Guide To Reconcile Sales Tax Updated June 2019

- Slides: 17

Guide To Reconcile Sales Tax Updated June 2019 Contact Information: Controller’s Office General Accounting Area Tel: 305 -284 -6148

Objectives of This Presentation Inform users about the Florida sales tax calculation Discuss the steps involved to submit the monthly sales tax reconciliation to the Controller’s Office Review exempt sales and corrections Follow instructions on preparing e-mail to be sent to the Controller’s Office and keeping backup documentation in the departments 2

Florida Sales Tax Rates Calculating Sales Tax Brackets SALES TAX TOPICS 3

Florida Sales Tax Rates The sales tax rate for Miami-Dade county is currently 7%. This rate is comprised of two components – the State “base rate” of 6%, and Miami-Dade county’s “surtax rate” of 1%. See the link below for surtax rates by county as well a detailed explanation of surtaxes and their applicability. Go to http: //dor. myflorida. com/dor/forms/index. html#discretionary to get to the Florida Department of Revenue Discretionary Sales Surtax section Download Form Number DR-15 DSS which takes you to information for the current calendar year Note that UM out of state sales are exempt from Florida sales tax. 4

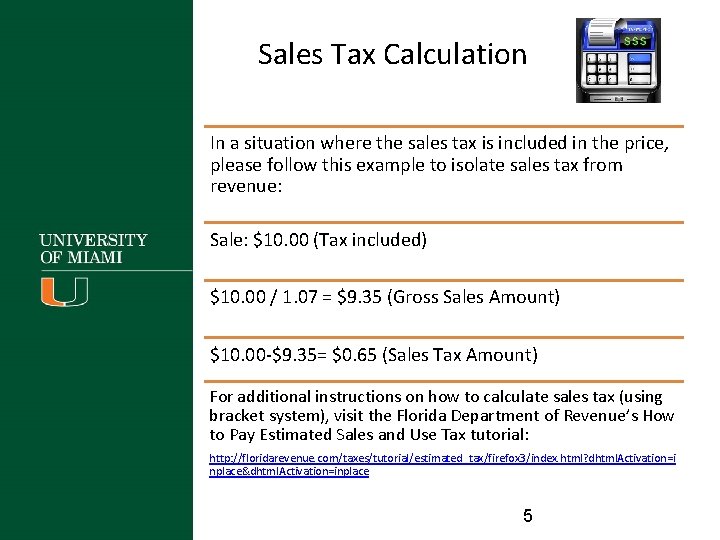

Sales Tax Calculation In a situation where the sales tax is included in the price, please follow this example to isolate sales tax from revenue: Sale: $10. 00 (Tax included) $10. 00 / 1. 07 = $9. 35 (Gross Sales Amount) $10. 00 -$9. 35= $0. 65 (Sales Tax Amount) For additional instructions on how to calculate sales tax (using bracket system), visit the Florida Department of Revenue’s How to Pay Estimated Sales and Use Tax tutorial: http: //floridarevenue. com/taxes/tutorial/estimated_tax/firefox 3/index. html? dhtml. Activation=i nplace&dhtml. Activation=inplace 5

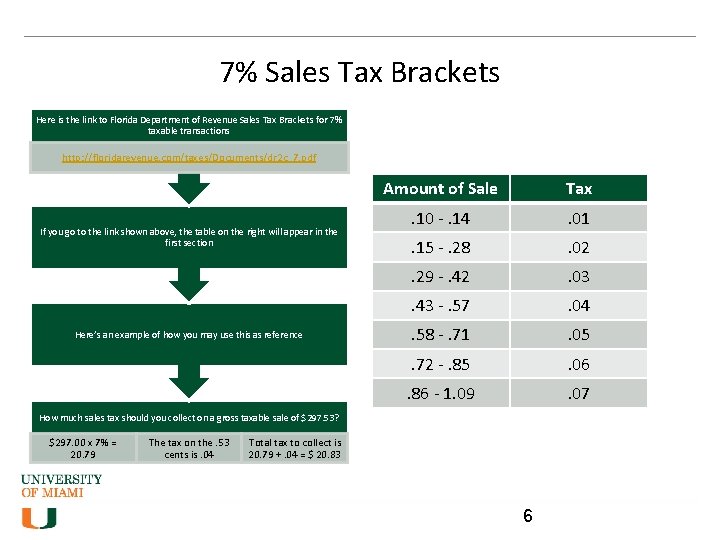

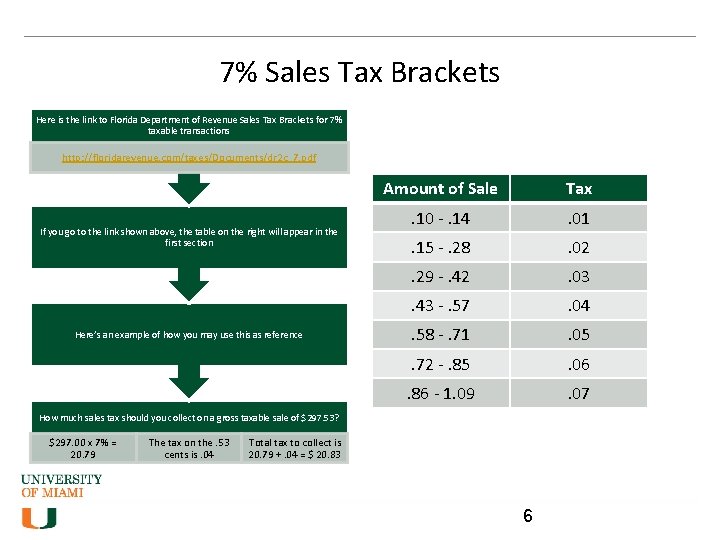

7% Sales Tax Brackets Here is the link to Florida Department of Revenue Sales Tax Brackets for 7% taxable transactions http: //floridarevenue. com/taxes/Documents/dr 2 c_7. pdf If you go to the link shown above, the table on the right will appear in the first section Here’s an example of how you may use this as reference Amount of Sale Tax . 10 -. 14 . 01 . 15 -. 28 . 02 . 29 -. 42 . 03 . 43 -. 57 . 04 . 58 -. 71 . 05 . 72 -. 85 . 06 . 86 - 1. 09 . 07 How much sales tax should you collect on a gross taxable sale of $297. 53? $297. 00 x 7% = 20. 79 The tax on the. 53 cents is. 04 Total tax to collect is 20. 79 +. 04 = $ 20. 83 6

Review Workday Screens Sales Tax Payable - Control Code Ledger 2151 Sales Tax Spreadsheet Balancing and Corrections THE STEPS TO SUBMIT THE MONTHLY SALES TAX RECONCILIATION 7

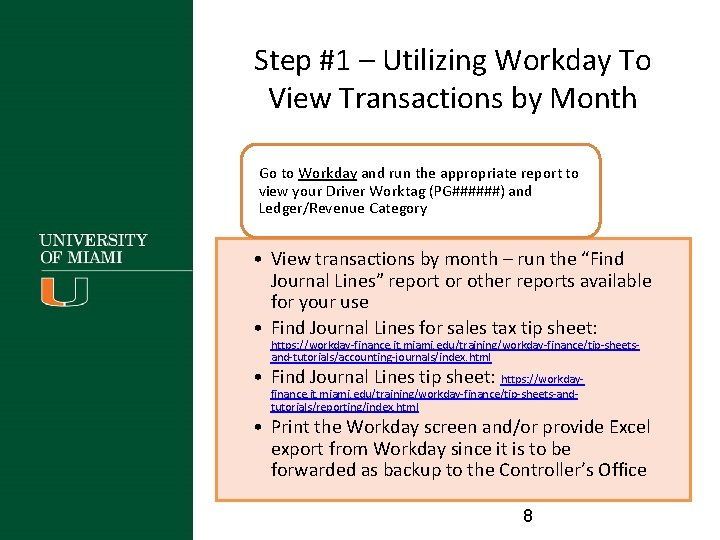

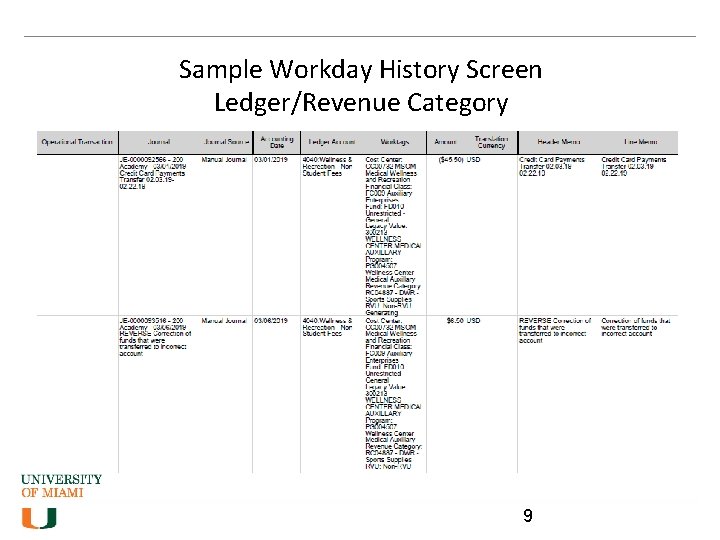

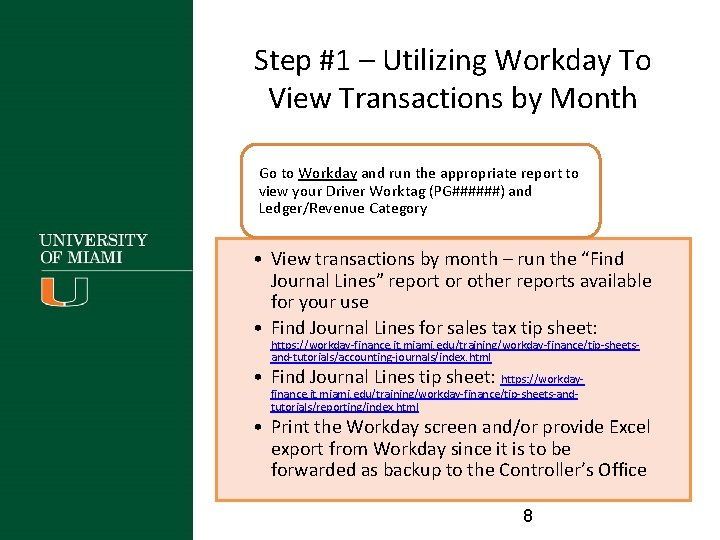

Step #1 – Utilizing Workday To View Transactions by Month Go to Workday and run the appropriate report to view your Driver Worktag (PG######) and Ledger/Revenue Category • View transactions by month – run the “Find Journal Lines” report or other reports available for your use • Find Journal Lines for sales tax tip sheet: https: //workday-finance. it. miami. edu/training/workday-finance/tip-sheetsand-tutorials/accounting-journals/index. html • Find Journal Lines tip sheet: https: //workdayfinance. it. miami. edu/training/workday-finance/tip-sheets-andtutorials/reporting/index. html • Print the Workday screen and/or provide Excel export from Workday since it is to be forwarded as backup to the Controller’s Office 8

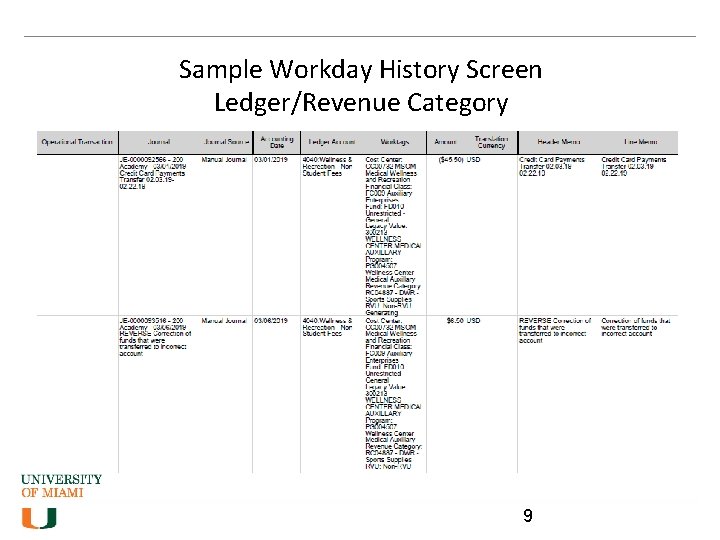

Sample Workday History Screen Ledger/Revenue Category 9

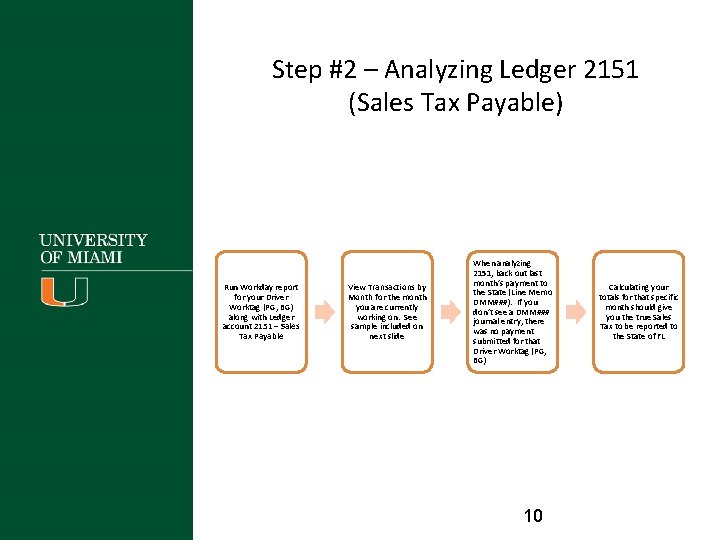

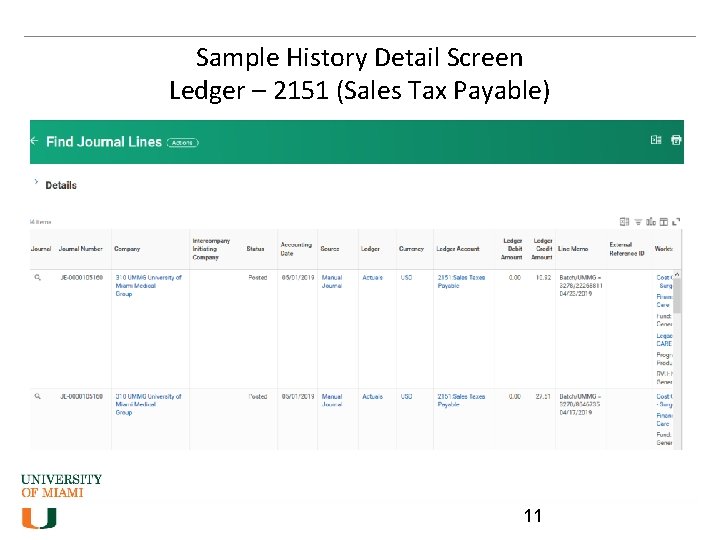

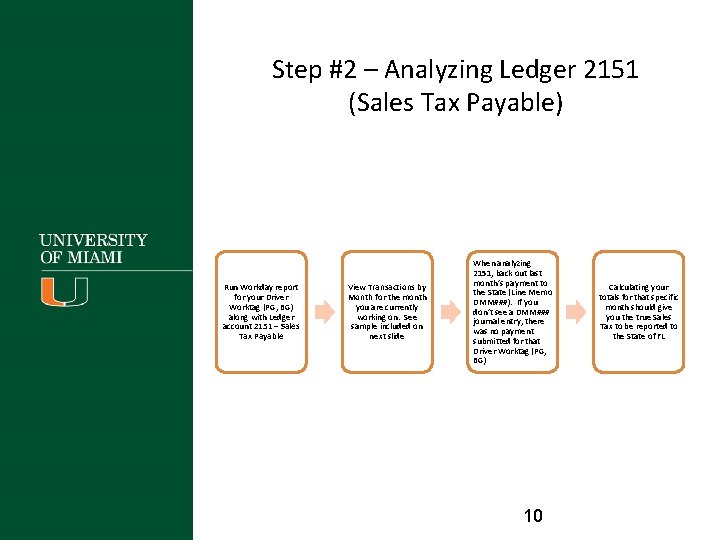

Step #2 – Analyzing Ledger 2151 (Sales Tax Payable) Run Workday report for your Driver Worktag (PG, BG) along with Ledger account 2151 – Sales Tax Payable View Transactions by Month for the month you are currently working on. See sample included on next slide When analyzing 2151, back out last month’s payment to the State (Line Memo DMM###). If you don’t see a DMM### journal entry, there was no payment submitted for that Driver Worktag (PG, BG) 10 Calculating your totals for that specific month should give you the true Sales Tax to be reported to the State of FL

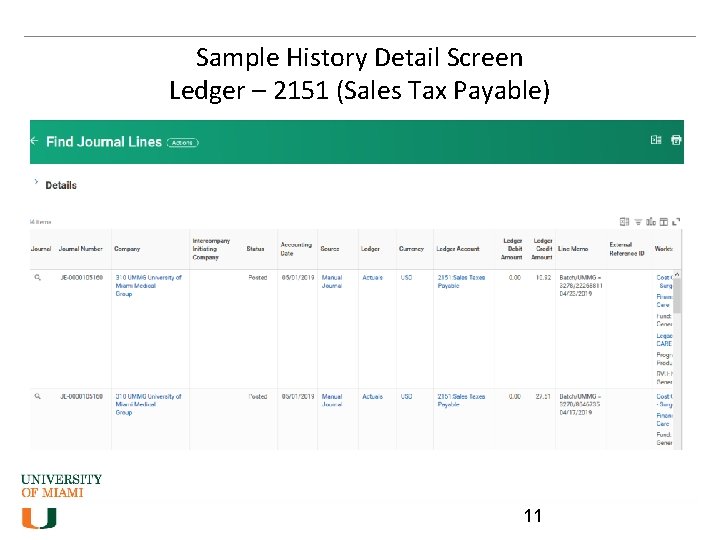

Sample History Detail Screen Ledger – 2151 (Sales Tax Payable) 11

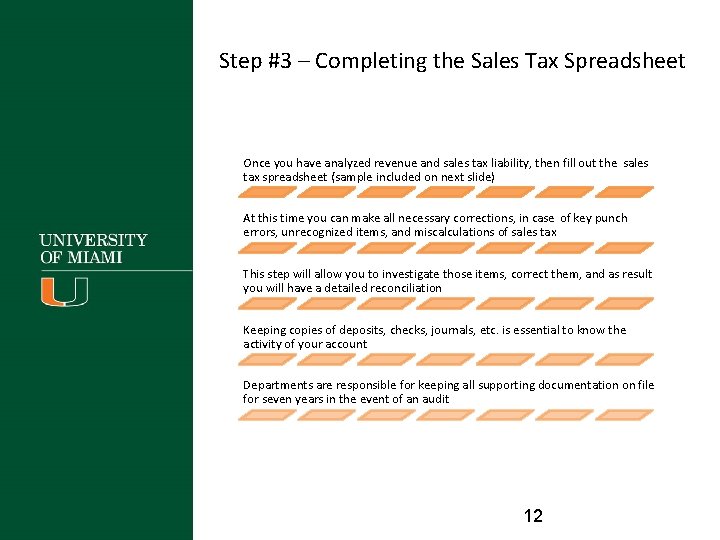

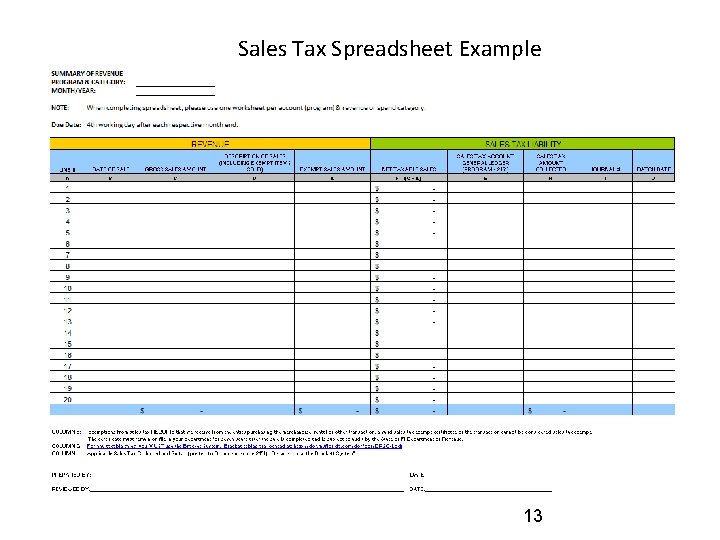

Step #3 – Completing the Sales Tax Spreadsheet Once you have analyzed revenue and sales tax liability, then fill out the sales tax spreadsheet (sample included on next slide) At this time you can make all necessary corrections, in case of key punch errors, unrecognized items, and miscalculations of sales tax This step will allow you to investigate those items, correct them, and as result you will have a detailed reconciliation Keeping copies of deposits, checks, journals, etc. is essential to know the activity of your account Departments are responsible for keeping all supporting documentation on file for seven years in the event of an audit 12

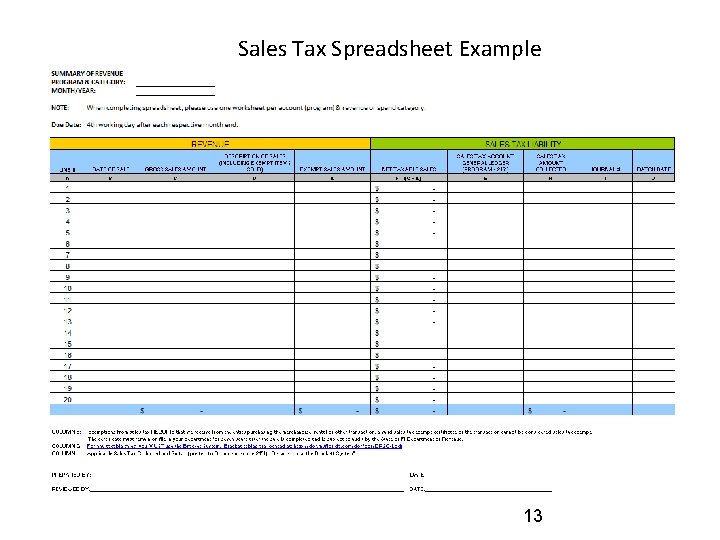

Sales Tax Spreadsheet Example 13

Step #4 – Exempt Sales & Corrections Keep Exempt Sales Amount (column E) in mind. Your bottom line totals – Gross Sales Amount (column C) and Sales Tax Amount Collected (Column H) should mirror your WD totals. Column F should only detail Net Taxable Sales Notify us via e-mail if you have any corrections and attach a copy of the correction Journal Entry For any follow up questions or additional information on how to fill out your sales tax spreadsheet contact General Accounting @ ext. 86148 14

Submitting Your Reconciliation To The Controller’s Office Include the following: • Sales Tax Spreadsheet with Prepared By and Reviewed By fields electronically signed off • Submit as an Excel attachment (PDF is not acceptable) • Workday History Detail print screens for Revenue Category (transactions for current processing month only) • Providing backup such as copy of deposits, checks, invoices, etc. is optional. This backup is required to be kept by the Department Once you have performed a full reconciliation of your revenue and sales tax: • E-mail Gables campus documentation to dmorciego@miami. edu • E-mail Medical campus documentation to both a. soto 2@miami. edu and dmorciego@miami. edu • Submit by the 4 th working day of the respective month 15

Summary The presentation covered sales tax topics and then the steps involved to submit the monthly sales tax reconciliation You should be able to view Workday transactions by month and provide print outs as backup to the Controller’s Office Recognize that Ledger 2151 – Sales Tax Payable is to be used for reconciliation and reporting Follow the guidelines and deadlines provided for submitting the monthly reconciliation 16

Thank You for Reviewing this Controller’s Office Presentation Visit our Tax Services Web Site: Resources and Technical Guidance for Additional Florida Sales Tax Information 17

During _____ branching, only car is updated with adr

During _____ branching, only car is updated with adr Deped mentoring and coaching form

Deped mentoring and coaching form June 2018 geometry regents answers

June 2018 geometry regents answers 2019 june calendar

2019 june calendar Definition of medication reconciliation

Definition of medication reconciliation Contra entry in control accounts

Contra entry in control accounts First reconcile with your brother

First reconcile with your brother Checkbook register example

Checkbook register example How to reconcile in quickbooks 2015

How to reconcile in quickbooks 2015 3-2 checking accounts worksheet answers

3-2 checking accounts worksheet answers Conclusion of gst

Conclusion of gst Ralphs annual income is about $32 000

Ralphs annual income is about $32 000 401k required mimimum distribution table

401k required mimimum distribution table How to figure out sales tax from total

How to figure out sales tax from total How to find sales tax

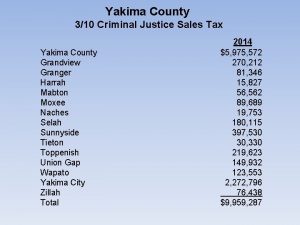

How to find sales tax Yakima sales tax

Yakima sales tax Sales tax for landscapers

Sales tax for landscapers Quotewerks api

Quotewerks api