Chapter 2 The Recording Process ACT 201 Lecture

- Slides: 25

Chapter 2: The Recording Process ACT 201 Lecture By: Ms. Adina Malik

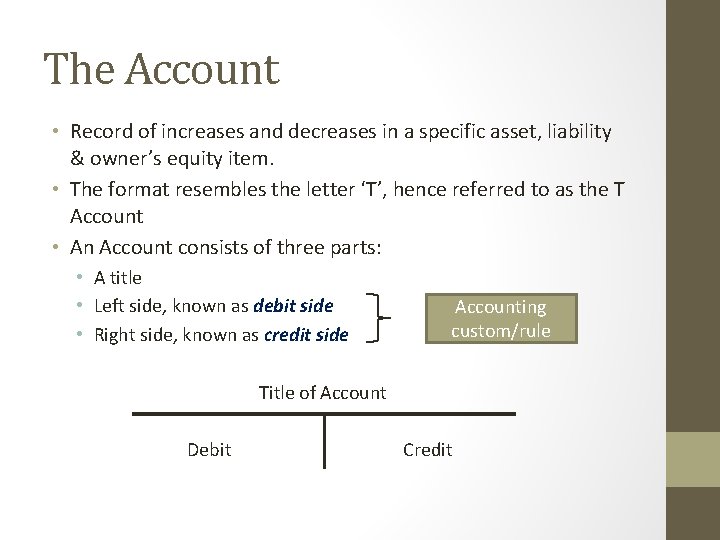

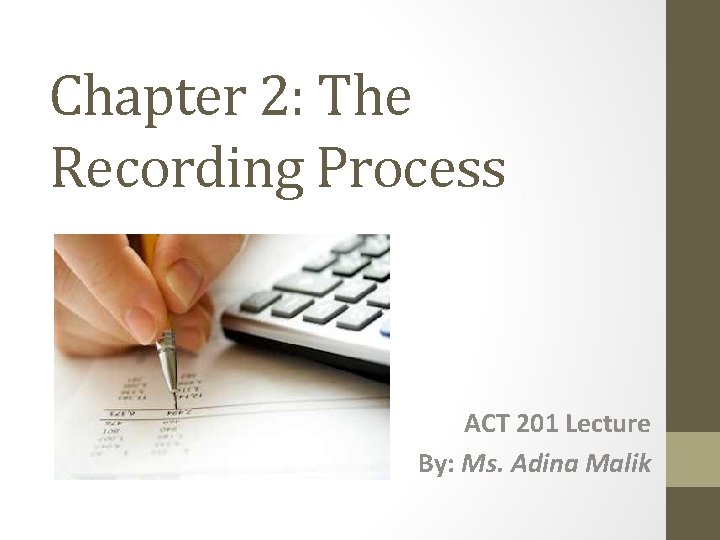

The Account • Record of increases and decreases in a specific asset, liability & owner’s equity item. • The format resembles the letter ‘T’, hence referred to as the T Account • An Account consists of three parts: • A title • Left side, known as debit side • Right side, known as credit side Accounting custom/rule Title of Account Debit Credit

Debits & Credits Double-entry accounting system • Commonly abbreviate Debit as ‘Dr. ’ and Credit as ‘Cr. ’ • Each transaction must affect two or more accounts to keep the basic accounting equation in balance. • Recording done by debiting at least one account and crediting another. • DEBITS must equal CREDITS.

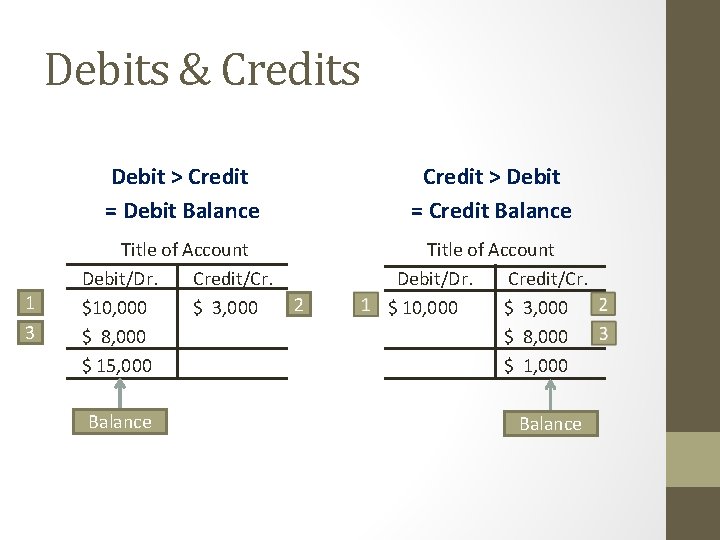

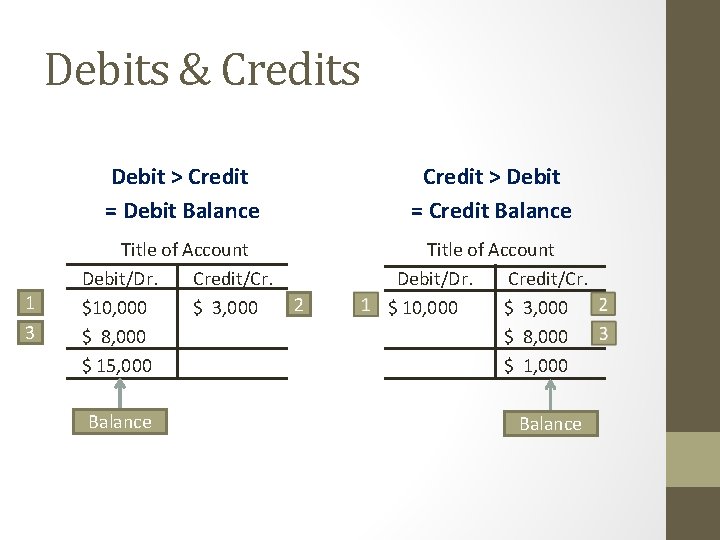

Debits & Credits 1 3 Debit > Credit = Debit Balance Credit > Debit = Credit Balance Title of Account Debit/Dr. Credit/Cr. $10, 000 $ 3, 000 $ 8, 000 $ 15, 000 Title of Account Debit/Dr. Credit/Cr. $ 10, 000 $ 3, 000 $ 8, 000 $ 1, 000 Balance 2 Balance

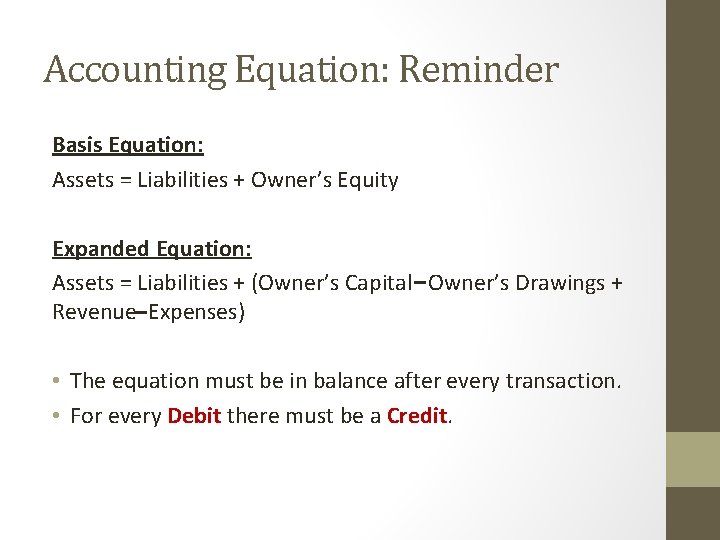

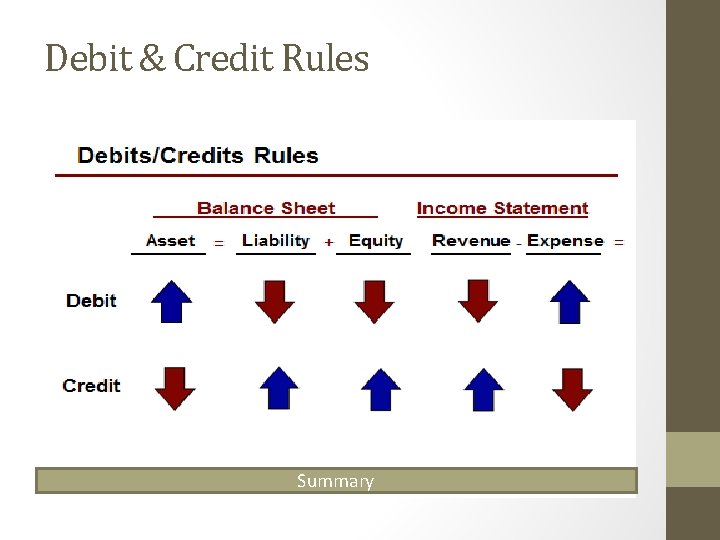

Accounting Equation: Reminder Basis Equation: Assets = Liabilities + Owner’s Equity Expanded Equation: Assets = Liabilities + (Owner’s Capital Owner’s Drawings + Revenue Expenses) • The equation must be in balance after every transaction. • For every Debit there must be a Credit.

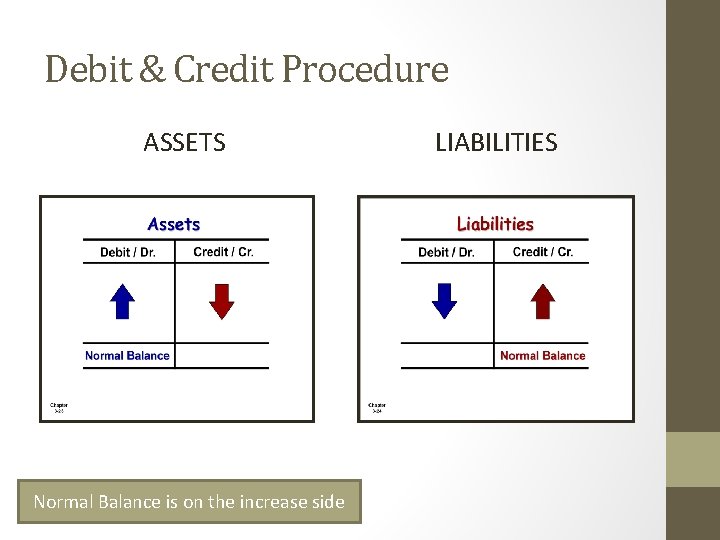

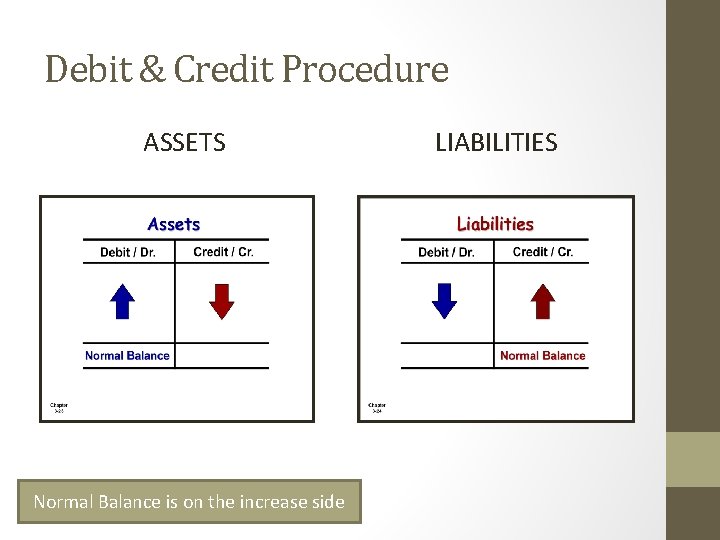

Debit & Credit Procedure ASSETS Normal Balance is on the increase side LIABILITIES

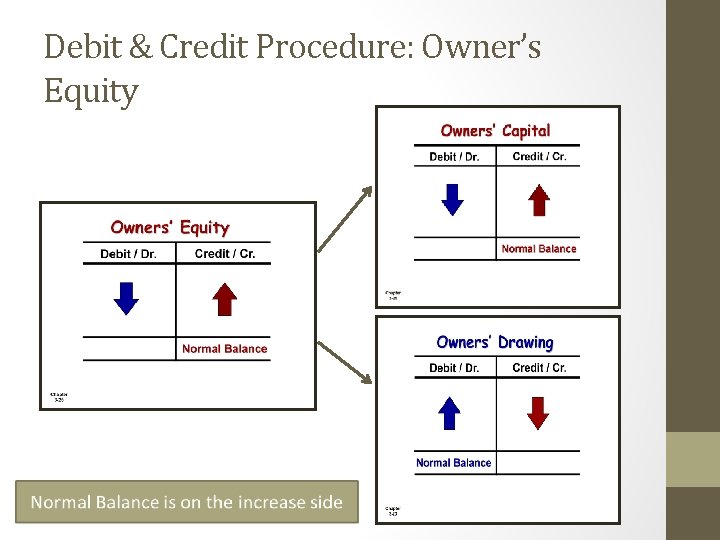

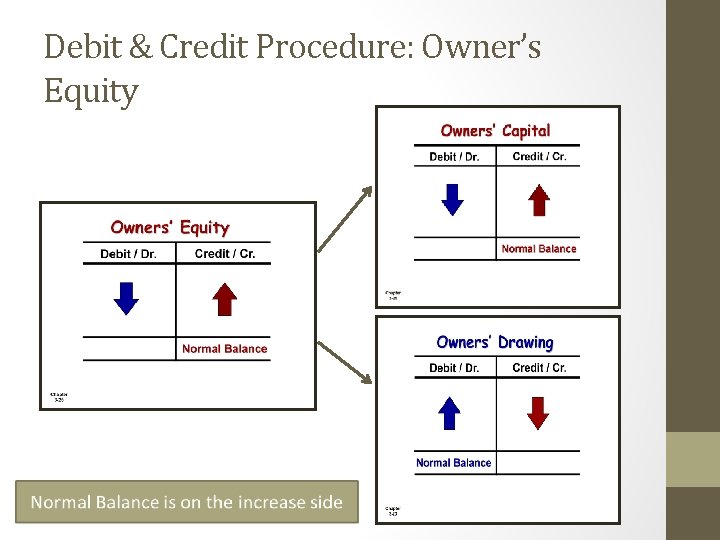

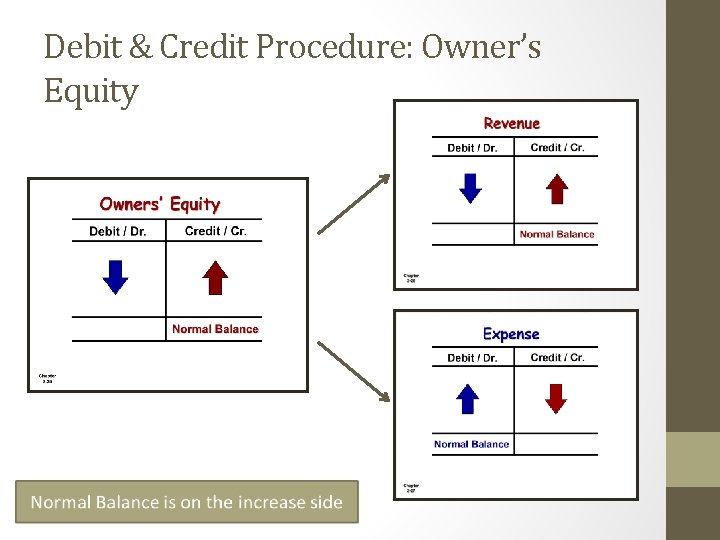

Debit & Credit Procedure: Owner’s Equity

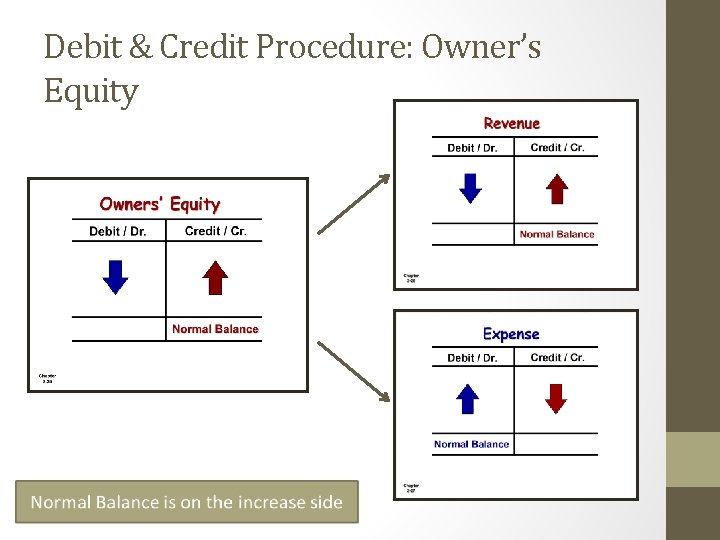

Debit & Credit Procedure: Owner’s Equity

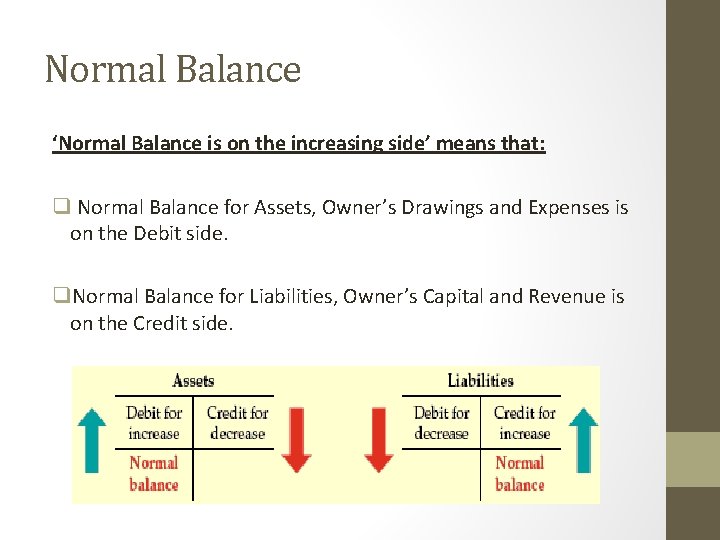

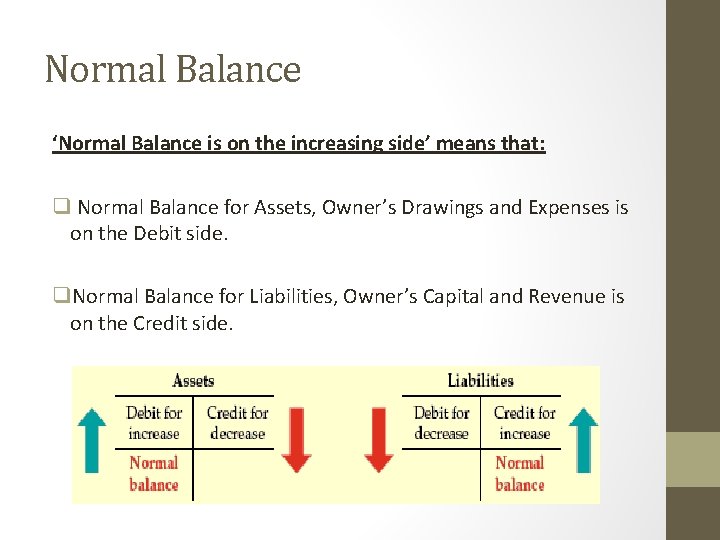

Normal Balance ‘Normal Balance is on the increasing side’ means that: q Normal Balance for Assets, Owner’s Drawings and Expenses is on the Debit side. q. Normal Balance for Liabilities, Owner’s Capital and Revenue is on the Credit side.

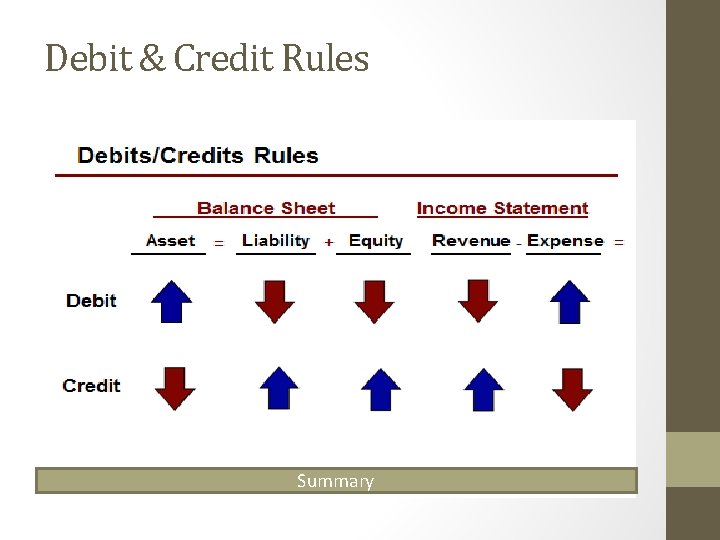

Debit & Credit Rules Summary

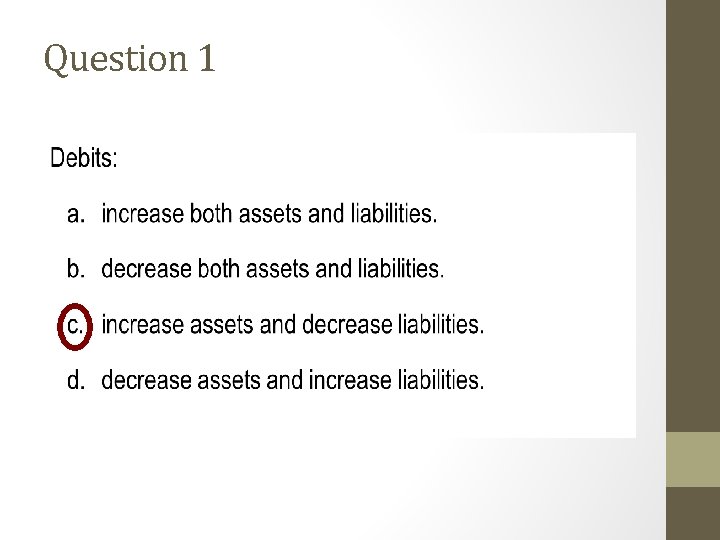

Question 1

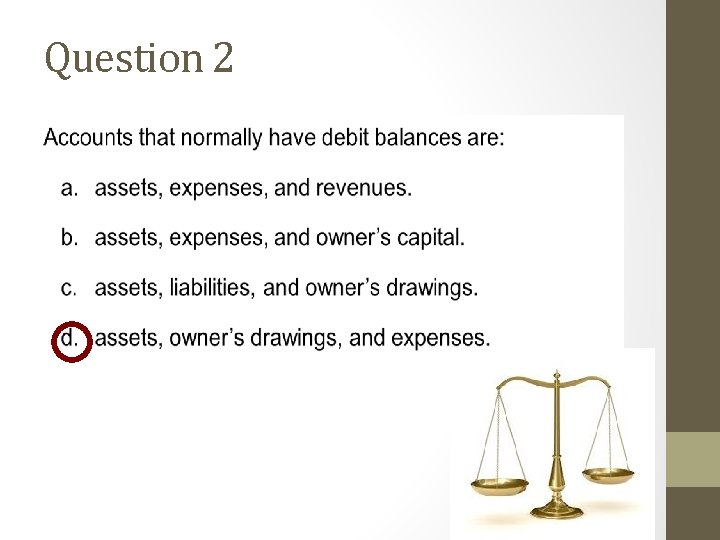

Question 2

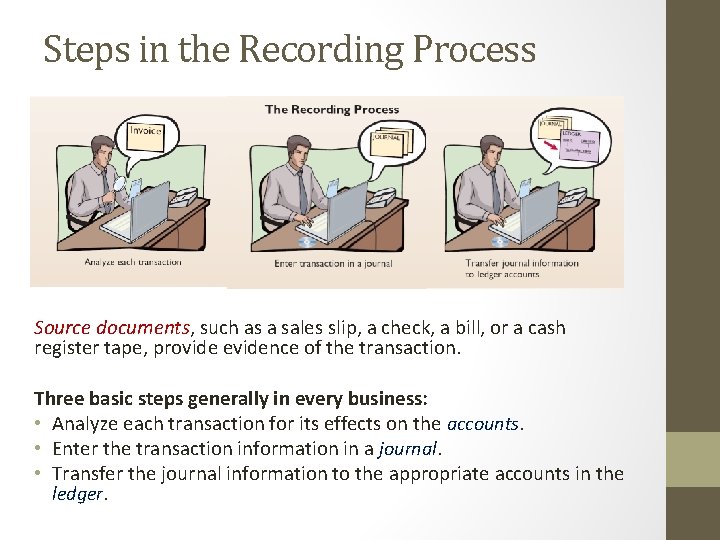

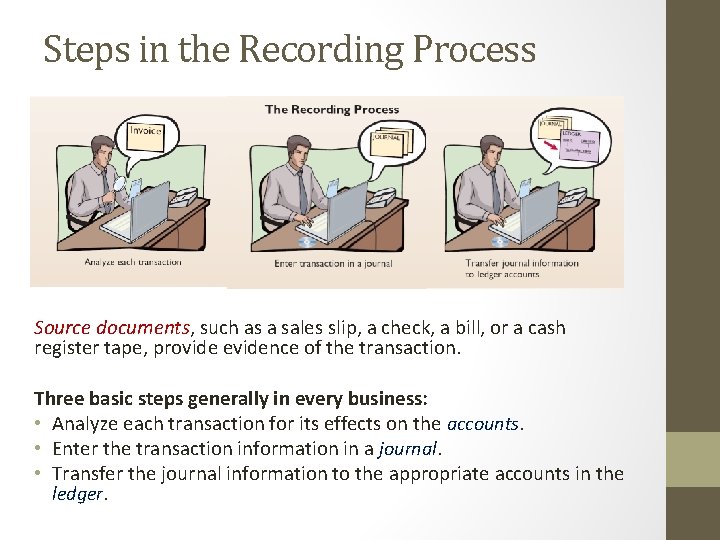

Steps in the Recording Process Source documents, such as a sales slip, a check, a bill, or a cash register tape, provide evidence of the transaction. Three basic steps generally in every business: • Analyze each transaction for its effects on the accounts. • Enter the transaction information in a journal. • Transfer the journal information to the appropriate accounts in the ledger.

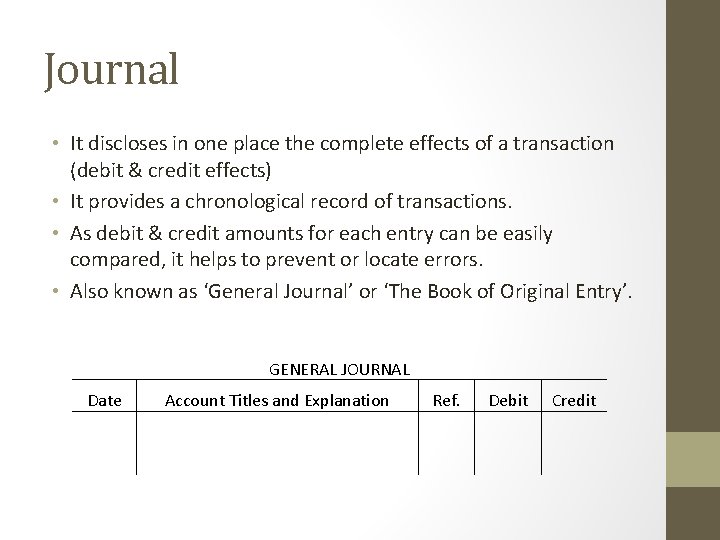

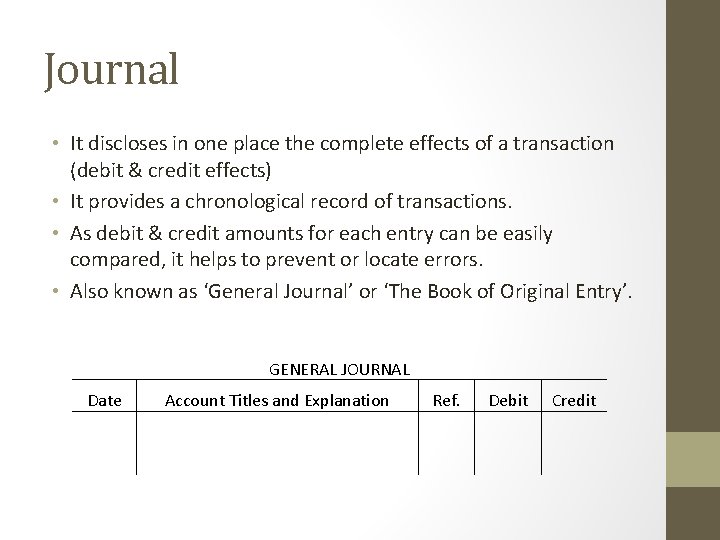

Journal • It discloses in one place the complete effects of a transaction (debit & credit effects) • It provides a chronological record of transactions. • As debit & credit amounts for each entry can be easily compared, it helps to prevent or locate errors. • Also known as ‘General Journal’ or ‘The Book of Original Entry’. GENERAL JOURNAL Date Account Titles and Explanation Ref. Debit Credit

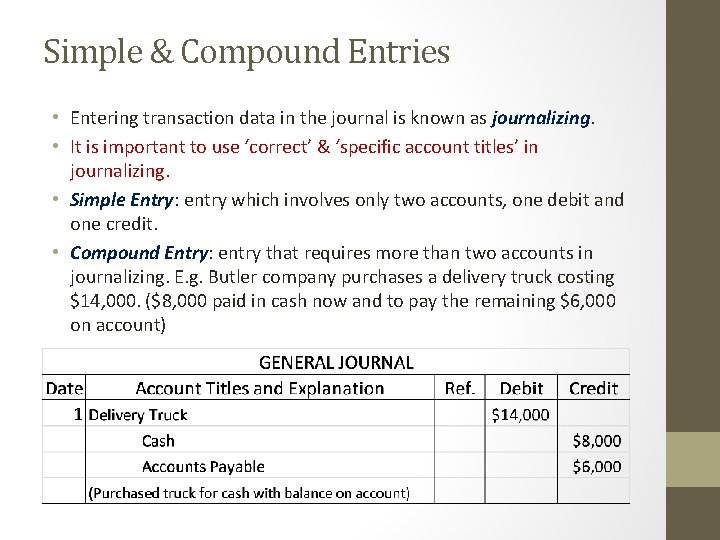

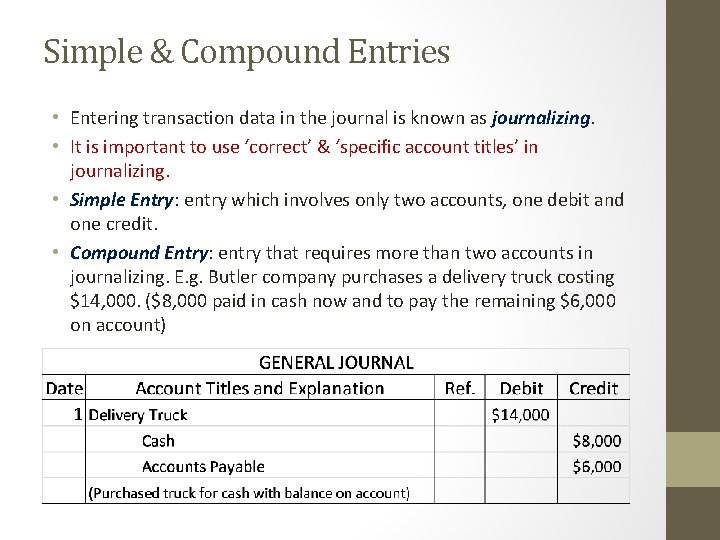

Simple & Compound Entries • Entering transaction data in the journal is known as journalizing. • It is important to use ‘correct’ & ‘specific account titles’ in journalizing. • Simple Entry: entry which involves only two accounts, one debit and one credit. • Compound Entry: entry that requires more than two accounts in journalizing. E. g. Butler company purchases a delivery truck costing $14, 000. ($8, 000 paid in cash now and to pay the remaining $6, 000 on account)

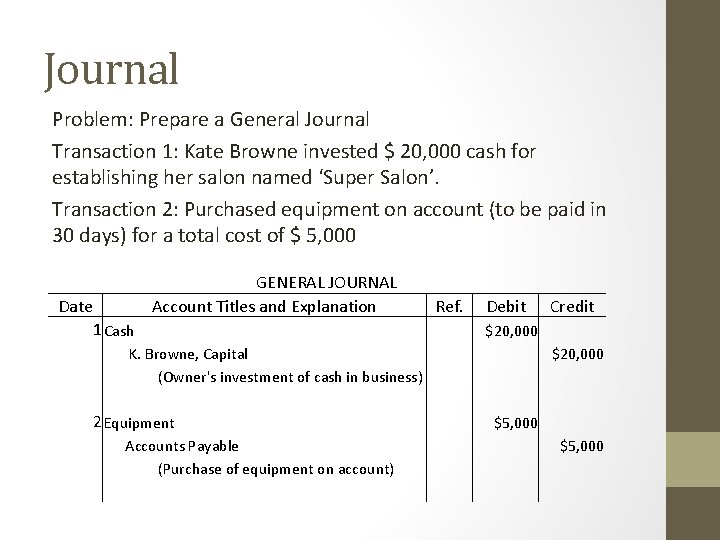

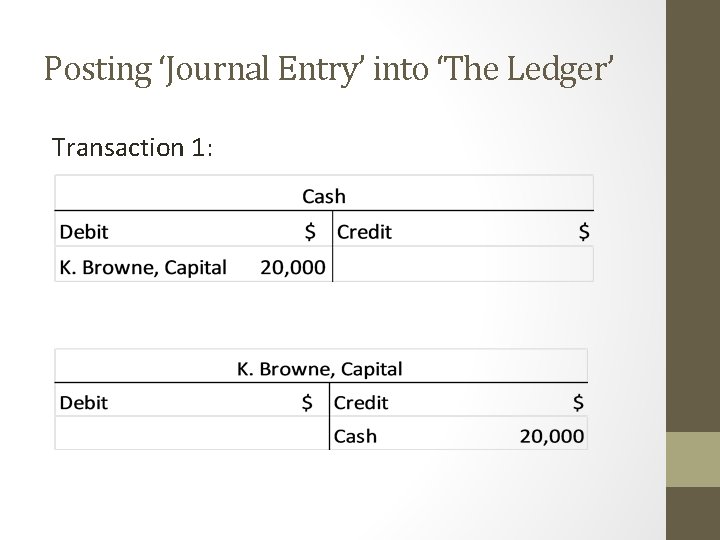

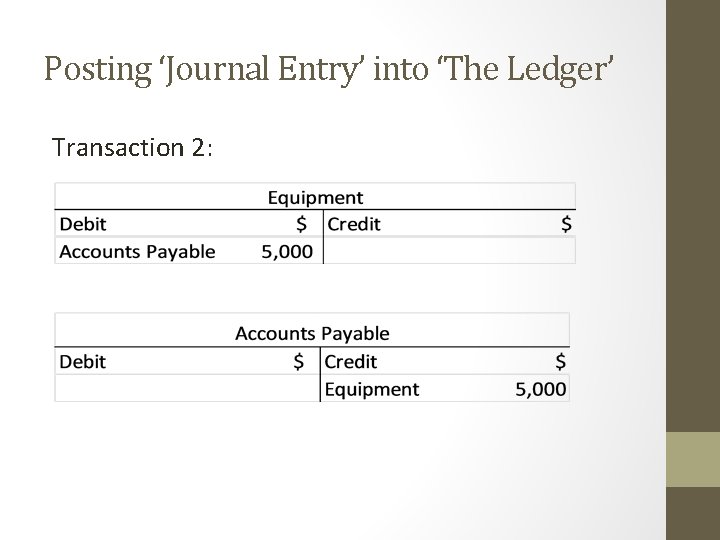

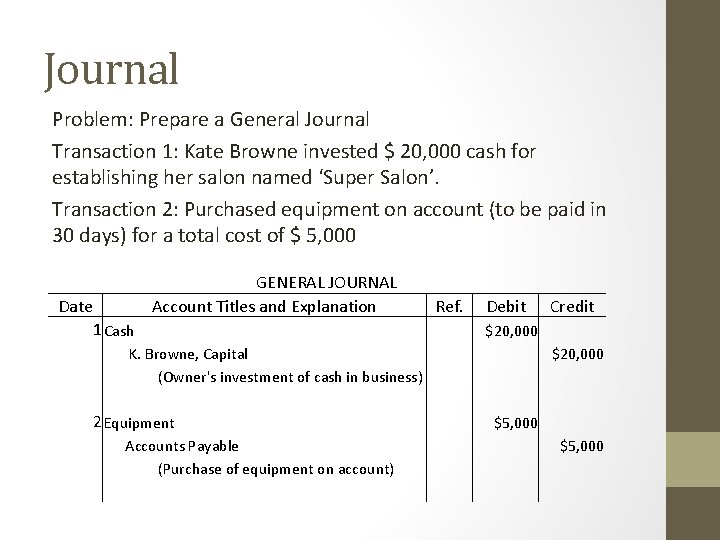

Journal Problem: Prepare a General Journal Transaction 1: Kate Browne invested $ 20, 000 cash for establishing her salon named ‘Super Salon’. Transaction 2: Purchased equipment on account (to be paid in 30 days) for a total cost of $ 5, 000 GENERAL JOURNAL Account Titles and Explanation Date Debit 1 Cash K. Browne, Capital (Owner's investment of cash in business) 2 Equipment Accounts Payable (Purchase of equipment on account) Ref. Credit $20, 000 $5, 000

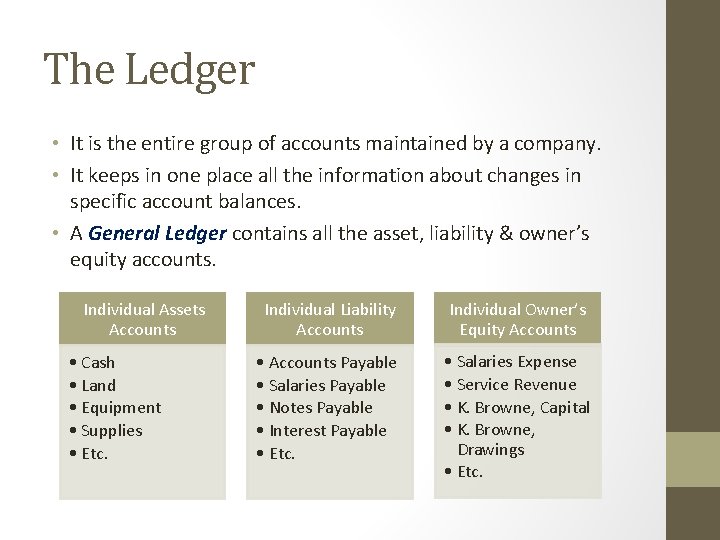

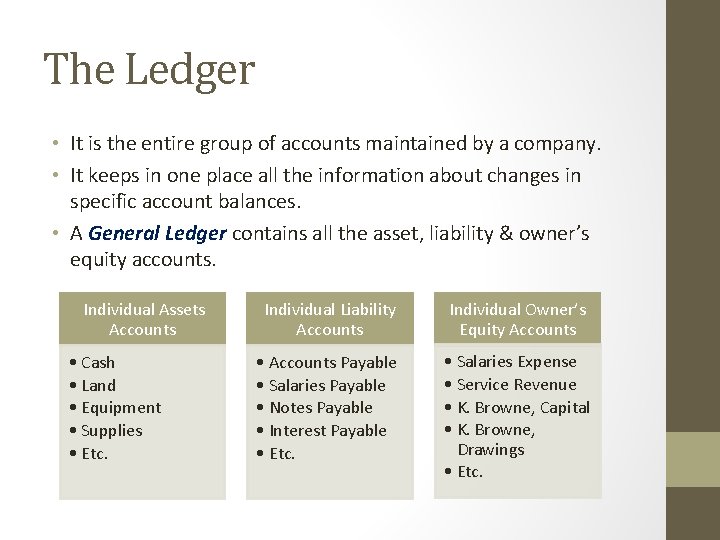

The Ledger • It is the entire group of accounts maintained by a company. • It keeps in one place all the information about changes in specific account balances. • A General Ledger contains all the asset, liability & owner’s equity accounts. Individual Assets Accounts • Cash • Land • Equipment • Supplies • Etc. Individual Liability Accounts Individual Owner’s Equity Accounts • Accounts Payable • Salaries Payable • Notes Payable • Interest Payable • Etc. • Salaries Expense • Service Revenue • K. Browne, Capital • K. Browne, Drawings • Etc.

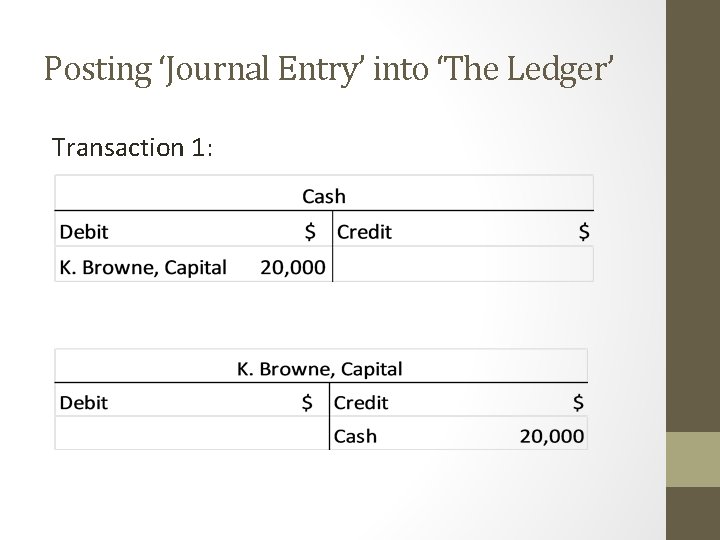

Posting ‘Journal Entry’ into ‘The Ledger’ Transaction 1:

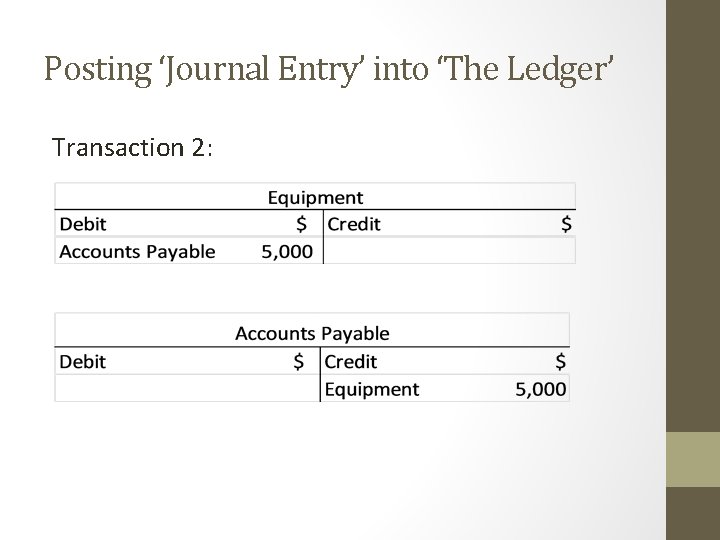

Posting ‘Journal Entry’ into ‘The Ledger’ Transaction 2:

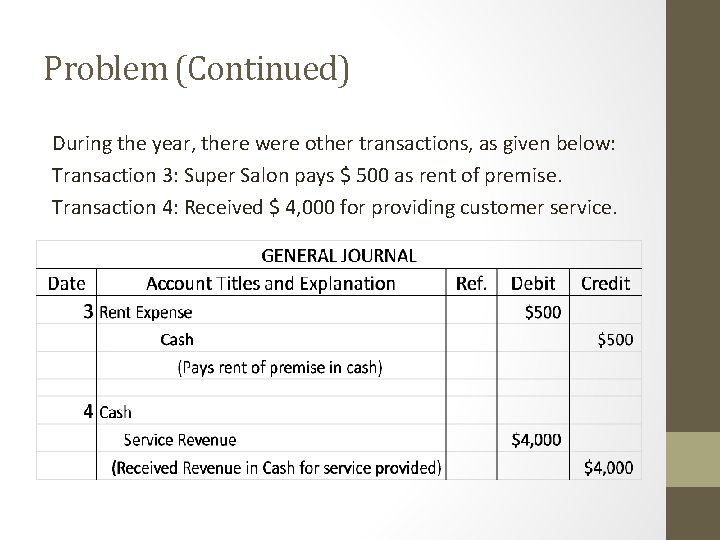

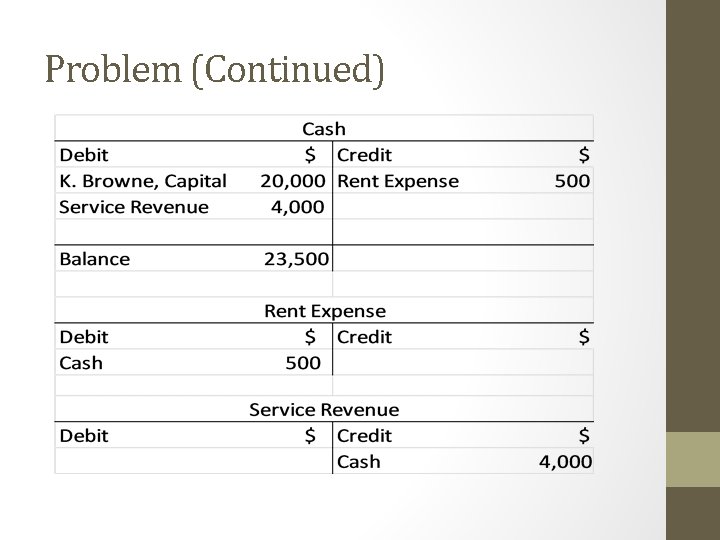

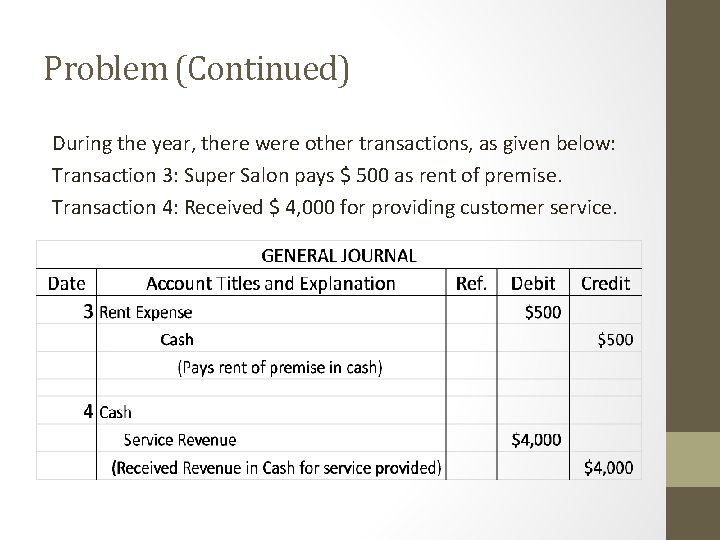

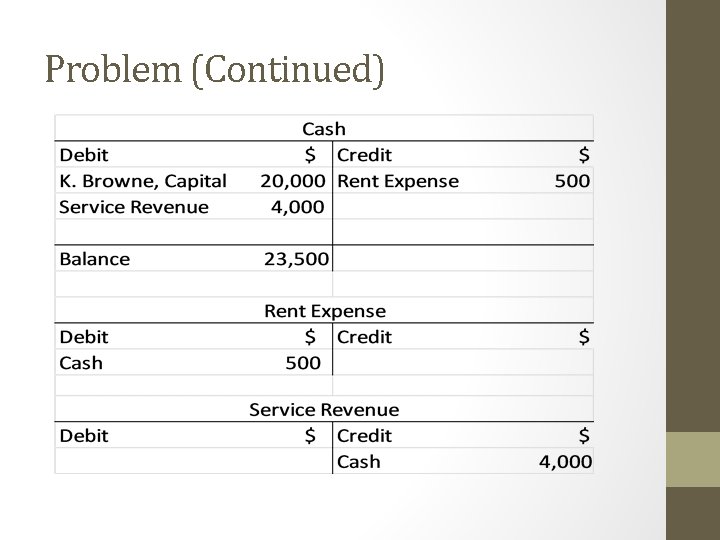

Problem (Continued) During the year, there were other transactions, as given below: Transaction 3: Super Salon pays $ 500 as rent of premise. Transaction 4: Received $ 4, 000 for providing customer service.

Problem (Continued)

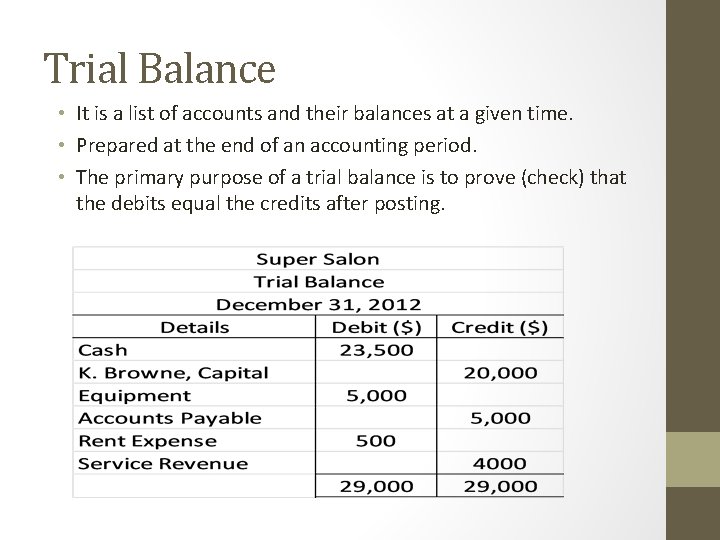

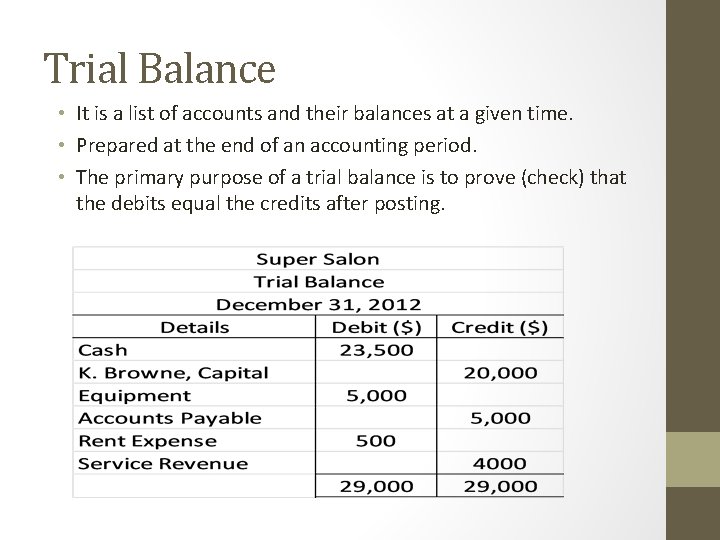

Trial Balance • It is a list of accounts and their balances at a given time. • Prepared at the end of an accounting period. • The primary purpose of a trial balance is to prove (check) that the debits equal the credits after posting.

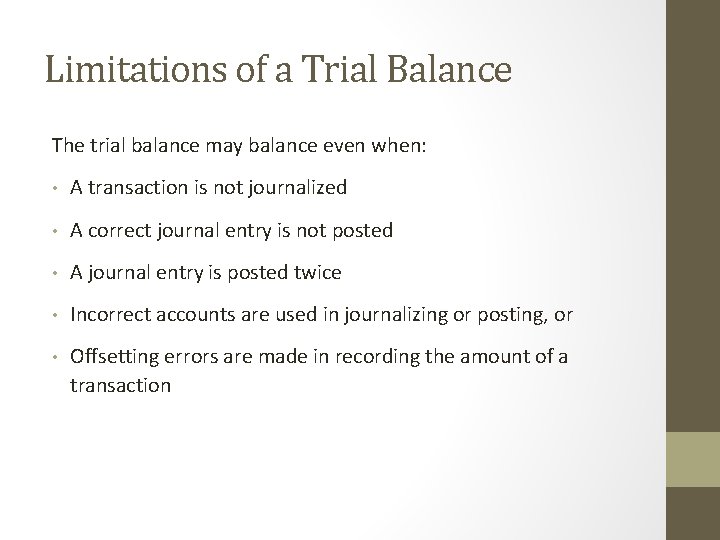

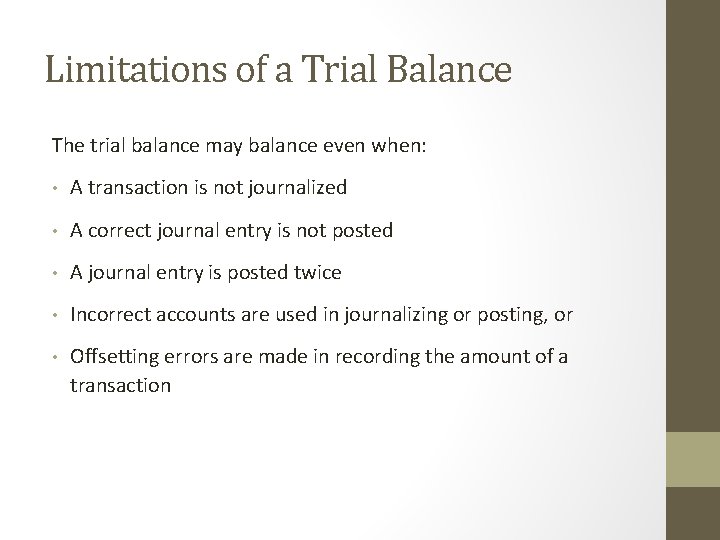

Limitations of a Trial Balance The trial balance may balance even when: • A transaction is not journalized • A correct journal entry is not posted • A journal entry is posted twice • Incorrect accounts are used in journalizing or posting, or • Offsetting errors are made in recording the amount of a transaction

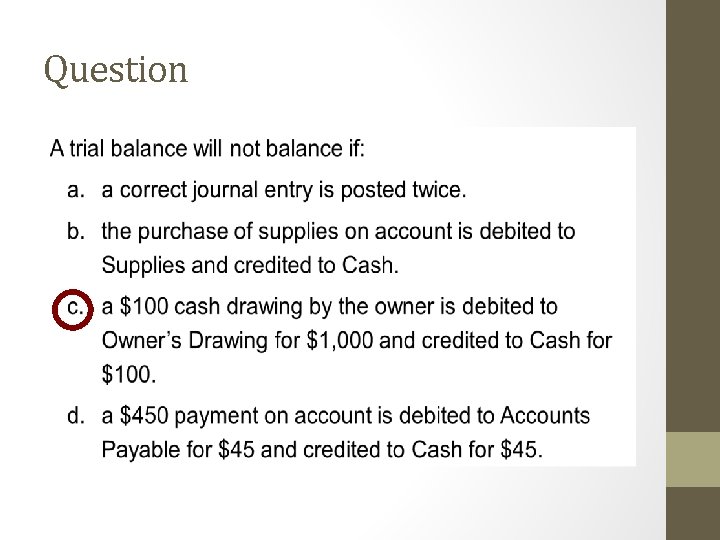

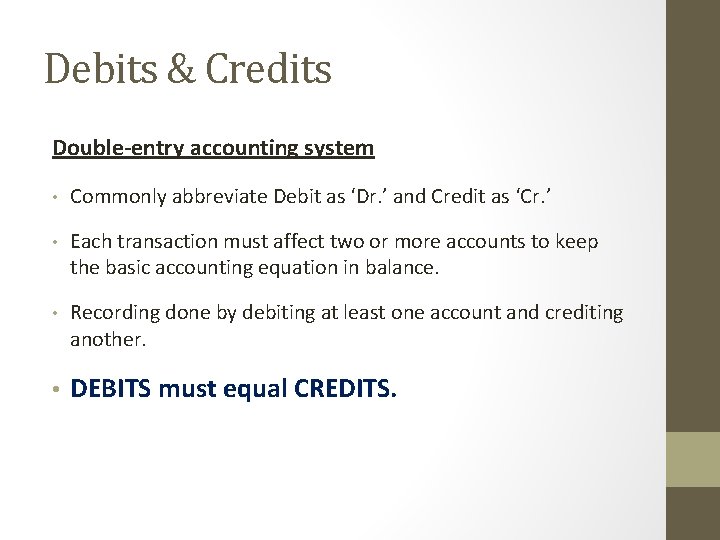

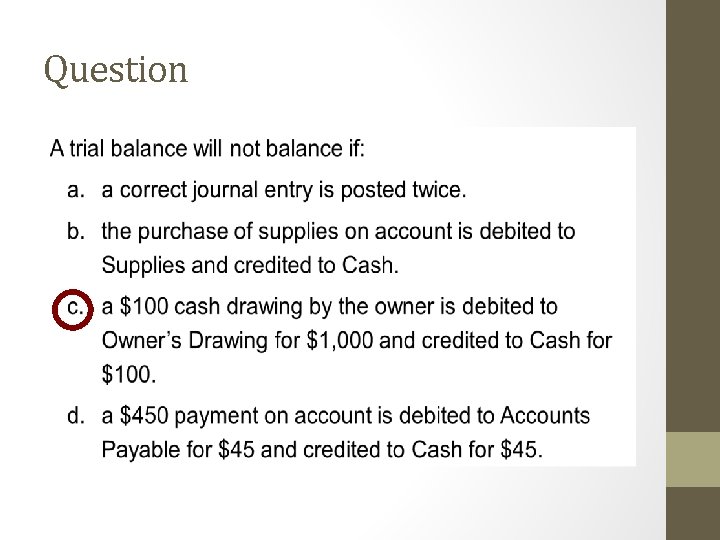

Question

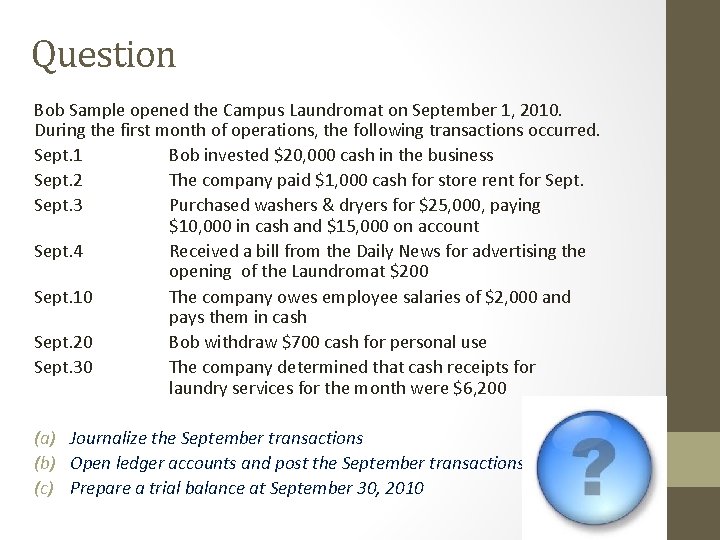

Question Bob Sample opened the Campus Laundromat on September 1, 2010. During the first month of operations, the following transactions occurred. Sept. 1 Bob invested $20, 000 cash in the business Sept. 2 The company paid $1, 000 cash for store rent for Sept. 3 Purchased washers & dryers for $25, 000, paying $10, 000 in cash and $15, 000 on account Sept. 4 Received a bill from the Daily News for advertising the opening of the Laundromat $200 Sept. 10 The company owes employee salaries of $2, 000 and pays them in cash Sept. 20 Bob withdraw $700 cash for personal use Sept. 30 The company determined that cash receipts for laundry services for the month were $6, 200 (a) Journalize the September transactions (b) Open ledger accounts and post the September transactions (c) Prepare a trial balance at September 30, 2010