Gautam Nayak Chartered Accountant Taxation of LLPs including

- Slides: 32

Gautam Nayak Chartered Accountant Taxation of LLPs (including conversion into LLP) DTC of ICAI National Tax Convention, Pune 4 th July 2015

What is a Limited Liability Partnership (LLP)? o o o CNK Hybrid between a partnership firm and a company Is a body corporate Considered as ‘Firm’ for taxation purposes Limits liability of partners to the extent of their contribution barring certain circumstances Various tax advantages as compared to a company Governed by LLP Act 2008 and LLP Rules 2009 Body Corporate Separate legal existence Perpetual succession Limited liability of Partners are agent of LLP and not other partners 1

Who Can Be A Partner ? o Minimum two partners o No limit on number of partners o Individual and/or Body Corporate o Company, LLP o HUF, Trust, or Partnership Firm ? o Circular No. 13/2013 dated 02. 07. 2013 – HUF not individual/body corporate – cannot be a partner o Karta, Trustee, Partner? o Minor or its guardian ? CNK 2

Capital Contribution o Should every partner contribute to the capital ? o Capital Contribution Ratio vis-à-vis Profit Sharing Ratio o Contribution may be in the form of tangible, intangible, movable or immovable property or other benefits – s. 32 of LLP Act o Monetary value of contribution of each partner to be accounted for & disclosed in accounts of LLP in prescribed manner o Rule 23 - Disclosure in the books of accounts CNK o Contribution to be accounted for & disclosed with nature of contribution & amount o Contribution of property or benefits or by way of agreement or contract for services to be valued by practicing CA/Cost Accountant/approved 3 valuer - whether necessarily market value?

Accounts And Audit o Accrual or Cash method of accounting ICDS not applicable if cash method followed o o Rule 24(1) and Rule 24(2) - Accounting Records o Normal books of account o Statement of account and solvency for a financial year to be filed within 6 months from the year end o o o Statement of Assets and Liabilities Statement of income and expenditure Certification by Auditor o Compulsory audit if turnover exceeds Rs. 40 lakhs or if total contribution exceeds Rs. 25 lakhs o Auditors to be appointed by Designated Partners CNK 4

Direct Tax Implications o Tax treatment of LLPs to be same as that of ‘Partnership Firms’ o S. 2(23) of the I T Act, 1961 – firm and partner to include ‘LLP’ and its ‘Partners’ o Partners share of profit will be exempt [s. 10(2 A) of the IT Act] o Whether exemption available for share in profit of HUF partner? o Designated Partners shall sign the Income Tax Return o Joint and several liability for payment of taxes CNK 5

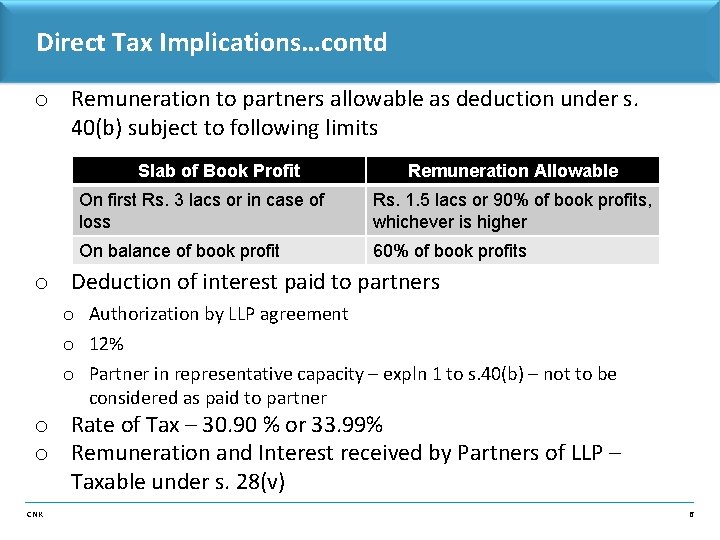

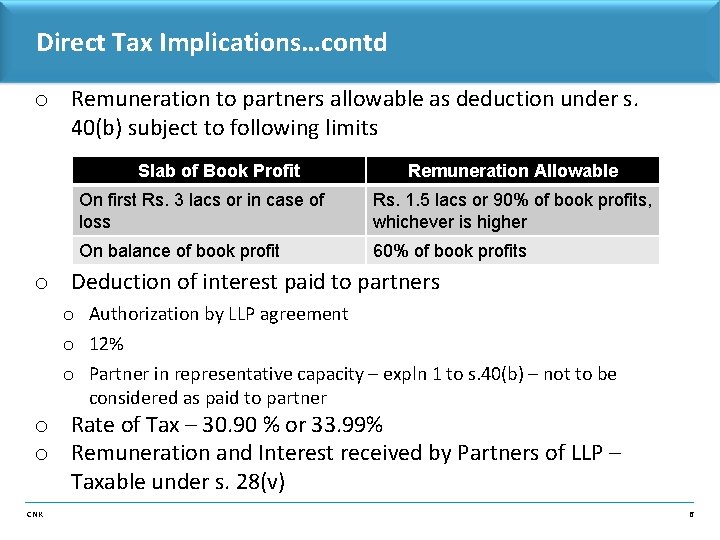

Direct Tax Implications…contd o Remuneration to partners allowable as deduction under s. 40(b) subject to following limits Slab of Book Profit Remuneration Allowable On first Rs. 3 lacs or in case of loss Rs. 1. 5 lacs or 90% of book profits, whichever is higher On balance of book profit 60% of book profits o Deduction of interest paid to partners o Authorization by LLP agreement o 12% o Partner in representative capacity – expln 1 to s. 40(b) – not to be considered as paid to partner o Rate of Tax – 30. 90 % or 33. 99% o Remuneration and Interest received by Partners of LLP – Taxable under s. 28(v) CNK 6

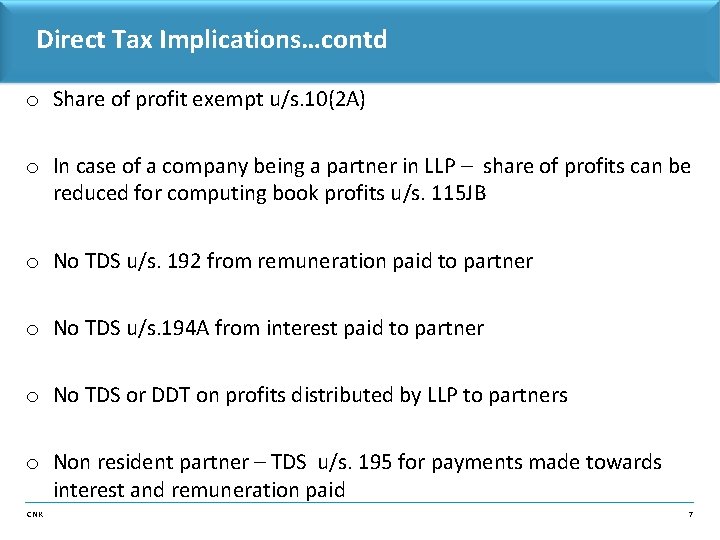

Direct Tax Implications…contd o Share of profit exempt u/s. 10(2 A) o In case of a company being a partner in LLP – share of profits can be reduced for computing book profits u/s. 115 JB o No TDS u/s. 192 from remuneration paid to partner o No TDS u/s. 194 A from interest paid to partner o No TDS or DDT on profits distributed by LLP to partners o Non resident partner – TDS u/s. 195 for payments made towards interest and remuneration paid CNK 7

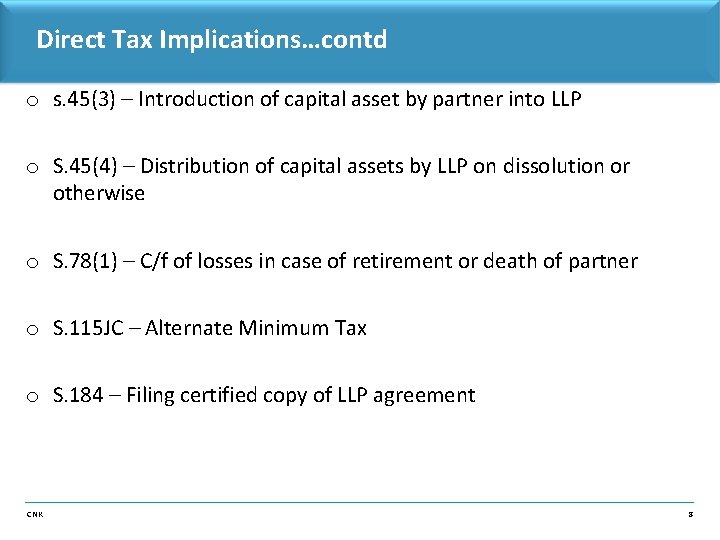

Direct Tax Implications…contd o s. 45(3) – Introduction of capital asset by partner into LLP o S. 45(4) – Distribution of capital assets by LLP on dissolution or otherwise o S. 78(1) – C/f of losses in case of retirement or death of partner o S. 115 JC – Alternate Minimum Tax o S. 184 – Filing certified copy of LLP agreement CNK 8

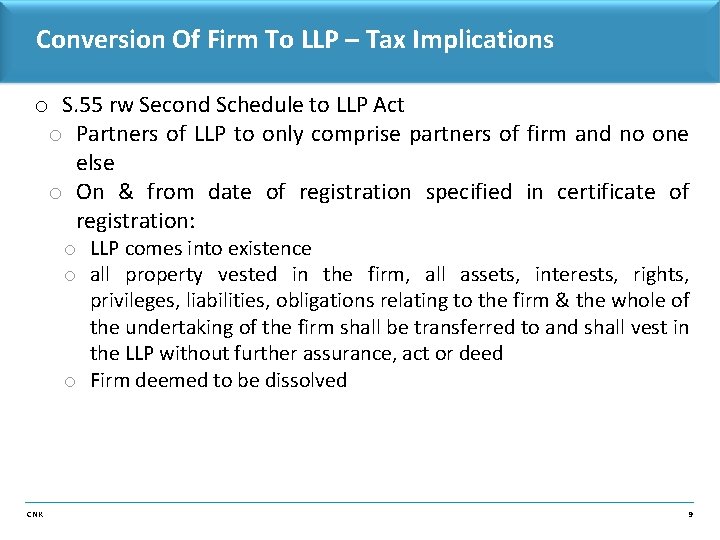

Conversion Of Firm To LLP – Tax Implications o S. 55 rw Second Schedule to LLP Act o Partners of LLP to only comprise partners of firm and no one else o On & from date of registration specified in certificate of registration: o LLP comes into existence o all property vested in the firm, all assets, interests, rights, privileges, liabilities, obligations relating to the firm & the whole of the undertaking of the firm shall be transferred to and shall vest in the LLP without further assurance, act or deed o Firm deemed to be dissolved CNK 9

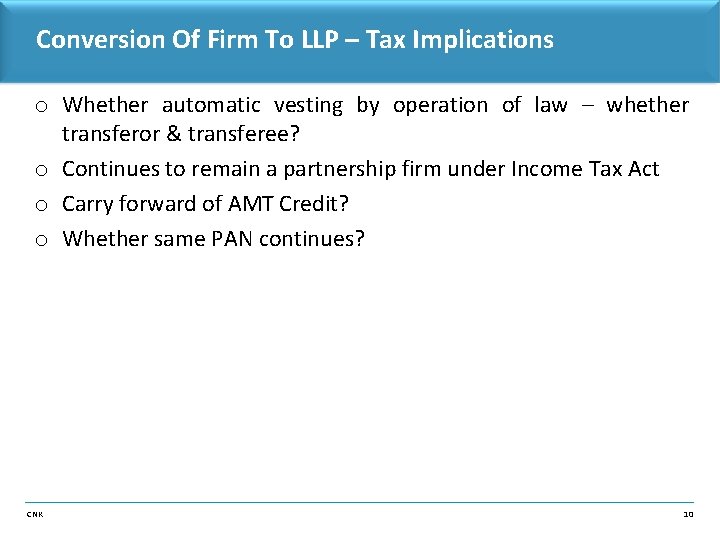

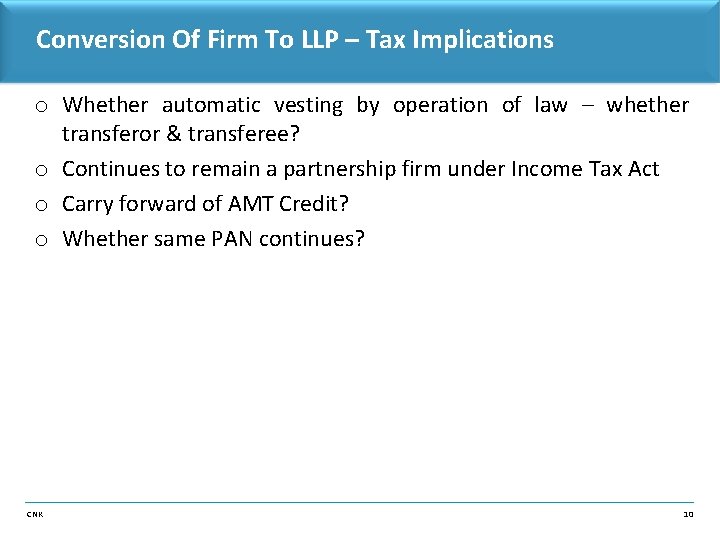

Conversion Of Firm To LLP – Tax Implications o Whether automatic vesting by operation of law – whether transferor & transferee? o Continues to remain a partnership firm under Income Tax Act o Carry forward of AMT Credit? o Whether same PAN continues? CNK 10

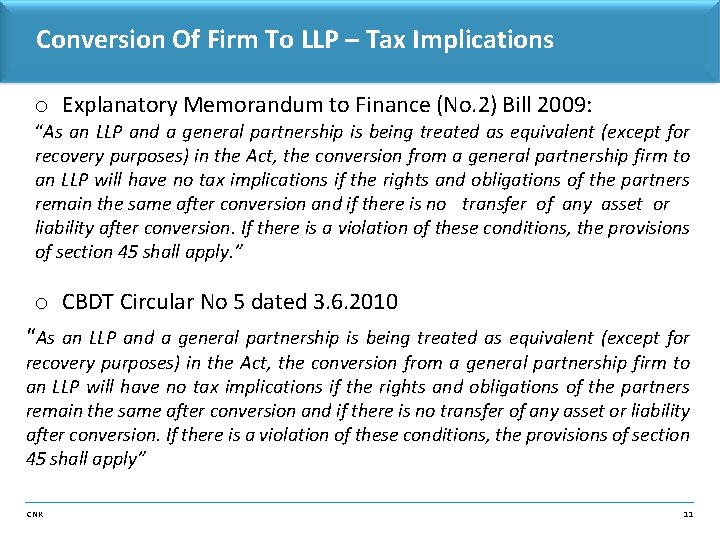

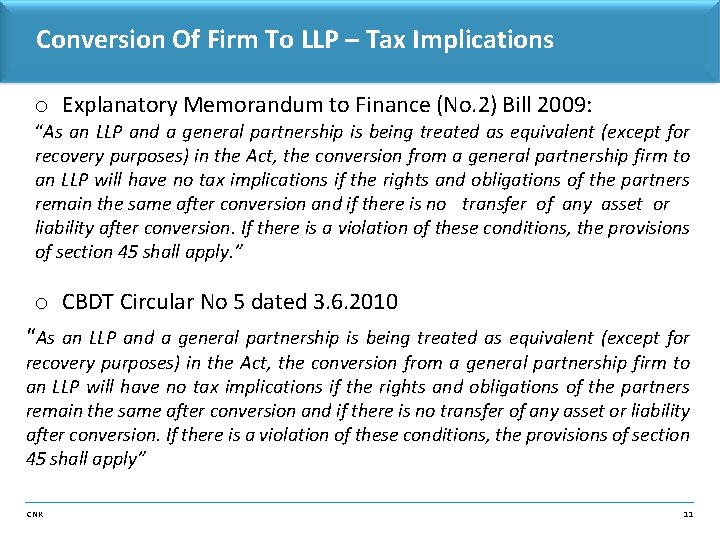

Conversion Of Firm To LLP – Tax Implications o Explanatory Memorandum to Finance (No. 2) Bill 2009: “As an LLP and a general partnership is being treated as equivalent (except for recovery purposes) in the Act, the conversion from a general partnership firm to an LLP will have no tax implications if the rights and obligations of the partners remain the same after conversion and if there is no transfer of any asset or liability after conversion. If there is a violation of these conditions, the provisions of section 45 shall apply. ” o CBDT Circular No 5 dated 3. 6. 2010 “As an LLP and a general partnership is being treated as equivalent (except for recovery purposes) in the Act, the conversion from a general partnership firm to an LLP will have no tax implications if the rights and obligations of the partners remain the same after conversion and if there is no transfer of any asset or liability after conversion. If there is a violation of these conditions, the provisions of section 45 shall apply” CNK 11

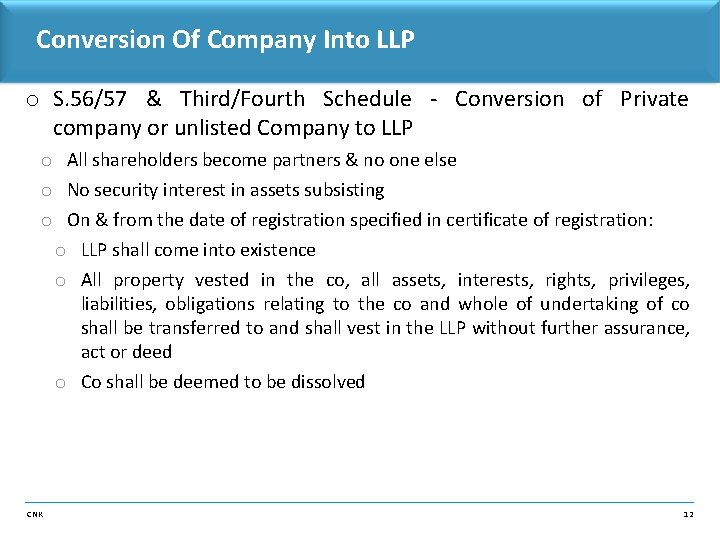

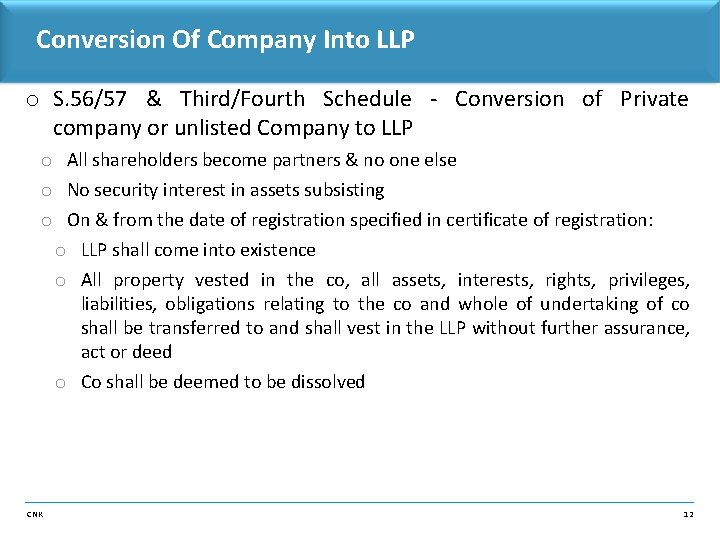

Conversion Of Company Into LLP o S. 56/57 & Third/Fourth Schedule - Conversion of Private company or unlisted Company to LLP o All shareholders become partners & no one else o No security interest in assets subsisting o On & from the date of registration specified in certificate of registration: o LLP shall come into existence o All property vested in the co, all assets, interests, rights, privileges, liabilities, obligations relating to the co and whole of undertaking of co shall be transferred to and shall vest in the LLP without further assurance, act or deed o Co shall be deemed to be dissolved CNK 12

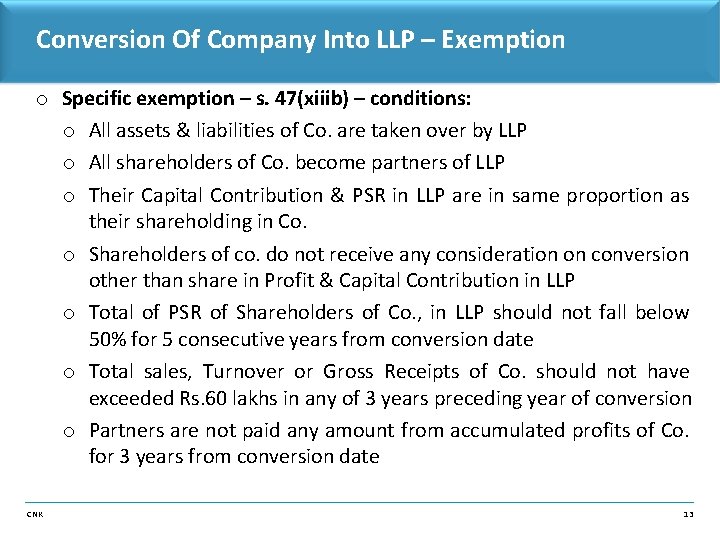

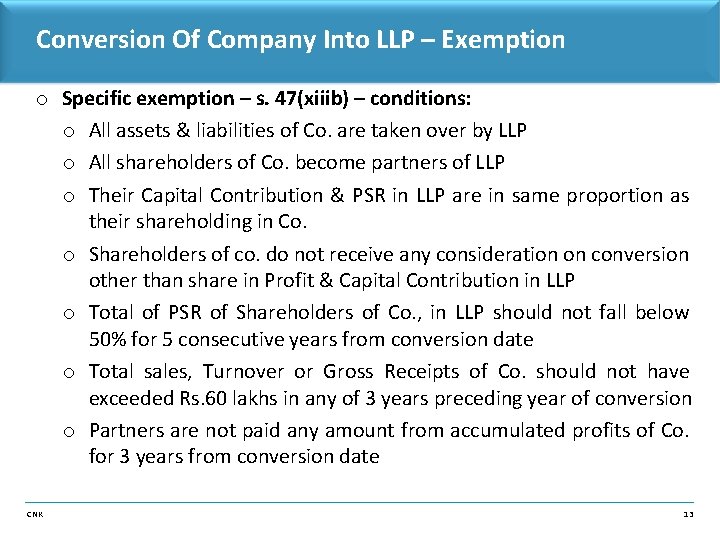

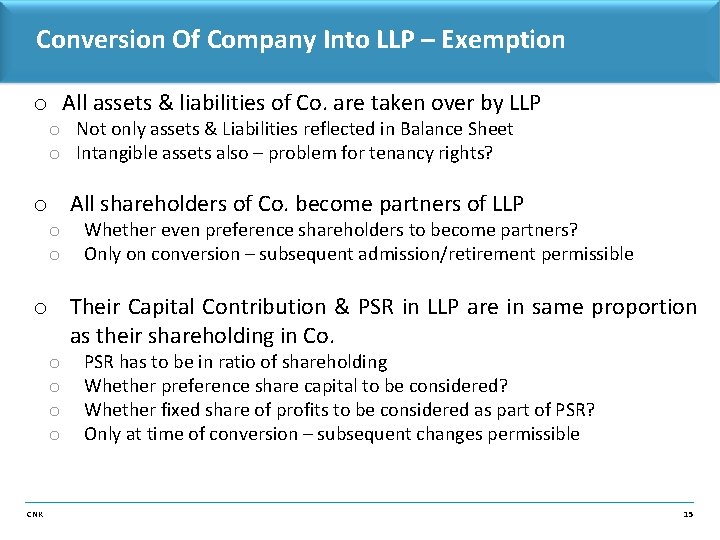

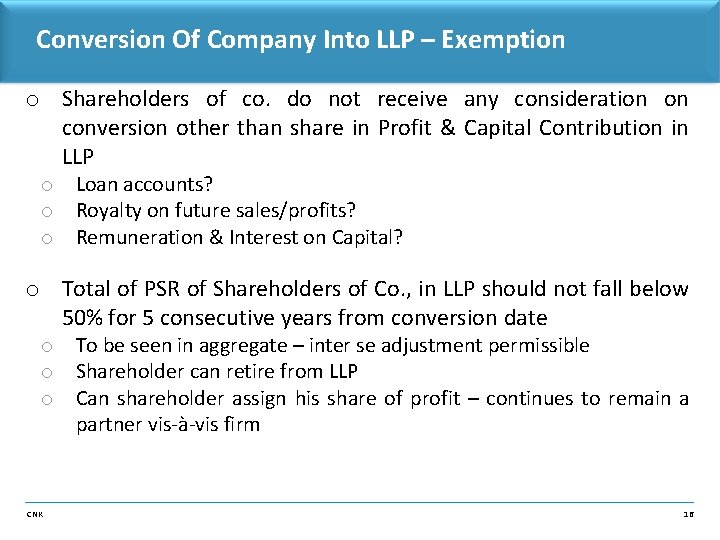

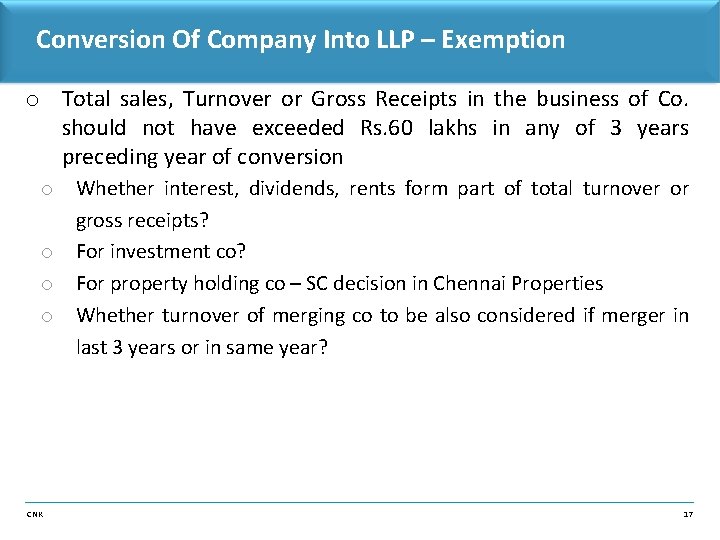

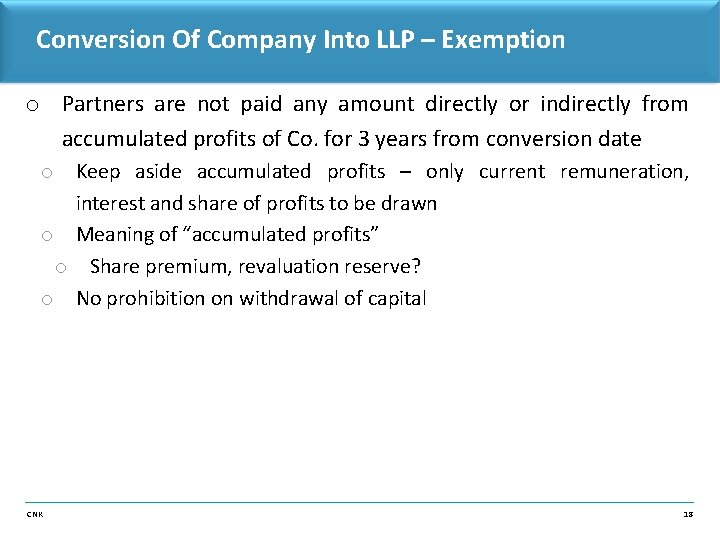

Conversion Of Company Into LLP – Exemption o Specific exemption – s. 47(xiiib) – conditions: o All assets & liabilities of Co. are taken over by LLP o All shareholders of Co. become partners of LLP o Their Capital Contribution & PSR in LLP are in same proportion as their shareholding in Co. o Shareholders of co. do not receive any consideration on conversion other than share in Profit & Capital Contribution in LLP o Total of PSR of Shareholders of Co. , in LLP should not fall below 50% for 5 consecutive years from conversion date o Total sales, Turnover or Gross Receipts of Co. should not have exceeded Rs. 60 lakhs in any of 3 years preceding year of conversion o Partners are not paid any amount from accumulated profits of Co. for 3 years from conversion date CNK 13

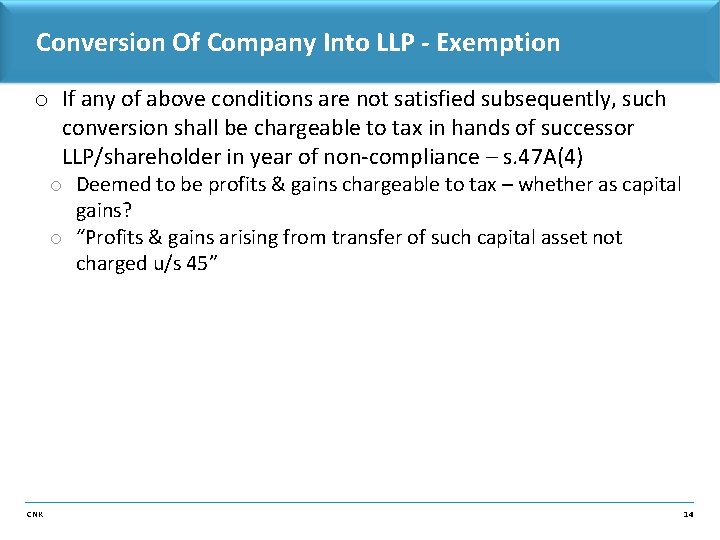

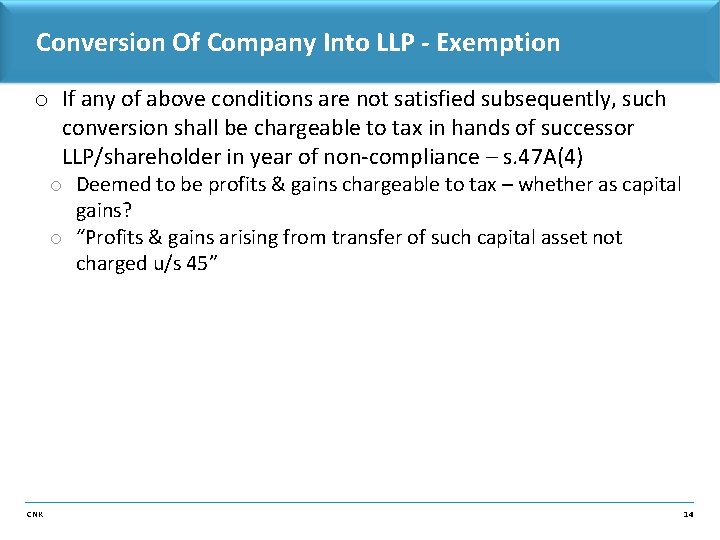

Conversion Of Company Into LLP - Exemption o If any of above conditions are not satisfied subsequently, such conversion shall be chargeable to tax in hands of successor LLP/shareholder in year of non-compliance – s. 47 A(4) o Deemed to be profits & gains chargeable to tax – whether as capital gains? o “Profits & gains arising from transfer of such capital asset not charged u/s 45” CNK 14

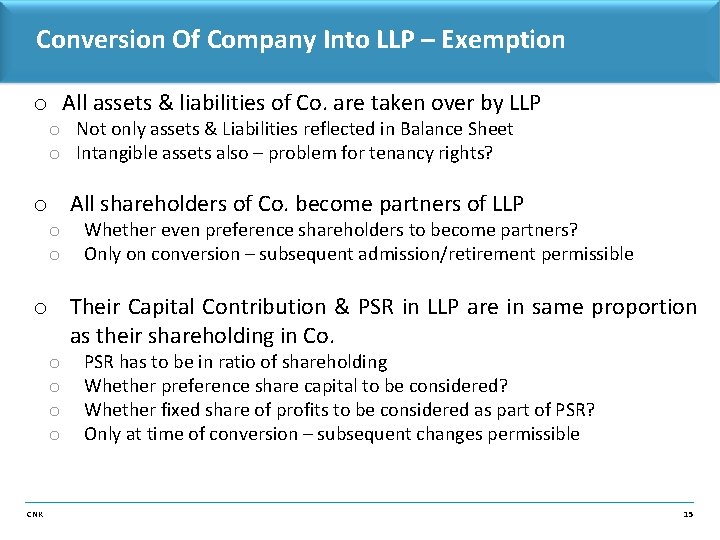

Conversion Of Company Into LLP – Exemption o All assets & liabilities of Co. are taken over by LLP o Not only assets & Liabilities reflected in Balance Sheet o Intangible assets also – problem for tenancy rights? o All shareholders of Co. become partners of LLP o o Whether even preference shareholders to become partners? Only on conversion – subsequent admission/retirement permissible o Their Capital Contribution & PSR in LLP are in same proportion as their shareholding in Co. o o CNK PSR has to be in ratio of shareholding Whether preference share capital to be considered? Whether fixed share of profits to be considered as part of PSR? Only at time of conversion – subsequent changes permissible 15

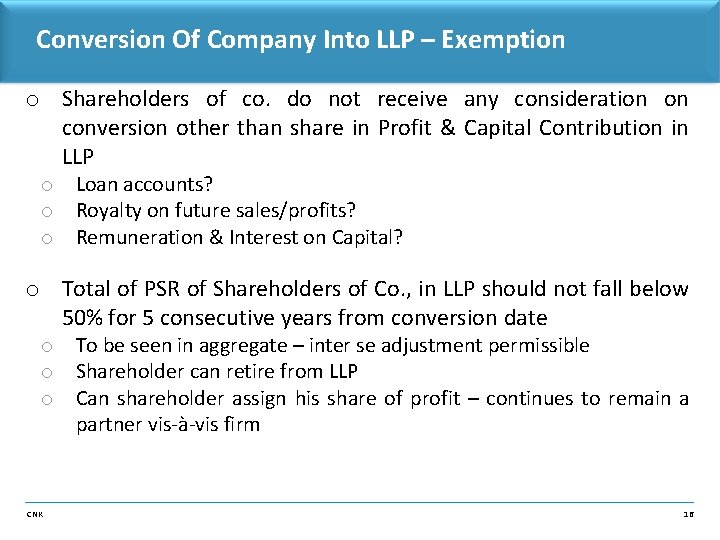

Conversion Of Company Into LLP – Exemption o Shareholders of co. do not receive any consideration on conversion other than share in Profit & Capital Contribution in LLP o o o Loan accounts? Royalty on future sales/profits? Remuneration & Interest on Capital? o Total of PSR of Shareholders of Co. , in LLP should not fall below 50% for 5 consecutive years from conversion date o o o CNK To be seen in aggregate – inter se adjustment permissible Shareholder can retire from LLP Can shareholder assign his share of profit – continues to remain a partner vis-à-vis firm 16

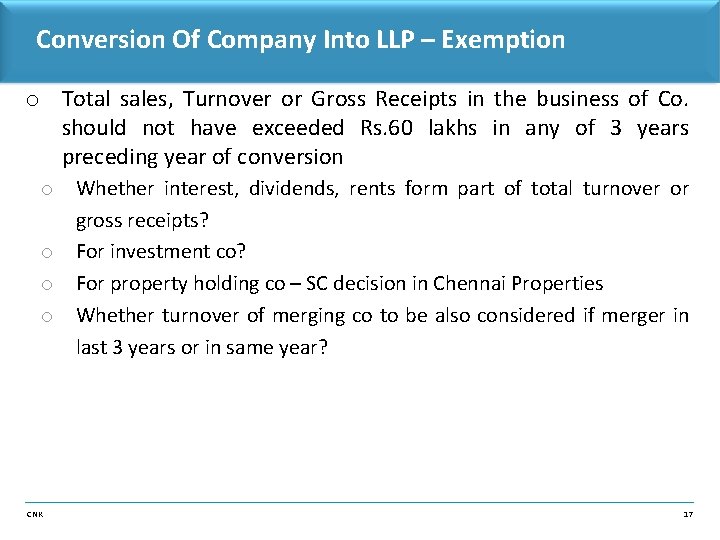

Conversion Of Company Into LLP – Exemption o Total sales, Turnover or Gross Receipts in the business of Co. should not have exceeded Rs. 60 lakhs in any of 3 years preceding year of conversion o o CNK Whether interest, dividends, rents form part of total turnover or gross receipts? For investment co? For property holding co – SC decision in Chennai Properties Whether turnover of merging co to be also considered if merger in last 3 years or in same year? 17

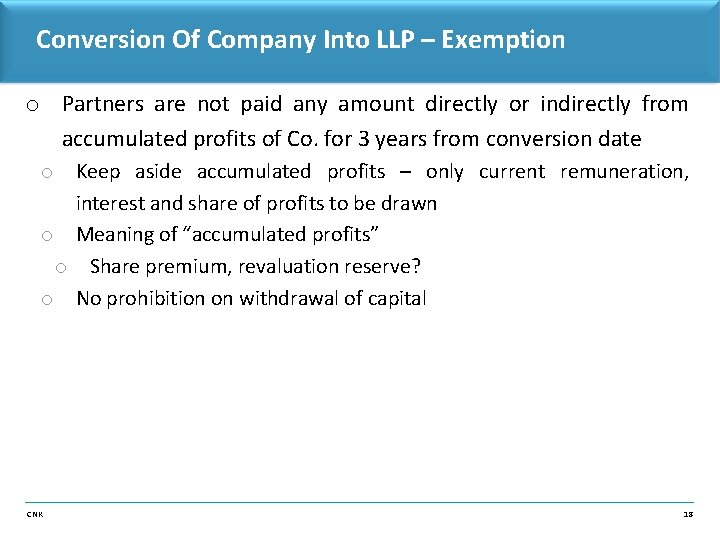

Conversion Of Company Into LLP – Exemption o Partners are not paid any amount directly or indirectly from accumulated profits of Co. for 3 years from conversion date Keep aside accumulated profits – only current remuneration, interest and share of profits to be drawn o Meaning of “accumulated profits” o Share premium, revaluation reserve? o No prohibition on withdrawal of capital o CNK 18

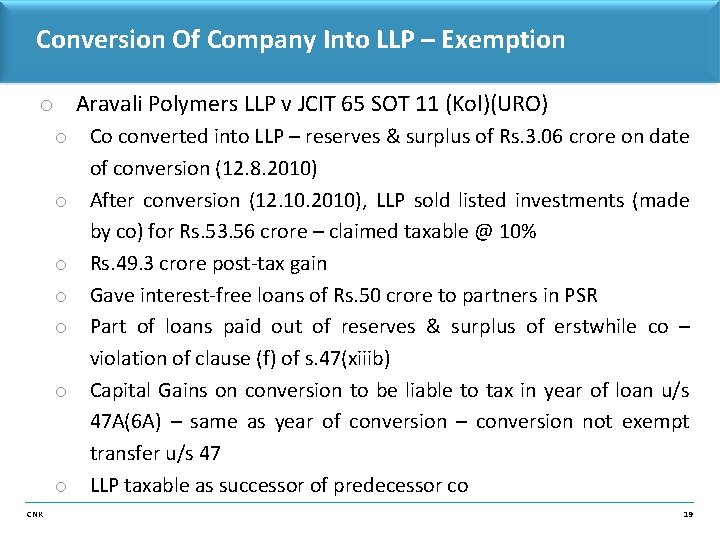

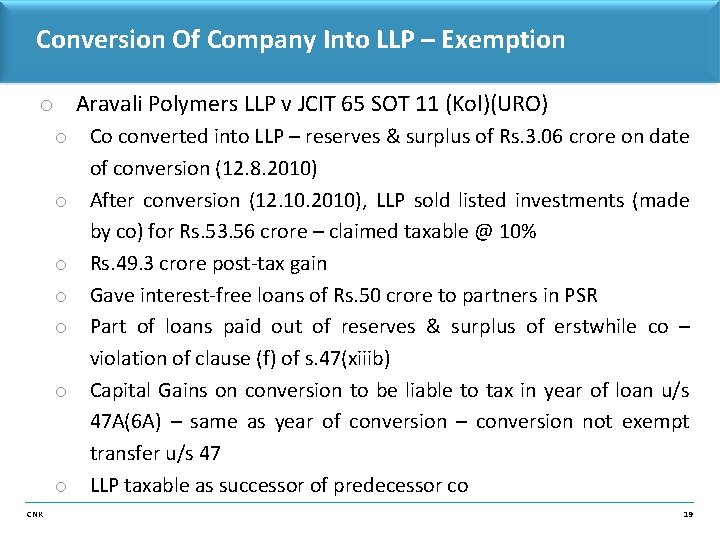

Conversion Of Company Into LLP – Exemption o Aravali Polymers LLP v JCIT 65 SOT 11 (Kol)(URO) o o o o CNK Co converted into LLP – reserves & surplus of Rs. 3. 06 crore on date of conversion (12. 8. 2010) After conversion (12. 10. 2010), LLP sold listed investments (made by co) for Rs. 53. 56 crore – claimed taxable @ 10% Rs. 49. 3 crore post-tax gain Gave interest-free loans of Rs. 50 crore to partners in PSR Part of loans paid out of reserves & surplus of erstwhile co – violation of clause (f) of s. 47(xiiib) Capital Gains on conversion to be liable to tax in year of loan u/s 47 A(6 A) – same as year of conversion – conversion not exempt transfer u/s 47 LLP taxable as successor of predecessor co 19

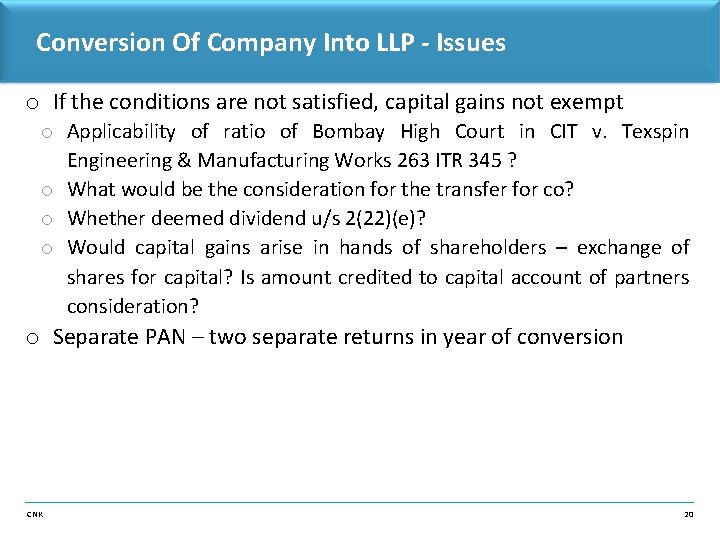

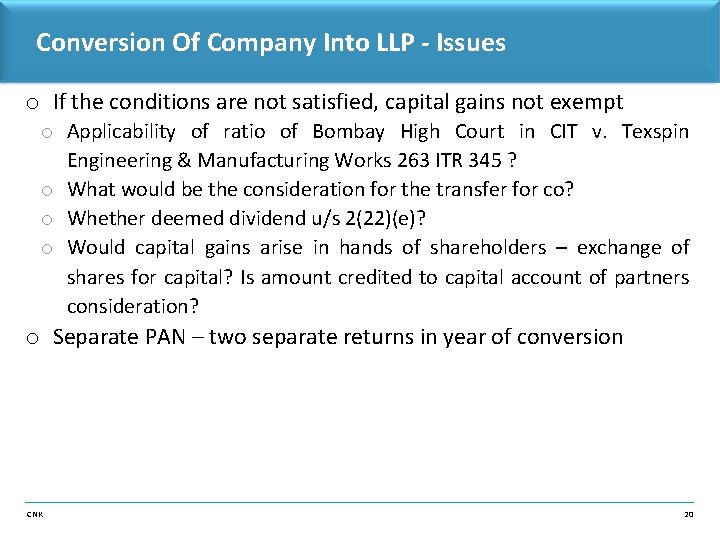

Conversion Of Company Into LLP - Issues o If the conditions are not satisfied, capital gains not exempt o Applicability of ratio of Bombay High Court in CIT v. Texspin Engineering & Manufacturing Works 263 ITR 345 ? o What would be the consideration for the transfer for co? o Whether deemed dividend u/s 2(22)(e)? o Would capital gains arise in hands of shareholders – exchange of shares for capital? Is amount credited to capital account of partners consideration? o Separate PAN – two separate returns in year of conversion CNK 20

Conversion Of Company Into LLP – Other Tax Aspects o Depreciation in year of succession – 6 th proviso to s. 32(1) – proportionate depreciation as if no conversion taken place o Amortisation of VRS Expenditure – s. 35 DDA(4 A) o If deduction u/s 35 AD to co (capital based incentive), actual cost nil to LLP – expln 13 to s. 43(1) o Actual cost of block of assets to LLP shall be wdv to co on date of conversion - expln (2 C) to s. 43(6) o Actual cost to LLP – cost to previous owner (co) – s. 49(1)(iii) o Cost of rights of partner in LLP on conversion from co – cost of shares of co immediately before conversion – s. 49(2 AAA) CNK 21

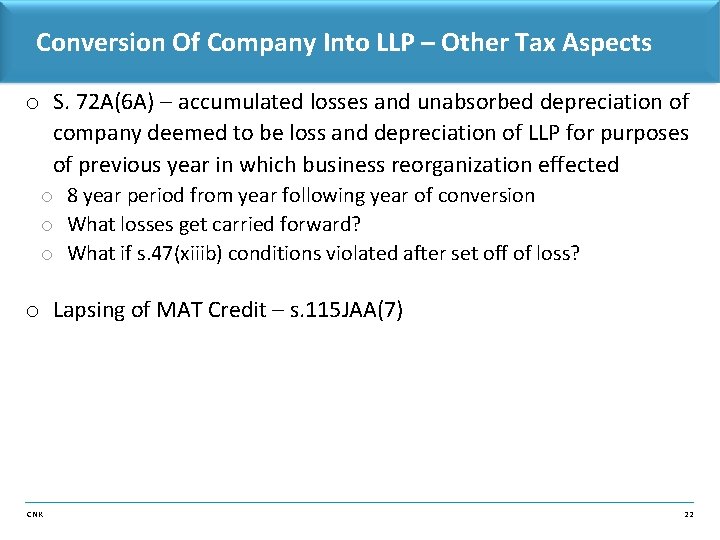

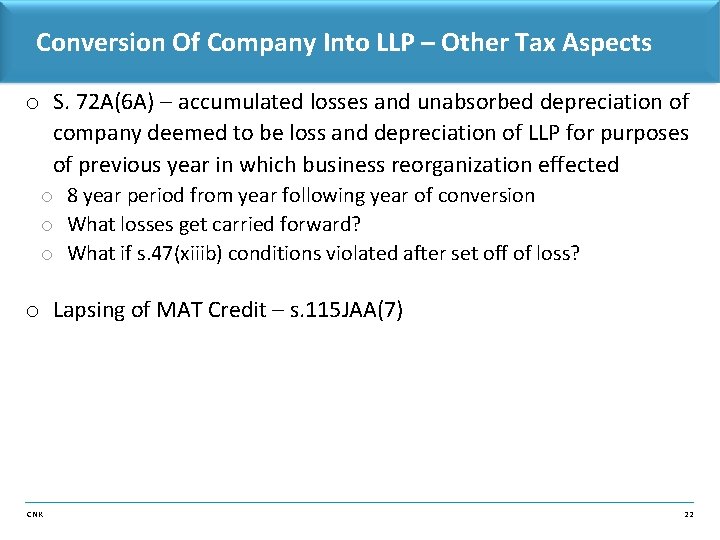

Conversion Of Company Into LLP – Other Tax Aspects o S. 72 A(6 A) – accumulated losses and unabsorbed depreciation of company deemed to be loss and depreciation of LLP for purposes of previous year in which business reorganization effected o 8 year period from year following year of conversion o What losses get carried forward? o What if s. 47(xiiib) conditions violated after set off of loss? o Lapsing of MAT Credit – s. 115 JAA(7) CNK 22

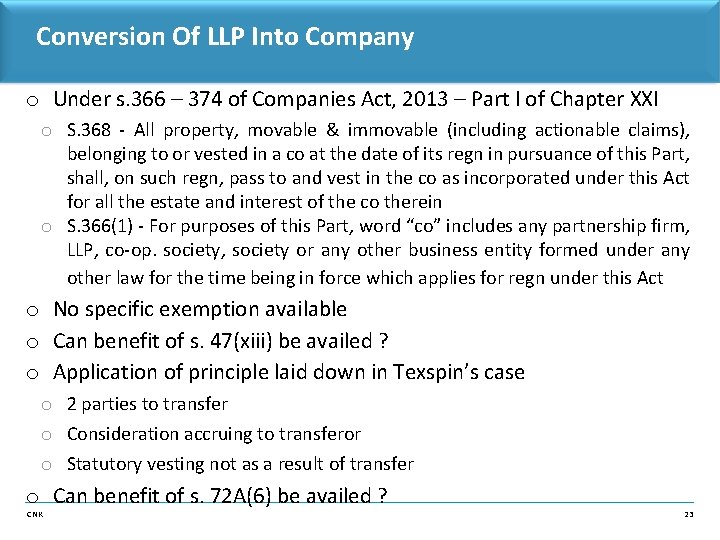

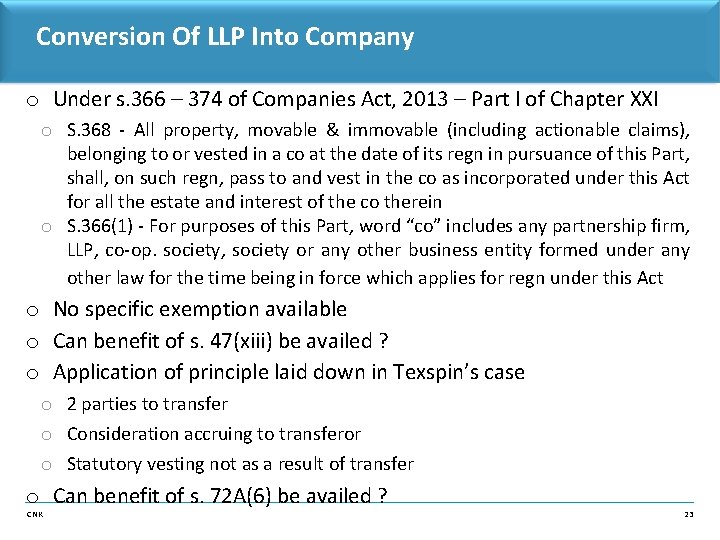

Conversion Of LLP Into Company o Under s. 366 – 374 of Companies Act, 2013 – Part I of Chapter XXI o S. 368 - All property, movable & immovable (including actionable claims), belonging to or vested in a co at the date of its regn in pursuance of this Part, shall, on such regn, pass to and vest in the co as incorporated under this Act for all the estate and interest of the co therein o S. 366(1) - For purposes of this Part, word “co” includes any partnership firm, LLP, co-op. society, society or any other business entity formed under any other law for the time being in force which applies for regn under this Act o No specific exemption available o Can benefit of s. 47(xiii) be availed ? o Application of principle laid down in Texspin’s case o 2 parties to transfer o Consideration accruing to transferor o Statutory vesting not as a result of transfer o Can benefit of s. 72 A(6) be availed ? CNK 23

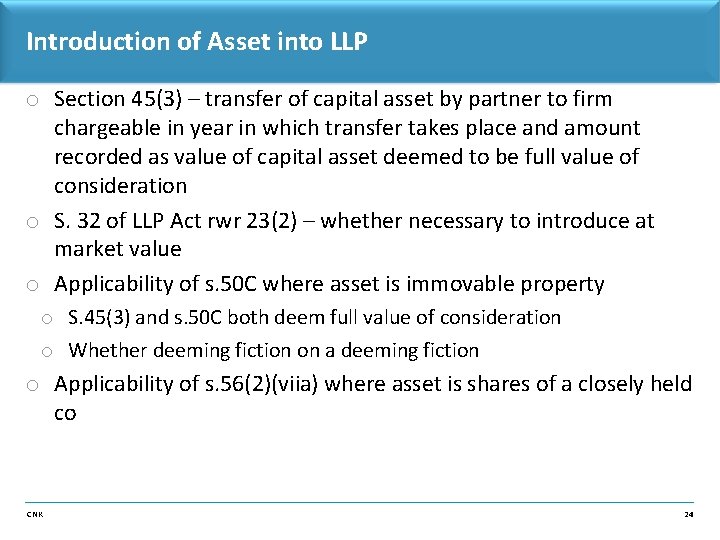

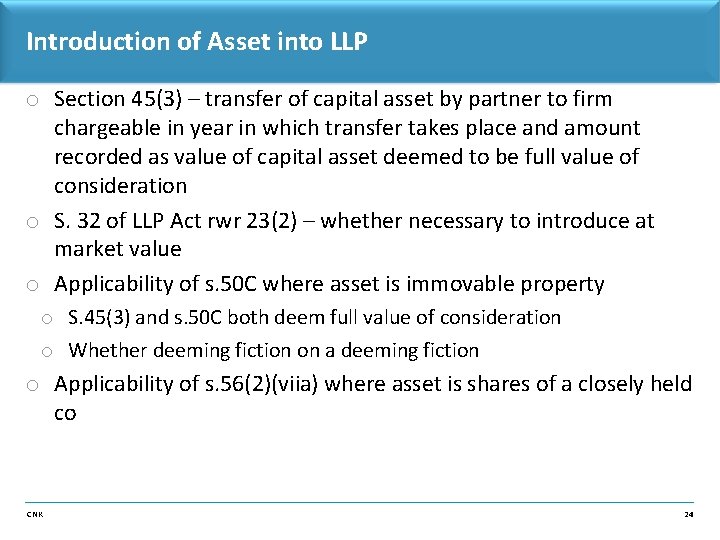

Introduction of Asset into LLP o Section 45(3) – transfer of capital asset by partner to firm chargeable in year in which transfer takes place and amount recorded as value of capital asset deemed to be full value of consideration o S. 32 of LLP Act rwr 23(2) – whether necessary to introduce at market value o Applicability of s. 50 C where asset is immovable property o S. 45(3) and s. 50 C both deem full value of consideration o Whether deeming fiction on a deeming fiction o Applicability of s. 56(2)(viia) where asset is shares of a closely held co CNK 24

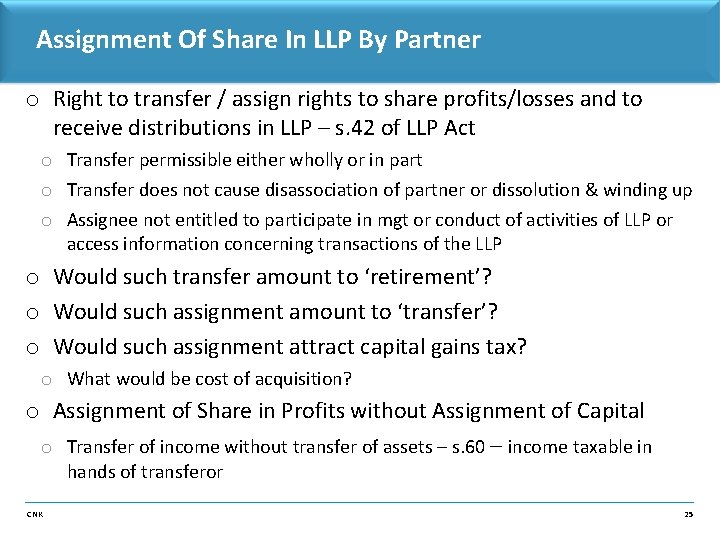

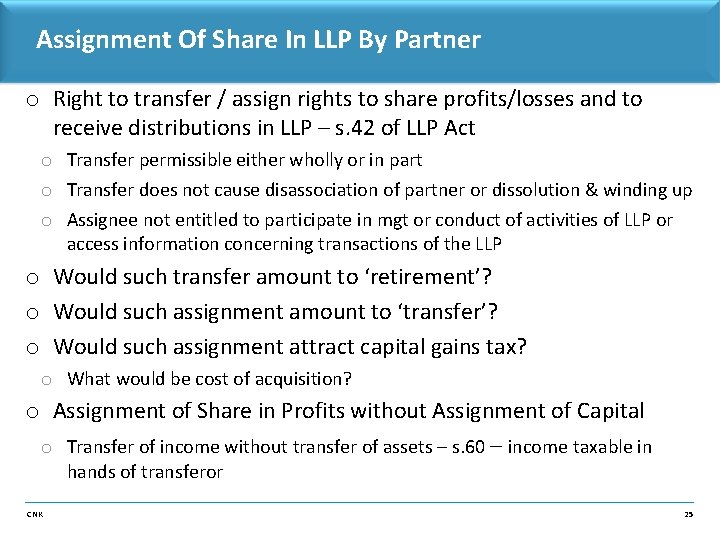

Assignment Of Share In LLP By Partner o Right to transfer / assign rights to share profits/losses and to receive distributions in LLP – s. 42 of LLP Act o Transfer permissible either wholly or in part o Transfer does not cause disassociation of partner or dissolution & winding up o Assignee not entitled to participate in mgt or conduct of activities of LLP or access information concerning transactions of the LLP o Would such transfer amount to ‘retirement’? o Would such assignment amount to ‘transfer’? o Would such assignment attract capital gains tax? o What would be cost of acquisition? o Assignment of Share in Profits without Assignment of Capital o Transfer of income without transfer of assets – s. 60 – income taxable in hands of transferor CNK 25

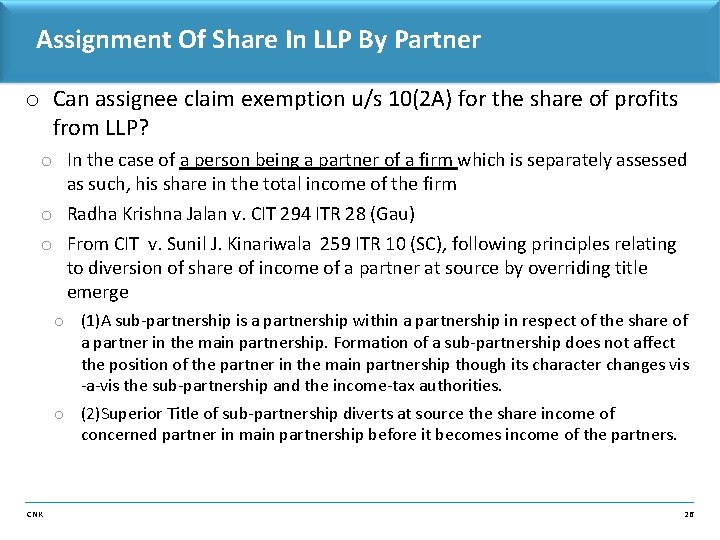

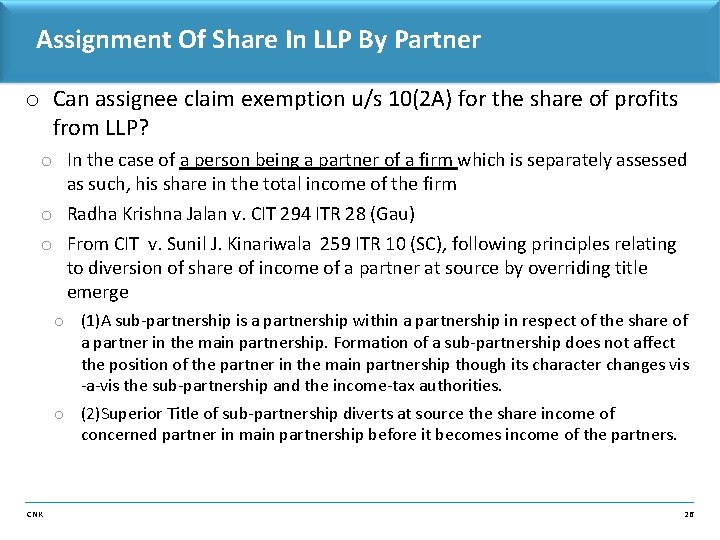

Assignment Of Share In LLP By Partner o Can assignee claim exemption u/s 10(2 A) for the share of profits from LLP? o In the case of a person being a partner of a firm which is separately assessed as such, his share in the total income of the firm o Radha Krishna Jalan v. CIT 294 ITR 28 (Gau) o From CIT v. Sunil J. Kinariwala 259 ITR 10 (SC), following principles relating to diversion of share of income of a partner at source by overriding title emerge o (1)A sub-partnership is a partnership within a partnership in respect of the share of a partner in the main partnership. Formation of a sub-partnership does not affect the position of the partner in the main partnership though its character changes vis -a-vis the sub-partnership and the income-tax authorities. o (2)Superior Title of sub-partnership diverts at source the share income of concerned partner in main partnership before it becomes income of the partners. CNK 26

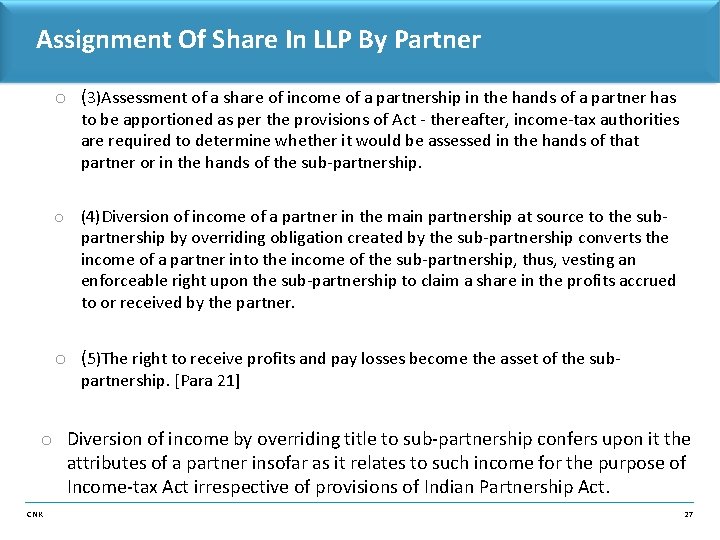

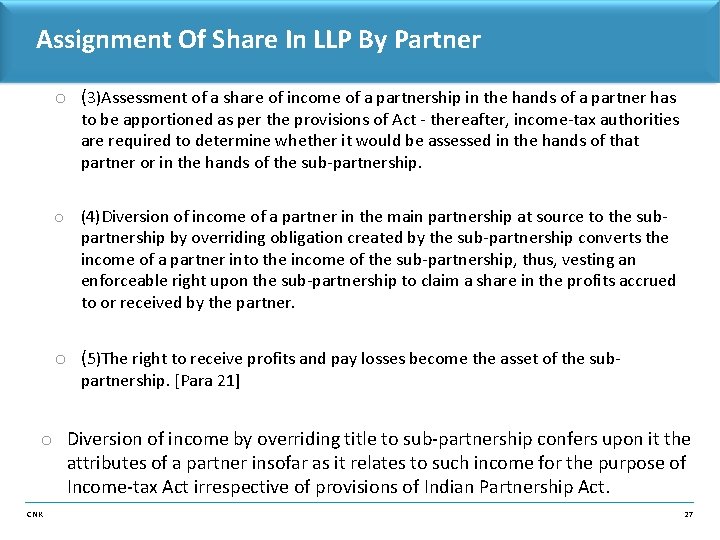

Assignment Of Share In LLP By Partner o (3)Assessment of a share of income of a partnership in the hands of a partner has to be apportioned as per the provisions of Act - thereafter, income-tax authorities are required to determine whether it would be assessed in the hands of that partner or in the hands of the sub-partnership. o (4)Diversion of income of a partner in the main partnership at source to the subpartnership by overriding obligation created by the sub-partnership converts the income of a partner into the income of the sub-partnership, thus, vesting an enforceable right upon the sub-partnership to claim a share in the profits accrued to or received by the partner. o (5)The right to receive profits and pay losses become the asset of the subpartnership. [Para 21] o Diversion of income by overriding title to sub-partnership confers upon it the attributes of a partner insofar as it relates to such income for the purpose of Income-tax Act irrespective of provisions of Indian Partnership Act. CNK 27

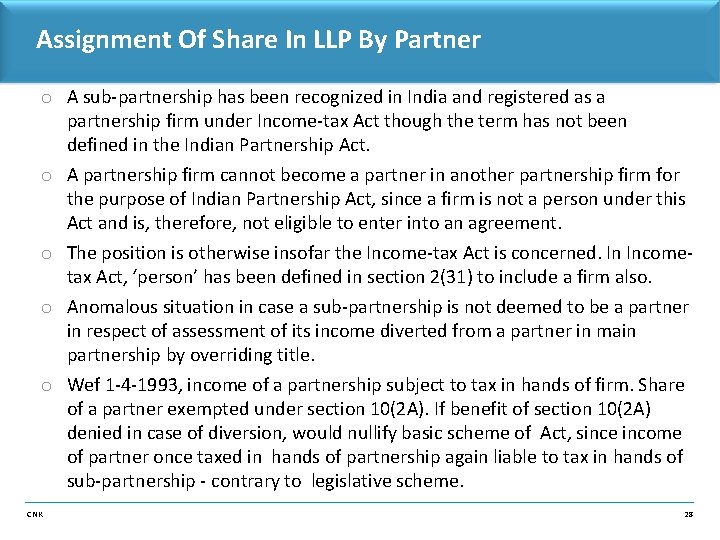

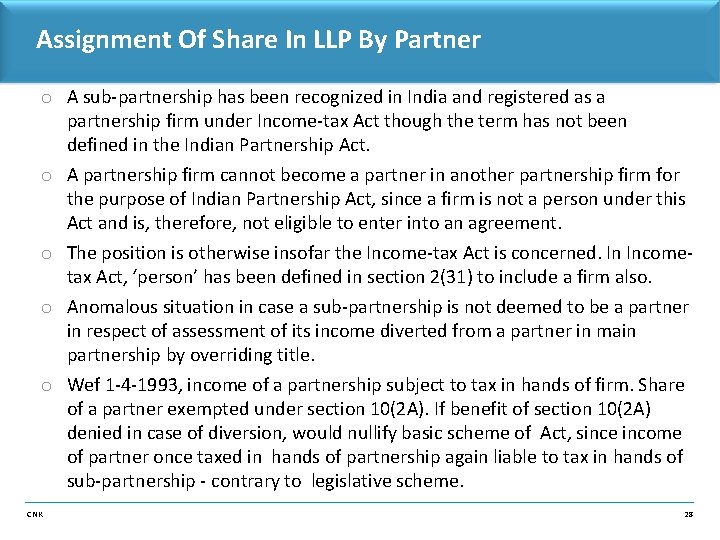

Assignment Of Share In LLP By Partner o A sub-partnership has been recognized in India and registered as a partnership firm under Income-tax Act though the term has not been defined in the Indian Partnership Act. o A partnership firm cannot become a partner in another partnership firm for the purpose of Indian Partnership Act, since a firm is not a person under this Act and is, therefore, not eligible to enter into an agreement. o The position is otherwise insofar the Income-tax Act is concerned. In Incometax Act, ‘person’ has been defined in section 2(31) to include a firm also. o Anomalous situation in case a sub-partnership is not deemed to be a partner in respect of assessment of its income diverted from a partner in main partnership by overriding title. o Wef 1 -4 -1993, income of a partnership subject to tax in hands of firm. Share of a partner exempted under section 10(2 A). If benefit of section 10(2 A) denied in case of diversion, would nullify basic scheme of Act, since income of partner once taxed in hands of partnership again liable to tax in hands of sub-partnership - contrary to legislative scheme. CNK 28

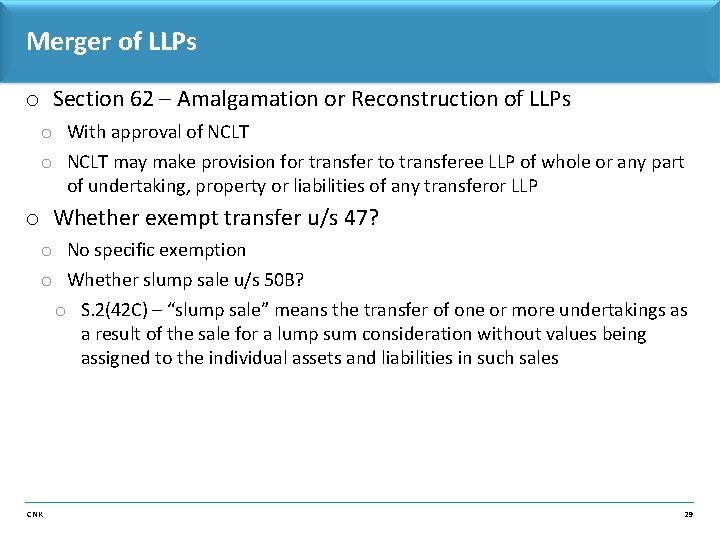

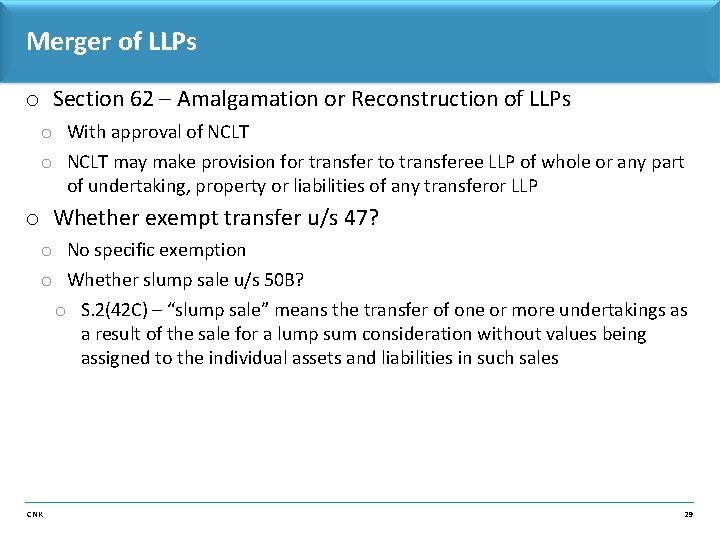

Merger of LLPs o Section 62 – Amalgamation or Reconstruction of LLPs o With approval of NCLT o NCLT may make provision for transfer to transferee LLP of whole or any part of undertaking, property or liabilities of any transferor LLP o Whether exempt transfer u/s 47? o No specific exemption o Whether slump sale u/s 50 B? o S. 2(42 C) – “slump sale” means the transfer of one or more undertakings as a result of the sale for a lump sum consideration without values being assigned to the individual assets and liabilities in such sales CNK 29

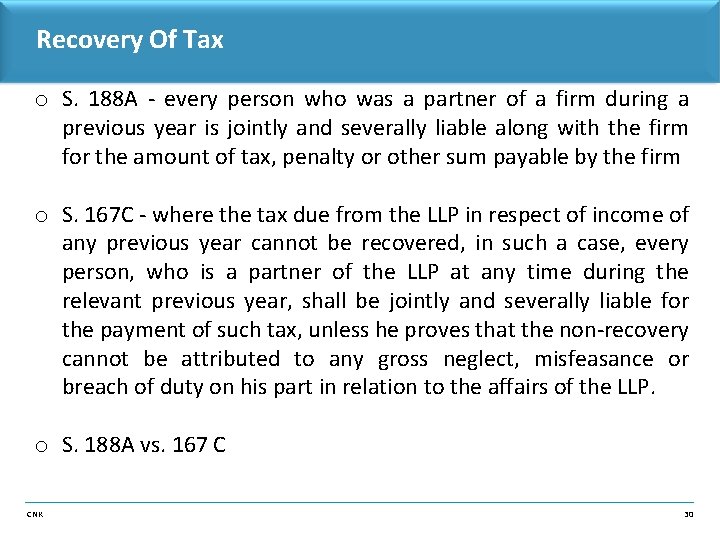

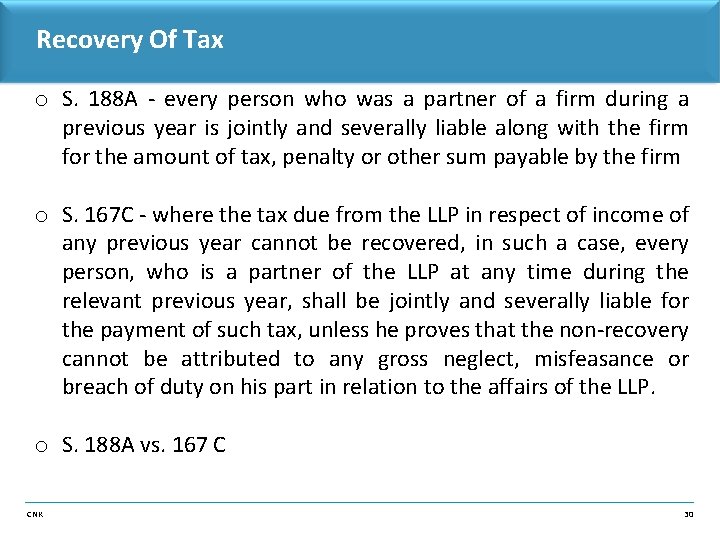

Recovery Of Tax o S. 188 A - every person who was a partner of a firm during a previous year is jointly and severally liable along with the firm for the amount of tax, penalty or other sum payable by the firm o S. 167 C - where the tax due from the LLP in respect of income of any previous year cannot be recovered, in such a case, every person, who is a partner of the LLP at any time during the relevant previous year, shall be jointly and severally liable for the payment of such tax, unless he proves that the non-recovery cannot be attributed to any gross neglect, misfeasance or breach of duty on his part in relation to the affairs of the LLP. o S. 188 A vs. 167 C CNK 30

Conclusion THANK YOU 2015 © CNK & Associates LLP. All rights reserved.

Sanjay gautam nayak

Sanjay gautam nayak Property valuation certificate by chartered accountant

Property valuation certificate by chartered accountant Pandu nayak

Pandu nayak Distance matrix

Distance matrix Nayak religion

Nayak religion Ut austin quantum computing

Ut austin quantum computing Namratha nayak

Namratha nayak Upper 6 morphology

Upper 6 morphology Why do you feel proud of mt everest and gautam buddha

Why do you feel proud of mt everest and gautam buddha Gautam das uta

Gautam das uta Gautam das uta

Gautam das uta Joshua kretchmer

Joshua kretchmer Dipendra gautam

Dipendra gautam Gautam venugopalan

Gautam venugopalan Gautam mandal tifr

Gautam mandal tifr Gautam shroff tcs

Gautam shroff tcs Gautam menon imsc

Gautam menon imsc Junior accountant career path

Junior accountant career path Certified management accountant

Certified management accountant Ethisch dilemma accountant voorbeeld

Ethisch dilemma accountant voorbeeld Mpathways

Mpathways Heart of darkness part 2 summary

Heart of darkness part 2 summary Cynthia cooper whistleblower

Cynthia cooper whistleblower Strategic accountant

Strategic accountant Estonia accountant

Estonia accountant Limitations of responsibility accounting ppt

Limitations of responsibility accounting ppt Accountant job at lenawee community mental health

Accountant job at lenawee community mental health Cynthia cooper (accountant)

Cynthia cooper (accountant) Ian devine accountant

Ian devine accountant Famous forensic accounting cases

Famous forensic accounting cases Clare sandland

Clare sandland Estonia accountant

Estonia accountant Chartered geologist

Chartered geologist