GST Input Tax Credit Analysis Gopal Mondal Presently

![Eligibility and Conditions For taking input tax credit [Section 16] Every registered taxable person Eligibility and Conditions For taking input tax credit [Section 16] Every registered taxable person](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-7.jpg)

![Apportionment of credit [Section-17] Section 17(1) Where goods and/or services are used by the Apportionment of credit [Section-17] Section 17(1) Where goods and/or services are used by the](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-11.jpg)

![List of items not eligible for ITC[ Section 17(4)] Motor vehicles Except when they List of items not eligible for ITC[ Section 17(4)] Motor vehicles Except when they](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-15.jpg)

![List of items not eligible for ITC[ Section 17(4)] (ii) Membership of a club, List of items not eligible for ITC[ Section 17(4)] (ii) Membership of a club,](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-16.jpg)

![List of items not eligible for ITC[ Section 17(4)] Construction of immovable property Goods List of items not eligible for ITC[ Section 17(4)] Construction of immovable property Goods](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-17.jpg)

- Slides: 29

GST: Input Tax Credit Analysis Gopal Mondal

Presently cascading effect in the existing system in India Cascading effect No credit of CST No Excise duty &Service tax for VAT No credit of basic customs duty and custom cess No credit of Swachh Bharat cess to Manufacturer & service provider No credit of Entry tax or octroi No credit of Krishi Kalyan cess to Manufacturer No credit of VAT to Service providers No credit to exempt Sectors

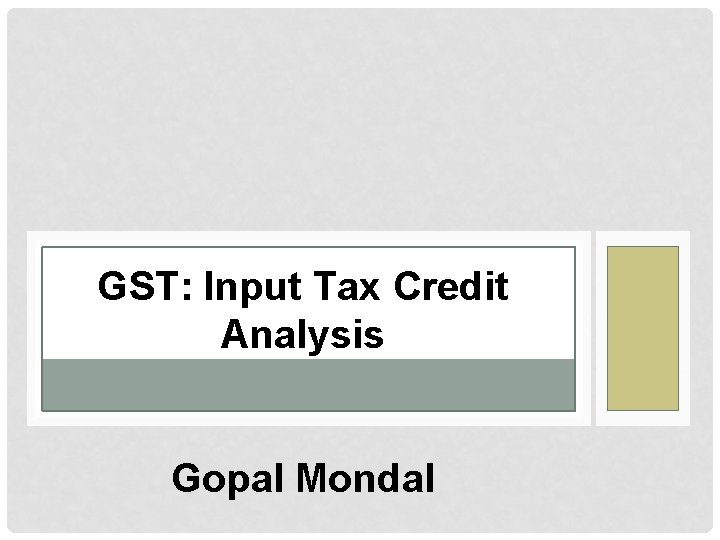

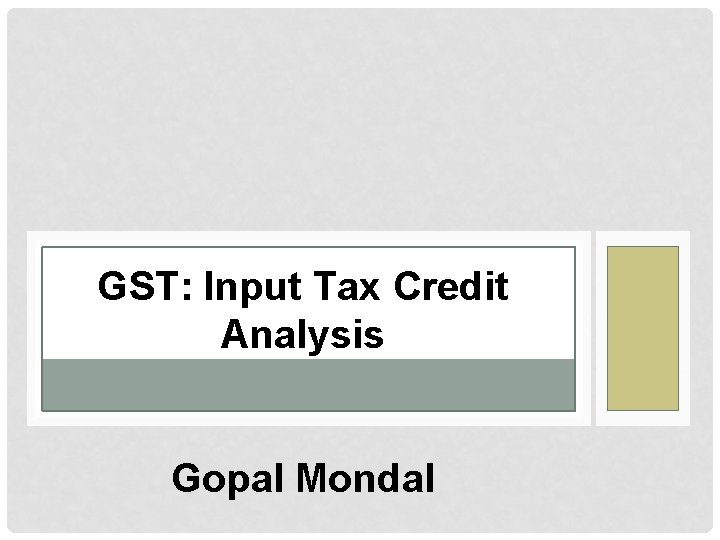

Aggregate Turnover -Meaning Model GST: November 2016 Model GST: June 2016 (S. 2 (6) “Aggregate turnover” means the aggregate value of all taxable supplies, exempt supplies, exports of goods and/or services and inter-state supplies of a person having the same PAN, to be computed on all India basis and excludes taxes, if any, charged under the CGST Act, SGST Act and the IGST Act, as the case may be; S. 2 (6) “Aggregate turnover” means the aggregate value of all taxable and non-taxable supplies, exempt supplies and exports of goods and/or services of a person having the same PAN, to be computed on all India basis and excludes taxes, if any, charged under the CGST Act, SGST Act and the IGST Act, as the case may be; Explanation – Aggregate turnover does not include the value of supplies on which tax is levied on reverse charge basis and the value of inward supplies.

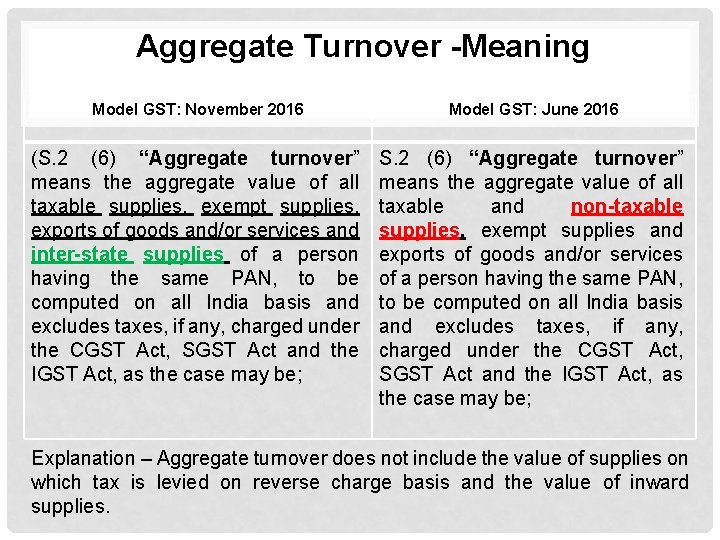

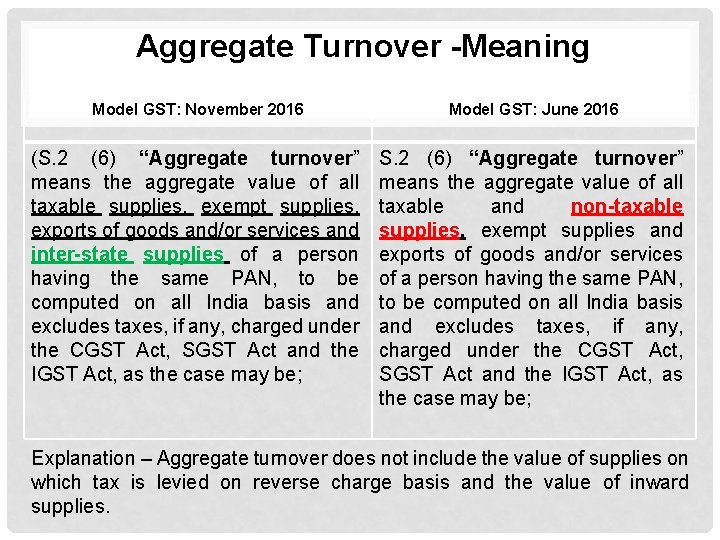

Input tax credit and input tax Model GST: November 2016 Model GST: June 2016 S. 2(56) “input tax credit” means S. 2(58) “input tax credit” means credit of ‘input tax’ as defined in section 2(55) section 2(57) S. 2(55) “input tax” in relation to a taxable person, means the IGST, including that on import of goods, CGST and SGST charged on any supply of goods or services to him and includes tax payable under section 8(3) but does not include the tax paid under section 9. S. 2(57) “input tax” in relation to a taxable person, means the {IGST and CGST}/(IGST and SGST} charged on any supply of goods or services to him which are used, or are intended to be used, in the course or furtherance of his business and includes the tax payable under section 7(3).

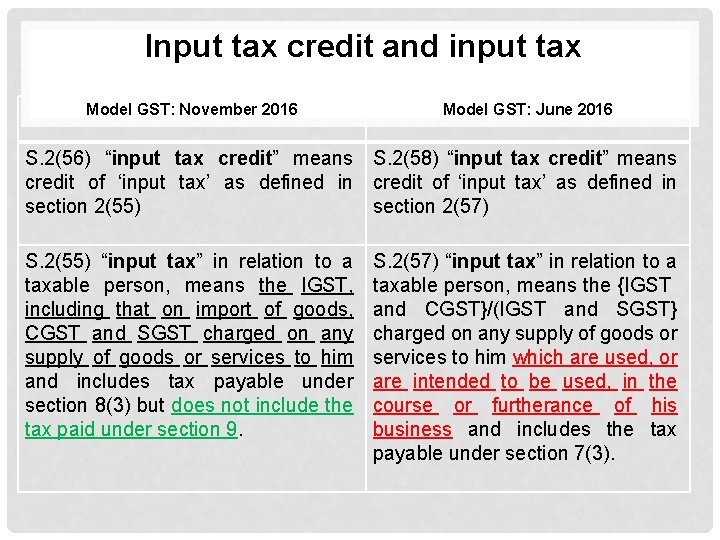

Meaning of Input Model GST: November 2016 Model GST: June 2016 S. 2(52) “input” means any goods other than capital goods used or intended to be used by supplier in the course or furtherance of business. S. 2(54) “input” means any goods other than capital goods, subject to exception as may be provided under this Act or the rules made thereunder, used or intended to be used by supplier for making an outward supply in the course or further of business. S. 2(53) “input service” means any service used or intended to be used by a supplier in the course or furtherance of business. S. 2(55) “input service” means any service subject to exceptions as may be provided under this Act or the rules made thereunder, used or intended to be used by a supplier for making an outward supply in the course or furtherance of business.

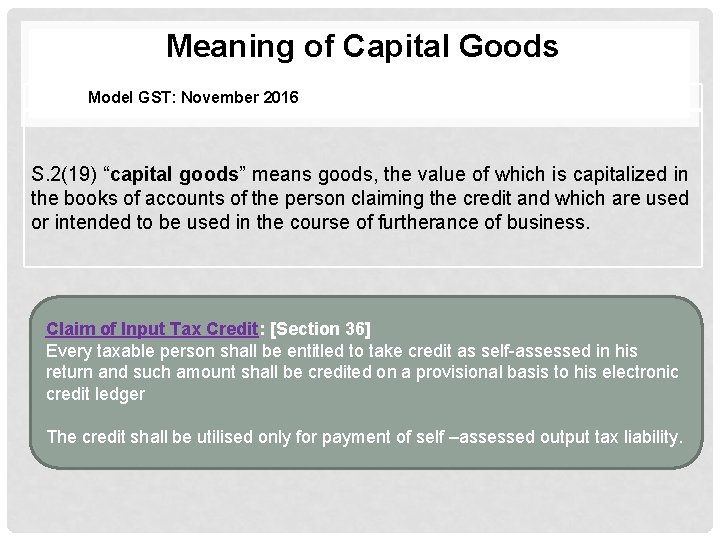

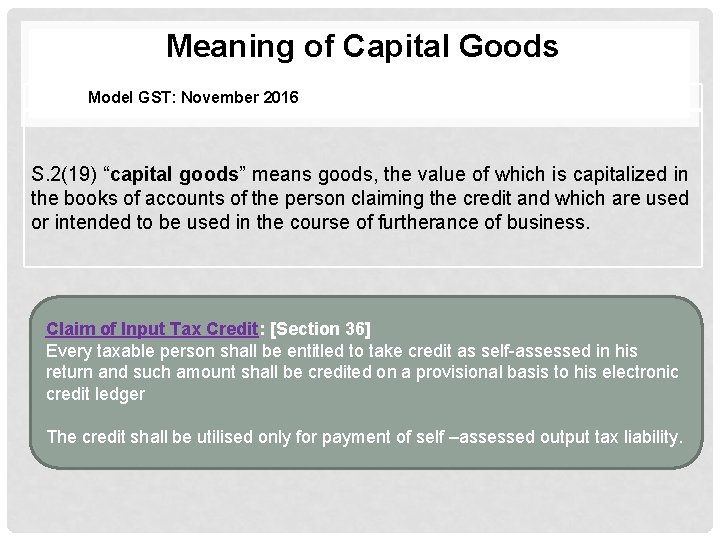

Meaning of Capital Goods Model GST: November 2016 S. 2(19) “capital goods” means goods, the value of which is capitalized in the books of accounts of the person claiming the credit and which are used or intended to be used in the course of furtherance of business. Claim of Input Tax Credit: [Section 36] Every taxable person shall be entitled to take credit as self-assessed in his return and such amount shall be credited on a provisional basis to his electronic credit ledger The credit shall be utilised only for payment of self –assessed output tax liability.

![Eligibility and Conditions For taking input tax credit Section 16 Every registered taxable person Eligibility and Conditions For taking input tax credit [Section 16] Every registered taxable person](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-7.jpg)

Eligibility and Conditions For taking input tax credit [Section 16] Every registered taxable person shall be entitled Subject to such conditions and restrictions as may be prescribed and within the time and manner specified in Section 44 To take credit of input tax charged on any supply of goods or services Which are used or intended to be used in the course or furtherance of his business The said amount shall be credited to the electronic credit ledger of such person

Requirements for availing Input Tax Credit Essential requirements for availing ITC under GST (b) Registered taxable person has received the goods and/or services (d) Registered taxable person has furnished the return under S 27

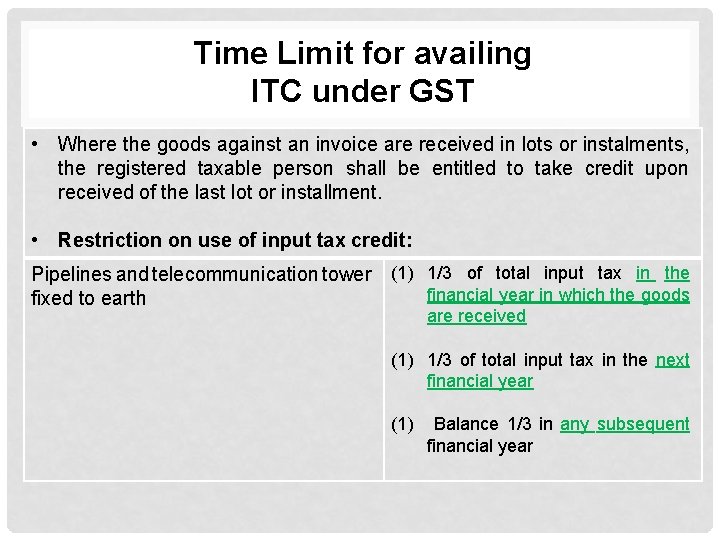

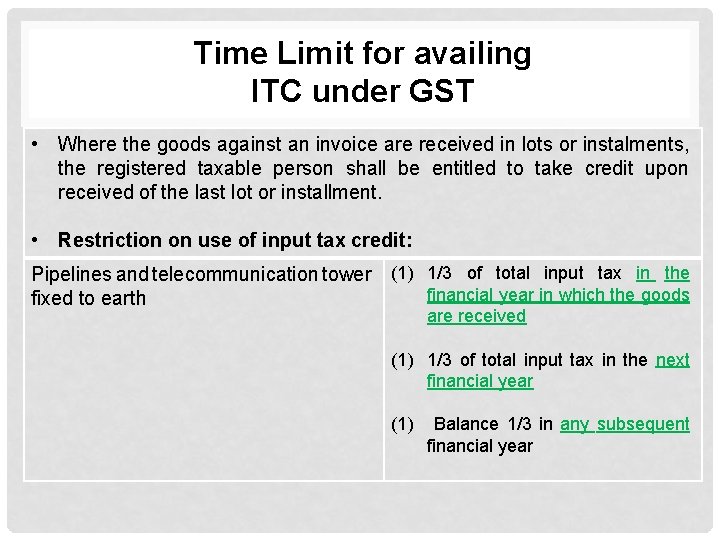

Time Limit for availing ITC under GST • Where the goods against an invoice are received in lots or instalments, the registered taxable person shall be entitled to take credit upon received of the last lot or installment. • Restriction on use of input tax credit: Pipelines and telecommunication tower (1) 1/3 of total input tax in the financial year in which the goods fixed to earth are received (1) 1/3 of total input tax in the next financial year (1) Balance 1/3 in any subsequent financial year

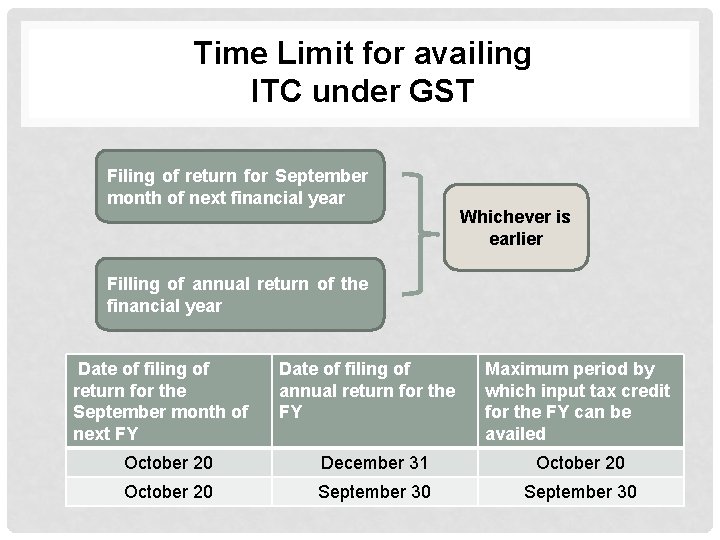

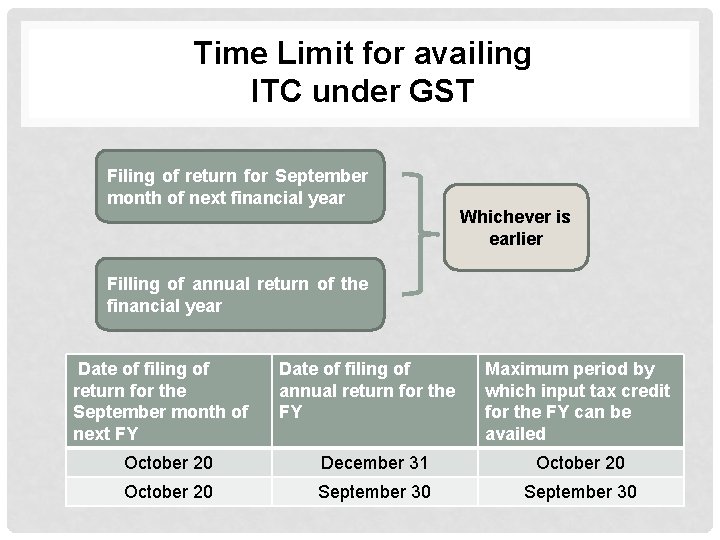

Time Limit for availing ITC under GST Filing of return for September month of next financial year Whichever is earlier Filling of annual return of the financial year Date of filing of return for the September month of next FY Date of filing of annual return for the FY Maximum period by which input tax credit for the FY can be availed October 20 December 31 October 20 September 30

![Apportionment of credit Section17 Section 171 Where goods andor services are used by the Apportionment of credit [Section-17] Section 17(1) Where goods and/or services are used by the](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-11.jpg)

Apportionment of credit [Section-17] Section 17(1) Where goods and/or services are used by the registered taxable person Party for the purpose of business Party for purposes other Section 17(2) Party for effecting taxable supplies including zero-rated supplies under this Act or IGST Act. Party for effecting exempt supplies including under reverse charge basis Section 8(3) Amount of credit shall be attributable to the purpose of business [Section 17(1)]/taxable supplies including zero rated supplies [Section 17(2)]

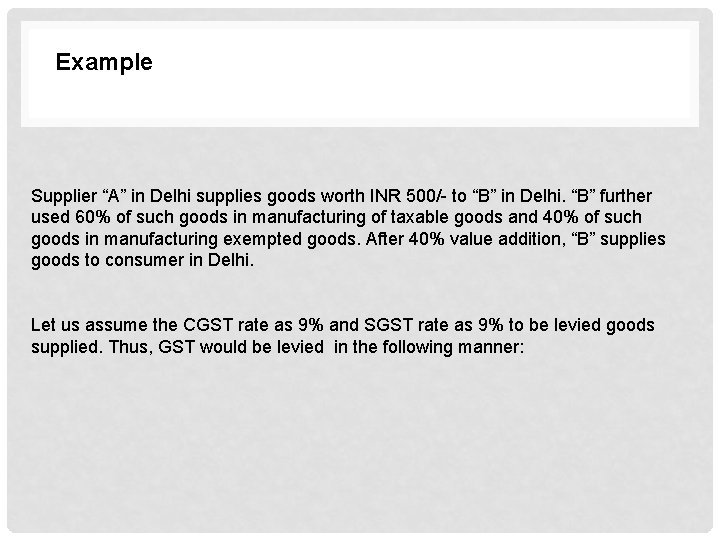

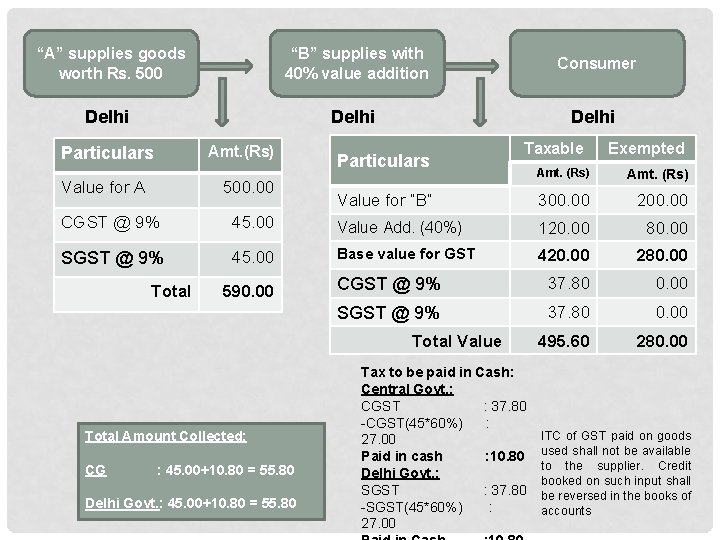

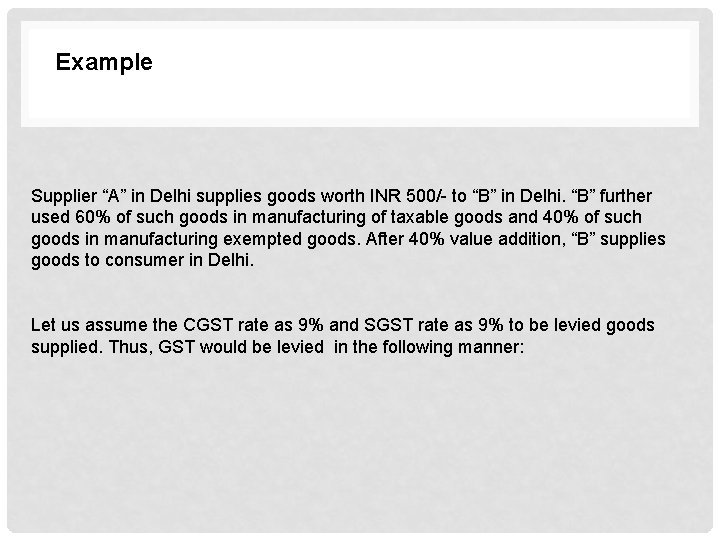

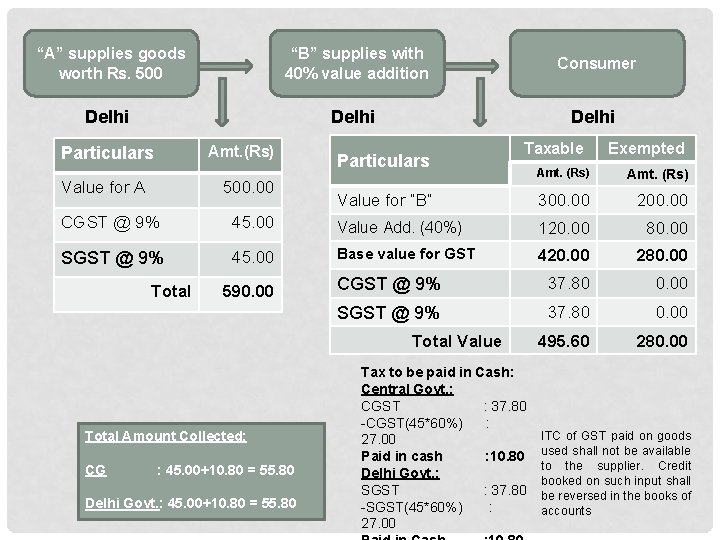

Example Supplier “A” in Delhi supplies goods worth INR 500/- to “B” in Delhi. “B” further used 60% of such goods in manufacturing of taxable goods and 40% of such goods in manufacturing exempted goods. After 40% value addition, “B” supplies goods to consumer in Delhi. Let us assume the CGST rate as 9% and SGST rate as 9% to be levied goods supplied. Thus, GST would be levied in the following manner:

“A” supplies goods worth Rs. 500 “B” supplies with 40% value addition Consumer Delhi Amt. (Rs) Particulars Value for A 500. 00 Particulars Taxable Exempted Amt. (Rs) Value for “B” 300. 00 200. 00 CGST @ 9% 45. 00 Value Add. (40%) 120. 00 80. 00 SGST @ 9% 45. 00 Base value for GST 420. 00 280. 00 CGST @ 9% 37. 80 0. 00 SGST @ 9% 37. 80 0. 00 495. 60 280. 00 Total 590. 00 Total Value Total Amount Collected: CG : 45. 00+10. 80 = 55. 80 Delhi Govt. : 45. 00+10. 80 = 55. 80 Tax to be paid in Cash: Central Govt. : CGST : 37. 80 -CGST(45*60%) : 27. 00 Paid in cash : 10. 80 Delhi Govt. : SGST : 37. 80 -SGST(45*60%) : 27. 00 ITC of GST paid on goods used shall not be available to the supplier. Credit booked on such input shall be reversed in the books of accounts

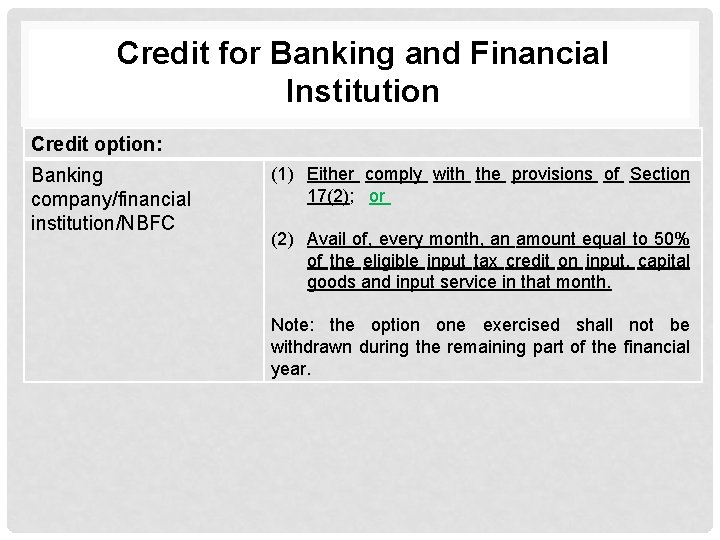

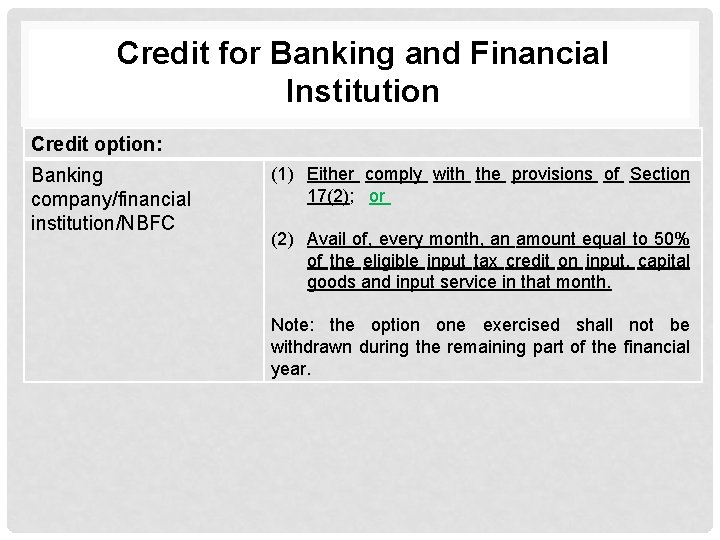

Credit for Banking and Financial Institution Credit option: Banking company/financial institution/NBFC (1) Either comply with the provisions of Section 17(2); or (2) Avail of, every month, an amount equal to 50% of the eligible input tax credit on input, capital goods and input service in that month. Note: the option one exercised shall not be withdrawn during the remaining part of the financial year.

![List of items not eligible for ITC Section 174 Motor vehicles Except when they List of items not eligible for ITC[ Section 17(4)] Motor vehicles Except when they](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-15.jpg)

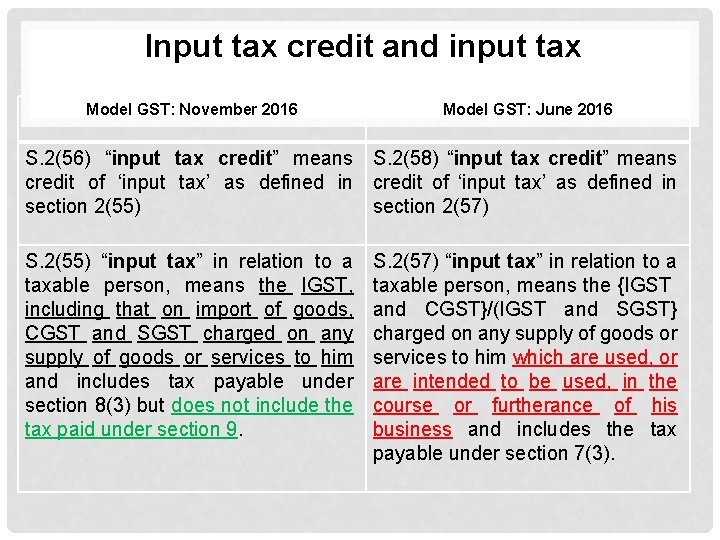

List of items not eligible for ITC[ Section 17(4)] Motor vehicles Except when they are used: (i) For making the following taxable supplies, namely: • further supply of such vehicles; or • transportation of passengers; or • imparting training on driving, flying, navigating such vehicles; (i) For transportation of goods Supply of goods and services for personal use or consumption of any employee (i) • • • Namely Food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery Except where such inward supply of goods or services of a particular category is used by a registered taxable person for making an outward taxable supply of the same category of goods or services;

![List of items not eligible for ITC Section 174 ii Membership of a club List of items not eligible for ITC[ Section 17(4)] (ii) Membership of a club,](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-16.jpg)

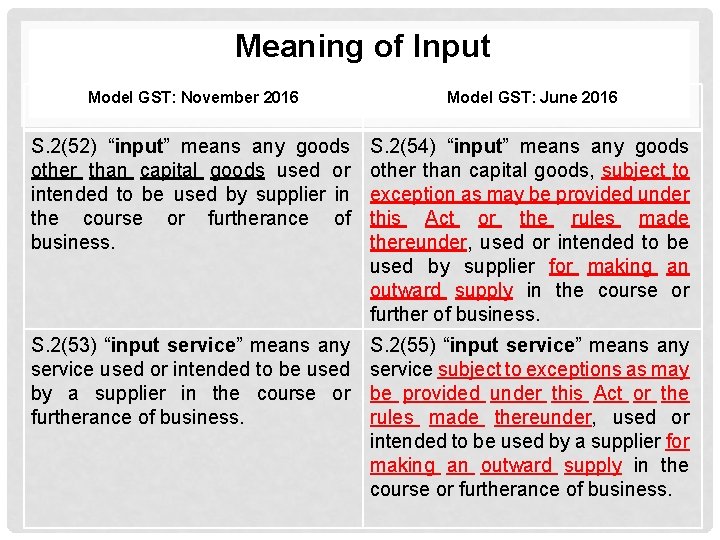

List of items not eligible for ITC[ Section 17(4)] (ii) Membership of a club, health & fitness centre , (iii) rent-a-cab, life insurance, health insurance Except where the Government notifies the services which are obligatory for an employer to provide to its employees under any law for the time being in force; and (iv) Travel benefits extended to employees on vacation such as leave or home travel concession Work contract services When supplied for construction of immovable property, other than plan and machinery, except where it is an input service for further supply of works contract service;

![List of items not eligible for ITC Section 174 Construction of immovable property Goods List of items not eligible for ITC[ Section 17(4)] Construction of immovable property Goods](https://slidetodoc.com/presentation_image_h2/564ea68fd8e13be8d7b1202c13af87dd/image-17.jpg)

List of items not eligible for ITC[ Section 17(4)] Construction of immovable property Goods or services received by a taxable person for construction of an immovable property on his own account, other than plan and machinery, even when used in course or furtherance of business. Composition scheme Goods and/or services on which tax has been paid under (Section 9) Section 9

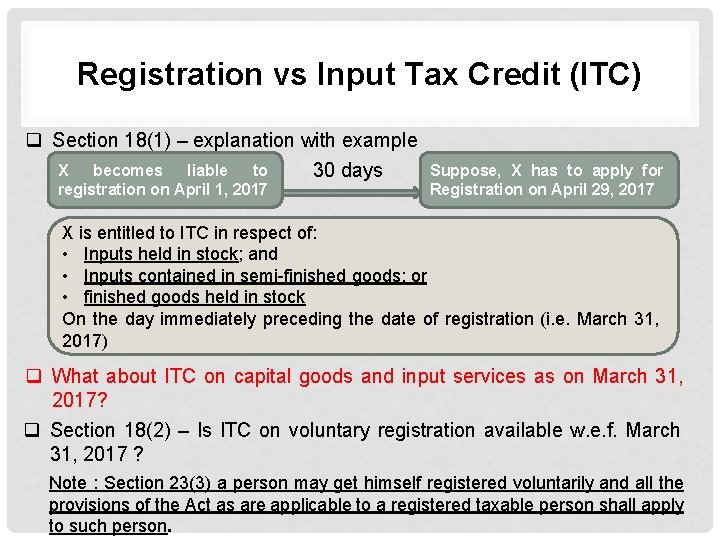

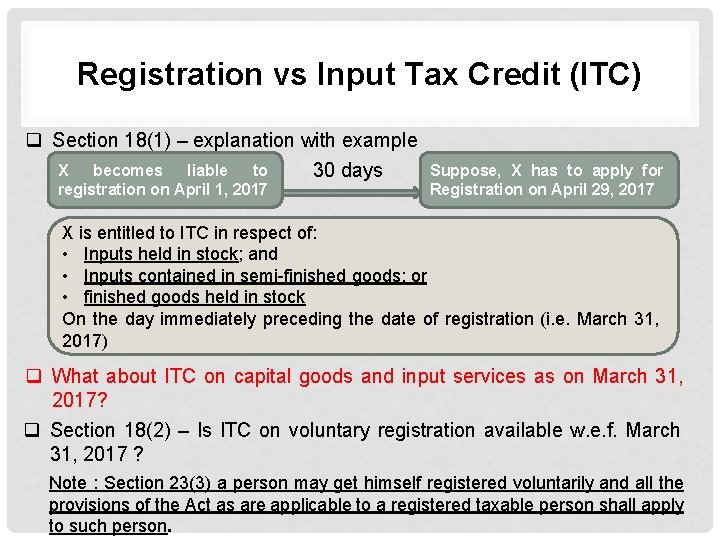

Registration vs Input Tax Credit (ITC) q Section 18(1) – explanation with example X becomes liable to 30 days registration on April 1, 2017 Suppose, X has to apply for Registration on April 29, 2017 X is entitled to ITC in respect of: • Inputs held in stock; and • Inputs contained in semi-finished goods; or • finished goods held in stock On the day immediately preceding the date of registration (i. e. March 31, 2017) q What about ITC on capital goods and input services as on March 31, 2017? q Section 18(2) – Is ITC on voluntary registration available w. e. f. March 31, 2017 ? Note : Section 23(3) a person may get himself registered voluntarily and all the provisions of the Act as are applicable to a registered taxable person shall apply to such person.

Registration vs Input Tax Credit (ITC) q Section 18(3) – composition scheme (Section 9) X’s taxable turnover exceeds INR 50 lakhs on May 1, 2017 (Section 9) X will not enjoy the benefit of Section 9 X is entitled to ITC in respect of : • Inputs held in stock; and • Inputs contained in semi-finished goods; or • finished goods held in stock , and • Capital goods, immediately preceding the date of May 1, 2016 [i. e. on April 30, 2017] Section 9: (a) Permission requires from proper officer; (b) tax rate not less that 2. 5% for manufacturer and 1% for other cases (c) no permission to service provider, inter-state supplier, E-commerce operator; (d) applicable to all taxable person having same PAN (e) no ITC (f) permission withdrawn on > 50 lacs.

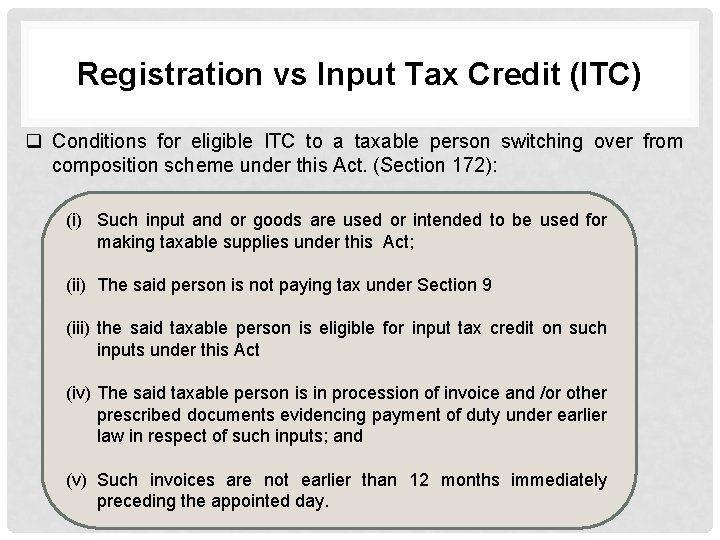

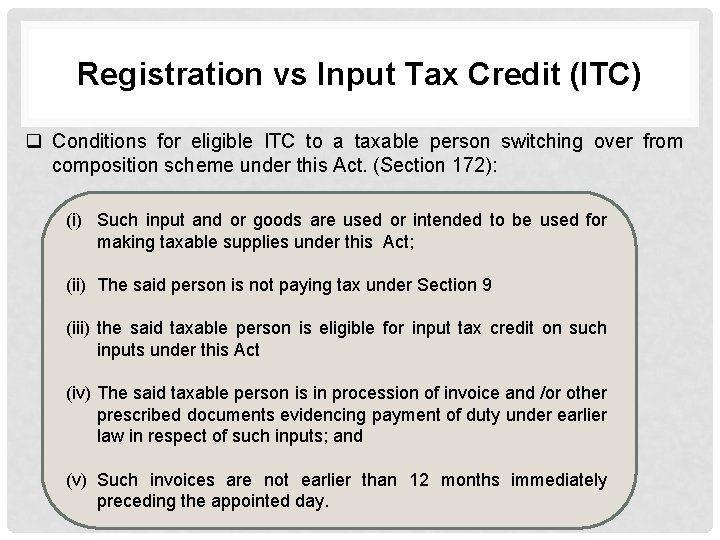

Registration vs Input Tax Credit (ITC) q Conditions for eligible ITC to a taxable person switching over from composition scheme under this Act. (Section 172): (i) Such input and or goods are used or intended to be used for making taxable supplies under this Act; (ii) The said person is not paying tax under Section 9 (iii) the said taxable person is eligible for input tax credit on such inputs under this Act (iv) The said taxable person is in procession of invoice and /or other prescribed documents evidencing payment of duty under earlier law in respect of such inputs; and (v) Such invoices are not earlier than 12 months immediately preceding the appointed day.

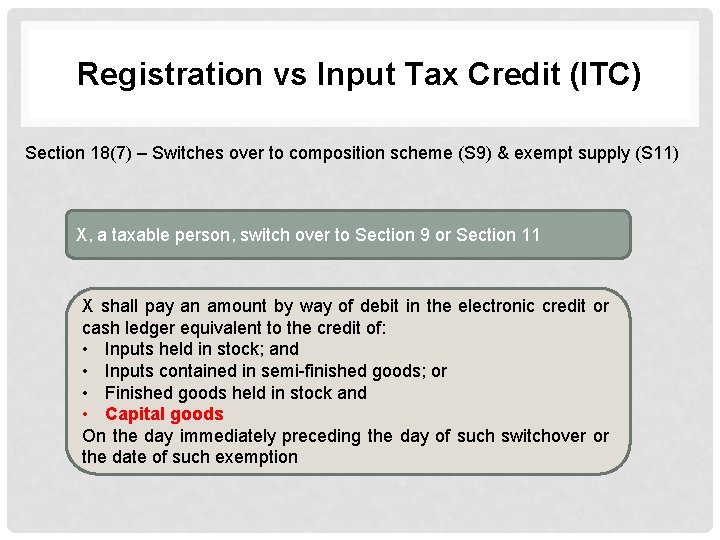

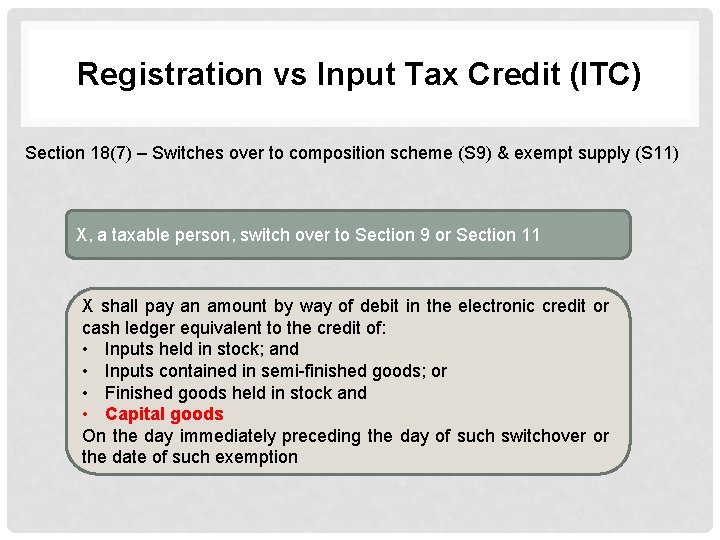

Registration vs Input Tax Credit (ITC) Section 18(7) – Switches over to composition scheme (S 9) & exempt supply (S 11) X, a taxable person, switch over to Section 9 or Section 11 X shall pay an amount by way of debit in the electronic credit or cash ledger equivalent to the credit of: • Inputs held in stock; and • Inputs contained in semi-finished goods; or • Finished goods held in stock and • Capital goods On the day immediately preceding the day of such switchover or the date of such exemption

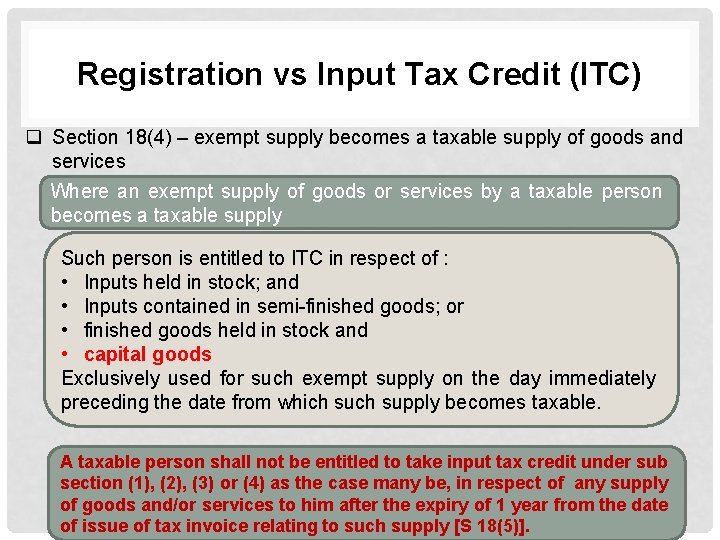

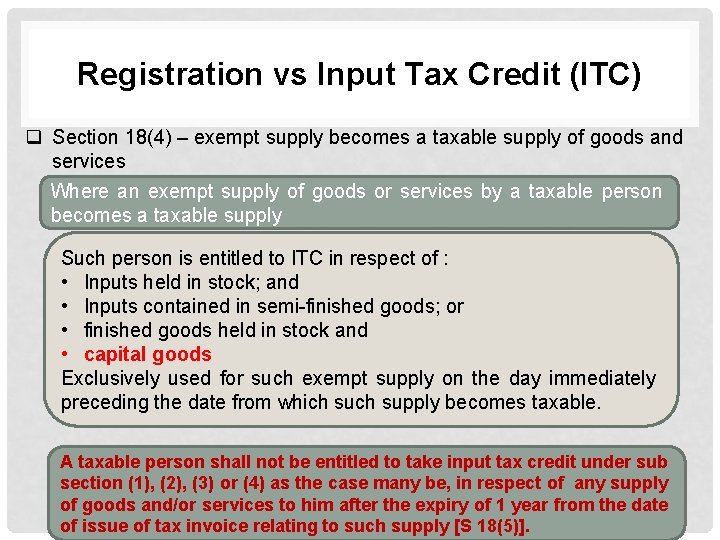

Registration vs Input Tax Credit (ITC) q Section 18(4) – exempt supply becomes a taxable supply of goods and services Where an exempt supply of goods or services by a taxable person becomes a taxable supply Such person is entitled to ITC in respect of : • Inputs held in stock; and • Inputs contained in semi-finished goods; or • finished goods held in stock and • capital goods Exclusively used for such exempt supply on the day immediately preceding the date from which supply becomes taxable. A taxable person shall not be entitled to take input tax credit under sub section (1), (2), (3) or (4) as the case many be, in respect of any supply of goods and/or services to him after the expiry of 1 year from the date of issue of tax invoice relating to such supply [S 18(5)].

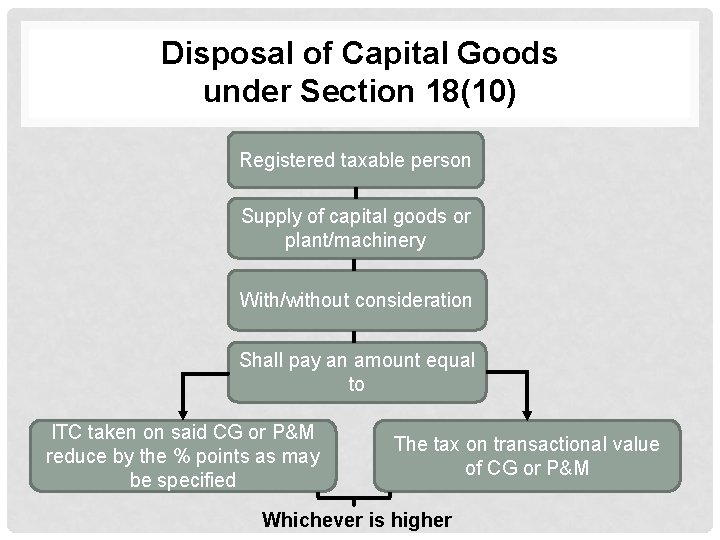

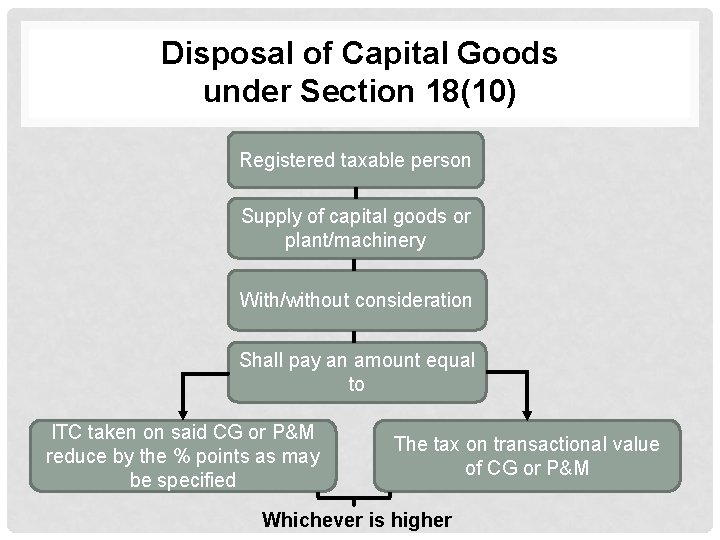

Disposal of Capital Goods under Section 18(10) Registered taxable person Supply of capital goods or plant/machinery With/without consideration Shall pay an amount equal to ITC taken on said CG or P&M reduce by the % points as may be specified The tax on transactional value of CG or P&M Whichever is higher

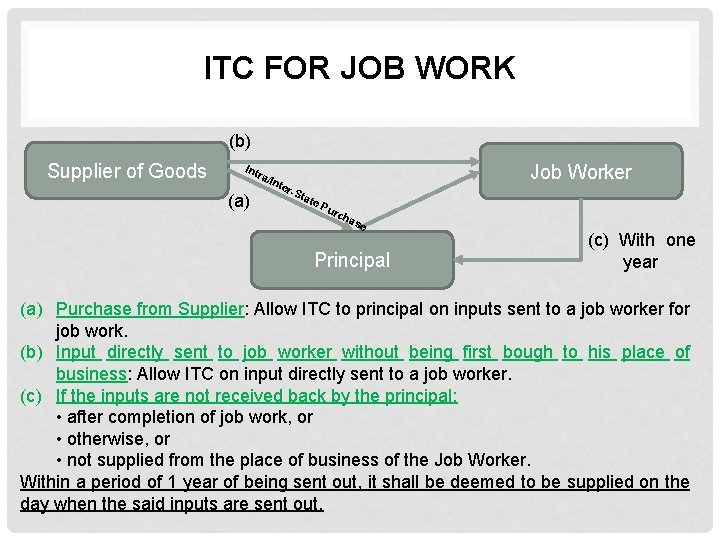

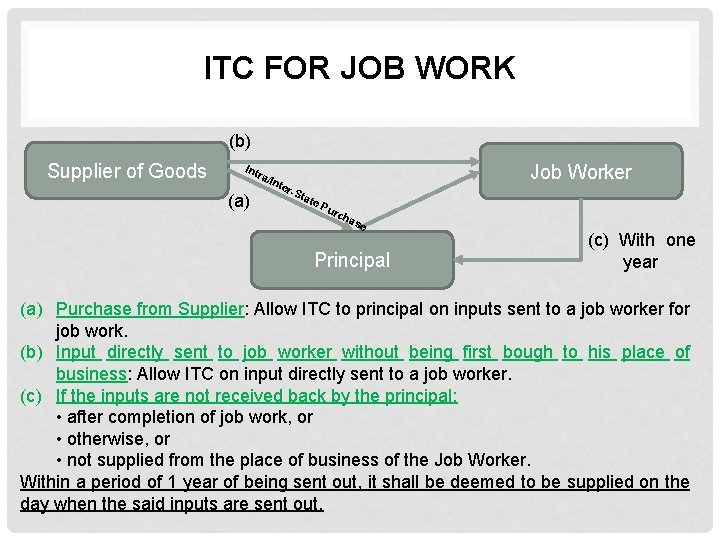

ITC FOR JOB WORK (b) Supplier of Goods Int ra/ In (a) Job Worker ter -St ate Pu rch ase Principal (c) With one year (a) Purchase from Supplier: Allow ITC to principal on inputs sent to a job worker for job work. (b) Input directly sent to job worker without being first bough to his place of business: Allow ITC on input directly sent to a job worker. (c) If the inputs are not received back by the principal: • after completion of job work, or • otherwise, or • not supplied from the place of business of the Job Worker. Within a period of 1 year of being sent out, it shall be deemed to be supplied on the day when the said inputs are sent out.

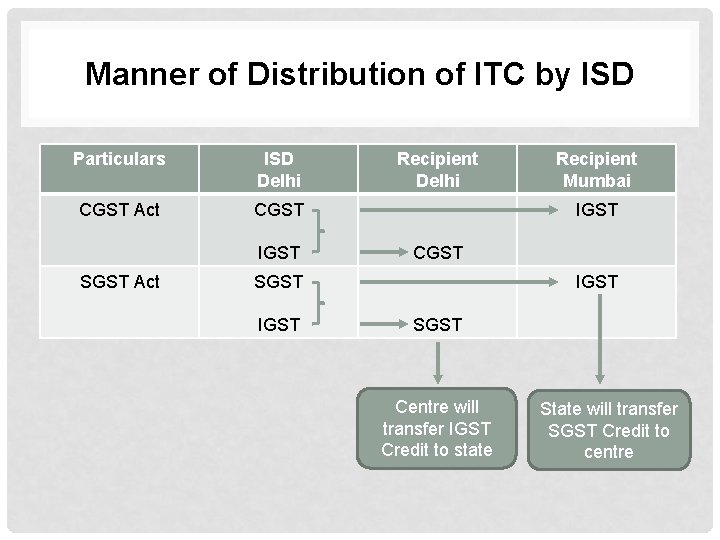

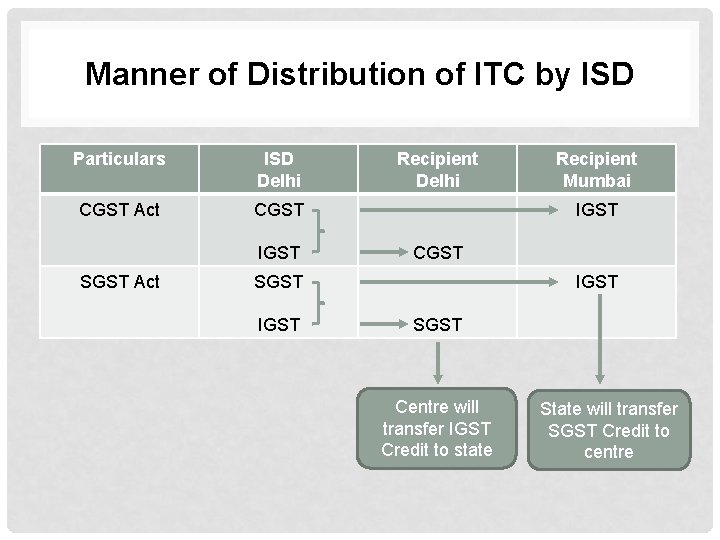

Manner of Distribution of ITC by ISD Particulars ISD Delhi CGST Act CGST IGST SGST Act Recipient Delhi IGST CGST SGST IGST Recipient Mumbai IGST SGST Centre will transfer IGST Credit to state State will transfer SGST Credit to centre

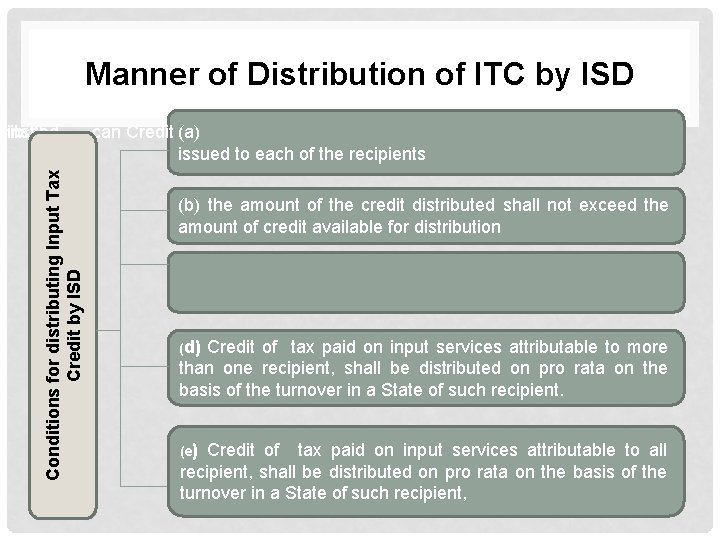

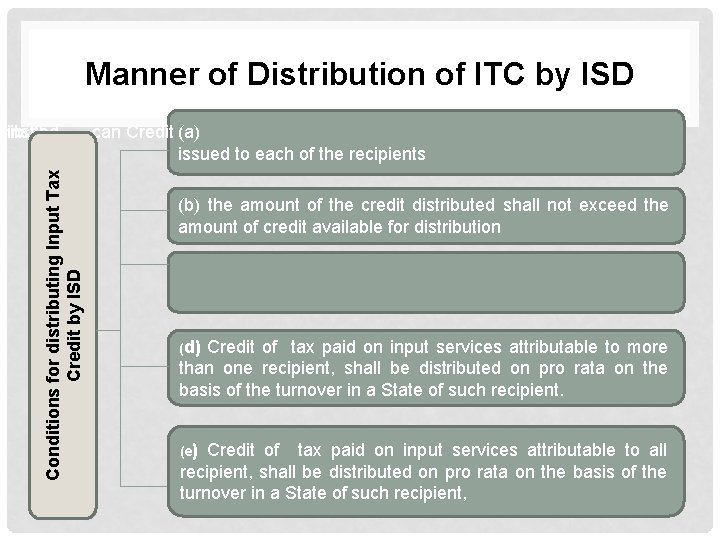

Manner of Distribution of ITC by ISD Conditions for distributing Input Tax Credit by ISD ainst tributed be can Credit (a) issued to each of the recipients (b) the amount of the credit distributed shall not exceed the amount of credit available for distribution (d) Credit of tax paid on input services attributable to more than one recipient, shall be distributed on pro rata on the basis of the turnover in a State of such recipient. (e) Credit of tax paid on input services attributable to all recipient, shall be distributed on pro rata on the basis of the turnover in a State of such recipient,

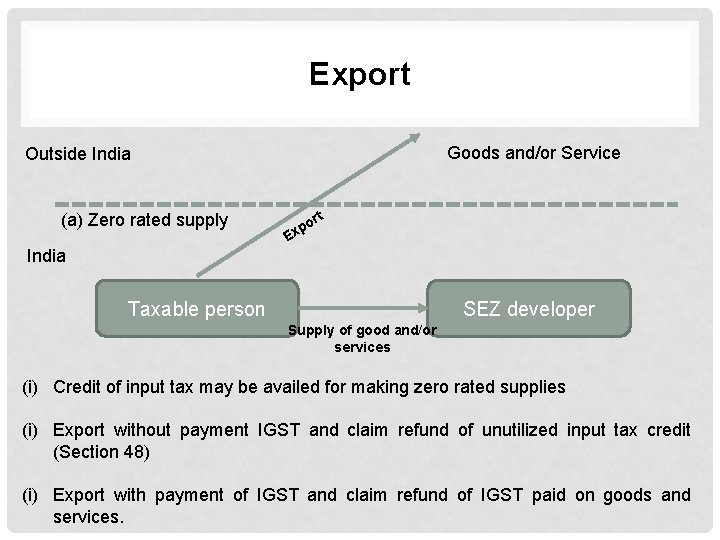

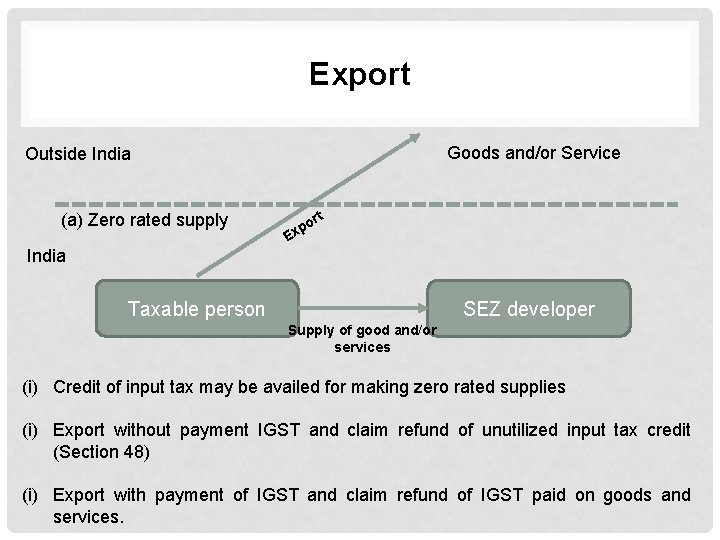

Export Goods and/or Service Outside India (a) Zero rated supply o xp rt E India Taxable person SEZ developer Supply of good and/or services (i) Credit of input tax may be availed for making zero rated supplies (i) Export without payment IGST and claim refund of unutilized input tax credit (Section 48) (i) Export with payment of IGST and claim refund of IGST paid on goods and services.

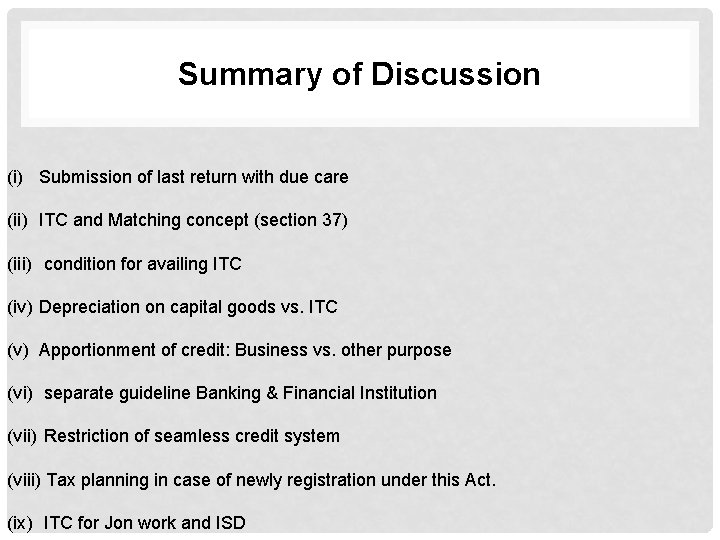

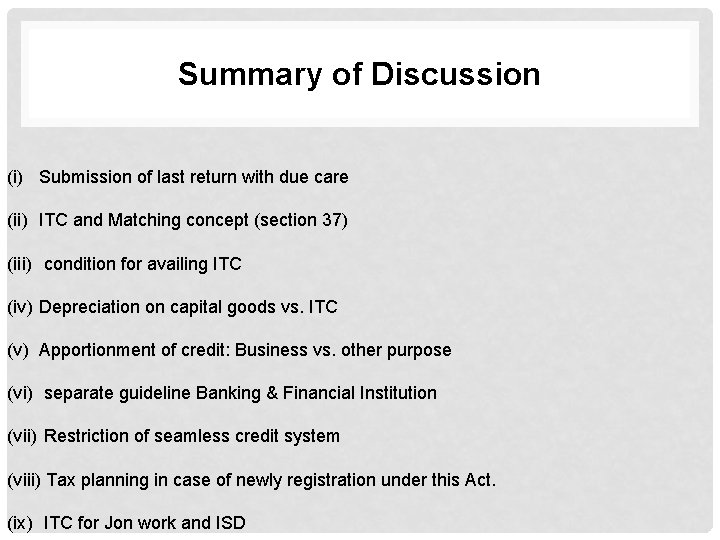

Summary of Discussion (i) Submission of last return with due care (ii) ITC and Matching concept (section 37) (iii) condition for availing ITC (iv) Depreciation on capital goods vs. ITC (v) Apportionment of credit: Business vs. other purpose (vi) separate guideline Banking & Financial Institution (vii) Restriction of seamless credit system (viii) Tax planning in case of newly registration under this Act. (ix) ITC for Jon work and ISD

Input tax credit meaning

Input tax credit meaning Importance of gst

Importance of gst Gopal kakivaya

Gopal kakivaya Gopal kutwaroo

Gopal kutwaroo Vinodh gopal

Vinodh gopal Shuba gopal

Shuba gopal Gopal vijayaraghavan

Gopal vijayaraghavan Susnata mondal

Susnata mondal Susnata mondal

Susnata mondal Susnata mondal

Susnata mondal Susnata mondal

Susnata mondal Vaibhav kesarwani

Vaibhav kesarwani Conclusion of gst

Conclusion of gst Roland purcell a technical writer

Roland purcell a technical writer Wotc tax credit calculation chart

Wotc tax credit calculation chart Form 8962 premium tax credit

Form 8962 premium tax credit New markets tax credit 101

New markets tax credit 101 Community investment tax credit tennessee

Community investment tax credit tennessee Combining nmtc and htc

Combining nmtc and htc Ey r&d tax credit

Ey r&d tax credit What is a mortgage credit certificate

What is a mortgage credit certificate Credit obsolete mi

Credit obsolete mi Historic tax credit syndication

Historic tax credit syndication Tusd tax credit

Tusd tax credit Solidarity tax credit eligibility

Solidarity tax credit eligibility Utah historic preservation tax credit

Utah historic preservation tax credit Historic tax credits 101

Historic tax credits 101 Cbma tax credit

Cbma tax credit This can be avoided by giving credit where credit is due.

This can be avoided by giving credit where credit is due. Berikut ini adalah salah satu peripheral input adalah.

Berikut ini adalah salah satu peripheral input adalah.