Fresno County Employees Retirement Association Retirement Planning Location

- Slides: 30

Fresno County Employees’ Retirement Association Retirement Planning Location: 1111 H Street Fresno, CA 93721 Phone: (559)457 -0681 Stop Mail #: 40 Web Address: http: //www. fcera. org Intranet Address: E-services Department Sites Retirement Association.

RETIREMENT PLANNING When Can I retire? n You can retire when your contributions have been in the plan for 10 years and are age 50 or older and are “vested” in the plan. n Being “vested” entitles you to Plan benefits funded by the County contributions. This entitlement is unaffected even if you terminate County service before retiring, provided that you leave your contributions and interest on deposit with the retirement plan. You are vested when you have completed 5 years of service credit in the retirement plan. n If you have completed 5 years with another public agency and meet the requirements to establish reciprocity, you would be immediately vested in the Retirement Plan once reciprocity is established.

How do I qualify for service retirement? You are eligible for service retirement benefits if: n You terminate your employment. n Leave your contributions and interest with the retirement plan. n Your contributions have been in the plan for 10 years and you are age 50 Or - you are a General Member with 30 years of service credit regardless of age. Or - you are a Safety Member with 20 years of service credit regardless of age. Or - you are age 70 regardless of years of service credit.

How are service retirement benefits determined? Retirement Benefits are based on: n Years of service credit. n Retirement Tier. n Age at retirement. n Final Compensation.

What types of service credit can be purchased (buyback)? n n n Prior service - Extra help hours worked or hours worked prior to becoming a member of the plan. Redeposit of previously withdrawn contributions. Unpaid medical leave - can purchase up to one year of continuous leave Unpaid military leave – can purchase all time served while a County employee. Prior Public Service - All employees hired prior to 4/1/01 must have applied by June 30, 2001. New employees hired after that date have 90 days from their date of membership to submit an application with the retirement office.

How can I purchase my additional service credit? n n All time must be purchased prior to your date of retirement. Complete and submit to the Retirement Office a “Request for Service Credit Calculation” form. The Retirement Office will calculate the amount of time available for purchase and the cost.

How and when do I apply for service retirement benefits? n n n You must file a written application with the retirement office no more than 60 days prior to your date of retirement. You should schedule an appointment with the retirement office at least 60 days prior to your date of retirement. This is to ensure all the necessary documents and paper work are completed timely. If reciprocity applies, the effective date of retirement from the reciprocal agency must be the same effective date as your retirement with FCERA.

What documents do I need to provide to the retirement office? n n n Your birth certificate. Your beneficiary(s) birth certificate. Your recorded marriage certificate (if applicable). Your notarized State of California “Declaration of Domestic Partnership” or valid “Certificate of Domestic Partnership” registered domestic partnership (if your beneficiary is your registered domestic partner). The original copy of your Social Security estimate (if taking the Temporary Annuity Option). Filed Stamped Copy of your Domestic Relations Order (DRO) (if applicable).

BENEFIT PAYMENT OPTIONS What benefit options are available and when do I elect my option? n The plan provides certain forms of monthly payments, depending on the Benefit Option you elect. You will elect your benefit option with the Retirement Office at the time you retire. The following are the forms of monthly benefits: n n n Unmodified Allowance OPTION 1 OPTION 2 OPTION 3 OPTION 4

Unmodified Allowance n n Provides the maximum retirement allowance to you 60% continuing monthly benefit to your qualified spouse/registered domestic partner – if you were married for at least one year immediately preceding your retirement date or – married for at least 2 years after retirement and your spouse/registered domestic partner is at least 55 years of age at the time of your death. n If you do not have a surviving spouse/registered domestic partner, – Provides a one time lump sum payment to your beneficiary of any balance remaining from your accumulated contributions less the sum of monthly retirement payments received by you before your death.

Optional Forms of Payment n At retirement, you may elect an optional form of payment. The election of an option results in a reduction of your service retirement benefit. All optional forms of payment are “actuarially equivalent” to your service retirement benefit. n Option 1 - No continuance to your beneficiary Option 2 - 100% continuance to your beneficiary Option 3 - 50% continuance to your beneficiary Option 4 – Equal continuing benefits to more than one beneficiary n n n

OPTION 1 n n n Provides a slightly reduced retirement allowance to you. Provides a one-time lump sum payment to your beneficiary of the remaining balance of your accumulated contributions less the sum of monthly annuity payments received by you before your death. Provides the opportunity to change your beneficiary after you retire.

OPTION 2 n n n Provides a reduced retirement allowance based upon the age difference between you and your beneficiary. Provides a 100% continuing monthly benefit to your beneficiary. No opportunity to change your beneficiary after your retirement even if the beneficiary dies before you.

OPTION 3 n n n Provides a reduced retirement allowance based upon the age difference between you and your beneficiary. Provides a 50% continuing monthly benefit to your beneficiary. No opportunity to change your beneficiary after your retirement even if the beneficiary dies before you.

OPTION 4 n n n Provides an actuarial equivalent retirement benefit paid out in a method approved by the Board of Retirement. Provides equal continuing benefits to more than one beneficiary, excluding an ex-spouse. No opportunity to change your named beneficiaries after your retirement even, if your beneficiaries die before you.

OPTION 4 (continued) n n No reversion to the remaining beneficiaries should they predecease one another. Typically selected when the Domestic Relations Order (DRO) requires a continuing benefit to an ex-spouse.

What is the Temporary Annuity Option (TAO)? n FCERA provides a Temporary Annuity Option (TAO) available to members retiring prior to 62 who are entitled to Social Security Benefits. n The option is designed to level out retirement income; increasing retirement benefits prior to age 62 and deceasing benefits after age 62, when Social Security Benefits begin.

What documents are required and when do I elect the TAO? n Provide a current copy of your Earnings and Benefit Statement from the Social Security Administration. The request should be made to Social Security no more than 6 months prior to your anticipated date of retirement. n Make your election at the time you elect your retirement option.

Will I receive a Cost of Living Adjustment (COLA) when I retire? n Yes. Cost of living adjustments (COLA) are added to your basic retirement allowance effective April 1 of each year in accordance with changes in the Consumer Price Index (CPI) for the San Francisco Bay Area. n The current maximum increase in any year is 3%.

What is the Health Benefit? n n Retiree health benefits are paid by FCERA in the form of an additional cash benefit, with the expectation (but not the requirement) that the funds are used to offset the cost of retiree health insurance. There are two components of the Health Benefit; the vested and Non-Vested portion.

Settlement (Vested) Health Benefit portion n Effective with the Settlement Agreement signed in December 2000, an additional health benefit is provided as established by the Agreement. Currently, the benefit is set at $3. 00 per full year of service, (excludes public service years purchased or golden handshakes granted by your employer), to a maximum of $90 per month. n Increases are defined in the Settlement Agreement.

Supplemental (Non-Vested) Health Benefit portion n In addition to your monthly retirement benefit, you may receive a non-vested health benefit funded through excess earnings of the retirement system. As of July 1, 2006, the benefit is a maximum of $150 per month for members with 30 years of qualifying service (excludes public service years purchased or golden handshakes granted by your employer). Adopted by the Board of Retirement. Current available monies are anticipated to be depleted in 10 to 15 years.

Does Health Insurance coverage continue during my retirement? n n Continued health care coverage is available to retirees and their spouses through the County of Fresno. At the time you apply for your retirement benefits, you must also contact the County of Fresno, Employee Benefits to apply for continuing health insurance coverage.

Are there any limitations on the amount of my benefit? n n Yes. The Plan is subject to the limits of Internal Revenue Code (IRC) Section 415. IRC 415 limits the amount of benefits a Public Retirement Plan may pay an individual in one year. ie: Age 62 -65, maximum 2006 annual limit is $175, 000 The County of Fresno has adopted a Replacement Benefit Plan

Will Social Security affect my Plan Benefit? n No. The amount you receive as a benefit from the Plan is not impacted by your other income sources, including Social Security.

Is Federal and State Income Tax withheld from my Retirement check? n n Your service retirement benefit is taxable and subject to Federal and State Income Tax laws. You may choose not to have taxes withheld from your retirement allowance. However, you may then owe taxes to the Federal or State taxing authorities.

When will I receive my first retirement check? n In general, you will receive your first check the month (end of the month) following your date of retirement. Please note that reciprocity, divorce, electing Option 4, or submitting your documents late, may delay receiving your first check.

When is payday? n Retirees are paid once a month on the last business day of the month by both direct deposit and paper check. n Paper checks are mailed to your home four business days before the last business day of the month.

Can I have my retirement check deposited directly into my Bank Account? n Yes. Direct deposit is available. The Board of Retirement strongly recommends that you select direct deposit of your retirement benefits because it is the fastest, safest and most convenient method of receiving payment.

Any Questions?

Retirement planning fresno

Retirement planning fresno Fresno county employees retirement association

Fresno county employees retirement association Milwaukee county retirements granted

Milwaukee county retirements granted Location planning and analysis in operation management

Location planning and analysis in operation management Fresno county probation department

Fresno county probation department Bel retired employees health scheme

Bel retired employees health scheme Keogh plan definition

Keogh plan definition Livingston federal employee retirement planning

Livingston federal employee retirement planning Retirement planning warsaw

Retirement planning warsaw Planning for retirement windsor

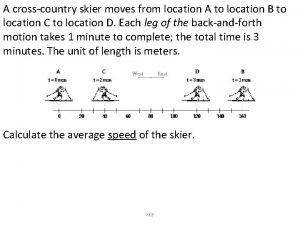

Planning for retirement windsor A cross country skier moves from location a to location b

A cross country skier moves from location a to location b Auditory association area location

Auditory association area location Apids

Apids Nebraska county attorney association

Nebraska county attorney association Genesee county bar association

Genesee county bar association Sacramento county bar association

Sacramento county bar association Sacramento county bar association

Sacramento county bar association Barnstable county beekeepers association

Barnstable county beekeepers association New york state county highway superintendents association

New york state county highway superintendents association Association of county commissions of alabama

Association of county commissions of alabama Alabama association of county engineers

Alabama association of county engineers Location planning analysis

Location planning analysis Location planning

Location planning Location planning and analysis

Location planning and analysis Facility location planning

Facility location planning Location planning and analysis

Location planning and analysis Location planning and analysis

Location planning and analysis Faktor yang mempengaruhi tata letak fasilitas jasa

Faktor yang mempengaruhi tata letak fasilitas jasa In location planning environmental regulations

In location planning environmental regulations The circuit panchito characterization

The circuit panchito characterization Rec center fresno state

Rec center fresno state