Commercial Farmers Exemption Certificate Program Use these computer

- Slides: 48

Commercial Farmer’s Exemption Certificate Program Use these computer keyboard keys to navigate within this course. Revised 6/26/2019

What is a Commercial Farmer? A “Commercial Farmer” is defined in Act 378 of the 2017 Regular Session as a person, partnership, or corporation who meets all of the following three requirements: 1. Occupationally engaged in producing food or agricultural commodities for sale or further use in producing food or such commodities for consumption or sale; 2. Regularly engaged in the commercial production for sale of vegetables, fruits, livestock and other food or agricultural products; and 3. Reports farm income and expenses on a federal Schedule F or similar federal tax form, including but not limited to, Form 1065, 1120 and 1120 S under the North American Industry Classification System (NAICS) Code beginning with 11 2

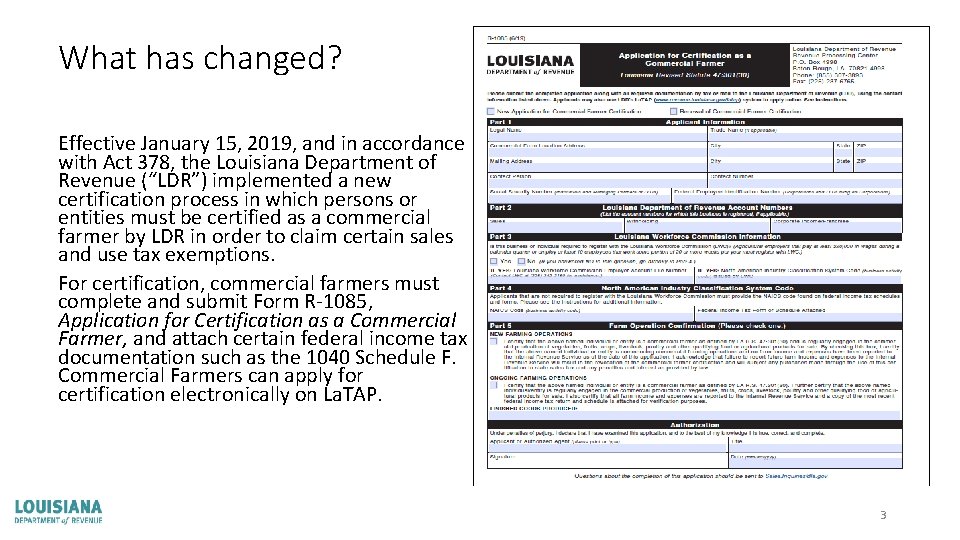

What has changed? Effective January 15, 2019, and in accordance with Act 378, the Louisiana Department of Revenue (“LDR”) implemented a new certification process in which persons or entities must be certified as a commercial farmer by LDR in order to claim certain sales and use tax exemptions. For certification, commercial farmers must complete and submit Form R-1085, Application for Certification as a Commercial Farmer, and attach certain federal income tax documentation such as the 1040 Schedule F. Commercial Farmers can apply for certification electronically on La. TAP. 3

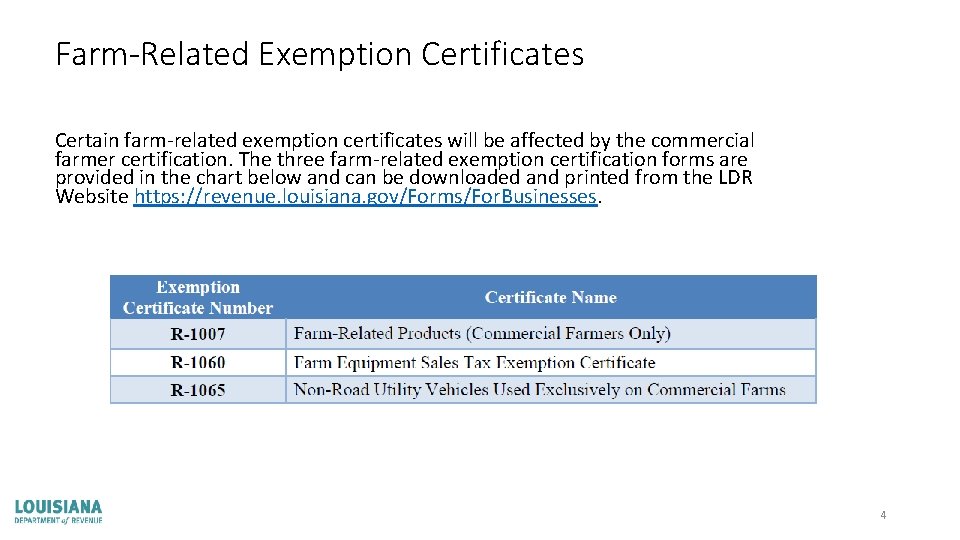

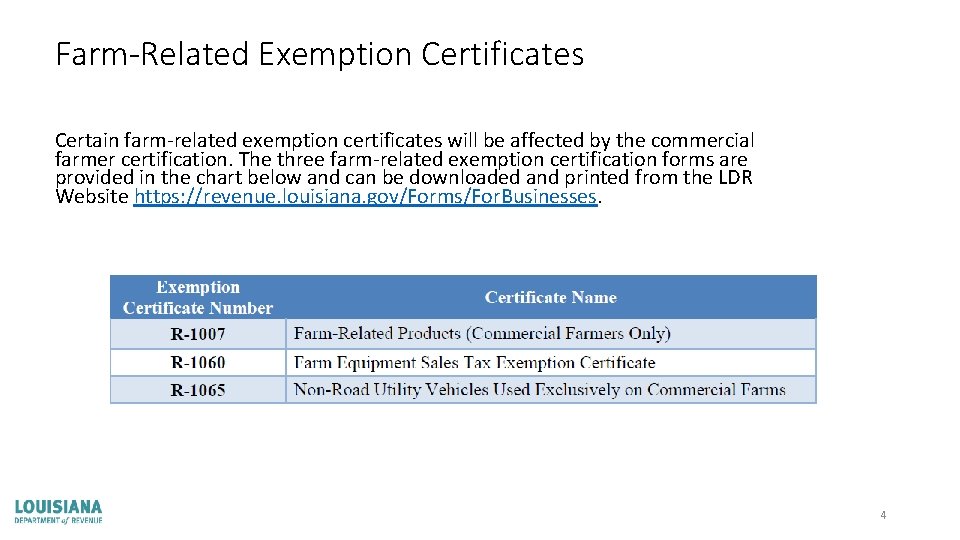

Farm-Related Exemption Certificates Certain farm-related exemption certificates will be affected by the commercial farmer certification. The three farm-related exemption certification forms are provided in the chart below and can be downloaded and printed from the LDR Website https: //revenue. louisiana. gov/Forms/For. Businesses. 4

Commercial Farmer Certification Current farmer exemption certificates will remain valid through June 30, 2019. Effective July 1, 2019, all farmers who currently use the applicable farm-related tax exemption certificates must be certified as Commercial Farmers by LDR in order to qualify for these sales tax farm exemptions. Starting July 1, 2019, the commercial farmer must attach a copy of their R-1091, Commercial Farmer Certification, to each completed applicable exemption certificate at the time of purchase in order to receive an exemption from state sales and use tax on the purchase of eligible farm-related items. 5

Dealers Responsibility The information entered in the Purchasers Information boxes for all three exemption certificates must match the information found on the Commercial Farmer Certification (R-1091). Exemption certificates will be considered invalid if the attached R-1091 does not match. Dealers are responsible for properly administering these agricultural sales tax exemptions. Dealers must request and retain from each commercial farmer a copy of their current commercial farmer certification and a completed applicable exemption certificate. If a dealer fails to retain copies of the commercial farmer certification and the applicable exemption certificate, then the dealer may be held liable for payment of the sales and use taxes due. 6

Commercial Farmer’s Certification Process 7

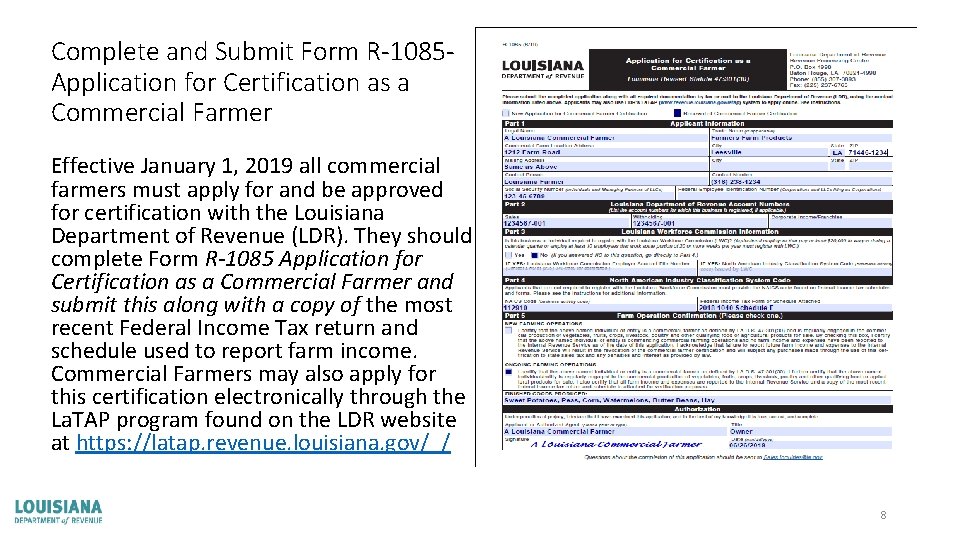

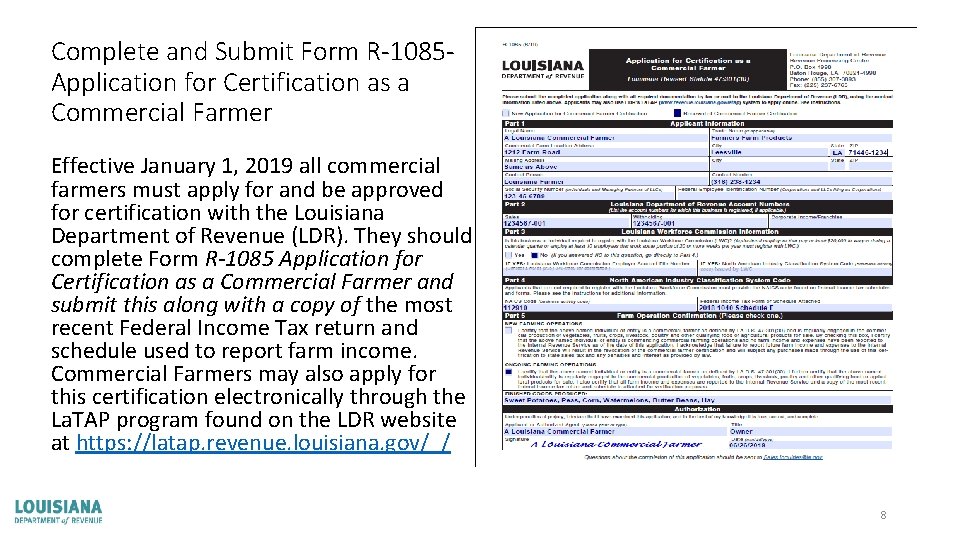

Complete and Submit Form R-1085 Application for Certification as a Commercial Farmer Effective January 1, 2019 all commercial farmers must apply for and be approved for certification with the Louisiana Department of Revenue (LDR). They should complete Form R-1085 Application for Certification as a Commercial Farmer and submit this along with a copy of the most recent Federal Income Tax return and schedule used to report farm income. Commercial Farmers may also apply for this certification electronically through the La. TAP program found on the LDR website at https: //latap. revenue. louisiana. gov/_/ 8

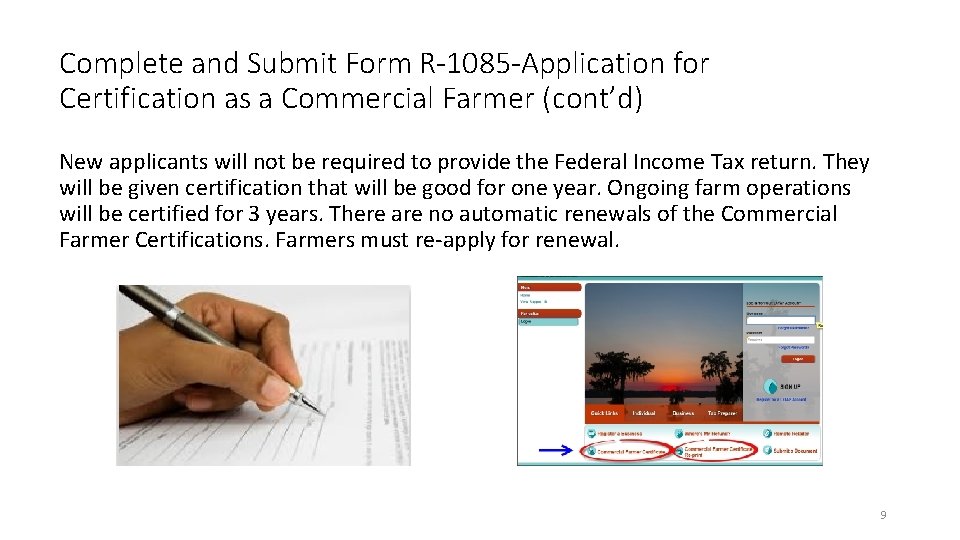

Complete and Submit Form R-1085 -Application for Certification as a Commercial Farmer (cont’d) New applicants will not be required to provide the Federal Income Tax return. They will be given certification that will be good for one year. Ongoing farm operations will be certified for 3 years. There are no automatic renewals of the Commercial Farmer Certifications. Farmers must re-apply for renewal. 9

Applications Commercial Farmers can submit the completed applications for certification as a commercial farmer to LDR by: 1. Facsimile to: (225) 237 -6765 2. Mail to: Louisiana Department of Revenue Processing Center PO Box 4998 Baton Rouge, LA 70821 -4998 3. Online via LDR’s La. TAP system by accessing https: //latap. revenue. louisiana. gov/ 10

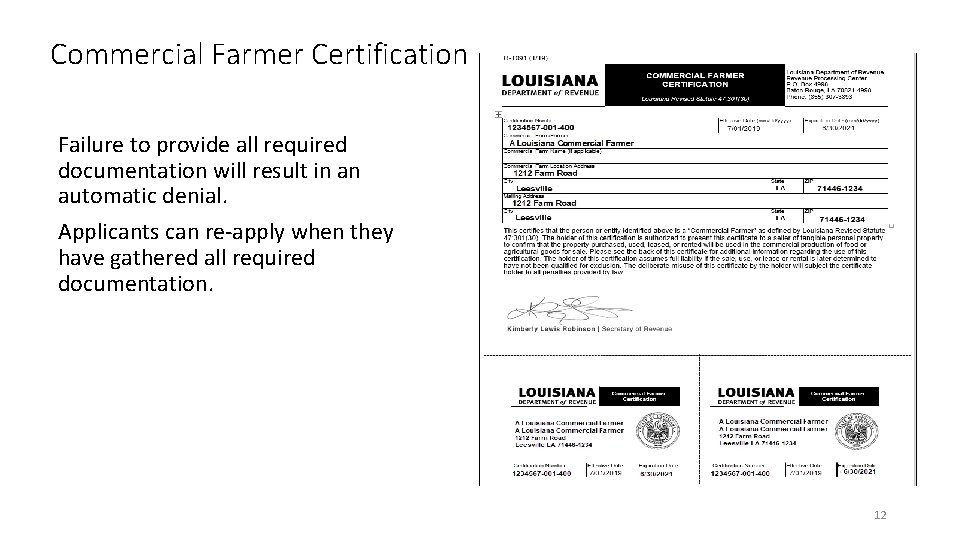

Application (cont’d) If the application is approved, the person or entity should receive Form R-1091, Commercial Farmer Certification within 2 -3 weeks. Each certification will contain two pocket-size versions of the certification. Reprints of the certification may be requested through LDR’s La. TAP system, by email (Sales. Inquires@la. gov), or by telephone (855 -3073893). 11

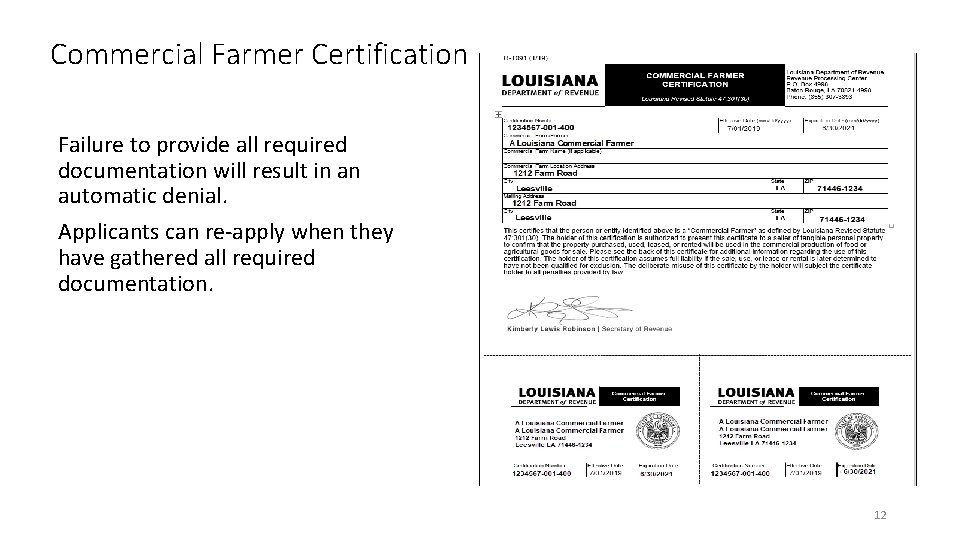

Commercial Farmer Certification Failure to provide all required documentation will result in an automatic denial. Applicants can re-apply when they have gathered all required documentation. 12

Items Eligible for Commercial Farmer Exemption R-1007 The following items may be eligible for exemption upon presentation of a valid commercial farmer certification and a completed, R-1007, exemption certificate: 1. Animal feed consumed only by livestock that are part of the purchaser’s commercial or agricultural stock such as cattle, sheep, goat, poultry, etc. The exemption may not be claimed on feed for animals held for personal use. [R. S. 47: 301(10)(e) and 47: 305(A)(3)] 2. Seed, fertilizers, or pesticides, including insecticides, herbicides, and fungicides used for planting or treatment of crops grown in commercial quantities for sale, or for consumption by livestock or livestock products that are for commercial sale. This exemption may not be claimed by persons growing vegetables, ornamental plants, lawns, etc. , for their personal use. [R. S. 47: 301(10)(e), 47: 305(D)(1)(f), 47: 305. 3, 47: 305. 8] 3. Polyroll tubing sold or used for commercial farm irrigation. [R. S. 47: 305. 25(A)(6), 47: 305. 63] 13

Items Eligible for Commercial Farmer Exemption R-1007 (cont’d) 4. Containers used in the packaging for sale of farm products grown by the commercial farmer. The containers must be sold with the farm products. [R. S. 47: 301(10)(a), 47: 305(D)(1)(f)] 5. Pharmaceuticals registered with the Louisiana Department of Agriculture and Forestry and administered to livestock used for agricultural purposes. The pharmaceuticals must be administered to the livestock by the commercial farmer. [R. S. 47: 301(16)(f)] 6. Feed and feed additives sold for agricultural or commercial purposes. Commercial purposes means purchasing, producing, or maintaining of animals, including breeding stock, for resale. [R. S. 47: 305(A)(4)(a), 47: 305(A)(4)(b)(i) & (iii)] 7. Diesel fuel, butane, propane, and other liquefied petroleum gases used for farm purposes such as a power source or as a heating fuel for equipment that is used directly in a commercial growing or livestock production operation. [R. S. 47: 305. 37] 14

Items Eligible for Commercial Farmer Exemption (cont’d) R-1060 Farm Equipment Sales Tax Exemption Certificate The sales or rental price paid for qualifying machinery and equipment used as an integral part of the production, processing, and storing of food and fiber. The qualifying machinery and equipment must be purchased by a certified commercial farmer. [R. S. 47: 301(3)(i), 47: 301(13)(c), 47: 301(13)(k), 47: 301(28)(a), 47: 305. 25] Dealers may continue to accept the existing LDR-approved R-1091, manufacturing machinery and equipment farmer exemption certificates until July 1, 2019. 15

Items Eligible for Commercial Farmer Exemption (cont’d) R-1065 Non-Road Utility Vehicles used exclusively on Commercial Farms Louisiana R. S. 47: 305. 25 provides an exemption on the first $50, 000 of the sales price of qualifying farm equipment. Purchasers must be certified as farmers by LDR and a copy of the approved R-1071 must be attached to this exemption certificate to certify the purchaser’s exempt status. 16

Exemption Certificates 17

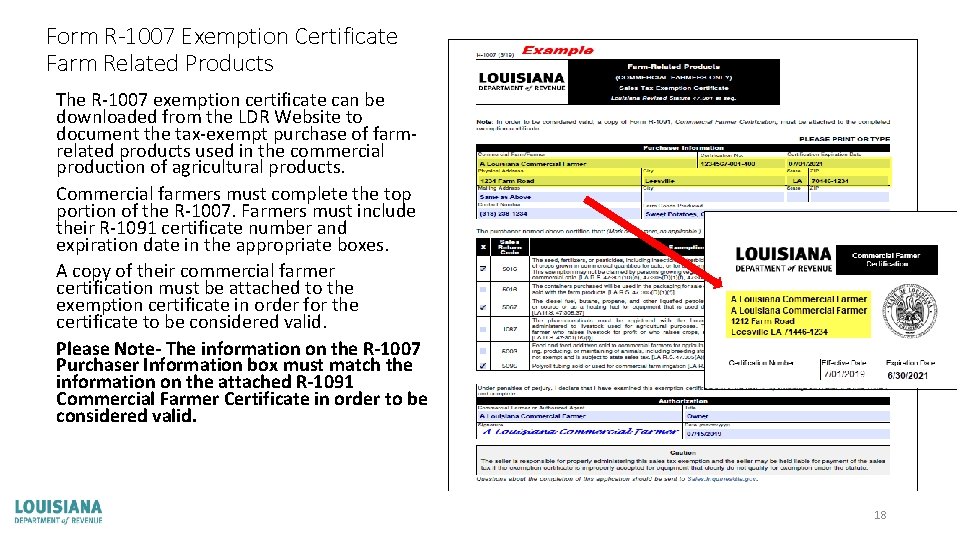

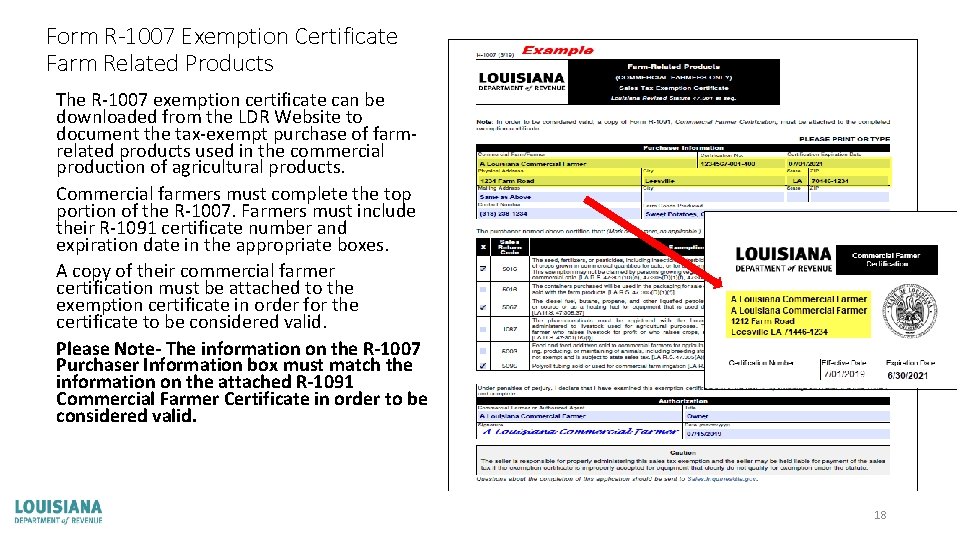

Form R-1007 Exemption Certificate Farm Related Products The R-1007 exemption certificate can be downloaded from the LDR Website to document the tax-exempt purchase of farmrelated products used in the commercial production of agricultural products. Commercial farmers must complete the top portion of the R-1007. Farmers must include their R-1091 certificate number and expiration date in the appropriate boxes. A copy of their commercial farmer certification must be attached to the exemption certificate in order for the certificate to be considered valid. Please Note- The information on the R-1007 Purchaser Information box must match the information on the attached R-1091 Commercial Farmer Certificate in order to be considered valid. 18

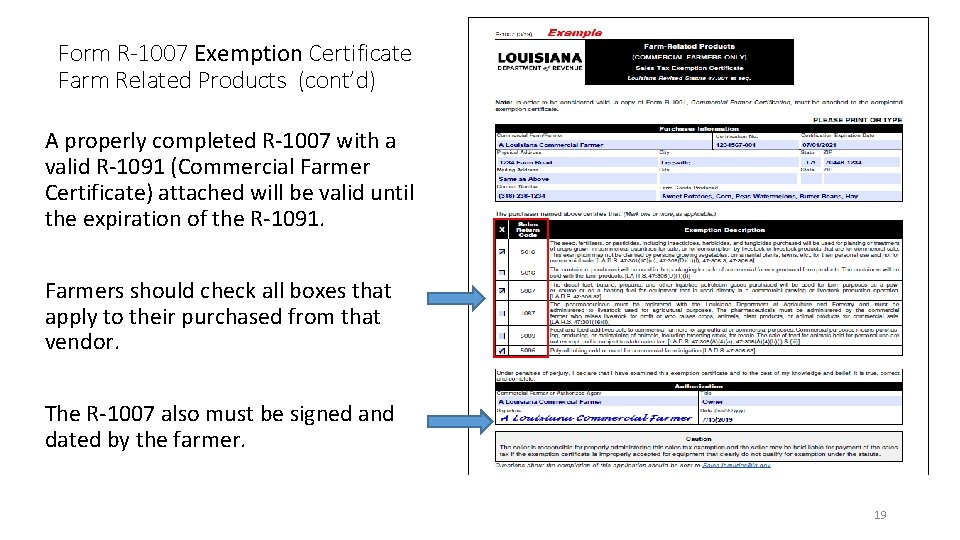

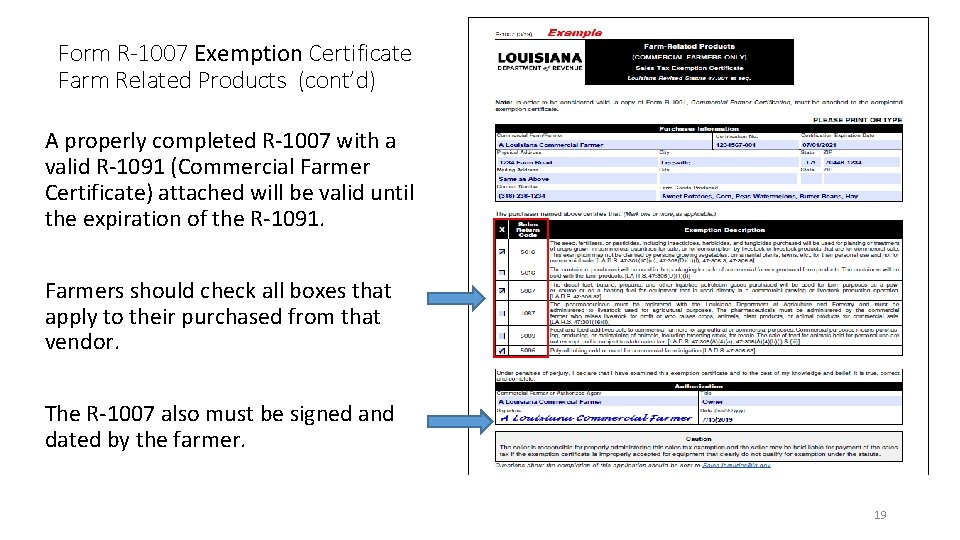

Form R-1007 Exemption Certificate Farm Related Products (cont’d) A properly completed R-1007 with a valid R-1091 (Commercial Farmer Certificate) attached will be valid until the expiration of the R-1091. Farmers should check all boxes that apply to their purchased from that vendor. The R-1007 also must be signed and dated by the farmer. 19

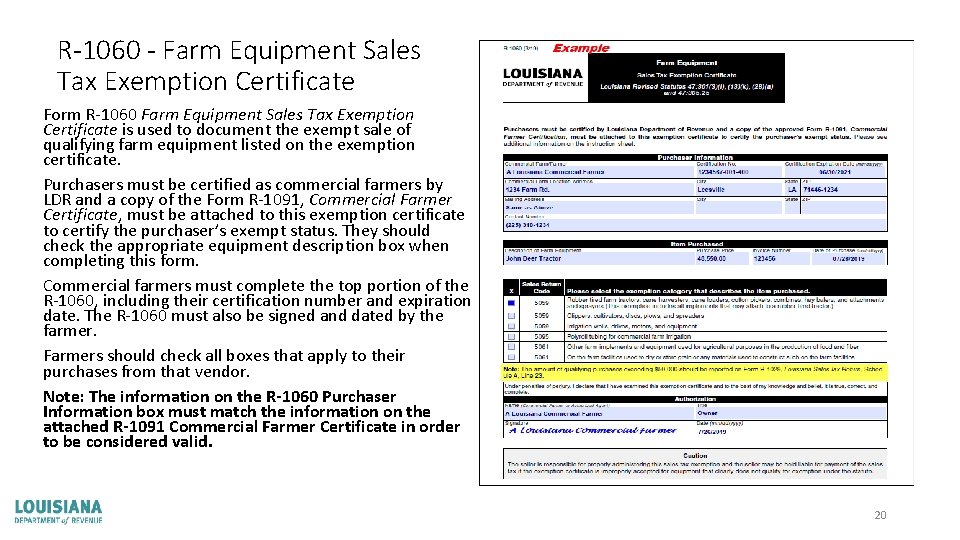

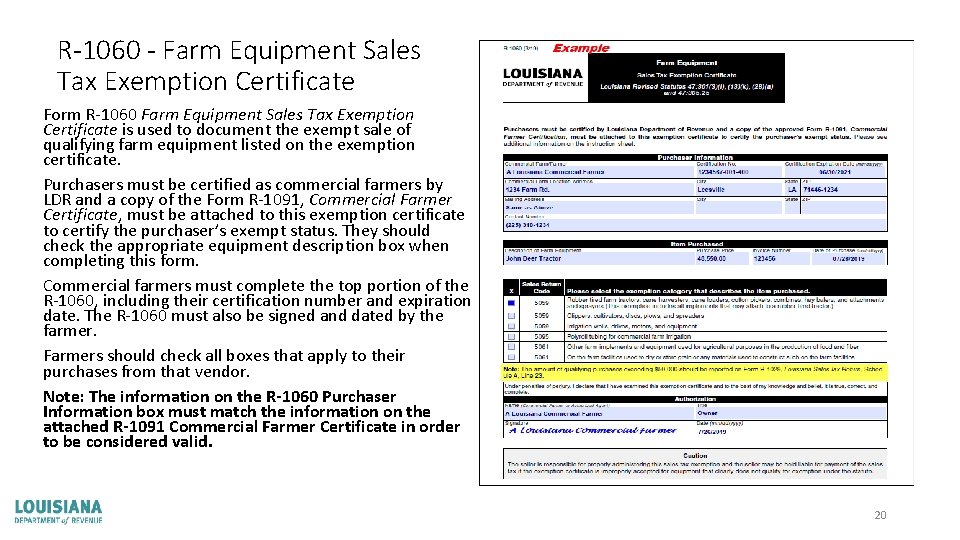

R-1060 - Farm Equipment Sales Tax Exemption Certificate Form R-1060 Farm Equipment Sales Tax Exemption Certificate is used to document the exempt sale of qualifying farm equipment listed on the exemption certificate. Purchasers must be certified as commercial farmers by LDR and a copy of the Form R-1091, Commercial Farmer Certificate, must be attached to this exemption certificate to certify the purchaser’s exempt status. They should check the appropriate equipment description box when completing this form. Commercial farmers must complete the top portion of the R-1060, including their certification number and expiration date. The R-1060 must also be signed and dated by the farmer. Farmers should check all boxes that apply to their purchases from that vendor. Note: The information on the R-1060 Purchaser Information box must match the information on the attached R-1091 Commercial Farmer Certificate in order to be considered valid. 20

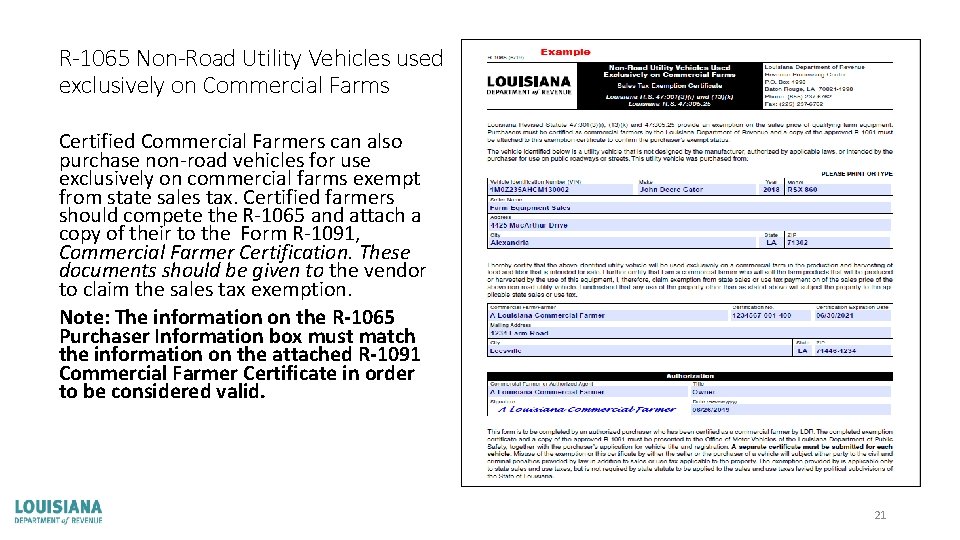

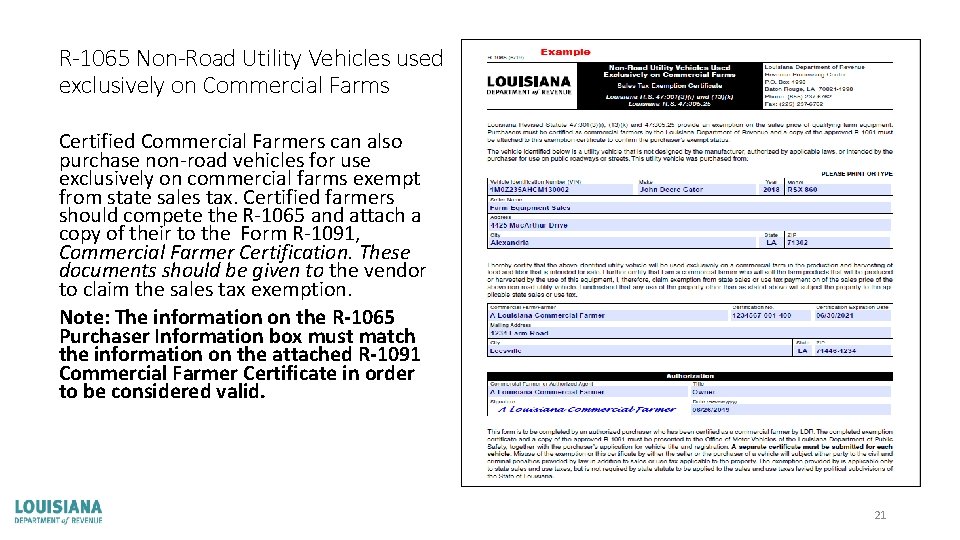

R-1065 Non-Road Utility Vehicles used exclusively on Commercial Farms Certified Commercial Farmers can also purchase non-road vehicles for use exclusively on commercial farms exempt from state sales tax. Certified farmers should compete the R-1065 and attach a copy of their to the Form R-1091, Commercial Farmer Certification. These documents should be given to the vendor to claim the sales tax exemption. Note: The information on the R-1065 Purchaser Information box must match the information on the attached R-1091 Commercial Farmer Certificate in order to be considered valid. 21

Louisiana Administrative Code 22

Louisiana Administrative Code (LAC) 61: I. 4301 • § 4401. For purposes of this definition, agricultural products shall mean any agronomic, aquacultural, floricultural, horticultural, maricultural, silvicultural, or viticultural crop, livestock or product. c. For purposes of this definition livestock means any animal, except dogs and cats. This definition includes bees, cattle, buffalo, bison, oxen, and other bovine; horses, mules, donkeys and other equine; sheep; goats; swine; domestic rabbits; fish, turtles, and other animals identified with aquaculture that are located in artificial reservoirs or enclosures that are both on privately owned property and constructed so as to prevent, at all times, the ingress and egress of fish life from public waters; imported exotic deer and antelope, elk, farm-raised white tailed deer, farm-raised ratites, and other farm-raised exotic animals; chickens, turkeys, and other poultry; and animals placed under the jurisdiction of the commissioner of agriculture and forestry and any hybrid, mixture, or mutation of any such animal. d. A person, partnership or corporation shall not be considered a commercial farmer if their livestock or crops are produced or maintained for reasons other than commercial use, such as recreational or personal consumption. e. In order to file a Schedule F or similar federal tax form, a farm must be operated for profit. If farming activity is not carried on for profit, as defined in 26 CFR 1. 183 -2, then expenses must be itemized on a Schedule A. f. The department will issue certifications to commercial farmers upon application and satisfaction of all legal requirements. 23

Louisiana Administrative Code (LAC) 61: I. 4404 • § 4404. Seeds Used in Planting of Crops • A. The sale at retail of seeds for use by a commercial farmer in the planting of crops of any kind is exempt from state and local sales or use tax. Crops do not include the planting of a garden to produce food for the personal consumption of the planter and his family. Neither is it intended to cover seed used in the planting of growth for landscape purposes unless the commercial farmer is engaged in the business of harvesting those plants and selling them in the commercial market. • B. It is not necessary that the farm operation result in a net profit or that a given acreage of any particular crop be planted. The only requirement is that the planting be made by a commercial farmer. • C. A commercial farmer must present a valid commercial farmer certification certificate and applicable exemption certificate at the time of the purchase. The seller must keep a record of the presentation of such documentation. If the dealer fails to retain evidence of the valid certification and exemption certificate then the dealer will be liable for the sales tax on such purchase. 24

Louisiana Administrative Code (LAC) 61: I. 4408 • § 4408. Pesticides Used for Agricultural Purposes • A. General. R. S. 47: 305. 8 provides an exemption from state and local sales or use tax for the sale at retail to commercial farmers of pesticides used for agricultural purposes. This exemption includes, but is not limited to, insecticides, herbicides, and fungicides used for agricultural purposes. • B. Definitions • Agricultural Purposes any purpose directly connected with the operation of any farm, including poultry, fish, and crawfish farms, ranch, orchard or any other operation by which products are grown on the land in sufficient quantity to constitute a commercial operation. The exemption is not intended to cover the sale of pesticides for use in private family vegetable gardens or in protecting ornamental plants used for landscape purposes. • Pesticides include any preparation useful in the control of insects, plant life, fungus, or any other pests detrimental to agricultural crops, including the control of animal pests that meets the definition of a pesticide in accordance with the Department of Agriculture and Forestry of the state of Louisiana under R. S. 3: 3202. Qualifying pesticides must be registered with the U. S. Environmental Protection Agency (EPA) and the Louisiana Department of Agriculture and Forestry or any other appropriate governmental agency and must carry a valid EPA FIFRA (Federal Insecticide, Fungicide, and Rodenticide Act) number issued by the U. S. Environmental Protection Agency or a special label number assigned by the Louisiana Department of Agriculture and Forestry. The exemption also includes any solution mixed with a qualifying pesticide to allow for the proper distribution and application of the pesticide, including but not limited to crop oils, surfactants, adjuvants, emulsions, soaps, and drift agents. • C. Dealer Requirements. A commercial farmer must present a valid commercial farmer certification certificate and applicable exemption certificate at the time of the purchase. The seller must keep a record of the presentation of such documentation. If the dealer fails to retain evidence of the presentation of valid certification and exemption certificate then the dealer will be liable for the sales tax on such purchase. 25

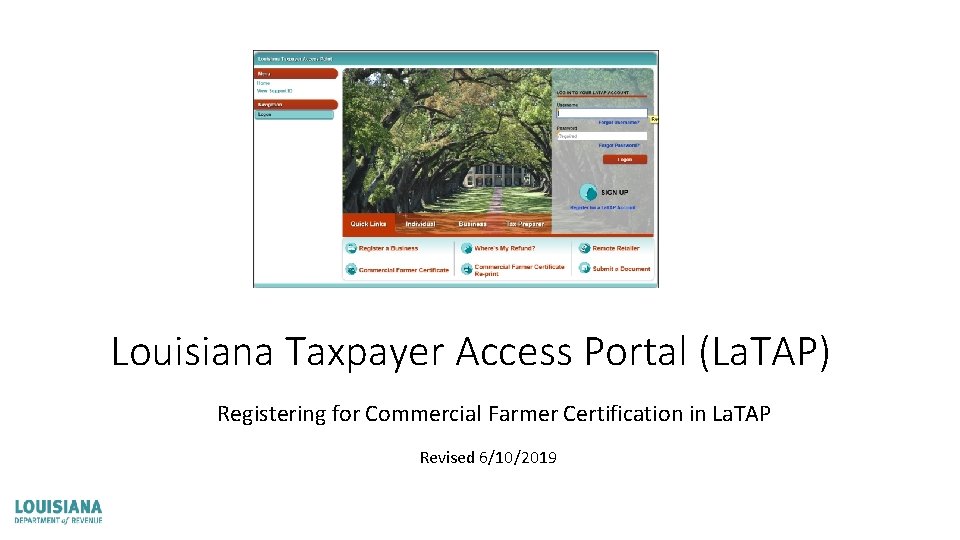

Louisiana Taxpayer Access Portal (La. TAP) Registering for Commercial Farmer Certification in La. TAP Revised 6/10/2019

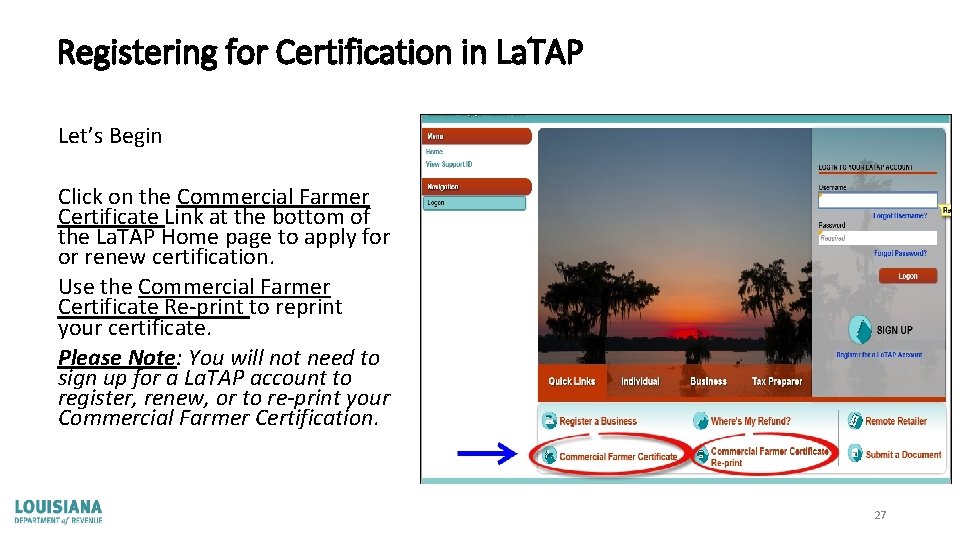

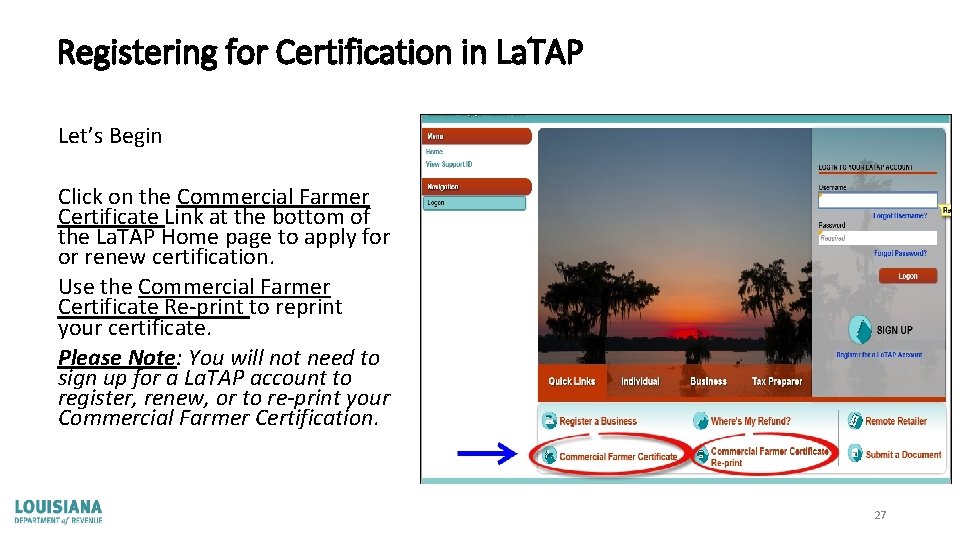

Registering for Certification in La. TAP Let’s Begin Click on the Commercial Farmer Certificate Link at the bottom of the La. TAP Home page to apply for or renew certification. Use the Commercial Farmer Certificate Re-print to reprint your certificate. Please Note: You will not need to sign up for a La. TAP account to register, renew, or to re-print your Commercial Farmer Certification. 27

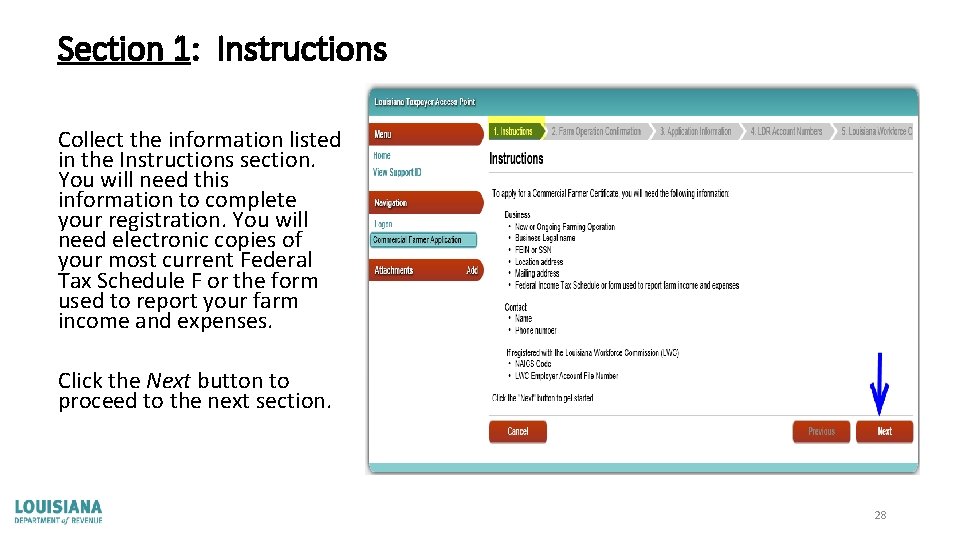

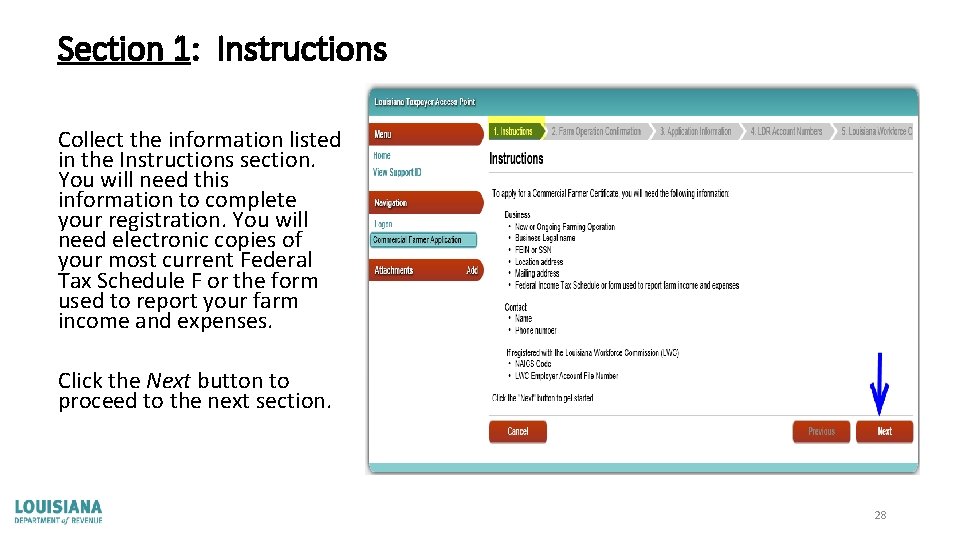

Section 1: Instructions Collect the information listed in the Instructions section. You will need this information to complete your registration. You will need electronic copies of your most current Federal Tax Schedule F or the form used to report your farm income and expenses. Click the Next button to proceed to the next section. 28

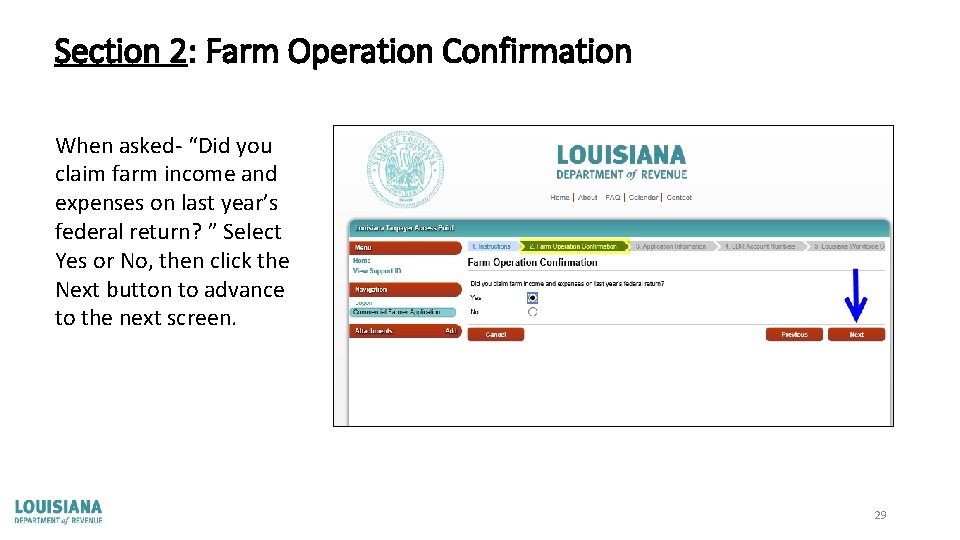

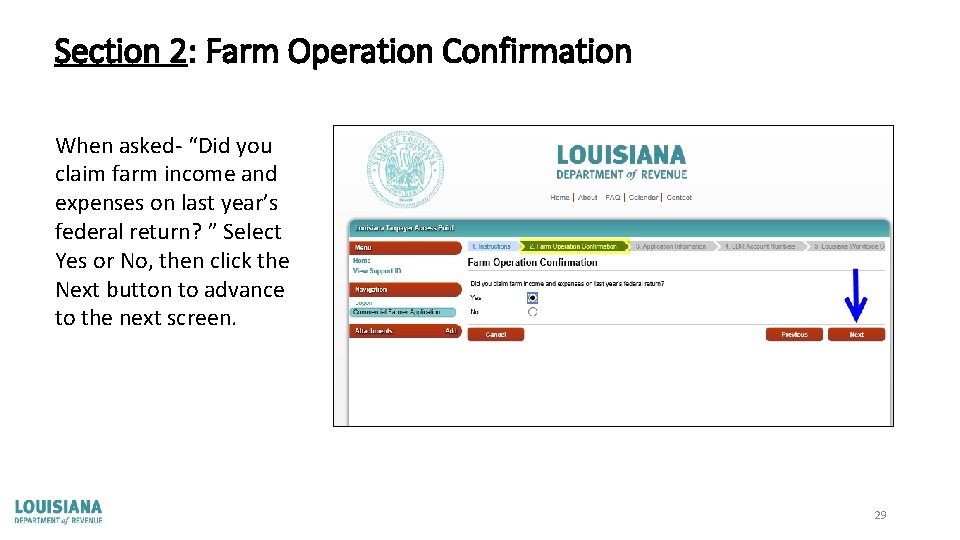

Section 2: Farm Operation Confirmation When asked- “Did you claim farm income and expenses on last year’s federal return? ” Select Yes or No, then click the Next button to advance to the next screen. 29

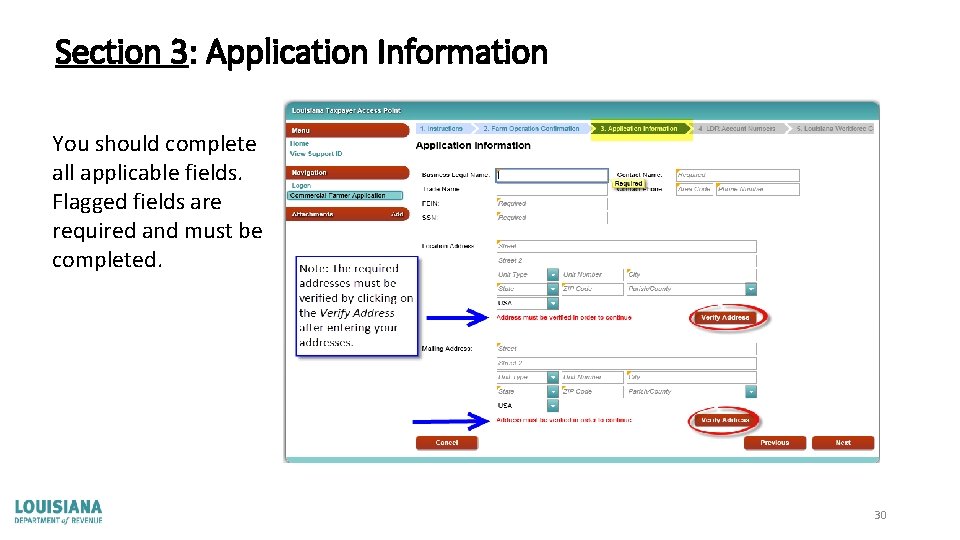

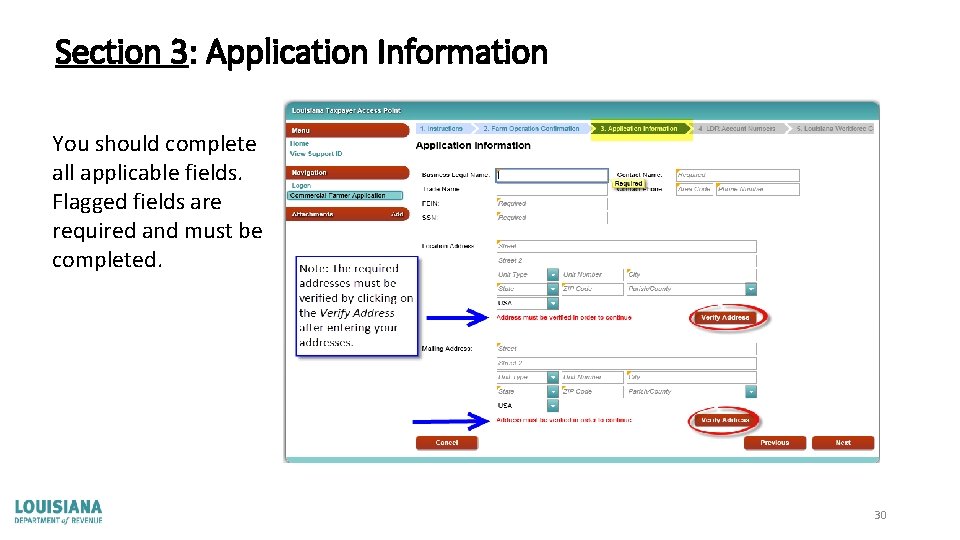

Section 3: Application Information You should complete all applicable fields. Flagged fields are required and must be completed. 30

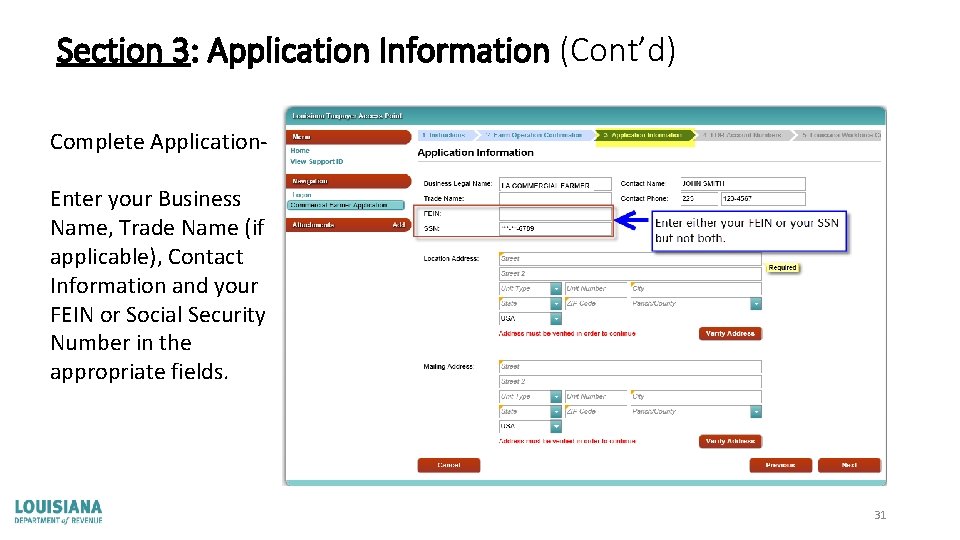

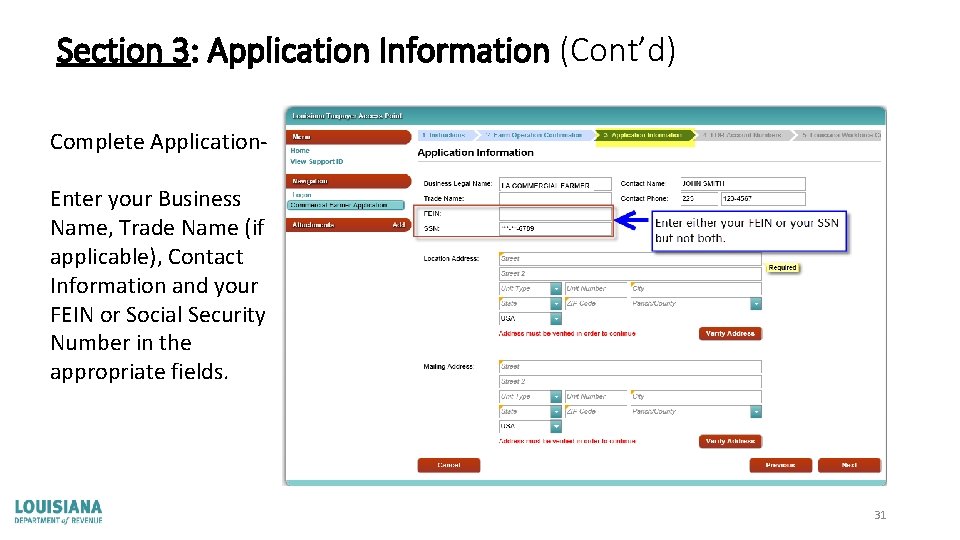

Section 3: Application Information (Cont’d) Complete Application. Enter your Business Name, Trade Name (if applicable), Contact Information and your FEIN or Social Security Number in the appropriate fields. 31

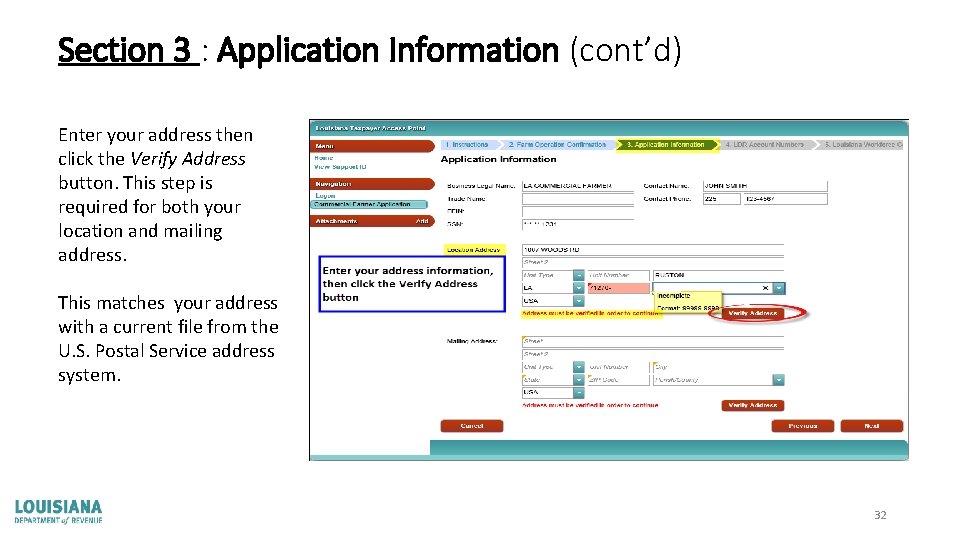

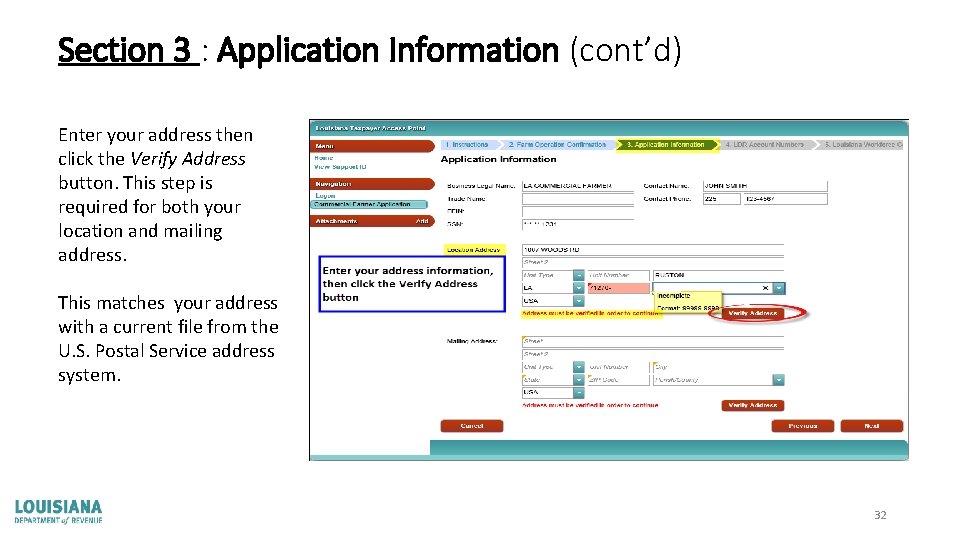

Section 3 : Application Information (cont’d) Enter your address then click the Verify Address button. This step is required for both your location and mailing address. This matches your address with a current file from the U. S. Postal Service address system. 32

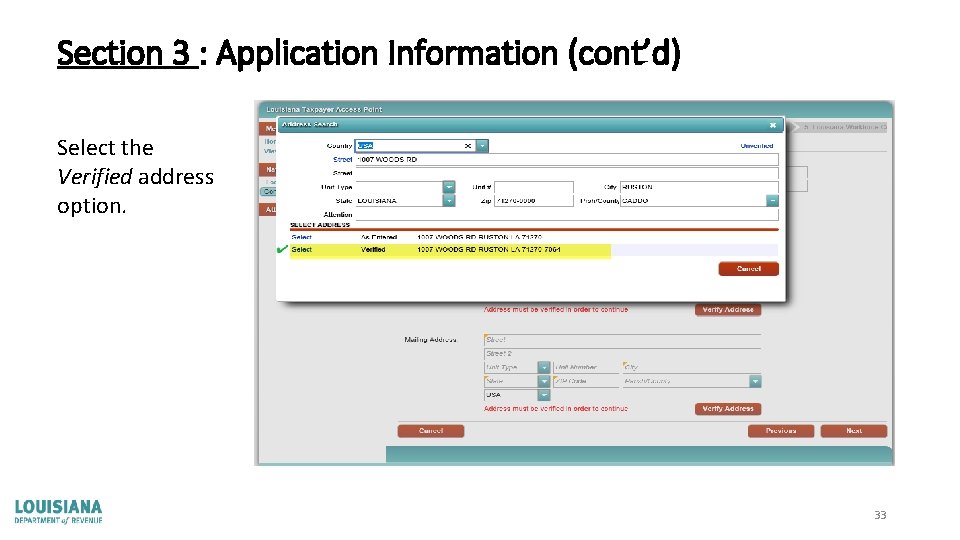

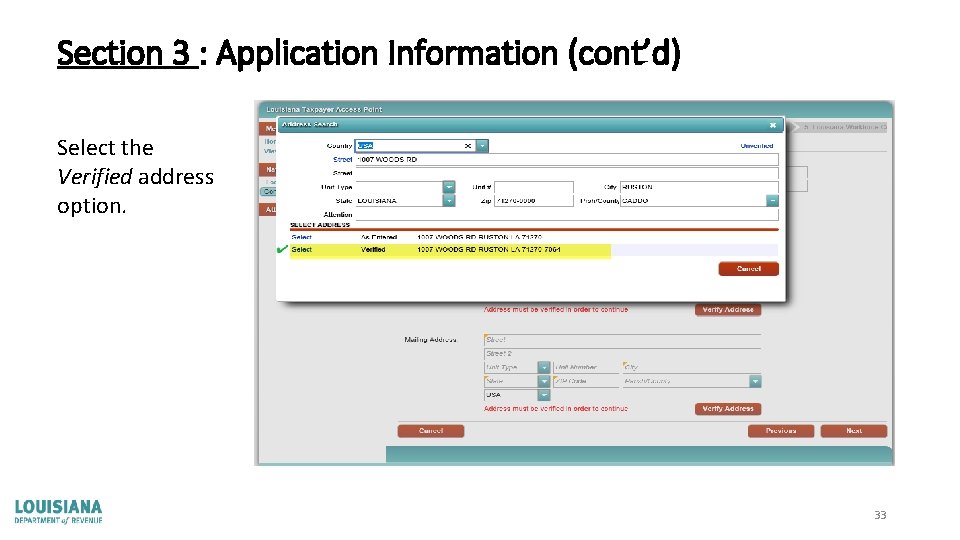

Section 3 : Application Information (cont’d) Select the Verified address option. 33

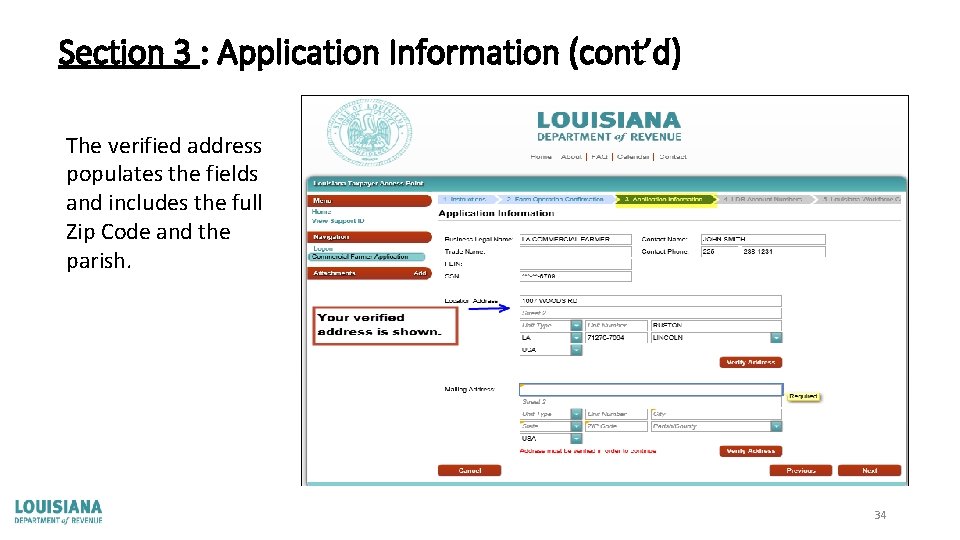

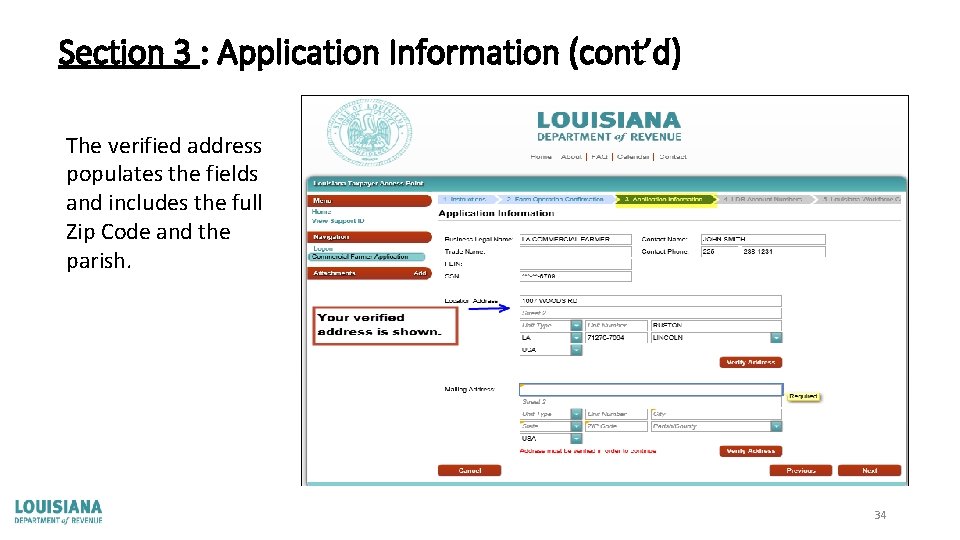

Section 3 : Application Information (cont’d) The verified address populates the fields and includes the full Zip Code and the parish. 34

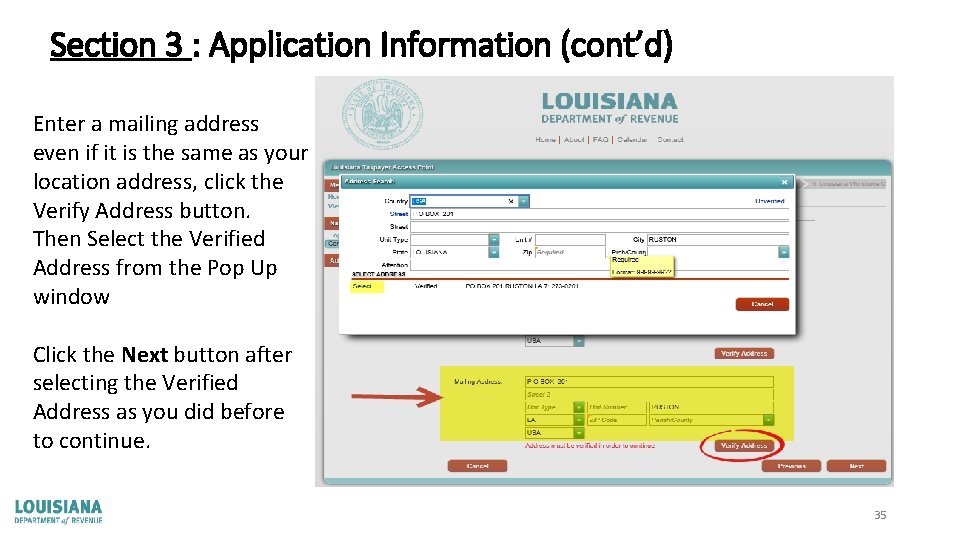

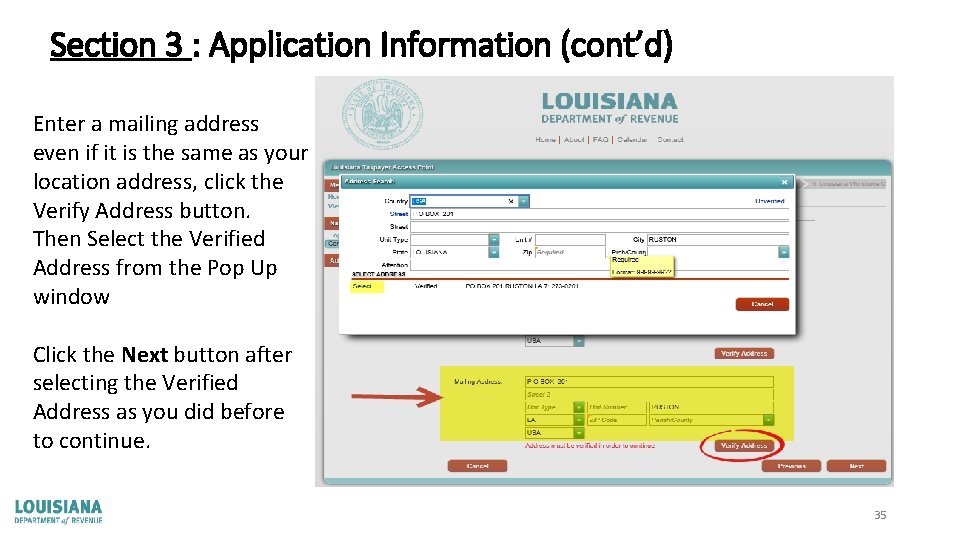

Section 3 : Application Information (cont’d) Enter a mailing address even if it is the same as your location address, click the Verify Address button. Then Select the Verified Address from the Pop Up window Click the Next button after selecting the Verified Address as you did before to continue. 35

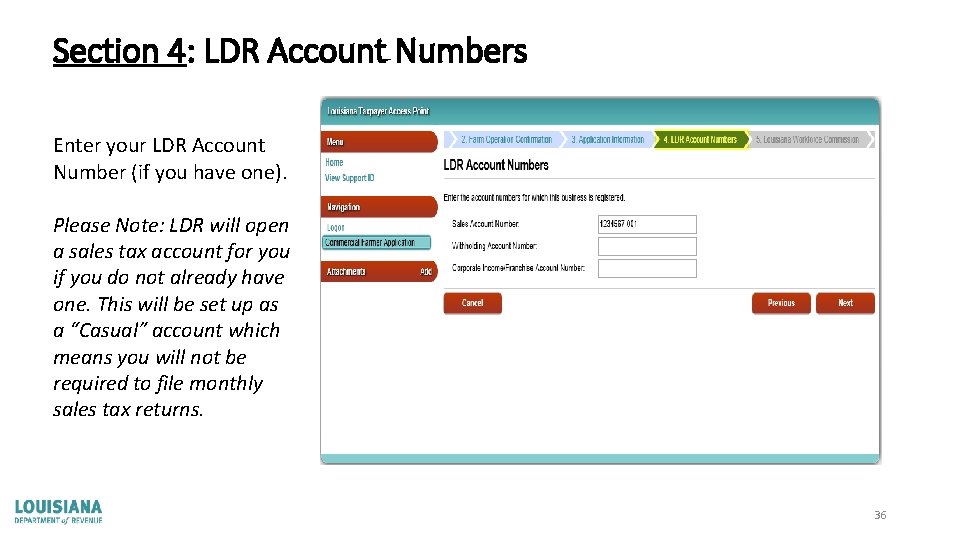

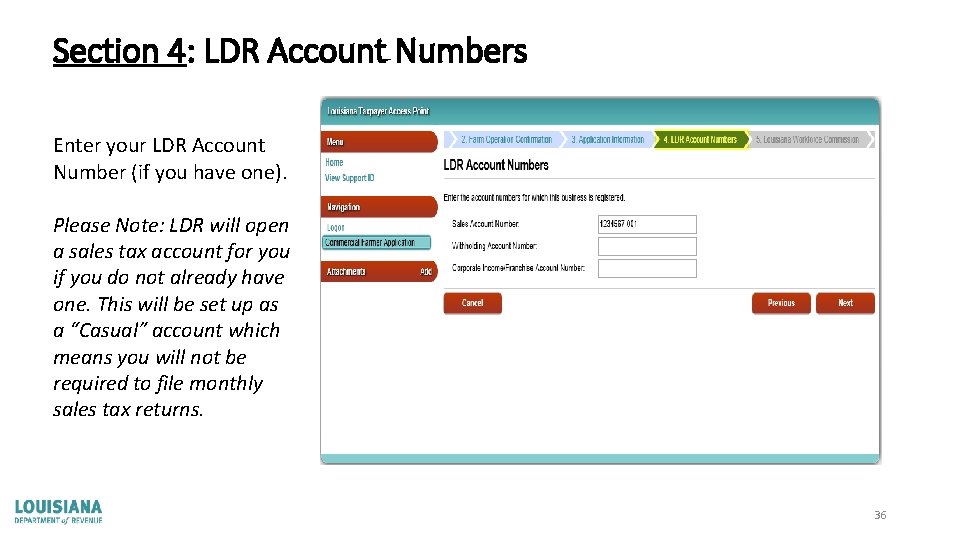

Section 4: LDR Account Numbers Enter your LDR Account Number (if you have one). Please Note: LDR will open a sales tax account for you if you do not already have one. This will be set up as a “Casual” account which means you will not be required to file monthly sales tax returns. 36

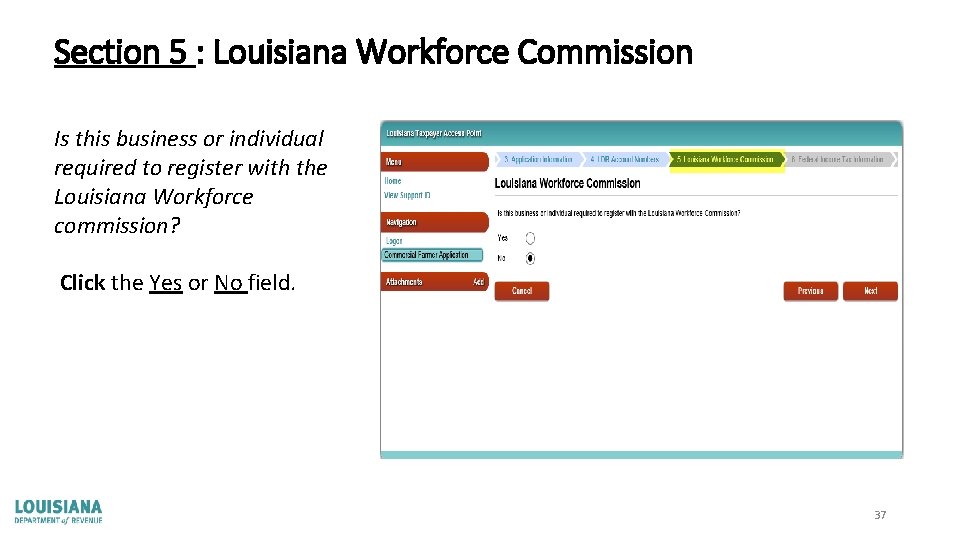

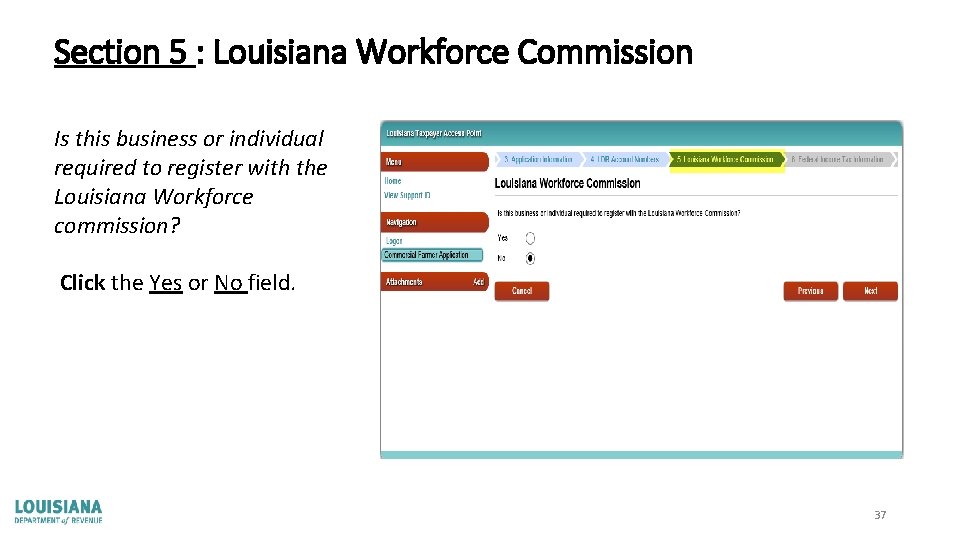

Section 5 : Louisiana Workforce Commission Is this business or individual required to register with the Louisiana Workforce commission? Click the Yes or No field. 37

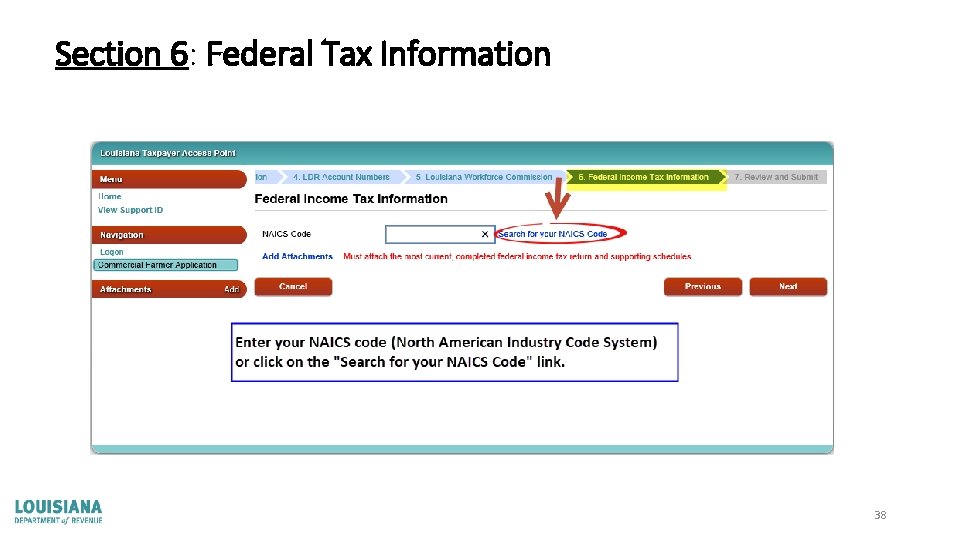

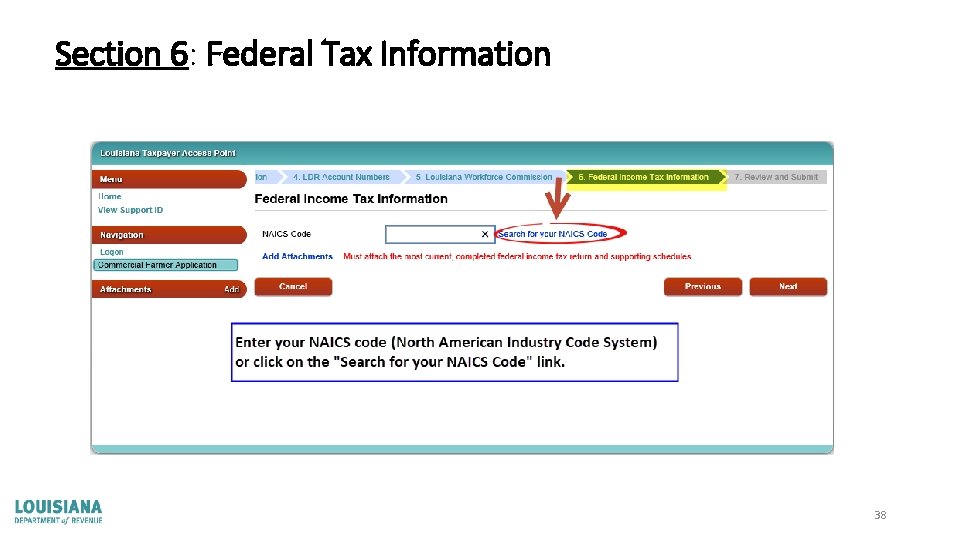

Section 6: Federal Tax Information 38

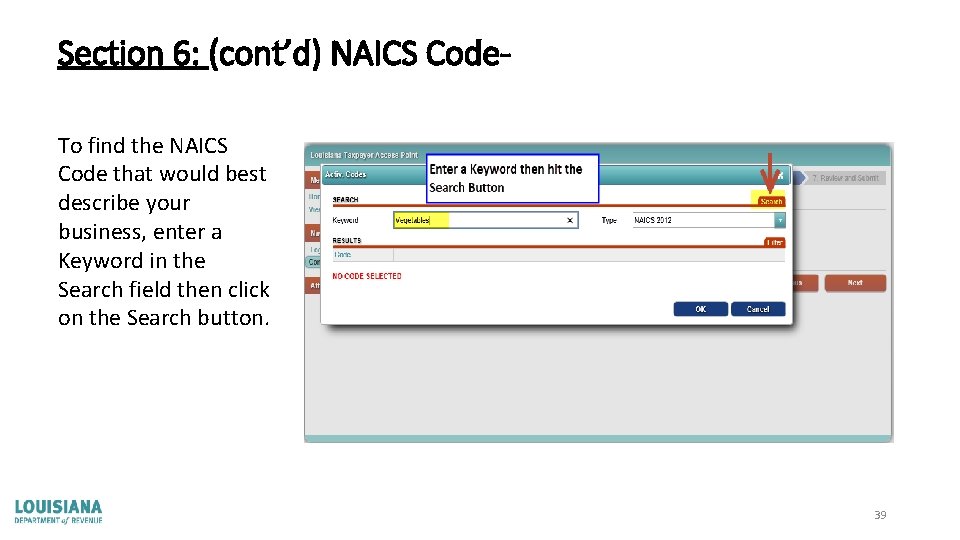

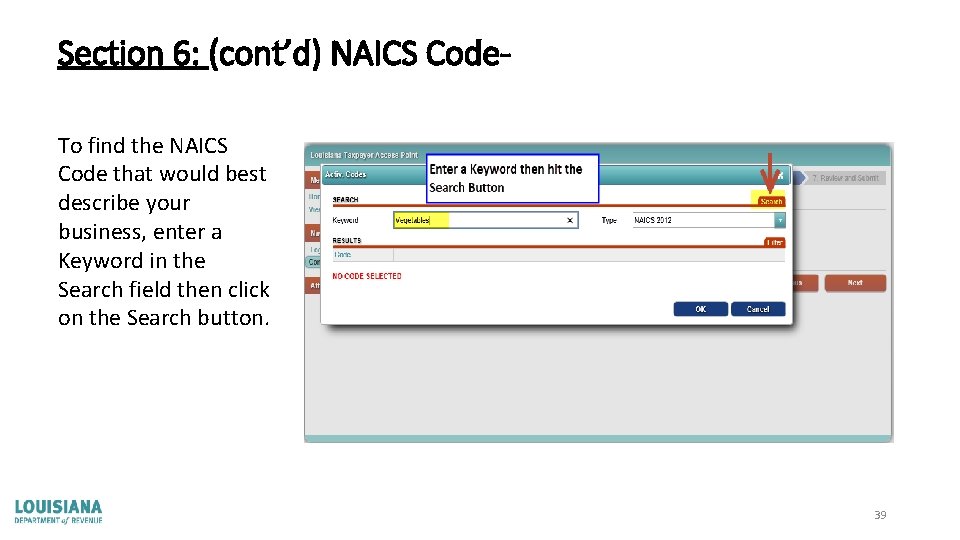

Section 6: (cont’d) NAICS Code. To find the NAICS Code that would best describe your business, enter a Keyword in the Search field then click on the Search button. 39

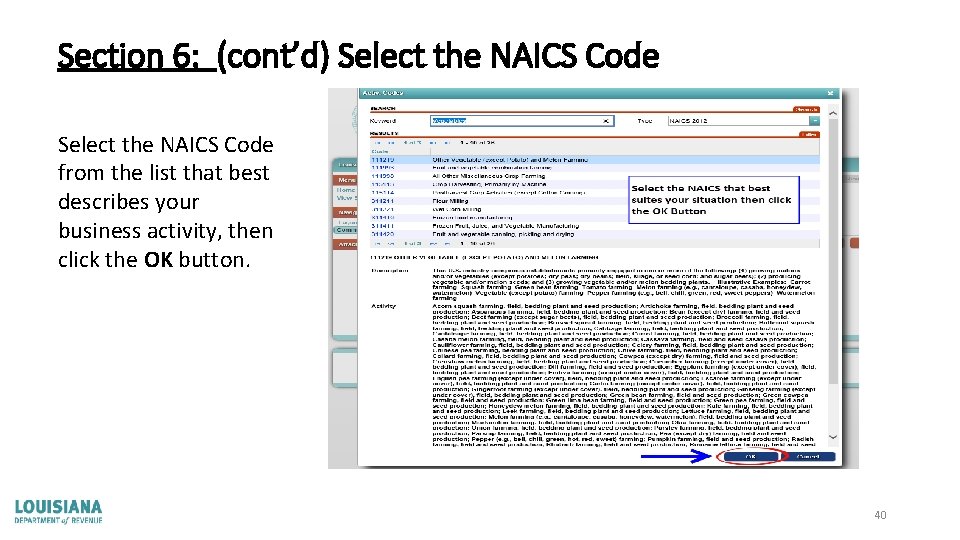

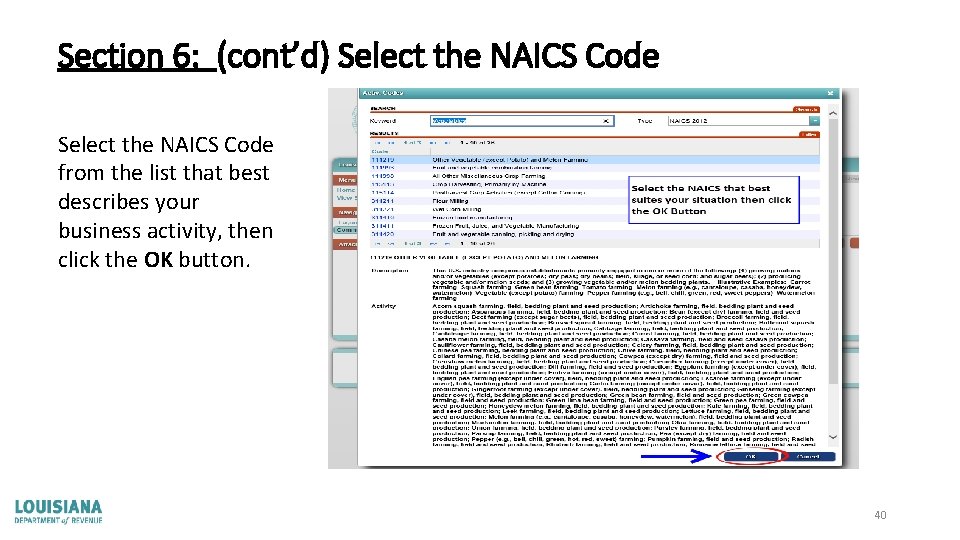

Section 6: (cont’d) Select the NAICS Code from the list that best describes your business activity, then click the OK button. 40

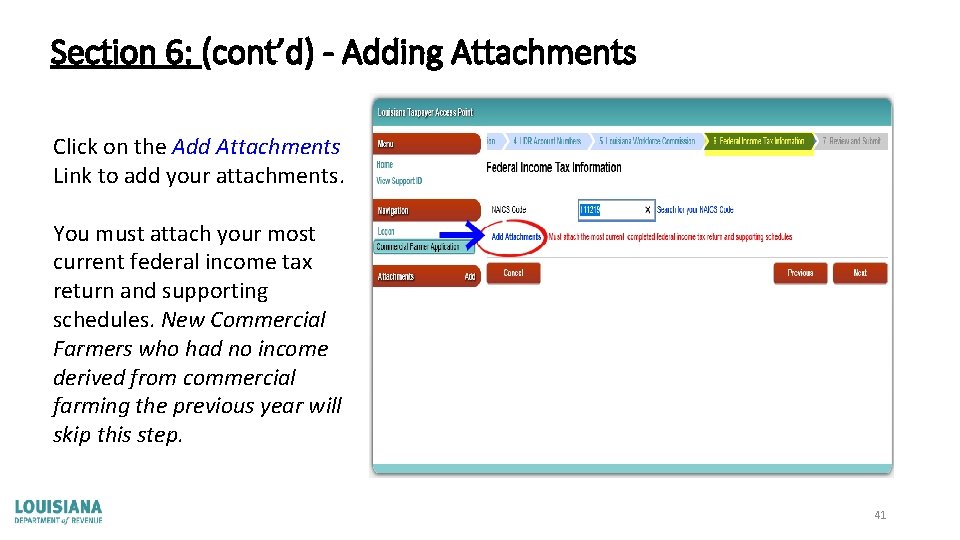

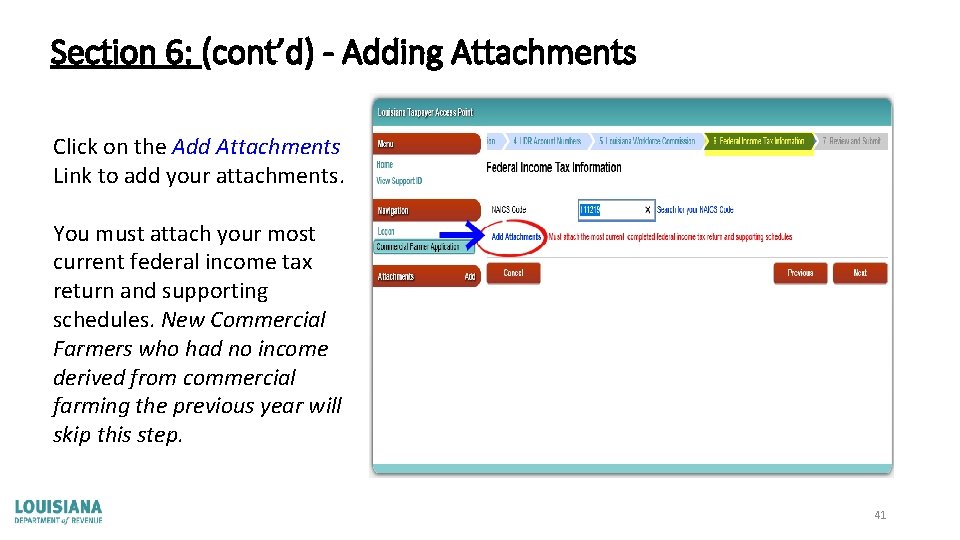

Section 6: (cont’d) - Adding Attachments Click on the Add Attachments Link to add your attachments. You must attach your most current federal income tax return and supporting schedules. New Commercial Farmers who had no income derived from commercial farming the previous year will skip this step. 41

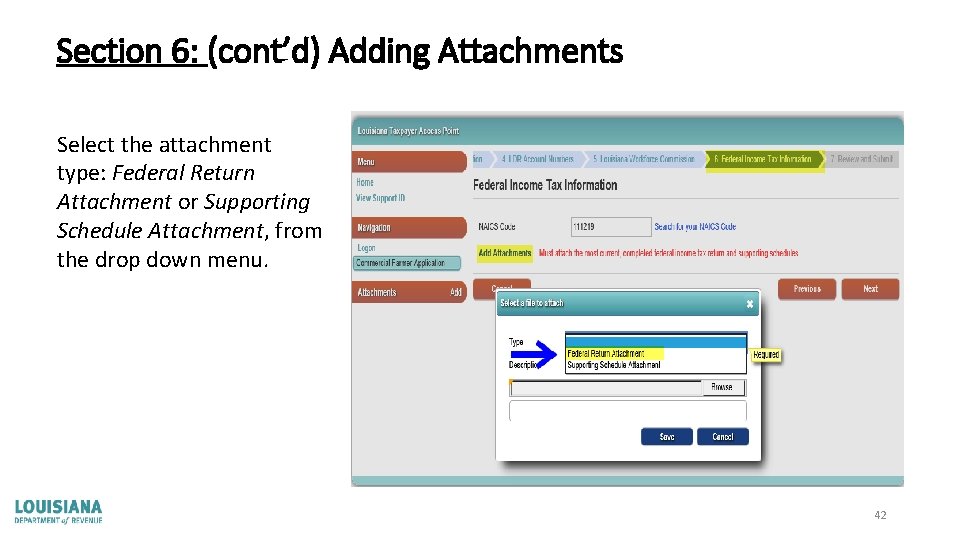

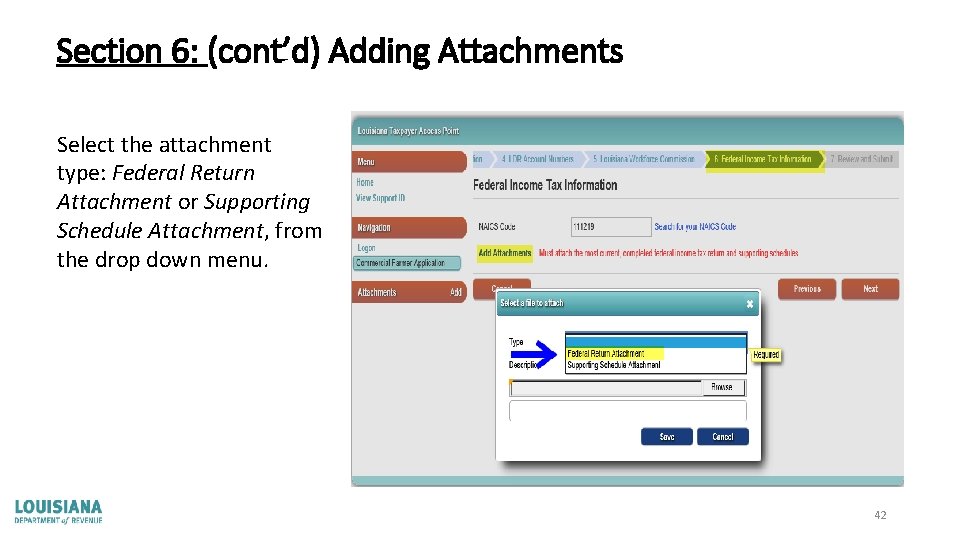

Section 6: (cont’d) Adding Attachments Select the attachment type: Federal Return Attachment or Supporting Schedule Attachment, from the drop down menu. 42

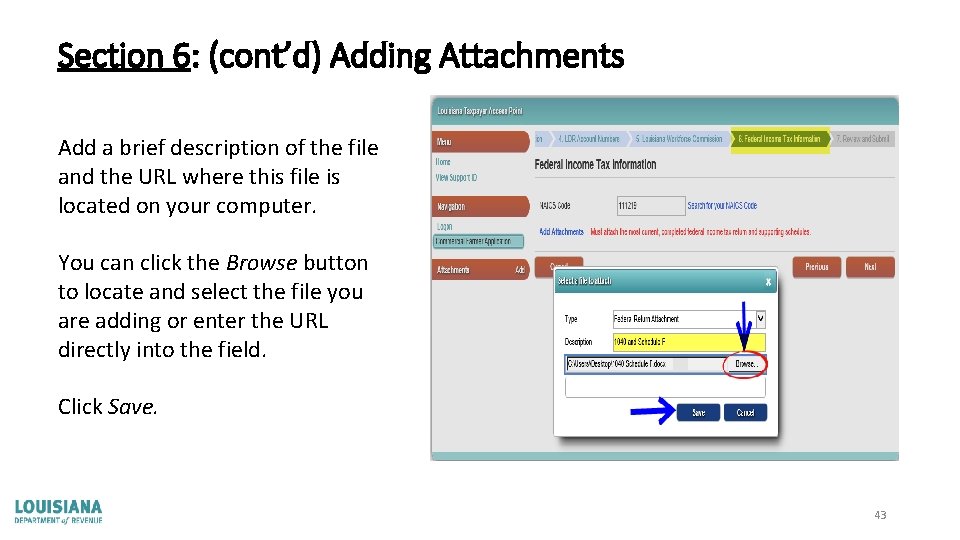

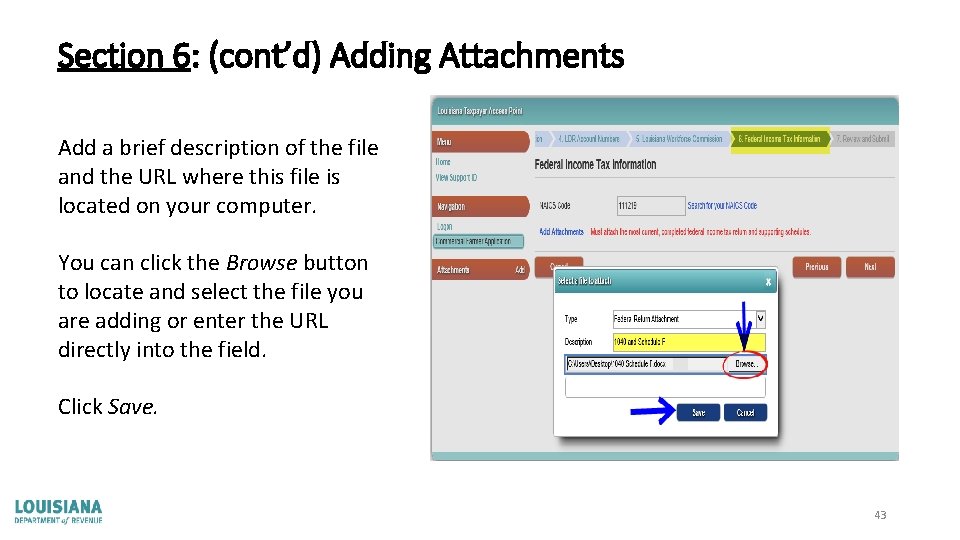

Section 6: (cont’d) Adding Attachments Add a brief description of the file and the URL where this file is located on your computer. You can click the Browse button to locate and select the file you are adding or enter the URL directly into the field. Click Save. 43

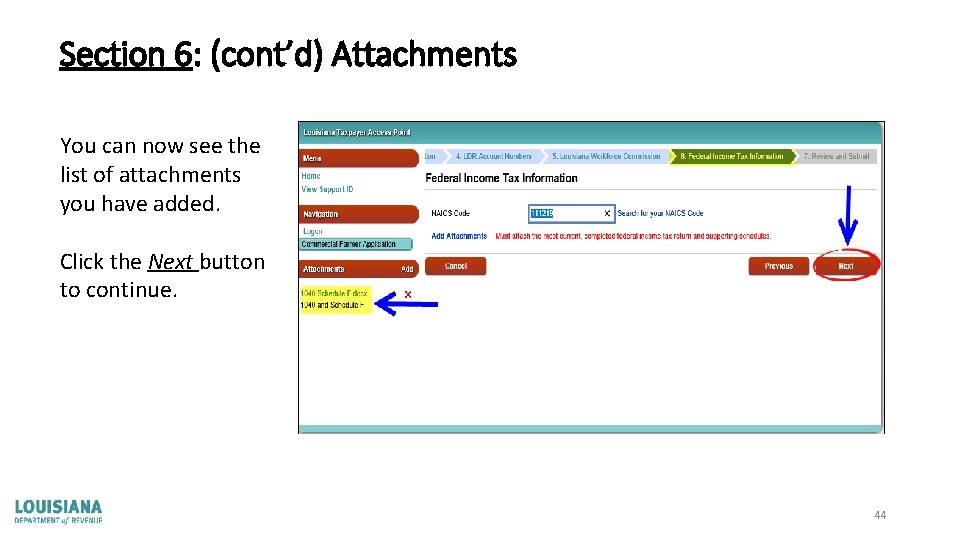

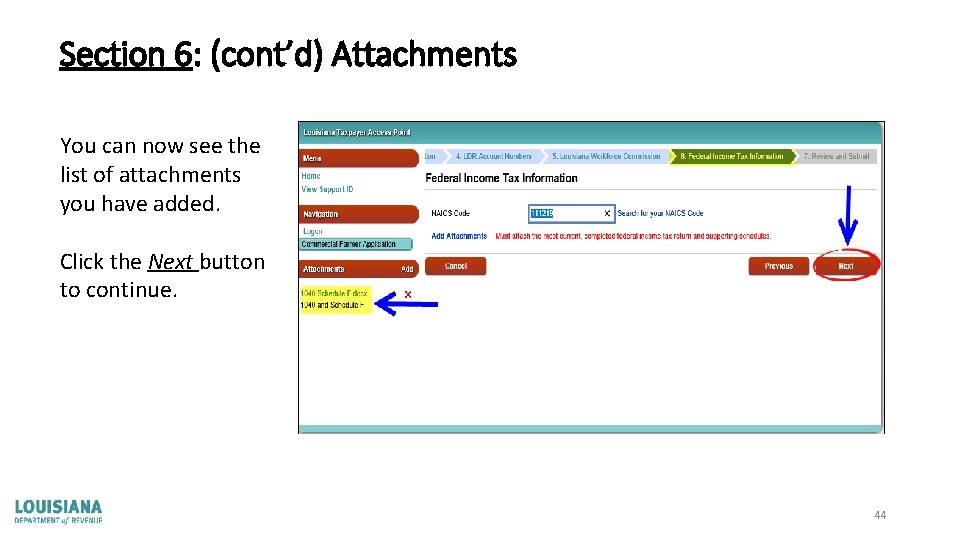

Section 6: (cont’d) Attachments You can now see the list of attachments you have added. Click the Next button to continue. 44

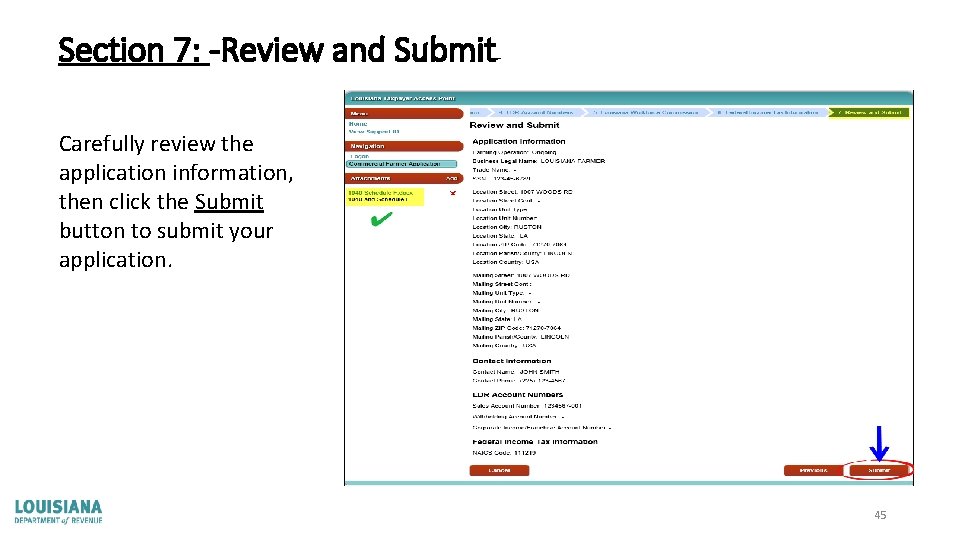

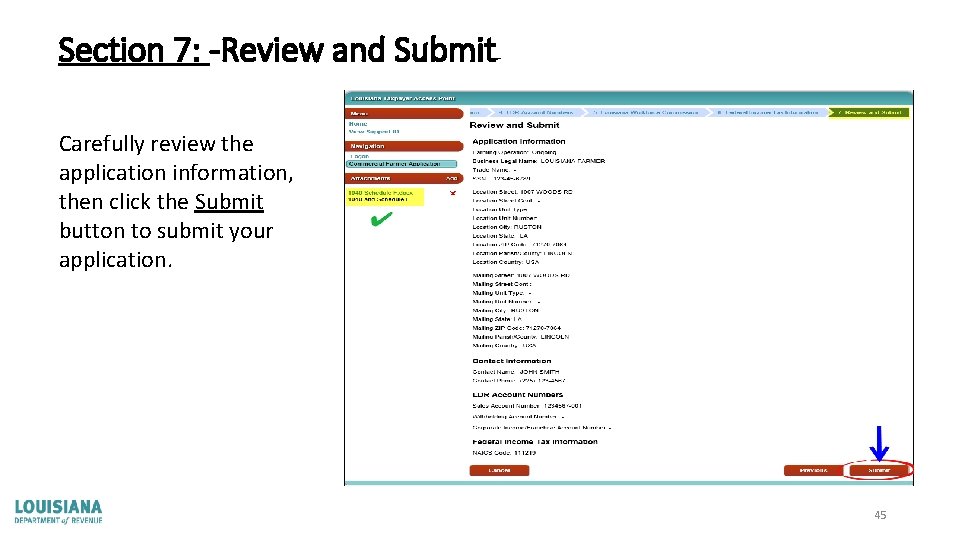

Section 7: -Review and Submit Carefully review the application information, then click the Submit button to submit your application. 45

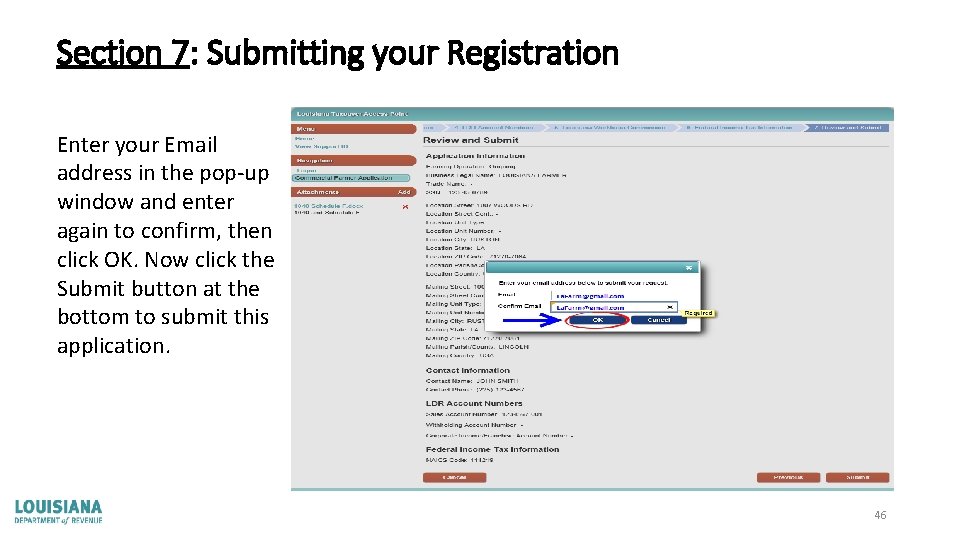

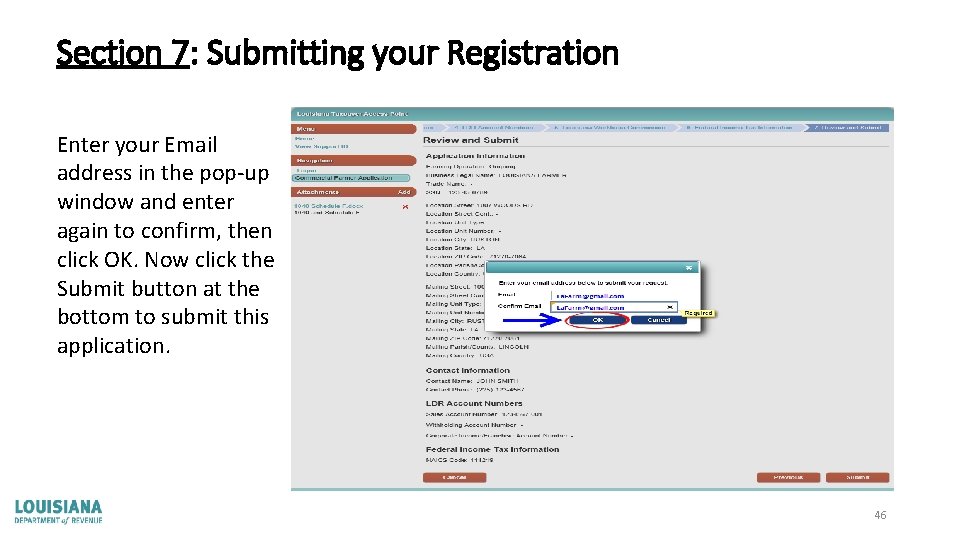

Section 7: Submitting your Registration Enter your Email address in the pop-up window and enter again to confirm, then click OK. Now click the Submit button at the bottom to submit this application. 46

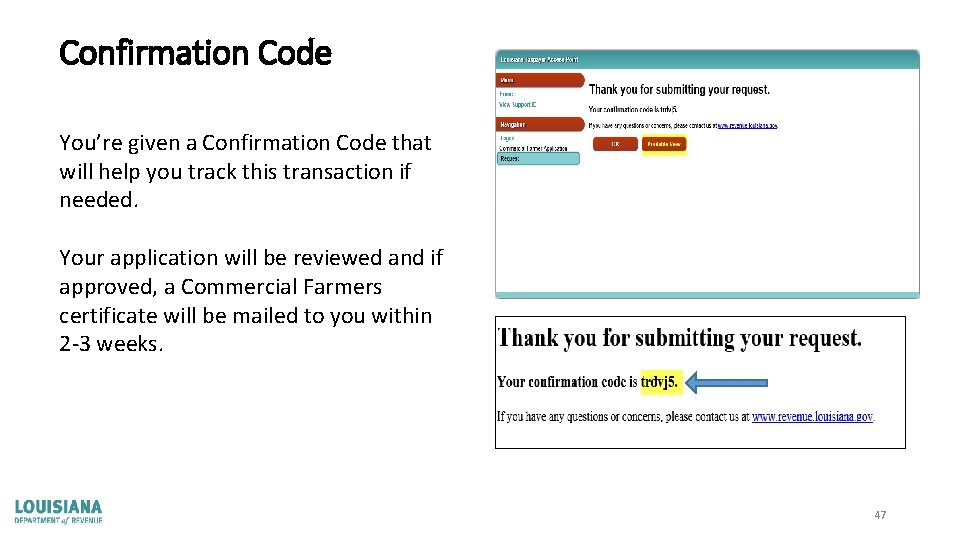

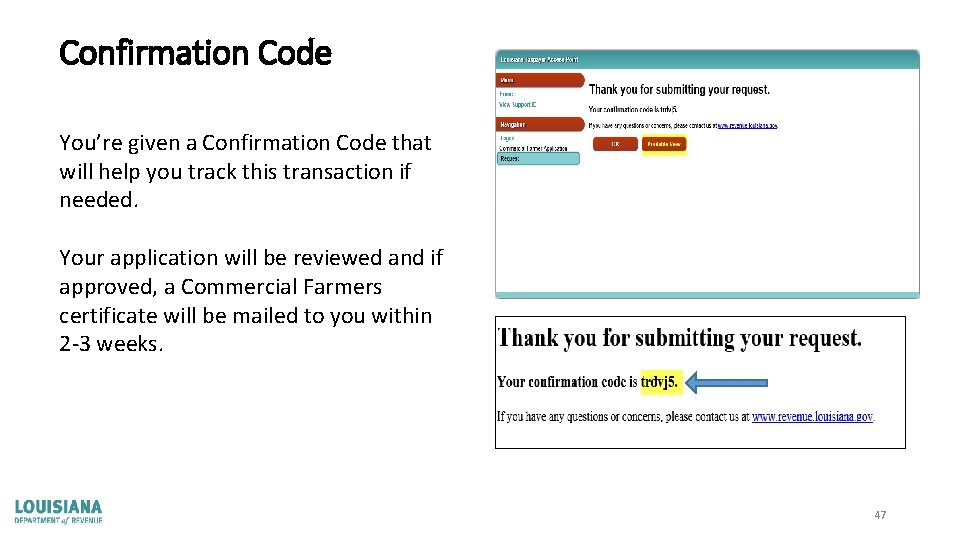

Confirmation Code You’re given a Confirmation Code that will help you track this transaction if needed. Your application will be reviewed and if approved, a Commercial Farmers certificate will be mailed to you within 2 -3 weeks. 47

For Additional Information ØRevenue Information Bulletin #18 -025. Ø Fax # (225) 237 -6765 Ø Phone Calls (855) 307 -3893 Ø Email to sales. inquiries@la. gov 48