INTERNATIONAL ORGANIZATIONS 396 THE ASIAN MONETARY FUND JAMES

- Slides: 32

INTERNATIONAL ORGANIZATIONS 396: THE ASIAN MONETARY FUND? JAMES RAYMOND VREELAND, PROFESSOR 2. 0 1

Lipscy, Phillip Y. 2003. Japan's Asian Monetary Fund Proposal. Stanford Journal of East Asian Affairs 3 (1): 93 -104. 2

Plan • Tequila Crisis • East Asian Financial Crisis • US vs. Japan preferences on bailouts • AMF • Regionalism 3

TEQUILA CRISIS 4

Tequila Crisis 1995 • US (IMF) helps Mexico – provides liquidity • Japan worried about “moral hazard” • US preference prevails at the IMF 5

East Asian Financial Crisis 1997 • Japan wants to help Thailand, Indonesia, …– provides liquidity • US worried about “moral hazard” • US preference again prevails at the IMF 6

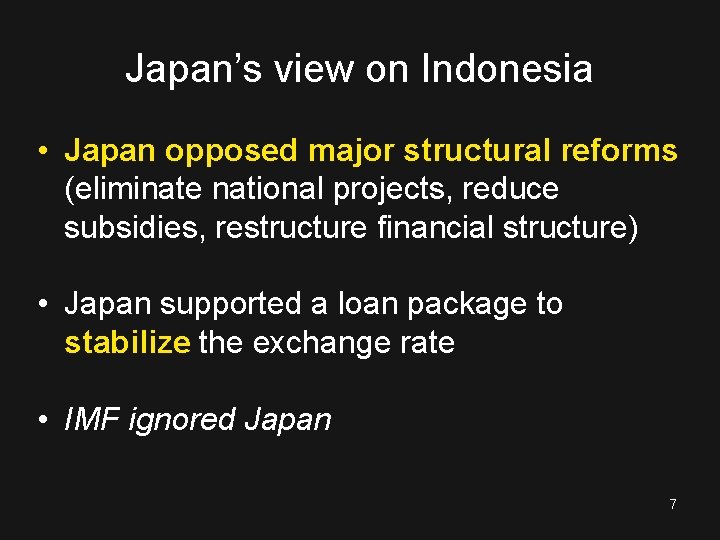

Japan’s view on Indonesia • Japan opposed major structural reforms (eliminate national projects, reduce subsidies, restructure financial structure) • Japan supported a loan package to stabilize the exchange rate • IMF ignored Japan 7

Why did Japan (not US or EU) lean towards liquidity provision in the East Asian Crisis? 25% of Japanese lending to all developing countries went to Thailand! 8

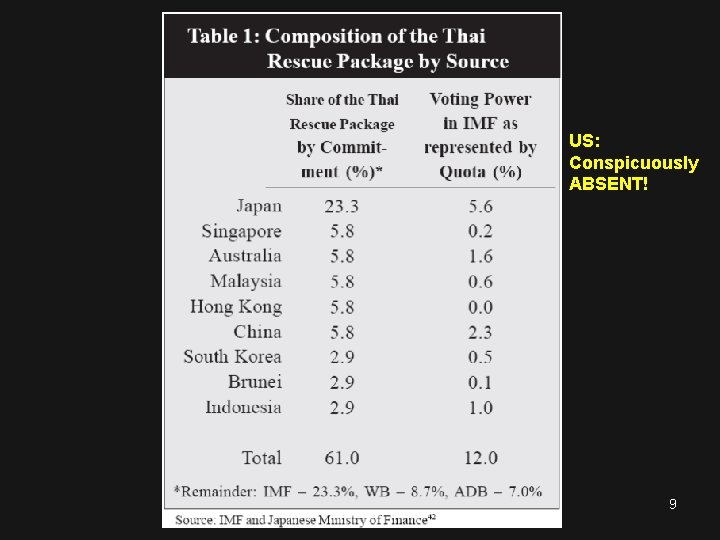

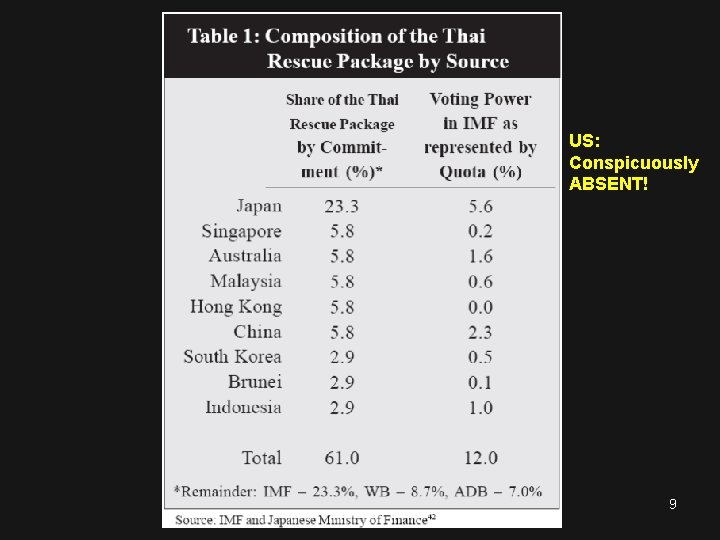

US: Conspicuously ABSENT! 9

10

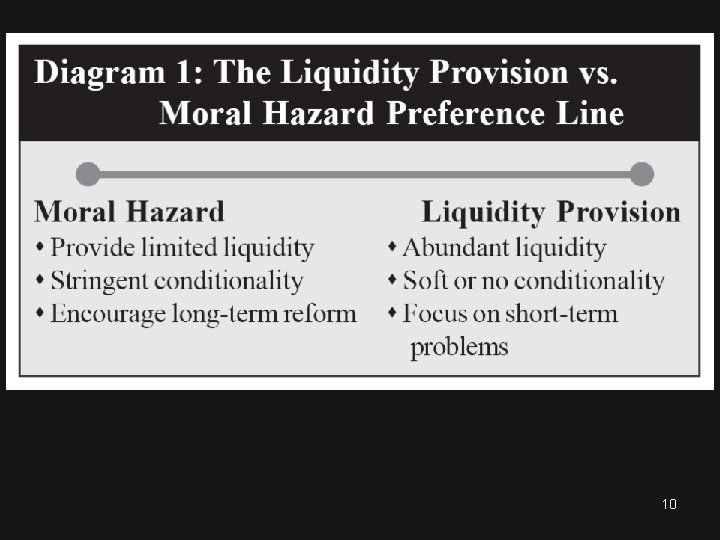

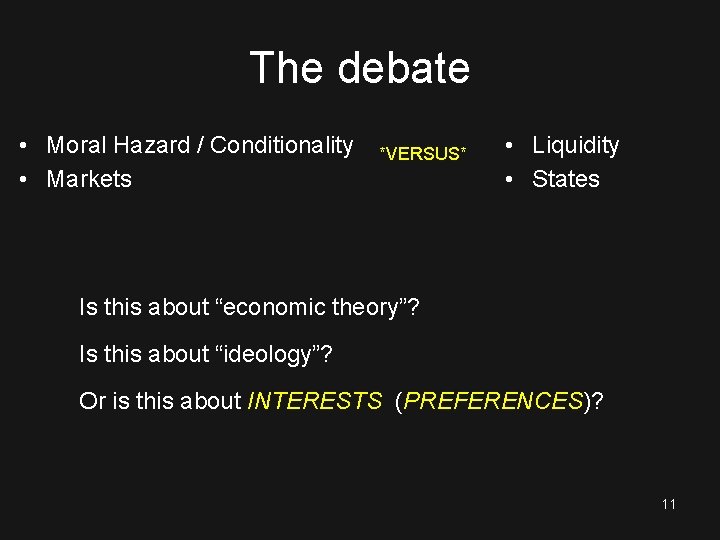

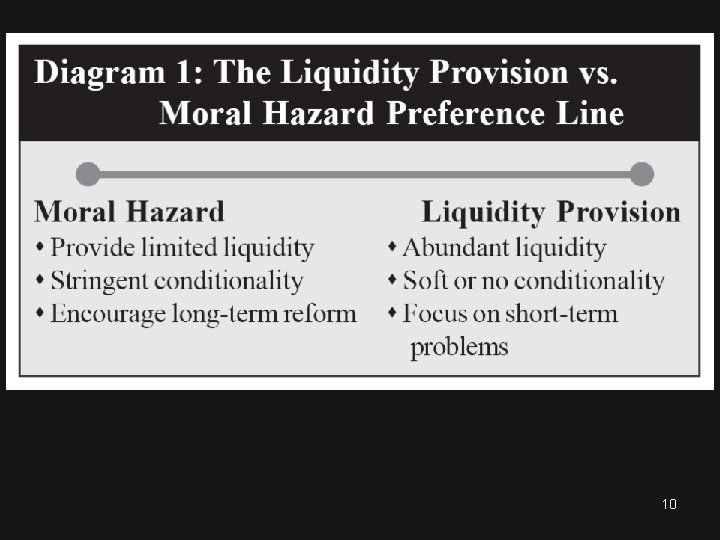

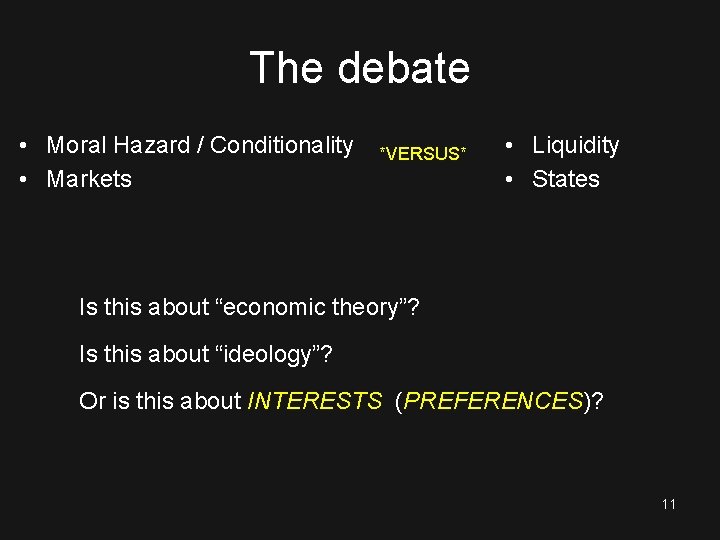

The debate • Moral Hazard / Conditionality • Markets *VERSUS* • Liquidity • States Is this about “economic theory”? Is this about “ideology”? Or is this about INTERESTS (PREFERENCES)? 11

Donor States prefer rapid liquidity provision if: • Political interests are at stake • Economic ties with the crisis-country are dense • This approach will provide a quick recovery of the crisis economy • Benefits creditors 12

Donors are CONCERNED ABOUT MORAL HAZARD if: • Economic & political ties to the crisis country are weak • The crisis = OPPORTUNITY: – Extract concessions from the crisis country (force it to open up to trade and investment) • Use the crisis country as an example to deter future “moral hazard” 13

14

Images from South Korea during the East Asian Financial Crisis 15

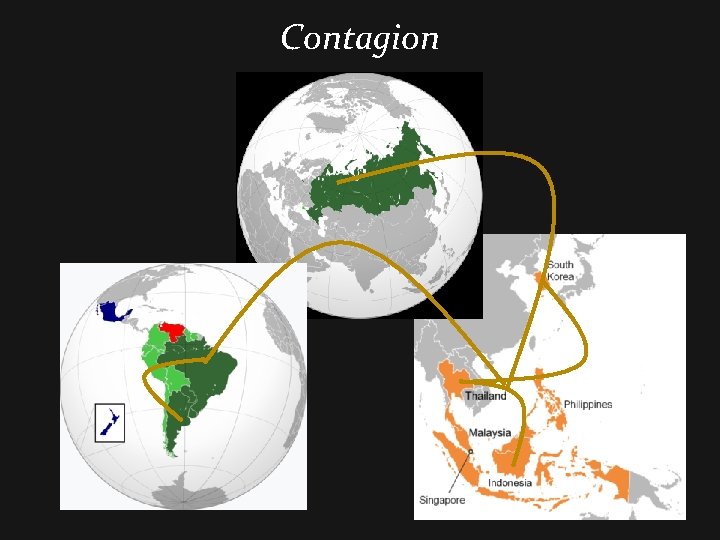

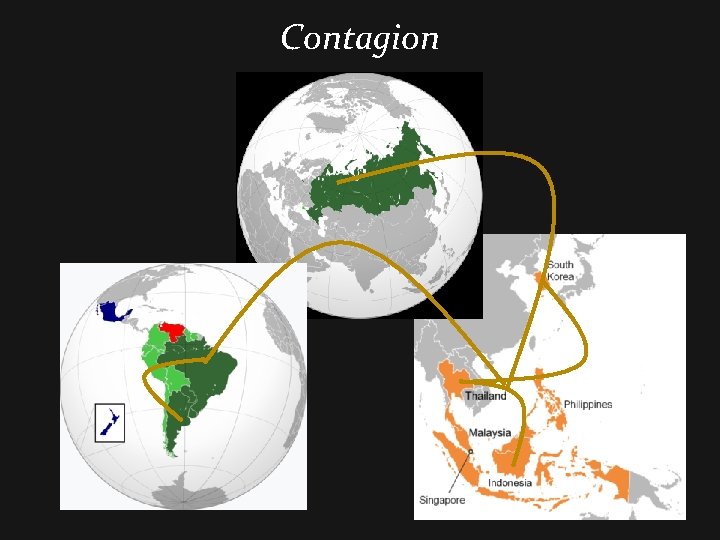

Contagion 16

http: //www. youtube. com/watch? v=Hyr. Typ. TRDbk https: //www. youtube. com/watch? v=j. A 8 vlreb. VXU 17

Post-East Asian Financial Crisis: NEVER AGAIN! 18

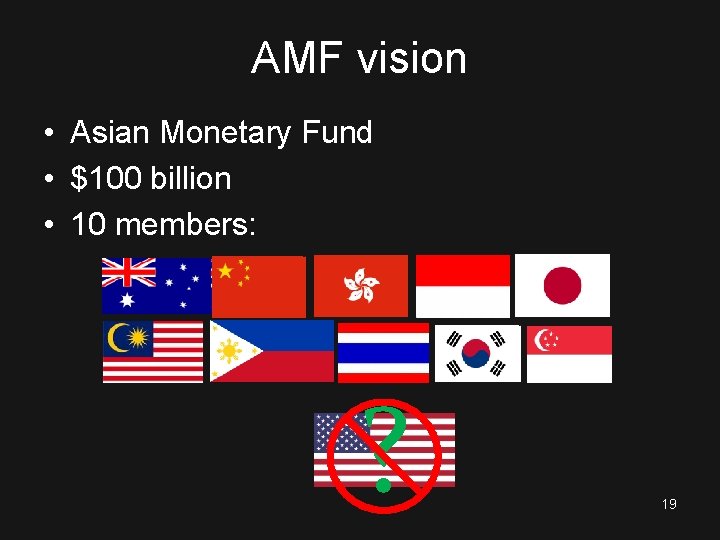

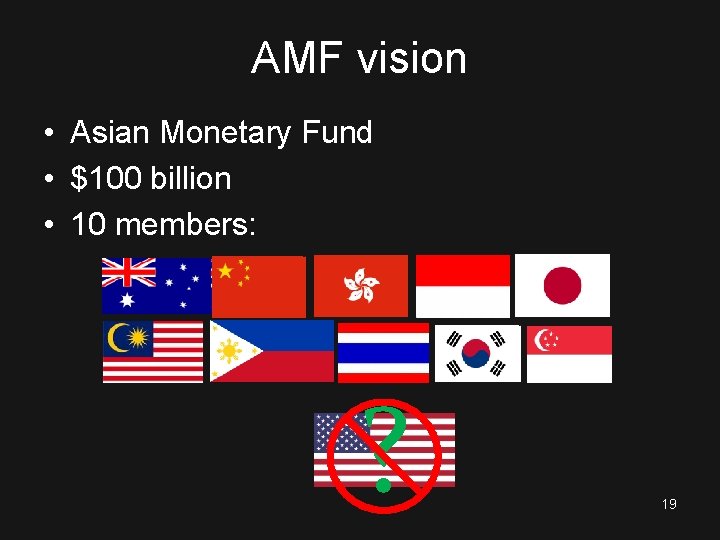

AMF vision • Asian Monetary Fund • $100 billion • 10 members: ? 19

Treasury Secretary Summers to MOF official Sakakibara: “I thought you were my friend!” 20

US argument against AMF • Moral hazard – – postpone adjustment • Duplication – Add little to the pre-existing IMF system 21

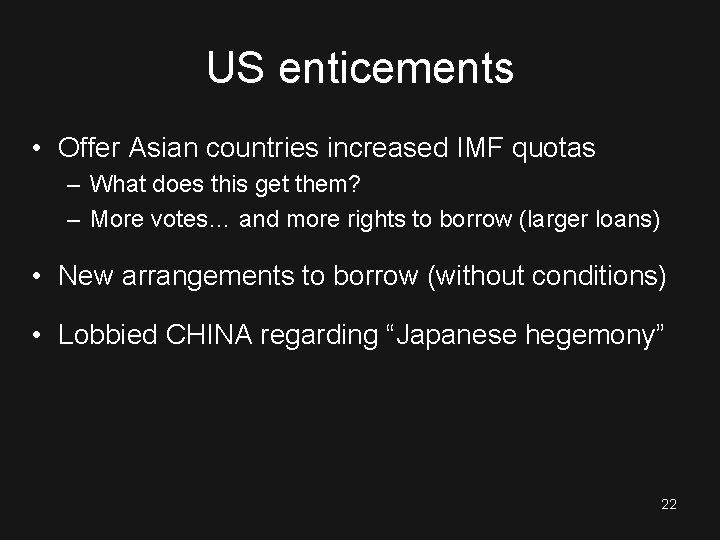

US enticements • Offer Asian countries increased IMF quotas – What does this get them? – More votes… and more rights to borrow (larger loans) • New arrangements to borrow (without conditions) • Lobbied CHINA regarding “Japanese hegemony” 22

Regional Finance Minister’s meeting Nov 1997 • ASEAN & South Korea support AMF proposal • Hong Kong & Australia neutral • China – no opinion… sealed the fate of the AMF 23

Thinking Strategically • “If Japan knew the chances of the AMF actually existing were very slim, then do you think the reason for trying to establish an AMF was for adjustments to the IMF to give them more resources and liquidity because of the economic crisis? ” – Chris Wright ’ 11 (GOVT 298 spring 2010) 24

Reply from Phillip Lipscy • Sounds like you have some really bright students! • Based on my conversations with the relevant officials, I think this is indeed part of the story. • Within the Japanese foreign policy establishment, there's something of a divide between Asia-oriented and internationally-oriented officials. • Sakakibara and Kuroda are more on the Asia-side, and my impression is that they genuinely wanted an AMF that could act autonomously of the IMF. • This is also true for potential borrowers in Asia such as Malaysia - they have argued for a CMI/CMIM more autonomous from the IMF. • (CMIM=Chiang Mai Initiative Multilateralisation) • However, subsequent Japanese policy on the CMI/CMIM has emphasized tying most of the lending to IMF conditionality, • and internationalist officials in Japan often mention using the CMI/CMIM as a way to enhance Asia's "voice" at the IMF. • So both motivations are at play. • Practically speaking, an autonomous AMF would need to have some mechanism for autonomous conditionality. Working out this issue is a major problem for China and Japan, who contribute the lion's share of reserves and don't want to be blamed for imposing conditionality on their Asian neighbors. http: //www. bangkokpost. com/breakingnews/136780/asean-3 -agree-to-expand-cmim 25

Flash-forward: March 2010 Chiang Mai Initiative • A multilateral currency swap arrangement • Members: Association of Southeast Asian Nations (ASEAN), China (including Hong Kong), Japan, and South Korea • ASEAN members: http: //www. aseansec. org/74. htm • Foreign exchange reserves pool of US$120 billion • Launched in March 2010 The ASEAN flag • The initiative began as a series of **bilateral** swap arrangements after the ASEAN + 3 countries met in May 2000 in Chiang Mai, Thailand • The big problem: Conditionality • Right now, using IMF conditionality as a backup! (yikes) 26

Japan & China Equal shares No real leadership 27

2014 28

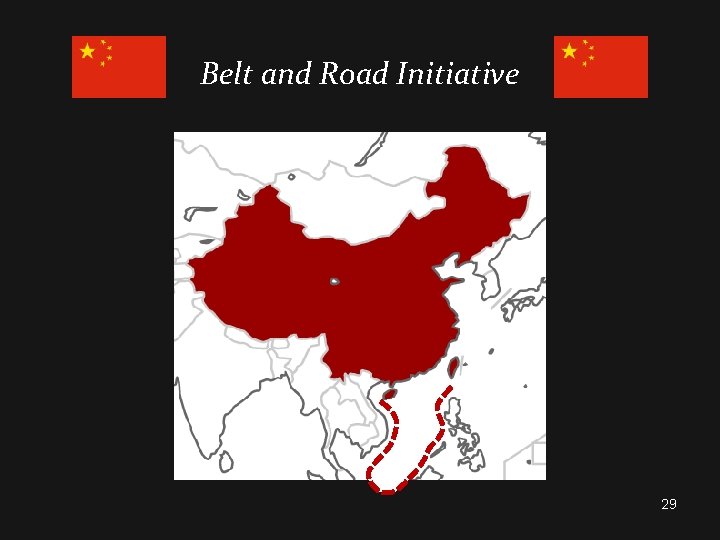

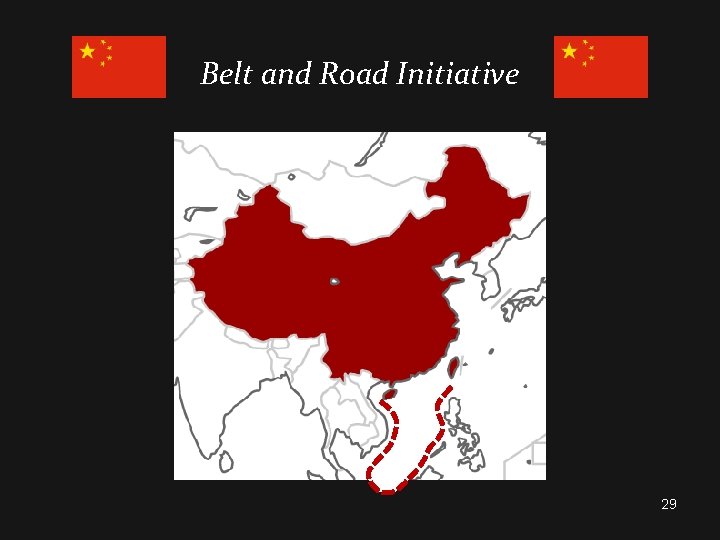

Belt and Road Initiative 29

Discussion • Regional organizations might produce increased MORAL HAZARD • But regional organizations make sense if economic ties are closest @ the regional level • The Invictus Question: – Who are we? – National identity? – Global identity? – Regional identity? 30

Take-aways SUBSTANTIVE take-aways • US preferred liquidity for Mexico, feared moral hazard for East Asia • Japan preferred liquidity for East Asia, feared moral hazard for Mexico ANALYTICAL take-aways • Moral Hazard v. Providing Liquidity • Self-interest vs. Ideology vs. Economic theory 31

Thank you 32

International monetary fund apush

International monetary fund apush International monetary fund

International monetary fund International monetary fund

International monetary fund Motor carrier safety consulting inc

Motor carrier safety consulting inc Fmcsa vehicle maintenance log

Fmcsa vehicle maintenance log Veja essa conta de multiplicar 396 x 54

Veja essa conta de multiplicar 396 x 54 Find the odd one : 396, 462, 572, 427, 671, 264

Find the odd one : 396, 462, 572, 427, 671, 264 International monetary system

International monetary system Objectives of international monetary system

Objectives of international monetary system International monetary and financial environment

International monetary and financial environment International financial environment

International financial environment International monetary system

International monetary system International monetary system

International monetary system Guided notes international organizations

Guided notes international organizations Agencies related to welfare services to the children

Agencies related to welfare services to the children Universal international organizations

Universal international organizations International union of forest research organizations

International union of forest research organizations Universal international organizations

Universal international organizations Safrns

Safrns Designing organizations for the international environment

Designing organizations for the international environment Designing organizations for the international environment

Designing organizations for the international environment Universal international organizations

Universal international organizations Fairtrade labelling organizations international flo

Fairtrade labelling organizations international flo Oxford international organizations

Oxford international organizations Fluctuating and imprest system

Fluctuating and imprest system China international fund management

China international fund management Commonwealth fund international health policy survey

Commonwealth fund international health policy survey The trailside killer

The trailside killer James russell odom and james clayton lawson

James russell odom and james clayton lawson Hình ảnh bộ gõ cơ thể búng tay

Hình ảnh bộ gõ cơ thể búng tay Ng-html

Ng-html Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em