Tax Accounting Standards Income Computation Disclosure Standards ICDS

- Slides: 24

Tax Accounting Standards Income Computation & Disclosure Standards (ICDS) Ameya Kunte – Taxsutra 30 April 2016 WWW. TAXSUTRA. COM

ICDS – Background • Section 145 of the Income Tax Act, 1961 gives power to Government to notify accounting standards to be followed by any class of taxpayers or in respect of any class of income • Two prescribed tax accounting standards notified since 1996 • Disclosure of Accounting Policies and • Disclosure of Prior Period and Extraordinary Items and Changes in Accounting Policies WWW. TAXSUTRA. COM

ICDS Background • Accounting scenario – • ICAI has notified 32 accounting standards • 39 - IND-AS (India’s effort to converge with International Financial Reporting Standard - IFRS !) • December 2010 – Government committee to study harmonization accounting standards with Income Tax Act and • To suggest method for addressing MAT issue in transitional year of convergence to IFRS • To suggest appropriate amendments to the ITA in view of transition to Ind-AS regime WWW. TAXSUTRA. COM

2012 Draft TAS Report • August 2012 – 14 draft standards announced • Suitable amendments to IT Act to provide certainty on the following issues: • Depreciation on goodwill arising on amalgamation. • Allowability of the provision made for the payment of pension on retirement or termination of an employee. • Separate Tax Accounting Standards covering the areas not covered by ICAI AS • Share-based payment. • Revenue recognition by real estate developers. • Service concession arrangements (e. g. , BOT agreements). • Exploration for and evaluation of mineral resources. • No TAS in respect of 17 ICAI AS WWW. TAXSUTRA. COM

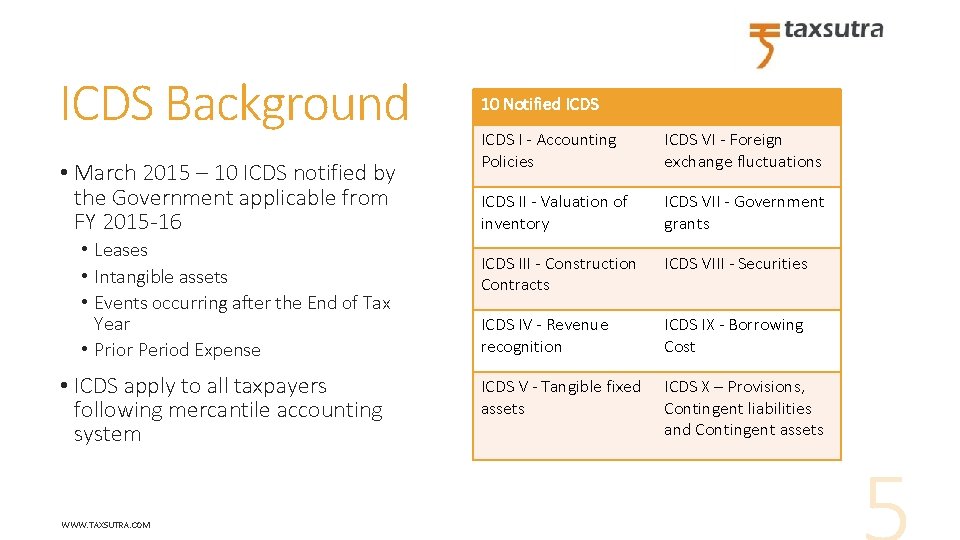

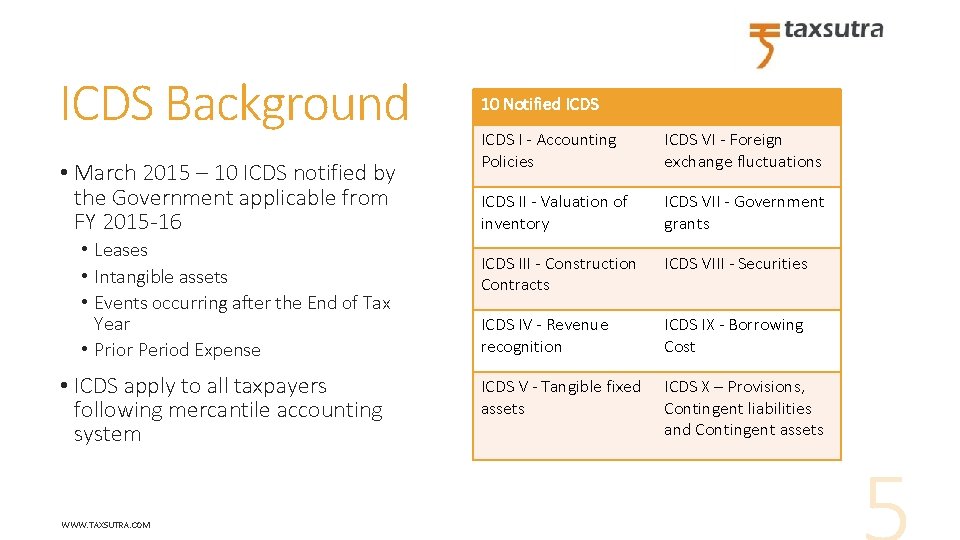

ICDS Background • March 2015 – 10 ICDS notified by the Government applicable from FY 2015 -16 • Leases • Intangible assets • Events occurring after the End of Tax Year • Prior Period Expense • ICDS apply to all taxpayers following mercantile accounting system WWW. TAXSUTRA. COM 10 Notified ICDS I - Accounting Policies ICDS VI - Foreign exchange fluctuations ICDS II - Valuation of inventory ICDS VII - Government grants ICDS III - Construction Contracts ICDS VIII - Securities ICDS IV - Revenue recognition ICDS IX - Borrowing Cost ICDS V - Tangible fixed assets ICDS X – Provisions, Contingent liabilities and Contingent assets

ICDS Concept • ICDS relevant only for income computation • No separate books of account necessary • Minimum Alternate Tax (MAT) shall apply on book profits (as per GAAP) • Income Tax Act to prevail where ICDS is in conflict • SC judgment is law of the land • The risk of best judgment assessment u/s 144 if positions adopted as per ICDS which is contrary to rulings. WWW. TAXSUTRA. COM

Simplification Committee on ICDS ! • Simplification Committee – 1 st report of 15 Jan 2016 suggests deferment of ICDS • Taxpayers grappling with regulatory changes of the Companies Act, 2013, Ind-AS and GST • Industry should be allowed more time to deal with another change of this nature • Taxpayers feel that many of the provisions of the ICDS are capable of generating a legal debate about which at present there is no clarity. • Multiple accounting methods - for accounts and other for tax purposes, creates confusion, interpretation issues, multiplicity of records and additional compliance burden • These outweigh gains to be obtained by ICDS application • ICDS at best brings timing difference on recognition of income or expense • Fuller study of ICDS implications necessary before it is implemented WWW. TAXSUTRA. COM

High level impact areas • Prescriptive approach • No harmony sought in Accounting and Tax • Delegated legislation on ICDS • Immediate impact on tax cash flow • No likely impact on EPS due to deferred tax WWW. TAXSUTRA. COM

Analysis of ICDS WWW. TAXSUTRA. COM

ICDS I - Accounting Policies • Concept of prudence modified and Concept of materiality removed • ICDS prohibits marked to market or expected loss recognition • Exceptions - marked to market forex loss on monetary items, inventory valuation etc. • ICDS silent on MTM gains • No likely significant tax impact - In absence of materiality concept, considerable time and cost will be involved making trivial adjustments in net profit as per books of accounts to arrive at PGBP since authorities may insist on strict application of ICDS even on small value items. WWW. TAXSUTRA. COM

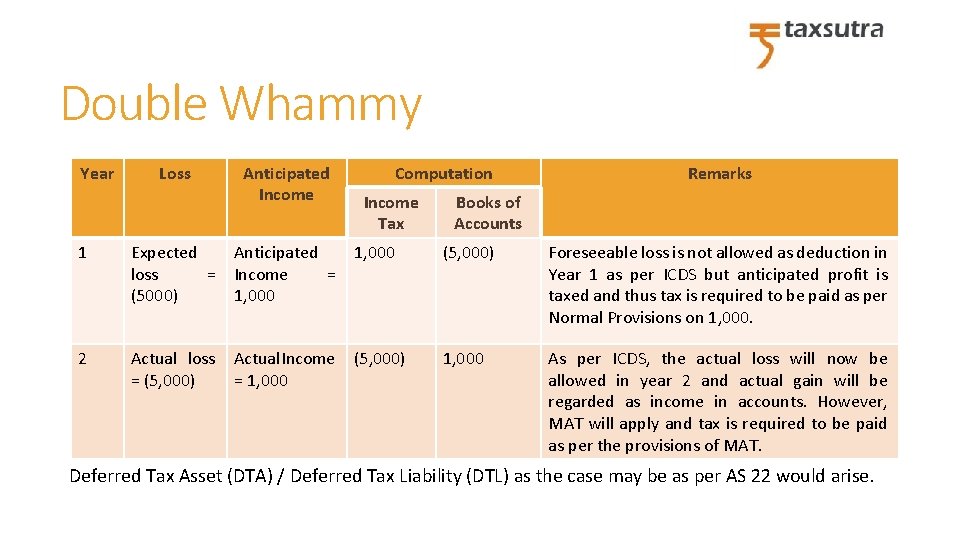

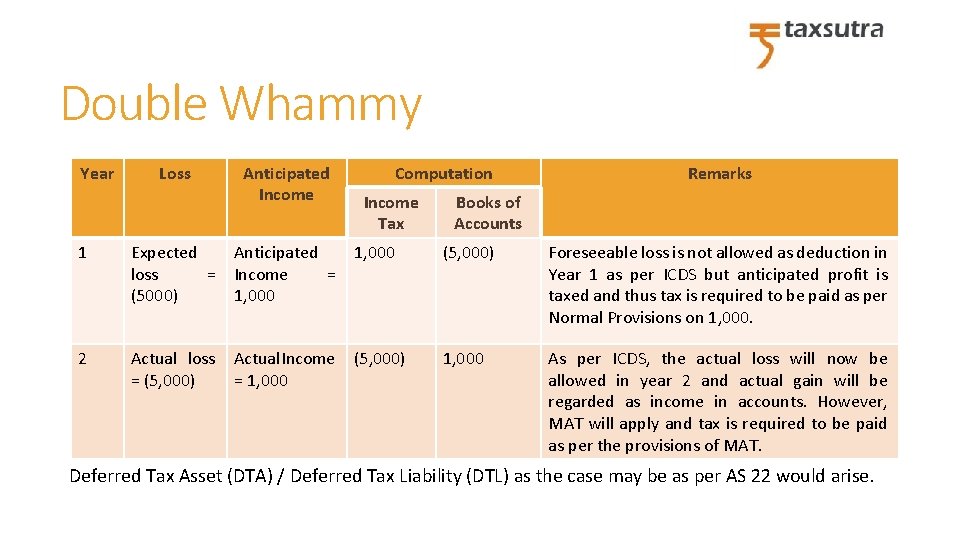

Double Whammy Year Loss Anticipated Income Computation Income Tax Remarks Books of Accounts 1 Expected loss = (5000) Anticipated Income = 1, 000 (5, 000) Foreseeable loss is not allowed as deduction in Year 1 as per ICDS but anticipated profit is taxed and thus tax is required to be paid as per Normal Provisions on 1, 000. 2 Actual loss = (5, 000) Actual Income = 1, 000 (5, 000) 1, 000 As per ICDS, the actual loss will now be allowed in year 2 and actual gain will be regarded as income in accounts. However, MAT will apply and tax is required to be paid as per the provisions of MAT. Deferred Tax Asset (DTA) / Deferred Tax Liability (DTL) as the case may be as per AS 22 would arise.

ICDS II - Valuation of inventory • Inventories shall be valued at cost or net realizable value, whichever is lower • NRV = estimated selling price in the ordinary course of business less the estimated costs of completion and the estimated costs necessary to make the sale. • NRV to be determined item – by- item basis • Exclusions from application of ICDS • WIP arising under ‘construction contract’ including directly related service contract • Shares, debentures and other financial instruments held as stock-in-trade • Producers’ inventories of livestock, agriculture and forest products, mineral oils, ores & gases to the extent that they are measured at net realisable value; • Machinery spares WWW. TAXSUTRA. COM

ICDS II - Valuation of inventory • Cost of Inventory shall comprise of cost of purchase, cost of services, costs of conversion and other costs incurred in bringing the inventories to their present location and condition. • Costs of purchase shall consist of purchase price including duties and taxes, freight inwards and other expenditure directly attributable to the acquisition. Trade discounts, rebates and other similar items shall be deducted in determining the costs of purchase. WWW. TAXSUTRA. COM

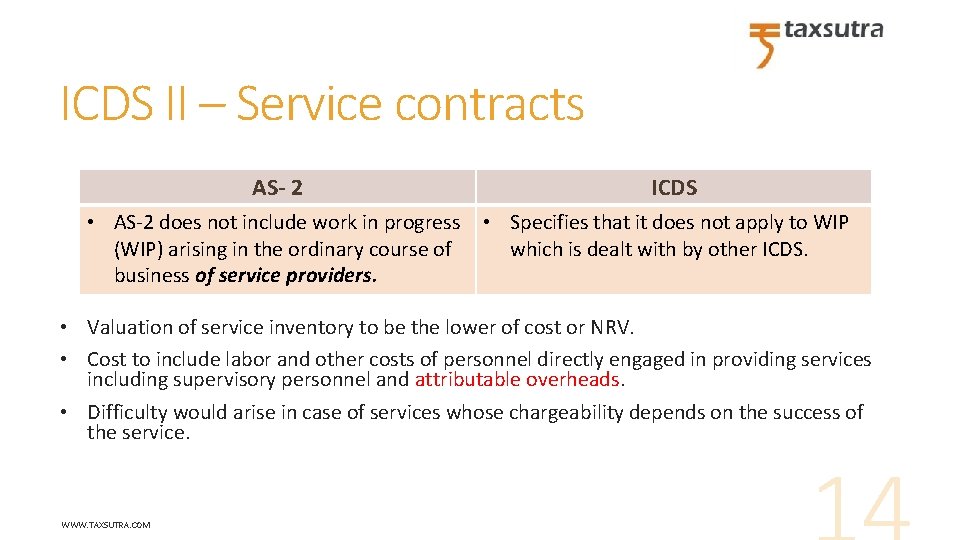

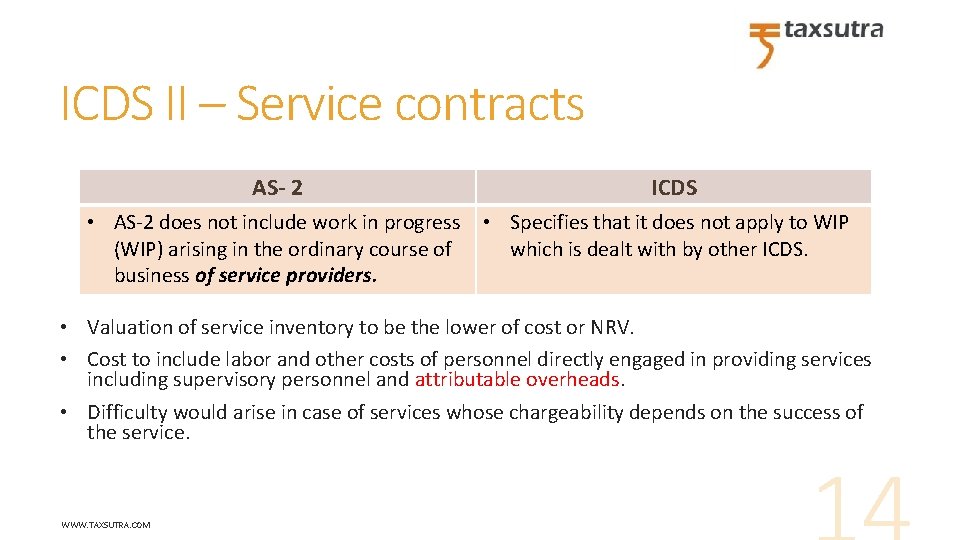

ICDS II – Service contracts AS- 2 ICDS • AS-2 does not include work in progress • Specifies that it does not apply to WIP (WIP) arising in the ordinary course of which is dealt with by other ICDS. business of service providers. • Valuation of service inventory to be the lower of cost or NRV. • Cost to include labor and other costs of personnel directly engaged in providing services including supervisory personnel and attributable overheads. • Difficulty would arise in case of services whose chargeability depends on the success of the service. WWW. TAXSUTRA. COM

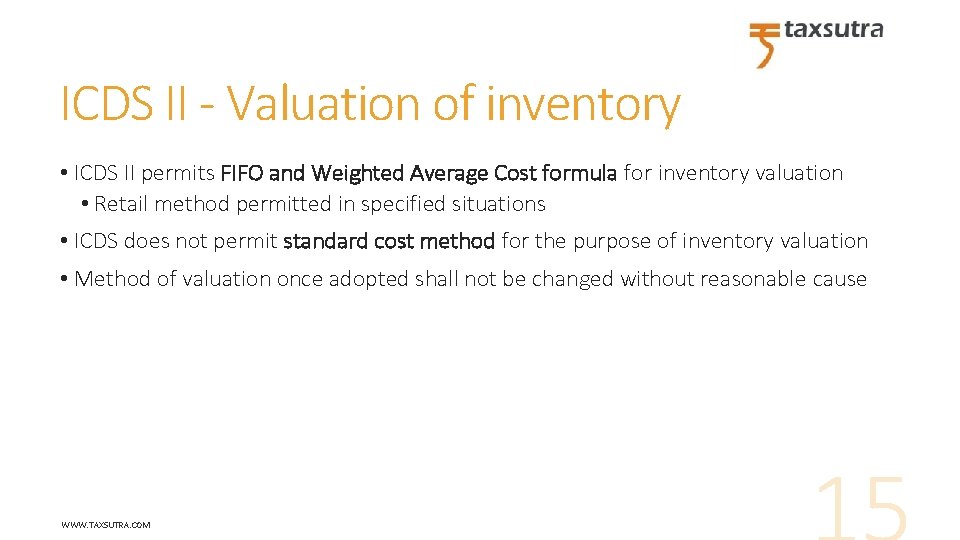

ICDS II - Valuation of inventory • ICDS II permits FIFO and Weighted Average Cost formula for inventory valuation • Retail method permitted in specified situations • ICDS does not permit standard cost method for the purpose of inventory valuation • Method of valuation once adopted shall not be changed without reasonable cause WWW. TAXSUTRA. COM

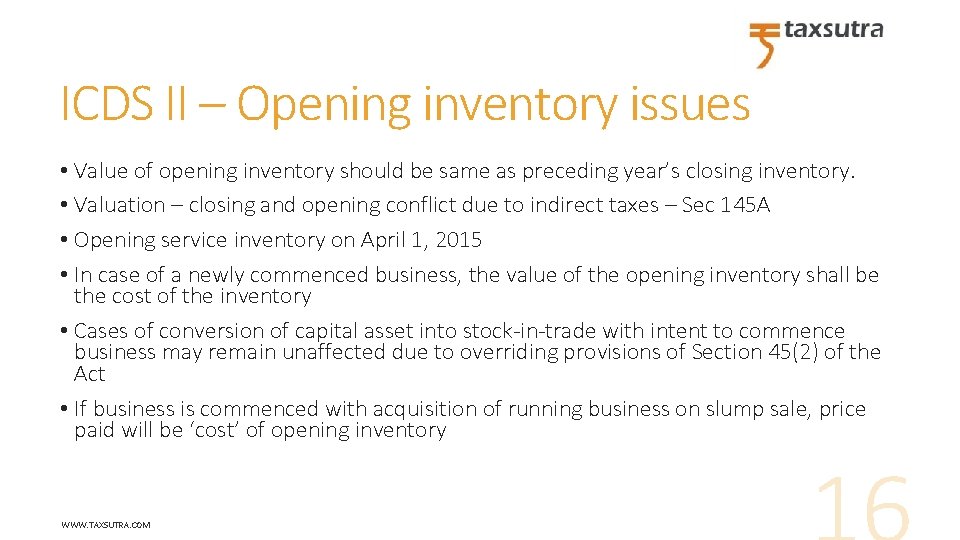

ICDS II – Opening inventory issues • Value of opening inventory should be same as preceding year’s closing inventory. • Valuation – closing and opening conflict due to indirect taxes – Sec 145 A • Opening service inventory on April 1, 2015 • In case of a newly commenced business, the value of the opening inventory shall be the cost of the inventory • Cases of conversion of capital asset into stock-in-trade with intent to commence business may remain unaffected due to overriding provisions of Section 45(2) of the Act • If business is commenced with acquisition of running business on slump sale, price paid will be ‘cost’ of opening inventory WWW. TAXSUTRA. COM

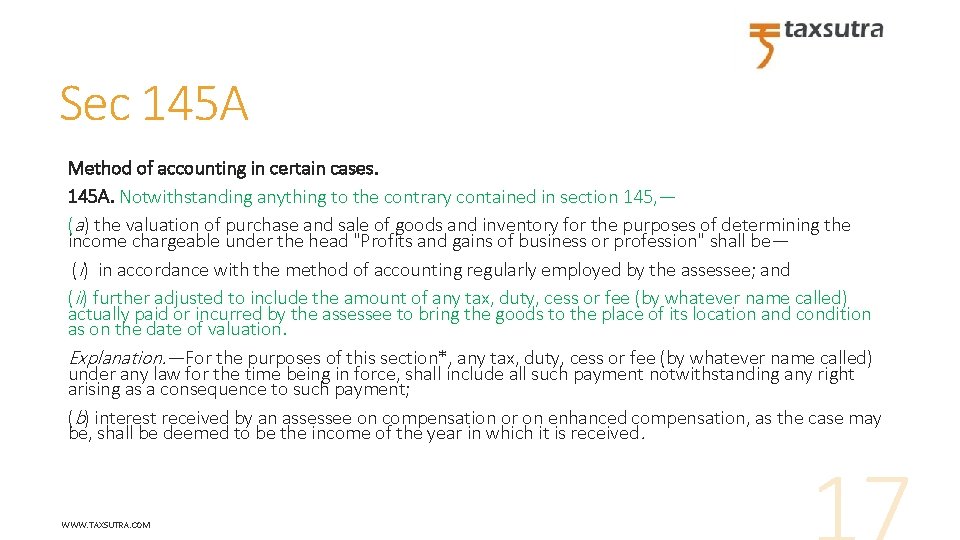

Sec 145 A Method of accounting in certain cases. 145 A. Notwithstanding anything to the contrary contained in section 145, — (a ) the valuation of purchase and sale of goods and inventory for the purposes of determining the income chargeable under the head "Profits and gains of business or profession" shall be— (i) in accordance with the method of accounting regularly employed by the assessee; and (ii) further adjusted to include the amount of any tax, duty, cess or fee (by whatever name called) actually paid or incurred by the assessee to bring the goods to the place of its location and condition as on the date of valuation. Explanation. —For the purposes of this section*, any tax, duty, cess or fee (by whatever name called) under any law for the time being in force, shall include all such payment notwithstanding any right arising as a consequence to such payment; (b) interest received by an assessee on compensation or on enhanced compensation, as the case may be, shall be deemed to be the income of the year in which it is received. WWW. TAXSUTRA. COM

ICDS II – Valuation in dissolution cases • In case of dissolution of a partnership firm or association of person or body of individuals, notwithstanding whether business is discontinued or not, the inventory on the date of dissolution shall be valued at the net realizable value. • No specific provision for allowing such NRV as the cost to the successor of the business. • Also this is contrary to law settled by Apex court in the case of Sakthi Trading Co. v. CIT WWW. TAXSUTRA. COM

ICDS – Inventory and borrowing costs • ICDS IX – Qualifying asset for ‘Borrowing Cost’ capitalisation purposes include inventories • Inventories – that require 12 months or more to bring them to saleable condition • Capitalisation means addition of borrowing cost to the cost of inventory (para 4) • Cessation of capitalisation for inventory - when substantially all activities necessary to prepare it for its intended sale are complete • Construction of qualifying asset is completed in part and a completed part is capable of being used while construction continues for the other parts , capitalisation of borrowing costs shall cease in relation to a part , when substantially all the activities to prepare such part of inventory for its intended sale are complete. WWW. TAXSUTRA. COM

ICDS X – Provisions, Contingent liabilities and Contingent assets • A provision should be recognized when – A person has a present obligation as a result of a past event; – It is “reasonably certain” that an outflow of resources embodying economic benefits will be required to settle the obligation; and – A reliable estimate can be made of the obligation amount. • However, as per AS-29, provision is recognized when outflow of resources is “probable” and not when it is ‘reasonably certain’. • Is “reasonably certain” same as “probable”? WWW. TAXSUTRA. COM

ICDS X – Provisions • Provision for Warranty is allowed as an expenditure upholding the test of ‘probable’ warranty obligation in many judgments. • Rotork Controls India P. Ltd. (2009) 314 ITR 62 (SC) “A provision to qualify for recognition, there must be a present obligation arising from past events, settlement of which is expected to result in an outflow of resources and in respect of which a reliable estimate of amount of obligation is possible. ” “If historical trend indicates that in past large number of sophisticated goods were being manufactured and defects existed in some of items manufactured and sold, then provision made for warranty in respect of army of such sophisticated goods would be entitled to deduction from gross receipts under section 37(1), provided data is systematically maintained by assessee. ” WWW. TAXSUTRA. COM

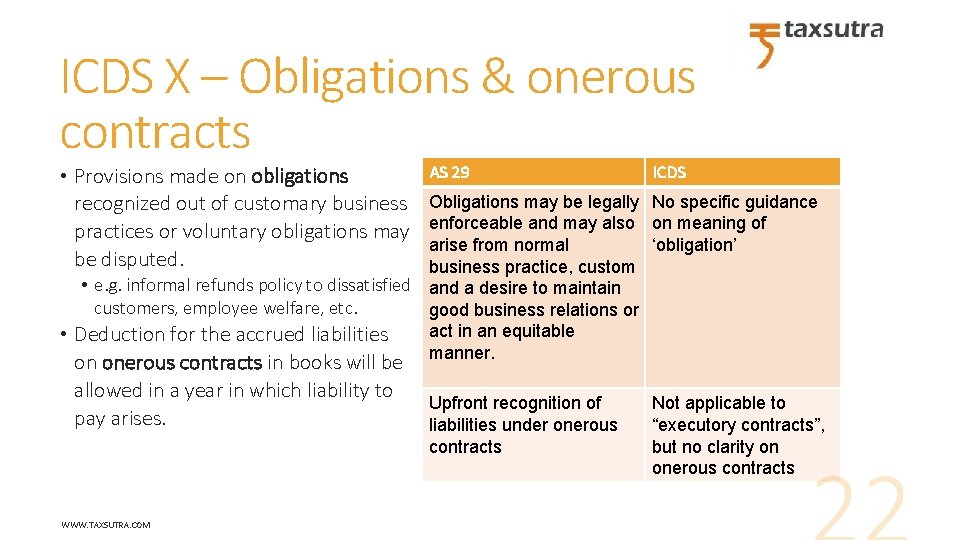

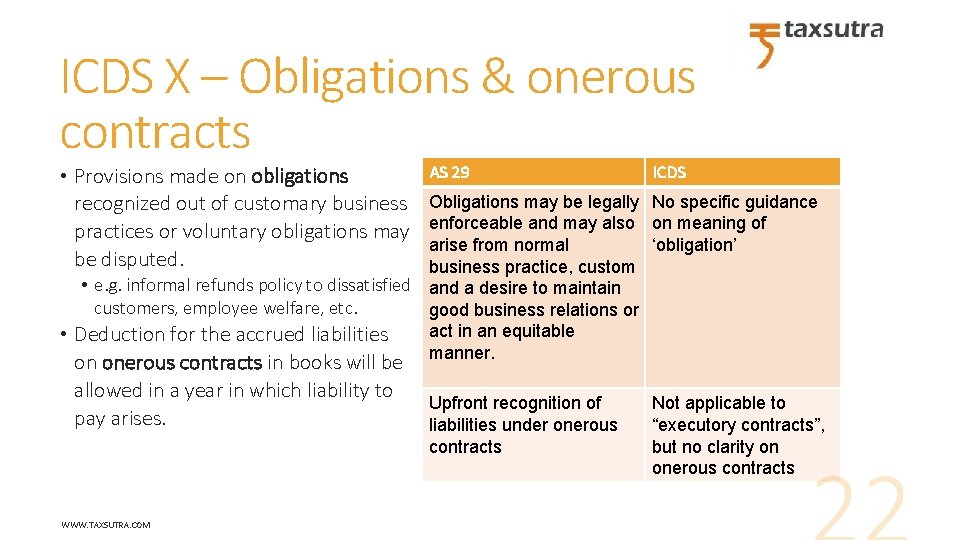

ICDS X – Obligations & onerous contracts • Provisions made on obligations recognized out of customary business practices or voluntary obligations may be disputed. • AS 29 ICDS Obligations may be legally No specific guidance enforceable and may also on meaning of arise from normal ‘obligation’ business practice, custom • e. g. informal refunds policy to dissatisfied and a desire to maintain customers, employee welfare, etc. good business relations or act in an equitable Deduction for the accrued liabilities manner. on onerous contracts in books will be allowed in a year in which liability to pay arises. WWW. TAXSUTRA. COM Upfront recognition of liabilities under onerous contracts Not applicable to “executory contracts”, but no clarity on onerous contracts

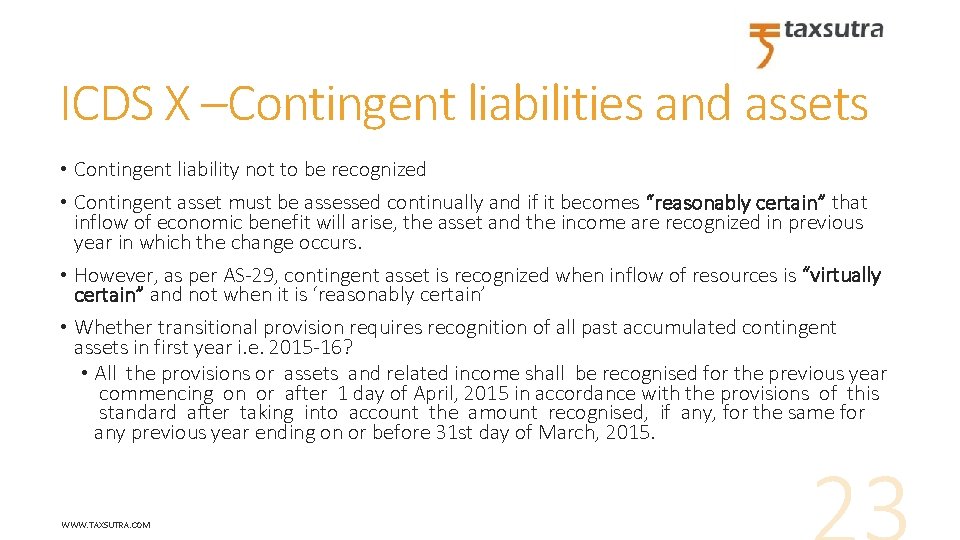

ICDS X –Contingent liabilities and assets • Contingent liability not to be recognized • Contingent asset must be assessed continually and if it becomes “reasonably certain” that inflow of economic benefit will arise, the asset and the income are recognized in previous year in which the change occurs. • However, as per AS-29, contingent asset is recognized when inflow of resources is “virtually certain” and not when it is ‘reasonably certain’ • Whether transitional provision requires recognition of all past accumulated contingent assets in first year i. e. 2015 -16? • All the provisions or assets and related income shall be recognised for the previous year commencing on or after 1 day of April, 2015 in accordance with the provisions of this standard after taking into account the amount recognised, if any, for the same for any previous year ending on or before 31 st day of March, 2015. WWW. TAXSUTRA. COM

Thank you Ameya Kunte Executive Editor and Co-founder - Taxsutra +91 9823038088 ameya. kunte@taxsutra. com Views are personal. WWW. TAXSUTRA. COM

Disclosure as per icds

Disclosure as per icds Computation of mcit

Computation of mcit Income tax computation format

Income tax computation format Income tax computation format

Income tax computation format Carrying value formula

Carrying value formula Deferred tax asset journal entry

Deferred tax asset journal entry Platinum ambassador herbalife salary

Platinum ambassador herbalife salary Expanded withholding tax computation

Expanded withholding tax computation Expanded withholding tax computation

Expanded withholding tax computation Expanded withholding tax computation

Expanded withholding tax computation 2307 rental sample

2307 rental sample W/tax compensation table

W/tax compensation table Computation of wealth tax

Computation of wealth tax Tripura icds

Tripura icds Icds mis

Icds mis Icds scheme

Icds scheme Icds

Icds Rapid reporting system

Rapid reporting system Full disclosure concept in accounting

Full disclosure concept in accounting Intermediate accounting chapter 1

Intermediate accounting chapter 1 Value added approach formula

Value added approach formula Income statement

Income statement How to file income tax return in winman software

How to file income tax return in winman software Movable assets

Movable assets Features of income tax

Features of income tax