Provincial Treasury Western Cape NCOP Select Committee on

- Slides: 43

Provincial Treasury Western Cape NCOP Select Committee on Finance Public Hearings Conditional Grants and Capex 16 January 2006 1

Outline • • • Conditional grant allocations Transfers CG – cash flow management Monitoring transfers Division of Revenue Act Expenditure Monitoring expenditure Service delivery agreements The way forward 2

Conditional Grant Allocations 3

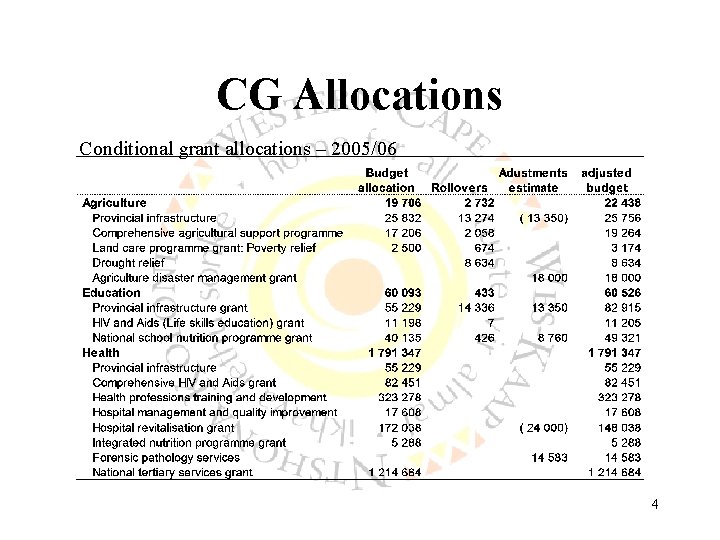

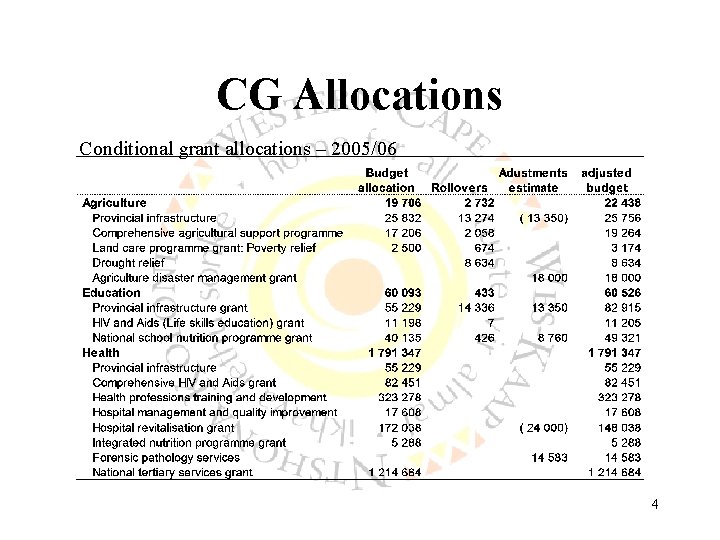

CG Allocations Conditional grant allocations – 2005/06 4

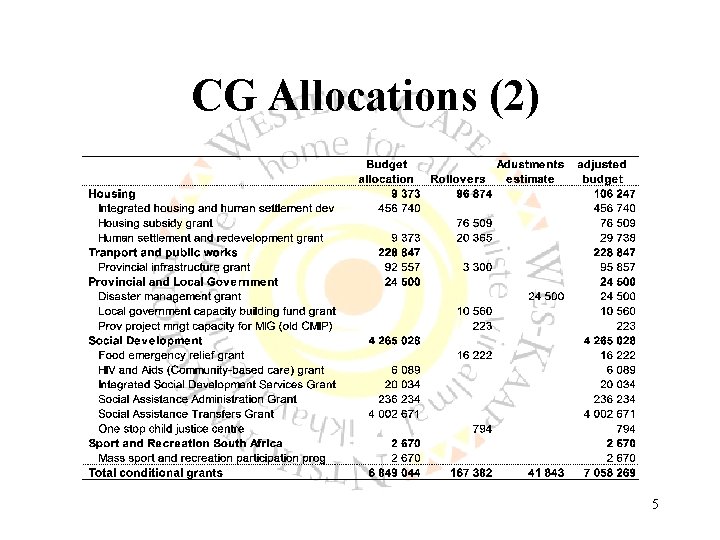

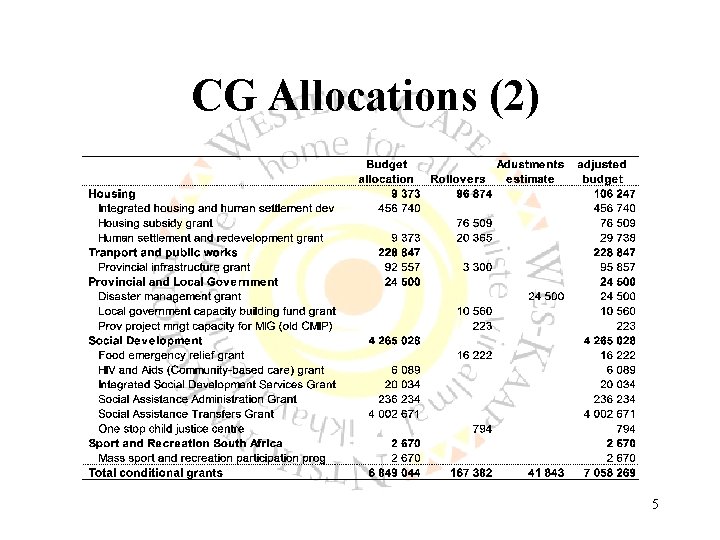

CG Allocations (2) 5

Conditional Grant Transfers 6

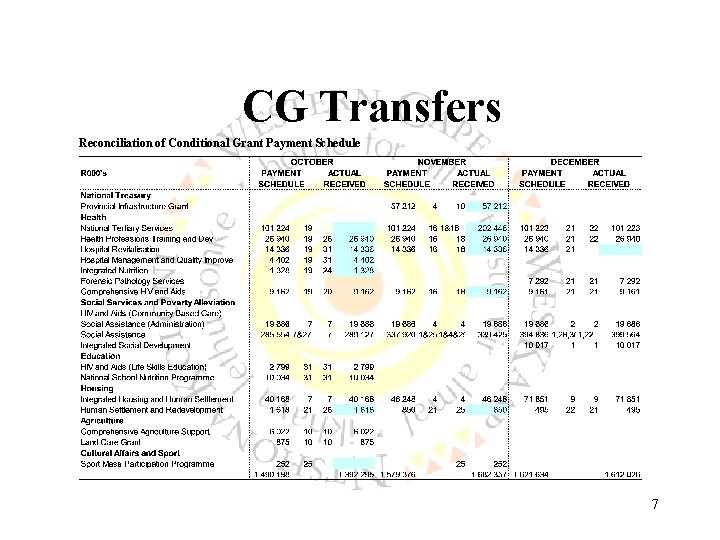

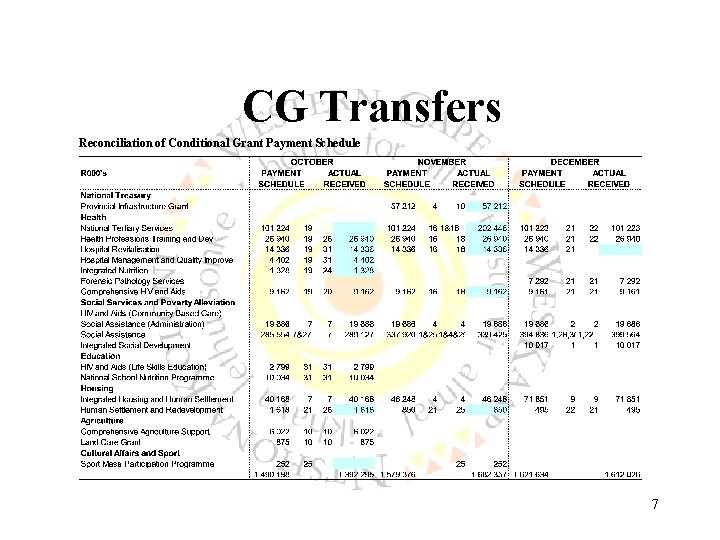

CG Transfers Reconciliation of Conditional Grant Payment Schedule 7

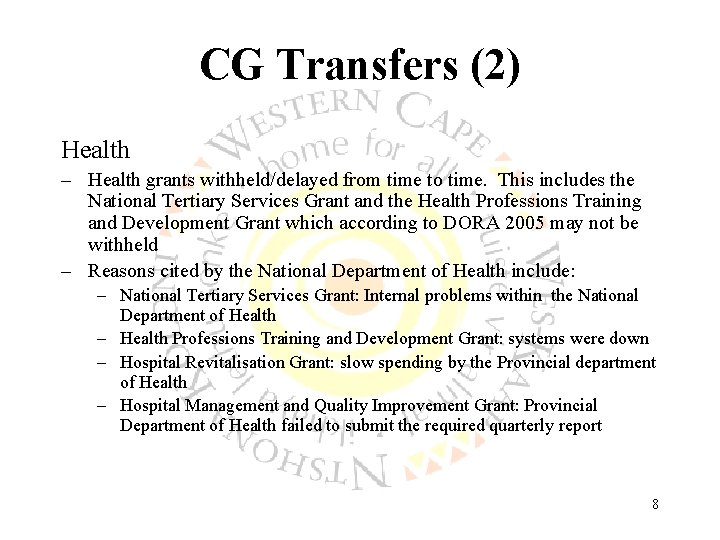

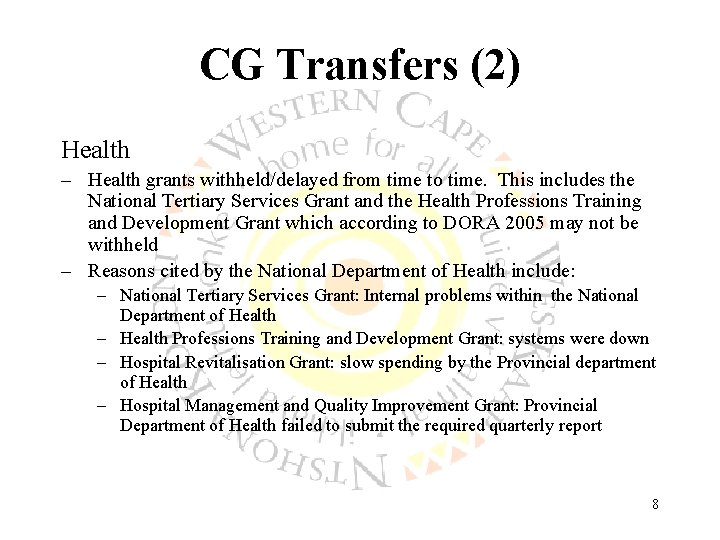

CG Transfers (2) Health – Health grants withheld/delayed from time to time. This includes the National Tertiary Services Grant and the Health Professions Training and Development Grant which according to DORA 2005 may not be withheld – Reasons cited by the National Department of Health include: – National Tertiary Services Grant: Internal problems within the National Department of Health – Health Professions Training and Development Grant: systems were down – Hospital Revitalisation Grant: slow spending by the Provincial department of Health – Hospital Management and Quality Improvement Grant: Provincial Department of Health failed to submit the required quarterly report 8

Conditional Grant Cash Flow Management 9

CG – Cash Flow Management • Conditional Grant transfers mostly received according to payment schedule issued by National Treasury • Funds are transferred directly to the exchequer account • Money transferred to accounts on a regular basis to cover scheduled payments • Liaise with Provincial and National Departments if transfers delayed to establish problem • Action with relevant parties to address accordingly • Continuous follow-up to ensure scheduled transfer effected 10

Monitoring Transfers 11

Monitoring transfers • The Western Cape has experienced some problems with the late transfer of Conditional Grant payments in 2005/06 • As there is no formalised process for monitoring these transfers, cash management only becomes aware of the intention to withhold transfer on day transfer expected as per payment schedule • PT recommended a more formalised process to NT to ensure PT alerted of a national departments intention to withhold funds timeously, this recommendation was subsequently taken up in Practice Note 3 of 2005 12

Monitoring transfers (2) • This process requires National Departments to, when giving a receiving officer notice of its intention to withhold funds, send a copy of the notice to National Treasury, who will inform Provincial Treasury of the intended delay • National Departments are still failing to comply with DORA 2005 and Practice Note 3 requirements • Provincial Treasury subsequently proposed that National Treasury – ensure that transferring departments are aware of conditions placed on them in terms of DORA and Practice Note 3 of 2005; – Explore ways to ensure that transferring departments adhere to the payment schedule and take necessary precautions to ensure that provinces receive funds timeously 13

Monitoring transfers (3) • All 2005/06 business plans have been approved and Service Level Agreements signed • Provincial Treasury in the process of contacting departments to ensure that business plans for 2006/07 have been submitted to their national counterparts for approval in accordance with the conditional grant frameworks. 14

Division of Revenue Act 15

Division of Revenue Act • Shortcomings in Division of Revenue Process – Section 33(2) requires National Departments to notify receiving officers of intention to withhold transfers, providing opportunity for Departments to submit reasons as to why allocation should not be withheld – No requirement for Provincial Treasuries (PT) to be informed while NT only needs to be informed if funds are to be withheld for more than 30 days – Administrative burden of negligible grants i. e. Land Care Grant R 2, 5 million with numerous reports required – Cash constraints place upon Province when funds withheld as commitments exist – Overlapping of measurable outputs 16 – Conditions of grants limit flexibility

DORA review process • Intergovernmental fiscal relations act (Act 97 of 1997) requires National Treasury to consult provinces and municipalities when drafting DOR bill • Treasury circular sent to line departments requesting departmental concerns and recommendations regarding DORA 2005 to be considered in DORA 2006. • Meetings were to be scheduled with line departments where deemed necessary based on inputs received from departments. • Consolidated input to be sent to National Treasury, awaiting first draft on DORA 2006 to make additional comments 17

Expenditure 18

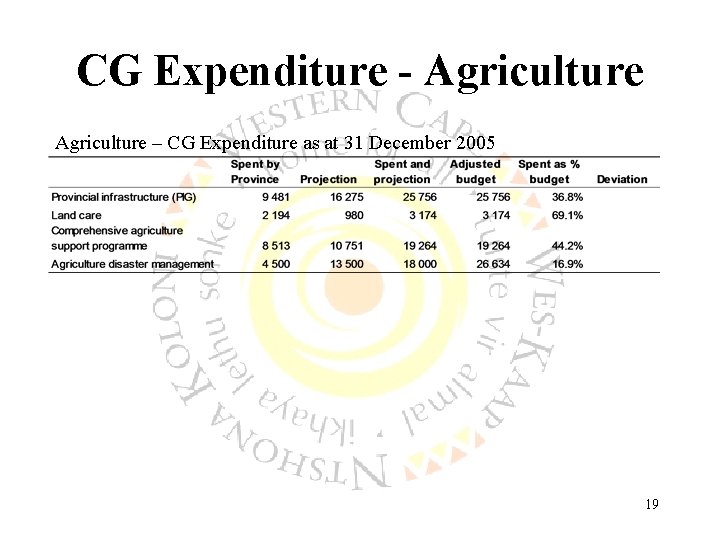

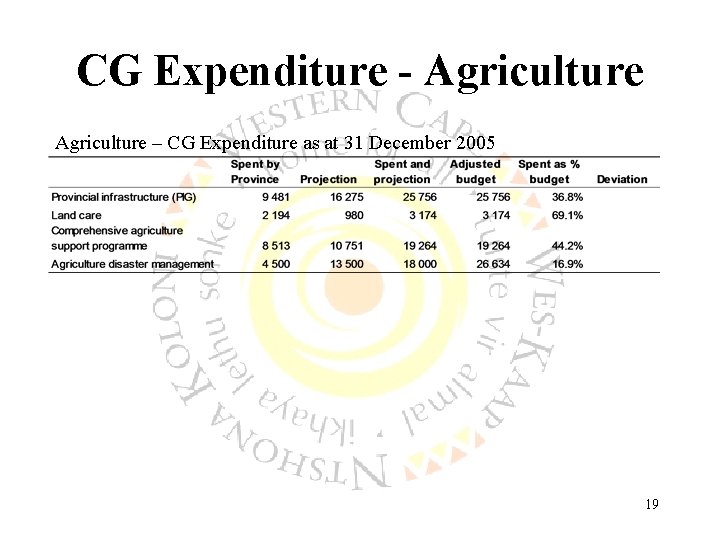

CG Expenditure - Agriculture – CG Expenditure as at 31 December 2005 19

CG Expenditure – Agriculture (2) • Challenges to overcome – Provincial infrastructure (PIG) • Planning and survey of projects and the approval of plans by the engineering section is time consuming and must take place before the tender process can commence • Difficulties experienced with tender process, tender applications were referred back by the tender committee and have to be re submitted • Seasons – harvest time of crops during the fourth quarter leads to increased procurement, repair and maintenance of capital equipment 20

CG Expenditure – Agriculture (3) – Land care grant • The eradication of invasive plants is seasonal as they start growing in summer. • Project execution is dependent on farmers who manage the project and only commences once farmers have harvested their crops – Comprehensive agriculture support programme • Lack of community participation and agreement on projects • Difficulty in getting commitment from communities – when discontinuing a project the process of finding alternative projects and reallocating funds is a lengthy process • Seasonal expenditure – some projects can only commence in planting season • Memorandum of agreement between Department and implementing agents is lengthy – this process must be finalised before transfer payments can be made 21

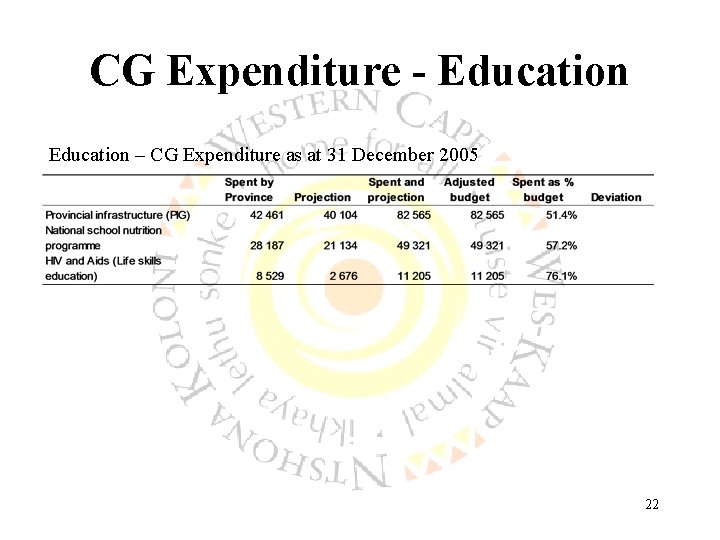

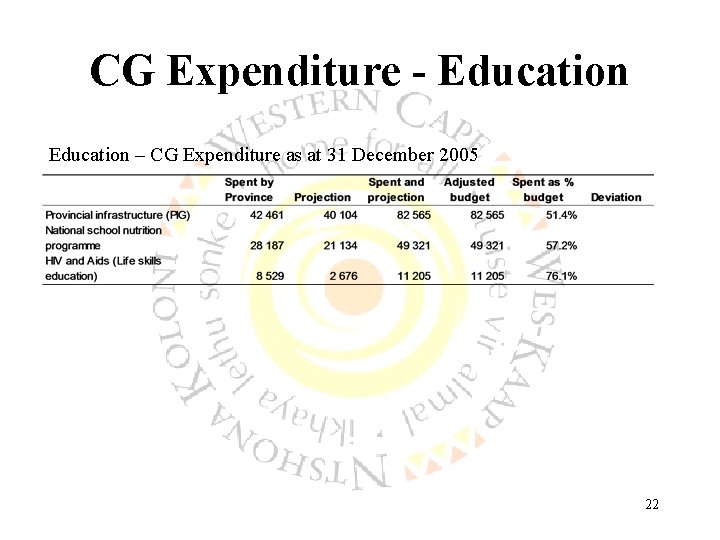

CG Expenditure - Education – CG Expenditure as at 31 December 2005 22

CG Expenditure – Education (2) • Challenges to overcome – Provincial infrastructure (PIG) • The Department received additional funds in the adjustments estimate for projects that will commence in January 2006 • Inefficient planning processes and delays in technical tendering processes are being tackled systematically – National school nutrition programme • Delay in the submission of claims by service providers results in slow payment by the department • Moving forward the Department will transfer funds directly to schools to allow them to set up mobile kitchens with the assistance of EMDC’s for the distribution of feeding schemes 23

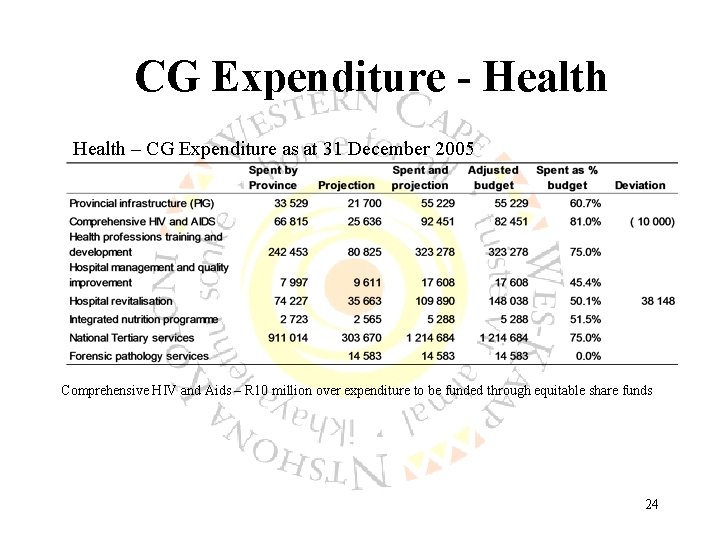

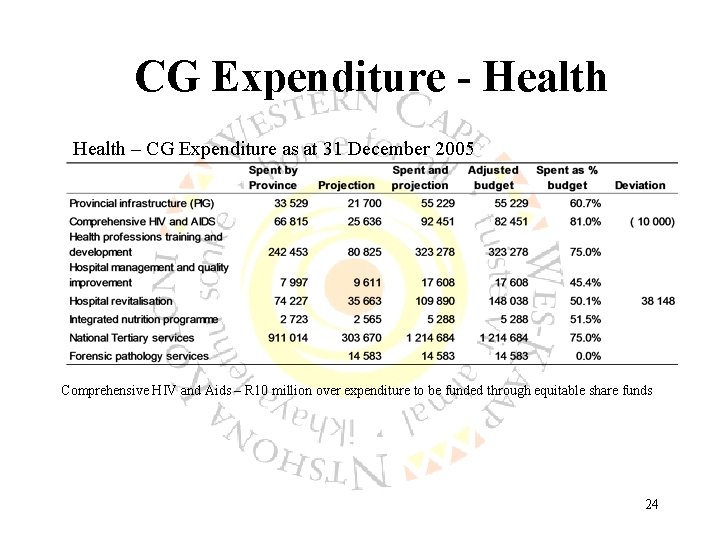

CG Expenditure - Health – CG Expenditure as at 31 December 2005 Comprehensive HIV and Aids – R 10 million over expenditure to be funded through equitable share funds 24

CG Expenditure – Health (2) • Challenges to overcome – Provincial infrastructure grant (PIG) • • On site problems The late submission of claims Journalising of expenditure wrongly classified Limited project management capacity to manage vast number of projects – Hospital management and quality improvement • The creation of additional posts took longer than expected 25

CG Expenditure - Health (3) – Hospital revitalisation programme: • Slow performance of contractors on various projects • Worcester Hospital – a shopping centre is being built in the same area resulting in competing for resources results in delay in construction • Paarl hospital – Delay in the approval of the business plan • The Department proposed the purchase of two linear accelerators for Tygerberg Hospital to offset the under expenditure but as no business plan had been approved this was not possible – Integrated nutrition programme • Claims outstanding from the City of Cape Town and rural regions 26

CG Expenditure - Health (4) – Forensic pathology services • Voted in the 2005/06 adjustments estimate • First tranch received in December • R 5 million transferred to the Department of Transport and Public Works for the purchase of motor vehicles • Expenditure for the remaining R 9, 583 million is dependent on approval by the National Department of Public Works, the National Department of Health and SAPS. 27

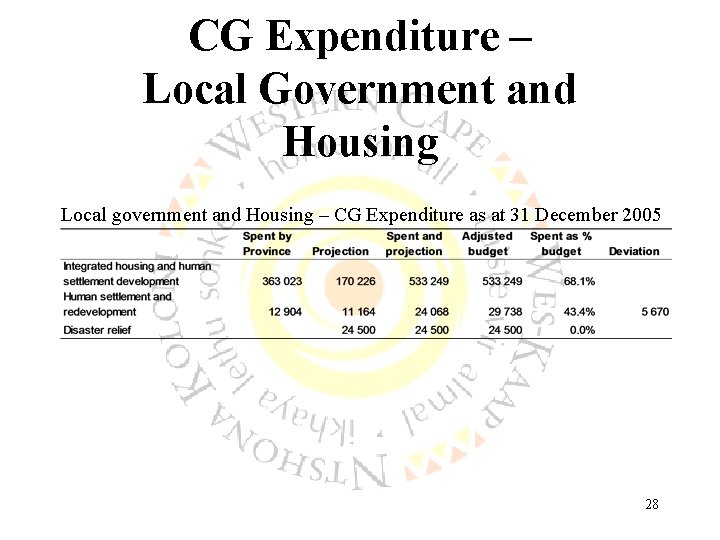

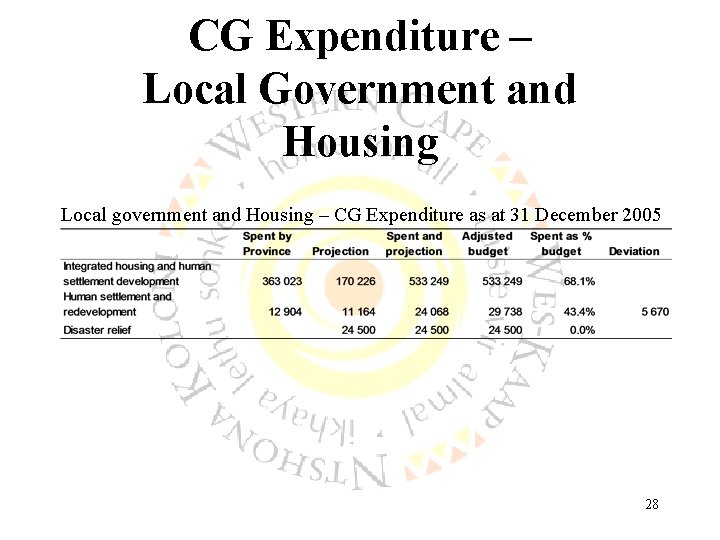

CG Expenditure – Local Government and Housing Local government and Housing – CG Expenditure as at 31 December 2005 28

CG Expenditure – Local Government and Housing (2) • Challenges to overcome – Human settlement and redevelopment grant • Tender approval process taking longer than expected • Maintenance projects that will not be completed by the end of the financial year – Disaster relief • Funds will only be transferred in March 2006 29

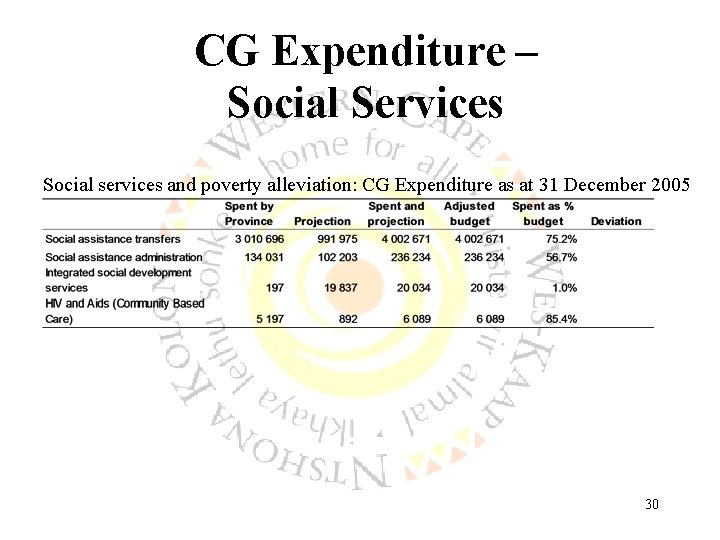

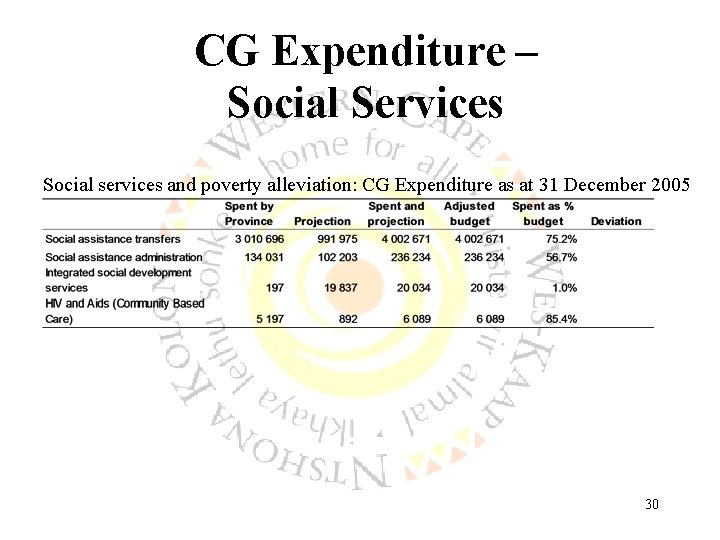

CG Expenditure – Social Services Social services and poverty alleviation: CG Expenditure as at 31 December 2005 30

CG Expenditure – Social Services (2) • Challenges to overcome – Integrated Social Development Services • Looking at more a integrated way of poverty alleviation (working together with other departments and local government) resulted in delays • Lag between IYM figures and actual spending, substantial spending has taken place – Social Assistance Administration • Establishment for support services staff for SASSA has not been approved by National Department of Social Development • Social Services pay administrative costs and claim back from SASSA 31

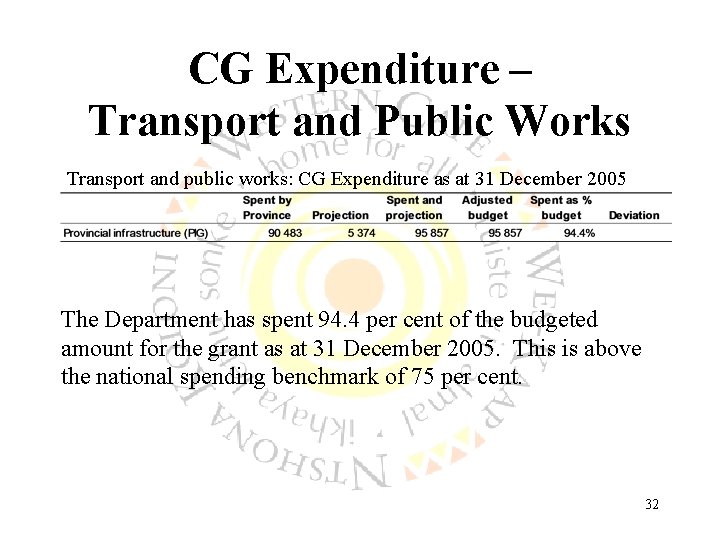

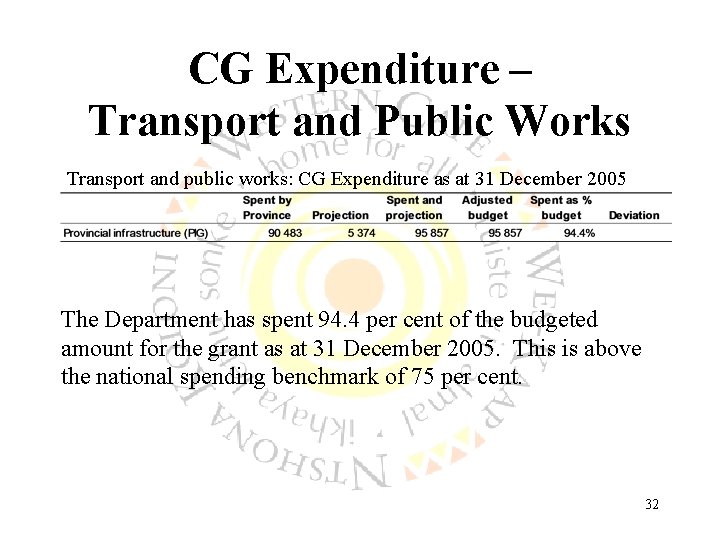

CG Expenditure – Transport and Public Works Transport and public works: CG Expenditure as at 31 December 2005 The Department has spent 94. 4 per cent of the budgeted amount for the grant as at 31 December 2005. This is above the national spending benchmark of 75 per cent. 32

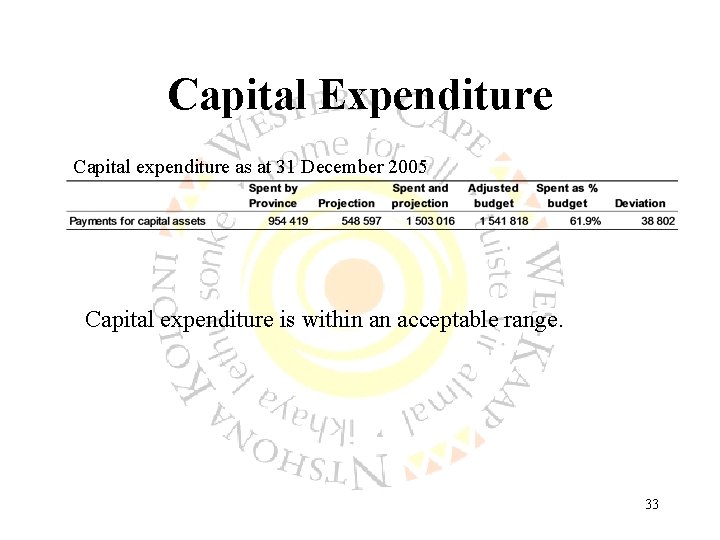

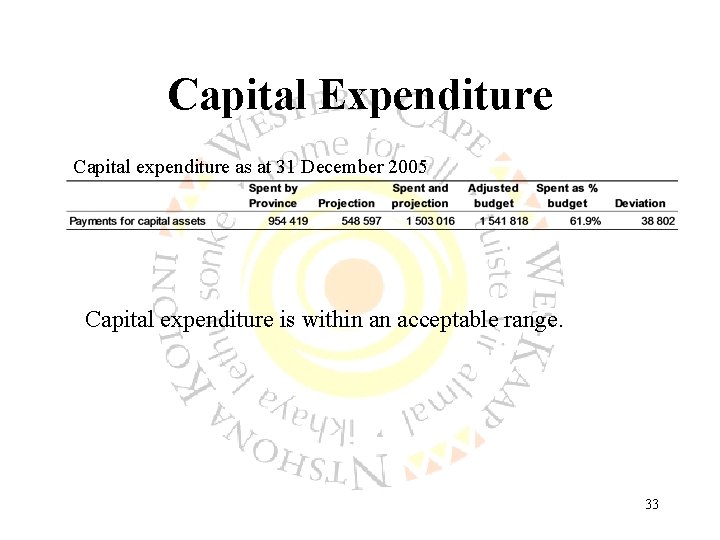

Capital Expenditure Capital expenditure as at 31 December 2005 Capital expenditure is within an acceptable range. 33

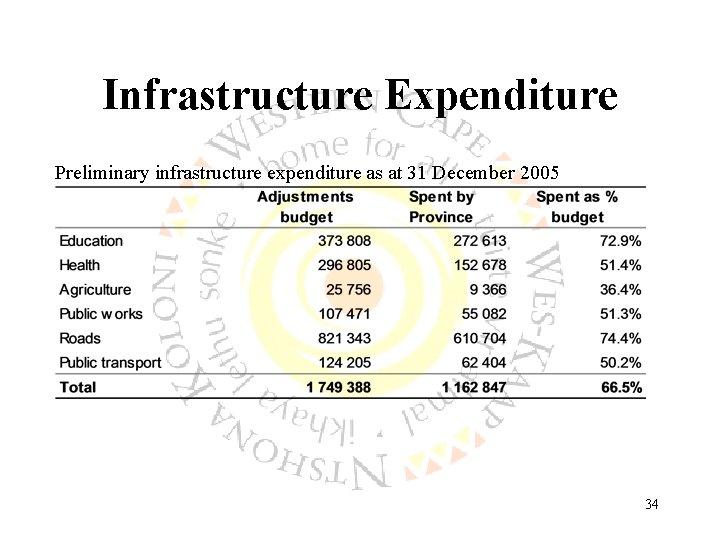

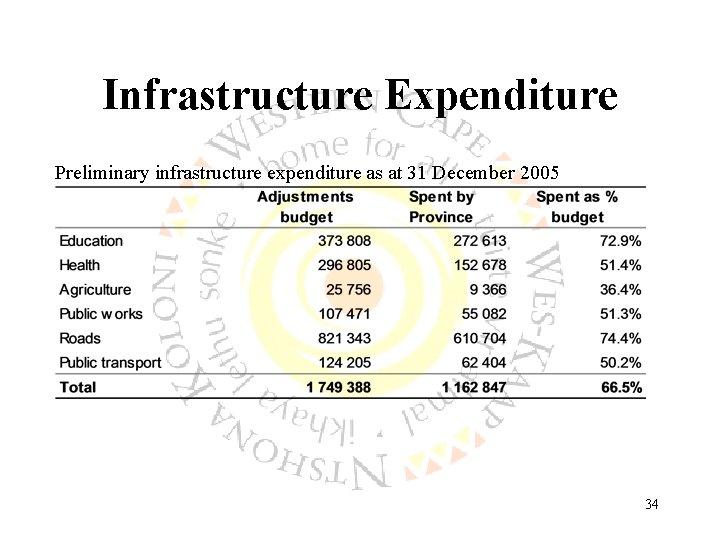

Infrastructure Expenditure Preliminary infrastructure expenditure as at 31 December 2005 34

Infrastructure Expenditure (2) • Challenges to overcome – Bottlenecks in the procurement process – Inefficiencies in the link between planning, budgeting and implementation – Capacity constraints 35

Monitoring Expenditure 36

Monitoring Provincial Expenditure • Monthly reports to NT • Quarterly reports to Top Management, Exco and Legislature (SCOF) • Quarterly narrative reports to AOs and CFOs • Frequent interaction with departments on spending performance and general issues • Quarterly meetings between MEC’s for finance, education, health and public works to discuss infrastructure spending and other difficulties • Continuous engagements with departments in a cooperative manner to jointly seek solutions 37

Monitoring Local Government Expenditure • 24 municipalities directly and 6 municipalities indirectly. • S 71 of MFMA: Monthly reports to PT & NT and quarterly Provincial Legislature. • IYM introduced in municipalities 1 July 2005 to monitor the budget outcomes. • Various municipal financial systems and capacity make it difficult for municipalities to comply. • Provide assistance to municipalities which could enable them to comply. • 11 municipalities submit the full IYM model while 19 municipalities submit a summary version of the IYM. • Developed a provincial IYM database. • Discussions with NT access to NT database. • Currently assessing the IYM and due to submit a report. • Assessed all municipal revenue and expenditure to determine the affordability of increases in Councillor remuneration. • CFO Forum: PT with municipalities, quarterly on financial matters. 38

Service Delivery Agreements 39

Service Delivery Agreements • Agreements concluded between implementing agent (Department of Transport and Public Works) and client department (Departments of Education and Health) • Key aspects covered include: – – – Scope of Delivery Roles and responsibilities Programme and project control Service levels Resolution of differences and disputes 40

The Way Forward 41

The way forward • Build on financial and non-financial quarterly reports to Legislature, Exco and Top Management: to better inform engagement with departments • Paradigm shifts – for alignment of infrastructure cycle with the budget cycle • Legislation needs to be more enabling – conditions result in delay in service delivery • There needs to be certainty regarding funding levels and the flow of funding, this is especially relevant for infrastructure spending • Ensure the early sign off of business plans • Care should be taken to ensure that conditions placed on conditional grants do not impact on service delivery 42

Discussion 43

Ontario provincial committee

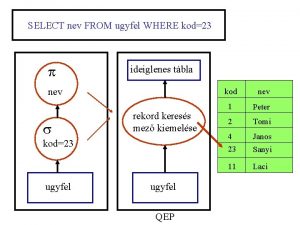

Ontario provincial committee Select * from select

Select * from select Select * from select

Select * from select Nameadmin

Nameadmin Select * from select

Select * from select Select committee training

Select committee training Society and culture in provincial america

Society and culture in provincial america Provincial exam essay sample

Provincial exam essay sample Governo provincial do cuanza norte

Governo provincial do cuanza norte Localización

Localización Direccion provincial de vialidad

Direccion provincial de vialidad Grade 7 provincial math assessment

Grade 7 provincial math assessment Governo provincial do cuanza norte

Governo provincial do cuanza norte Chapter 3 society and culture in provincial america

Chapter 3 society and culture in provincial america What is quebec's provincial flower

What is quebec's provincial flower Alberta provincial logbook rules

Alberta provincial logbook rules David william shearing

David william shearing Provincial medical oversight

Provincial medical oversight Limpopo development plan 2020

Limpopo development plan 2020 Direccion provincial de vialidad

Direccion provincial de vialidad Provincial salary rate

Provincial salary rate Provincial hours of service

Provincial hours of service Boyhood scenes from provincial life

Boyhood scenes from provincial life Provincial achievement tests

Provincial achievement tests Niveles de gobierno

Niveles de gobierno Municipalidad provincial de arequipa

Municipalidad provincial de arequipa Provincial style architecture

Provincial style architecture Governo provincial do namibe

Governo provincial do namibe Estelle setan national treasury

Estelle setan national treasury Abb treasury

Abb treasury Trends in treasury management

Trends in treasury management Treasury automation provider

Treasury automation provider When treasury stock is resold at a price above cost:

When treasury stock is resold at a price above cost: Treasury activities definition

Treasury activities definition Treasury cash balance

Treasury cash balance Sap treasury workstation

Sap treasury workstation Treasury account symbol

Treasury account symbol Treasury inflation protected securities cfa

Treasury inflation protected securities cfa Fxall download

Fxall download Treasury stock retained earnings

Treasury stock retained earnings Tsa module in pfms

Tsa module in pfms Georgia state treasury

Georgia state treasury Cyber treasury mponline

Cyber treasury mponline Treasury key performance indicators

Treasury key performance indicators