Financial Aid Financial Aid Myths and Tips Financial

- Slides: 44

Financial Aid

Financial Aid Myths and Tips

Financial Aid Published Costs • Myth – The published cost represents the true cost of a college or university. • The Larger Story – What really matters to the student is the amount the student will pay for college. – This is called “net price. ”

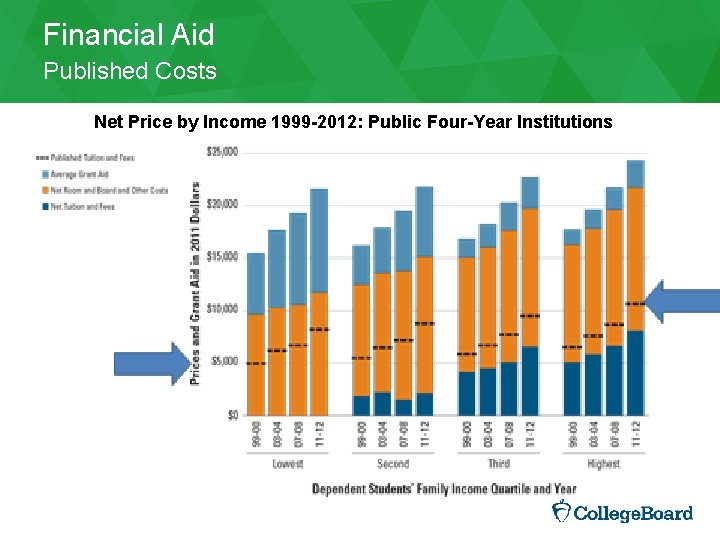

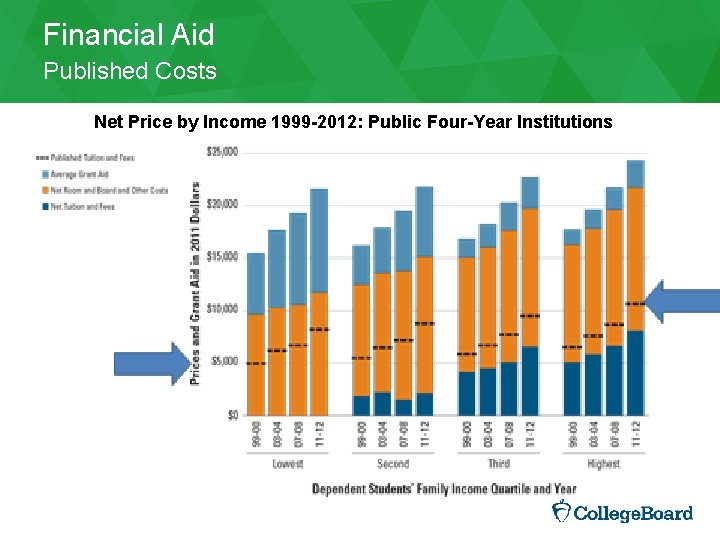

Financial Aid Published Costs Net Price by Income 1999 -2012: Public Four-Year Institutions

Financial Aid Published Costs Net Price by Cost Private Institutions

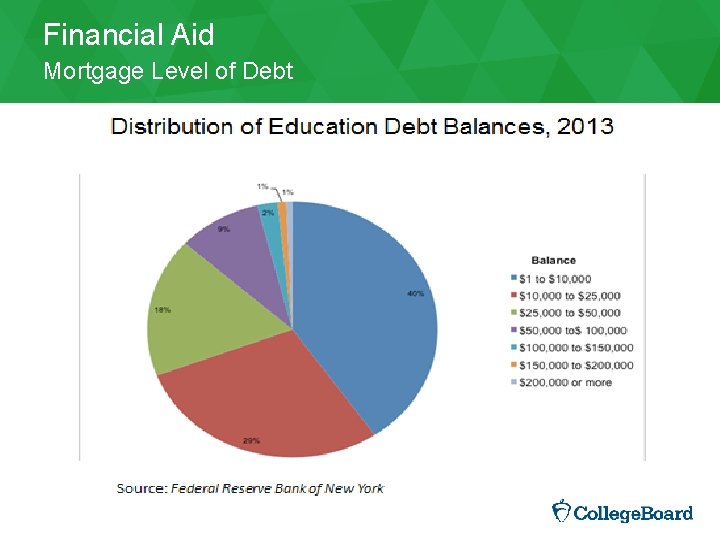

Financial Aid Mortgage Level of Debt • Myth – Students borrow over $100, 000. • The Larger Story – Only 4% of individuals with outstanding student debt owe $100, 000 or more. – Most had pursued advanced degrees! Trends in Student Aid, 2013

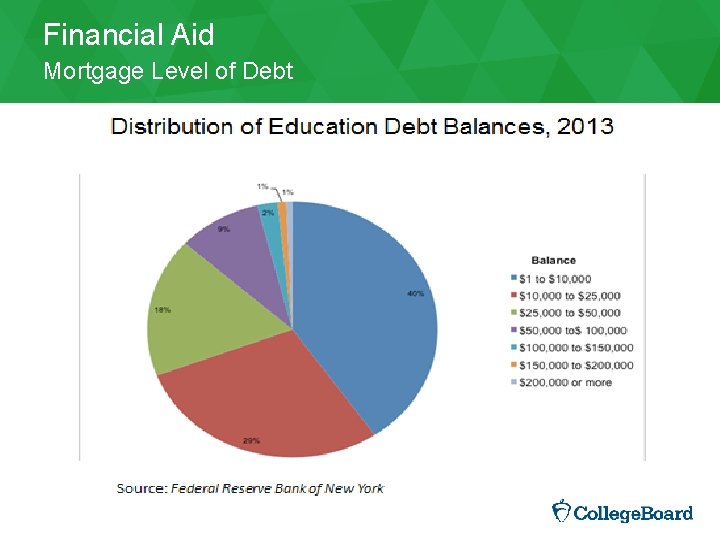

Financial Aid Mortgage Level of Debt

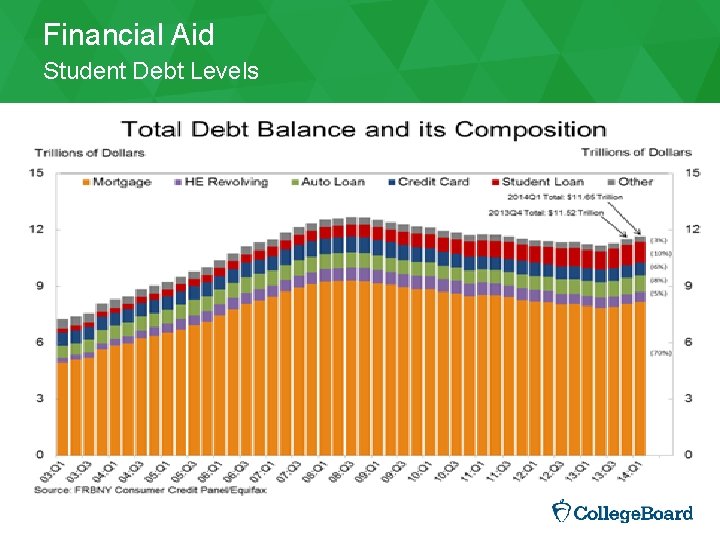

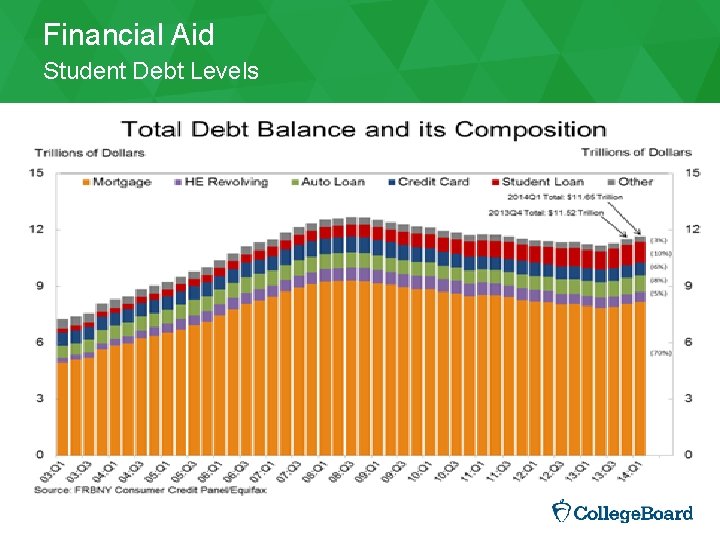

Financial Aid Student Debt Levels • Myth – Student debt is at a crisis level. • The Larger Story – More students are going to college and therefore, more students are borrowing. – Those who do are borrowing more. .

Financial Aid Student Debt Levels

Financial Aid Student Debt Levels

Financial Aid Who Qualifies for Financial Aid? • Myth – Only low-income families qualify for financial aid. • Truth – The EFC should be less than the cost of attendance for a student to qualify for need or merit-based aid.

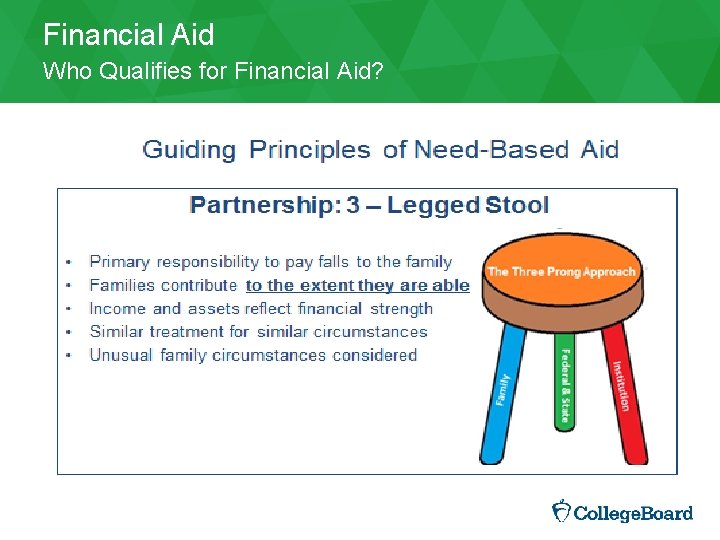

Financial Aid Who Qualifies for Financial Aid? Universal Philosophy • Students and their family(ies) have the primary responsibility to pay for college. • Sacrifice is assumed. • Financial aid assessment is NOT a cash flow analysis but rather an evaluation of an individual family’s economic strength. • The contribution is determined by a standard formula that assesses a family’s ability to pay. • Willingness is not a factor.

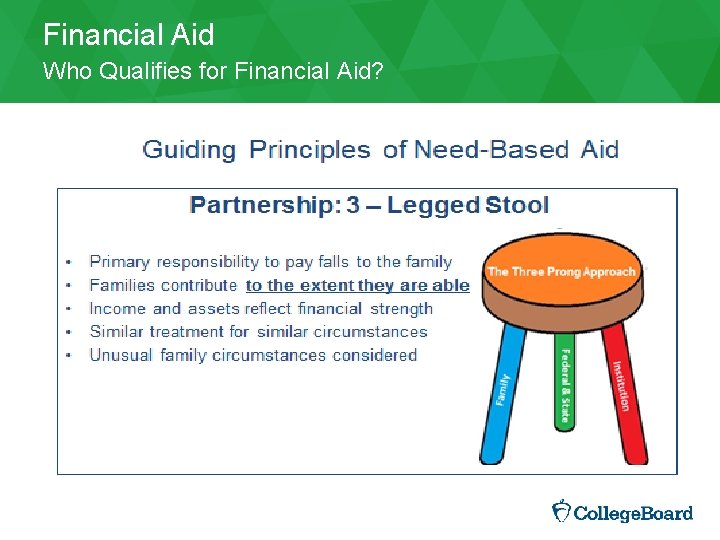

Financial Aid Who Qualifies for Financial Aid?

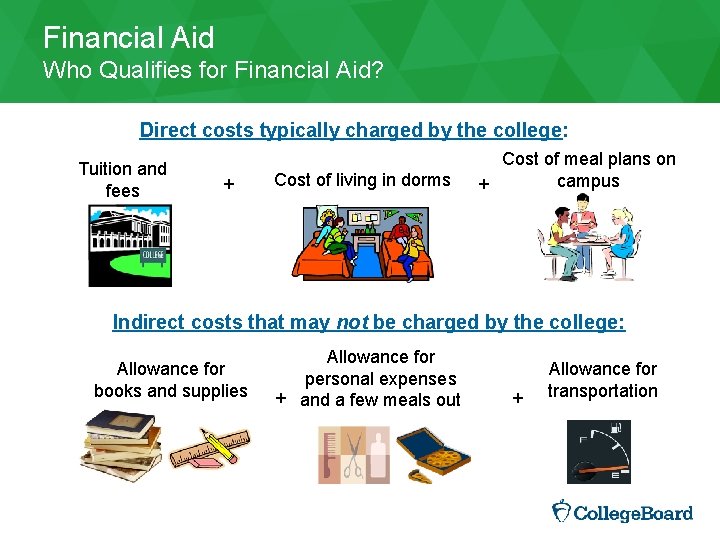

Financial Aid Who Qualifies for Financial Aid? Direct costs typically charged by the college: Tuition and fees + Cost of living in dorms Cost of meal plans on campus + Indirect costs that may not be charged by the college: Allowance for books and supplies Allowance for personal expenses + and a few meals out + Allowance for transportation

Financial Aid Who Qualifies for Financial Aid? The Expected Family Contribution (EFC) is the number that is used to determine students’ eligibility for federal student financial aid. Many states also use the EFC to determine eligibility for state aid; institutions may also use the EFC to determine eligibility for institutional aid. This number is calculated from the results of the financial information the student and family provide in the Free Application for Federal Student Aid (FAFSA). The student's EFC is reported on the Student Aid Report (SAR).

Financial Aid Saving for College • Myth – Saving for college hurts the chances of getting aid. • Truth – If you save, you won’t need to borrow or borrow as much! – The EFC includes only 5. 64% of the net worth of assets (after allowances for retirement and emergencies are removed).

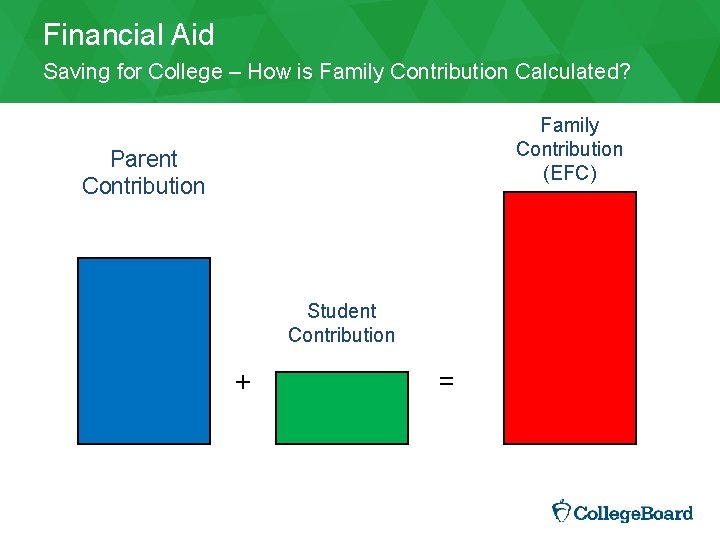

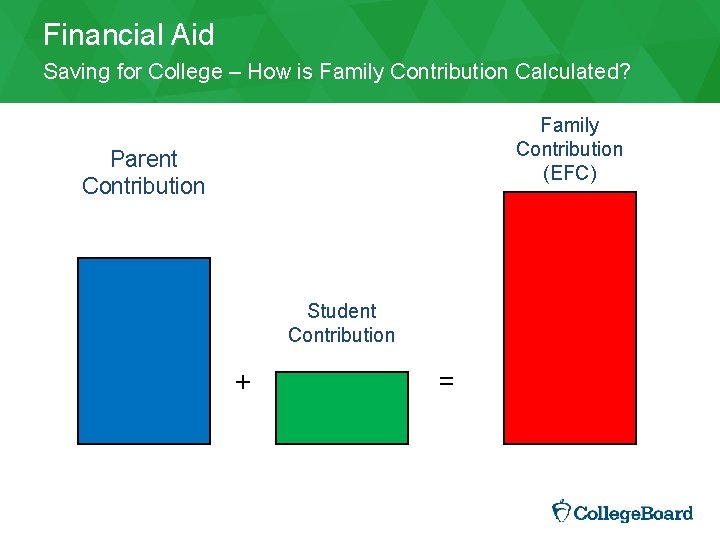

Financial Aid Saving for College – How is Family Contribution Calculated? Family Contribution (EFC) Parent Contribution Student Contribution + =

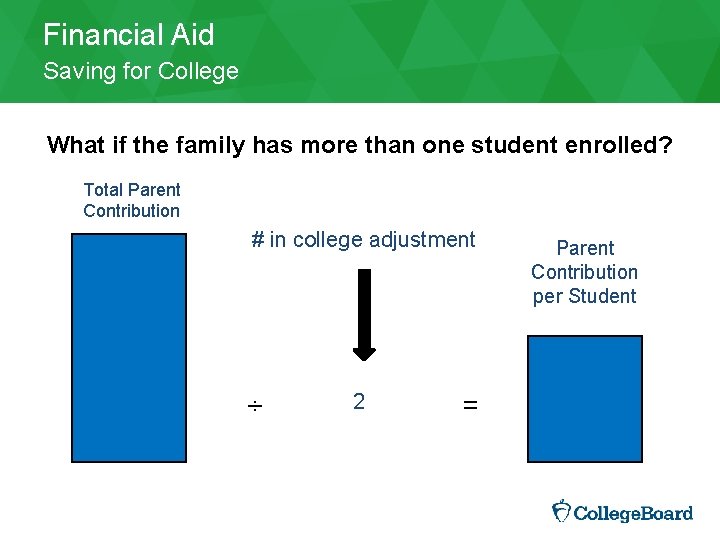

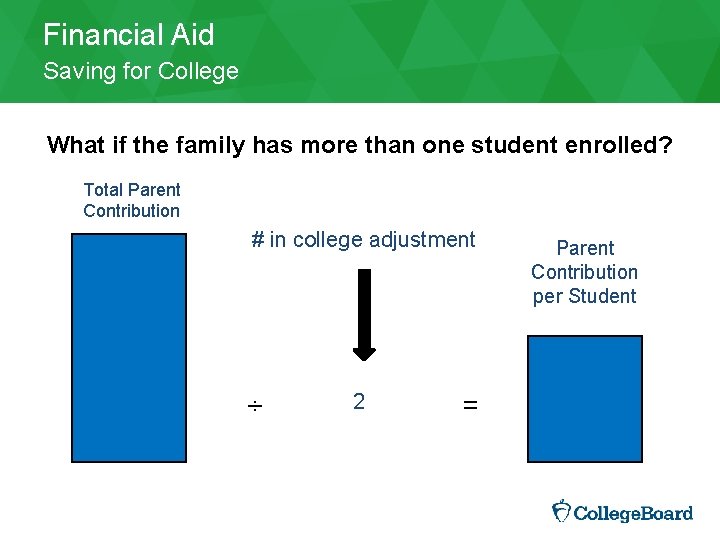

Financial Aid Saving for College What if the family has more than one student enrolled? Total Parent Contribution # in college adjustment ÷ 2 = Parent Contribution per Student

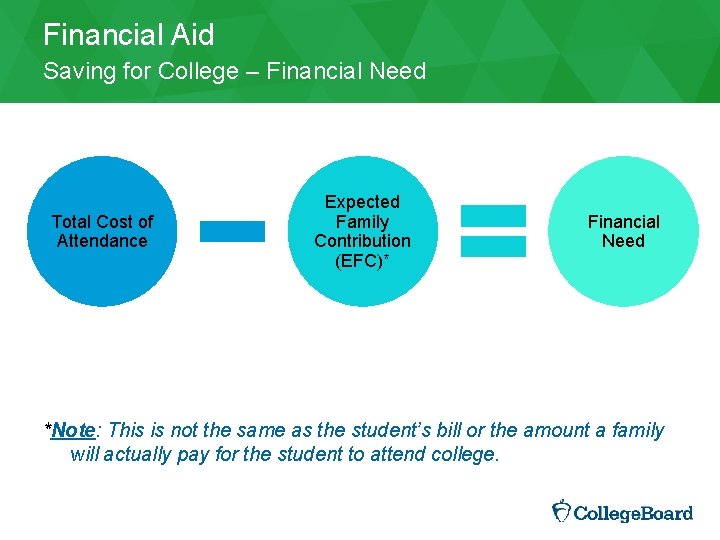

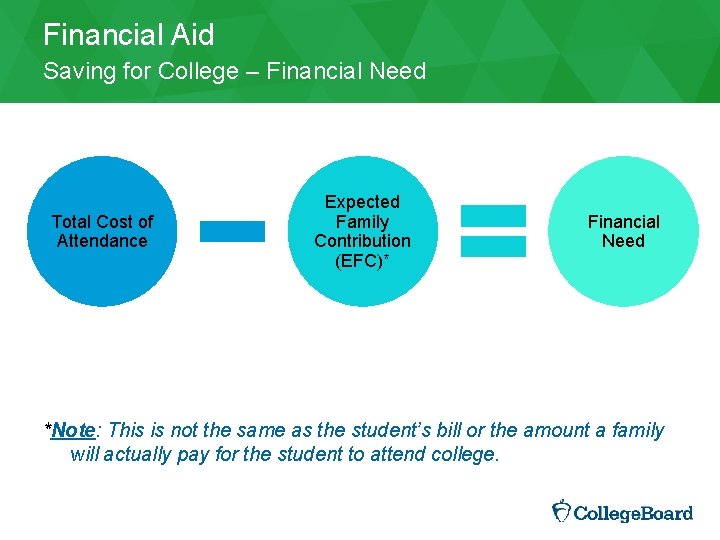

Financial Aid Saving for College – Financial Need Total Cost of Attendance Expected Family Contribution (EFC)* Financial Need *Note: This is not the same as the student’s bill or the amount a family will actually pay for the student to attend college.

Financial Aid The FAFSA • Myth – The FAFSA is too complex and takes too long to complete. • Truth – For most first-time filers, the FAFSA takes less than 30 minutes to complete. – Repeat filers spend less than 20 minutes completing the FAFSA.

Financial Aid The FAFSA may be filed at any time during an academic year, but no earlier than January 1 st prior to the academic year for which the student requests aid. For the 2016 - 2017 academic year, the FAFSA may be filed beginning January 1, 2016. While most colleges set FAFSA filing deadlines, do not forget to check for state filing deadlines. Website: https: //fafsa. gov

Financial Aid The Federal Student Aid Log-In – New Process ▶ No more PIN! ▶ Students now create an FSA ID. ▶ Yes, parents also create their own. ▶ Both the student and at least one parent will use their individual FSA ID to electronically sign the student’s FAFSA.

Financial Aid The FAFSA ▶ ▶ File federal tax returns as soon as possible. Notify the school if an extension is filed. Use the Data Retrieval Tool (DRT) to update any estimates. Be aware of the school’s deadlines. Better to provide estimated information than miss the deadline.

Financial Aid The FAFSA The FATAL Mistakes �DEADLINES �missing application dates �missing admission dates �missing information

Financial Aid Debt and Cost ▶ Myth ▶ ▶ Students borrow more because college costs more. Truth ▶ College does cost more, but families are also less prepared to pay for college. ▶ Only 51% of college bound families saved for college ▶ Age 0 - 6 years average total savings - $10, 282 ▶ Age 7 - 12 years average total savings - $16, 498 ▶ Age 13 - 17 years average total savings - $21, 416 How America Saves for College 2014, Sallie Mae

Financial Aid Cost Increases – The College ▶ Myth ▶ ▶ Students borrow more because college costs more. Truth ▶ College costs increased due to the cost of labor and other expenses. ▶ Wages to a highly educated workforce ▶ Expense increases are also outside the inflation rate ▶ Medical ▶ Retirement (tied to wages) ▶ Energy Archibald and Feldman, Forbes 8/12/2010

Financial Aid Cost Increases – The Student ▶ Myth ▶ ▶ Students borrow more because college costs more. Truth ▶ Length of time to graduate ▶ 40% of undergraduate in 4 years ▶ 58% of undergraduate in 5 years ▶ Loss of a year’s earnings

Financial Aid Less Aid ▶ Myth ▶ ▶ There is less aid available. Truth ▶ ▶ In 2013 -14, over $184, 000, 000 was awarded in financial aid to undergraduates. Grants represented 57% of the total resources awarded to the student. ▶ Another 8% are given to the family in tax credits. Trends in Student Aid, 2014

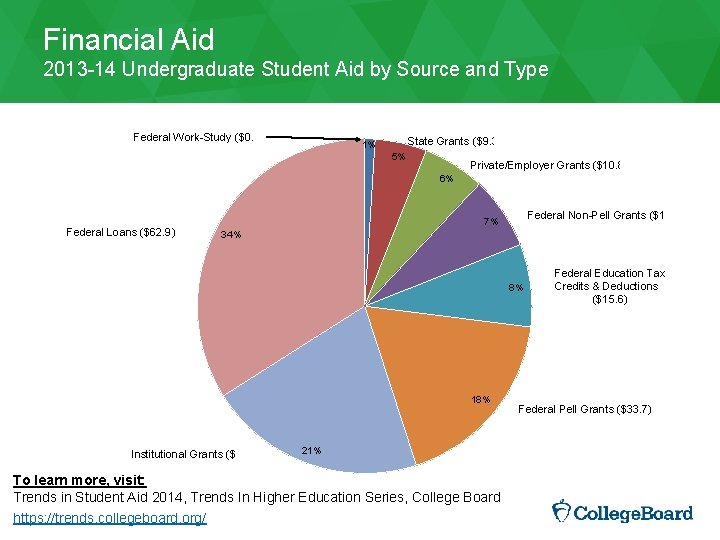

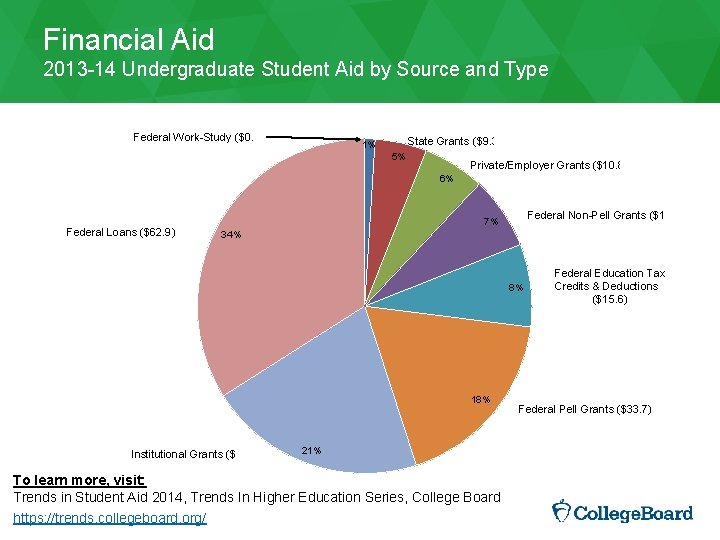

Financial Aid 2013 -14 Undergraduate Student Aid by Source and Type Federal Work-Study ($0. 9) State Grants ($9. 3) 1% 5% Private/Employer Grants ($10. 8) 6% Federal Loans ($62. 9) Federal Non-Pell Grants ($13. 4) 7% 34% 8% 18% Institutional Grants ($37. 5) 21% To learn more, visit: Trends in Student Aid 2014, Trends In Higher Education Series, College Board https: //trends. collegeboard. org/ Federal Education Tax Credits & Deductions ($15. 6) Federal Pell Grants ($33. 7)

Financial Aid Loan Repayment ▶ Myth ▶ ▶ Loans are too hard to pay back. Truth ▶ ▶ ▶ Income contingent payment plans are available. PAYE (Pay As You Earn) only asks for payment of 10% of a borrower’s net income. Allows the borrower to opt into other plans without a penalty.

Financial Aid Return on Investment ▶ Myth ▶ ▶ The return on a college degree is less because of the increase in the cost of an education. Truth ▶ A college degree is at its highest premium. ▶ College graduate salaries decreased by 5% during the Great Recession, while those without a degree had a 10 - 12% decline. ▶ The number of college graduates getting jobs remain steady throughout the Great Recession. ▶ Those without a degree experienced 8 - 10% unemployment. US Bureau of Labor Statistics

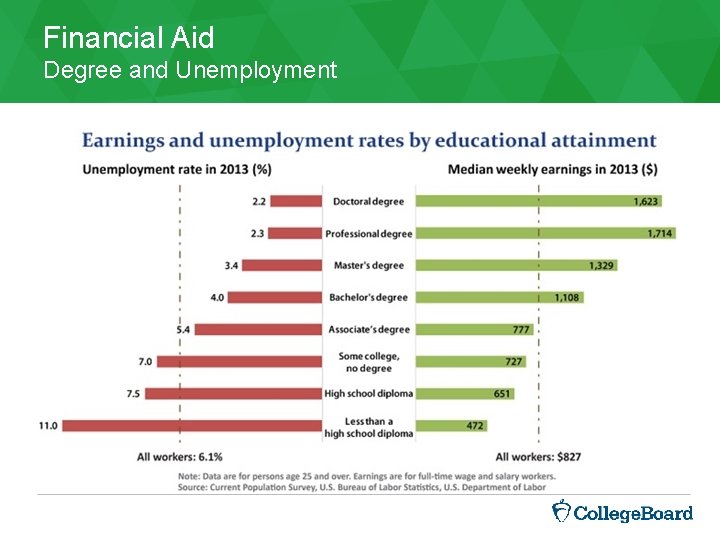

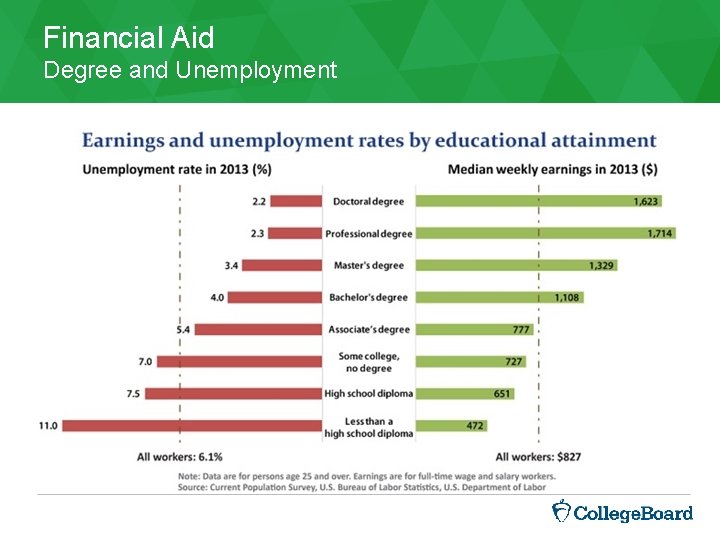

Financial Aid Degree and Unemployment

Financial Aid Bait and Switch ▶ Myth ▶ ▶ Colleges will offer grants in the first years but only offer loans in the later years. Truth ▶ If the family’s economy remains similar from year to year and the student makes satisfactory progress towards a degree, then the financial aid offered in the first year will be renewed annually.

Financial Aid Best Practices • Get your FSA IDs as soon as possible. • Attend financial aid presentations as early as the freshman year in high school. • Always ask tough questions of all offices. - Why does your college cost $_______? • Ask about medians. - Averages are influenced by the outliers. • Complete applications before the earliest deadline and know all deadlines.

Financial Aid Best Practices • Know requirements to complete awarding and disbursing – There’s more to financial aid than getting the award • When in doubt, ask a local financial aid officer • Keep all tax records up to date – File as early as possible • When possible, use the Data Retrieval Tool • Review the Student Aid Report (SAR) – Results from filing the FAFSA • Compare awards – Look at the percentages for each type of financial aid being offered

Financial Aid Tools & Resources Top 5 Things Counselors Should Tell Students About Financial Aid 1. Never rule out a college because of cost alone. 2. Compare costs before applying — Net price calculators can provide an estimate of financial aid eligibility and remaining college costs. Net price calculators should be available on every college's website. 3. Remember to apply — FAFSA deadlines are available online at https: //fafsa. ed. gov/deadlines. htm. Many colleges and universities also provide funds through an institutional application, the CSS/Financial Aid PROFILE®, and/or a state application. 4. Get advice — The financial aid office at local colleges often provides workshops or can give advice. 5. Compare awards — Look at grants, loans, and parental contributions before making a final decision on a college.

Financial Aid Tools & Resources Financial Aid Tools and Resources

Financial Aid Tools & Resources National Scholarship and Grant Resources http: //www. fastweb. com/

Financial Aid Tools & Resources National Scholarship and Grant Resources https: //bigfuture. collegeboard. org/scholarship-search

Financial Aid Tools & Resources National Scholarship and Grant Resources https: //mycollegedollars. com/

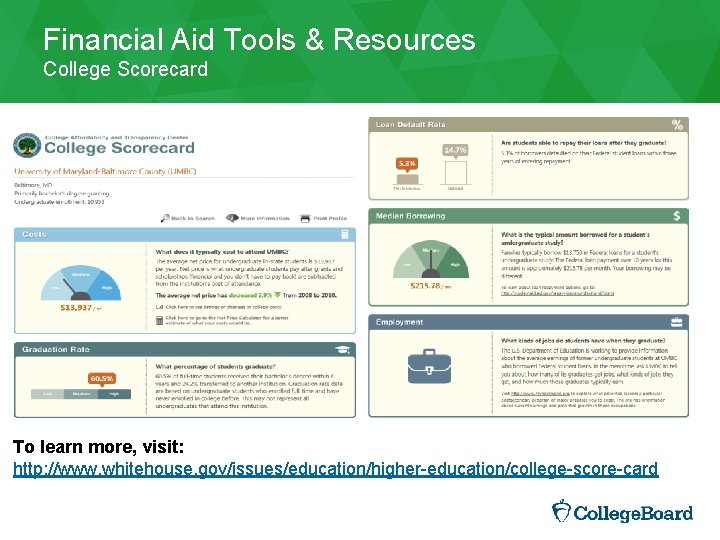

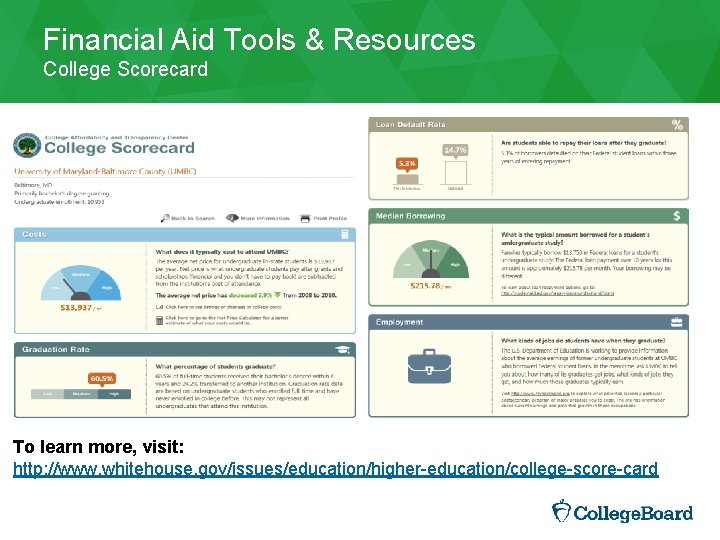

Financial Aid Tools & Resources College Scorecard To learn more, visit: http: //www. whitehouse. gov/issues/education/higher-education/college-score-card

Financial Aid Tools & Resources Federal Student Aid https: //studentaid. ed. gov/ FAFSA 4 caster https: //fafsa. ed. gov/FAFSA/app/f 4 c. Form? execution=e 1 s 1 Federal Student Aid Financial Aid Toolkit http: //www. financialaidtoolkit. ed. gov Big. Future https: //bigfuture. collegeboard. org/ Net Price Calculators http: //studentnpc. collegeboard. org/ ▶ Specific net price calculators should be found on the individual college’s website.

Financial Aid Tools & Resources College Comparison Tools College Navigator (NCES) http: //nces. ed. gov/collegenavigator/ Big. Future https: //bigfuture. collegeboard. org/compare-colleges Financial Aid Shopping Sheet (US Department of Education) http: //www 2. ed. gov/policy/highered/guid/aid-offer/annotatedshoppingsheet. pdf Award Letter Comparison Tools https: //bigfuture. collegeboard. org/pay-for-college/financial-aid-awards/compare-aid-calculator Scholarship and Grant Search Tools Fastweb http: //www. fastweb. com/ Big. Future https: //bigfuture. collegeboard. org/scholarship-search My College Dollars https: //mycollegedollars. hyfnrsx 1. com/

Financial Aid

Myths and legends quiz questions and answers

Myths and legends quiz questions and answers Tulpar turkish mythology

Tulpar turkish mythology Flower myths: narcissus, hyacinth, and adonis

Flower myths: narcissus, hyacinth, and adonis Polish urban legends

Polish urban legends Legends and myths difference

Legends and myths difference Myth legend fable

Myth legend fable Fables and legends

Fables and legends Myths and legends of king arthur

Myths and legends of king arthur Hediod

Hediod Brer possum's dilemma

Brer possum's dilemma Folk examples

Folk examples Irish myths and legends lesson plans

Irish myths and legends lesson plans Equation for drag

Equation for drag Myths and legends jeopardy

Myths and legends jeopardy Anasazi mythology

Anasazi mythology What are legends?

What are legends? Hurricanes myths and facts

Hurricanes myths and facts Myths and fallacies about non communicable diseases

Myths and fallacies about non communicable diseases Folktales examples

Folktales examples Heroes myths and legends

Heroes myths and legends First aid merit badge first aid kit

First aid merit badge first aid kit Greenhill medical centre

Greenhill medical centre Creation myth definition

Creation myth definition What is software myths

What is software myths Myths about pirates

Myths about pirates Myths about comets

Myths about comets 5 myths about attic ventilation

5 myths about attic ventilation Types of myths

Types of myths Test chapter 10 geriatric care

Test chapter 10 geriatric care Dogon creation myth

Dogon creation myth Myths of business ethics

Myths of business ethics Mythological allusion

Mythological allusion Generic viagra myths

Generic viagra myths Business ethics is a personal, individual affair

Business ethics is a personal, individual affair Bulgarian animals

Bulgarian animals Ex nihilo myths

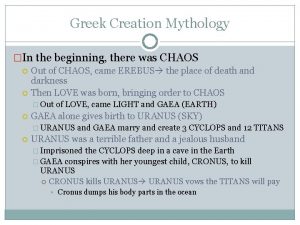

Ex nihilo myths In the beginning there was chaos

In the beginning there was chaos Management myths in software engineering

Management myths in software engineering Practitioner myths in software engineering

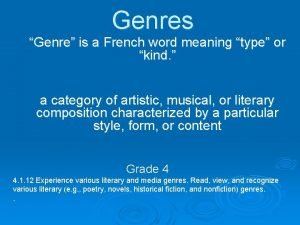

Practitioner myths in software engineering What is genre in french

What is genre in french Practitioner myths in software engineering

Practitioner myths in software engineering Why do people tell myths

Why do people tell myths Greek god thesis

Greek god thesis Famous legends around the world

Famous legends around the world Myths about termites

Myths about termites