Withdrawal of VAT Exemption for Research Services This

- Slides: 19

Withdrawal of VAT Exemption for Research Services This was presented at the Research Services Support Conference 1 st July 2013 and represents guidance on the changes as known at that time. HMRC’s principal guidance on this matter is contained in Revenue & Customs Brief 10/13. Supplementary guidance on transitional arrangements is expected to be issued by HMRC and will be published here once details are available. 19 th July 2013

Withdrawal of VAT Exemption for Research Services Louise Bissell – Head of Corporate Accounts June Harris – VAT Manager James Gillen – Senior VAT Assistant

Current position: Income received by the University for research purposes can be: • Vatable at the standard rate, (e. g. commercial contracts) • Vatable at the zero rate (e. g. overseas, EU VAT registered) • Exempt from a VAT charge (e. g. universities) • Outside the scope of VAT (e. g. RCUK and charities)

With effect from 1 st August 2013: Exempt from a VAT charge (or is treated as VAT exempt) will no longer apply Currently exempt: Supplies of research between ‘eligible bodies’ e. g. • Payment (consideration) received by Uo. M (an eligible body for research purposes) for research services provided to another eligible body • Payment made by Uo. M for receipt of research services provided by another eligible body

What is an eligible body? • UK universities • UK public bodies e. g. Local Authority, Government Department, Health Authority etc. • Non-profit making organisations that meet certain conditions

Background to withdrawal of exemption • EC notified the UK that exemption for supplies of research did not comply with European legislation • Germany had been similarly advised in 2002 • HMRC Consultation held between December 2012 and March 2013 • HMRC conclusion: widespread confusion regarding correct VAT treatment between ‘exempt’ and ‘outside the scope’ of VAT transactions • Revenue & Customs Brief 10/13 issued April 2013

Effect of withdrawal of VAT exemption Currently: • No material distinction between VAT exempt research income and outside the scope research income; no VAT due on income nor recoverable on expenditure From 1 st August ’ 13: • Supplies of research between eligible bodies will become standard rated if not meeting certain criteria Impact: • Cost of grant funded research will increase if part of work is subcontracted between Universities etc. • VAT on related expenditure is recoverable except payroll costs (research costs mainly payroll related!)

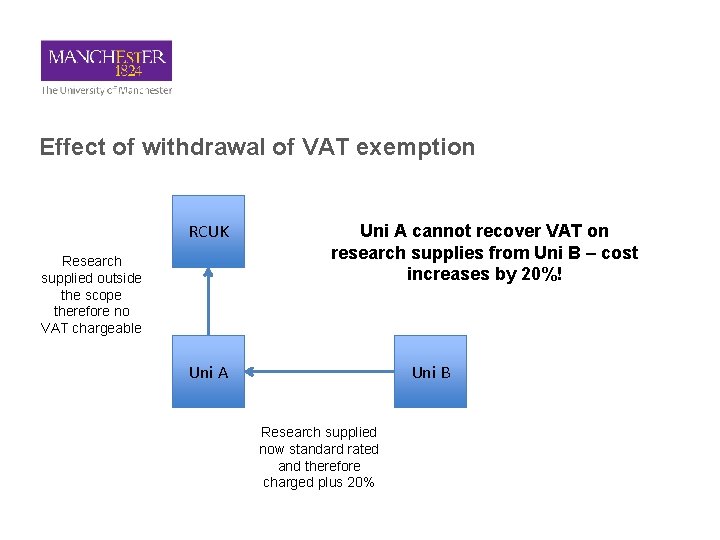

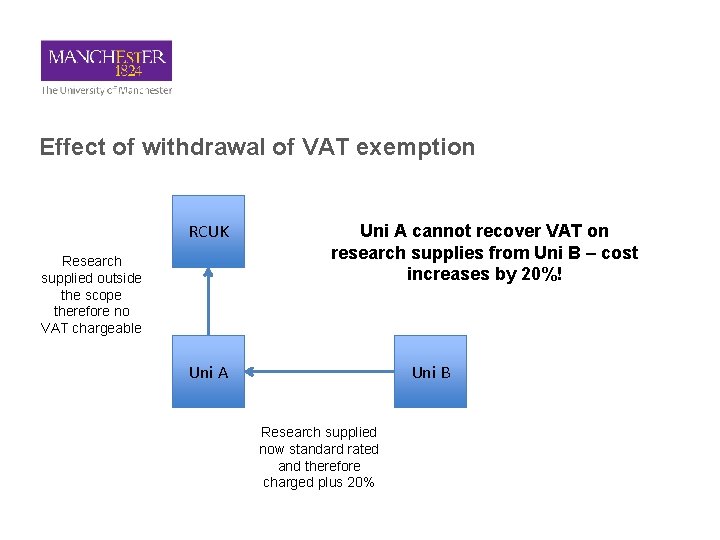

Effect of withdrawal of VAT exemption RCUK Research supplied outside the scope therefore no VAT chargeable Uni A cannot recover VAT on research supplies from Uni B – cost increases by 20%! Uni A Uni B Research supplied now standard rated and therefore charged plus 20%

Outside the scope research • Research funding which is collaborative and outside the scope of VAT will be unaffected by the change in legislation • If sub-contracting services – then standard rated • Therefore optimum is for research services between eligible bodies, e. g. universities, to be treated as outside the scope • Four main scenarios. .

Outside the scope research (continued) Scenario 1 • Research which is funded by either the public sector or by the charitable sector • Must be for the wider public benefit • No direct benefit for the funding body

Outside the scope research (continued) Scenario 2 • Research funded for the general public good • Either not expected to generate any IP; or • Reports or findings will be freely available to others

Outside the scope research (continued) Scenario 3 • Collaborative agreement between different research institutions • All parties to the grant are named on the application to the funding body (eg RCUK or charity or NHS) • This is the key change for universities and key message from HMRC’s guidance

Outside the scope research (continued) Scenario 4 • Where funding flows through one named party • This party acts purely as a conduit passing on funds to others involved in the research project

Collaborative research HMRC definition ‘Where several bodies (typically universities or other eligible bodies) get together to apply for grant funding to undertake a research project. It is not uncommon for one of the applicants to be shown as the head or lead body which deals primarily with the funding body including receiving funding which is passed to other applicant bodies for their contribution to the project. For ease contracts are often concluded only in the name of the funding body and the lead research body even though this is a collaborative project’

Collaborative research (continued) HMRC also states that it: ‘Will accept in such cases of collaborative research, all research services provided by each of the bodies involved in the project are outside the Scope of VAT, even if the funding may be passed on by the lead research body to others and that only the lead research body is party to the contract with the funding body’. Best evidence: Partners named on the original application for funding

Current issues • Late or substituted collaborators? • Commercial parties? • HMRC are expected to issue further guidance re. transitional arrangements from 1 st August 2013 • Eg grandfathering of existing contracts? • Guidance still outstanding

Actions to mitigate the effect of the withdrawal • Identify all the research institutions who will be participating • Ensure that they are all named on the funding application • Where funding is received initially by a lead party – helpful if the funding body lists all collaborators in an annex to the grant letter • If unsure – ASK THE VAT TEAM!

Any Questions?

Contact Details: Primary Contact: James Gillen (Senior VAT Assistant) Tel: 52165 Email: james. gillen@manchester. ac. uk June Harris (VAT Manager) Tel: 52133 Email: june. harris@manchester. ac. uk Louise Bissell (Head of Corporate Accounts) Tel: 52528 Email: louise. bissell@manchester. ac. uk

Vat input

Vat input Vat input meaning

Vat input meaning Vat input meaning

Vat input meaning Vai trò của thực vật đối với động vật

Vai trò của thực vật đối với động vật Vat on research services

Vat on research services Goods and services exempted from vat in rwanda

Goods and services exempted from vat in rwanda Flsa exemption test flow chart

Flsa exemption test flow chart Lcisd exemption policy

Lcisd exemption policy Ibp exemption policy

Ibp exemption policy 12555 extension position source

12555 extension position source Aes exemption

Aes exemption Split sleeper berth rule examples

Split sleeper berth rule examples Exemption certificate manager

Exemption certificate manager Cset exemption

Cset exemption Dol limited scope audit exemption

Dol limited scope audit exemption Managing sales tax exemption certificates

Managing sales tax exemption certificates Louisiana farm tax exemption

Louisiana farm tax exemption Scuml meaning

Scuml meaning Mysst exemption

Mysst exemption Good cause exemption indiana

Good cause exemption indiana