Financial Aid for College Jennifer Knight Linfield College

- Slides: 40

Financial Aid for College Jennifer Knight Linfield College 1

Sources of paying for college • • • Family Private College State Federal How am I going to pay for college? 2

Financial Aid – What is it? Money from a source other than the family to assist with the cost of attending college s t n a r G Schol arship s 3

How and When to Submit the FAFSA… Free Application for Federal Student Aid (FAFSA) 4

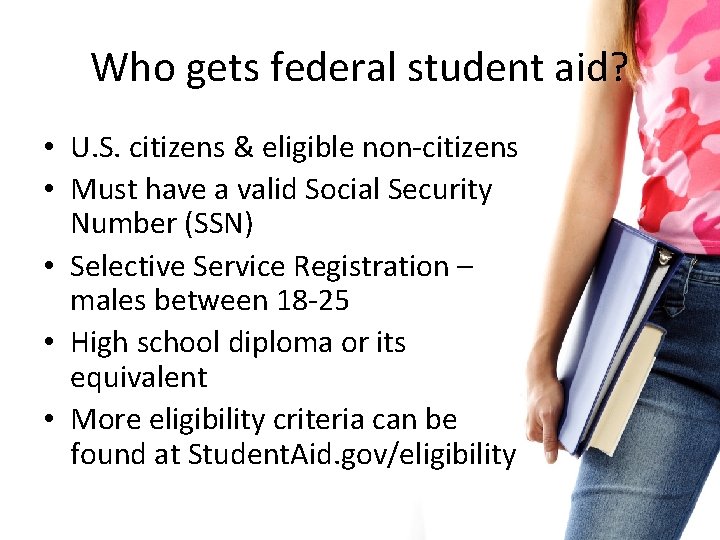

Who gets federal student aid? • U. S. citizens & eligible non-citizens • Must have a valid Social Security Number (SSN) • Selective Service Registration – males between 18 -25 • High school diploma or its equivalent • More eligibility criteria can be found at Student. Aid. gov/eligibility

How do I get started? • Completing the Free Application for Federal Student Aid (FAFSA®) is the first step toward getting federal aid for college, career school, or graduate school • Federal Student Aid, an Office of the U. S. Department of Education, provides more than $150 billion in grants, loans, and work-study funds each year, but you have to complete the FAFSA to see if you can get any of that money • The FAFSA is for everybody regardless of income • The FAFSA is student-centric 6

When you ask why should I file a FAFSA… “My parents say we make too much money to qualify for financial aid…” • You should know – Some scholarship agencies require the FAFSA – Some colleges use the FAFSA results to determine nonneed based financial aid – Financial aid includes student and parent loans, a FAFSA is required to receive these loans – Sometimes your family’s circumstances may change, called Special Circumstances, and your financial aid office may consider them, such as • • Death Divorce High medical/dental expenses Job loss 7

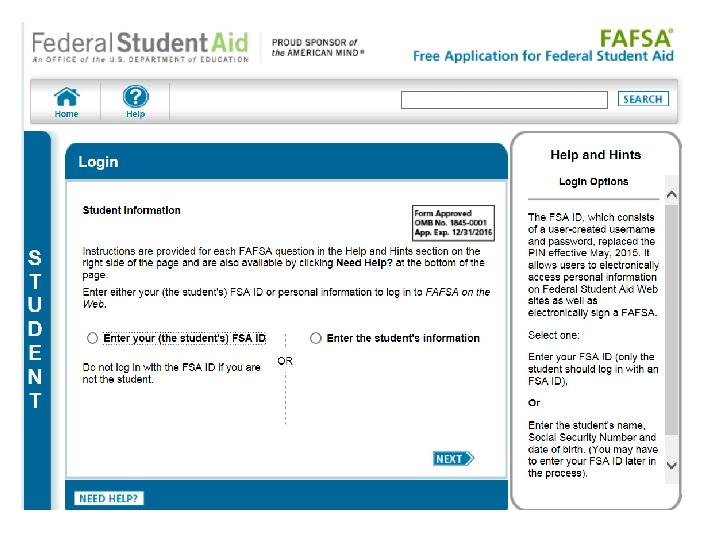

Federal Student Aid (FSA) ID • Who Gets One – Student – Parent of dependent student if their information is required on the FAFSA – Parent borrowing a Federal Direct Parent PLUS Loan and their information was not required on the FAFSA • How to get an FSA ID – Create an FSA ID when logging into certain U. S. Department of Education (ED) websites, including “create an FSA ID now” https: //fsaid. ed. gov/npas/index. htm • Federal Student Aid Information Center (FSAIC) Toll Free for help 1 -800 -4 FED AID (1 -800 -4333243)

FSA ID Process – 3 Main Steps 1. 2. – – – Enter your log-in information Provide your email address, a unique username, and password, and verify that you are at least 13 years old Enter your personal information – 3. Provide your Social Security Number (SSN), name, and date of birth Include your mailing address, email address, telephone number, and language preference For security purposes, provide answers to five challenge questions Submit your FSA ID information – – Agree to the terms and conditions Verify your email address (This is optional, but helpful. By verifying your e-mail address, you can use your e-mail address as your username when logging into certain ED websites. This verification also allows you to retrieve your username or reset your password without answering challenge questions. )

Free Application for Federal Student Aid (FAFSA) – www. fafsa. gov 10

FAFSA 4 Caster • Apply early • Simulates FAFSA • EFC 11

When Should I File the FAFSA? • Annually – Your senior year of high school • File 2016 -2017 FAFSA on or as soon after January 1, 2016 as possible for 2016 -2017 academic year – And then file a renewal FAFSA on the Web each year following – Why apply early? • First come first served – State deadlines » Oregon Opportunity Grant – College deadlines » Vary 12

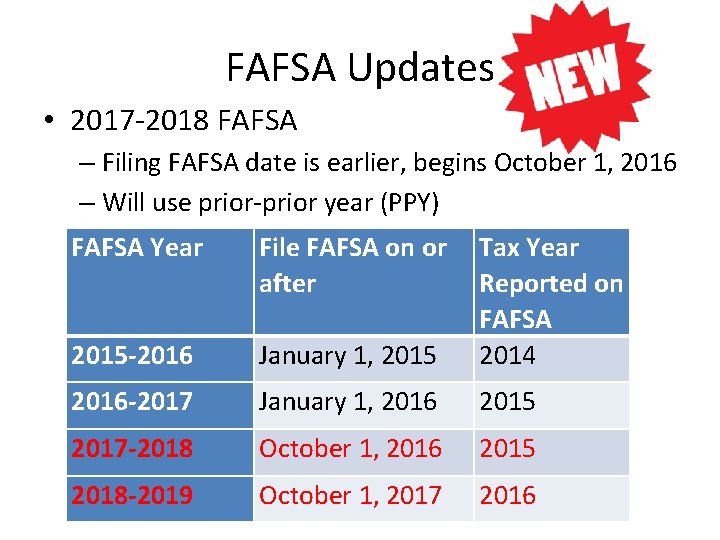

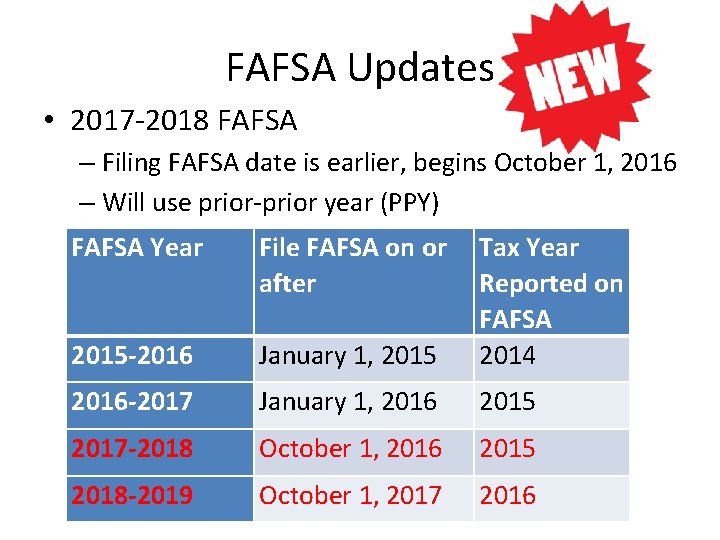

FAFSA Updates • 2017 -2018 FAFSA – Filing FAFSA date is earlier, begins October 1, 2016 – Will use prior-prior year (PPY) FAFSA Year File FAFSA on or after 2015 -2016 January 1, 2015 Tax Year Reported on FAFSA 2014 2016 -2017 January 1, 2016 2015 2017 -2018 October 1, 2016 2015 2018 -2019 October 1, 2017 2016

FAFSA Overview Federal Student Aid Video Student. Aid. ed. gov You. Tube Video: https: //www. youtube. com/watch? v=c-23 SMf 5 Dy. Q

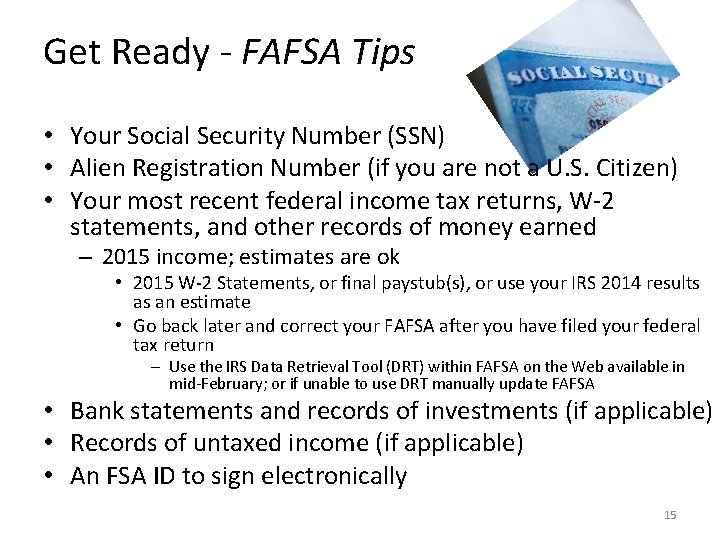

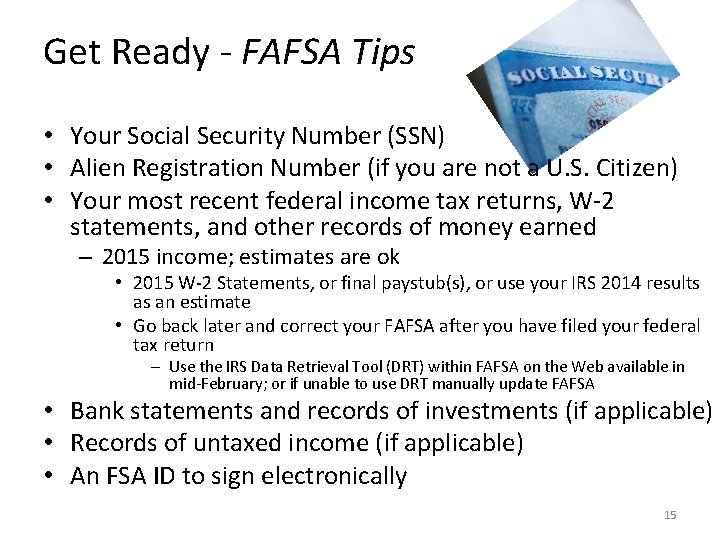

Get Ready - FAFSA Tips • Your Social Security Number (SSN) • Alien Registration Number (if you are not a U. S. Citizen) • Your most recent federal income tax returns, W-2 statements, and other records of money earned – 2015 income; estimates are ok • 2015 W-2 Statements, or final paystub(s), or use your IRS 2014 results as an estimate • Go back later and correct your FAFSA after you have filed your federal tax return – Use the IRS Data Retrieval Tool (DRT) within FAFSA on the Web available in mid-February; or if unable to use DRT manually update FAFSA • Bank statements and records of investments (if applicable) • Records of untaxed income (if applicable) • An FSA ID to sign electronically 15

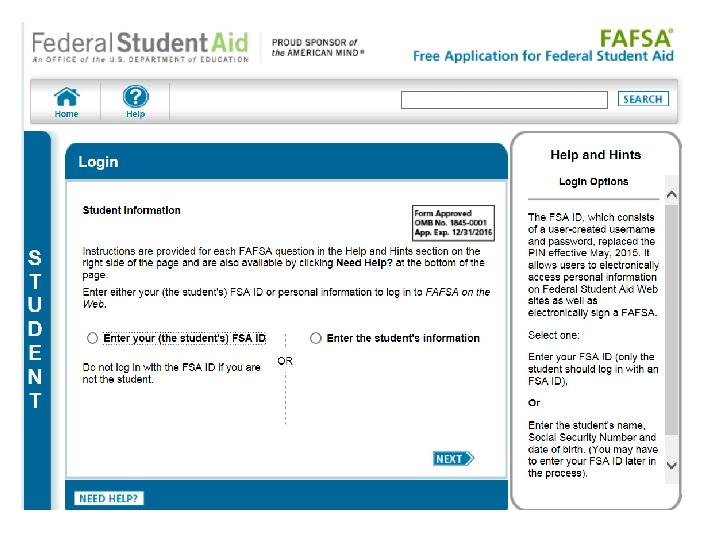

Free Application for Federal Student Aid (FAFSA) – www. fafsa. gov 16

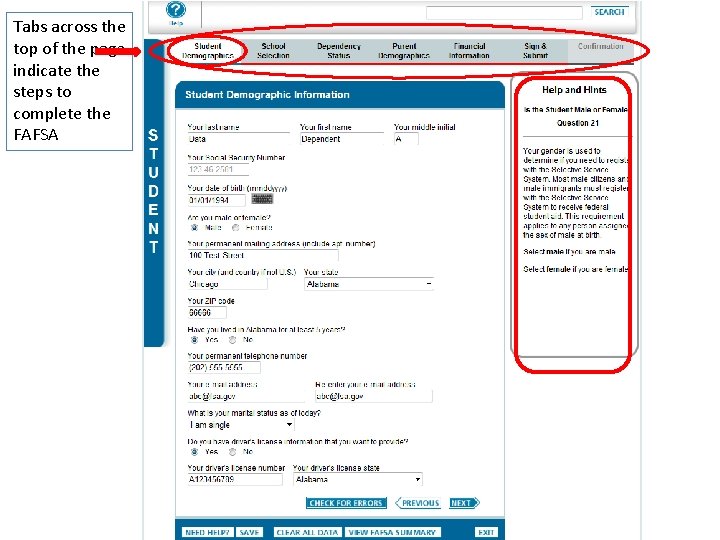

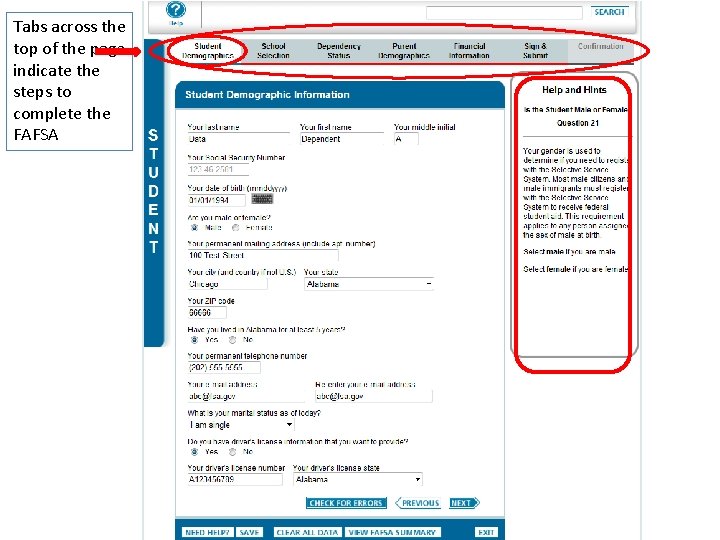

Tabs across the top of the page indicate the steps to complete the FAFSA

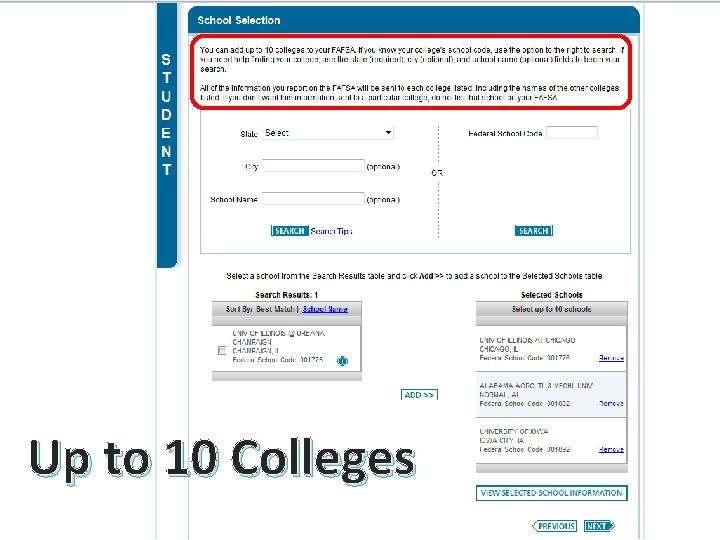

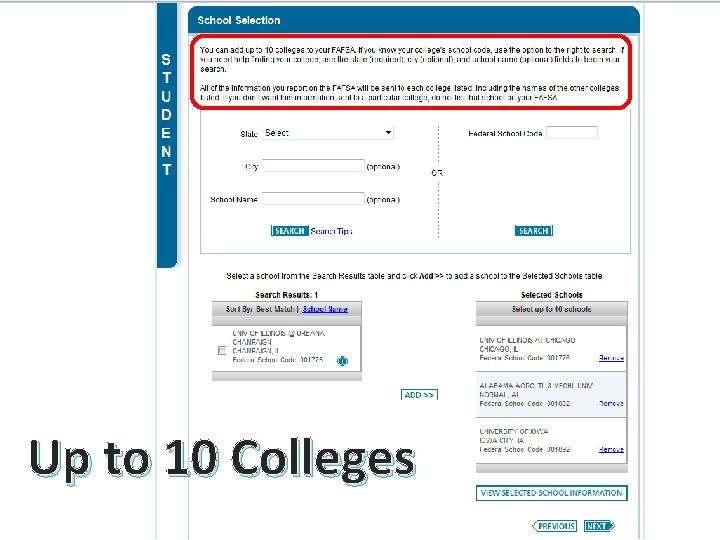

Up to 10 Colleges

FAFSA: Determining Your Dependency Status Student. Aid. ed. gov You. Tube Video: https: //www. youtube. com/watch? v=d. Ebxa. Rjl. Lus

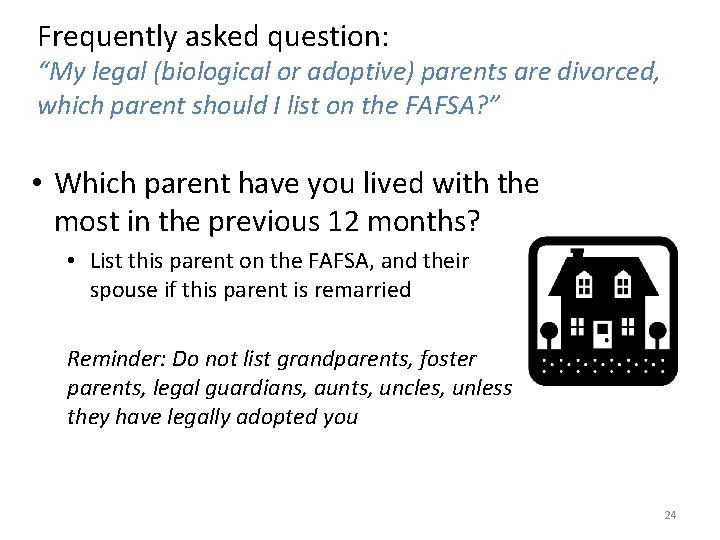

Frequently asked question: “My legal (biological or adoptive) parents are divorced, which parent should I list on the FAFSA? ” • Which parent have you lived with the most in the previous 12 months? • List this parent on the FAFSA, and their spouse if this parent is remarried Reminder: Do not list grandparents, foster parents, legal guardians, aunts, uncles, unless they have legally adopted you 24

Parent sections are always purple

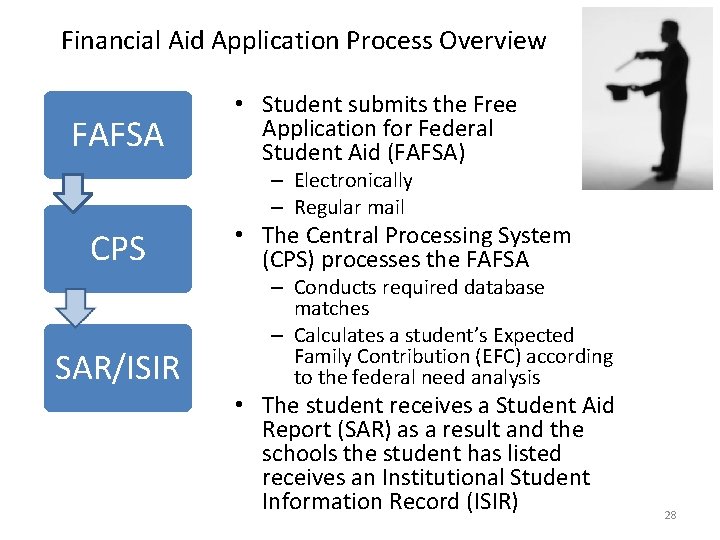

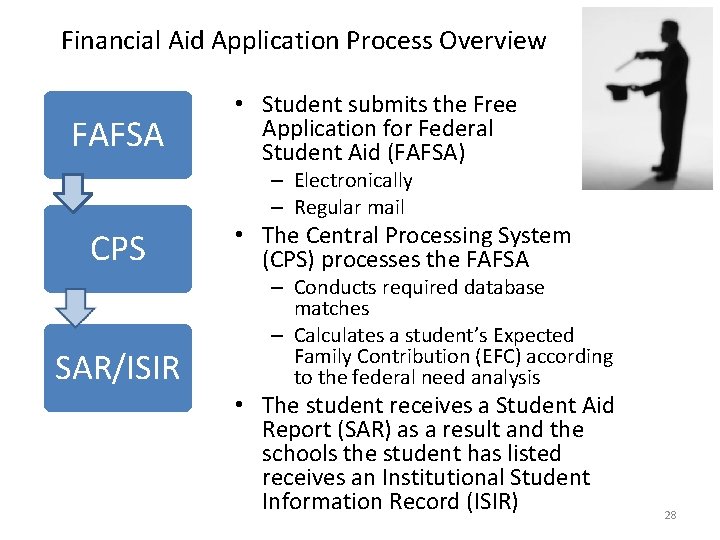

Financial Aid Application Process Overview FAFSA • Student submits the Free Application for Federal Student Aid (FAFSA) – Electronically – Regular mail CPS SAR/ISIR • The Central Processing System (CPS) processes the FAFSA – Conducts required database matches – Calculates a student’s Expected Family Contribution (EFC) according to the federal need analysis • The student receives a Student Aid Report (SAR) as a result and the schools the student has listed receives an Institutional Student Information Record (ISIR) 28

After the FAFSA • • • Student Aid Report Verification Special Circumstances College financial aid forms Award Letter Loans require additional steps before the funds can be disbursed to the student: – Master Promissory Note (MPN) – Entrance Counseling 29

How much aid will I receive? • The financial aid office at your college will let you know the amount of financial aid you are eligible to receive • Your college will use your EFC to prepare a financial aid package to help you meet your financial need 30

Types of Financial Aid – Grants E FRE Y E N Gift Aid MO Programs Annual Amount Federal Pell Grant Up to $5, 775 for 2015 -2016 Federal Supplemental Education Opportunity Grant $100 -$4, 000 Teacher Education Assistance for College and Higher Education Grant (TEACH Grant) Up to $4, 000 Iraq & Afghanistan Service Grant Visit Student. Aid. gov/Iraq-Afghanistan Oregon Opportunity Grant Up to $2, 100 Visit www. oregonstudentaid. gov College/University Grant Amounts Vary

Finding Scholarships • Start local, your home town – Your high school – Foundations – Community organizations and civic groups – Local business, and employers – Religious or ethnicity-based organizations • Your college/university • Your state – Oregon: www. oregonstudentaid. gov • Free internet search; search engines Beware of scams! 32

Types of Financial Aid – Student Employment Self Help • Student can work part time while enrolled – Campus Employment – Federal Work Study • Need based award

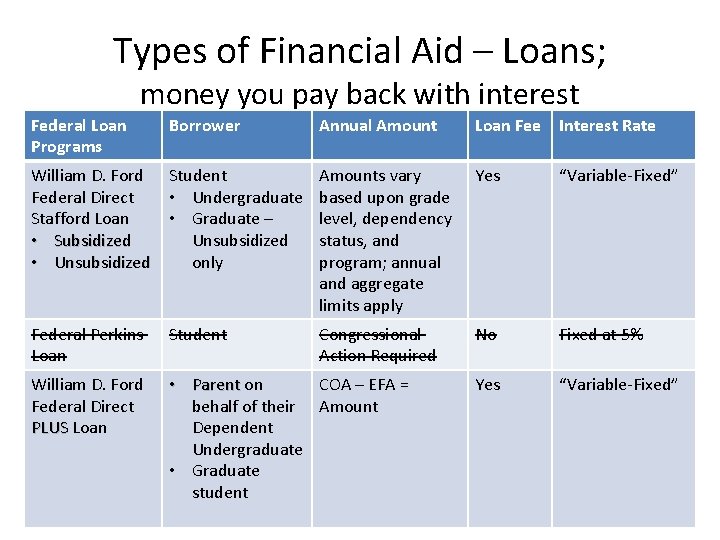

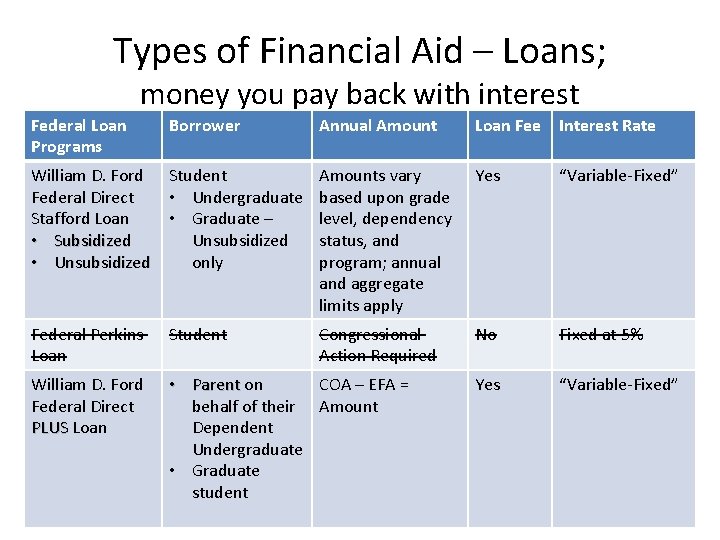

Types of Financial Aid – Loans; money you pay back with interest Federal Loan Programs Borrower Annual Amount Loan Fee Interest Rate William D. Ford Student Federal Direct • Undergraduate Stafford Loan • Graduate – • Subsidized Unsubsidized • Unsubsidized only Amounts vary based upon grade level, dependency status, and program; annual and aggregate limits apply Yes “Variable-Fixed” Federal Perkins Loan Student Congressional Action Required No Fixed at 5% William D. Ford Federal Direct PLUS Loan • Parent on COA – EFA = behalf of their Amount Dependent Undergraduate • Graduate student Yes “Variable-Fixed”

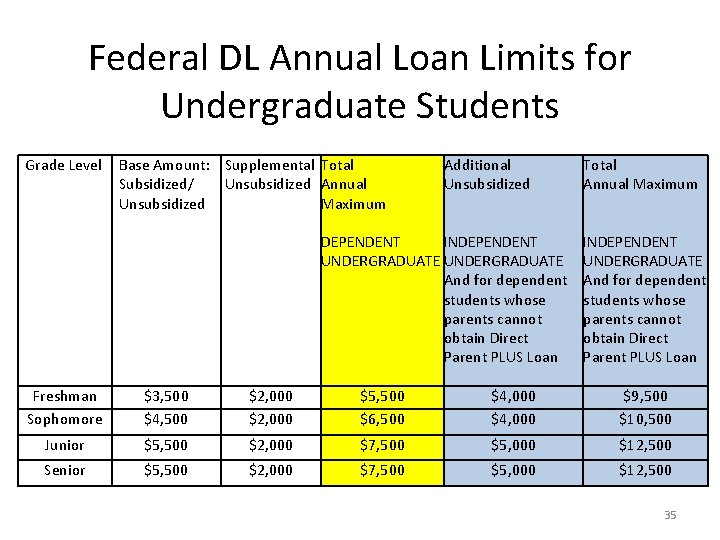

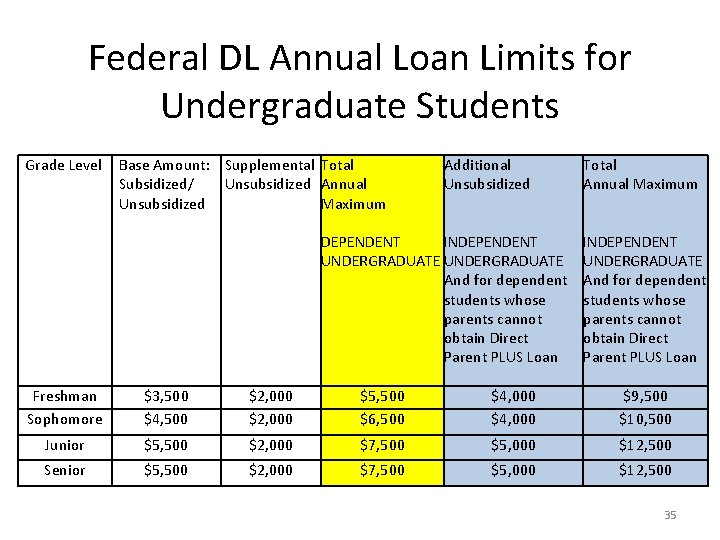

Federal DL Annual Loan Limits for Undergraduate Students Grade Level Base Amount: Supplemental Total Subsidized/ Unsubsidized Annual Unsubsidized Maximum Additional Unsubsidized DEPENDENT INDEPENDENT UNDERGRADUATE And for dependent students whose parents cannot obtain Direct Parent PLUS Loan Total Annual Maximum INDEPENDENT UNDERGRADUATE And for dependent students whose parents cannot obtain Direct Parent PLUS Loan Freshman Sophomore $3, 500 $4, 500 $2, 000 $5, 500 $6, 500 $4, 000 $9, 500 $10, 500 Junior $5, 500 $2, 000 $7, 500 $5, 000 $12, 500 Senior $5, 500 $2, 000 $7, 500 $5, 000 $12, 500 35

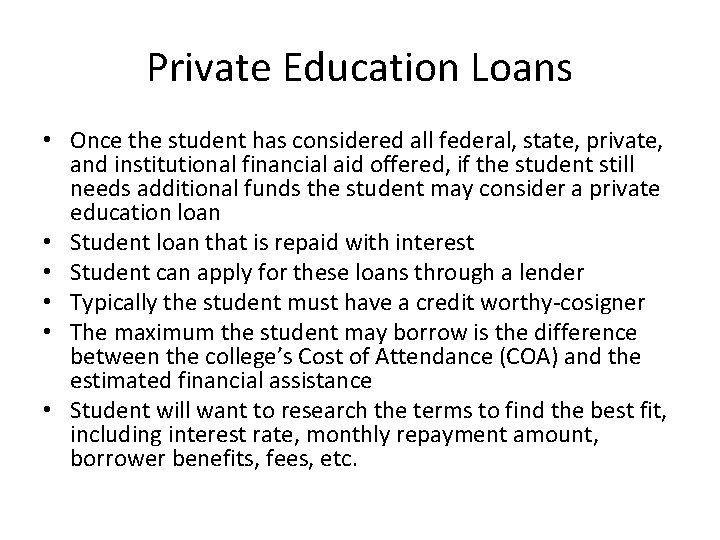

Private Education Loans • Once the student has considered all federal, state, private, and institutional financial aid offered, if the student still needs additional funds the student may consider a private education loan • Student loan that is repaid with interest • Student can apply for these loans through a lender • Typically the student must have a credit worthy-cosigner • The maximum the student may borrow is the difference between the college’s Cost of Attendance (COA) and the estimated financial assistance • Student will want to research the terms to find the best fit, including interest rate, monthly repayment amount, borrower benefits, fees, etc.

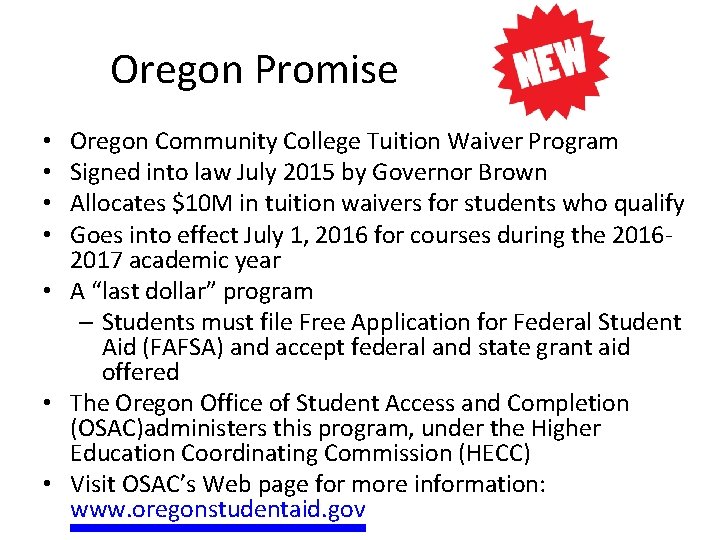

Oregon Promise Oregon Community College Tuition Waiver Program Signed into law July 2015 by Governor Brown Allocates $10 M in tuition waivers for students who qualify Goes into effect July 1, 2016 for courses during the 20162017 academic year • A “last dollar” program – Students must file Free Application for Federal Student Aid (FAFSA) and accept federal and state grant aid offered • The Oregon Office of Student Access and Completion (OSAC)administers this program, under the Higher Education Coordinating Commission (HECC) • Visit OSAC’s Web page for more information: www. oregonstudentaid. gov • •

What can I do now? • Apply for Admission to your college choice(s) • Research financial aid process requirements at your college(s) – CSS/Financial Aid PROFILE® • Research scholarship deadlines and requirements • FAFSA 4 Caster • Obtain FSA ID (student and parent) • Net Price Calculator 39

Your Future Awaits! 40

Linfield financial aid office

Linfield financial aid office Algonquin college financial aid

Algonquin college financial aid Cashnet juniata

Cashnet juniata Fafsa dvc

Fafsa dvc Loyalist college financial aid

Loyalist college financial aid Tarrant county college financial aid

Tarrant county college financial aid Sac city lvn to rn

Sac city lvn to rn First aid merit badge first aid kit

First aid merit badge first aid kit Neasden and greenhill park medical centre

Neasden and greenhill park medical centre Financial aid card

Financial aid card Southeastern louisiana university dual enrollment

Southeastern louisiana university dual enrollment Snu gsis

Snu gsis Texas higher education coordinating board

Texas higher education coordinating board Fscj financial aid office

Fscj financial aid office Twu web advisor

Twu web advisor Fau financial aid

Fau financial aid Troy financial aid office

Troy financial aid office Duke financial aid office

Duke financial aid office Butte financial aid

Butte financial aid Ucla dgsom financial aid

Ucla dgsom financial aid Longwood university financial aid office

Longwood university financial aid office Csudh scholarships

Csudh scholarships Baylor financial aid pin

Baylor financial aid pin Dayton financial aid

Dayton financial aid Kent state financial aid office hours

Kent state financial aid office hours Prosam financial aid

Prosam financial aid Mustang guarantee program

Mustang guarantee program Columbia financial aid office

Columbia financial aid office Kaiser financial aid

Kaiser financial aid Fafsav

Fafsav Chapman university student business services

Chapman university student business services University of puget sound financial aid

University of puget sound financial aid Auburn ebill login

Auburn ebill login Financial aid office iup

Financial aid office iup Dmacc online bookstore

Dmacc online bookstore Rush financial aid

Rush financial aid Fvsu registrar office phone number

Fvsu registrar office phone number Financial aid

Financial aid Vanderbilt isfaa

Vanderbilt isfaa Uwf financial aid

Uwf financial aid Fredonia financial aid office

Fredonia financial aid office