Hedging Strategies Using Futures Chapter 3 Options Futures

- Slides: 29

Hedging Strategies Using Futures Chapter 3 Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 1

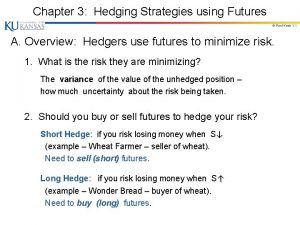

Hedge : A trade designed to reduce risk. ◦ Many of the participants in futures markets are hedgers. Their aim is to use futures markets to reduce a particular risk that they face. A perfect hedge is one that completely eliminates the risk. ◦ Perfect hedges are rare. Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 2

Short Hedges A short futures hedge is appropriate when 1. The hedger already owns an asset and expects to sell it at some time in the future Example: A farmer who owns some hogs and knows that they will be ready for sale in two months. Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 3

Short Hedges An asset is not owned right now but will be owned at some time in the future Example: A US exporter who knows that he or she will receive euros in 3 months. The exporter will realize a gain if the euro increases in value r. t. the US dollar and will sustain a loss if it decreases in value. A short futures position offsets the risk. 2. Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 4

Long Hedges A long hedge is appropriate when 1. a company knows it will have to purchase a certain asset in the future and wants to lock in a price now Example: In January 15, a copper fabricator knows it will require 100, 00 pounds of copper on May 15 to meet a certain contract Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 5

Long Hedges An investor has a short position and wants to manage its risk Example: An investor who has shorted a certain stock. Part of the risk faced by him is related to the performance of the whole stock market, and could be neutralize with a long position in index futures contracts. 2. Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 6

Arguments in Favor of Hedging Companies should focus on the main business they are in and take steps to minimize risks arising from interest rates, exchange rates, and other market variables Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 7

Arguments against Hedging Shareholders are usually well diversified and can make their own hedging decisions It may increase risk to hedge when competitors do not Explaining a situation where there is a loss on the hedge and a gain on the underlying can be difficult Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 8

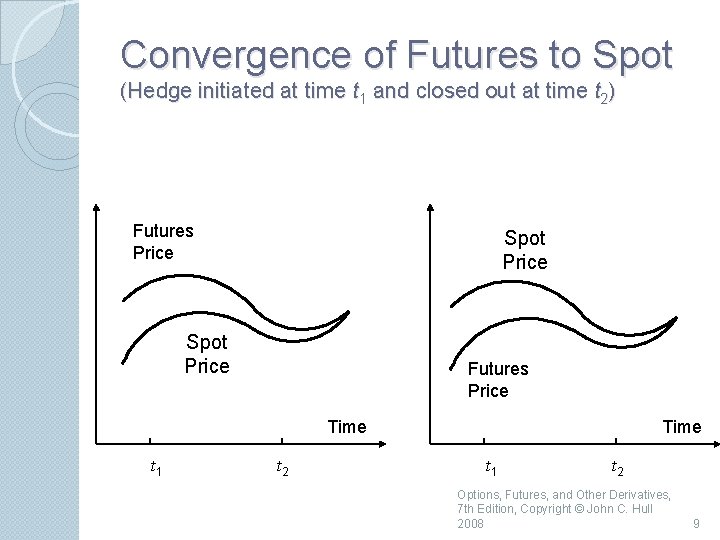

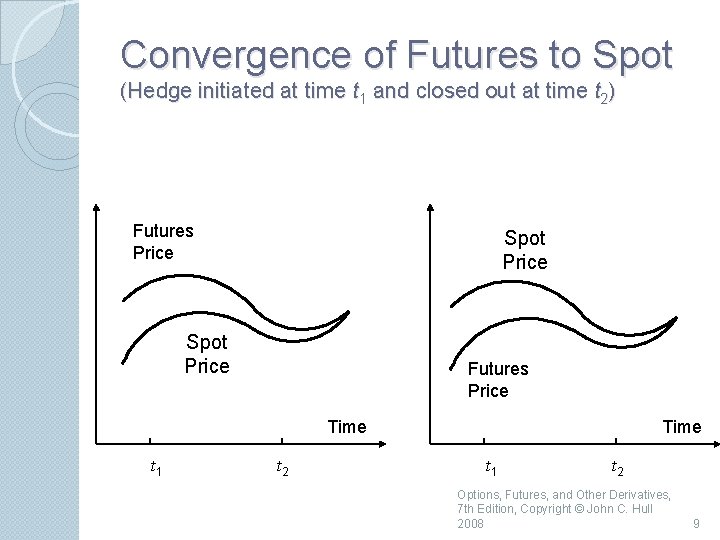

Convergence of Futures to Spot (Hedge initiated at time t 1 and closed out at time t 2) Futures Price Spot Price Futures Price Time t 1 t 2 Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 9

Basis Risk Basis is the difference between the spot and futures price Basis risk arises because of the uncertainty about the basis when the hedge is closed out Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 10

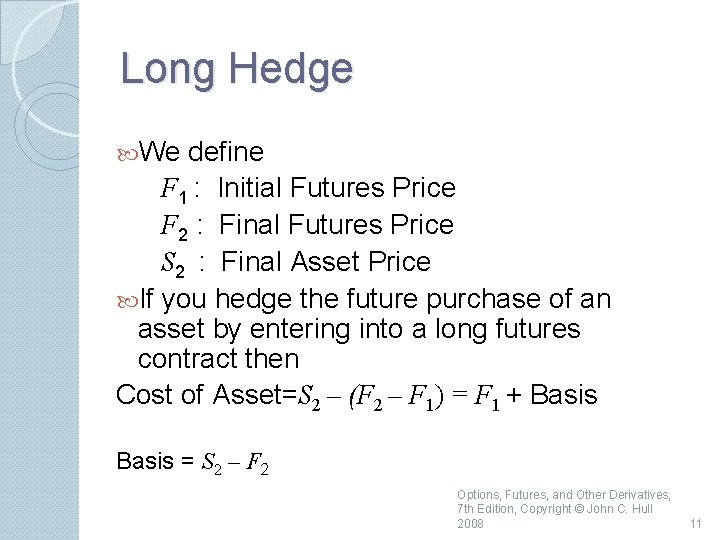

Long Hedge We define F 1 : Initial Futures Price F 2 : Final Futures Price S 2 : Final Asset Price If you hedge the future purchase of an asset by entering into a long futures contract then Cost of Asset=S 2 – (F 2 – F 1) = F 1 + Basis = S 2 – F 2 Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 11

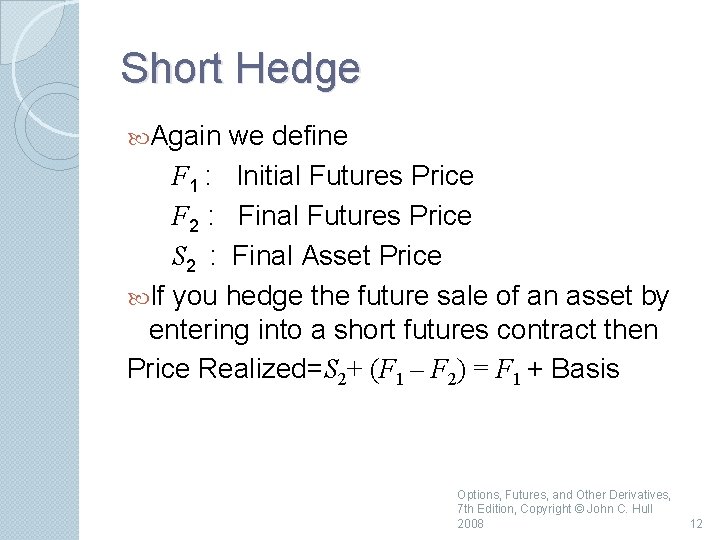

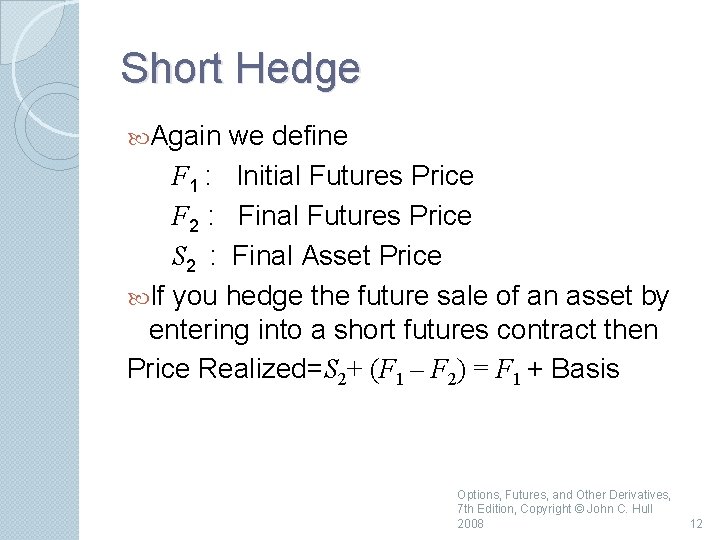

Short Hedge Again we define F 1 : Initial Futures Price F 2 : Final Futures Price S 2 : Final Asset Price If you hedge the future sale of an asset by entering into a short futures contract then Price Realized=S 2+ (F 1 – F 2) = F 1 + Basis Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 12

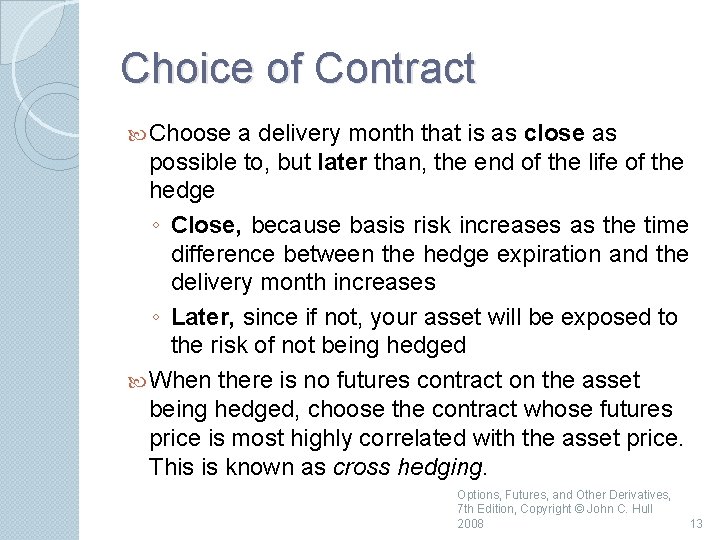

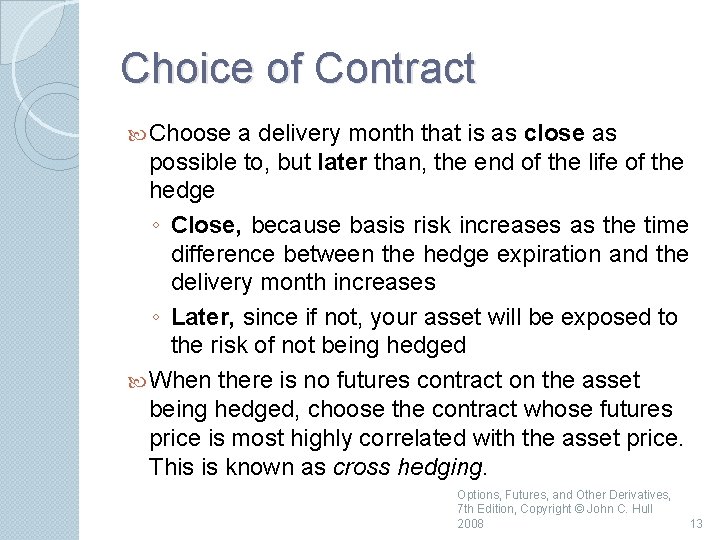

Choice of Contract Choose a delivery month that is as close as possible to, but later than, the end of the life of the hedge ◦ Close, because basis risk increases as the time difference between the hedge expiration and the delivery month increases ◦ Later, since if not, your asset will be exposed to the risk of not being hedged When there is no futures contract on the asset being hedged, choose the contract whose futures price is most highly correlated with the asset price. This is known as cross hedging. Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 13

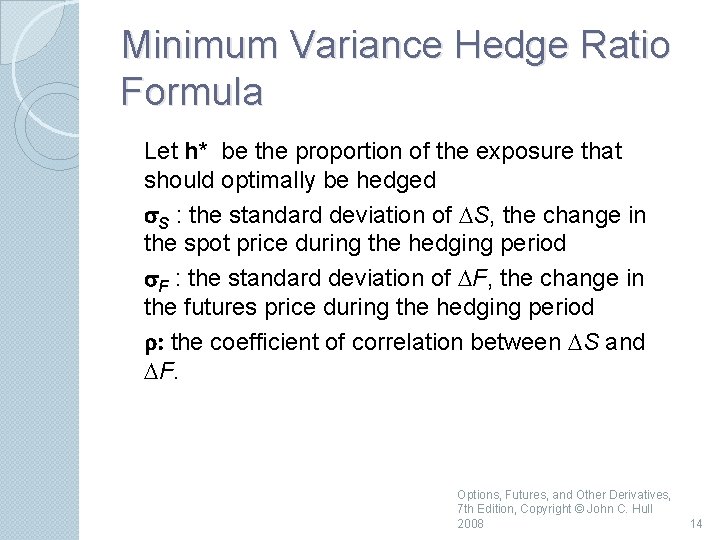

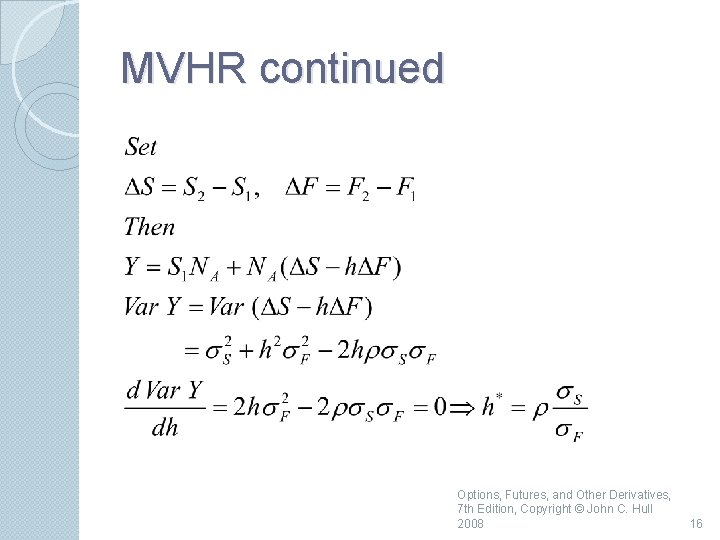

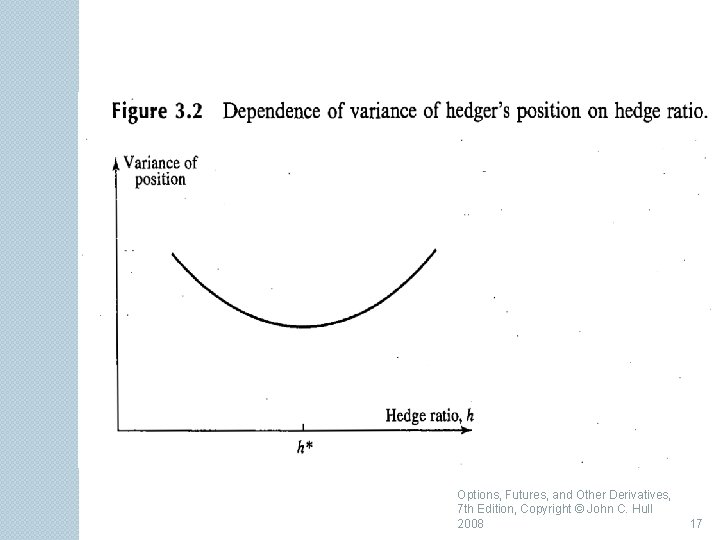

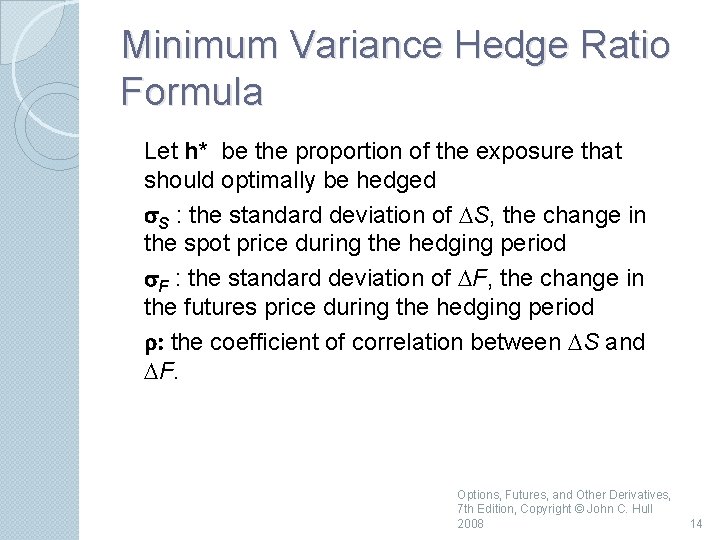

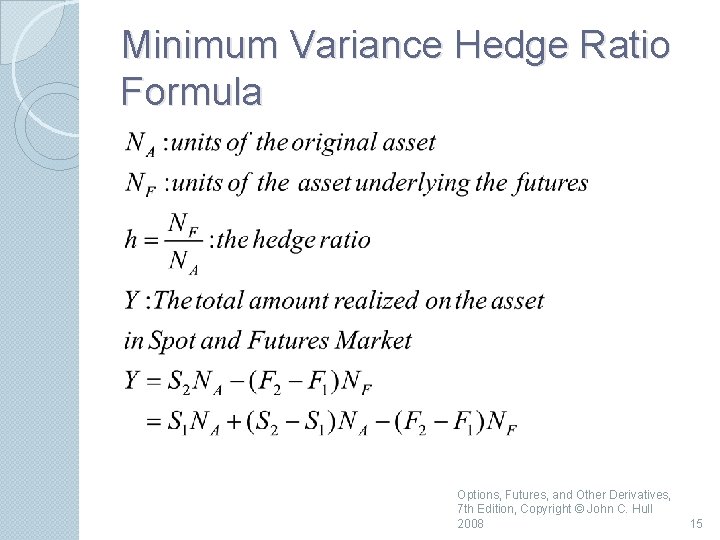

Minimum Variance Hedge Ratio Formula Let h* be the proportion of the exposure that should optimally be hedged s. S : the standard deviation of DS, the change in the spot price during the hedging period s. F : the standard deviation of DF, the change in the futures price during the hedging period r: the coefficient of correlation between DS and DF. Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 14

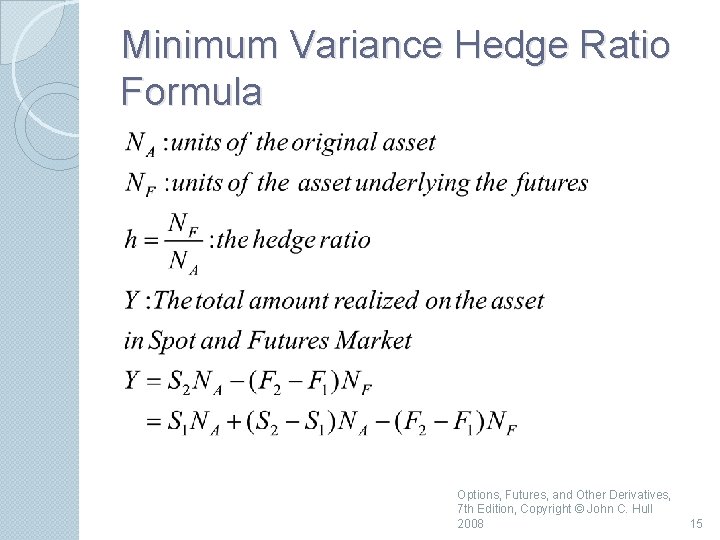

Minimum Variance Hedge Ratio Formula Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 15

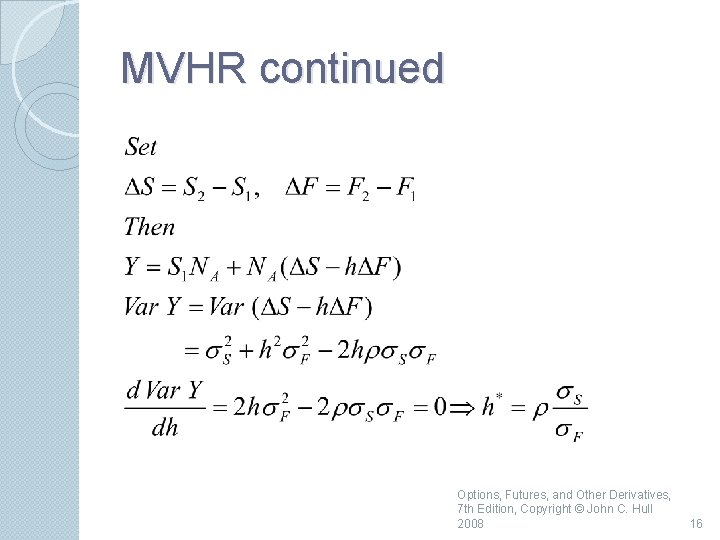

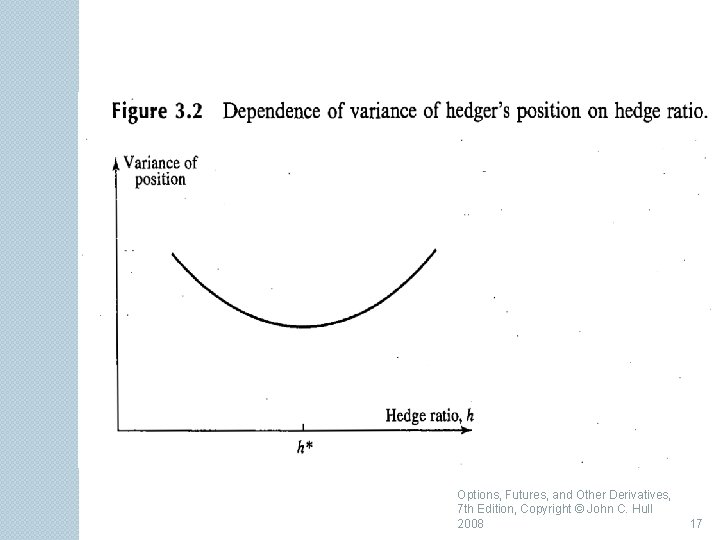

MVHR continued Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 16

Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 17

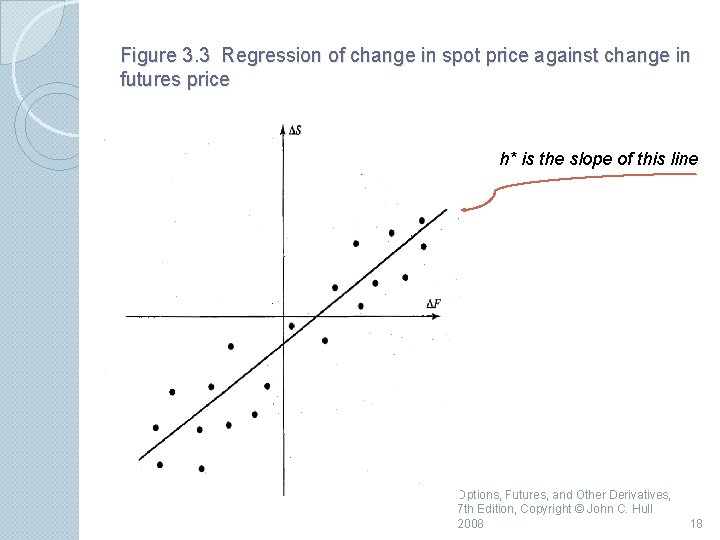

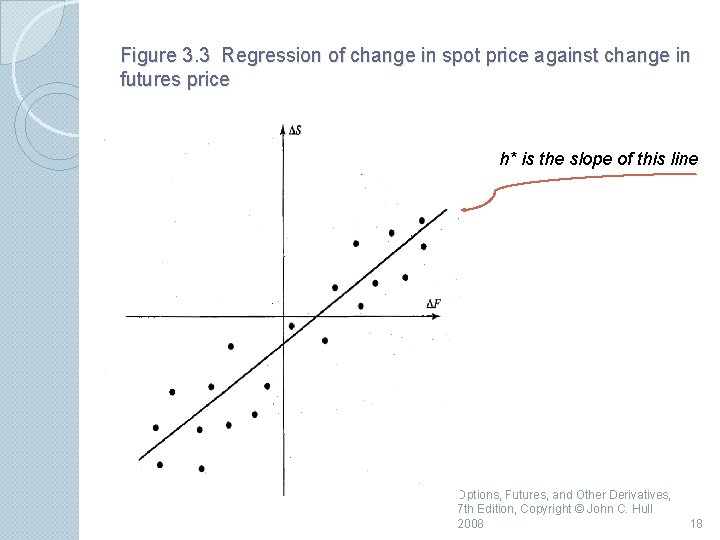

Figure 3. 3 Regression of change in spot price against change in futures price h* is the slope of this line Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 18

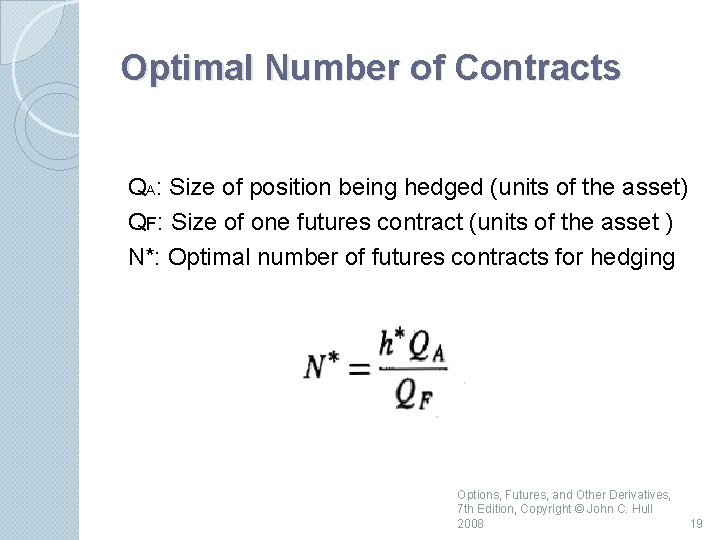

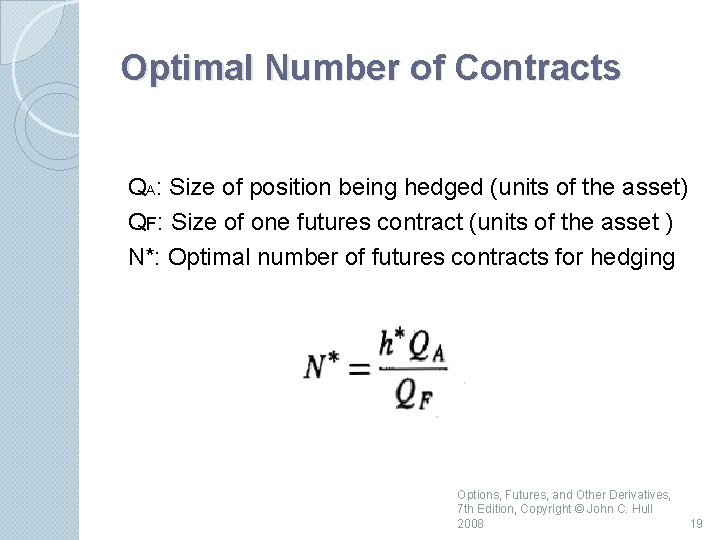

Optimal Number of Contracts QA: Size of position being hedged (units of the asset) QF: Size of one futures contract (units of the asset ) N*: Optimal number of futures contracts for hedging Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 19

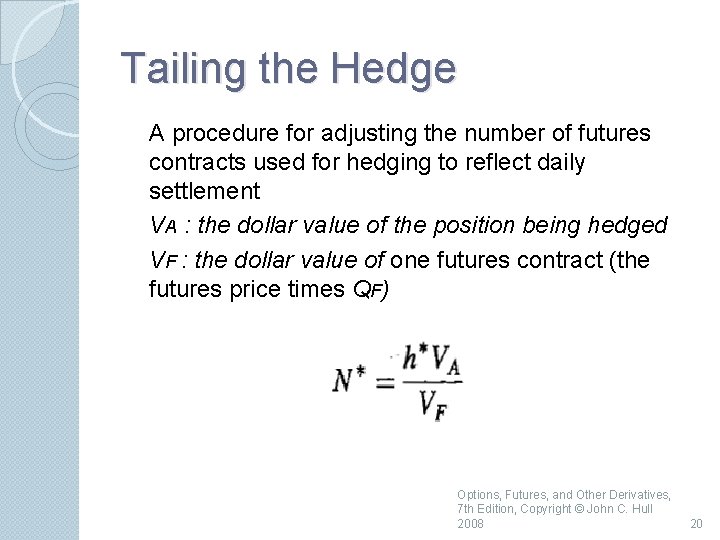

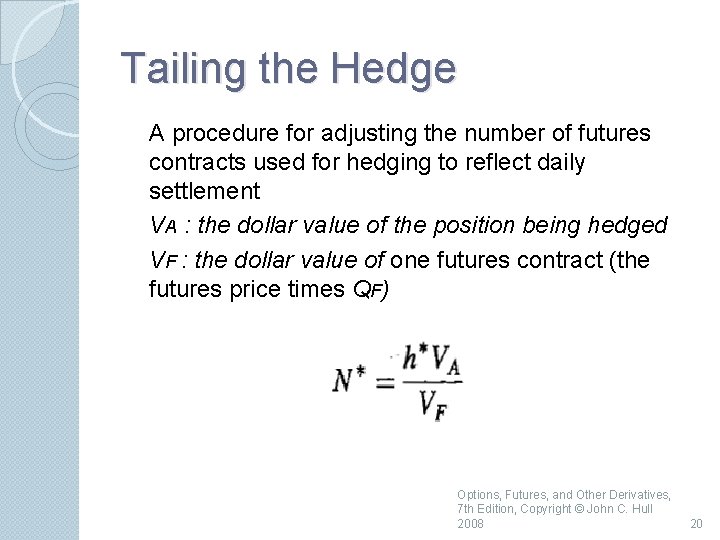

Tailing the Hedge A procedure for adjusting the number of futures contracts used for hedging to reflect daily settlement VA : the dollar value of the position being hedged VF : the dollar value of one futures contract (the futures price times QF) Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 20

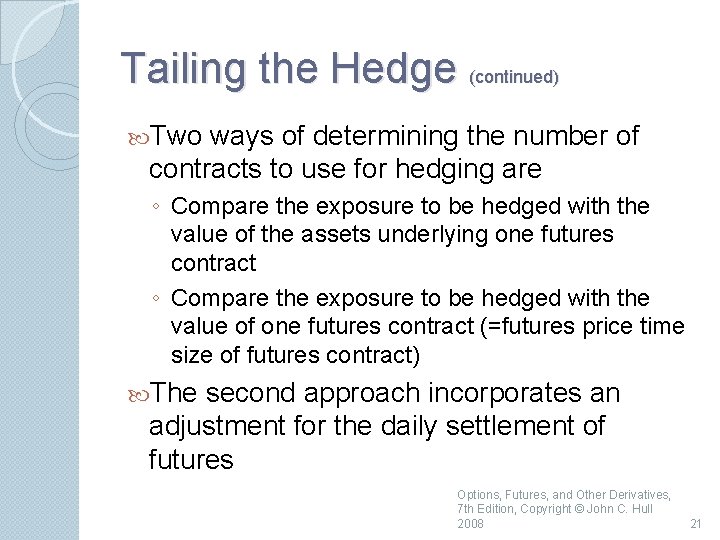

Tailing the Hedge (continued) Two ways of determining the number of contracts to use for hedging are ◦ Compare the exposure to be hedged with the value of the assets underlying one futures contract ◦ Compare the exposure to be hedged with the value of one futures contract (=futures price time size of futures contract) The second approach incorporates an adjustment for the daily settlement of futures Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 21

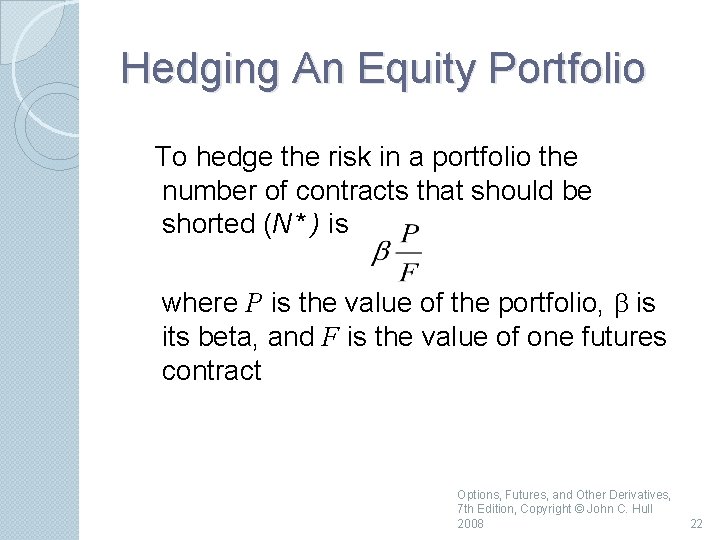

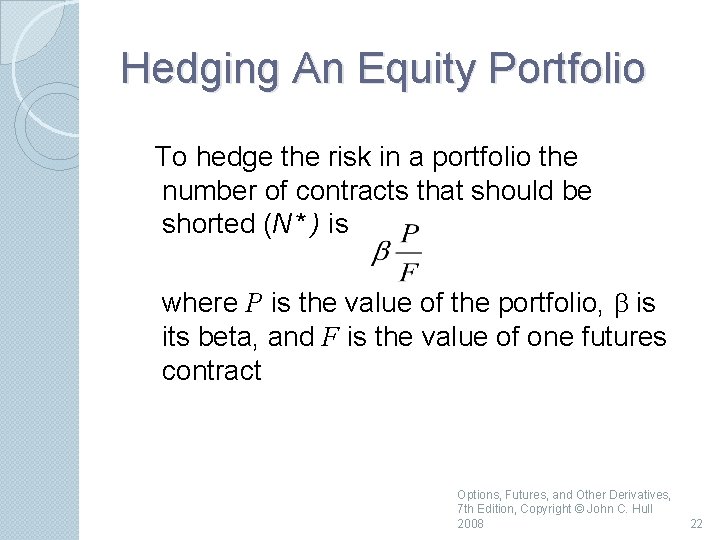

Hedging An Equity Portfolio To hedge the risk in a portfolio the number of contracts that should be shorted (N* ) is where P is the value of the portfolio, b is its beta, and F is the value of one futures contract Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 22

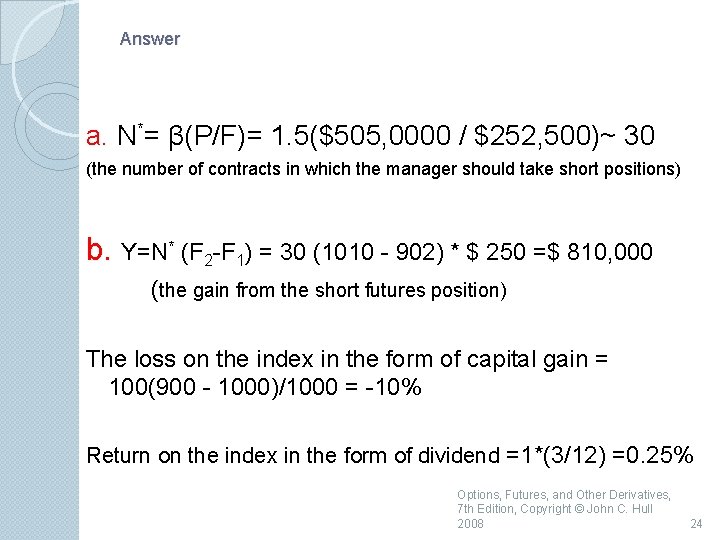

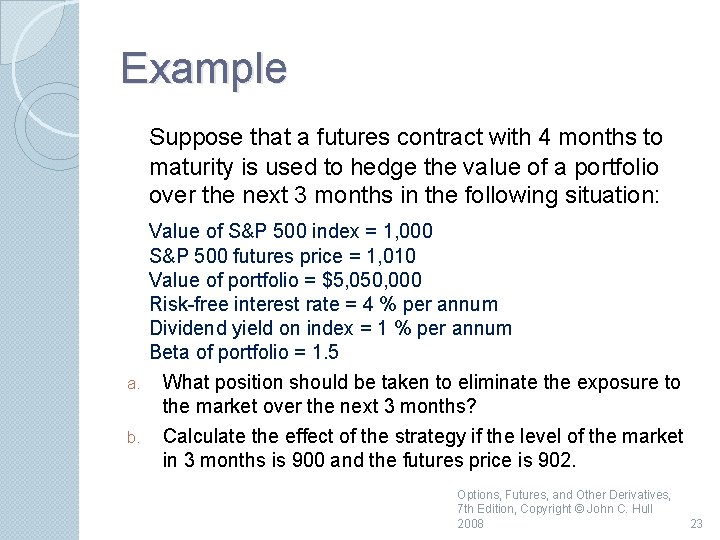

Example Suppose that a futures contract with 4 months to maturity is used to hedge the value of a portfolio over the next 3 months in the following situation: Value of S&P 500 index = 1, 000 S&P 500 futures price = 1, 010 Value of portfolio = $5, 050, 000 Risk-free interest rate = 4 % per annum Dividend yield on index = 1 % per annum Beta of portfolio = 1. 5 a. What position should be taken to eliminate the exposure to the market over the next 3 months? b. Calculate the effect of the strategy if the level of the market in 3 months is 900 and the futures price is 902. Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 23

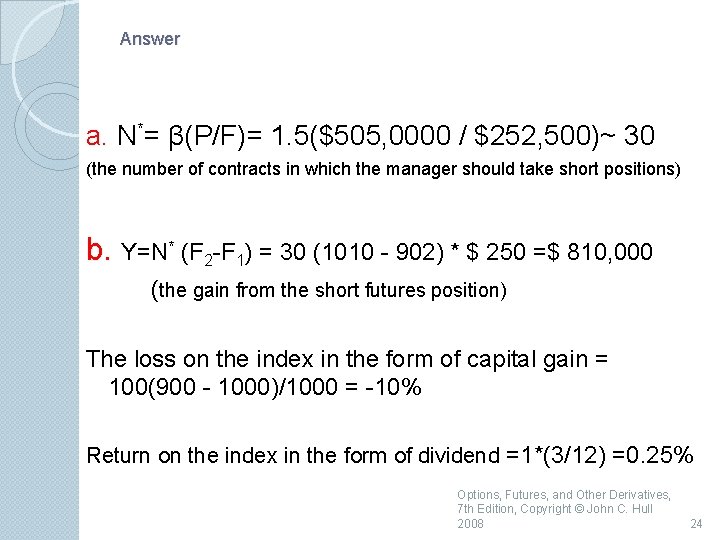

Answer a. N*= β(P/F)= 1. 5($505, 0000 / $252, 500)~ 30 (the number of contracts in which the manager should take short positions) b. Y=N* (F 2 -F 1) = 30 (1010 - 902) * $ 250 =$ 810, 000 (the gain from the short futures position) The loss on the index in the form of capital gain = 100(900 - 1000)/1000 = -10% Return on the index in the form of dividend =1*(3/12) =0. 25% Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 24

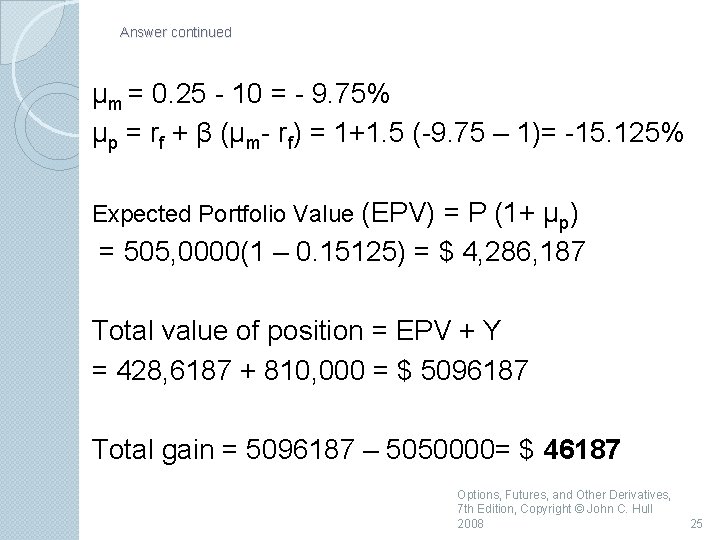

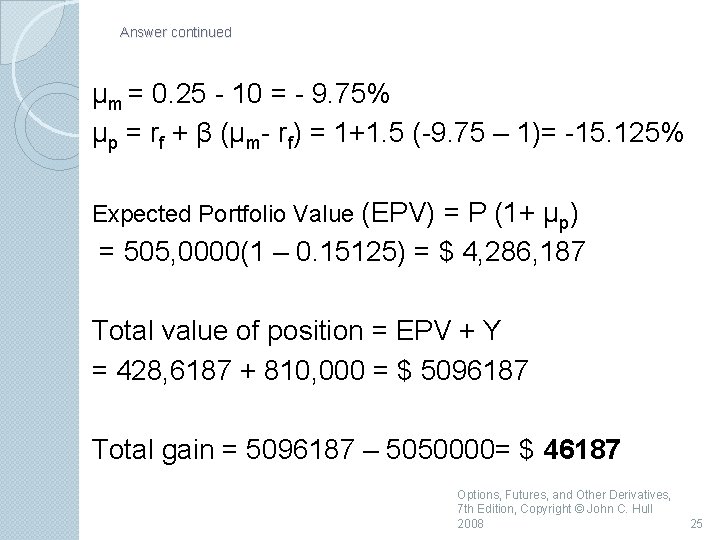

Answer continued µm = 0. 25 - 10 = - 9. 75% µp = rf + β (µm- rf) = 1+1. 5 (-9. 75 – 1)= -15. 125% Expected Portfolio Value (EPV) = P (1+ µp) = 505, 0000(1 – 0. 15125) = $ 4, 286, 187 Total value of position = EPV + Y = 428, 6187 + 810, 000 = $ 5096187 Total gain = 5096187 – 5050000= $ 46187 Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 25

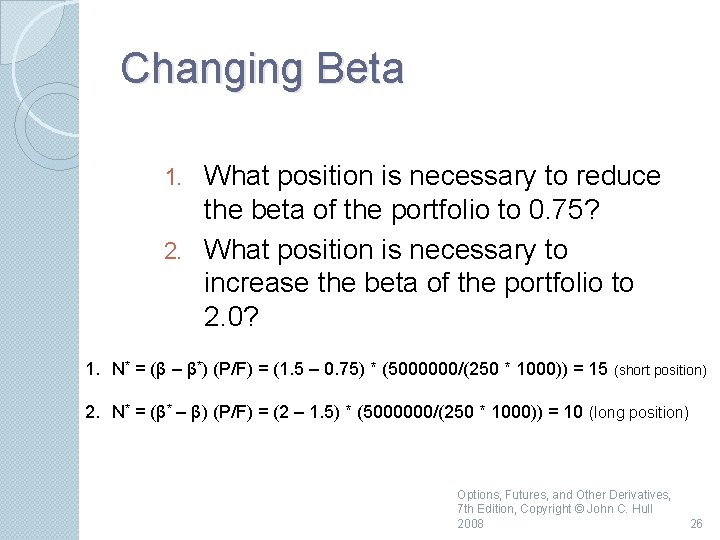

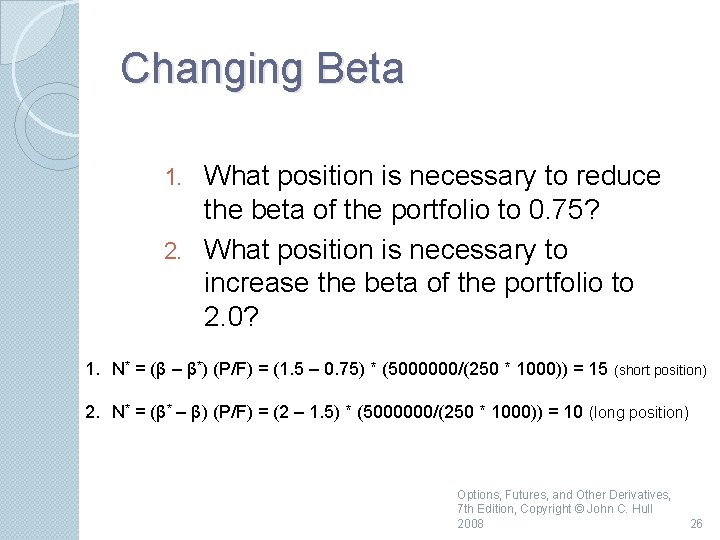

Changing Beta What position is necessary to reduce the beta of the portfolio to 0. 75? 2. What position is necessary to increase the beta of the portfolio to 2. 0? 1. N* = (β – β*) (P/F) = (1. 5 – 0. 75) * (5000000/(250 * 1000)) = 15 (short position) 2. N* = (β* – β) (P/F) = (2 – 1. 5) * (5000000/(250 * 1000)) = 10 (long position) Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 26

Hedging Price of an Individual Stock Similar to hedging a portfolio Does not work as well because only the systematic risk is hedged The unsystematic risk that is unique to the stock is not hedged Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 27

Why Hedge Equity Returns May want to be out of the market for a while. Hedging avoids the costs of selling and repurchasing the portfolio Suppose stocks in your portfolio have an average beta of 1. 0, but you feel they have been chosen well and will outperform the market in both good and bad times. Hedging ensures that the return you earn is the risk-free return plus the excess return of your portfolio over the market. Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 28

Rolling The Hedge Forward (page 64 -65) We can use a series of futures contracts to increase the life of a hedge Each time we switch from one futures contract to another we incur a type of basis risk Options, Futures, and Other Derivatives, 7 th Edition, Copyright © John C. Hull 2008 29

Tailing the hedge

Tailing the hedge Hedging strategies using futures

Hedging strategies using futures Hedging strategies using futures

Hedging strategies using futures Hedge ratio formula

Hedge ratio formula Hedging interest rate risk with futures

Hedging interest rate risk with futures Hedging credit risk with options

Hedging credit risk with options Static hedging of exotic options

Static hedging of exotic options Cattle hedging strategies

Cattle hedging strategies Options futures and risk management

Options futures and risk management Options, futures, and other derivatives

Options, futures, and other derivatives Introduction to futures and options

Introduction to futures and options Futures style options

Futures style options Traders in financial futures

Traders in financial futures Currency futures

Currency futures Advantages and disadvantages of derivatives

Advantages and disadvantages of derivatives Academic style words

Academic style words Trading strategies involving options

Trading strategies involving options Cboe options strategies

Cboe options strategies Hedging in academic writing exercises

Hedging in academic writing exercises Greek letter vega

Greek letter vega Transfer risiko adalah

Transfer risiko adalah Basis risk arises due to

Basis risk arises due to Hedging language

Hedging language Hedging adalah

Hedging adalah Hedging and boosting

Hedging and boosting Hedging in writing

Hedging in writing Hedging manages risk that are manageable

Hedging manages risk that are manageable Main objective of hedging

Main objective of hedging F mayer imports case study solution

F mayer imports case study solution Contoh lindung nilai atas nilai wajar

Contoh lindung nilai atas nilai wajar