Thinking Mathematically Seventh Edition Chapter 8 Personal Finance

- Slides: 31

Thinking Mathematically Seventh Edition Chapter 8 Personal Finance Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 1

Section 8. 5 Annuities, Methods of Saving, and Investments Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 2

Objectives 1. Determine the value of an annuity. 2. Determine regular annuity payments needed to achieve a financial goal. 3. Understand stocks and bonds as investments. 4. Read stock tables. 5. Understand accounts designed for retirement savings. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 3

Annuities An annuity is a sequence of equal payments made at equal time periods. The value of an annuity is the sum of all deposits plus all interest paid. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 4

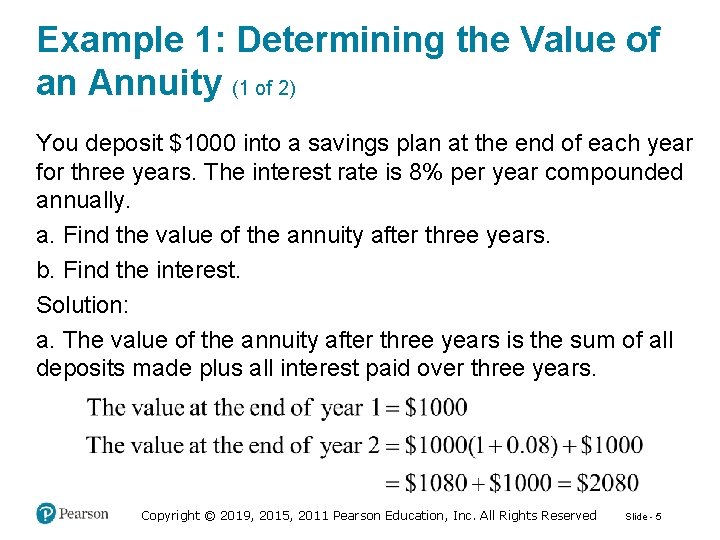

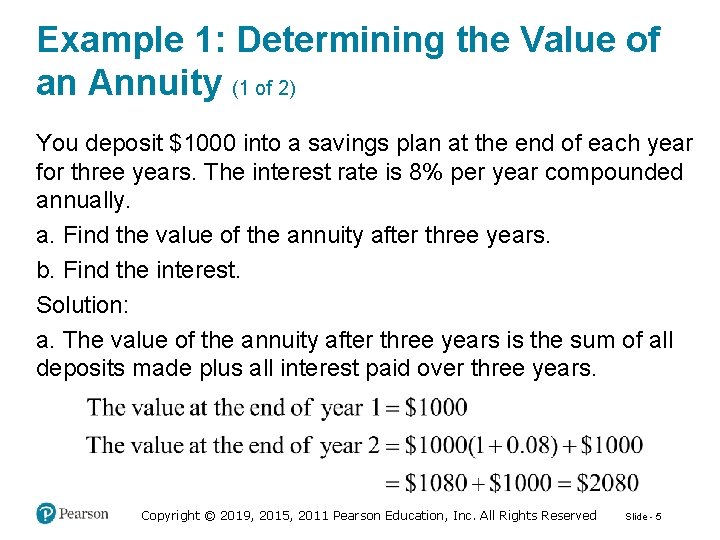

Example 1: Determining the Value of an Annuity (1 of 2) You deposit $1000 into a savings plan at the end of each year for three years. The interest rate is 8% per year compounded annually. a. Find the value of the annuity after three years. b. Find the interest. Solution: a. The value of the annuity after three years is the sum of all deposits made plus all interest paid over three years. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 5

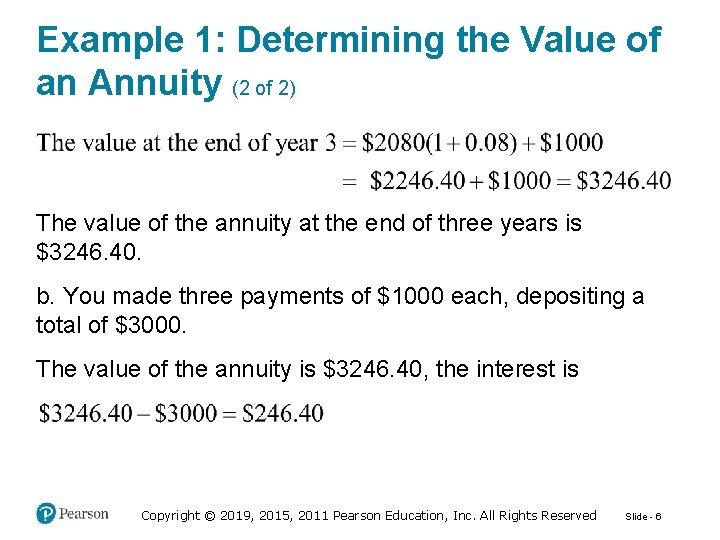

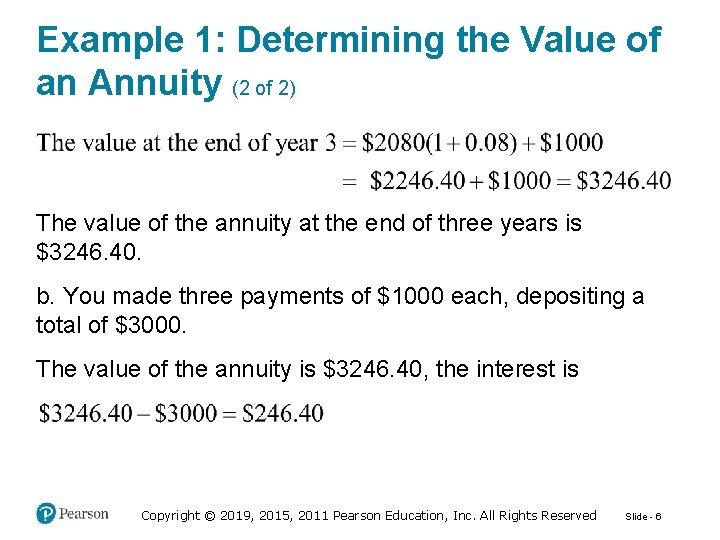

Example 1: Determining the Value of an Annuity (2 of 2) The value of the annuity at the end of three years is $3246. 40. b. You made three payments of $1000 each, depositing a total of $3000. The value of the annuity is $3246. 40, the interest is Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 6

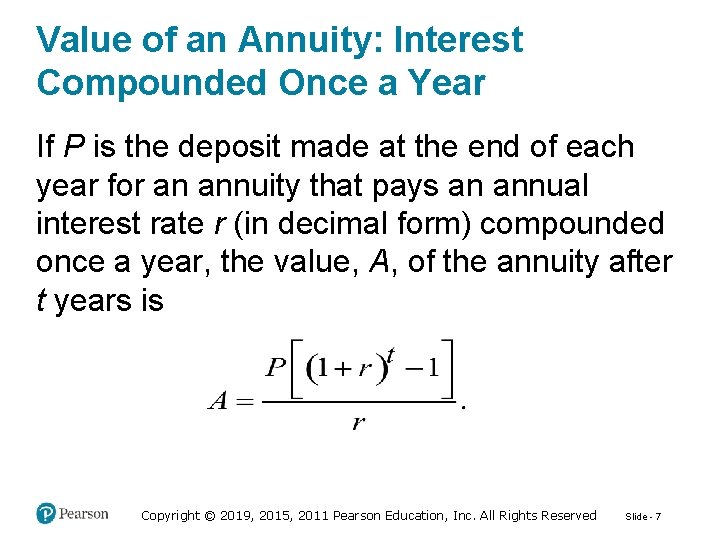

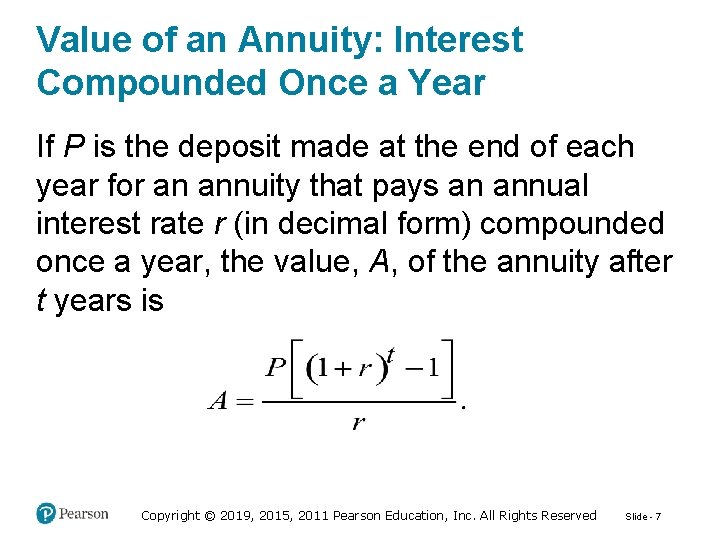

Value of an Annuity: Interest Compounded Once a Year If P is the deposit made at the end of each year for an annuity that pays an annual interest rate r (in decimal form) compounded once a year, the value, A, of the annuity after t years is Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 7

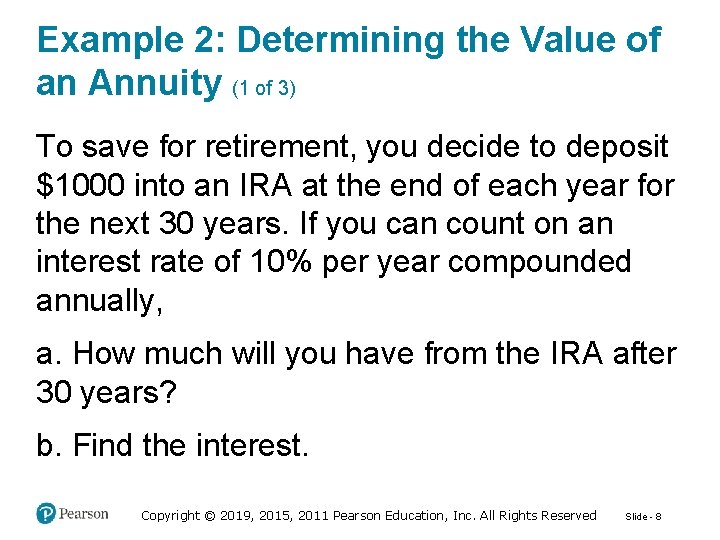

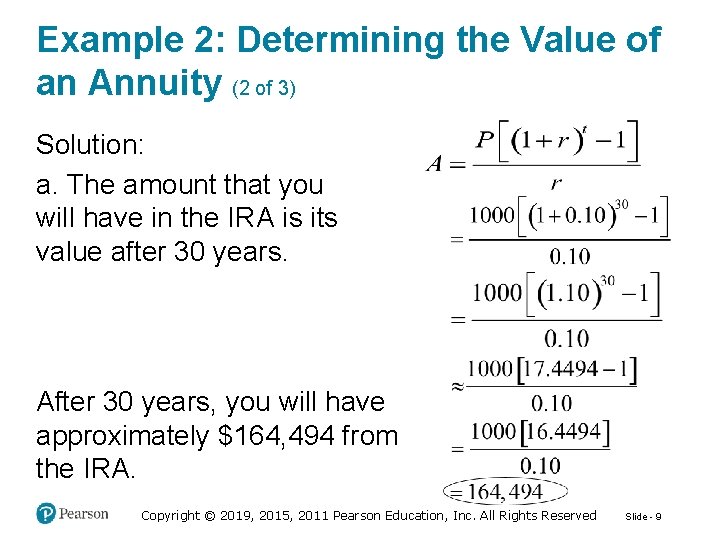

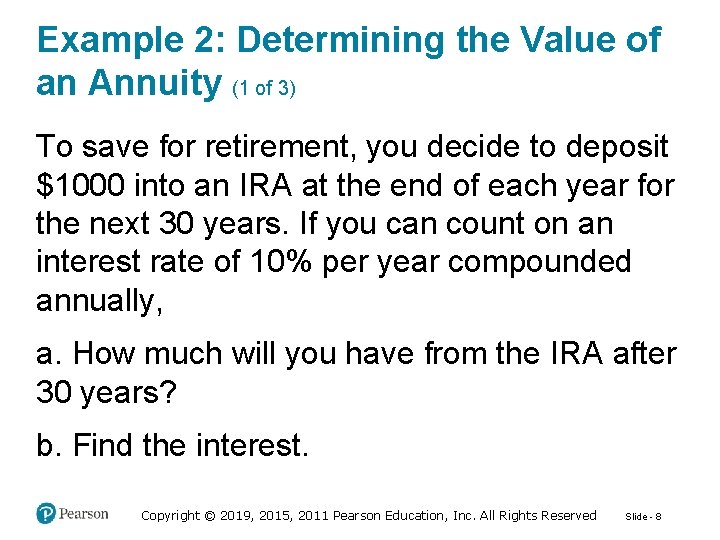

Example 2: Determining the Value of an Annuity (1 of 3) To save for retirement, you decide to deposit $1000 into an IRA at the end of each year for the next 30 years. If you can count on an interest rate of 10% per year compounded annually, a. How much will you have from the IRA after 30 years? b. Find the interest. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 8

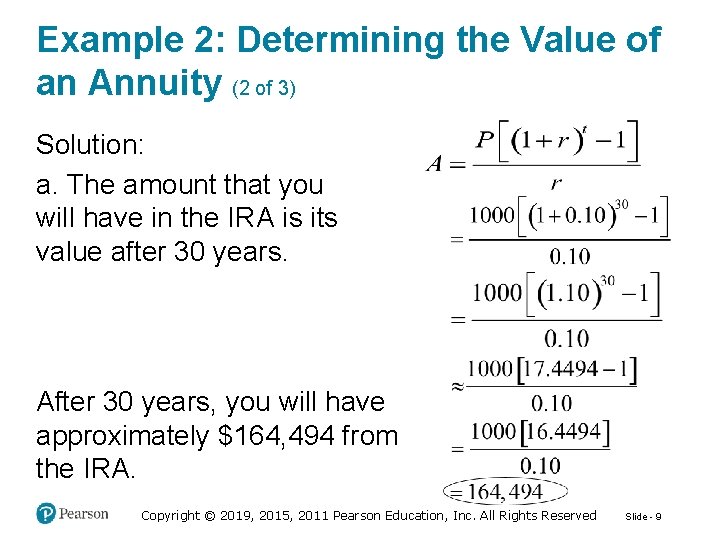

Example 2: Determining the Value of an Annuity (2 of 3) Solution: a. The amount that you will have in the IRA is its value after 30 years. After 30 years, you will have approximately $164, 494 from the IRA. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 9

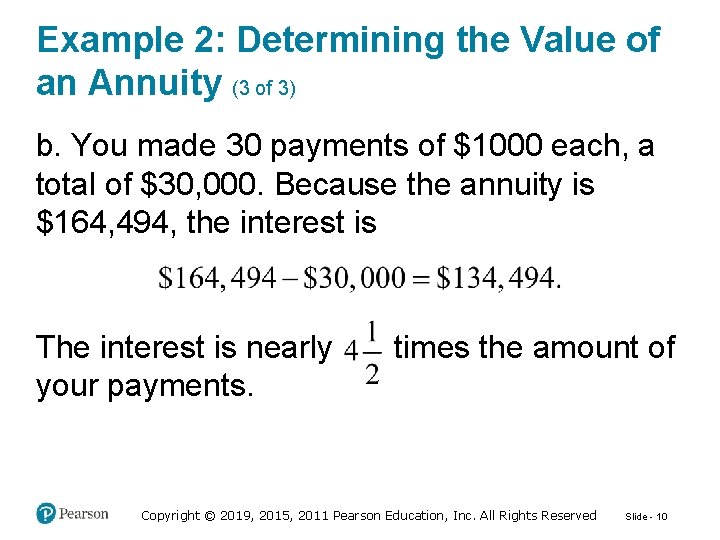

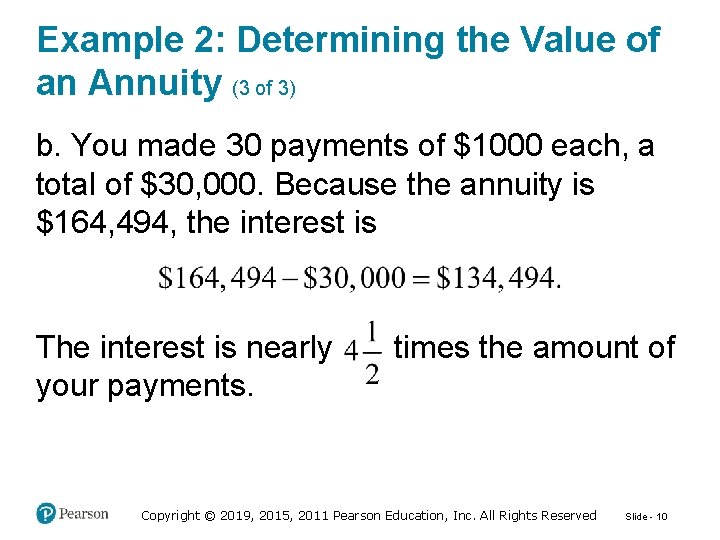

Example 2: Determining the Value of an Annuity (3 of 3) b. You made 30 payments of $1000 each, a total of $30, 000. Because the annuity is $164, 494, the interest is The interest is nearly your payments. times the amount of Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 10

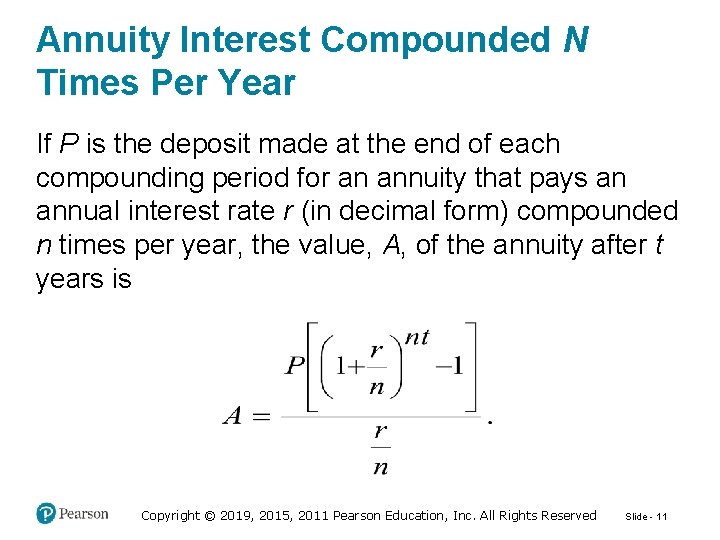

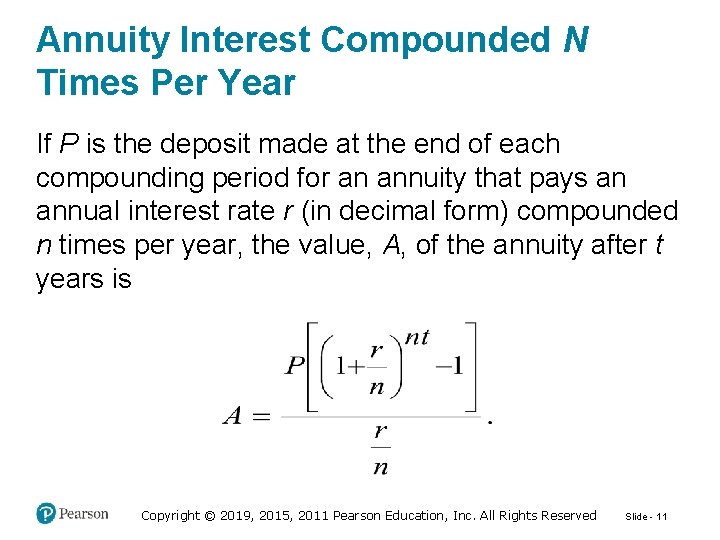

Annuity Interest Compounded N Times Per Year If P is the deposit made at the end of each compounding period for an annuity that pays an annual interest rate r (in decimal form) compounded n times per year, the value, A, of the annuity after t years is Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 11

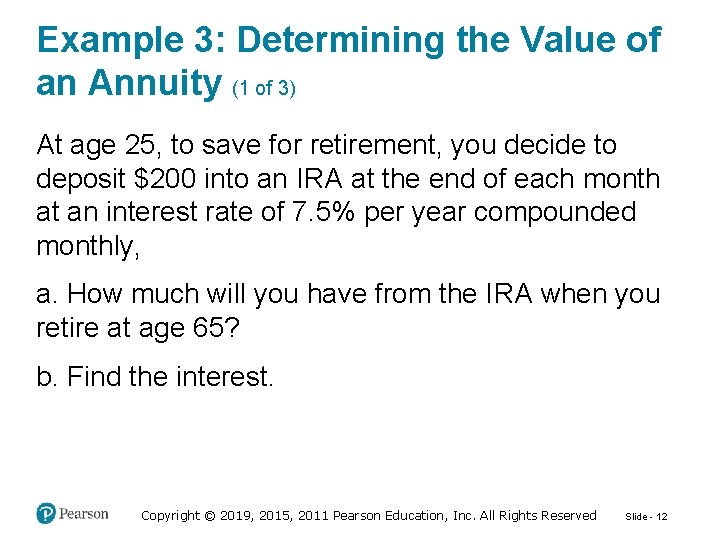

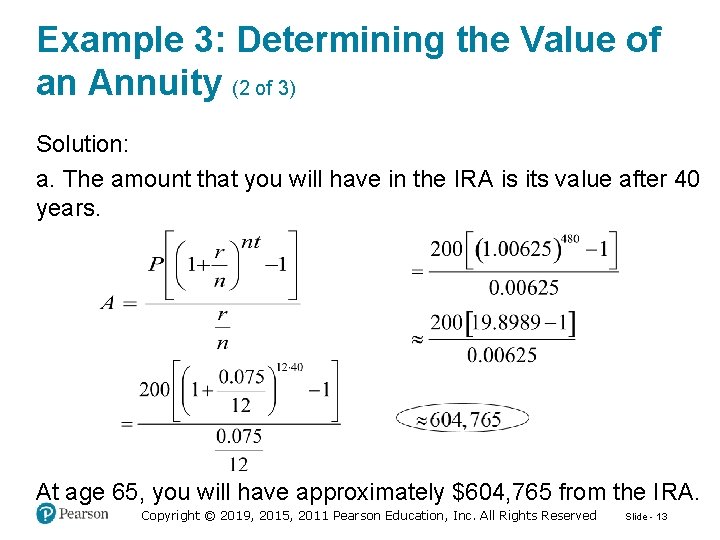

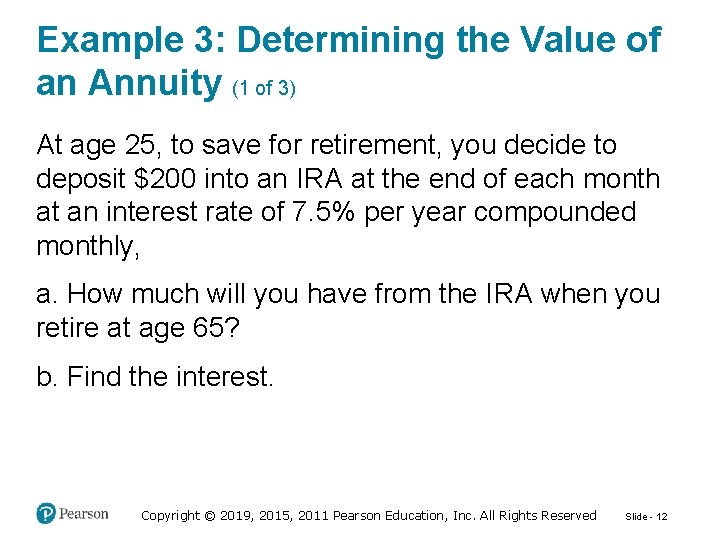

Example 3: Determining the Value of an Annuity (1 of 3) At age 25, to save for retirement, you decide to deposit $200 into an IRA at the end of each month at an interest rate of 7. 5% per year compounded monthly, a. How much will you have from the IRA when you retire at age 65? b. Find the interest. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 12

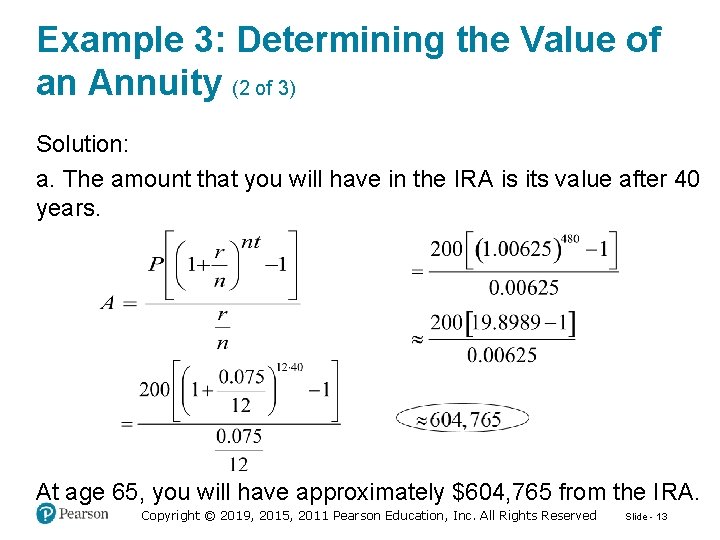

Example 3: Determining the Value of an Annuity (2 of 3) Solution: a. The amount that you will have in the IRA is its value after 40 years. At age 65, you will have approximately $604, 765 from the I RA. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 13

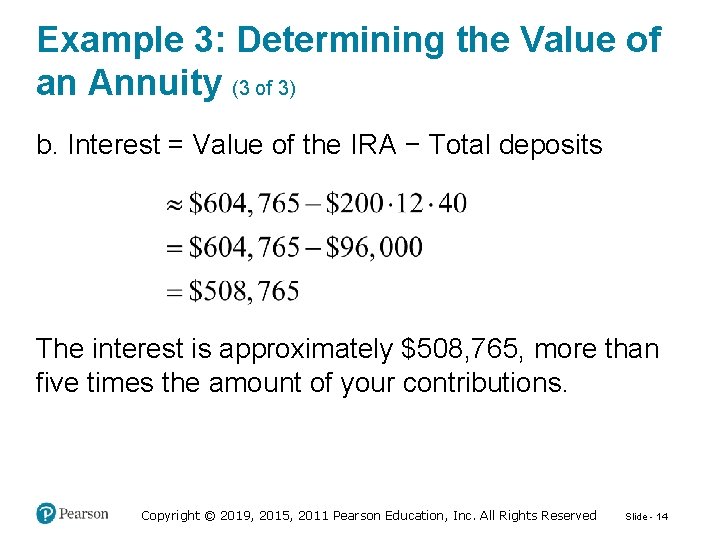

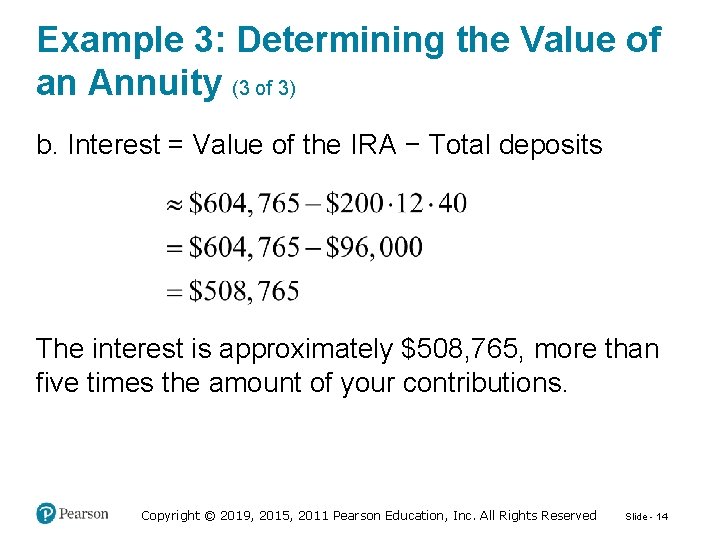

Example 3: Determining the Value of an Annuity (3 of 3) b. Interest = Value of the IRA − Total deposits The interest is approximately $508, 765, more than five times the amount of your contributions. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 14

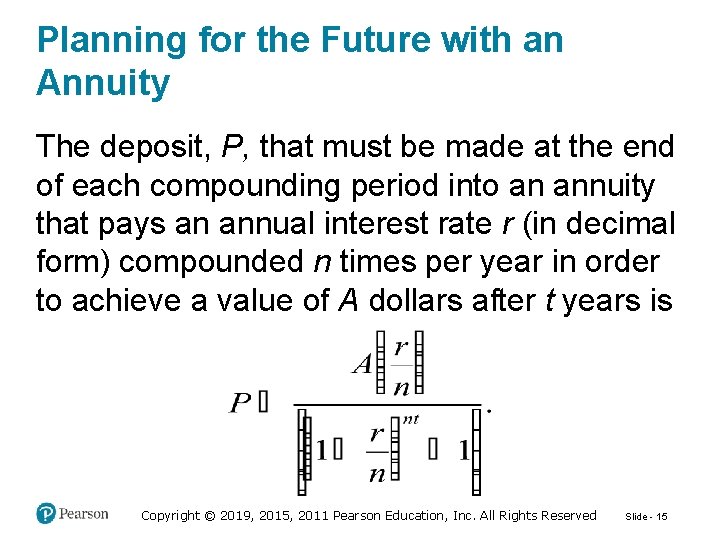

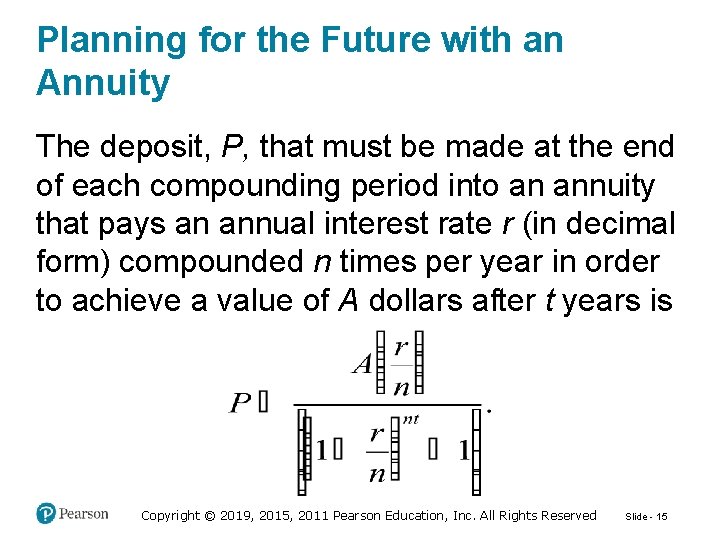

Planning for the Future with an Annuity The deposit, P, that must be made at the end of each compounding period into an annuity that pays an annual interest rate r (in decimal form) compounded n times per year in order to achieve a value of A dollars after t years is Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 15

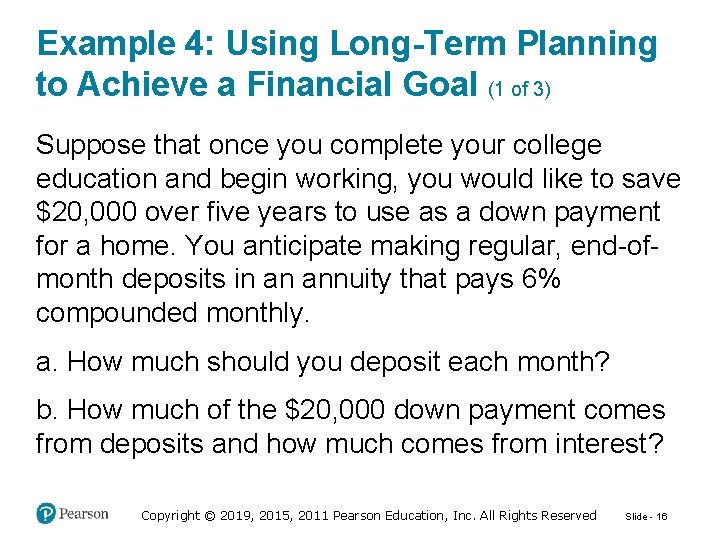

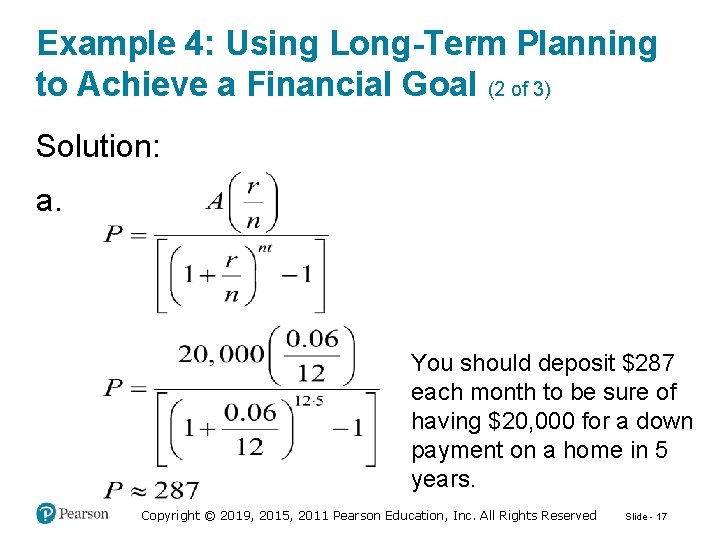

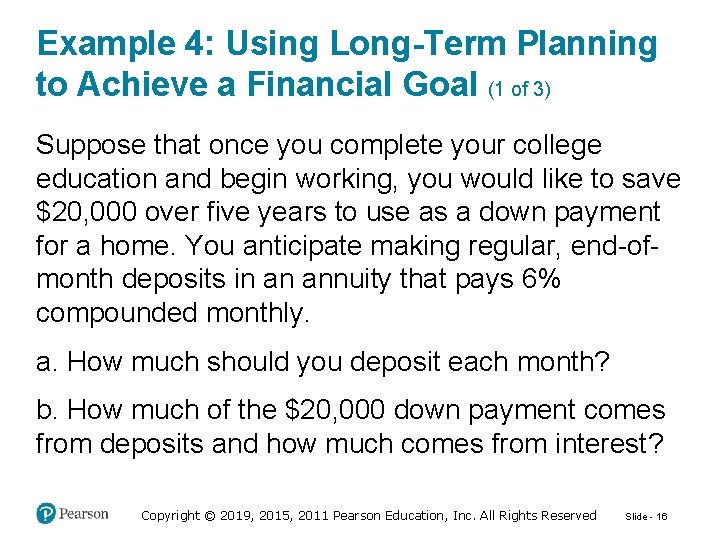

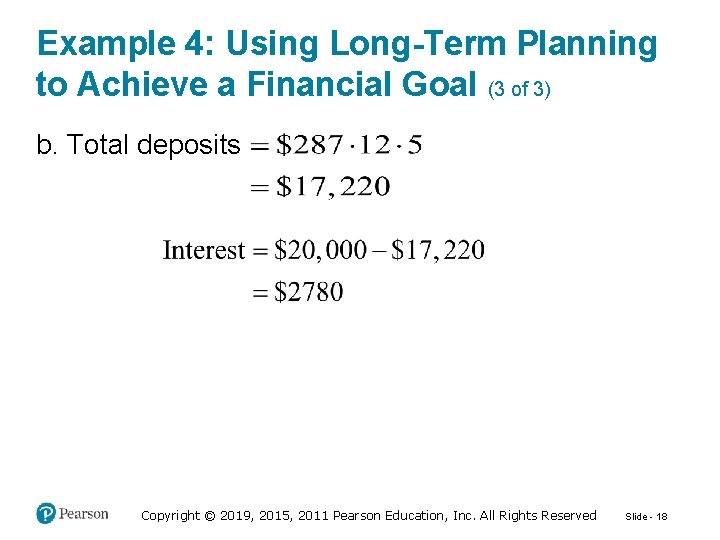

Example 4: Using Long-Term Planning to Achieve a Financial Goal (1 of 3) Suppose that once you complete your college education and begin working, you would like to save $20, 000 over five years to use as a down payment for a home. You anticipate making regular, end-ofmonth deposits in an annuity that pays 6% compounded monthly. a. How much should you deposit each month? b. How much of the $20, 000 down payment comes from deposits and how much comes from interest? Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 16

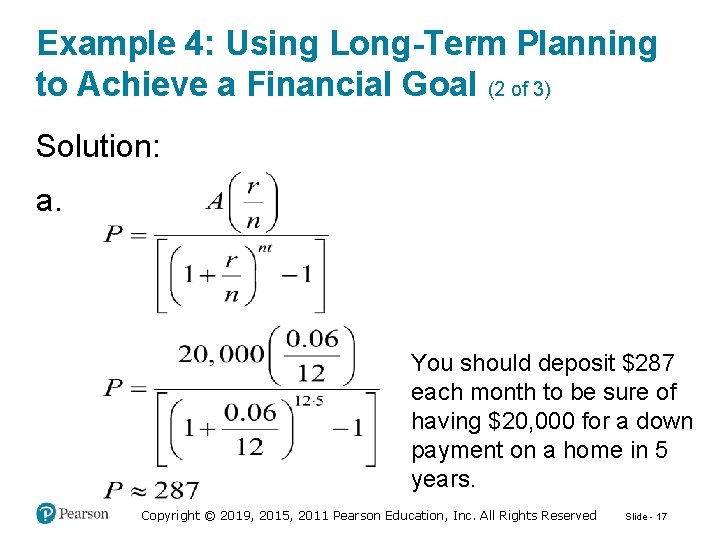

Example 4: Using Long-Term Planning to Achieve a Financial Goal (2 of 3) Solution: a. You should deposit $287 each month to be sure of having $20, 000 for a down payment on a home in 5 years. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 17

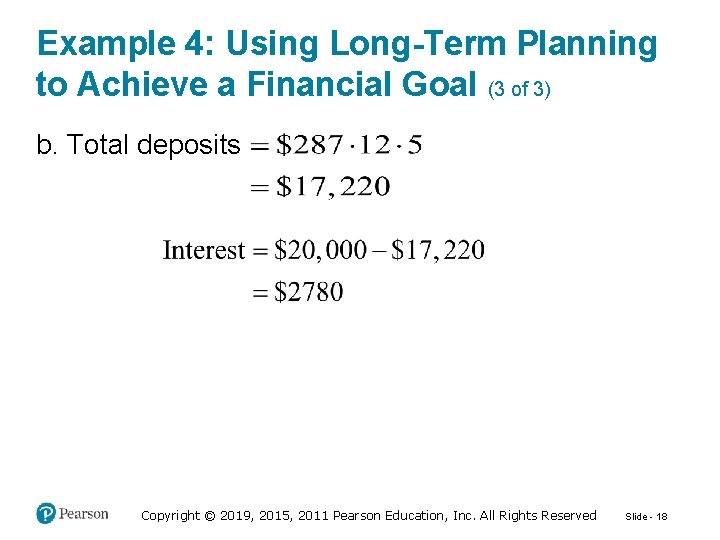

Example 4: Using Long-Term Planning to Achieve a Financial Goal (3 of 3) b. Total deposits Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 18

Investments When depositing money into a bank account, you are making a cash investment. The account’s interest rate guarantees a certain percent increase in your investment, called its return. Other kind of investments that are riskier are called stocks and bonds. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 19

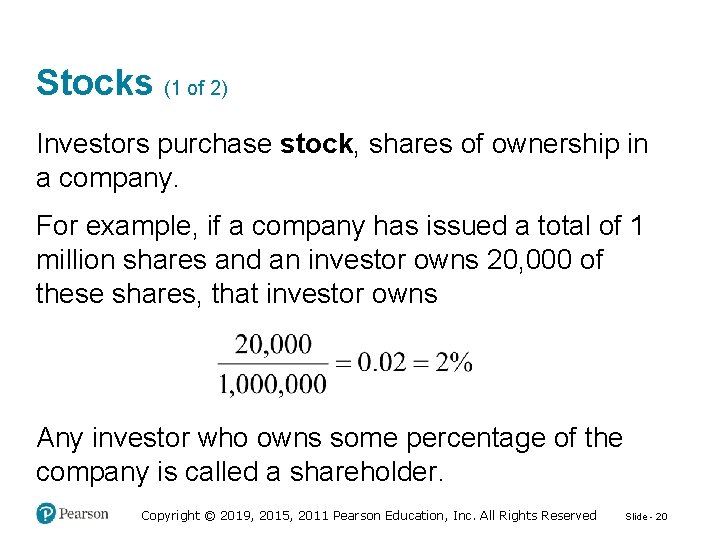

Stocks (1 of 2) Investors purchase stock, shares of ownership in a company. For example, if a company has issued a total of 1 million shares and an investor owns 20, 000 of these shares, that investor owns Any investor who owns some percentage of the company is called a shareholder. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 20

Stocks (2 of 2) Buying or selling stocks is referred to as trading. Stocks are traded on a stock exchange. There are two ways to make money by investing in stock: You sell shares for more money than you paid for them, in which case you have a capital gain on the sale of stock. While you own the stock, the company distributes all or part of its profits to shareholders as dividends. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 21

Bonds In order to raise money and dilute the ownership of current stockholders, companies sell bonds. People who buy a bond are lending money to the company from which they buy the bond. Bonds are a commitment from a company to pay the price an investor pays for the bond at the time it was purchased, called the face value, along with interest payments at a given rate. A listing of all the investments that a person holds is called a financial portfolio. Most financial advisors recommend a portfolio with a mixture of low-risk and high-risk investments, called a diversified portfolio. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 22

Reading Stock Tables (1 of 2) Daily newspapers and online services give current stock prices and other information about stocks. 52 -week high refers to the highest price at which a company traded during the past 52 weeks. 52 -week low refers to the lowest price at which a company traded during the past 52 weeks. Stock refers to the company name. SYM refers to the symbol the company uses for trading. Div refers to dividends paid per share to stockholders last year. Yld% stands for percent yield. Vol 100 s stands for sales volume in hundreds. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 23

Reading Stock Tables (2 of 2) Hi stands for the highest price at which the company’s stock traded yesterday. Low stands for the lowest price at which the company’s stock traded yesterday. Close stands for the price at which shares traded when the stock exchange closed yesterday. Net Chg stands for net change. PE stands for the price-to-earnings ratio. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 24

Example 5: Reading Stock Tables (1 of 5) Use the stock table for Disney to answer the following questions: a. What were the high and low prices for the past 52 weeks? b. If you owned 3000 shares of Disney stock last year, what dividend did you receive? c. What is the annual return for dividends alone? How does this compare to a bank account offering a 3. 5% interest rate? d. How many shares of Disney were traded yesterday? e. What were the high and low prices for Disney shares yesterday? Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 25

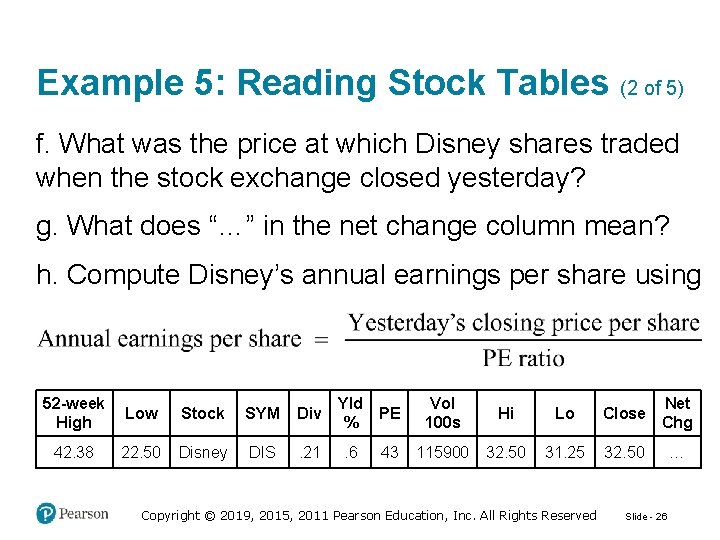

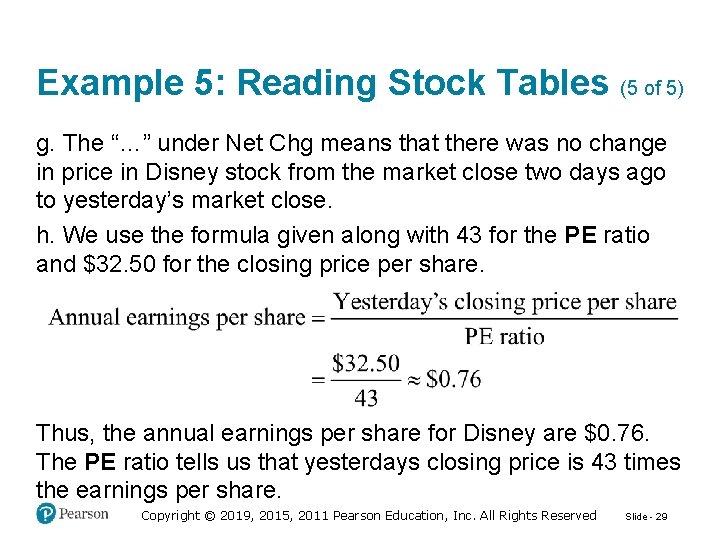

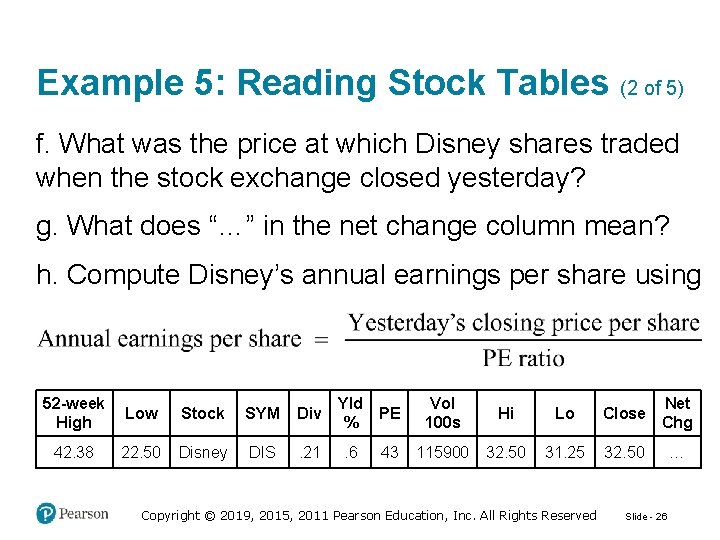

Example 5: Reading Stock Tables (2 of 5) f. What was the price at which Disney shares traded when the stock exchange closed yesterday? g. What does “…” in the net change column mean? h. Compute Disney’s annual earnings per share using 52 -week High Low Stock SYM Div 42. 38 22. 50 Disney DIS . 21 Yld PE %. 6 43 Vol 100 s Hi Lo Close Net Chg 115900 32. 50 31. 25 32. 50 … Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 26

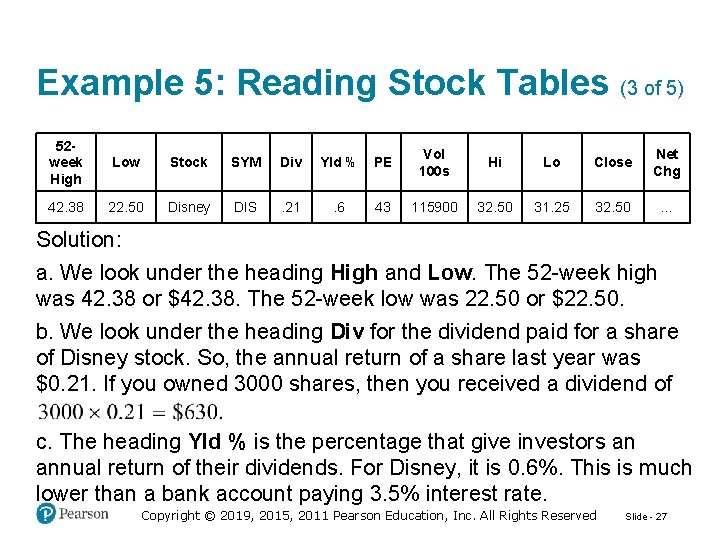

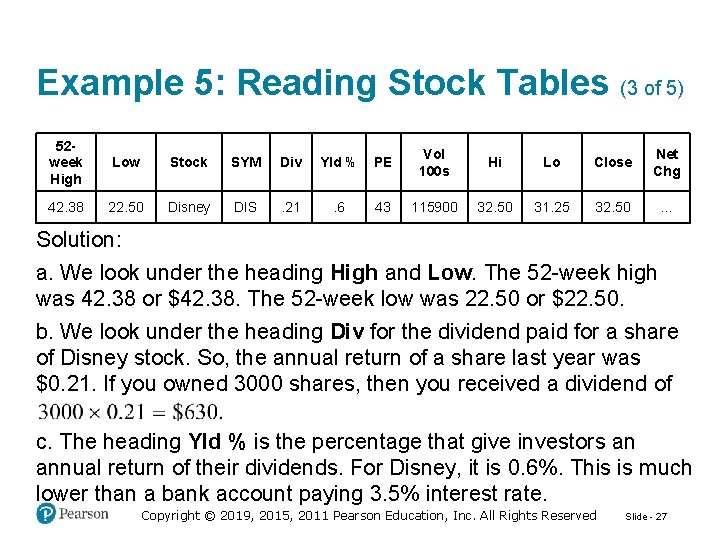

Example 5: Reading Stock Tables (3 of 5) 52 week High Low Stock SYM Div Yld % PE Vol 100 s Hi Lo Close Net Chg 42. 38 22. 50 Disney DIS . 21 . 6 43 115900 32. 50 31. 25 32. 50 … Solution: a. We look under the heading High and Low. The 52 -week high was 42. 38 or $42. 38. The 52 -week low was 22. 50 or $22. 50. b. We look under the heading Div for the dividend paid for a share of Disney stock. So, the annual return of a share last year was $0. 21. If you owned 3000 shares, then you received a dividend of c. The heading Yld % is the percentage that give investors an annual return of their dividends. For Disney, it is 0. 6%. This is much lower than a bank account paying 3. 5% interest rate. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 27

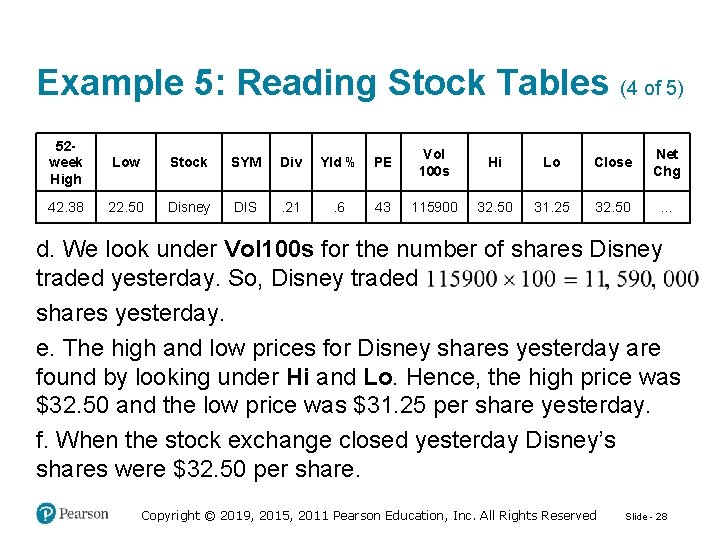

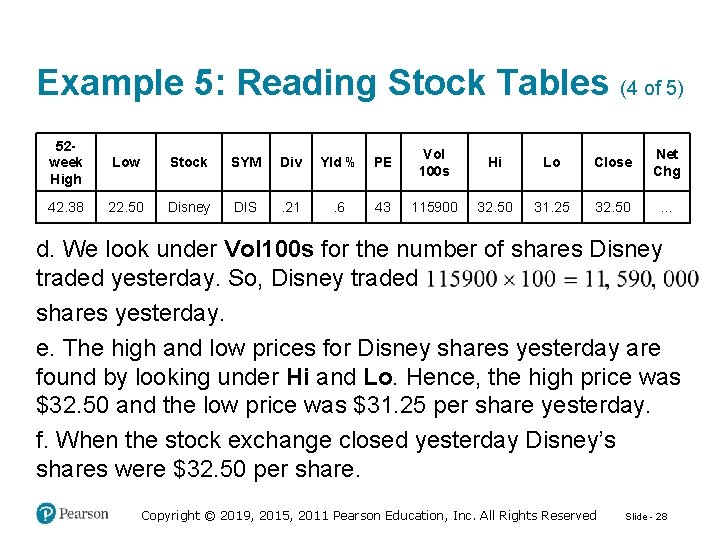

Example 5: Reading Stock Tables (4 of 5) 52 week High Low Stock SYM Div Yld % PE Vol 100 s Hi Lo Close Net Chg 42. 38 22. 50 Disney DIS . 21 . 6 43 115900 32. 50 31. 25 32. 50 … d. We look under Vol 100 s for the number of shares Disney traded yesterday. So, Disney traded shares yesterday. e. The high and low prices for Disney shares yesterday are found by looking under Hi and Lo. Hence, the high price was $32. 50 and the low price was $31. 25 per share yesterday. f. When the stock exchange closed yesterday Disney’s shares were $32. 50 per share. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 28

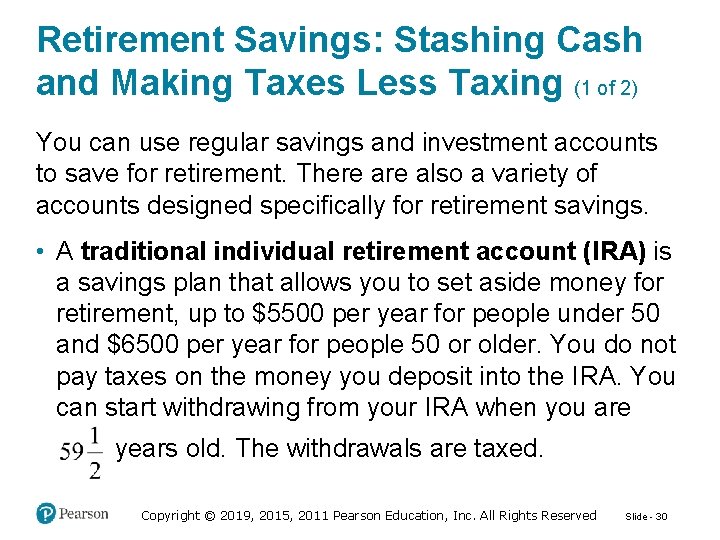

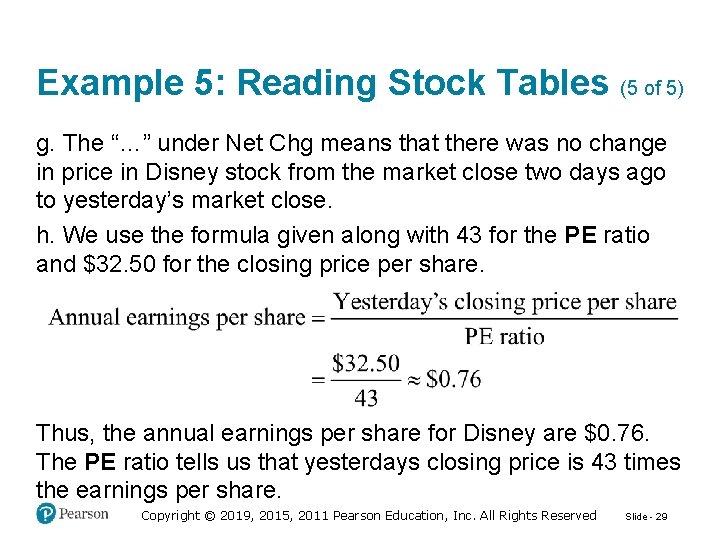

Example 5: Reading Stock Tables (5 of 5) g. The “…” under Net Chg means that there was no change in price in Disney stock from the market close two days ago to yesterday’s market close. h. We use the formula given along with 43 for the PE ratio and $32. 50 for the closing price per share. Thus, the annual earnings per share for Disney are $0. 76. The PE ratio tells us that yesterdays closing price is 43 times the earnings per share. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 29

Retirement Savings: Stashing Cash and Making Taxes Less Taxing (1 of 2) You can use regular savings and investment accounts to save for retirement. There also a variety of accounts designed specifically for retirement savings. • A traditional individual retirement account (IRA) is a savings plan that allows you to set aside money for retirement, up to $5500 per year for people under 50 and $6500 per year for people 50 or older. You do not pay taxes on the money you deposit into the IRA. You can start withdrawing from your IRA when you are years old. The withdrawals are taxed. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 30

Retirement Savings: Stashing Cash and Making Taxes Less Taxing (2 of 2) • A Roth IRA is a type of IRA with slightly different tax benefits. You pay taxes on the money you deposit into the IRA, but then you can withdraw your earnings tax-free when you are years old. Although your contributions are not tax deductible, your earnings are never taxed, even after withdrawal. • Employer-sponsored retirement plans, including 401(k) and 403(b) plans, are set up by the employer, who often makes some contribution to the plan on your behalf. These plans are not offered by all employers and are used to attract high quality employees. Copyright © 2019, 2015, 2011 Pearson Education, Inc. All Rights Reserved Slide - 31