Econ 215 Introduction to the Economy of Ghana

- Slides: 32

Econ 215: Introduction to the Economy of Ghana 1 The External Sector Instructor: Dr. Emmanuel Codjoe

The External Sector Ghana’s external sector is a very important part of the economy. Ghana would be much poorer if it had no trade with the rest of the world.

Background to External Sector We can distinguish between two broad periods; pre-1983 and post 1983. Pre-1983 was marked by greater controls and interventions by government.

Background to External Sector Pre-1983 was characterized by several restrictions on trade and capital movements. These included, restrictions on international capital flows, quantitative restrictions on trade and high import tariffs.

Background to External Sector However, post-1983 marked the commencement of a marked and significant shift in economic paradigm away from a more interventionist regime.

Background to External Sector Currently there are few restrictions on trade and capital flows. Ghana is actively engaged in attracting foreign investments as well as seeking to expand trade with other regions of the world.

External Sector Developments In recent decades, the importance of the external sector has become apparent because of the important role in economic development. This is especially so given the expansion of global trade in goods and services and that fact that many economies of the world have become increasing linked.

External Sector Developments The growth in world trade and the associated interconnectedness of the economies of many countries has been described by the term GLOBALISATION. Thus, we are now in a globalised world, where the fortunes of individual economies are affected, either directly or indirectly, by the performance of other economies, especially the major economies of the world.

External Sector Developments But in its core economic meaning, globalisation refers to the increased openness of economies to international trade, financial flows and direct foreign investment. Thus, by choosing to engage economically with the rest of the world a country obtains the following benefits:

Importance of the External Sector q Access to foreign goods and services, especially those that are not/cannot be produced locally. q Access to foreign markets for domestically produced goods and services q Access to foreign expertise and know-how as well as to technology and capital that is needed for development

Importance of the External Sector q Because of the economic relations with the rest of the world, there is increased diversity and variety in respect of the goods and services available to Ghanaians. q Moreover, there is increased competition which forces domestic firms to increase their level of efficiency, productivity, and competitiveness.

Concerns About External Sector It is worth noting, however, that increased integration with the world economy also raises several concerns for many economic agents. These concerns include: § increased inequality within countries and between countries, § degradation of the environment, increased dominance of world economy by the richest countries §

Concerns About External Sector In Ghana, many domestic firms have expressed several concerns about the effect on domestic firms’ competitiveness as well as their operational viability in the face of relatively cheap imports.

Assessing the Performance of the External Sector in Ghana It is well established that the performance of the external sector cannot be independent of the performance of both the domestic and global economies as well as policies that are pursued domestically and internationally.

Assessing the Performance of the External Sector in Ghana Many developing countries are powerless when it comes to policies pursued within the international economic framework, despite the fact that many developing countries are members of the major international organisations or agencies that affect the fortunes of the global economy (IMF, World Bank, UN, WTO, etc).

Assessing the Performance of the External Sector in Ghana Besides, with an increasingly globalised economy, it can also be argued that domestic economic policy making is constrained by external influences, such as membership of international organisations and the rules that govern membership. Thus, countries cannot pursue policies that contravene the general objectives of WTO towards promoting free trade, or restrictive foreign exchange policies which goes against the general policy direction of the IMF.

Assessing the Performance of the External Sector in Ghana’s external sector, measured by the balance of payments, the current account deficit, exports and imports, terms of trade, exchange rate, and foreign investment inflows, provides important indicators on the health of the economy.

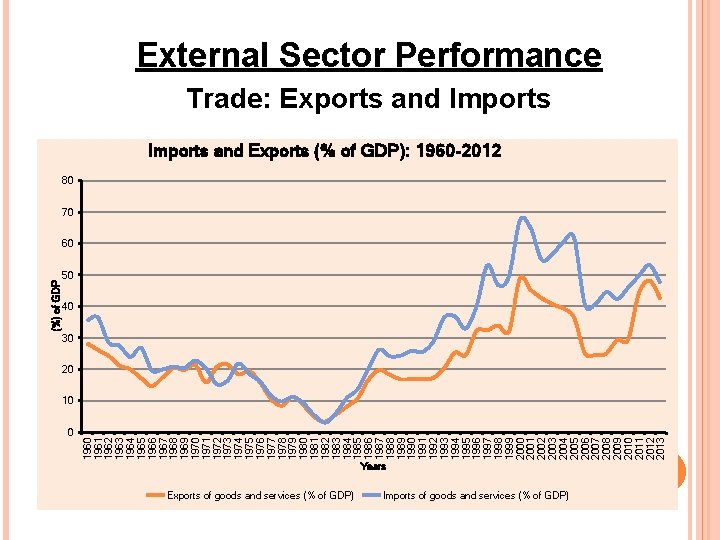

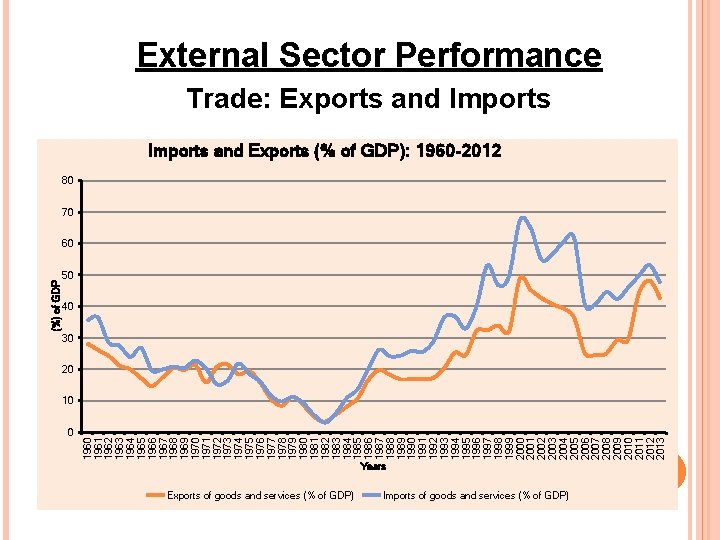

External Sector Performance Trade: Exports and Imports

0 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 (%) of GDP External Sector Performance Trade: Exports and Imports and Exports (% of GDP): 1960 -2012 80 70 60 50 40 30 20 10 Years Exports of goods and services (% of GDP) Imports of goods and services (% of GDP)

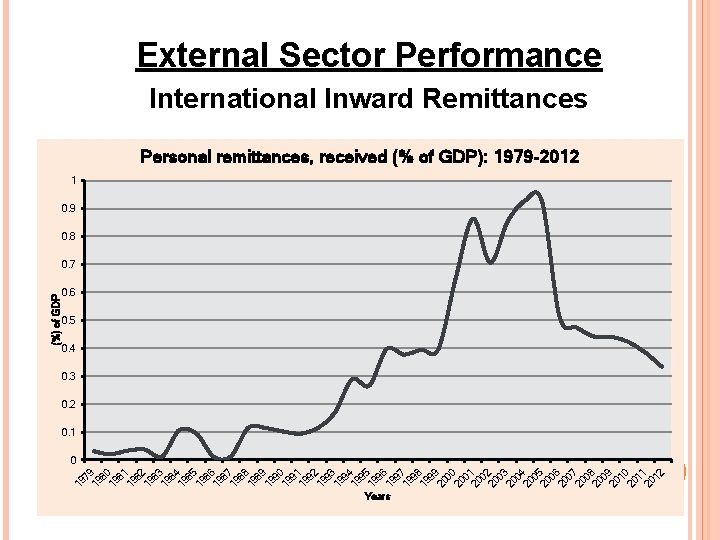

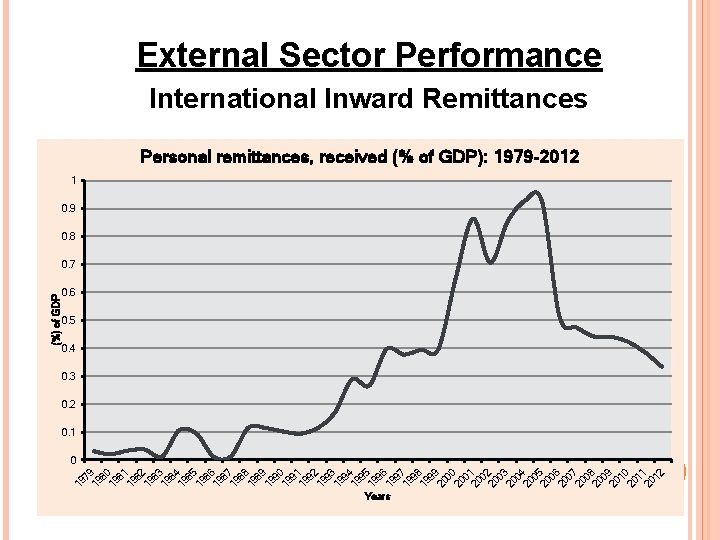

79 80 19 81 19 82 19 83 19 84 19 85 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 19 19 (%) of GDP External Sector Performance International Inward Remittances Personal remittances, received (% of GDP): 1979 -2012 1 0. 9 0. 8 0. 7 0. 6 0. 5 0. 4 0. 3 0. 2 0. 1 0 Years

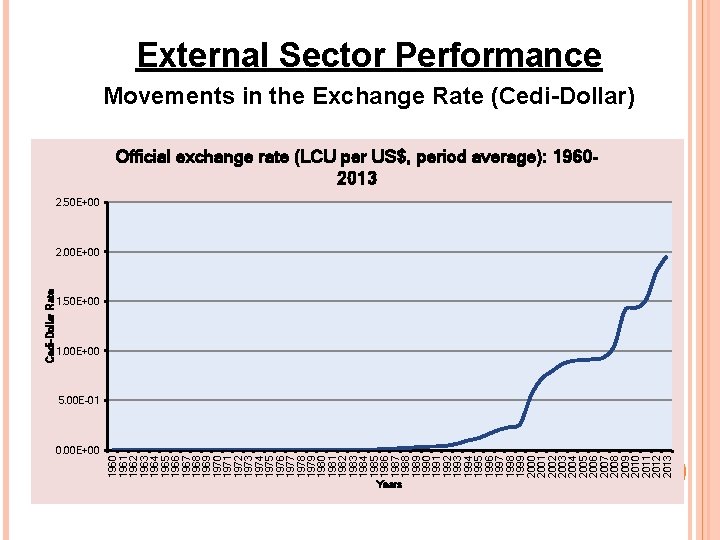

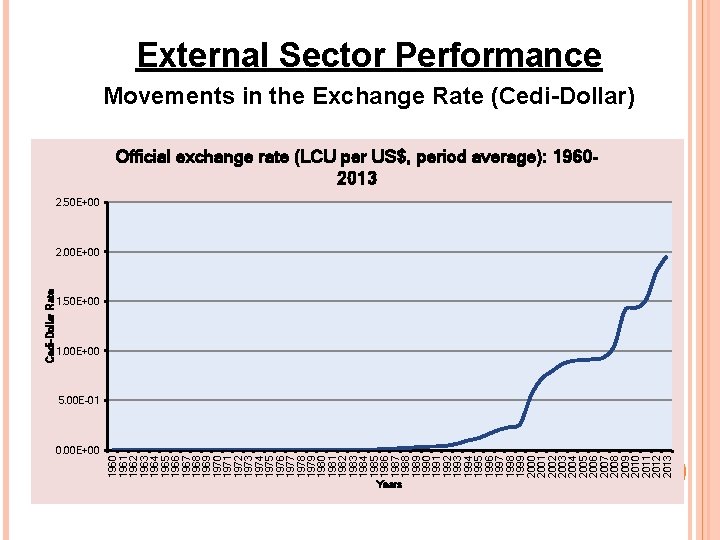

0. 00 E+00 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Cedi-Dollar Rate External Sector Performance Movements in the Exchange Rate (Cedi-Dollar) Official exchange rate (LCU per US$, period average): 19602013 2. 50 E+00 2. 00 E+00 1. 50 E+00 1. 00 E+00 5. 00 E-01 Years

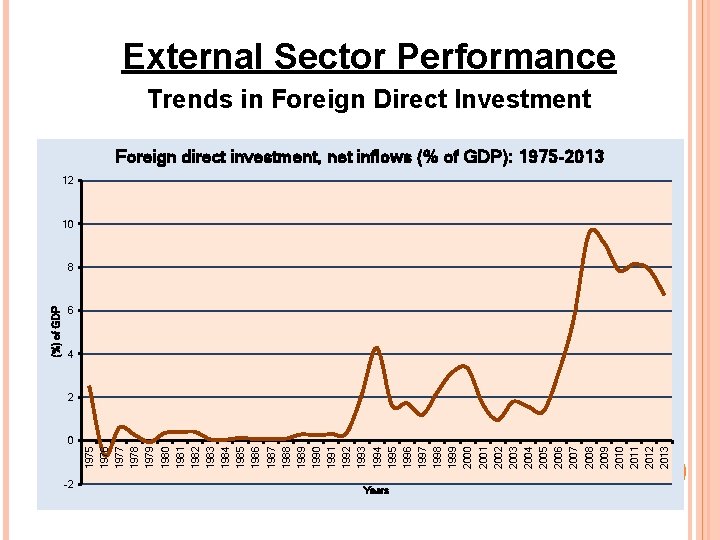

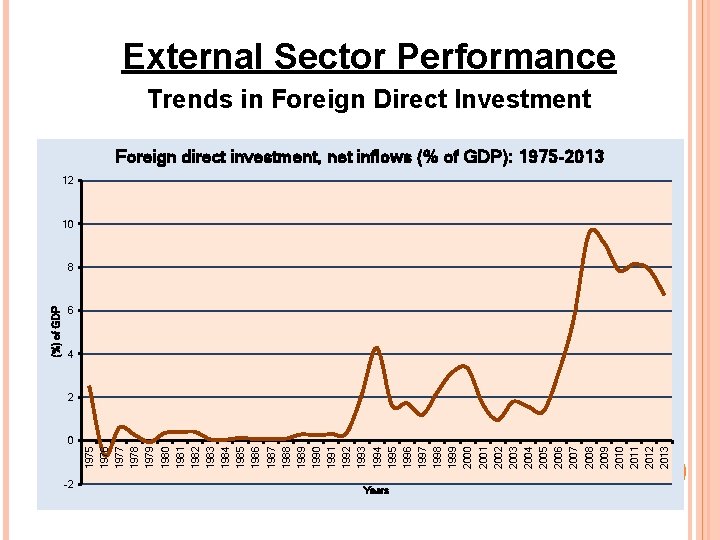

0 -2 Years 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 (%) of GDP External Sector Performance Trends in Foreign Direct Investment Foreign direct investment, net inflows (% of GDP): 1975 -2013 12 10 8 6 4 2

The External Sector: Some Important Relations Remember!!! Y ≡ (S-I) + (T-G) – (X-M) ------ (1) If we assume for a moment we are dealing with a closed economy, then all output is either consumed or saved/invested. Where we have an open economy, then the identity above sheds some interesting light on the interactions between the economy and the rest of the world.

The External Sector: Some Important Relations Y ≡ (S-I) + (T-G) – (X-M) -------- (1) Here we observe that net national saving which is made up of net private/household saving (S-I) and net government saving (T-G) must result in the net consumption of foreign goods and services. In other words, national savings equals net exports (X -M) or the trade balance.

The External Sector: Some Important Relations Y ≡ (S-I) + (T-G) – (X-M) ----- (2) An alternative expression of (3) can be given as follows: (S-I) + (T-G) = (X-M) ------ (3) The left-hand side indicates net national savings or in an open-economy framework net capital outflow.

The External Sector: Some Important Relations If net national saving is positive, then it indicates that domestic residents (Ghanaians) are lending to the rest of the world. If net national saving is negative, it means domestic residents (Ghanaians) are borrowing from the rest of the world to finance activities within the economy.

The External Sector: Some Important Relations Further, where net national saving and net exports are positive, we have a trade surplus => we are net lenders in world financial markets. On the other hand, if net national saving and net exports are negative, we have a trade deficit => we are net borrowers in the world markets. If both are exactly zero, we have balanced trade.

The External Sector Questions and Comments

Athenian economy vs sparta economy

Athenian economy vs sparta economy Sentenza corte costituzionale 215/87

Sentenza corte costituzionale 215/87 Completed ics 215 form

Completed ics 215 form Http //servsoc/inicio.aspx

Http //servsoc/inicio.aspx Po box 1220 philadelphia pa 19105 provider phone number

Po box 1220 philadelphia pa 19105 provider phone number Fixed point addition and subtraction flowchart

Fixed point addition and subtraction flowchart Eecs 270 umich

Eecs 270 umich Ley 40/215

Ley 40/215 The formula c=5p+215 relates c

The formula c=5p+215 relates c What is the definition of work in physics

What is the definition of work in physics Dtu-215

Dtu-215 The tangent ratio is used for _____ triangles.

The tangent ratio is used for _____ triangles. Economic 215

Economic 215 Guggisberg 10 year development plan

Guggisberg 10 year development plan Stc 215/1994

Stc 215/1994 Tc 215

Tc 215 239 rounded to the nearest ten

239 rounded to the nearest ten Introduction to engineering economy

Introduction to engineering economy How to find mpc

How to find mpc Fiscal policy ib definition

Fiscal policy ib definition Flipit econ

Flipit econ Econ 151

Econ 151 Midpoint method formula

Midpoint method formula Mpc economics

Mpc economics Marginal analysis econ

Marginal analysis econ Sports econ austria

Sports econ austria Econ 1410

Econ 1410 Econ 424

Econ 424 Mr darp econ

Mr darp econ Game theory econ

Game theory econ Econ 432

Econ 432 Econ 134

Econ 134 Econ

Econ