Sampa Video Project Valuation Sampa Video Case This

- Slides: 18

Sampa Video Project Valuation

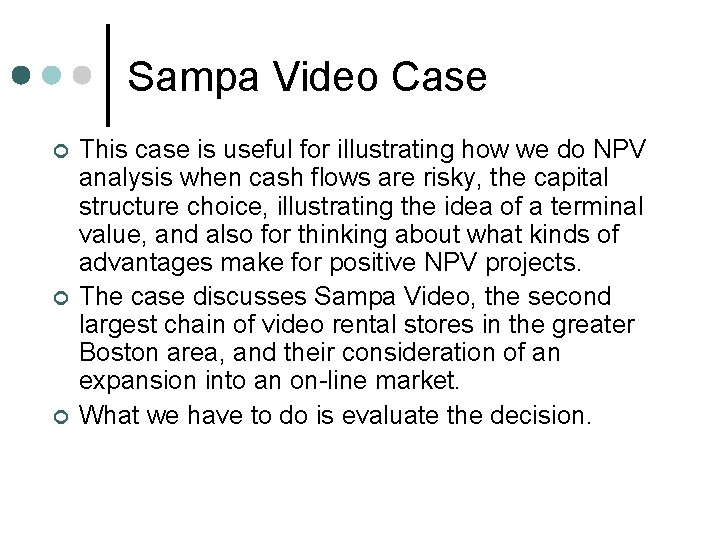

Sampa Video Case ¢ ¢ ¢ This case is useful for illustrating how we do NPV analysis when cash flows are risky, the capital structure choice, illustrating the idea of a terminal value, and also for thinking about what kinds of advantages make for positive NPV projects. The case discusses Sampa Video, the second largest chain of video rental stores in the greater Boston area, and their consideration of an expansion into an on-line market. What we have to do is evaluate the decision.

Sampa Video – History ¢ ¢ Sampa began as a small store in Harvard Square catering mostly to students. The company expanded quickly, largely due to its reputation for customer service and its extensive selection of foreign and independent films. In March of 2001 Sampa was considering entering into the business of home delivery of videos. This follows on the heals of rumors of similar considerations by Blockbuster and the appearance of internet based competitors (Kramer. com and City. Retrieve. com).

Expectations ¢ ¢ ¢ The project was expected to increase its annual revenue growth rate from 5% to 10% a year over the next 5 years. Subsequent to this, the free cash flow from the home delivery unit was expected to grow at the same 5% rate that was typical of the video rental industry as a whole. Up-front investment required for delivery vehicles, developing the necessary website, and marketing efforts were expected to run $1. 5 M.

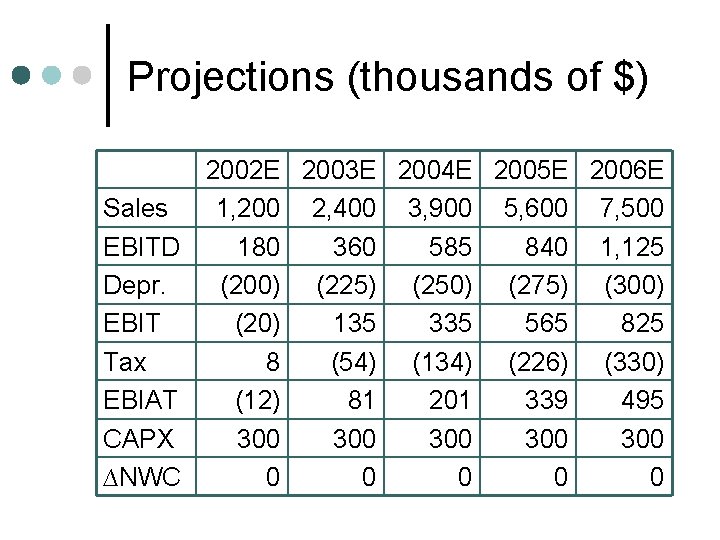

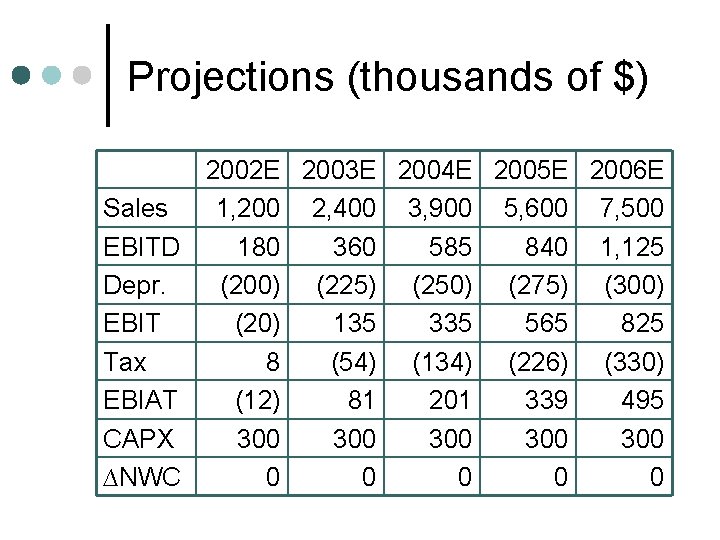

Projections (thousands of $) 2002 E 2003 E 2004 E 2005 E 2006 E Sales 1, 200 2, 400 3, 900 5, 600 7, 500 EBITD 180 360 585 840 1, 125 Depr. (200) (225) (250) (275) (300) EBIT (20) 135 335 565 825 Tax 8 (54) (134) (226) (330) EBIAT (12) 81 201 339 495 CAPX 300 300 300 ∆NWC 0 0 0

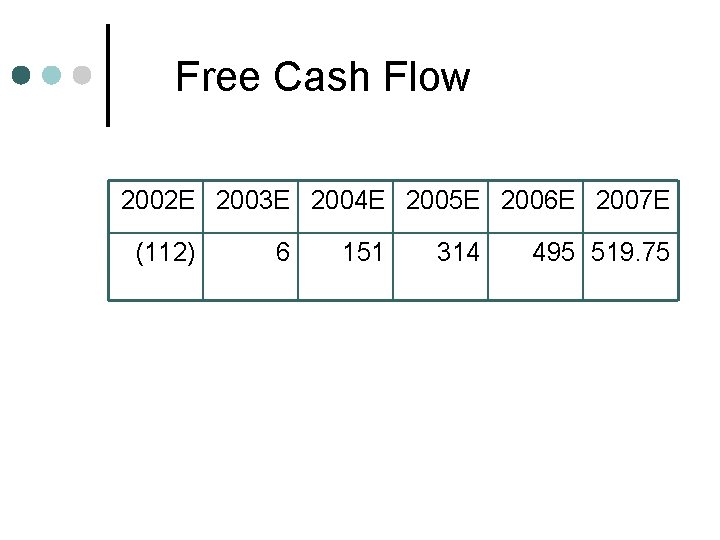

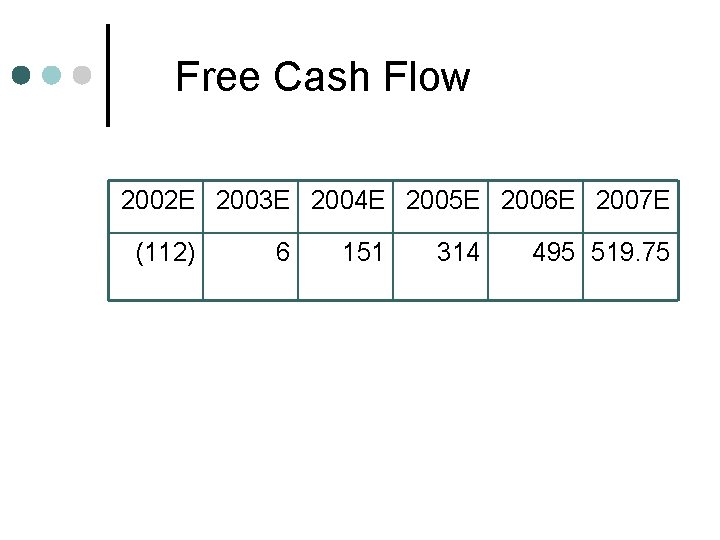

Free Cash Flow 2002 E 2003 E 2004 E 2005 E 2006 E 2007 E (112) 6 151 314 495 519. 75

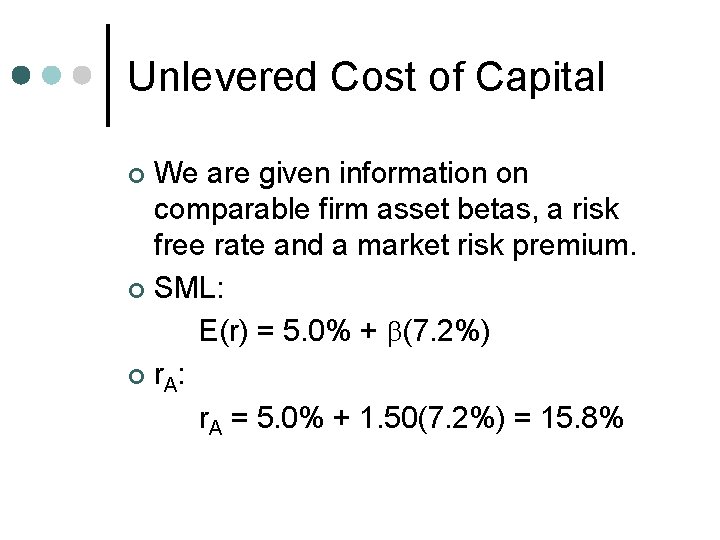

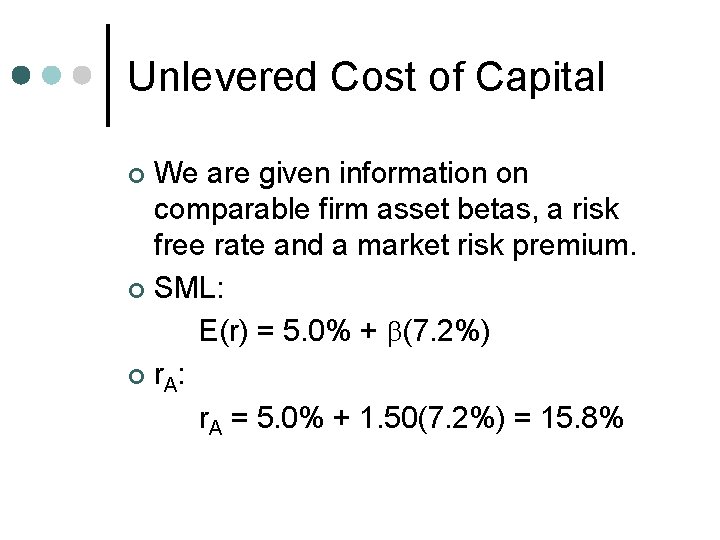

Unlevered Cost of Capital We are given information on comparable firm asset betas, a risk free rate and a market risk premium. ¢ SML: E(r) = 5. 0% + (7. 2%) ¢ r. A : r. A = 5. 0% + 1. 50(7. 2%) = 15. 8% ¢

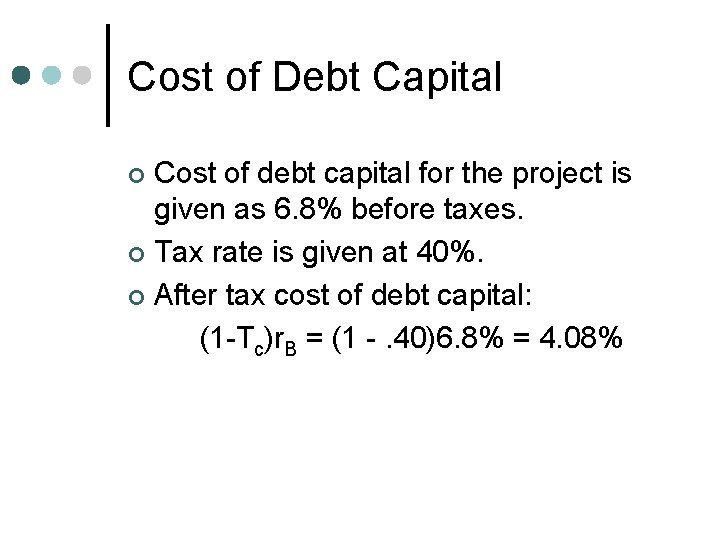

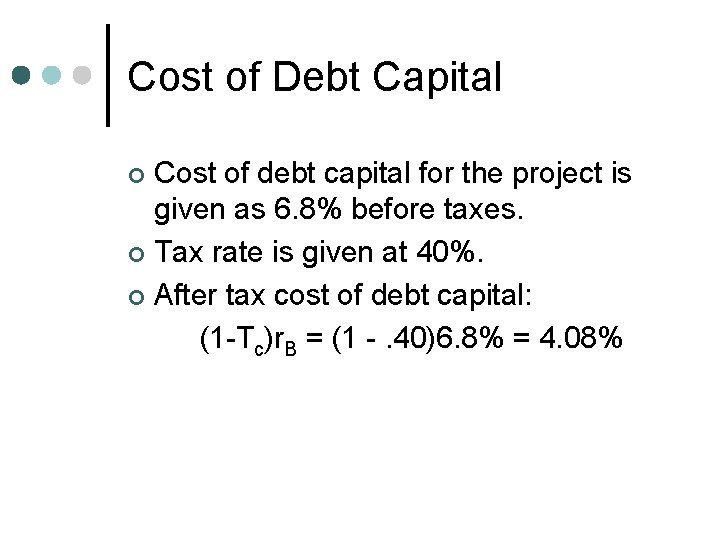

Cost of Debt Capital Cost of debt capital for the project is given as 6. 8% before taxes. ¢ Tax rate is given at 40%. ¢ After tax cost of debt capital: (1 -Tc)r. B = (1 -. 40)6. 8% = 4. 08% ¢

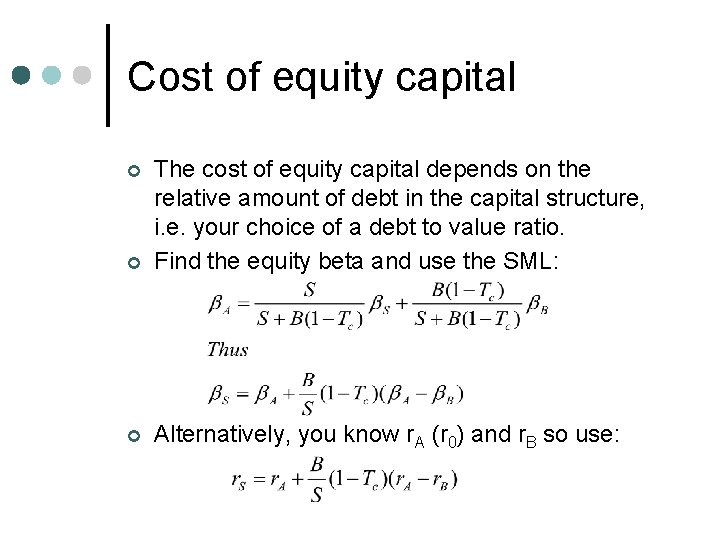

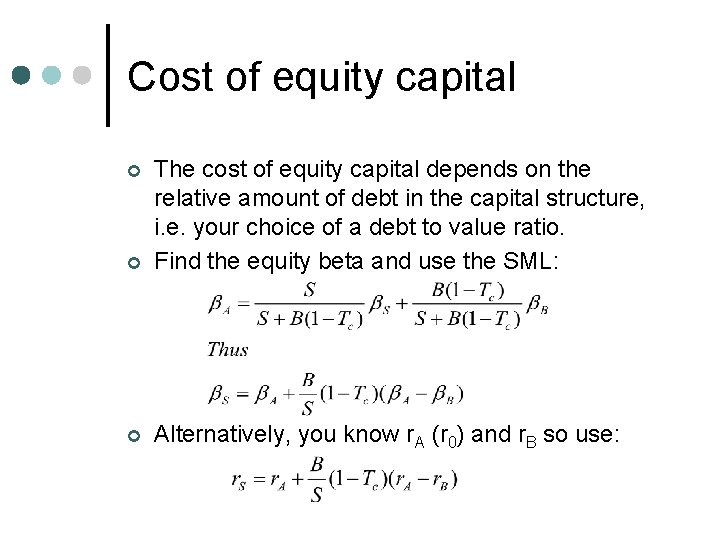

Cost of equity capital ¢ The cost of equity capital depends on the relative amount of debt in the capital structure, i. e. your choice of a debt to value ratio. Find the equity beta and use the SML: ¢ Alternatively, you know r. A (r 0) and r. B so use: ¢

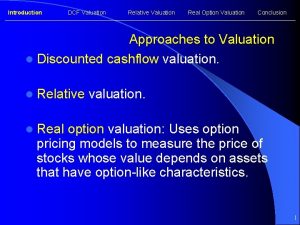

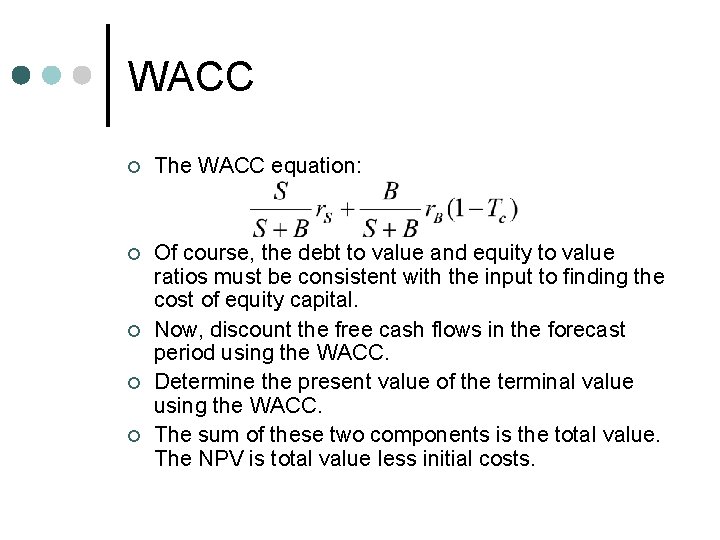

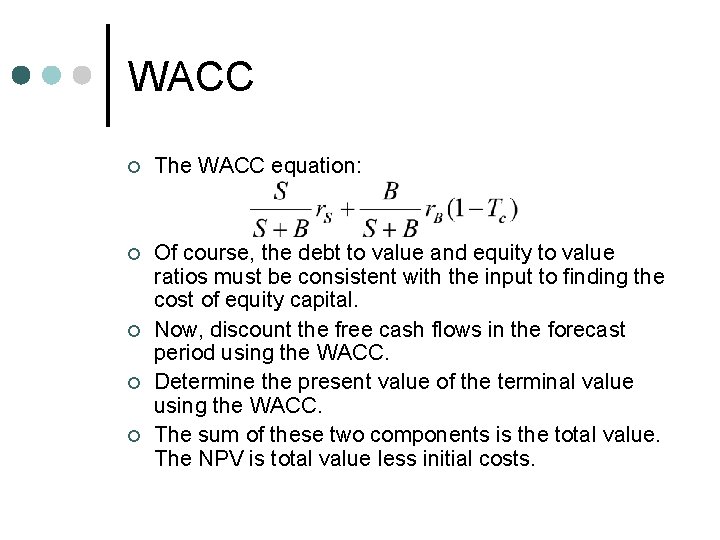

WACC ¢ The WACC equation: ¢ Of course, the debt to value and equity to value ratios must be consistent with the input to finding the cost of equity capital. Now, discount the free cash flows in the forecast period using the WACC. Determine the present value of the terminal value using the WACC. The sum of these two components is the total value. The NPV is total value less initial costs. ¢ ¢ ¢

APV Value the free cash flows in the forecast period using the cost of capital of the assets. ¢ Find the present value of the terminal value using this same discount rate. ¢ The sum of these components is the unlevered total value. ¢ Add the value of the debt tax shields to find the levered total value. ¢

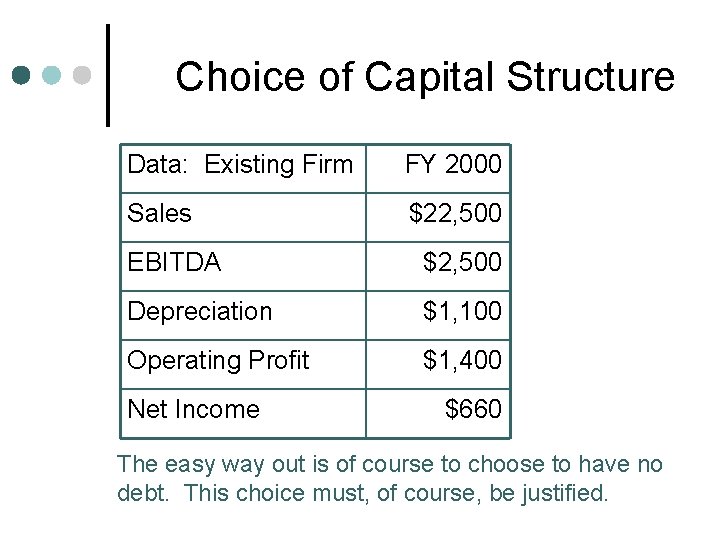

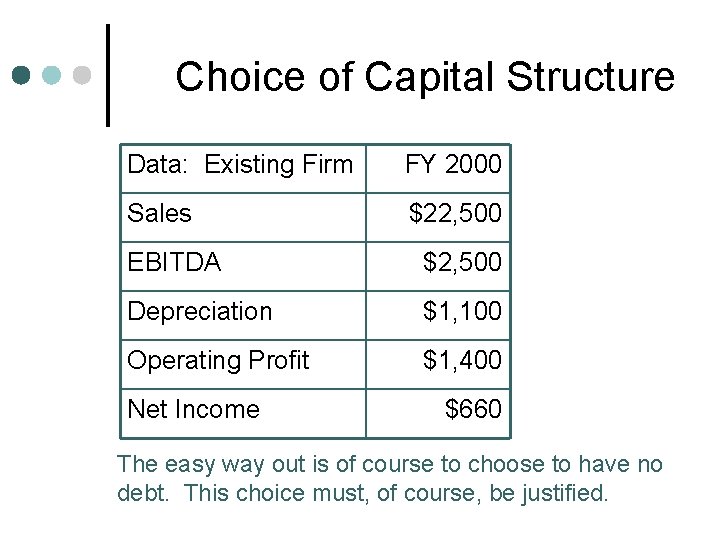

Choice of Capital Structure Data: Existing Firm FY 2000 Sales $22, 500 EBITDA $2, 500 Depreciation $1, 100 Operating Profit $1, 400 Net Income $660 The easy way out is of course to choose to have no debt. This choice must, of course, be justified.

NPV – No Debt Value the free cash flows in the forecast period using the cost of capital we derived. ¢ Find the present value of the terminal value using this same discount rate. ¢ The sum of these components is the unlevered total value. ¢

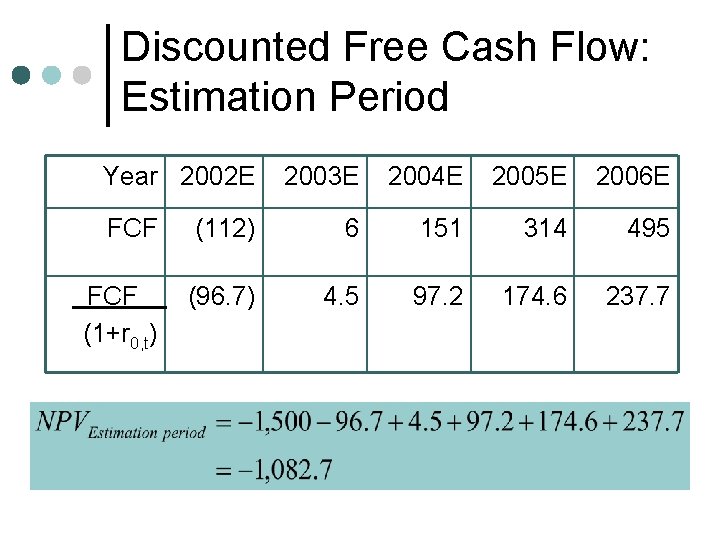

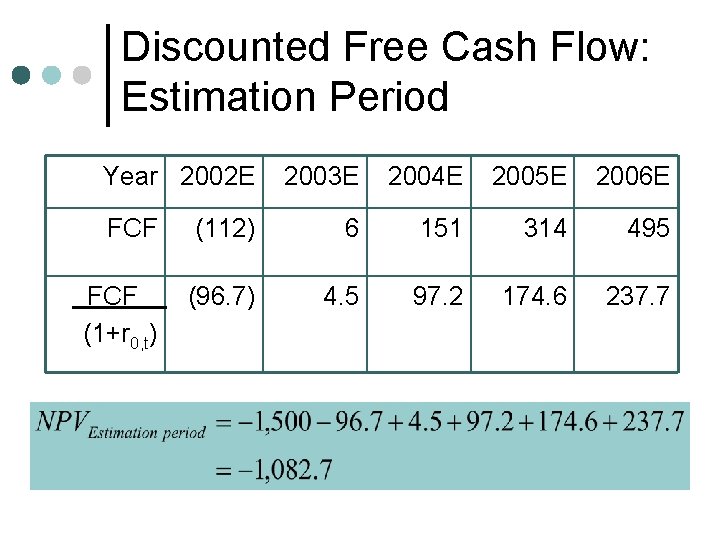

Discounted Free Cash Flow: Estimation Period Year 2002 E 2003 E 2004 E 2005 E 2006 E FCF (112) 6 151 314 495 FCF (1+r 0, t) (96. 7) 4. 5 97. 2 174. 6 237. 7

Terminal Value Calculation ¢ ¢ ¢ The project is not expected to end at 2006. We are told that management expects free cash flow to increase at 5% per year after 2006. This makes the estimated 2007 free cash flow value equal to $519. 75. We can now value the “rest of the life of this project” (under the assumption its life span is “forever”) using a growing perpetuity formula.

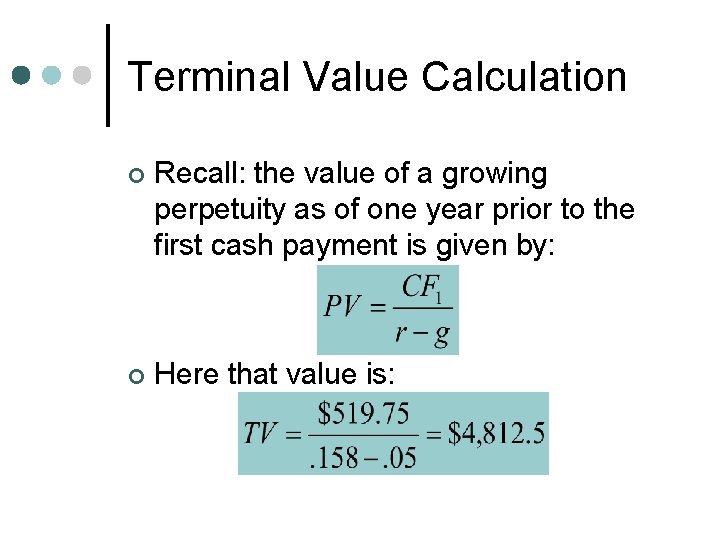

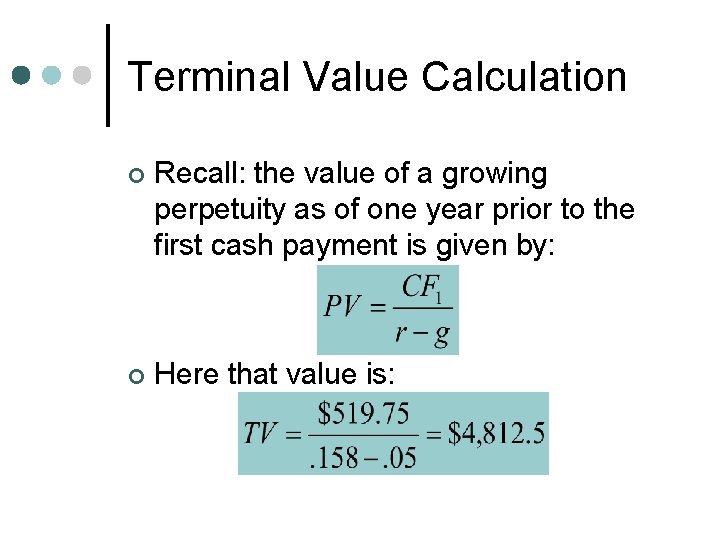

Terminal Value Calculation ¢ Recall: the value of a growing perpetuity as of one year prior to the first cash payment is given by: ¢ Here that value is:

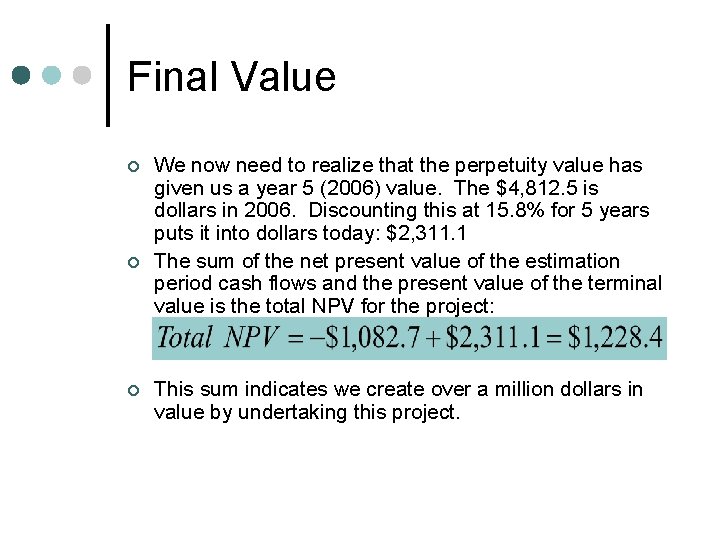

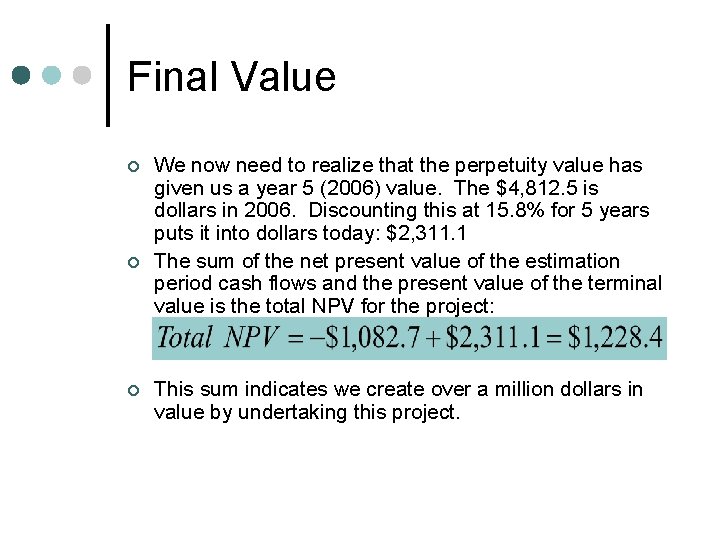

Final Value ¢ ¢ ¢ We now need to realize that the perpetuity value has given us a year 5 (2006) value. The $4, 812. 5 is dollars in 2006. Discounting this at 15. 8% for 5 years puts it into dollars today: $2, 311. 1 The sum of the net present value of the estimation period cash flows and the present value of the terminal value is the total NPV for the project: This sum indicates we create over a million dollars in value by undertaking this project.

Cautions Estimates like this are only as good as the projections that go into them. ¢ Are there any issues? ¢ l ¢ How does their competitive advantage translate to the new arena? What if I told you that it takes over 11 years of operation at these estimated levels to make the project a positive NPV project (discounted payback period calculation)?

Sampa capital

Sampa capital Sampa video inc case solution

Sampa video inc case solution Fixed income valuation methods

Fixed income valuation methods Best worst and average case

Best worst and average case Plant and machinery valuation report

Plant and machinery valuation report Fuentes proteicas

Fuentes proteicas Planeja sampa

Planeja sampa Yandex ru video search text video

Yandex ru video search text video Yahoo gravity

Yahoo gravity Httptw

Httptw The frame size of a video refers to the video’s

The frame size of a video refers to the video’s Use case diagram for video rental system

Use case diagram for video rental system Difference between short case and long case

Difference between short case and long case Linear search big o notation

Linear search big o notation Glennan building cwru

Glennan building cwru Bubble sort best case and worst case

Bubble sort best case and worst case Crm failure case study

Crm failure case study Bubble sort best case and worst case

Bubble sort best case and worst case Bubble sort best case and worst case

Bubble sort best case and worst case