East Asian Community and East Asian Summit Concepts

- Slides: 24

East Asian Community and East Asian Summit -Concepts, Reality and Opportunities May 11, 2006 Regional Anatomy I Ken JIMBO

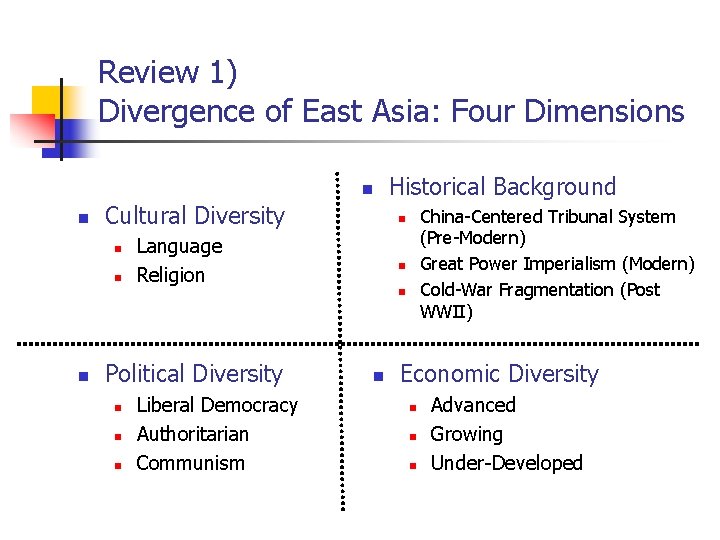

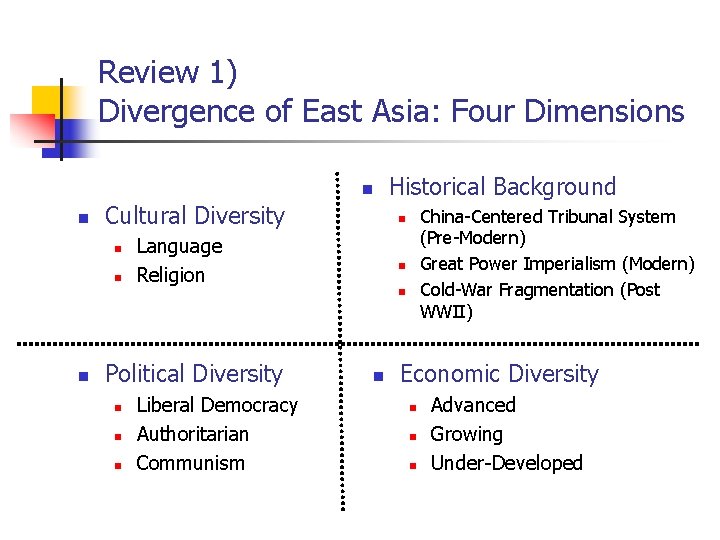

Review 1) Divergence of East Asia: Four Dimensions Historical Background Cultural Diversity China-Centered Tribunal System (Pre-Modern) Great Power Imperialism (Modern) Cold-War Fragmentation (Post WWII) Language Religion Political Diversity Liberal Democracy Authoritarian Communism Economic Diversity Advanced Growing Under-Developed

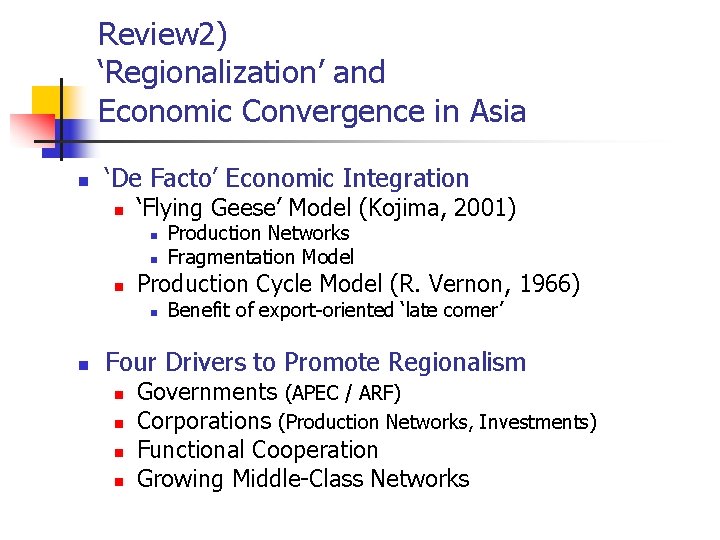

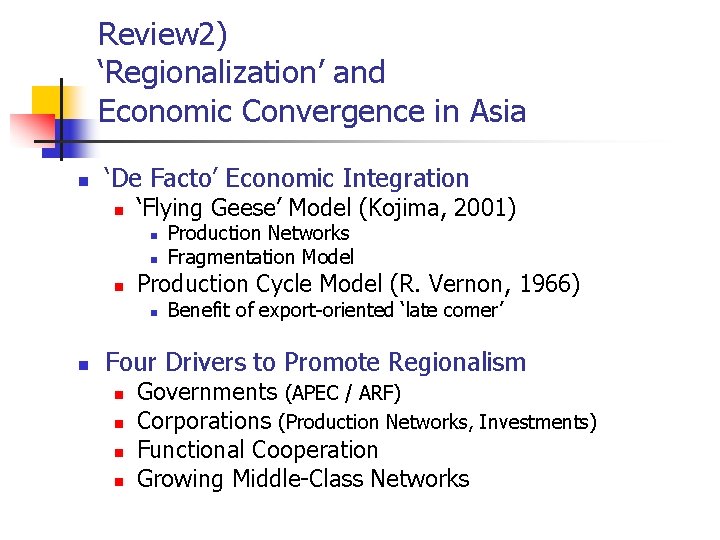

Review 2) ‘Regionalization’ and Economic Convergence in Asia ‘De Facto’ Economic Integration ‘Flying Geese’ Model (Kojima, 2001) Production Cycle Model (R. Vernon, 1966) Production Networks Fragmentation Model Benefit of export-oriented ‘late comer’ Four Drivers to Promote Regionalism Governments (APEC / ARF) Corporations (Production Networks, Investments) Functional Cooperation Growing Middle-Class Networks

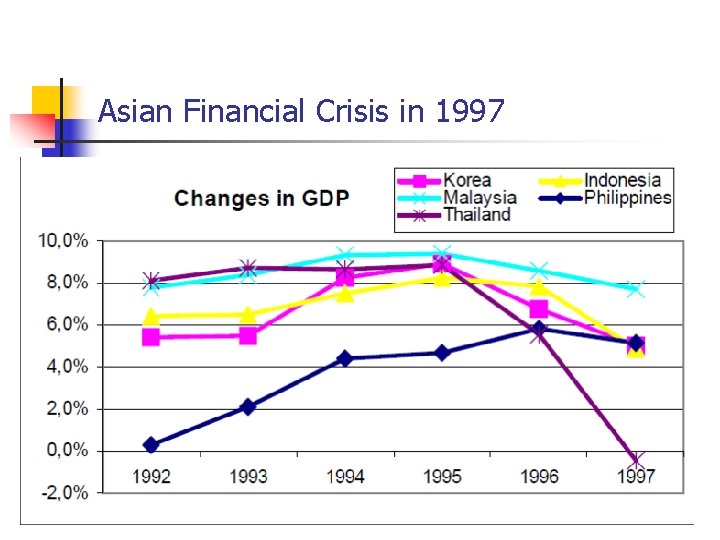

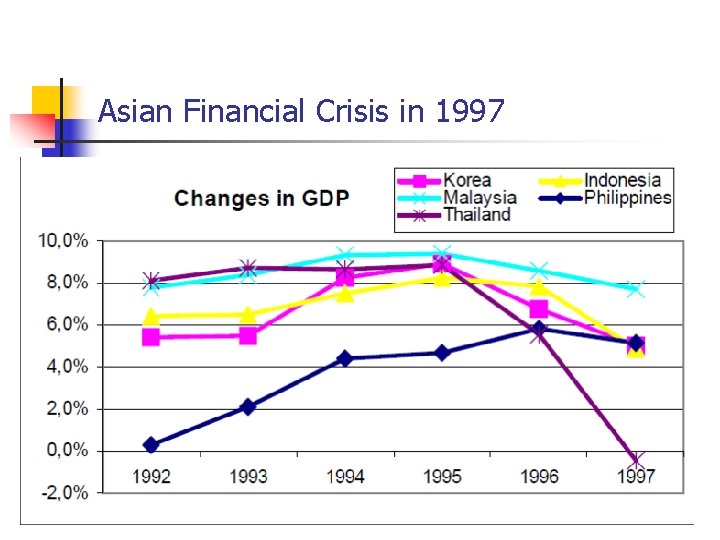

Asian Financial Crisis in 1997

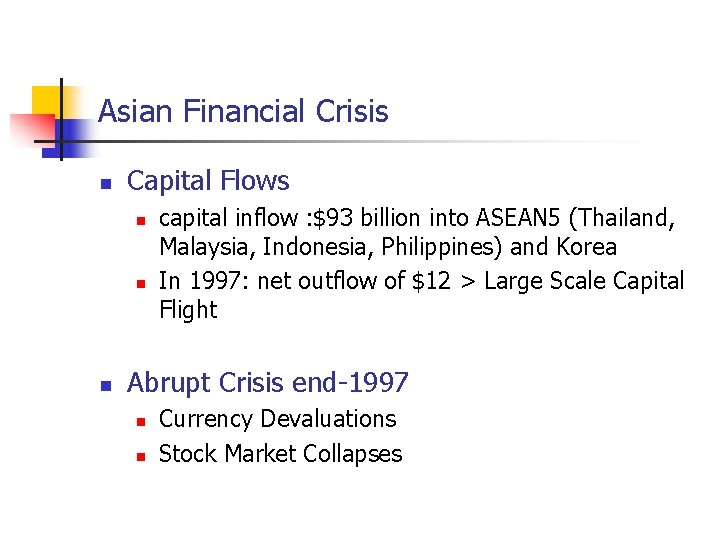

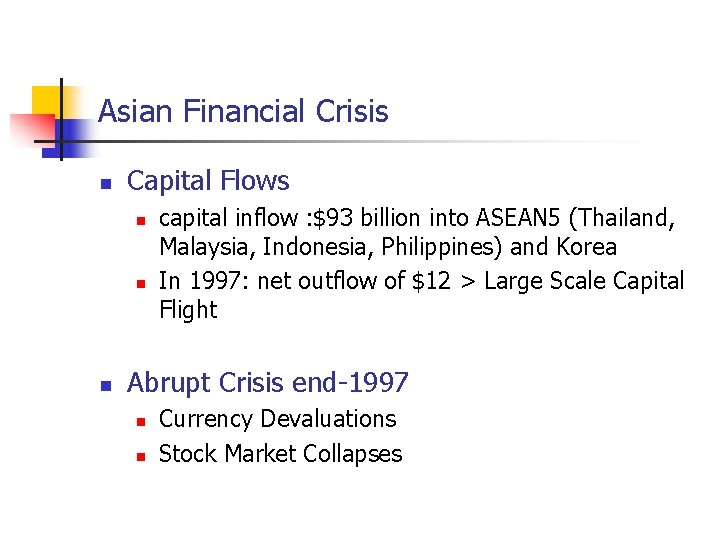

Asian Financial Crisis Capital Flows capital inflow : $93 billion into ASEAN 5 (Thailand, Malaysia, Indonesia, Philippines) and Korea In 1997: net outflow of $12 > Large Scale Capital Flight Abrupt Crisis end-1997 Currency Devaluations Stock Market Collapses

Asian Financial Crisis Spill-over Effect From Thailand to Asian Countries From Asian to Wide-Stock Markets Depreciations of Currencies Indonesian Rupiah: 75% Malaysia Ringgit: 40% Philippines Peso: 40% Thai Bahts and Korean Won: 50% > From East Asian Miracle to East Asian Meltdown?

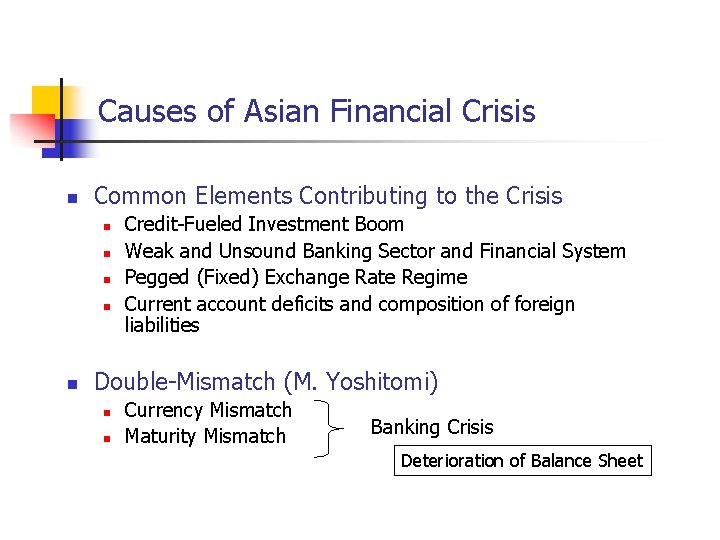

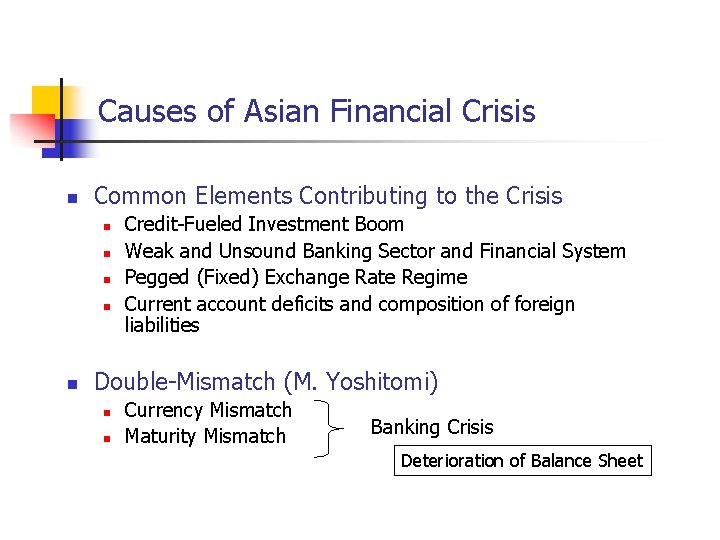

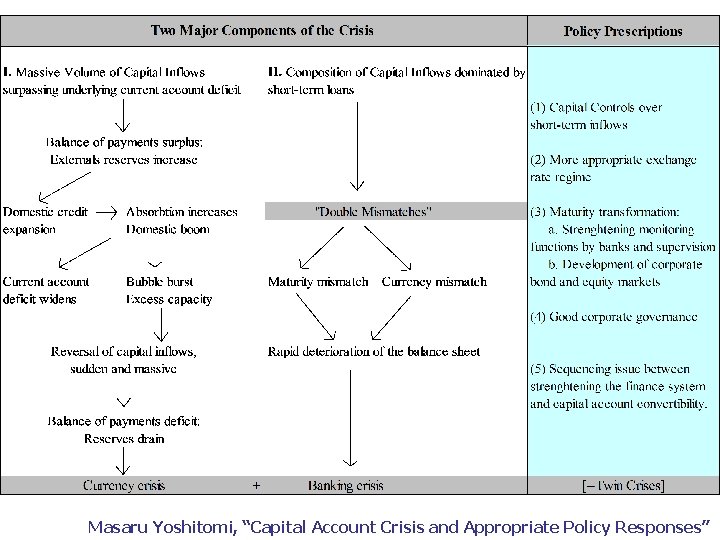

Causes of Asian Financial Crisis Common Elements Contributing to the Crisis Credit-Fueled Investment Boom Weak and Unsound Banking Sector and Financial System Pegged (Fixed) Exchange Rate Regime Current account deficits and composition of foreign liabilities Double-Mismatch (M. Yoshitomi) Currency Mismatch Maturity Mismatch Banking Crisis Deterioration of Balance Sheet

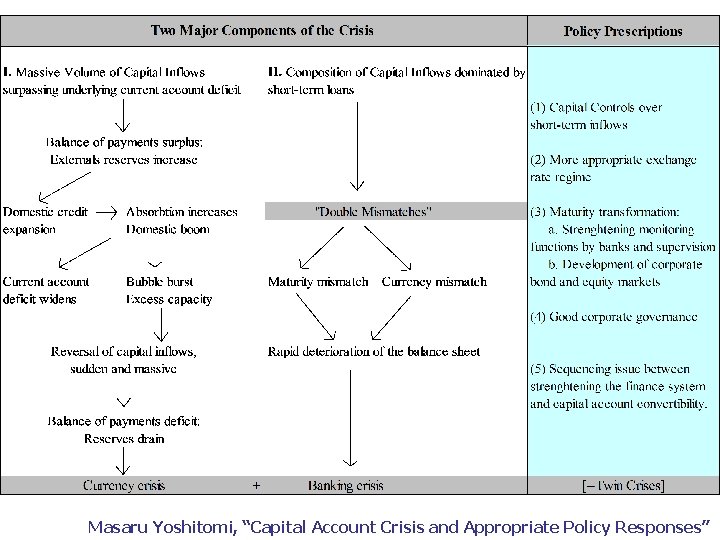

Masaru Yoshitomi, “Capital Account Crisis and Appropriate Policy Responses”

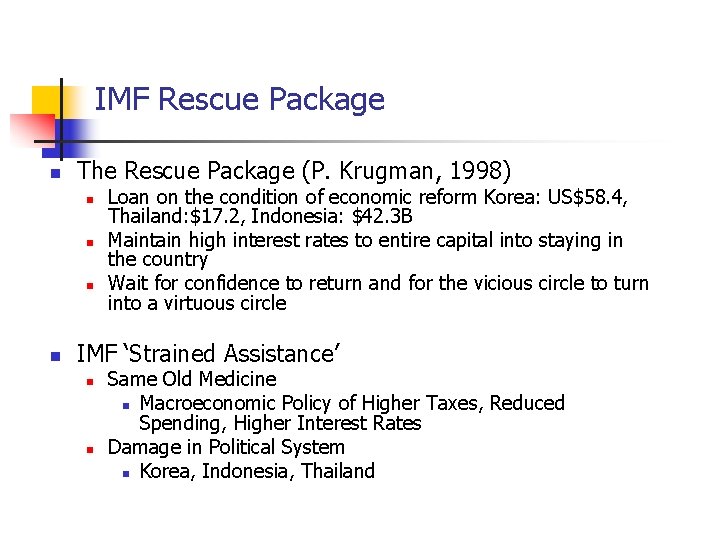

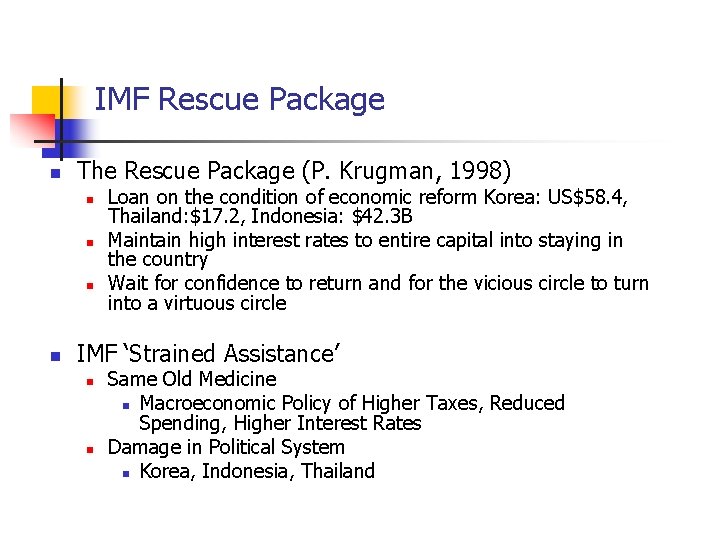

IMF Rescue Package The Rescue Package (P. Krugman, 1998) Loan on the condition of economic reform Korea: US$58. 4, Thailand: $17. 2, Indonesia: $42. 3 B Maintain high interest rates to entire capital into staying in the country Wait for confidence to return and for the vicious circle to turn into a virtuous circle IMF ‘Strained Assistance’ Same Old Medicine Macroeconomic Policy of Higher Taxes, Reduced Spending, Higher Interest Rates Damage in Political System Korea, Indonesia, Thailand

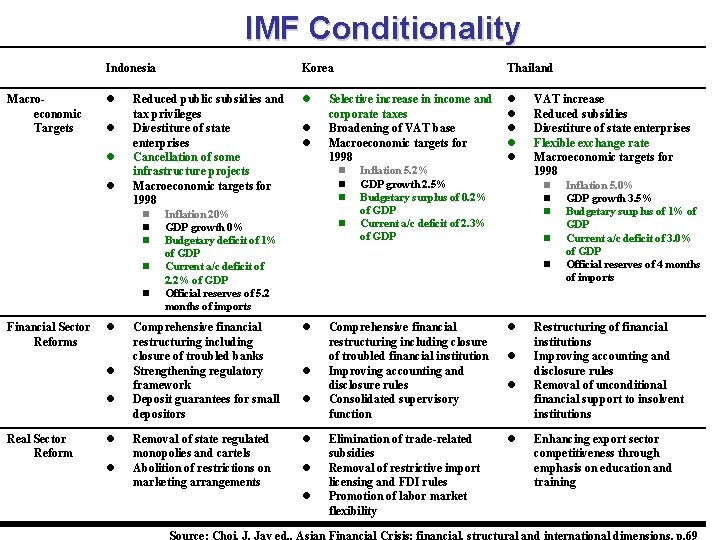

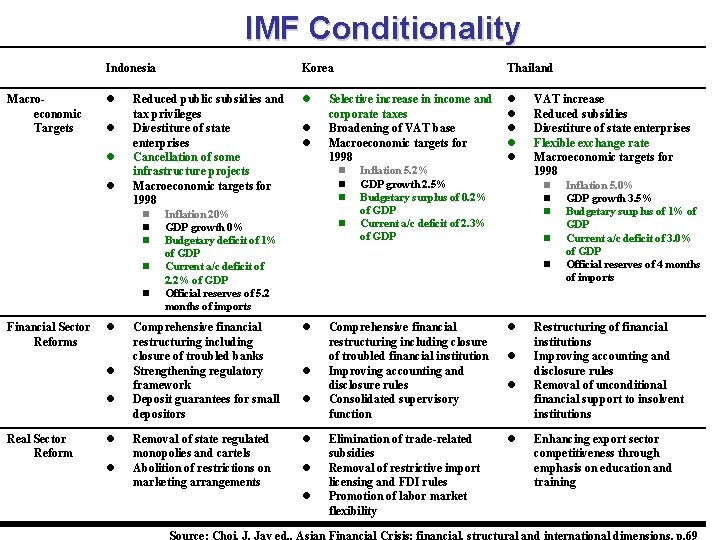

IMF Conditionality Macroeconomic Targets Indonesia Korea Thailand Reduced public subsidies and tax privileges Divestiture of state enterprises Cancellation of some infrastructure projects Macroeconomic targets for 1998 Inflation 20% GDP growth 0% Budgetary deficit of 1% Financial Sector Reforms Real Sector Reform Selective increase in income and corporate taxes Broadening of VAT base Macroeconomic targets for 1998 Inflation 5. 2% GDP growth 2. 5% Budgetary surplus of 0. 2% of GDP Current a/c deficit of 2. 3% of GDP VAT increase Reduced subsidies Divestiture of state enterprises Flexible exchange rate Macroeconomic targets for 1998 Inflation 5. 0% GDP growth 3. 5% Budgetary surplus of 1% of GDP Current a/c deficit of 2. 2% of GDP Official reserves of 5. 2 months of imports Comprehensive financial restructuring including closure of troubled banks Strengthening regulatory framework Deposit guarantees for small depositors Removal of state regulated monopolies and cartels Abolition of restrictions on marketing arrangements Comprehensive financial restructuring including closure of troubled financial institution Improving accounting and disclosure rules Consolidated supervisory function Elimination of trade-related subsidies Removal of restrictive import licensing and FDI rules Promotion of labor market flexibility GDP Current a/c deficit of 3. 0% of GDP Official reserves of 4 months of imports Restructuring of financial institutions Improving accounting and disclosure rules Removal of unconditional financial support to insolvent institutions Enhancing export sector competitiveness through emphasis on education and training Source: Choi, J. Jay ed. , Asian Financial Crisis: financial, structural and international dimensions, p. 69

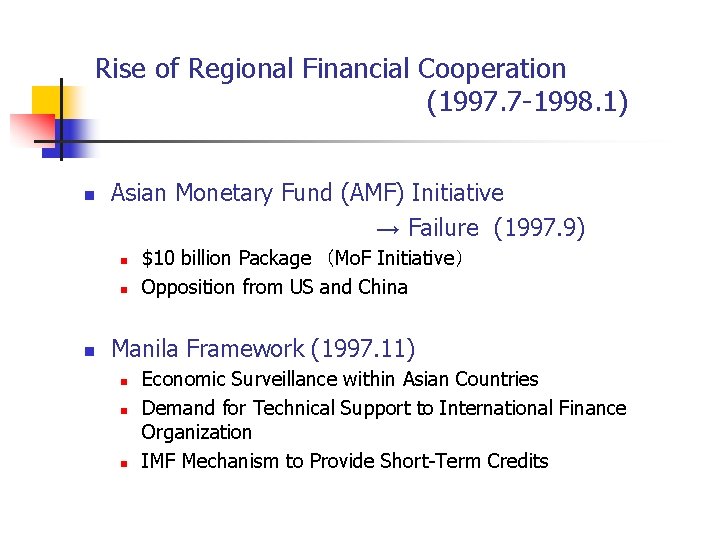

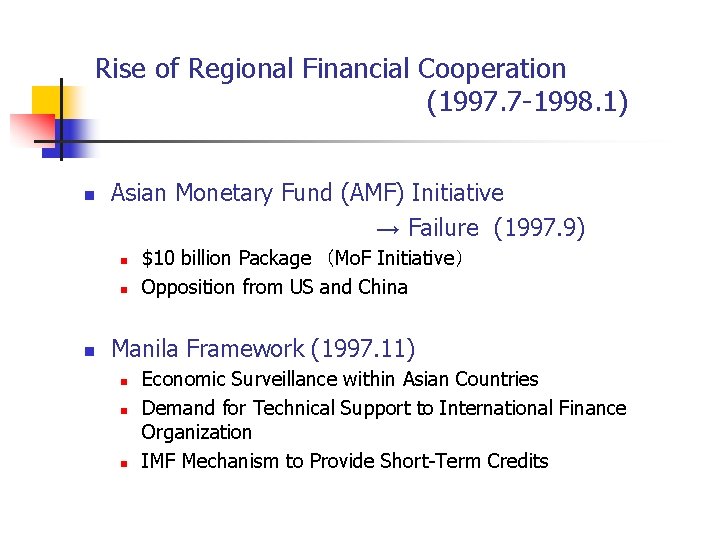

Rise of Regional Financial Cooperation (1997. 7 -1998. 1) Asian Monetary Fund (AMF) Initiative → Failure (1997. 9) $10 billion Package (Mo. F Initiative) Opposition from US and China Manila Framework (1997. 11) Economic Surveillance within Asian Countries Demand for Technical Support to International Finance Organization IMF Mechanism to Provide Short-Term Credits

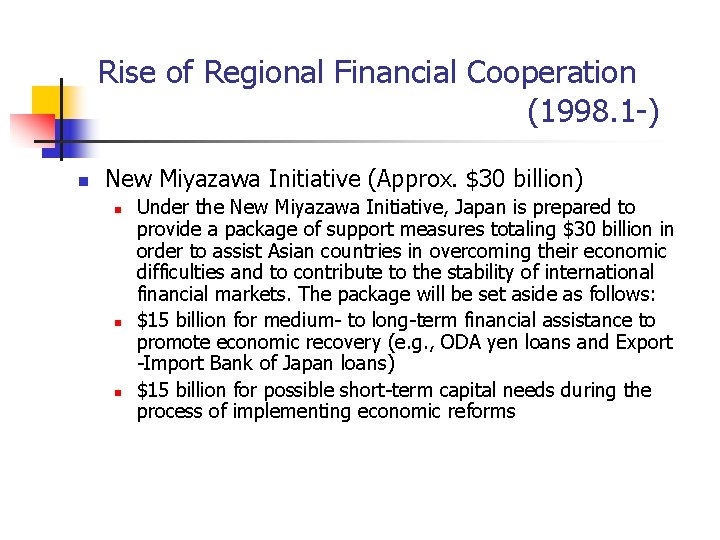

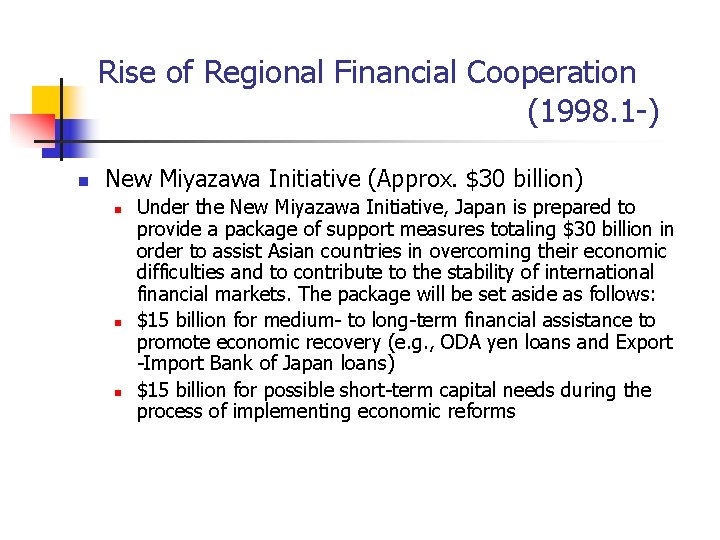

Rise of Regional Financial Cooperation (1998. 1 -) New Miyazawa Initiative (Approx. $30 billion) Under the New Miyazawa Initiative, Japan is prepared to provide a package of support measures totaling $30 billion in order to assist Asian countries in overcoming their economic difficulties and to contribute to the stability of international financial markets. The package will be set aside as follows: $15 billion for medium- to long-term financial assistance to promote economic recovery (e. g. , ODA yen loans and Export -Import Bank of Japan loans) $15 billion for possible short-term capital needs during the process of implementing economic reforms

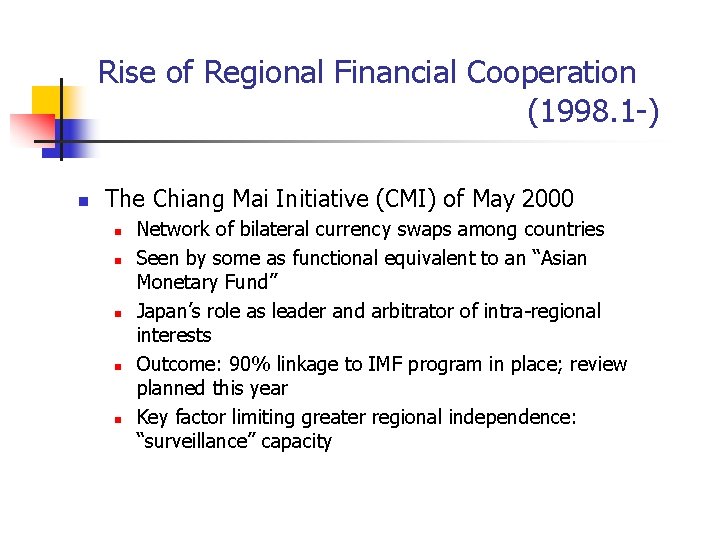

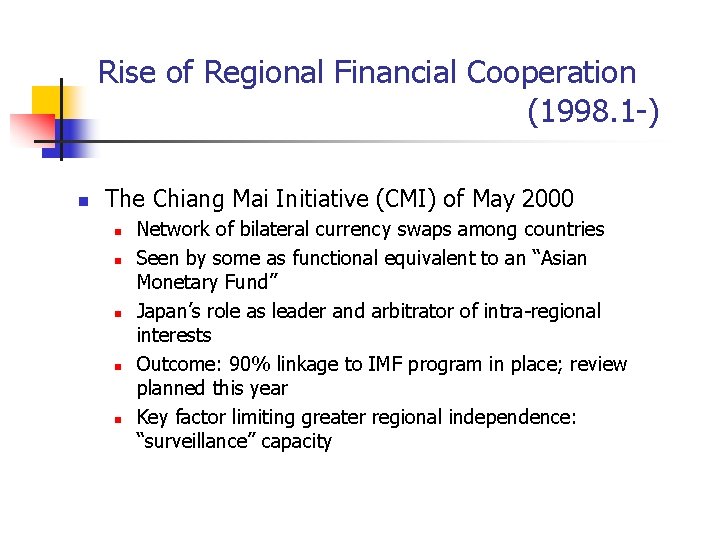

Rise of Regional Financial Cooperation (1998. 1 -) The Chiang Mai Initiative (CMI) of May 2000 Network of bilateral currency swaps among countries Seen by some as functional equivalent to an “Asian Monetary Fund” Japan’s role as leader and arbitrator of intra-regional interests Outcome: 90% linkage to IMF program in place; review planned this year Key factor limiting greater regional independence: “surveillance” capacity

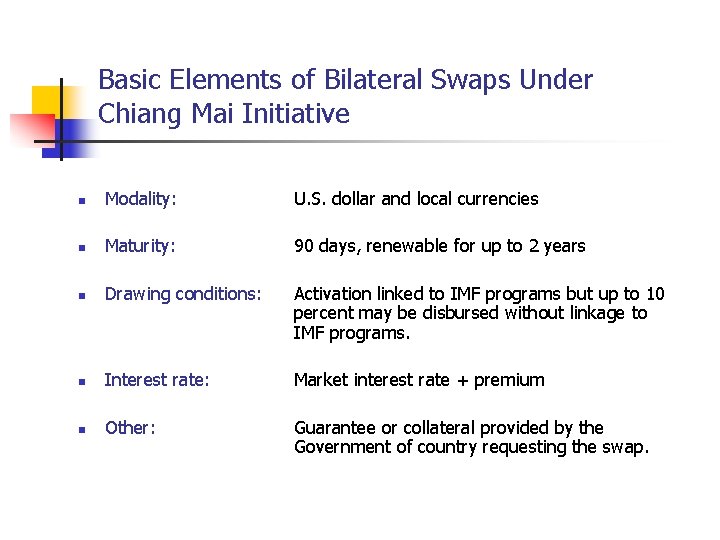

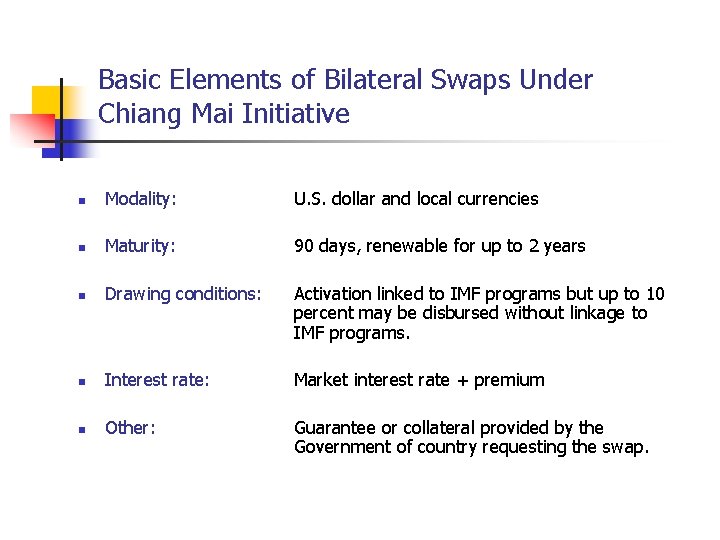

Basic Elements of Bilateral Swaps Under Chiang Mai Initiative Modality: U. S. dollar and local currencies Maturity: 90 days, renewable for up to 2 years Drawing conditions: Activation linked to IMF programs but up to 10 percent may be disbursed without linkage to IMF programs. Interest rate: Market interest rate + premium Other: Guarantee or collateral provided by the Government of country requesting the swap.

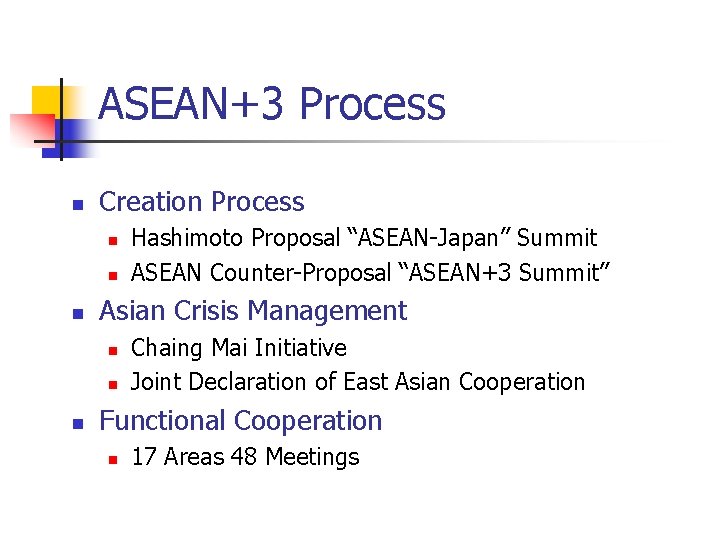

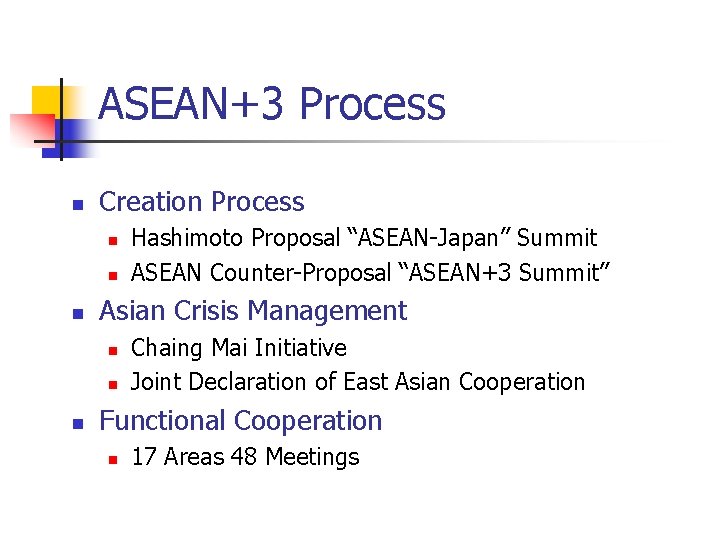

ASEAN+3 Process Creation Process Asian Crisis Management Hashimoto Proposal “ASEAN-Japan” Summit ASEAN Counter-Proposal “ASEAN+3 Summit” Chaing Mai Initiative Joint Declaration of East Asian Cooperation Functional Cooperation 17 Areas 48 Meetings

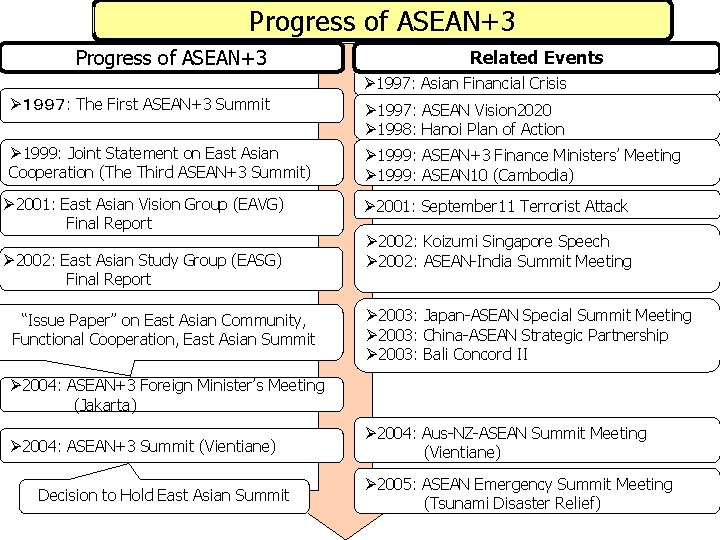

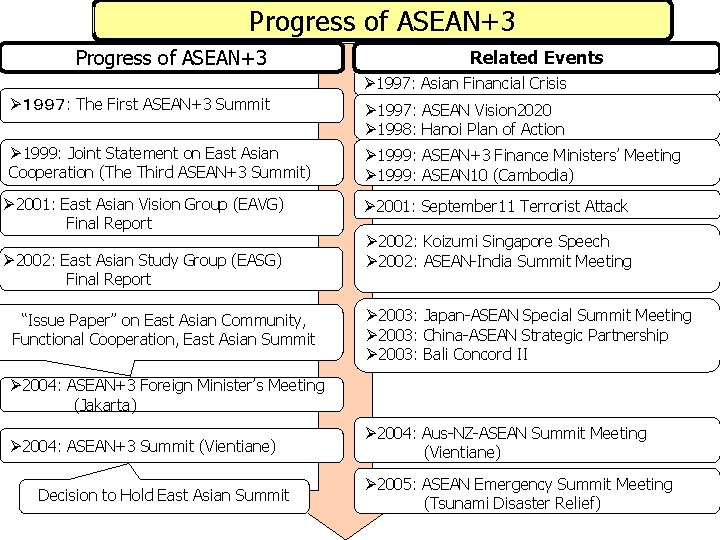

Progress of ASEAN+3 Related Events Ø 1997: Asian Financial Crisis Ø1997: The First ASEAN+3 Summit Ø 1997: ASEAN Vision 2020 Ø 1998: Hanoi Plan of Action Ø 1999: Joint Statement on East Asian Cooperation (The Third ASEAN+3 Summit) Ø 1999: ASEAN+3 Finance Ministers’ Meeting Ø 1999: ASEAN 10 (Cambodia) Ø 2001: East Asian Vision Group (EAVG) Final Report Ø 2002: East Asian Study Group (EASG) Final Report “Issue Paper” on East Asian Community, Functional Cooperation, East Asian Summit Ø 2001: September 11 Terrorist Attack Ø 2002: Koizumi Singapore Speech Ø 2002: ASEAN-India Summit Meeting Ø 2003: Japan-ASEAN Special Summit Meeting Ø 2003: China-ASEAN Strategic Partnership Ø 2003: Bali Concord II Ø 2004: ASEAN+3 Foreign Minister’s Meeting (Jakarta) Ø 2004: ASEAN+3 Summit (Vientiane) Decision to Hold East Asian Summit Ø 2004: Aus-NZ-ASEAN Summit Meeting (Vientiane) Ø 2005: ASEAN Emergency Summit Meeting (Tsunami Disaster Relief)

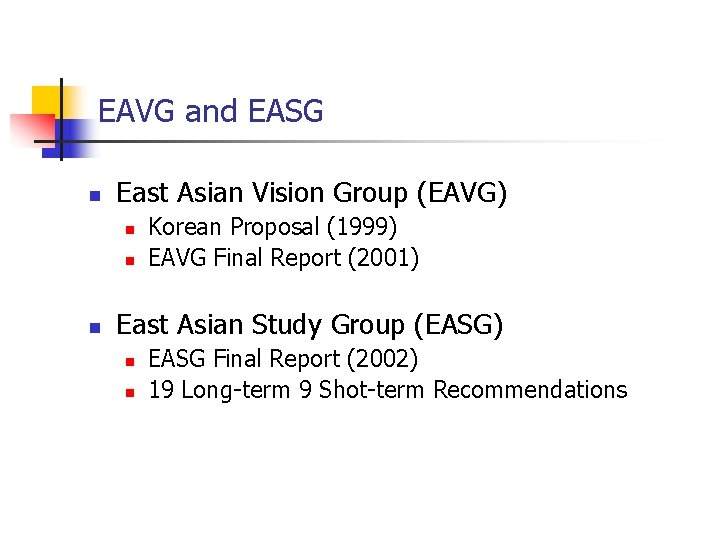

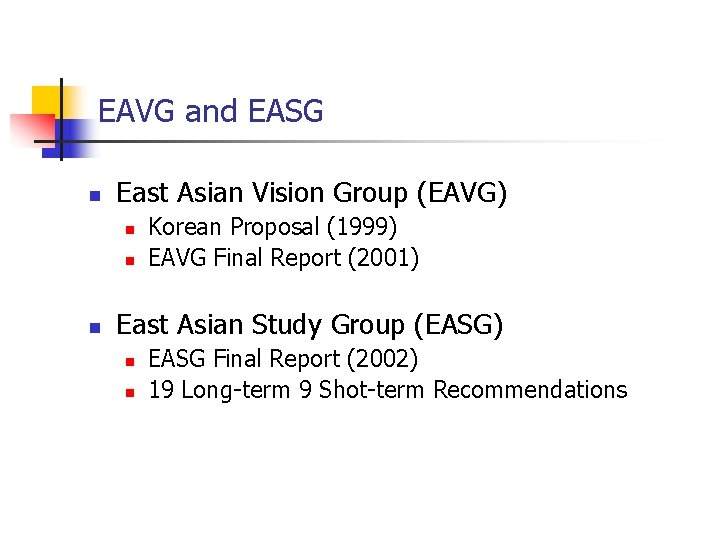

EAVG and EASG East Asian Vision Group (EAVG) Korean Proposal (1999) EAVG Final Report (2001) East Asian Study Group (EASG) EASG Final Report (2002) 19 Long-term 9 Shot-term Recommendations

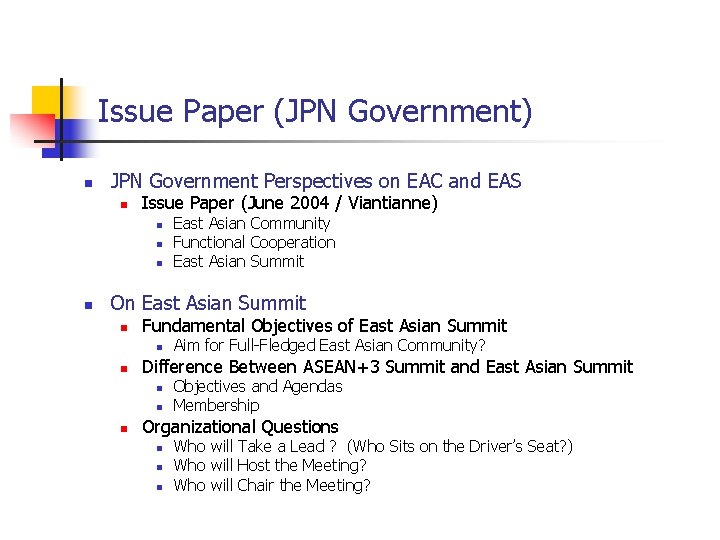

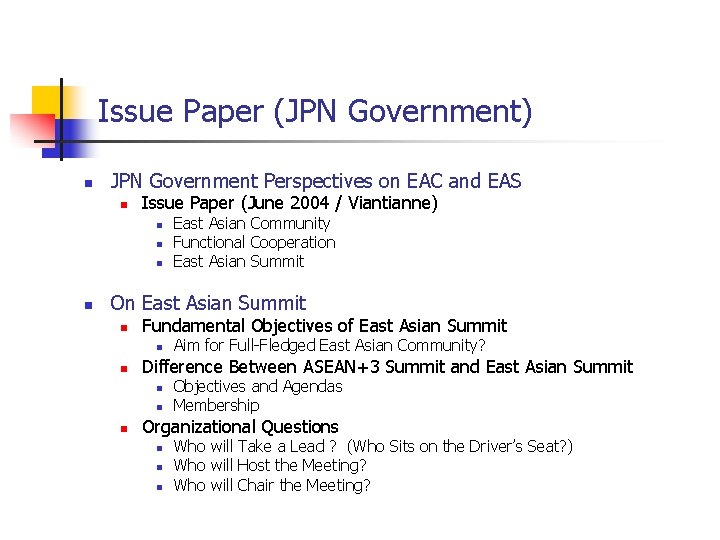

Issue Paper (JPN Government) JPN Government Perspectives on EAC and EAS Issue Paper (June 2004 / Viantianne) East Asian Community Functional Cooperation East Asian Summit On East Asian Summit Fundamental Objectives of East Asian Summit Difference Between ASEAN+3 Summit and East Asian Summit Aim for Full-Fledged East Asian Community? Objectives and Agendas Membership Organizational Questions Who will Take a Lead ? (Who Sits on the Driver’s Seat? ) Who will Host the Meeting? Who will Chair the Meeting?

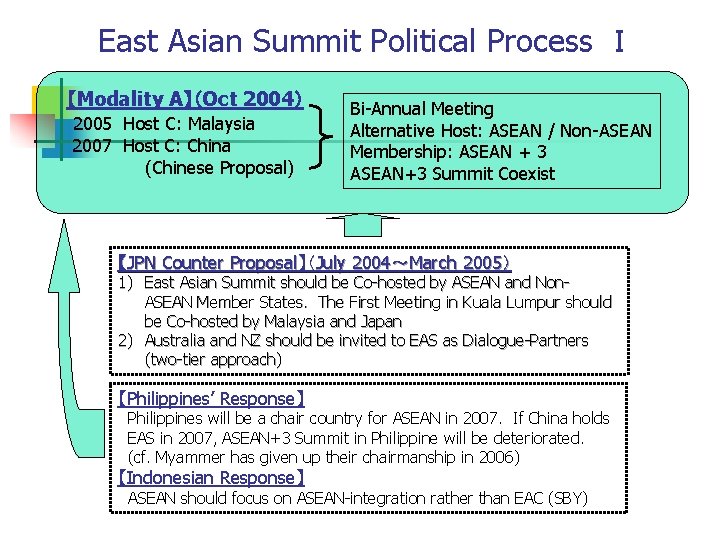

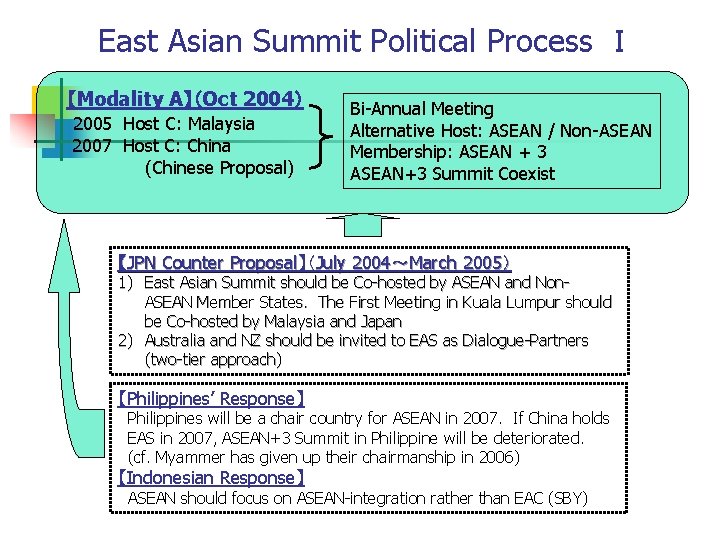

East Asian Summit Political Process I 【Modality A】(Oct 2004) 2005 Host C: Malaysia 2007 Host C: China (Chinese Proposal) Bi-Annual Meeting Alternative Host: ASEAN / Non-ASEAN Membership: ASEAN + 3 ASEAN+3 Summit Coexist 【JPN Counter Proposal】(July 2004~March 2005) 1) East Asian Summit should be Co-hosted by ASEAN and Non. ASEAN Member States. The First Meeting in Kuala Lumpur should be Co-hosted by Malaysia and Japan 2) Australia and NZ should be invited to EAS as Dialogue-Partners (two-tier approach) 【Philippines’ Response】 Philippines will be a chair country for ASEAN in 2007. If China holds EAS in 2007, ASEAN+3 Summit in Philippine will be deteriorated. (cf. Myammer has given up their chairmanship in 2006) 【Indonesian Response】 ASEAN should focus on ASEAN-integration rather than EAC (SBY)

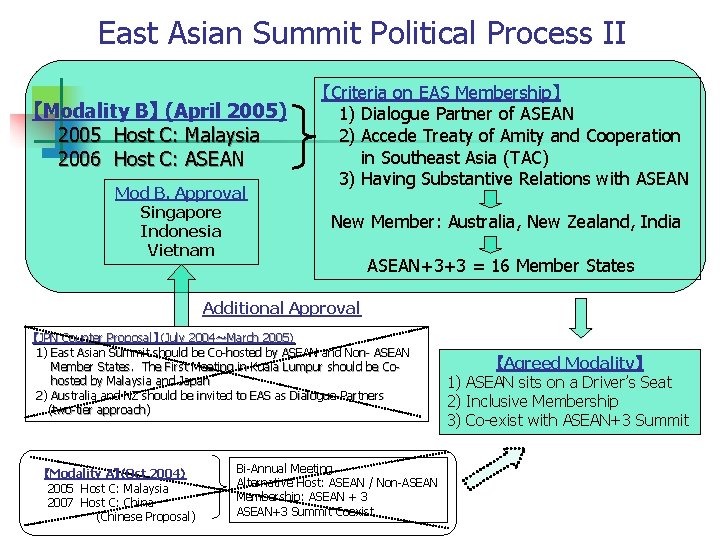

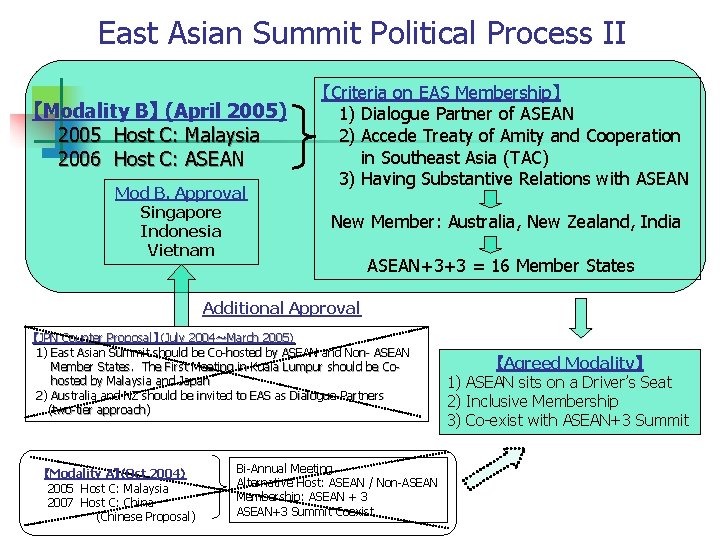

East Asian Summit Political Process II 【Modality B】 (April 2005) 2005 Host C: Malaysia 2006 Host C: ASEAN Mod B. Approval Singapore Indonesia Vietnam 【Criteria on EAS Membership】 1) Dialogue Partner of ASEAN 2) Accede Treaty of Amity and Cooperation in Southeast Asia (TAC) 3) Having Substantive Relations with ASEAN New Member: Australia, New Zealand, India ASEAN+3+3 = 16 Member States Additional Approval 【JPN Counter Proposal】(July 2004~March 2005) 1) East Asian Summit should be Co-hosted by ASEAN and Non- ASEAN Member States. The First Meeting in Kuala Lumpur should be Cohosted by Malaysia and Japan 2) Australia and NZ should be invited to EAS as Dialogue-Partners (two-tier approach) 【Modality A】(Oct 2004) 2005 Host C: Malaysia 2007 Host C: China (Chinese Proposal) Bi-Annual Meeting Alternative Host: ASEAN / Non-ASEAN Membership: ASEAN + 3 ASEAN+3 Summit Coexist 【Agreed Modality】 1) ASEAN sits on a Driver’s Seat 2) Inclusive Membership 3) Co-exist with ASEAN+3 Summit

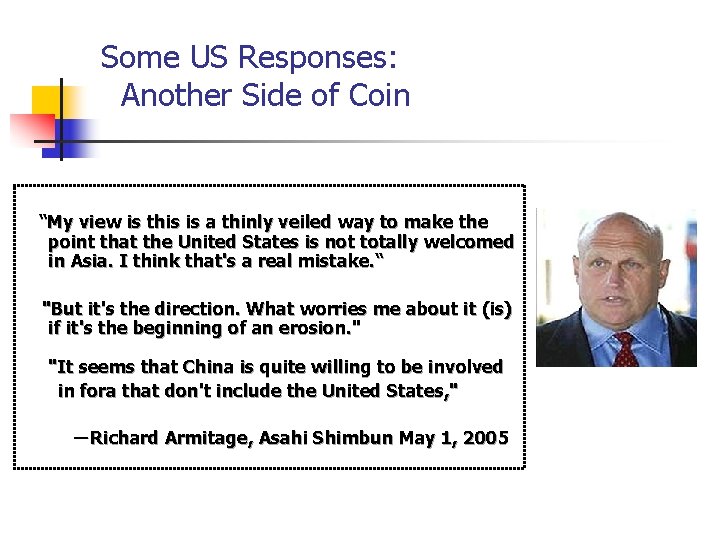

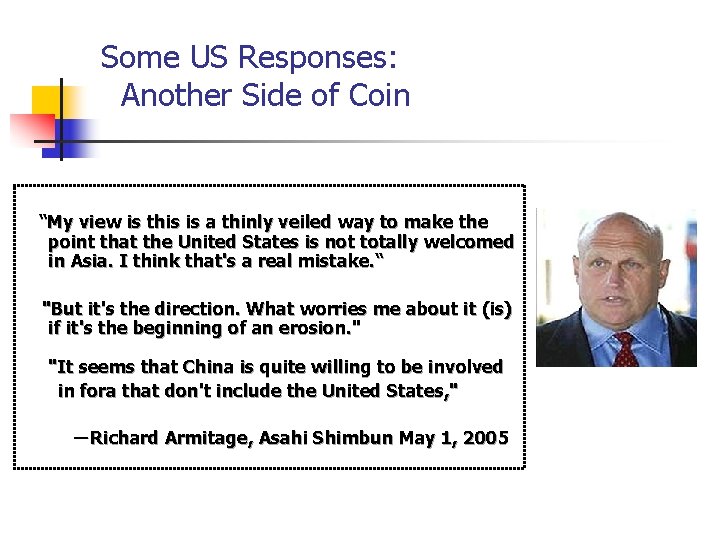

Some US Responses: Another Side of Coin “My view is this is a thinly veiled way to make the point that the United States is not totally welcomed in Asia. I think that's a real mistake. “ "But it's the direction. What worries me about it (is) if it's the beginning of an erosion. " "It seems that China is quite willing to be involved in fora that don't include the United States, " -Richard Armitage, Asahi Shimbun May 1, 2005

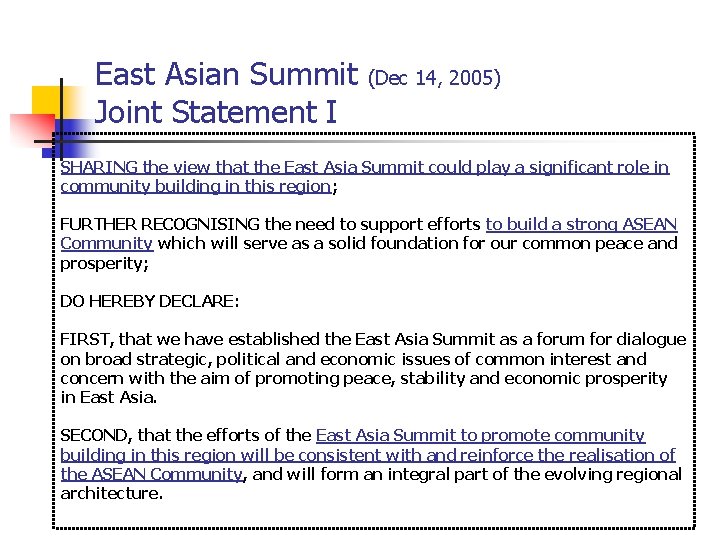

East Asian Summit Joint Statement I (Dec 14, 2005) SHARING the view that the East Asia Summit could play a significant role in community building in this region; FURTHER RECOGNISING the need to support efforts to build a strong ASEAN Community which will serve as a solid foundation for our common peace and prosperity; DO HEREBY DECLARE: FIRST, that we have established the East Asia Summit as a forum for dialogue on broad strategic, political and economic issues of common interest and concern with the aim of promoting peace, stability and economic prosperity in East Asia. SECOND, that the efforts of the East Asia Summit to promote community building in this region will be consistent with and reinforce the realisation of the ASEAN Community, and will form an integral part of the evolving regional architecture.

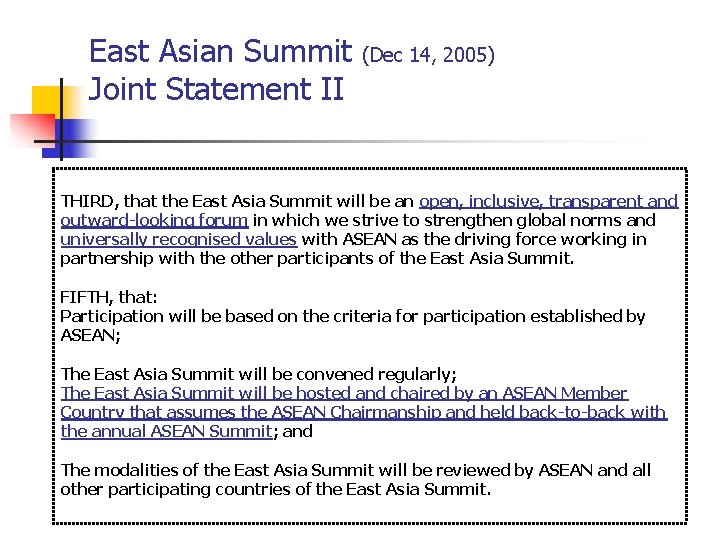

East Asian Summit Joint Statement II (Dec 14, 2005) THIRD, that the East Asia Summit will be an open, inclusive, transparent and outward-looking forum in which we strive to strengthen global norms and universally recognised values with ASEAN as the driving force working in partnership with the other participants of the East Asia Summit. FIFTH, that: Participation will be based on the criteria for participation established by ASEAN; The East Asia Summit will be convened regularly; The East Asia Summit will be hosted and chaired by an ASEAN Member Country that assumes the ASEAN Chairmanship and held back-to-back with the annual ASEAN Summit; and The modalities of the East Asia Summit will be reviewed by ASEAN and all other participating countries of the East Asia Summit.

China and the world east asian connections

China and the world east asian connections Chapter 8 china and the world east asian connections

Chapter 8 china and the world east asian connections How is the arirang song classified

How is the arirang song classified Southeast asian ministers of education organization

Southeast asian ministers of education organization Relative location of israel

Relative location of israel Community land summit

Community land summit East is east and west is west

East is east and west is west What are the roles of community health nurse

What are the roles of community health nurse Horizontal movement of air

Horizontal movement of air Laissez faire theory

Laissez faire theory Ministry of east african community affairs uganda

Ministry of east african community affairs uganda Central east community care access centre

Central east community care access centre Community action cycle

Community action cycle Gartner portfolio management summit

Gartner portfolio management summit Gartner peer forum 2017

Gartner peer forum 2017 Portfolio management gartner

Portfolio management gartner Elevated land with sloping sides and rounded summit

Elevated land with sloping sides and rounded summit Atd data summit

Atd data summit Difference between african elephant and asian elephant

Difference between african elephant and asian elephant Black and asian counselling network

Black and asian counselling network Tungsten fabric architecture

Tungsten fabric architecture Solar company summit county

Solar company summit county Summit county adult probation

Summit county adult probation Summit county continuum of care

Summit county continuum of care Microsoft summit sydney

Microsoft summit sydney