India Economic Overview FIN 680 D FIN 360

- Slides: 34

India: Economic Overview FIN 680 D/ FIN 360 A MAR 680 V/ MAR 356 E/ INB 670 C P. V. Viswanath

Economic History: 1950 -1990 Post-independence India had a mixed economy, i. e. including both private and public sectors. The reasons for a strong public sector were: – Greate inequality in income distribution – doubts as to the viability of free markets – Free trade would probably have led to exploitation by stronger foreign countries • Exports were seen as a drain of resources from the country.

Post-independence economy Foreign Investment was seen as foreign domination. The quickest path to economic development was seen to be rapid industrialization, which would probably not happen without government intervention – Capital goods and heavy industry were seen as particularly needed. – Planning was needed to ensure industrial growth and the concomitant agricultural and service growth, as well as employment growth

Objectives The broad objectives were: – Rapid growth in production with a view to achieving a higher level of national and per -capita income. – Full employment – Reduction of inequalities in income and wealth – Socialistic pattern of society with a democratic framework, based on equality and justice and absence of exploitation.

Policy Measures for Industrial Development Trade and Regulatory Regimes designed to shield industrial producers from competition – High tariffs – Industrial licensing of production and investment – Monopoly and Restrictive Trade Practices (MRTP) Act – Foreign Exchange Regulation Act (FERA) – Export Restrictions

Industrial Policy Directed allocation of subsidized credit through the commercial and developmental banking system Administered interest rates and financial institutions required to lend for specific purposes at the administered rates. Fixed, overvalued exchange rates; this ensured cheap imports for the government.

Industrial & Agricultural Policy Price control for many products Rigid labor laws that made it difficult to lay off workers. Direct public investment in industrial activities. Management of the agricultural sector to ensure reasonable supplies of food grains, edible oils, sugar and cotton to the domestic market.

Agricultural Policy Procurement prices were fixed, which , in times of surplus, worked as a minimum support price. At times of deficit, the government mandatorily procured a part of the grain at the procurement price and distributed it to poorer people through ration shops. Fertilizer, irrigation, power and credit were subsidised for the agricultural sector.

Agricultural and Fiscal Policy The need to mop up excess production led to trade restrictions. – Quantitative restrictions on exports and imports, through licensing – Canalization – the use of a single parastatal for imports and exports; the use of minimum export prices. – High income tax rates

Social Policies Higher education was emphasized (IITs and IIMs) Growth-oriented strategy as a means of mitigating poverty and unemployment. However, structural inequalities in land ownership, availability of water, access to credit etc. led to growth without income and employment growth for poorer people.

Social Policies Land reform (at least in some states) Alleviation of poverty through special programs and policies, such as asset creation programs, employment generation programs, minimum needs programs. Intervention programs to solve the problems of malnutrition and hunger.

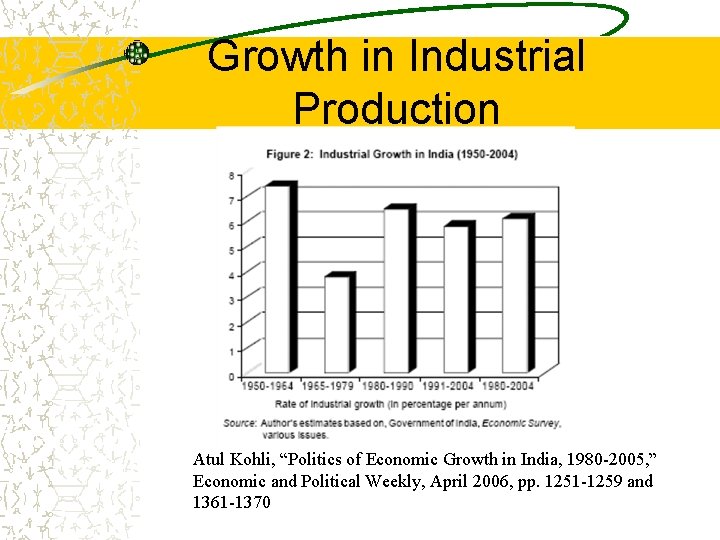

Did the policies work? Industry grew 6% p. a. between 1951 and 1989 There was little competition; hence there was little R&D. The capital-input ratio went up considerably; total factor productivity dropped. Capacity utilization fell. Deeply entrenched interest groups.

Agricultural Progress Between 1950 and 1980, food grain production increased by 2. 8% p. a. , due primarily to productivity gains and multiple cropping. But, investment growth slowed. R&D suffered, development of irrigation lagged behind plan targets. There was a substantial rise in subsidies for food and fertilizer and for credit, water and electricity. India became self-reliant, but at great cost.

Social Progress From 1970 -88, the proportion of population below poverty dropped from 46. 17% to 37. 76% in urban areas and from 58. 75% to 48. 69% in rural areas. Average life expectancy improved from 32. 1 in 1950 -51 to 58. 7 in 1990 -91. The death rate dropped from 27. 4 to 12. 5 during the same period. Literacy was 52. 2% in 1990 -91 compared to 18. 33% in 1950 -51. But compared to other developing countries, this was not good.

The crisis and the change A massive rise in the government deficit spilled over to the current account deficit because it was financed by external debt. External shocks, such as increased oil prices, decreased access to concessionary loans from abroad Structural rigidities in the Indian economy made Indian products non-

The solution A twofold solution: – Make the economic structure more competitive – Contain the government deficit Effects: – Structural Change and – Fiscal stabilization.

Initial Reforms Trade policy reforms have done away with most quantitative restrictions and reduced tariff levels Industrial policy has removed barriers to entry and limits on growth in the size of firms Regimes foreign investment and foreign technology have been liberalized considerably Domestic tax structure has been

Second-generation reforms Privatization of public sector undertakings – Very slow, but steady. BHEL Exit policy for labor Reforms of the agricultural sector Reforms of the state government

Real Net National Product

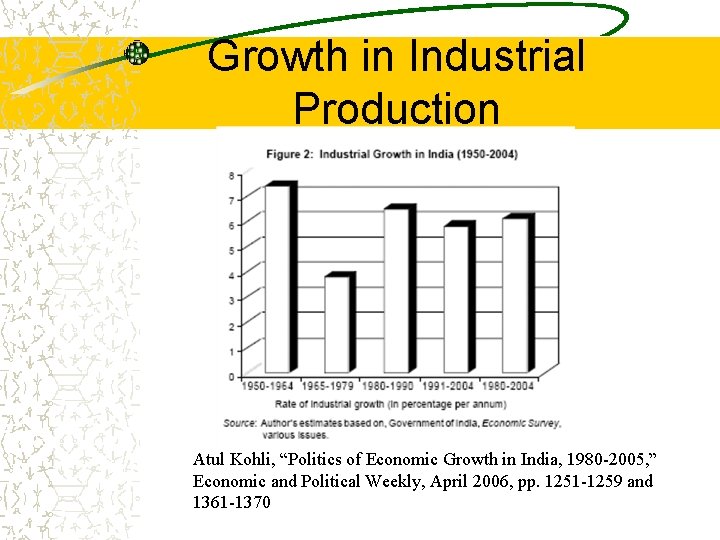

Growth in Industrial Production Atul Kohli, “Politics of Economic Growth in India, 1980 -2005, ” Economic and Political Weekly, April 2006, pp. 1251 -1259 and 1361 -1370

Changes post-1991 Disparity in growth across states Move towards service sector Lack of industrial growth Income inequalities High poverty in the rural sector – farmer suicides Continued casteism, gender inequality, communal unrest

Microfinance Lack of rural development was thought to be due to lack of production assets and credit. The government introduced easy credit programs through Regional Rural Banks. These banks improved access to credit of better-off farmers, but failed to reach the vast numbers of landless people, microentrepreneurs, agricultural labourers and illiterate women. Cheap credit skewed development to richer farmers.

Microfinance Early Rural Credit programs failed because: – procedures of rural banks were unduly complicated and costly – the sole emphasis on production loans was ill-guided – the poor were able to save, but had no opportunity of depositing their savings – transaction costs were prohibitive – financial products were unsuitable

Microfinance in India National Bank for Agriculture and Rural Development (NABARD) concluded from a study that: – Microfinance programs have to be savingsled, not credit-driven. – The poor have to have a say in their design. The NABARD program with the help of the RBI based itself on the work of selfhelp groups (SHGs).

SHGs are successful because they are self-directed, largely homogeneous in terms of caste and activity, build a common fund from very small regular savings and interest income lend to their members for periods of 1 -3 months at an interest rate of 2 -3% per month.

SHG Banking The NABARD program piggy-backs on the work of established SHGs by providing them refinance. This program works because India already has in place a network of rural banks. By March 2005 SHG banking reached 1. 6 million savings-based groups with 24 million members, covering over 120 million people from the lowest strata of the rural population. The program is in the hands of local agencies, driven by local SHG ownership.

Microfinance Why does it work? Incentives Group Monitoring

Economic Discrimination Two theories of employee discrimination: – Statistical Discrimination – desired characteristics are more prevalent in the sought-after group. Hence employees belonging to this group are preferred. – A recent study concluded that SC/ST graduates of the 2006 IIM-Ahmedabad batch got jobs with lower pay offers. – The study found that after adjusting for

Economic Discrimination Preference-Based Discrimination (Becker) If employers prefer to associate with employees of a certain background, then that characteristic will be priced – employees of the favored group will be preferred even if there is no difference on efficiency grounds. This may be changed by advertising,

Capital Account Convertibility CAC based on theory that capital will flow from high capital-endowment countries to low capital-endowment countries, from low-returnto-capital countries to high-return-to-capital countries. But CAC often led to movement of capital from developing countries to developed countries. One reason is information asymmetry problems in developing countries combined with contract enforcement difficulties.

Capital Account Convertibility Preconditions: – Low governmental fiscal deficit as a proportion of revenues – Contract enforcement – Line of credit

Shareholder Dispersion: Why? Helps stock market liquidity Which, in turn, helps market efficiency and – Information aggregation Prevents control of government by corporate sector, leading to subversion of political system. From the firm’s point of view, IPOs directed to shareholders at large, rather than Financial Institutions will keep the cost of capital lower. This will ensure economic efficiency.

Shareholder Dispersion: Why not? Agency costs – Leads to divergence between managerial goals and shareholder goals – Reduced investment in monitoring of managers – Inefficient investment Need strong market for corporate control and well-regulated securities market to offset this. Empirically, dispersed share-ownership

Shareholder Dispersion: The facts As of end Mar 2007, promoters held 54. 94% of total shares, individuals held 13. 78% and institutional holdings accounted for 14. 64%