Monetary Policy MONETARY POLICY Monetary policy is the

- Slides: 9

Monetary Policy

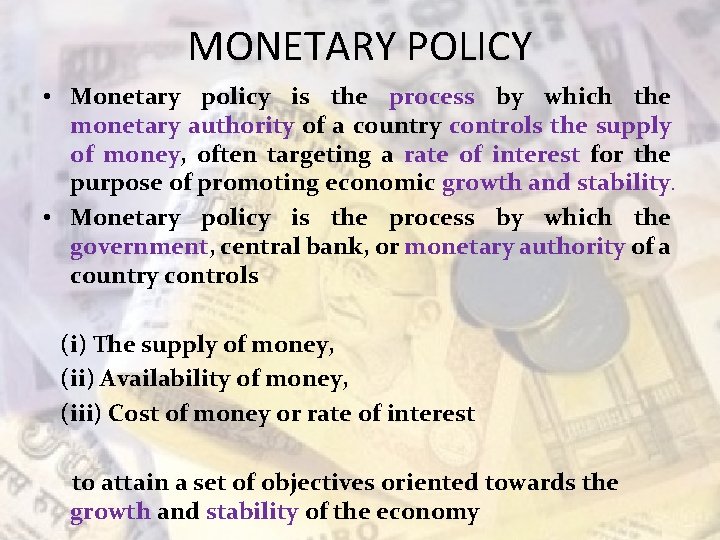

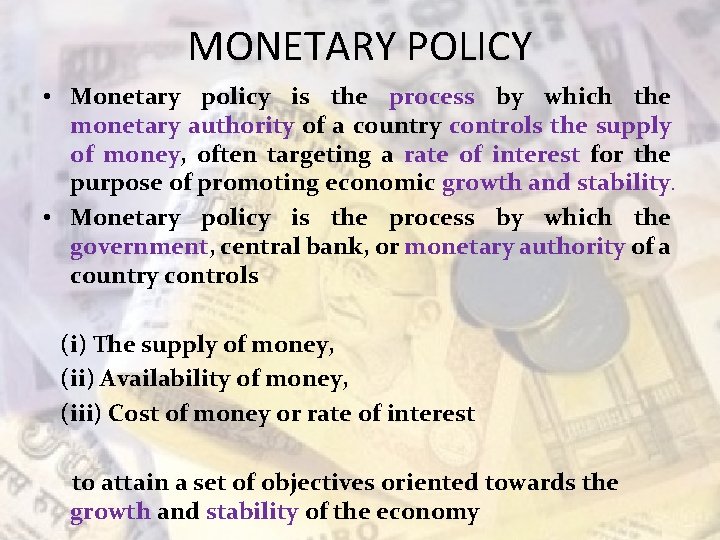

MONETARY POLICY • Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. • Monetary policy is the process by which the government, central bank, or monetary authority of a country controls (i) The supply of money, (ii) Availability of money, (iii) Cost of money or rate of interest to attain a set of objectives oriented towards the growth and stability of the economy

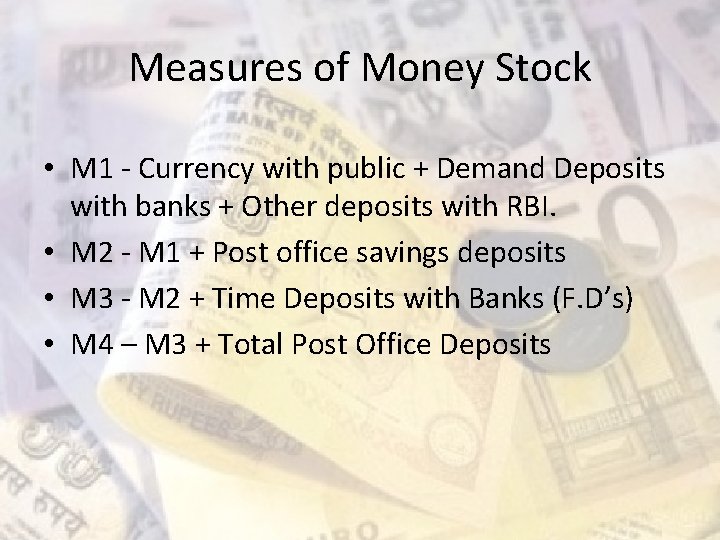

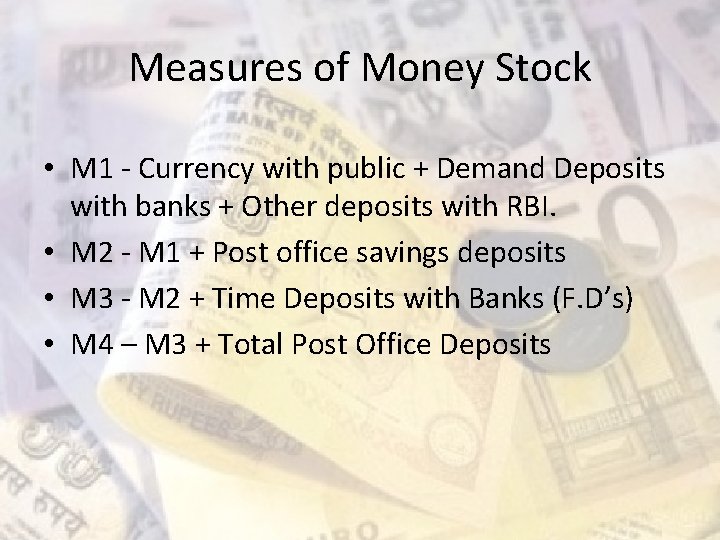

Measures of Money Stock • M 1 - Currency with public + Demand Deposits with banks + Other deposits with RBI. • M 2 - M 1 + Post office savings deposits • M 3 - M 2 + Time Deposits with Banks (F. D’s) • M 4 – M 3 + Total Post Office Deposits

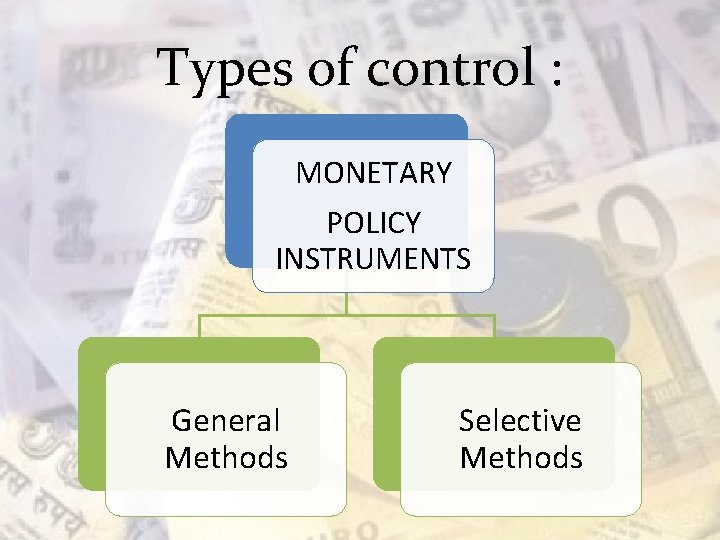

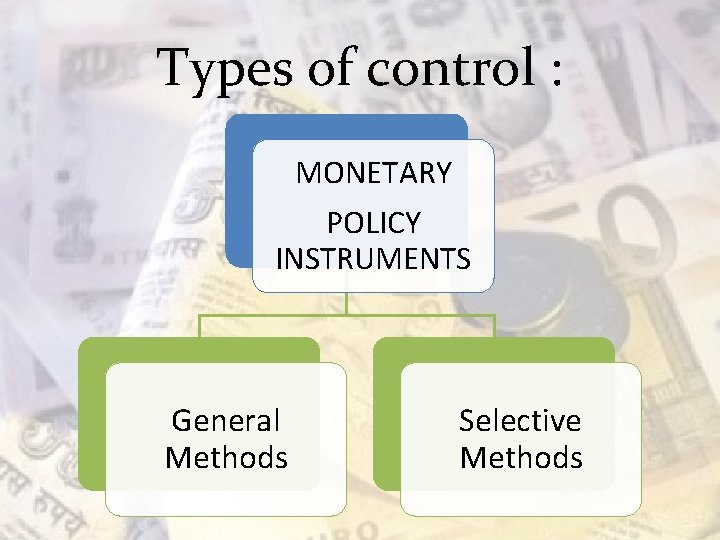

Types of control : MONETARY POLICY INSTRUMENTS General Methods Selective Methods

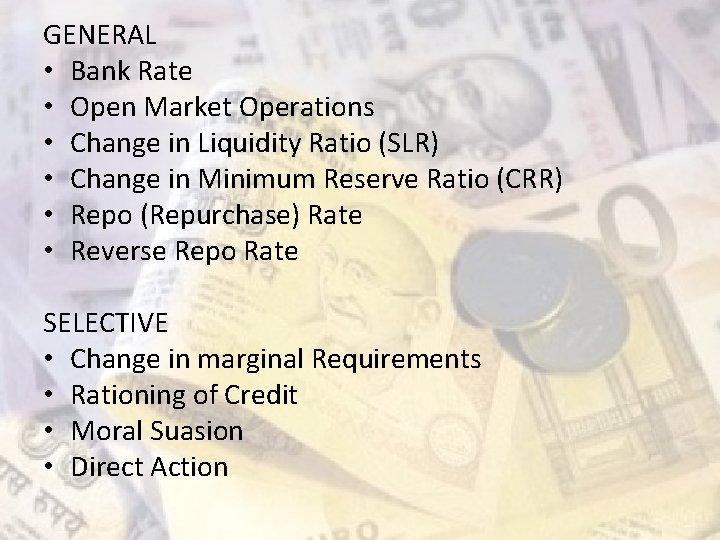

GENERAL • Bank Rate • Open Market Operations • Change in Liquidity Ratio (SLR) • Change in Minimum Reserve Ratio (CRR) • Repo (Repurchase) Rate • Reverse Repo Rate SELECTIVE • Change in marginal Requirements • Rationing of Credit • Moral Suasion • Direct Action

Fiscal Policy Use of “Government Expenditure”, and “taxation” to manage the economy. Purpose of Fiscal Policy Accelerate the rate of investment, rapid economic development, Full Employment, promoting Foreign Trade, Reducing inequalities of Income Fiscal Policy operates through Budget. The Budget simply means the estimate of revenue and expenditure

Objectives • • Accelerate the rate of Investment Promoting socially desirable Investment Achieving rapid economic development Achieving full employment Promoting foreign trade Reducing inequalities of income Welfare of society

The constitution of India provides that • No tax can be collected or levied except by authority of law. • No expenditure can be incurred for public funds except in the manner provided in constitution.

• The work of preparing the Union Budget starts in the month of August every year and after finalization, it is presented to the parliament on last day of February. • The receipts and expenditure of the Govt. are audited by the Comptroller and Auditor General in order to ensure that the executive has spent the appropriated money in accordance with the wishes of legislature.