Intercorporate investments p Market value accounting minority passive

- Slides: 25

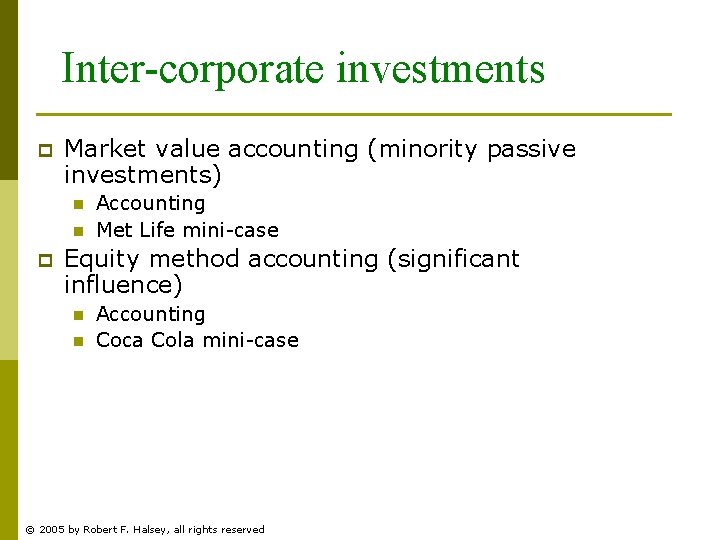

Inter-corporate investments p Market value accounting (minority passive investments) n n p Accounting Met Life mini-case Equity method accounting (significant influence) n n Accounting Coca Cola mini-case © 2005 by Robert F. Halsey, all rights reserved

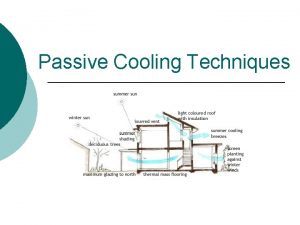

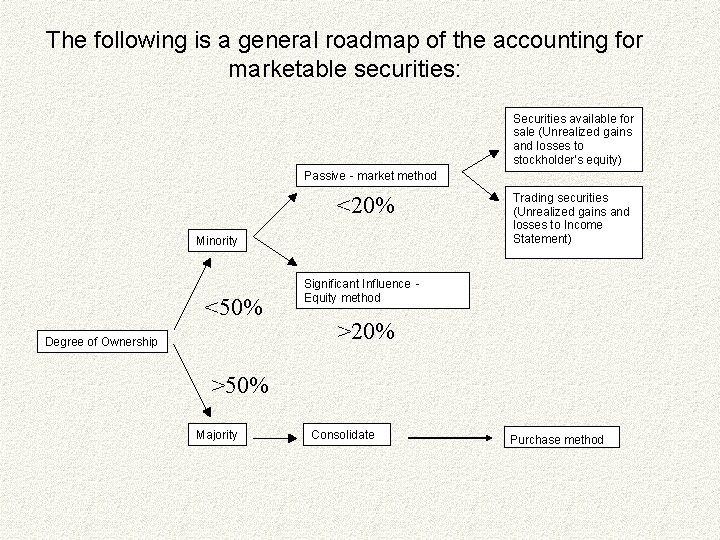

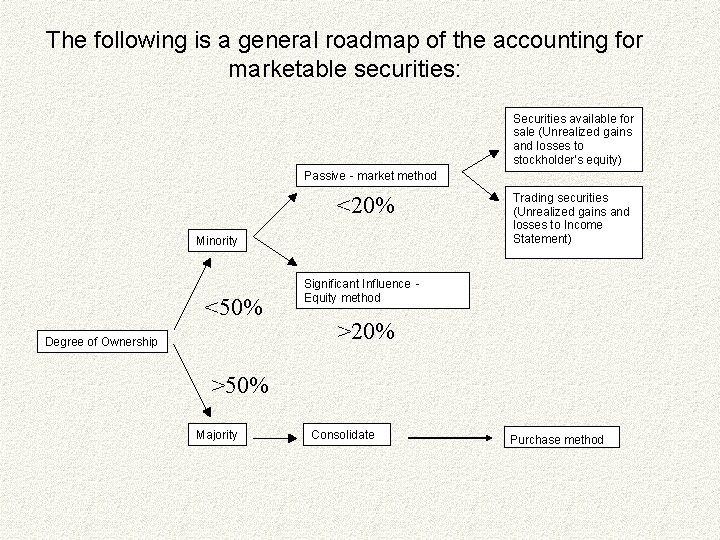

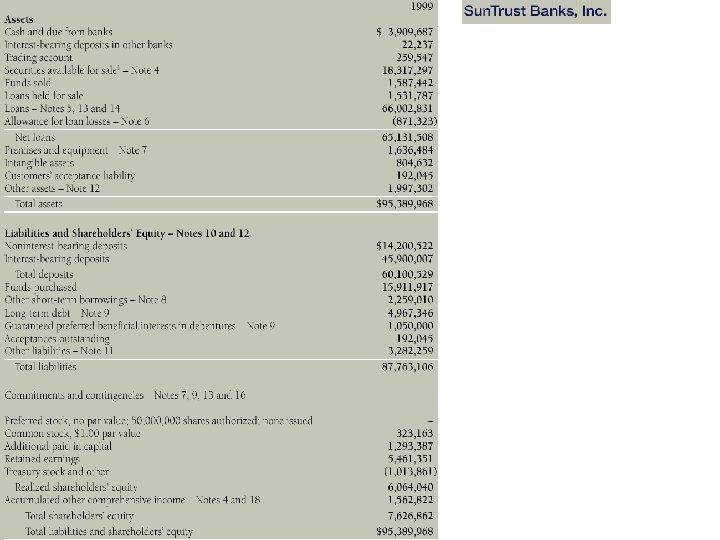

The following is a general roadmap of the accounting for marketable securities: Securities available for sale (Unrealized gains and losses to stockholder's equity) Passive - market method <20% Minority <50% Degree of Ownership Trading securities (Unrealized gains and losses to Income Statement) Significant Influence Equity method >20% >50% Majority © 2005 by Robert F. Halsey, all rights reserved Consolidate Purchase method

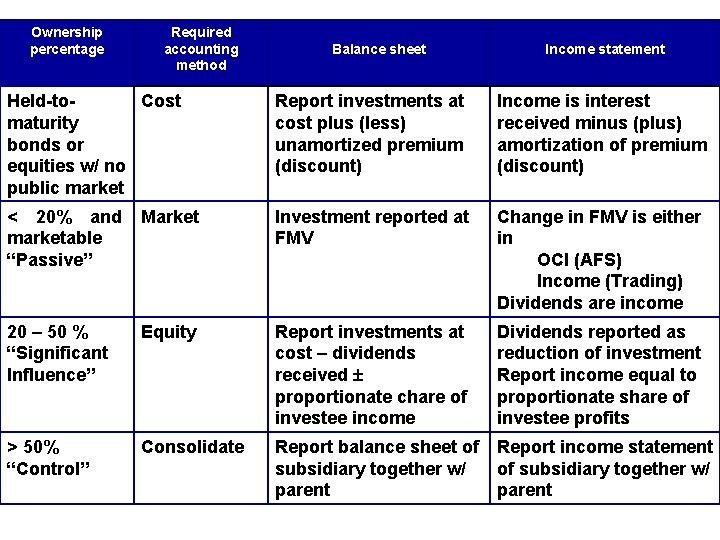

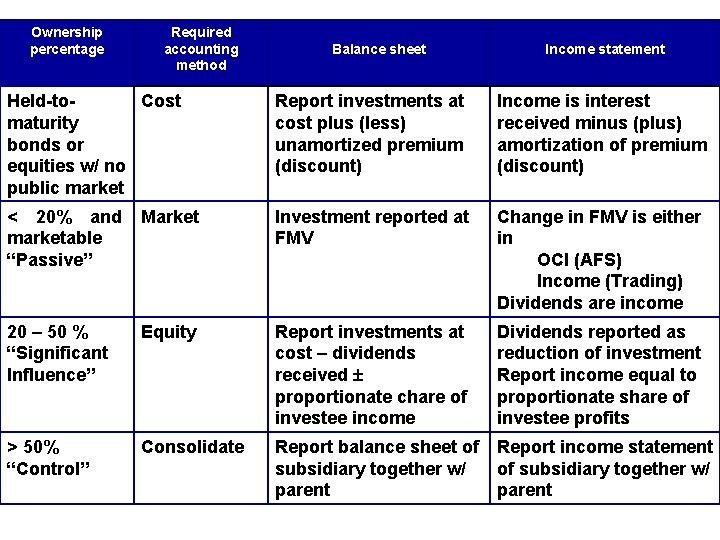

Ownership percentage Required accounting method Balance sheet Income statement Held-to. Cost maturity bonds or equities w/ no public market Report investments at cost plus (less) unamortized premium (discount) Income is interest received minus (plus) amortization of premium (discount) < 20% and marketable “Passive” Market Investment reported at FMV Change in FMV is either in OCI (AFS) Income (Trading) Dividends are income 20 – 50 % “Significant Influence” Equity Report investments at cost – dividends received proportionate chare of investee income Dividends reported as reduction of investment Report income equal to proportionate share of investee profits > 50% “Control” Consolidate Report balance sheet of subsidiary together w/ parent Report income statement of subsidiary together w/ parent

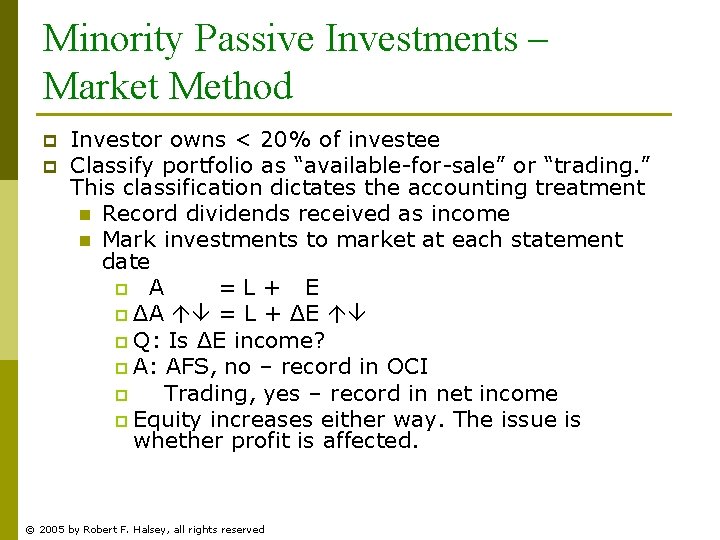

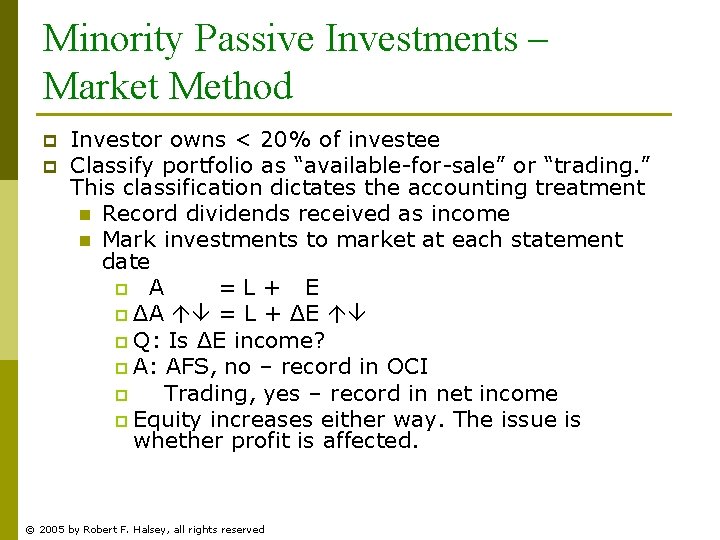

Minority Passive Investments – Market Method p p Investor owns < 20% of investee Classify portfolio as “available-for-sale” or “trading. ” This classification dictates the accounting treatment n Record dividends received as income n Mark investments to market at each statement date p A =L+ E p ΔA = L + ΔE p Q: Is ΔE income? p A: AFS, no – record in OCI p Trading, yes – record in net income p Equity increases either way. The issue is whether profit is affected. © 2005 by Robert F. Halsey, all rights reserved

Met Life mini-case © 2005 by Robert F. Halsey, all rights reserved

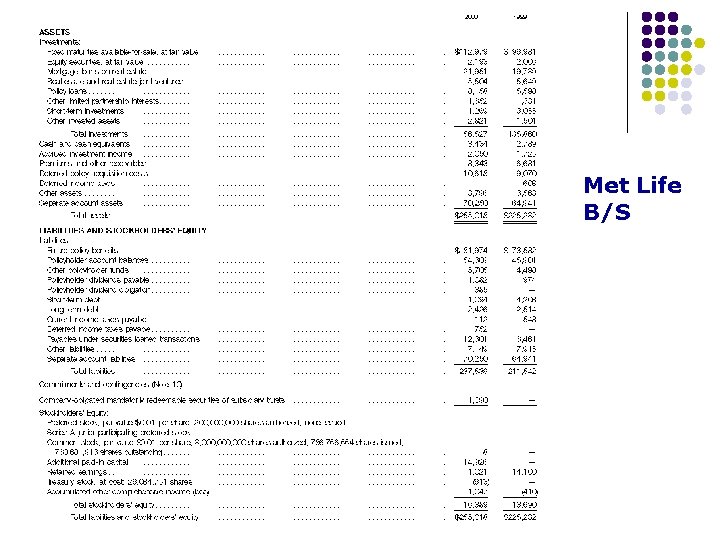

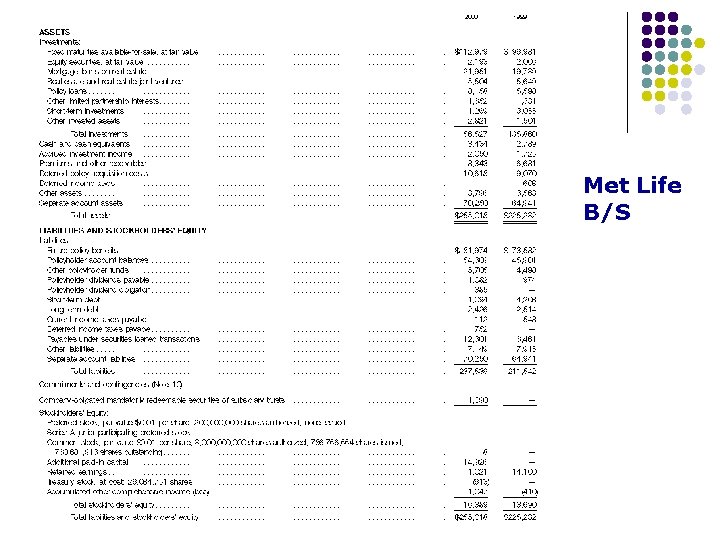

Met Life B/S

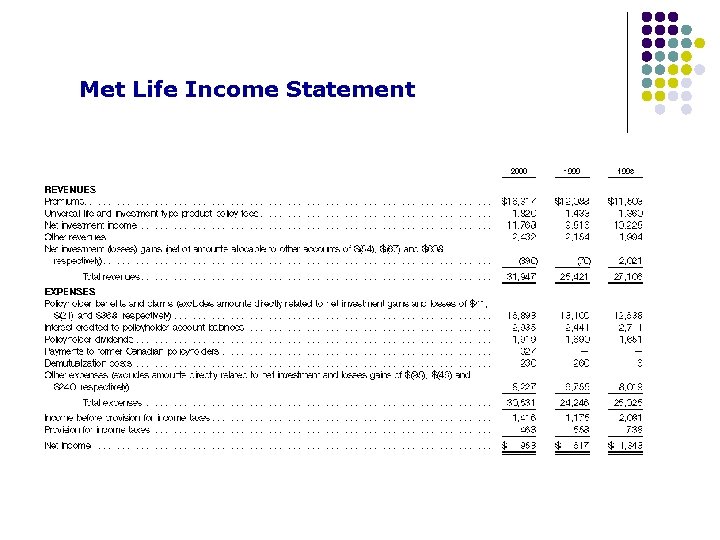

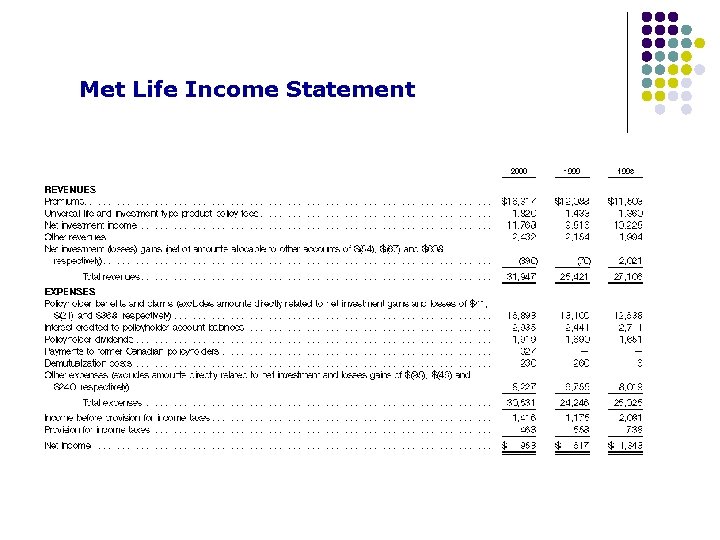

Met Life Income Statement

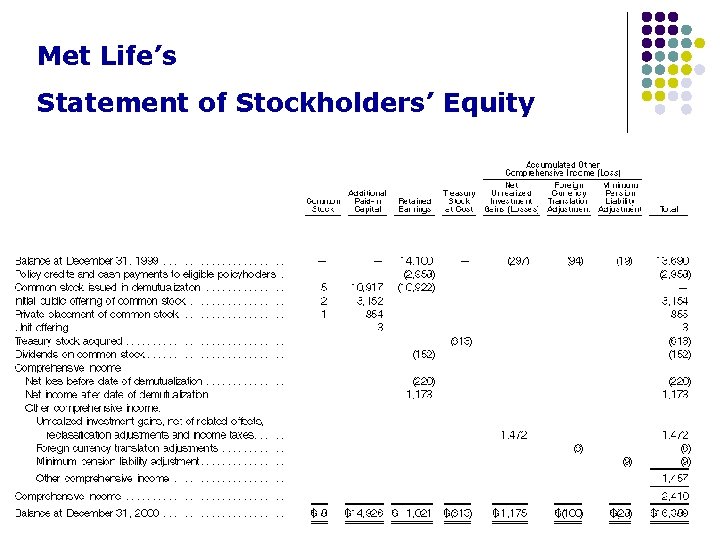

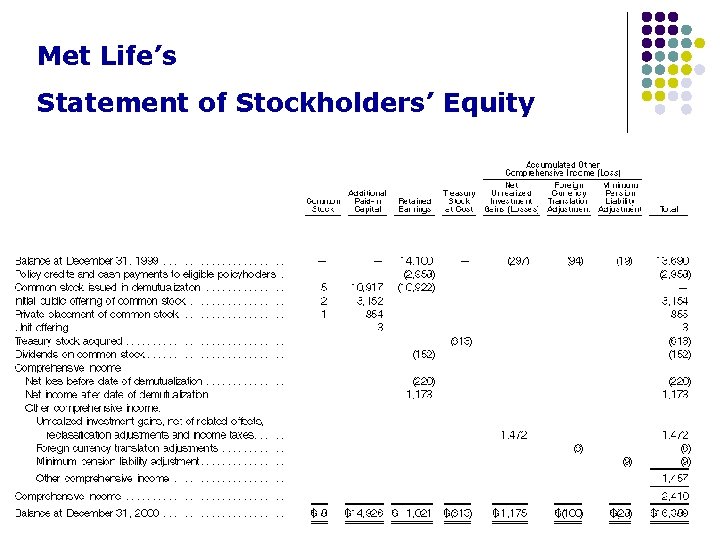

Met Life’s Statement of Stockholders’ Equity

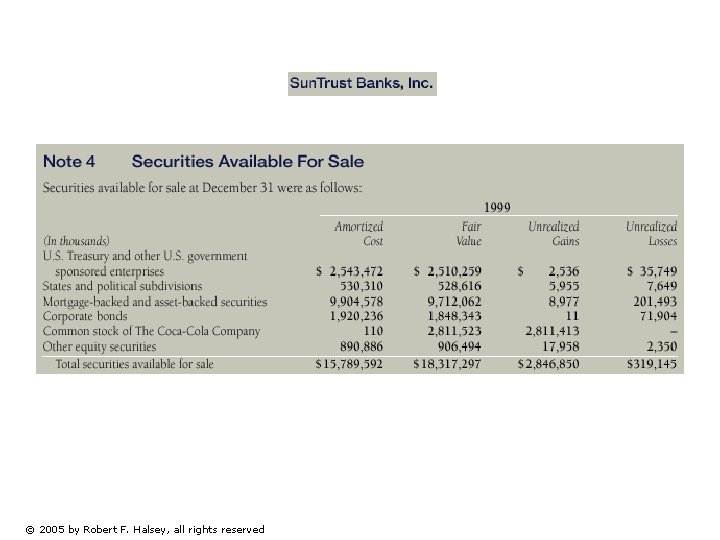

Met Life’s Investment Footnote

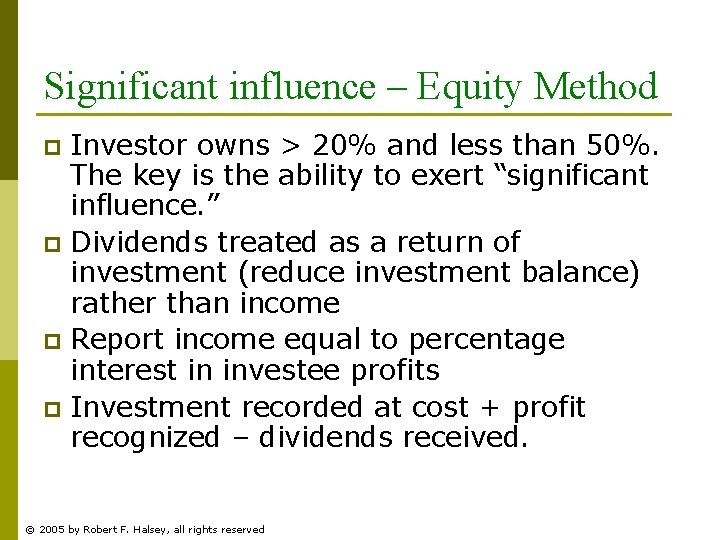

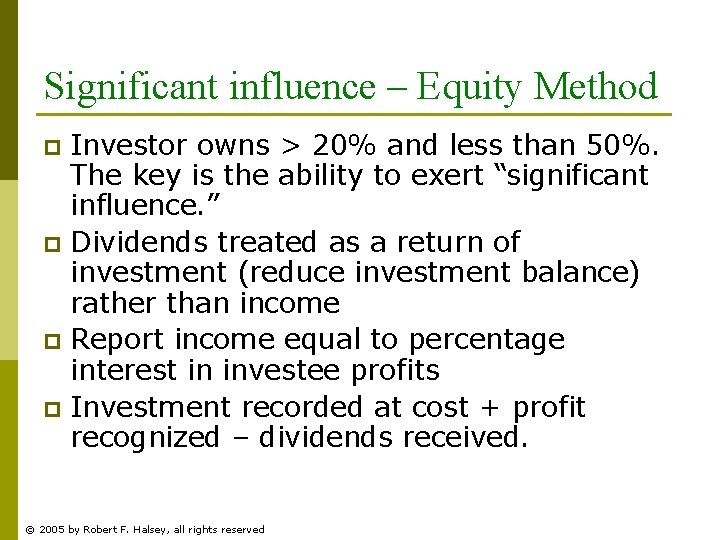

Significant influence – Equity Method Investor owns > 20% and less than 50%. The key is the ability to exert “significant influence. ” p Dividends treated as a return of investment (reduce investment balance) rather than income p Report income equal to percentage interest in investee profits p Investment recorded at cost + profit recognized – dividends received. p © 2005 by Robert F. Halsey, all rights reserved

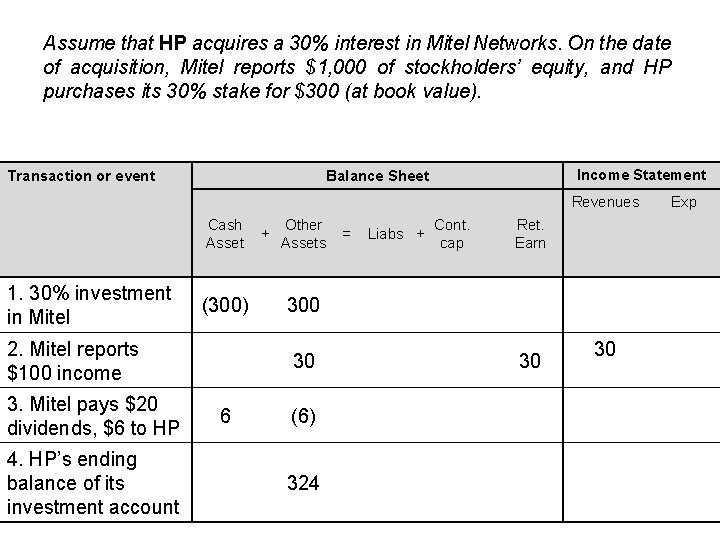

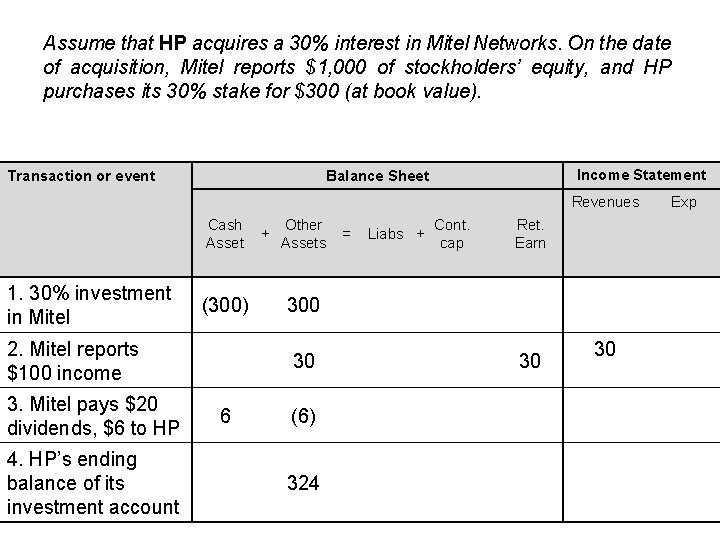

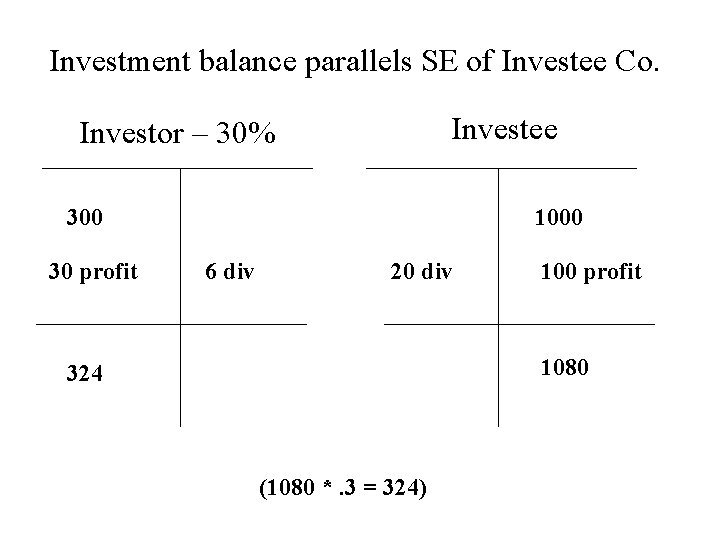

Assume that HP acquires a 30% interest in Mitel Networks. On the date of acquisition, Mitel reports $1, 000 of stockholders’ equity, and HP purchases its 30% stake for $300 (at book value). Transaction or event Income Statement Balance Sheet Revenues Cash Asset 1. 30% investment in Mitel (300) 2. Mitel reports $100 income 3. Mitel pays $20 dividends, $6 to HP 4. HP’s ending balance of its investment account + Other Assets Liabs + Cont. cap Ret. Earn 300 30 6 = (6) 324 30 30 Exp

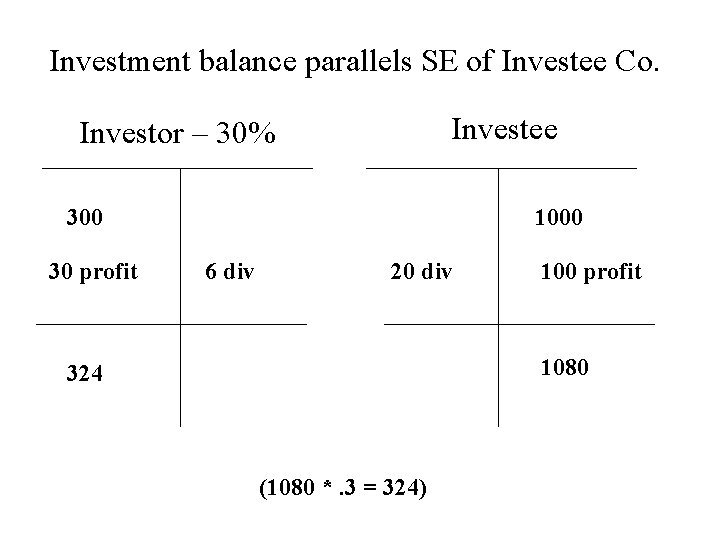

Investment balance parallels SE of Investee Co. Investee Investor – 30% 300 30 profit 1000 6 div 20 div 100 profit 1080 324 (1080 *. 3 = 324)

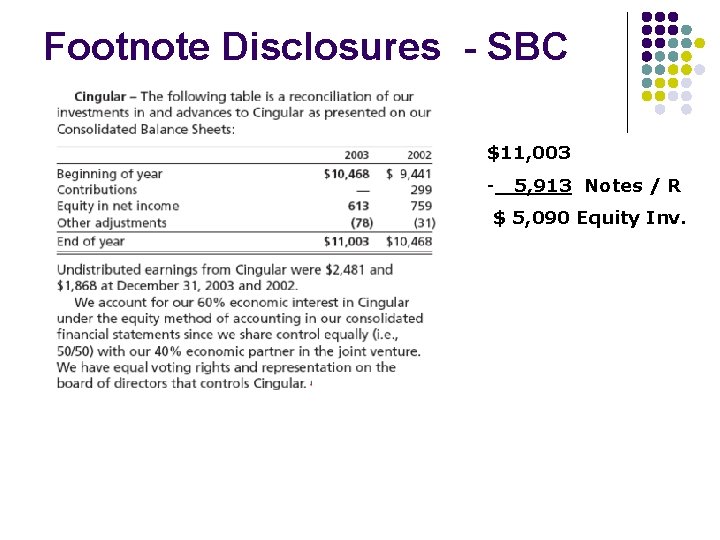

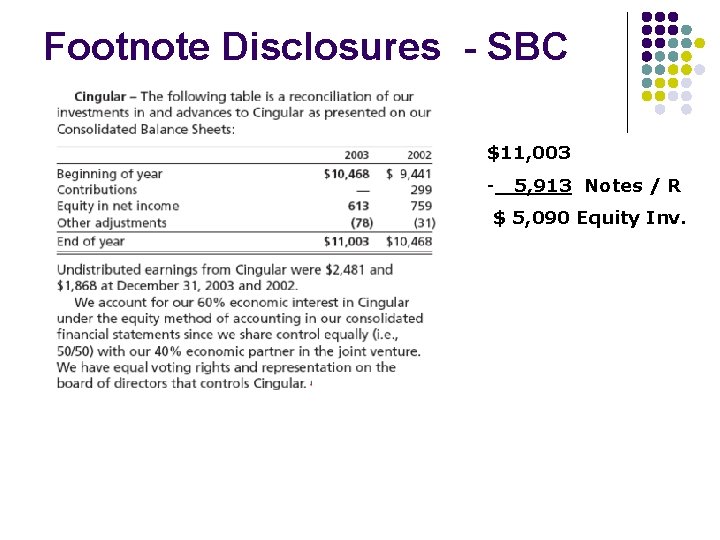

Footnote Disclosures - SBC $11, 003 - 5, 913 Notes / R $ 5, 090 Equity Inv.

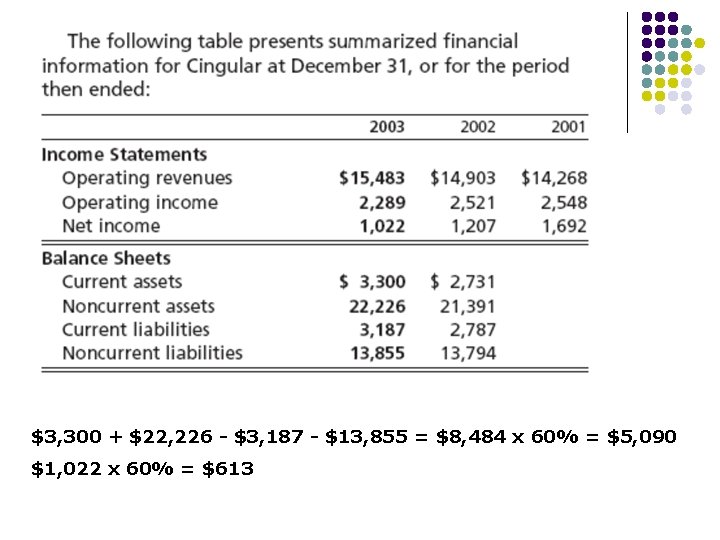

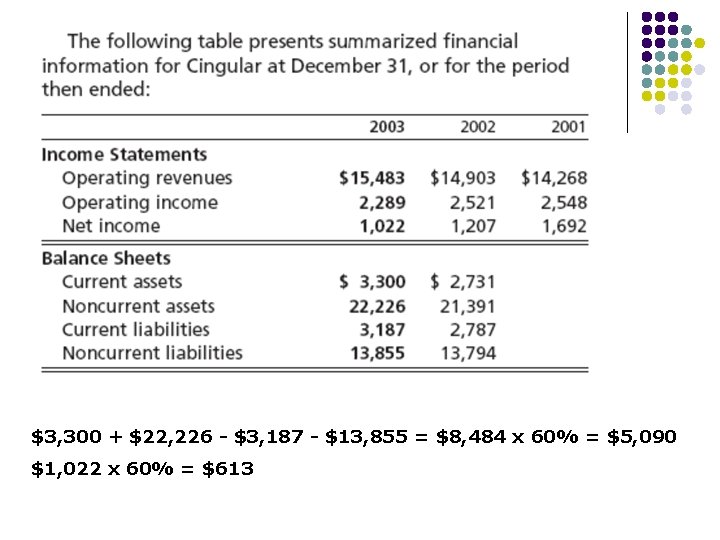

$3, 300 + $22, 226 - $3, 187 - $13, 855 = $8, 484 x 60% = $5, 090 $1, 022 x 60% = $613

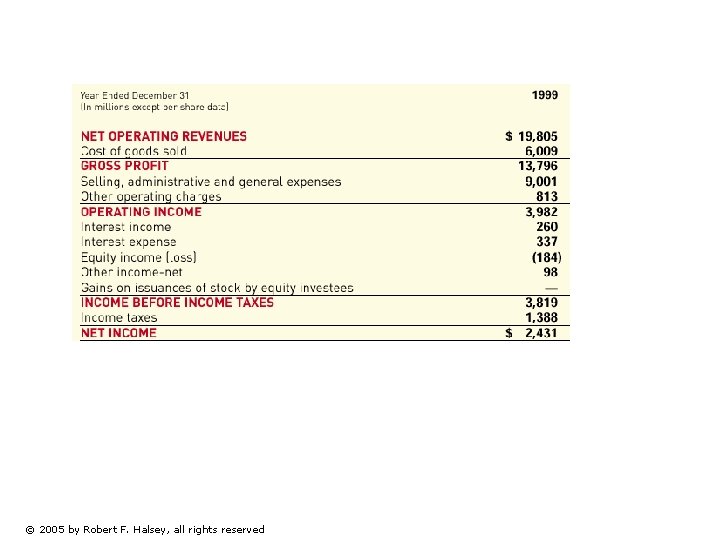

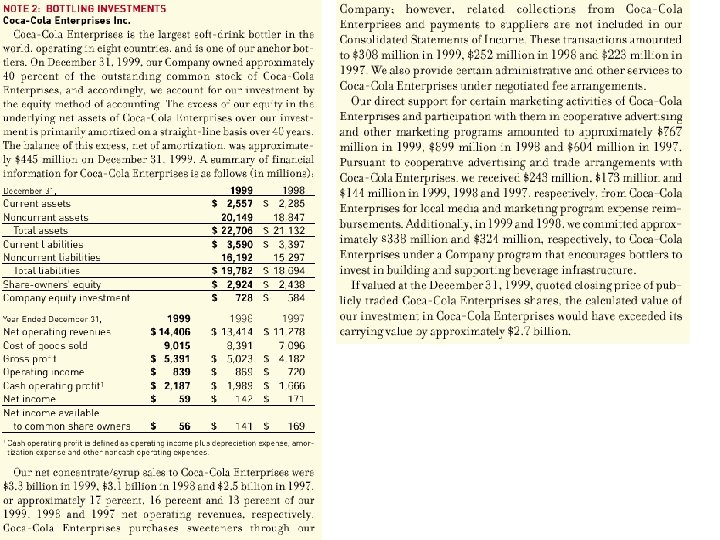

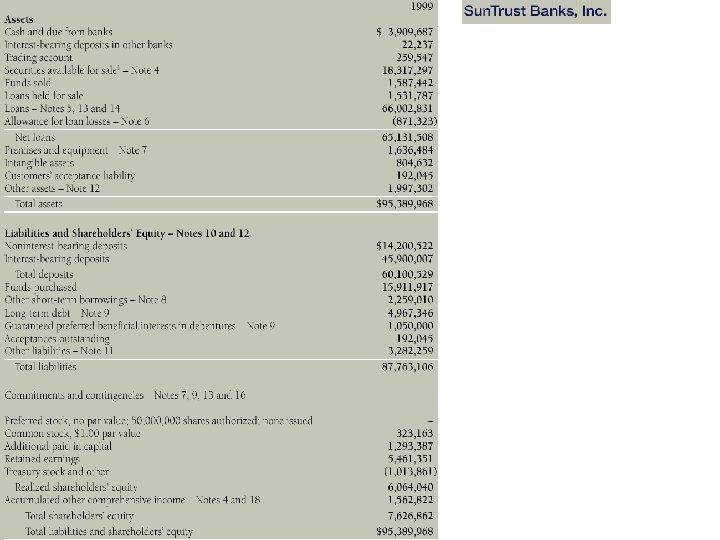

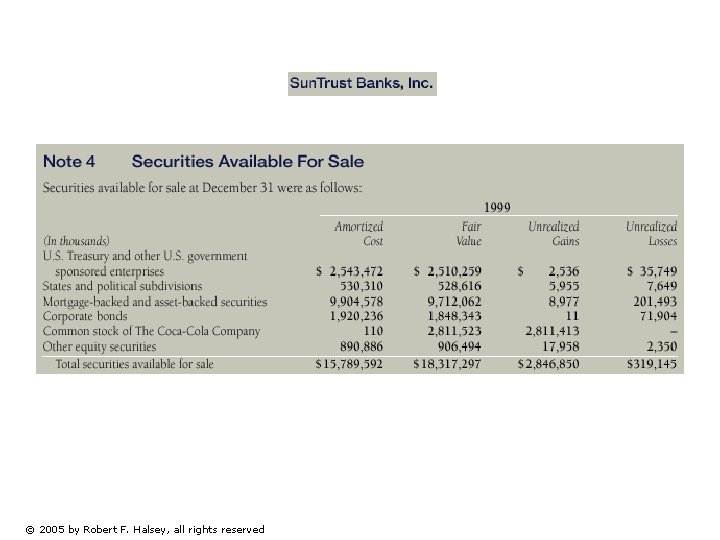

Coca-Cola mini-case © 2005 by Robert F. Halsey, all rights reserved

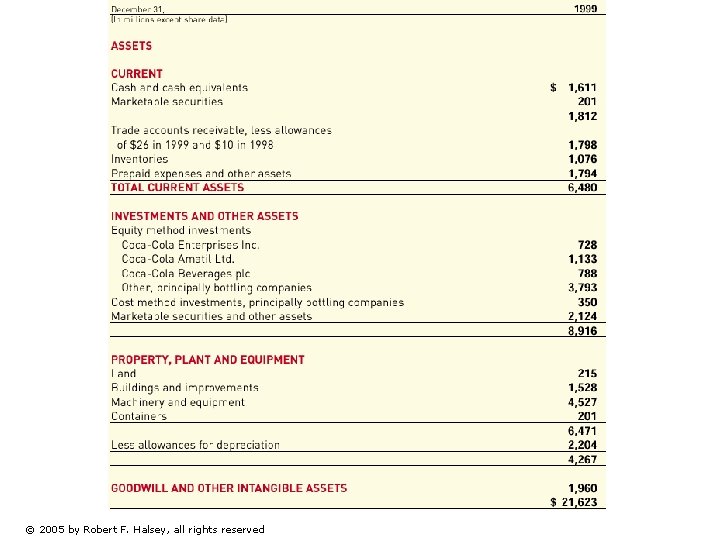

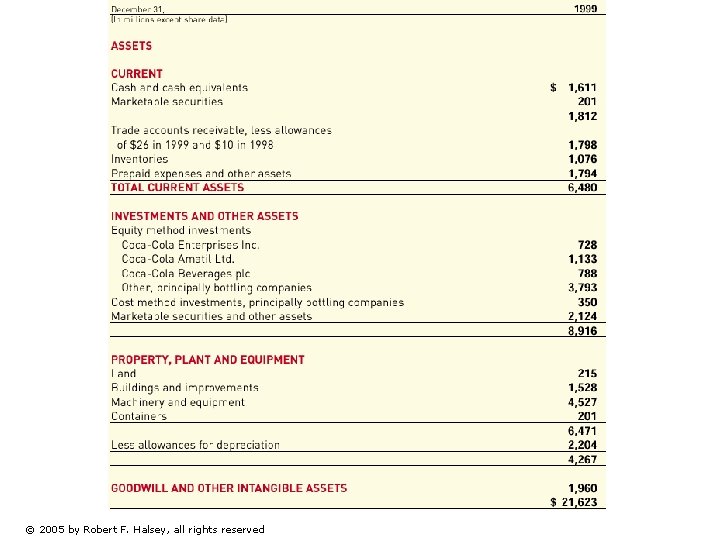

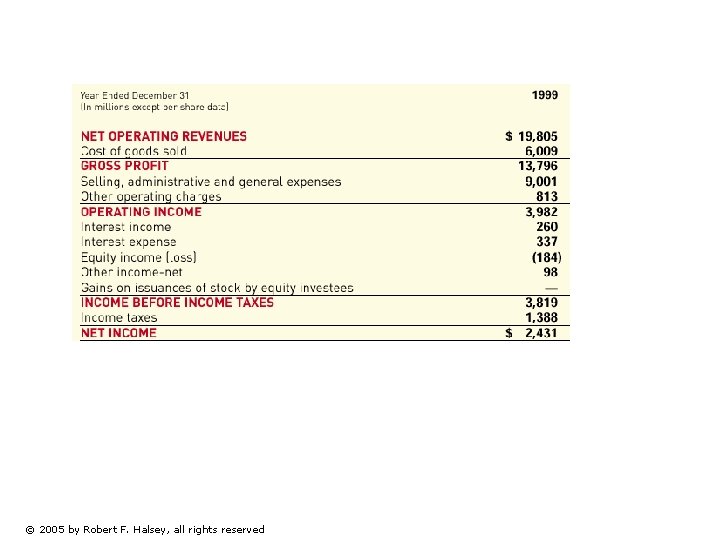

© 2005 by Robert F. Halsey, all rights reserved

© 2005 by Robert F. Halsey, all rights reserved

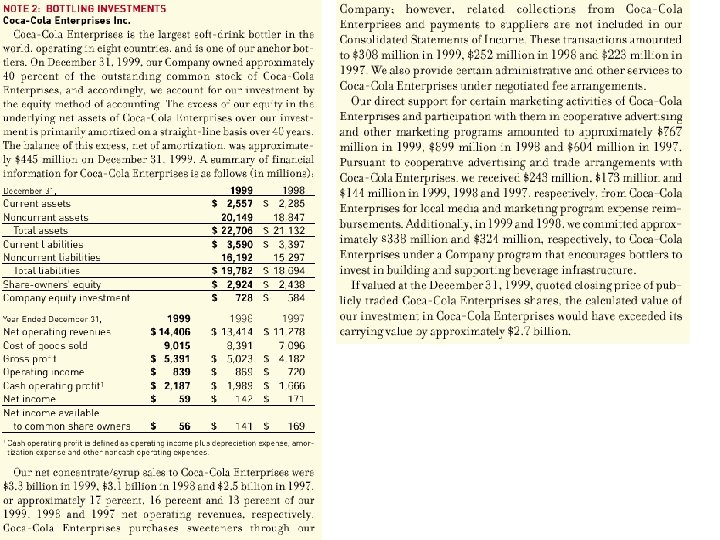

© 2005 by Robert F. Halsey, all rights reserved

© 2005 by Robert F. Halsey, all rights reserved

© 2005 by Robert F. Halsey, all rights reserved

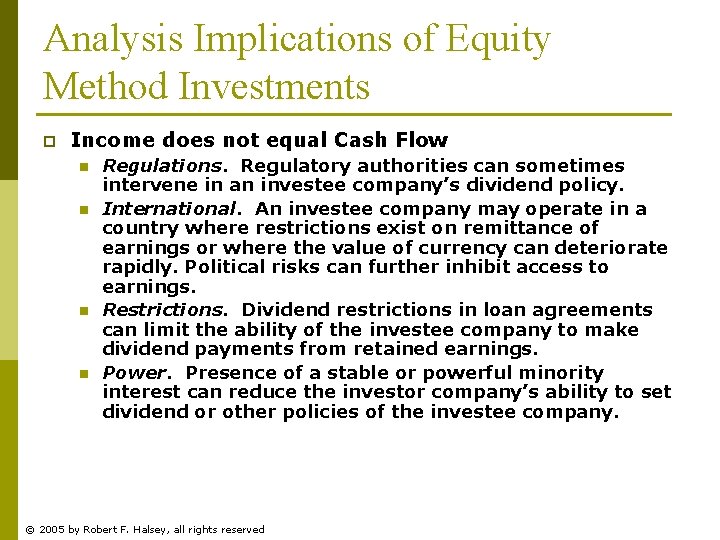

Analysis Implications of Equity Method Investments p Income does not equal Cash Flow n n Regulations. Regulatory authorities can sometimes intervene in an investee company’s dividend policy. International. An investee company may operate in a country where restrictions exist on remittance of earnings or where the value of currency can deteriorate rapidly. Political risks can further inhibit access to earnings. Restrictions. Dividend restrictions in loan agreements can limit the ability of the investee company to make dividend payments from retained earnings. Power. Presence of a stable or powerful minority interest can reduce the investor company’s ability to set dividend or other policies of the investee company. © 2005 by Robert F. Halsey, all rights reserved

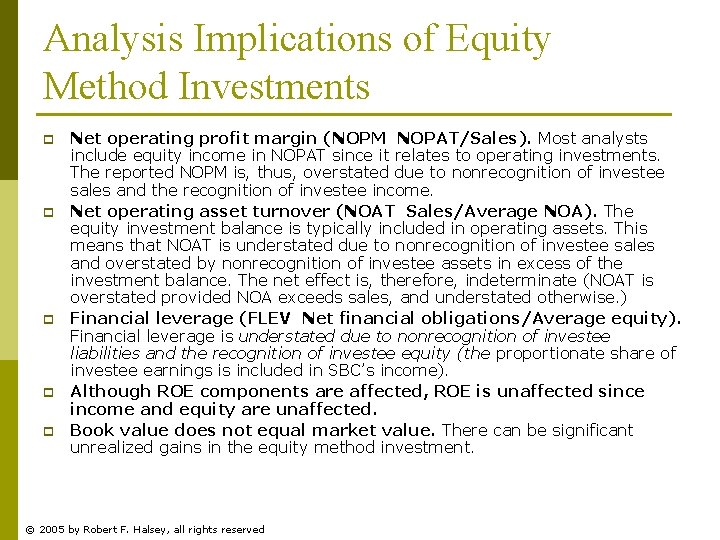

Analysis Implications of Equity Method Investments p p p Net operating profit margin (NOPM NOPAT/Sales). Most analysts include equity income in NOPAT since it relates to operating investments. The reported NOPM is, thus, overstated due to nonrecognition of investee sales and the recognition of investee income. Net operating asset turnover (NOAT Sales/Average NOA). The equity investment balance is typically included in operating assets. This means that NOAT is understated due to nonrecognition of investee sales and overstated by nonrecognition of investee assets in excess of the investment balance. The net effect is, therefore, indeterminate (NOAT is overstated provided NOA exceeds sales, and understated otherwise. ) Financial leverage (FLEV Net financial obligations/Average equity). Financial leverage is understated due to nonrecognition of investee liabilities and the recognition of investee equity (the proportionate share of investee earnings is included in SBC’s income). Although ROE components are affected, ROE is unaffected since income and equity are unaffected. Book value does not equal market value. There can be significant unrealized gains in the equity method investment. © 2005 by Robert F. Halsey, all rights reserved

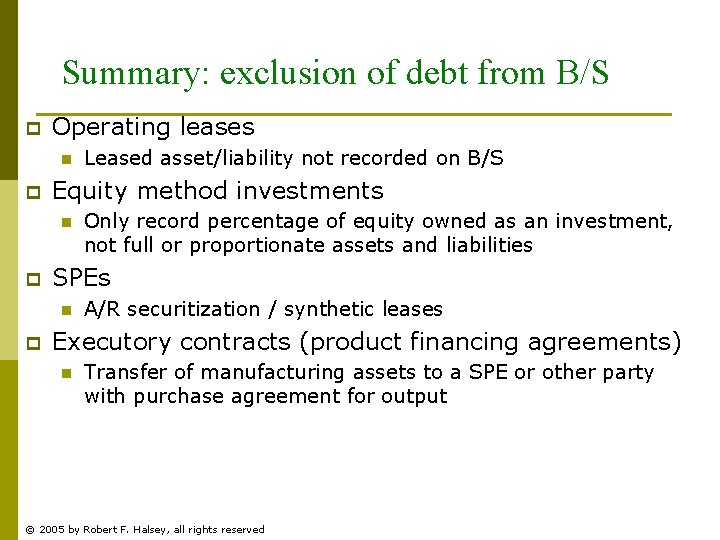

Summary: exclusion of debt from B/S p Operating leases n p Equity method investments n p Only record percentage of equity owned as an investment, not full or proportionate assets and liabilities SPEs n p Leased asset/liability not recorded on B/S A/R securitization / synthetic leases Executory contracts (product financing agreements) n Transfer of manufacturing assets to a SPE or other party with purchase agreement for output © 2005 by Robert F. Halsey, all rights reserved

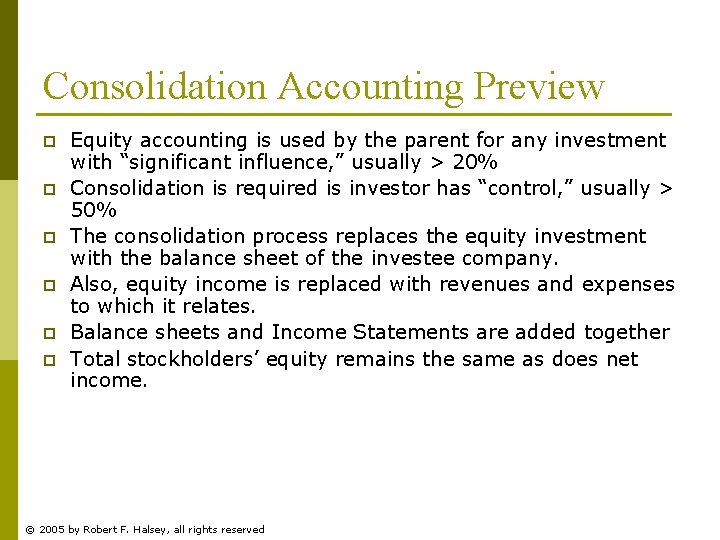

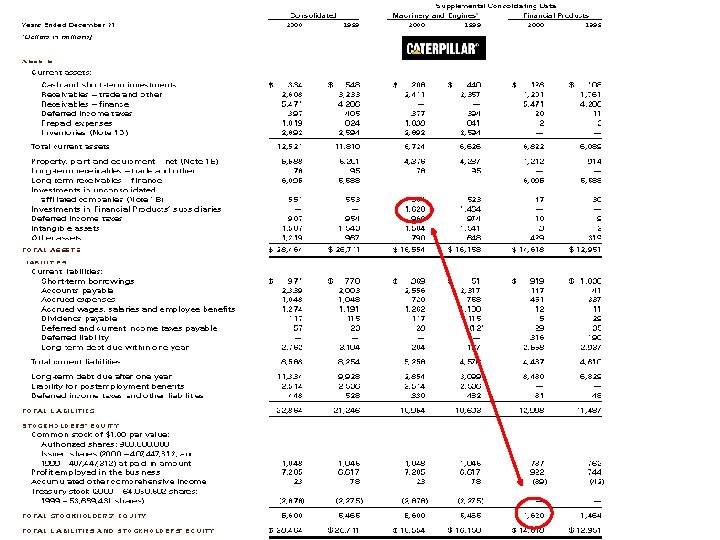

Consolidation Accounting Preview p p p Equity accounting is used by the parent for any investment with “significant influence, ” usually > 20% Consolidation is required is investor has “control, ” usually > 50% The consolidation process replaces the equity investment with the balance sheet of the investee company. Also, equity income is replaced with revenues and expenses to which it relates. Balance sheets and Income Statements are added together Total stockholders’ equity remains the same as does net income. © 2005 by Robert F. Halsey, all rights reserved

© 2005 by Robert F. Halsey, all rights reserved

Intercorporate investments

Intercorporate investments Intercorporate investments

Intercorporate investments Equity accounting vs proportionate consolidation

Equity accounting vs proportionate consolidation Intercompany asset transfer accounting entries

Intercompany asset transfer accounting entries Kieso chapter 17

Kieso chapter 17 Accounting for short term investments

Accounting for short term investments Intermediate accounting chapter 17 investments test bank

Intermediate accounting chapter 17 investments test bank Diorama investments

Diorama investments 3-7 future value of investments answers

3-7 future value of investments answers Apa itu value creation

Apa itu value creation Leader challenger follower

Leader challenger follower Segmenting targeting and positioning

Segmenting targeting and positioning Truth always rests with the minority

Truth always rests with the minority Define minority group

Define minority group Behaviours that enable a minority to influence a majority

Behaviours that enable a minority to influence a majority Define minority group

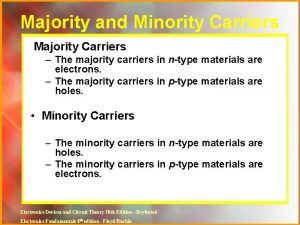

Define minority group Continuity equation in semiconductor

Continuity equation in semiconductor Npn and pnp transistor difference

Npn and pnp transistor difference Minority definition

Minority definition Control account purpose

Control account purpose Minority interest example

Minority interest example Majority-minority districts definition ap human geography

Majority-minority districts definition ap human geography Minority contractors near me

Minority contractors near me Difference between majority and minority carriers

Difference between majority and minority carriers Indigenized dialect

Indigenized dialect Office of minority health resource center

Office of minority health resource center