Fin 464 Chapter 1 An Overview of the

- Slides: 16

Fin 464 Chapter 1: An Overview of the Changing Financial - Services Sector Instructor: Rushdy MD Bakth

1 -2 Introduction • A bank is a financial intermediary whose core activity is to channel funds from savers to borrowers increasing the economic efficiency by productive allocation of resources. • Make payments • Financial advice • Finance public facilities by purchasing government notes and bonds • Source of Working capital • Banks are the principal source of credit (loanable funds) for millions of individuals and families and for many units of government. • The credit crisis of 2007 -2009 dramatically altered the banking landscape. • Worldwide banks grant more installment loans to consumers (individuals and families) than any other financial-service provider. • Bank and non-bank financial firms are declining in numbers, consolidating into fewer but also much larger companies.

1 -3 What Is a Bank? A commercial bank can be defined in terms of: 1. The economic functions it performs: They transfer funds from savers to borrowers and in paying for goods & service 2. The services it offers its customers: Bank services have expanded from traditional services (checking & debit accounts, credit cards, savings plans, loans) and including investment banking, insurance protection, financial planning, advice for merging companies, the sale of risk-management services, and so on. 3. The legal basis for its existence: A bank is any business offering deposits subject to withdrawal on demand making commercial or business nature loans.

1 -4 What Is a Bank? (continued) ▫ As organizations bearing the label of banks (investment banks, mortgage banks, merchant banks, universal banks) and several industrial companies invaded to control bank or offer bank like services, regulators decided to add another factor so that they can’t claim exemption from being regulated as a bank. ▫ Congress then defined a bank as any institution that could qualify for deposit insurance administered by the Federal Deposit Insurance Corporation (FDIC) ▫ In the U. S. , a bank had come to be defined, not so much by its array of service offerings, but by the government agency insuring its deposits. ▫ In Bangladesh, Bank Deposit Insurance Scheme (BDIS) run under Central Bank of Bangladesh

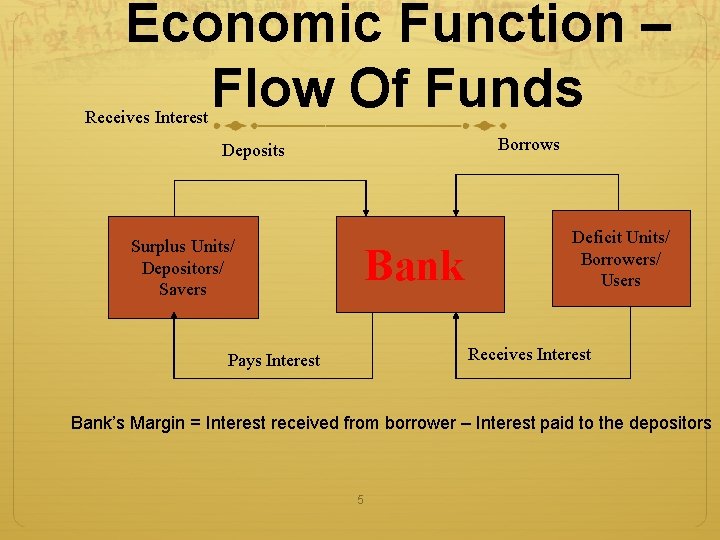

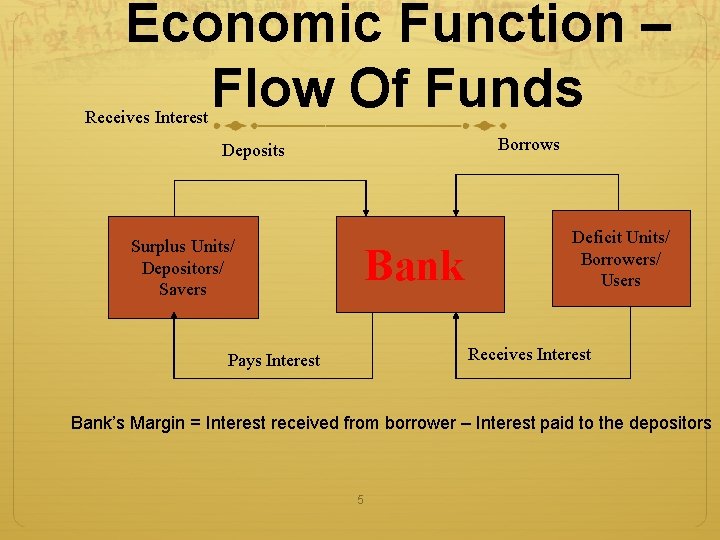

Economic Function – Flow Of Funds Receives Interest Borrows Deposits Surplus Units/ Depositors/ Savers Bank Deficit Units/ Borrowers/ Users Receives Interest Pays Interest Bank’s Margin = Interest received from borrower – Interest paid to the depositors 5

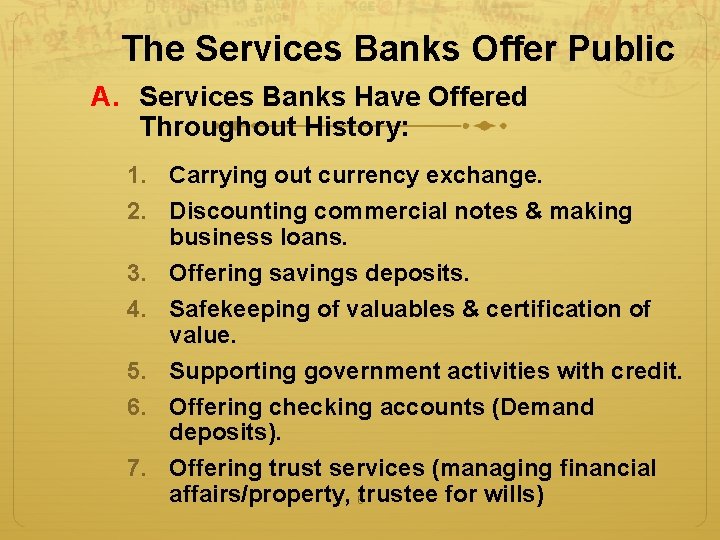

The Services Banks Offer Public A. Services Banks Have Offered Throughout History: 1. Carrying out currency exchange. 2. Discounting commercial notes & making business loans. 3. Offering savings deposits. 4. Safekeeping of valuables & certification of value. 5. Supporting government activities with credit. 6. Offering checking accounts (Demand deposits). 7. Offering trust services (managing financial affairs/property, 6 trustee for wills)

The Services Banks Offer Public----Contd B. Services Banks have Developed More Recently: 1. Granting Consumer Loans. 2. Financial Advising. 3. Cash Management. 4. Offering Equipment Leasing. 5. Making Venture Capital Loans. 6. Selling Insurance. 7. Selling Retirement Plans 8. Security Brokerage. 9. Offering Mutual Funds & Annuities. 10. Offering Merchant Banking Services. 7

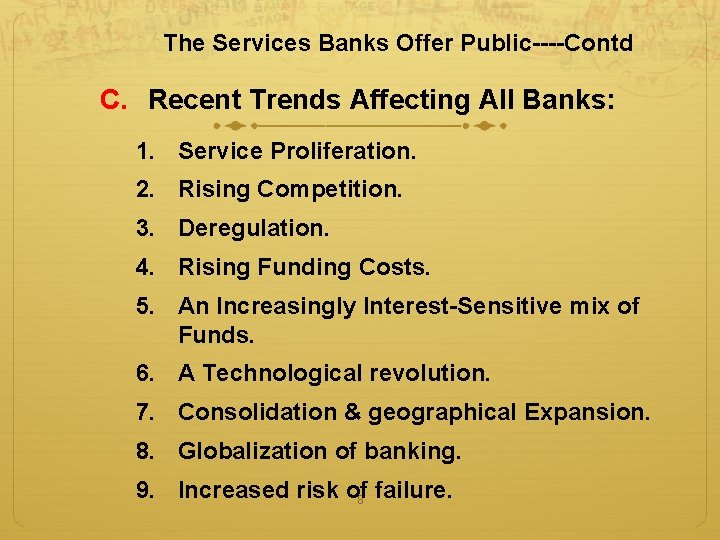

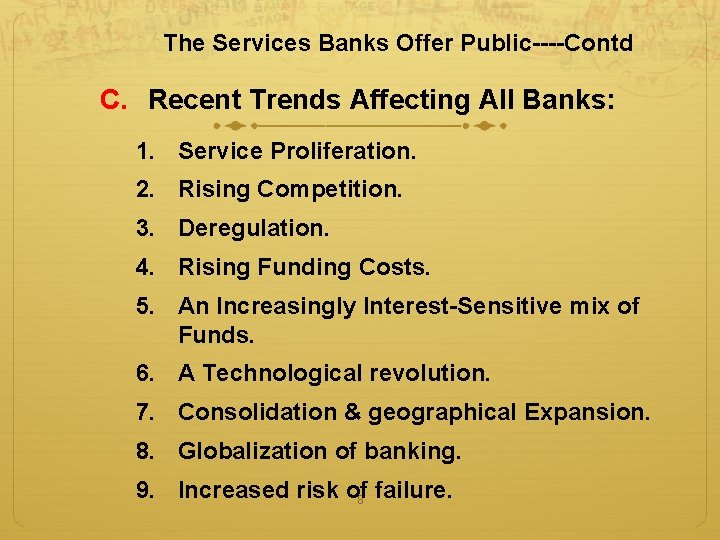

The Services Banks Offer Public----Contd C. Recent Trends Affecting All Banks: 1. Service Proliferation. 2. Rising Competition. 3. Deregulation. 4. Rising Funding Costs. 5. An Increasingly Interest-Sensitive mix of Funds. 6. A Technological revolution. 7. Consolidation & geographical Expansion. 8. Globalization of banking. 9. Increased risk of 8 failure.

Considerations While Choosing a Bank 1. Features 2. Services 3. Fees 4. ATMs 9

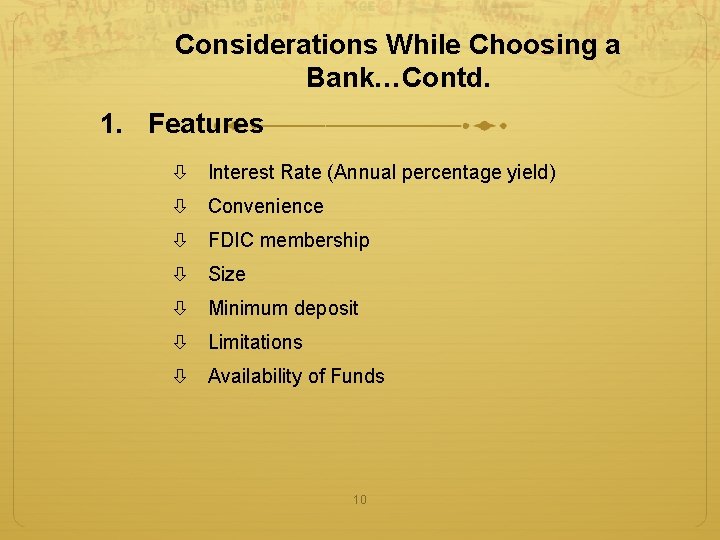

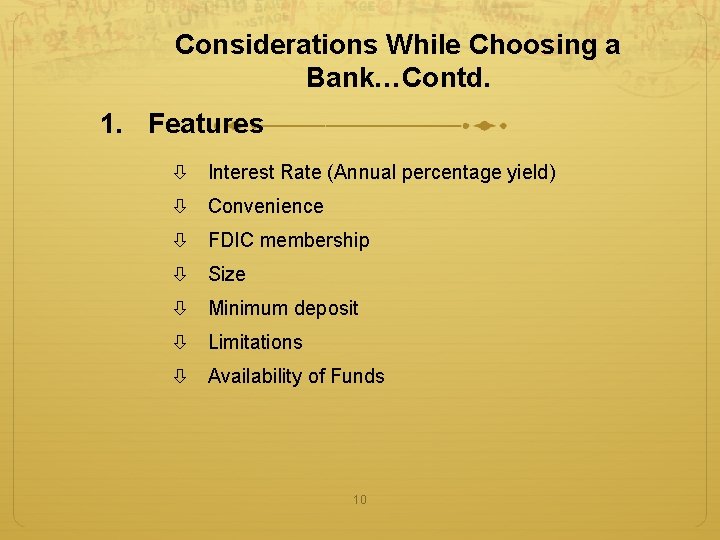

Considerations While Choosing a Bank…Contd. 1. Features Interest Rate (Annual percentage yield) Convenience FDIC membership Size Minimum deposit Limitations Availability of Funds 10

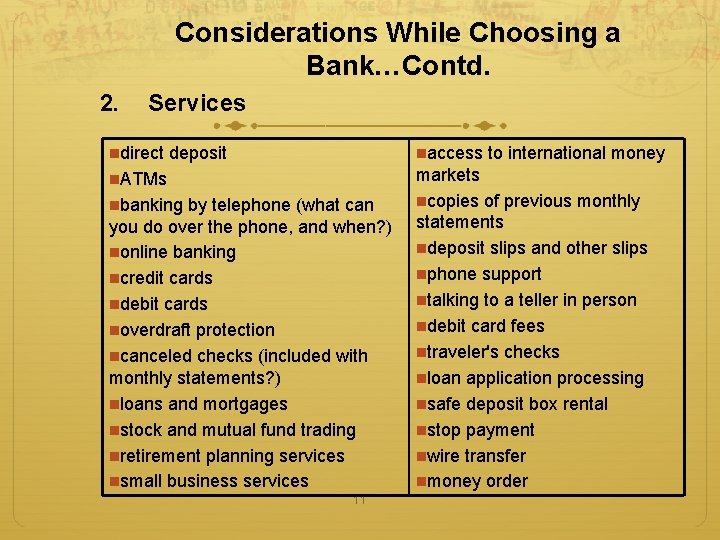

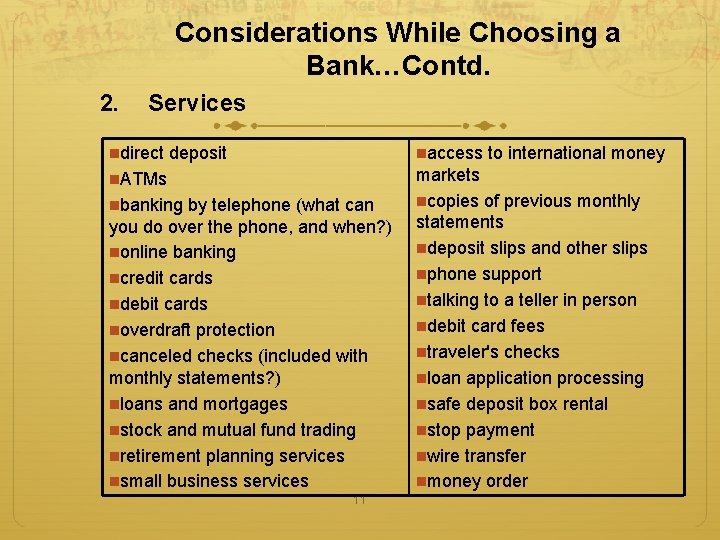

Considerations While Choosing a Bank…Contd. 2. Services ndirect deposit naccess n. ATMs nbanking by telephone (what can you do over the phone, and when? ) nonline banking ncredit cards ndebit cards noverdraft protection ncanceled checks (included with monthly statements? ) nloans and mortgages nstock and mutual fund trading nretirement planning services nsmall business services 11 to international money markets ncopies of previous monthly statements ndeposit slips and other slips nphone support ntalking to a teller in person ndebit card fees ntraveler's checks nloan application processing nsafe deposit box rental nstop payment nwire transfer nmoney order

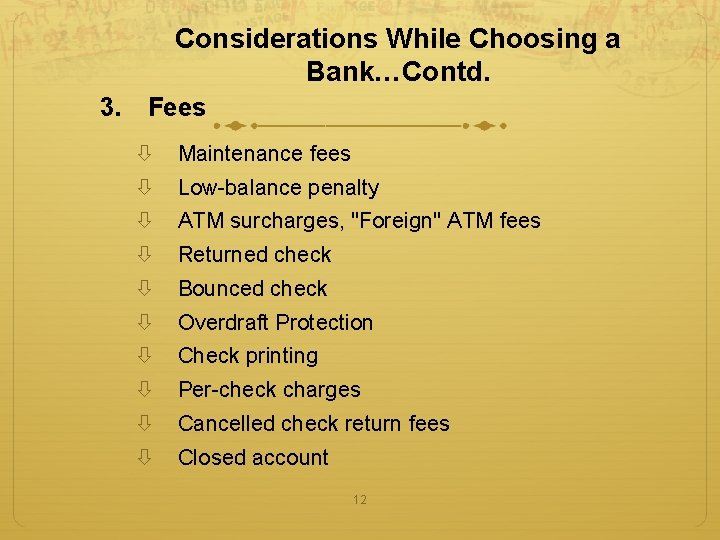

Considerations While Choosing a Bank…Contd. 3. Fees Maintenance fees Low-balance penalty ATM surcharges, "Foreign" ATM fees Returned check Bounced check Overdraft Protection Check printing Per-check charges Cancelled check return fees Closed account 12

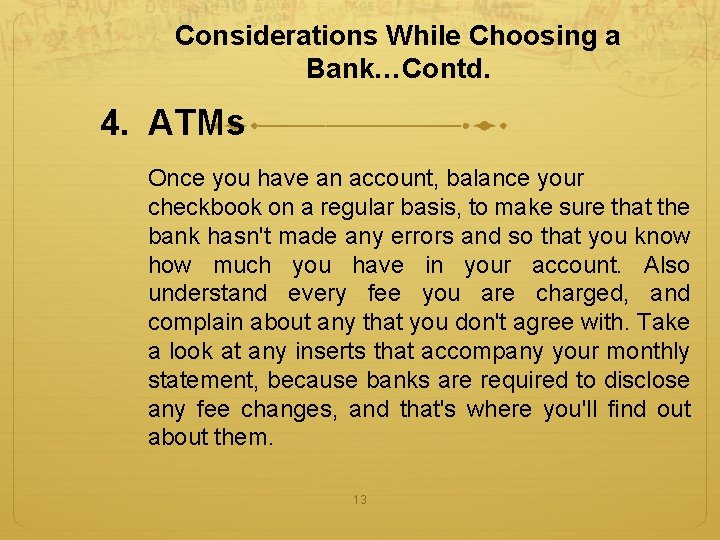

Considerations While Choosing a Bank…Contd. 4. ATMs Once you have an account, balance your checkbook on a regular basis, to make sure that the bank hasn't made any errors and so that you know how much you have in your account. Also understand every fee you are charged, and complain about any that you don't agree with. Take a look at any inserts that accompany your monthly statement, because banks are required to disclose any fee changes, and that's where you'll find out about them. 13

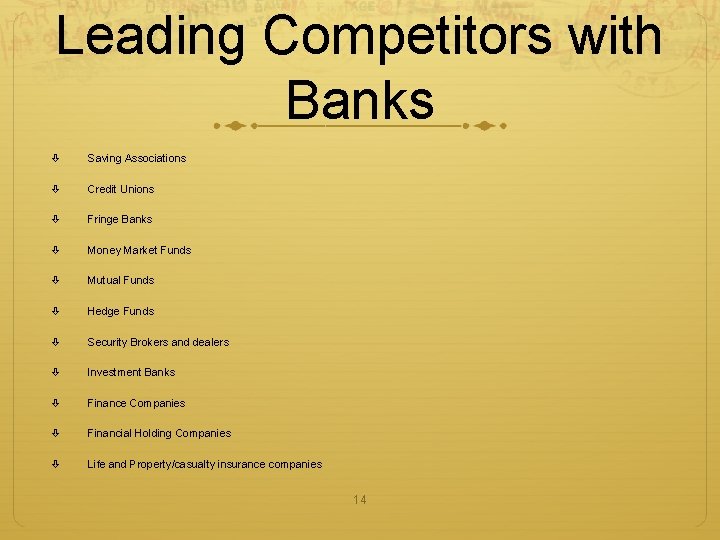

Leading Competitors with Banks Saving Associations Credit Unions Fringe Banks Money Market Funds Mutual Funds Hedge Funds Security Brokers and dealers Investment Banks Finance Companies Financial Holding Companies Life and Property/casualty insurance companies 14

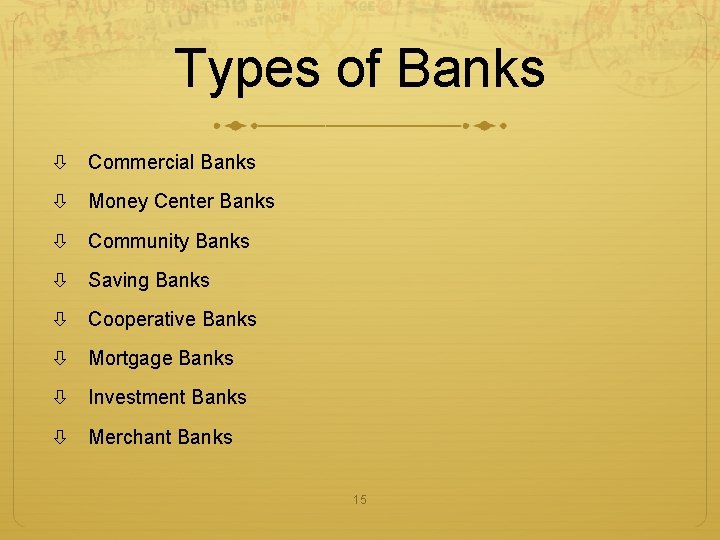

Types of Banks Commercial Banks Money Center Banks Community Banks Saving Banks Cooperative Banks Mortgage Banks Investment Banks Merchant Banks 15

Types of Banks International Banks Wholesale Banks Retail Banks Affiliated Banks Virtual Banks Fringe Banks 16

Spf fin fod fin

Spf fin fod fin Faces superposables

Faces superposables Wees stil voor het aangezicht

Wees stil voor het aangezicht Hoeveel is 1 lb

Hoeveel is 1 lb Mil-std-464

Mil-std-464 Erd normalization

Erd normalization Kin 464

Kin 464 Industrial information system

Industrial information system Isys 464

Isys 464 Alur sertifikasi halal

Alur sertifikasi halal Sql certification microsoft

Sql certification microsoft Isys 464

Isys 464 Isys 464

Isys 464 Kin 464

Kin 464 Digital systems engineering dally

Digital systems engineering dally Hình ảnh bộ gõ cơ thể búng tay

Hình ảnh bộ gõ cơ thể búng tay Frameset trong html5

Frameset trong html5