Mechanics of Futures Markets Chapter 2 FORWARDS AND

- Slides: 71

Mechanics of Futures Markets Chapter 2

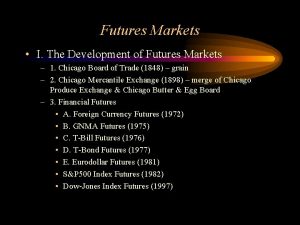

FORWARDS AND FUTURES The CONTRACTS The MARKETS PRICING FORWARDS and FUTURES Speculation Arbitrage Hedging 1

CASH OR SPOT MARKET THE MARKET FOR IMMEDIATE DELIVERY AND PAYMENT GAS STATION, GROCERY STORE, DEPARTMENT STORE…. . SELLER BUYER DELIVERS COMMODITY AND RECEIVES PAYMENT NOW ACCEPTS PAYS The SELLER is said to be LONG The BUYER is said to be SHORT 2

A FORWARD MARKET THE MARKET FOR DEFERRED DELIVERY AND DEFFERED PAYMENT. SHORT =obliged to sell LONG = obliged to buy THE TWO PARTIES MAKE A CONTRACT THAT DETERMINES THE DELIVERY AND PAYMENT PLACE AND TIME IN THE FUTURE. 3

A FORWARD IS A CONTRACT IN WHICH ONE PARTY (the long) COMMITS TO BUY AND THE OTHER PARTY (the short) COMMITS TO SELL A SPECIFIED AMOUNT OF AN AGREED UPON COMMODITY FOR A PREDETERMINED PRICE ON A SPECIFIC DATE IN THE FUTURE. 4

A FUTURES IS A STANDARDIZED FORWARD TRADED ON AN ORGANIZED EXCHANGE. STANDARDIZATION THE COMMODITY TYPE AND QUALITY THE QUANTITY PRICE QUOTES DELIVERY DATES DELIVERY PROCEDURES 5

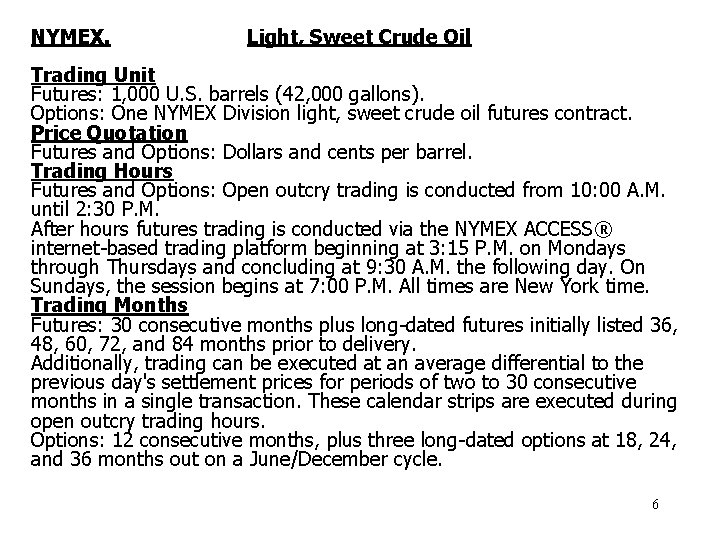

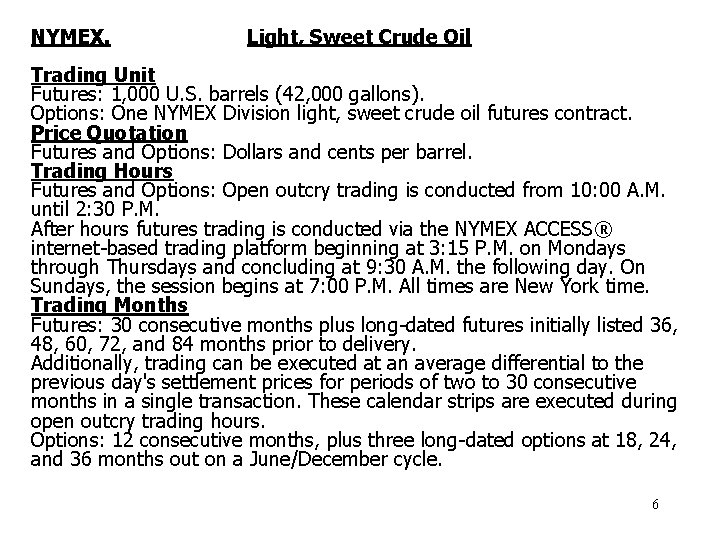

NYMEX. Light, Sweet Crude Oil Trading Unit Futures: 1, 000 U. S. barrels (42, 000 gallons). Options: One NYMEX Division light, sweet crude oil futures contract. Price Quotation Futures and Options: Dollars and cents per barrel. Trading Hours Futures and Options: Open outcry trading is conducted from 10: 00 A. M. until 2: 30 P. M. After hours futures trading is conducted via the NYMEX ACCESS® internet-based trading platform beginning at 3: 15 P. M. on Mondays through Thursdays and concluding at 9: 30 A. M. the following day. On Sundays, the session begins at 7: 00 P. M. All times are New York time. Trading Months Futures: 30 consecutive months plus long-dated futures initially listed 36, 48, 60, 72, and 84 months prior to delivery. Additionally, trading can be executed at an average differential to the previous day's settlement prices for periods of two to 30 consecutive months in a single transaction. These calendar strips are executed during open outcry trading hours. Options: 12 consecutive months, plus three long-dated options at 18, 24, and 36 months out on a June/December cycle. 6

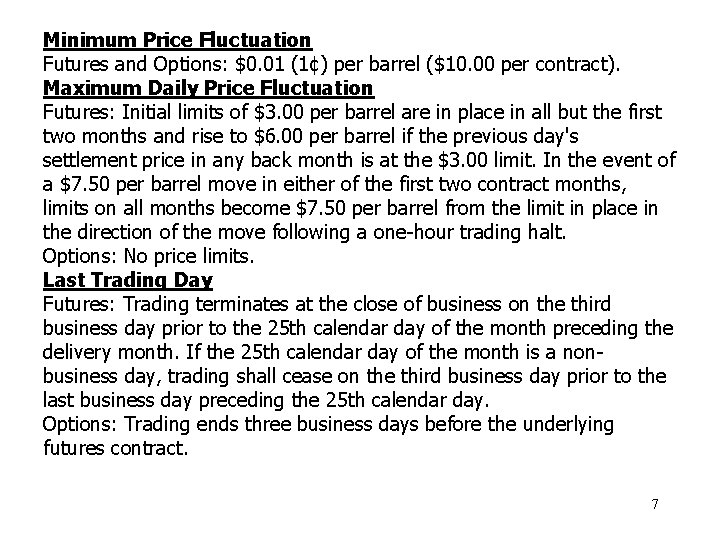

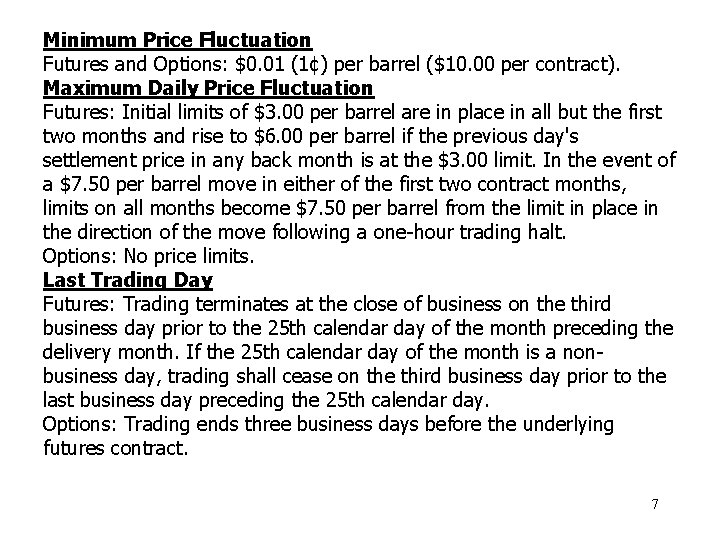

Minimum Price Fluctuation Futures and Options: $0. 01 (1¢) per barrel ($10. 00 per contract). Maximum Daily Price Fluctuation Futures: Initial limits of $3. 00 per barrel are in place in all but the first two months and rise to $6. 00 per barrel if the previous day's settlement price in any back month is at the $3. 00 limit. In the event of a $7. 50 per barrel move in either of the first two contract months, limits on all months become $7. 50 per barrel from the limit in place in the direction of the move following a one-hour trading halt. Options: No price limits. Last Trading Day Futures: Trading terminates at the close of business on the third business day prior to the 25 th calendar day of the month preceding the delivery month. If the 25 th calendar day of the month is a nonbusiness day, trading shall cease on the third business day prior to the last business day preceding the 25 th calendar day. Options: Trading ends three business days before the underlying futures contract. 7

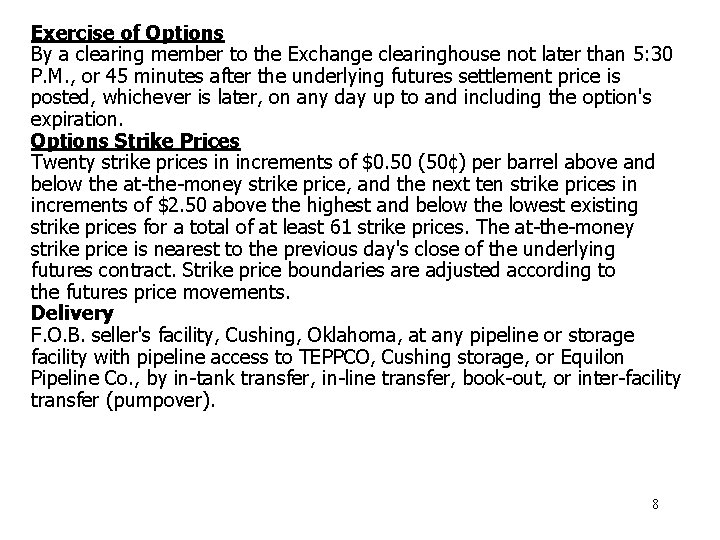

Exercise of Options By a clearing member to the Exchange clearinghouse not later than 5: 30 P. M. , or 45 minutes after the underlying futures settlement price is posted, whichever is later, on any day up to and including the option's expiration. Options Strike Prices Twenty strike prices in increments of $0. 50 (50¢) per barrel above and below the at-the-money strike price, and the next ten strike prices in increments of $2. 50 above the highest and below the lowest existing strike prices for a total of at least 61 strike prices. The at-the-money strike price is nearest to the previous day's close of the underlying futures contract. Strike price boundaries are adjusted according to the futures price movements. Delivery F. O. B. seller's facility, Cushing, Oklahoma, at any pipeline or storage facility with pipeline access to TEPPCO, Cushing storage, or Equilon Pipeline Co. , by in-tank transfer, in-line transfer, book-out, or inter-facility transfer (pumpover). 8

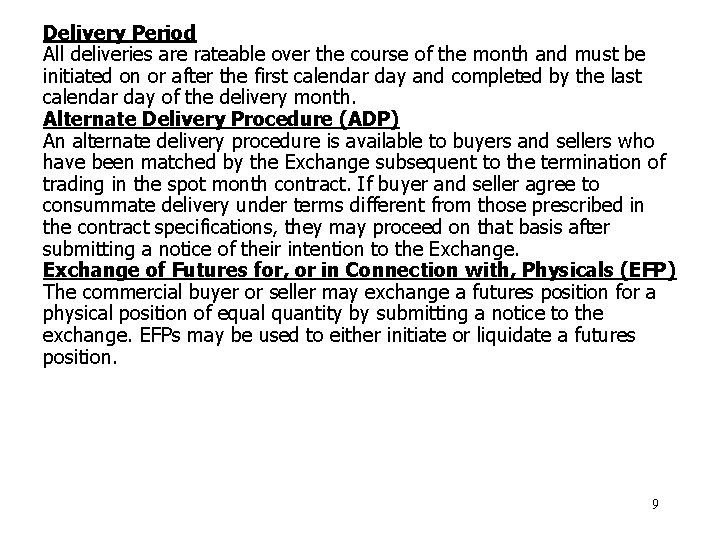

Delivery Period All deliveries are rateable over the course of the month and must be initiated on or after the first calendar day and completed by the last calendar day of the delivery month. Alternate Delivery Procedure (ADP) An alternate delivery procedure is available to buyers and sellers who have been matched by the Exchange subsequent to the termination of trading in the spot month contract. If buyer and seller agree to consummate delivery under terms different from those prescribed in the contract specifications, they may proceed on that basis after submitting a notice of their intention to the Exchange of Futures for, or in Connection with, Physicals (EFP) The commercial buyer or seller may exchange a futures position for a physical position of equal quantity by submitting a notice to the exchange. EFPs may be used to either initiate or liquidate a futures position. 9

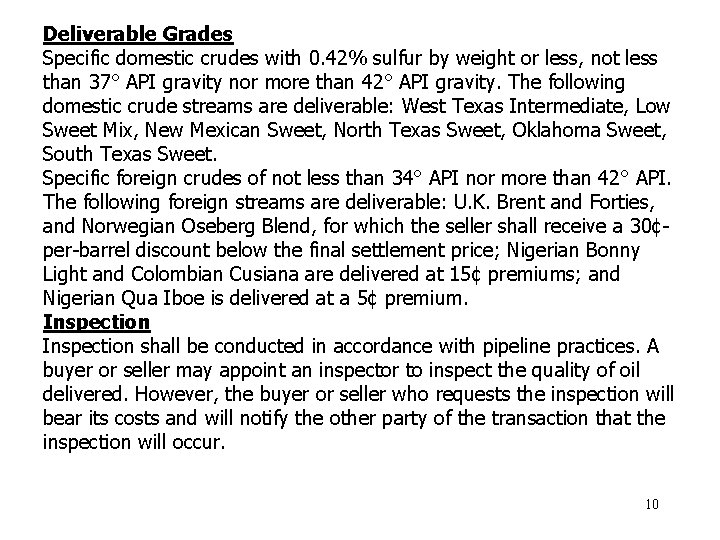

Deliverable Grades Specific domestic crudes with 0. 42% sulfur by weight or less, not less than 37° API gravity nor more than 42° API gravity. The following domestic crude streams are deliverable: West Texas Intermediate, Low Sweet Mix, New Mexican Sweet, North Texas Sweet, Oklahoma Sweet, South Texas Sweet. Specific foreign crudes of not less than 34° API nor more than 42° API. The following foreign streams are deliverable: U. K. Brent and Forties, and Norwegian Oseberg Blend, for which the seller shall receive a 30¢per-barrel discount below the final settlement price; Nigerian Bonny Light and Colombian Cusiana are delivered at 15¢ premiums; and Nigerian Qua Iboe is delivered at a 5¢ premium. Inspection shall be conducted in accordance with pipeline practices. A buyer or seller may appoint an inspector to inspect the quality of oil delivered. However, the buyer or seller who requests the inspection will bear its costs and will notify the other party of the transaction that the inspection will occur. 10

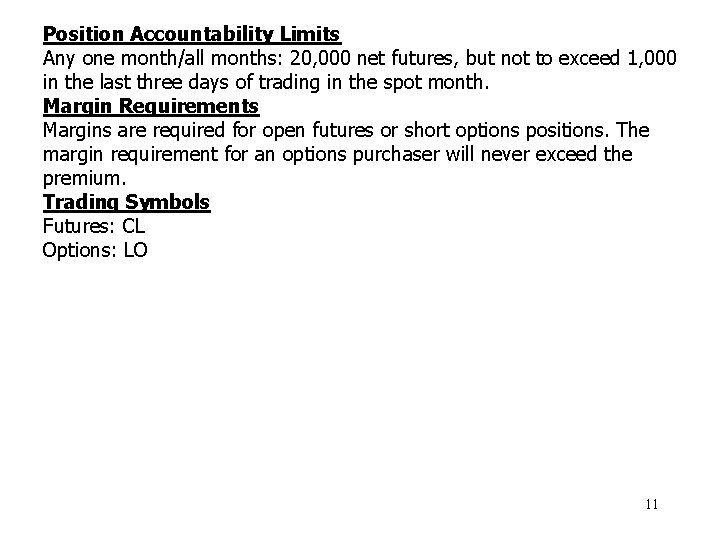

Position Accountability Limits Any one month/all months: 20, 000 net futures, but not to exceed 1, 000 in the last three days of trading in the spot month. Margin Requirements Margins are required for open futures or short options positions. The margin requirement for an options purchaser will never exceed the premium. Trading Symbols Futures: CL Options: LO 11

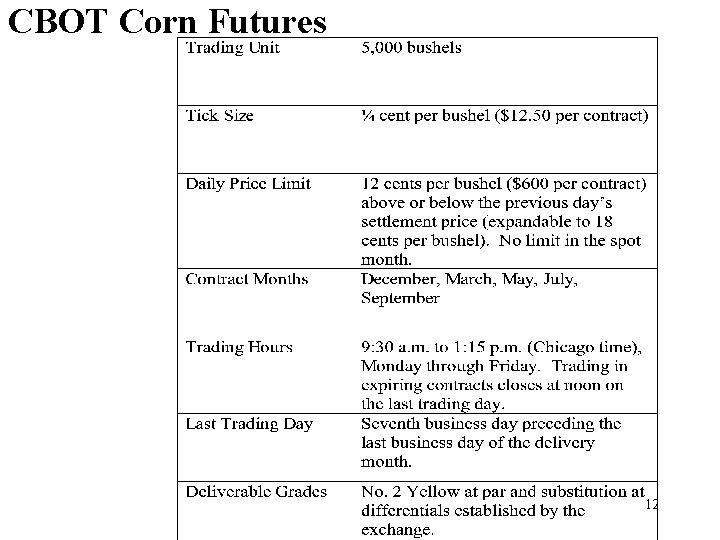

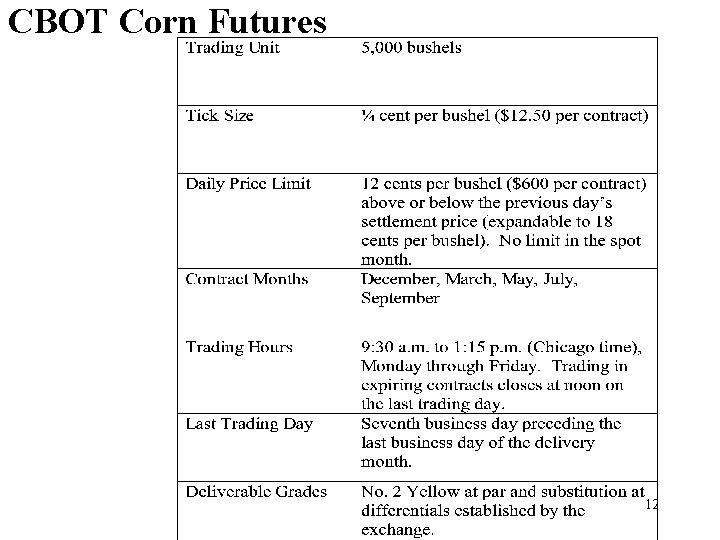

CBOT Corn Futures 12

NYMEX Copper Futures Trading Unit 25, 000 pounds. Price Quotation Cents per pound. For example, 75. 80¢ per pound. Trading Hours Open outcry trading is conducted from 8: 10 A. M. until 1: 00 P. M. After-hours futures trading is conducted via the NYMEX ACCESS® Trading Months Trading is conducted for delivery during the current calendar month and the next 23 consecutive calendar months. Minimum Price Fluctuation Price changes are registered in multiples of five one hundredths of one cent ($0. 0005, or 0. 05¢) per pound, equal to $12. 50 per contract. A fluctuation of one cent ($0. 01 or 1¢) is equal to $250. 00 per contract. 13

Maximum Daily Price Fluctuation Initial price limit, based upon the preceding day's settlement price is $0. 20 (20¢) per pound. Two minutes after either of the two most active months trades at the limit, trading in all months of futures and options will cease for a 15 -minute period. Trading will also cease if either of the two active months is bid at the upper limit or offered at the lower limit for two minutes without trading. Trading will not cease if the limit is reached during the final 20 minutes of a day's trading. If the limit is reached during the final half hour of trading, trading will resume no later than 10 minutes before the normal closing time. When trading resumes after a cessation of trading, the price limits will be expanded by increments of 100%. Last Trading Day Trading terminates at the close of business on the third to last business day of the maturing delivery month. 14

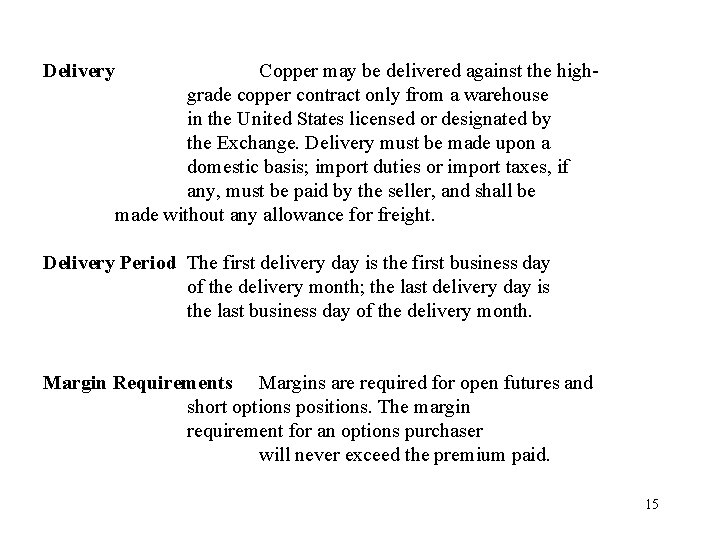

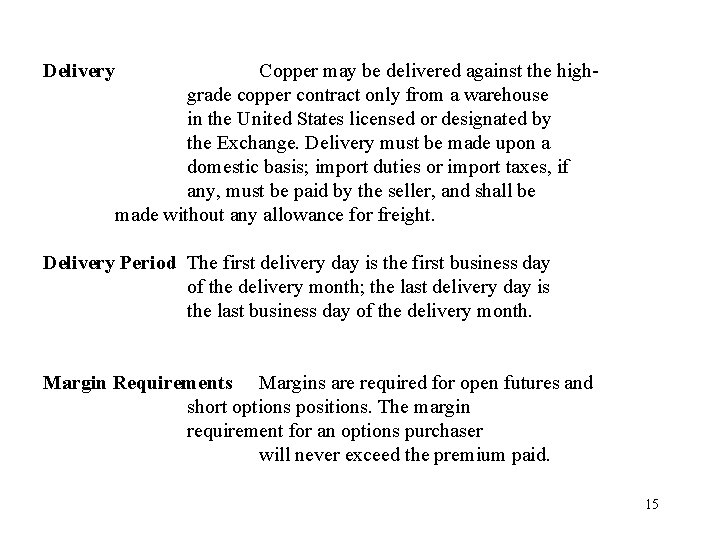

Delivery Copper may be delivered against the highgrade copper contract only from a warehouse in the United States licensed or designated by the Exchange. Delivery must be made upon a domestic basis; import duties or import taxes, if any, must be paid by the seller, and shall be made without any allowance for freight. Delivery Period The first delivery day is the first business day of the delivery month; the last delivery day is the last business day of the delivery month. Margin Requirements Margins are required for open futures and short options positions. The margin requirement for an options purchaser will never exceed the premium paid. 15

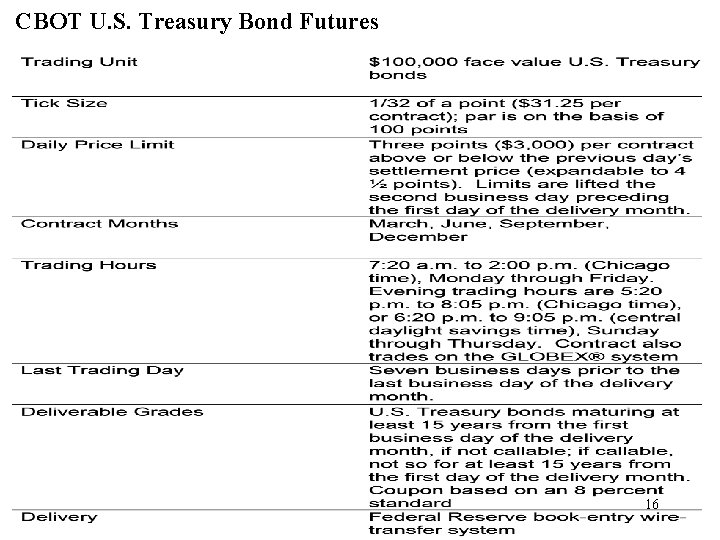

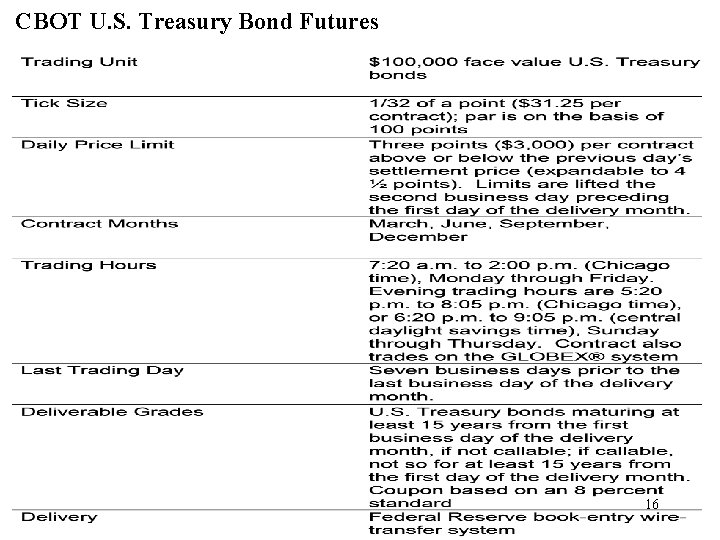

CBOT U. S. Treasury Bond Futures 16

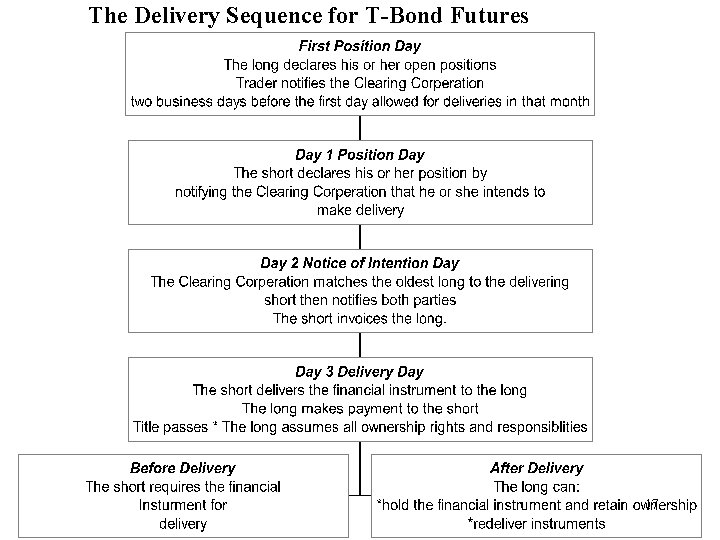

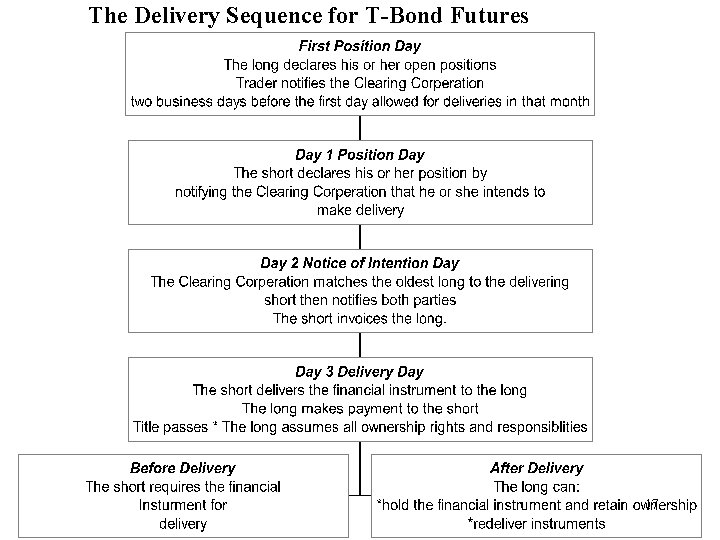

The Delivery Sequence for T-Bond Futures 17

CME Standard & Poor’s 500 Stock Index Futures 18

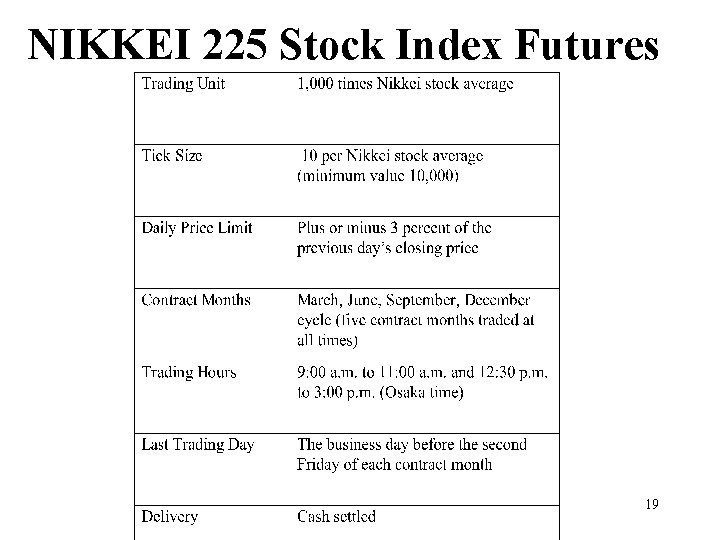

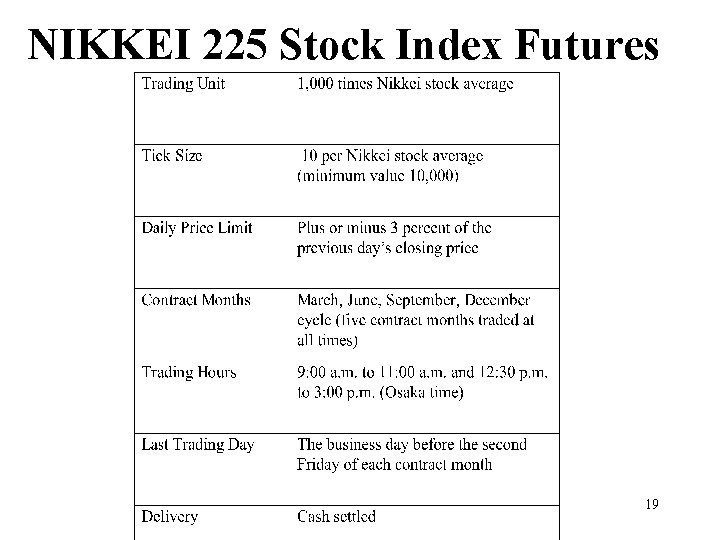

NIKKEI 225 Stock Index Futures 19

HOW ARE FUTURES CONTRACTS CREATED ? FUTURES CONTRACTS ARE SUGGESTED BY THE FUTURES EXCHANGES. THE PROPOPSALS ARE SENT FOR APPROVAL TO THE REGULATORY AUTHORITY: In the US: THE FUTURES COMMODITY TRADING COMMISSION. (FCTC) 20

WHY TRADE FUTURES AND NOT FORWARDS? FORWARDS ARE TRADED ON THE OTC: Credit risk Operational risk Liquidity risk 21

1. Credit Risk: Does the other party have the means to pay? 2. Operational Risk: Will the other party deliver the commodity? Will the other party take delivery? Will the other party pay? 22

3. Liquidity Risk. 4. In case either party wishes to get out of its side of the contract, what are the obstacles? How to find another counterparty? It may not be easy to do that. Even if you find someone who is willing to take your side of the contract, the other party may not agree. 23

The exchanges understood that there will exist no efficient markets until the above problems are resolved. So they created the: CLEARINGHOUSE 24

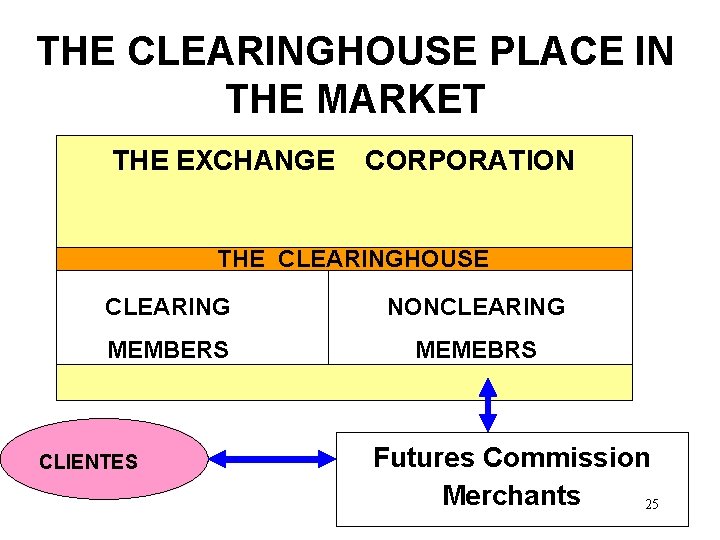

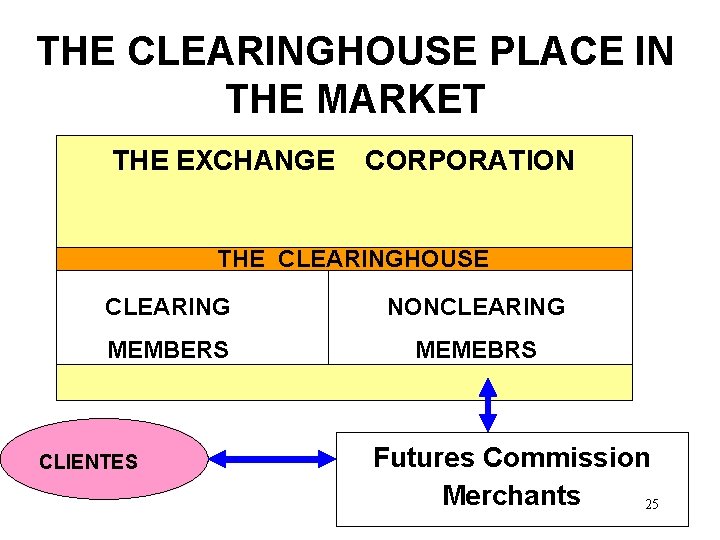

THE CLEARINGHOUSE PLACE IN THE MARKET THE EXCHANGE CORPORATION THE CLEARINGHOUSE CLEARING NONCLEARING MEMBERS MEMEBRS CLIENTES Futures Commission Merchants 25

The clearinghouse is a non profit corporation. It gives every trading party an absolute guarantee of the completion of its side of the contract 26

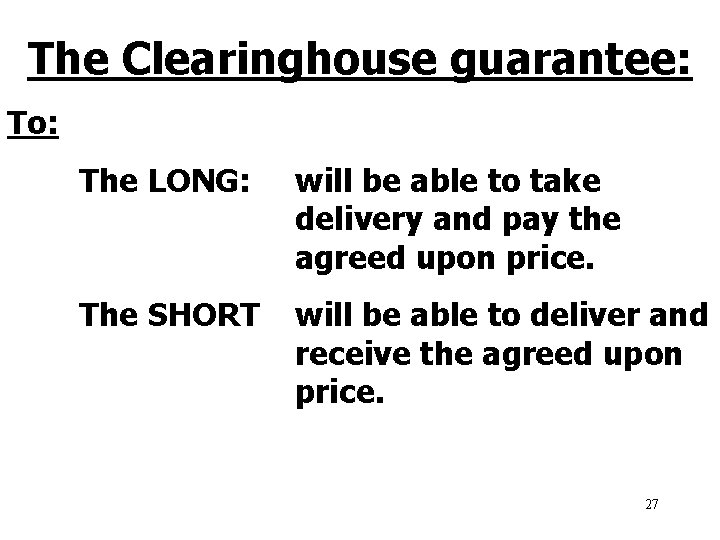

The Clearinghouse guarantee: To: The LONG: will be able to take delivery and pay the agreed upon price. The SHORT will be able to deliver and receive the agreed upon price. 27

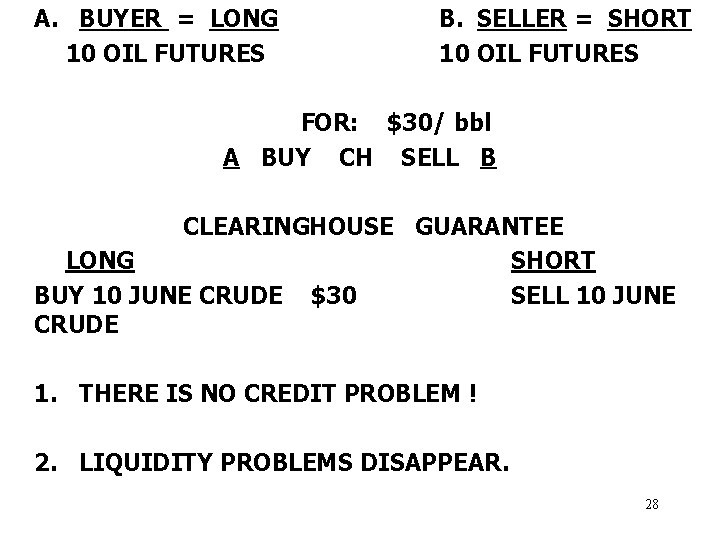

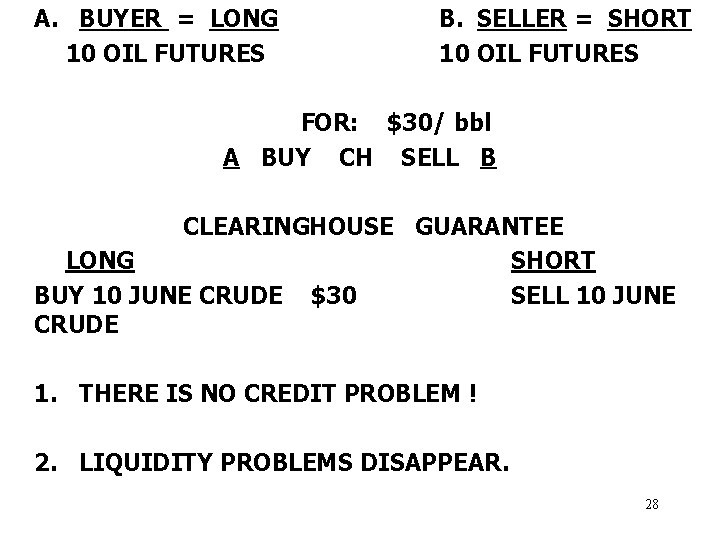

A. BUYER = LONG 10 OIL FUTURES B. SELLER = SHORT 10 OIL FUTURES FOR: $30/ bbl A BUY CH SELL B CLEARINGHOUSE GUARANTEE LONG SHORT BUY 10 JUNE CRUDE $30 SELL 10 JUNE CRUDE 1. THERE IS NO CREDIT PROBLEM ! 2. LIQUIDITY PROBLEMS DISAPPEAR. 28

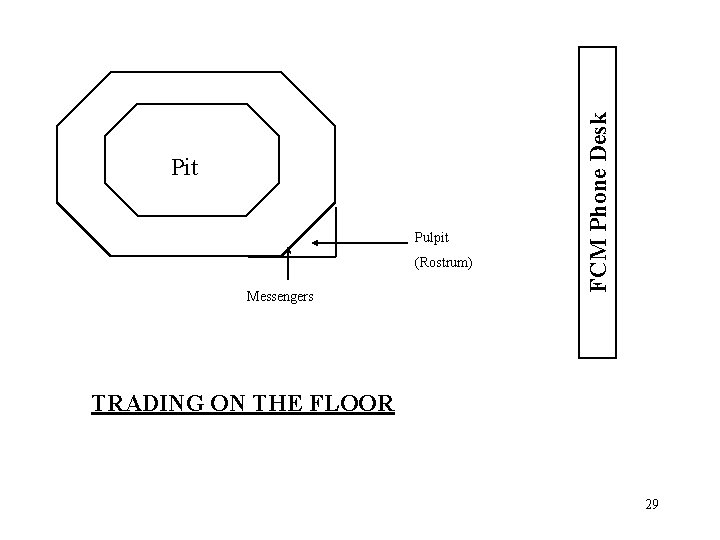

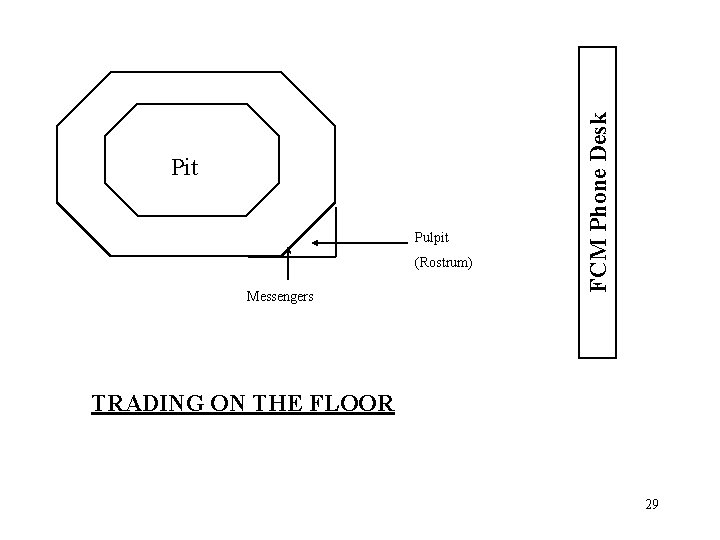

Pulpit (Rostrum) Messengers FCM Phone Desk Pit TRADING ON THE FLOOR 29

2 1 3 Day Trading: 4 Open Outcry and Hand Signals. After Hours: Automated systems 30

Margins • A margin is cash or marketable securities deposited by an investor with his or her broker • The balance in the margin account is adjusted to reflect daily settlement • Margins minimize the possibility of a loss through a default on a contract 31

MARGINS A MARGIN is an amount of money that must be deposited in a margin account in order to open any futures position. It is a “good will” deposit. The clearinghouse maintains a system of margin requirements from all traders, brokers and futures commercial merchants. 32

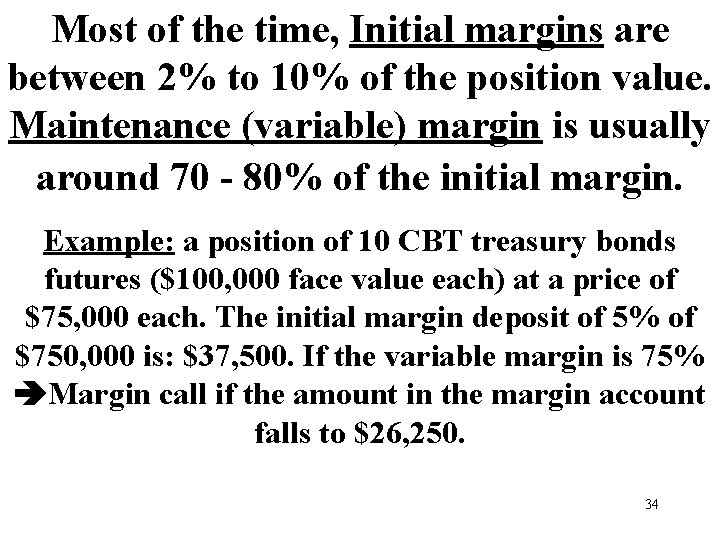

MARGINS. There are two types of margins: The initial margin: This is the amount that every trader must deposit with the broker in order to open an account; short or long. The maintenance (variable) margin: This is a minimum level of the trader’s equity in the margin account. If the trader’s equity falls below this level, the trader will receive a margin call requiring the trader to deposit more money and bring the account to its initial level. Otherwise, the account will be closed. 33

Most of the time, Initial margins are between 2% to 10% of the position value. Maintenance (variable) margin is usually around 70 - 80% of the initial margin. Example: a position of 10 CBT treasury bonds futures ($100, 000 face value each) at a price of $75, 000 each. The initial margin deposit of 5% of $750, 000 is: $37, 500. If the variable margin is 75% Margin call if the amount in the margin account falls to $26, 250. 34

Example of a Futures Trade • On JUN 5 an investor takes a long position in 2 NYMEX DEC gold futures. – contract size is 100 oz. – futures price is USD 400/oz – margin requirement is 5%. USD 2, 000/contract (USD 4, 000 in total) – maintenance margin is 75%. USD 1, 500/contract (USD 3, 000 in 35 total).

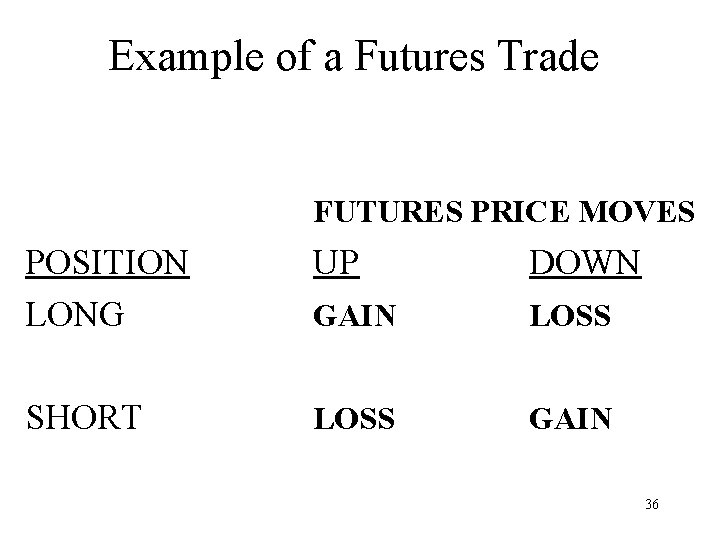

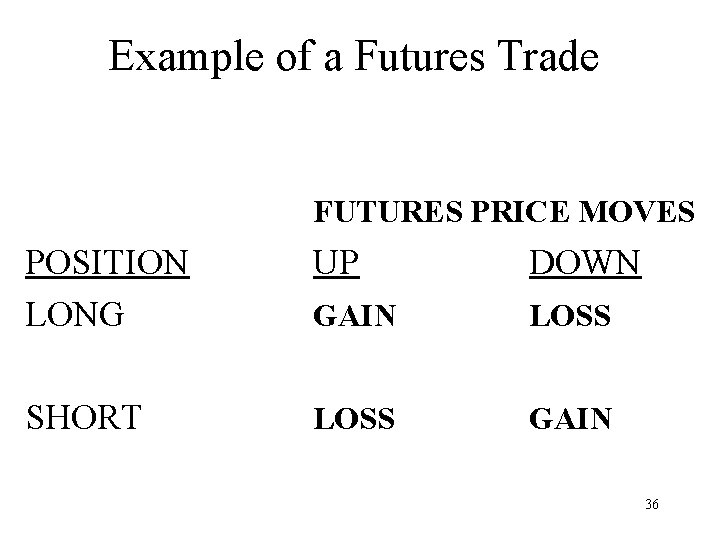

Example of a Futures Trade FUTURES PRICE MOVES POSITION LONG UP DOWN GAIN LOSS SHORT LOSS GAIN 36

A Possible Outcome Table 2. 1, Page 25 Day Futures Price (US$) Daily Gain (Loss) (US$) Cumulative Gain (Loss) (US$) 400. 00 Margin Account Margin Balance Call (US$) 4, 000 5 -Jun 397. 00. . . (600). . . 3, 400. . . 13 -Jun 393. 30. . . (420). . . (1, 340). . . 2, 660 + 1, 340 = 4, 000. . . < 3, 000 19 -Jun 387. 00. . . (1, 140). . . (2, 600). . . 2, 740 + 1, 260 = 4, 000. . . 26 -Jun 392. 30 260 (1, 540) 5, 060 0 37

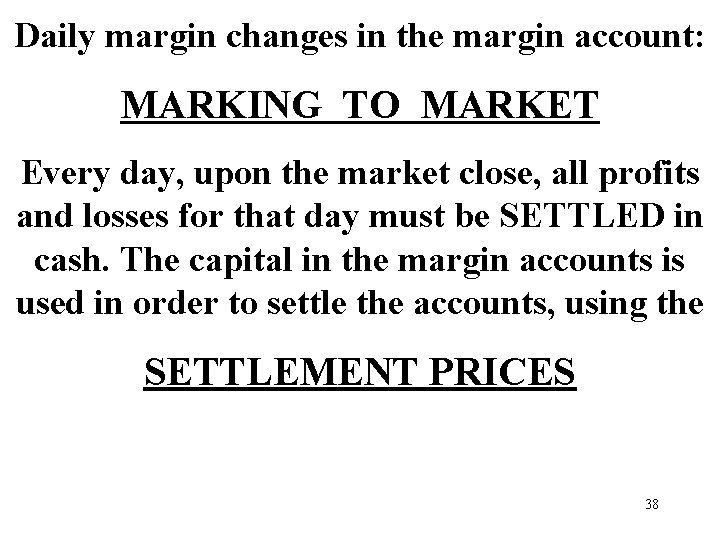

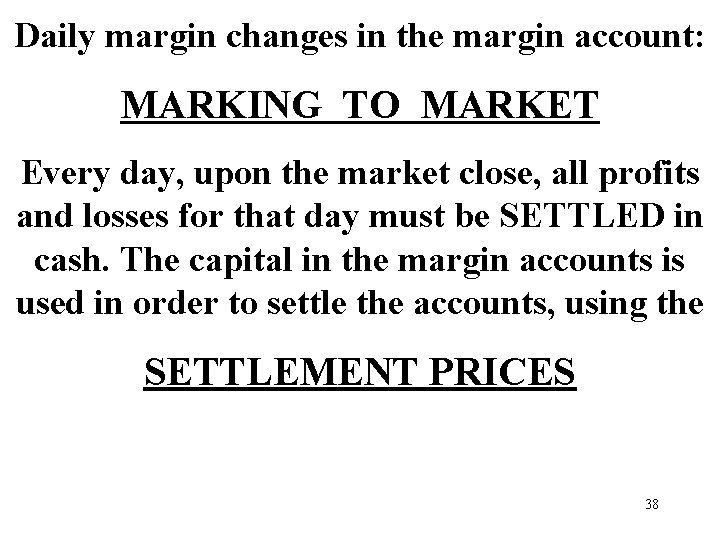

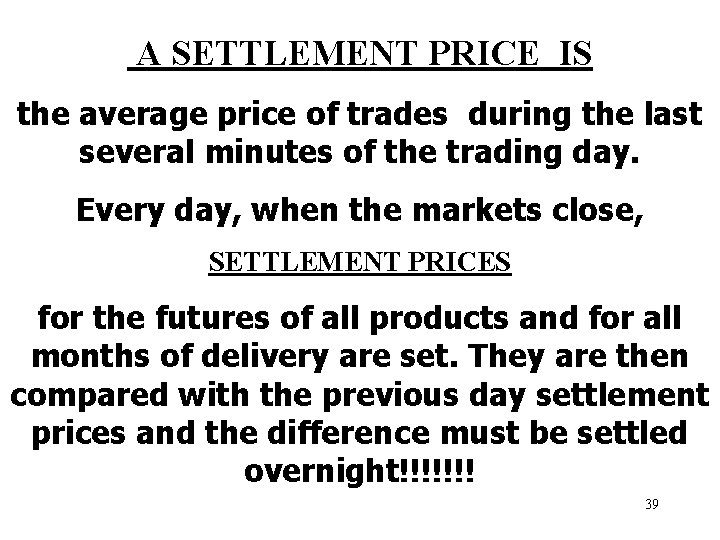

Daily margin changes in the margin account: MARKING TO MARKET Every day, upon the market close, all profits and losses for that day must be SETTLED in cash. The capital in the margin accounts is used in order to settle the accounts, using the SETTLEMENT PRICES 38

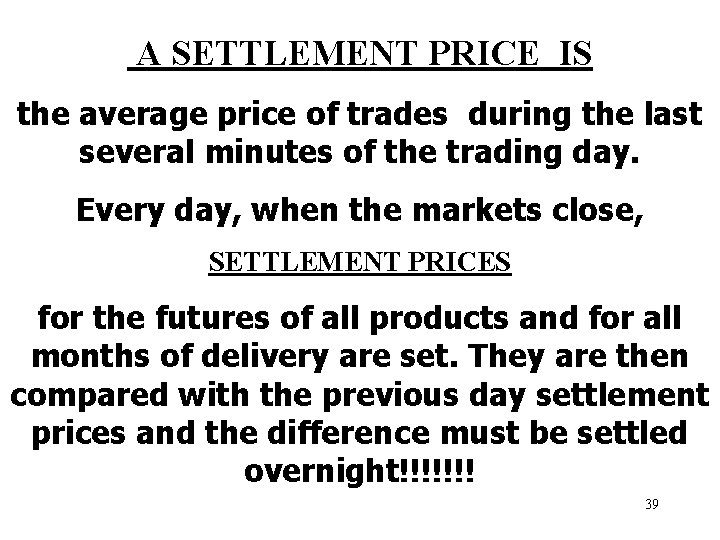

A SETTLEMENT PRICE IS the average price of trades during the last several minutes of the trading day. Every day, when the markets close, SETTLEMENT PRICES for the futures of all products and for all months of delivery are set. They are then compared with the previous day settlement prices and the difference must be settled overnight!!!!!!! 39

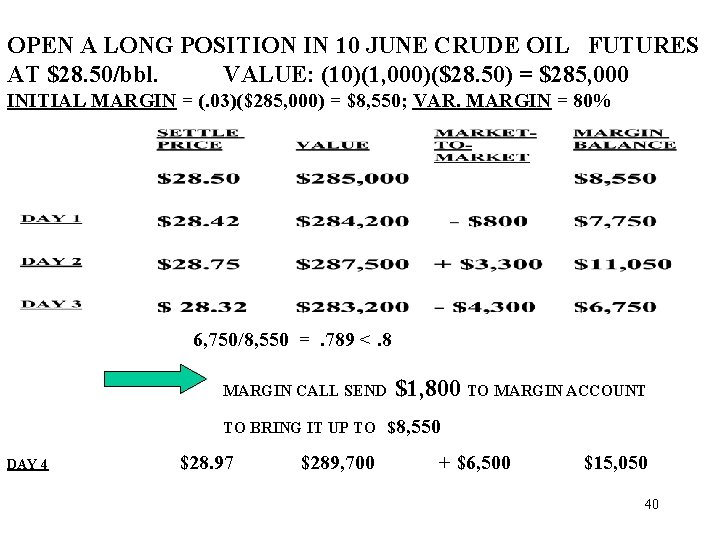

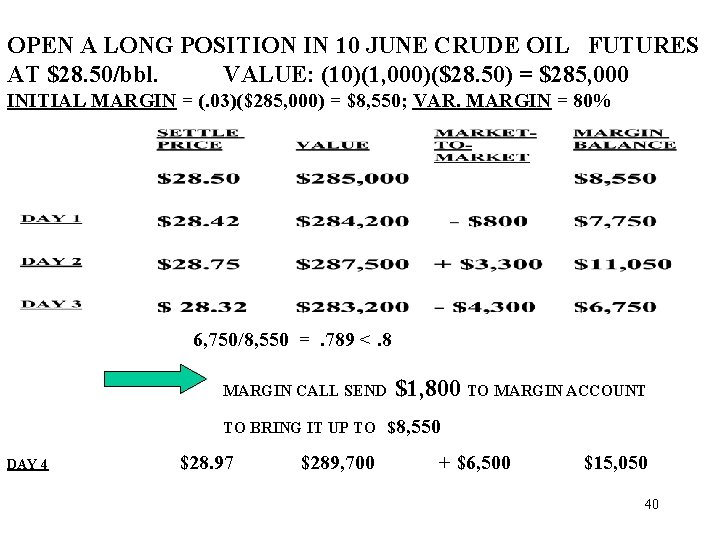

OPEN A LONG POSITION IN 10 JUNE CRUDE OIL FUTURES AT $28. 50/bbl. VALUE: (10)(1, 000)($28. 50) = $285, 000 INITIAL MARGIN = (. 03)($285, 000) = $8, 550; VAR. MARGIN = 80% 6, 750/8, 550 =. 789 <. 8 MARGIN CALL SEND $1, 800 TO MARGIN ACCOUNT TO BRING IT UP TO $8, 550 DAY 4 $28. 97 $289, 700 + $6, 500 $15, 050 40

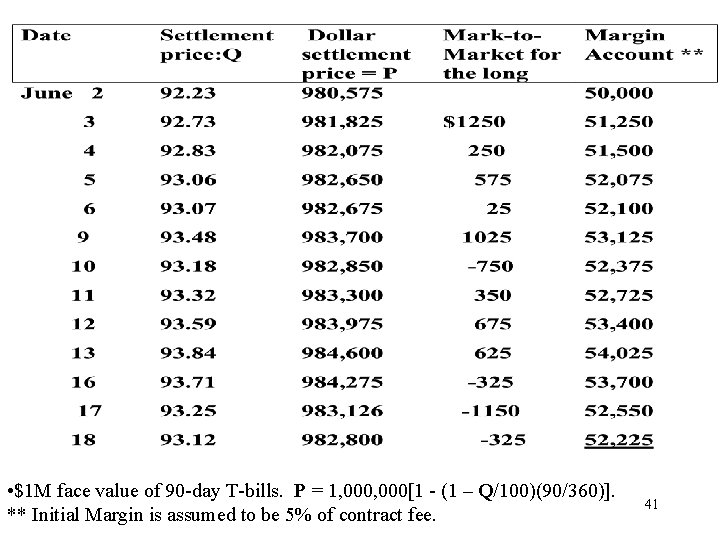

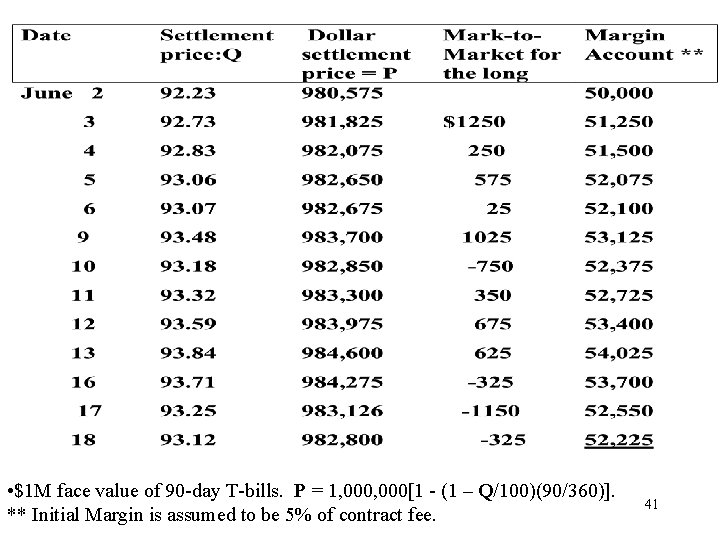

• $1 M face value of 90 -day T-bills. P = 1, 000[1 - (1 – Q/100)(90/360)]. ** Initial Margin is assumed to be 5% of contract fee. 41

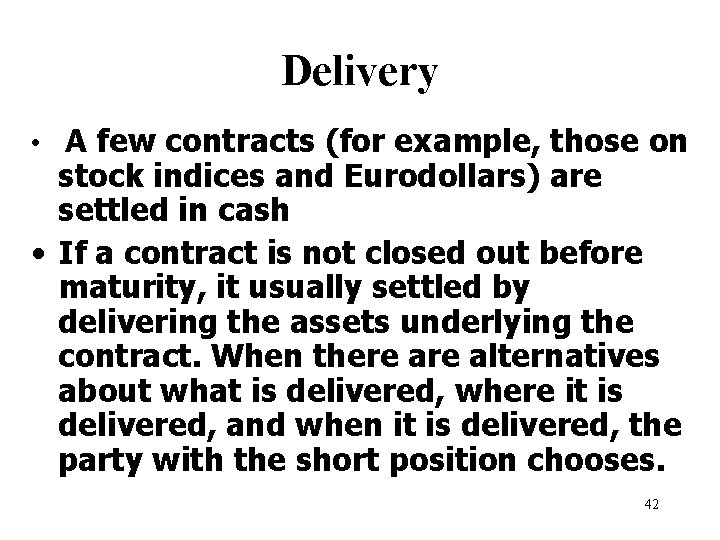

Delivery • A few contracts (for example, those on stock indices and Eurodollars) are settled in cash • If a contract is not closed out before maturity, it usually settled by delivering the assets underlying the contract. When there alternatives about what is delivered, where it is delivered, and when it is delivered, the party with the short position chooses. 42

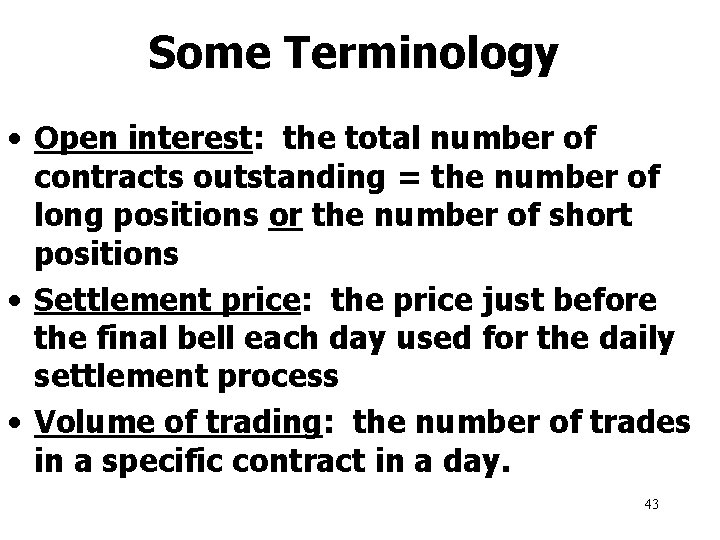

Some Terminology • Open interest: the total number of contracts outstanding = the number of long positions or the number of short positions • Settlement price: the price just before the final bell each day used for the daily settlement process • Volume of trading: the number of trades in a specific contract in a day. 43

A futures markets statistic: 97 -98% of all the futures for all delivery months and for all underlying assets do not get to delivery!! This means that: 1. Only 2 -3% do reach delivery. 2. Most traders close their positions before they get to delivery. 3. Most traders do not open futures positions for business. 4. Most futures are traded for financial 44 purpose

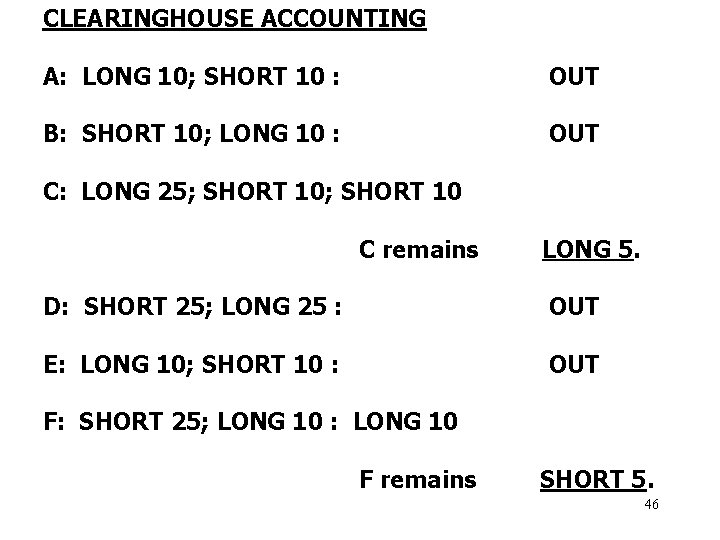

JUNE WTI FUTURE - 1, 000 bbls PER CONTRACT DATE PARTY NUM Th. 5. 16 A: LONG 10 $20 CH B: SHORT 10 $20 10 5. 16 C: LONG 25 $21 CH D: SHORT 25 $21 35 5. 16 SETTLE Fr. 5. 17 E: LONG PRICE PARTY NUM $21 10 5. 17 SETTLE $22 PRICE $21 CH A: SHORT 10 $22 VOL OPEN INT 35 $22 35 10 Mo. 5. 20 D: LONG 25 $22. 5 CH F: SHORT 25 $22. 5 35 5. 20 B: LONG 10 $21. 5 CH C: SHORT 10 $21. 5 25 5. 20 SETTLE Tu. 5. 21 F: LONG $21. 5 10 5. 21 SETTLE We. 5. 22 F: LONG 5. 22 SETTLE $21. 5 CH E: SHORT 10 $20. 5 10 $20 $21 CH C: SHORT 10 35 15 10 $20 5 10 45

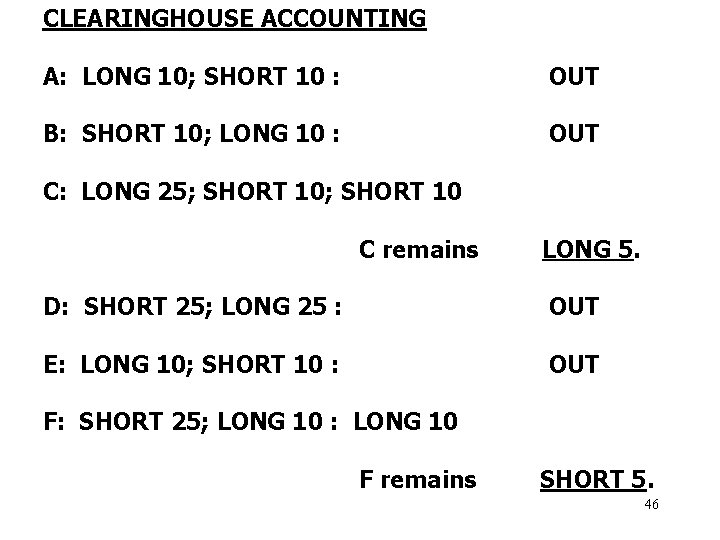

CLEARINGHOUSE ACCOUNTING A: LONG 10; SHORT 10 : OUT B: SHORT 10; LONG 10 : OUT C: LONG 25; SHORT 10 C remains LONG 5. D: SHORT 25; LONG 25 : OUT E: LONG 10; SHORT 10 : OUT F: SHORT 25; LONG 10 : LONG 10 F remains SHORT 5. 46

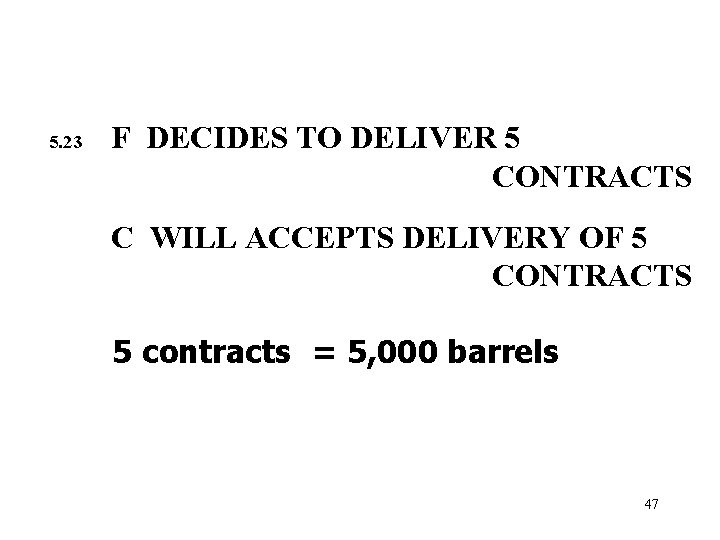

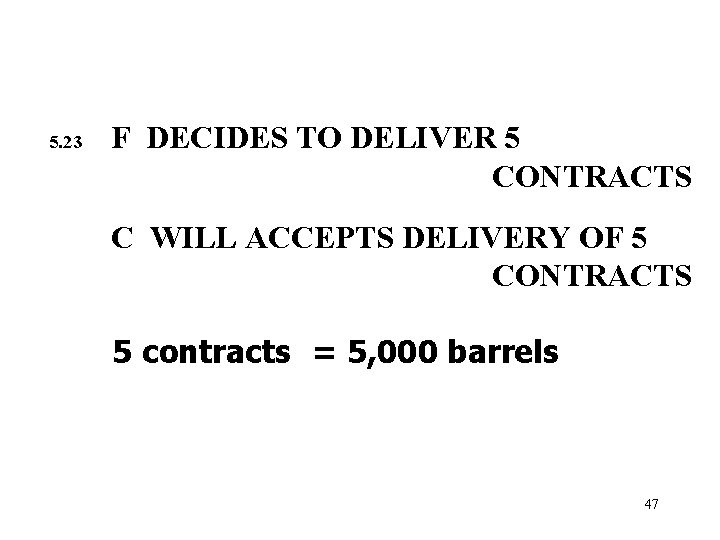

5. 23 F DECIDES TO DELIVER 5 CONTRACTS C WILL ACCEPTS DELIVERY OF 5 CONTRACTS 5 contracts = 5, 000 barrels 47

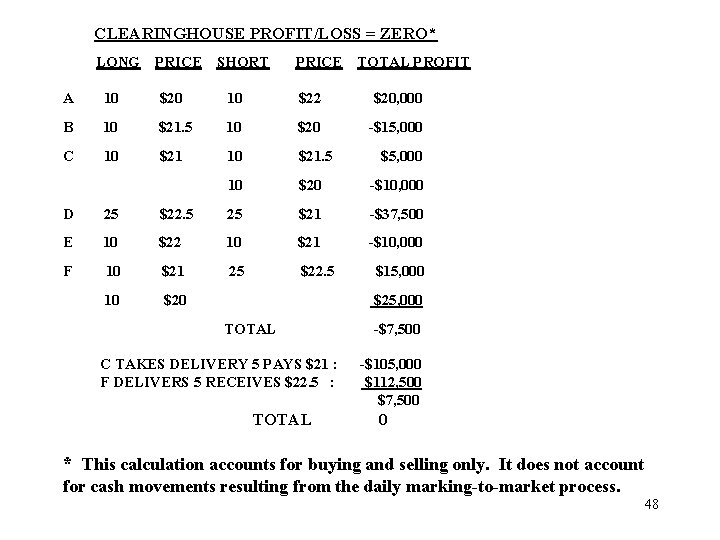

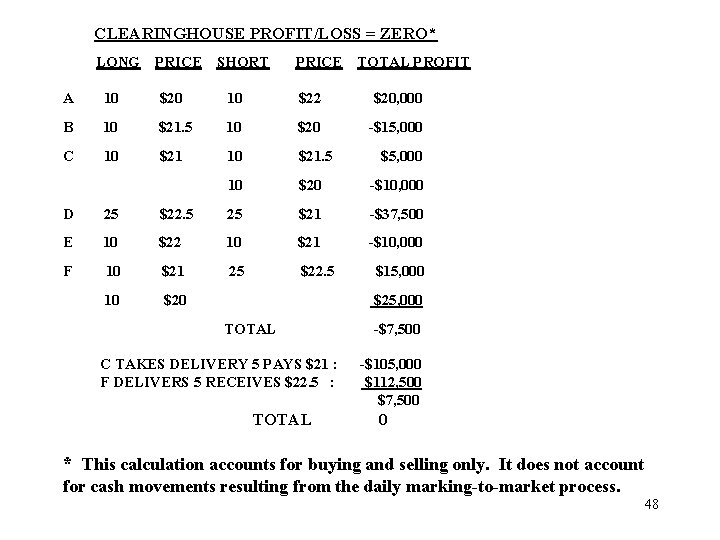

CLEARINGHOUSE PROFIT/LOSS = ZERO* LONG PRICE SHORT PRICE TOTAL PROFIT A 10 $20 10 $22 $20, 000 B 10 $21. 5 10 $20 -$15, 000 C 10 $21. 5 10 $20 -$10, 000 $5, 000 D 25 $22. 5 25 $21 -$37, 500 E 10 $22 10 $21 -$10, 000 F 10 $21 25 $22. 5 10 $20 $15, 000 $25, 000 TOTAL C TAKES DELIVERY 5 PAYS $21 : F DELIVERS 5 RECEIVES $22. 5 : TOTAL -$7, 500 -$105, 000 $112, 500 $7, 500 0 * This calculation accounts for buying and selling only. It does not account for cash movements resulting from the daily marking-to-market process. 48

THE ACTUAL PROFITS AND LOSSES OF ALL MARKET PARTICIPANTS ARE ACCUMULATED IN THEIR RESPECTIVE MARGIN ACCOUNTS. 49

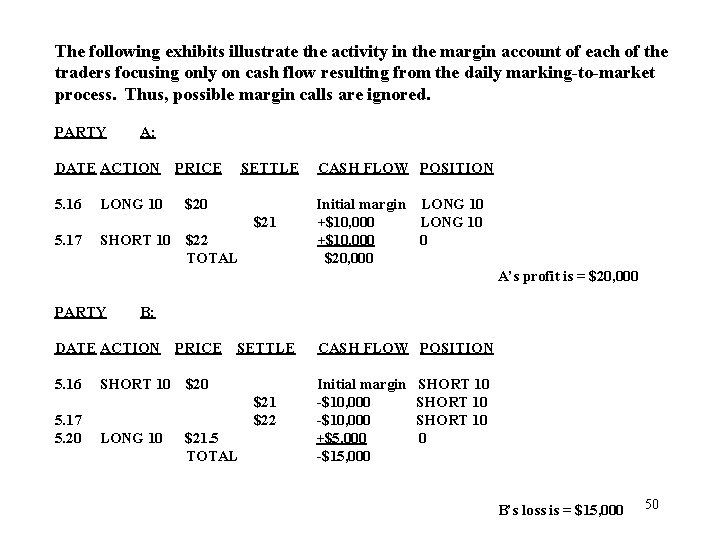

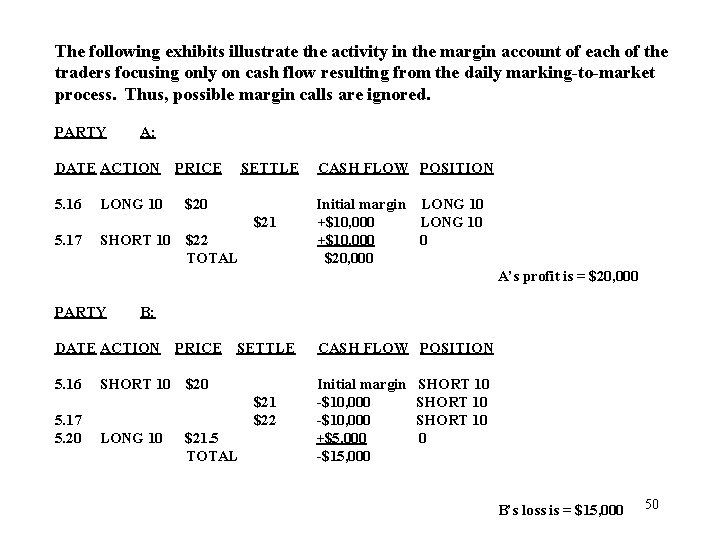

The following exhibits illustrate the activity in the margin account of each of the traders focusing only on cash flow resulting from the daily marking-to-market process. Thus, possible margin calls are ignored. PARTY A: DATE ACTION 5. 16 LONG 10 PRICE SETTLE $20 $21 5. 17 SHORT 10 $22 TOTAL CASH FLOW POSITION Initial margin LONG 10 +$10, 000 0 $20, 000 A’s profit is = $20, 000 PARTY B: DATE ACTION 5. 16 5. 17 5. 20 SHORT 10 PRICE SETTLE $20 $21 $22 LONG 10 $21. 5 TOTAL CASH FLOW POSITION Initial margin -$10, 000 +$5, 000 -$15, 000 SHORT 10 0 B’s loss is = $15, 000 50

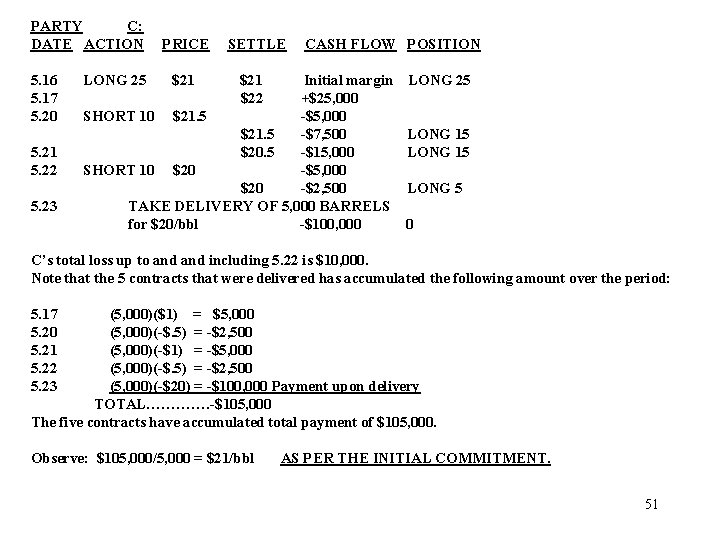

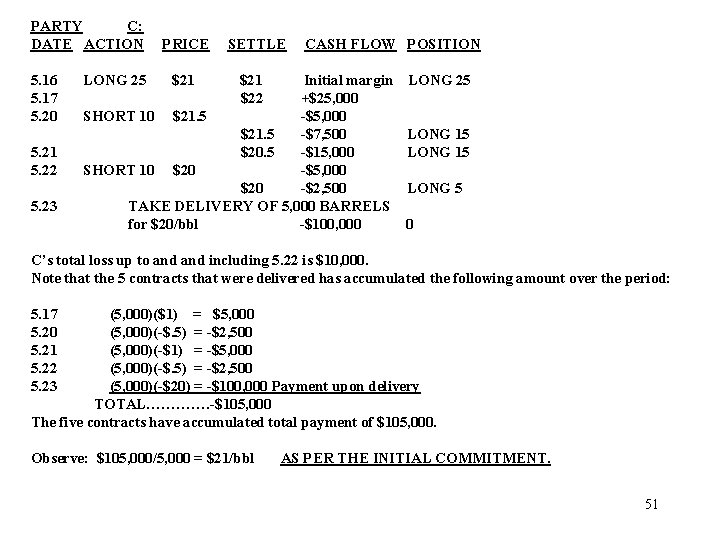

PARTY C: DATE ACTION 5. 16 5. 17 5. 20 5. 21 5. 22 5. 23 LONG 25 PRICE $21 SETTLE $21 $22 CASH FLOW POSITION Initial margin +$25, 000 SHORT 10 $21. 5 -$5, 000 $21. 5 -$7, 500 $20. 5 -$15, 000 SHORT 10 $20 -$5, 000 $20 -$2, 500 TAKE DELIVERY OF 5, 000 BARRELS for $20/bbl -$100, 000 LONG 25 LONG 15 LONG 5 0 C’s total loss up to and including 5. 22 is $10, 000. Note that the 5 contracts that were delivered has accumulated the following amount over the period: 5. 17 5. 20 5. 21 5. 22 5. 23 (5, 000)($1) = $5, 000 (5, 000)(-$. 5) = -$2, 500 (5, 000)(-$1) = -$5, 000 (5, 000)(-$. 5) = -$2, 500 (5, 000)(-$20) = -$100, 000 Payment upon delivery TOTAL…………. -$105, 000 The five contracts have accumulated total payment of $105, 000. Observe: $105, 000/5, 000 = $21/bbl AS PER THE INITIAL COMMITMENT. 51

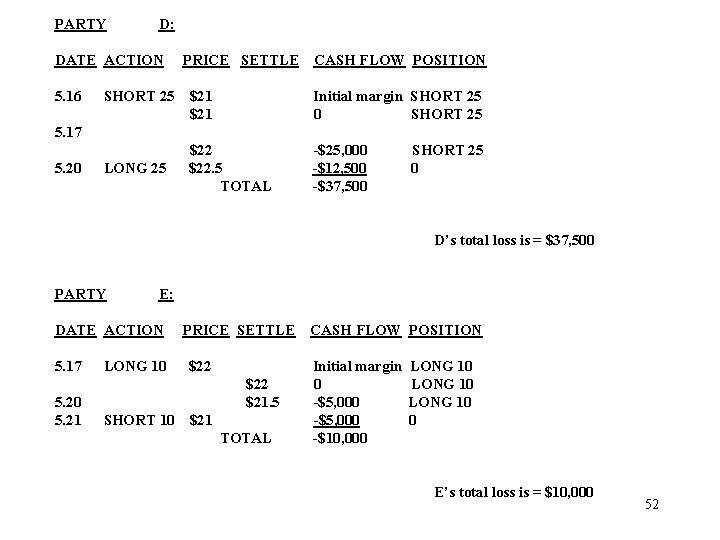

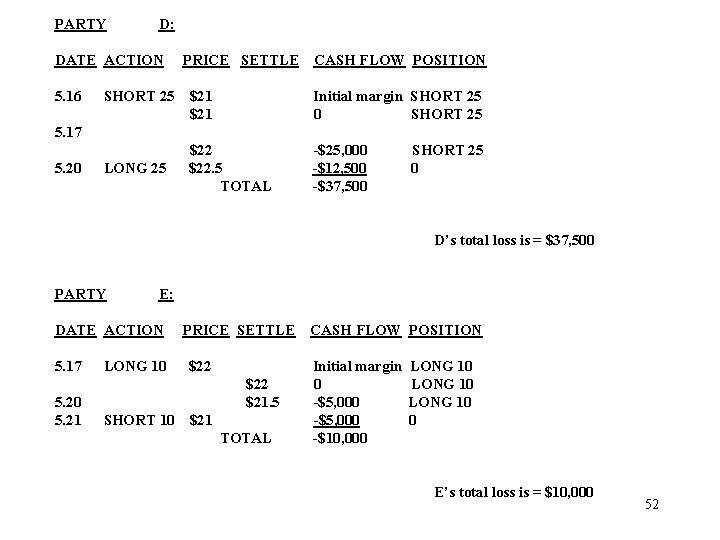

PARTY D: DATE ACTION 5. 16 SHORT 25 PRICE SETTLE CASH FLOW POSITION $21 Initial margin SHORT 25 0 SHORT 25 $22. 5 TOTAL -$25, 000 -$12, 500 -$37, 500 5. 17 5. 20 LONG 25 SHORT 25 0 D’s total loss is = $37, 500 PARTY E: DATE ACTION 5. 17 5. 20 5. 21 LONG 10 PRICE SETTLE $22 $21. 5 SHORT 10 $21 TOTAL CASH FLOW POSITION Initial margin 0 -$5, 000 -$10, 000 LONG 10 0 E’s total loss is = $10, 000 52

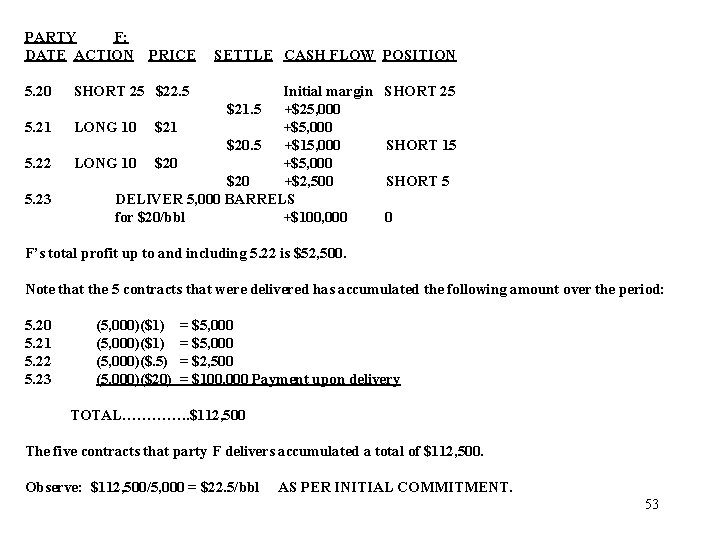

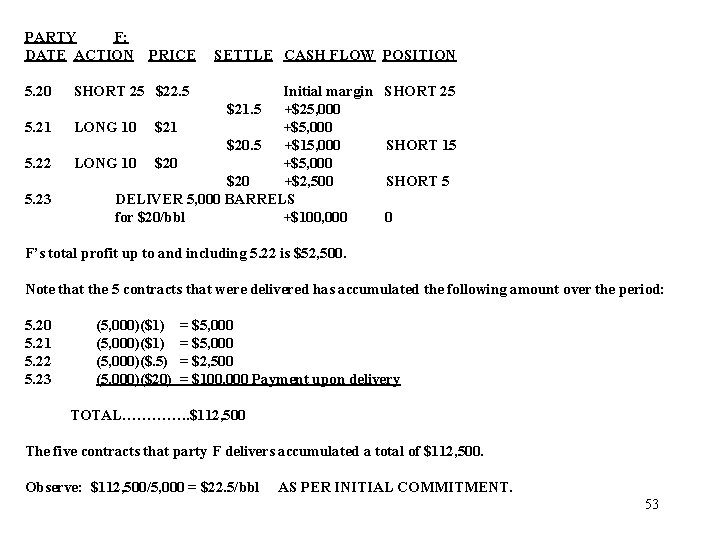

PARTY F: DATE ACTION 5. 20 5. 21 5. 22 5. 23 PRICE SETTLE CASH FLOW POSITION SHORT 25 $22. 5 Initial margin $21. 5 +$25, 000 LONG 10 $21 +$5, 000 $20. 5 +$15, 000 LONG 10 $20 +$5, 000 $20 +$2, 500 DELIVER 5, 000 BARRELS for $20/bbl +$100, 000 SHORT 25 SHORT 15 SHORT 5 0 F’s total profit up to and including 5. 22 is $52, 500. Note that the 5 contracts that were delivered has accumulated the following amount over the period: 5. 20 5. 21 5. 22 5. 23 (5, 000)($1) (5, 000)($. 5) (5, 000)($20) = $5, 000 = $2, 500 = $100, 000 Payment upon delivery TOTAL…………. . $112, 500 The five contracts that party F delivers accumulated a total of $112, 500. Observe: $112, 500/5, 000 = $22. 5/bbl AS PER INITIAL COMMITMENT. 53

EXAMPLE The next example is based on a real data on trading gasoline futures. These futures are traded on NYMEX and each contract is for 42, 000 gallons of gasoline. 54

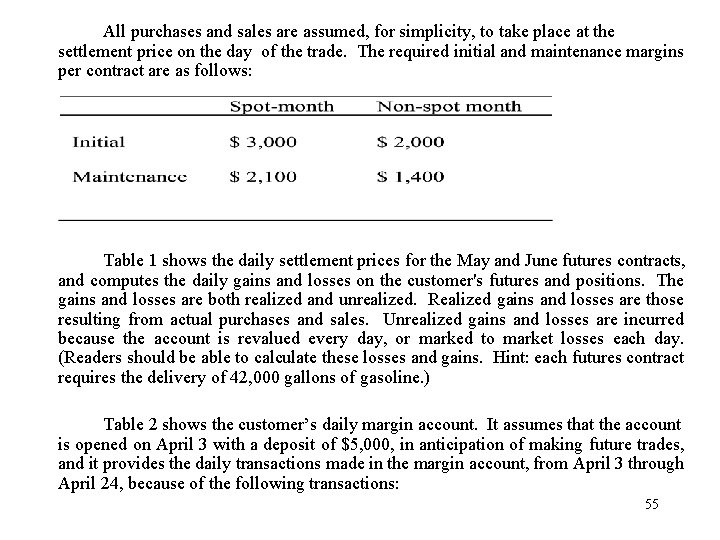

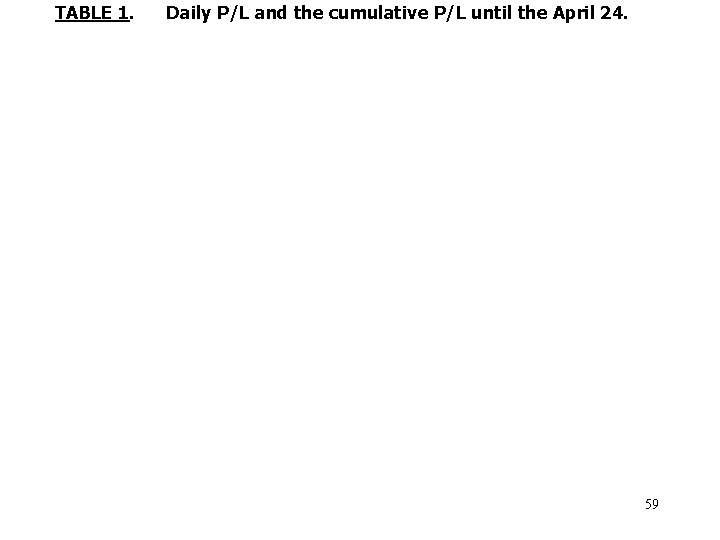

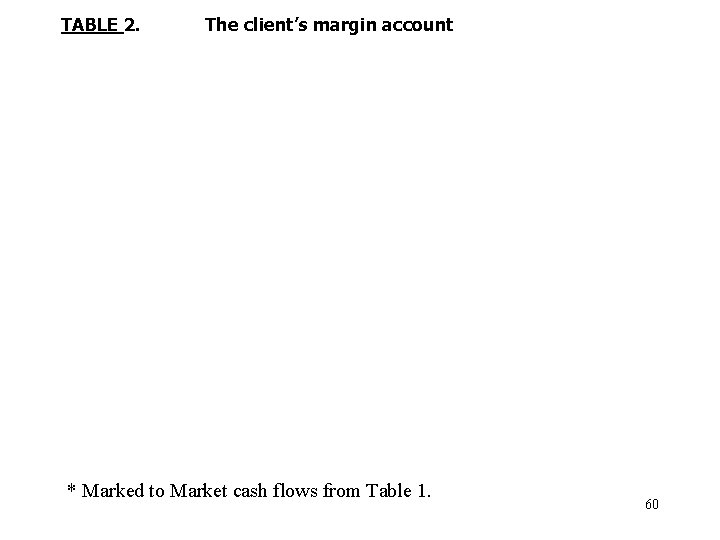

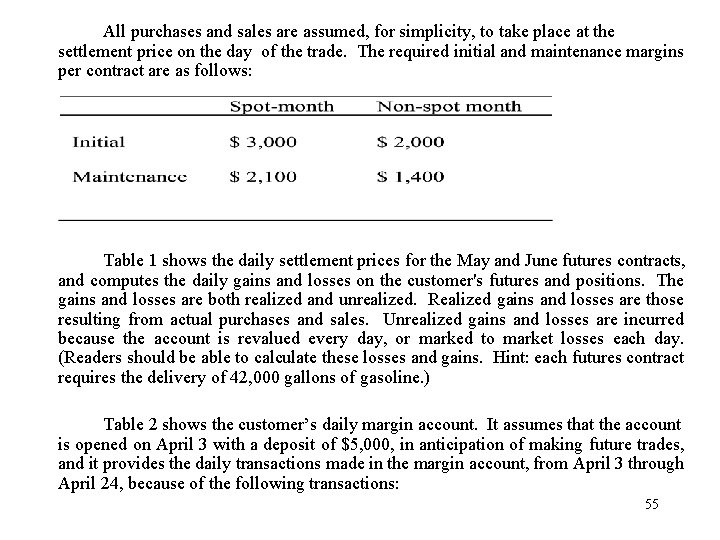

All purchases and sales are assumed, for simplicity, to take place at the settlement price on the day of the trade. The required initial and maintenance margins per contract are as follows: Table 1 shows the daily settlement prices for the May and June futures contracts, and computes the daily gains and losses on the customer's futures and positions. The gains and losses are both realized and unrealized. Realized gains and losses are those resulting from actual purchases and sales. Unrealized gains and losses are incurred because the account is revalued every day, or marked to market losses each day. (Readers should be able to calculate these losses and gains. Hint: each futures contract requires the delivery of 42, 000 gallons of gasoline. ) Table 2 shows the customer’s daily margin account. It assumes that the account is opened on April 3 with a deposit of $5, 000, in anticipation of making future trades, and it provides the daily transactions made in the margin account, from April 3 through April 24, because of the following transactions: 55

April 3 Customer purchases 2 May contracts resulting in an initial margin call for $1000, which is the difference between the customer’s $5000 deposit on the previous day and the initial margin requirement of $6000 (3000 x 2 = $6000). April 4 Customer responds to the margin call and deposits $1000. His account experiences an unrealized gain of $1352. 40 during the day, bringing his equity to $ 7352. 40. Since the equity is above the initial margin requirement, the customer is entitled to withdraw cash if he wishes, but he does not. April 5 A substantial drop in gasoline prices result in an unrealized loss of $ 2545. 20. The equity falls to $4807. 20. Since total equity is still above the $4200 ($2100 x 2) maintenance margin level, no margin call is issued. April 6 Gasoline prices continue to decline, resulting in another loss of $1579. 20, further reducing equity to $ 3228. 00. Since equity is now less than the required maintenance margin of $4200, a variation margin call is issued for $2772 ($6000 -$3228 = $2772), bringing the equity in the account back to the initial $6000 required margin level. April 7 Customer answers the margin call by depositing $2772. Gasoline prices make a slight recovery. Equity rises to $6336. 56

April 10 The price of gasoline continues to rise. The customer’s equity increases to $8301. 60. He requests that the broker pay him the excess in his margin account, which is $2301. 60 (the difference between the initial required margin of $6000 and the current equity of $8301. 60). April 11 Gasoline prices increase. The customer has an unrealized gain of $1436. 40, bringing the equity in the account to $7436. 40. April 12 The customer liquidates his position by selling 2 May contracts at 70. 11 cents per gallon, realizing a gain for that day of $932. 40. His equity rises to $8368. 80. The columns on the right side of Table 2 show this cumulative performance up to this date: he has a net profit of $1898. 40. April 13 The customer withdraws $3368. 80 from his account, leaving only the $5000 he originally used to open his account. April 18 Customer sells 4 June contracts, requiring an initial margin of $8000 ($2000 x 4). Hence, a margin call of $3000 is issued ($8000 - $5000 = $3000). 57

April 19 Customer meets his margin call by depositing $3000. An increase in gasoline prices results in an unrealized loss of $1512. 00. The account equity is still above the required $5600 ($1400 x 4) maintenance level, so no margin call is issued. April 20 Gasoline prices continue to surge, causing a further loss of $1898. 40. Equity falls to $4589. 60, resulting in the broker issuing a margin call for $3410. 40 to restore the account equity to the initial required margin level of $8000 ($8000 $4589. 60 = $3410. 40). April 21 The customer cannot meet the margin call and decides to offset his position by buying 4 June contracts at 71. 18 cents per gallon, for a gain of $302. 40. His remaining equity is $4892, which he requests be paid to him. For the entire month, the customer’s trading activity has resulted in a net loss of $1209. 60. 58

TABLE 1. Daily P/L and the cumulative P/L until the April 24. 59

TABLE 2. The client’s margin account * Marked to Market cash flows from Table 1. 60

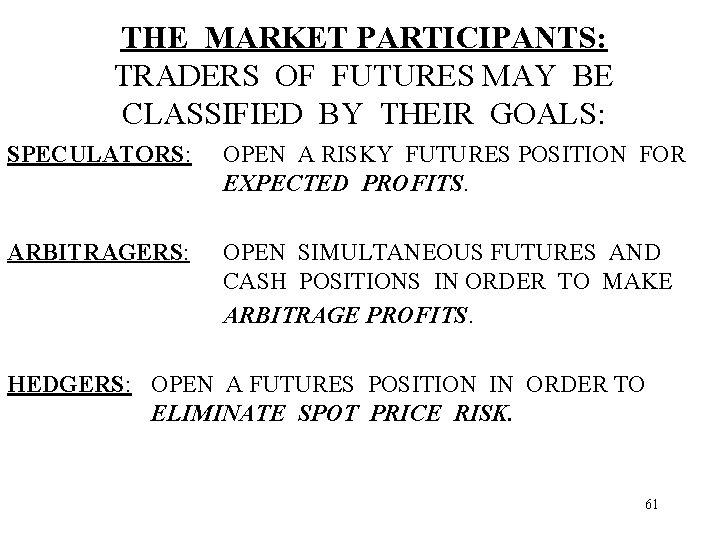

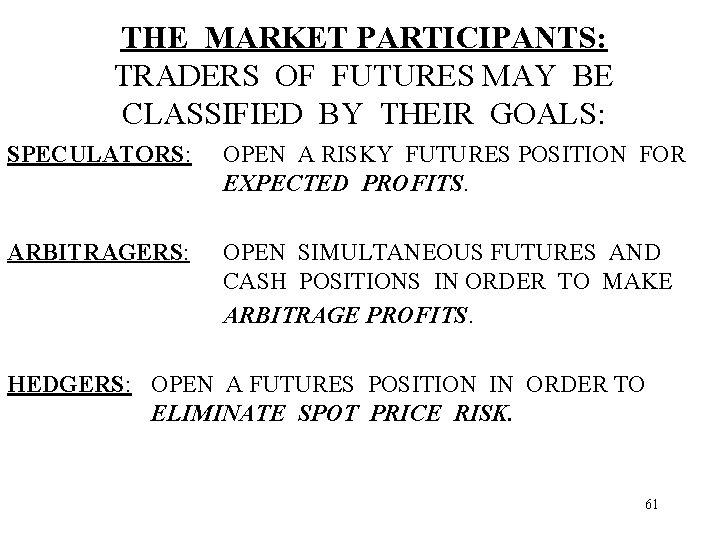

THE MARKET PARTICIPANTS: TRADERS OF FUTURES MAY BE CLASSIFIED BY THEIR GOALS: SPECULATORS: OPEN A RISKY FUTURES POSITION FOR EXPECTED PROFITS. ARBITRAGERS: OPEN SIMULTANEOUS FUTURES AND CASH POSITIONS IN ORDER TO MAKE ARBITRAGE PROFITS. HEDGERS: OPEN A FUTURES POSITION IN ORDER TO ELIMINATE SPOT PRICE RISK. 61

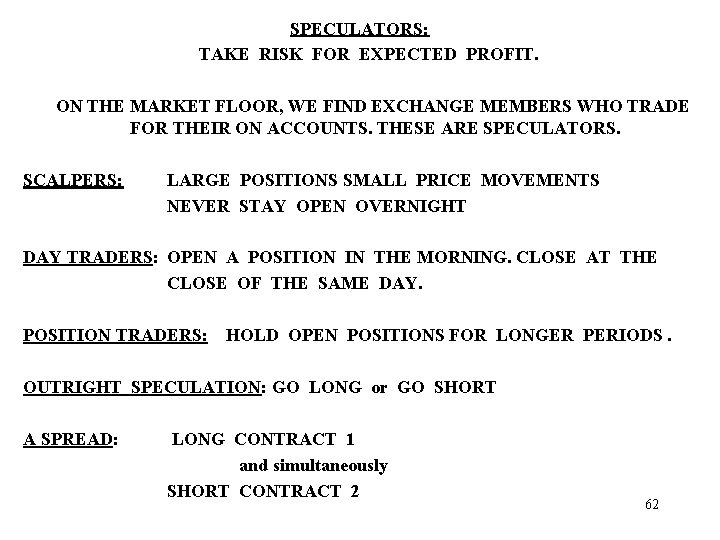

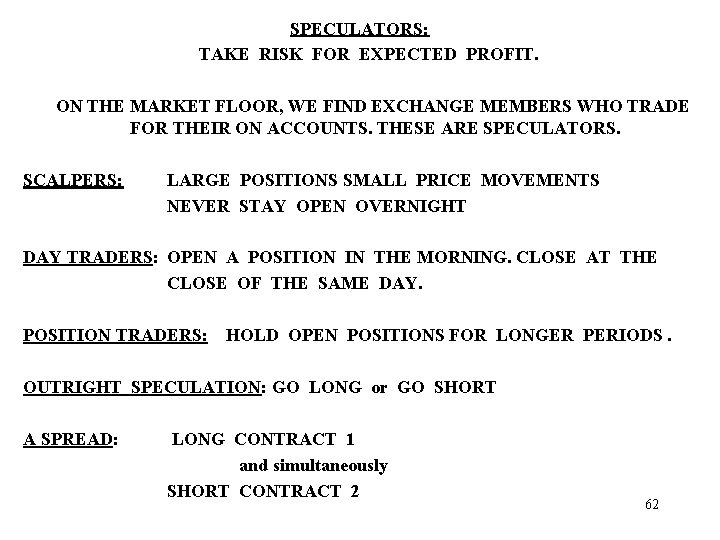

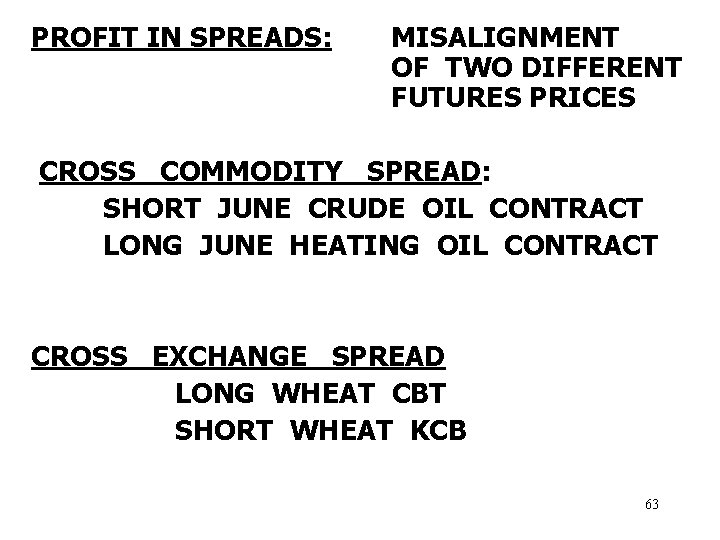

SPECULATORS: TAKE RISK FOR EXPECTED PROFIT. ON THE MARKET FLOOR, WE FIND EXCHANGE MEMBERS WHO TRADE FOR THEIR ON ACCOUNTS. THESE ARE SPECULATORS. SCALPERS: LARGE POSITIONS SMALL PRICE MOVEMENTS NEVER STAY OPEN OVERNIGHT DAY TRADERS: OPEN A POSITION IN THE MORNING. CLOSE AT THE CLOSE OF THE SAME DAY. POSITION TRADERS: HOLD OPEN POSITIONS FOR LONGER PERIODS. OUTRIGHT SPECULATION: GO LONG or GO SHORT A SPREAD: LONG CONTRACT 1 and simultaneously SHORT CONTRACT 2 62

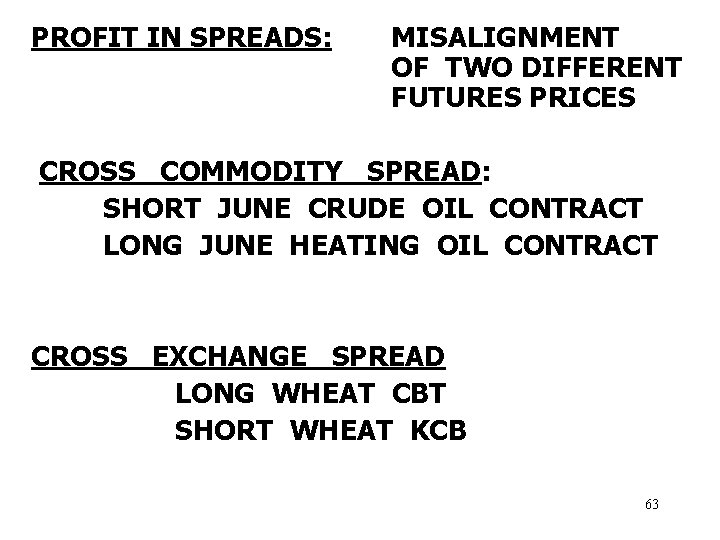

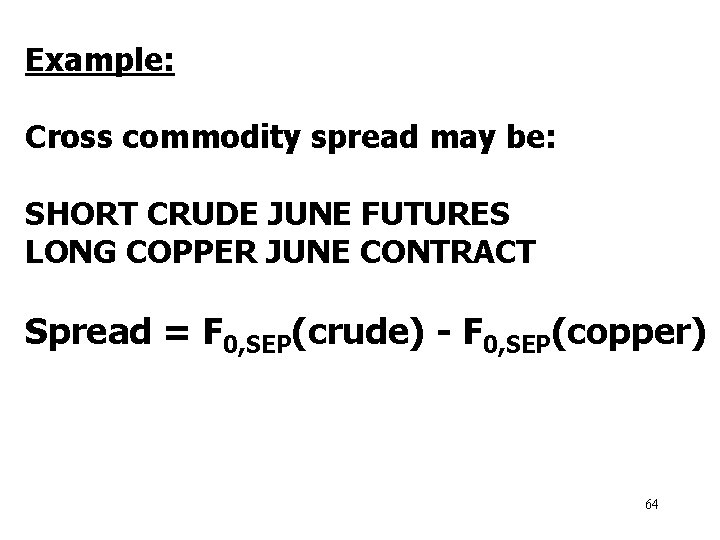

PROFIT IN SPREADS: MISALIGNMENT OF TWO DIFFERENT FUTURES PRICES CROSS COMMODITY SPREAD: SHORT JUNE CRUDE OIL CONTRACT LONG JUNE HEATING OIL CONTRACT CROSS EXCHANGE SPREAD LONG WHEAT CBT SHORT WHEAT KCB 63

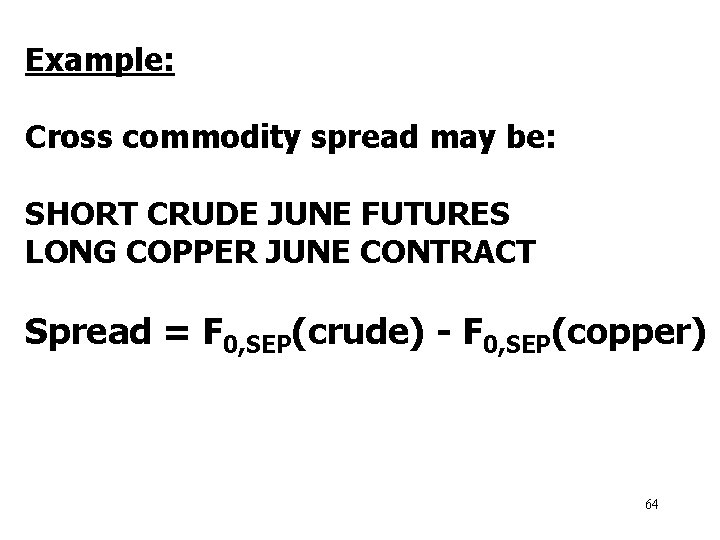

Example: Cross commodity spread may be: SHORT CRUDE JUNE FUTURES LONG COPPER JUNE CONTRACT Spread = F 0, SEP(crude) - F 0, SEP(copper) 64

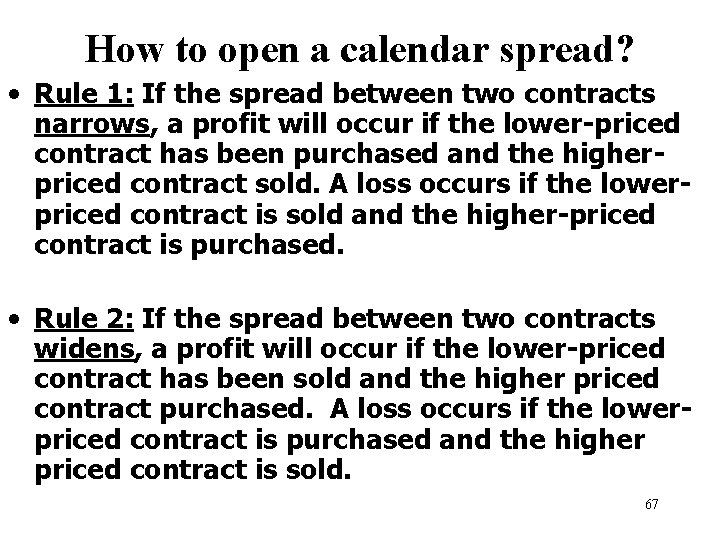

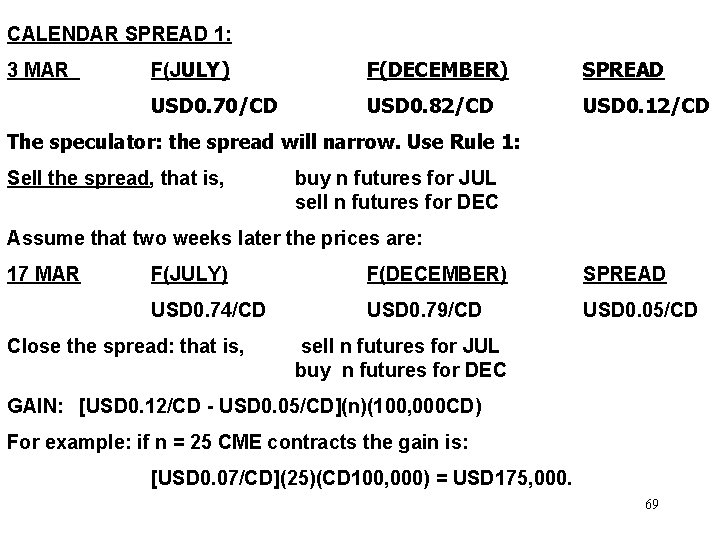

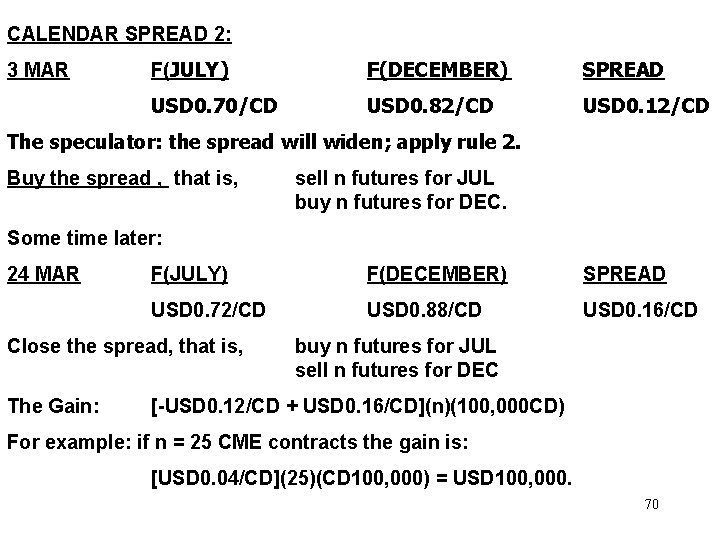

CALENDAR SPREAD Definition: A long position with a simultaneous short position on the same underlying asset for two different delivery months, T 1 y T 2. The spread is the price difference Spread = F 0, T 1 - F 0, T 2 The speculator expectation is that the spread will narrow or widen in the future. 65

Example: LONG POSITION SHORT POSTION CONTRACT for JUNE CONTRACT for SEPTEMBER. Spread = F 0, SEP - F 0, JUN How does a spread function? 66

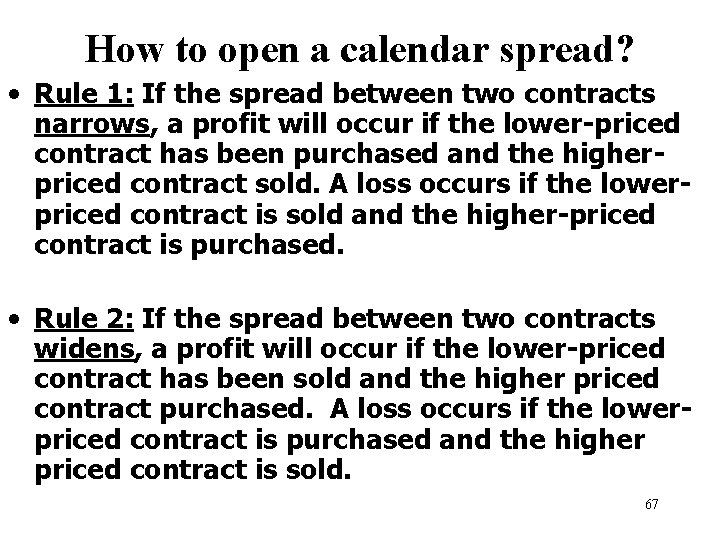

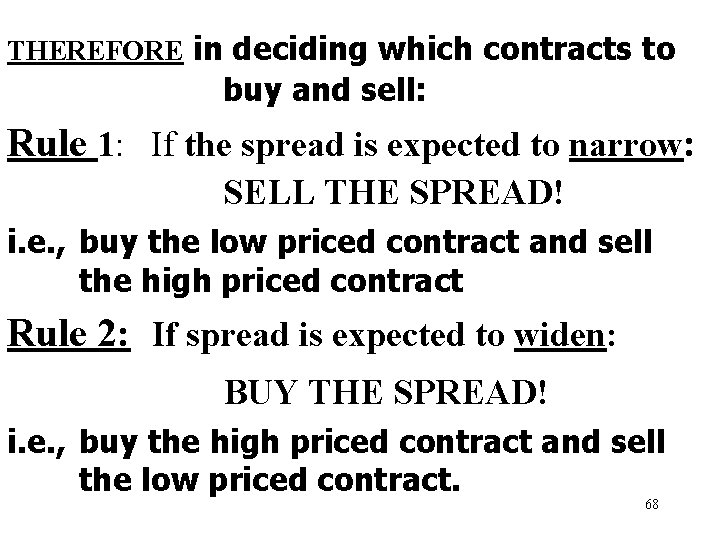

How to open a calendar spread? • Rule 1: If the spread between two contracts narrows, a profit will occur if the lower-priced contract has been purchased and the higherpriced contract sold. A loss occurs if the lowerpriced contract is sold and the higher-priced contract is purchased. • Rule 2: If the spread between two contracts widens, a profit will occur if the lower-priced contract has been sold and the higher priced contract purchased. A loss occurs if the lowerpriced contract is purchased and the higher priced contract is sold. 67

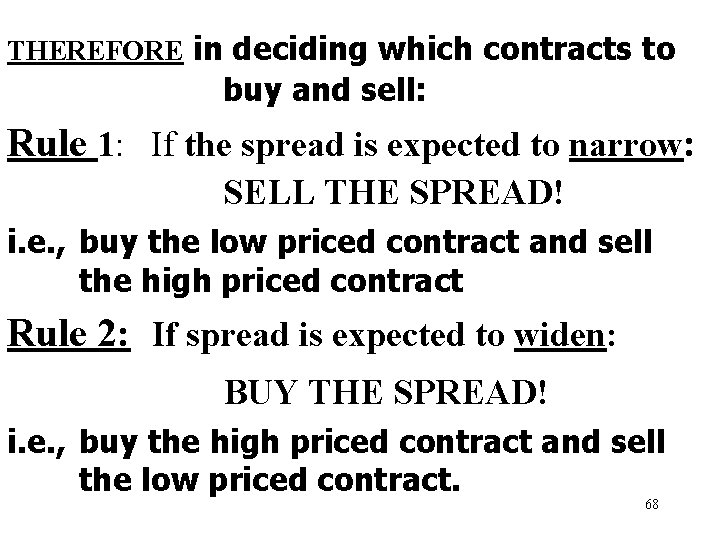

THEREFORE in deciding which contracts to buy and sell: Rule 1: If the spread is expected to narrow: SELL THE SPREAD! i. e. , buy the low priced contract and sell the high priced contract Rule 2: If spread is expected to widen: BUY THE SPREAD! i. e. , buy the high priced contract and sell the low priced contract. 68

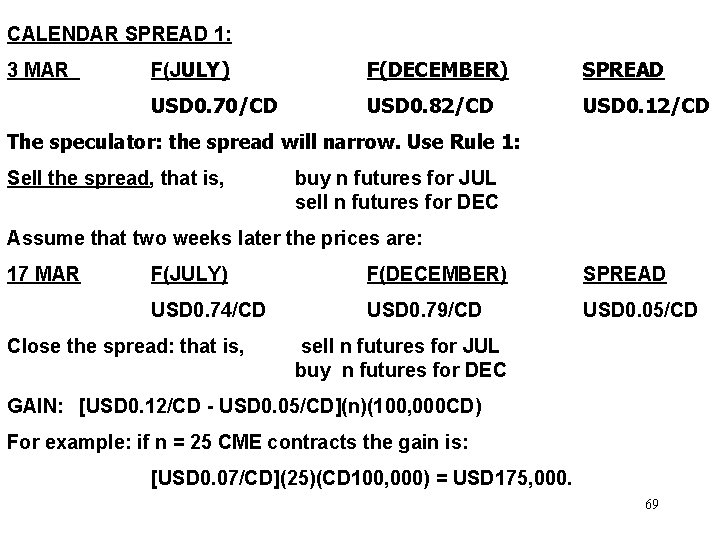

CALENDAR SPREAD 1: 3 MAR F(JULY) F(DECEMBER) SPREAD USD 0. 70/CD USD 0. 82/CD USD 0. 12/CD The speculator: the spread will narrow. Use Rule 1: Sell the spread, that is, buy n futures for JUL sell n futures for DEC Assume that two weeks later the prices are: 17 MAR F(JULY) F(DECEMBER) SPREAD USD 0. 74/CD USD 0. 79/CD USD 0. 05/CD Close the spread: that is, sell n futures for JUL buy n futures for DEC GAIN: [USD 0. 12/CD - USD 0. 05/CD](n)(100, 000 CD) For example: if n = 25 CME contracts the gain is: [USD 0. 07/CD](25)(CD 100, 000) = USD 175, 000. 69

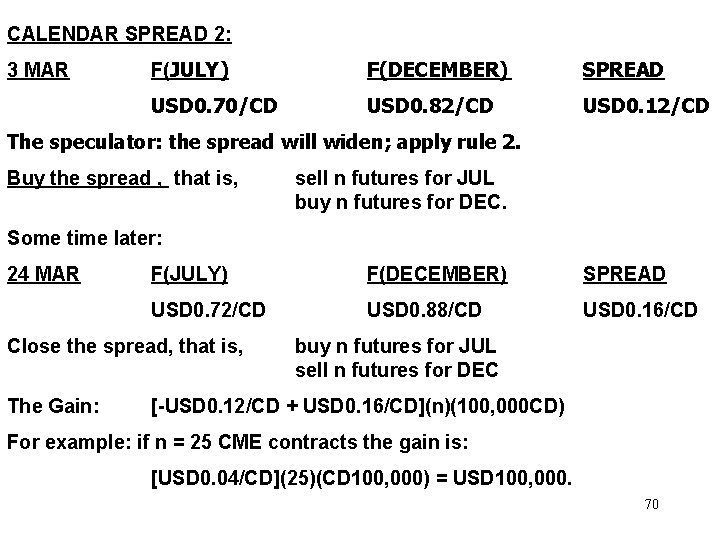

CALENDAR SPREAD 2: 3 MAR F(JULY) F(DECEMBER) SPREAD USD 0. 70/CD USD 0. 82/CD USD 0. 12/CD The speculator: the spread will widen; apply rule 2. Buy the spread , that is, sell n futures for JUL buy n futures for DEC. Some time later: 24 MAR F(JULY) F(DECEMBER) SPREAD USD 0. 72/CD USD 0. 88/CD USD 0. 16/CD Close the spread, that is, The Gain: buy n futures for JUL sell n futures for DEC [-USD 0. 12/CD + USD 0. 16/CD](n)(100, 000 CD) For example: if n = 25 CME contracts the gain is: [USD 0. 04/CD](25)(CD 100, 000) = USD 100, 000. 70

Synthetic forward contract

Synthetic forward contract Mechanics of futures markets

Mechanics of futures markets Mechanics of futures markets

Mechanics of futures markets Mechanics of futures markets

Mechanics of futures markets Advantages and disadvantages of derivatives

Advantages and disadvantages of derivatives Fundamentals of futures and options markets

Fundamentals of futures and options markets Mechanics of futures market

Mechanics of futures market Mechanics of futures market

Mechanics of futures market Mechanics of options

Mechanics of options Mechanics of options markets

Mechanics of options markets Mechanics of options markets

Mechanics of options markets Fx forwards manchester

Fx forwards manchester Forward contract hedging

Forward contract hedging Equity forward

Equity forward Mercados de forwards y swaps

Mercados de forwards y swaps Bottle of rum to fill my tum

Bottle of rum to fill my tum Derivatives hedging strategies

Derivatives hedging strategies Why study financial institutions

Why study financial institutions Characteristic of consumer behaviour

Characteristic of consumer behaviour Chapter 9 expanding markets and moving west

Chapter 9 expanding markets and moving west Buyer behaviour

Buyer behaviour Business buyer behavior refers to the

Business buyer behavior refers to the Chapter 5 consumer markets and buyer behavior

Chapter 5 consumer markets and buyer behavior Chapter 9 expanding markets and moving west

Chapter 9 expanding markets and moving west Chapter 9 expanding markets and moving west

Chapter 9 expanding markets and moving west Chapter 7 consumers producers and the efficiency of markets

Chapter 7 consumers producers and the efficiency of markets Options futures and risk management

Options futures and risk management Options futures and other derivatives

Options futures and other derivatives Traders in financial futures

Traders in financial futures Currency futures and options

Currency futures and options Hedging strategies using futures and options

Hedging strategies using futures and options Cultural dynamics in assessing global markets

Cultural dynamics in assessing global markets Analyzing consumer and business markets

Analyzing consumer and business markets Chapter 18 the markets for the factors of production

Chapter 18 the markets for the factors of production Analyzing consumer markets chapter 6

Analyzing consumer markets chapter 6 Firms in competitive markets chapter 14 ppt

Firms in competitive markets chapter 14 ppt Chapter 6 safety and body mechanics

Chapter 6 safety and body mechanics Csm neurovascular assessment

Csm neurovascular assessment Pass and race acronyms

Pass and race acronyms Safety and body mechanics

Safety and body mechanics Chapter 6 safety and body mechanics workbook answers

Chapter 6 safety and body mechanics workbook answers Body mechanics and mobility

Body mechanics and mobility For a broad base of support feet should be

For a broad base of support feet should be Member of jakarta futures exchange bali

Member of jakarta futures exchange bali Futures pricing

Futures pricing Cheapest to deliver futures

Cheapest to deliver futures Short-term euro-btp futures

Short-term euro-btp futures Futures contracts

Futures contracts Add-on yield

Add-on yield Currency futures

Currency futures Bright futures requirements

Bright futures requirements Aap bright futures periodicity schedule

Aap bright futures periodicity schedule Tobacco free futures

Tobacco free futures Hesa data futures

Hesa data futures Dividend derivatives

Dividend derivatives Blogspot

Blogspot Many mncs use forward contracts.

Many mncs use forward contracts. Language futures

Language futures Fair value of futures contract

Fair value of futures contract Hedging strategies using futures

Hedging strategies using futures Esf futures

Esf futures Enron weather futures

Enron weather futures Blue chip derivatives

Blue chip derivatives Futures trading risk management

Futures trading risk management Eurodollar futures definition

Eurodollar futures definition Short hedging

Short hedging Hedging interest rate risk with futures

Hedging interest rate risk with futures Futures for you

Futures for you Fixed income futures

Fixed income futures Managed futures glossary

Managed futures glossary Put call parity

Put call parity Euro-bono

Euro-bono