LAPORAN LABA RUGI KOMPREHENSIF Laporan Laba Rugi 1

LAPORAN LABA RUGI KOMPREHENSIF Laporan Laba Rugi 1

Topik 1. Kegunaan dan Keterbatasan Income Statement 2. Manajemen Laba 3. Laporan Laba Rugi menurut PSAK 1 4. Operasi dalam Penghentian PSAK 58 5. Laporan Laba Rugi menurut US-GAAP Laporan Laba Rugi 2

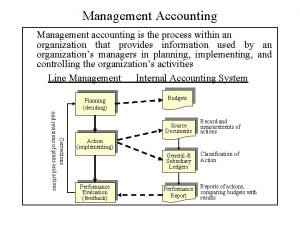

Income Statement Usefulness Evaluate past performance. Predicting future performance. Help assess the risk or uncertainty of achieving future cash flows. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 3

Income Statement Limitations Companies omit items that cannot be measured reliably. Income is affected by the accounting methods employed. Income measurement involves judgment. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 4

Income Statement Quality of Earnings Companies have incentives to manage income to meet or beat Wall Street expectations, so that market price of stock increases and value of stock options increase. Quality of earnings is reduced if earnings management results in information that is less useful for predicting future earnings and cash flows. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 5

Earning Management – Manajemen Laba • Earnings management sering disebut creative accounting practices, income smoothing, income manipulation, agresive accounting, financial numbers game dan lain-lain. • Istilah terakhir yang banyak digunakan di kalangan pasar modal di Amerika (US SEC) adalah financial shenanigans • Earnings management dapat dilakukan dari tingkatan sopan dan tidak berbahaya (benign) sampai dengan tingkatan kotor (penipuan) dan membahayakan publik atau lebih dikenal dengan istilah fraudulent financial statement (Howart Schilit, 2002). Laporan Laba Rugi 6

Definisi q Menurut Scott (2000): Earnings management is the choice by a manager of accounting policies so as to achieve some specific objectives. Karena manajemen dapat memilih kebijakan akuntansi dari berbagai pilihan kebijakan maka wajar jika manajemen akan memilih kebijakan akuntansi untuk memaksimalkan utilitynya dan/atau untuk memaksimalkan nilai perusahaan (value of the firm). q Menurut C Mulford and E Commiskey (2002) : Earnings management is the active manipulation of accounting results for the purpose of creating an altered impression of business performance Laporan Laba Rugi 7

Tujuan l Tujuan dilakukannya earnings management adalah untuk memberikan fleksibilitas kepada manajemen untuk melindungi diri dan perusahaannya dalam menghadapi keadaan yang tidak diinginkan seperti kerugian bagi pihak yang terlibat dalam kontrak dengan perusahaan l Jensen dan Meckling dalam tahun 1976 mengeluarkan agency theory dan contracting theory yang menyebutkan bahwa perusahaan adalah kumpulan kontrak atau nexus of contract, sehingga manajemen cenderung melakukan tindakan yang menguntungkan kepentingannya Laporan Laba Rugi 8

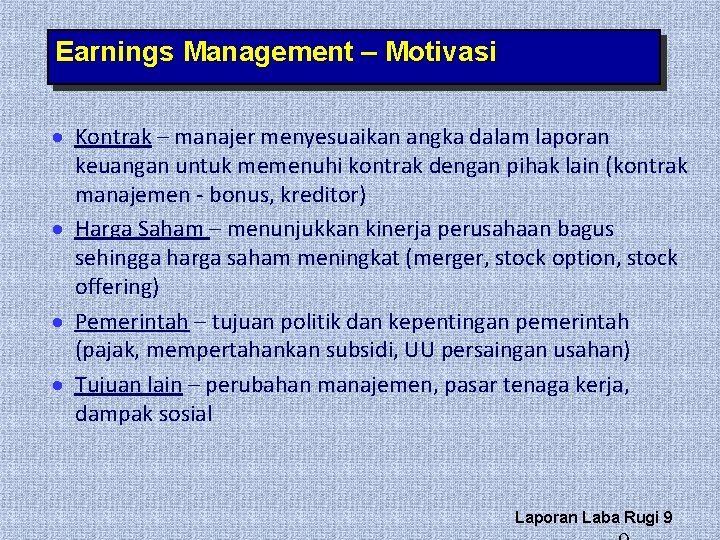

Earnings Management – Motivasi · Kontrak – manajer menyesuaikan angka dalam laporan keuangan untuk memenuhi kontrak dengan pihak lain (kontrak manajemen - bonus, kreditor) · Harga Saham – menunjukkan kinerja perusahaan bagus sehingga harga saham meningkat (merger, stock option, stock offering) · Pemerintah – tujuan politik dan kepentingan pemerintah (pajak, mempertahankan subsidi, UU persaingan usahan) · Tujuan lain – perubahan manajemen, pasar tenaga kerja, dampak sosial Laporan Laba Rugi 9

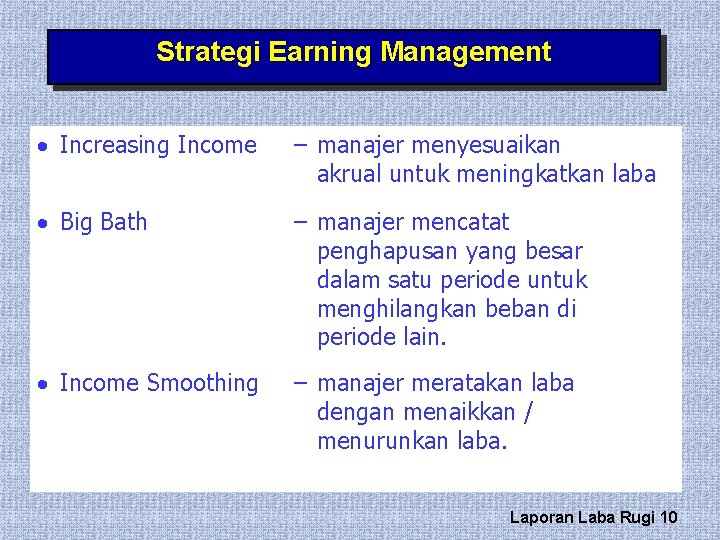

Strategi Earning Management · Increasing Income – manajer menyesuaikan akrual untuk meningkatkan laba · Big Bath – manajer mencatat penghapusan yang besar dalam satu periode untuk menghilangkan beban di periode lain. · Income Smoothing – manajer meratakan laba dengan menaikkan / menurunkan laba. Laporan Laba Rugi 10

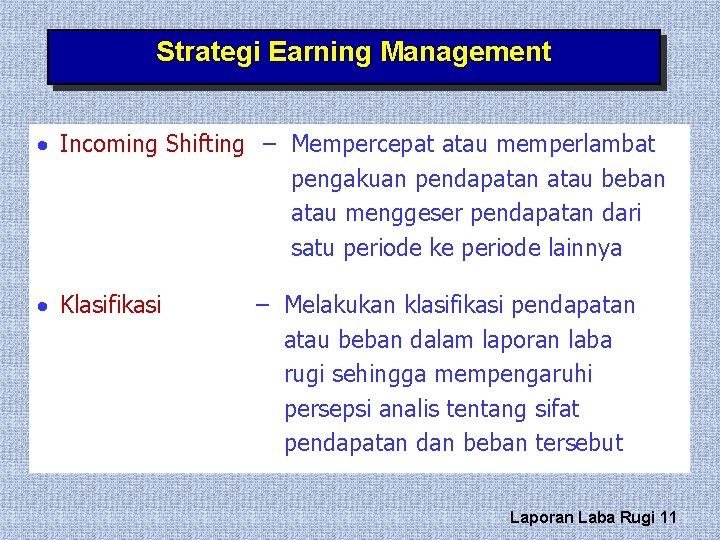

Strategi Earning Management · Incoming Shifting – Mempercepat atau memperlambat pengakuan pendapatan atau beban atau menggeser pendapatan dari satu periode ke periode lainnya · Klasifikasi – Melakukan klasifikasi pendapatan atau beban dalam laporan laba rugi sehingga mempengaruhi persepsi analis tentang sifat pendapatan dan beban tersebut Laporan Laba Rugi 11

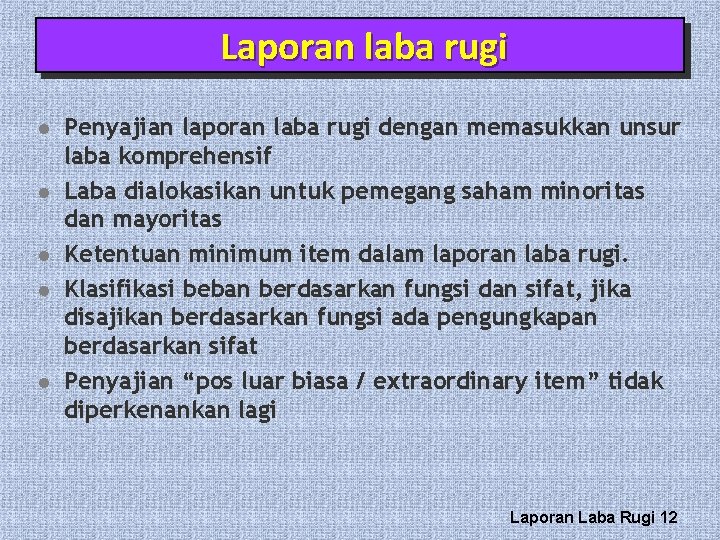

Laporan laba rugi l l l Penyajian laporan laba rugi dengan memasukkan unsur laba komprehensif Laba dialokasikan untuk pemegang saham minoritas dan mayoritas Ketentuan minimum item dalam laporan laba rugi. Klasifikasi beban berdasarkan fungsi dan sifat, jika disajikan berdasarkan fungsi ada pengungkapan berdasarkan sifat Penyajian “pos luar biasa / extraordinary item” tidak diperkenankan lagi Laporan Laba Rugi 12

Laporan laba komprehensive l Laba komprehensif: Perubahan aset atau laibilitas yang tidak mempengaruhi laba pada periode rugi l l Selisih revaluasi aset tetap Perubahan nilai investasi available for sales Dampak translasi laporan keuangan Dalam dua laporan : l l Laba sebelum laba komprehensif Laporan laba komprehensif dimulai dari laba/rugi bersih Ref: PSAK 1 Laporan Laba Rugi 13

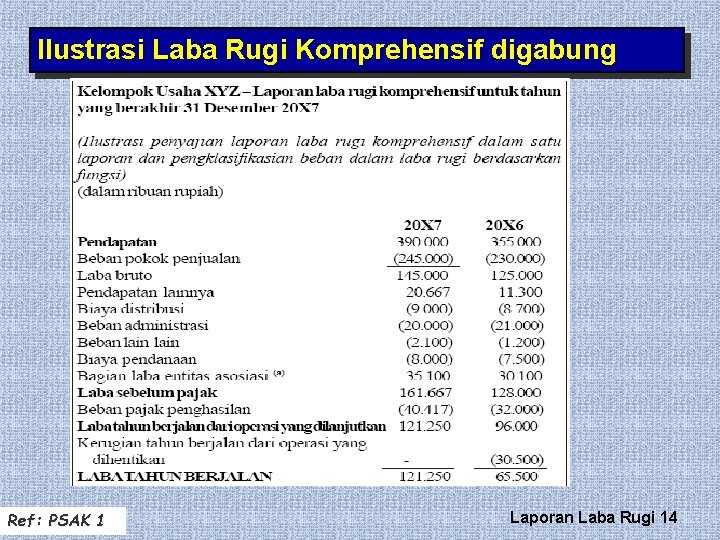

Ilustrasi Laba Rugi Komprehensif digabung Ref: PSAK 1 Laporan Laba Rugi 14

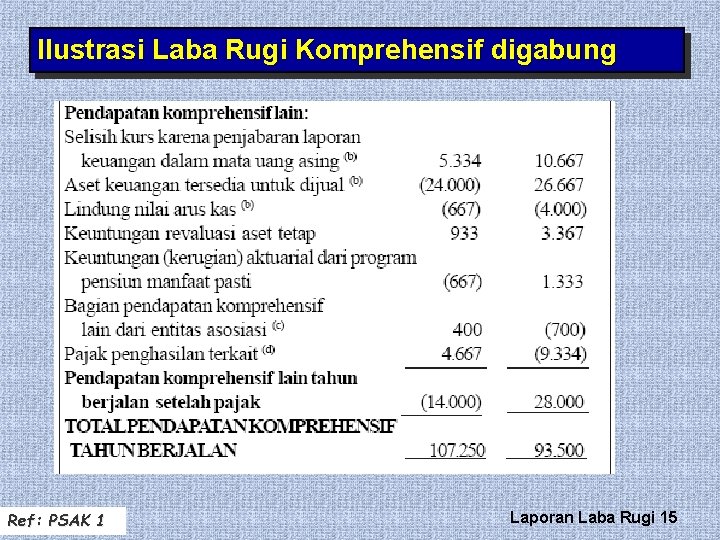

Ilustrasi Laba Rugi Komprehensif digabung Ref: PSAK 1 Laporan Laba Rugi 15

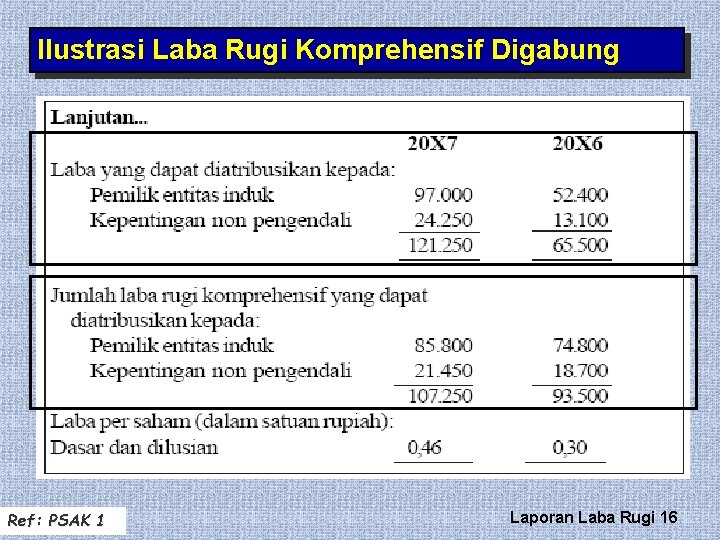

Ilustrasi Laba Rugi Komprehensif Digabung Ref: PSAK 1 Laporan Laba Rugi 16

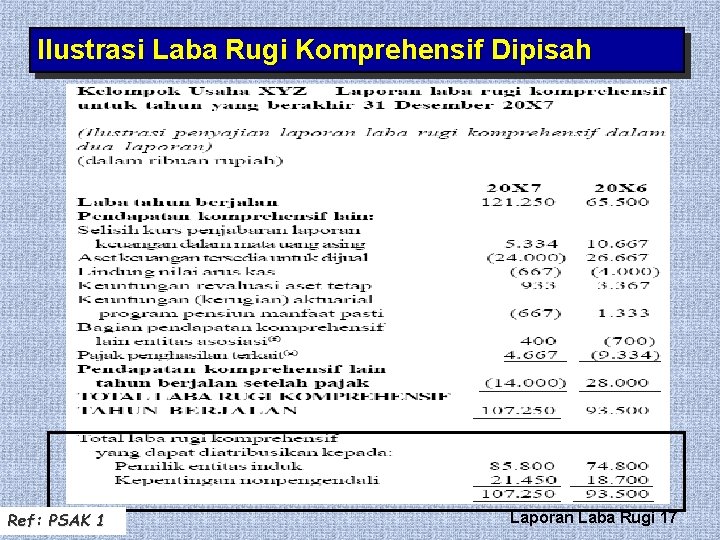

Ilustrasi Laba Rugi Komprehensif Dipisah Ref: PSAK 1 Laporan Laba Rugi 17

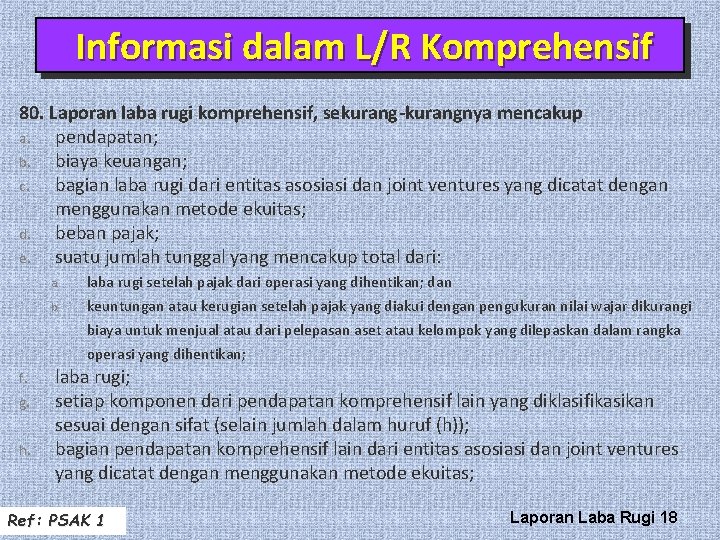

Informasi dalam L/R Komprehensif 80. Laporan laba rugi komprehensif, sekurang-kurangnya mencakup a. pendapatan; b. biaya keuangan; c. bagian laba rugi dari entitas asosiasi dan joint ventures yang dicatat dengan menggunakan metode ekuitas; d. beban pajak; e. suatu jumlah tunggal yang mencakup total dari: a. b. f. g. h. laba rugi setelah pajak dari operasi yang dihentikan; dan keuntungan atau kerugian setelah pajak yang diakui dengan pengukuran nilai wajar dikurangi biaya untuk menjual atau dari pelepasan aset atau kelompok yang dilepaskan dalam rangka operasi yang dihentikan; laba rugi; setiap komponen dari pendapatan komprehensif lain yang diklasifikasikan sesuai dengan sifat (selain jumlah dalam huruf (h)); bagian pendapatan komprehensif lain dari entitas asosiasi dan joint ventures yang dicatat dengan menggunakan metode ekuitas; Ref: PSAK 1 Laporan Laba Rugi 18

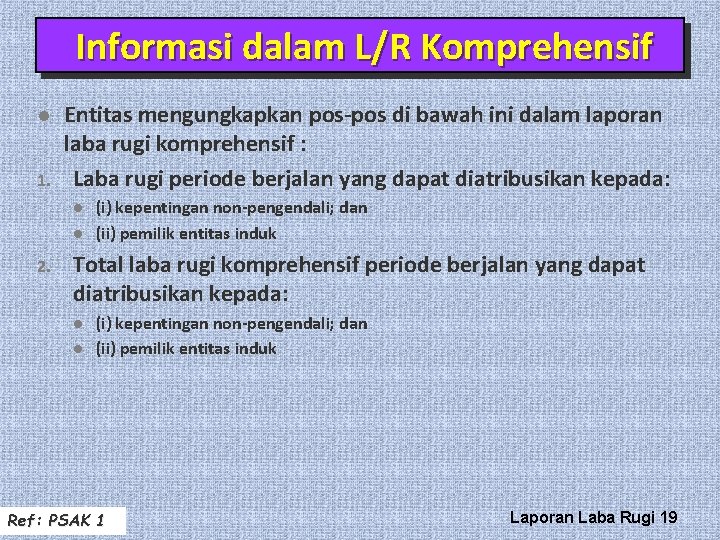

Informasi dalam L/R Komprehensif l 1. Entitas mengungkapkan pos-pos di bawah ini dalam laporan laba rugi komprehensif : Laba rugi periode berjalan yang dapat diatribusikan kepada: l l 2. (i) kepentingan non-pengendali; dan (ii) pemilik entitas induk Total laba rugi komprehensif periode berjalan yang dapat diatribusikan kepada: l l (i) kepentingan non-pengendali; dan (ii) pemilik entitas induk Ref: PSAK 1 Laporan Laba Rugi 19

Pos Luar Biasa l 85. Entitas tidak diperkenankan menyajikan pos-pos pendapatan dan beban sebagai pos luar biasa dalam laporan laba rugi komprehensif, laporan laba rugi terpisah (jika disajikan), atau dalam catatan atas laporan keuangan. Ref: PSAK 1 Laporan Laba Rugi 20

Laba Rugi Selama Periode l 86. Entitas mengakui seluruh pos-pos pendapatan dan beban pada suatu periode dalam laba rugi kecuali suatu PSAK mensyaratkan atau memperkenankan lain. l Koreksi kesalahan PSAK 25 menjelaskan pada periode mana dampak koreksi. Ref: PSAK 1 Laporan Laba Rugi 21

Pendapatan Komprehensif Lain l l 88. Entitas mengungkapkan jumlah pajak penghasilan terkait dengan setiap komponen dari pendapatan komprehensif lain, termasuk penyesuaian reklasifikasi, baik dalam laporan pendapatan komprehensif atau catatan atas laporan keuangan. 89. Entitas dapat menyajikan komponen pendapatan komprehensif lain: l l (a) jumlah neto dari dampak pajak terkait, atau (b) jumlah sebelum dampak pajak terkait disertai dengan total pajak penghasilan tersebut Ref: PSAK 1 Laporan Laba Rugi 22

Informasi dalam L/R Komprehensif l Ketika pos-pos pendapatan atau beban bernilai material, maka entitas mengungkapkan sifat dan jumlahnya secara terpisah. Penyebab pengungkapan terpisah: l l l l penurunan nilai persediaan /aset tetap dan pemulihannya restrukturisasi atas aktivitas-aktivitas suatu entitas dan untuk setiap laibilitas diestimasi atas biaya restrukturisasi; pelepasan aset tetap; pelepasan investasi; operasi yang dihentikan; penyelesaian litigasi; dan pembalikan laibilitas diestimasi lain. Entitas menyajikan analisis beban yang diakui dalam laba rugi dengan menggunakan klasifikasi berdasarkan sifat atau fungsinya dalam entitas, mana yang dapat menyediakan informasi yang lebih andal dan relevan. Ref: PSAK 1 Laporan Laba Rugi 23

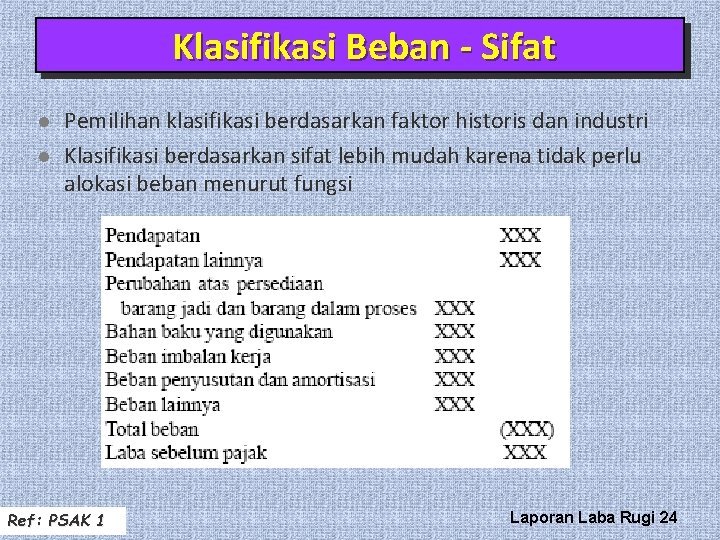

Klasifikasi Beban - Sifat l l Pemilihan klasifikasi berdasarkan faktor historis dan industri Klasifikasi berdasarkan sifat lebih mudah karena tidak perlu alokasi beban menurut fungsi Ref: PSAK 1 Laporan Laba Rugi 24

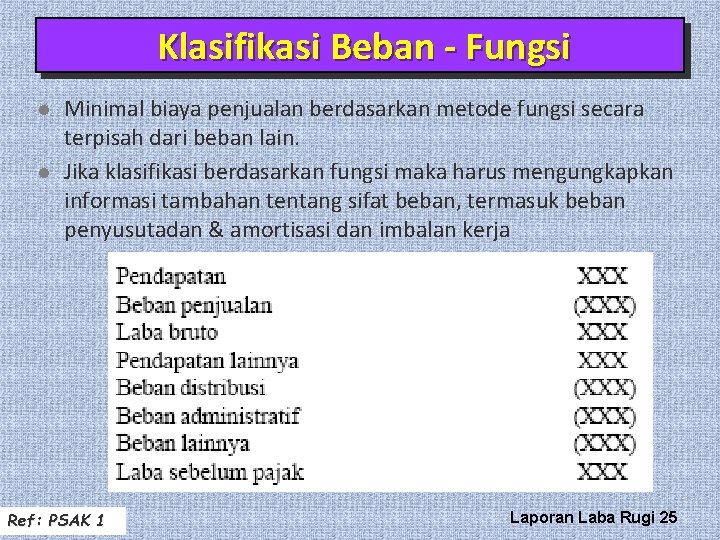

Klasifikasi Beban - Fungsi l l Minimal biaya penjualan berdasarkan metode fungsi secara terpisah dari beban lain. Jika klasifikasi berdasarkan fungsi maka harus mengungkapkan informasi tambahan tentang sifat beban, termasuk beban penyusutadan & amortisasi dan imbalan kerja Ref: PSAK 1 Laporan Laba Rugi 25

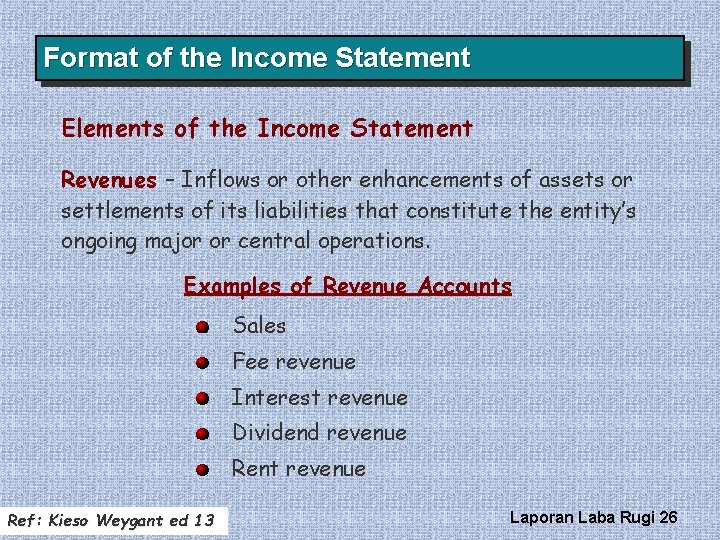

Format of the Income Statement Elements of the Income Statement Revenues – Inflows or other enhancements of assets or settlements of its liabilities that constitute the entity’s ongoing major or central operations. Examples of Revenue Accounts Sales Fee revenue Interest revenue Dividend revenue Rent revenue Ref: Kieso Weygant ed 13 Laporan Laba Rugi 26

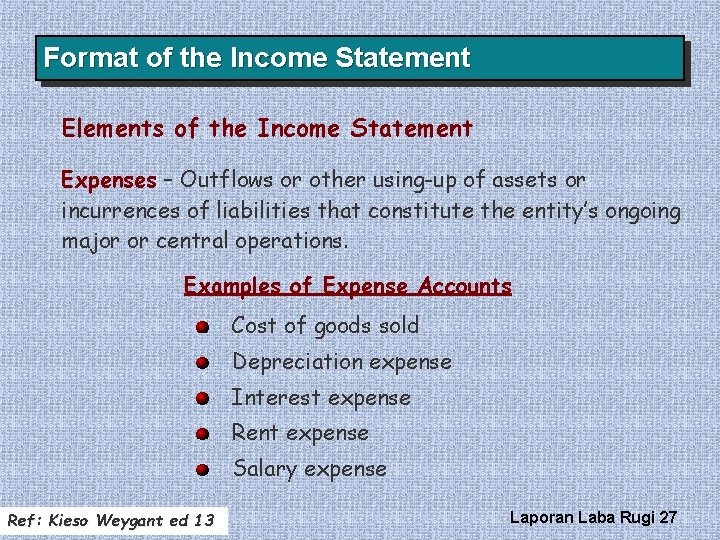

Format of the Income Statement Elements of the Income Statement Expenses – Outflows or other using-up of assets or incurrences of liabilities that constitute the entity’s ongoing major or central operations. Examples of Expense Accounts Cost of goods sold Depreciation expense Interest expense Rent expense Salary expense Ref: Kieso Weygant ed 13 Laporan Laba Rugi 27

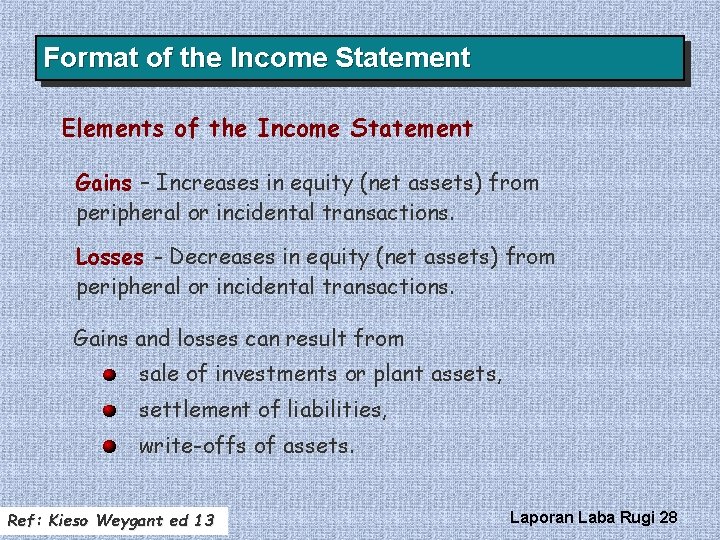

Format of the Income Statement Elements of the Income Statement Gains – Increases in equity (net assets) from peripheral or incidental transactions. Losses - Decreases in equity (net assets) from peripheral or incidental transactions. Gains and losses can result from sale of investments or plant assets, settlement of liabilities, write-offs of assets. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 28

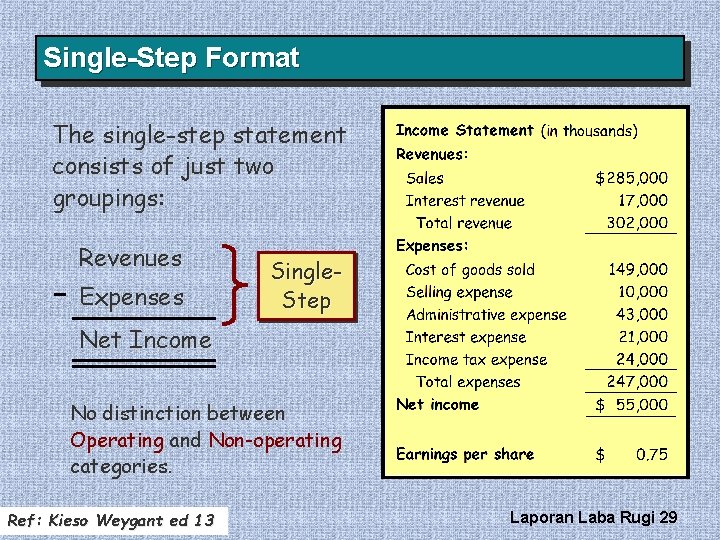

Single-Step Format The single-step statement consists of just two groupings: Revenues Expenses Single. Step Net Income No distinction between Operating and Non-operating categories. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 29

Multiple-Step Format Background Separates operating transactions from nonoperating transactions. Matches costs and expenses with related revenues. Highlights certain intermediate components of income that analysts use. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 30

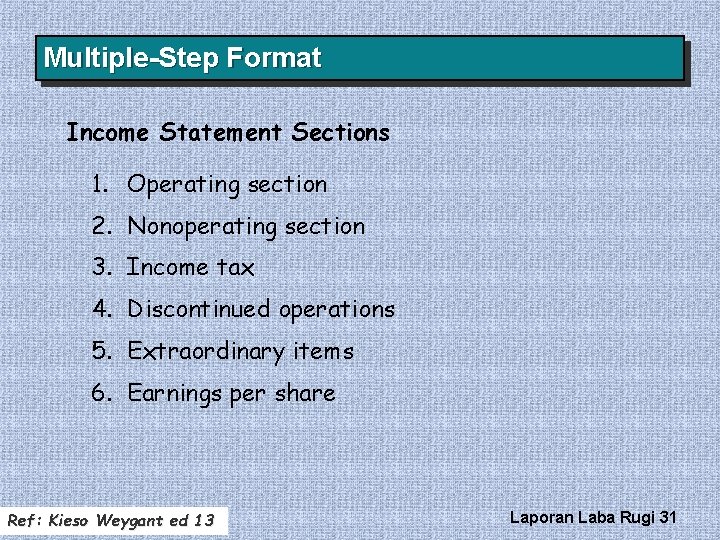

Multiple-Step Format Income Statement Sections 1. Operating section 2. Nonoperating section 3. Income tax 4. Discontinued operations 5. Extraordinary items 6. Earnings per share Ref: Kieso Weygant ed 13 Laporan Laba Rugi 31

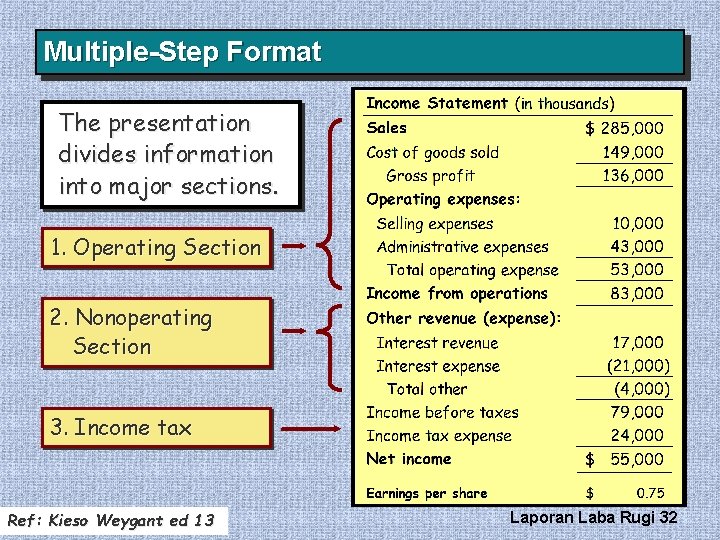

Multiple-Step Format The presentation divides information into major sections. 1. Operating Section 2. Nonoperating Section 3. Income tax Ref: Kieso Weygant ed 13 Laporan Laba Rugi 32

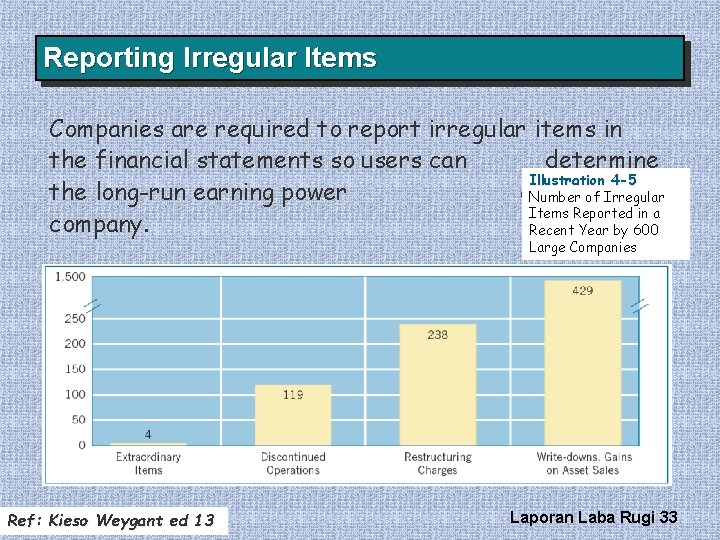

Reporting Irregular Items Companies are required to report irregular items in the financial statements so users can determine Illustration 4 -5 the long-run earning power of theof Irregular Number Items Reported in a company. Recent Year by 600 Large Companies Ref: Kieso Weygant ed 13 Laporan Laba Rugi 33

Reporting Irregular Items Irregular items fall into six categories 1. Discontinued operations. 2. Extraordinary items. 3. Unusual gains and losses. 4. Changes in accounting principle. 5. Changes in estimates. 6. Corrections of errors. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 34

Reporting Irregular Items Discontinued Operations occurs when, (a) company eliminates the results of operations and cash flows of a component. (b) there is no significant continuing involvement in that component. Amount reported “net of tax. ” Ref: Kieso Weygant ed 13 Laporan Laba Rugi 35

Reporting Irregular Items Extraordinary items are nonrecurring material items that differ significantly from a company’s typical business activities. Extraordinary Item must be both of an Unusual Nature and Occur Infrequently Company must consider the environment in which it operates. Amount reported “net of tax. ” Ref: Kieso Weygant ed 13 Laporan Laba Rugi 36

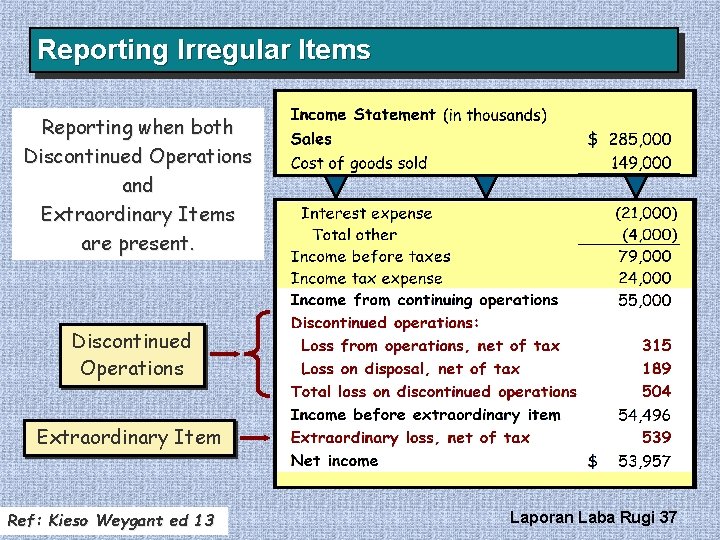

Reporting Irregular Items Reporting when both Discontinued Operations and Extraordinary Items are present. Discontinued Operations Extraordinary Item Ref: Kieso Weygant ed 13 Laporan Laba Rugi 37

Reporting Irregular Items Unusual Gains and Losses Material items that are unusual or infrequent, but not both, should be reported in a separate section just above “Income from continuing operations before income taxes. ” Examples can include: Write-downs of inventories Foreign exchange transaction gains and losses The Board prohibits net-of-tax treatment for these items. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 38

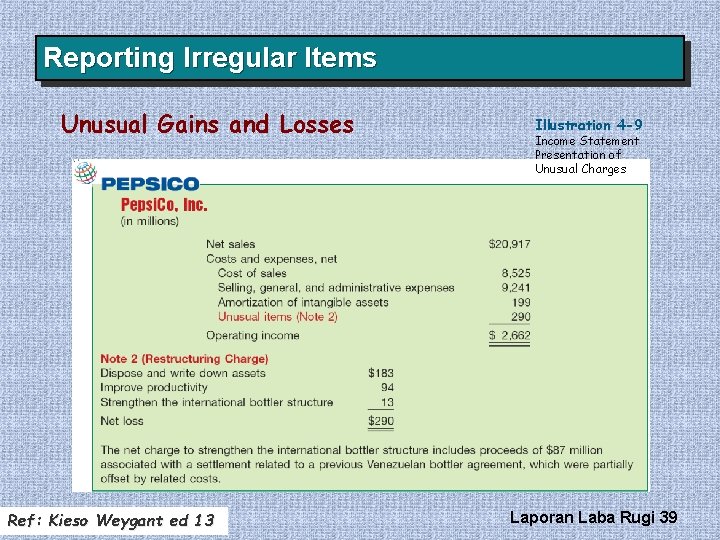

Reporting Irregular Items Unusual Gains and Losses Ref: Kieso Weygant ed 13 Illustration 4 -9 Income Statement Presentation of Unusual Charges Laporan Laba Rugi 39

Reporting Irregular Items Changes in Accounting Principles Retrospective adjustment Cumulative effect adjustment to beginning retained earnings Approach preserves comparability Examples include: Ø change from FIFO to average cost Ø change from the percentage-of-completion to the completed-contract method Ref: Kieso Weygant ed 13 Laporan Laba Rugi 40

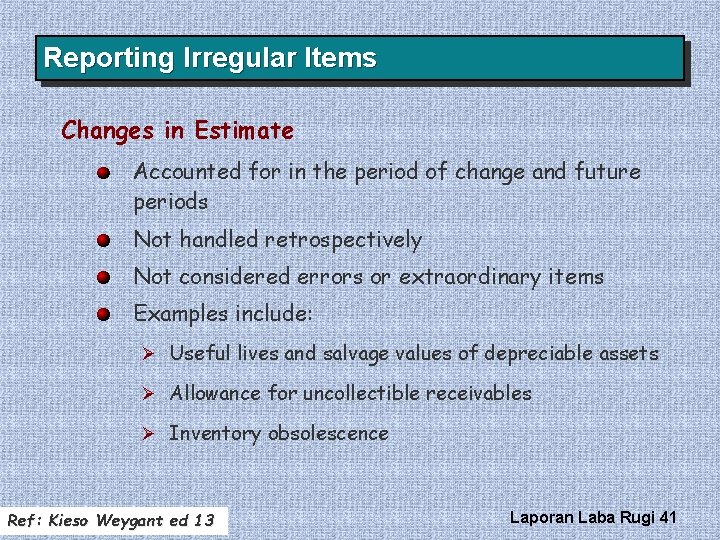

Reporting Irregular Items Changes in Estimate Accounted for in the period of change and future periods Not handled retrospectively Not considered errors or extraordinary items Examples include: Ø Useful lives and salvage values of depreciable assets Ø Allowance for uncollectible receivables Ø Inventory obsolescence Ref: Kieso Weygant ed 13 Laporan Laba Rugi 41

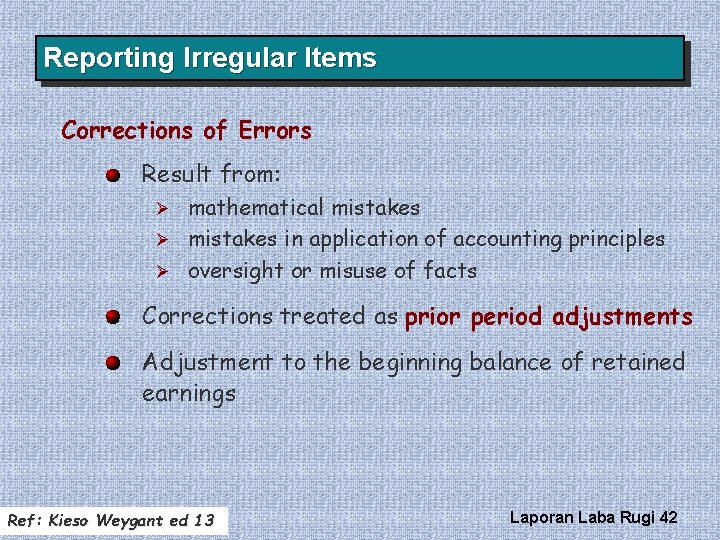

Reporting Irregular Items Corrections of Errors Result from: mathematical mistakes Ø mistakes in application of accounting principles Ø oversight or misuse of facts Ø Corrections treated as prior period adjustments Adjustment to the beginning balance of retained earnings Ref: Kieso Weygant ed 13 Laporan Laba Rugi 42

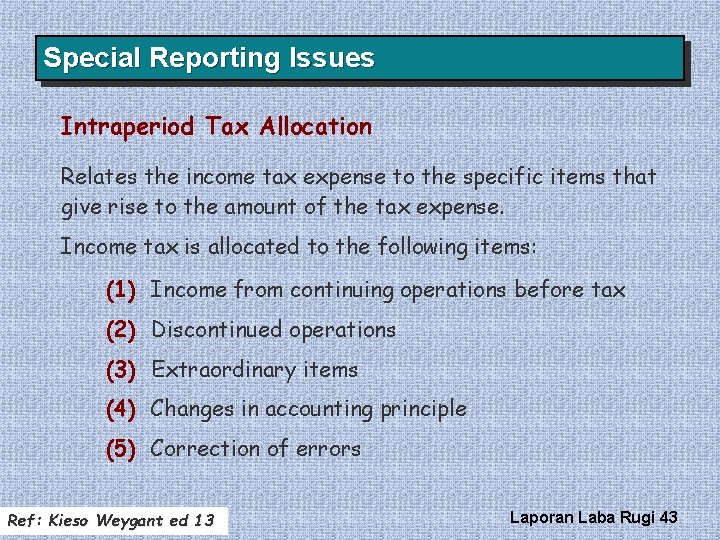

Special Reporting Issues Intraperiod Tax Allocation Relates the income tax expense to the specific items that give rise to the amount of the tax expense. Income tax is allocated to the following items: (1) Income from continuing operations before tax (2) Discontinued operations (3) Extraordinary items (4) Changes in accounting principle (5) Correction of errors Ref: Kieso Weygant ed 13 Laporan Laba Rugi 43

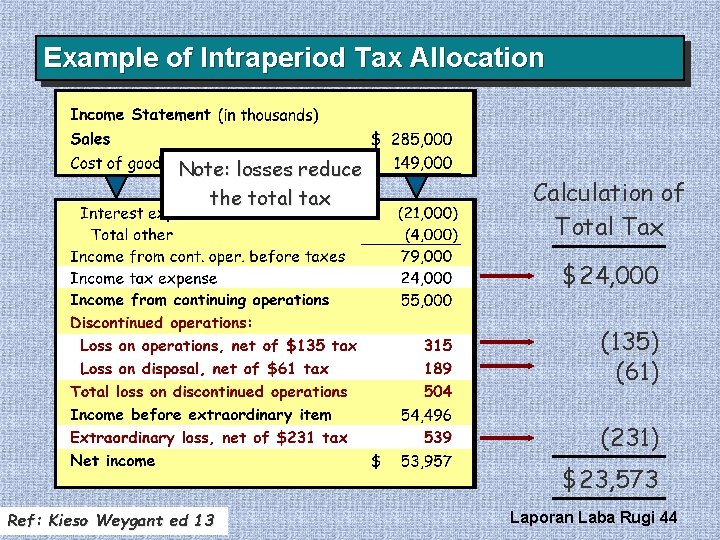

Example of Intraperiod Tax Allocation Note: losses reduce the total tax Calculation of Total Tax $24, 000 (135) (61) (231) $23, 573 Ref: Kieso Weygant ed 13 Laporan Laba Rugi 44

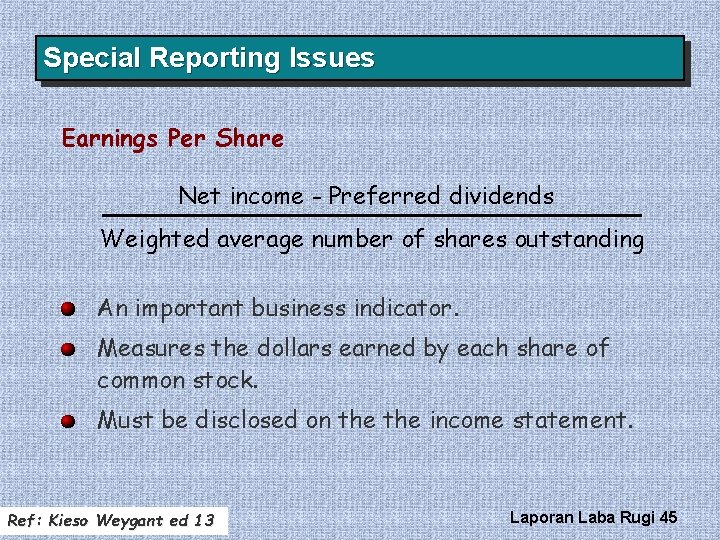

Special Reporting Issues Earnings Per Share Net income - Preferred dividends Weighted average number of shares outstanding An important business indicator. Measures the dollars earned by each share of common stock. Must be disclosed on the income statement. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 45

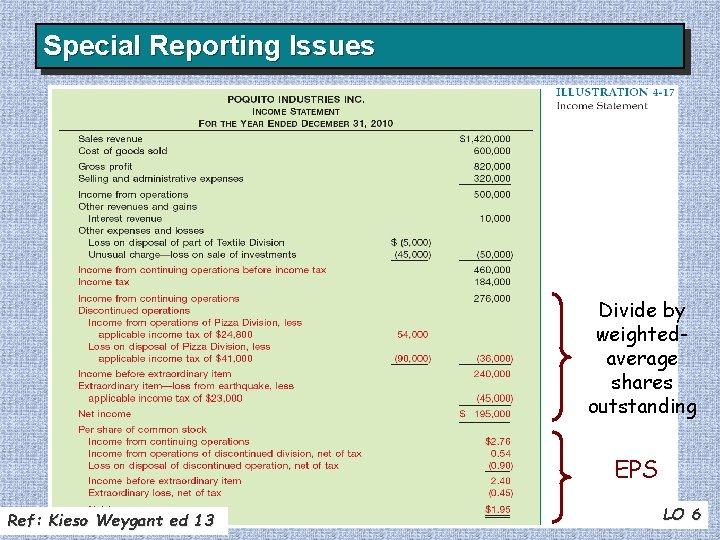

Special Reporting Issues Divide by weightedaverage shares outstanding EPS Ref: Kieso Weygant ed 13 LO 6 Laporan Laba Rugi 46

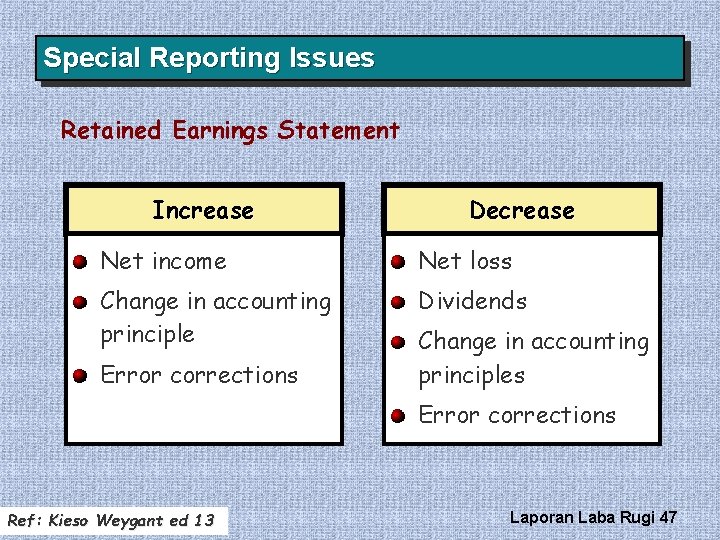

Special Reporting Issues Retained Earnings Statement Increase Decrease Net income Net loss Change in accounting principle Dividends Error corrections Change in accounting principles Error corrections Ref: Kieso Weygant ed 13 Laporan Laba Rugi 47

Special Reporting Issues Restricted Retained Earnings Disclosed In notes to the financial statements As Appropriated Retained Earnings Ref: Kieso Weygant ed 13 Laporan Laba Rugi 48

Special Reporting Issues Comprehensive Income All changes in equity during a period except those resulting from investments by owners and distributions to owners. Includes: ü all revenues and gains, expenses and losses reported in net income, and ü all gains and losses that bypass net income but affect stockholders’ equity. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 49

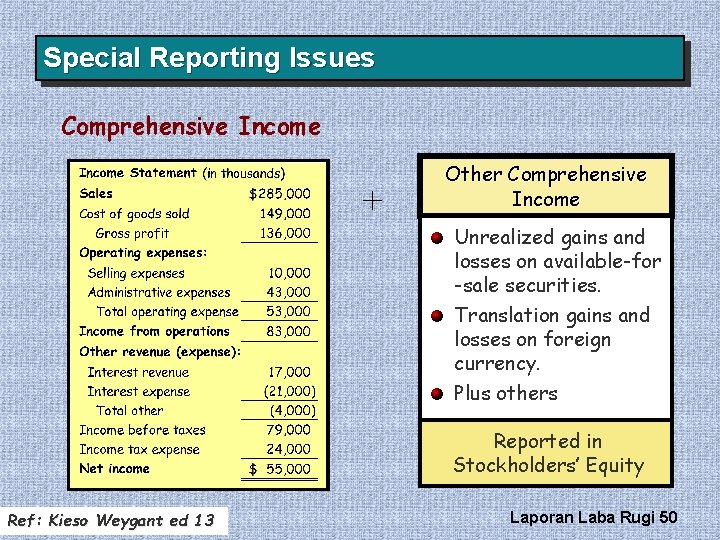

Special Reporting Issues Comprehensive Income + Other Comprehensive Income Unrealized gains and losses on available-for -sale securities. Translation gains and losses on foreign currency. Plus others Reported in Stockholders’ Equity Ref: Kieso Weygant ed 13 Laporan Laba Rugi 50

Special Reporting Issues Three approaches to reporting Comprehensive Income (SFAS No. 130, June 1997): 1. A second separate income statement; 2. A combined income statement of comprehensive income; or 3. As part of the statement of stockholders’ equity Ref: Kieso Weygant ed 13 Laporan Laba Rugi 51

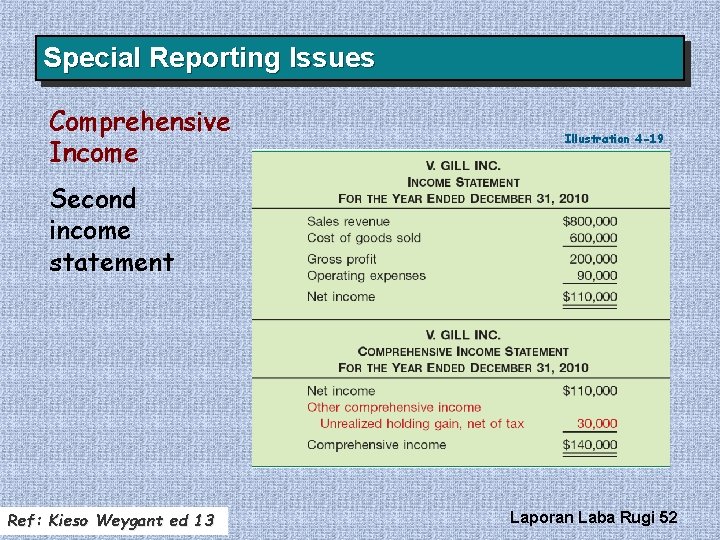

Special Reporting Issues Comprehensive Income Illustration 4 -19 Second income statement Ref: Kieso Weygant ed 13 Laporan Laba Rugi 52

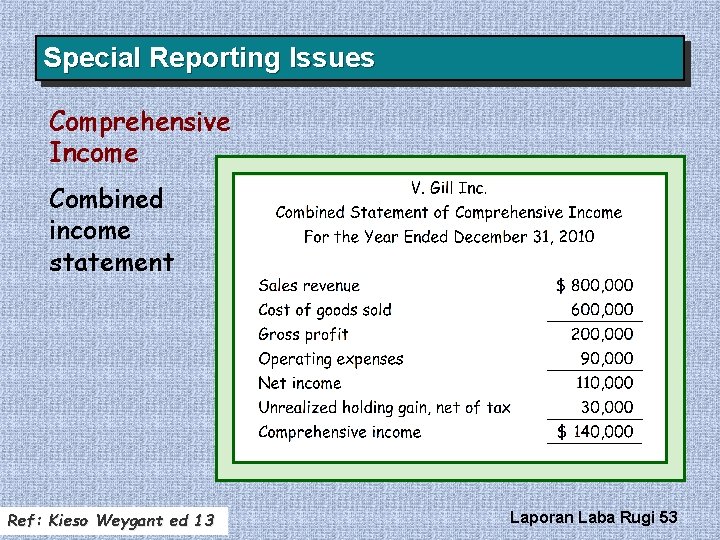

Special Reporting Issues Comprehensive Income Combined income statement Ref: Kieso Weygant ed 13 Laporan Laba Rugi 53

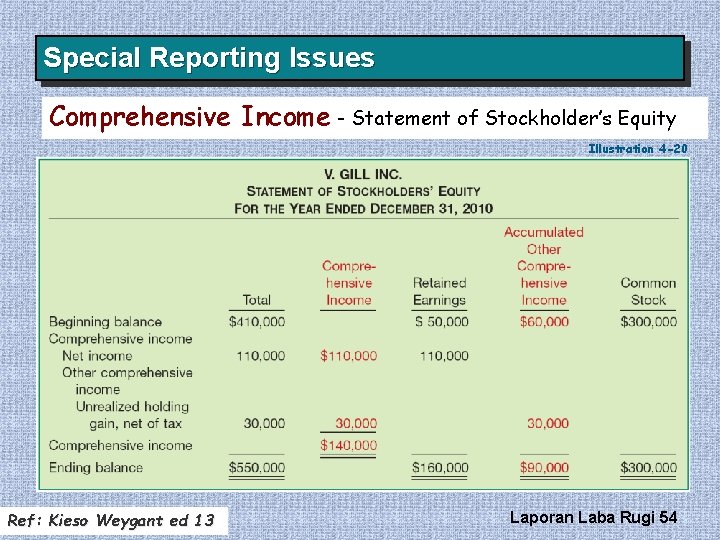

Special Reporting Issues Comprehensive Income - Statement of Stockholder’s Equity Illustration 4 -20 Ref: Kieso Weygant ed 13 Laporan Laba Rugi 54

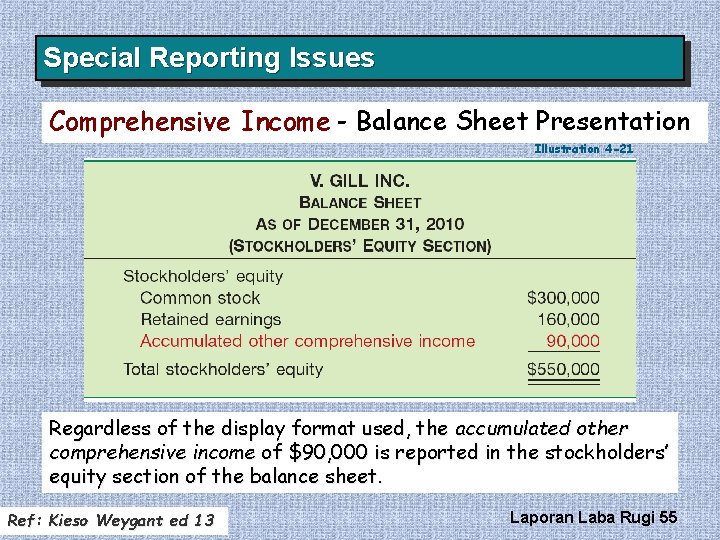

Special Reporting Issues Comprehensive Income - Balance Sheet Presentation Illustration 4 -21 Regardless of the display format used, the accumulated other comprehensive income of $90, 000 is reported in the stockholders’ equity section of the balance sheet. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 55

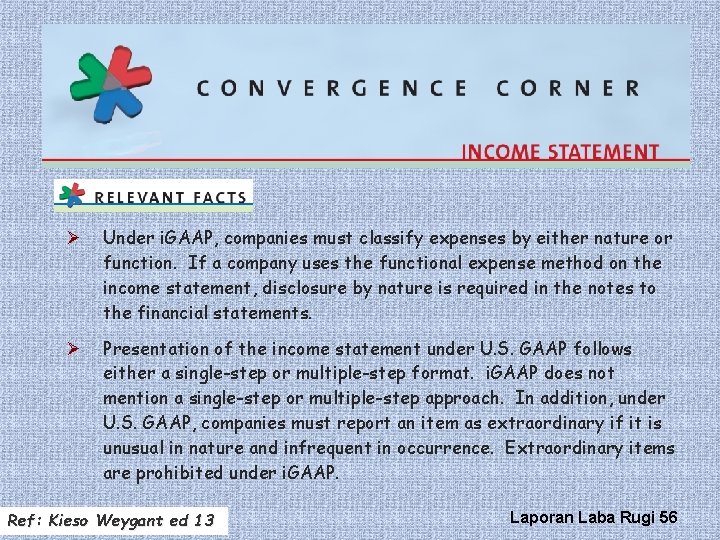

Ø Under i. GAAP, companies must classify expenses by either nature or function. If a company uses the functional expense method on the income statement, disclosure by nature is required in the notes to the financial statements. Ø Presentation of the income statement under U. S. GAAP follows either a single-step or multiple-step format. i. GAAP does not mention a single-step or multiple-step approach. In addition, under U. S. GAAP, companies must report an item as extraordinary if it is unusual in nature and infrequent in occurrence. Extraordinary items are prohibited under i. GAAP. Ref: Kieso Weygant ed 13 Laporan Laba Rugi 56

Ø Under i. GAAP, companies are required to prepare as a primary financial statement either a statement of stockholders’ equity similar to the one prepared under U. S. GAAP or a statement of recognized income and expense (called a So. RIE ). Ø Both i. GAAP and U. S. GAAP have items that are recognized in equity as part of comprehensive income but do not affect net income. U. S. GAAP provides three possible formats for presenting this information. i. GAAP allows either the statement of stockholders’ equity approach or the So. RIE format. Ø Under i. GAAP revaluation of land, buildings, and intangible assets is permitted. Laporan Laba Rugi 57 Ref: Kieso Weygant ed 13

Main References l Intermediate Accounting Kieso, Weygandt, Walfield, 13 th edition, John Wiley l Standar Akuntansi Keuangan Dewan Standar Akuntansi Keuangan, IAI, Penerbit Salemba 4 l International Financial Reporting Standards – Certificate Learning Material The Institute of Chartered Accountants, England Wales Laporan Laba Rugi 58

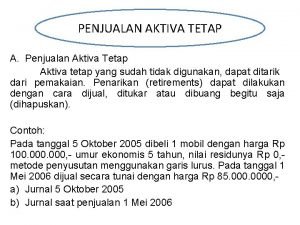

- Slides: 58