Value of supply GST Value of supply Rate

![(b) such persons are legally recognised partners in business Clause [a] [2] of explanation (b) such persons are legally recognised partners in business Clause [a] [2] of explanation](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-19.jpg)

![One of them directly or controls the other Sub clause [5] of clause [a] One of them directly or controls the other Sub clause [5] of clause [a]](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-20.jpg)

![Determination of transaction value u/s 15[1] Include inclusions in transaction value u/s 15 {2} Determination of transaction value u/s 15[1] Include inclusions in transaction value u/s 15 {2}](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-22.jpg)

![Interest or late fee or penalty It is specifically provided in clause [d] u/s Interest or late fee or penalty It is specifically provided in clause [d] u/s](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-25.jpg)

![Step V. Government can notify any other method [U/s 15(5)] Notwithstanding anything contained in Step V. Government can notify any other method [U/s 15(5)] Notwithstanding anything contained in](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-36.jpg)

- Slides: 36

Value of supply

GST = Value of supply * Rate of GST/100 But before we learn how to calculate value of supply, we need to confirm few questions, explained below in the flow chart :

Transaction value Section 15 of the central goods and services tax (CGST) Act, 2017 makes provision for the purpose of determining the transaction value of supply of goods or services in different circumstances. Section 15 states : 1. The value of a supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both, where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.

2. The value of supply shall include – (a) Any taxes, duties, cesses, fees and charges levied under any law for the time being in force other than this act, the state goods and services act, the union territory goods and services tax act and the goods and service tax (compensation to states ) act- if charged separately by the supplier; (b) Any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both; (c) incidental expenses, including commission and packaging, charged by the supplier to the recipient of a supply and any amount charged for anything done by the supplier in respect of the supply of goods or services or both at the time of, or before delivery of goods or supply of services;

(i) Such discount is established in terms of an agreement entered into at or before the time of such supply and specifically linked to relevant invoices; and (ii) Input tax credit as is attributable to the discount on the basis of document issued by the supplier that has been reversed by the recipient of the supply. 4. Where the value of the supply of goods or services or both cannot be determined under sub-section (1), the same shall be determined in such manner as may be prescribed. Explanation. For the purposes of this act, : (a) Persons shall be deemed to be “related persons” if : (i) such persons are officers or directors of one another’s businesses; , (ii) such persons are legally recognized partners in business; (iii) such persons are employer and employee;

(iv) Any person directly or indirectly owns, controls or holds twenty-five per cent or more of the outstanding voting stock or shares of both of them; (v) One of them directly or indirectly controls the other; (vi) Both of them are directly or indirectly controlled by a third person; (vii) Together they directly or indirectly control a third person; or (viii) They are members of the same family; (b) The term “person” also includes legal persons; (c) persons who are associated in the business of one another in that one is the sole agent or sole distributor or sole concessionaire, howsoever described, of the other, shall be deemed to be related. The above stated definition of “transaction value” helps us to extract the essential elements that must be present in the transaction value.

Essentials / conditions for acceptance of transactions value 1. Transaction value is the basis for valuation. section 15(1) makes it clear that the value of supply ( of goods or services or both ) shall be the transaction value. In simple language, the transaction that happened between the supplier and the recipient, the value of this transaction as decided between supplier and recipient shall be the value which will be considered for calculating tax. Examples :

2. Price actually paid or payable. The definition of transaction value states that transaction value shall be the price which has been already paid or is payable by the recipient to the supplier for the supply of goods or services or both. In order words, transaction value means the payment made can be on actual basis or future payment basis. The amount actually paid or payable shall be determined based on the contract entered into between the supplier and recipient of goods or services. The contract will indicate the amount payable by the recipient for the supply of goods or services. This can be explained by an example. Example. Chartered Accountant ‘Ashish’ has entered into contract for conducting audit of a company. The contract specifies the amount for audit fee and in addition also provides that car of chartered accountant ‘Ashish’ would be refurbished by the company. Thus the price payable for the service of auditing is not only the amount paid to chartered accountant as audit fees, but will also include the expenditure incurred by the company on refurbished the car of chartered accountant. Thus the contract forms the basis for determining the amount actually paid or payable.

3. Nexus between the amount received and supply made. section 15(1) provides that transaction value shall be the price actually paid or payable for the supply of goods or services. It clearly means that there should be nexus between the supply of goods or services and the amount received by the supplier of goods or service. In case there is no nexus between the supply of goods or services and the amount received, the amount cannot be considered as the value of taxable supply. Example. like the receipt for rendering the service of “Commercial Training and Coaching” cannot include the mess charges collected for availing the facility of mess by the trainees. Primarily because there is no nexus between the mess charges collected and rendering of training and coaching services. The mess is meant for providing food to the trainees and hence it cannot be brought under the category of receipt for “Commercial Training and Coaching”.

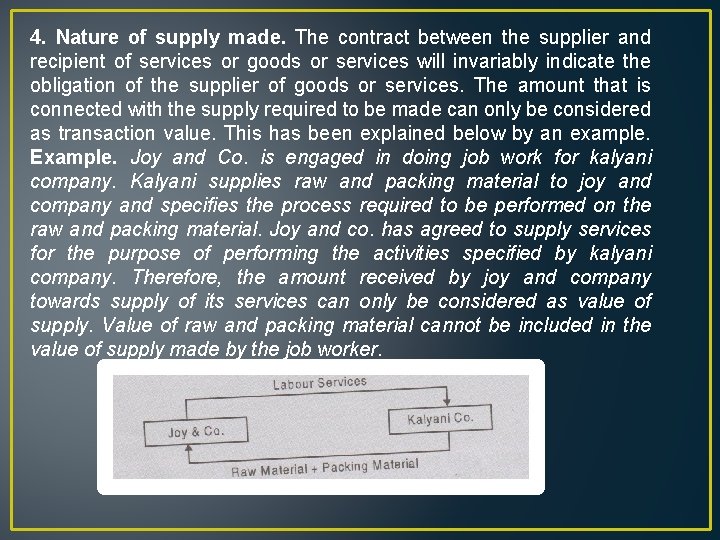

4. Nature of supply made. The contract between the supplier and recipient of services or goods or services will invariably indicate the obligation of the supplier of goods or services. The amount that is connected with the supply required to be made can only be considered as transaction value. This has been explained below by an example. Example. Joy and Co. is engaged in doing job work for kalyani company. Kalyani supplies raw and packing material to joy and company and specifies the process required to be performed on the raw and packing material. Joy and co. has agreed to supply services for the purpose of performing the activities specified by kalyani company. Therefore, the amount received by joy and company towards supply of its services can only be considered as value of supply. Value of raw and packing material cannot be included in the value of supply made by the job worker.

it may be mentioned that as per the previsions contained in section 4 of central excise act, the value of raw and packing material was also required to be added in the assessable value for the purpose of payment of excise duty. The incidence of tax in case of excise duty was on manufacturer of goods. The value of manufactured goods is required to be determined under central excise act. Therefore, the value of input required for manufacture of goods was required to be included in the value of goods manufactured. The incidence of tax under GST is not on manufacture of goods, but on supply of goods or services. Hence, first and foremost step to determine the value is to identify the goods or services supplied under the contract. Thereafter the value of that supply is required to be computed.

5. Price is the sole consideration. Section 15(1) further provides that price should be the sole consideration for supply. If any additional consideration, whether in monetary or non-monetary terms, is received, the value of such consideration shall be added to the consideration to arrive at the transaction value. Interpretative notes provide that payment made directly or indirectly by the recipient to supplier will constitute the price actually paid or payable.

6. Supplier and recipient should not be related. The transaction value shall be considered as the value of supply only when the supplier and recipient are not related. The explanation attached to the section 15 of the CGST act, 2017 defines the term “Related person”. Persons shall be deemed to be related person if : (a) Such persons are officers of directors of one another’s business. Sub clause 1 of clause (A) of explanation attached to section 15 provides that two person shall be treated as related person if such persons are officers of directors of one another’s business. The meaning of ‘officer’ as given in companies act ad ‘director’ given in black law dictionary substantiates that the officer and director are responsible for managing the business of the company.

They are one of the key management persons in deciding the policy of the company. If any persons from the supplier’s end only manages the affairs of the recipient , the supplier and recipient cannot be considered as related person as per clause (a). But in addition to this, if the person from recipient end also manages the affairs of supplier, then both the supplier and recipient will be considered as related person in terms of clause. Then shall be reciprocal relationship between the supplier and recipient.

![b such persons are legally recognised partners in business Clause a 2 of explanation (b) such persons are legally recognised partners in business Clause [a] [2] of explanation](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-19.jpg)

(b) such persons are legally recognised partners in business Clause [a] [2] of explanation attached to section 15 provides that the supplier and recipient shall be considered to be related persons if they are legally recognised partners in a business. The supplier and recipient shall be considered as related persons where when the national legal requirement of partnership is fulfilled. Such persons are employee and employer If the relationship between those persons is of employee and employer then those will be considered as related persons Any person directly or indirectly owns or controls or holds 25% or more of the outstanding voting share of both of them Sub clause [4] of clause [a] of explanation attached to section 15 provides that supplier and recipient will be considered as related persons if any person directly or indirectly owns , controls or holds 2 of both of them 5% or more of outstanding voting shares

![One of them directly or controls the other Sub clause 5 of clause a One of them directly or controls the other Sub clause [5] of clause [a]](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-20.jpg)

One of them directly or controls the other Sub clause [5] of clause [a] u/s 15 [1] states that control exercised by one person on other person The relationship between supplier and recipient of goods or services needs to be judged to determine whether one of them controls the other. It will be considered as related person. Other cases Both of them directly or indirectly are controlled by the third person. Together they directly or indirectly control the third person. Members of the same family.

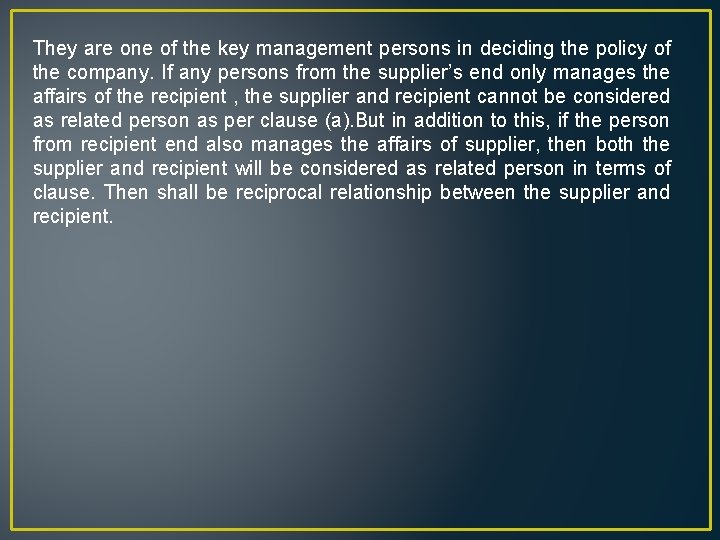

How to calculate Transaction Value

![Determination of transaction value us 151 Include inclusions in transaction value us 15 2 Determination of transaction value u/s 15[1] Include inclusions in transaction value u/s 15 {2}](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-22.jpg)

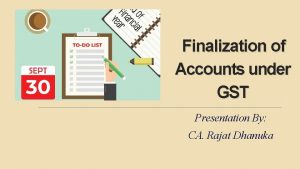

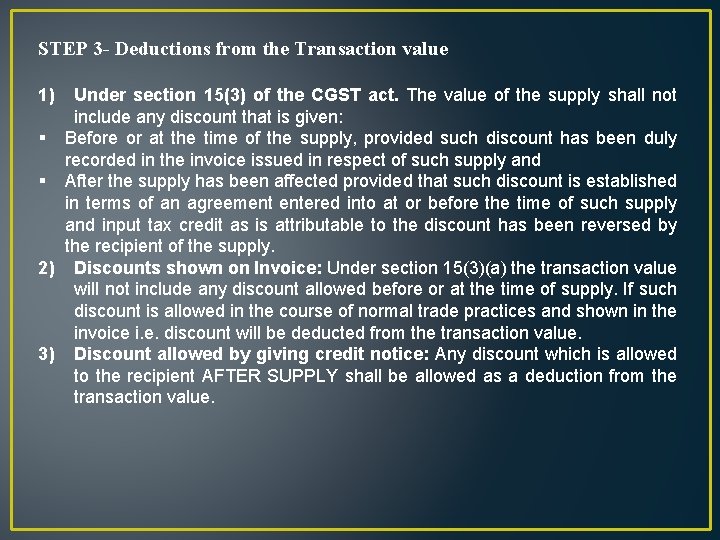

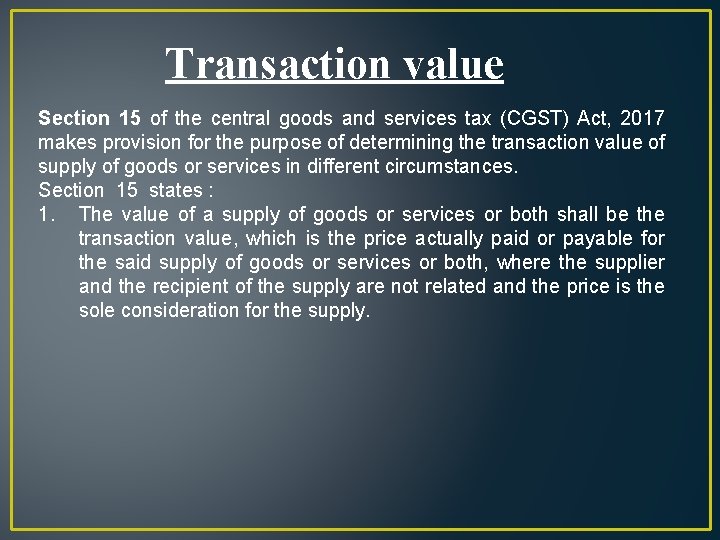

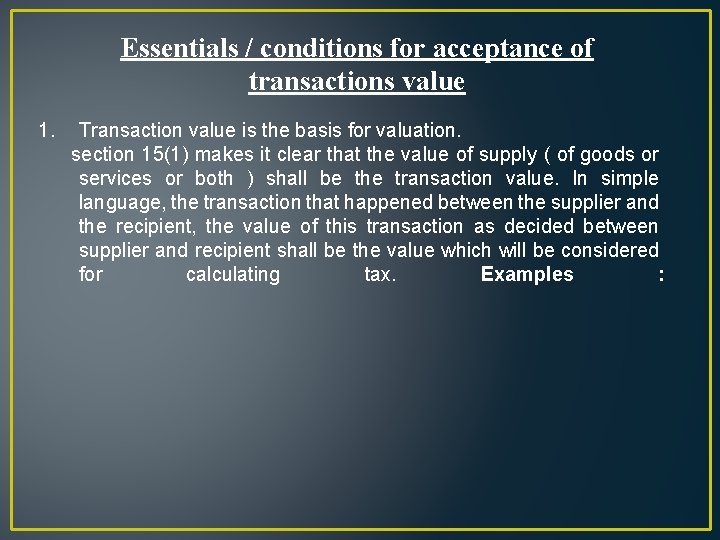

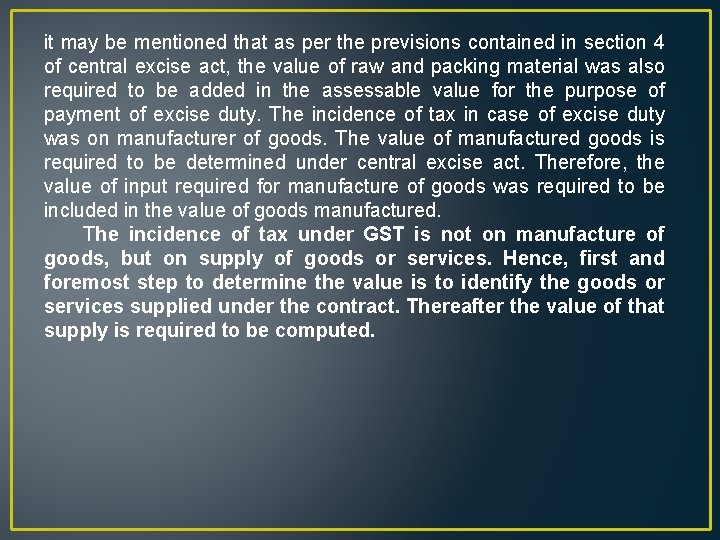

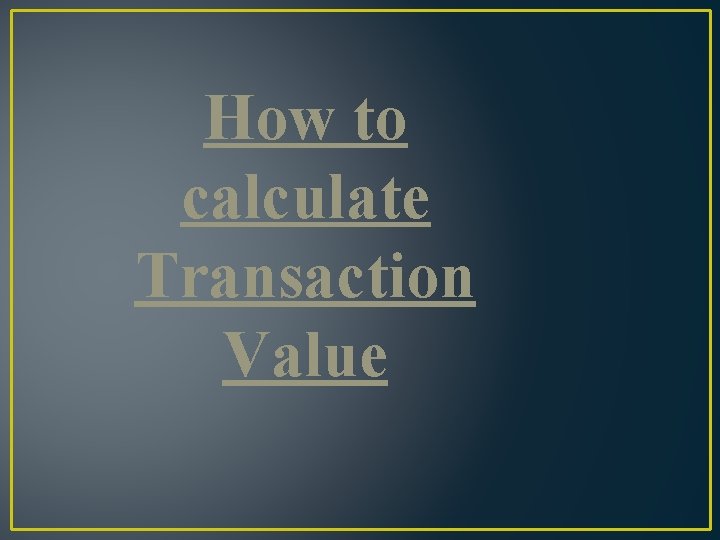

Determination of transaction value u/s 15[1] Include inclusions in transaction value u/s 15 {2} Exclude deductions u/s 15 [3] Follow GST valuation rules if transaction value cannot be determined u/s 15 [4] Govt. Can notify any other method to determine value of supply u/s 15 [5]

Determination of transaction value It us the value of supply of goods , services or both. It is the price paid or actually payable. There must be a nexus between amount received or supply made. Nature of supply must be ascertained. Price must be the sole consideration. Supplier and recipient must not be related. Inclusions in the transaction value Value does not include GST but all other taxes: Any taxes , duties levied under any other act other than CGST or SGST act or UT GST act will bee includable.

Amount paid by recipient on behalf of supplier Any amount which the supplier is liable to pay. But this amount must be connected to the supply. this amount is being paid by the recipient on behalf of supplier. And this amount is not included in the price paid or actually payable. THEN , this amount must be included in the tranasction value. Incidental expenses incurred before supply These include commission and packing. Charges by the supplier to the recipient. Including any amount charged for anything done by the supplier in respect to the supply of goods or services or both. At the time of delivery or delivery of goods or supply of services.

![Interest or late fee or penalty It is specifically provided in clause d us Interest or late fee or penalty It is specifically provided in clause [d] u/s](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-25.jpg)

Interest or late fee or penalty It is specifically provided in clause [d] u/s 15 [2] that interest or late fee penalty for delay payment of any consideration of supply will form part of the supply The GST will be payable on the same. Subsidy linked to supply Clause [c] states that subsidy provided in any included in the calculation in the value of supply. of manner will be

STEP 3 - Deductions from the Transaction value 1) Under section 15(3) of the CGST act. The value of the supply shall not include any discount that is given: § Before or at the time of the supply, provided such discount has been duly recorded in the invoice issued in respect of such supply and § After the supply has been affected provided that such discount is established in terms of an agreement entered into at or before the time of such supply and input tax credit as is attributable to the discount has been reversed by the recipient of the supply. 2) Discounts shown on Invoice: Under section 15(3)(a) the transaction value will not include any discount allowed before or at the time of supply. If such discount is allowed in the course of normal trade practices and shown in the invoice i. e. discount will be deducted from the transaction value. 3) Discount allowed by giving credit notice: Any discount which is allowed to the recipient AFTER SUPPLY shall be allowed as a deduction from the transaction value.

Conditions when discount will be deducted from transaction value: § Discount to be known to customer § Reversal of input tax credit. STEP 4 - Follow GST valuation rules, 2017[U/S 15(4)] Section 15(4) of GST act provides that if value of goods and services cannot be determined under sub section 15(1), the same shall be determined as per the manner prescribed. RULE 1: When consideration is not wholly in money. Rule 1 of determination of value of supply provides where the supply of goods or services is not for consideration wholly in money, the value supply shall be(a) The open market of such supply: open market value means the price at which supply of goods or services are made; supplier and recipient are not related; price is the sole consideration for supply; supply should be made at the time at which supply is being valued.

(b) If open market is not available: the sum total of consideration in money and any such further amount in money as is equivalent to the consideration, if such amount is known as the time of supply. (c) If the value of supply is not determinable under clause (a) or clause (b) be the value of supply of goods or services or both of like kind and quality. For example, Value of a product in Mumbai, Maharashtra will be higher than the value of product in Orissa or Tripura or Meghalaya. The circumstances prevailing in Mumbai and in other states. (d) If value is not determinable under clause (a) or (b) or (c) be the sum total of consideration in money and such further amount in money that is equivalent to consideration not in money as determined by application of rule 4 or rule 5 in that order. Rule- 2 Supply between distinct or related person other than through agent who is a distinct person. A person who has obtained or is required to obtain more than one registration, whether in one state or UT or more than one state or UT shall, in respect of each such registration, be treated as distinct persons for the purposes of this CGST act.

RULE-3 Value of supply of goods made or received through an agent. Clause 3 of schedule 1 of GST act provides as follows: (a) By a principal to his agent where the agent undertakes to supply such goods on behalf of the principal or (b) By an agent to his principal where the agent undertakes to receive such goods on behalf of the principal.

q Cost of Accounting = Is the cost incurred by the person for bringing the products in the condition in which they are sold. It include : -Cost of material - Duties and taxes - Transport Cost - Insurance - Other Expenses q Trade Discounts , rebate and other discounts shall be deducted. q Recipient shall be allowed ITC of CGST, SGST, IGST and UTGST.

Cost of Providing services However, basic principle for determining the cost has been enumerated in CAS-4. 5. Residual Method. In case where the value of supply of goods or services or both cannot be determined under Rule 1 to Rule 4 , value shall be determined by using reasonable means which shall be consistent with the provisions of section 15. 6. Value in case of certain supply. The value in respect of supplies specified below shall at the option of the supplier , be determined in the manner of stated below. (i) FOREIGN CURRENCY. Value of supply of services in relation to purchase and sale of foreign currency including money changing shall be determined in the following manner :

(a) For a currency , when exchanged from , or to , Indian Rupees , the value shall be equal to the difference in the buying rate or the selling rate , as the case may be , and the Reserve Bank of India rate for that currency at that time , multiplied by the total units of currency. (b) At the option of supplies of services , the value of relation to supply of foreign currency , (i) 1 % of gross amount of currency exchanged. (ii) 1000 and half of a percent of gross amount of currency exchanged. (iii) 5000 and 500 rupees and 1/10 of a percent of gross amount of currency exchanged. (ii) AIR TRAVEL AGENT. As per rule 6(3) of determination value of supply of services in relation to booking of tickets for travel by air provided by an air travel agent , shall be deemed to be calculated at the rate of 5% of basic fare in case of domestic booking and 10% in case of international booking.

(iii) LIFE INSURANCE BUSINESS. As per rule 6(4) the value of supply of services in case of life insurance shall be as follow : (a) The gross premium charged from a policy holder reduced by the allocated amount for investment. (b) In case of single premium annuity policies other than 10% of single premium charged from the policy. (c) In all other cases , 25 % of the premium charged from the policy holder. (iv) BUYING AND SELLING OF SECOND HAND GOODS. Used goods as such minor processing which does not change the nature of goods , the value of supply shall be the difference between the selling price and purchase price.

(v) REDEEMABLE VOUCHER/COUPONS ETC. . As per sub rule (6) of rule 6, the value of such voucher shall be equal to money value of goods services or both redeemed against such coupons , token , voucher etc. Briefly the face value of such voucher shall be considered under GST. 7. Value of supply in case of pure agent. Rule 7 provides that the expenditure or cost incurred by the supplies as pure agent of recipient shall be excluded from the value of services if following conditions are satisfied : For the purpose of this rule , “ pure agent” means a person who : (a) Enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or the costs in the course of supply of goods or services or both ; (b) Neither intends to hold nor holds any title to the goods or services.

(c) Does not use for his own interest such goods services so procured; (d) Receive only the actual amount incurred to procure such goods or services in addition to the amount received for supply he provides on his own account. FOR EXAMPLE : Corporate services firm M/s Dhingra is engaged to handle the legal work pertaining to the incorporation of company M/s Arora. Other than its services fees, M/s Dhingra also recovers from M/s Arora registration fee and approval fee for the name of the company paid to registrar of the companies the fees is charged by ROC of companies levied on M/s Arora , M/s Dhingra is merely acting as a pure agent in the payment of those fees. Therefore , M/s Dhingra recovery of such expenses is a disbursement and not a part of the value of supply made by M/s Dhingra to M/s Arora. s

![Step V Government can notify any other method Us 155 Notwithstanding anything contained in Step V. Government can notify any other method [U/s 15(5)] Notwithstanding anything contained in](https://slidetodoc.com/presentation_image_h/fda5b0df13cd5238faca4d3f574b7480/image-36.jpg)

Step V. Government can notify any other method [U/s 15(5)] Notwithstanding anything contained in Sec. 15(1) or Sec. 15(4) of CGST Act, the value of such supplies as may be notified by the Government on the recommendation of the council shall be determined in such manner as may be prescribed Sec. 15(5) of CGST Act. Thus any other method may be fixed. However , ‘value’ cannot be determined on basis of production capacity.

Time and value of supply under gst

Time and value of supply under gst Yash

Yash Taxmann gst rate finder

Taxmann gst rate finder Value creation value delivery value capture

Value creation value delivery value capture What is utr in gst

What is utr in gst Gst deduction at source

Gst deduction at source Annexure b for gst refund

Annexure b for gst refund Gst pulldown assay

Gst pulldown assay Gst 105: use of english pdf

Gst 105: use of english pdf Gst 113

Gst 113 Section 18(1)(c) of gst

Section 18(1)(c) of gst Srinivas kotni

Srinivas kotni Introduction of gst

Introduction of gst Section 18(1)(c) of gst

Section 18(1)(c) of gst Negative list of gst

Negative list of gst Gst rates on services pdf

Gst rates on services pdf Gsp ecosystem

Gsp ecosystem Gst 101

Gst 101 Importance of gst

Importance of gst Gst concept

Gst concept Role of gst

Role of gst Gst eway bill login problem

Gst eway bill login problem Gst 111 communication in english

Gst 111 communication in english Impact of gst on construction industry

Impact of gst on construction industry Conclusion on gst

Conclusion on gst Gst matchup chart

Gst matchup chart Ctin in gst

Ctin in gst Definition of gst

Definition of gst Needs of gst

Needs of gst Ppt on itc under gst

Ppt on itc under gst Eway bill system

Eway bill system Impact of gst on hotel industry pdf

Impact of gst on hotel industry pdf Phinix

Phinix 28% gst

28% gst Direct tax and indirect tax

Direct tax and indirect tax Gst legnano

Gst legnano Disciplina mercado financeiro

Disciplina mercado financeiro