Financial Risk Management Zvi Wiener Following P Jorion

- Slides: 43

Financial Risk Management Zvi Wiener Following P. Jorion, Financial Risk Manager Handbook http: //pluto. huji. ac. il/~mswiener/zvi. html FRM 972 -2 -588 -3049

Chapter 2 Quantitative Analysis Fundamentals of Probability Following P. Jorion 2001 Financial Risk Manager Handbook http: //pluto. huji. ac. il/~mswiener/zvi. html FRM 972 -2 -588 -3049

Random Variables Values, probabilities. Distribution function, cumulative probability. Example: a die with 6 faces. Ch. 2, Handbook Zvi Wiener 3

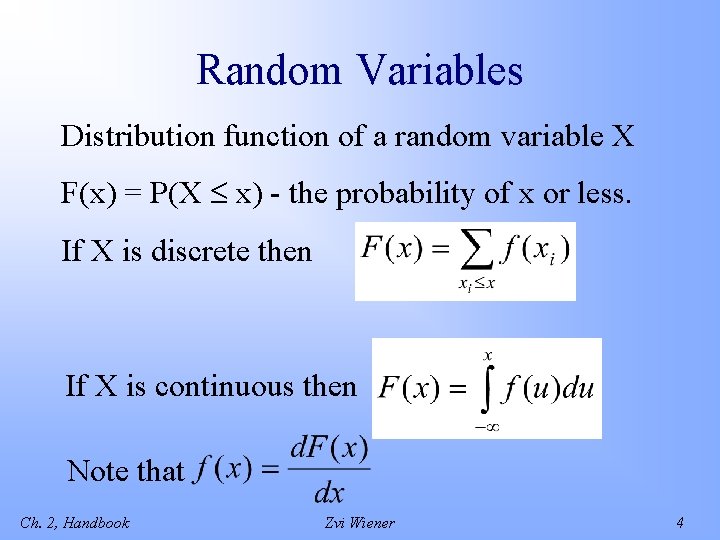

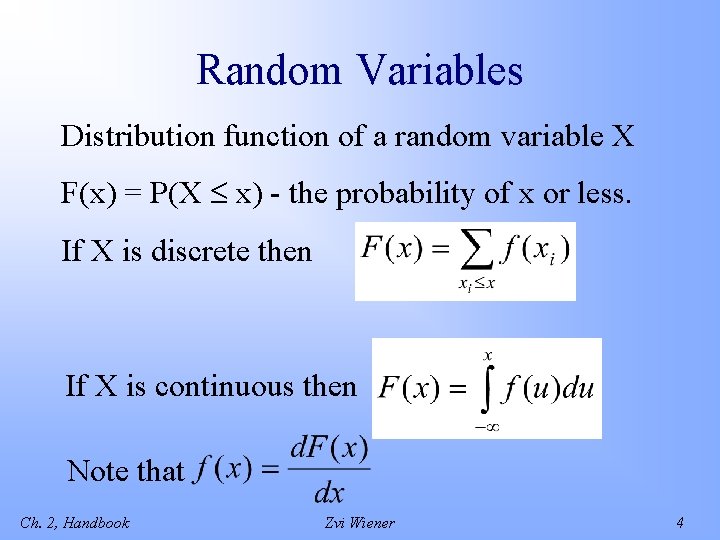

Random Variables Distribution function of a random variable X F(x) = P(X x) - the probability of x or less. If X is discrete then If X is continuous then Note that Ch. 2, Handbook Zvi Wiener 4

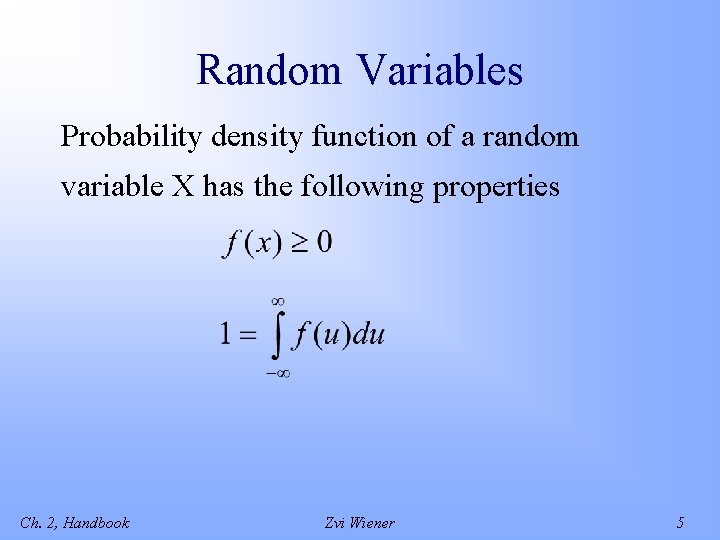

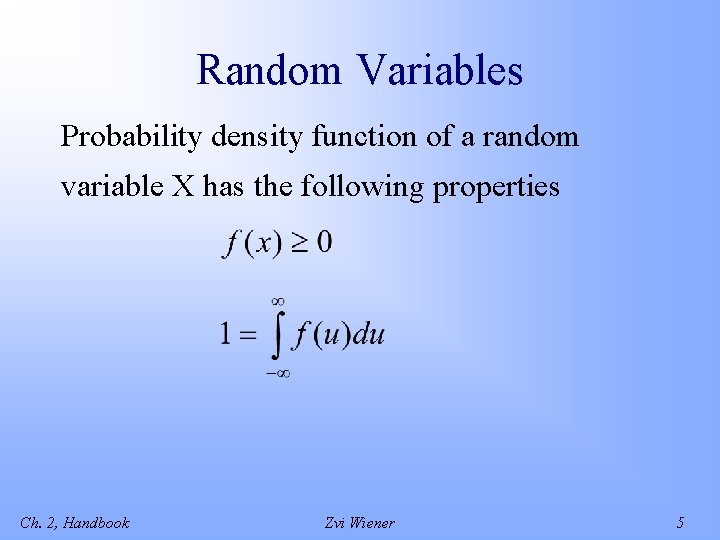

Random Variables Probability density function of a random variable X has the following properties Ch. 2, Handbook Zvi Wiener 5

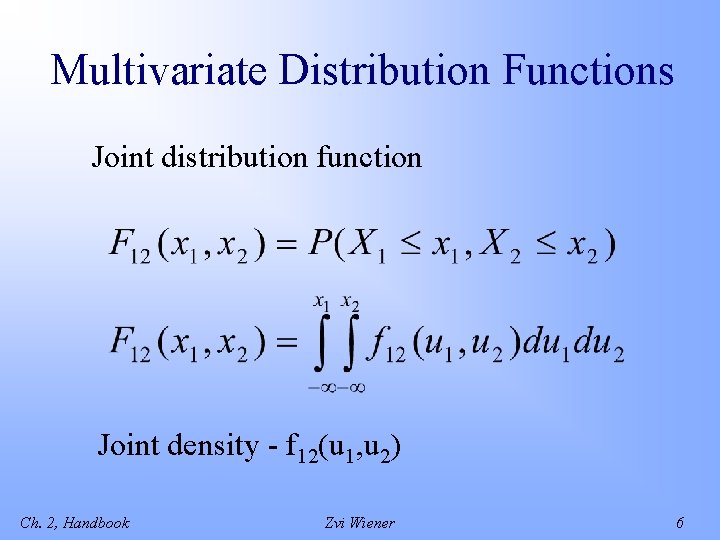

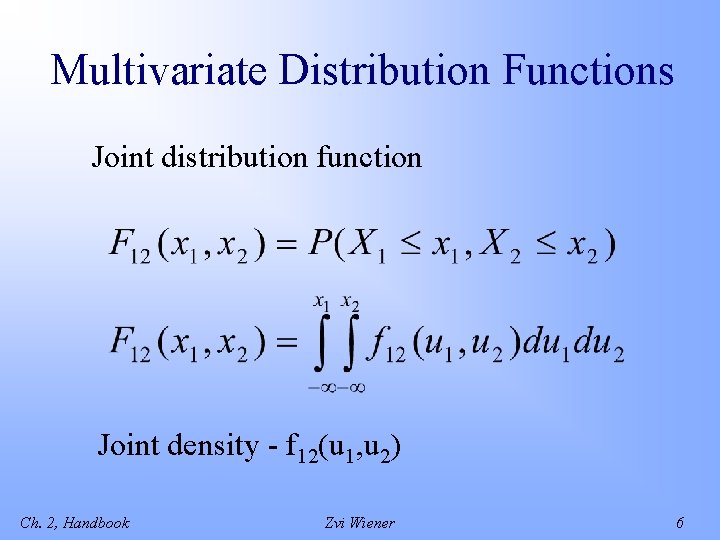

Multivariate Distribution Functions Joint distribution function Joint density - f 12(u 1, u 2) Ch. 2, Handbook Zvi Wiener 6

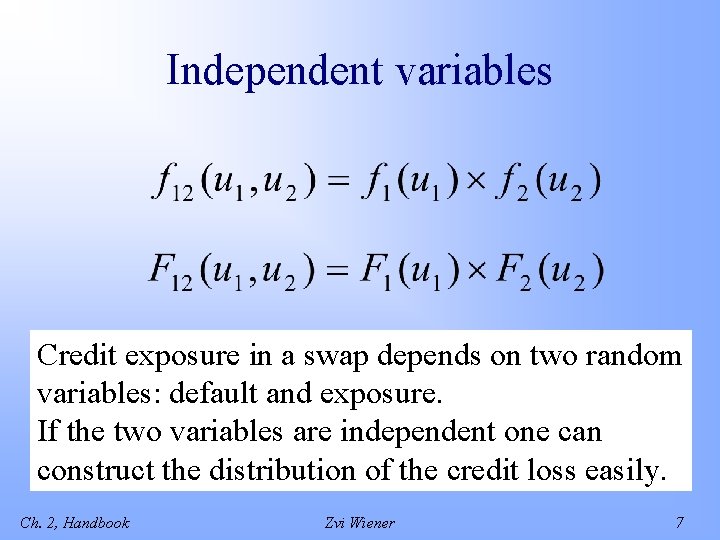

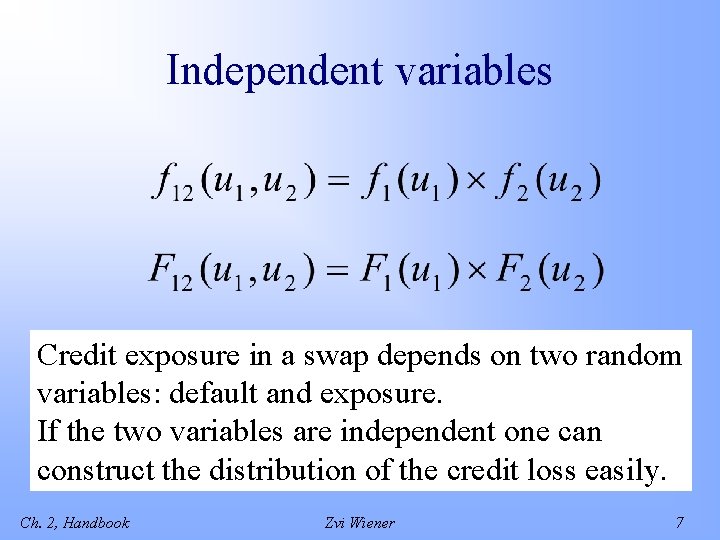

Independent variables Credit exposure in a swap depends on two random variables: default and exposure. If the two variables are independent one can construct the distribution of the credit loss easily. Ch. 2, Handbook Zvi Wiener 7

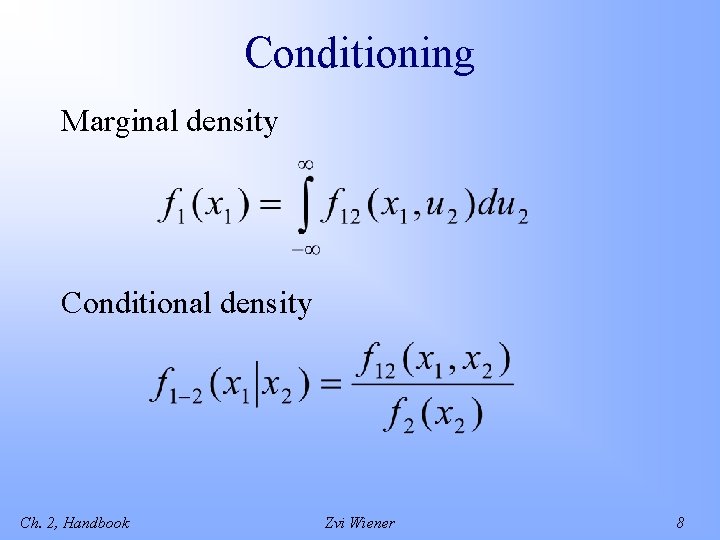

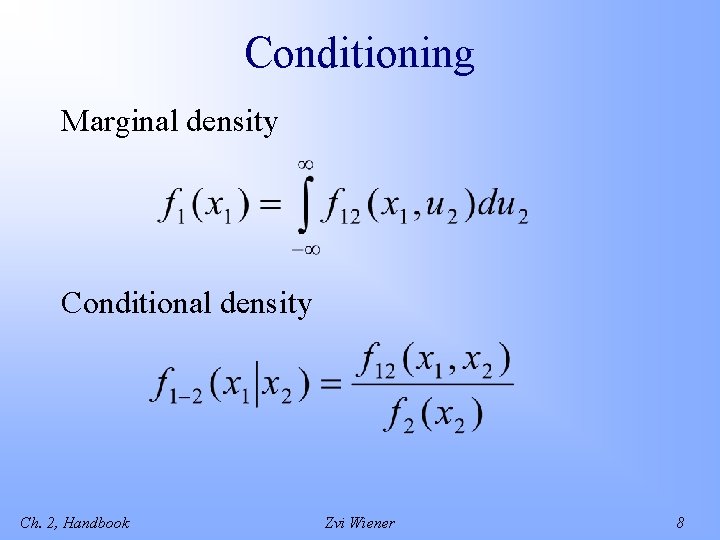

Conditioning Marginal density Conditional density Ch. 2, Handbook Zvi Wiener 8

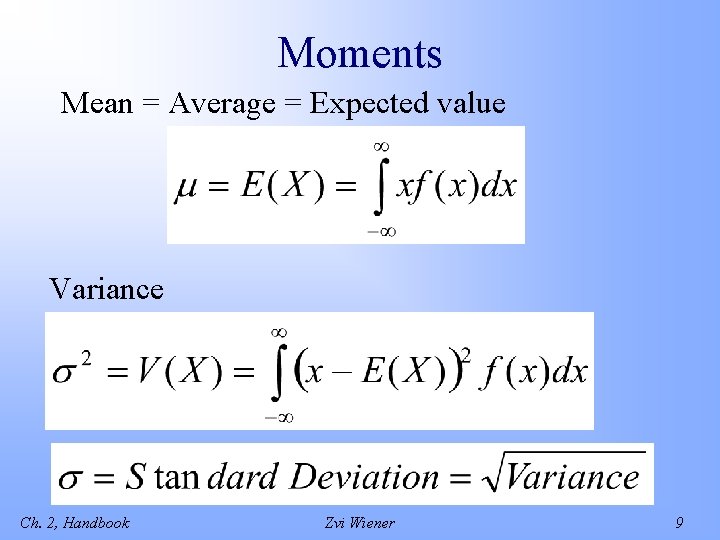

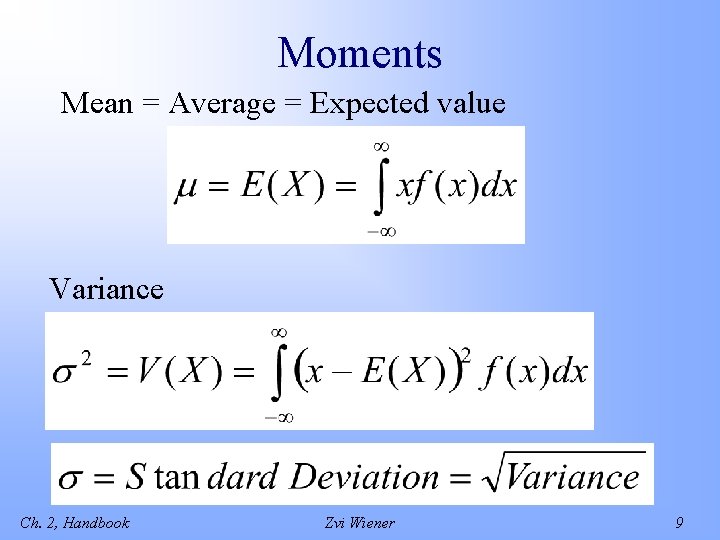

Moments Mean = Average = Expected value Variance Ch. 2, Handbook Zvi Wiener 9

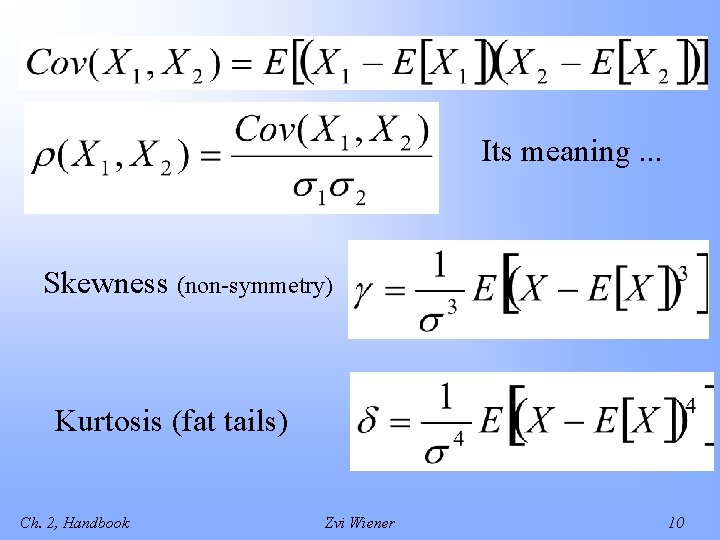

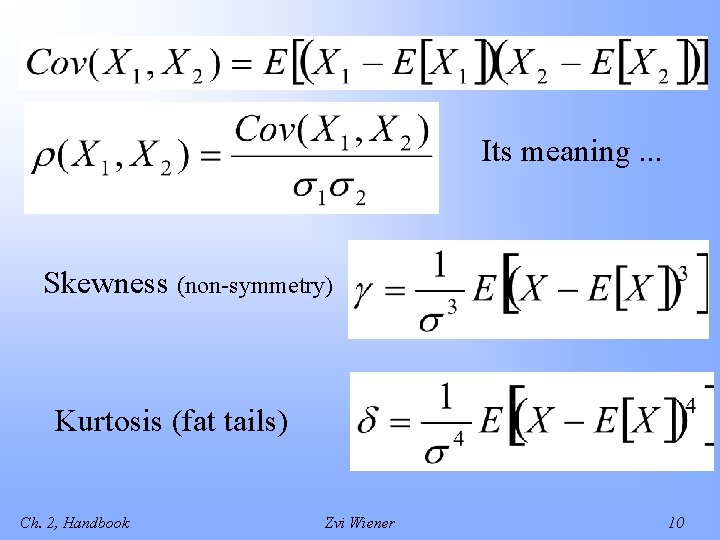

Its meaning. . . Skewness (non-symmetry) Kurtosis (fat tails) Ch. 2, Handbook Zvi Wiener 10

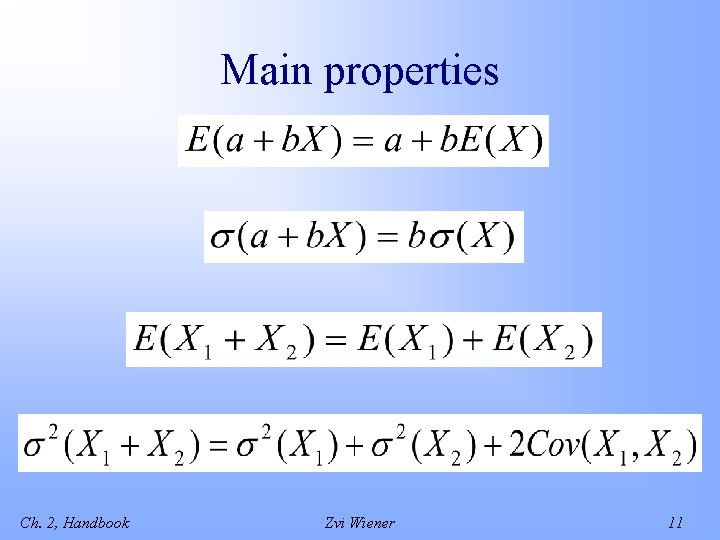

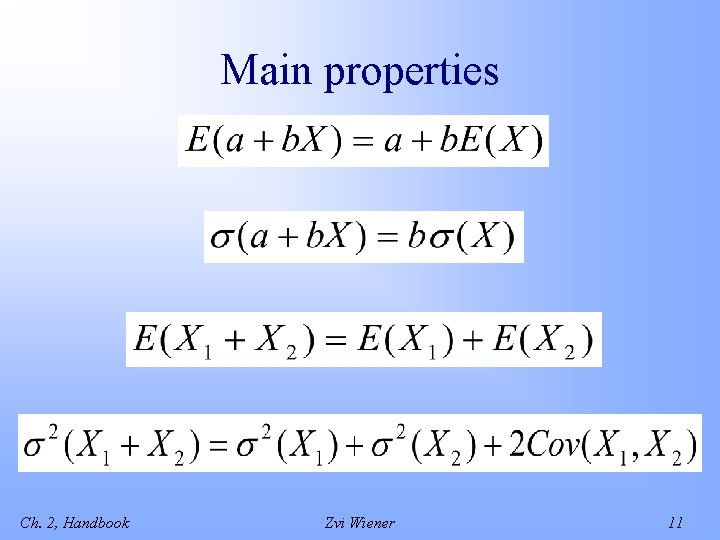

Main properties Ch. 2, Handbook Zvi Wiener 11

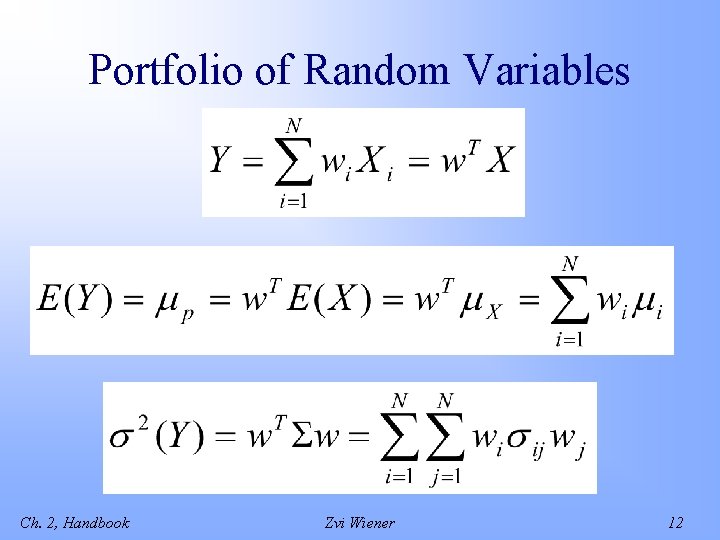

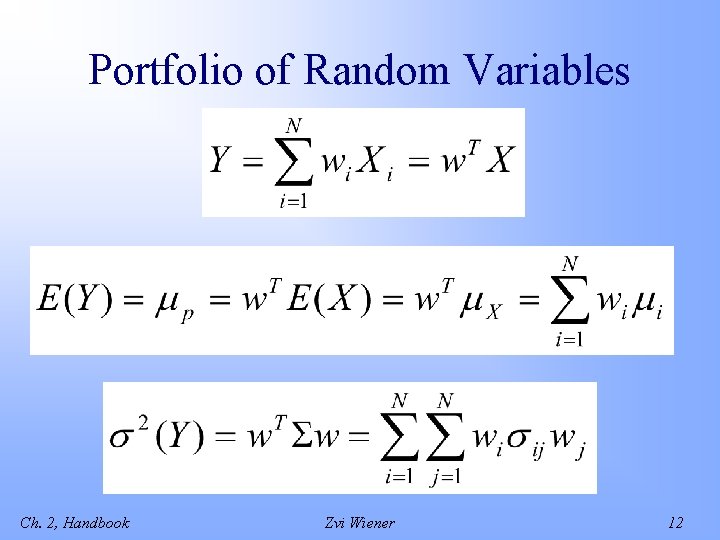

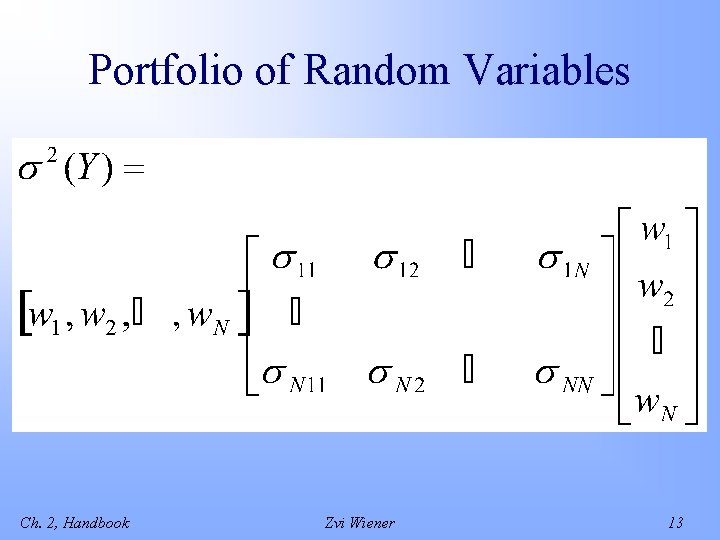

Portfolio of Random Variables Ch. 2, Handbook Zvi Wiener 12

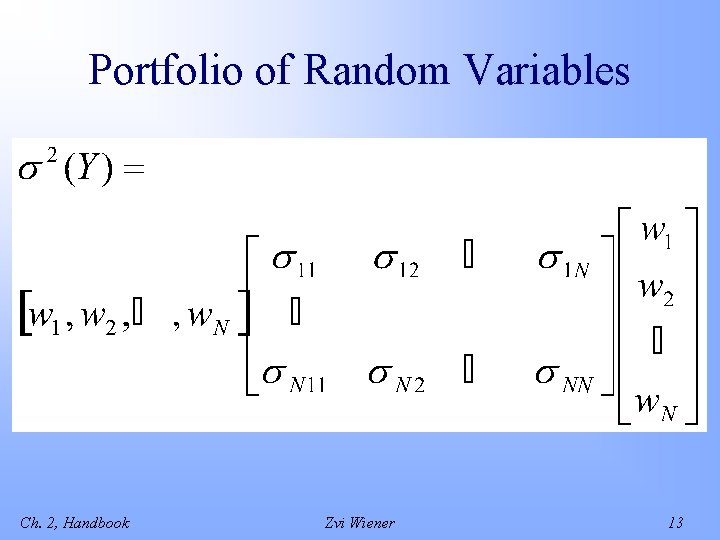

Portfolio of Random Variables Ch. 2, Handbook Zvi Wiener 13

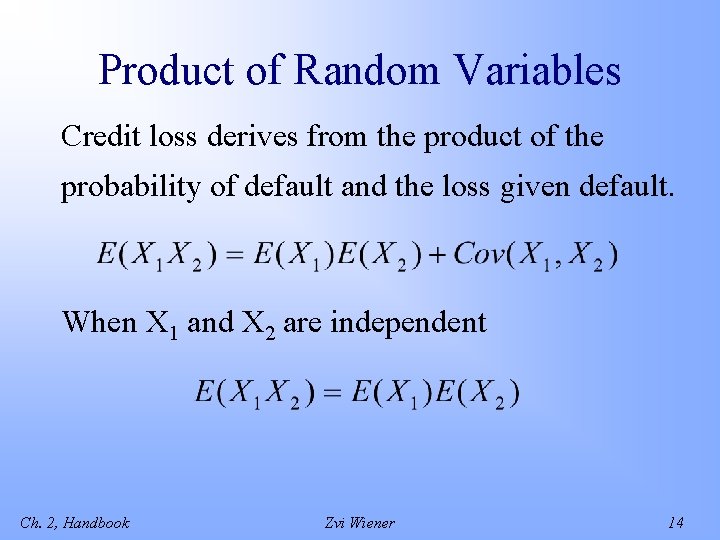

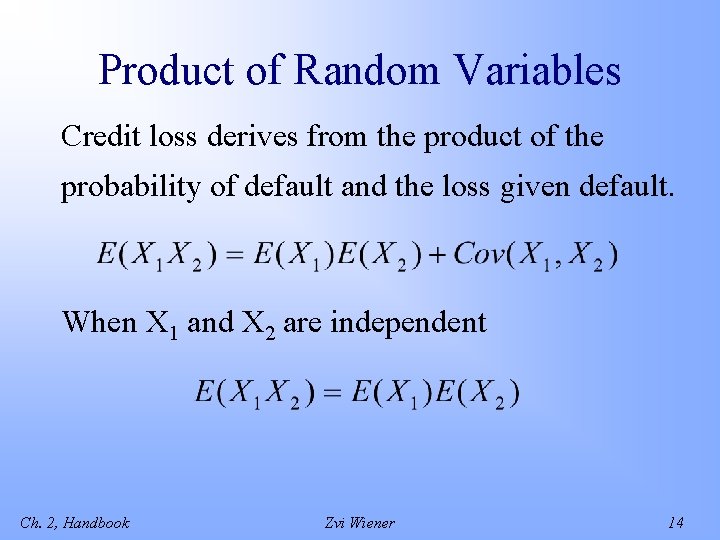

Product of Random Variables Credit loss derives from the product of the probability of default and the loss given default. When X 1 and X 2 are independent Ch. 2, Handbook Zvi Wiener 14

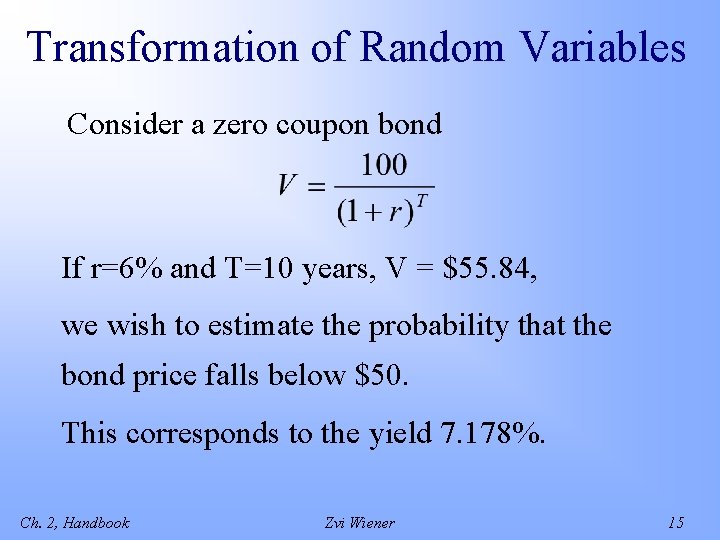

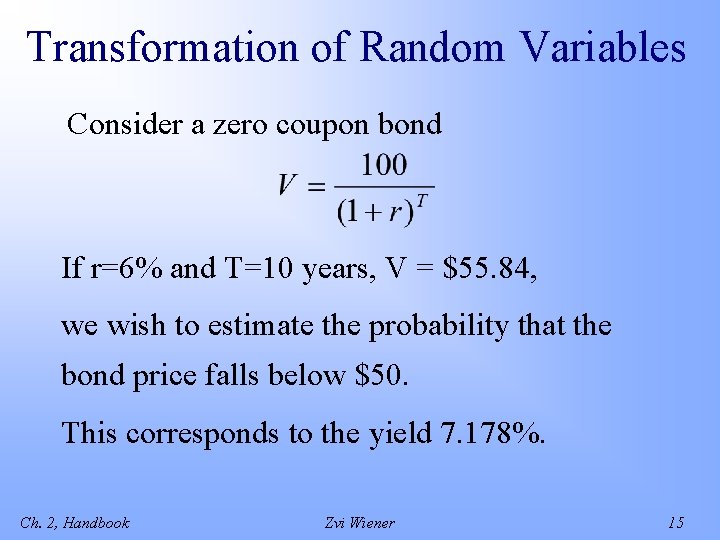

Transformation of Random Variables Consider a zero coupon bond If r=6% and T=10 years, V = $55. 84, we wish to estimate the probability that the bond price falls below $50. This corresponds to the yield 7. 178%. Ch. 2, Handbook Zvi Wiener 15

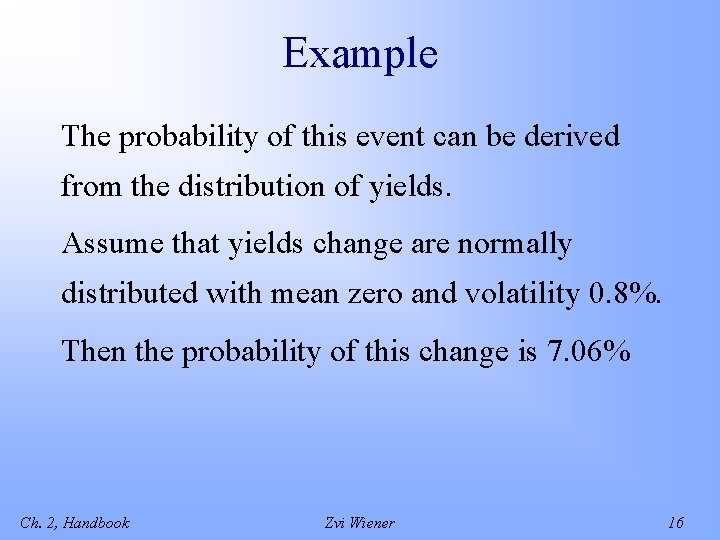

Example The probability of this event can be derived from the distribution of yields. Assume that yields change are normally distributed with mean zero and volatility 0. 8%. Then the probability of this change is 7. 06% Ch. 2, Handbook Zvi Wiener 16

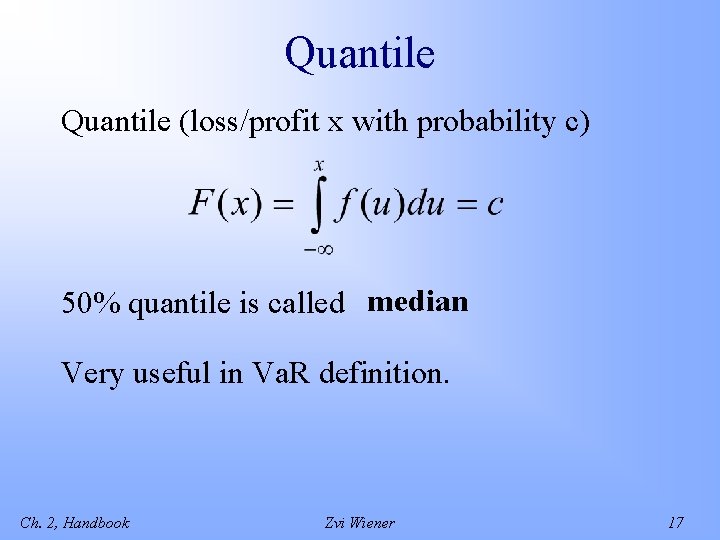

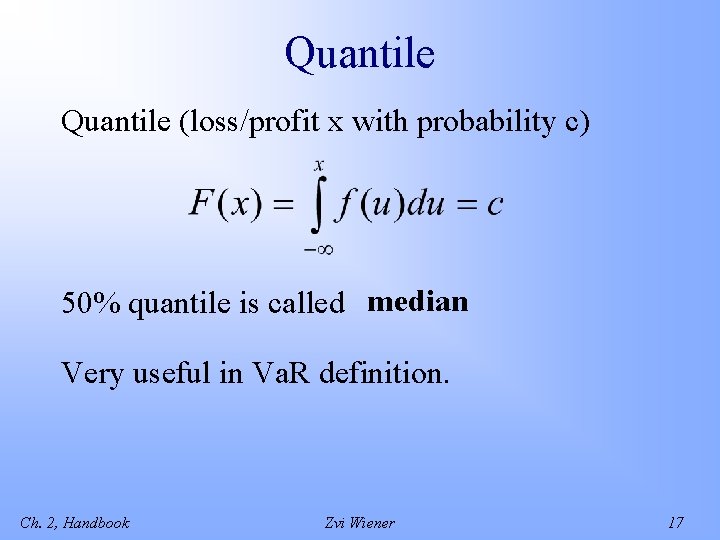

Quantile (loss/profit x with probability c) 50% quantile is called median Very useful in Va. R definition. Ch. 2, Handbook Zvi Wiener 17

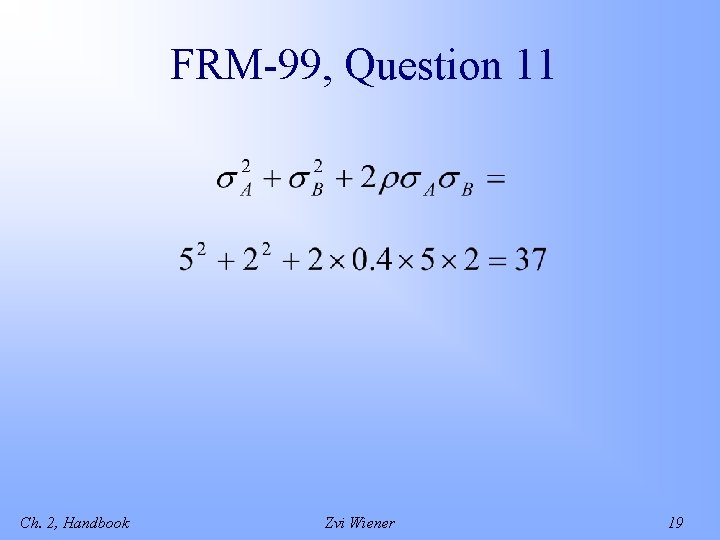

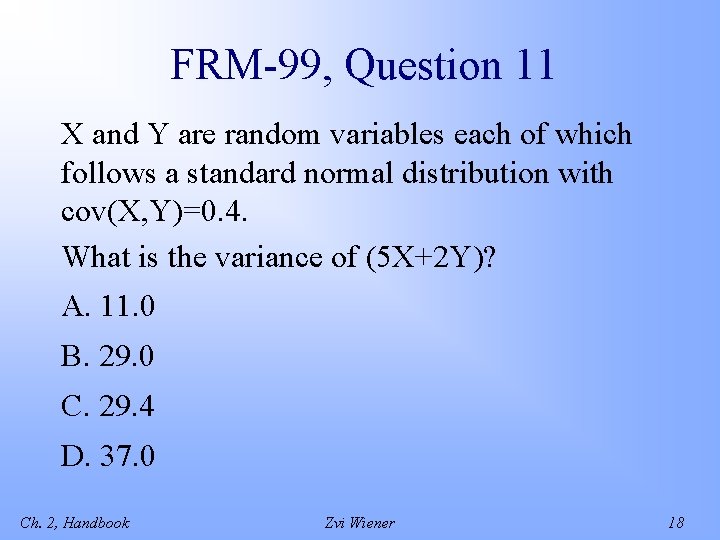

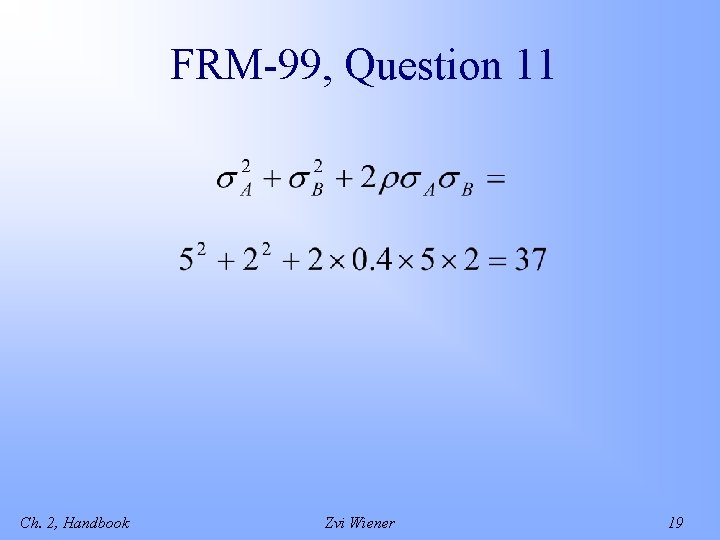

FRM-99, Question 11 X and Y are random variables each of which follows a standard normal distribution with cov(X, Y)=0. 4. What is the variance of (5 X+2 Y)? A. 11. 0 B. 29. 0 C. 29. 4 D. 37. 0 Ch. 2, Handbook Zvi Wiener 18

FRM-99, Question 11 Ch. 2, Handbook Zvi Wiener 19

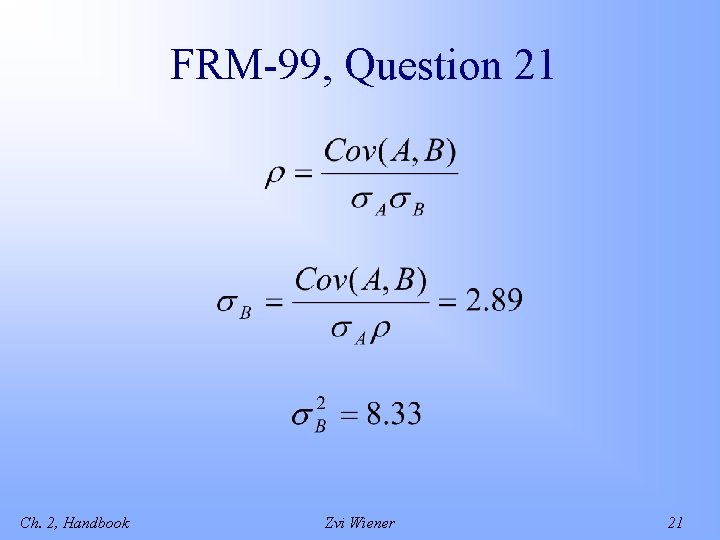

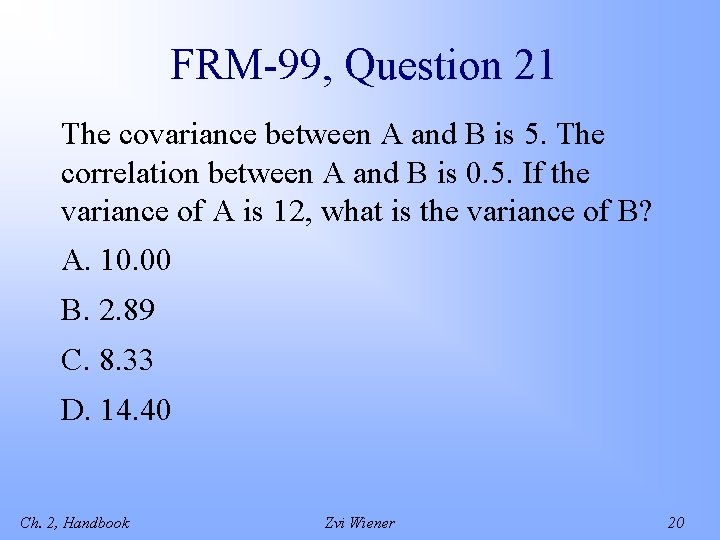

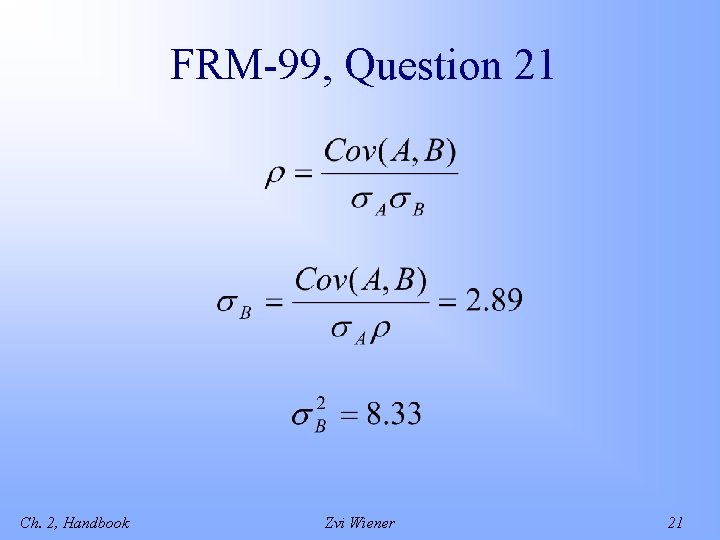

FRM-99, Question 21 The covariance between A and B is 5. The correlation between A and B is 0. 5. If the variance of A is 12, what is the variance of B? A. 10. 00 B. 2. 89 C. 8. 33 D. 14. 40 Ch. 2, Handbook Zvi Wiener 20

FRM-99, Question 21 Ch. 2, Handbook Zvi Wiener 21

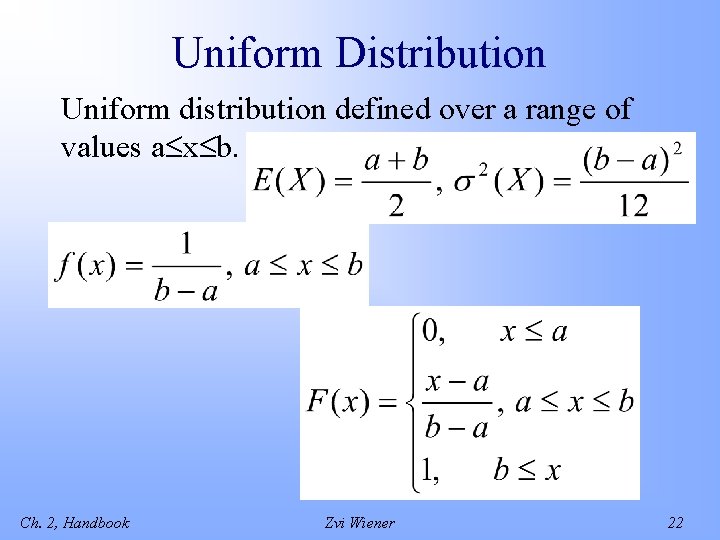

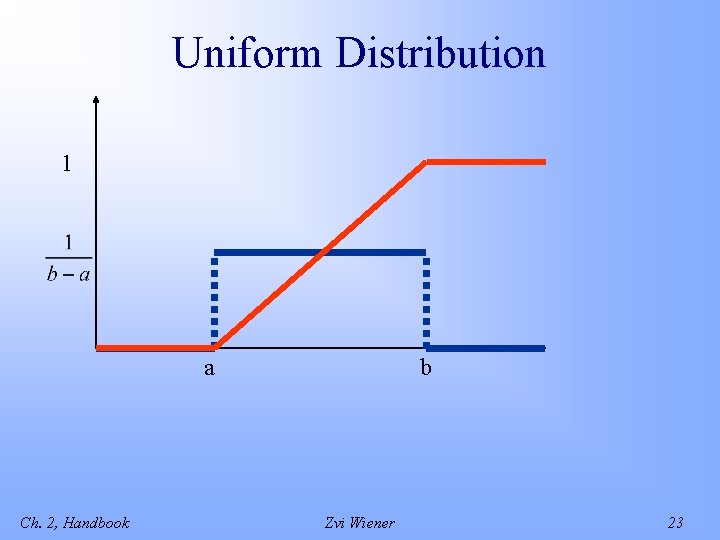

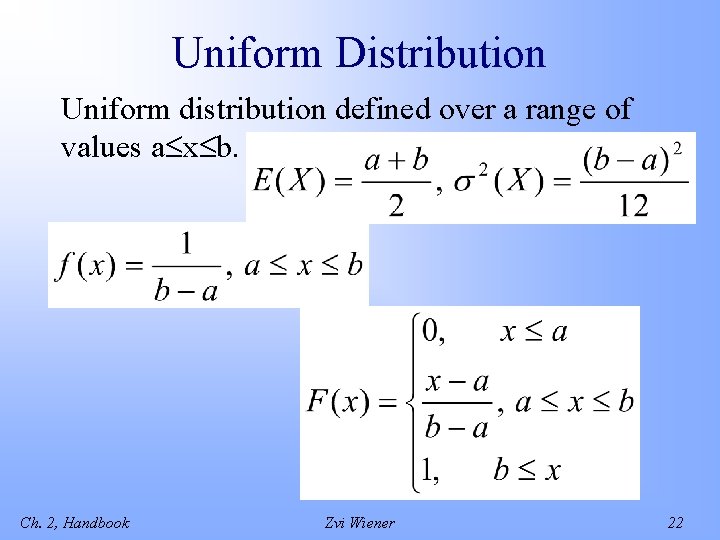

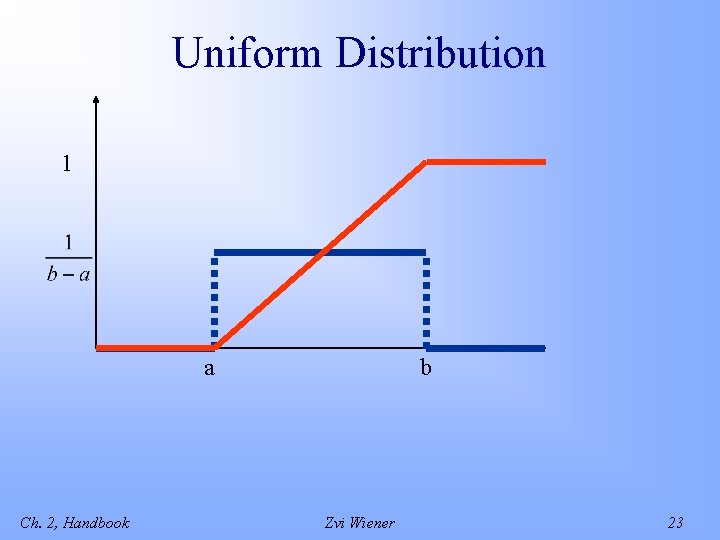

Uniform Distribution Uniform distribution defined over a range of values a x b. Ch. 2, Handbook Zvi Wiener 22

Uniform Distribution 1 a Ch. 2, Handbook b Zvi Wiener 23

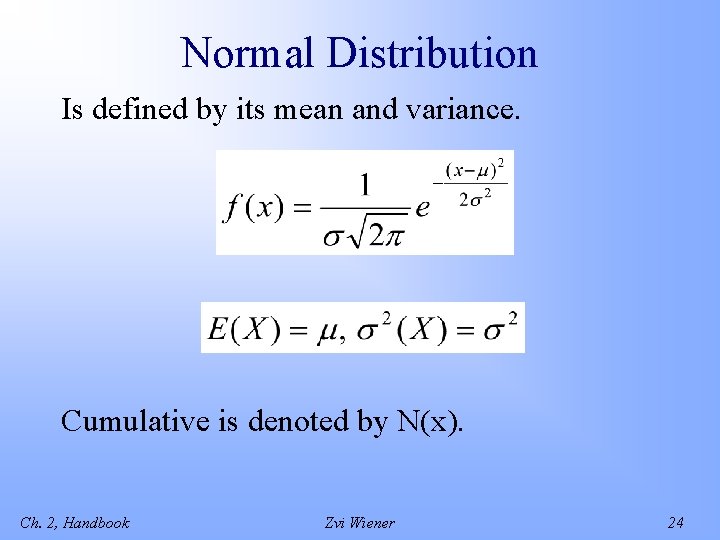

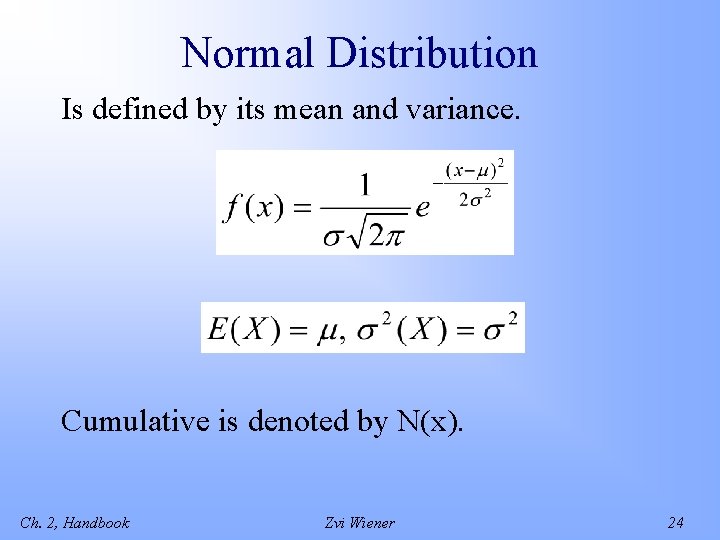

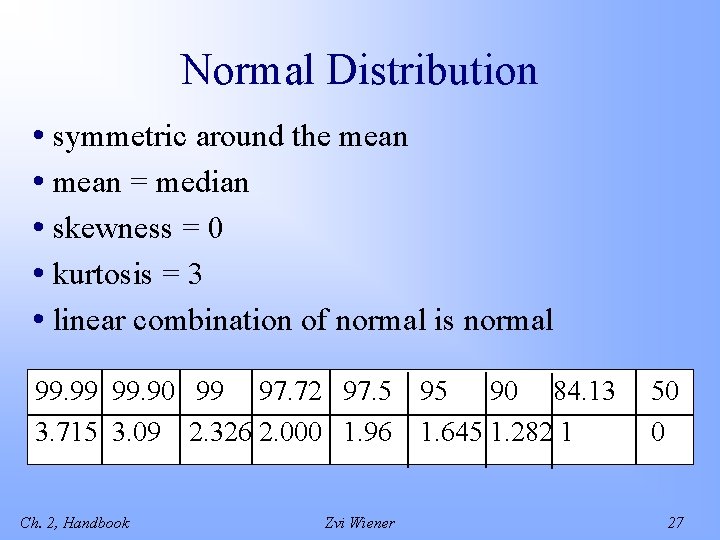

Normal Distribution Is defined by its mean and variance. Cumulative is denoted by N(x). Ch. 2, Handbook Zvi Wiener 24

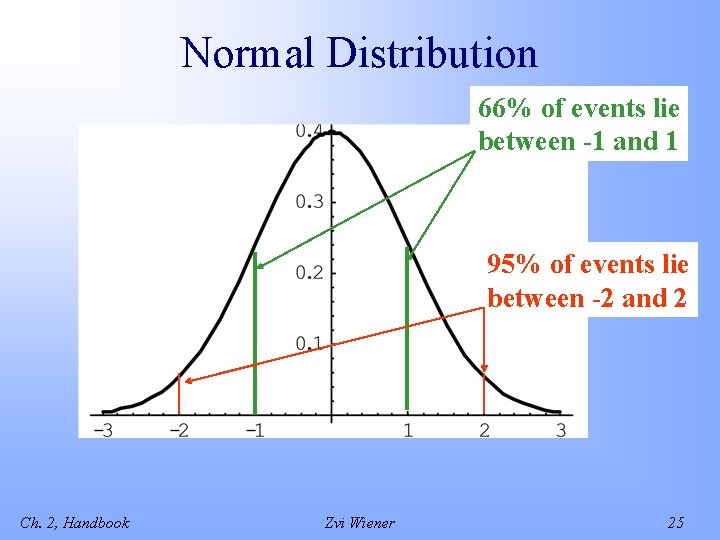

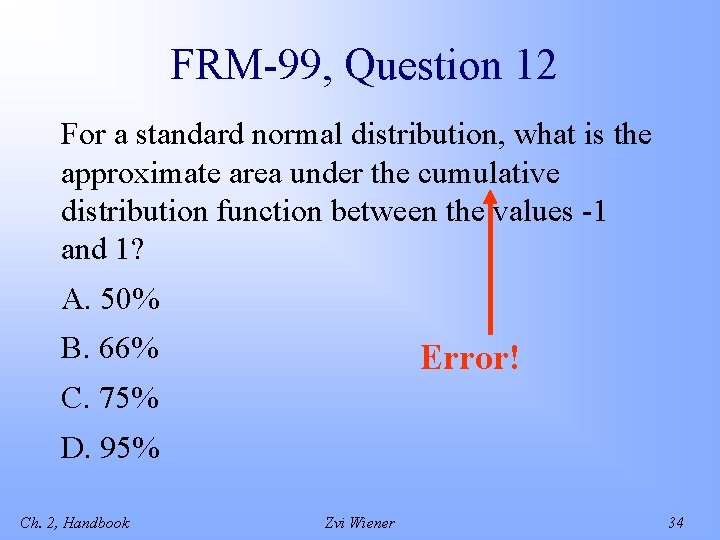

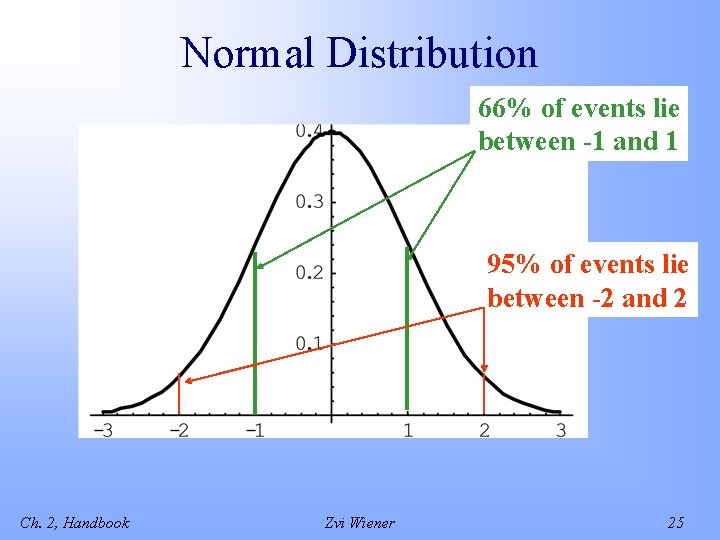

Normal Distribution 66% of events lie between -1 and 1 95% of events lie between -2 and 2 Ch. 2, Handbook Zvi Wiener 25

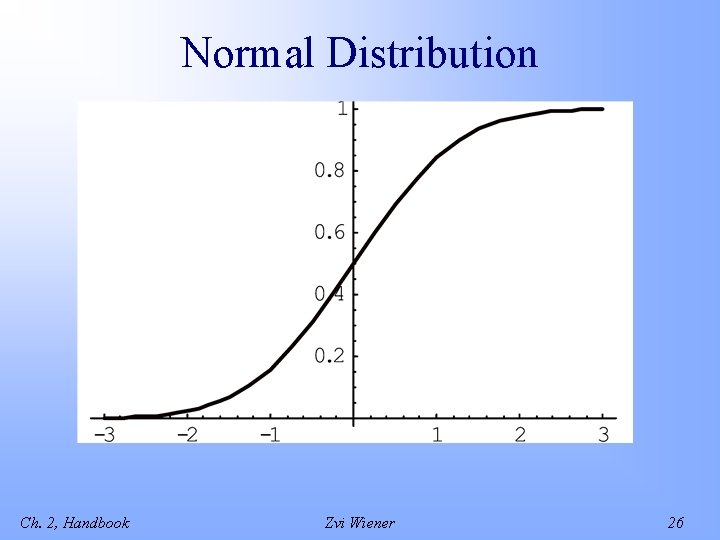

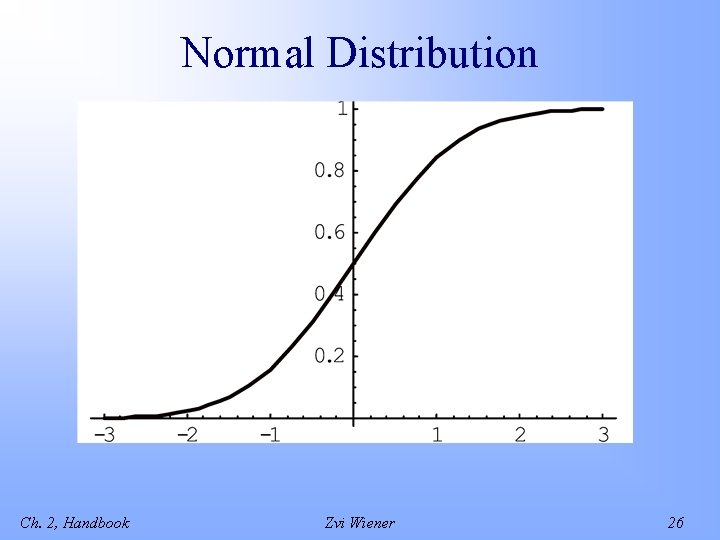

Normal Distribution Ch. 2, Handbook Zvi Wiener 26

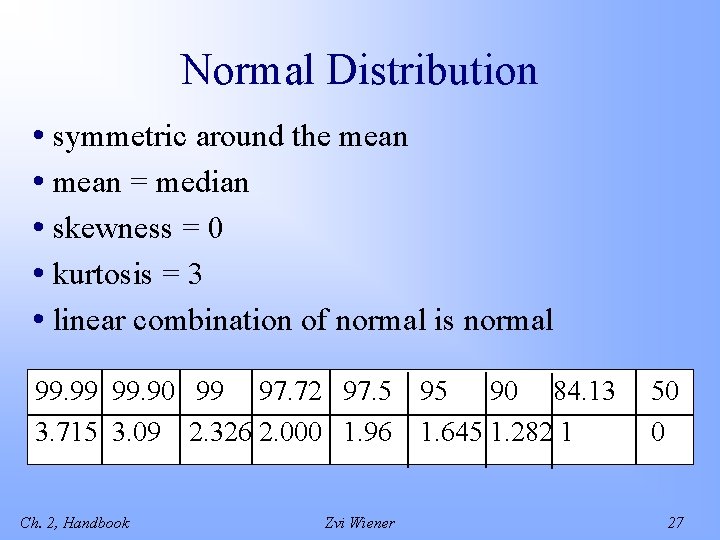

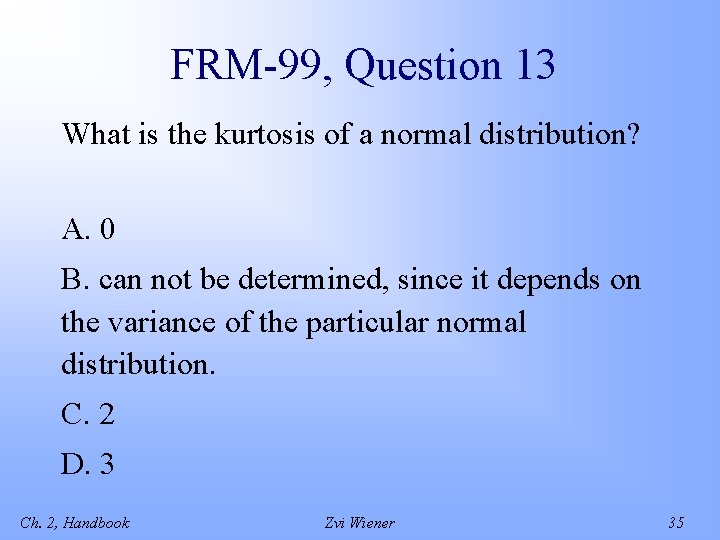

Normal Distribution • symmetric around the mean • mean = median • skewness = 0 • kurtosis = 3 • linear combination of normal is normal 99. 99 99. 90 99 97. 72 97. 5 3. 715 3. 09 2. 326 2. 000 1. 96 Ch. 2, Handbook Zvi Wiener 95 90 84. 13 1. 645 1. 282 1 50 0 27

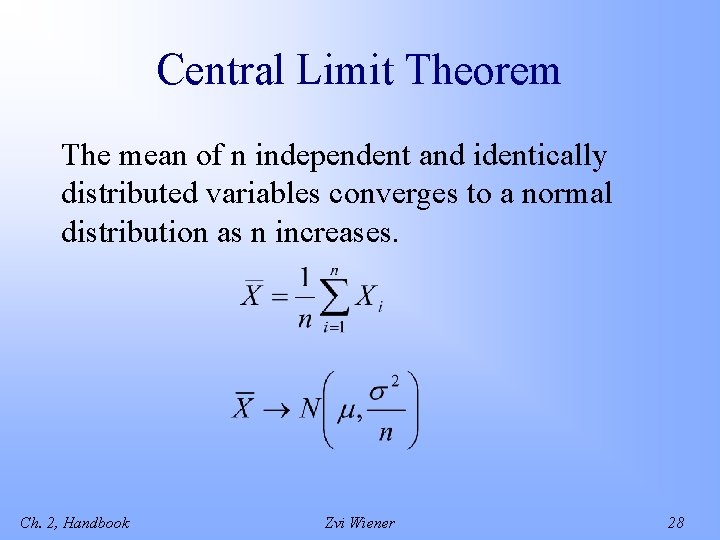

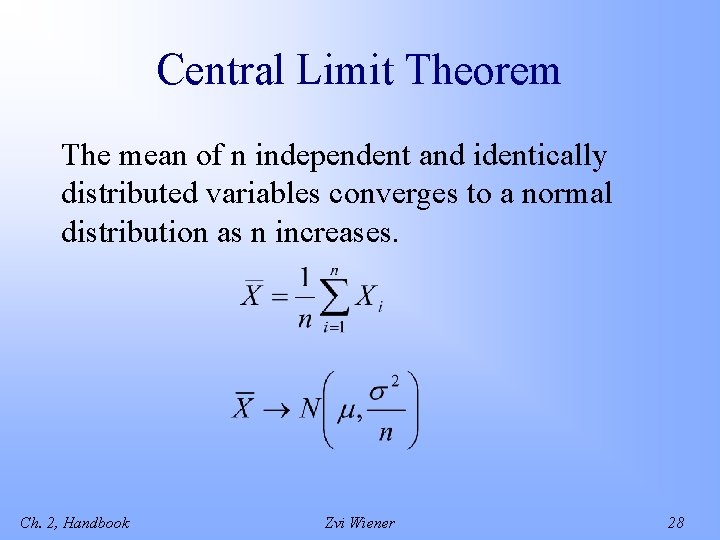

Central Limit Theorem The mean of n independent and identically distributed variables converges to a normal distribution as n increases. Ch. 2, Handbook Zvi Wiener 28

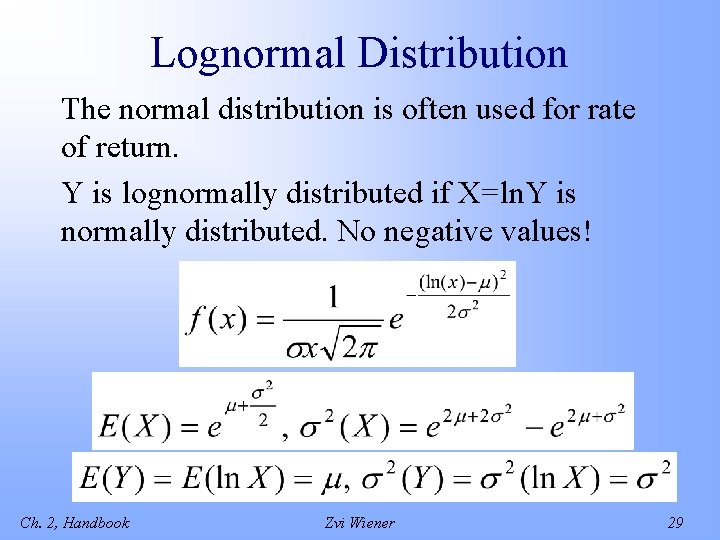

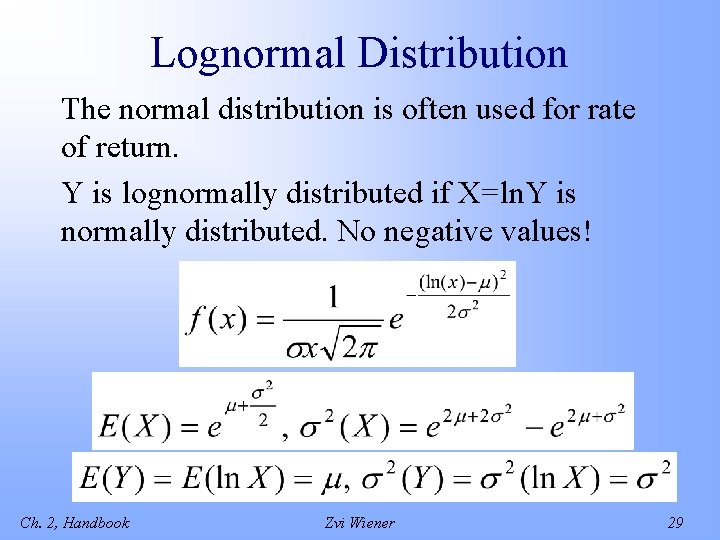

Lognormal Distribution The normal distribution is often used for rate of return. Y is lognormally distributed if X=ln. Y is normally distributed. No negative values! Ch. 2, Handbook Zvi Wiener 29

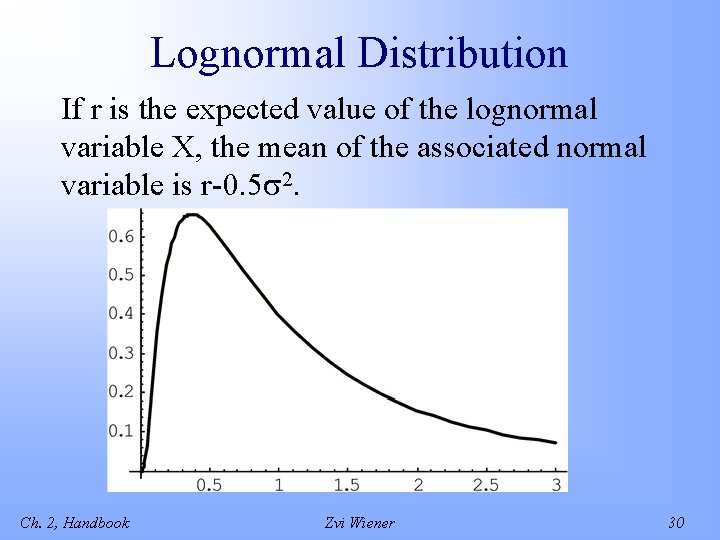

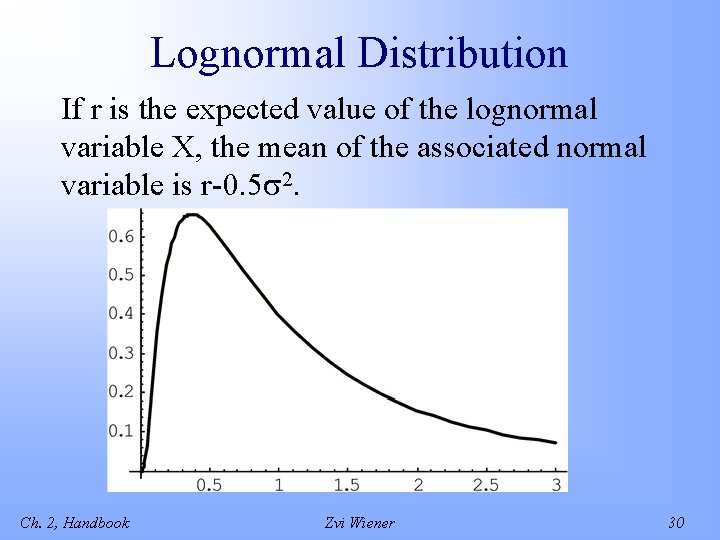

Lognormal Distribution If r is the expected value of the lognormal variable X, the mean of the associated normal variable is r-0. 5 2. Ch. 2, Handbook Zvi Wiener 30

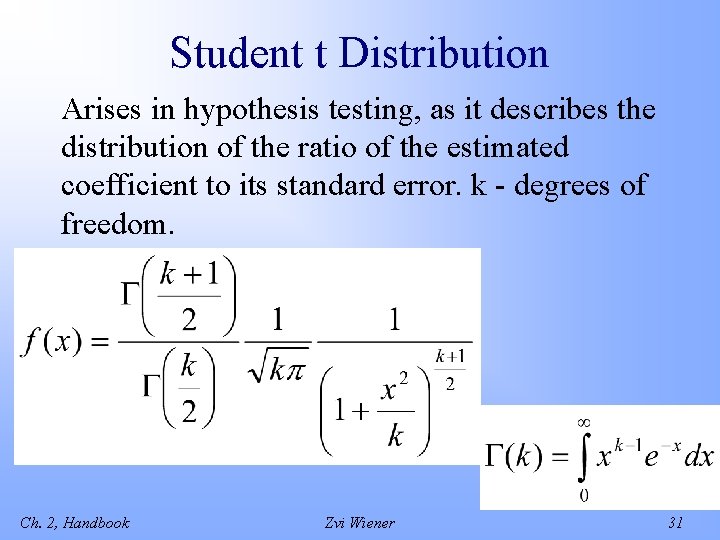

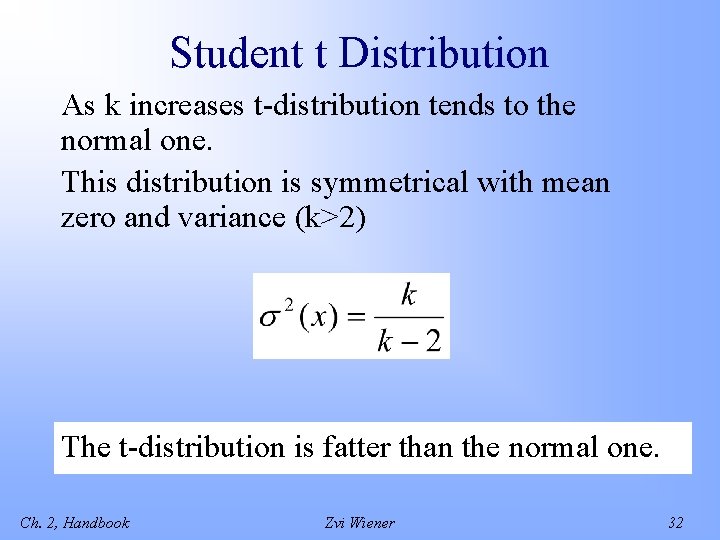

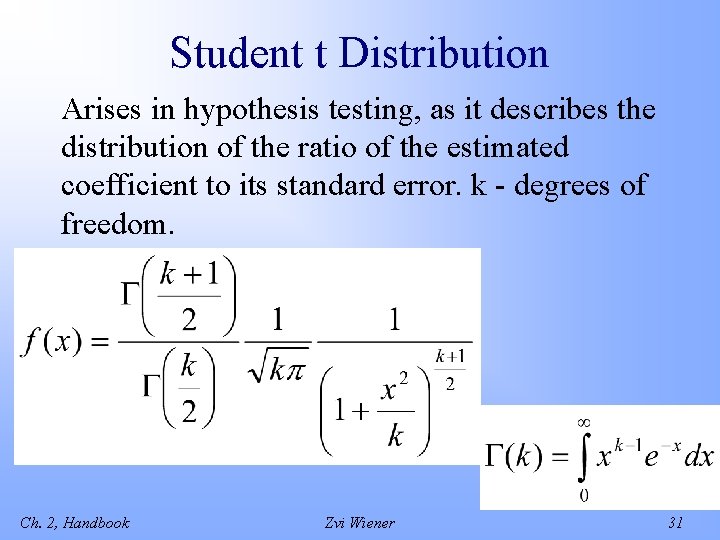

Student t Distribution Arises in hypothesis testing, as it describes the distribution of the ratio of the estimated coefficient to its standard error. k - degrees of freedom. Ch. 2, Handbook Zvi Wiener 31

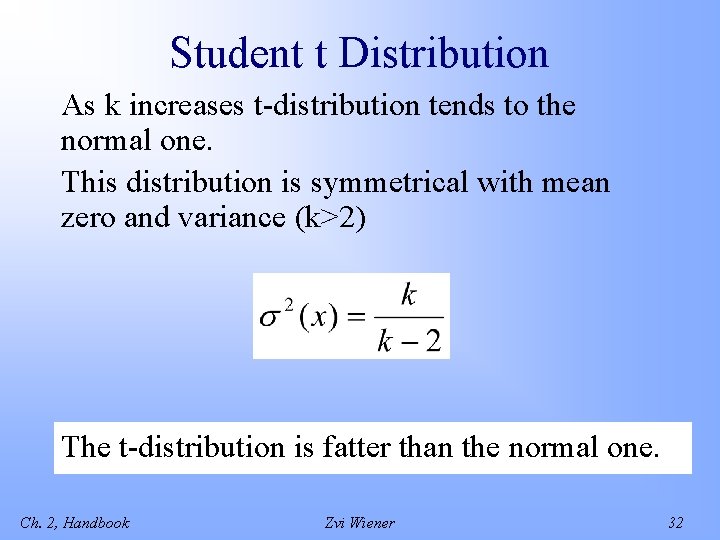

Student t Distribution As k increases t-distribution tends to the normal one. This distribution is symmetrical with mean zero and variance (k>2) The t-distribution is fatter than the normal one. Ch. 2, Handbook Zvi Wiener 32

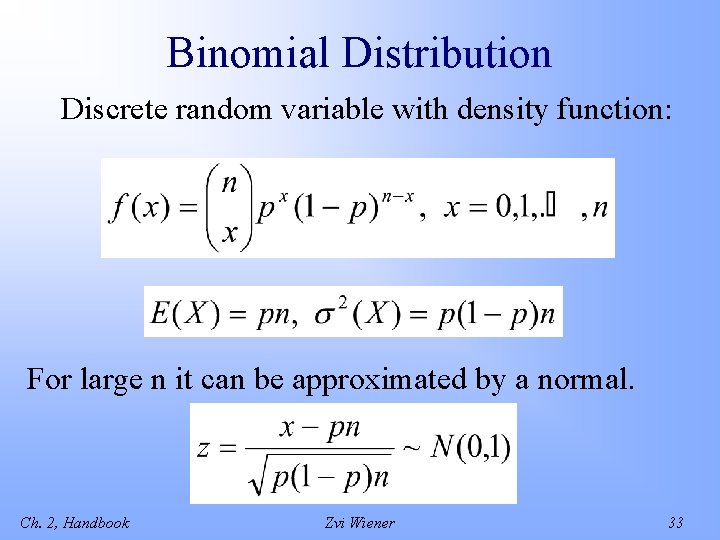

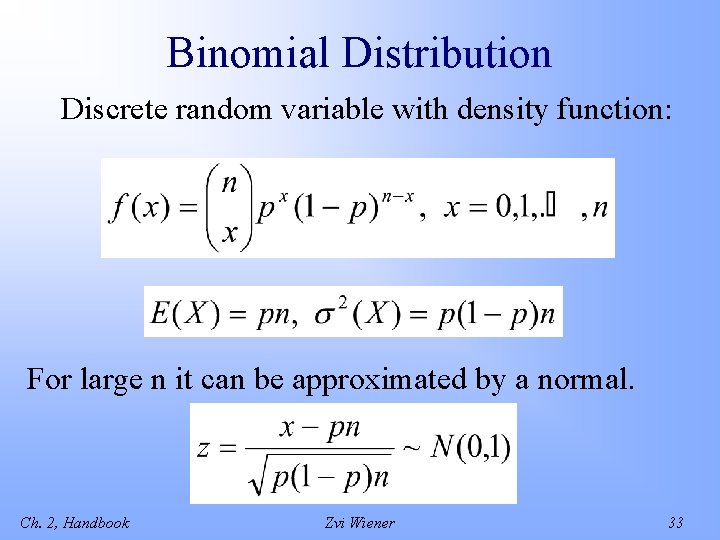

Binomial Distribution Discrete random variable with density function: For large n it can be approximated by a normal. Ch. 2, Handbook Zvi Wiener 33

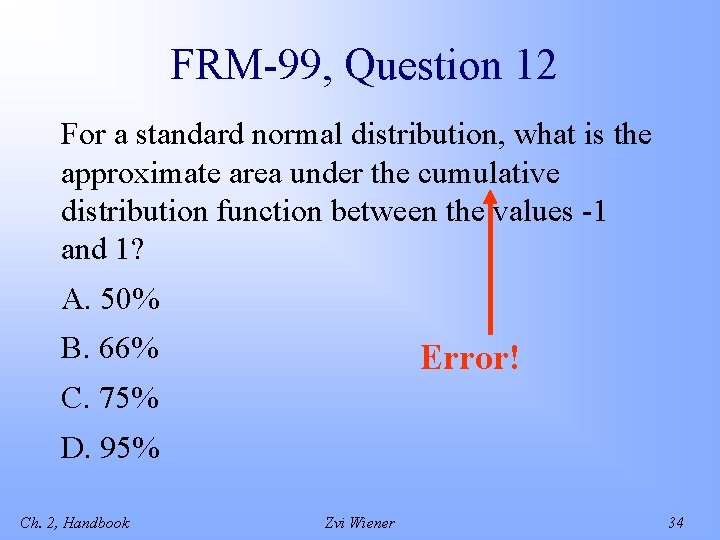

FRM-99, Question 12 For a standard normal distribution, what is the approximate area under the cumulative distribution function between the values -1 and 1? A. 50% B. 66% Error! C. 75% D. 95% Ch. 2, Handbook Zvi Wiener 34

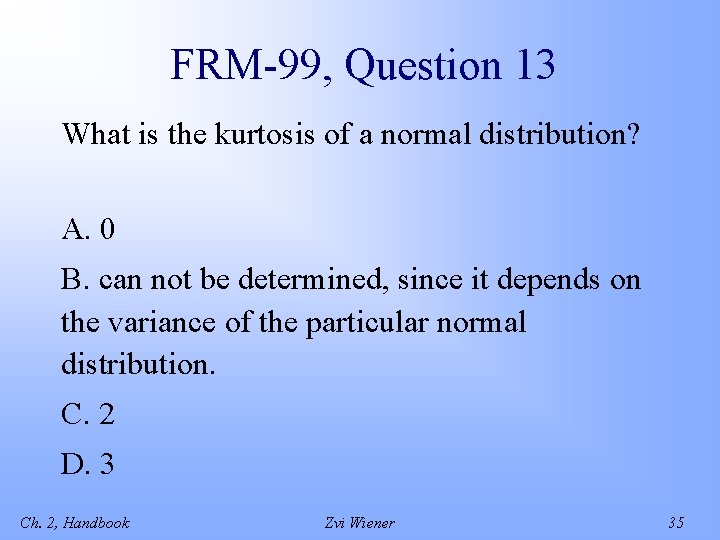

FRM-99, Question 13 What is the kurtosis of a normal distribution? A. 0 B. can not be determined, since it depends on the variance of the particular normal distribution. C. 2 D. 3 Ch. 2, Handbook Zvi Wiener 35

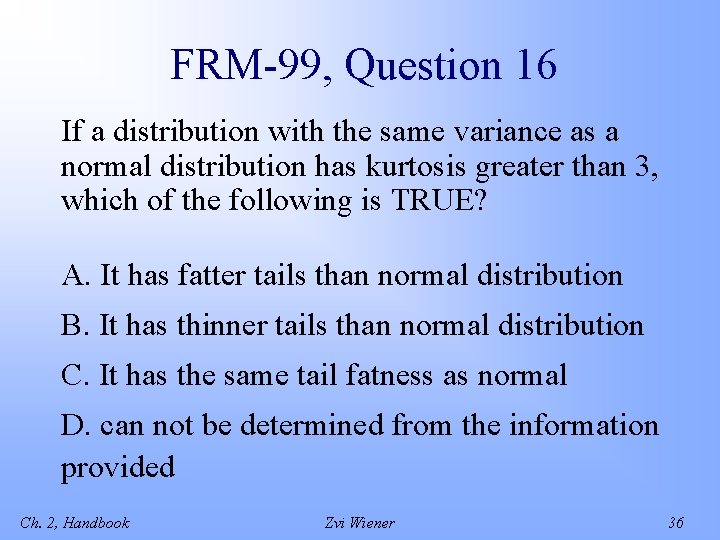

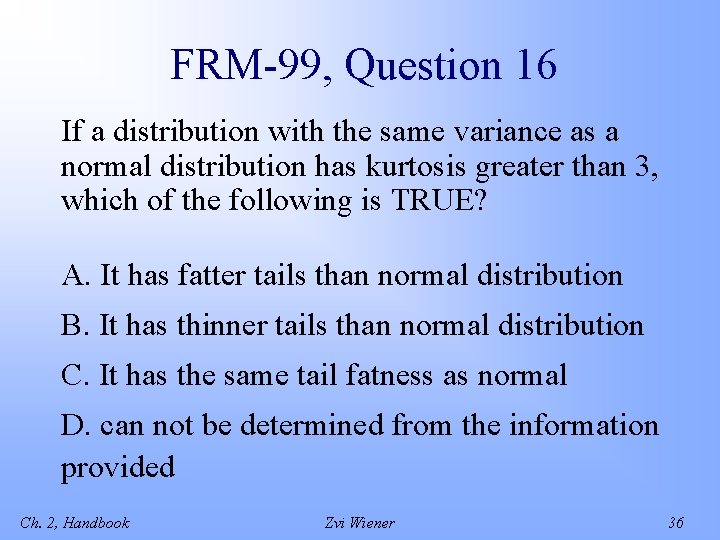

FRM-99, Question 16 If a distribution with the same variance as a normal distribution has kurtosis greater than 3, which of the following is TRUE? A. It has fatter tails than normal distribution B. It has thinner tails than normal distribution C. It has the same tail fatness as normal D. can not be determined from the information provided Ch. 2, Handbook Zvi Wiener 36

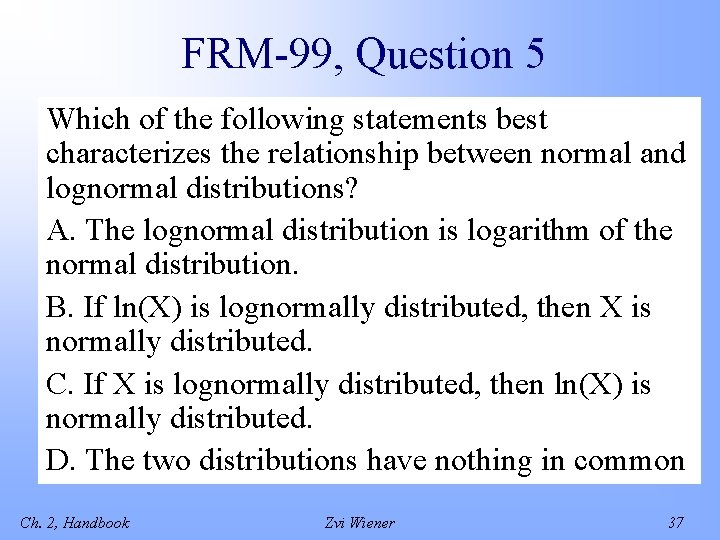

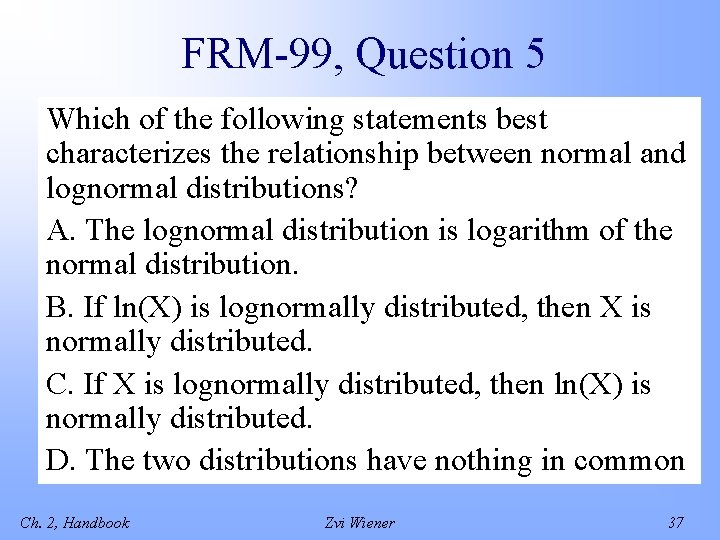

FRM-99, Question 5 Which of the following statements best characterizes the relationship between normal and lognormal distributions? A. The lognormal distribution is logarithm of the normal distribution. B. If ln(X) is lognormally distributed, then X is normally distributed. C. If X is lognormally distributed, then ln(X) is normally distributed. D. The two distributions have nothing in common Ch. 2, Handbook Zvi Wiener 37

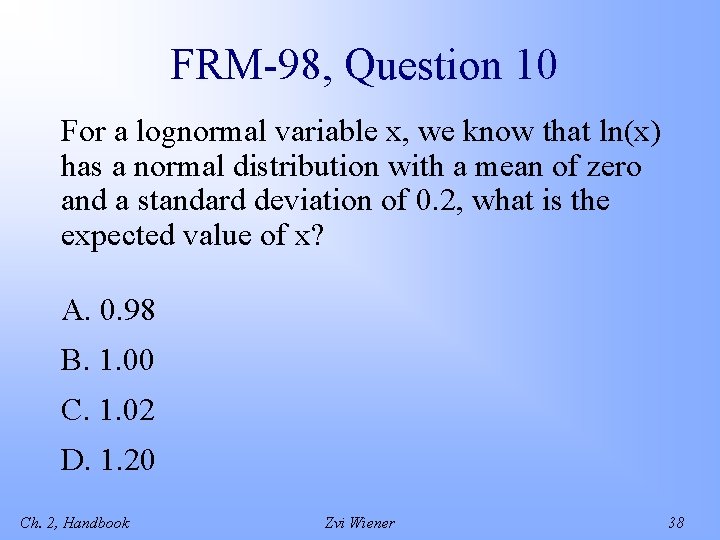

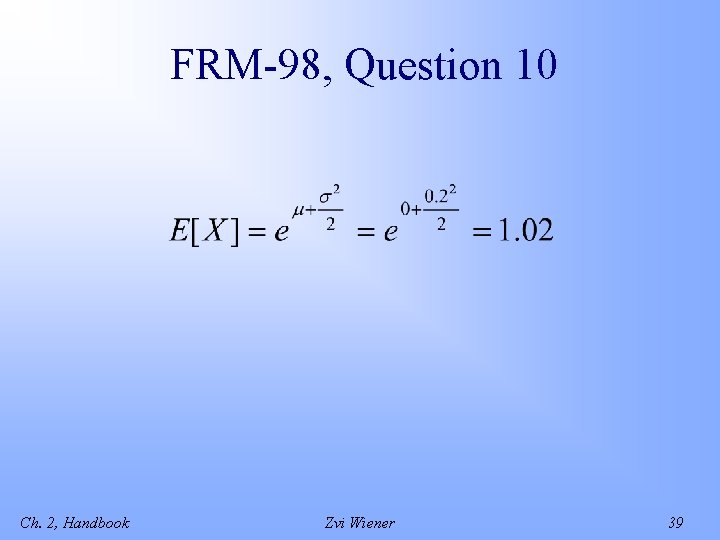

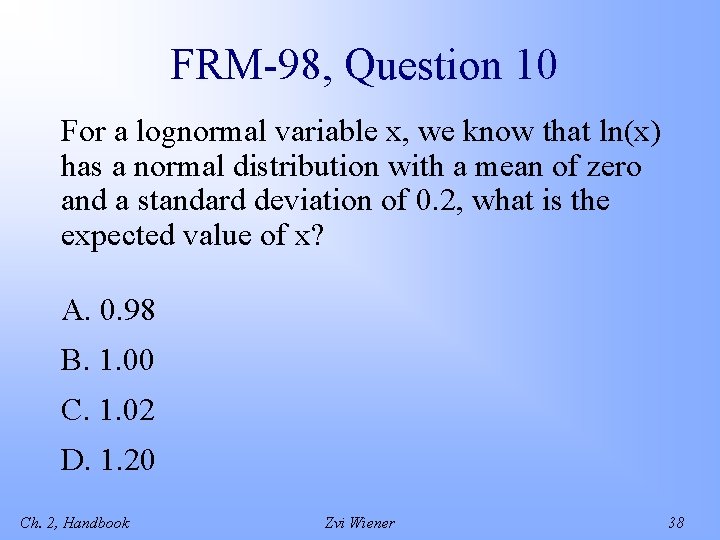

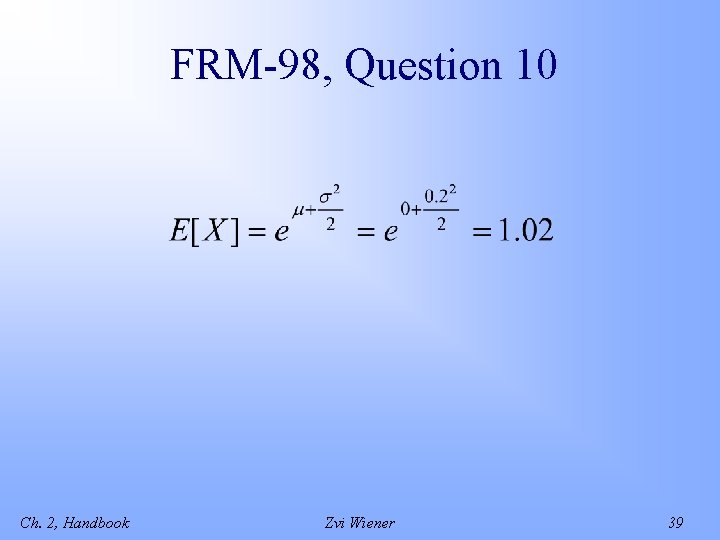

FRM-98, Question 10 For a lognormal variable x, we know that ln(x) has a normal distribution with a mean of zero and a standard deviation of 0. 2, what is the expected value of x? A. 0. 98 B. 1. 00 C. 1. 02 D. 1. 20 Ch. 2, Handbook Zvi Wiener 38

FRM-98, Question 10 Ch. 2, Handbook Zvi Wiener 39

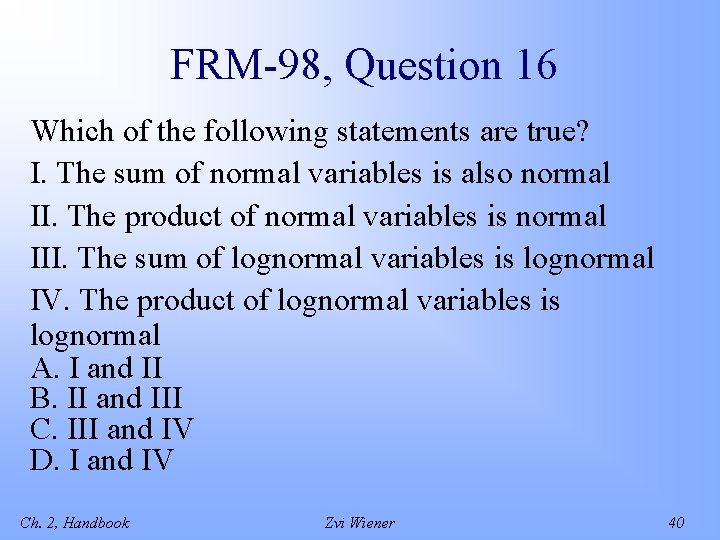

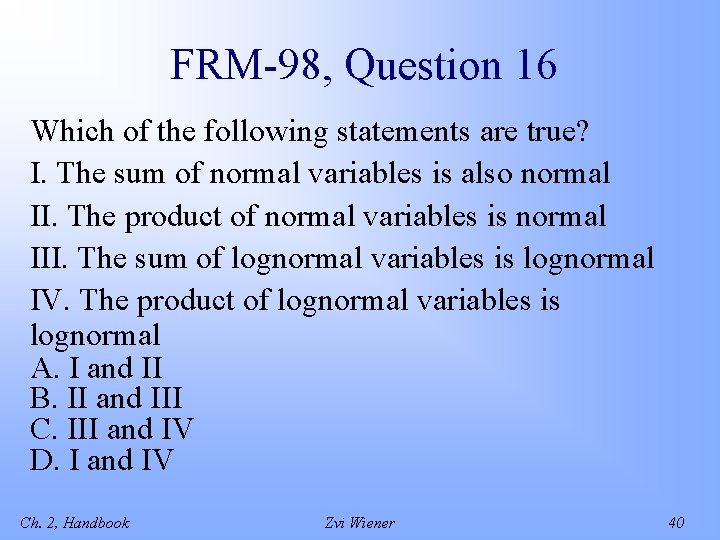

FRM-98, Question 16 Which of the following statements are true? I. The sum of normal variables is also normal II. The product of normal variables is normal III. The sum of lognormal variables is lognormal IV. The product of lognormal variables is lognormal A. I and II B. II and III C. III and IV D. I and IV Ch. 2, Handbook Zvi Wiener 40

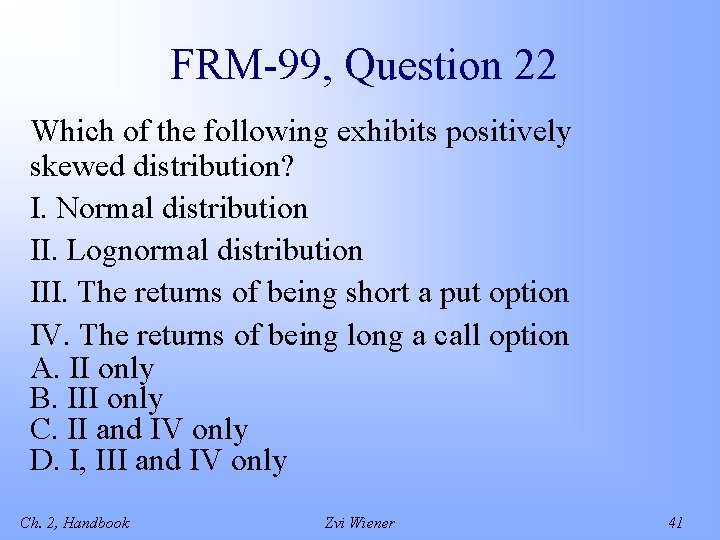

FRM-99, Question 22 Which of the following exhibits positively skewed distribution? I. Normal distribution II. Lognormal distribution III. The returns of being short a put option IV. The returns of being long a call option A. II only B. III only C. II and IV only D. I, III and IV only Ch. 2, Handbook Zvi Wiener 41

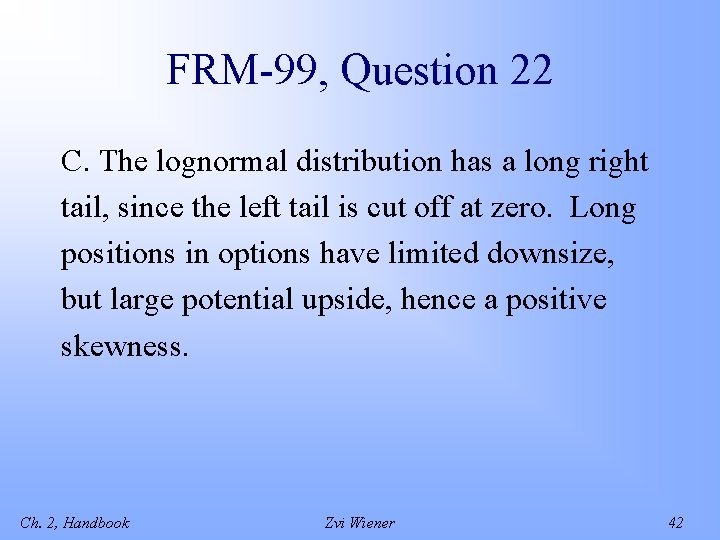

FRM-99, Question 22 C. The lognormal distribution has a long right tail, since the left tail is cut off at zero. Long positions in options have limited downsize, but large potential upside, hence a positive skewness. Ch. 2, Handbook Zvi Wiener 42

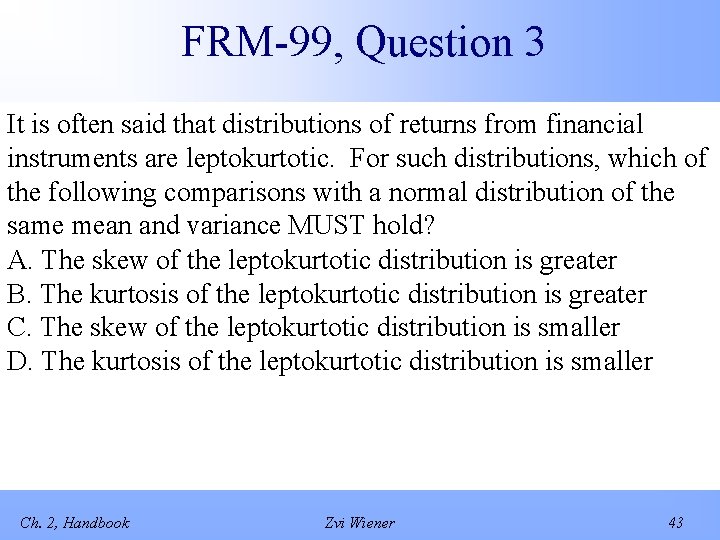

FRM-99, Question 3 It is often said that distributions of returns from financial instruments are leptokurtotic. For such distributions, which of the following comparisons with a normal distribution of the same mean and variance MUST hold? A. The skew of the leptokurtotic distribution is greater B. The kurtosis of the leptokurtotic distribution is greater C. The skew of the leptokurtotic distribution is smaller D. The kurtosis of the leptokurtotic distribution is smaller Ch. 2, Handbook Zvi Wiener 43

Zvi wiener

Zvi wiener 02 588

02 588 Zvi wiener

Zvi wiener Key risk indicators financial risk management

Key risk indicators financial risk management Market risk credit risk operational risk

Market risk credit risk operational risk Business vs financial risk

Business vs financial risk Corporate strategy examples

Corporate strategy examples Leadership theories

Leadership theories Ms 640

Ms 640 Zvi margaliot

Zvi margaliot Zvi aronson

Zvi aronson Zvi kedem

Zvi kedem Dr zvi margaliot

Dr zvi margaliot Zvi roth

Zvi roth Risk map

Risk map Introduction to financial risk

Introduction to financial risk Financial management chapter 8 risk and return

Financial management chapter 8 risk and return Elements of financial risk management peter christoffersen

Elements of financial risk management peter christoffersen Financial engineering derivatives and risk management

Financial engineering derivatives and risk management Financial risk management syllabus

Financial risk management syllabus Enterprise risk management for financial institutions

Enterprise risk management for financial institutions Financial risk management conference 2018

Financial risk management conference 2018 Financial management framework

Financial management framework Financial engineering derivatives and risk management

Financial engineering derivatives and risk management Financial engineering derivatives and risk management

Financial engineering derivatives and risk management Wiener schlosserbuben

Wiener schlosserbuben Cornelia brezik

Cornelia brezik Indeks kesamaan komunitas

Indeks kesamaan komunitas Dr craig wiener

Dr craig wiener Ito lemma example

Ito lemma example Wiener liste antibiotika

Wiener liste antibiotika Modèle de lasswell

Modèle de lasswell Wiener tafelspitz beilagen

Wiener tafelspitz beilagen Thomas kutschera

Thomas kutschera Wiener rh-hr terminology

Wiener rh-hr terminology Wiener klassik geschichtlicher hintergrund

Wiener klassik geschichtlicher hintergrund Diese landeshauptstadt liegt im vorland im südosten

Diese landeshauptstadt liegt im vorland im südosten Fundación wiener cursos a distancia 2020

Fundación wiener cursos a distancia 2020 Wiener

Wiener Wiener

Wiener Wiener salon gulasch

Wiener salon gulasch Thomas wiener

Thomas wiener Normtabelle

Normtabelle Wiener anerkennungssystem

Wiener anerkennungssystem