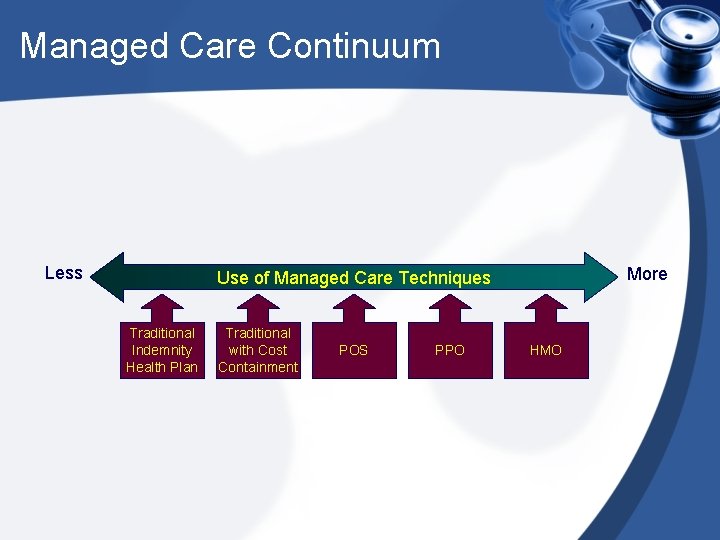

Managed Care Organizations Managed Care Continuum Less More

- Slides: 20

Managed Care Organizations

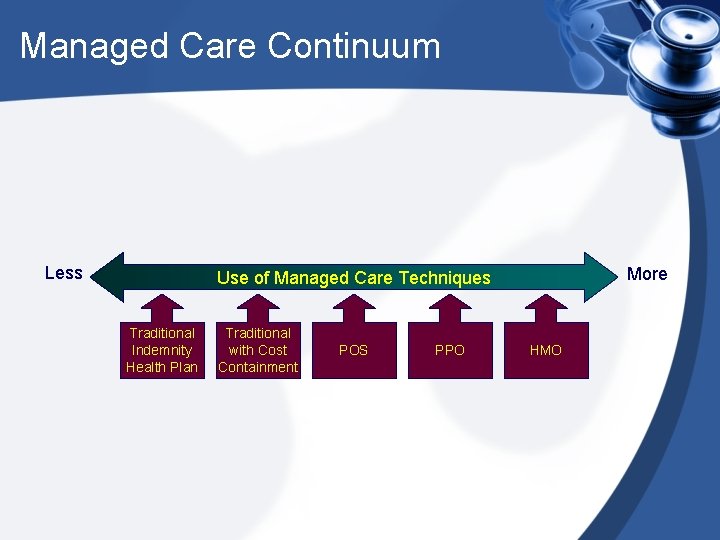

Managed Care Continuum Less More Use of Managed Care Techniques Traditional Indemnity Health Plan Traditional with Cost Containment POS PPO HMO

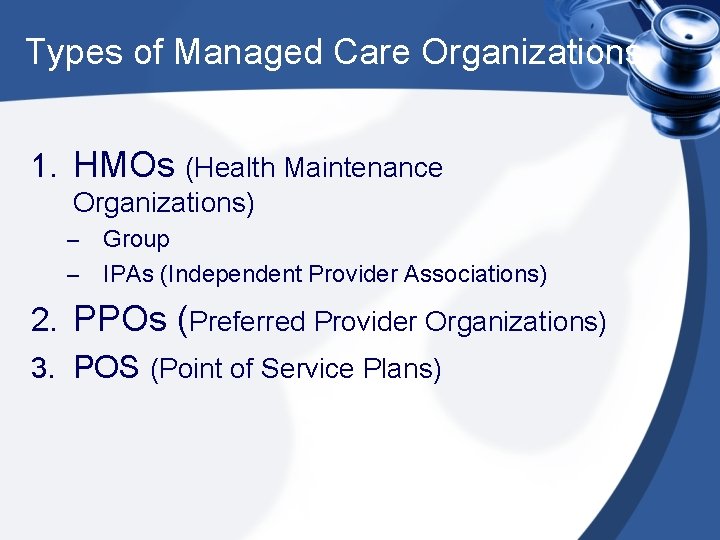

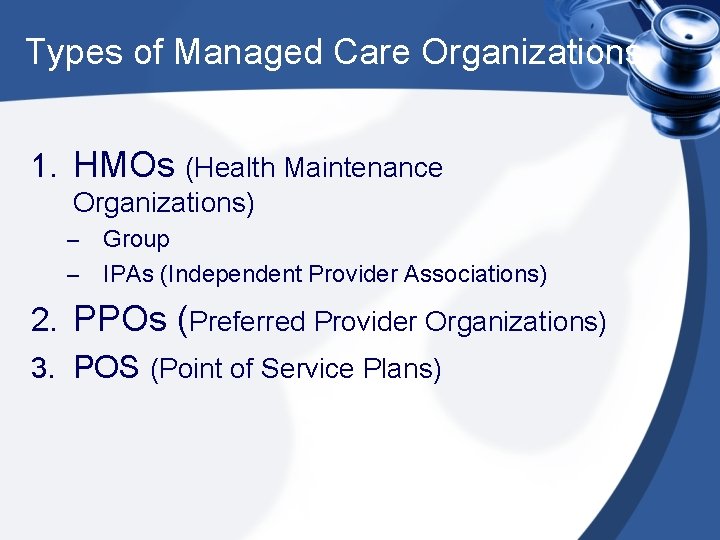

Types of Managed Care Organizations 1. HMOs (Health Maintenance Organizations) Group – IPAs (Independent Provider Associations) – 2. PPOs (Preferred Provider Organizations) 3. POS (Point of Service Plans)

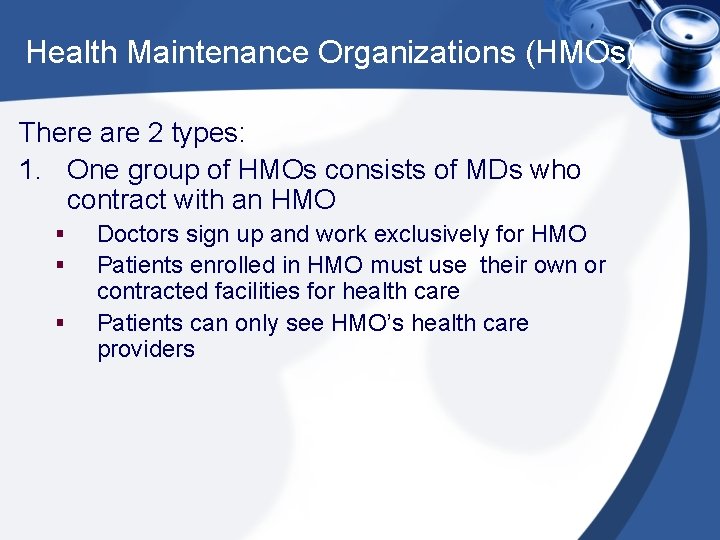

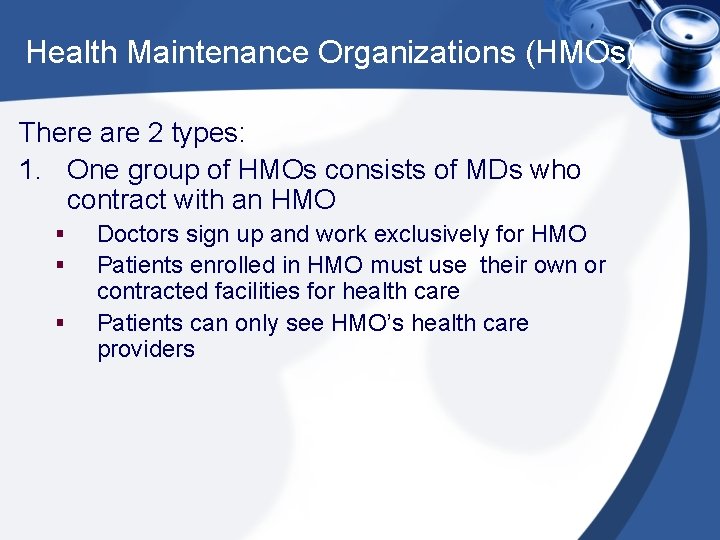

Health Maintenance Organizations (HMOs) There are 2 types: 1. One group of HMOs consists of MDs who contract with an HMO § § § Doctors sign up and work exclusively for HMO Patients enrolled in HMO must use their own or contracted facilities for health care Patients can only see HMO’s health care providers

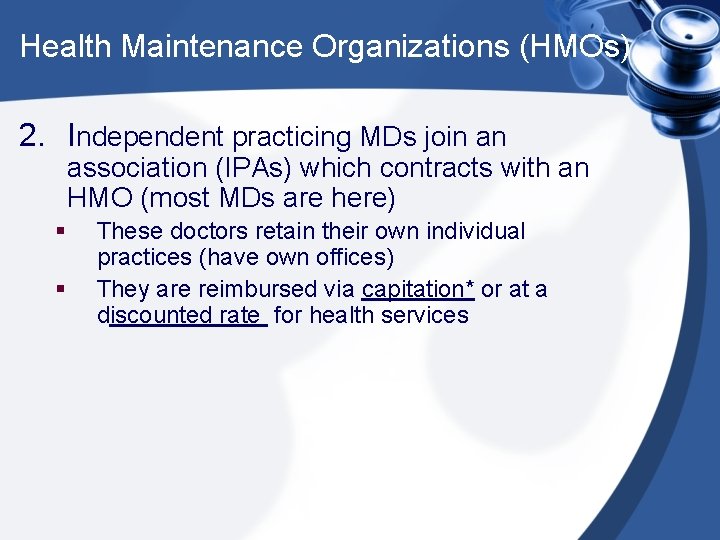

Health Maintenance Organizations (HMOs) 2. Independent practicing MDs join an association (IPAs) which contracts with an HMO (most MDs are here) § § These doctors retain their own individual practices (have own offices) They are reimbursed via capitation* or at a discounted rate for health services

HMOs • The HMO is generally the most tightly managed form of managed care. • This term describes a plan in which routine care is provided exclusively by physicians who are affiliated (or contracted) with the plan. • In most HMOs, primary care providers may act as “gatekeepers” and be required to approve all ancillary services.

HMOs – Pre-authorization • Prior authorization may also be used to review non-emergent or non-urgent procedures and services. • This usually means that a request is sent to the health plan for a procedure or service before it occurs, allowing the plan time to review the request and determine if it is a covered benefit under the member’s policy and meets clinical guidelines for care. • If the plan does not feel the service is medically necessary or if it does not fall within the benefit structure, payment could be denied.

HMOs • It is important to note that the MCO is not saying the patient cannot have the care or service, simply that it will not be paid for under their benefit.

PPOs • PPO describes an organization where independent physicians agree to provide services at discounted rates. This differs from an HMO because in PPOs contracts are not generally prepaid but are paid as services are delivered.

Preferred Providers Organization (PPO) • Group of health care providers contract with an organization to negotiate contracts • Providers are paid at a discount rate (e. g. paid 80%) • Patients enrolled in PPOs do not have gatekeepers and don’t need permission to see a specialist by their PCP • Patients are restricted to a panel of doctors and cannot see anyone outside the health plan • Often times, there is a greater monetary cost to patients/employers (co-payments, deductibles, etc). E. g. Patients may have to pay a $500 deductible before the PPO/ or insurance company “kicks in”

Point of Service • Similar to PPO except patients can use other facilities and doctors outside of plan • Cost to patient is much higher than a PPO

POS • The Point of Service (POS) product is less tightly managed than the HMO, allowing members to choose whether they will go to a provider within or outside of the plan’s established network at the time medical services are needed. • The member will generally pay a larger co-pay or percent of the total cost for care provided outside of the network. • This plan structure was originally created as a transition product to move patients from indemnity to managed care coverage with a higher level of comfort about their ability to seek care from a wider variety of providers. • However, it has become one of the most popular managed care plan structures as Americans continue to equate choice with quality in healthcare.

Indemnity Insurance 80% Specialist Hospital PCP 80% 80% Hospital Specialist 80%

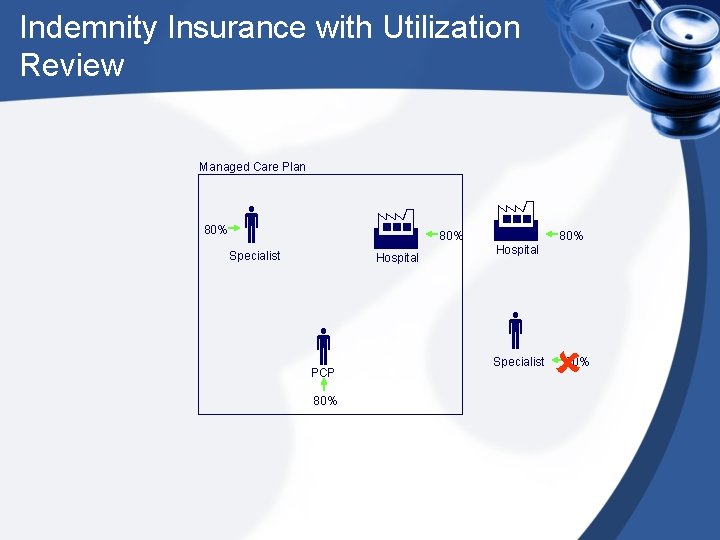

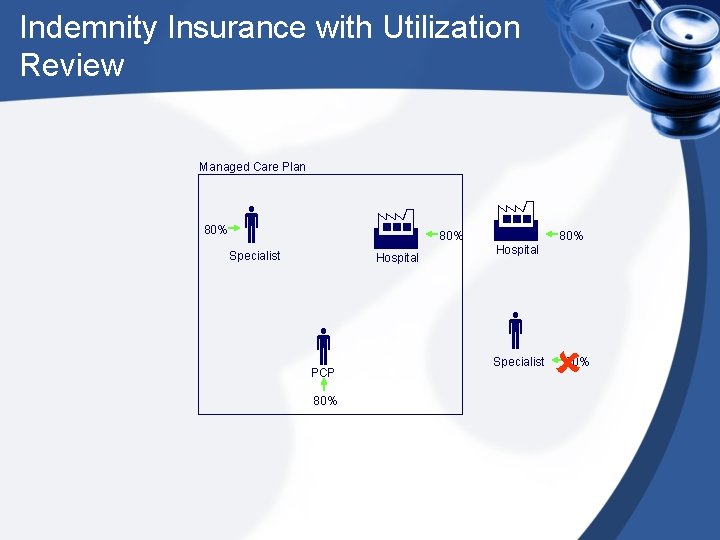

Indemnity Insurance with Utilization Review Managed Care Plan 80% Specialist Hospital PCP 80% 80% Hospital Specialist 80%

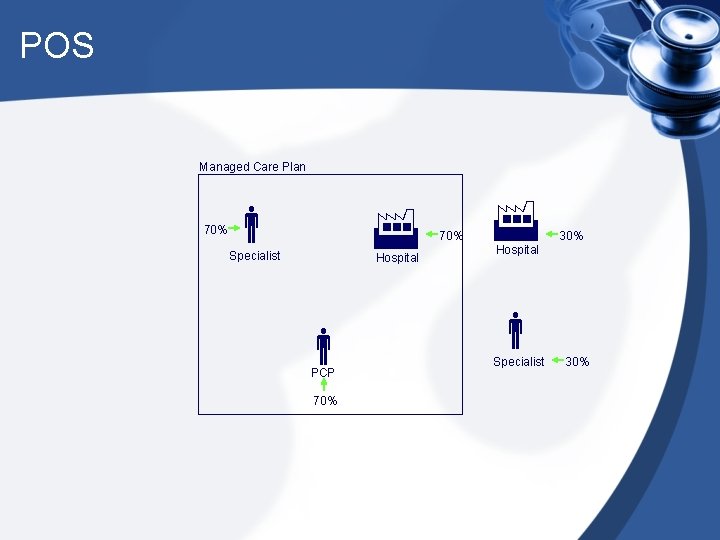

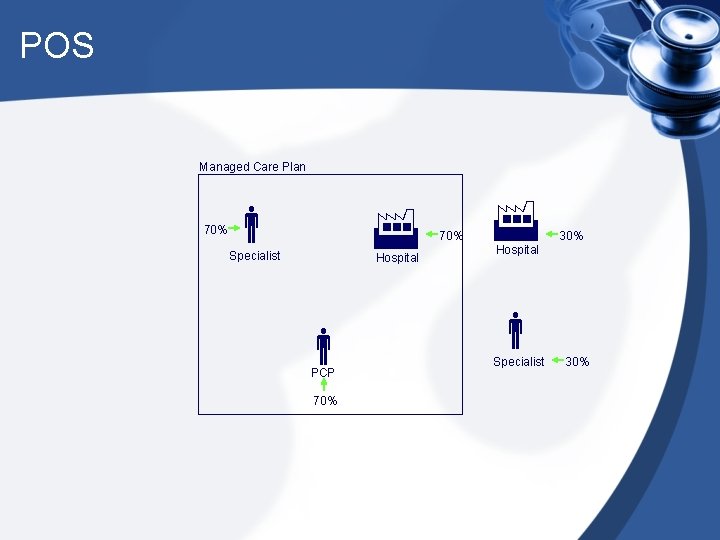

POS Managed Care Plan 70% Specialist Hospital PCP 70% 30% Hospital Specialist 30%

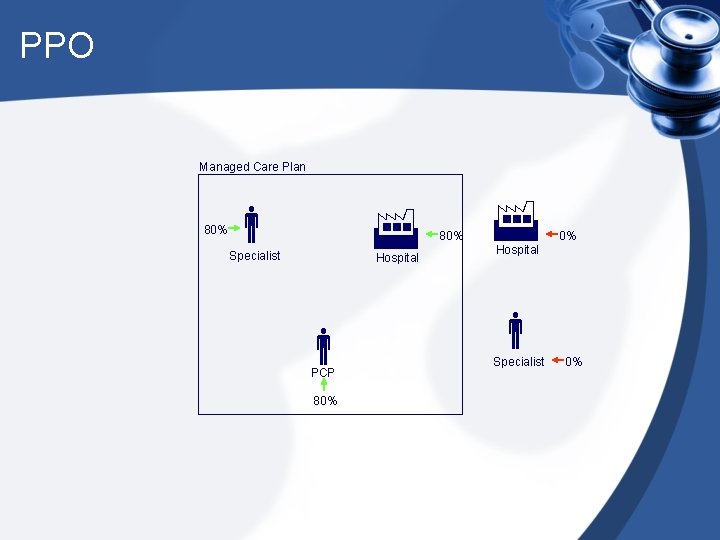

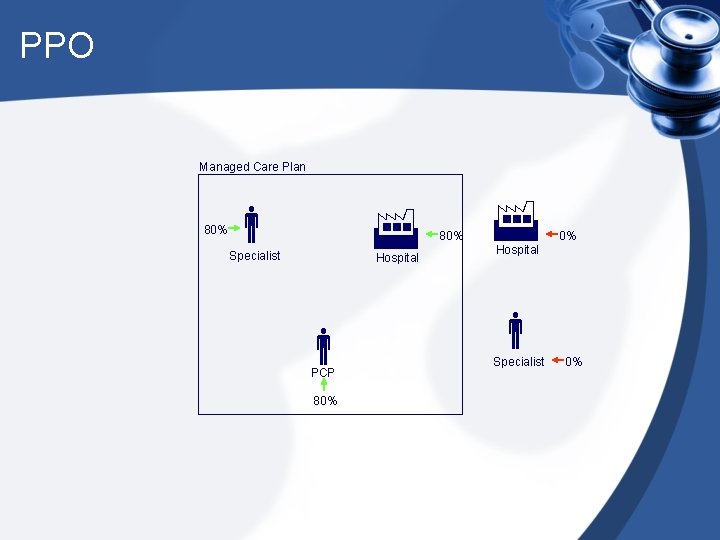

PPO Managed Care Plan 80% Specialist Hospital PCP 80% 0% Hospital Specialist 0%

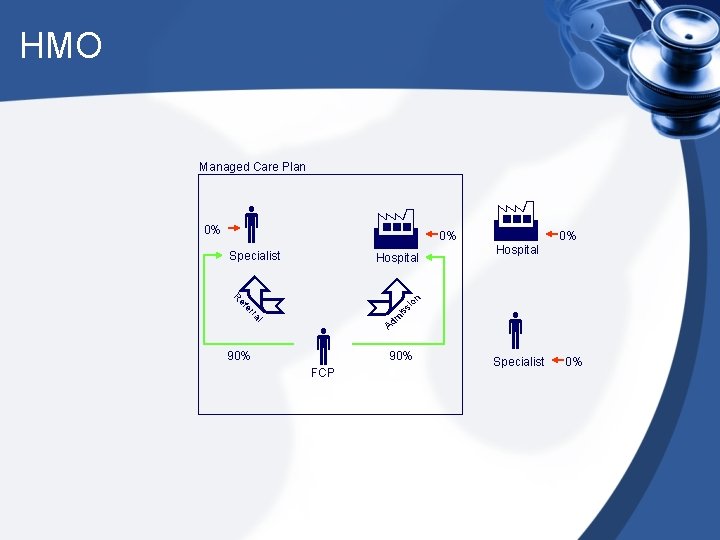

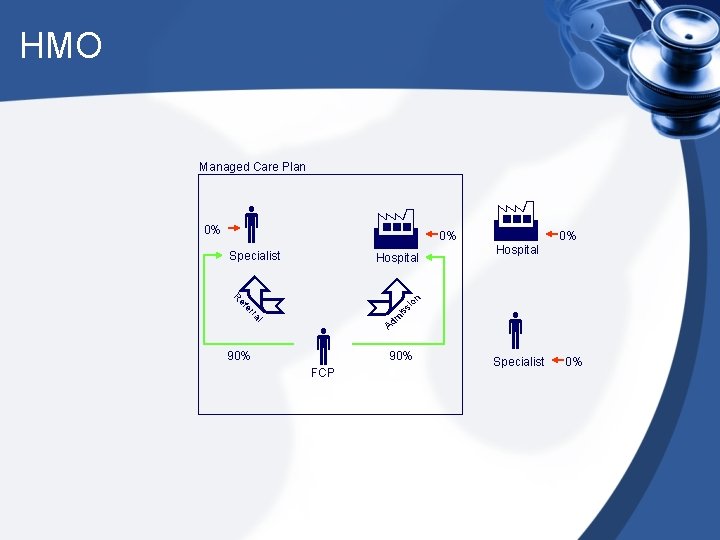

HMO Managed Care Plan Specialist Hospital l m is ra er si ef 90% 0% 0% Hospital on R FCP Ad 0% 90% Specialist 0%

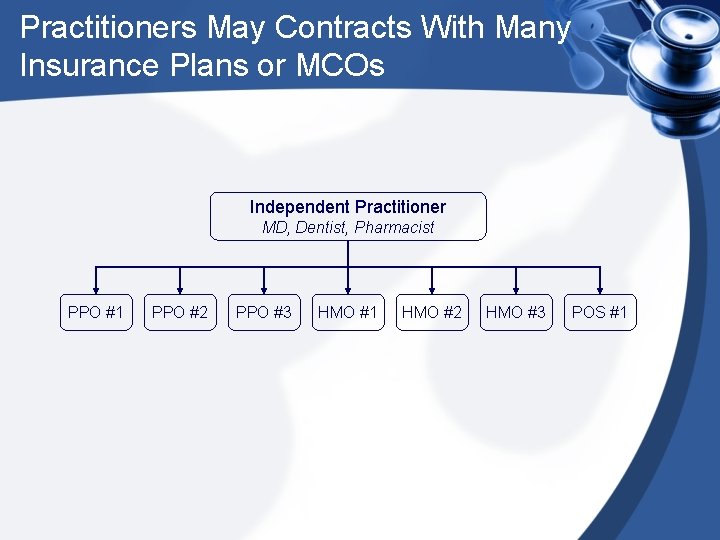

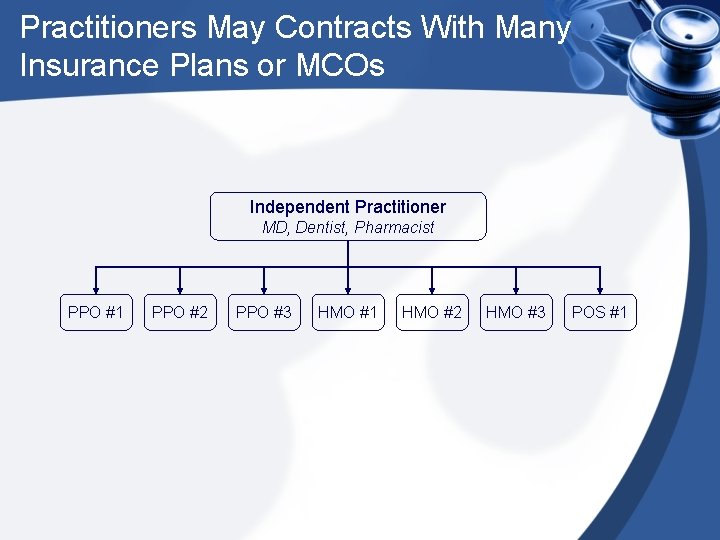

Practitioners May Contracts With Many Insurance Plans or MCOs Independent Practitioner MD, Dentist, Pharmacist PPO #1 PPO #2 PPO #3 HMO #1 HMO #2 HMO #3 POS #1

The Problems With Contracting • Health professionals such as doctors often contract with a number of HMOs and PPOs. • This is why they often ask you, as the patient, what type of insurance (MCO plan) you have. • Each plan has its own restrictions on care and reimbursement scale. So this can be very confusing and time consuming to those who work in the provider’s office.

Thank You ! Any Question ?