Economic Impacts of COVID19 Summary Understanding the impacts

- Slides: 19

Economic Impacts of COVID-19: Summary Understanding the impacts of COVID-19 – Summary Update Prepared by Economy & Planning: Research & Intelligence Team Updated 23. 10. 2020

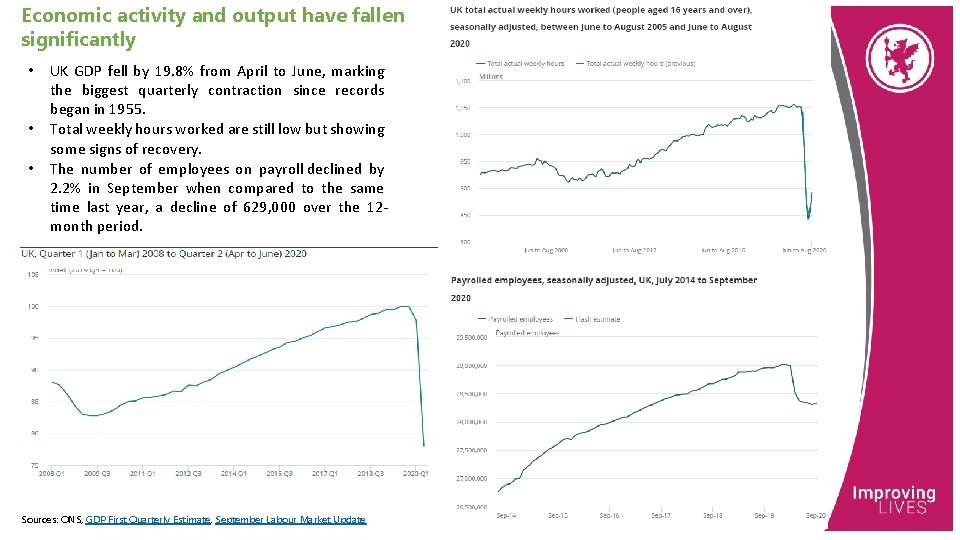

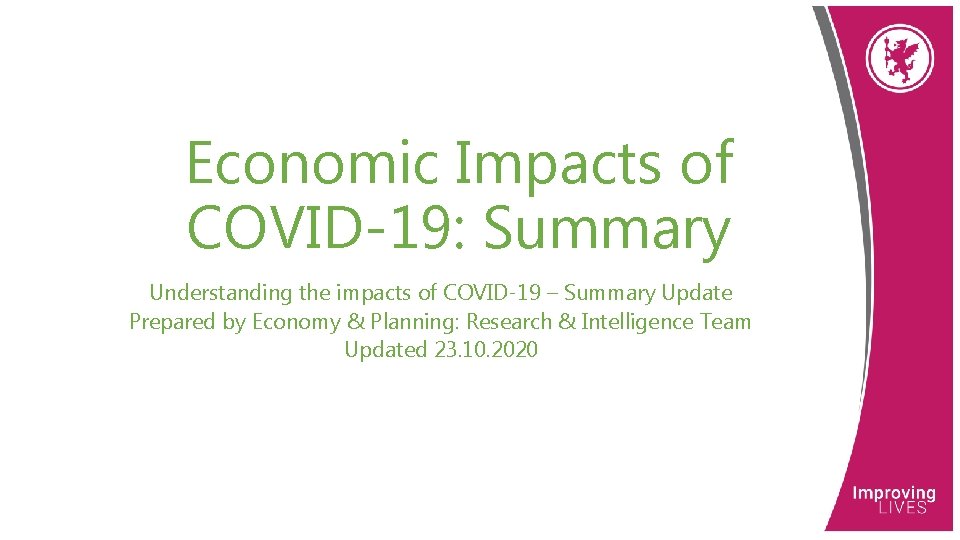

Economic activity and output have fallen significantly • • • UK GDP fell by 19. 8% from April to June, marking the biggest quarterly contraction since records began in 1955. Total weekly hours worked are still low but showing some signs of recovery. The number of employees on payroll declined by 2. 2% in September when compared to the same time last year, a decline of 629, 000 over the 12 month period. Sources: ONS, GDP First Quarterly Estimate, September Labour Market Update

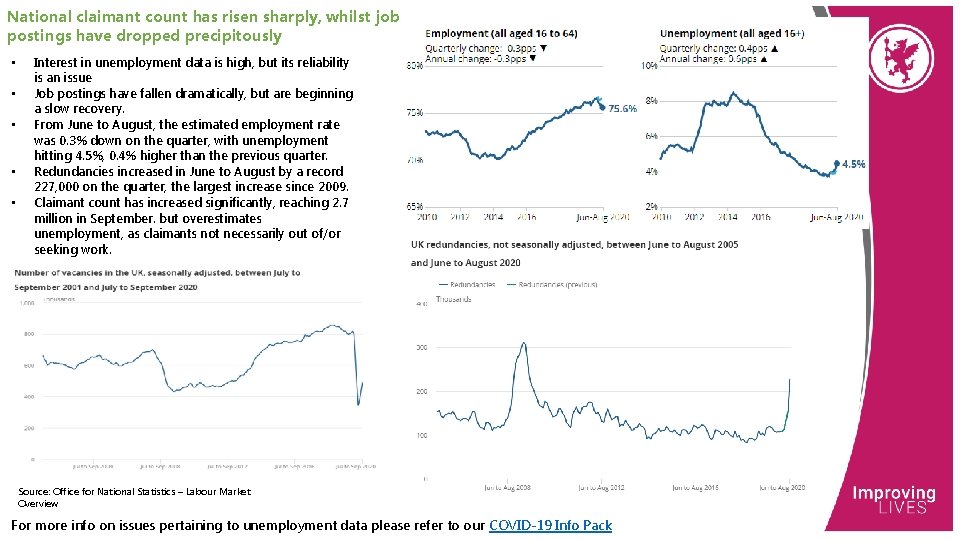

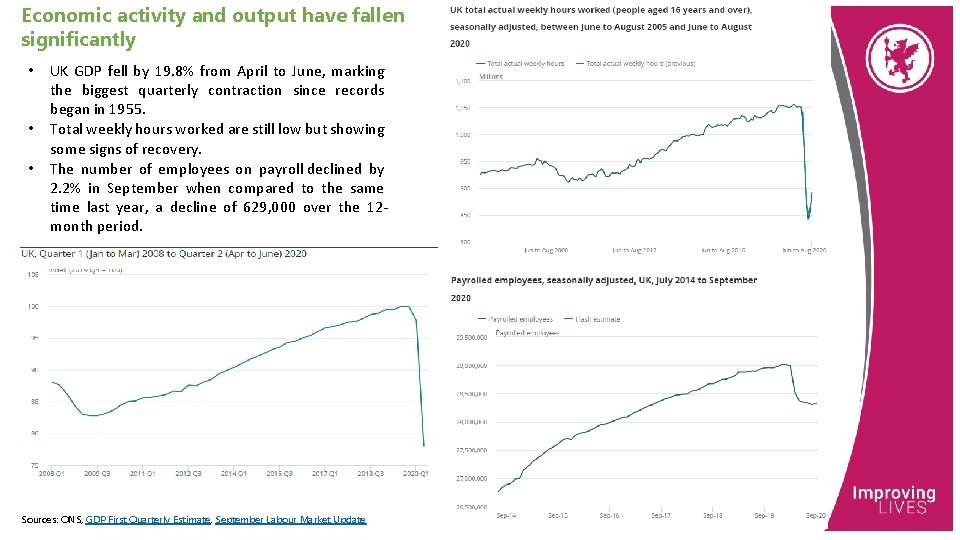

National claimant count has risen sharply, whilst job postings have dropped precipitously • • • Interest in unemployment data is high, but its reliability is an issue Job postings have fallen dramatically, but are beginning a slow recovery. From June to August, the estimated employment rate was 0. 3% down on the quarter, with unemployment hitting 4. 5%, 0. 4% higher than the previous quarter. Redundancies increased in June to August by a record 227, 000 on the quarter, the largest increase since 2009. Claimant count has increased significantly, reaching 2. 7 million in September. but overestimates unemployment, as claimants not necessarily out of/or seeking work. Source: Office for National Statistics – Labour Market Overview For more info on issues pertaining to unemployment data please refer to our COVID-19 Info Pack

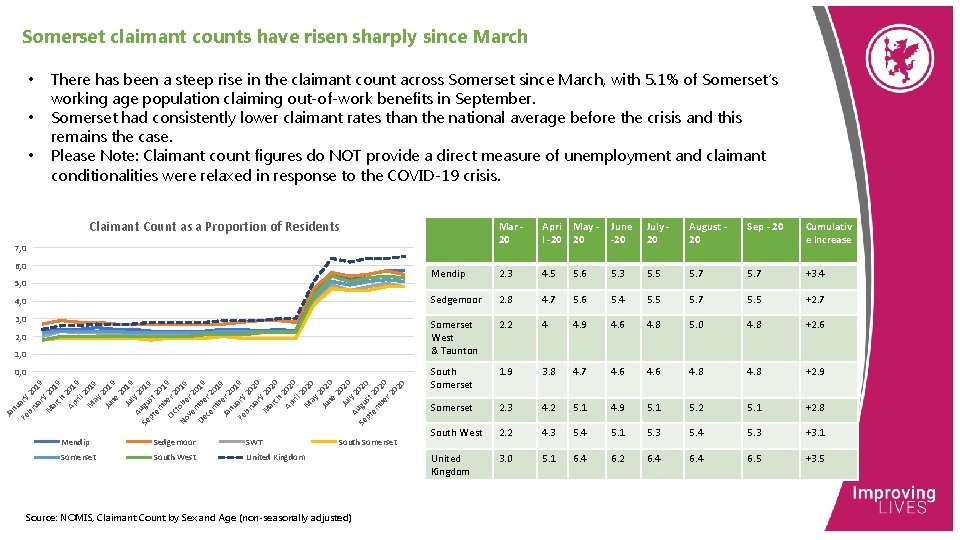

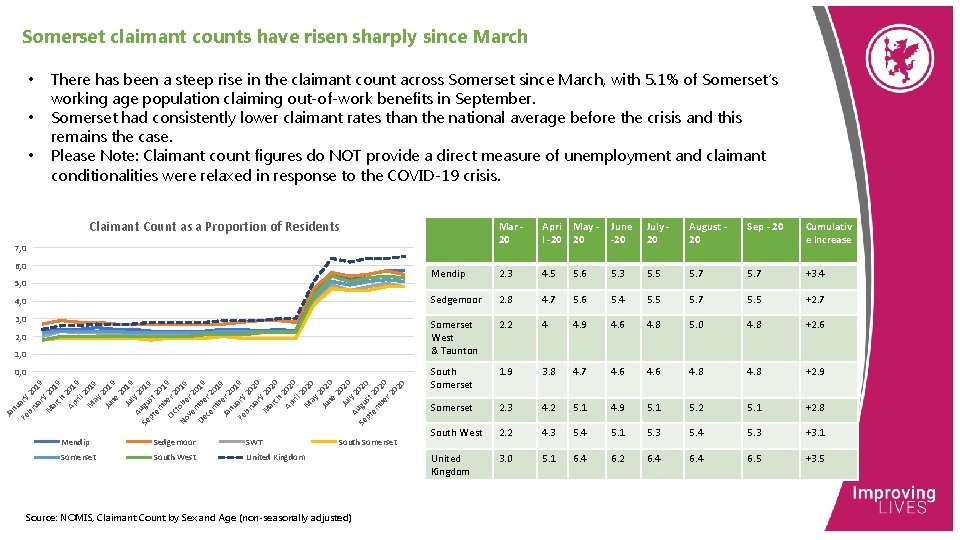

Somerset claimant counts have risen sharply since March • • • There has been a steep rise in the claimant count across Somerset since March, with 5. 1% of Somerset’s working age population claiming out-of-work benefits in September. Somerset had consistently lower claimant rates than the national average before the crisis and this remains the case. Please Note: Claimant count figures do NOT provide a direct measure of unemployment and claimant conditionalities were relaxed in response to the COVID-19 crisis. Claimant Count as a Proportion of Residents Mar 20 Apri l -20 May 20 June -20 July 20 August 20 Sep - 20 Cumulativ e Increase Mendip 2. 3 4. 5 5. 6 5. 3 5. 5 5. 7 +3. 4 4, 0 Sedgemoor 2. 8 4. 7 5. 6 5. 4 5. 5 5. 7 5. 5 +2. 7 3, 0 Somerset West & Taunton 2. 2 4 4. 9 4. 6 4. 8 5. 0 4. 8 +2. 6 South Somerset 1. 9 3. 8 4. 7 4. 6 4. 8 +2. 9 Somerset 2. 3 4. 2 5. 1 4. 9 5. 1 5. 2 5. 1 +2. 8 South West 2. 2 4. 3 5. 4 5. 1 5. 3 5. 4 5. 3 +3. 1 United Kingdom 3. 0 5. 1 6. 4 6. 2 6. 4 6. 5 +3. 5 7, 0 6, 0 5, 0 2, 0 1, 0 Ja n u Fe ary br 20 ua 1 9 r M y 20 ar 1 ch 9 Ap 201 ril 9 2 M 019 ay 2 Ju 01 ne 9 2 Ju 019 l y A 2 Se ugu 019 pt st em 20 b 1 Oc er 2 9 t No obe 019 ve r 2 m 0 De be 19 ce r 2 m 01 b 9 Ja er 2 nu 0 1 Fe ary 9 br 20 ua 2 0 r M y 20 ar ch 20 Ap 202 ril 0 2 M 020 ay 2 Ju 02 ne 0 2 Ju 020 l y A 2 Se ugu 020 pt st em 20 be 20 r 2 02 0 0, 0 Mendip Sedgemoor SWT Somerset South West United Kingdom South Somerset Source: NOMIS, Claimant Count by Sex and Age (non-seasonally adjusted)

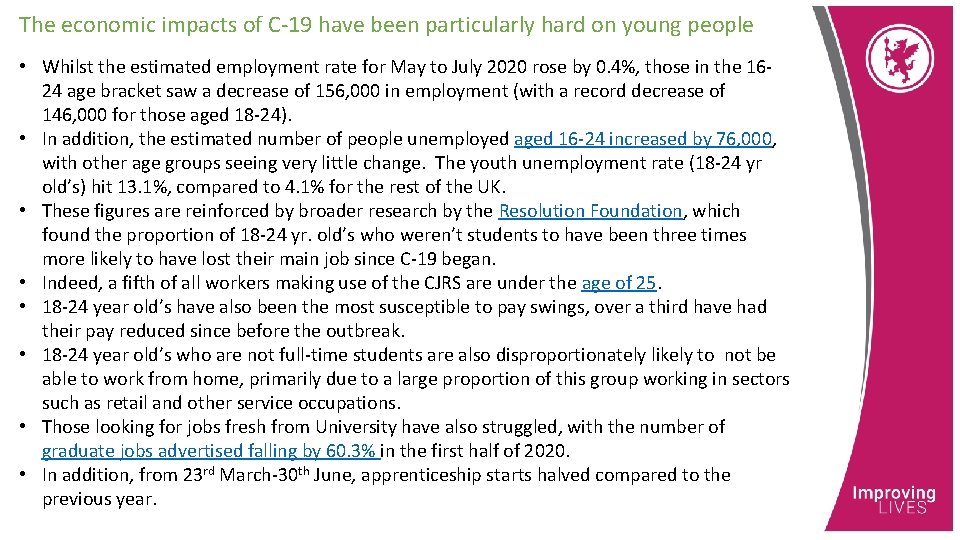

The economic impacts of C-19 have been particularly hard on young people • Whilst the estimated employment rate for May to July 2020 rose by 0. 4%, those in the 1624 age bracket saw a decrease of 156, 000 in employment (with a record decrease of 146, 000 for those aged 18 -24). • In addition, the estimated number of people unemployed aged 16 -24 increased by 76, 000, with other age groups seeing very little change. The youth unemployment rate (18 -24 yr old’s) hit 13. 1%, compared to 4. 1% for the rest of the UK. • These figures are reinforced by broader research by the Resolution Foundation, which found the proportion of 18 -24 yr. old’s who weren’t students to have been three times more likely to have lost their main job since C-19 began. • Indeed, a fifth of all workers making use of the CJRS are under the age of 25. • 18 -24 year old’s have also been the most susceptible to pay swings, over a third have had their pay reduced since before the outbreak. • 18 -24 year old’s who are not full-time students are also disproportionately likely to not be able to work from home, primarily due to a large proportion of this group working in sectors such as retail and other service occupations. • Those looking for jobs fresh from University have also struggled, with the number of graduate jobs advertised falling by 60. 3% in the first half of 2020. • In addition, from 23 rd March-30 th June, apprenticeship starts halved compared to the previous year.

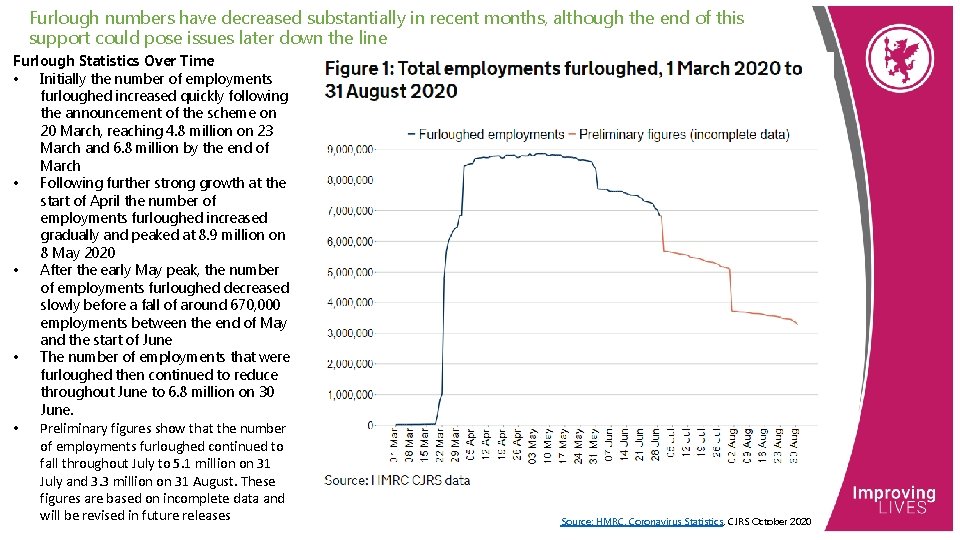

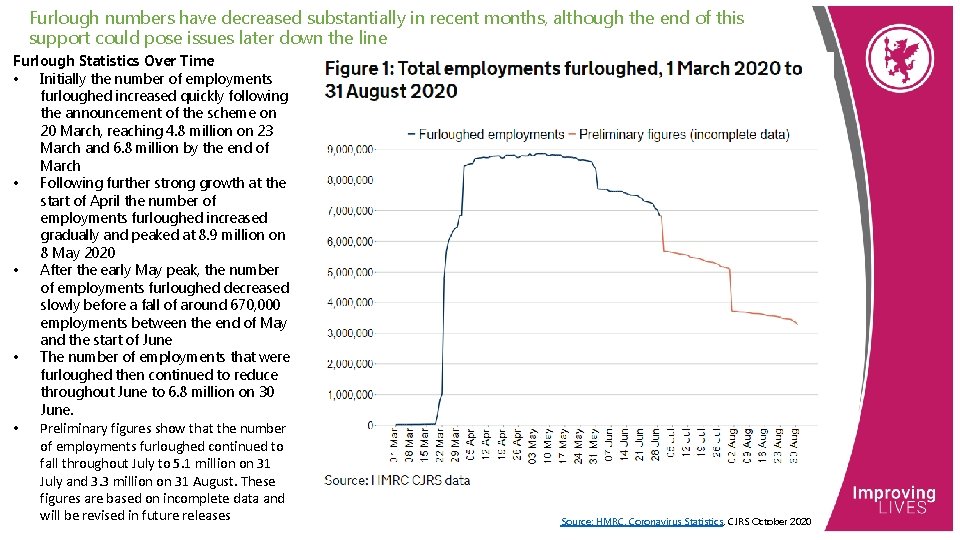

Furlough numbers have decreased substantially in recent months, although the end of this support could pose issues later down the line Furlough Statistics Over Time • Initially the number of employments furloughed increased quickly following the announcement of the scheme on 20 March, reaching 4. 8 million on 23 March and 6. 8 million by the end of March • Following further strong growth at the start of April the number of employments furloughed increased gradually and peaked at 8. 9 million on 8 May 2020 • After the early May peak, the number of employments furloughed decreased slowly before a fall of around 670, 000 employments between the end of May and the start of June • The number of employments that were furloughed then continued to reduce throughout June to 6. 8 million on 30 June. • Preliminary figures show that the number of employments furloughed continued to fall throughout July to 5. 1 million on 31 July and 3. 3 million on 31 August. These figures are based on incomplete data and will be revised in future releases Source: HMRC, Coronavirus Statistics, CJRS October 2020

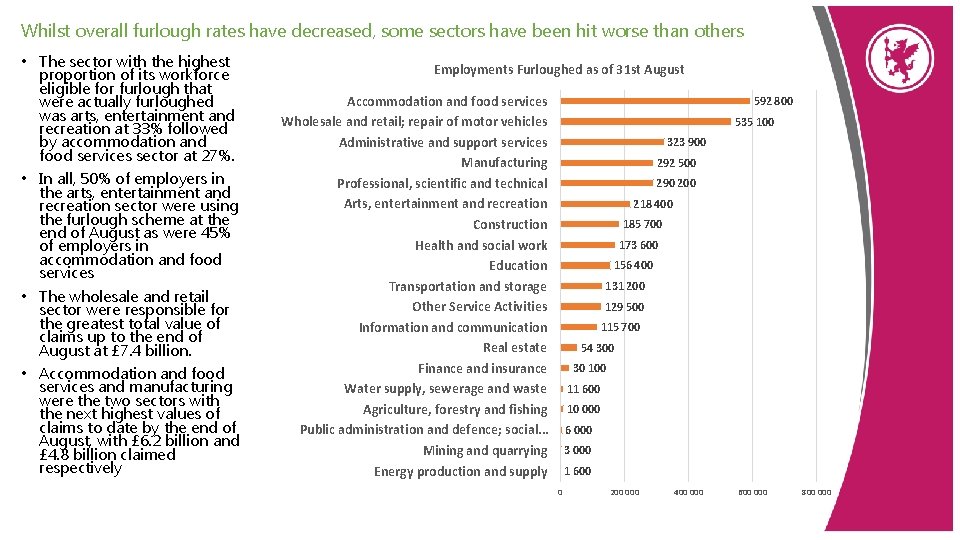

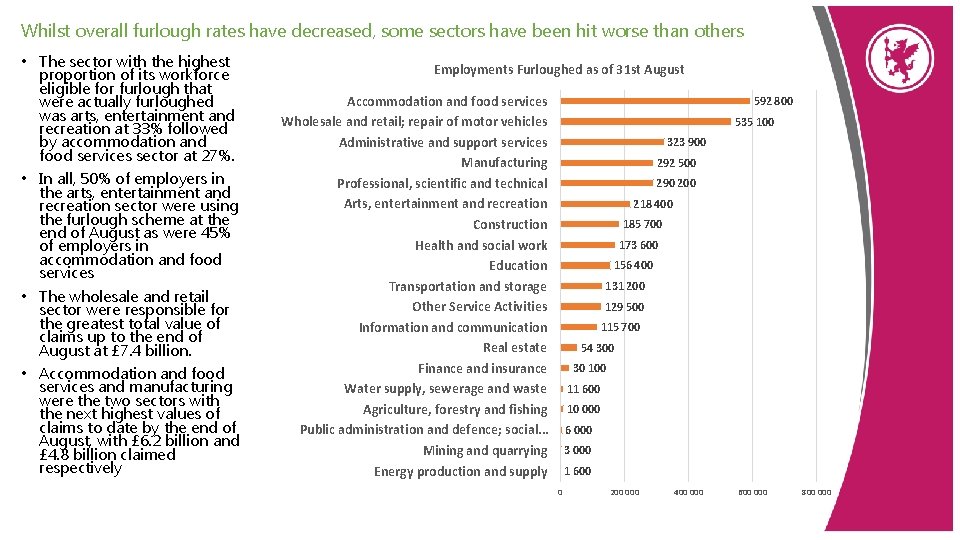

Whilst overall furlough rates have decreased, some sectors have been hit worse than others • The sector with the highest proportion of its workforce eligible for furlough that were actually furloughed was arts, entertainment and recreation at 33% followed by accommodation and food services sector at 27%. • In all, 50% of employers in the arts, entertainment and recreation sector were using the furlough scheme at the end of August as were 45% of employers in accommodation and food services • The wholesale and retail sector were responsible for the greatest total value of claims up to the end of August at £ 7. 4 billion. • Accommodation and food services and manufacturing were the two sectors with the next highest values of claims to date by the end of August, with £ 6. 2 billion and £ 4. 8 billion claimed respectively Employments Furloughed as of 31 st August Accommodation and food services Wholesale and retail; repair of motor vehicles Administrative and support services Manufacturing Professional, scientific and technical Arts, entertainment and recreation Construction Health and social work Education Transportation and storage Other Service Activities Information and communication Real estate Finance and insurance Water supply, sewerage and waste Agriculture, forestry and fishing Public administration and defence; social. . . Mining and quarrying Energy production and supply 592 800 535 100 323 900 292 500 290 200 218 400 185 700 173 600 156 400 131 200 129 500 115 700 54 300 30 100 11 600 10 000 6 000 3 000 1 600 0 200 000 400 000 600 000 800 000

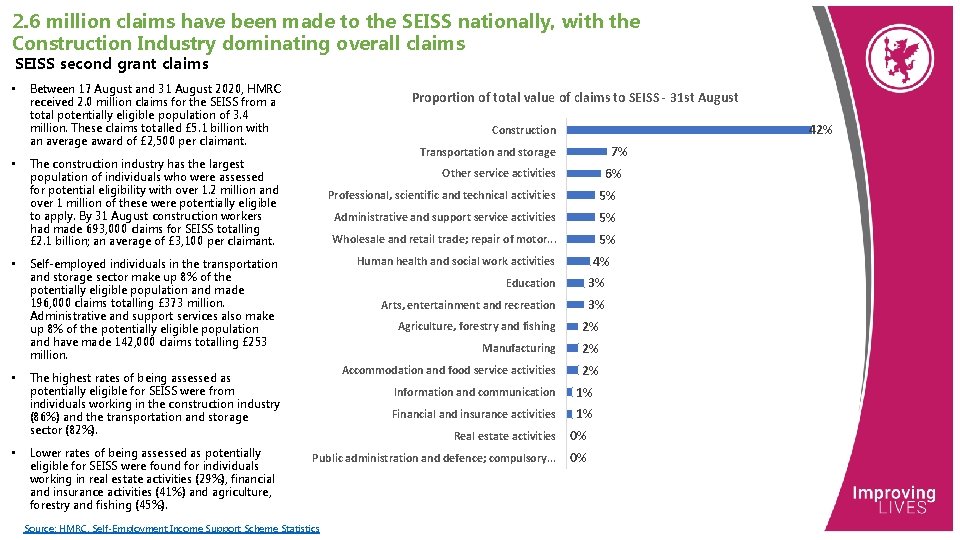

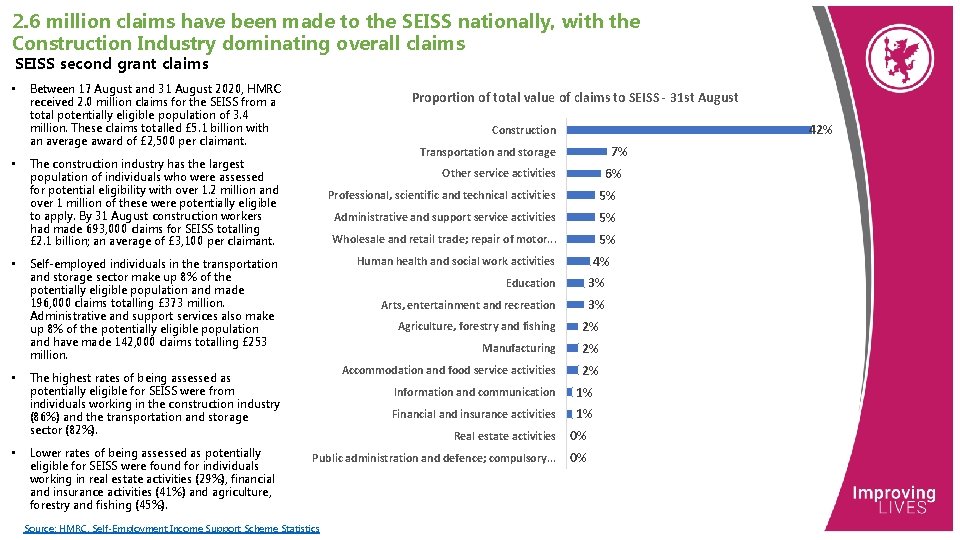

2. 6 million claims have been made to the SEISS nationally, with the Construction Industry dominating overall claims SEISS second grant claims • • • Between 17 August and 31 August 2020, HMRC received 2. 0 million claims for the SEISS from a total potentially eligible population of 3. 4 million. These claims totalled £ 5. 1 billion with an average award of £ 2, 500 per claimant. Proportion of total value of claims to SEISS - 31 st August 7% Transportation and storage The construction industry has the largest population of individuals who were assessed for potential eligibility with over 1. 2 million and over 1 million of these were potentially eligible to apply. By 31 August construction workers had made 693, 000 claims for SEISS totalling £ 2. 1 billion; an average of £ 3, 100 per claimant. 6% Other service activities Professional, scientific and technical activities 5% Administrative and support service activities 5% Wholesale and retail trade; repair of motor. . . 5% 4% Human health and social work activities Self-employed individuals in the transportation and storage sector make up 8% of the potentially eligible population and made 196, 000 claims totalling £ 373 million. Administrative and support services also make up 8% of the potentially eligible population and have made 142, 000 claims totalling £ 253 million. The highest rates of being assessed as potentially eligible for SEISS were from individuals working in the construction industry (86%) and the transportation and storage sector (82%). Lower rates of being assessed as potentially eligible for SEISS were found for individuals working in real estate activities (29%), financial and insurance activities (41%) and agriculture, forestry and fishing (45%). 42% Construction Education 3% Arts, entertainment and recreation 3% Agriculture, forestry and fishing 2% Manufacturing 2% Accommodation and food service activities 2% Information and communication 1% Financial and insurance activities 1% Real estate activities 0% Public administration and defence; compulsory. . . 0% Source: HMRC, Self-Employment Income Support Scheme Statistics

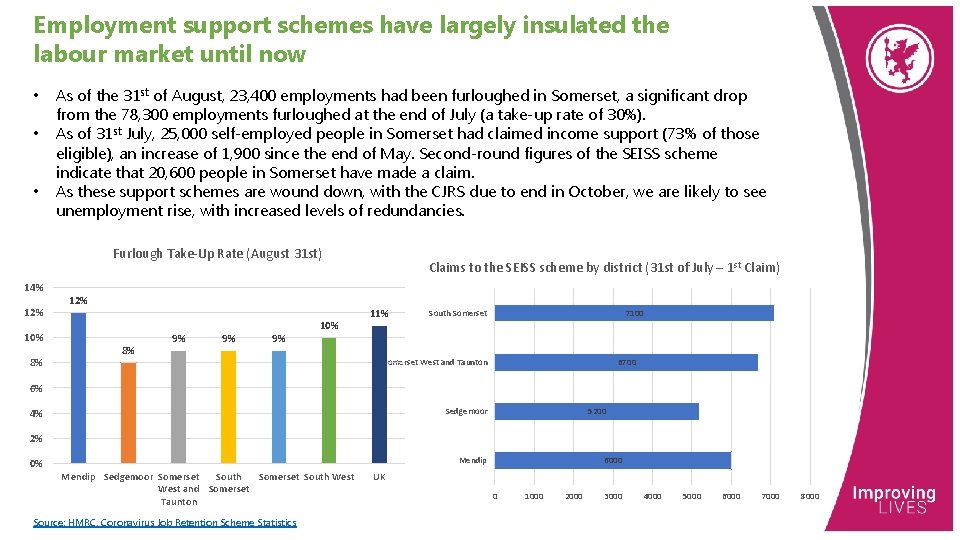

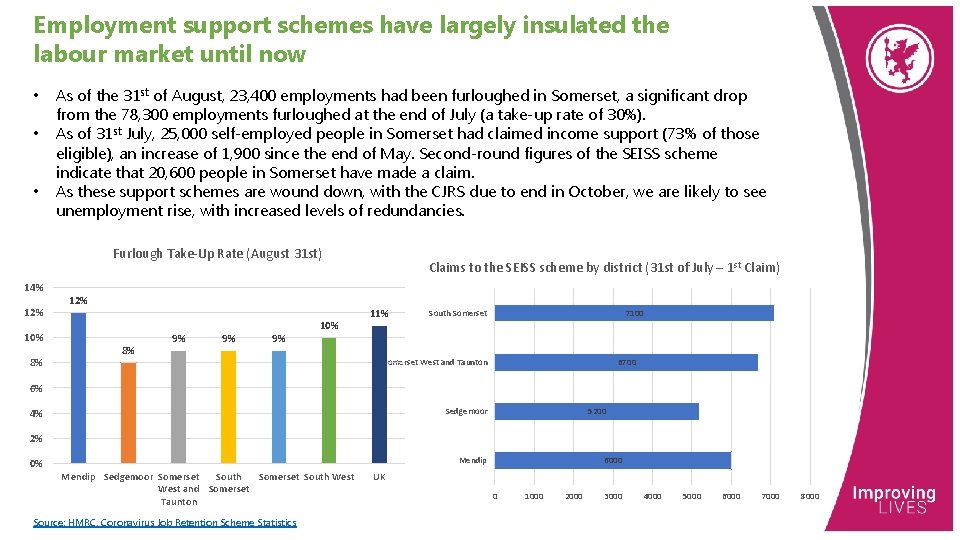

Employment support schemes have largely insulated the labour market until now • • • As of the 31 st of August, 23, 400 employments had been furloughed in Somerset, a significant drop from the 78, 300 employments furloughed at the end of July (a take-up rate of 30%). As of 31 st July, 25, 000 self-employed people in Somerset had claimed income support (73% of those eligible), an increase of 1, 900 since the end of May. Second-round figures of the SEISS scheme indicate that 20, 600 people in Somerset have made a claim. As these support schemes are wound down, with the CJRS due to end in October, we are likely to see unemployment rise, with increased levels of redundancies. Furlough Take-Up Rate (August 31 st) 14% 12% 10% 8% 12% 8% 9% 9% 9% 10% Claims to the SEISS scheme by district (31 st of July – 1 st Claim) 11% South Somerset 7100 Somerset West and Taunton 6700 6% Sedgemoor 4% 5200 2% 0% Mendip Sedgemoor Somerset South West and Somerset Taunton Source: HMRC, Coronavirus Job Retention Scheme Statistics 6000 UK 0 1000 2000 3000 4000 5000 6000 7000 8000

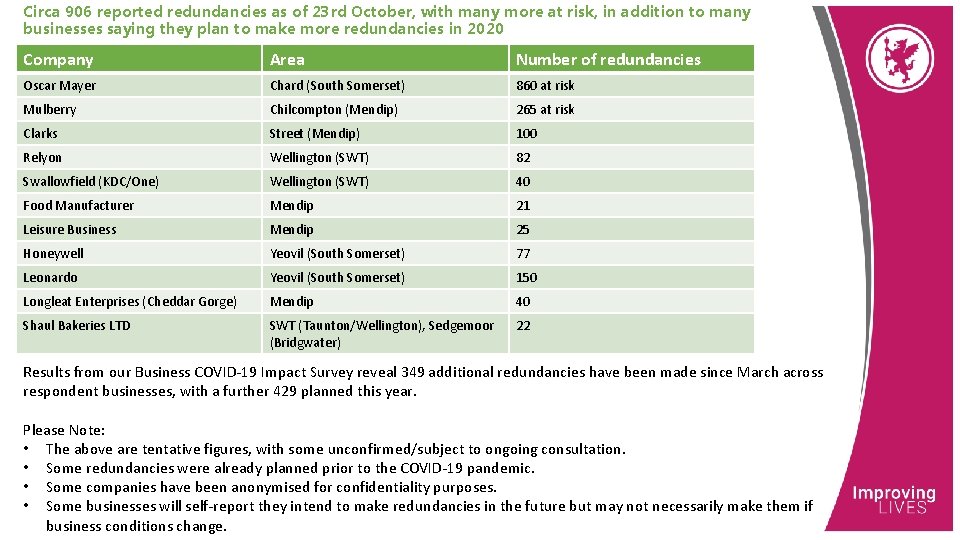

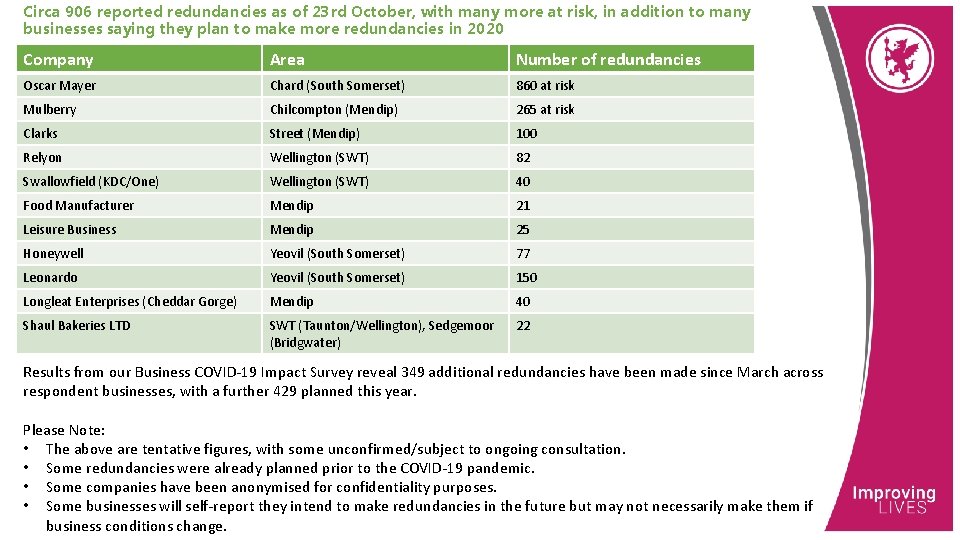

Circa 906 reported redundancies as of 23 rd October, with many more at risk, in addition to many businesses saying they plan to make more redundancies in 2020 Company Area Number of redundancies Oscar Mayer Chard (South Somerset) 860 at risk Mulberry Chilcompton (Mendip) 265 at risk Clarks Street (Mendip) 100 Relyon Wellington (SWT) 82 Swallowfield (KDC/One) Wellington (SWT) 40 Food Manufacturer Mendip 21 Leisure Business Mendip 25 Honeywell Yeovil (South Somerset) 77 Leonardo Yeovil (South Somerset) 150 Longleat Enterprises (Cheddar Gorge) Mendip 40 Shaul Bakeries LTD SWT (Taunton/Wellington), Sedgemoor (Bridgwater) 22 Results from our Business COVID-19 Impact Survey reveal 349 additional redundancies have been made since March across respondent businesses, with a further 429 planned this year. Please Note: • The above are tentative figures, with some unconfirmed/subject to ongoing consultation. • Some redundancies were already planned prior to the COVID-19 pandemic. • Some companies have been anonymised for confidentiality purposes. • Some businesses will self-report they intend to make redundancies in the future but may not necessarily make them if business conditions change.

Trading status, financial performance and business resilience have all been impacted by the pandemic Businesses are re-opening in large numbers; but some sectors face bigger challenges than others. Trading Status: • The latest ONS Business Impact Survey from the period 21 st September to the 4 th of October reported 84% of businesses had been trading for more than the last two weeks across industries, 2% of businesses had started trading within the last two weeks after a pause in trading, 9% of businesses had paused trading and do not intend to restart in the next two weeks. • The arts, entertainment and recreation industry and the administrative and support service activities industry had the highest percentages of businesses that were temporarily closed or paused trading, at 30% and 21% respectively. Financial Performance • Across all industries of businesses currently trading, 48% experienced a decrease in their turnover compared with what is normally expected for this time of year, whilst 34% experienced no impact on their turnover. • The arts, entertainment and recreation industry and the accommodation and food service activities industry had the highest percentages of businesses experiencing a decrease in turnover, at 75% and 68% respectively. Business Resilience • Across all industries, of businesses not permanently stopped trading, 4% had no cash reserves, 23% had less than three months’ cash reserves, with 35% having more than six months’ cash reserves. • The accommodation and food service activities industry had the highest percentage of businesses indicating they had no cash reserves, at 7%. This was followed by the arts, entertainment and recreation industry at 6%. • Regarding risk of insolvency, 5% of businesses had a severe risk, 46% had low risk, and 25% no risk. • The accommodation and food service industry, and the administrative and support services industry, had the highest percentage of businesses indicating they had a severe risk of insolvency, at 17% and 9% respectively.

There are significant challenges for many sectors, although these impacts are varied Retail: • The wholesale & retail trade has struggled markedly as a result of lockdown measures. Rolling three-month growth rates to August indicate 30% growth in the industry as lockdown measures have been eased, with output now recovering February 2020 levels. • National retail sales data shows an increase of 0. 8% compared to July, resulting in an increase of 4% when compared to February 2020. Clothing store sales remain 15. 9% below February levels however, with non-food retailing sales 18. 2% down on the same time last year. Accommodation & Food Services: • Accommodation & Food has suffered markedly as a result of lockdown measures. However, the ‘eat out to help out’ scheme, alongside an easing of restrictions saw 85. 5% growth in rolling three-month rates to August. With restrictions being re-introduced however, this could prove a temporary reprieve. • On Exmoor, 89% of accommodation businesses had temporarily ceased all trading from responses gathered in May-June. Health & Social Care Activities • This industry shrank by 2. 1% in rolling three month-growth rates to August, primarily due to reductions in elective operations and fewer accident and emergency visits

The manufacturing, construction and agricultural industries have also faced challenges nationally Manufacturing • Manufacturing grew by 11. 3% in rolling-three month growth rates to August, most notably with the manufacture of transport equipment increasing by 25. 6%. • Overall output in 10 out of 13 sub-sectors of manufacturing continue to remain below February 2020 levels however, • Regionally, the SWMAS barometer has highlighted the challenges of the pandemic for manufacturing, with 70% reporting reduced sales turnover in the past six months, with 42% expecting further falls in the next six months. Construction • This industry grew by 18. 5% in rolling three month growth rates up to August, Despite this, growth in construction output has slowed since June. Total output remains 10. 8% lower than Feb 2020 levels. • The growth that this industry has seen is primarily due to new housing, particularly private new housing which grew by 12. 8% in August. Agriculture • Agriculture grew by 1. 5% in rolling three-month grow rates up to August, although overall GDP remains 4. 3% lower compared to February 2020. • Many farmers have been unable to access grants due to agricultural property not being rateable, with Government loan schemes often bumping up against state aid restrictions.

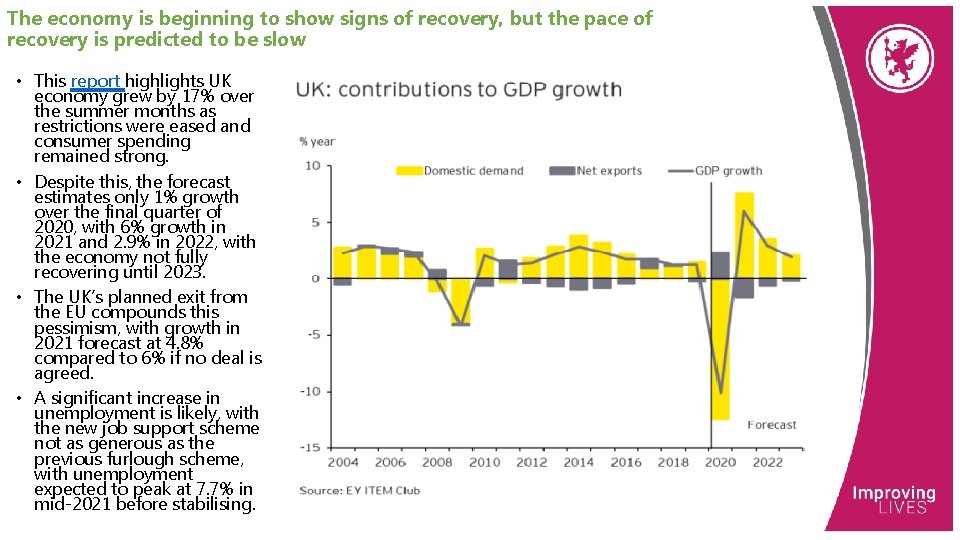

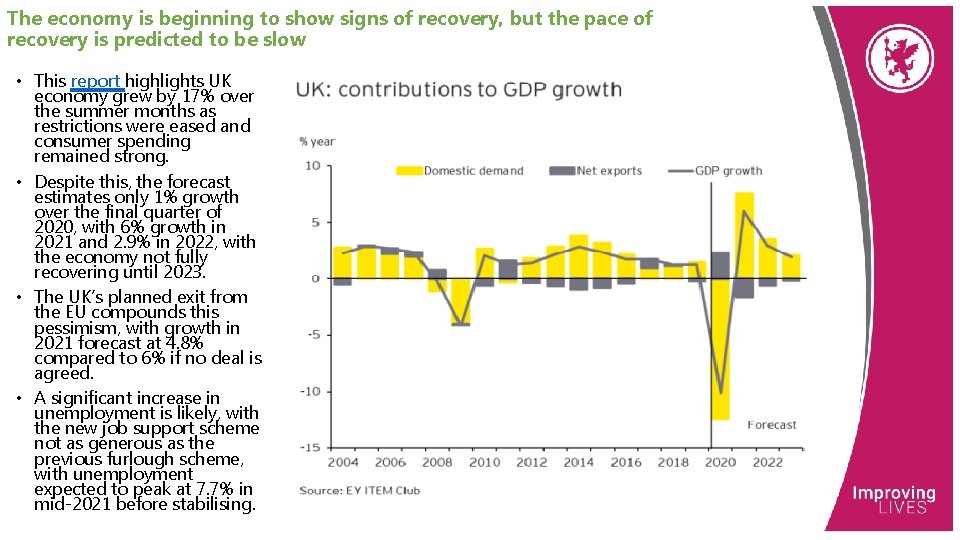

The economy is beginning to show signs of recovery, but the pace of recovery is predicted to be slow • This report highlights UK economy grew by 17% over the summer months as restrictions were eased and consumer spending remained strong. • Despite this, the forecast estimates only 1% growth over the final quarter of 2020, with 6% growth in 2021 and 2. 9% in 2022, with the economy not fully recovering until 2023. • The UK’s planned exit from the EU compounds this pessimism, with growth in 2021 forecast at 4. 8% compared to 6% if no deal is agreed. • A significant increase in unemployment is likely, with the new job support scheme not as generous as the previous furlough scheme, with unemployment expected to peak at 7. 7% in mid-2021 before stabilising.

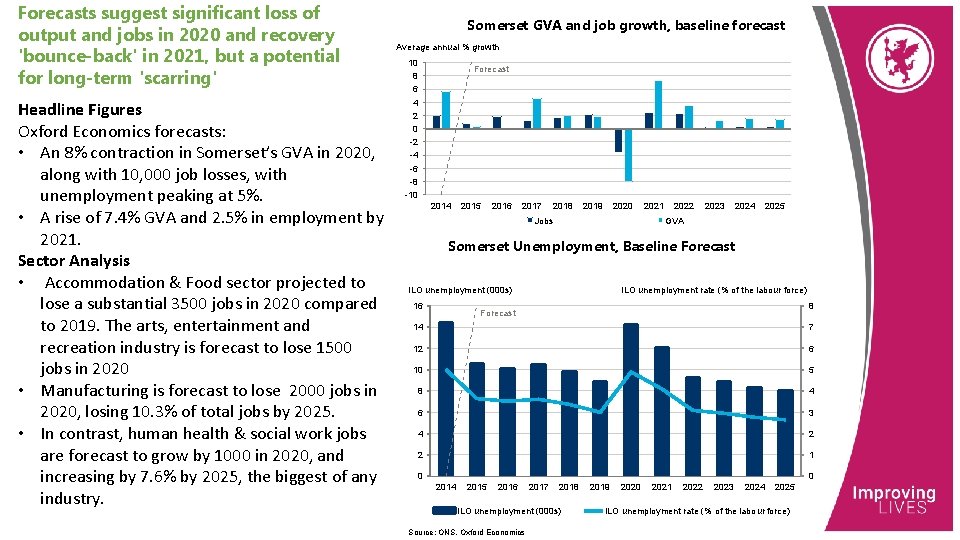

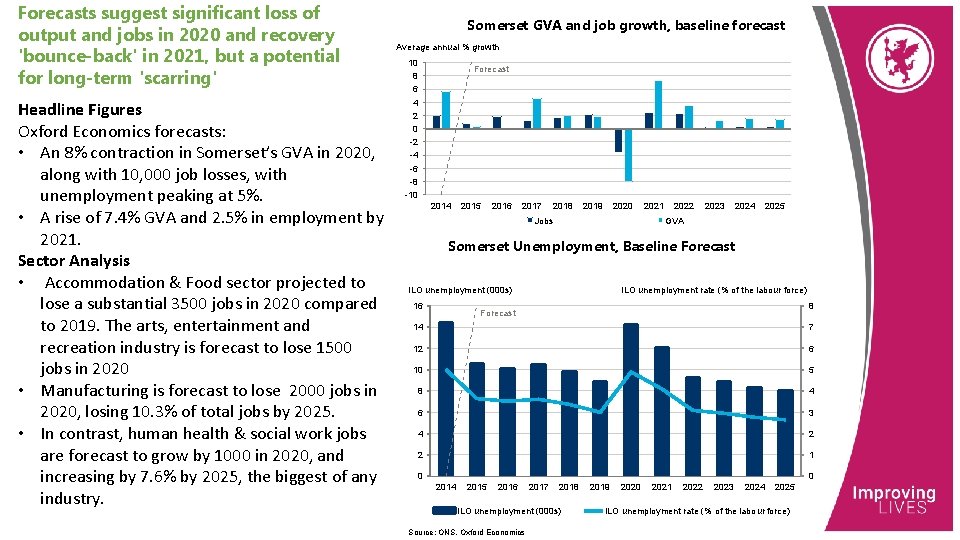

Forecasts suggest significant loss of output and jobs in 2020 and recovery 'bounce-back' in 2021, but a potential for long-term 'scarring' Headline Figures Oxford Economics forecasts: • An 8% contraction in Somerset’s GVA in 2020, along with 10, 000 job losses, with unemployment peaking at 5%. • A rise of 7. 4% GVA and 2. 5% in employment by 2021. Sector Analysis • Accommodation & Food sector projected to lose a substantial 3500 jobs in 2020 compared to 2019. The arts, entertainment and recreation industry is forecast to lose 1500 jobs in 2020 • Manufacturing is forecast to lose 2000 jobs in 2020, losing 10. 3% of total jobs by 2025. • In contrast, human health & social work jobs are forecast to grow by 1000 in 2020, and increasing by 7. 6% by 2025, the biggest of any industry. Somerset GVA and job growth, baseline forecast Average annual % growth 10 8 6 4 2 0 -2 -4 -6 -8 -10 Forecast 2014 2015 2016 2017 2018 2019 2020 Jobs 2021 2022 2023 2024 2025 GVA Somerset Unemployment, Baseline Forecast ILO unemployment rate (% of the labour force) ILO unemployment (000 s) 16 8 Forecast 14 7 12 6 10 5 8 4 6 3 4 2 2 1 0 0 2014 2015 2016 2017 2018 ILO unemployment (000 s) Source: ONS, Oxford Economics 2019 2020 2021 2022 2023 2024 2025 ILO unemployment rate (% of the labour force)

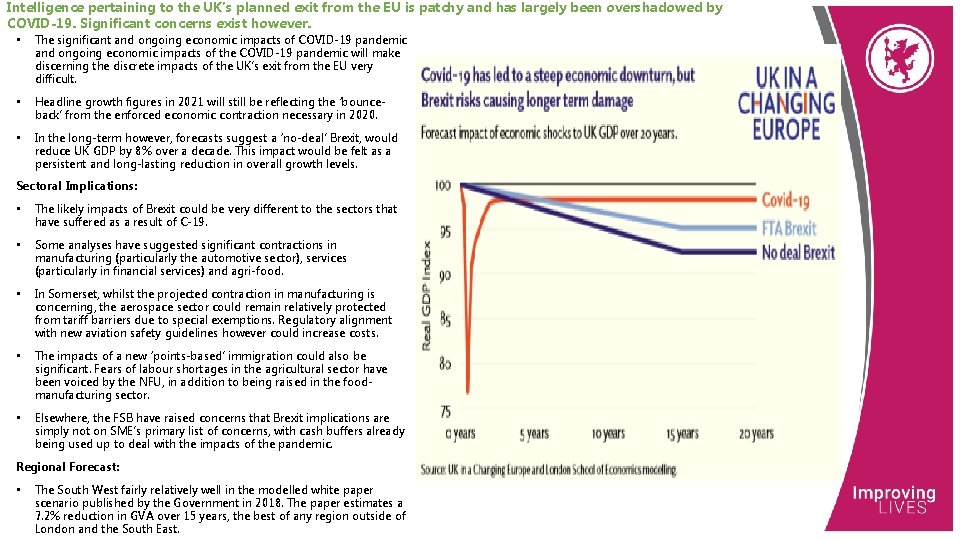

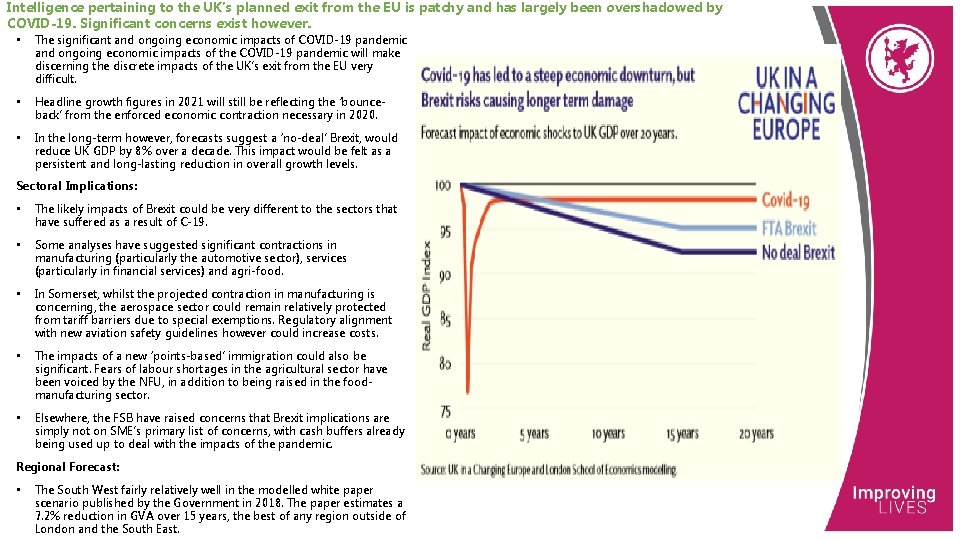

Intelligence pertaining to the UK’s planned exit from the EU is patchy and has largely been overshadowed by COVID-19. Significant concerns exist however. • The significant and ongoing economic impacts of COVID-19 pandemic and ongoing economic impacts of the COVID-19 pandemic will make discerning the discrete impacts of the UK’s exit from the EU very difficult. • Headline growth figures in 2021 will still be reflecting the ‘bounceback’ from the enforced economic contraction necessary in 2020. • In the long-term however, forecasts suggest a ‘no-deal’ Brexit, would reduce UK GDP by 8% over a decade. This impact would be felt as a persistent and long-lasting reduction in overall growth levels. Sectoral Implications: • The likely impacts of Brexit could be very different to the sectors that have suffered as a result of C-19. • Some analyses have suggested significant contractions in manufacturing (particularly the automotive sector), services (particularly in financial services) and agri-food. • In Somerset, whilst the projected contraction in manufacturing is concerning, the aerospace sector could remain relatively protected from tariff barriers due to special exemptions. Regulatory alignment with new aviation safety guidelines however could increase costs. • The impacts of a new ‘points-based’ immigration could also be significant. Fears of labour shortages in the agricultural sector have been voiced by the NFU, in addition to being raised in the foodmanufacturing sector. • Elsewhere, the FSB have raised concerns that Brexit implications are simply not on SME’s primary list of concerns, with cash buffers already being used up to deal with the impacts of the pandemic. Regional Forecast: • The South West fairly relatively well in the modelled white paper scenario published by the Government in 2018. The paper estimates a 7. 2% reduction in GVA over 15 years, the best of any region outside of London and the South East.

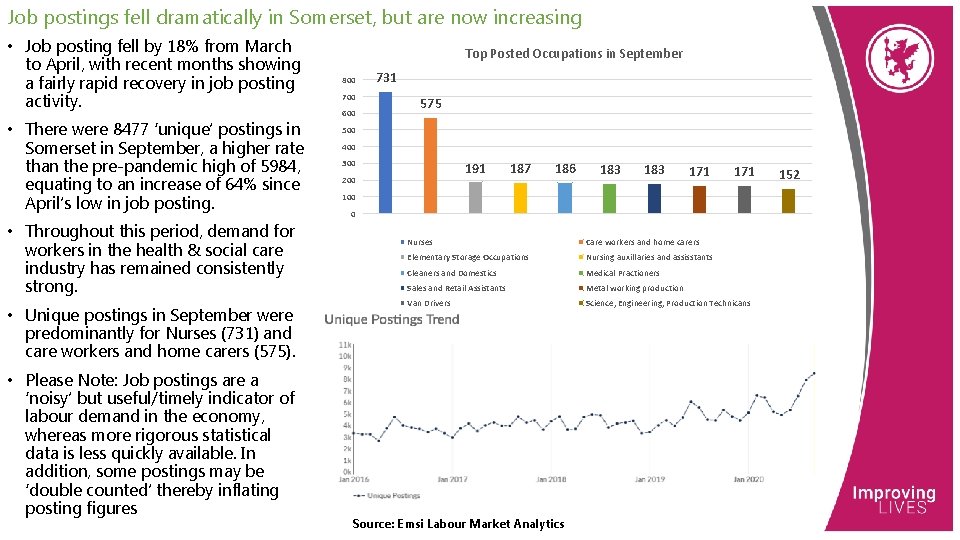

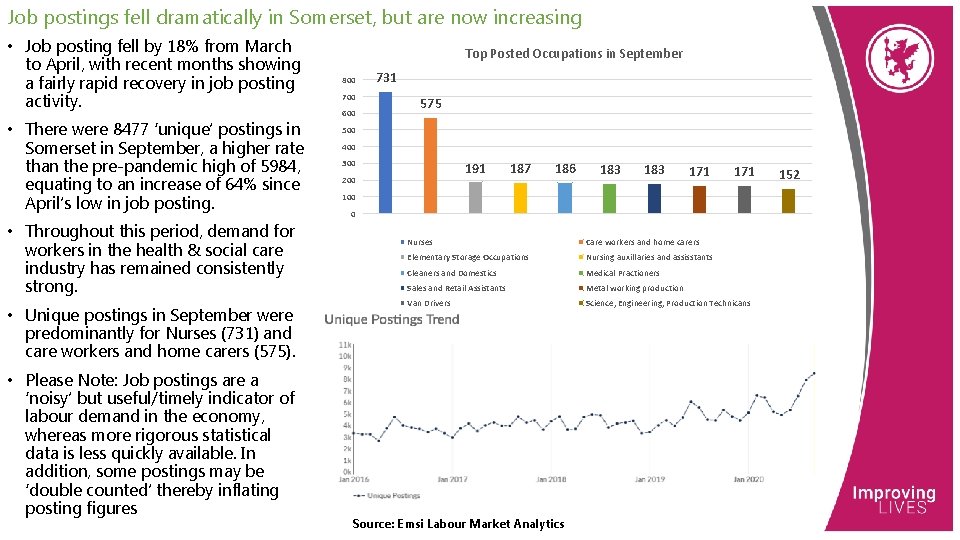

Job postings fell dramatically in Somerset, but are now increasing • Job posting fell by 18% from March to April, with recent months showing a fairly rapid recovery in job posting activity. • There were 8477 ‘unique’ postings in Somerset in September, a higher rate than the pre-pandemic high of 5984, equating to an increase of 64% since April’s low in job posting. • Throughout this period, demand for workers in the health & social care industry has remained consistently strong. • Unique postings in September were predominantly for Nurses (731) and care workers and home carers (575). • Please Note: Job postings are a ‘noisy’ but useful/timely indicator of labour demand in the economy, whereas more rigorous statistical data is less quickly available. In addition, some postings may be ‘double counted’ thereby inflating posting figures Top Posted Occupations in September 800 700 600 731 575 500 400 300 191 200 187 186 183 171 100 0 Nurses Care workers and home carers Elementary Storage Occupations Nursing auxillaries and assisstants Cleaners and Domestics Medical Practioners Sales and Retail Assistants Metal working production Van Drivers Science, Engineering, Production Technicans Source: Emsi Labour Market Analytics 152

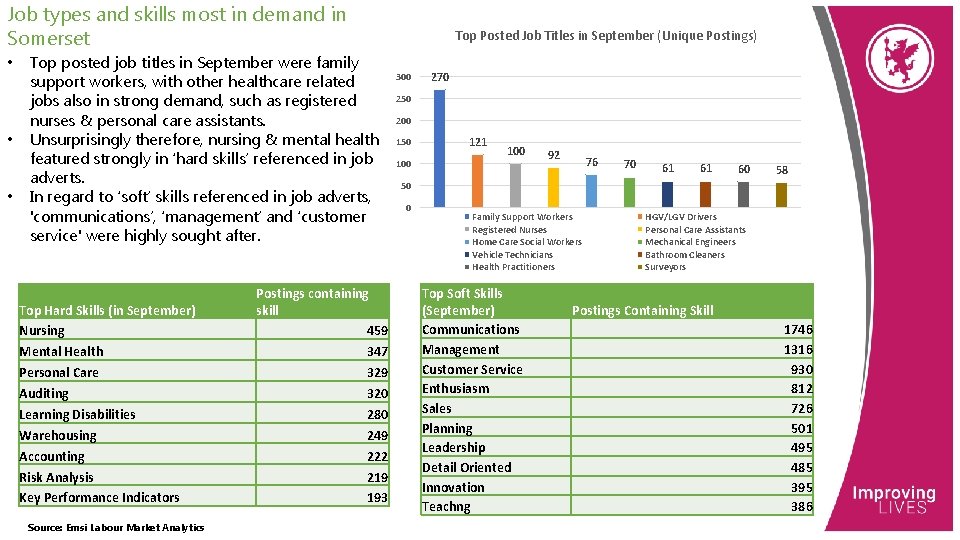

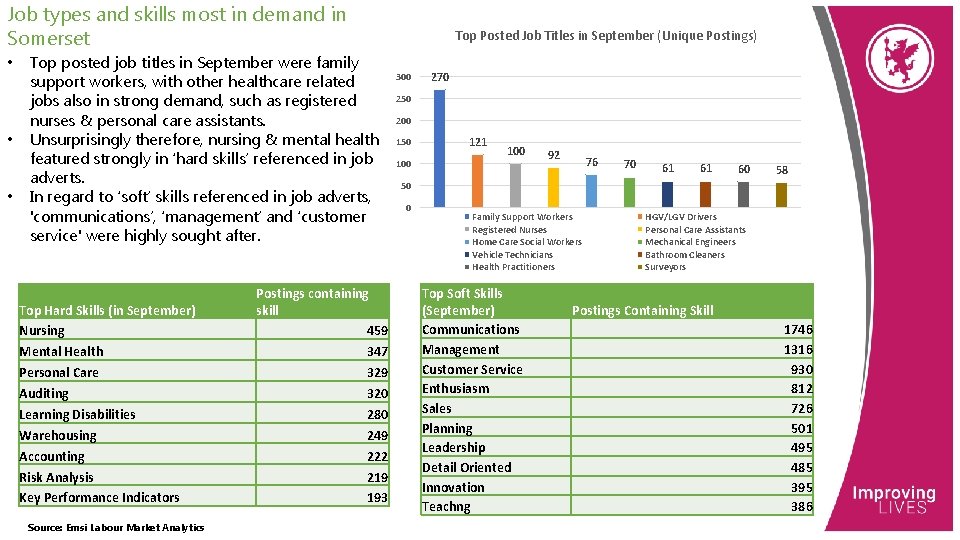

Job types and skills most in demand in Somerset • • • Top posted job titles in September were family support workers, with other healthcare related jobs also in strong demand, such as registered nurses & personal care assistants. Unsurprisingly therefore, nursing & mental health featured strongly in ‘hard skills’ referenced in job adverts. In regard to ‘soft’ skills referenced in job adverts, 'communications’, ‘management’ and ‘customer service' were highly sought after. Top Hard Skills (in September) Nursing Mental Health Personal Care Auditing Learning Disabilities Warehousing Accounting Risk Analysis Key Performance Indicators Source: Emsi Labour Market Analytics Postings containing skill 459 347 329 320 280 249 222 219 193 Top Posted Job Titles in September (Unique Postings) 300 270 250 200 150 100 121 100 92 76 70 61 61 60 58 50 0 Family Support Workers Registered Nurses Home Care Social Workers Vehicle Technicians Health Practitioners Top Soft Skills (September) Communications Management Customer Service Enthusiasm Sales Planning Leadership Detail Oriented Innovation Teachng HGV/LGV Drivers Personal Care Assistants Mechanical Engineers Bathroom Cleaners Surveyors Postings Containing Skill 1746 1316 930 812 726 501 495 485 395 386

Labour Market Implications for Recovery Actions needed: • Supporting those unemployed back into work, either through redeployment or reskilling/training. • Supporting those on furlough back into employment, either by helping them return to current jobs, re-skilling/training within current organisations into new roles. Against the backdrop of: • A gradually re-emerging economy, wherein economic output is likely to recover more quickly than employment levels, but also, one in which we have moved from years of having a tight labour market (labour demand out-stripping supply) to one in which supply is outstripping demand. • A more rapidly restructuring economy, wherein some sectors prove more resilient and ‘recoverable’ than others, and structural unemployment (the mismatch between skills supply and demand) is likely to be hastened, and re-skilling/training is going to be even more important. • Proximity to a fixed physical workspace is likely to become both more and less important to recruitment, where some jobs will continue to require attendance at sites and premises whilst others may move towards home working as a viable option. This dynamic is likely to have consequences for the matching of local skills supply and demand.

Http//apps.tujuhbukit.com/covid19

Http//apps.tujuhbukit.com/covid19 Do if you covid19

Do if you covid19 Covid19 athome rapid what know

Covid19 athome rapid what know What do if test positive covid19

What do if test positive covid19 Vaksin covid19

Vaksin covid19 Impacts of logging on agriculture production

Impacts of logging on agriculture production Economic growth vs economic development

Economic growth vs economic development What is economic growth and development

What is economic growth and development Economics unit 1 lesson 2 difficult choices

Economics unit 1 lesson 2 difficult choices Ruby k payne a framework for understanding poverty

Ruby k payne a framework for understanding poverty Hát kết hợp bộ gõ cơ thể

Hát kết hợp bộ gõ cơ thể Bổ thể

Bổ thể Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Gấu đi như thế nào

Gấu đi như thế nào Chụp tư thế worms-breton

Chụp tư thế worms-breton Chúa yêu trần thế

Chúa yêu trần thế Các môn thể thao bắt đầu bằng tiếng chạy

Các môn thể thao bắt đầu bằng tiếng chạy Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới