RETIREMENT PRESENTATION Tulare County Office of Education Retirement

- Slides: 30

RETIREMENT PRESENTATION Tulare County Office of Education Retirement Department

Agenda • How are Service Retirement Benefits Calculated • PERS Service Credit • PERS Final Compensation • PERS Special Compensation • Retiree Limitations/Exemptions • Membership Criteria – Penalties for untimely membership enrollment

How are Service Retirement Benefits Calculated? • Service Credit* • Benefit (Age) Factor • Final Compensation* • Payroll reporting affects both the *service credit and *final compensation of the retirement allowance calculation.

PERS Service Credit • It takes 1720 hours of reportable service to earn one year of service credit. • A PERS member does not earn more than one year of service in a fiscal year even if they work more than 1720 hours.

PERS Service Credit If a monthly rate was used for the retirement base, it would take 1733. 33 hours to earn a full year of service credit. This is why it is important to use an hourly retirement base for classified employees that are less than 8 hours and/or 12 months.

PERS Service Credit Certificated employees that are PERS members are not covered under the Public Employees Retirement Law (PERL), therefore, their salaries can be reported with a monthly base even if they are less than 8 hours and/or 12 months.

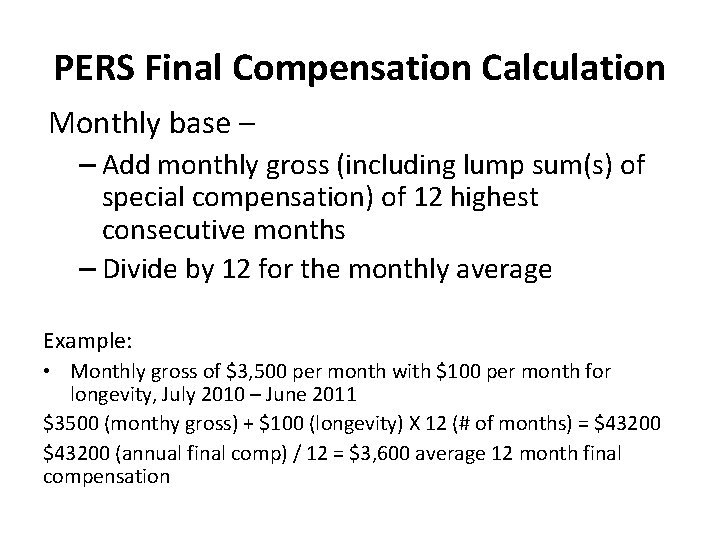

PERS Final Compensation Calculation Monthly base – – Add monthly gross (including lump sum(s) of special compensation) of 12 highest consecutive months – Divide by 12 for the monthly average Example: • Monthly gross of $3, 500 per month with $100 per month for longevity, July 2010 – June 2011 $3500 (monthy gross) + $100 (longevity) X 12 (# of months) = $43200 (annual final comp) / 12 = $3, 600 average 12 month final compensation

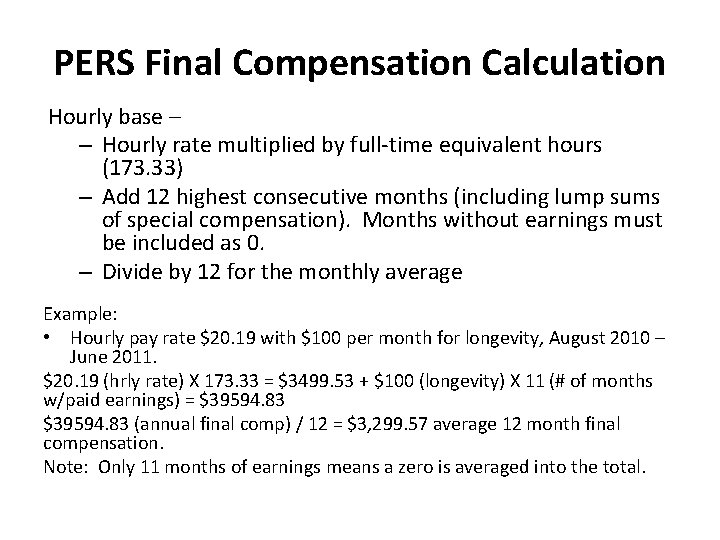

PERS Final Compensation Calculation Hourly base – – Hourly rate multiplied by full-time equivalent hours (173. 33) – Add 12 highest consecutive months (including lump sums of special compensation). Months without earnings must be included as 0. – Divide by 12 for the monthly average Example: • Hourly pay rate $20. 19 with $100 per month for longevity, August 2010 – June 2011. $20. 19 (hrly rate) X 173. 33 = $3499. 53 + $100 (longevity) X 11 (# of months w/paid earnings) = $39594. 83 (annual final comp) / 12 = $3, 299. 57 average 12 month final compensation. Note: Only 11 months of earnings means a zero is averaged into the total.

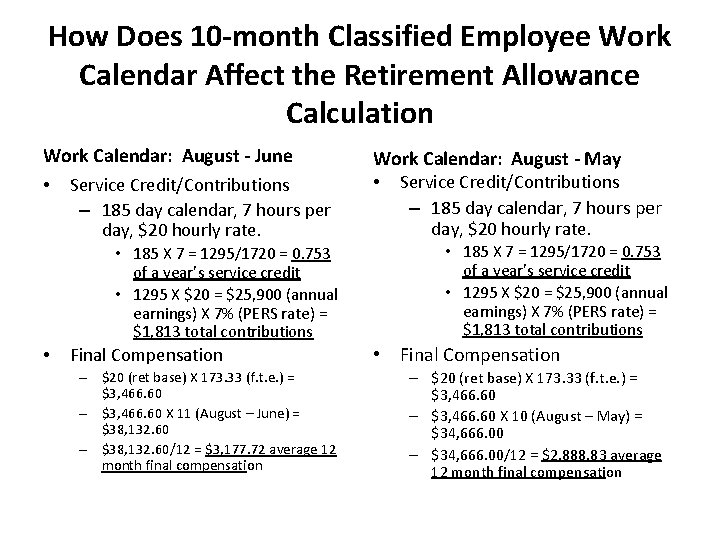

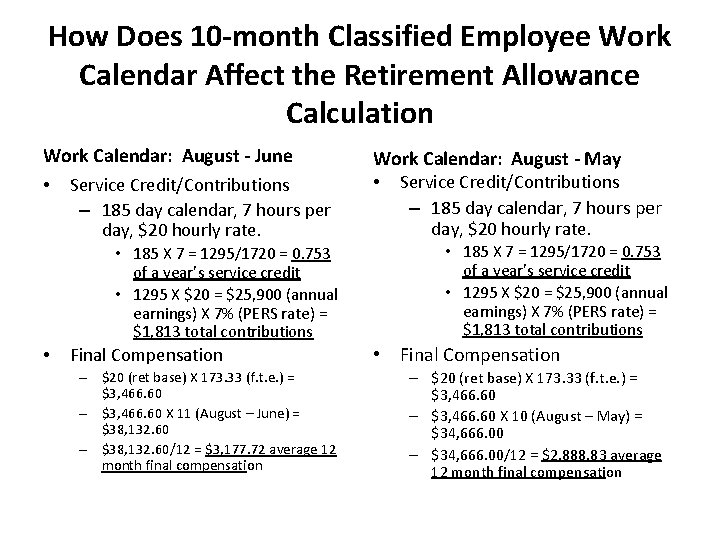

How Does 10 -month Classified Employee Work Calendar Affect the Retirement Allowance Calculation Work Calendar: August - June • Service Credit/Contributions – 185 day calendar, 7 hours per day, $20 hourly rate. • 185 X 7 = 1295/1720 = 0. 753 of a year’s service credit • 1295 X $20 = $25, 900 (annual earnings) X 7% (PERS rate) = $1, 813 total contributions • Final Compensation – $20 (ret base) X 173. 33 (f. t. e. ) = $3, 466. 60 – $3, 466. 60 X 11 (August – June) = $38, 132. 60 – $38, 132. 60/12 = $3, 177. 72 average 12 month final compensation Work Calendar: August - May • Service Credit/Contributions – 185 day calendar, 7 hours per day, $20 hourly rate. • 185 X 7 = 1295/1720 = 0. 753 of a year’s service credit • 1295 X $20 = $25, 900 (annual earnings) X 7% (PERS rate) = $1, 813 total contributions • Final Compensation – $20 (ret base) X 173. 33 (f. t. e. ) = $3, 466. 60 – $3, 466. 60 X 10 (August – May) = $34, 666. 00 – $34, 666. 00/12 = $2, 888. 83 average 12 month final compensation

PERS Special Compensation is limited to that which is received by a member pursuant to a labor policy or agreement to similarly situated members of a group or class of employment in addition to pay rate.

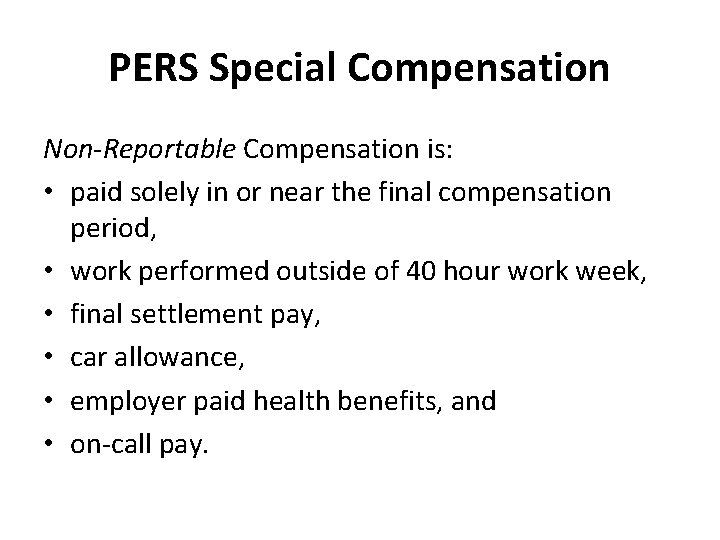

PERS Special Compensation Non-Reportable Compensation is: • paid solely in or near the final compensation period, • work performed outside of 40 hour work week, • final settlement pay, • car allowance, • employer paid health benefits, and • on-call pay.

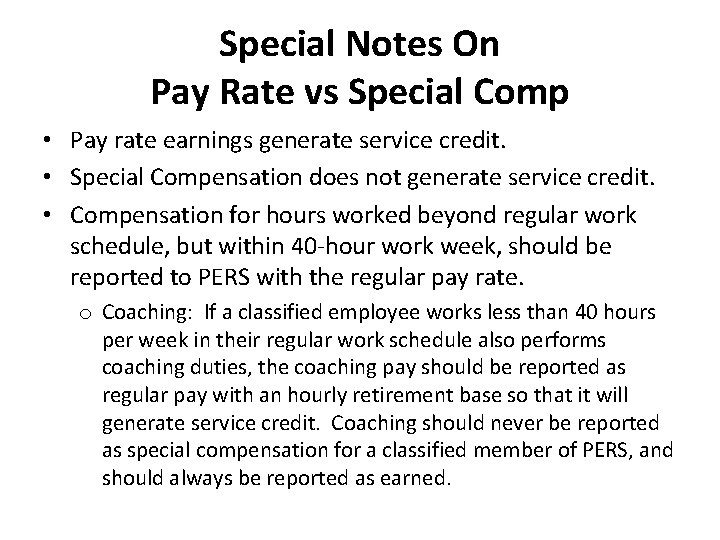

Special Notes On Pay Rate vs Special Comp • Pay rate earnings generate service credit. • Special Compensation does not generate service credit. • Compensation for hours worked beyond regular work schedule, but within 40 -hour work week, should be reported to PERS with the regular pay rate. o Coaching: If a classified employee works less than 40 hours per week in their regular work schedule also performs coaching duties, the coaching pay should be reported as regular pay with an hourly retirement base so that it will generate service credit. Coaching should never be reported as special compensation for a classified member of PERS, and should always be reported as earned.

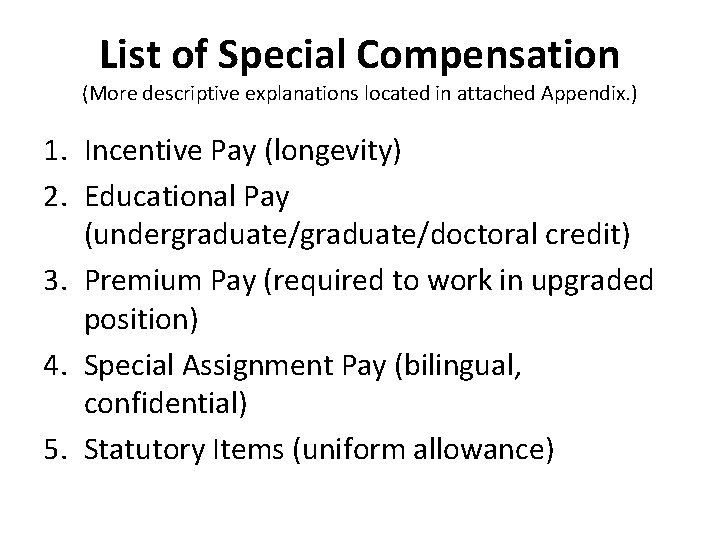

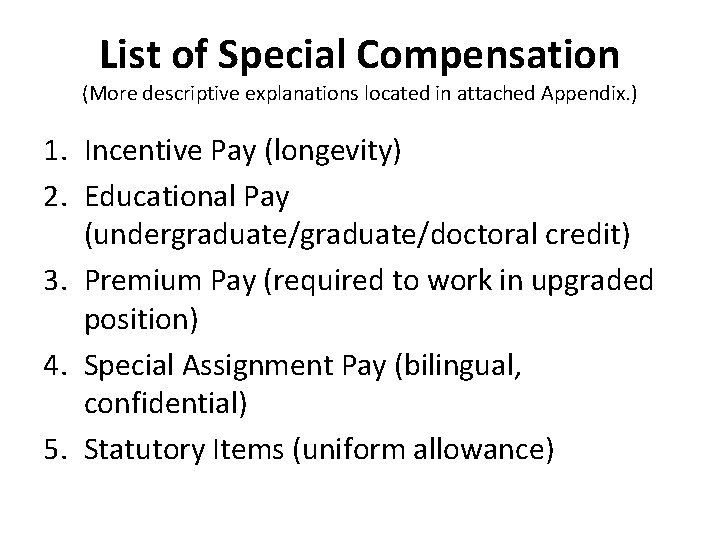

List of Special Compensation (More descriptive explanations located in attached Appendix. ) 1. Incentive Pay (longevity) 2. Educational Pay (undergraduate/doctoral credit) 3. Premium Pay (required to work in upgraded position) 4. Special Assignment Pay (bilingual, confidential) 5. Statutory Items (uniform allowance)

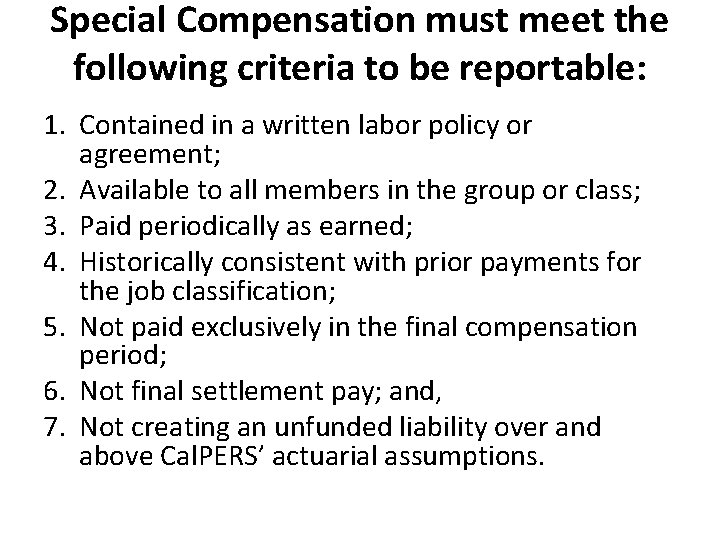

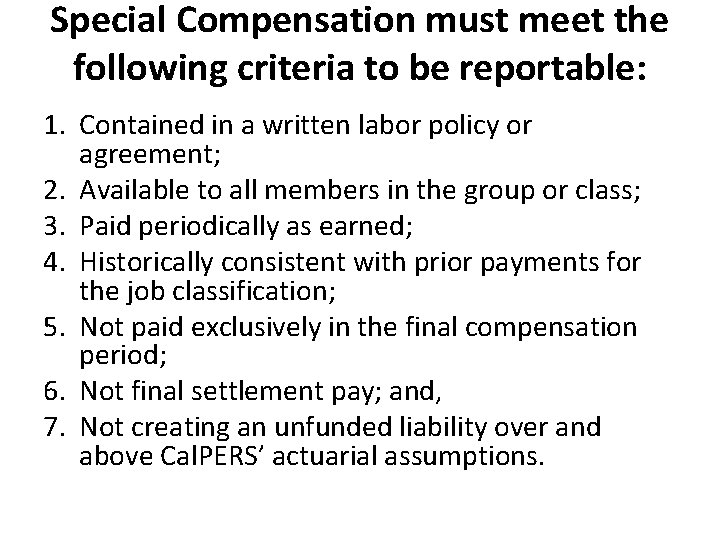

Special Compensation must meet the following criteria to be reportable: 1. Contained in a written labor policy or agreement; 2. Available to all members in the group or class; 3. Paid periodically as earned; 4. Historically consistent with prior payments for the job classification; 5. Not paid exclusively in the final compensation period; 6. Not final settlement pay; and, 7. Not creating an unfunded liability over and above Cal. PERS’ actuarial assumptions.

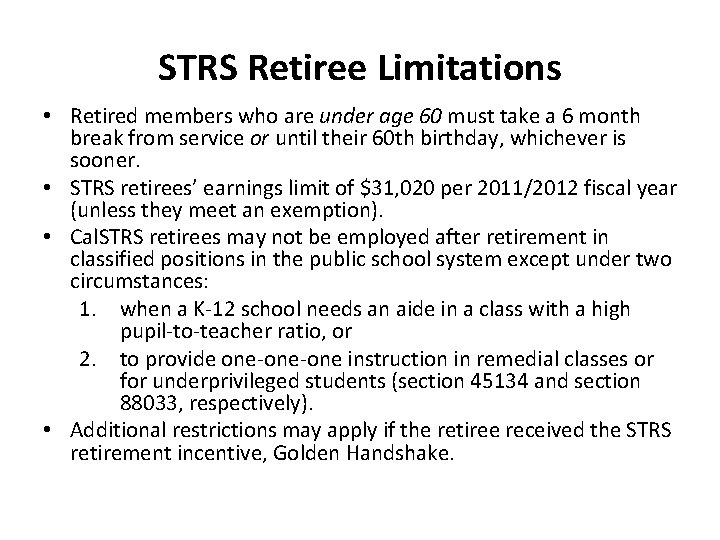

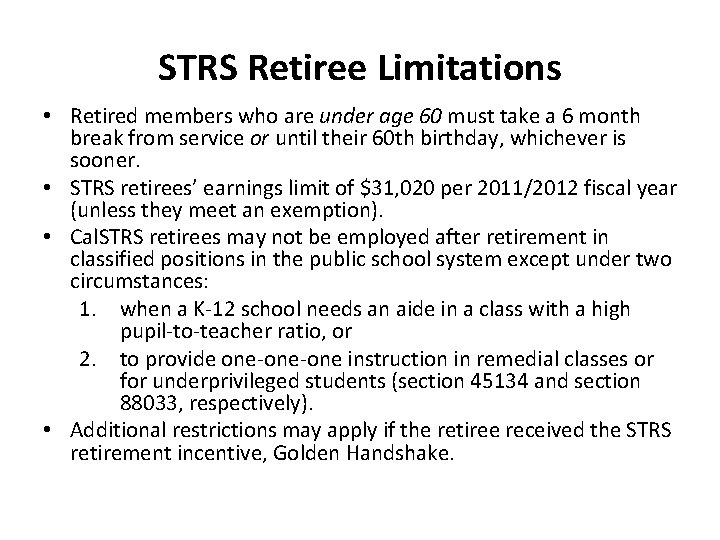

STRS Retiree Limitations • Retired members who are under age 60 must take a 6 month break from service or until their 60 th birthday, whichever is sooner. • STRS retirees’ earnings limit of $31, 020 per 2011/2012 fiscal year (unless they meet an exemption). • Cal. STRS retirees may not be employed after retirement in classified positions in the public school system except under two circumstances: 1. when a K-12 school needs an aide in a class with a high pupil-to-teacher ratio, or 2. to provide one-one instruction in remedial classes or for underprivileged students (section 45134 and section 88033, respectively). • Additional restrictions may apply if the retiree received the STRS retirement incentive, Golden Handshake.

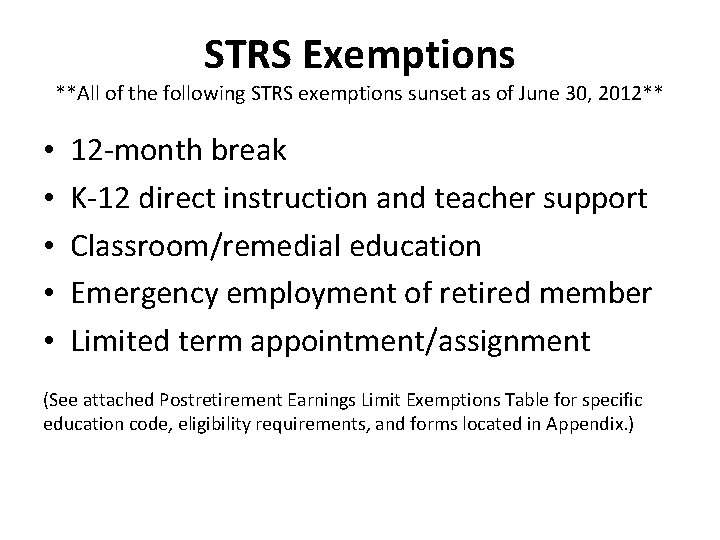

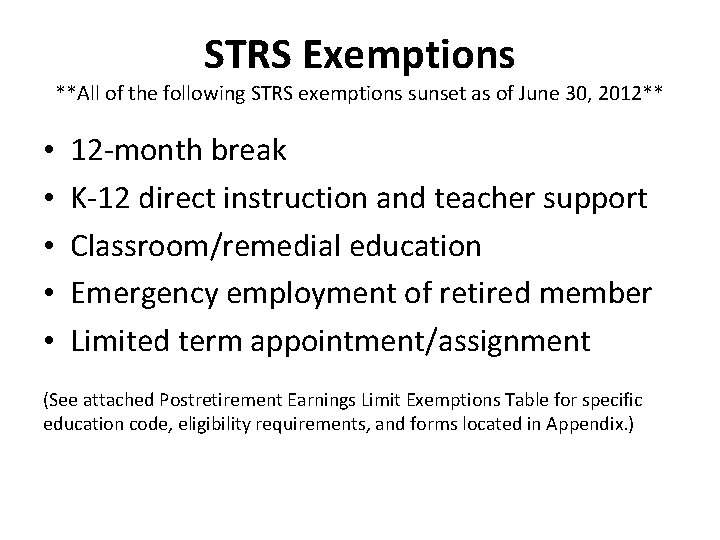

STRS Exemptions **All of the following STRS exemptions sunset as of June 30, 2012** • • • 12 -month break K-12 direct instruction and teacher support Classroom/remedial education Emergency employment of retired member Limited term appointment/assignment (See attached Postretirement Earnings Limit Exemptions Table for specific education code, eligibility requirements, and forms located in Appendix. )

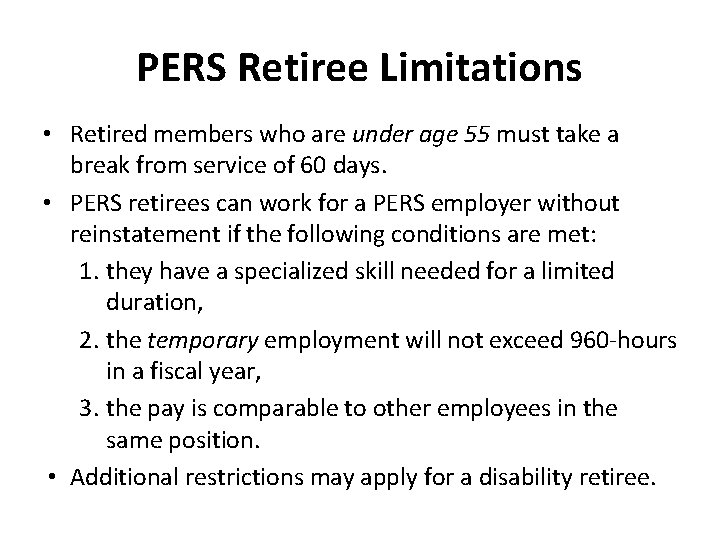

PERS Retiree Limitations • Retired members who are under age 55 must take a break from service of 60 days. • PERS retirees can work for a PERS employer without reinstatement if the following conditions are met: 1. they have a specialized skill needed for a limited duration, 2. the temporary employment will not exceed 960 -hours in a fiscal year, 3. the pay is comparable to other employees in the same position. • Additional restrictions may apply for a disability retiree.

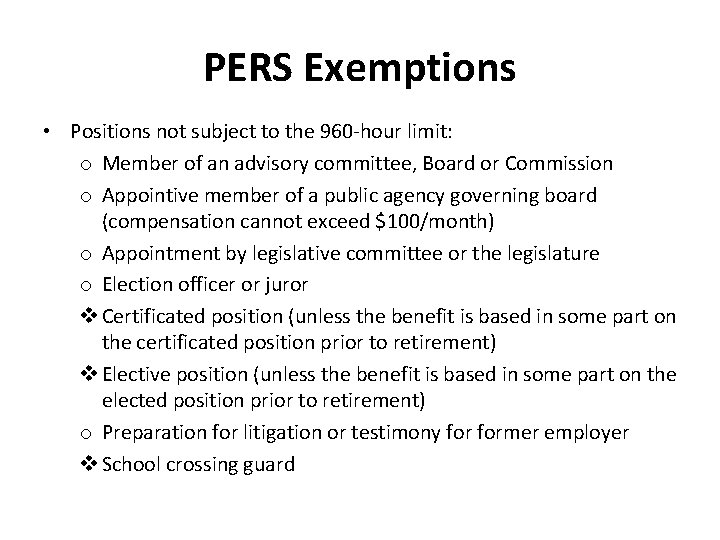

PERS Exemptions • Positions not subject to the 960 -hour limit: o Member of an advisory committee, Board or Commission o Appointive member of a public agency governing board (compensation cannot exceed $100/month) o Appointment by legislative committee or the legislature o Election officer or juror v Certificated position (unless the benefit is based in some part on the certificated position prior to retirement) v Elective position (unless the benefit is based in some part on the elected position prior to retirement) o Preparation for litigation or testimony former employer v School crossing guard

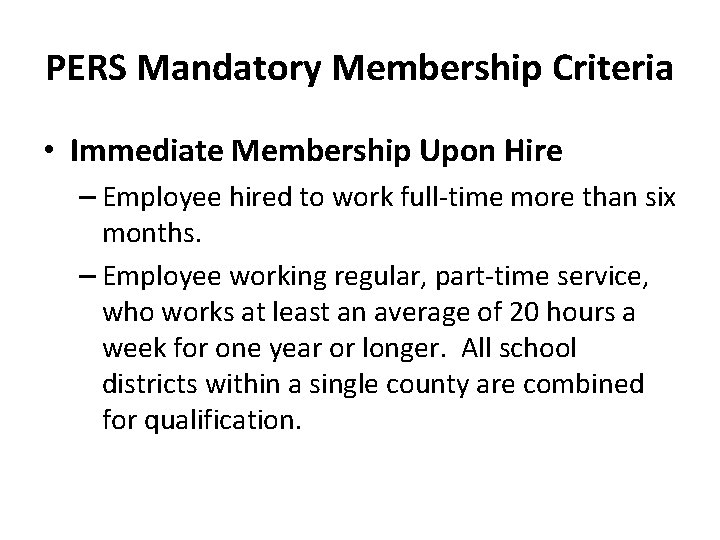

PERS Mandatory Membership Criteria • Immediate Membership Upon Hire – Employee hired to work full-time more than six months. – Employee working regular, part-time service, who works at least an average of 20 hours a week for one year or longer. All school districts within a single county are combined for qualification.

PERS Mandatory Membership Criteria • Less than full-time Employees – Employee works at least 1000 hours/125 days in a single fiscal year. – All school districts within an individual county are to be combined for membership qualification. – Membership effective date is the first day of the following pay period—even if the date falls in the next fiscal year or is with another PERS employer.

PERS Mandatory Membership Criteria • Employees Who Must be Monitored – Indeterminate/Indefinite term employee that works full-time (hired to fill in for a worker who is out due to serious illness for an unknown period of time). • Enrollment no later than the first day of the pay period of the seventh month.

PERS Mandatory Membership Criteria • Employees Who Must be Monitored – All other part-time employees that do not meet mandatory membership criteria as of hire date must be monitored for 1000 hours/125 days in a fiscal year. • Vacation, holiday pay, sick leave, and overtime are used for membership qualification. • Membership is effective the first of the month following the qualifying pay period—even if the date falls in another fiscal year.

Failure to Enroll Member on a Timely Basis • Employer’s responsibility to determine if its employees are eligible to participate in Cal. PERS. • Failure to enroll an eligible employee into Cal. PERS membership within 90 days of qualifying, when the employer knows or should have known, the employer shall be required to pay all arrear costs for member contributions, as well as administrative costs of $500 per member. • The employer shall not pass on to an employee any costs assessed due to untimely enrollment.

STRS Mandatory Membership Criteria • Immediate Membership – Full-time Contract • Mandatory membership effective on the first day of the contract. • Exempt – Exchange teachers – STRS retired teachers

STRS Mandatory Membership Criteria (Non-member employees must be informed within 30 days of hire that they may elect membership. ) • Part-Time Percentage Contract – Less than 50%. Does not qualify for mandatory membership. – 50% or more at one district • membership date is the first day of the following pay period, but only if the following pay period falls within the same fiscal year.

STRS Mandatory Membership Criteria (Non-member employees must be informed within 30 days of hire that they may elect membership. ) • Part-time Hourly/Daily – 10 days/60 hours in a single pay period – Single district – Membership date is the first day of the following pay period at the same district, but only if the date falls within the same fiscal year.

STRS Mandatory Membership Criteria (Non-member employees must be informed within 30 days of hire that they may elect membership. ) Substitutes • 100 days • At the same school district within one fiscal year • Membership effective the first day of the following pay period, but only if the following pay period falls within the same fiscal year.

Failure to Provide a Timely Membership and/or Election • Employer may be liable for employer and employee contributions and interest if the employee advises STRS they would have elected membership if given the proper notification. • Additional penalties and interest will be assessed to the employer for untimely reporting of contributions.

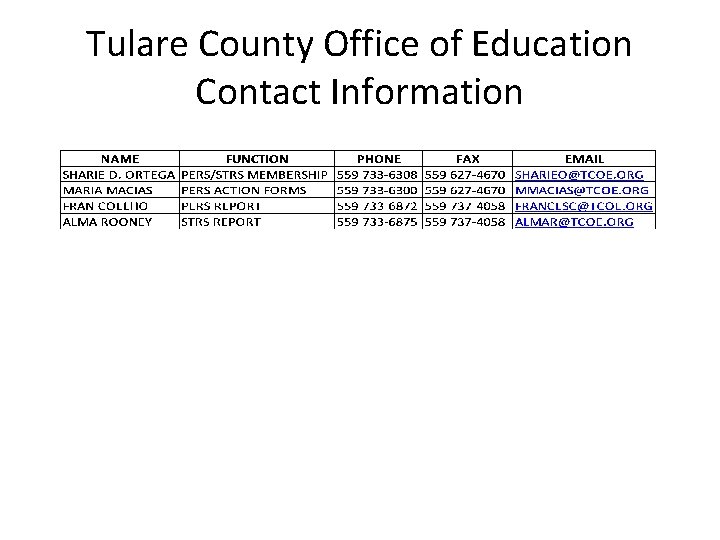

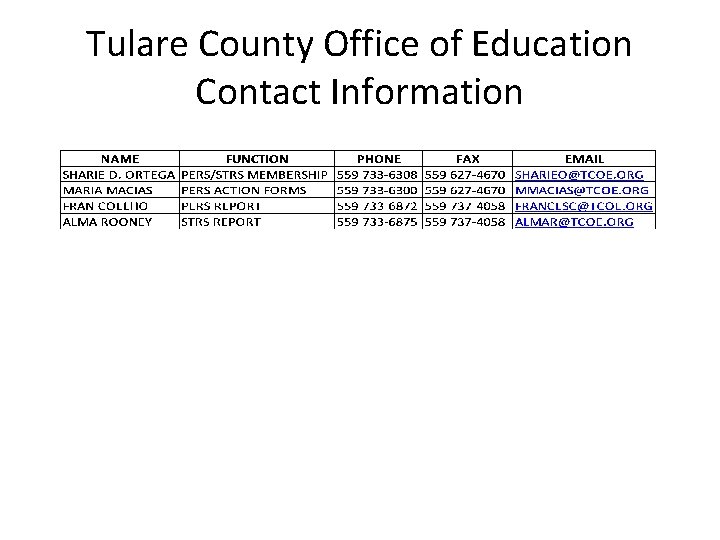

Tulare County Office of Education Contact Information

Appendix • PERS Special Compensation List • STRS Postretirement Earnings Limit Exemptions Table & Forms • STRS Exemption Forms • STRS Permissive Membership Election Form (ES 0350 06/11) • STRS/PERS Retirement System Election Form (ES 372 05/09)

Tulare county recycling

Tulare county recycling Tnt swimming

Tnt swimming Tulare air quality

Tulare air quality Fresno county retirement calculator

Fresno county retirement calculator Fresno county birth certificate

Fresno county birth certificate Fresno county employees retirement association

Fresno county employees retirement association Seneca county extension office

Seneca county extension office Shelby county office of preparedness

Shelby county office of preparedness Seneca county 4-h extension office

Seneca county 4-h extension office Marin county probation department

Marin county probation department Campbell county sheriff tn

Campbell county sheriff tn Seneca county 4-h extension office

Seneca county 4-h extension office Kitsap county police activity

Kitsap county police activity Genesee county office of senior services

Genesee county office of senior services Pickens county school transportation department

Pickens county school transportation department Santa clara county office of supportive housing

Santa clara county office of supportive housing North orange county aa

North orange county aa Morris county office of health management

Morris county office of health management Fresno county probation department

Fresno county probation department Snohomish county sheriff south precinct

Snohomish county sheriff south precinct Palm coast police department

Palm coast police department Vanderburgh county probation

Vanderburgh county probation Santa clara county probation office

Santa clara county probation office Lorain county medical examiner

Lorain county medical examiner Factory office layout

Factory office layout Brow presentation birth

Brow presentation birth Fundal height transverse lie

Fundal height transverse lie Claiborne county board of education

Claiborne county board of education Https://gates.powerschool.com/public

Https://gates.powerschool.com/public Barbour county board of education

Barbour county board of education Fowler v. board of education of lincoln county

Fowler v. board of education of lincoln county