Hot Topics in Corporate Law Insider Trading and

![2. Bebchuk & Jackson Lucien Bebchuk Robert Jackson • “[C]orporate law rules … cannot 2. Bebchuk & Jackson Lucien Bebchuk Robert Jackson • “[C]orporate law rules … cannot](https://slidetodoc.com/presentation_image_h2/c97fe043f3932d2f333b78c3d083e941/image-24.jpg)

- Slides: 40

Hot Topics in Corporate Law: Insider Trading and Corporate Political Spending Disclosure June 10, 2016 Professor Michael D. Guttentag

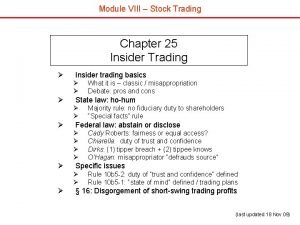

Why are these hot topics? The key triggering event: • Insider Trading: – U. S. v. Newman, Dec. 10, 2014 • Political Spending Disclosure: – Citizens United v, FEC, Jan. 19 , 2010

Why are these hot topics? The key triggering event: • Insider Trading: – U. S. v. Newman, Dec. 10, 2014

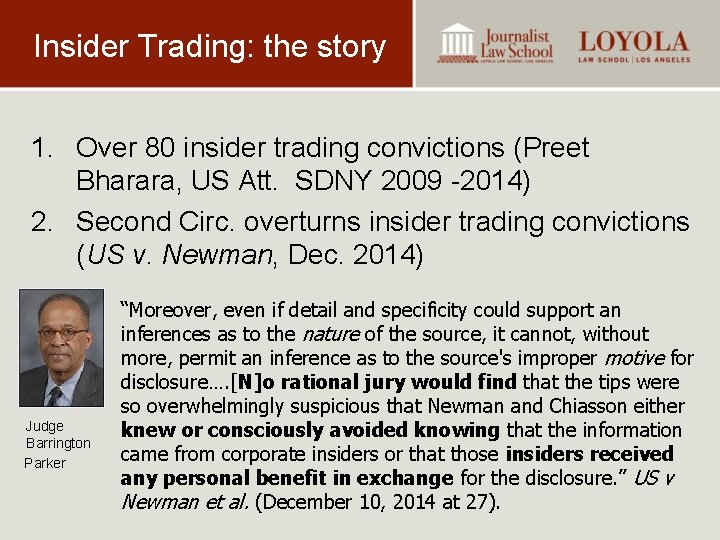

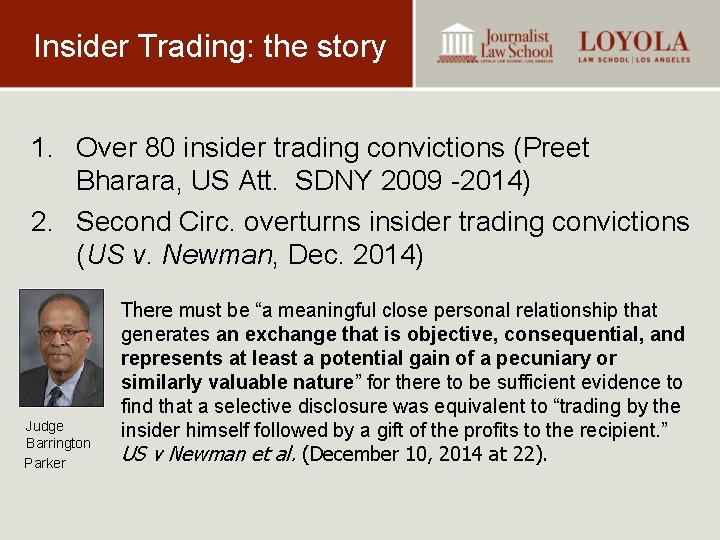

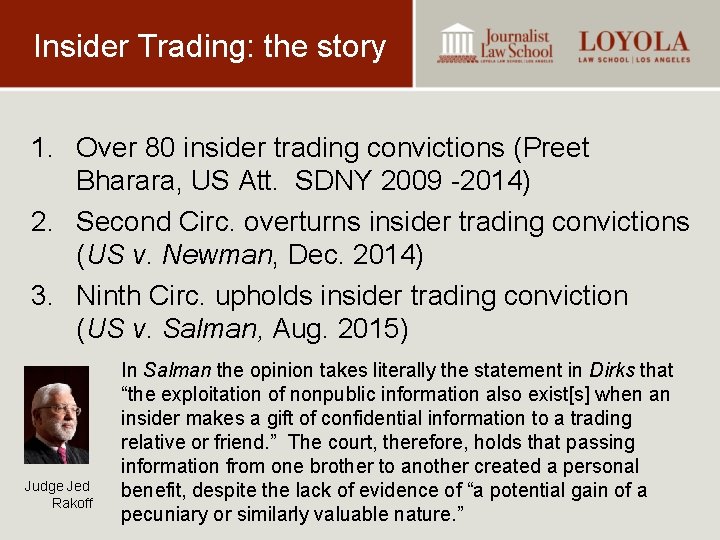

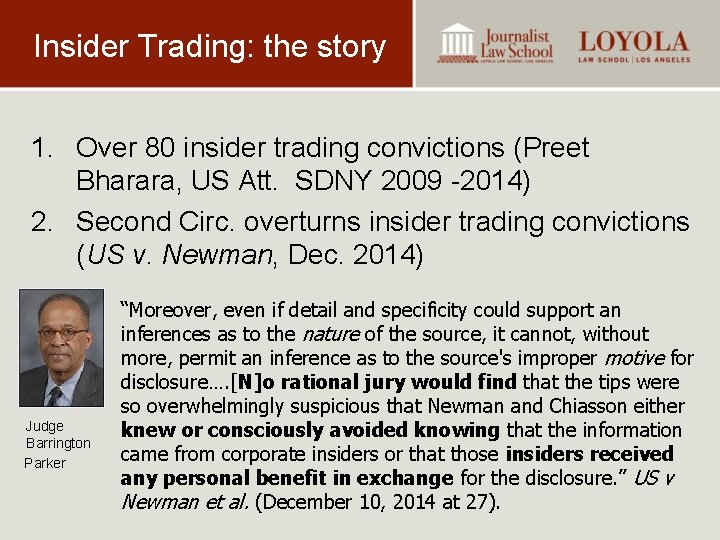

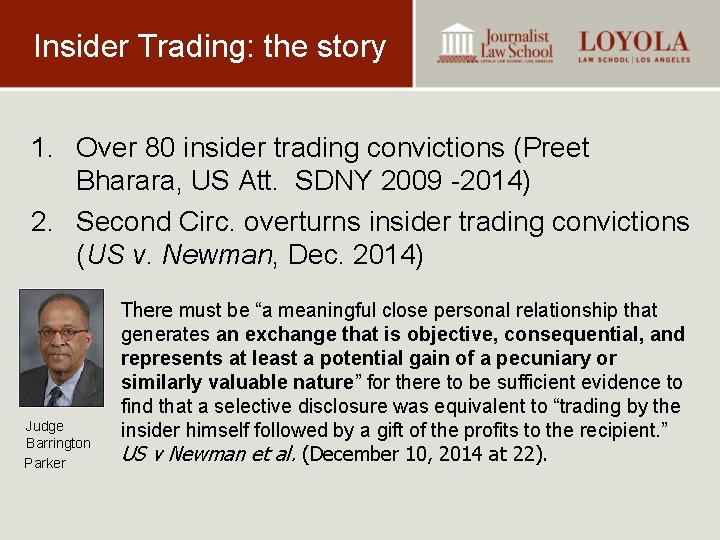

Insider Trading: the story 1. Over 80 insider trading convictions (Preet Bharara, US Att. SDNY 2009 -2014)

Insider Trading: the story 1. Over 80 insider trading convictions (Preet Bharara, US Att. SDNY 2009 -2014) 2. Second Circ. overturns insider trading convictions (US v. Newman, Dec. 2014)

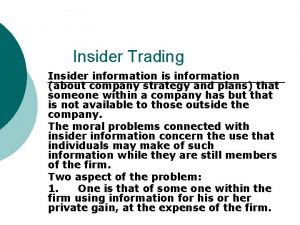

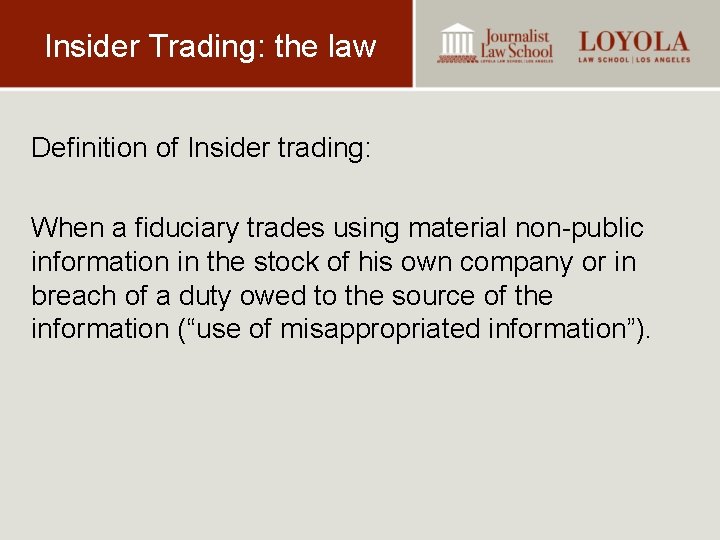

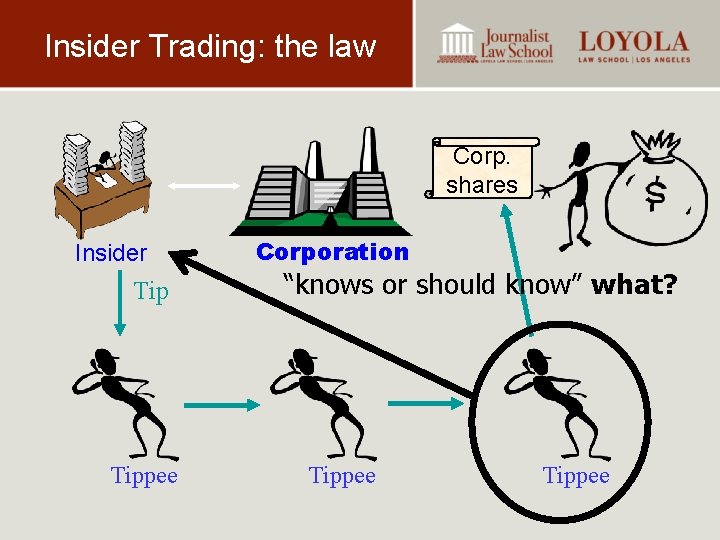

Insider Trading: the law Definition of Insider trading: When a fiduciary trades using material non-public information in the stock of his own company or in breach of a duty owed to the source of the information (“use of misappropriated information”).

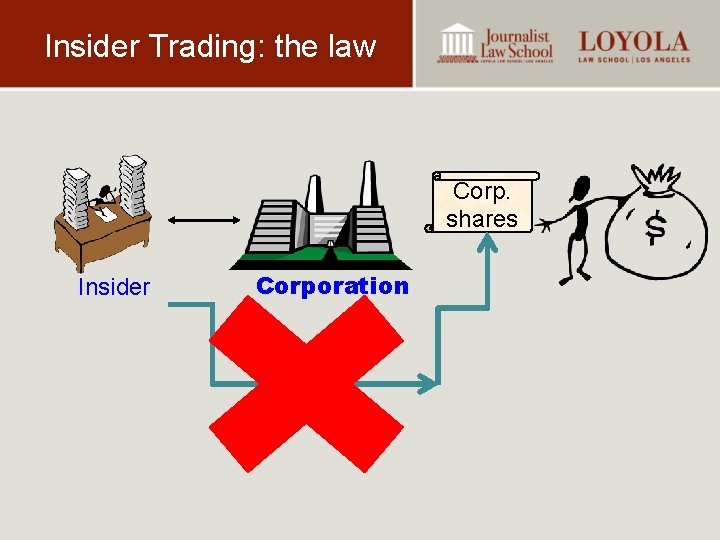

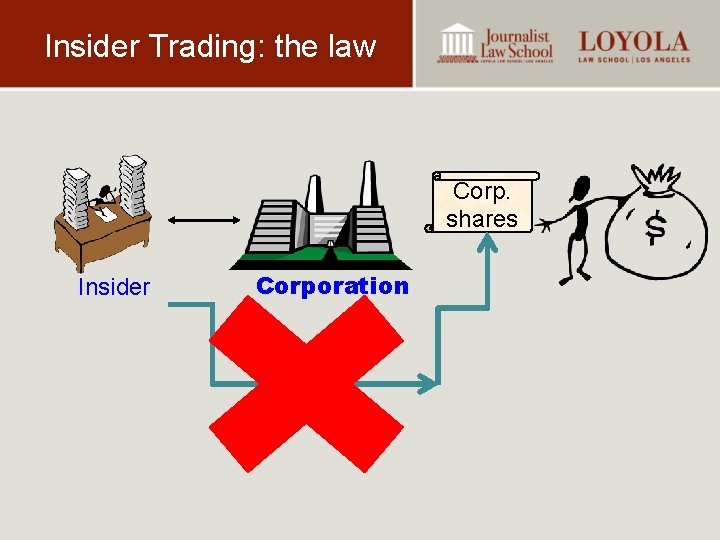

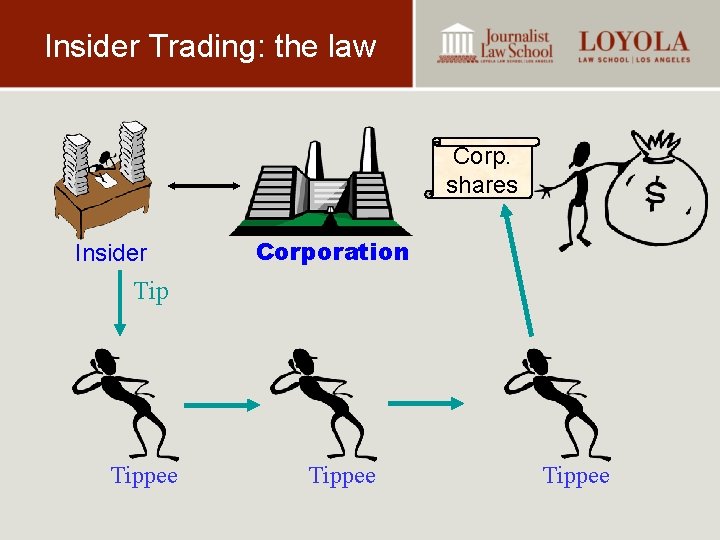

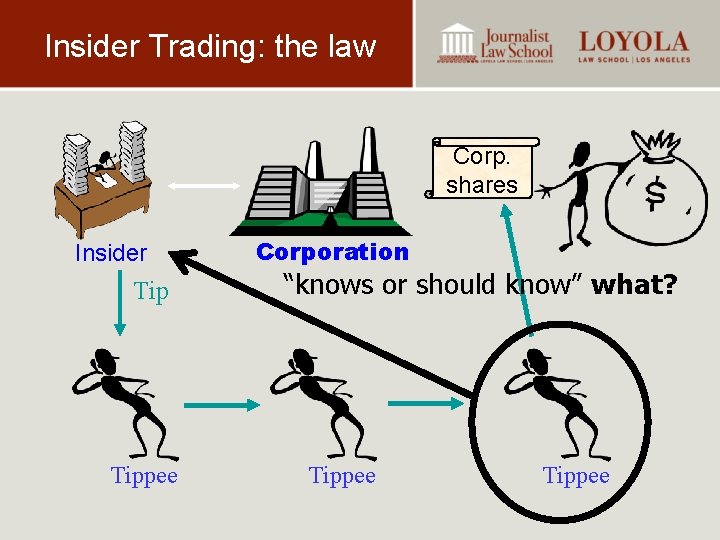

Insider Trading: the law Corp. shares Insider Corporation

Insider Trading: the law What about the case where there is a tip passed on from one person to another?

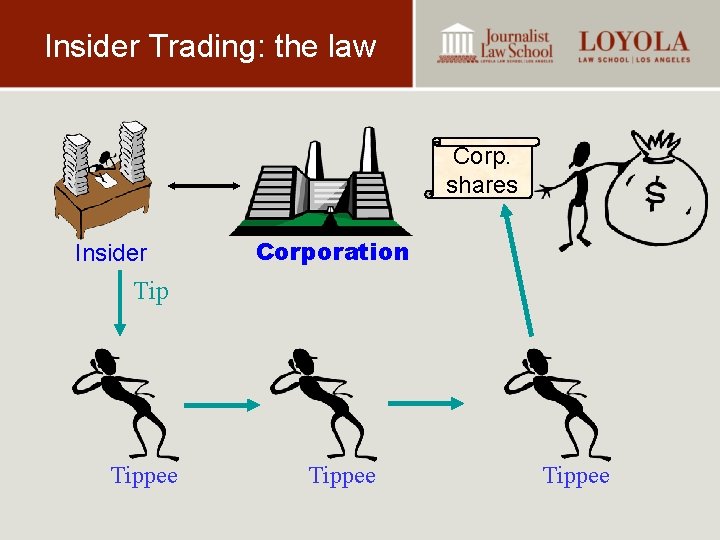

Insider Trading: the law Corp. shares Insider Corporation Tippee

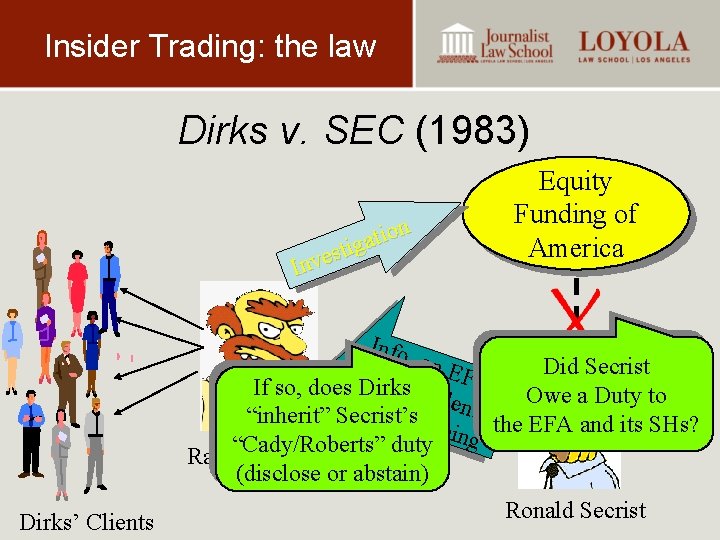

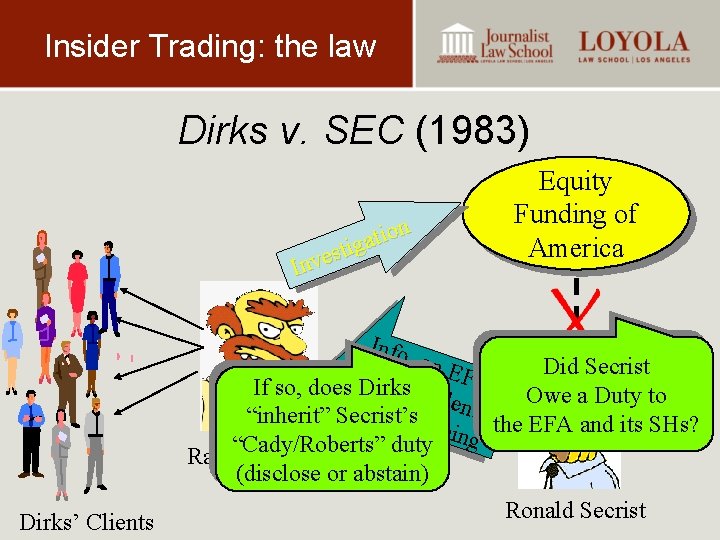

Insider Trading: the law Dirks v. SEC (1983) n o i t a g i t s Inve Equity Funding of America Info. on Did Secrist E F F A raud ’s Owe a Duty to If so, does Dirks u l Boo e kkee nt the EFA and its SHs? “inherit” Secrist’s ping “Cady/Roberts” duty Raymond Dirks (disclose or abstain) Dirks’ Clients Ronald Secrist

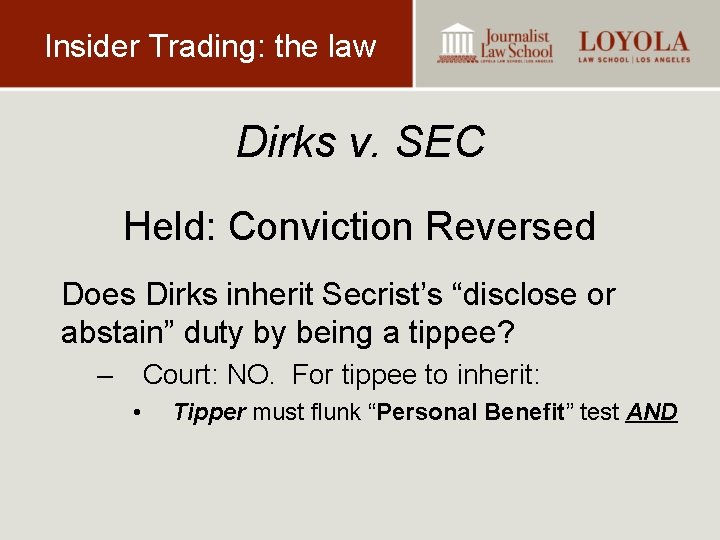

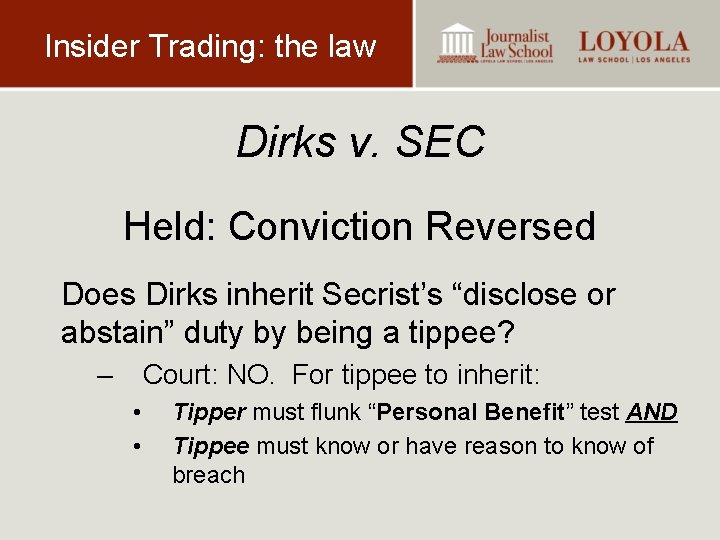

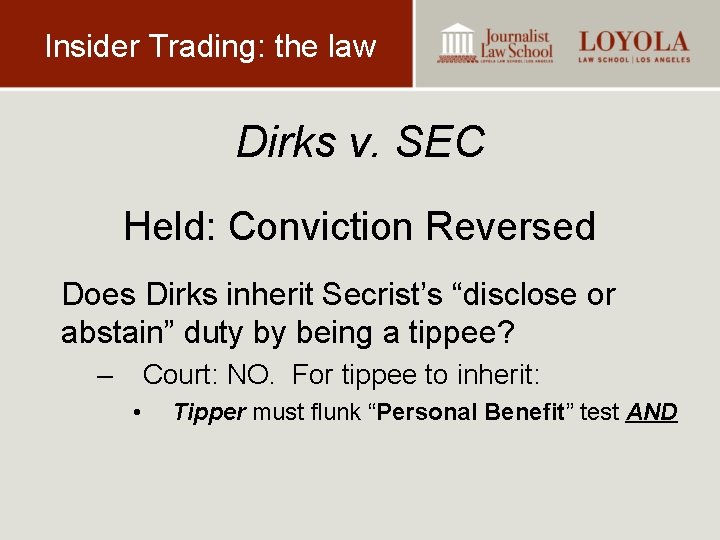

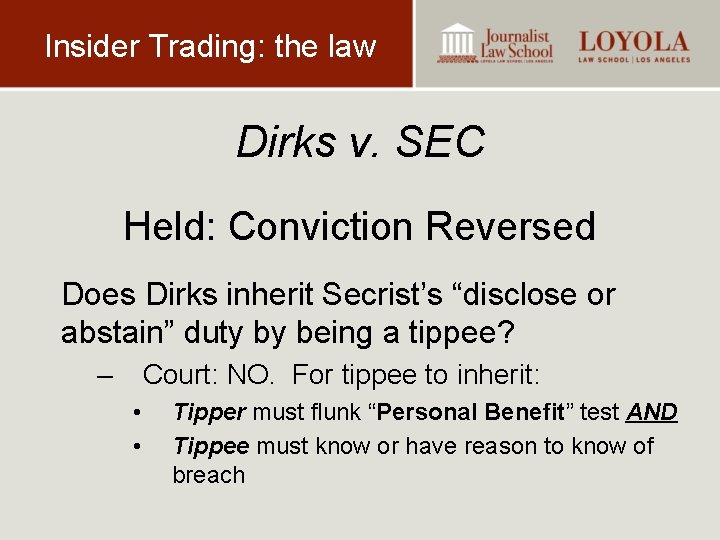

Insider Trading: the law Dirks v. SEC Held: Conviction Reversed Does Dirks inherit Secrist’s “disclose or abstain” duty by being a tippee? – Court: NO. For tippee to inherit: • Tipper must flunk “Personal Benefit” test AND

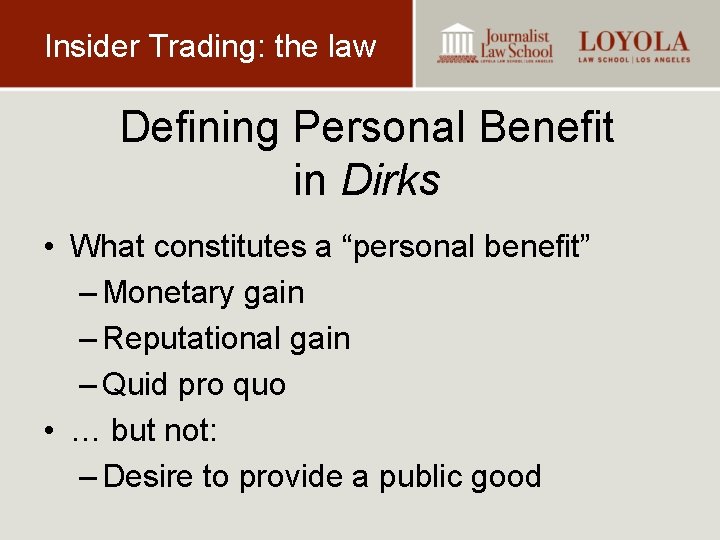

Insider Trading: the law Defining Personal Benefit in Dirks • What constitutes a “personal benefit” – Monetary gain – Reputational gain – Quid pro quo • … but not: – Desire to provide a public good

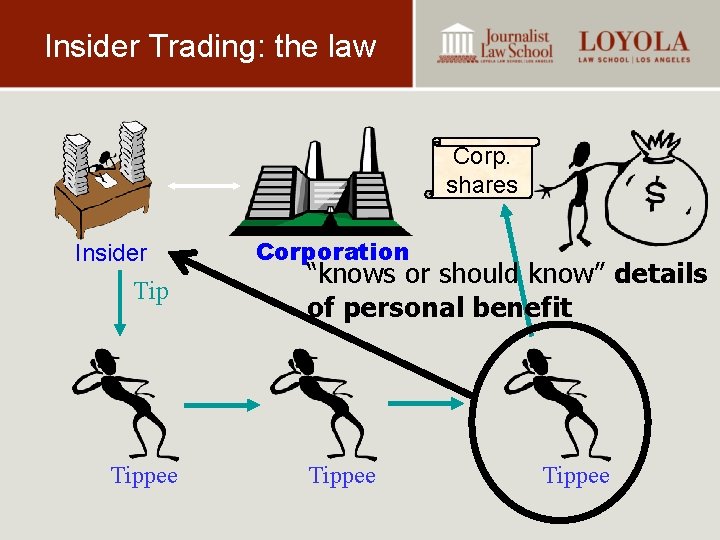

Insider Trading: the law Dirks v. SEC Held: Conviction Reversed Does Dirks inherit Secrist’s “disclose or abstain” duty by being a tippee? – Court: NO. For tippee to inherit: • • Tipper must flunk “Personal Benefit” test AND Tippee must know or have reason to know of breach

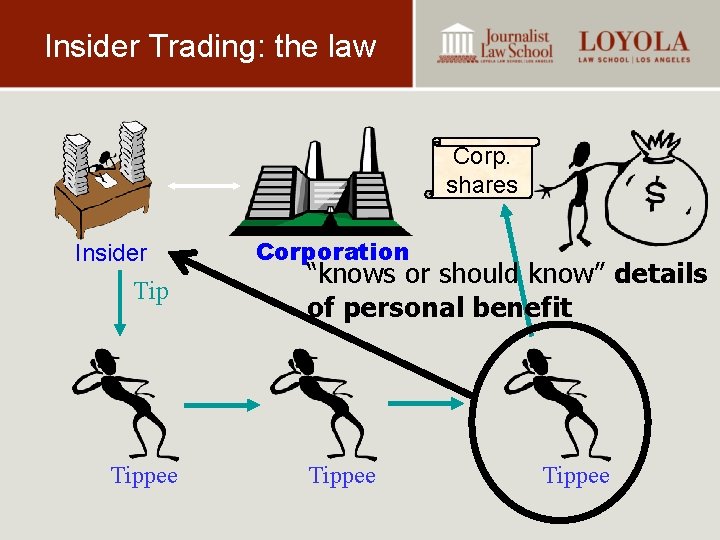

Insider Trading: the law Corp. shares Insider Tippee Corporation “knows or should know” what? Tippee

Insider Trading: the story 1. Over 80 insider trading convictions (Preet Bharara, US Att. SDNY 2009 -2014) 2. Second Circ. overturns insider trading convictions (US v. Newman, Dec. 2014) Judge Barrington Parker “Moreover, even if detail and specificity could support an inferences as to the nature of the source, it cannot, without more, permit an inference as to the source's improper motive for disclosure…. [N]o rational jury would find that the tips were so overwhelmingly suspicious that Newman and Chiasson either knew or consciously avoided knowing that the information came from corporate insiders or that those insiders received any personal benefit in exchange for the disclosure. ” US v Newman et al. (December 10, 2014 at 27).

Insider Trading: the story 1. Over 80 insider trading convictions (Preet Bharara, US Att. SDNY 2009 -2014) 2. Second Circ. overturns insider trading convictions (US v. Newman, Dec. 2014) Judge Barrington Parker There must be “a meaningful close personal relationship that generates an exchange that is objective, consequential, and represents at least a potential gain of a pecuniary or similarly valuable nature” for there to be sufficient evidence to find that a selective disclosure was equivalent to “trading by the insider himself followed by a gift of the profits to the recipient. ” US v Newman et al. (December 10, 2014 at 22).

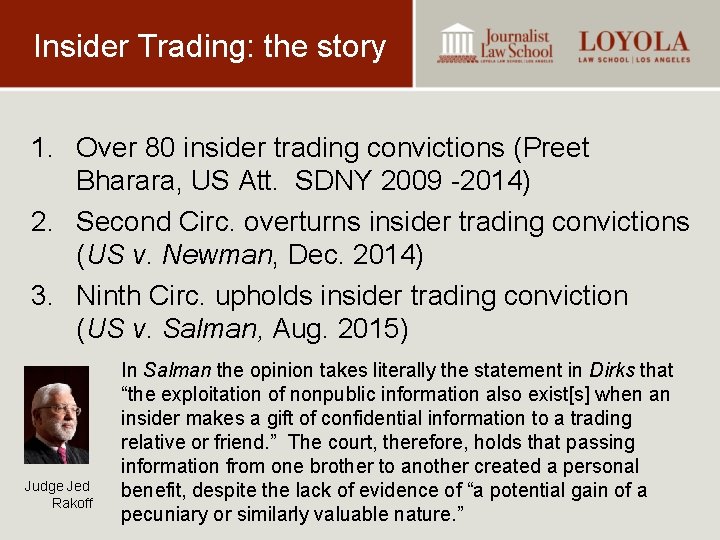

Insider Trading: the story 1. Over 80 insider trading convictions (Preet Bharara, US Att. SDNY 2009 -2014) 2. Second Circ. overturns insider trading convictions (US v. Newman, Dec. 2014) 3. Ninth Circ. upholds insider trading conviction (US v. Salman, Aug. 2015) Judge Jed Rakoff In Salman the opinion takes literally the statement in Dirks that “the exploitation of nonpublic information also exist[s] when an insider makes a gift of confidential information to a trading relative or friend. ” The court, therefore, holds that passing information from one brother to another created a personal benefit, despite the lack of evidence of “a potential gain of a pecuniary or similarly valuable nature. ”

Insider Trading: the story 1. Over 80 insider trading convictions (Preet Bharara, US Att. SDNY 2009 -2014) 2. Second Circ. overturns insider trading convictions (US v. Newman, Dec. 2014) 3. Ninth Circ. upholds insider trading conviction (US v. Salman, Aug. 2015) 4. Supreme Court agrees to hear US v. Salman (Jan. 2016) 5. Phil Mickelson not charged with insider trading (May 2016)

Insider Trading: the law Corp. shares Insider Tippee Corporation “knows or should know” details of personal benefit Tippee

Why are these hot topics? The key triggering event: • Insider Trading: – U. S. v. Newman, Dec. 10, 2014 • Political Spending Disclosure: – Citizens United v, FEC, Jan. 19 , 2010

Political Spending Disclosure: the story 1. Citizens United v. FEC, (2010)

1. Citizens United • “If the First Amendment has any force, it prohibits Congress from fining or jailing citizens, or associations of citizens, for simply engaging in political speech. … Yet certain disfavored associations of citizens—those that have taken Justice Kennedy on the corporate form—are penalized for engaging in the same political speech. ” Citizens United (2010). • “There is, furthermore, little evidence of abuse that cannot be corrected by shareholders ‘through the procedures of corporate democracy. ” Citizens United (2010).

Political Spending Disclosure: the story 1. Citizens United v. FEC, Jan. 19 , 2010 2. Bebchuk & Jackson, Harvard Law Review (2010)

![2 Bebchuk Jackson Lucien Bebchuk Robert Jackson Corporate law rules cannot 2. Bebchuk & Jackson Lucien Bebchuk Robert Jackson • “[C]orporate law rules … cannot](https://slidetodoc.com/presentation_image_h2/c97fe043f3932d2f333b78c3d083e941/image-24.jpg)

2. Bebchuk & Jackson Lucien Bebchuk Robert Jackson • “[C]orporate law rules … cannot be expected to have a meaningful impact on political speech decisions if shareholders are uninformed about the corporation’s political spending. ” Corporate Political Speech: Who Decides, Harvard Law Review (2010).

Political Spending Disclosure: the story 1. Citizens United v. FEC, Jan. 19 , 2010 2. Bebchuk & Jackson, Harvard Law Review (2010) 3. Petition to the SEC (2011)

3. SEC Petition • Investor interest in public company political spending justifies requiring the disclosure of this information. Letter to the SEC (August, 2011). Lucien Bebchuk Robert Jackson Jeff Gordon John Coffee Hillary Sale Bernie Black Ronald Gilson James Cox Henry Hansmann Donald Langevoort

Political Spending Disclosure: the story 1. Citizens United v. FEC, Jan. 19 , 2010 2. Bebchuk & Jackson, Harvard Law Review (2010) 3. Petition to the SEC (2011) 4. White (SEC Chair) shelves petition (2013)

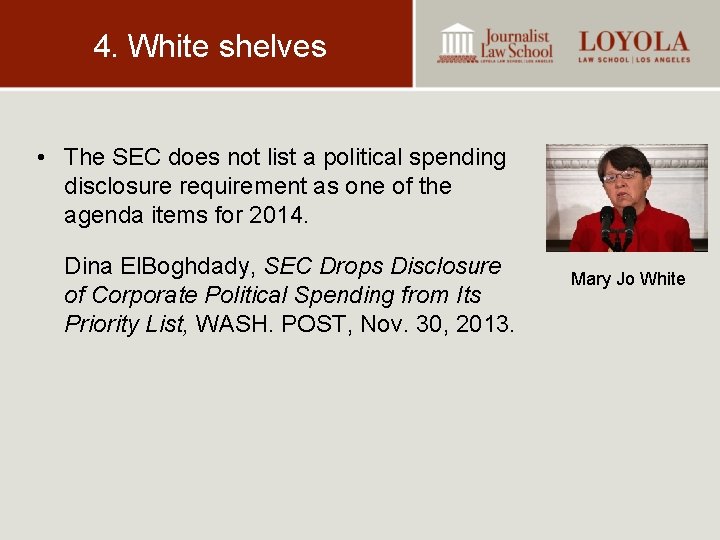

4. White shelves • The SEC does not list a political spending disclosure requirement as one of the agenda items for 2014. Dina El. Boghdady, SEC Drops Disclosure of Corporate Political Spending from Its Priority List, WASH. POST, Nov. 30, 2013. Mary Jo White

Political Spending Disclosure: the story 1. Citizens United v. FEC, Jan. 19 , 2010 2. Bebchuk & Jackson, Harvard Law Review (2010) 3. Petition to the SEC (2011) 4. White (SEC Chair) shelves petition (2013) 5. Senators object (2014)

5. Senators Object Elizabeth Warren • “Good corporate governance requires that companies are transparent about their use of corporate resources [on political spending]. Shareholders know this and have demanded disclosure. ” Letter from Seventeen US Senators to SEC Chair Mary Jo White (January, 2014). Robert Menendez

Political Spending Disclosure: the story 1. Citizens United v. FEC, Jan. 19 , 2010 2. Bebchuk & Jackson, Harvard Law Review (2010) 3. Petition to the SEC (2011) 4. White (SEC Chair) shelves petition (2013) 5. Senators object (2014) 6. Legislation blocks funding (2015)

6. Funding Legislation • “None of the funds made available by any division of this act shall be used by the SEC to finalize, issue or implement any rule, regulation or order regarding the disclosure of political contributions, contributions to tax exempt organizations or dues paid to trade associations. ” Consolidated Appropriations Act (December 2015).

Political Spending Disclosure: the story 1. Citizens United v. FEC, Jan. 19 , 2010 2. Bebchuk & Jackson, Harvard Law Review (2010) 3. Petition to the SEC (2011) 4. White (SEC Chair) shelves petition (2013) 5. Senators object (2014) 6. Legislation blocks funding (2015) 7. Schumer holds up SEC appointments (2016)

7. Schumer blocks Fairfax Lisa Fairfax • “The SEC needs commissioners who believe in and support campaign spending transparency, " Schumer said. "I hope that both nominees will reconsider their fence-sitting on this critical issue before the vote, and make clear that they will support an SEC rule that will help root out secret money from our politics. “ (April 2016).

Behind the story 1. Understanding the public/private divide

Public/private divide What is the public/private divide?

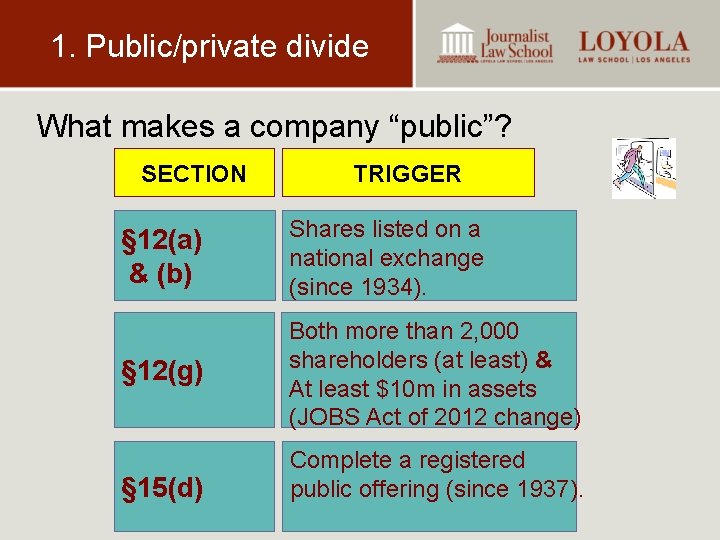

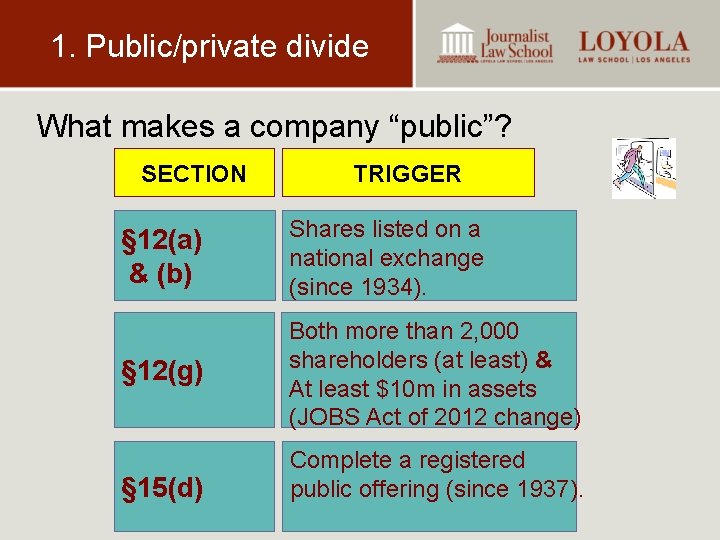

1. Public/private divide What makes a company “public”? SECTION TRIGGER § 12(a) & (b) Shares listed on a national exchange (since 1934). § 12(g) Both more than 2, 000 shareholders (at least) & At least $10 m in assets (JOBS Act of 2012 change) § 15(d) Complete a registered public offering (since 1937).

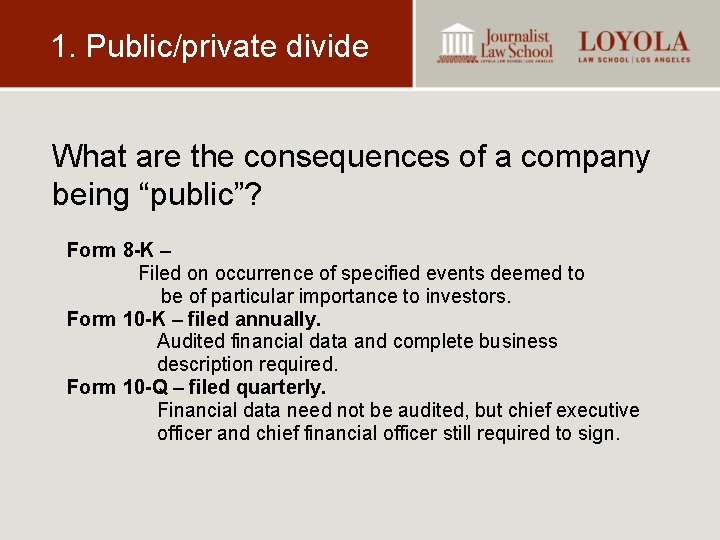

1. Public/private divide What are the consequences of a company being “public”? Form 8 -K – Filed on occurrence of specified events deemed to be of particular importance to investors. Form 10 -K – filed annually. Audited financial data and complete business description required. Form 10 -Q – filed quarterly. Financial data need not be audited, but chief executive officer and chief financial officer still required to sign.

1. Public/private divide The SEC political spending disclosure proposal:

Why are these hot topics? Questions?

Insider trading and market abuse

Insider trading and market abuse Earning management adalah

Earning management adalah Avoiding insider trading training

Avoiding insider trading training Accidental insider trading

Accidental insider trading Yg insider trading

Yg insider trading Insider and outsider system of corporate governance

Insider and outsider system of corporate governance Hot topics in patent law

Hot topics in patent law Meaning of non trading concern

Meaning of non trading concern Newton's first law and second law and third law

Newton's first law and second law and third law Newton's first law

Newton's first law Objectives of corporate governance

Objectives of corporate governance Emily edison nutrition

Emily edison nutrition Hot topics in networking

Hot topics in networking Hot topics in leadership

Hot topics in leadership Travel histology jobs

Travel histology jobs Hot topics in networking

Hot topics in networking White hot vs red hot temperature

White hot vs red hot temperature Advantage of hot working process

Advantage of hot working process Perbedaan hot lava dan hot lava volcano

Perbedaan hot lava dan hot lava volcano Hot nor hot

Hot nor hot Boyles law

Boyles law How to calculate boyle's law

How to calculate boyle's law Who are defra

Who are defra Insider threat awareness training

Insider threat awareness training Potential insider threat indicators cyber awareness

Potential insider threat indicators cyber awareness Preconditions for an insider threat

Preconditions for an insider threat Insiderscore llc

Insiderscore llc Insider threat automation

Insider threat automation Insider threat training slides

Insider threat training slides Insider dealing

Insider dealing Uw insider

Uw insider Insider pressure groups

Insider pressure groups Classic insider

Classic insider Insider research ethics

Insider research ethics Corporate law definition

Corporate law definition Charltons law

Charltons law Corporate banking law

Corporate banking law Gas law hot air balloon

Gas law hot air balloon Vertical format of trading profit and loss account

Vertical format of trading profit and loss account In departmental account

In departmental account Six errors of trial balance

Six errors of trial balance