Chapter 8 Stock Index Futures Organization of Slides

- Slides: 45

Chapter 8 Stock Index Futures • Organization of Slides: – – History Futures Contract Specifications Risk Management Index Calculations (Appear in the Extra Section). 1

Stock Index Futures, History I. • Trading began on February 24, 1982, when the Kansas City Board of Trade introduced futures on the Value Line Index. • About two months later, the Chicago Mercantile Exchange introduced futures contracts on the S&P 500 index. • By 1986, the S&P 500 futures contract had become the second most actively traded futures contract in the world, with over 19. 5 million contracts traded in that year. • In May 1982, the NYSE Composite Index futures contract began trading on the New York Futures Exchange, the NYFE. 2

Stock Index Futures, History II. • In July 1984, the Chicago Board of Trade began trading futures contracts on the Major Market Index (MMI). – Dow Jones and Company went to court to block its attempts to trade futures on the Dow Jones Industrial Average (DJIA) • But, in June 1997, Dow Jones and Company agreed to allow DJIA options, futures, and options on futures to begin trading. • On October 6, 1997, futures on the DJIA began trading on the Chicago Board of Trade. 3

In their short trading history, stock index futures contracts have had a great impact. • Trading in stock index futures has allegedly made the world's stock markets more volatile than ever before. • Critics claim that individual investors have been driven out of the equity markets because institutional traders' actions in both the spot and futures markets cause stock values to gyrate with no links to their fundamental values. • Many political figures have called for greater regulation, going so far as to favor an outright ban on stock index futures trading. • Fortunately, such extreme measures have been avoided. 4

Stock index futures have become irreplaceable in the modern world of institutional money management. • Stock Index futures have revolutionized the art and science of equity portfolio management as practiced by: – – – mutual funds pension plans endowments insurance company other money managers. 5

2 Important Details • A futures contract on a stock market index represents the right and obligation to buy or to sell a portfolio of stocks characterized by the index. • Stock index futures are cash settled. – That is, there is no delivery of the underlying stocks. – The contracts are marked to market daily. – On the last trading day, the futures price is set equal to the spot index level and there is a final mark to market cash flow. 6

What is an Index? • An index is, in one sense, just a number that is computed in order to measure the value of a portfolio of stocks. – Other indices have been constructed to track the values of other types of securities, such as bonds and futures. – Still other indices track such economic indicators as the consumer price index (CPI) or the index of leading indicators. • When constructing a stock market index, three issues are of particular interest: – which stocks are in the index – how each stock is weighted – how the average is computed • We will describe three different stock market indices. 7

A Famous Price-Weighted Index: The Dow Jones Industrial Average • When one asks: "How is the market doing? ", it is usually implicit that the question is refers to the DJIA. • Other stock market indices that are computed in the same way as the DJIA, and which have futures and options trading on them include the Nikkei 225 stock index of Japanese stocks. 8

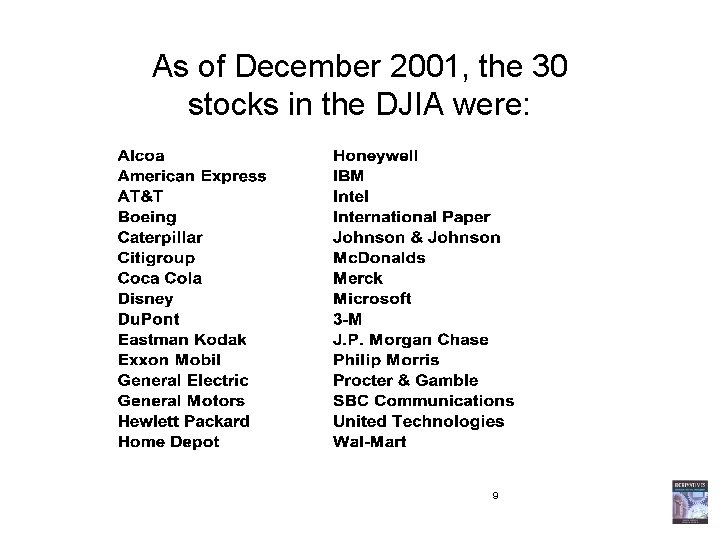

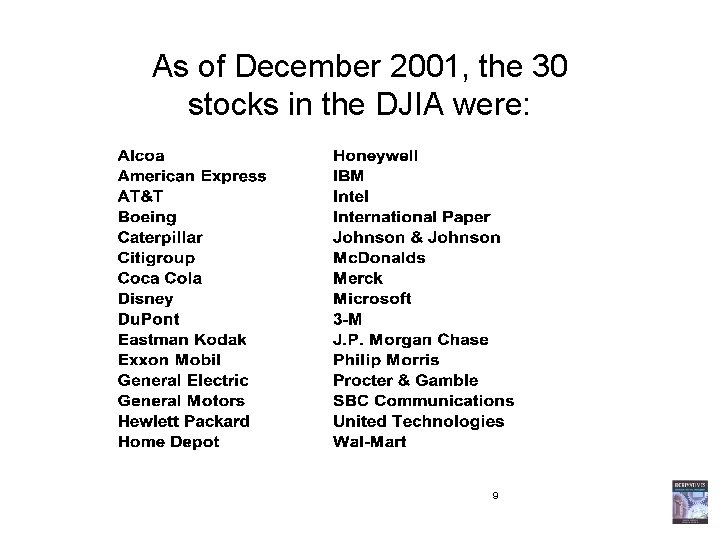

As of December 2001, the 30 stocks in the DJIA were: 9

Dow Jones Futures • Futures on the DJIA trade on the Chicago Board of Trade. • The value of stock underlying one DJIA futures contract equals $10 times the futures price. • One tick is one Dow-point, and this equals $10. • Thus, if the DJIA futures price rises one tick, i. e. , from 10813 to 10814, a trader who is long one contract profits by $10 because the value of the stock underlying the contract rises from $108, 130 to $108, 140. 10

A Famous Value-Weighted Average: The S&P 500 Stock Index • A widely quoted benchmark portfolio. • Vanguard S&P 500 Trust. • SPDR. (http: //www. amex. com). • Standard and Poor’s (S&P) webpage: http: //www. standardandpoors. com. 11

Many Futures Trade on Value-Weighted Indices • Trading on the CME alone: – The S&P 500 futures (the future’s face value is $250 times the S&P 500 index level) – Mini-S&P 500 futures (the future’s face value is only $50 times the S&P 500 index level) – The S&P Midcap 400 (400 middle-sized firms) – Nasdaq 100 (100 Largest Nasdaq Stocks) – Russell 2000 (small cap stocks) 12

S&P 500 stock index futures contracts • Perhaps the most actively traded stock index futures in the world. • The last trading day for this contract is the Thursday before third Friday of the delivery month. • Therefore, there are four delivery months: – – March June September December 13

Marking to Market • The smallest allowed price change (the “tick”) is 0. 10 point, which equals $25. • Thus, if the S&P 500 futures price falls from 1, 019. 40 to 1, 019. 30, the face value of the futures contract declines $25. That is: (1, 019. 40)(250) = $254, 850 (1, 019. 30)(250) = $254, 825 • This one tick decrease in the futures price creates a mark to market profit of $25 for an individual who is short one contract. 14

Portfolio Risk Management Using Stock Index Futures • Portfolio managers often have reasons for selling parts of their portfolio. For example: a) b) c) They may feel some stocks no longer offer adequate returns for the risks the stocks possess; They may have turned bearish (or less bullish) on the overall market, or; They may have to sell in order to provide cash for their clients. Stock index futures provide an efficient means to achieve their objectives for reasons b) and c) above. 15

Stock index futures are also surrogates for the stock purchases when the portfolio manager: a) has received an inflow of cash but has not decided which stocks or market sectors in which to invest. b) has a growing bullishness about the market. c) wants to get market exposure in advance of a near-term expected cash inflow. d) wants an investment that can be quickly liquidated to raise cash, if needed. 16

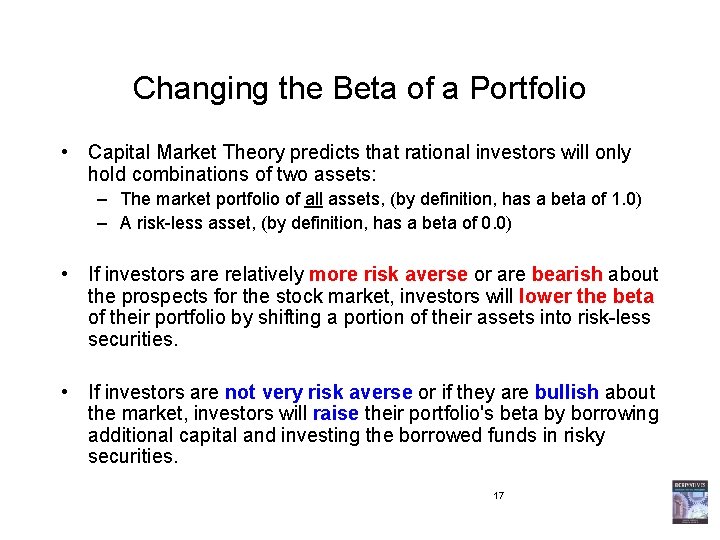

Changing the Beta of a Portfolio • Capital Market Theory predicts that rational investors will only hold combinations of two assets: – The market portfolio of all assets, (by definition, has a beta of 1. 0) – A risk-less asset, (by definition, has a beta of 0. 0) • If investors are relatively more risk averse or are bearish about the prospects for the stock market, investors will lower the beta of their portfolio by shifting a portion of their assets into risk-less securities. • If investors are not very risk averse or if they are bullish about the market, investors will raise their portfolio's beta by borrowing additional capital and investing the borrowed funds in risky securities. 17

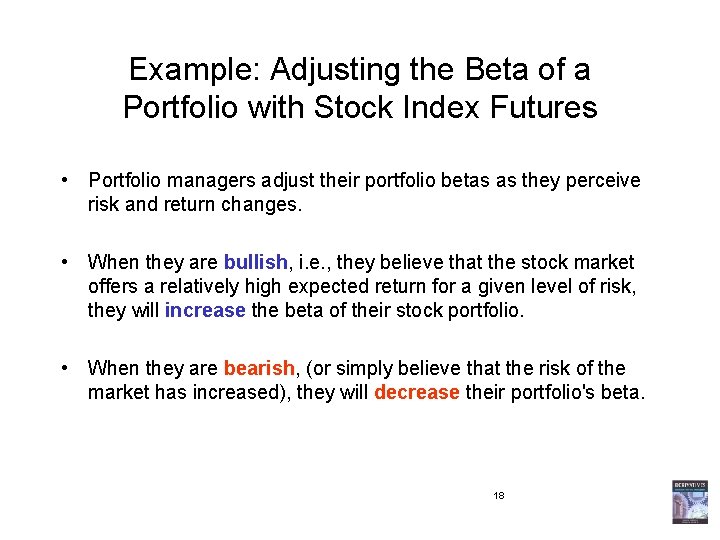

Example: Adjusting the Beta of a Portfolio with Stock Index Futures • Portfolio managers adjust their portfolio betas as they perceive risk and return changes. • When they are bullish, i. e. , they believe that the stock market offers a relatively high expected return for a given level of risk, they will increase the beta of their stock portfolio. • When they are bearish, (or simply believe that the risk of the market has increased), they will decrease their portfolio's beta. 18

Equation to Adjust Beta: • A negative number indicates that futures should be sold in order to lower the portfolio beta. A positive number means that futures should be bought. • Note: Generally, b. F = 1, and the Futures Multiplier for the S&P 500 is 250. 19

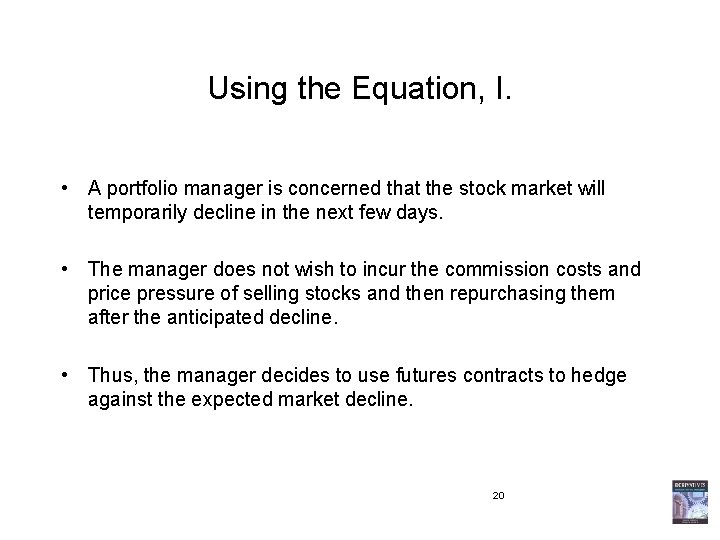

Using the Equation, I. • A portfolio manager is concerned that the stock market will temporarily decline in the next few days. • The manager does not wish to incur the commission costs and price pressure of selling stocks and then repurchasing them after the anticipated decline. • Thus, the manager decides to use futures contracts to hedge against the expected market decline. 20

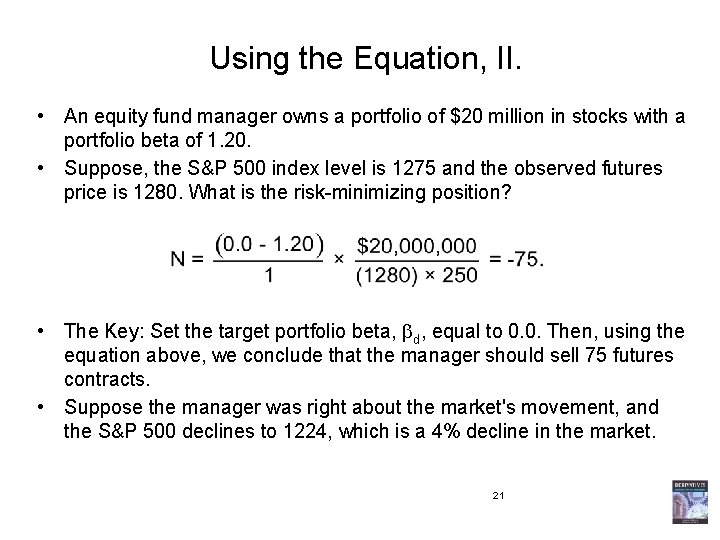

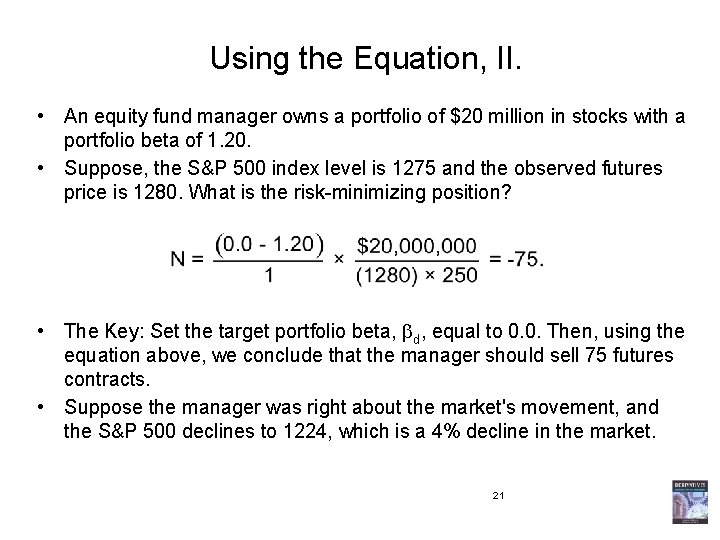

Using the Equation, II. • An equity fund manager owns a portfolio of $20 million in stocks with a portfolio beta of 1. 20. • Suppose, the S&P 500 index level is 1275 and the observed futures price is 1280. What is the risk-minimizing position? • The Key: Set the target portfolio beta, d, equal to 0. 0. Then, using the equation above, we conclude that the manager should sell 75 futures contracts. • Suppose the manager was right about the market's movement, and the S&P 500 declines to 1224, which is a 4% decline in the market. 21

Using the Equation, III. • If beta was estimated accurately, the value of the manager’s equity portfolio should decline by 4. 8% (1. 20 times 4%). This results in a loss in the capital value of the portfolio of $960, 000. • Now assume that the futures price also declines by 4%, to 1228. 80. • A futures price decline of 51. 2 points results in a profit of $12, 800 on one futures contract. On a position of 75 short futures contracts, the profit would be $960, 000. • Here, the hedge eliminated the effects of the market decline. 22

Stock Index Arbitrage • Stock Index Arbitrage is an attempt to exploit any futures mispricing relative to the index level. • When futures prices lie outside their no-arbitrage bounds, arbitrageurs will quickly act to realize the (near) riskless profits by buying cheap stock and selling futures (buy programs), or buying cheap futures and selling stock (sell programs). • Between July 1, 2002 and August 30, 2002, program trading averaged 34. 6% of total NYSE volume, and stock index arbitrage as a percentage of total program trading ranged between 8. 4% and 14. 3%, with an average of 11. 9%. 23

Arbitrage Bounds • In practice, if F > S + CC - CR, then arbitrageurs' purchases of stock increase stock prices (these are called “buy programs”). • Their sales of futures will depress futures prices, until equilibrium is again reached (F S + CC - CR), and no arbitrage opportunities exist. • Similarly, if F < S + CC - CR, the buying of cheap futures and the sale of expensive stock (“sell programs”). • Their purchases of futures will increase futures prices, until equilibrium is again reached (F S + CC - CR), and no arbitrage opportunities exist. 24

Program Trading • Program trading is a technique for trading a stock portfolio in one single order. • The NYSE defines a program trade as: "a wide range of portfolio trading strategies involving the purchase or sale of a basket of 15 stocks or more, and valued at more than $1 million". • Program trading may involve stock index arbitrage, option replication strategies, or asset allocation shifts (such as between equities and bonds), etc. • Recent growth in program trading has arisen from brokers who offer institutions the ability to trade large portfolios of stocks with low cost and little price impact. • In 2001, program trading accounted for almost 30% of total NYSE volume. 25

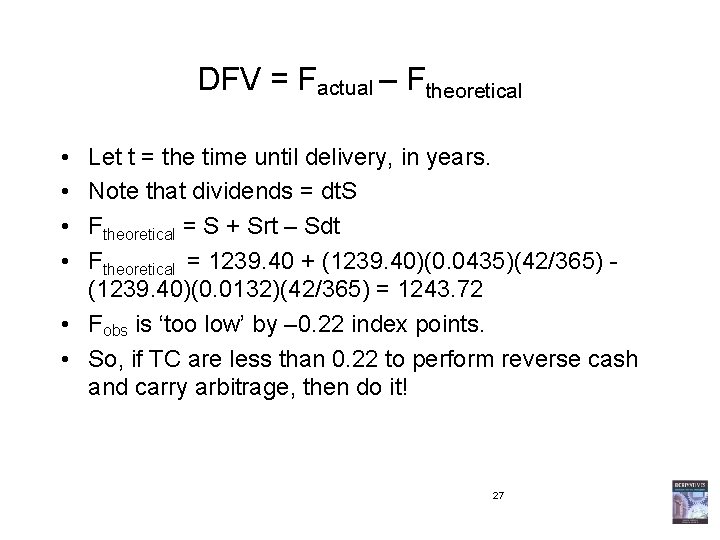

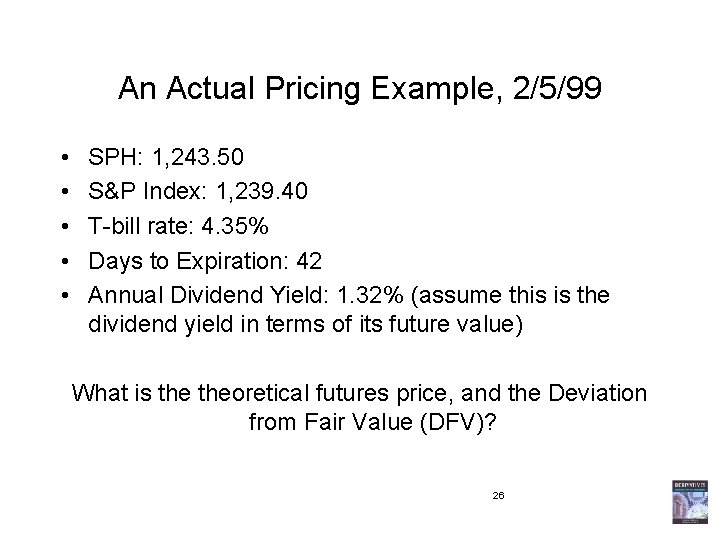

An Actual Pricing Example, 2/5/99 • • • SPH: 1, 243. 50 S&P Index: 1, 239. 40 T-bill rate: 4. 35% Days to Expiration: 42 Annual Dividend Yield: 1. 32% (assume this is the dividend yield in terms of its future value) What is theoretical futures price, and the Deviation from Fair Value (DFV)? 26

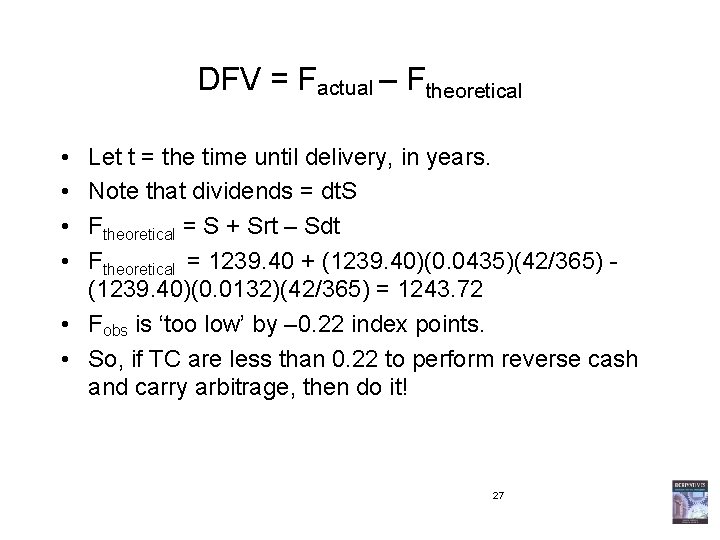

DFV = Factual – Ftheoretical • • Let t = the time until delivery, in years. Note that dividends = dt. S Ftheoretical = S + Srt – Sdt Ftheoretical = 1239. 40 + (1239. 40)(0. 0435)(42/365) (1239. 40)(0. 0132)(42/365) = 1243. 72 • Fobs is ‘too low’ by – 0. 22 index points. • So, if TC are less than 0. 22 to perform reverse cash and carry arbitrage, then do it! 27

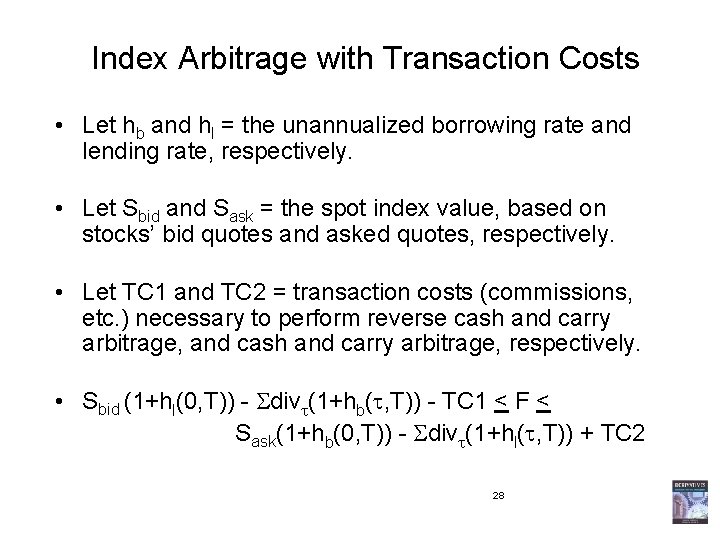

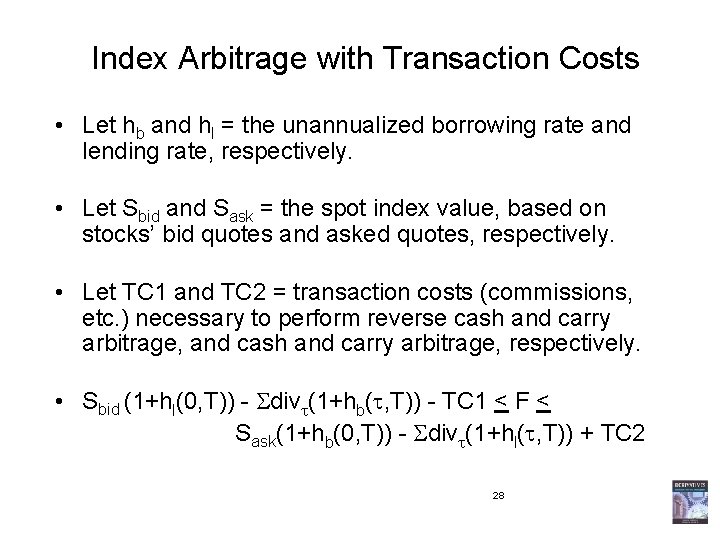

Index Arbitrage with Transaction Costs • Let hb and hl = the unannualized borrowing rate and lending rate, respectively. • Let Sbid and Sask = the spot index value, based on stocks’ bid quotes and asked quotes, respectively. • Let TC 1 and TC 2 = transaction costs (commissions, etc. ) necessary to perform reverse cash and carry arbitrage, and cash and carry arbitrage, respectively. • Sbid (1+hl(0, T)) - div (1+hb( , T)) - TC 1 < F < Sask(1+hb(0, T)) - div (1+hl( , T)) + TC 2 28

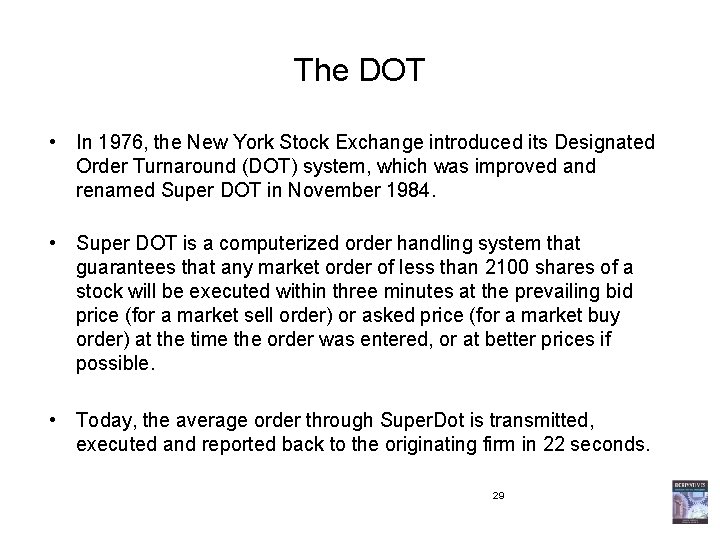

The DOT • In 1976, the New York Stock Exchange introduced its Designated Order Turnaround (DOT) system, which was improved and renamed Super DOT in November 1984. • Super DOT is a computerized order handling system that guarantees that any market order of less than 2100 shares of a stock will be executed within three minutes at the prevailing bid price (for a market sell order) or asked price (for a market buy order) at the time the order was entered, or at better prices if possible. • Today, the average order through Super. Dot is transmitted, executed and reported back to the originating firm in 22 seconds. 29

DOT and Stock Index Arbitrage • Originally, DOT was designed to alleviate the traffic around specialists' trading posts by automatically handling the orders of small individual investors. • Runners do not have to hand-carry small orders to the specialist. Instead, they are electronically transmitted from order rooms to the specialists' posts. • Little did the designers of DOT realize that their system would be adopted by index arbitrageurs, who now enter orders to buy or sell portfolios of stocks, including the composition of any index replicating portfolio (e. g. , 1000 shares of IBM, 1267 shares of GM, etc. ). 30

Computerized Trading • Whenever an arbitrage opportunity arises a trader can literally push a button to submit these orders to buy (at the asked) or sell (at the bid) the entire basket of stocks. • On average, the execution of the trade is reported back to the buyer or seller in 22 seconds. • At the same time, the arbitrageur will trade the necessary stock index futures contracts. • Larger orders (more than 2099 shares of one stock) are handled less efficiently, with trades occurring only after an arbitrageur's human representative carries the order to the specialists' posts. 31

Risks of Stock Index Arbitrage • Even with Super DOT, there are some risks to index arbitrage. Large orders to trade securities are not guaranteed any price, and prices can change quickly in the few minutes that it takes to execute all of the desired trades. • Arbitrageurs' orders to buy stock may create upward price pressure on those stocks unless there happens to be a contemporaneous flow of sell orders, or the specialist is willing to reduce his inventory of stock. • Similarly, program selling will often lead to price declines in the spot stock market. 32

Some Extra Slides on this Material • Note: In some chapters, we try to include some extra slides in an effort to allow for a deeper (or different) treatment of the material in the chapter. • If you have created some slides that you would like to share with the community of educators that use our book, please send them to us! 33

Three Basic Weighting Schemes • Capitalization-Weighting (AKA Value Weighting or Market-Value Weighting): – Stocks held in proportion to their market value. – Large-cap companies have more influence on the index. 34

Three Basic Weighting Schemes, Cont. • Price Weighting: Equal number of shares invested in each stock, therefore, the price is the weight. – The highest-priced stocks have the largest weight. – Berkshire Hathaway • Equal Dollar Weighting: Same dollar investment in each stock. – The lowest-priced stocks have more influence. 35

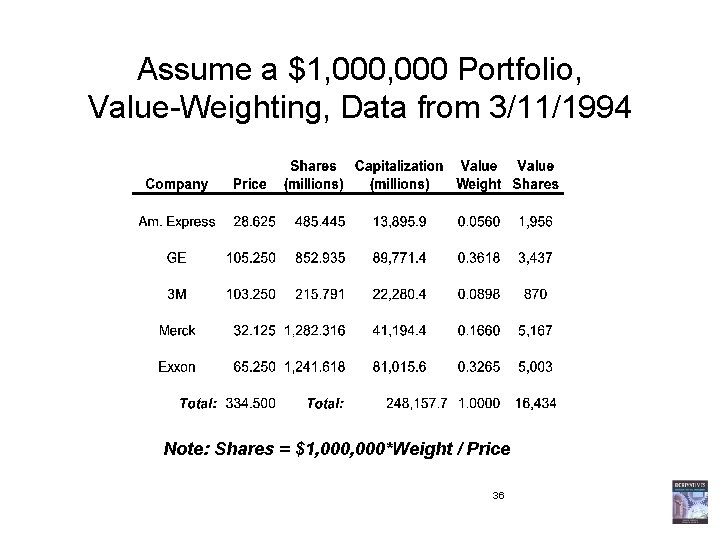

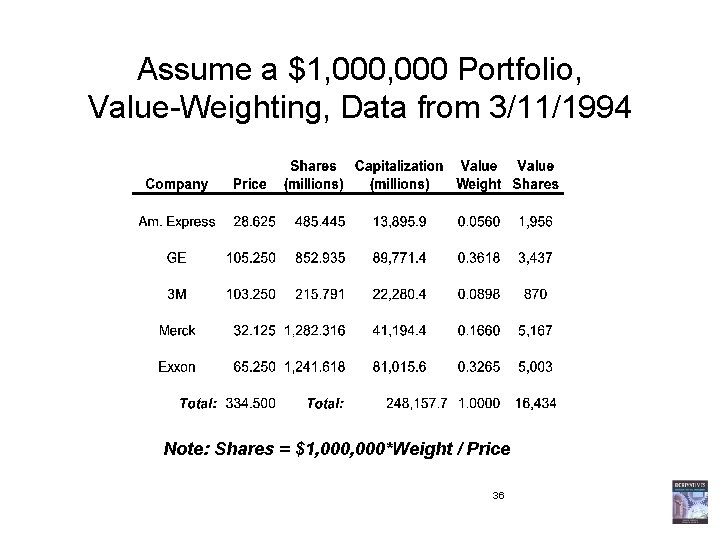

Assume a $1, 000 Portfolio, Value-Weighting, Data from 3/11/1994 Note: Shares = $1, 000*Weight / Price 36

Assume a $1, 000 Portfolio, Price-Weighting, Data from 3/11/1994 Note: Shares = $1, 000 / 334. 500 = 2, 990 37

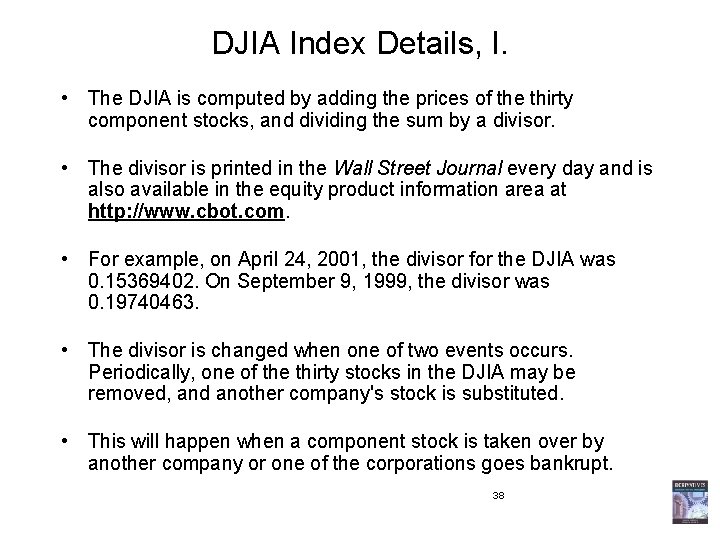

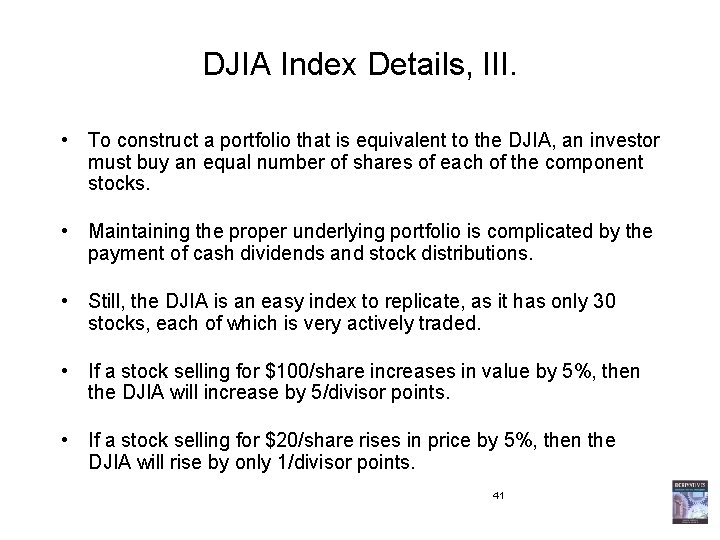

DJIA Index Details, I. • The DJIA is computed by adding the prices of the thirty component stocks, and dividing the sum by a divisor. • The divisor is printed in the Wall Street Journal every day and is also available in the equity product information area at http: //www. cbot. com. • For example, on April 24, 2001, the divisor for the DJIA was 0. 15369402. On September 9, 1999, the divisor was 0. 19740463. • The divisor is changed when one of two events occurs. Periodically, one of the thirty stocks in the DJIA may be removed, and another company's stock is substituted. • This will happen when a component stock is taken over by another company or one of the corporations goes bankrupt. 38

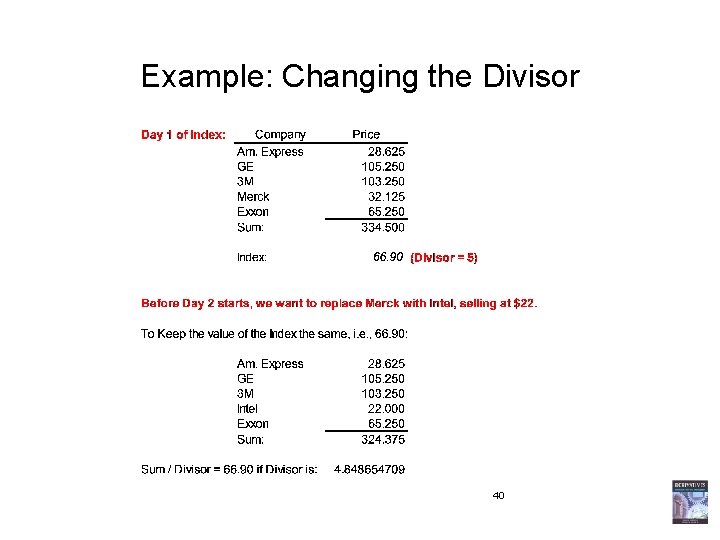

DJIA Index Details, II. • For example, Anaconda, a component of the DJIA, was bought by Atlantic Richfield (ARCO) in 1976. Thus, a new component stock (which was MMM) was chosen to replace Anaconda. • Dow Jones may decide that the DJIA no longer representative of "the market", so the composition will change. – This occurred on November 1, 1999 – IN: Home Depot, Intel, Microsoft, and SBC Communications – OUT: Chevron, Goodyear, Sears Roebuck, and Union Carbide. • So, anytime there is a change in the portfolio of the constituent stocks, or if there are splits, stock dividends, or mergers, the DJIA divisor will change because Dow Jones and Company wants to remove the impact on the index from these events. • NB: The DJIA is not adjusted to account for regular dividend payments. 39

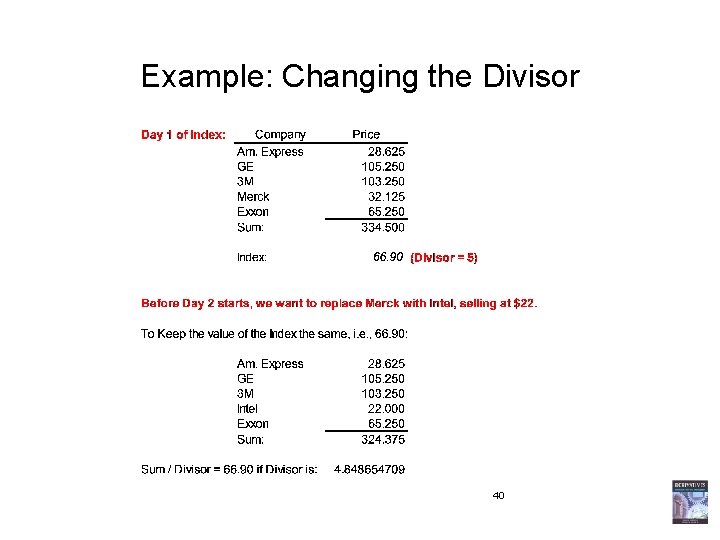

Example: Changing the Divisor 40

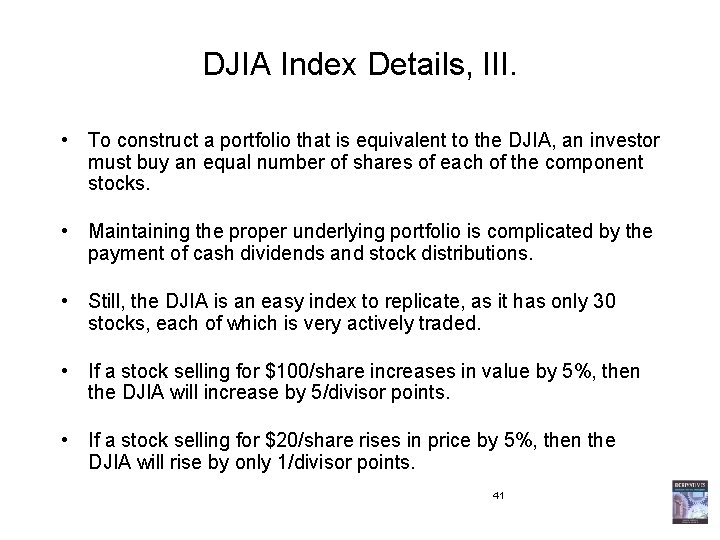

DJIA Index Details, III. • To construct a portfolio that is equivalent to the DJIA, an investor must buy an equal number of shares of each of the component stocks. • Maintaining the proper underlying portfolio is complicated by the payment of cash dividends and stock distributions. • Still, the DJIA is an easy index to replicate, as it has only 30 stocks, each of which is very actively traded. • If a stock selling for $100/share increases in value by 5%, then the DJIA will increase by 5/divisor points. • If a stock selling for $20/share rises in price by 5%, then the DJIA will rise by only 1/divisor points. 41

Assume a $1, 000 Portfolio, Equal-Weighting, Data from 3/11/1994 Shares = $1, 000*0. 20 / Price 42

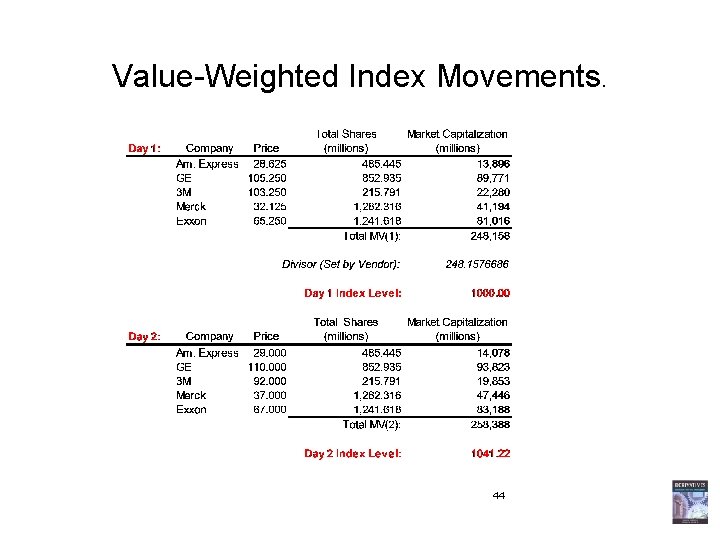

Many stock market indices are Value. Weighted Averages • In the Capital Asset Pricing Model (CAPM), a stock's correlation with the market portfolio is the factor that determines its price, and that market portfolio is value-weighted. • Besides the NYSE and S&P Indices, other value-weighted indices include the AMEX Market Value Index, the NASDAQ Composite Index, the Russell 2000 Index, and the Wilshire 5000. • The levels of these and yet other indices are presented daily in the Wall Street Journal. While each index is a different portfolio of stocks, the method of computing each index is the same. 43

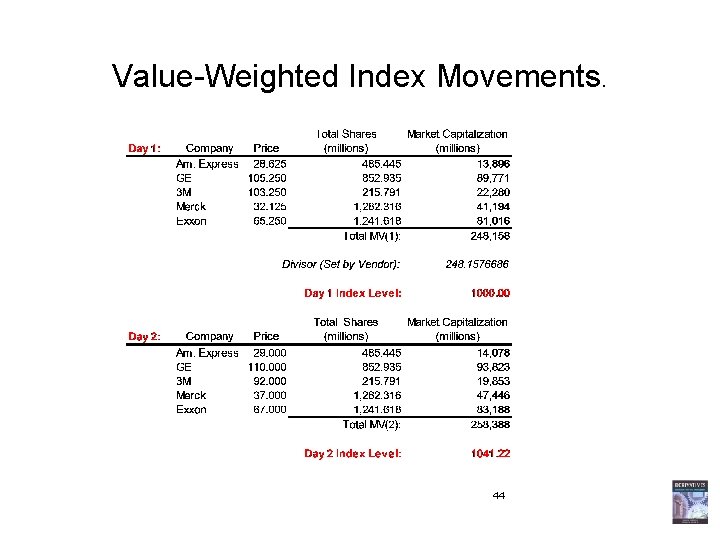

Value-Weighted Index Movements. 44

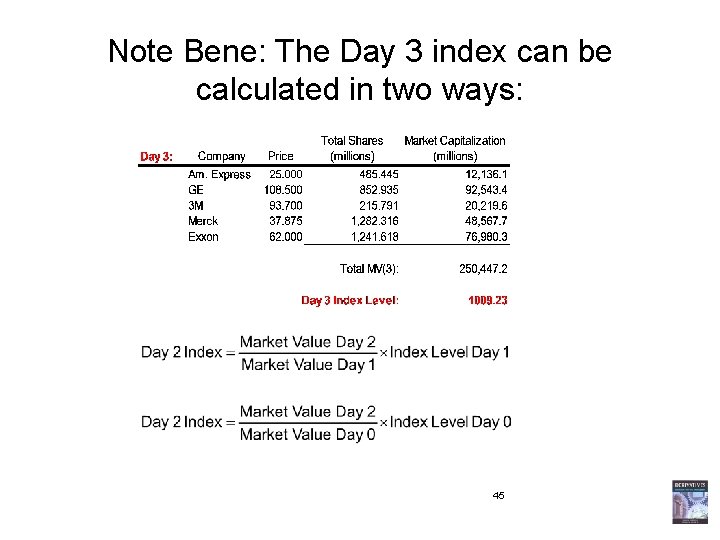

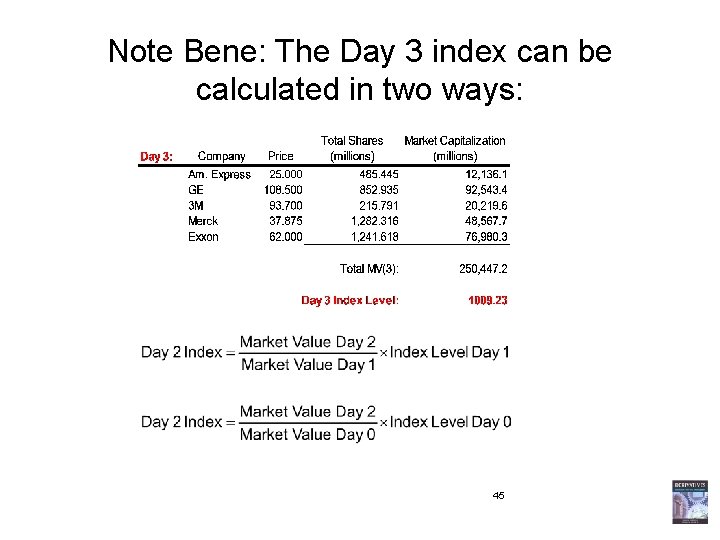

Note Bene: The Day 3 index can be calculated in two ways: 45

Declared dividend index futures

Declared dividend index futures A small child slides down the four frictionless slides

A small child slides down the four frictionless slides A crane lowers a girder into place

A crane lowers a girder into place Long-term debt preferred stock and common stock

Long-term debt preferred stock and common stock Makanan cair yang terbuat dari bahan dasar stock adalah

Makanan cair yang terbuat dari bahan dasar stock adalah Characteristics of corporate bonds and stocks

Characteristics of corporate bonds and stocks Pramv

Pramv Hedging strategies using futures

Hedging strategies using futures Thai stock market set index series

Thai stock market set index series Diff between step index and graded index fiber

Diff between step index and graded index fiber Primary index is dense or sparse

Primary index is dense or sparse Mitsuda reaction

Mitsuda reaction Compare india and sri lanka on the basis of hdi

Compare india and sri lanka on the basis of hdi Optical fiber waveguide

Optical fiber waveguide Simpson index example

Simpson index example Consistency limits

Consistency limits Clustered index và non clustered index

Clustered index và non clustered index What is serial file organisation

What is serial file organisation Process organization in computer organization

Process organization in computer organization Point by point organization

Point by point organization Saham samsung

Saham samsung Cme tbond futures

Cme tbond futures Interest rate futures

Interest rate futures Euro-btp options

Euro-btp options Futures definition

Futures definition Add-on yield

Add-on yield Currency futures

Currency futures Currency futures

Currency futures Bright futures scholarship

Bright futures scholarship Aap bright futures periodicity schedule

Aap bright futures periodicity schedule Tobacco free futures

Tobacco free futures Hesa data futures

Hesa data futures A pedagogy of multiliteracies: designing social futures

A pedagogy of multiliteracies: designing social futures Currency futures contracts sold on an exchange:

Currency futures contracts sold on an exchange: Language futures

Language futures Fair value of futures contract

Fair value of futures contract Hedging strategies using futures

Hedging strategies using futures Esf futures

Esf futures Enron weather futures

Enron weather futures Stoxx blue chip

Stoxx blue chip Futures trading risk management

Futures trading risk management Options futures and risk management

Options futures and risk management Synthetic forward contract

Synthetic forward contract Options futures and other derivatives

Options futures and other derivatives Eurodollar adalah

Eurodollar adalah Mechanics of futures market

Mechanics of futures market