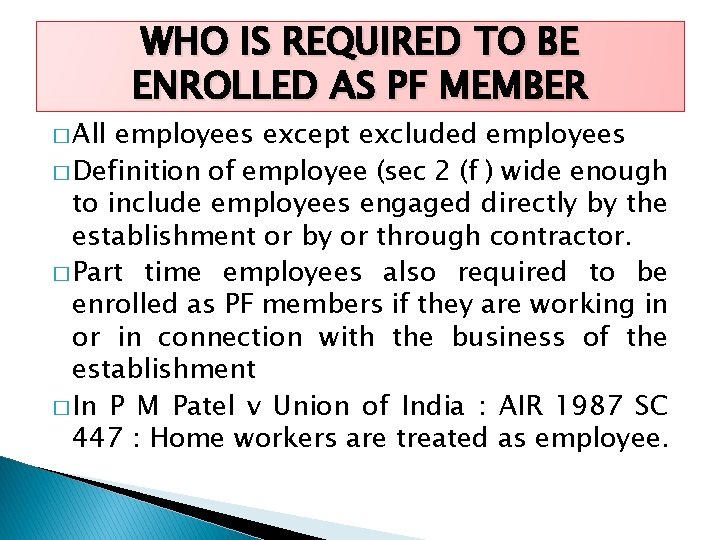

� All WHO IS REQUIRED TO BE ENROLLED AS PF MEMBER employees except excluded employees � Definition of employee (sec 2 (f ) wide enough to include employees engaged directly by the establishment or by or through contractor. � Part time employees also required to be enrolled as PF members if they are working in or in connection with the business of the establishment � In P M Patel v Union of India : AIR 1987 SC 447 : Home workers are treated as employee.

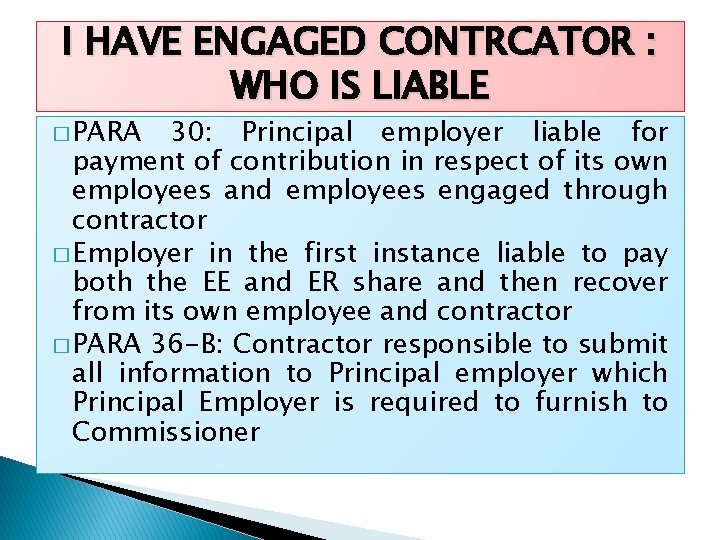

I HAVE ENGAGED CONTRCATOR : WHO IS LIABLE � PARA 30: Principal employer liable for payment of contribution in respect of its own employees and employees engaged through contractor � Employer in the first instance liable to pay both the EE and ER share and then recover from its own employee and contractor � PARA 36 -B: Contractor responsible to submit all information to Principal employer which Principal Employer is required to furnish to Commissioner

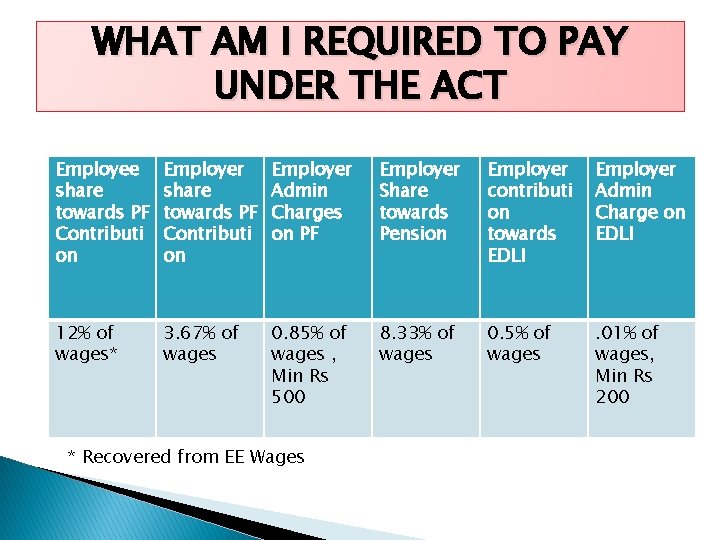

WHAT AM I REQUIRED TO PAY UNDER THE ACT Employee share towards PF Contributi on Employer Admin Charges on PF Employer Share towards Pension Employer contributi on towards EDLI Employer Admin Charge on EDLI 12% of wages* 3. 67% of wages 0. 85% of wages , Min Rs 500 8. 33% of wages 0. 5% of wages . 01% of wages, Min Rs 200 * Recovered from EE Wages

WHAT ARE THE BENEFITS AVAILABLE TO THE EMPLOYEE � Compulsory savings in the form of Provident Fund with contribution from EE and ER � Tax free savings (EEE) � Highest interest rate (interest on monthly running balance) � Partial Withdrawal for specific purpose like, illness, marriage, education, house etc. � Insurance up to Rs 6 lakh in case of death of employee in service. � Pension under EPS 95 (Member Pension, Spouse Pension, Children Pension, Disability Pension, Nominee Pension etc)

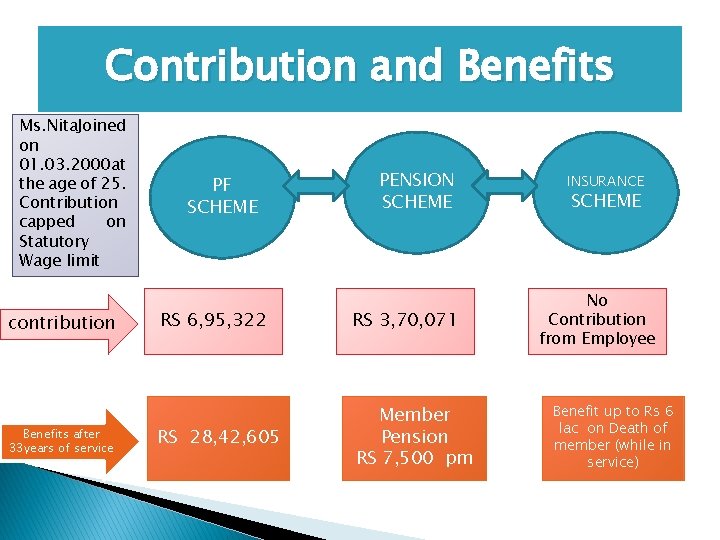

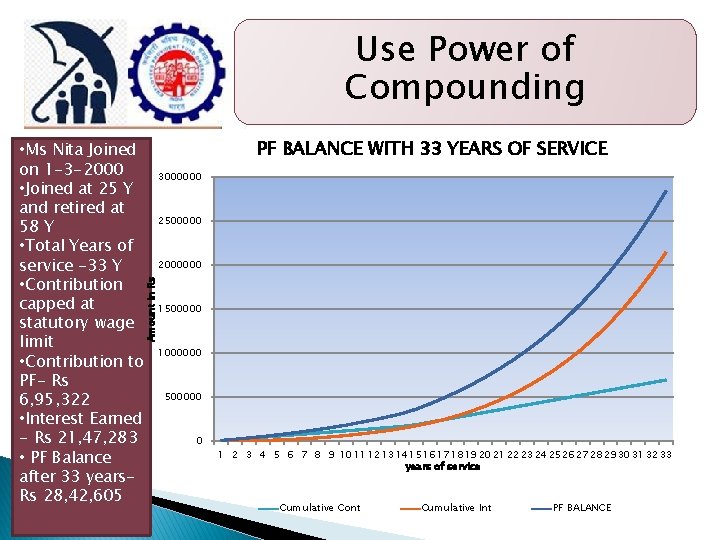

Contribution and Benefits Ms. Nita. Joined on 01. 03. 2000 at the age of 25. Contribution capped on Statutory Wage limit contribution Benefits after 33 years of service PF SCHEME PENSION SCHEME RS 6, 95, 322 RS 3, 70, 071 RS 28, 42, 605 Member Pension RS 7, 500 pm INSURANCE SCHEME No Contribution from Employee Benefit up to Rs 6 lac on Death of member (while in service)

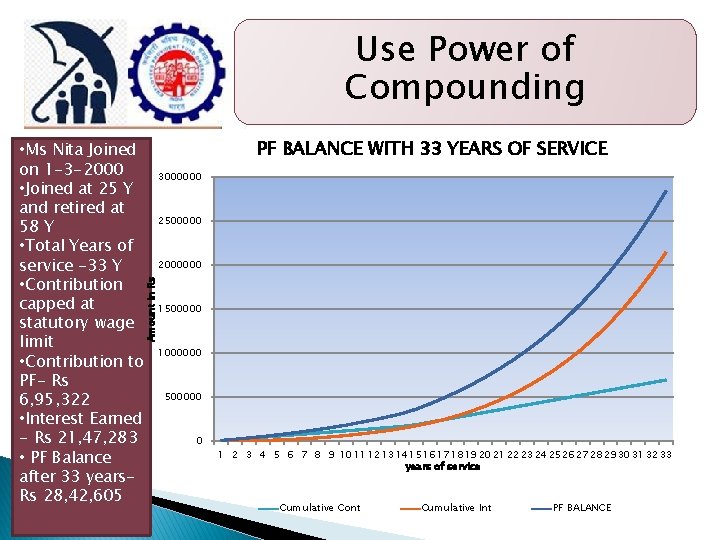

Use Power of Compounding PF BALANCE WITH 33 YEARS OF SERVICE 3000000 2500000 2000000 Amount in Rs • Ms Nita Joined on 1 -3 -2000 • Joined at 25 Y and retired at 58 Y • Total Years of service -33 Y • Contribution capped at statutory wage limit • Contribution to PF- Rs 6, 95, 322 • Interest Earned - Rs 21, 47, 283 • PF Balance after 33 years. Rs 28, 42, 605 1500000 1000000 500000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 years of service Cumulative Cont Cumulative Int PF BALANCE

CONCERNS OF EMPLOYEES WORKING IN CONSTRUCTION & BUILDING INDUSTRY MIGRANT WORKER, HOW WILL I GET BENEFIT, FREQUENT JOB CHANGE. � � � UAN (Universal Account Number). All benefits based on UAN Employee needs to be enrolled for UAN & thereafter same UAN can be used. Seed UAN with Aadhaar & Bank Account. Know your PF balance by giving missed call at 011 -22901406. Use EPFO App (Android Version) to view your pass book and UAN details.

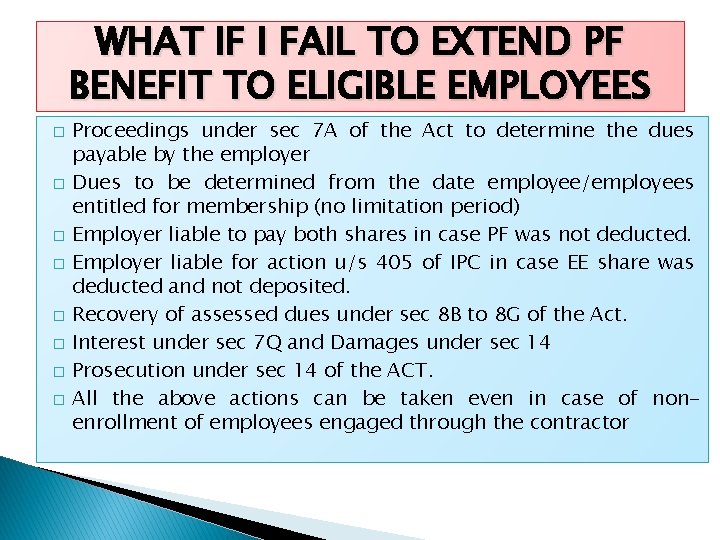

WHAT IF I FAIL TO EXTEND PF BENEFIT TO ELIGIBLE EMPLOYEES � � � � Proceedings under sec 7 A of the Act to determine the dues payable by the employer Dues to be determined from the date employee/employees entitled for membership (no limitation period) Employer liable to pay both shares in case PF was not deducted. Employer liable for action u/s 405 of IPC in case EE share was deducted and not deposited. Recovery of assessed dues under sec 8 B to 8 G of the Act. Interest under sec 7 Q and Damages under sec 14 Prosecution under sec 14 of the ACT. All the above actions can be taken even in case of nonenrollment of employees engaged through the contractor

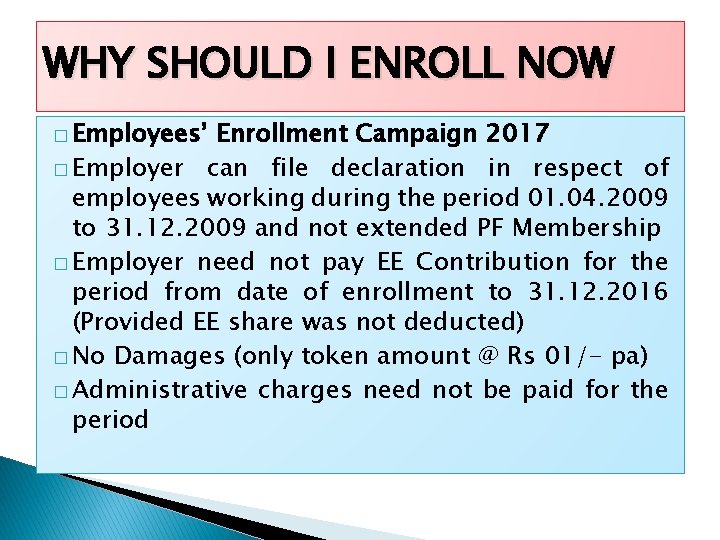

WHY SHOULD I ENROLL NOW � Employees’ Enrollment Campaign 2017 � Employer can file declaration in respect of employees working during the period 01. 04. 2009 to 31. 12. 2009 and not extended PF Membership � Employer need not pay EE Contribution for the period from date of enrollment to 31. 12. 2016 (Provided EE share was not deducted) � No Damages (only token amount @ Rs 01/- pa) � Administrative charges need not be paid for the period

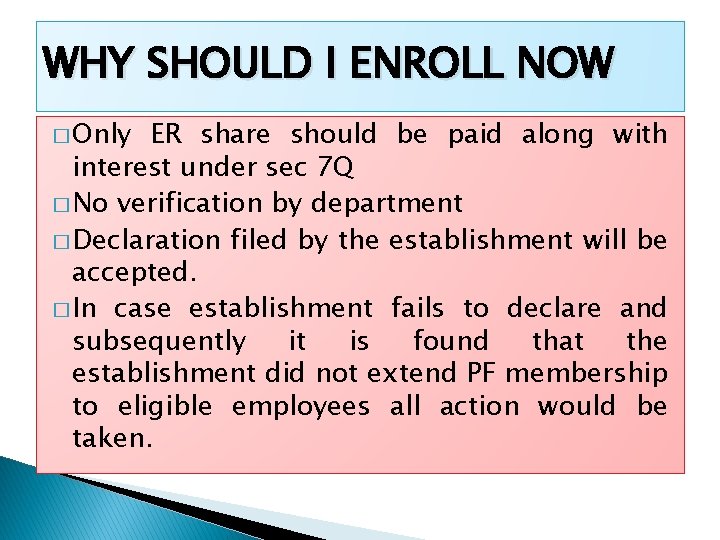

WHY SHOULD I ENROLL NOW � Only ER share should be paid along with interest under sec 7 Q � No verification by department � Declaration filed by the establishment will be accepted. � In case establishment fails to declare and subsequently it is found that the establishment did not extend PF membership to eligible employees all action would be taken.

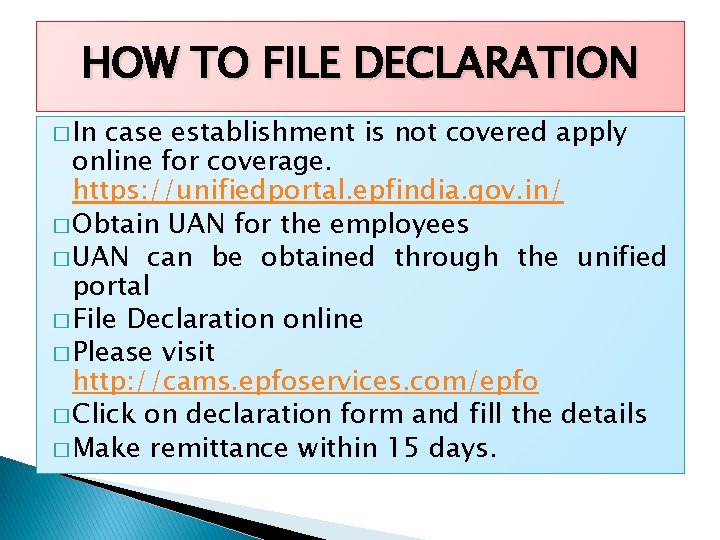

HOW TO FILE DECLARATION � In case establishment is not covered apply online for coverage. https: //unifiedportal. epfindia. gov. in/ � Obtain UAN for the employees � UAN can be obtained through the unified portal � File Declaration online � Please visit http: //cams. epfoservices. com/epfo � Click on declaration form and fill the details � Make remittance within 15 days.

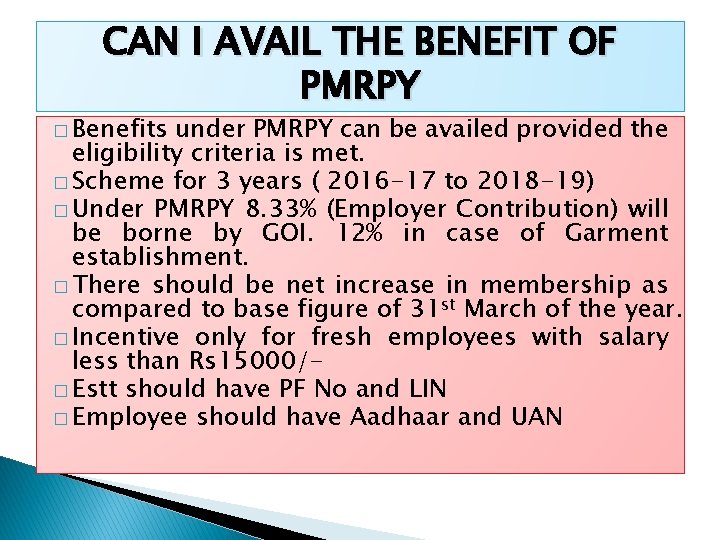

CAN I AVAIL THE BENEFIT OF PMRPY � Benefits under PMRPY can be availed provided the eligibility criteria is met. � Scheme for 3 years ( 2016 -17 to 2018 -19) � Under PMRPY 8. 33% (Employer Contribution) will be borne by GOI. 12% in case of Garment establishment. � There should be net increase in membership as compared to base figure of 31 st March of the year. � Incentive only for fresh employees with salary less than Rs 15000/� Estt should have PF No and LIN � Employee should have Aadhaar and UAN

� CONSIDER PF AS INVESTMENT IN HUMAN CAPITAL AND NATION BUILDING ANY QUESTIONS?