National Pension and Institutional Investor Summit Understanding Treasury

- Slides: 6

National Pension and Institutional Investor Summit Understanding Treasury Inflation Protected Securities Kirk Brown, CFA American Beacon Advisors December 3, 2009

Treasury Inflation Protected Securities Large Cap Value Fund Treasury Inflation Protected Securities (“TIPS”) – What are they? • TIPS were first issued by the U. S. Treasury in 1997 • TIPS are U. S. government guaranteed bonds that protect investors from rising inflation as they guarantee investors a real rate of return above inflation • Similarities with nominal Treasuries 1. Issued by the U. S. Treasury 2. Backed by the full faith and credit of the U. S. government 3. Coupon rate fixed at time of issuance 4. Coupon payment paid on a semi-annual basis 5. Coupon payment is calculated as a fixed percentage of principal (however, principal fluctuates with inflation / deflation) • Differences from nominal Treasuries 1. Principal fluctuates daily based on changes in the Consumer Price Index (CPI-U 1), lagged 3 months 2. Provide protection from deflation as redemption is at the greater of the inflation adjusted principal or original par amount 3. Coupon rate represents the real rate of return required by investors at the time of issuance 4. Coupon payments rise/fall with inflation/deflation as the fixed coupon rate is applied to a growing/falling principal balance 5. TIPS cash flows are more back-end loaded as their real coupons are lower but their principal grows with inflation 1 CPI-U: the nonseasonally adjusted U. S. City Average All Items Consumer Price Index for All Urban Consumers, published by the Bureau of Labor Statistics of the U. S. Department of Labor

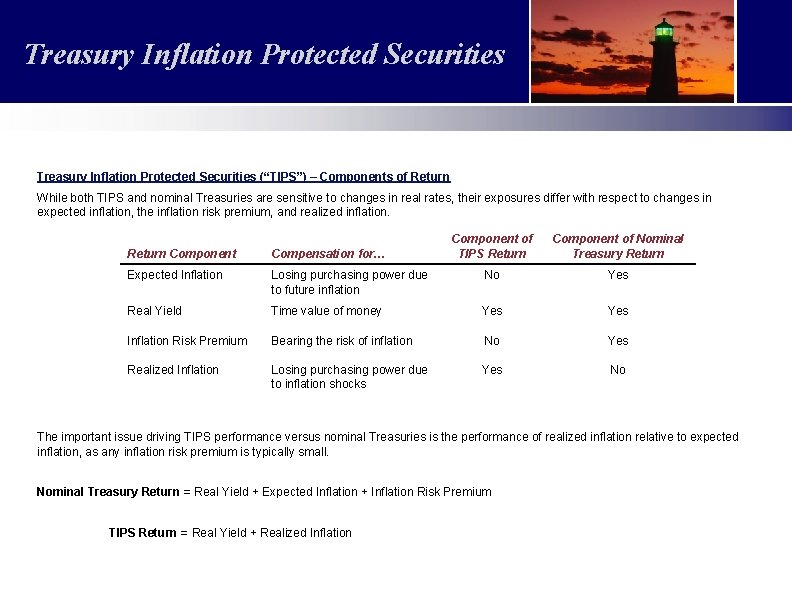

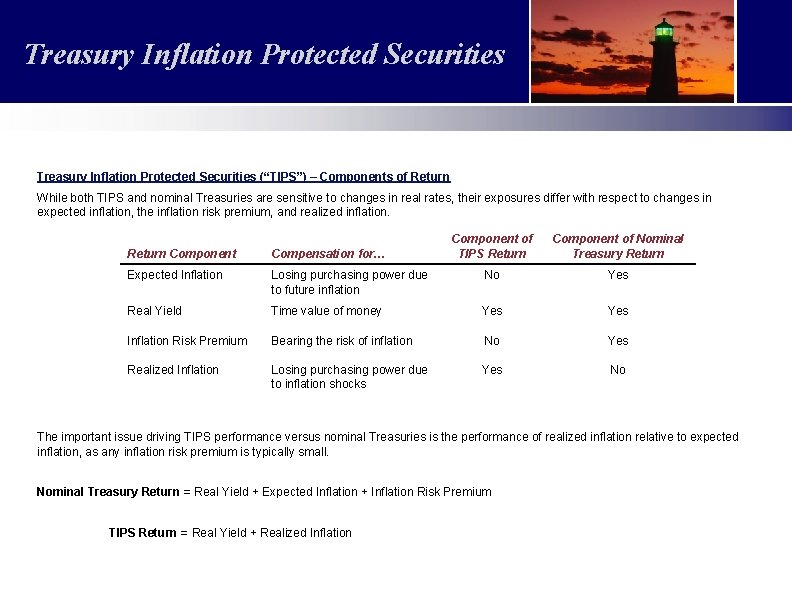

Treasury Inflation Protected Securities Large Cap Value Fund Treasury Inflation Protected Securities (“TIPS”) – Components of Return While both TIPS and nominal Treasuries are sensitive to changes in real rates, their exposures differ with respect to changes in expected inflation, the inflation risk premium, and realized inflation. Component of TIPS Return Component of Nominal Treasury Return Component Compensation for… Expected Inflation Losing purchasing power due to future inflation No Yes Real Yield Time value of money Yes Inflation Risk Premium Bearing the risk of inflation No Yes Realized Inflation Losing purchasing power due to inflation shocks Yes No The important issue driving TIPS performance versus nominal Treasuries is the performance of realized inflation relative to expected inflation, as any inflation risk premium is typically small. Nominal Treasury Return = Real Yield + Expected Inflation + Inflation Risk Premium TIPS Return = Real Yield + Realized Inflation

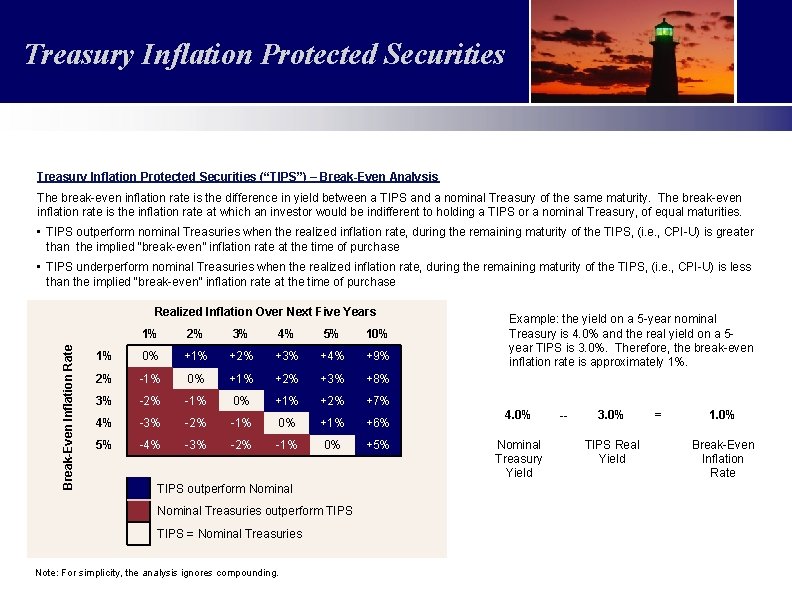

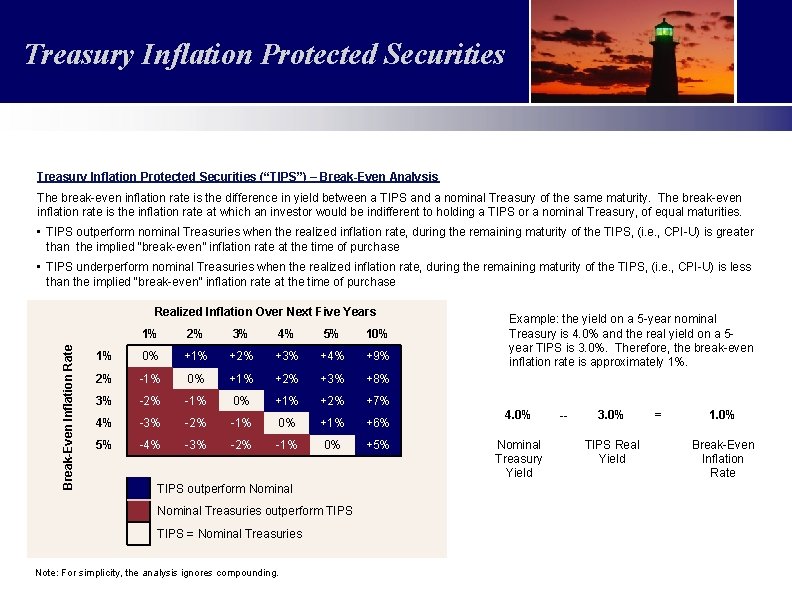

Treasury Inflation Protected Securities Large Cap Value Fund Treasury Inflation Protected Securities (“TIPS”) – Break-Even Analysis The break-even inflation rate is the difference in yield between a TIPS and a nominal Treasury of the same maturity. The break-even inflation rate is the inflation rate at which an investor would be indifferent to holding a TIPS or a nominal Treasury, of equal maturities. • TIPS outperform nominal Treasuries when the realized inflation rate, during the remaining maturity of the TIPS, (i. e. , CPI-U) is greater than the implied “break-even” inflation rate at the time of purchase • TIPS underperform nominal Treasuries when the realized inflation rate, during the remaining maturity of the TIPS, (i. e. , CPI-U) is less than the implied “break-even” inflation rate at the time of purchase Break-Even Inflation Rate Realized Inflation Over Next Five Years 1% 2% 3% 4% 5% 10% 1% 0% +1% +2% +3% +4% +9% 2% -1% 0% +1% +2% +3% +8% 3% -2% -1% 0% +1% +2% +7% 4% -3% -2% -1% 0% +1% +6% 5% -4% -3% -2% -1% 0% +5% TIPS outperform Nominal Treasuries outperform TIPS = Nominal Treasuries Note: For simplicity, the analysis ignores compounding. Example: the yield on a 5 -year nominal Treasury is 4. 0% and the real yield on a 5 year TIPS is 3. 0%. Therefore, the break-even inflation rate is approximately 1%. 4. 0% Nominal Treasury Yield -- 3. 0% TIPS Real Yield = 1. 0% Break-Even Inflation Rate

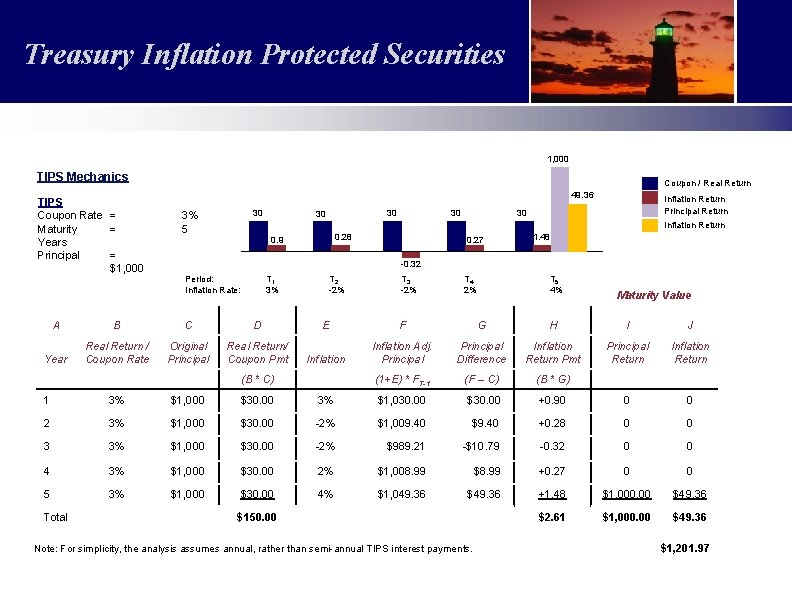

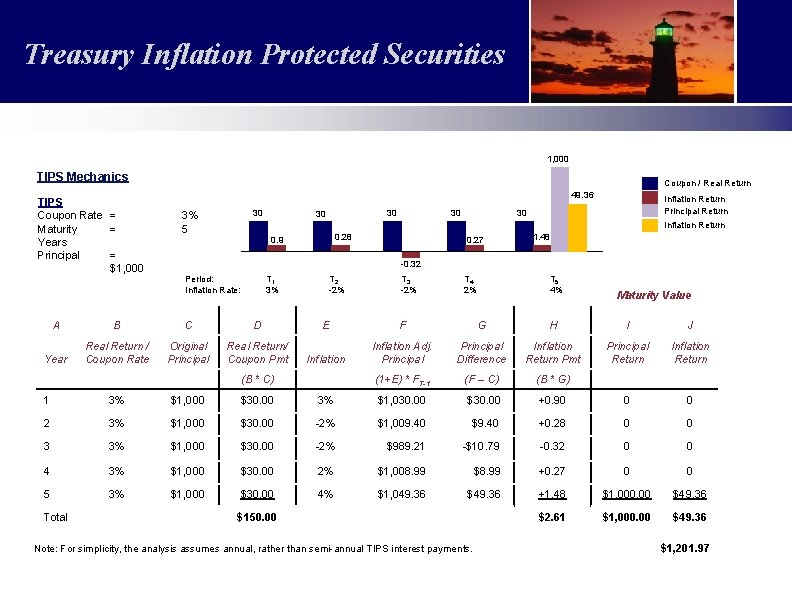

Treasury Inflation Protected Securities Large Cap Value Fund 1, 000 TIPS Mechanics TIPS Coupon Rate = Maturity = Years Principal = $1, 000 Coupon / Real Return 49. 36 30 3% 5 30 30 Inflation Return Principal Return 30 30 Inflation Return 0. 28 0. 9 0. 27 1. 48 -0. 32 Period: Inflation Rate: T 1 3% T 2 -2% T 3 -2% T 4 2% T 5 4% Maturity Value A B C D E F G H I J Year Real Return / Coupon Rate Original Principal Return/ Coupon Pmt Inflation Adj. Principal Difference Inflation Return Pmt Principal Return Inflation Return (1+E) * FT-1 (F – C) (B * G) (B * C) 1 3% $1, 000 $30. 00 3% $1, 030. 00 $30. 00 +0. 90 0 0 2 3% $1, 000 $30. 00 -2% $1, 009. 40 $9. 40 +0. 28 0 0 3 3% $1, 000 $30. 00 -2% $989. 21 -$10. 79 -0. 32 0 0 4 3% $1, 000 $30. 00 2% $1, 008. 99 $8. 99 +0. 27 0 0 5 3% $1, 000 $30. 00 4% $1, 049. 36 $49. 36 +1. 48 $1, 000. 00 $49. 36 $2. 61 $1, 000. 00 $49. 36 Total $150. 00 Note: For simplicity, the analysis assumes annual, rather than semi-annual TIPS interest payments. $1, 201. 97

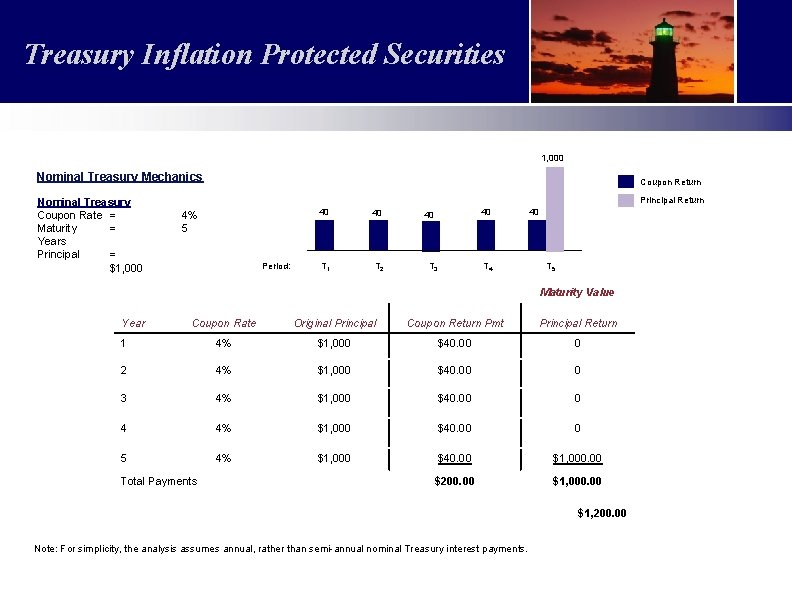

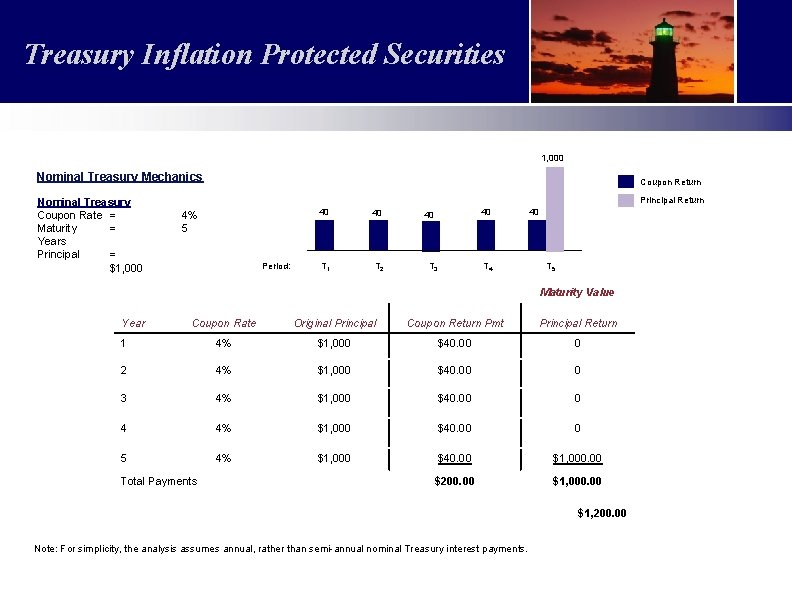

Treasury Inflation Protected Securities Large Cap Value Fund 1, 000 Nominal Treasury Mechanics Nominal Treasury Coupon Rate = Maturity = Years Principal = $1, 000 Coupon Return Principal Return 4% 5 Period: 40 40 T 1 T 2 40 40 T 3 T 4 40 T 5 Maturity Value Year Coupon Rate Original Principal Coupon Return Pmt Principal Return 1 4% $1, 000 $40. 00 0 2 4% $1, 000 $40. 00 0 3 4% $1, 000 $40. 00 0 4 4% $1, 000 $40. 00 0 5 4% $1, 000 $40. 00 $1, 000. 00 $200. 00 $1, 000. 00 Total Payments $1, 200. 00 Note: For simplicity, the analysis assumes annual, rather than semi-annual nominal Treasury interest payments.