6 Accounting for Merchandising Businesses After studying this

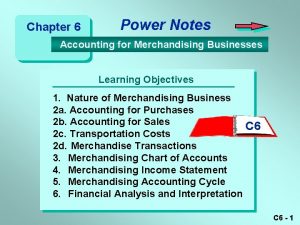

6 – Accounting for Merchandising Businesses After studying this chapter, you should be able to: 1. Distinguish between the activities and financial statements of service and merchandising businesses. 2. Describe and illustrate the financial statements of a merchandising business. 3. Describe and illustrate the accounting for merchandise transactions including: § purchase of merchandise § sale of merchandise § freight costs, sales taxes, trade discounts § dual nature of merchandising transactions. 4. Describe the adjusting and closing process for a merchandising business 1

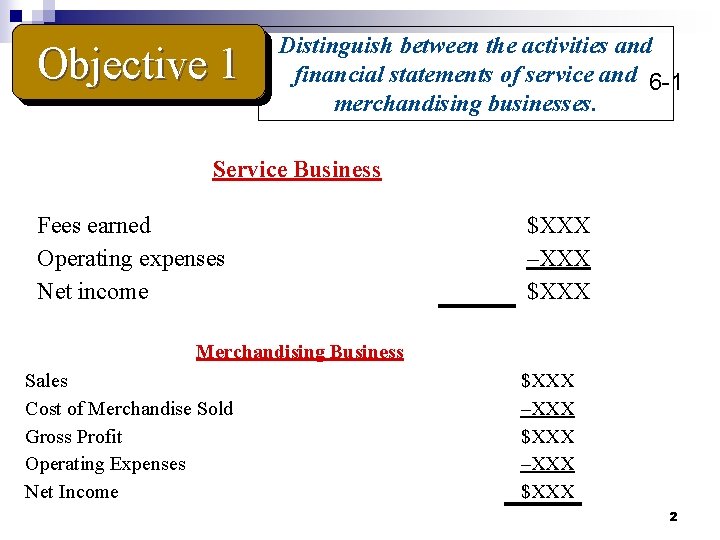

Objective 1 Distinguish between the activities and financial statements of service and 6 -1 merchandising businesses. Service Business Fees earned Operating expenses Net income $XXX –XXX $XXX Merchandising Business Sales Cost of Merchandise Sold Gross Profit Operating Expenses Net Income $XXX –XXX $XXX 2

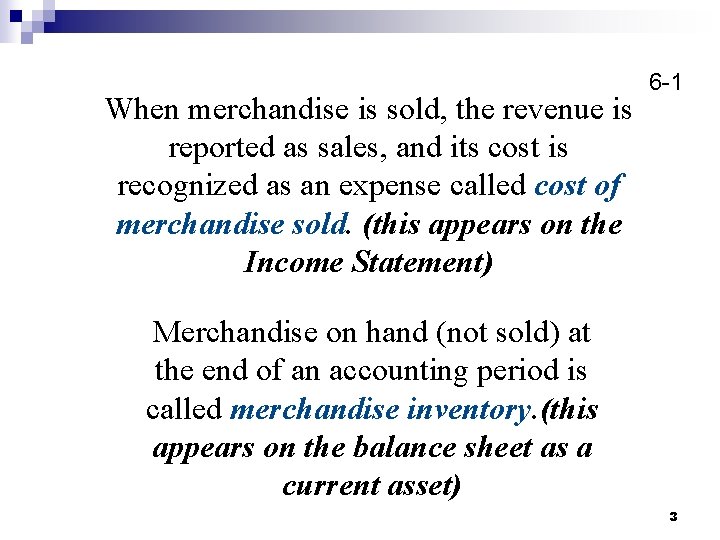

When merchandise is sold, the revenue is reported as sales, and its cost is recognized as an expense called cost of merchandise sold. (this appears on the Income Statement) 6 -1 Merchandise on hand (not sold) at the end of an accounting period is called merchandise inventory. (this appears on the balance sheet as a current asset) 3

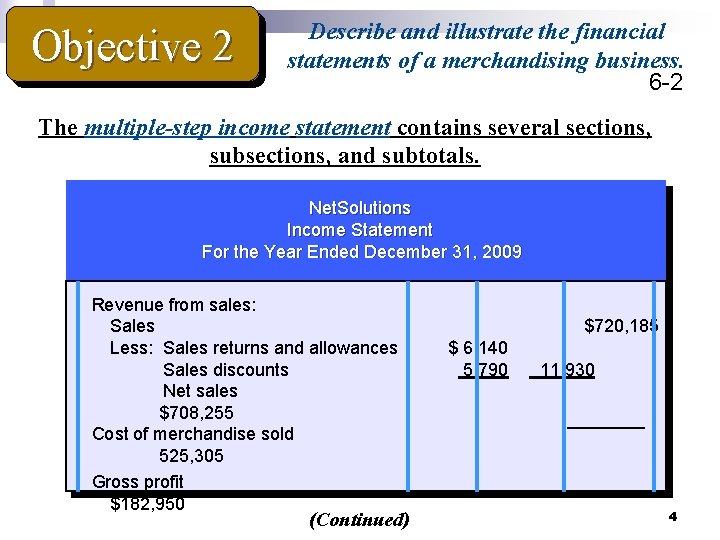

Objective 2 Describe and illustrate the financial statements of a merchandising business. 6 -2 The multiple-step income statement contains several sections, subsections, and subtotals. Net. Solutions Income Statement For the Year Ended December 31, 2009 Revenue from sales: Sales Less: Sales returns and allowances Sales discounts Net sales $708, 255 Cost of merchandise sold 525, 305 Gross profit $182, 950 (Continued) $720, 185 $ 6, 140 5, 790 11, 930 4

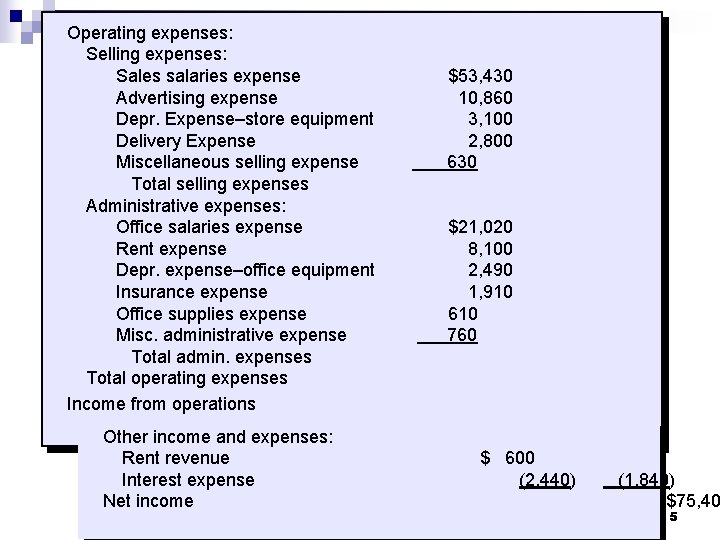

Operating expenses: Selling expenses: Sales salaries expense Advertising expense Depr. Expense–store equipment Delivery Expense Miscellaneous selling expense Total selling expenses Administrative expenses: Office salaries expense Rent expense Depr. expense–office equipment Insurance expense Office supplies expense Misc. administrative expense Total admin. expenses Total operating expenses Income from operations Other income and expenses: Rent revenue Interest expense Net income $53, 430 10, 860 3, 100 2, 800 630 $21, 020 8, 100 2, 490 1, 910 610 760 $ 600 (2, 440) (1, 840) $75, 40 5

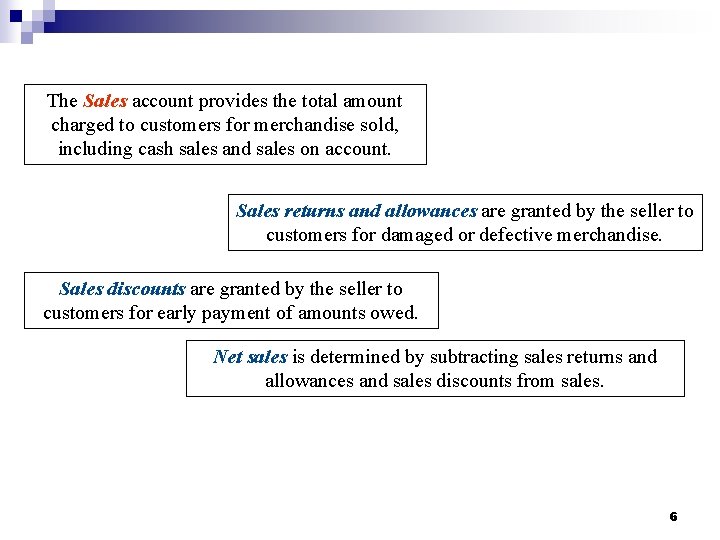

The Sales account provides the total amount charged to customers for merchandise sold, including cash sales and sales on account. Sales returns and allowances are granted by the seller to customers for damaged or defective merchandise. Sales discounts are granted by the seller to customers for early payment of amounts owed. Net sales is determined by subtracting sales returns and allowances and sales discounts from sales. 6

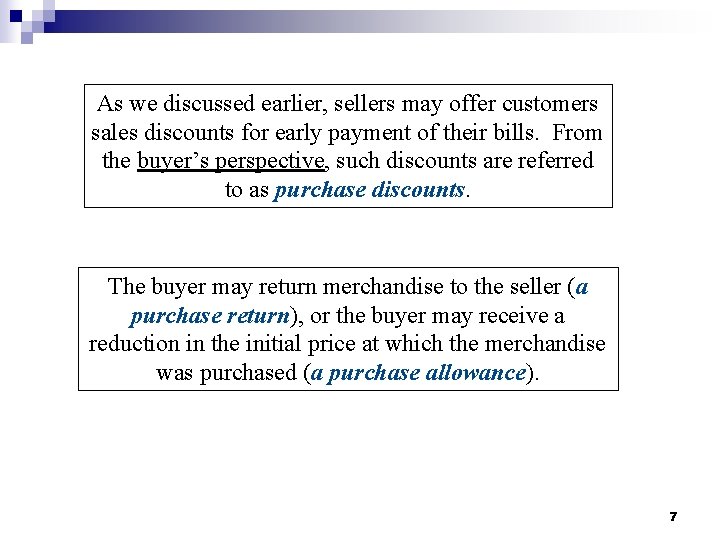

As we discussed earlier, sellers may offer customers sales discounts for early payment of their bills. From the buyer’s perspective, such discounts are referred to as purchase discounts. The buyer may return merchandise to the seller (a purchase return), or the buyer may receive a reduction in the initial price at which the merchandise was purchased (a purchase allowance). 7

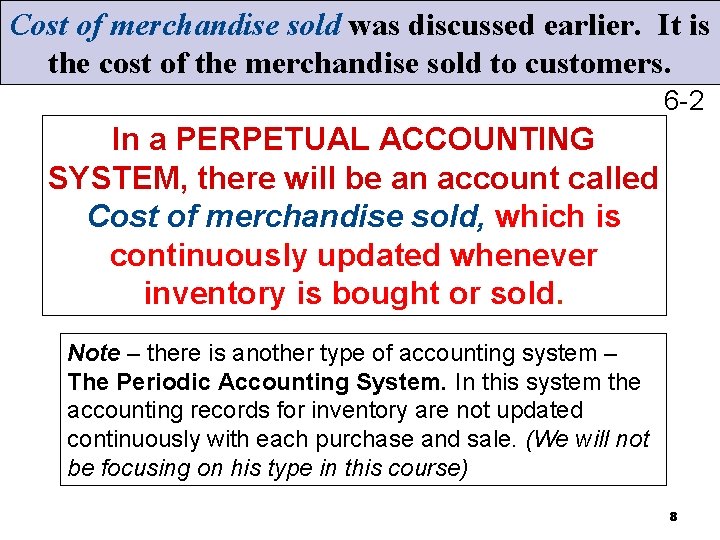

Cost of merchandise sold was discussed earlier. It is the cost of the merchandise sold to customers. 6 -2 In a PERPETUAL ACCOUNTING SYSTEM, there will be an account called Cost of merchandise sold, which is continuously updated whenever inventory is bought or sold. Note – there is another type of accounting system – The Periodic Accounting System. In this system the accounting records for inventory are not updated continuously with each purchase and sale. (We will not be focusing on his type in this course) 8

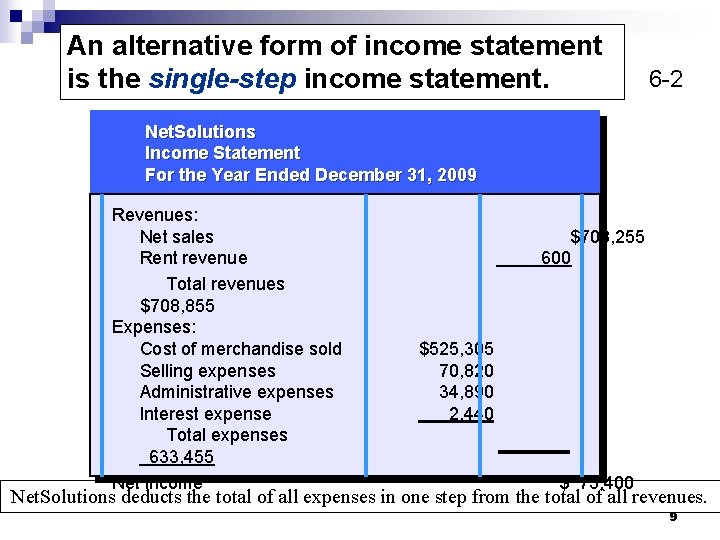

An alternative form of income statement is the single-step income statement. 6 -2 Net. Solutions Income Statement For the Year Ended December 31, 2009 Revenues: Net sales Rent revenue Total revenues $708, 855 Expenses: Cost of merchandise sold Selling expenses Administrative expenses Interest expense Total expenses 633, 455 Net income $708, 255 600 $525, 305 70, 820 34, 890 2, 440 $ 75, 400 Net. Solutions deducts the total of all expenses in one step from the total of all revenues. 9

Objective 3 6 -3 Describe and illustrate the accounting for merchandise transactions including: sale of merchandise; purchase of merchandise; freight costs, sales taxes, trade discounts; dual nature of merchandise transactions. Recall that we are using the PERPETUAL SYSTEM 10

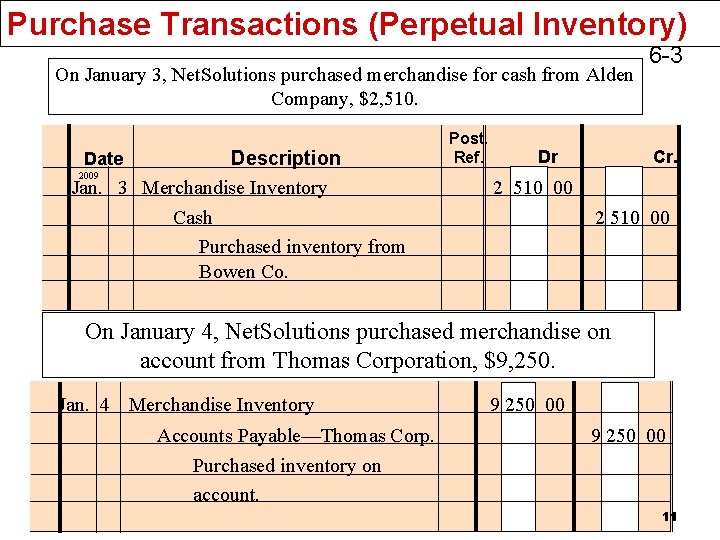

Purchase Transactions (Perpetual Inventory) On January 3, Net. Solutions purchased merchandise for cash from Alden Company, $2, 510. Description 2009 Jan. 3 Merchandise Inventory Cash Purchased inventory from Bowen Co. Date Post. Ref. Dr 6 -3 Cr. 2 510 00 On January 4, Net. Solutions purchased merchandise on account from Thomas Corporation, $9, 250. Jan. 4 Merchandise Inventory Accounts Payable—Thomas Corp. Purchased inventory on account. 9 250 00 45 9 250 00 11

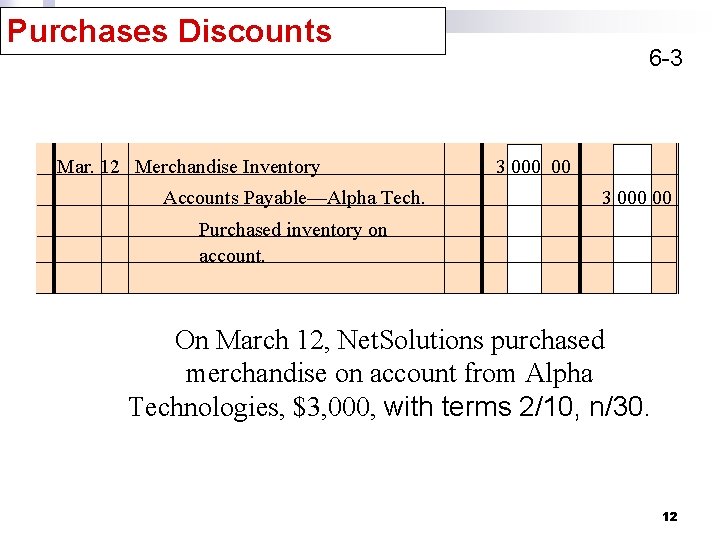

Purchases Discounts Mar. 12 Merchandise Inventory Accounts Payable—Alpha Tech. 6 -3 3 000 00 Purchased inventory on account. On March 12, Net. Solutions purchased merchandise on account from Alpha Technologies, $3, 000, with terms 2/10, n/30. 12

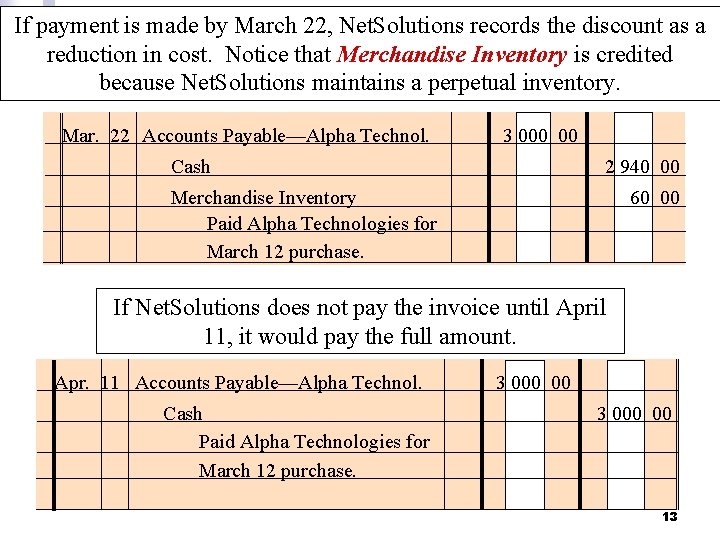

If payment is made by March 22, Net. Solutions records the discount as a reduction in cost. Notice that Merchandise Inventory is credited because Net. Solutions maintains a perpetual inventory. Mar. 22 Accounts Payable—Alpha Technol. 3 000 00 Cash 2 940 00 Merchandise Inventory Paid Alpha Technologies for March 12 purchase. 60 00 If Net. Solutions does not pay the invoice until April 11, it would pay the full amount. Apr. 11 Accounts Payable—Alpha Technol. Cash Paid Alpha Technologies for March 12 purchase. 3 000 00 13

Purchases Returns A purchases return involves actually returning merchandise that is damaged or does not meet the specifications of the order. 6 -3 Purchases Allowances When the defective or incorrect merchandise is kept by the buyer and the vendor makes a price adjustment, this is a purchases allowance. 14

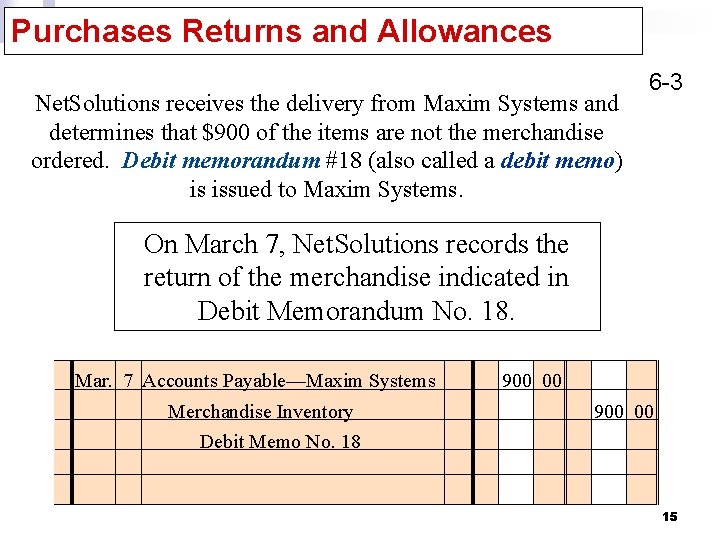

Purchases Returns and Allowances Net. Solutions receives the delivery from Maxim Systems and determines that $900 of the items are not the merchandise ordered. Debit memorandum #18 (also called a debit memo) is issued to Maxim Systems. 6 -3 On March 7, Net. Solutions records the return of the merchandise indicated in Debit Memorandum No. 18. Mar. 7 Accounts Payable—Maxim Systems Merchandise Inventory Debit Memo No. 18 900 00 15

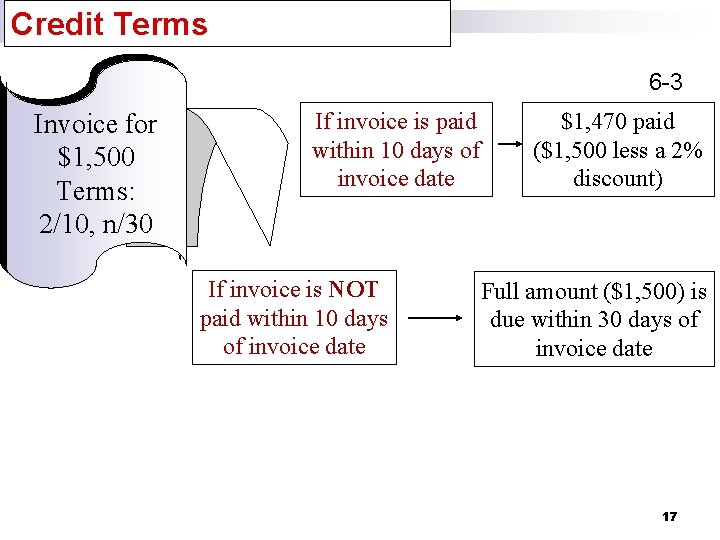

Sales (Purchases) Discounts 6 -3 The terms for when payments for merchandise are to be made, agreed on by the buyer and the seller, are called credit terms. If buyer is allowed an amount of time to pay, it is known as the credit period. 16

Credit Terms 6 -3 Invoice for $1, 500 Terms: 2/10, n/30 If invoice is paid within 10 days of invoice date If invoice is NOT paid within 10 days of invoice date $1, 470 paid ($1, 500 less a 2% discount) Full amount ($1, 500) is due within 30 days of invoice date 17

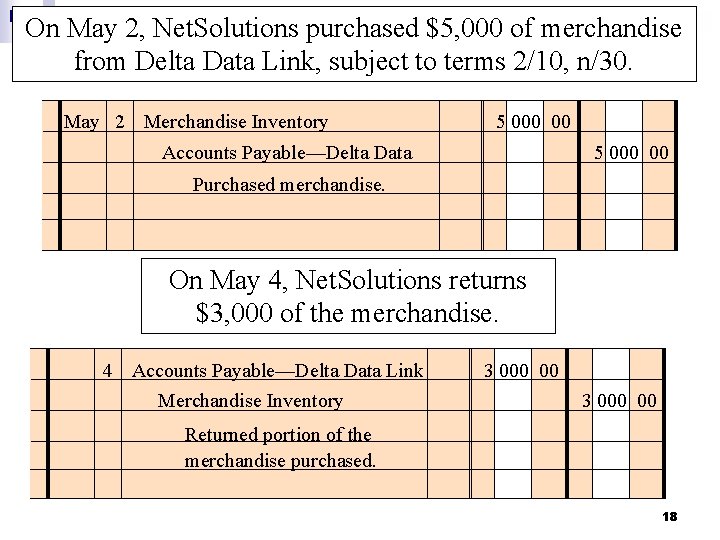

On May 2, Net. Solutions purchased $5, 000 of merchandise from Delta Data Link, subject to terms 2/10, n/30. May 2 Merchandise Inventory 5 000 00 Accounts Payable—Delta Data 5 000 00 Purchased merchandise. On May 4, Net. Solutions returns $3, 000 of the merchandise. 4 Accounts Payable—Delta Data Link Merchandise Inventory 3 000 00 Returned portion of the merchandise purchased. 18

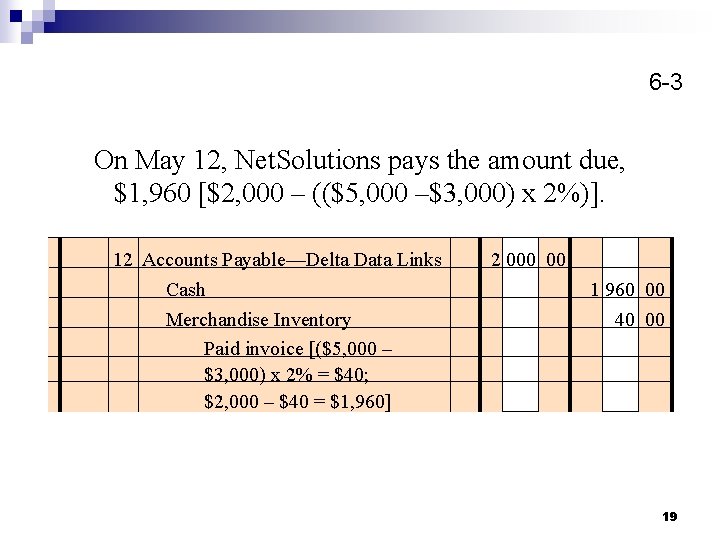

6 -3 On May 12, Net. Solutions pays the amount due, $1, 960 [$2, 000 – (($5, 000 –$3, 000) x 2%)]. 12 Accounts Payable—Delta Data Links Cash Merchandise Inventory Paid invoice [($5, 000 – $3, 000) x 2% = $40; $2, 000 – $40 = $1, 960] 2 000 00 1 960 00 40 00 19

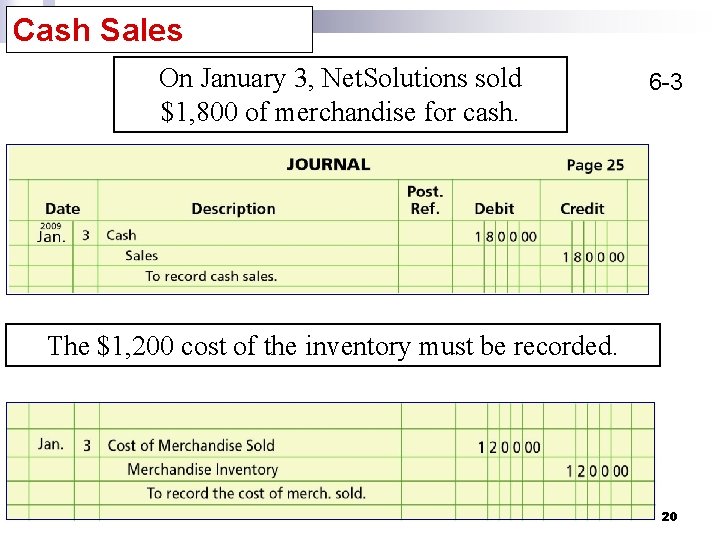

Cash Sales On January 3, Net. Solutions sold $1, 800 of merchandise for cash. 6 -3 The $1, 200 cost of the inventory must be recorded. 20

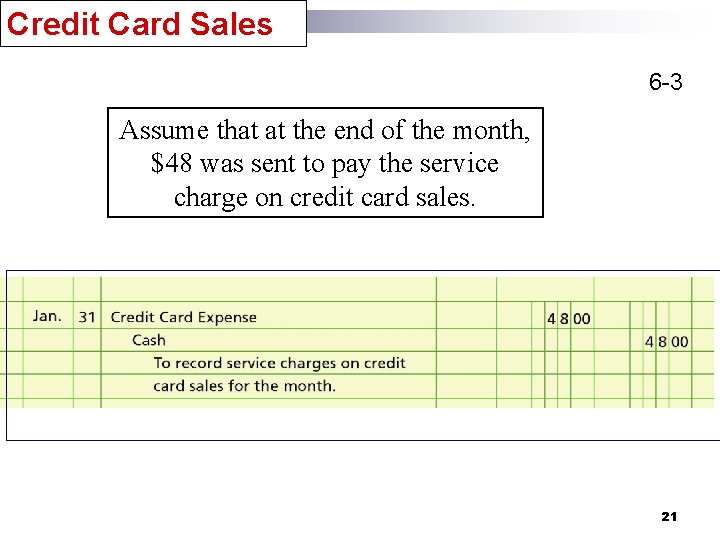

Credit Card Sales 6 -3 Assume that at the end of the month, $48 was sent to pay the service charge on credit card sales. 21

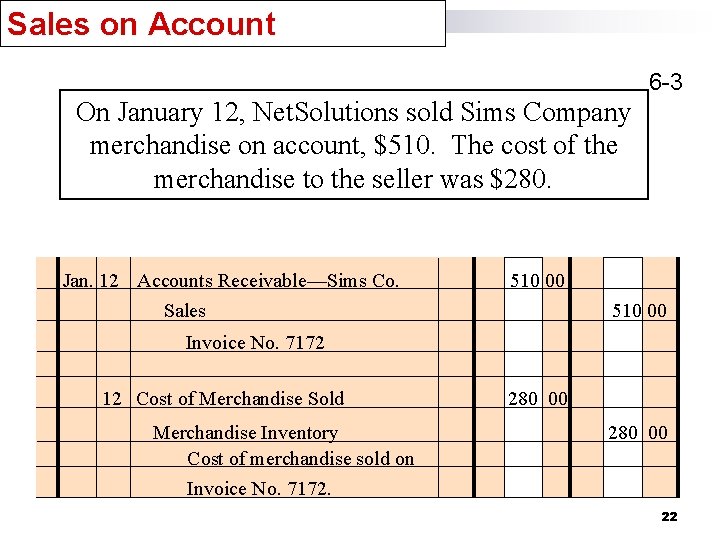

Sales on Account 6 -3 On January 12, Net. Solutions sold Sims Company merchandise on account, $510. The cost of the merchandise to the seller was $280. Jan. 12 Accounts Receivable—Sims Co. 510 00 Sales 510 00 Invoice No. 7172 12 Cost of Merchandise Sold Merchandise Inventory Cost of merchandise sold on Invoice No. 7172. 280 00 22

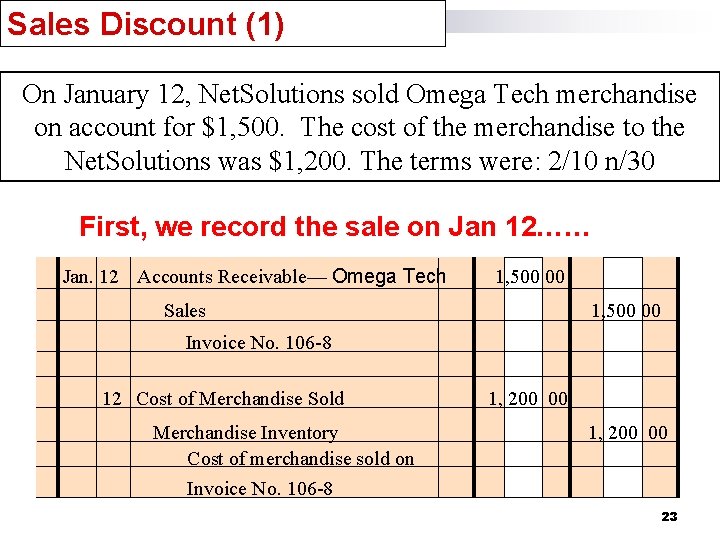

Sales Discount (1) On January 12, Net. Solutions sold Omega Tech merchandise on account for $1, 500. The cost of the merchandise to the Net. Solutions was $1, 200. The terms were: 2/10 n/30 First, we record the sale on Jan 12…… Jan. 12 Accounts Receivable— Omega Tech 1, 500 00 Sales 1, 500 00 Invoice No. 106 -8 12 Cost of Merchandise Sold Merchandise Inventory Cost of merchandise sold on Invoice No. 106 -8 1, 200 00 23

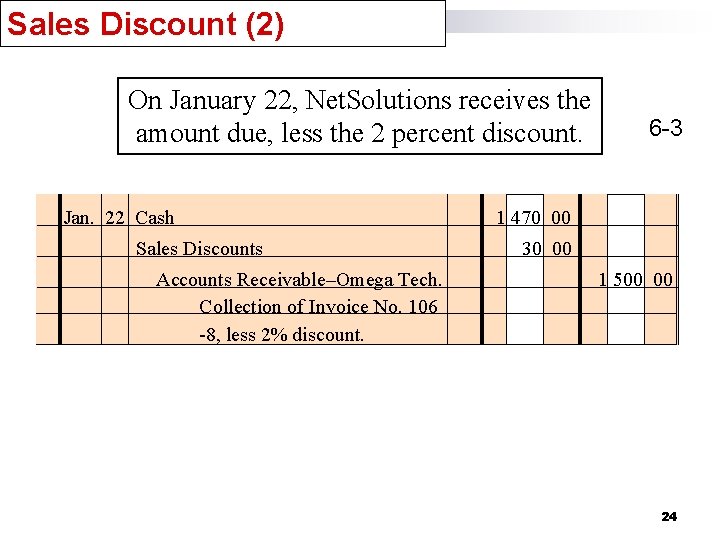

Sales Discount (2) On January 22, Net. Solutions receives the amount due, less the 2 percent discount. Jan. 22 Cash Sales Discounts Accounts Receivable–Omega Tech. Collection of Invoice No. 106 -8, less 2% discount. 6 -3 1 470 00 30 00 1 500 00 24

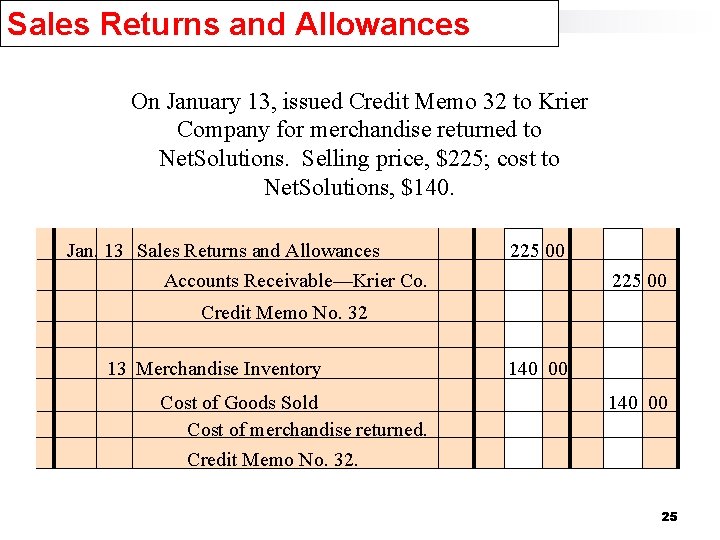

Sales Returns and Allowances On January 13, issued Credit Memo 32 to Krier Company for merchandise returned to Net. Solutions. Selling price, $225; cost to Net. Solutions, $140. Jan. 13 Sales Returns and Allowances 225 00 Accounts Receivable—Krier Co. 225 00 Credit Memo No. 32 13 Merchandise Inventory Cost of Goods Sold Cost of merchandise returned. Credit Memo No. 32. 140 00 25

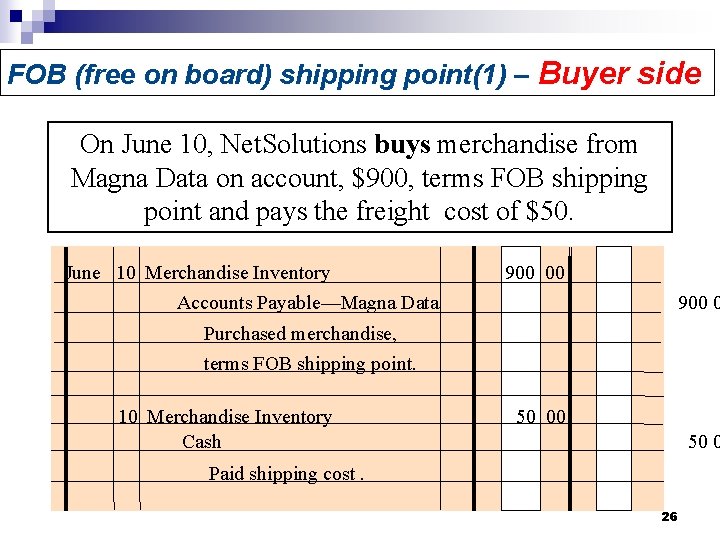

FOB (free on board) shipping point(1) – Buyer side On June 10, Net. Solutions buys merchandise from Magna Data on account, $900, terms FOB shipping point and pays the freight cost of $50. June 10 Merchandise Inventory Accounts Payable—Magna Data 900 00 900 0 Purchased merchandise, terms FOB shipping point. 10 Merchandise Inventory Cash 50 00 50 0 Paid shipping cost. 26

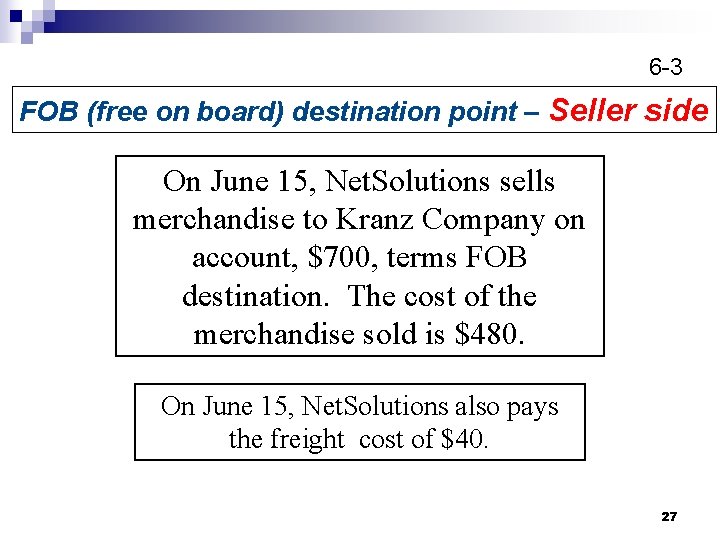

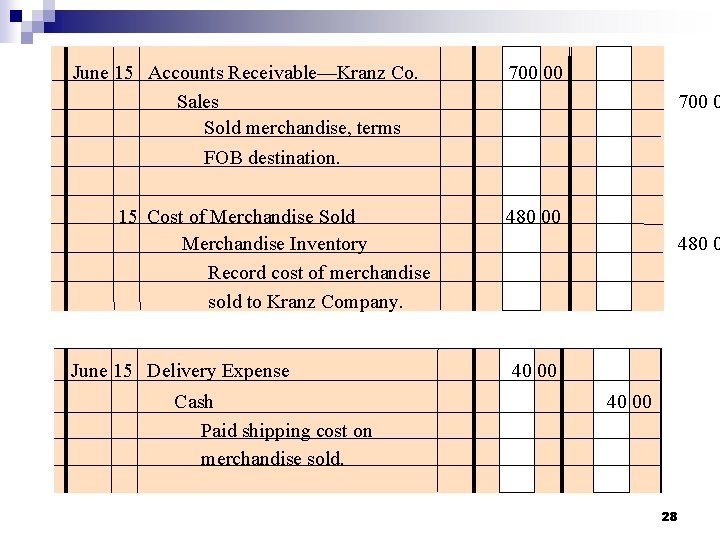

6 -3 FOB (free on board) destination point – Seller side On June 15, Net. Solutions sells merchandise to Kranz Company on account, $700, terms FOB destination. The cost of the merchandise sold is $480. On June 15, Net. Solutions also pays the freight cost of $40. 27

June 15 Accounts Receivable—Kranz Co. Sales Sold merchandise, terms FOB destination. 15 Cost of Merchandise Sold Merchandise Inventory Record cost of merchandise sold to Kranz Company. June 15 Delivery Expense Cash Paid shipping cost on merchandise sold. 700 00 700 0 480 0 40 00 28

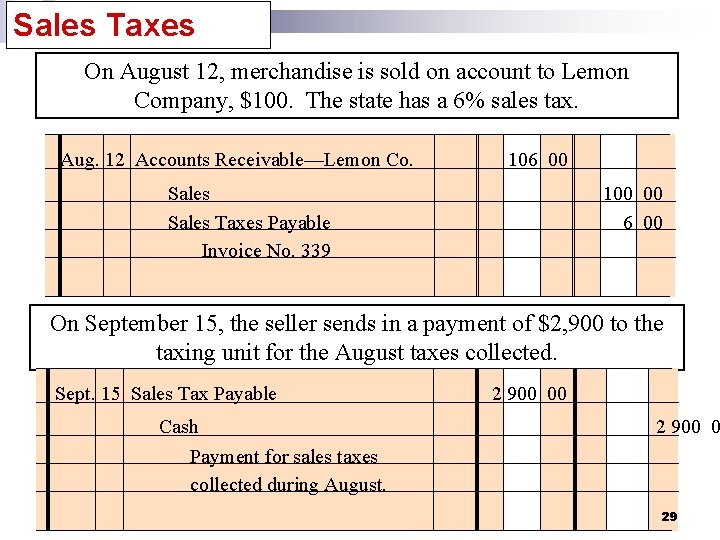

Sales Taxes On August 12, merchandise is sold on account to Lemon Company, $100. The state has a 6% sales tax. Aug. 12 Accounts Receivable—Lemon Co. 106 00 Sales Taxes Payable Invoice No. 339 100 00 6 00 On September 15, the seller sends in a payment of $2, 900 to the taxing unit for the August taxes collected. Sept. 15 Sales Tax Payable Cash 2 900 00 2 900 0 Payment for sales taxes collected during August. 29

Dual Nature of Merchandise Transactions Each merchandising transaction affects a buyer and a seller. In the following illustrations, we show the same transactions would be recorded by both the seller and the buyer. See page 272 30

Objective 4 Describe the adjusting and closing process for a merchandising business. 6 -4 Adjusting Entries Inventory Shrinkage Merchandising businesses may experience some loss of inventory due to shoplifting, employee theft, or errors in recording or counting inventory. If the balance of the Merchandise Inventory account is larger than the total amount of merchandise count, the difference is often called inventory shrinkage or inventory shortage. 31

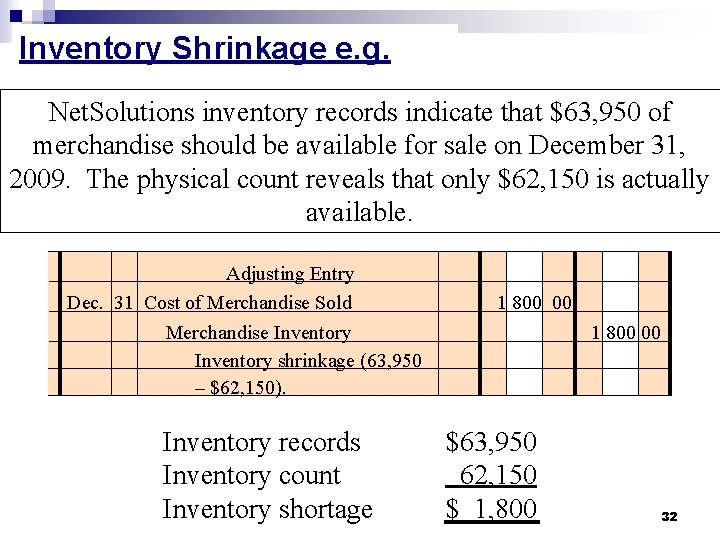

Inventory Shrinkage e. g. Net. Solutions inventory records indicate that $63, 950 of merchandise should be available for sale on December 31, 6 -4 2009. The physical count reveals that only $62, 150 is actually available. Adjusting Entry Dec. 31 Cost of Merchandise Sold Merchandise Inventory shrinkage (63, 950 – $62, 150). Inventory records Inventory count Inventory shortage 1 800 00 $63, 950 62, 150 $ 1, 800 32

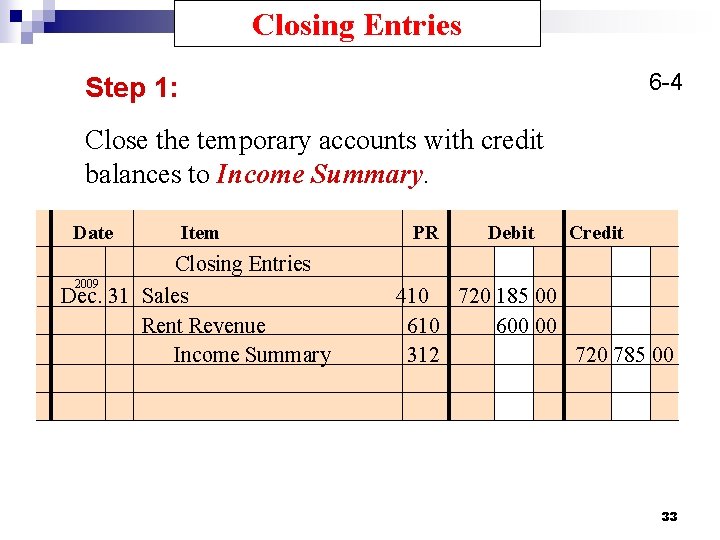

Closing Entries 6 -4 Step 1: Close the temporary accounts with credit balances to Income Summary. Date Item Closing Entries 2009 Dec. 31 Sales Rent Revenue Income Summary PR Debit Credit 410 720 185 00 610 600 00 312 720 785 00 33

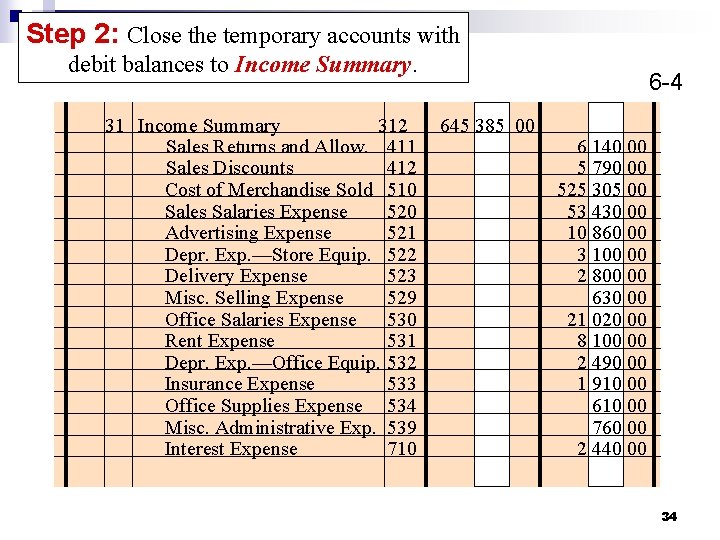

Step 2: Close the temporary accounts with debit balances to Income Summary. 31 Income Summary 312 Sales Returns and Allow. 411 Sales Discounts 412 Cost of Merchandise Sold 510 Sales Salaries Expense 520 Advertising Expense 521 Depr. Exp. —Store Equip. 522 Delivery Expense 523 Misc. Selling Expense 529 Office Salaries Expense 530 Rent Expense 531 Depr. Exp. —Office Equip. 532 Insurance Expense 533 Office Supplies Expense 534 Misc. Administrative Exp. 539 Interest Expense 710 6 -4 645 385 00 6 140 00 5 790 00 525 305 00 53 430 00 10 860 00 3 100 00 2 800 00 630 00 21 020 00 8 100 00 2 490 00 1 910 00 610 00 760 00 2 440 00 34

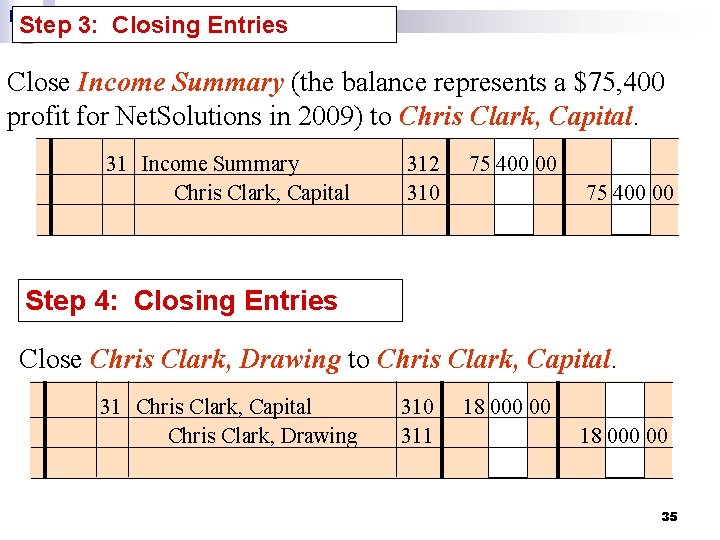

Step 3: Closing Entries Close Income Summary (the balance represents a $75, 400 profit for Net. Solutions in 2009) to Chris Clark, Capital. 31 Income Summary Chris Clark, Capital 312 310 75 400 00 Step 4: Closing Entries Close Chris Clark, Drawing to Chris Clark, Capital. 31 Chris Clark, Capital Chris Clark, Drawing 310 311 18 000 00 35

- Slides: 35