PETTY CASH FUND MANAGEMENT PETTY CASH FUND MANAGEMENT

- Slides: 14

PETTY CASH FUND MANAGEMENT

PETTY CASH FUND MANAGEMENT I. Definition of Cash • Cash is the standard medium of exchange and the basis for measuring and accounting for all other items • It is generally classified as current assets • Cash consists of coin, currency, an available funds on deposit at bank and other financial • institutions. Cash must be immediately available for the payment of current obligation and must be

II. Classification of Cash A. Cash in Bank • It is included saving accounts, R/C B. Cash on Hand • It is available in the company for paying daily operational expenses. • Cash on hand is prepared to pay for small payment called petty cash

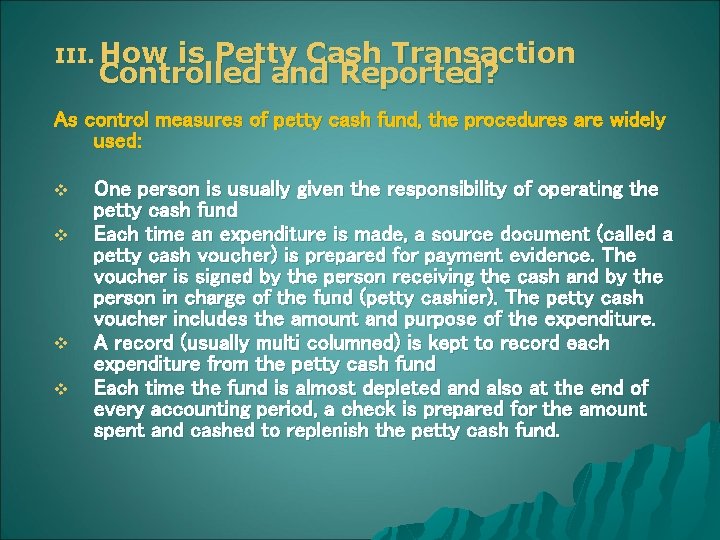

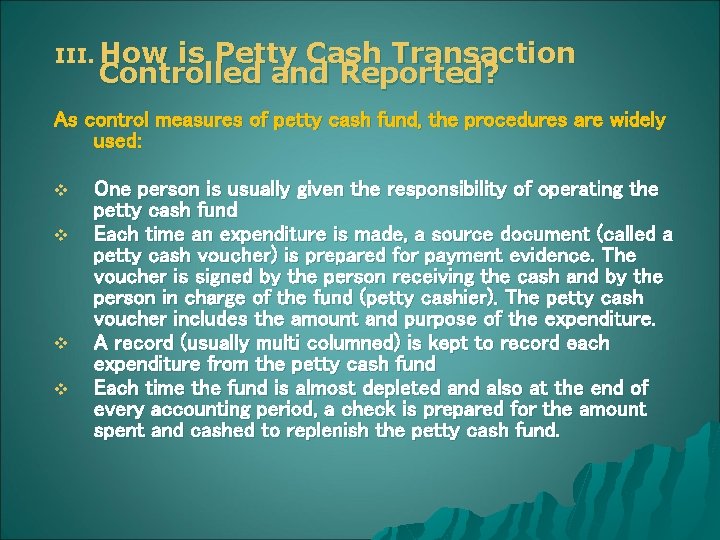

III. How is Petty Cash Transaction Controlled and Reported? As control measures of petty cash fund, the procedures are widely used: v v One person is usually given the responsibility of operating the petty cash fund Each time an expenditure is made, a source document (called a petty cash voucher) is prepared for payment evidence. The voucher is signed by the person receiving the cash and by the person in charge of the fund (petty cashier). The petty cash voucher includes the amount and purpose of the expenditure. A record (usually multi columned) is kept to record each expenditure from the petty cash fund Each time the fund is almost depleted and also at the end of every accounting period, a check is prepared for the amount spent and cashed to replenish the petty cash fund.

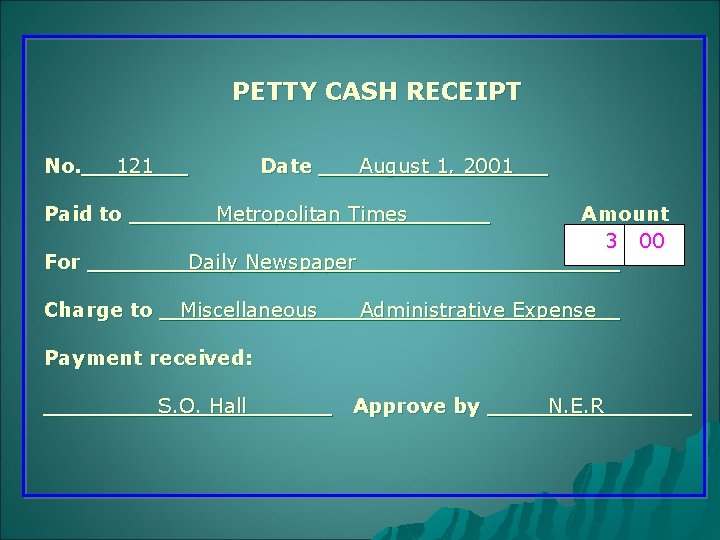

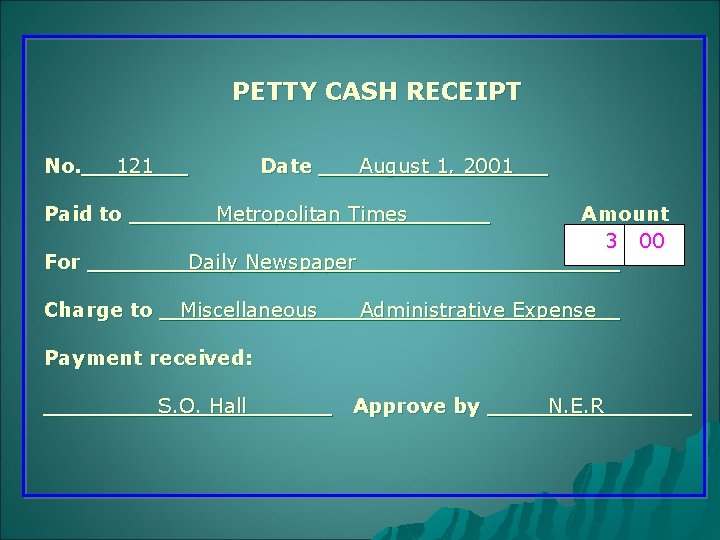

PETTY CASH RECEIPT No. 121 Paid to For Charge to Date August 1, 2001 Metropolitan Times Daily Newspaper Amount 3 00 Miscellaneous Administrative Expense Payment received: S. O. Hall Approve by N. E. R

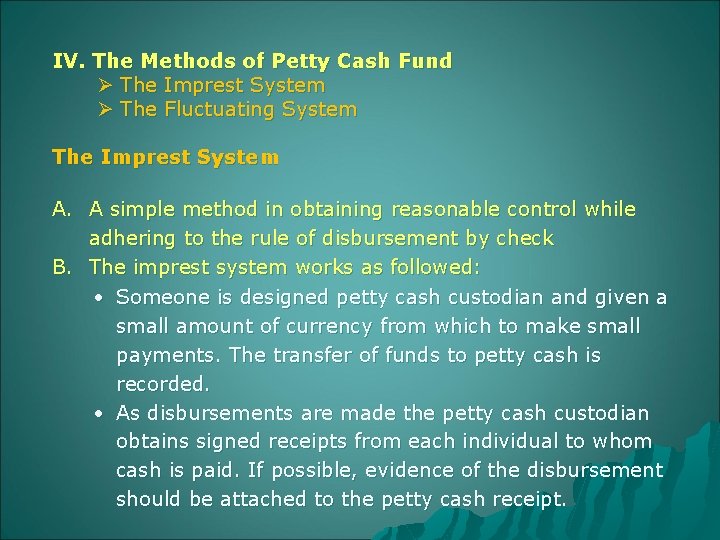

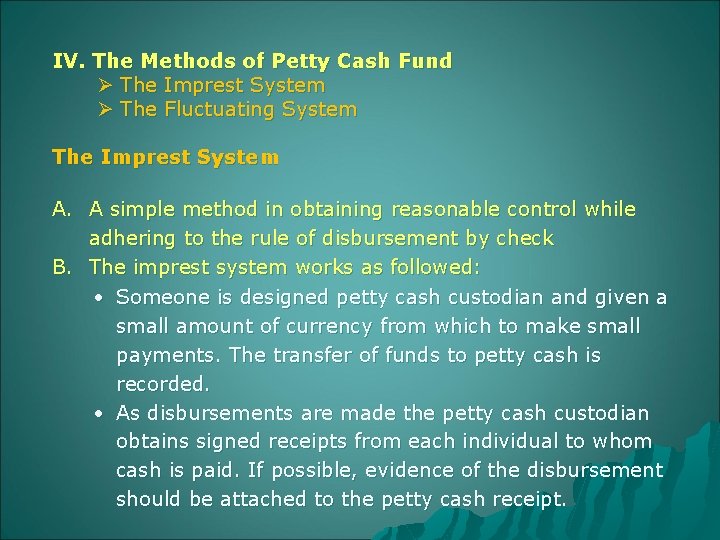

IV. The Methods of Petty Cash Fund Ø The Imprest System Ø The Fluctuating System The Imprest System A. A simple method in obtaining reasonable control while adhering to the rule of disbursement by check B. The imprest system works as followed: • Someone is designed petty cash custodian and given a small amount of currency from which to make small payments. The transfer of funds to petty cash is recorded. • As disbursements are made the petty cash custodian obtains signed receipts from each individual to whom cash is paid. If possible, evidence of the disbursement should be attached to the petty cash receipt.

u Petty cash transaction is not recorded until the fund is reimbursed and then such entries are recorded by other person besides the petty cash custodian u When the supply of cash runs low, the custodian presents a request to the general cashier for reimbursement supported by the petty cash receipts and other disbursement evidence. The custodian receives a company check to replenish the fund. u If it is decided that the amount of cash in the petty cash funds is excessive, an adjustment may be made. u Entries are made to the Petty Cash account only to increase or decrease the size of the fund

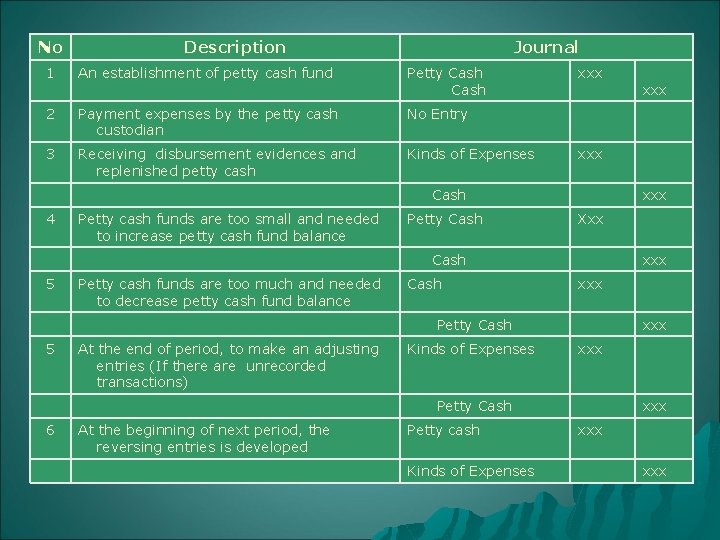

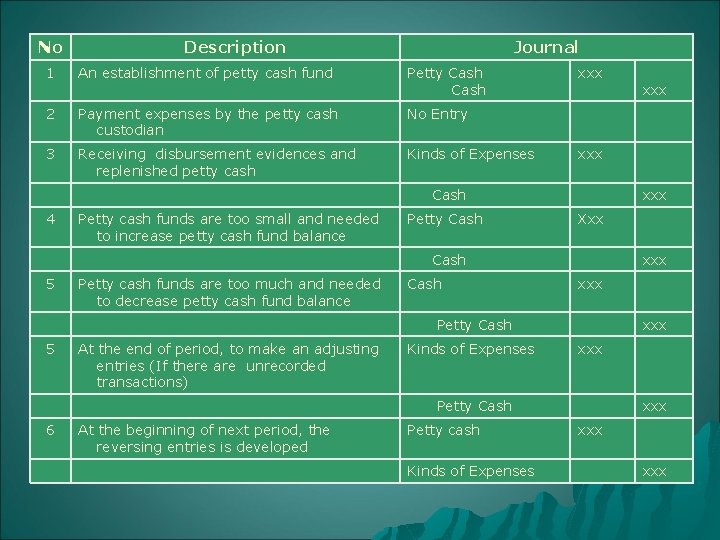

No Description Journal 1 An establishment of petty cash fund Petty Cash xxx 2 Payment expenses by the petty cash custodian No Entry 3 Receiving disbursement evidences and replenished petty cash Kinds of Expenses xxx Cash 4 Petty cash funds are too small and needed to increase petty cash fund balance Petty Cash Xxx Cash xxx 5 Petty cash funds are too much and needed to decrease petty cash fund balance Cash xxx Petty Cash 5 At the end of period, to make an adjusting entries (If there are unrecorded transactions) Kinds of Expenses xxx Petty Cash xxx 6 At the beginning of next period, the reversing entries is developed Petty cash xxx Kinds of Expenses xxx xxx

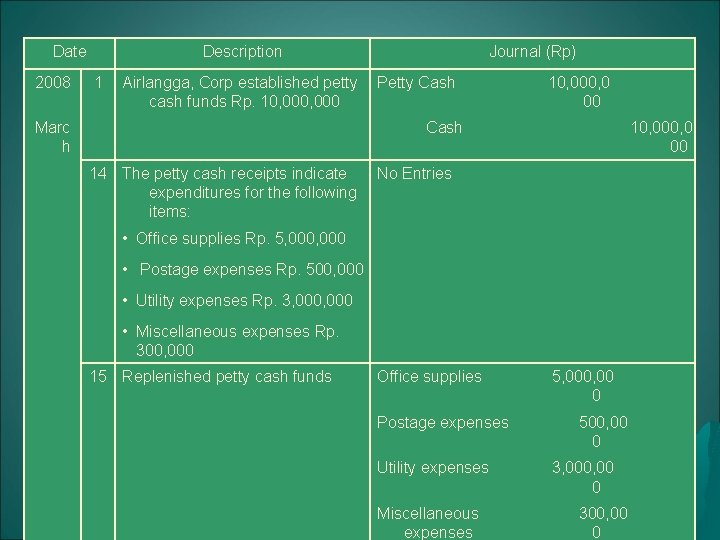

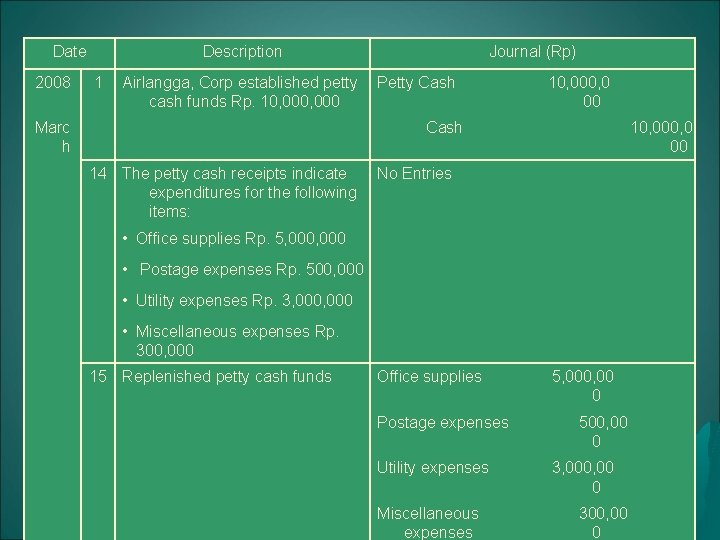

Date 2008 Description 1 Airlangga, Corp established petty Petty Cash cash funds Rp. 10, 000 Marc h Journal (Rp) Cash 10, 000, 0 00 14 The petty cash receipts indicate No Entries expenditures for the following items: • Office supplies Rp. 5, 000 • Postage expenses Rp. 500, 000 • Utility expenses Rp. 3, 000 • Miscellaneous expenses Rp. 300, 000 15 Replenished petty cash funds Office supplies Postage expenses Utility expenses Miscellaneous expenses 5, 000, 00 0 500, 00 0 3, 000, 00 0 300, 00 0

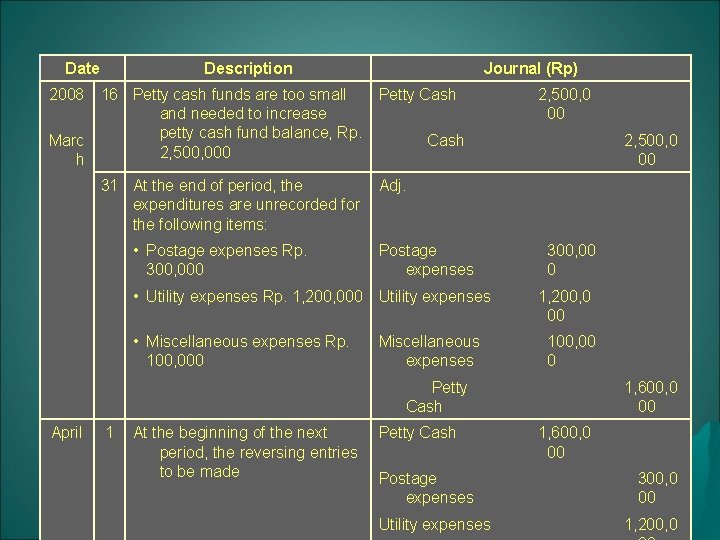

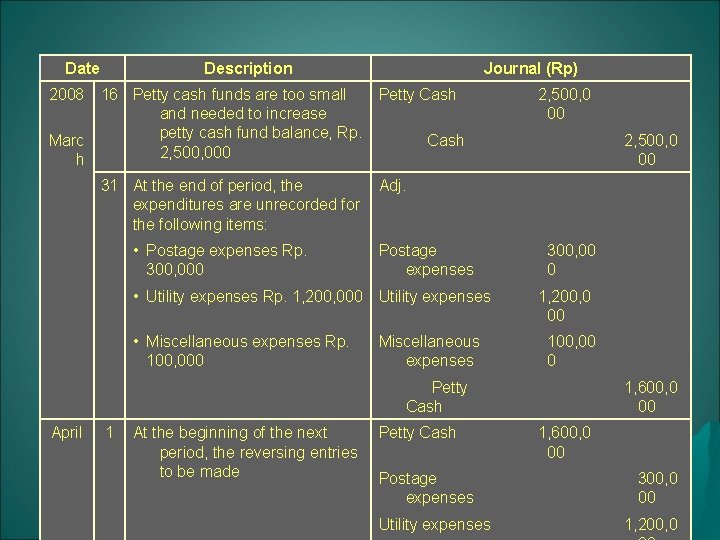

Date 2008 Marc h Description Journal (Rp) 16 Petty cash funds are too small Petty Cash and needed to increase petty cash fund balance, Rp. Cash 2, 500, 000 2, 500, 0 00 31 At the end of period, the Adj. expenditures are unrecorded for the following items: 2, 500, 0 00 • Postage expenses Rp. 300, 000 • Utility expenses Rp. 1, 200, 000 Utility expenses 1, 200, 0 00 • Miscellaneous expenses Rp. 100, 000 Miscellaneous expenses 100, 00 0 Petty Cash 1, 600, 0 00 At the beginning of the next period, the reversing entries to be made Petty Cash 1, 600, 0 00 April 1 Postage expenses 300, 00 0 Postage expenses 300, 0 00 Utility expenses 1, 200, 0

The Fluctuating System A. The differences between imprest system and fluctuating system No. Imprest System Fluctuating System 1. The petty cash funds balance is fixed fluctuating. It depends on the amount of receipts and disbursements in petty cash funds 2. The expenditures of petty cash Each expenditure must be recorded funds just recorded at at the transaction occured replenished petty cash funds 3. The function of petty cash recording is as a tool of control and it can not be posted to general ledger It is necessary to make adjusting entries for unrecorded transaction at the end of period. The beginning of the next period must be made reversing entries 4. The function of petty cash recording is as a journal. It is used to be a source of posting to each account in general ledger It is not necessary to make adjusting entries for unrecorded transaction at the end of period. Adjusting entries are made at the beginning of the next period

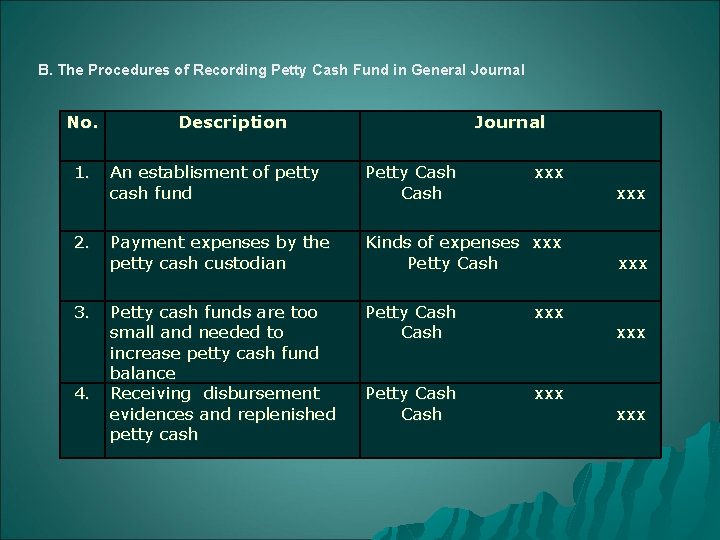

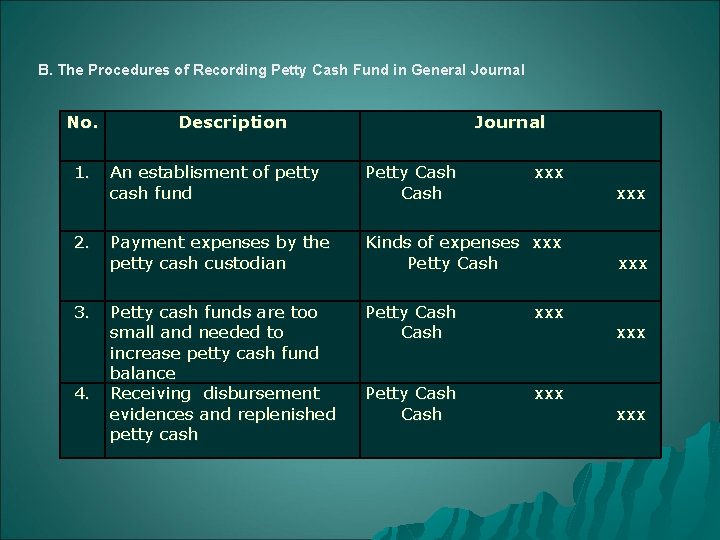

B. The Procedures of Recording Petty Cash Fund in General Journal No. Description Journal 1. An establisment of petty cash fund Petty Cash xxx Cash xxx 2. Payment expenses by the petty cash custodian Kinds of expenses xxx Petty Cash xxx 3. Petty cash funds are too small and needed to increase petty cash fund balance Receiving disbursement evidences and replenished petty cash Petty Cash xxx Cash xxx 4. Petty Cash xxx Cash xxx

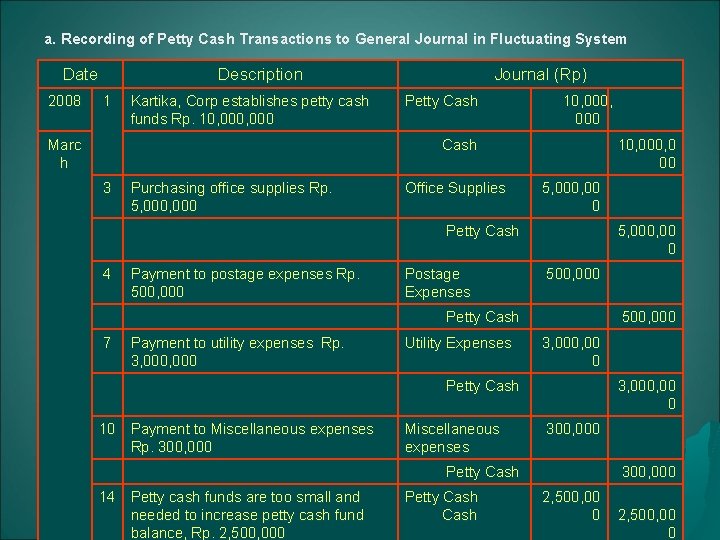

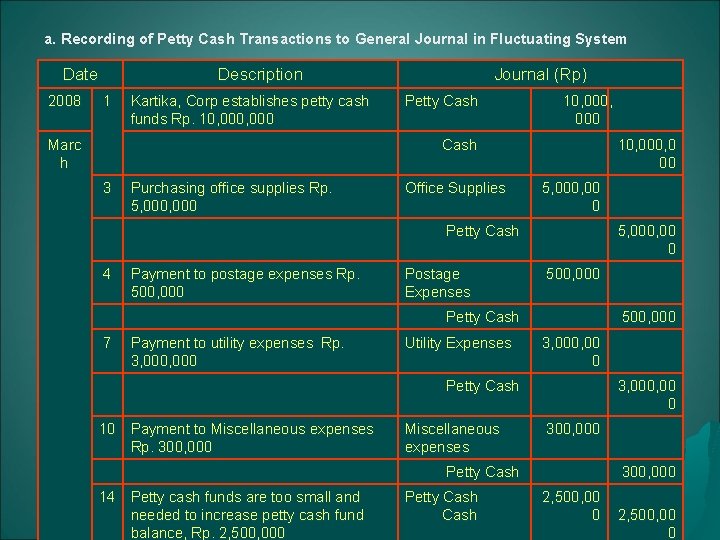

a. Recording of Petty Cash Transactions to General Journal in Fluctuating System Date 2008 Description 1 Kartika, Corp establishes petty cash funds Rp. 10, 000 Marc h Journal (Rp) Petty Cash 10, 000 Cash 3 Purchasing office supplies Rp. 5, 000 Office Supplies 10, 000, 0 00 5, 000, 00 0 Petty Cash 4 Payment to postage expenses Rp. 500, 000 Postage Expenses 5, 000, 00 0 500, 000 Petty Cash 7 Payment to utility expenses Rp. 3, 000 Utility Expenses 500, 000 3, 000, 00 0 Petty Cash 10 Payment to Miscellaneous expenses Rp. 300, 000 Miscellaneous expenses 3, 000, 00 0 300, 000 Petty Cash 14 Petty cash funds are too small and needed to increase petty cash fund balance, Rp. 2, 500, 000 Petty Cash 300, 000 2, 500, 00 0

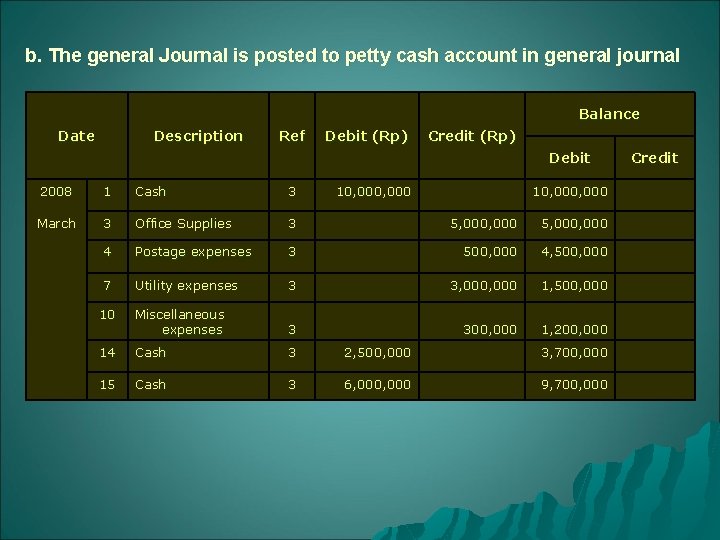

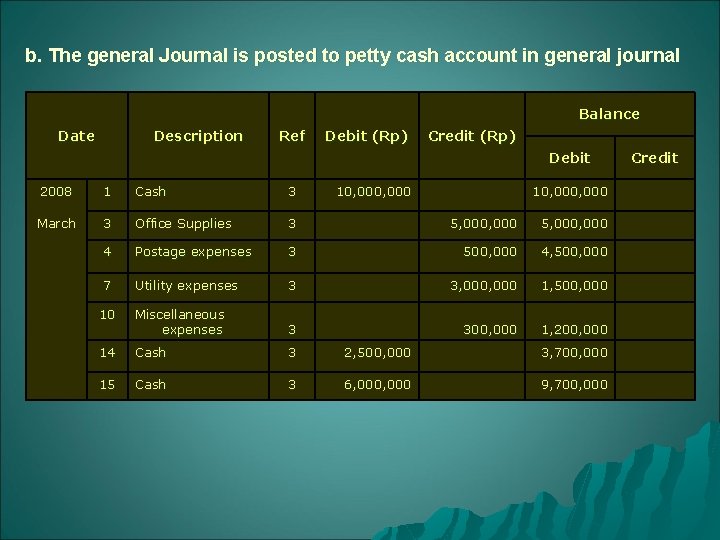

b. The general Journal is posted to petty cash account in general journal Balance Date Description Ref Debit (Rp) Credit (Rp) Debit Credit 2008 1 Cash 3 10, 000, 000 March 3 Office Supplies 3 5, 000, 000 4 Postage expenses 3 500, 000 4, 500, 000 7 Utility expenses 3 3, 000 1, 500, 000 10 Miscellaneous expenses 3 14 Cash 3 15 Cash 3 300, 000 1, 200, 000 2, 500, 000 3, 700, 000 6, 000 9, 700, 000

Paid cash to establish a petty cash fund

Paid cash to establish a petty cash fund List six reasons why a bank may dishonor a check.

List six reasons why a bank may dishonor a check. Petty cash fund imprest and fluctuating

Petty cash fund imprest and fluctuating An endorsement indicating a new owner of a check.

An endorsement indicating a new owner of a check. Imprest system

Imprest system Analytical petty cash book

Analytical petty cash book 9-7 preparing financial statements

9-7 preparing financial statements Petty cash reimbursement example

Petty cash reimbursement example Day book format

Day book format Petty cash book format in sinhala

Petty cash book format in sinhala Apa aspek utama perencanaan kas

Apa aspek utama perencanaan kas Petty cash chit

Petty cash chit Petty cash retirement

Petty cash retirement Cash

Cash Petty cash flow

Petty cash flow