What is Financial Aid Financial aid consists of

- Slides: 42

What is Financial Aid? Financial aid consists of funds provided to students and families to help pay for postsecondary educational expenses. Includes: Grants, Scholarships, Loans, Work Study • Not all families qualify for financial aid • There is no guarantee that you will get any free money to pay for higher education

Where does the money come from? • Federal Government • State Government • School/Colleges • Private Scholarship Sources: • • HS Counselors Clubs and organizations Employers Internet scholarship searches

Basis for awarding aid… • Merit – scholarships usually based on: • Academic or athletic ability • Special talent or achievement • Program of study • Need-based grants, loans, and employment usually based on: • Income • Assets • Other factors

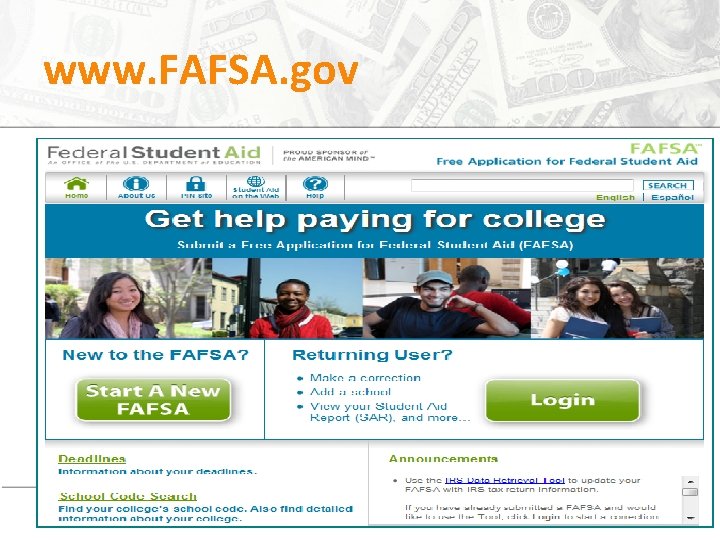

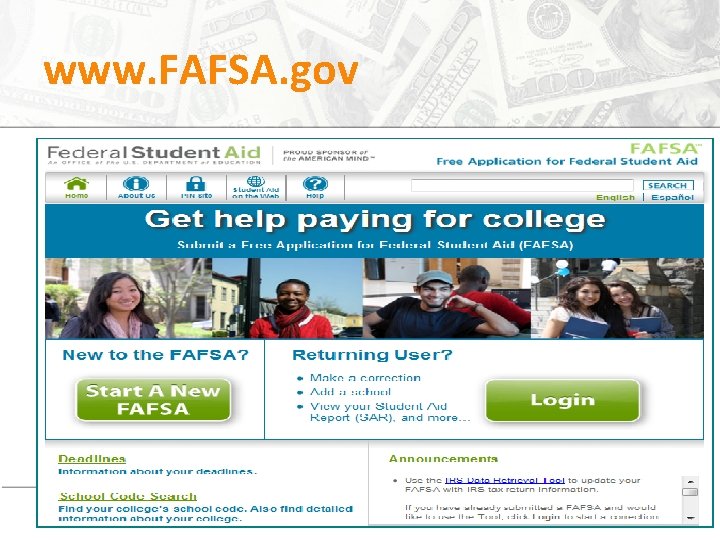

The Free Application for Federal Student Aid (FAFSA) Online at www. fafsa. ed. gov safe, secure, fast, skip logic, built in edits The FAFSA (Free Application for Federal Student Aid) is a federal form used to determine student eligibility for the following: • Federal programs, such as Pell Grants, work-study, and student loans • State programs, such as Pennsylvania State Grant , and other special programs • School programs, such as need-based grants and scholarships. Paper FAFSA – call 1 -800 -433 -3243

When to Apply Seniors • The FAFSA may be filed beginning on January 1 of the upcoming award year. For the 2015 -16 award year this would be January 1, 2015 • Every year in college

Information you Need to Complete the FAFSA Social security numbers 2014 Federal income tax return (1040, 1040 A or 1040 EZ) W-2 forms from all employers Current bank statements (checking and savings) Current business and farm records Records of any stocks, bonds and other investments, including 529 accounts • Additional untaxed income tax records may be needed such as: Veteran’s non educational benefits, child support paid/received and workers compensation. • Alien registration or permanent resident card (if not a US citizen) • • •

Things not counted on the FAFSA • • • Primary home/residence Qualified Insurance Policies Retirement Social Security Credit Card Debt Any Debt

www. FAFSA. gov

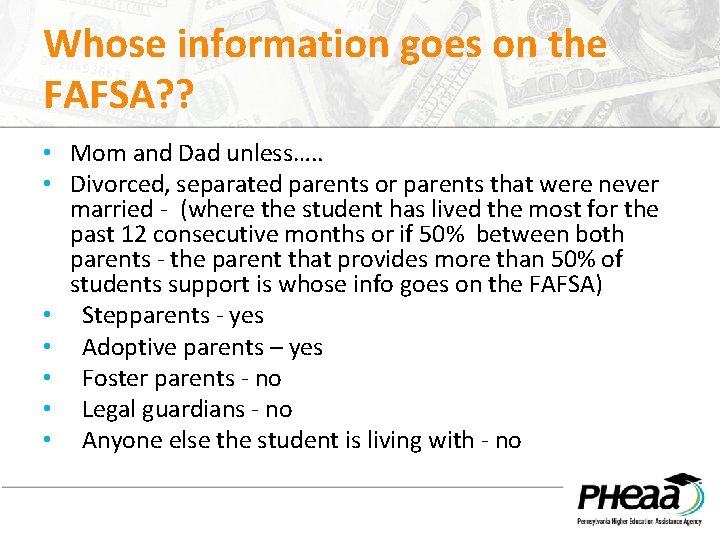

Whose information goes on the FAFSA? ? • Mom and Dad unless…. . • Divorced, separated parents or parents that were never married - (where the student has lived the most for the past 12 consecutive months or if 50% between both parents - the parent that provides more than 50% of students support is whose info goes on the FAFSA) • Stepparents - yes • Adoptive parents – yes • Foster parents - no • Legal guardians - no • Anyone else the student is living with - no

PIN Personal Identification Number • Website: www. pin. ed. gov • Sign FAFSA electronically • Student and one parent signs electronically with PIN • Do NOT lose it. Write it down and store in a safe place • Do NOT share it with anyone

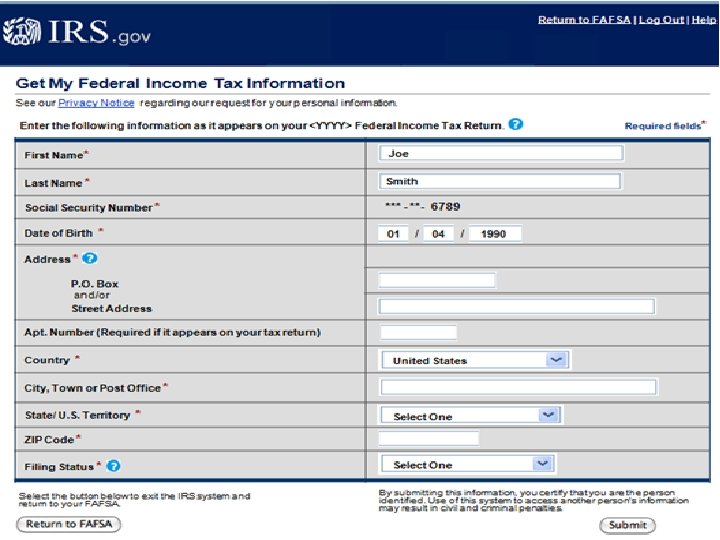

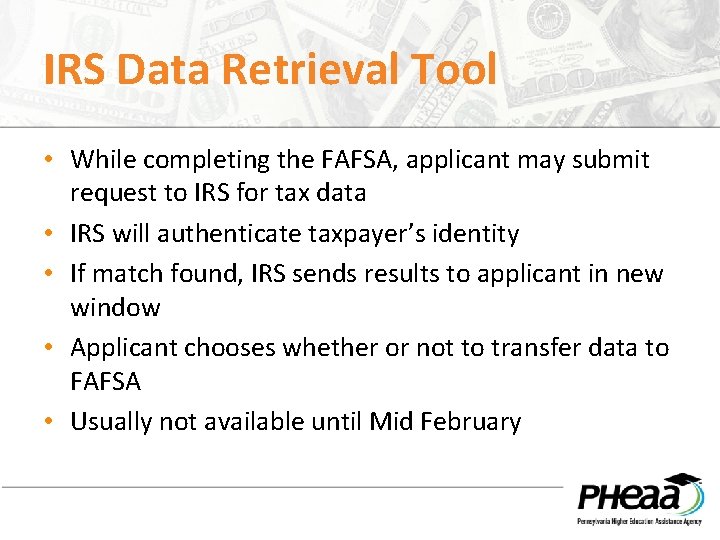

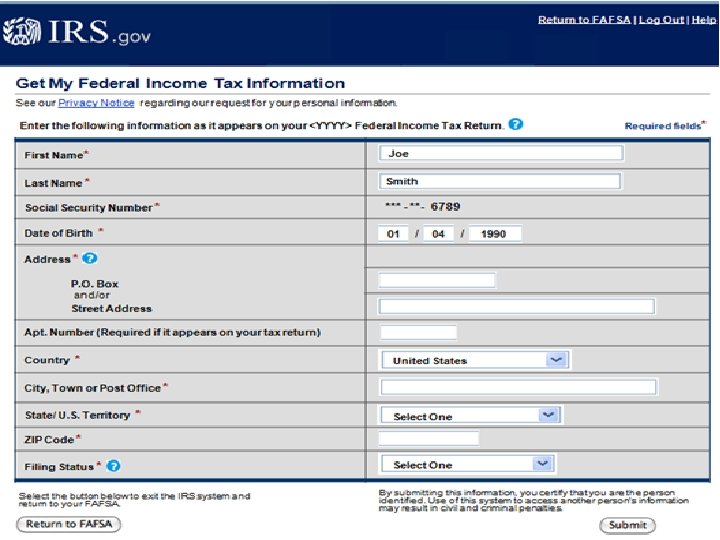

IRS Data Retrieval Tool • While completing the FAFSA, applicant may submit request to IRS for tax data • IRS will authenticate taxpayer’s identity • If match found, IRS sends results to applicant in new window • Applicant chooses whether or not to transfer data to FAFSA • Usually not available until Mid February

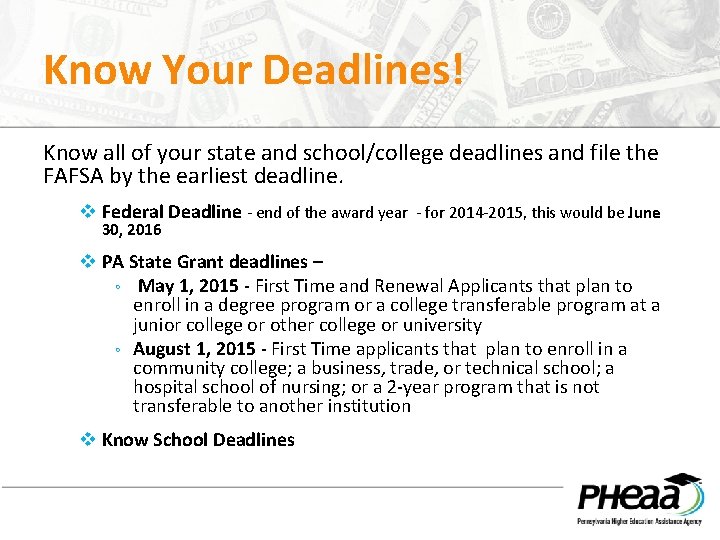

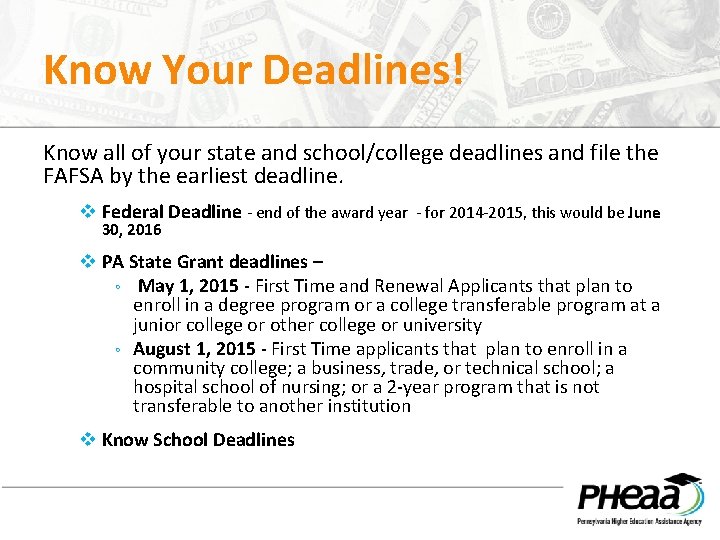

Know Your Deadlines! Know all of your state and school/college deadlines and file the FAFSA by the earliest deadline. v Federal Deadline - end of the award year - for 2014 -2015, this would be June 30, 2016 v PA State Grant deadlines – ◦ May 1, 2015 - First Time and Renewal Applicants that plan to enroll in a degree program or a college transferable program at a junior college or other college or university ◦ August 1, 2015 - First Time applicants that plan to enroll in a community college; a business, trade, or technical school; a hospital school of nursing; or a 2 -year program that is not transferable to another institution v Know School Deadlines

Know what financial aid forms your school may require and their deadlines: • Free Application for Federal Student Aid (FAFSA) • PA State Grant Form (SGF) • CSS PROFILE Form (Private schools) • Institutional Application

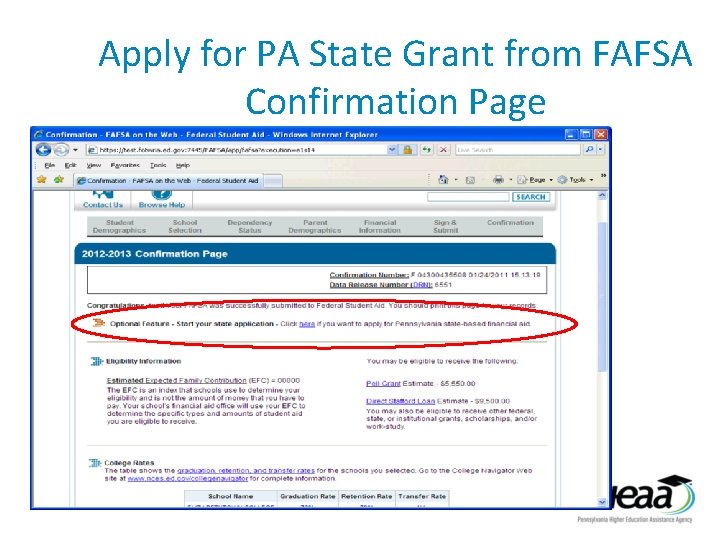

Online State Grant Application • Additional questions needed to determine PA State Grant eligibility » » enrollment status value of PA 529 College Savings Program program of study for students in vocational programs employment status • Link off the FAFSA Application CONFIRMATION Page! • Link in an email sent to student/parent from PHEAA • Help screens are available for all questions

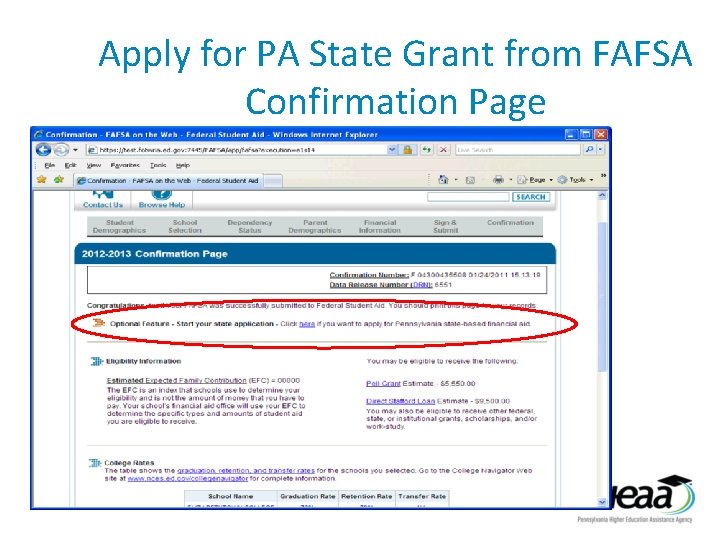

Apply for PA State Grant from FAFSA Confirmation Page

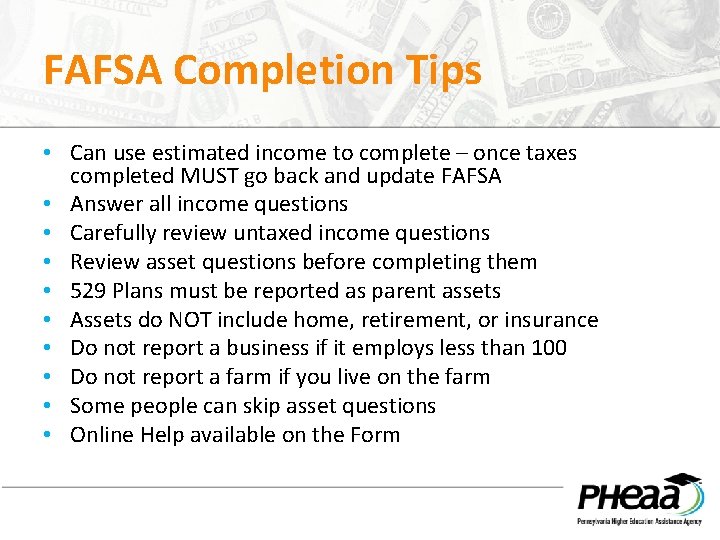

FAFSA Completion Tips • Can use estimated income to complete – once taxes completed MUST go back and update FAFSA • Answer all income questions • Carefully review untaxed income questions • Review asset questions before completing them • 529 Plans must be reported as parent assets • Assets do NOT include home, retirement, or insurance • Do not report a business if it employs less than 100 • Do not report a farm if you live on the farm • Some people can skip asset questions • Online Help available on the Form

Forms are filed! Now what? !?

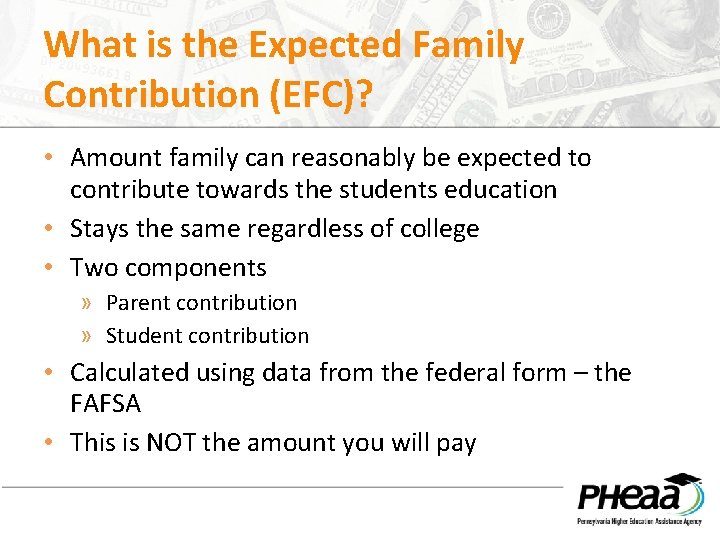

What is the Expected Family Contribution (EFC)? • Amount family can reasonably be expected to contribute towards the students education • Stays the same regardless of college • Two components » Parent contribution » Student contribution • Calculated using data from the federal form – the FAFSA • This is NOT the amount you will pay

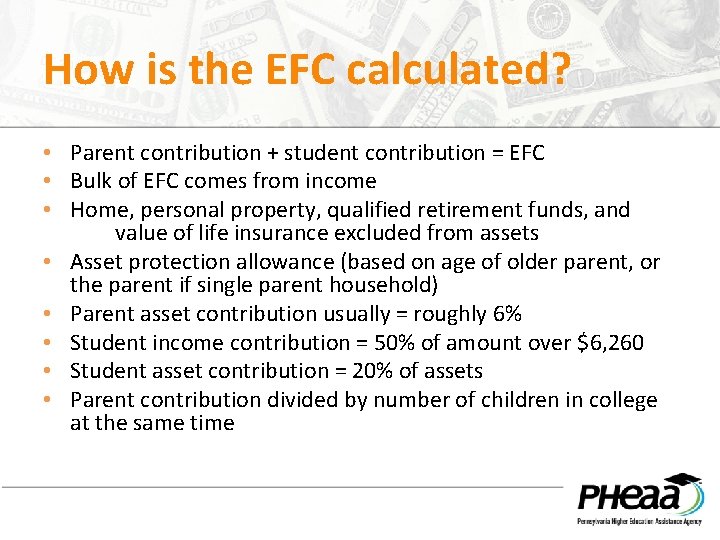

How is the EFC calculated? • Parent contribution + student contribution = EFC • Bulk of EFC comes from income • Home, personal property, qualified retirement funds, and value of life insurance excluded from assets • Asset protection allowance (based on age of older parent, or the parent if single parent household) • Parent asset contribution usually = roughly 6% • Student income contribution = 50% of amount over $6, 260 • Student asset contribution = 20% of assets • Parent contribution divided by number of children in college at the same time

What school costs are considered by the financial aid office at the school? School costs include: » Tuition and fees » Room and board » Books and supplies » Transportation » Miscellaneous living expenses • Varies widely from college to college

Calculating Financial Need Schools/colleges receive financial aid information and calculate financial need by the following: School cost…………. $26, 000 EFC……………minus… - 3, 000 Financial need………………… $23, 000 Financial Aid Offices “awards” student based on financial need and available funding (varies from school to school). Financial aid award letter sent to student.

Financial Aid Award Letter • Is official notification from school about financial aid, terms, and conditions • Lists the type and amount of each award to be received • Describes what must be done to accept or reject any award • Discloses students rights, responsibilities, and academic requirements

Reviewing the Financial Aid Package • After reviewing financial aid packages, students should be sure they know and understand the following: » How much is gift aid, and how much is not? » Which awards are based on need, and which are based on merit? » Are there any conditions on the gift aid; in particular, is there a GPA requirement? » Will their awards change from year to year? » Will institutional awards increase as tuition increases?

Special Circumstances Contact the school and ask for a special consideration AND Contact State Grant Division at PHEAA if: • Recent death or disability • Change in employment status – reduced income • Change in parent marital status – separation or divorce • Student cannot obtain parent information

Financial Aid Programs Federal, State, and Schoolbased

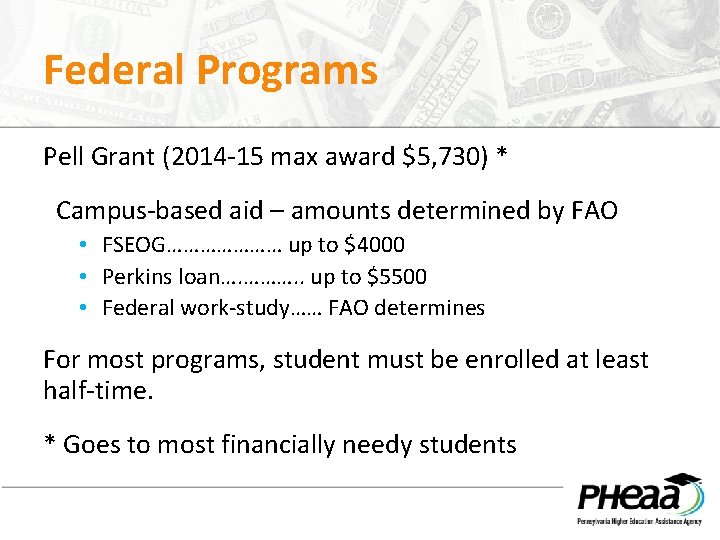

Federal Programs Pell Grant (2014 -15 max award $5, 730) * Campus-based aid – amounts determined by FAO • FSEOG………………… up to $4000 • Perkins loan…. ………. . up to $5500 • Federal work-study…… FAO determines For most programs, student must be enrolled at least half-time. * Goes to most financially needy students

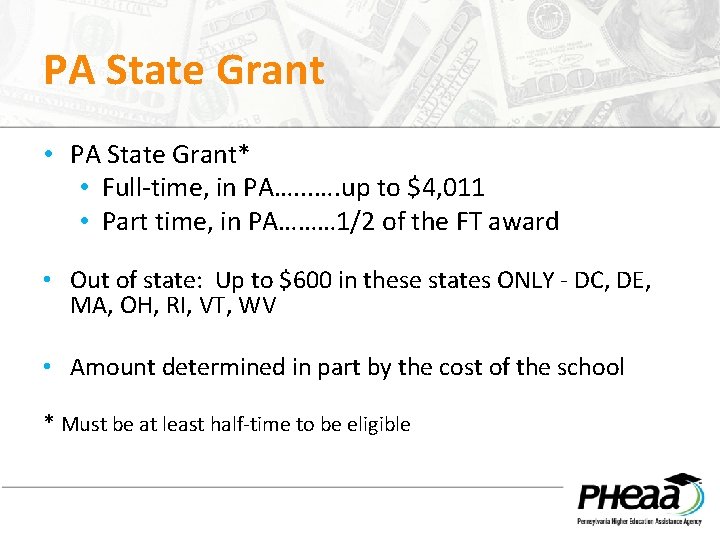

PA State Grant • PA State Grant* • Full-time, in PA…. . . …. up to $4, 011 • Part time, in PA……… 1/2 of the FT award • Out of state: Up to $600 in these states ONLY - DC, DE, MA, OH, RI, VT, WV • Amount determined in part by the cost of the school * Must be at least half-time to be eligible

Federal Loans If you need to borrow… Go with federal loans first!

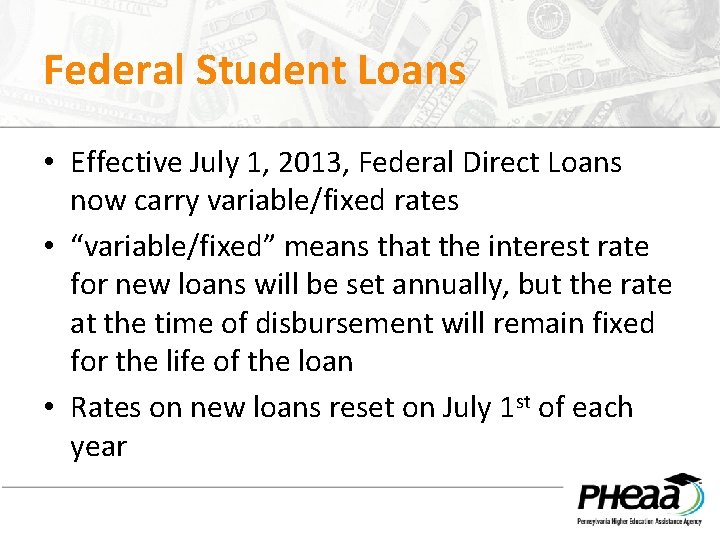

Federal Student Loans • Effective July 1, 2013, Federal Direct Loans now carry variable/fixed rates • “variable/fixed” means that the interest rate for new loans will be set annually, but the rate at the time of disbursement will remain fixed for the life of the loan • Rates on new loans reset on July 1 st of each year

Types of Federal Direct Loans Undergraduate Students • Subsidized • Unsubsidized Parents • PLUS Loan Graduate students • Unsubsidized • PLUS Loan

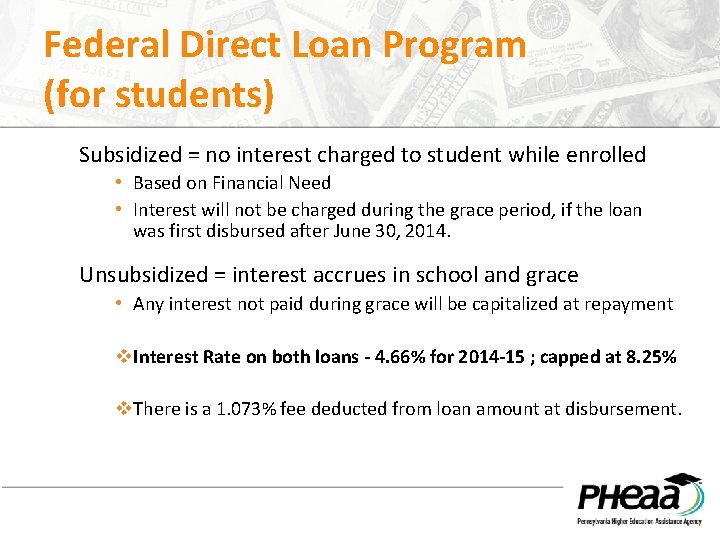

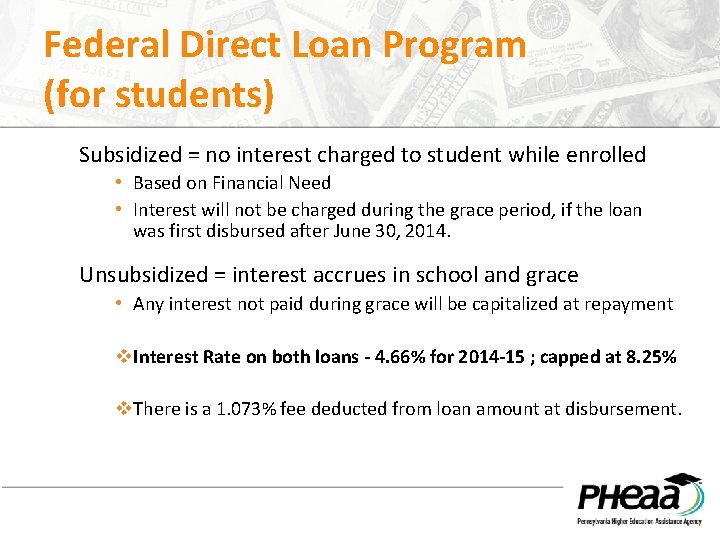

Federal Direct Loan Program (for students) Subsidized = no interest charged to student while enrolled • Based on Financial Need • Interest will not be charged during the grace period, if the loan was first disbursed after June 30, 2014. Unsubsidized = interest accrues in school and grace • Any interest not paid during grace will be capitalized at repayment v. Interest Rate on both loans - 4. 66% for 2014 -15 ; capped at 8. 25% v. There is a 1. 073% fee deducted from loan amount at disbursement.

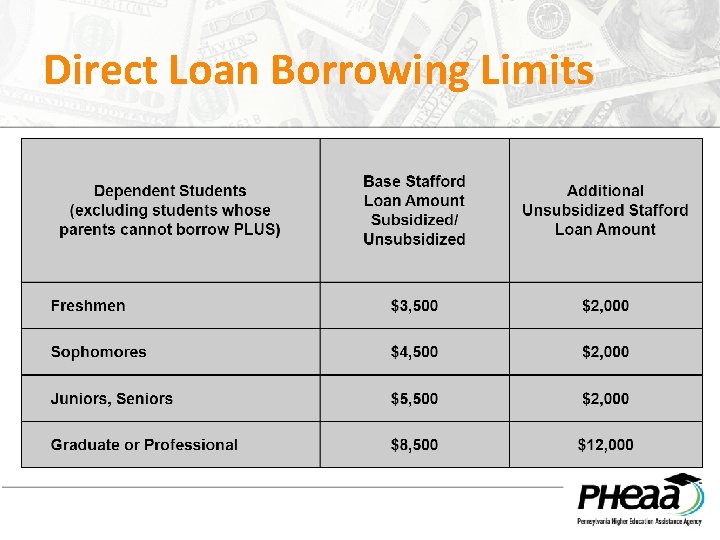

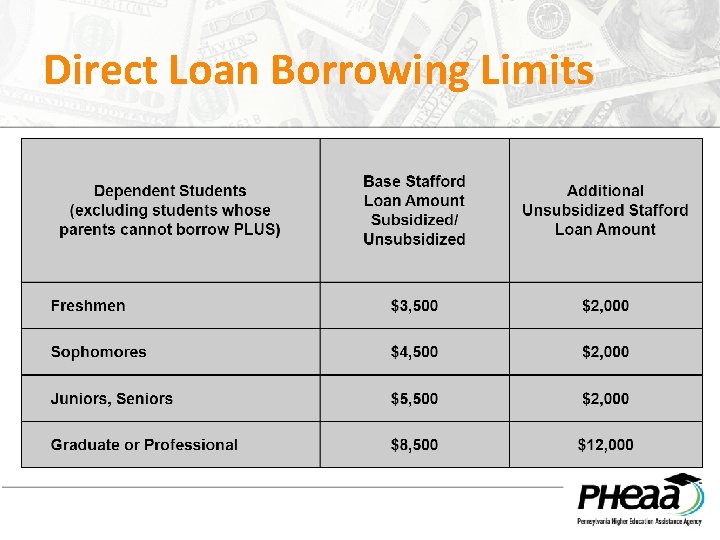

Direct Loan Borrowing Limits

Parent Loan for Undergraduate Students (PLUS) PLUS Loans – Parent & Grad. PLUS • 7. 21% for 2014 -15 • Capped at 10. 50 % • Up-front fee of 4. 292% deducted at disbursement • May borrow up to full cost of education minus financial aid • Credit check is required on this loan

Federal Direct PLUS Loan Repayment begins immediately - can defer repayment until 6 months after student graduates or drops below half-time enrollment. • If defer payment – encouraged to make interest payments • Standard Repayment is 10 years

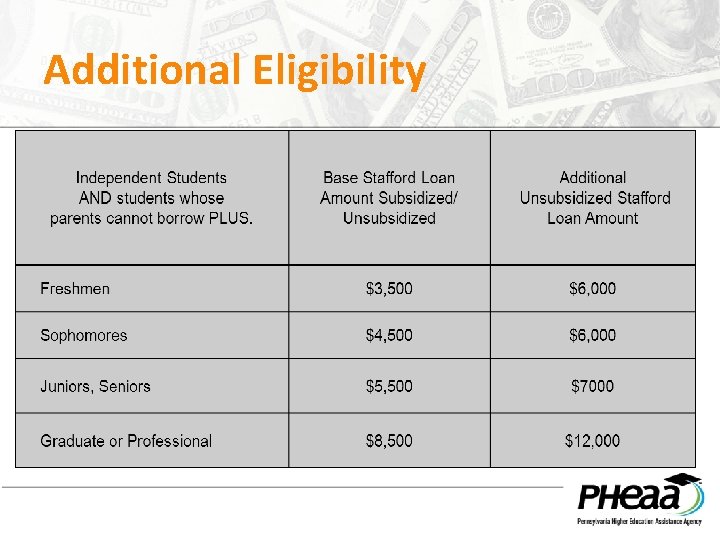

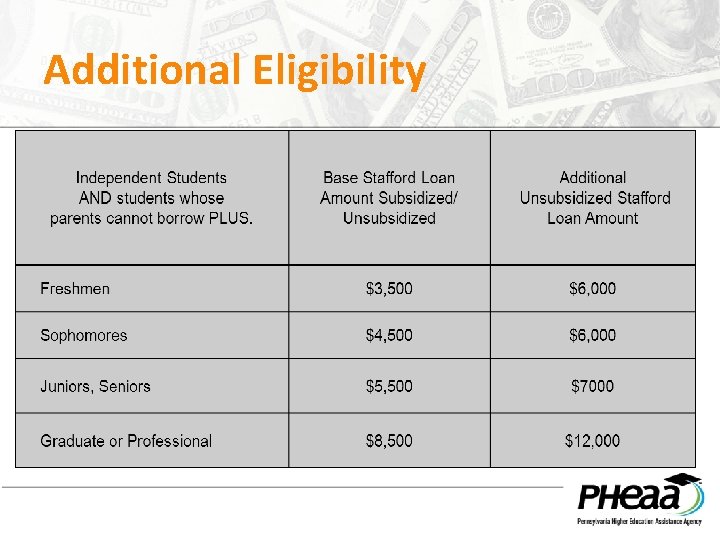

Additional Eligibility

Alternative/Private Education Loans • Nonfederal loans, made by a lender such as a bank, credit union, state agency, or a school. • Student borrows in his or her own name • Based on credit scoring and debt-to-income ratio • Repayment may be deferred until education completed • Fees, interest rates, loan amounts, and repayment provisions vary by lender and are generally higher than federal student loans • Co-signers usually required. Some loan products have a cosigner release option • Compare loans before making choice and read the fine print!

Scholarships Get the free money first!

Scholarship Search Tips • Start Searching Early • Use FREE Scholarship Search sites – » Fastweb. com is the largest, most accurate and most frequently updated scholarship database. • Don’t ignore scholarships with smaller award amounts • Don’t miss deadlines • Search for Scholarships every year

Scholarship Scams Application Fees “Guaranteed” Scholarships Solicitations • “You’ve been selected…. ” • “You are a finalist……” Official-looking Companies • The logo may look like the US Dept of Education’s logo • The company may talk about “federal” or “national” awards Seminars • Don’t get pressured into paying for services on the spot.

Things To Talk About (now) • Keep borrowing in line with future earning power (estimate loan payments at youcandealwithit. com and research your earning potential) • Clearly determine who will pay for what • How much debt can the family take on? • Are there options for cutting costs? • Give yourself a low-cost alternative • How much will the student work? • How many years will college take?

Your Presenter Marla Kane Higher Education Access Partner North Central Region PA Higher Ed Assistance Agency mkane@pheaa. org

Greenhill medical centre

Greenhill medical centre First aid merit badge first aid kit

First aid merit badge first aid kit Mga financial aid

Mga financial aid Fau financial aid office number

Fau financial aid office number Nuig financial aid

Nuig financial aid Auburn e bill

Auburn e bill Rush financial aid office

Rush financial aid office Palmer financial aid

Palmer financial aid Msu texas financial aid

Msu texas financial aid Ucla efan

Ucla efan Baylor fafsa

Baylor fafsa Ualr financial aid office

Ualr financial aid office Texas higher education coordinating board

Texas higher education coordinating board Michael corso

Michael corso Is cal maritime a military school

Is cal maritime a military school Melinda nixon vanderbilt

Melinda nixon vanderbilt Tarrant county college financial aid

Tarrant county college financial aid Prosam financial aid

Prosam financial aid National association of financial aid administrators

National association of financial aid administrators Roaenrl

Roaenrl Uc clermont financial aid

Uc clermont financial aid Troy financial aid

Troy financial aid Bursar's office university of louisville

Bursar's office university of louisville Financial aid card

Financial aid card Fvsu book voucher

Fvsu book voucher Columbia financial aid office

Columbia financial aid office Lvn to bsn sacramento

Lvn to bsn sacramento Financial aid longwood

Financial aid longwood Algonquin college bursaries

Algonquin college bursaries Financial aid csuci

Financial aid csuci Fscj financial aid office

Fscj financial aid office Rcbc financial aid

Rcbc financial aid Uwf financial aid

Uwf financial aid Chapman student business services

Chapman student business services Iup clark hall

Iup clark hall Cbs financial aid

Cbs financial aid Dvc financial aid

Dvc financial aid Ttuhsc financial aid

Ttuhsc financial aid Duke pa school tuition

Duke pa school tuition Duke financial aid office

Duke financial aid office Udm dental admissions

Udm dental admissions Www southeastern edu financialaid

Www southeastern edu financialaid Loyalist college financial aid

Loyalist college financial aid