Risk Management Helping Rice Farmers Cope with Risk

- Slides: 24

Risk Management: Helping Rice Farmers Cope with Risk Sumiter Singh Broca, Policy Officer, ESP Group 2 nd ERAG Consultation on Formulation of a Rice Strategy for Asia Bangkok 28 -29 Nov 2013 1

Risks facing smallholder farmers in Asia • Food security is under threat from: – Population growth and demographic changes – Changes in food preferences with rising incomes – Instability in international markets • High and volatile prices – Land degradation and water constraints – Climate change and natural disasters 2

What is risk? • Definition: “Risks are undesirable fluctuations in consumption that are not perfectly predictable. ” (Sinha & Lipton) • The key to determining who bears risk is finding out who will suffer a loss if something bad happens 3

Typology of risks • Poor, rural households face price/market related risks and non market-related risks: 1. Price/market related risks: a. Price shocks 2. Non market-related risks: a. b. c. d. e. f. Crop damage from weather or pests / disease Death of livestock Illness or death of household members Loss of employment or self-employment Natural calamities (drought, flood, fire etc. ) War and other forms of violence, e. g. crime 4

Strategies to deal with risk • Households can respond with a variety of strategies: try to keep income/consumption stable over time – Perhaps at low levels – Risk management strategies seek to minimize fluctuations in income itself – Risk coping strategies try to keep consumption stable in the face of income fluctuations 5

Strategies to deal with risk (cont’d) • Risk management strategies • Diversification of income sources • Negative correlation between incomes from different source • Examples: a. Crop and field diversification b. Diversification of income sources c. Contractual arrangements e. g. sharecropping etc d. Adoption of hardier varieties • Risk coping strategies • Insurance (crop, livestock, weather, health, life) • Savings and credit • Social protection / charity 6

Risk concepts (cont’d) • In practice two sets of strategies cannot be neatly separted • Key point: consumption can be (somewhat) stabilized, but only by accepting low return in exchange for low risk – Wealthy households: can choose more risky strategies and can therefore earn higher returns. – Poor households: forced to choose production technologies that are less risky but earn lower returns • Key point: Therefore policies to help poor rural households manage and cope with risk are also anti-poverty strategies. 7

Risk concepts (cont’d) • Some issues – Moral hazard: People may build houses in flood plains because it’s cheaper. Know that politicians will come to the rescue if house is washed away – Measuring risk: How to decide whether one household faces “more” risk than another, i. e. how to measure extent of risk faced by a household. 8

Vulnerability • “Vulnerability is the likelihood that at a given time in the future, an individual will have a level of welfare below some norm or benchmark. ” Hoddinott and Quisumbing (2003) • The time horizon and welfare measure must be specified for the concept to be well defined • Can be defined at the individual or household level or even community 9

Measuring vulnerability • Vulnerability can be defined as: – Expected poverty (i. e. probability that someone will fall into poverty in the near future) – Low expected utility – Uninsured exposure to risk 10

Example: drought and rice farmers • Pandey, Bhandari and Hardy (2007): – Rice farmers in E India, SE Thailand S China – Larger impact on farmers’ incomes in aggregate in India, less so in Thailand China – Household level impacts were quite severe in all 3 regions – Eastern India: • Household incomes 24 -58 % less in drought years, despite partial compensation from nonfarm income • Coping mechanisms: sale of assets, dipping into savings, borrowing 11

Example: drought and rice farmers • Farm households were unable to: – Keep income reasonably stable – Keep food and other consumption reasonably stable • Reduced number of meals and amount eaten • Even dipped into seed reserves in many cases • Incidence of poverty increased • More vulnerable groups included: – Small farm size – Farms in drought prone upland areas – Fewer working age family members 12

Example: drought and rice farmers • Conclusion: Evidence indicates serious impact of risk on poverty and malnutrition in rice farming households in at least some parts of Asia: – Risk management and coping strategies require resources which smallholders lack by definition – Therefore cannot protect themselves to the desired extent 13

Example: drought and rice farmers • Policies to help farmers implement these strategies are required – Agricultural research – Better technology design – Water resource development • Drought analysis and mapping • Drought relief and long-term mitigation • Drough forecasting and preparedness – Social protection – Crop insurance 14

Example of risk management: agricultural insurance • Does not eliminate risk but pools it • Spreads risk across an industry or economy and through time • Can help households and governments manage natural hazards • More efficient than credit and savings if financial market is little developed • Reduces credit default risk • Facilitates adoption of production innovations 15

Example of risk management: agricultural insurance • Conditions for successful insurance - Statistical independence - Symmetric information - Calculable expected frequency/magnitude of loss - Determinable and measurable losses - Significant potential losses and interest to insure - Limited policyholder control over insured event (moral hazard) - Affordable premiums 16

Example of risk management: agricultural insurance • Impediments to insurance – High administrative cost – Mismatch between preferences and willingness to pay – Inadequate legal/regulatory framework – Distorted incentives – Thin international reinsurance market for some kinds of insurance 17

Example of risk management: agricultural insurance • Lending to Agriculture – High systemic, market and credit risks – Slow return on rural investments – Low profitability of small-holder agriculture – Inability to offer guarantees due to low levels of assets – High cost due to geographical dispersion of clients – Insufficient knowledge about agriculture – Political interference 18

Example of risk management: agricultural insurance • Traditional Insurance Products –Single (named) peril –Multiple peril Actual physical loss or damage is measured infield, and the claim is specific to that field/farmer 19

Example of risk management: agricultural insurance • Innovative insurance products – Crop area yield index insurance – Crop weather index insurance – Livestock mortality index insurance The claim is calculated based on an external index designed to reflect as accurately as possible the loss incurred by the farmer –Crop revenue insurance Protects insured parties from the consequences of low yields, low prices or a combination of both 20

Example of risk management: agricultural insurance • Conclusions – Insurance can only be implemented if insurance companies perceive profitable commercial opportunity to exploit in the medium term –Farmers must perceive that the premiums and expected benefits offers additional value – Insurance will be financially viable without the full support of re-insurers 21

Example of risk management: agricultural insurance • Conclusions (continued) – Essential to promote better on-farm risk management and risk coping strategies – Understand farmer risk attitudes better – Blend insurance with other financial products 22

THANK YOU 23

Specific objectives • Review of available evidence on types of risks faced by smallholder rice farming households in Asia • Analysis of impact on incomes / welfare of these households. • Analysis of risk coping strategies available to and adopted by these households and their dependence on socio-economic variables. • Analysis of the effectiveness of these strategies, together with a review of alternative strategies. • Based on above, recommendations for public policy measures to help these households cope more 24 effectively with risk.

23 helping verbs list

23 helping verbs list Rice risk management

Rice risk management Quality management software for farmers

Quality management software for farmers Market risk credit risk operational risk

Market risk credit risk operational risk Tich miller poem analysis

Tich miller poem analysis Demjanov rearrangement

Demjanov rearrangement Tich miller poet

Tich miller poet Cope level

Cope level Cope certificate

Cope certificate Comprehend cope and connect

Comprehend cope and connect Comprehend cope and connect

Comprehend cope and connect Psoas sogn

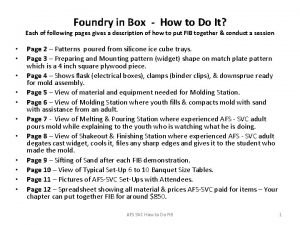

Psoas sogn Drag flask assembly

Drag flask assembly How did china cope with internal division and foreign

How did china cope with internal division and foreign Open or closed form poem

Open or closed form poem Diels alder

Diels alder Cope elimination

Cope elimination Rules for mad gab

Rules for mad gab Mini-cope podskale

Mini-cope podskale Do you think rowdy and junior will remain friends

Do you think rowdy and junior will remain friends Fiduciary investment risk management association

Fiduciary investment risk management association Risk map

Risk map A farmer wanted to rid his apple

A farmer wanted to rid his apple Queer farmers

Queer farmers The component of agricultural renewal action plan

The component of agricultural renewal action plan