Revise Lecture 23 Revise Lecture 23 Reasons for

- Slides: 34

Revise Lecture 23

Revise Lecture 23 Reasons for holding cash Business need to keep a certain amount readily available. The reasons include; 1. Transaction motive 2. Finance motive 3. Precautionary motive 4. Investment motive

Revise Lecture 23 There are two mathematical models that you need to be aware of: 1. Baumol’s model 2. Miller-Orr’s model

Managing Cash flow Surpluses Most companies would want to avoid risk on short-term cash surpluses that are invested because the funds will be needed in the near future. Desirable investments would generally be low risk and liquid.

Managing Cash flow Surpluses These could include: • Treasury bills: Short-term government IOUs, can be sold when needed • Term deposits: Fixed period deposits • Certificates of deposits: Issued by banks, entitle the holder to interest + principal, can be sold when needed

Managing Cash flow Surpluses • Commercial paper: Short-term IOU issued by companies, unsecured Long term cash surpluses may be used to fund: 1. Investments: new projects or acquisitions 2. Financing: Repay debt, buy back shares 3. Dividends

Managing Cash flow Shortages Working capital funding policy Cash shortages can be funded by either long-term finance or short-term borrowings. 3 types of assets 1. Non-current (fixed) assets 2. Permanent current assets 3. Fluctuating current assets

Managing Cash flow Shortages 1. Non-current (fixed) assets: Long-term assets e. g. building, machinery 2. Permanent current assets: Required to meet long-term minimum needs and sustain normal trading activity. e. g. stock, average level of accounts receivable 3. Fluctuating current assets Vary according to normal business activity. E. g. due to seasonal variations

Managing Cash flow Shortages 3 Approaches 1. Moderate approach 2. Conservative approach 3. Aggressive approach

Managing Cash flow Shortages Moderate approach • Long-term funds finance permanent assets. Short-term funds finance non-permanent assets. Maturity of the funds matches the maturity of the assets. A balance between risk & return can be achieved by a moderate approach

Managing Cash flow Shortages Conservative approach Less risky & less profitable than moderate policy. Fixed, permanent current assets, partly fluctuating assets financed by long-term funding

Managing Cash flow Shortages Aggressive approach • Increased risk of liquidity & cash flow problem. Some current assets and all fluctuating current assets financed by short-term sources

Which approach is better? • As a general rule, assets yield profits over a long period of time should be financed by long -term funds. This is an application of the matching principle. (Moderate approach). • In moderate approach normally short-term assets partly with short-term funding and partly with long-term funding.

Which approach is better? The likelihood of a company adopting an aggressive approach depends on: 1. Management attitude to risk 2. Strength of relationship with the bank providing an overdraft 3. Ability to raise long-term finance

The role of Treasury Management • Treasury management is concerned with liquidity and covers the activities: 1. 2. 3. 4. 5. Banking and exchange Cash and currency management Investment in short-term assets Risk and insurance Raising finance

The role of Treasury Management • A company must choose between having its treasury management: 1. Centralized 2. Decentralized

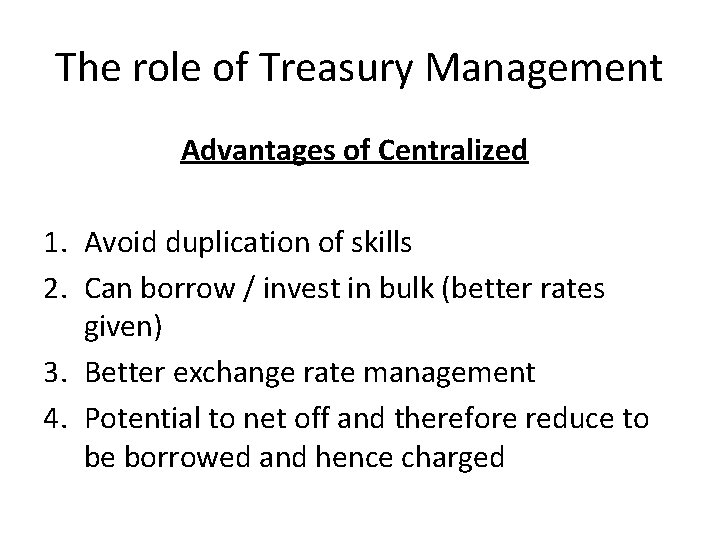

The role of Treasury Management Advantages of Centralized 1. Avoid duplication of skills 2. Can borrow / invest in bulk (better rates given) 3. Better exchange rate management 4. Potential to net off and therefore reduce to be borrowed and hence charged

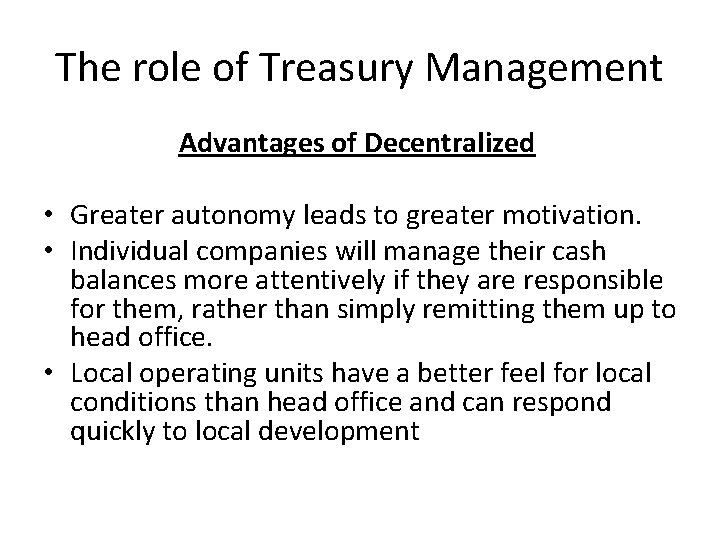

The role of Treasury Management Advantages of Decentralized • Greater autonomy leads to greater motivation. • Individual companies will manage their cash balances more attentively if they are responsible for them, rather than simply remitting them up to head office. • Local operating units have a better feel for local conditions than head office and can respond quickly to local development

Stock • How to manage stock?

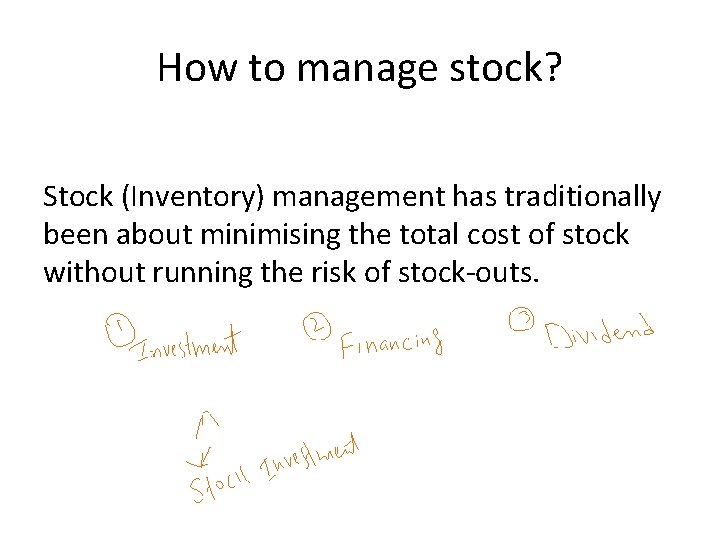

How to manage stock? Stock (Inventory) management has traditionally been about minimising the total cost of stock without running the risk of stock-outs.

How to manage stock? Different models can be used for stock management 1. ABC model / system 2. Economic order quantity model 3. JIT (just-in-time)

ABC model • The stock days ratio gives an overview of a company’s overall inventory position and is a useful method of monitoring a company’s overall stock position. • But major companies may well have thousands of items in stock and will want to calculate how much stock to hold of each individual item.

ABC model A simple stock classification system called an ABC system is often used to achieve this: • A = High value stock items, requiring careful stock control using sophisticated methods such as EOQ • B = Medium value stock items, as above but with less frequent review

ABC model • C = Low value stock items, aim to keep a continuous availability

Economic order quantity model • The level of inventory that minimises costs can be established by the economic order quantity model. • This model analyses how to minimises the total stock related costs of a company • For businesses that do not use JIT, there is an optimum order quantity for inventory items, known as the EOQ.

Economic order quantity model • The aim of the EOQ model is to minimise the total cost of holding and ordering inventory. • When the re-order quantity chosen minimises the total cost of holding and ordering, it is known as the EOQ

Economic order quantity model • This model analyses how to minimise the total stock related costs of a company. Stock related costs are: Holding Costs 1. Warehouse 2. Insurance 3. Obsolete 4. Opportunity cost of capital

Economic order quantity model Ordering Costs: Admin & delivery costs

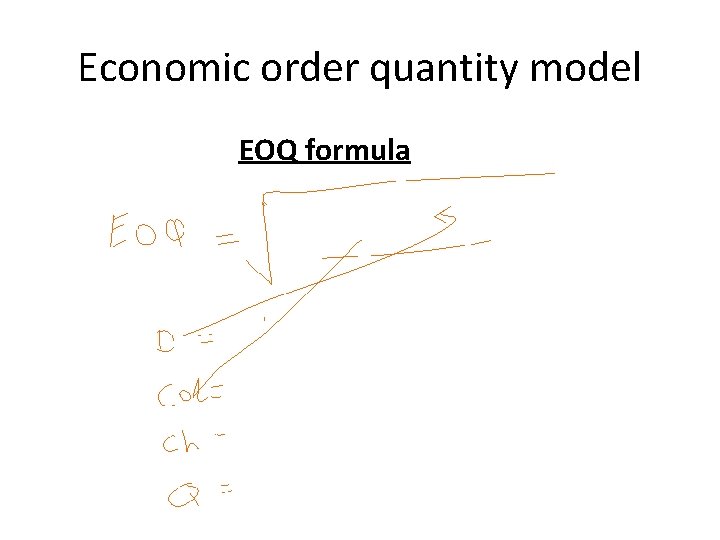

Economic order quantity model EOQ formula

Economic order quantity model Example: • Demand is 150 units per month • Purchase cost per unit Rs 25 • Fixed order cost Rs 32 • Holding cost 18% p. a. Required: • Calaculate the economic order quantity - EOQ

Solution

Economic order quantity model Assumptions: 1. Demand lead time are constant and known 2. Purchase price is constant 3. No buffer inventory held (not needed)

Economic order quantity model • Lead time: The lag (time) between when an order is placed and the item is delivered • Buffer stock : The basic level of stock kept for emergencies. A buffer is required because both demand lead time will fluctuate and predictions can only be based on best estimates

Economic order quantity model EOQ model drawbacks 1. Assumes 0 lead times, and 0 bulk purchase discounts 2. Ignores the possibility of supplier shortages or price rise 3. Ignores fluctuations in demand 4. Ignores the benefit of holding stock to customers

01:640:244 lecture notes - lecture 15: plat, idah, farad

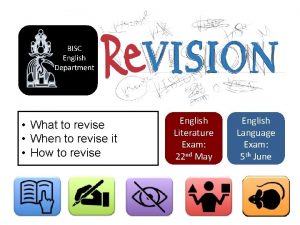

01:640:244 lecture notes - lecture 15: plat, idah, farad Lets revise

Lets revise Revise well

Revise well Assure lesson plan

Assure lesson plan How long should i revise for

How long should i revise for How to revise and remember

How to revise and remember Lets revise

Lets revise Ismary4

Ismary4 Tentative goal statement

Tentative goal statement Helping students revise knowledge

Helping students revise knowledge Macbeth revision

Macbeth revision Revise picture

Revise picture I dont know how to revise

I dont know how to revise What does revise mean

What does revise mean I will revise

I will revise How to revise english literature gcse

How to revise english literature gcse Judith murciano

Judith murciano An item has a positive discriminating power when

An item has a positive discriminating power when Revise present simple

Revise present simple What is proofreading

What is proofreading How to revise effectively

How to revise effectively Latin prefix dis

Latin prefix dis Revise and resubmit letter example

Revise and resubmit letter example How to revise for english language

How to revise for english language Angket terstruktur

Angket terstruktur Revise drawing

Revise drawing What is a decision letter

What is a decision letter Påbyggnader för flakfordon

Påbyggnader för flakfordon I gullregnens månad

I gullregnens månad Inköpsprocessen steg för steg

Inköpsprocessen steg för steg A gastrica

A gastrica Egg för emanuel

Egg för emanuel Strategi för svensk viltförvaltning

Strategi för svensk viltförvaltning Fr formel

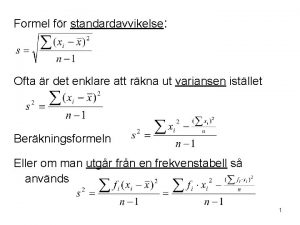

Fr formel Rutin för avvikelsehantering

Rutin för avvikelsehantering