Welcome Proposed Pension Scheme of NTPC DPE WORKSHOP

- Slides: 27

Welcome Proposed Pension Scheme of NTPC DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 1

Plan of presentation Salient features of the Pension Scheme Status of Implementation Issues of concern Way forward DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 2

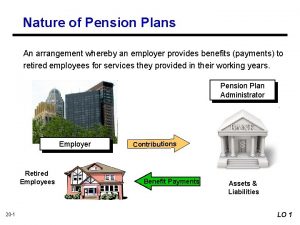

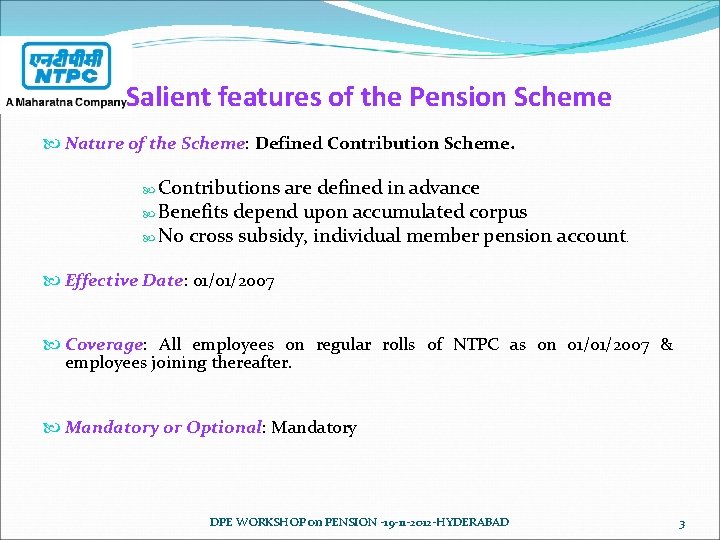

Salient features of the Pension Scheme Nature of the Scheme: Defined Contribution Scheme. Contributions are defined in advance Benefits depend upon accumulated corpus No cross subsidy, individual member pension account. Effective Date: 01/01/2007 Coverage: All employees on regular rolls of NTPC as on 01/01/2007 & employees joining thereafter. Mandatory or Optional: Mandatory DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 3

Salient features of the Pension Scheme Administration of the Scheme: By a separate Pension Trust recognized as approved superannuation fund under IT Act, Trustees nominated by both management and employees. : In the form of pension annuity from annuity service provider-LIC of India. Pension payment DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 4

Contribution Structure Company Contribution: Within 30% of (Basic Pay + DA) as stipulated for all superannuation benefits i. e CPF, Gratuity, PRMS & Pension. After paying for CPF, Gratuity and PRMS, exact rate of company contribution for Pension shall be notified annually. Contribution for Gratuity and PRMS shall be taken as per actuarial valuation. DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 5

Contribution Structure Mandatory member’s Contribution: 1% of (Basic Pay + DA) Voluntary Contribution: Option to make voluntary contribution by member DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 6

Members Account Just like CPF- individual member Pension account shall be maintained. Contribution made by Company and Member shall be credited in individual member pension account. Interest earned by Trust on investment of Fund shall be credited to individual member account at the end of the year. DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 7

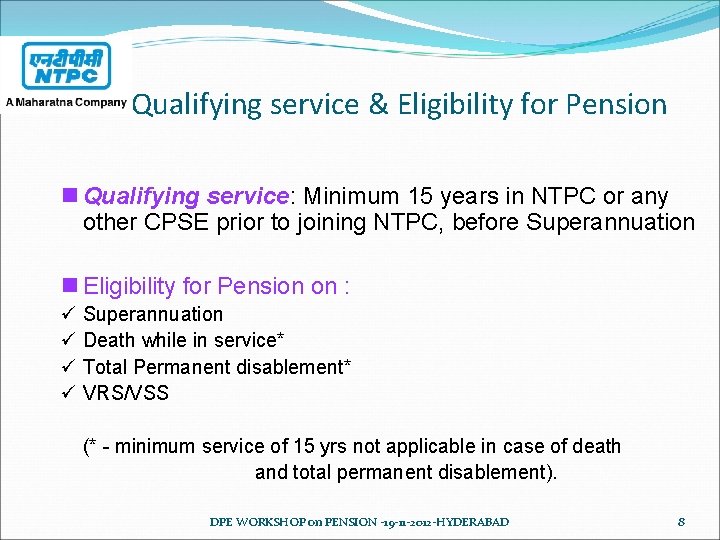

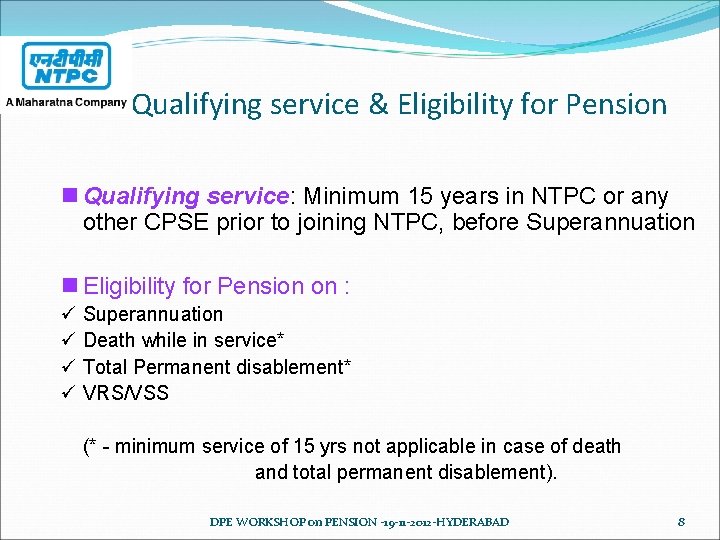

Qualifying service & Eligibility for Pension n Qualifying service: Minimum 15 years in NTPC or any other CPSE prior to joining NTPC, before Superannuation n Eligibility for Pension on : ü Superannuation ü Death while in service* ü Total Permanent disablement* ü VRS/VSS (* - minimum service of 15 yrs not applicable in case of death and total permanent disablement). DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 8

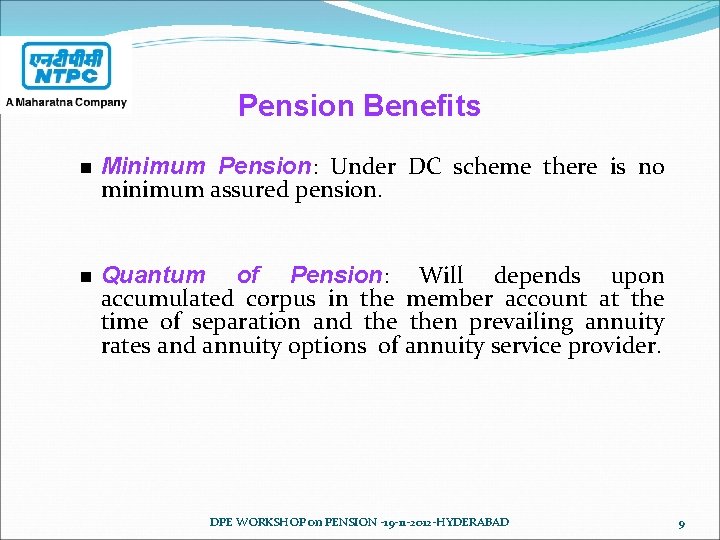

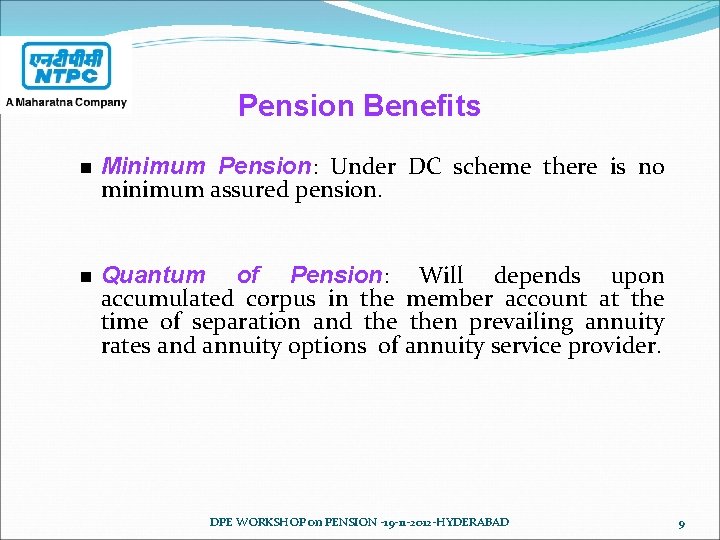

Pension Benefits n Minimum Pension: Under DC scheme there is no minimum assured pension. n Quantum of Pension: Will depends upon accumulated corpus in the member account at the time of separation and then prevailing annuity rates and annuity options of annuity service provider. DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 9

Mode of Pension Payment n In the form of pension annuity from LIC of India. n Member to have option to choose any of the annuity option of LIC of India. - LIC Pension options n Member shall have option to commute 1/3 rd of pension for lump sum payment as commutation of pension. n Pension payable for life time of the Member DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 10

Pension Benefits on Resignation Termination/Dismissals etc. Pension annuity to be purchased only from members contribution and interest earned thereon. DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 11

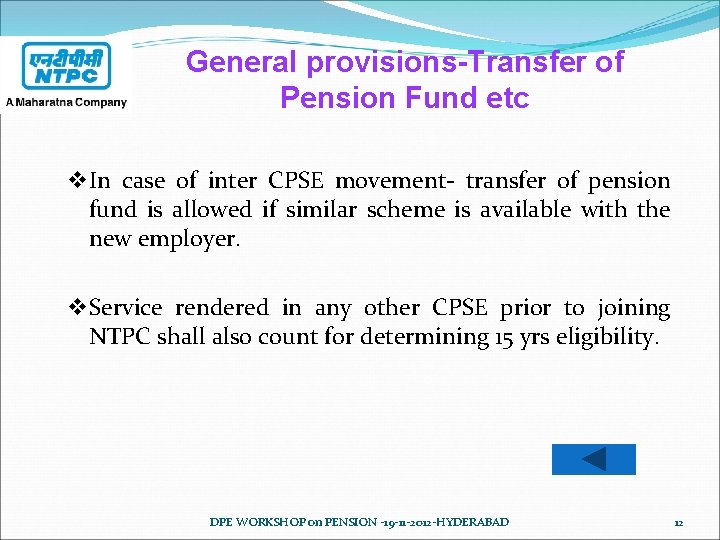

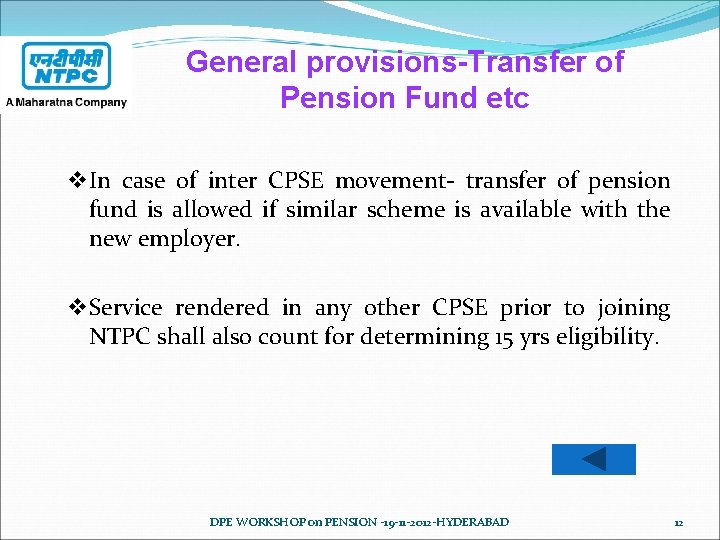

General provisions-Transfer of Pension Fund etc v. In case of inter CPSE movement- transfer of pension fund is allowed if similar scheme is available with the new employer. v. Service rendered in any other CPSE prior to joining NTPC shall also count for determining 15 yrs eligibility. DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 12

Plan of presentation Salient features of the Pension Scheme Status of Implementation Issues of concern Way forward DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 13

Status of Implementation ü Approval received from Ministry of Power, Govt of India. ü Pension Trust formed and approval received from Commissioner Income Tax. ü LIC appointed as Annuity Service Provider. ü Agreement signed with Unions for member contribution @1% of Salary. DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 14

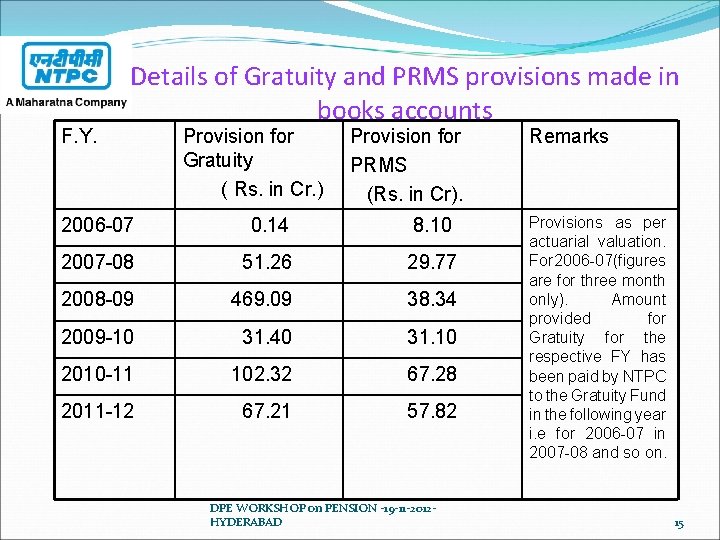

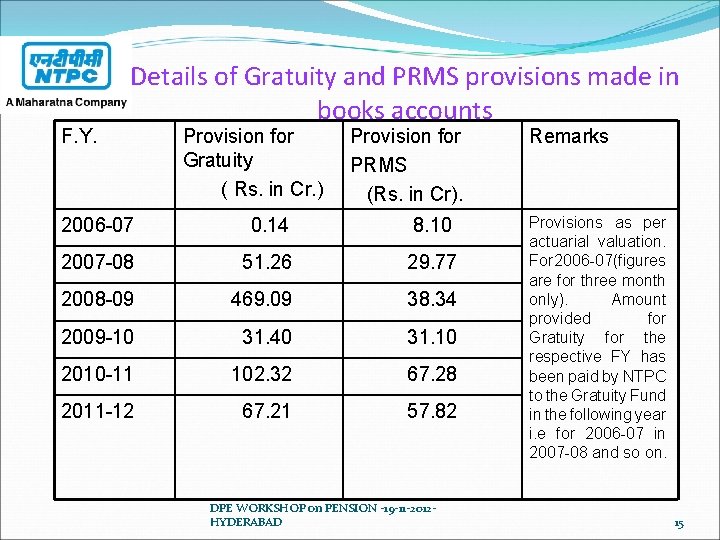

F. Y. Details of Gratuity and PRMS provisions made in books accounts Provision for Gratuity ( Rs. in Cr. ) Provision for PRMS (Rs. in Cr). 2006 -07 0. 14 8. 10 2007 -08 51. 26 29. 77 2008 -09 469. 09 38. 34 2009 -10 31. 40 31. 10 2010 -11 102. 32 67. 28 2011 -12 67. 21 57. 82 DPE WORKSHOP on PENSION -19 -11 -2012 HYDERABAD Remarks Provisions as per actuarial valuation. For 2006 -07(figures are for three month only). Amount provided for Gratuity for the respective FY has been paid by NTPC to the Gratuity Fund in the following year i. e for 2006 -07 in 2007 -08 and so on. 15

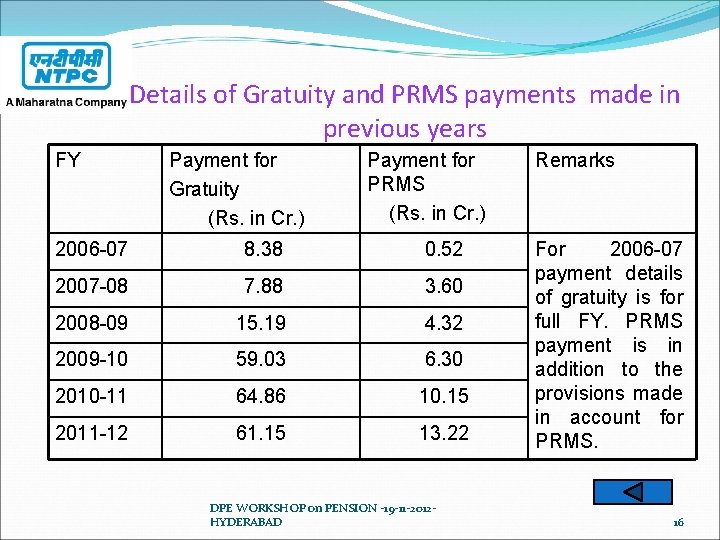

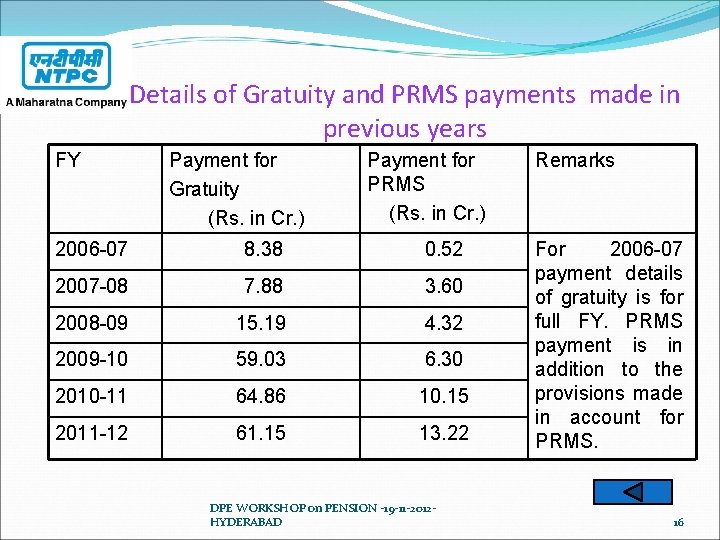

Details of Gratuity and PRMS payments made in previous years FY Payment for Gratuity (Rs. in Cr. ) Payment for PRMS (Rs. in Cr. ) 2006 -07 8. 38 0. 52 2007 -08 7. 88 3. 60 2008 -09 15. 19 4. 32 2009 -10 59. 03 6. 30 2010 -11 64. 86 10. 15 2011 -12 61. 15 13. 22 DPE WORKSHOP on PENSION -19 -11 -2012 HYDERABAD Remarks For 2006 -07 payment details of gratuity is for full FY. PRMS payment is in addition to the provisions made in account for PRMS. 16

Plan of presentation Salient features of the Pension Scheme Status of Implementation Issues of concern Way forward DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 17

Issues of concern Methodology for computation of rate of Employer contribution towards Pension. Ceiling of 30% of (Basic Pay + DA) for all superannuation benefits (CPF, Gratuity, Pension and PRMS). As per DPE guidelines all superannuation benefits has to be Defined Contribution Scheme. Gratuity is a Defined Benefits scheme as per the Payment of Gratuity Act. Provision for liabilities towards gratuity is kept in the Company Balance Sheet based on actuarial valuation DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 18

Issues of concern Gratuity ceiling increased from Rs. 3. 50 Lakh to Rs. 10. 00 Lakh w. e. f. 01. 2007. Increase in Company Liability for gratuity which relates to entire service of an employee i. e service rendered prior to and post 01. 2007. Whether entire liability is to be deducted from 30% ceiling or is to be divided in proportion to service prior to and post 01. 2007? If apportionment is not allowed then this will result into cross subsidy. No money will be left for pension scheme in the initial four years in NTPC and defeat of very purpose of providing pension benefits. DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 19

Issues of concern PRMS scheme in existence in NTPC since 1986. Ceiling of 30% applicable only for employees on roll as on 01. 2007? . Whether PRMS liabilities of employees already retired prior to 01. 2007 is to be covered within 30% ceiling? 30% guidelines applicable from 01. 2007 and if retired employees PRMS are under 30% then this would tantamount to cross subsidy by existing employees for retired employees. DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 20

Issues of concern Reasonableness/adequacy of pension in case of death and early retirement DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 21

Plan of presentation Salient features of the Pension Scheme Status of Implementation Issues of concern Way forward DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 22

Way forward Clarification required from DPE on following issues: How to compute rate of company contribution for gratuity- 15 days formulas or actuarial valuation method? Apportionment of increased liability for gratuity in proportion to service prior to and post 01. 2007? Treatment of PRMS liabilities for employees already separated prior to 01. 2007 -outside 30% ? How to provide reasonable/adequate pension in cases of death and early retirement – can it be done from the corpus created from 1. 5% of PTB? . DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 23

Thank You DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 24

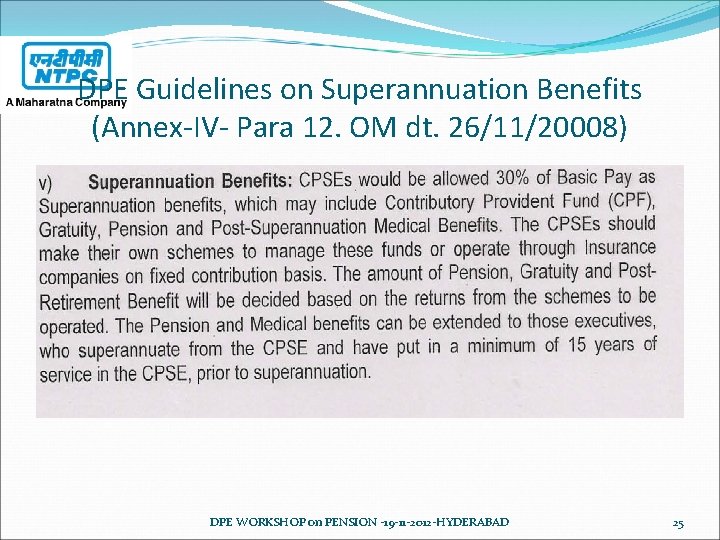

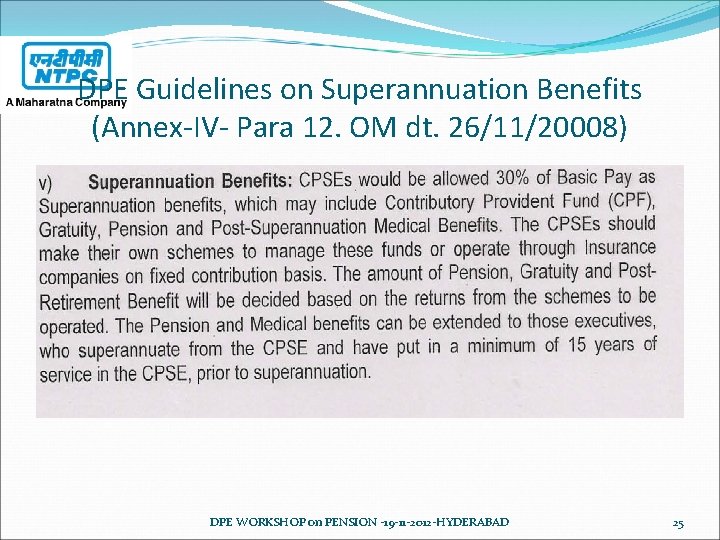

DPE Guidelines on Superannuation Benefits (Annex-IV- Para 12. OM dt. 26/11/20008) DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 25

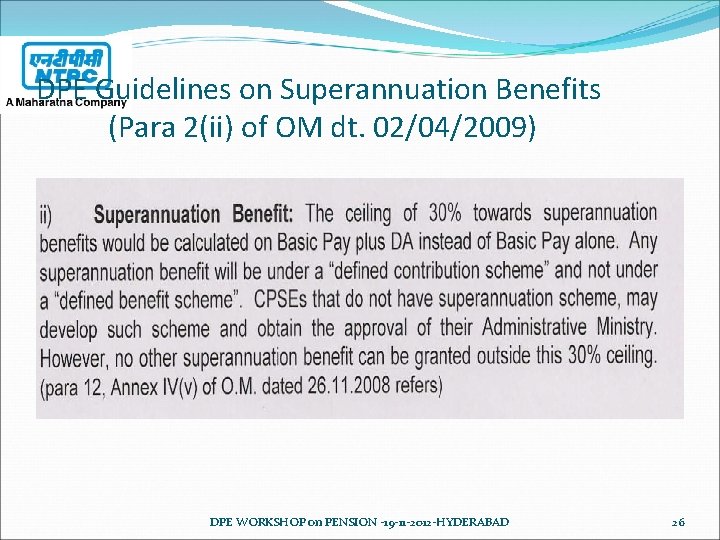

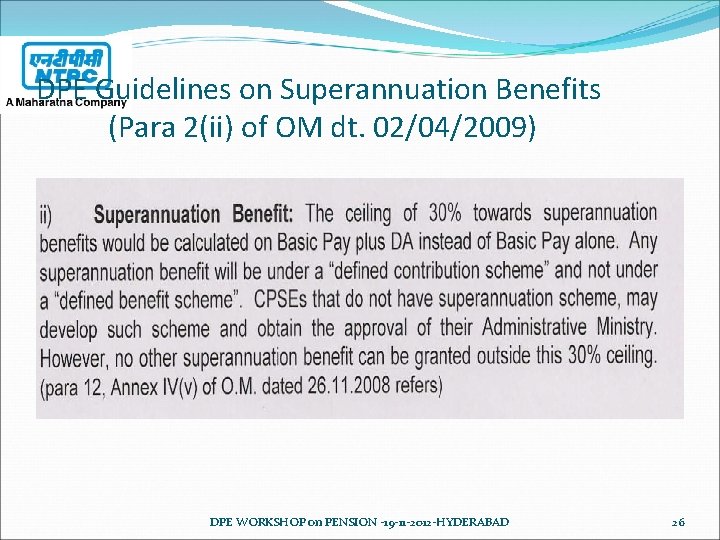

DPE Guidelines on Superannuation Benefits (Para 2(ii) of OM dt. 02/04/2009) DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 26

Annuity options available from the Insurance Co. Pension for life Pension guaranteed for certain years 5/10/15/20 or life time, whichever is more Pension for life with return of capital (ROC) Joint Life Pension with/without ROC and option of 50% or 100% pension to spouse. Increasing annuity- annuity increasing every year by a fixed % - say 3% simple increase p. a. DPE WORKSHOP on PENSION -19 -11 -2012 -HYDERABAD 27

Ntpc pension scheme

Ntpc pension scheme Commuted pension vs uncommuted pension

Commuted pension vs uncommuted pension Dpe lab

Dpe lab Dpe

Dpe Nmdc pension scheme

Nmdc pension scheme Bel retired officers association bangalore

Bel retired officers association bangalore Raws workshop

Raws workshop Florida department of financial regulation

Florida department of financial regulation 3 domain scheme and 5 kingdom scheme

3 domain scheme and 5 kingdom scheme Stata schemes

Stata schemes Welcome welcome this is our christmas story

Welcome welcome this is our christmas story Nhs pension examples

Nhs pension examples Hkkf pension

Hkkf pension Hsc pension calculator

Hsc pension calculator Imprudential inc has an unfunded pension

Imprudential inc has an unfunded pension Pension russe meaning

Pension russe meaning Portalq

Portalq Hsc pension service

Hsc pension service Air canada hr connex

Air canada hr connex Northamptonshire pension fund

Northamptonshire pension fund Iamnpf

Iamnpf Teesside pension fund

Teesside pension fund Pension schultze

Pension schultze Pension master trust

Pension master trust Max cpp payments

Max cpp payments Hampshire pension services member portal

Hampshire pension services member portal How to calculate pension expense

How to calculate pension expense Dotpension gov in

Dotpension gov in