Sales Tax Schedules Adnan Mufti ACA Shekha Mufti

- Slides: 22

Sales Tax Schedules Adnan Mufti ACA Shekha & Mufti Chartered Accountants 1

Schedules - Overview q Third Schedule (Retail Price Regime) q Fifth Schedule (Zero Rating Regime) q Sixth Schedule (Tax Exemptions) 2

Retail Price Regime rd (3 Schedule) 3

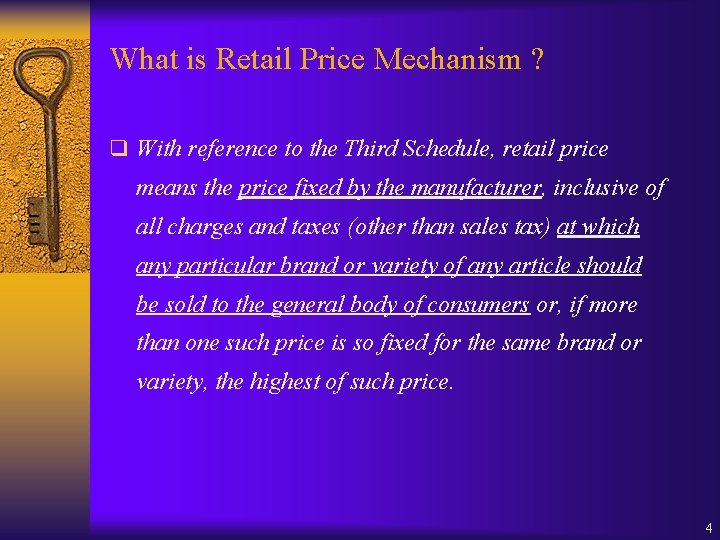

What is Retail Price Mechanism ? q With reference to the Third Schedule, retail price means the price fixed by the manufacturer, inclusive of all charges and taxes (other than sales tax) at which any particular brand or variety of any article should be sold to the general body of consumers or, if more than one such price is so fixed for the same brand or variety, the highest of such price. 4

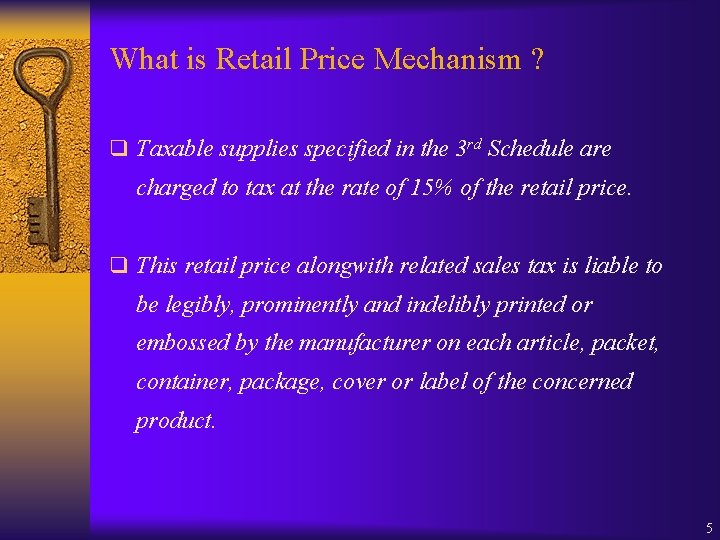

What is Retail Price Mechanism ? q Taxable supplies specified in the 3 rd Schedule are charged to tax at the rate of 15% of the retail price. q This retail price alongwith related sales tax is liable to be legibly, prominently and indelibly printed or embossed by the manufacturer on each article, packet, container, package, cover or label of the concerned product. 5

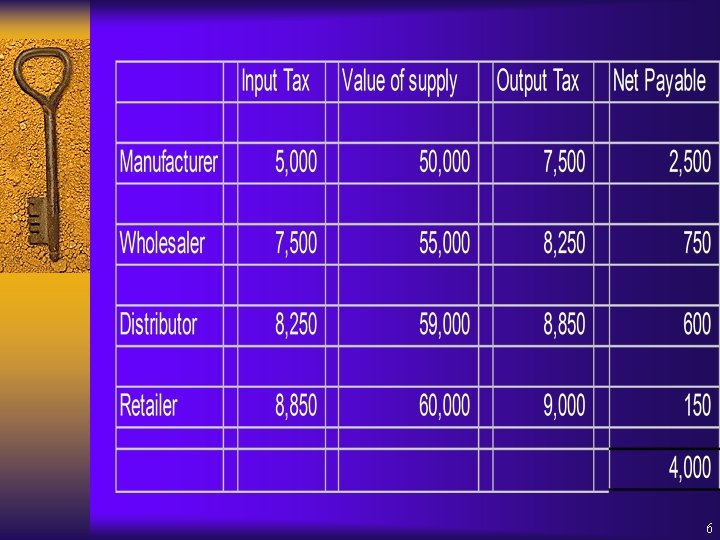

6

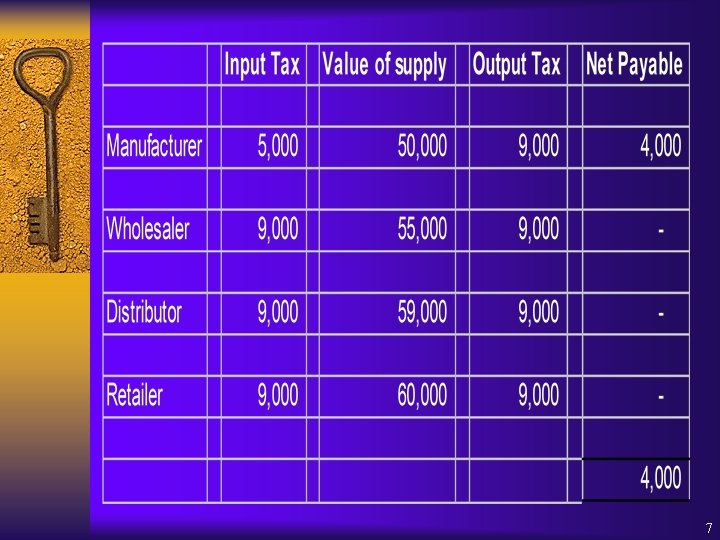

7

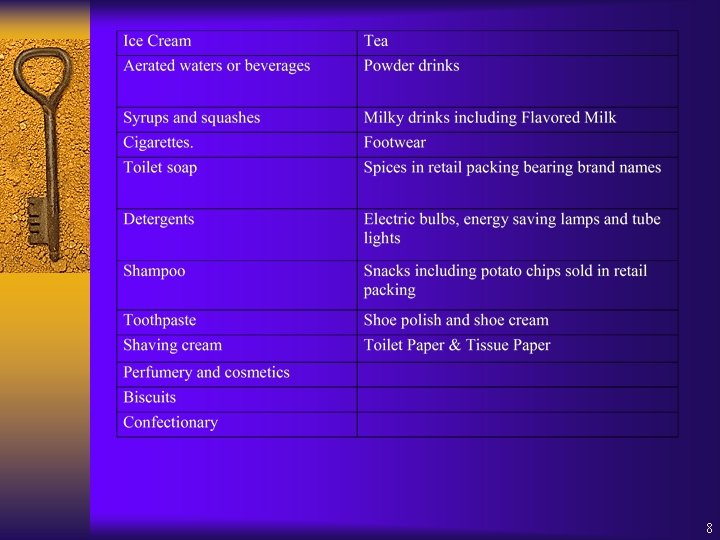

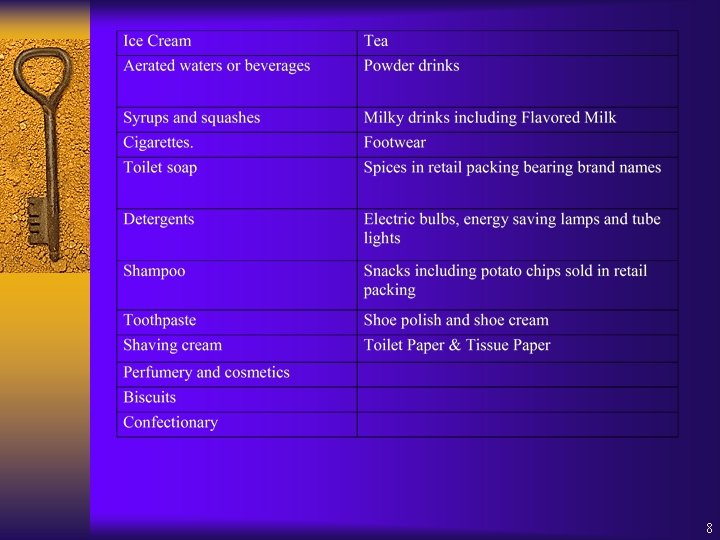

8

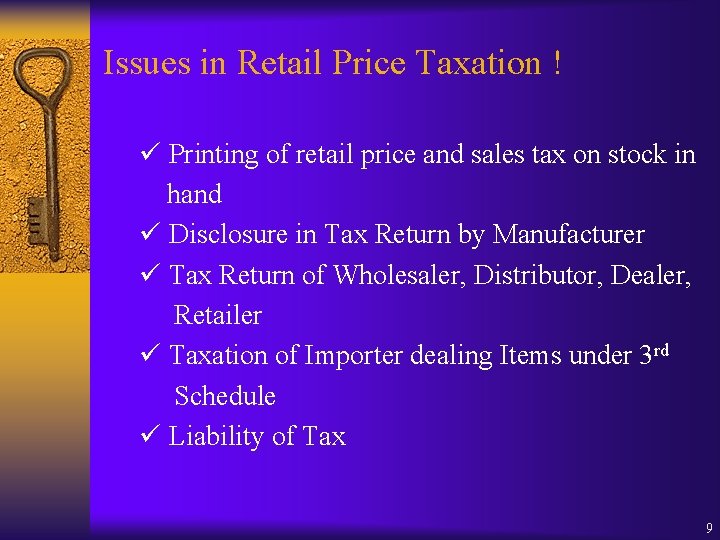

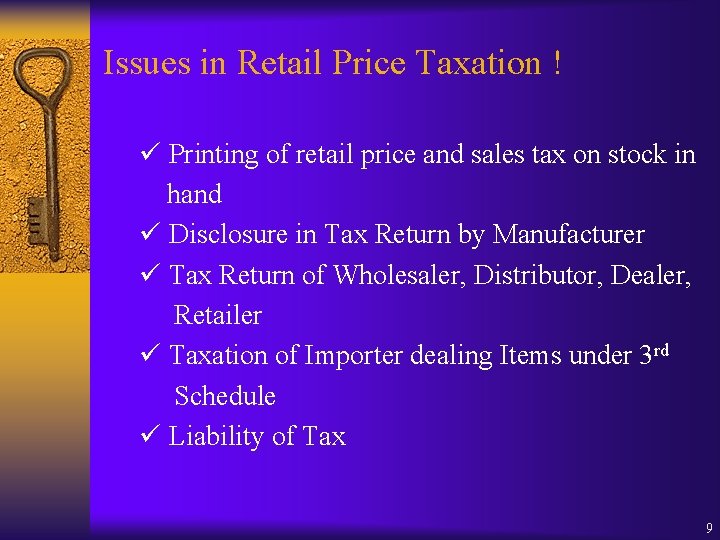

Issues in Retail Price Taxation ! ü Printing of retail price and sales tax on stock in hand ü Disclosure in Tax Return by Manufacturer ü Tax Return of Wholesaler, Distributor, Dealer, Retailer ü Taxation of Importer dealing Items under 3 rd Schedule ü Liability of Tax 9

Zero Rating Regime th (5 Schedule) 10

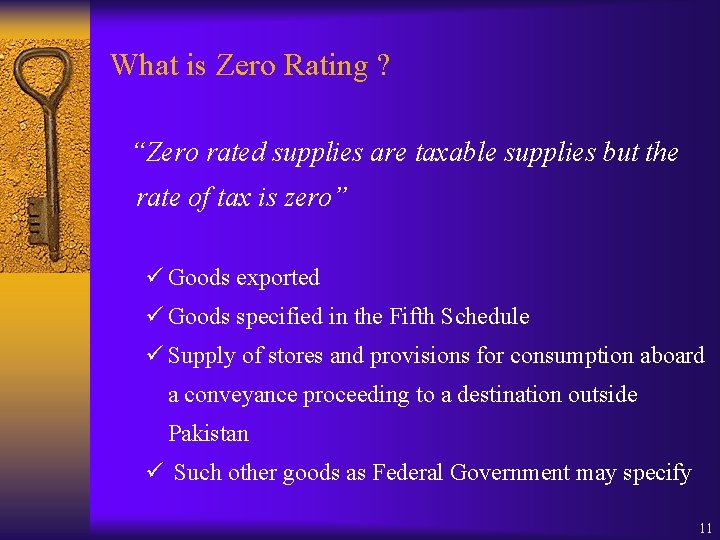

What is Zero Rating ? “Zero rated supplies are taxable supplies but the rate of tax is zero” ü Goods exported ü Goods specified in the Fifth Schedule ü Supply of stores and provisions for consumption aboard a conveyance proceeding to a destination outside Pakistan ü Such other goods as Federal Government may specify 11

5 th Schedule ü Supply, repair or maintenance of specific ships ü Supply, repair or maintenance of specific aircrafts ü Supply to diplomats, diplomatic missions, etc ü Supplies to duty free shops ü Supplies of raw materials, components for further manufacturing in the Export Processing Zone ü Supplies against international tenders ü Dairy Items 12

5 th Schedule ü Supplies of specified locally manufactured plant and machinery to the Export Processing Zones and to petroleum and gas sector Exploration & Production companies ü Supplies made to exporters under the Duty and Tax Remission Rules, 2001 ü Imports or supplies made to Gawadar Special Economic Zone, (excluding vehicles) 13

Zero Rated Sectors Ø Leather and articles thereof including artificial leather footwear Ø Textile and articles thereof Ø Carpets Ø Sports goods Ø Surgical goods 14

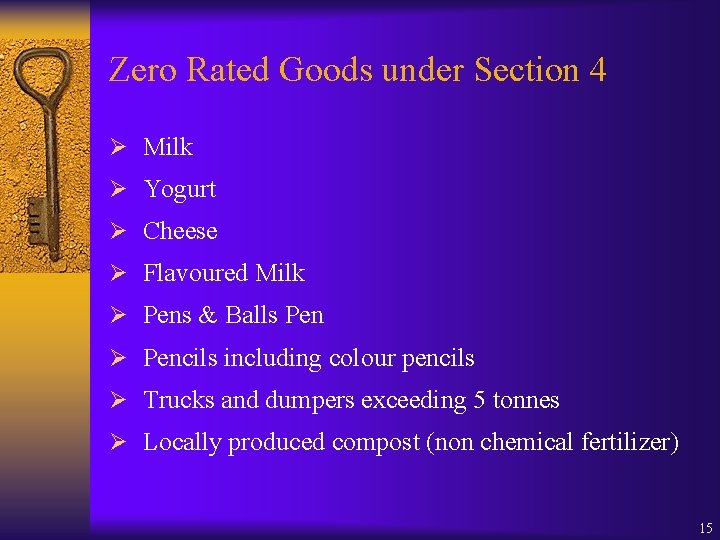

Zero Rated Goods under Section 4 Ø Milk Ø Yogurt Ø Cheese Ø Flavoured Milk Ø Pens & Balls Pen Ø Pencils including colour pencils Ø Trucks and dumpers exceeding 5 tonnes Ø Locally produced compost (non chemical fertilizer) 15

Goods Specified by Govt. as Zero Rated Goods § Imported plant, machinery and equipment (whether or not manufactured locally), including parts thereof § Supply of plant, machinery and equipment, whether locally manufactured or imported § Electricity and Gas of zero rated sectors is also zero rated 16

Issues in Zero Rating ! üExempt vs. Zero Rating üZero Rating of Exempt Products possible ? üRegistration of Commercial Exporters under Section 14 of the Act üIndirect Exporter liable for zero rating ? 17

Tax Exemptions th (6 Schedule) 18

Exempted Goods Ø Agricultural Produce Ø Pulses, Grains, Cereals, Vegetables, Fruits, Eggs, Poultry, Meat, Dried Milk Ø Newspapers, Books, Journals, Directories Ø Currency Notes Ø Temporary Imports for subsequent exportation Ø Imported Samples Ø Import of Personal Effects including vehicles 19

Exempted Goods Ø Supplies made by Manufacturers & Retailers not exceeding Rs. 5 million in a year Ø Raw Material & Intermediary Goods manufactured and consumed or Services rendered to himself in the manufacture of taxable goods Ø Computer Software (Hardware now subject to sales tax ! ) Ø Supply of Fixed Assets whose input tax in not admissible 20

Issues in Tax Exemptions ! Ø Pharma Products not registered in Drug Act Ø Implication when exempt product used in manufacture of taxable goods and vice versa 21

THANK YOU 22

6-1 tax tables worksheets and schedules

6-1 tax tables worksheets and schedules Ihsan institute

Ihsan institute Humaira zia mufti

Humaira zia mufti Spleen percussion

Spleen percussion Find the local tax deducted: $456 biweekly, 2 1/2 % tax.

Find the local tax deducted: $456 biweekly, 2 1/2 % tax. Conclusion on gst

Conclusion on gst Louisville sales tax

Louisville sales tax Connecticut sales tax exemptions

Connecticut sales tax exemptions Sales tax on landscaping

Sales tax on landscaping Tennessee sls-450

Tennessee sls-450 Javascript sales tax script

Javascript sales tax script How to figure out sales tax from total

How to figure out sales tax from total Ttvs quotes

Ttvs quotes Introduction quotes

Introduction quotes Madison county ohio sales tax rate

Madison county ohio sales tax rate Managing sales tax exemption certificates

Managing sales tax exemption certificates Scentsy sales tax

Scentsy sales tax How to find sales tax

How to find sales tax Wisconsin sales tax license

Wisconsin sales tax license Workday sales tax

Workday sales tax Sindh sales tax on renting of immovable property

Sindh sales tax on renting of immovable property Infor xa sales tax report

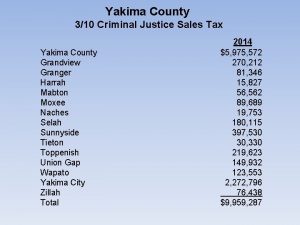

Infor xa sales tax report Yakima assigned counsel

Yakima assigned counsel