Pyramid Drilling Company LLC A 60 000 LIMITED

![Pyramid Operations Board of Directors Role • Authorized [5] person board - Gary Van Pyramid Operations Board of Directors Role • Authorized [5] person board - Gary Van](https://slidetodoc.com/presentation_image/224d174748b249a07cbb0bbef111002f/image-24.jpg)

- Slides: 46

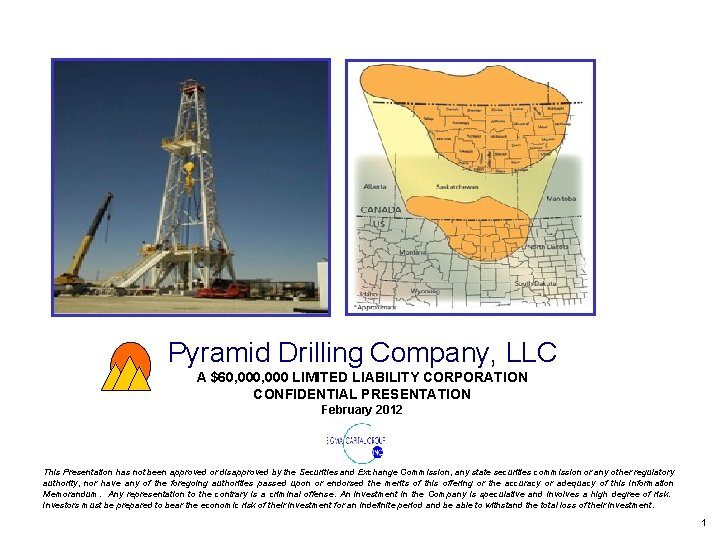

Pyramid Drilling Company, LLC A $60, 000 LIMITED LIABILITY CORPORATION CONFIDENTIAL PRESENTATION February 2012 This Presentation has not been approved or disapproved by the Securities and Exchange Commission, any state securities commission or any other regulatory authority, nor have any of the foregoing authorities passed upon or endorsed the merits of this offering or the accuracy or adequacy of this Information Memorandum. Any representation to the contrary is a criminal offense. An investment in the Company is speculative and involves a high degree of risk. Investors must be prepared to bear the economic risk of their investment for an indefinite period and be able to withstand the total loss of their investment. 1

Disclaimers NOTICE TO POTENTIAL INVESTORS This Confidential Information Memorandum (the “Memorandum”), based upon information supplied by Pyramid Drilling Company, LLC (“Pyramid” or the “Company”) and its managing member, Firemoon Energy, LLC (the “Managing Member” or “Firemoon”), is being furnished solely for the consideration of eligible investors who have the knowledge and experience in financial and business matters and the capability to conduct their own due diligence investigation and evaluation in connection with the investment described herein (the “Potential Investors”). This information is supplied by the Company, solely for use by Potential Investors in connection with their consideration of an investment of $15, 000 in the Company. This Confidential Information Memorandum presents information with respect to the Company as of the date hereof. The Company does not intend to update or otherwise revise this Amendment following its distribution, and Potential Investors should not expect the Company to do so. Neither the Company nor any of their respective affiliates, employees, or representatives make any representation or warranty, expressed or implied, as to the accuracy or completeness of any of the information contained in this Confidential Information Memorandum or any other information (whether communicated in written or oral form) transmitted or made available to prospective investors, and each such person, expressly disclaim any and all liabilities relating to or resulting from the use of this Memorandum or any other such information by perspective investor, their affiliates or representatives. Sigma Capital Group has not independently verified the information contained herein. Only those particular representations or warranties, if any, which may be made by the Company to the investor in a definitive, written Private Placement Memorandum (“Private Placement Memorandum”), and subject to such limitations and restrictions as may be specified therein, will have any legal effect. CONFIDENTIALITY Each recipient agrees that the subject matter hereof and all of the information contained herein is of a confidential nature and that the recipient will treat it in a confidential manner and that they will not, directly or indirectly, use for any purpose, disclose or permit its affiliates or representatives to use for any purpose or disclose any information regarding its receipt hereof or any information contained herein to any other person, or to reproduce this Memorandum, in whole or in part, without the prior written consent of the Company. FORWARD-LOOKING STATEMENTS The market analysis and financial projections presented in this Memorandum represent the subjective views of the management of the Company and are management’s current estimates of future performance based on various assumptions which management believes are reasonable, but which may or may not prove to be correct. There can be no assurance that management’s views are accurate or that the projections will be realized and actual results may vary from those shown. Industry experts may disagree with these assumptions and with the management views of the market and prospects for the Company. NO SOLICITATION This Memorandum does not constitute an offer to sell or solicitation of any offer to buy any securities. The purpose of this Memorandum is to assist prospective investors in deciding to proceed with a further investigation and evaluation of the Company in conjunction with their consideration of the investment in the Company. This Memorandum does not propose to contain all information that may be material to an investor ad recipients of this Memorandum should conduct their own independent evaluation of the Company. This Memorandum has not been filed or reviewed by, and the securities offered have not been registered with or approved by, the Securities and Exchange Commission (“SEC”) or any securities regulatory authority, or any state, nor has the SEC or any authority passed upon the accuracy or the adequacy of this Memorandum. CONTACT INFORMATION No person has been authorized to provide any information to Potential Investors with respect to the Company or the proposed offering except the information contained herein. Disinterested party should immediately return the information to the address listed below. Neither the Company nor any of its representatives should be contacted directly, and all communications, inquiries and requests for information should be directed to the following individual: Sigma Capital Group, LLC Bruce Woodry, Chairman and CEO 906 -483 -0406 2

Introduction Table Of Contents • • • Summary Oil Shale Overview Market and Competition Pyramid Drilling Strategy Pyramid Operations Investment Opportunity 3

Summary • This presentation outlines an original concept initiated by Everett Toombs and Gary Van Cleave and previously used by Peak Energy. • Pyramid focuses on the Bakken, one of the largest (possibly the largest) continuous oil accumulations in the world. • Advances in horizontal drilling has made the Bakken oil shale possible • Mr. Toombs Everett is known as one of the preeminent horizontal drilling experts having drilled 20 K ft. wells with 10 K ft. laterals and very knowledgeable of the Bakken shale play. Pyramid is seeking $60 m to purchase rigs, upgrade for cold weather use, purchase tubulars, establish a man camp, and working capital. 4

Table Of Contents • • • Summary Oil Shale Overview Market and Competition Pyramid Drilling Strategy Pyramid Operations Investment Opportunity 5

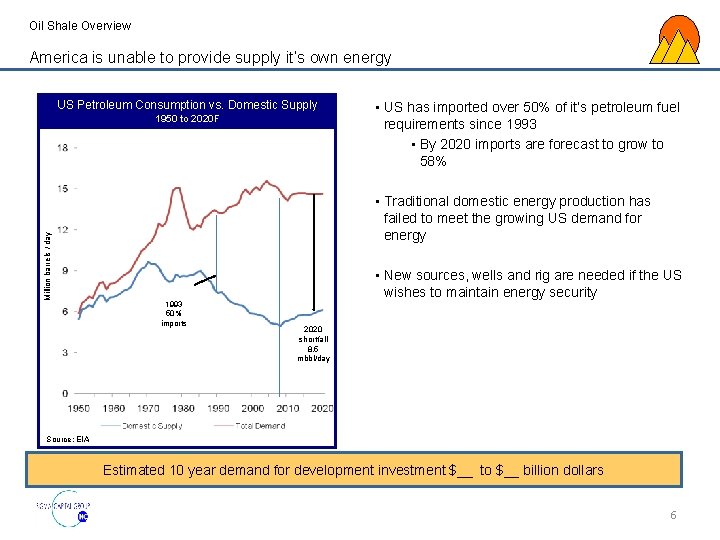

Oil Shale Overview America is unable to provide supply it’s own energy US Petroleum Consumption vs. Domestic Supply Million barrels / day 1950 to 2020 F • US has imported over 50% of it’s petroleum fuel requirements since 1993 • By 2020 imports are forecast to grow to 58% • Traditional domestic energy production has failed to meet the growing US demand for energy 1993 50% imports • New sources, wells and rig are needed if the US wishes to maintain energy security 2020 shortfall 8. 5 mbbl/day Source: EIA Estimated 10 year demand for development investment $__ to $__ billion dollars 6

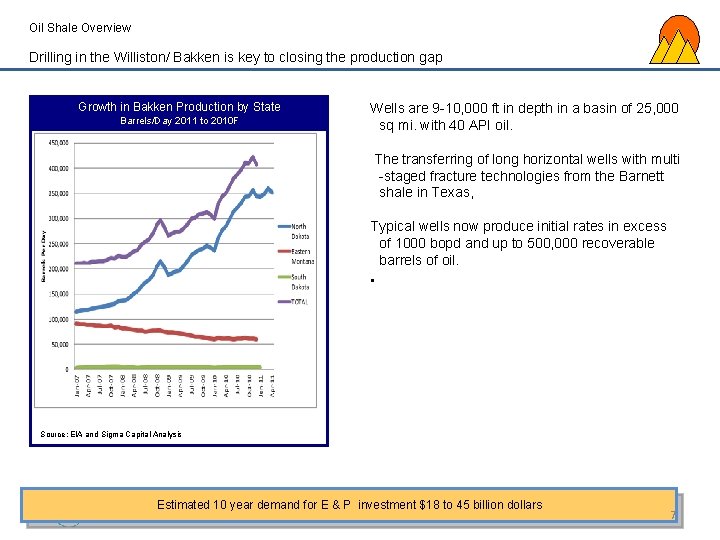

Oil Shale Overview Drilling in the Williston/ Bakken is key to closing the production gap Growth in Bakken Production by State Barrels/Day 2011 to 2010 F Wells are 9 -10, 000 ft in depth in a basin of 25, 000 sq mi. with 40 API oil. The transferring of long horizontal wells with multi -staged fracture technologies from the Barnett shale in Texas, Typical wells now produce initial rates in excess of 1000 bopd and up to 500, 000 recoverable barrels of oil. • Source: EIA and Sigma Capital Analysis Estimated 10 year demand for E & P investment $18 to 45 billion dollars 7

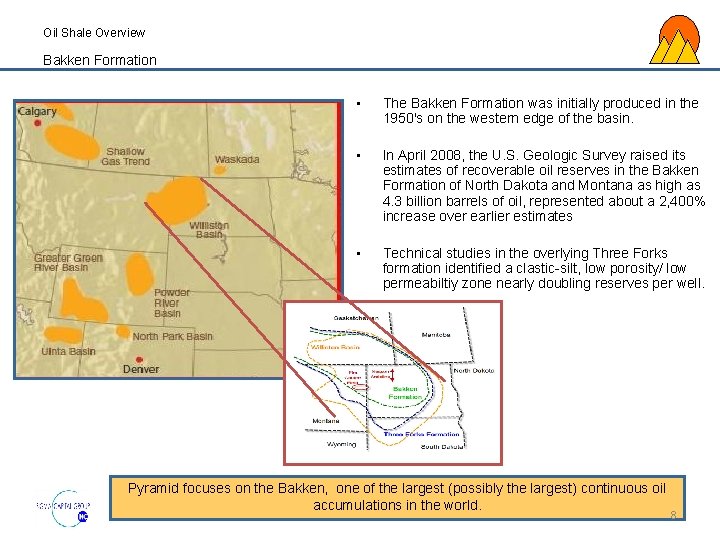

Oil Shale Overview Bakken Formation • The Bakken Formation was initially produced in the 1950's on the western edge of the basin. • In April 2008, the U. S. Geologic Survey raised its estimates of recoverable oil reserves in the Bakken Formation of North Dakota and Montana as high as 4. 3 billion barrels of oil, represented about a 2, 400% increase over earlier estimates • Technical studies in the overlying Three Forks formation identified a clastic-silt, low porosity/ low permeabiltiy zone nearly doubling reserves per well. Pyramid focuses on the Bakken, one of the largest (possibly the largest) continuous oil accumulations in the world. 8

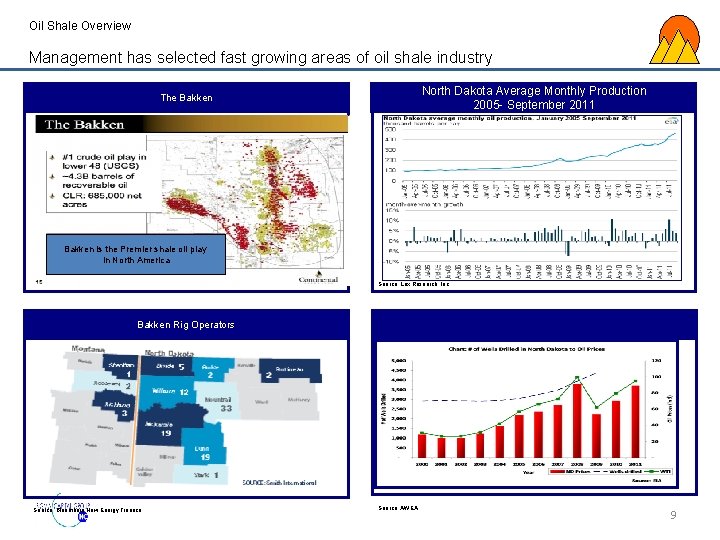

Oil Shale Overview Management has selected fast growing areas of oil shale industry North Dakota Average Monthly Production 2005 - September 2011 The Bakken is the Premier shale oil play in North America Source: EIA Source: Lux Research, Inc Bakken Rig Operators Source: Bloomberg New Energy Finance Source: AWEA 9

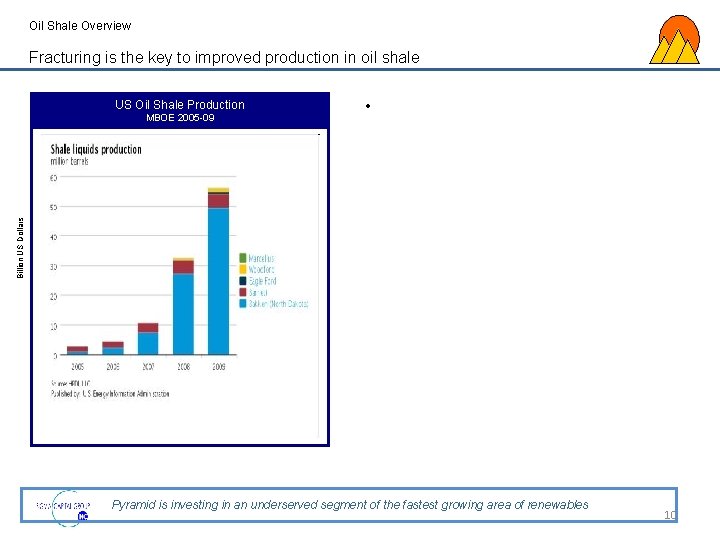

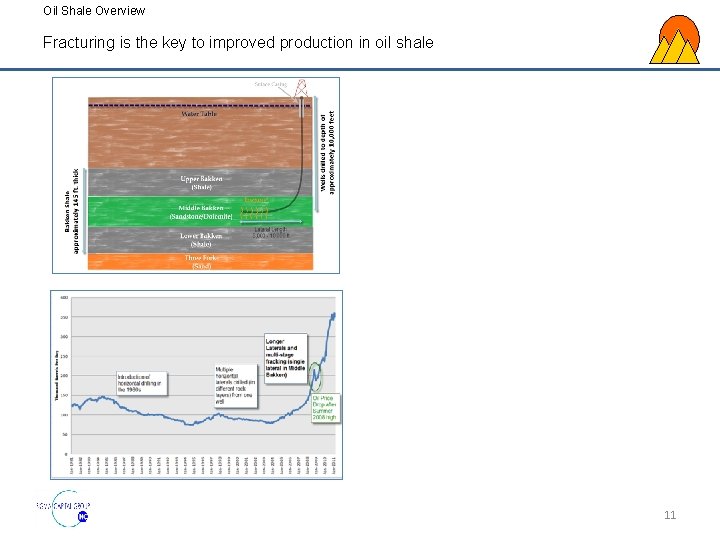

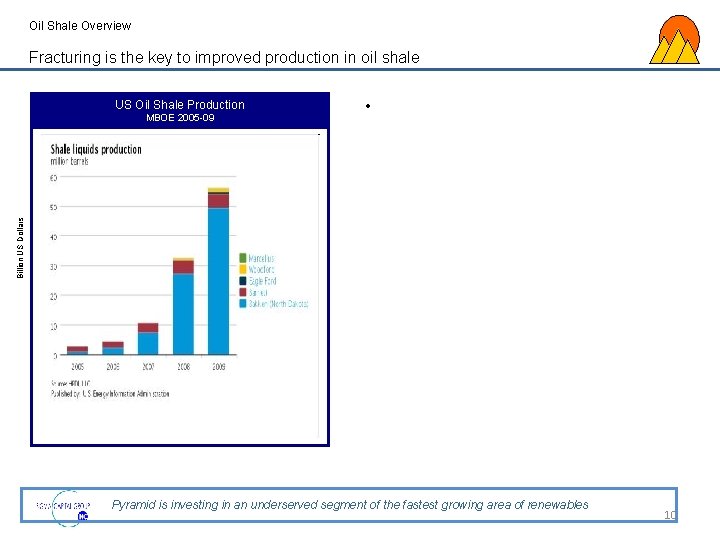

Oil Shale Overview Fracturing is the key to improved production in oil shale US Oil Shale Production • Billion US Dollars MBOE 2005 -09 Pyramid is investing in an underserved segment of the fastest growing area of renewables 10

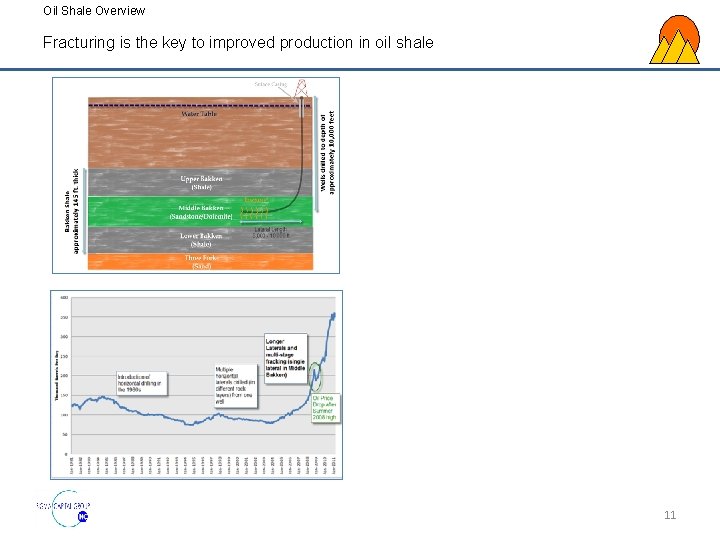

Oil Shale Overview Fracturing is the key to improved production in oil shale 11

Table Of Contents • • • Summary Oil Shale Overview Market and Competition Pyramid Drilling Strategy Pyramid Operations Investment Opportunity 12

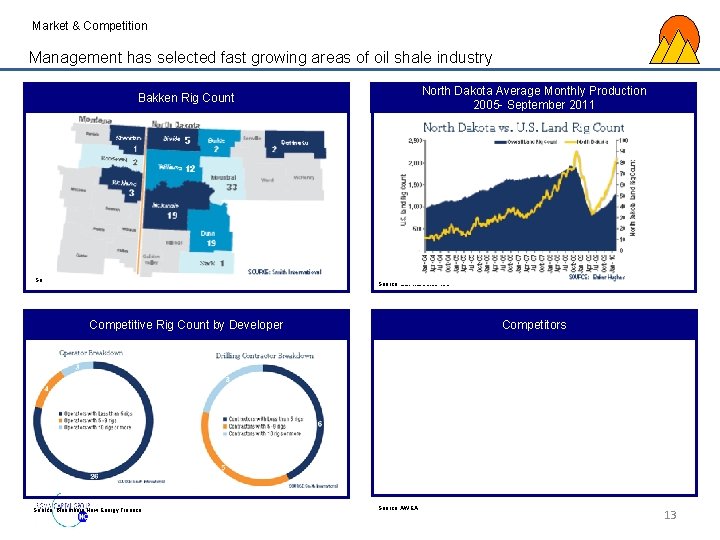

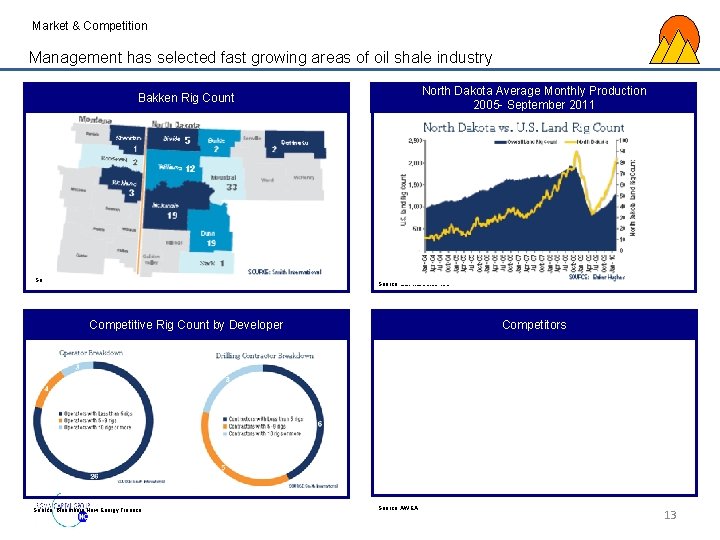

Market & Competition Management has selected fast growing areas of oil shale industry North Dakota Average Monthly Production 2005 - September 2011 Bakken Rig Count Source: EIA Source: Lux Research, Inc Competitive Rig Count by Developer Source: Bloomberg New Energy Finance Competitors Source: AWEA 13

Introduction Table Of Contents • • • Summary Oil Shale Overview Market and Competition Pyramid Drilling Strategy Pyramid Operations Investment Opportunity 14

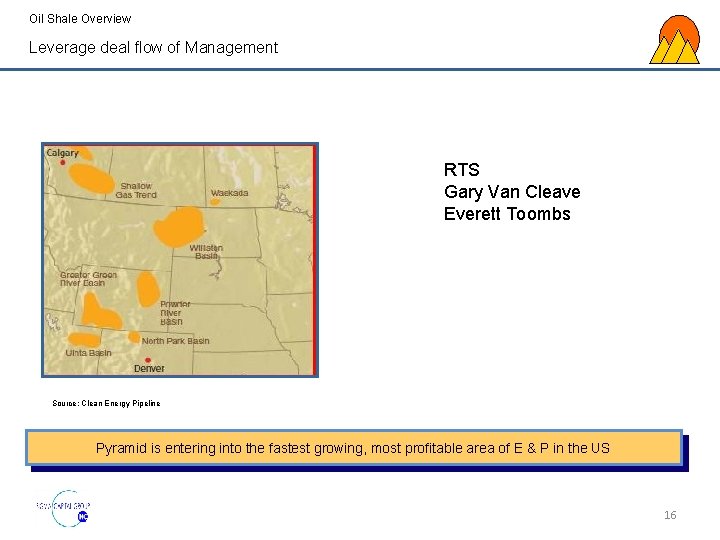

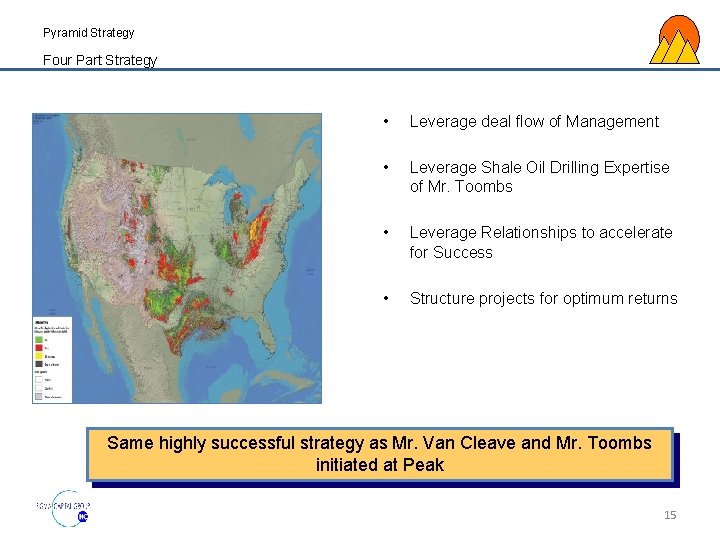

Pyramid Strategy Four Part Strategy • Leverage deal flow of Management • Leverage Shale Oil Drilling Expertise of Mr. Toombs • Leverage Relationships to accelerate for Success • Structure projects for optimum returns Same highly successful strategy as Mr. Van Cleave and Mr. Toombs initiated at Peak 15

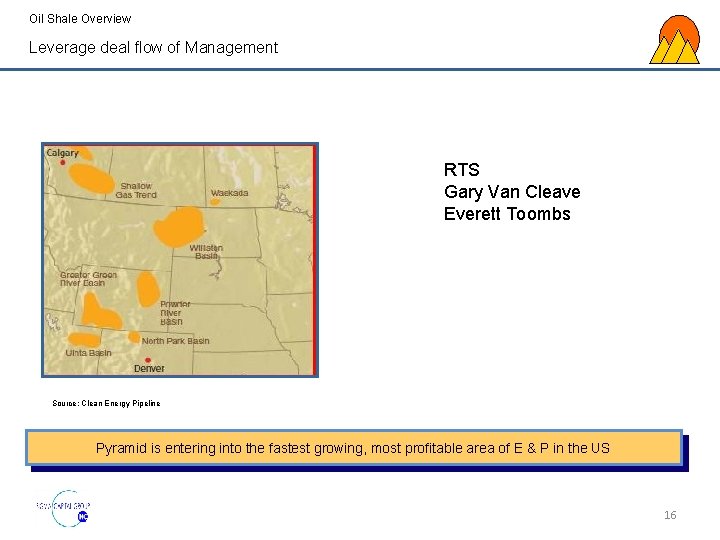

Oil Shale Overview Leverage deal flow of Management RTS Gary Van Cleave Everett Toombs Source: Clean Energy Pipeline Pyramid is entering into the fastest growing, most profitable area of E & P in the US 16

Pyramid Strategy Leverage Shale Oil / Bakken Drilling Expertise of Mr. Toombs • • Experience in Bakken – Deep wells (x to y ‘) – Wide radials (a to b’) – Fracturing (Fracking) completion – Bakken play, known geologies – Low cost driller. Pyramid is able to drill difficult wells cost effectively 17

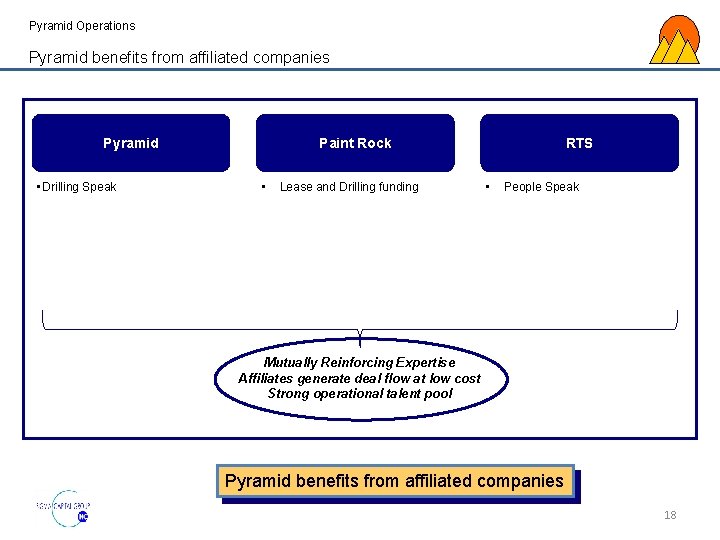

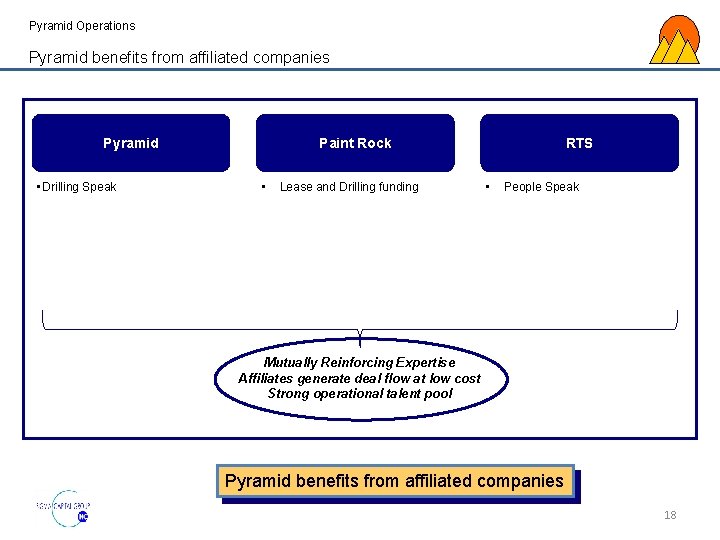

Pyramid Operations Pyramid benefits from affiliated companies Pyramid • Drilling Speak Paint Rock • Lease and Drilling funding RTS • People Speak Mutually Reinforcing Expertise Affiliates generate deal flow at low cost Strong operational talent pool Pyramid benefits from affiliated companies 18

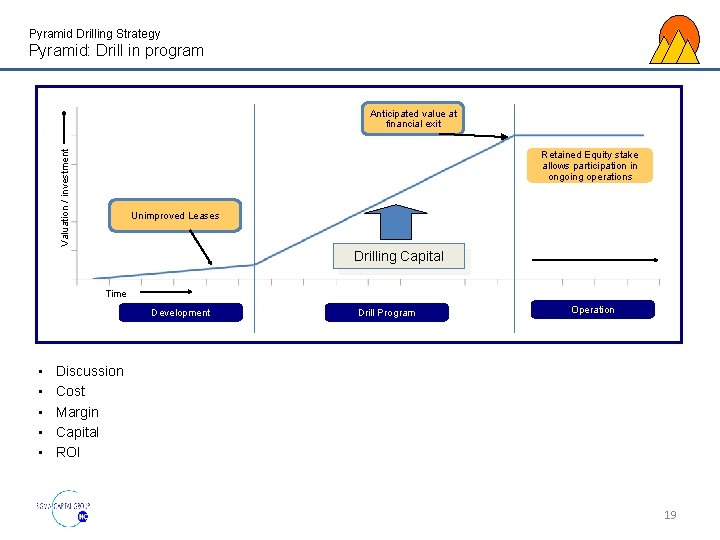

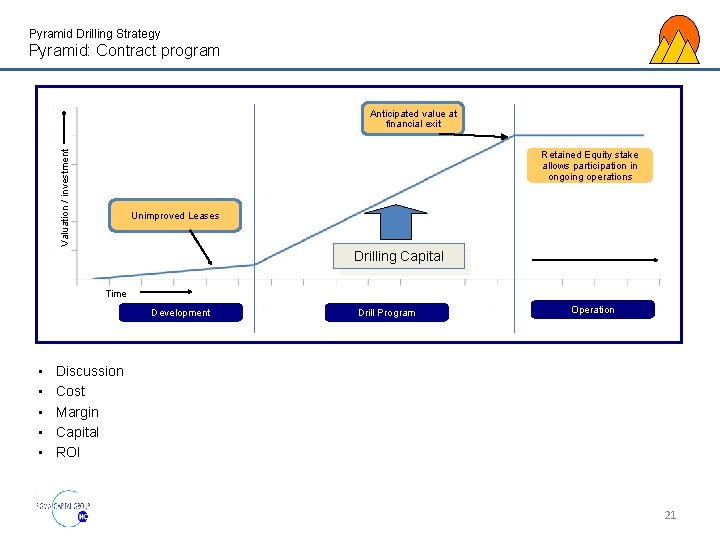

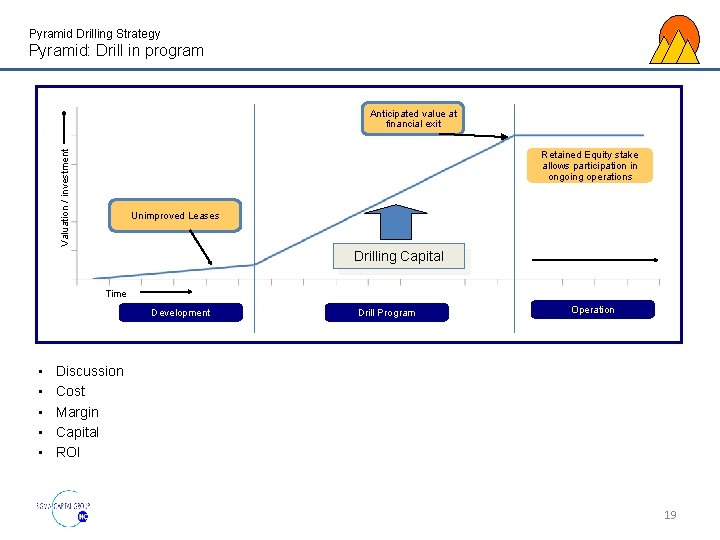

Pyramid Drilling Strategy Pyramid: Drill in program Valuation / investment Anticipated value at financial exit Retained Equity stake allows participation in ongoing operations Unimproved Leases Drilling Capital Time Development • • • Drill Program Operation Discussion Cost Margin Capital ROI 19

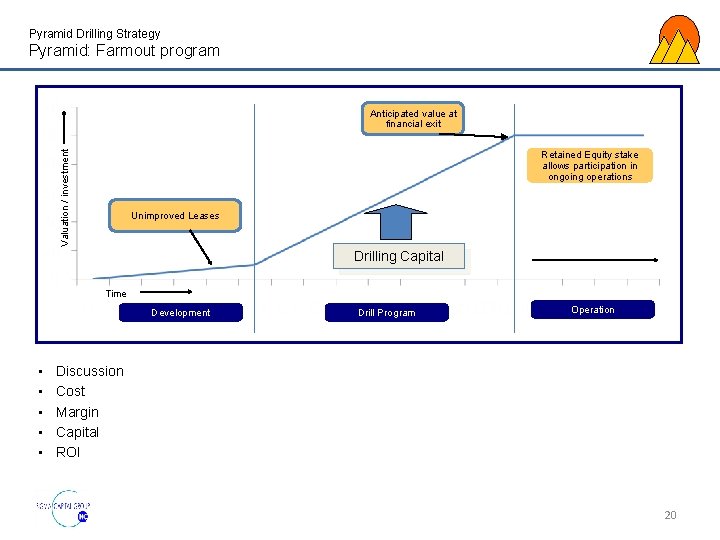

Pyramid Drilling Strategy Pyramid: Farmout program Valuation / investment Anticipated value at financial exit Retained Equity stake allows participation in ongoing operations Unimproved Leases Drilling Capital Time Development • • • Drill Program Operation Discussion Cost Margin Capital ROI 20

Pyramid Drilling Strategy Pyramid: Contract program Valuation / investment Anticipated value at financial exit Retained Equity stake allows participation in ongoing operations Unimproved Leases Drilling Capital Time Development • • • Drill Program Operation Discussion Cost Margin Capital ROI 21

Introduction Table Of Contents • • • Summary Oil Shale Overview Market and Competition Pyramid Drilling Strategy Pyramid Operations Investment Opportunity 22

Pyramid Operations Experienced management team is poised for growth Bruce Woodry Managing Member • . Founder, Chairman and Chief Executive Officer of Sigma Capital Group, Inc. 14 years of increasing responsibility with industrial conglomerates includes Sperry Univac, and General Electric. Founded several entrepreneurial companies, and currently serves on the board of several energy companies BS Electrical Engineering, selected for advanced coursework in marketing and finance at General Electric’s Crotonville Campus where he was given the P. E. A. K Award for outstanding contribution. 23

![Pyramid Operations Board of Directors Role Authorized 5 person board Gary Van Pyramid Operations Board of Directors Role • Authorized [5] person board - Gary Van](https://slidetodoc.com/presentation_image/224d174748b249a07cbb0bbef111002f/image-24.jpg)

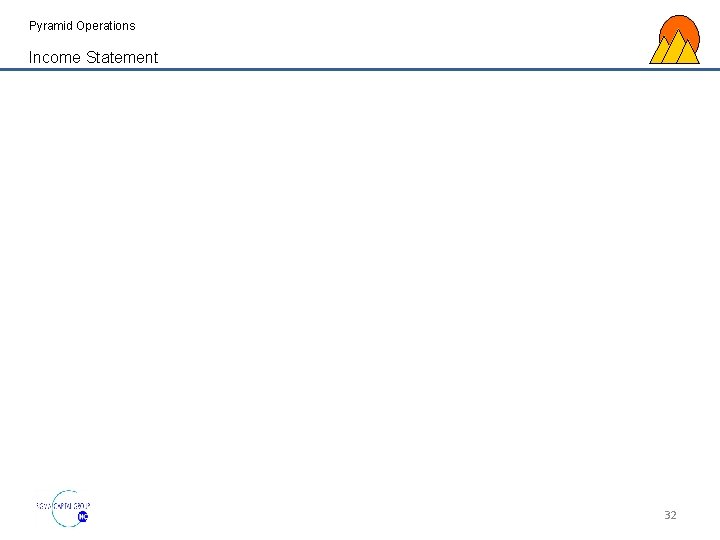

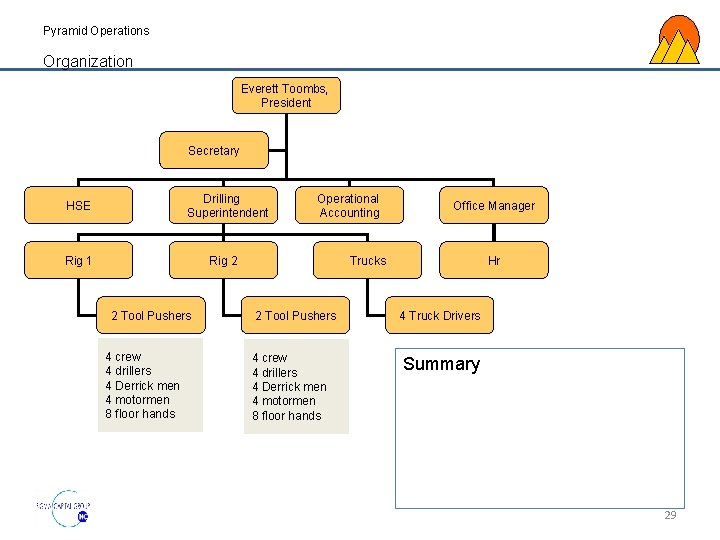

Pyramid Operations Board of Directors Role • Authorized [5] person board - Gary Van Cleave, CEO Everett Toombs, President Bruce Woodry, Chairman Investor Advisory Board Members Advisory Board Role • • Vinton Rollins Lynn Van Cleave 24

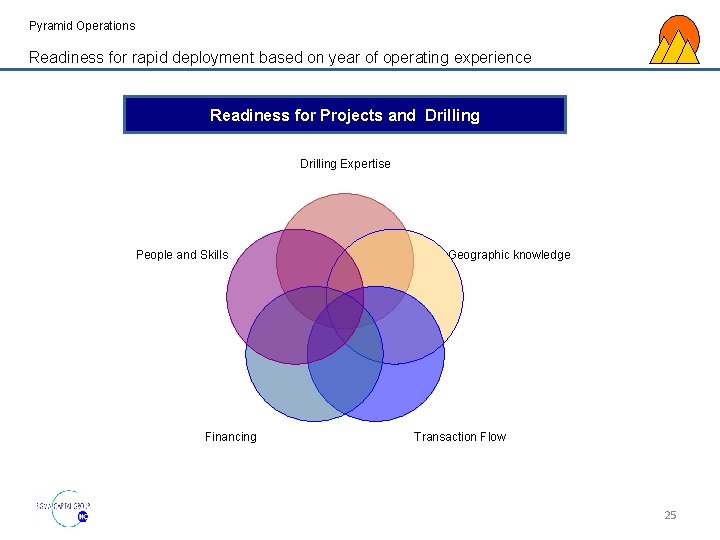

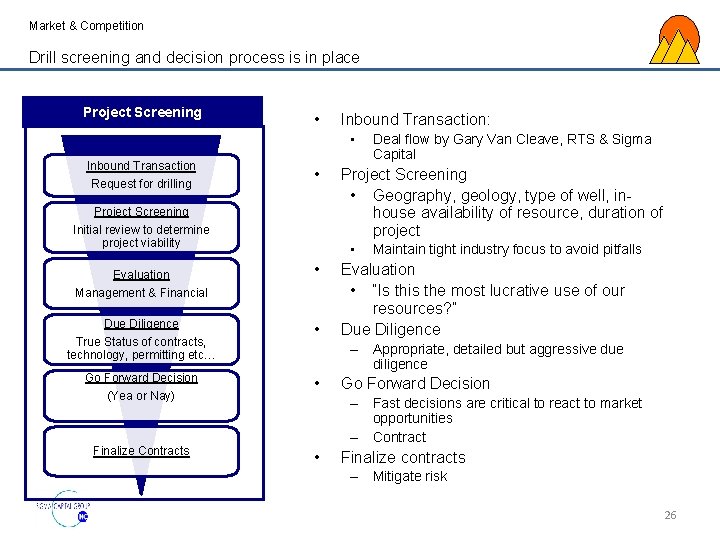

Pyramid Operations Readiness for rapid deployment based on year of operating experience Readiness for Projects and Drilling Expertise People and Skills Financing Geographic knowledge Transaction Flow 25

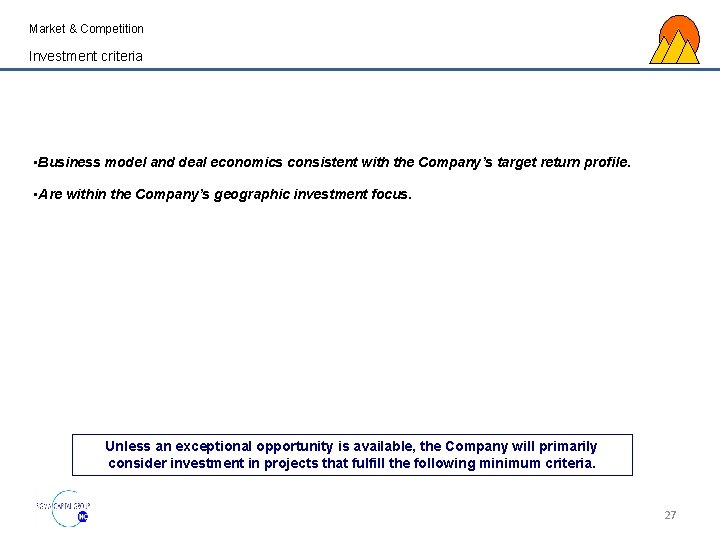

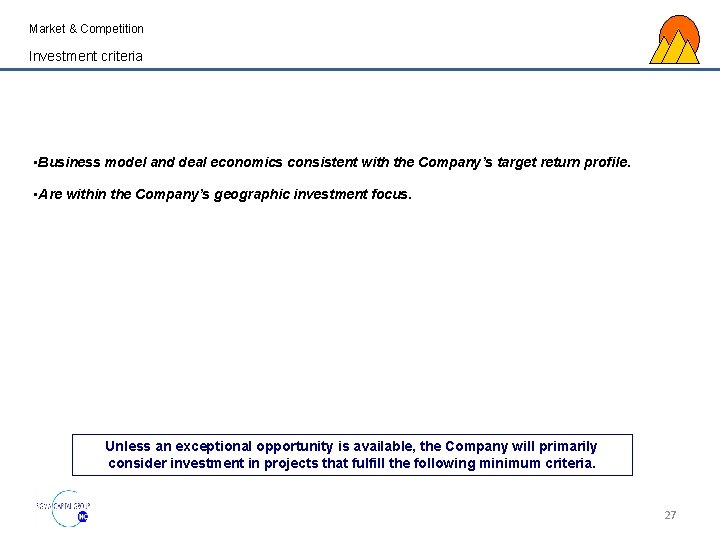

Market & Competition Drill screening and decision process is in place Project Screening • Inbound Transaction: • Inbound Transaction Request for drilling • Project Screening Initial review to determine project viability Evaluation Management & Financial Due Diligence True Status of contracts, technology, permitting etc… • Go Forward Decision • (Yea or Nay) Finalize Contracts Project Screening • Geography, geology, type of well, inhouse availability of resource, duration of project • • Deal flow by Gary Van Cleave, RTS & Sigma Capital Maintain tight industry focus to avoid pitfalls Evaluation • “Is this the most lucrative use of our resources? ” Due Diligence – Appropriate, detailed but aggressive due diligence Go Forward Decision – Fast decisions are critical to react to market opportunities – Contract • Finalize contracts – Mitigate risk 26

Market & Competition Investment criteria • Business model and deal economics consistent with the Company’s target return profile. • Are within the Company’s geographic investment focus. Unless an exceptional opportunity is available, the Company will primarily consider investment in projects that fulfill the following minimum criteria. 27

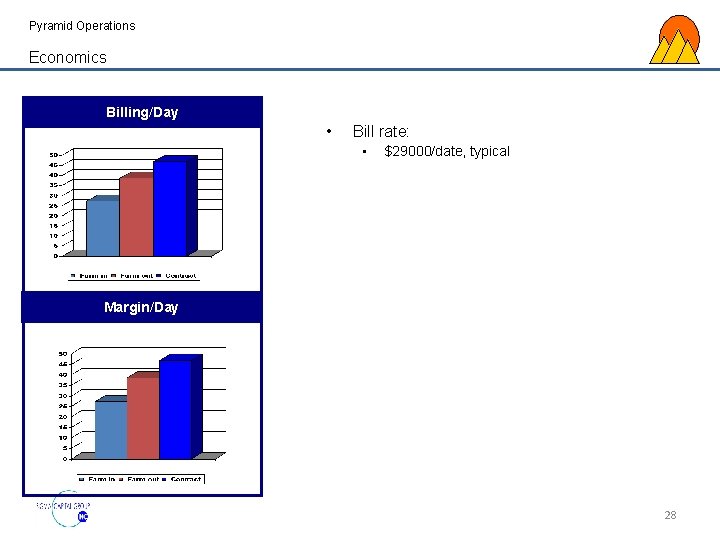

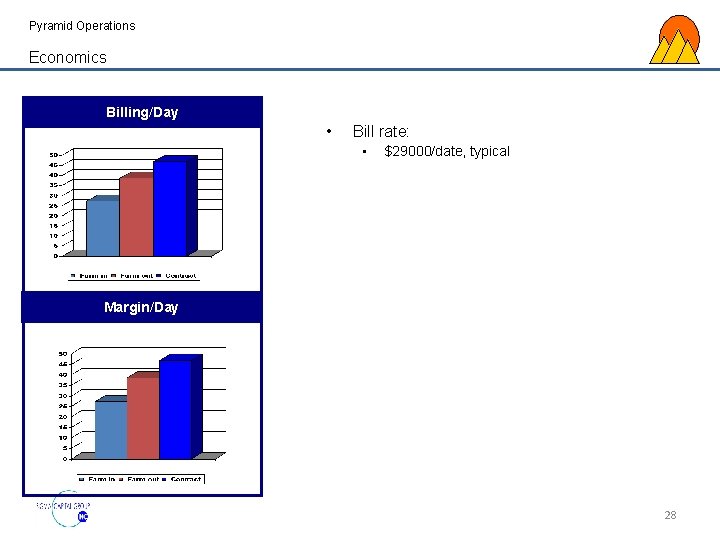

Pyramid Operations Economics Billing/Day • Bill rate: • $29000/date, typical Margin/Day 28

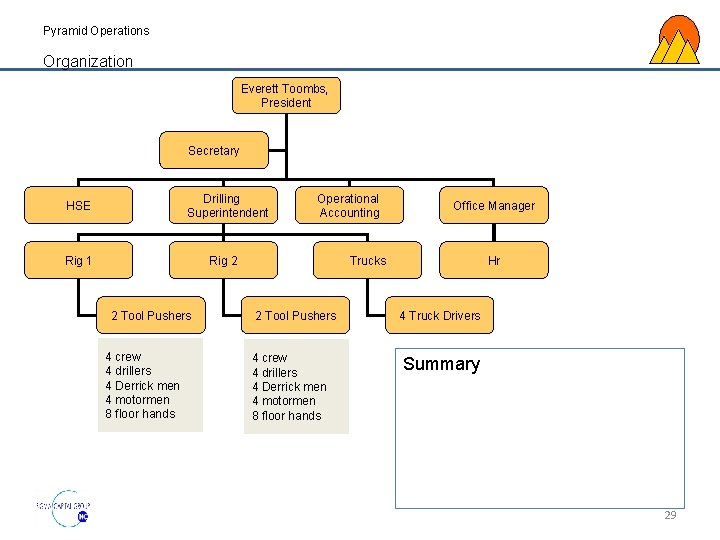

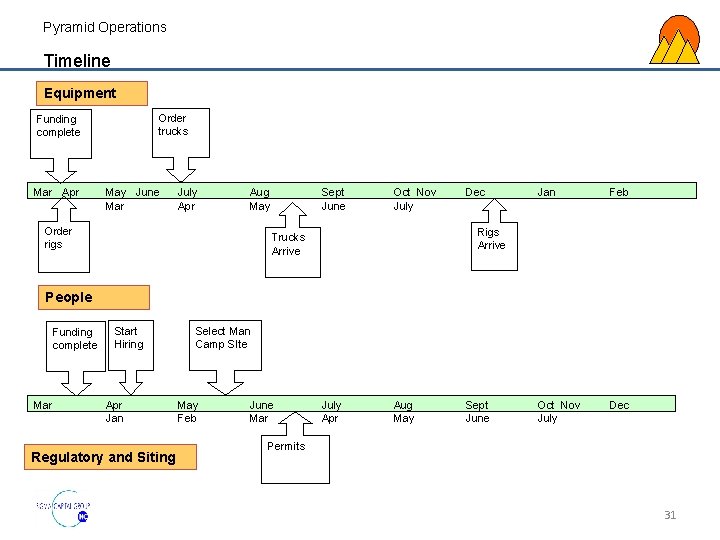

Pyramid Operations Organization Everett Toombs, President Secretary Drilling Superintendent HSE Rig 1 Operational Accounting Rig 2 2 Tool Pushers 4 crew 4 drillers 4 Derrick men 4 motormen 8 floor hands Office Manager Hr Trucks 2 Tool Pushers 4 crew 4 drillers 4 Derrick men 4 motormen 8 floor hands 4 Truck Drivers Summary 29

Pyramid Operations Rigs • Why National Oilwell Varco? – – – • New Rigs • – High Horsepower – Mobile to reduce mobilization costs Selection of options – – – • Delivery times – – – • Transport to Site – – • Price and Terms – – – See budget, following 30

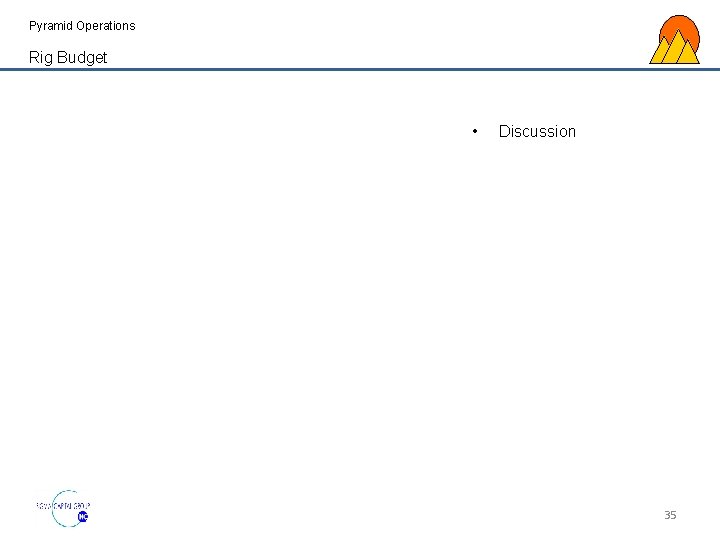

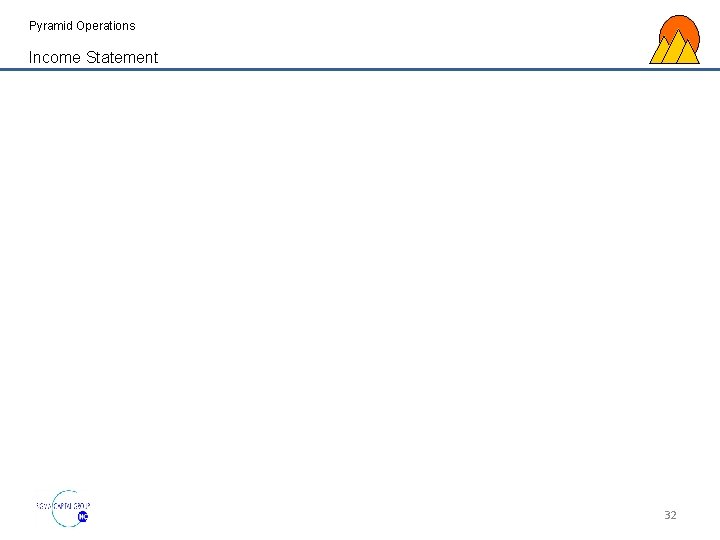

Pyramid Operations Timeline Equipment Order trucks Funding complete Mar Apr May June Mar July Apr Aug May Order rigs Sept June Oct Nov July Dec Jan Feb Oct Nov July Dec Rigs Arrive Trucks Arrive People Funding complete Mar Start Hiring Apr Jan Regulatory and Siting Select Man Camp SIte May Feb June Mar July Apr Aug May Sept June Permits 31

Pyramid Operations Income Statement 32

Pyramid Operations Balance Sheet 33

Pyramid Operations Cashflow 34

Pyramid Operations Rig Budget • Discussion 35

Pyramid Operations Man Camp Budget • Discussion 36

Introduction Table Of Contents • • • Summary Oil Shale Overview Market and Competition Pyramid Drilling Strategy Pyramid Operations Investment Opportunity 37

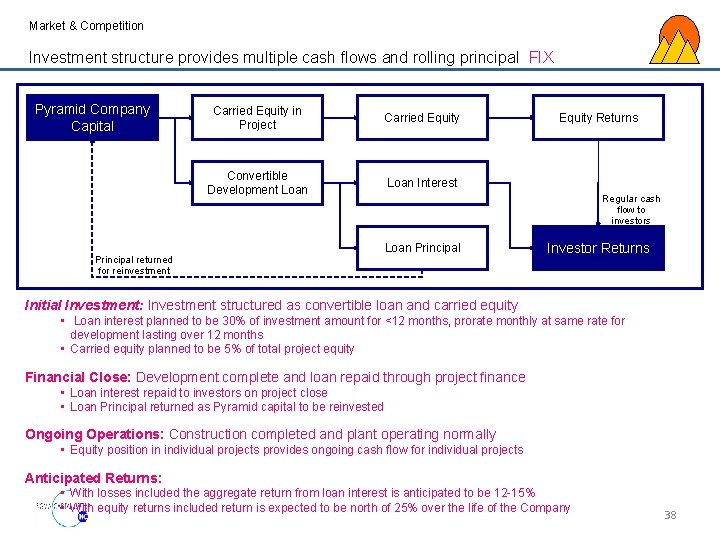

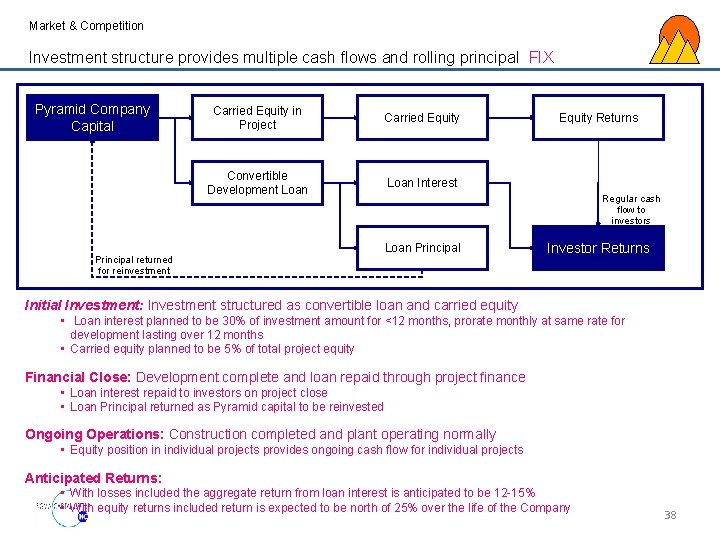

Market & Competition Investment structure provides multiple cash flows and rolling principal FIX Pyramid Company Capital Carried Equity in Project Carried Equity Convertible Development Loan Interest Principal returned for reinvestment Equity Returns Regular cash flow to investors Loan Principal Investor Returns Initial Investment: Investment structured as convertible loan and carried equity • Loan interest planned to be 30% of investment amount for <12 months, prorate monthly at same rate for development lasting over 12 months • Carried equity planned to be 5% of total project equity Financial Close: Development complete and loan repaid through project finance • Loan interest repaid to investors on project close • Loan Principal returned as Pyramid capital to be reinvested Ongoing Operations: Construction completed and plant operating normally • Equity position in individual projects provides ongoing cash flow for individual projects Anticipated Returns: • With losses included the aggregate return from loan interest is anticipated to be 12 -15% • With equity returns included return is expected to be north of 25% over the life of the Company 38

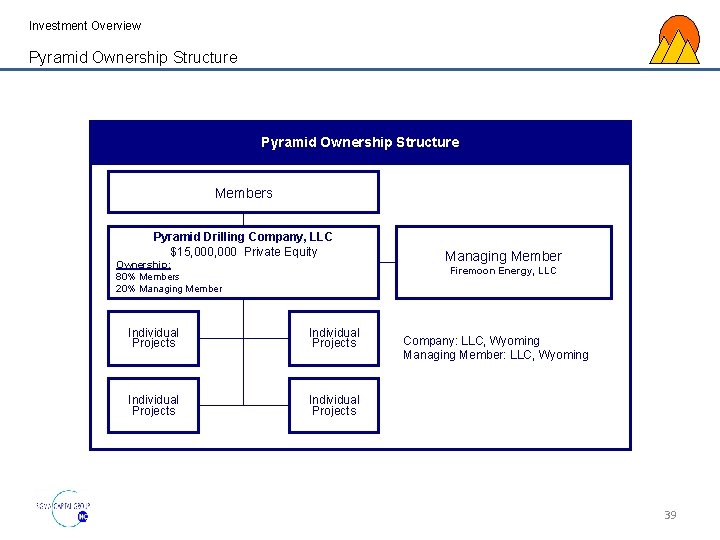

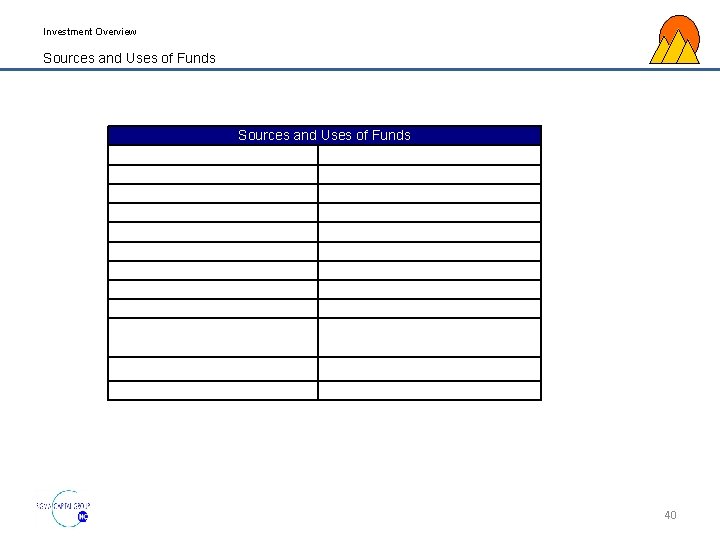

Investment Overview Pyramid Ownership Structure Members Pyramid Drilling Company, LLC $15, 000 Private Equity Ownership: 80% Members 20% Managing Member Firemoon Energy, LLC Individual Projects Company: LLC, Wyoming Managing Member: LLC, Wyoming 39

Investment Overview Sources and Uses of Funds 40

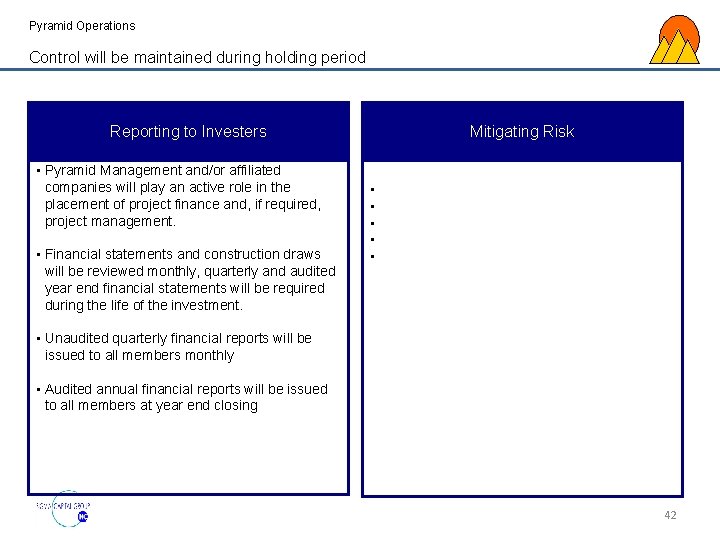

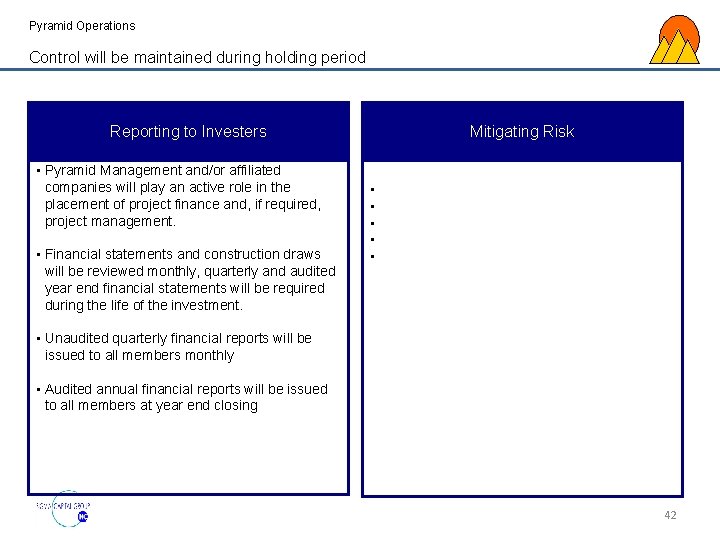

Investment Overview Proposed Company Term and Goals Company Name Pyramid Drilling Company, LLC Organization Wyoming Limited Liability Corporation Pyramid Manager Firemoon Energy, LLC Total Transaction $60 million, $45 m debt, $15 M equity Equity Raise $15 million Percentage Offered Target first closing date 80% of Pyramid Membership Units for 100% of financing March 15 th, 2012 Investment Period 5 years Liquidity Event Anticipate 3 -4 years Incentived Drilling Costs In proportion to Membership Units Management Fee Per budget Performance Fee 20% of all distributed profits Target ROI to Investors over Term Targeting 25%-35% overall return Target Investors Highly knowledgeable institutional investors Minimum Investment $15, 000 41

Pyramid Operations Control will be maintained during holding period Reporting to Investers • Pyramid Management and/or affiliated companies will play an active role in the placement of project finance and, if required, project management. • Financial statements and construction draws will be reviewed monthly, quarterly and audited year end financial statements will be required during the life of the investment. Mitigating Risk • • • Unaudited quarterly financial reports will be issued to all members monthly • Audited annual financial reports will be issued to all members at year end closing 42

Investment Overview Investment Returns 43

Investment Overview Investment Timing 44

Investment Overview Exit Strategy 45

Investment Overview Summary • • • The Right Play The Right Market The Right Rigs The Right Team The Right Investment The Time is NOW… Pyramid Drilling, LLC Bruce Woodry, Woodry@Sigma. Capital. net 906 -483 -0406 46

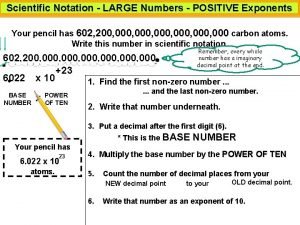

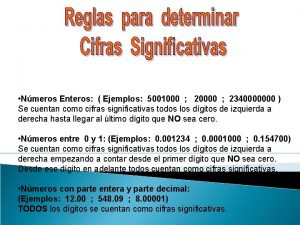

97 700 000 000 000 000 000 000 in scientific notation

97 700 000 000 000 000 000 000 in scientific notation 602 200 000 000 000 000 000 000 in scientific notation

602 200 000 000 000 000 000 000 in scientific notation 7 500 000 000 000 000 000 in scientific notation

7 500 000 000 000 000 000 in scientific notation 090-0000-0000

090-0000-0000 Pyramid drilling

Pyramid drilling Perfusion limited vs diffusion limited

Perfusion limited vs diffusion limited Nitin group

Nitin group American transmission company llc

American transmission company llc The nielsen company us llc

The nielsen company us llc Ghana nuts company limited

Ghana nuts company limited Barista coffee company ltd

Barista coffee company ltd Nursing organizational chart in hospital

Nursing organizational chart in hospital Kenya seed company limited

Kenya seed company limited Limited company vs partnership

Limited company vs partnership Tpbi & myanmar star company limited

Tpbi & myanmar star company limited Khyber tobacco company limited

Khyber tobacco company limited Introduction to company account

Introduction to company account Private limited company advantages and disadvantages gcse

Private limited company advantages and disadvantages gcse Ib business meaning

Ib business meaning Iifcl uk

Iifcl uk Syed nabeel haider jafri

Syed nabeel haider jafri Types of business gcse

Types of business gcse Waterfront shipping company limited

Waterfront shipping company limited Memorandum of private limited company

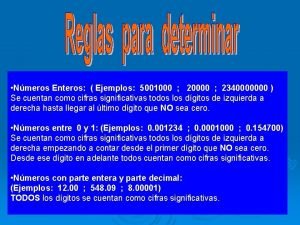

Memorandum of private limited company Proper scientific notation

Proper scientific notation 4 000 000

4 000 000 123 000 000 in scientific notation

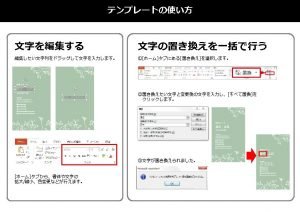

123 000 000 in scientific notation Scientific notation

Scientific notation 4 500 000 000

4 500 000 000 1, 10, 100, 1000, 10000

1, 10, 100, 1000, 10000 1 000 000 0000

1 000 000 0000 Pedipalpos quelados

Pedipalpos quelados 1 600 000

1 600 000 2,340,000,000

2,340,000,000 4 500 000

4 500 000 Milli micro nano

Milli micro nano Frans cooijmans

Frans cooijmans 1,000 x 3,000

1,000 x 3,000 2,340,000,000

2,340,000,000 Advantage of scientific notation

Advantage of scientific notation 260 000 000

260 000 000 450 000 000 in scientific notation

450 000 000 in scientific notation Express 4,980,000, 000 in scientific notation

Express 4,980,000, 000 in scientific notation Cancion lemuriana

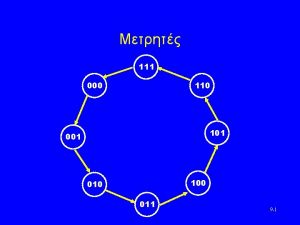

Cancion lemuriana 110-000-110 & 111-000-111

110-000-110 & 111-000-111 4 500 000 000

4 500 000 000 A company has sales of 695 000 and cost of goods

A company has sales of 695 000 and cost of goods