MENAOECD Investment Programme COLLECTIVE INVESTMENT SCHEMES IN OECD

- Slides: 19

MENA-OECD Investment Programme COLLECTIVE INVESTMENT SCHEMES IN OECD COUNTRIES Sustainable Capital Markets Development in the Gulf, Middle East and Northern Africa London. 24 July 2006 John K. Thompson Senior Financial Sector Expert, OECD MENA-OECD Investment Programme

Collective Investment Schemes (CIS): Background • Boom in Capital Markets 1980 -2000 • Individuals increasingly prefer institutional investment to direct investment • Pooling of savings by many small investors – Small investors cannot afford diversified portfolios – Small investors cannot make informed portfolio selection MENA-OECD Investment Programme

Collective Investment Schemes (CIS) Pooling of Savings by many small investors • • • Many opportunities in capital markets Small investors cannot afford diversified portfolios Small investors cannot trade efficiently Access to professional management Selection of strategy MENA-OECD Investment Programme

Characteristics of CIS • Defined legal and governance structure – – – – Special laws Diversity of legal structure Regulatory systems Disclosure Professional management Investment policy Low cost execution • Safeguards for investors MENA-OECD Investment Programme

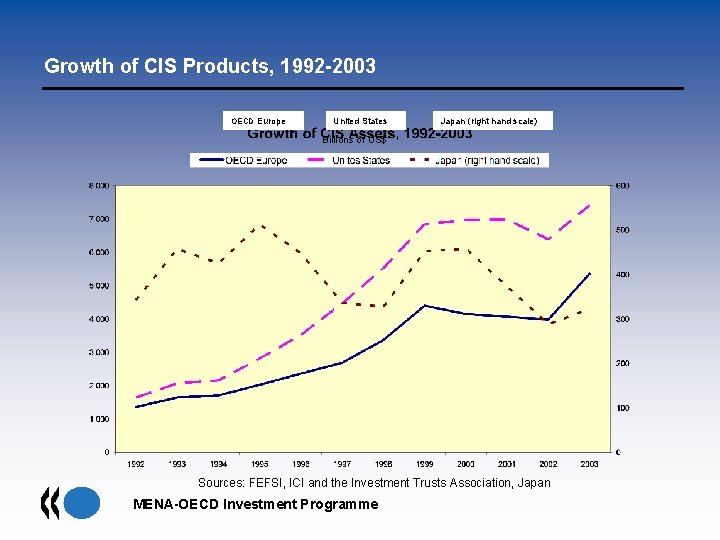

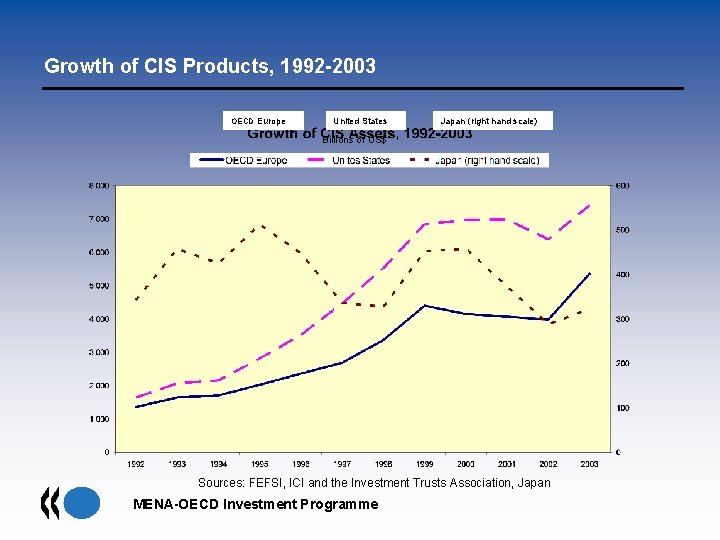

Growth of CIS Products, 1992 -2003 OECD Europe United States Japan (right hand scale) Billions of US$ Sources: FEFSI, ICI and the Investment Trusts Association, Japan MENA-OECD Investment Programme

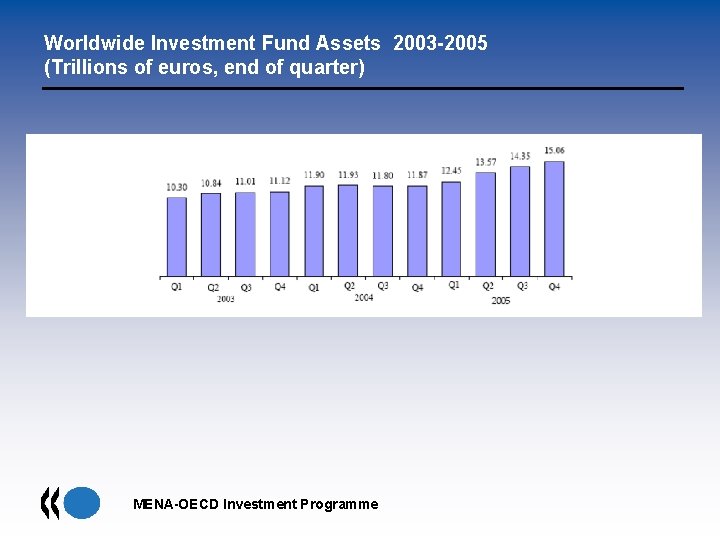

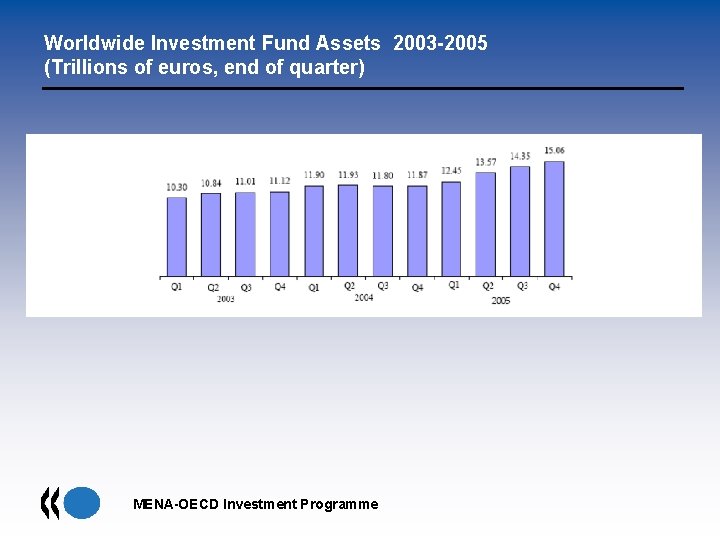

Worldwide Investment Fund Assets 2003 -2005 (Trillions of euros, end of quarter) MENA-OECD Investment Programme

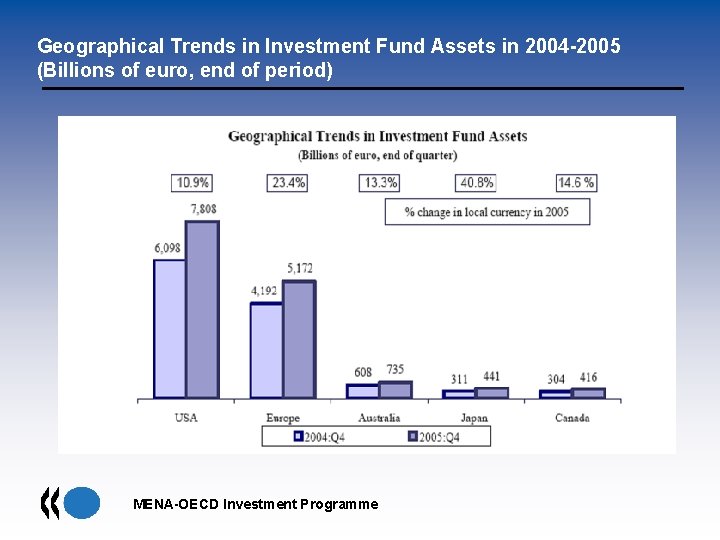

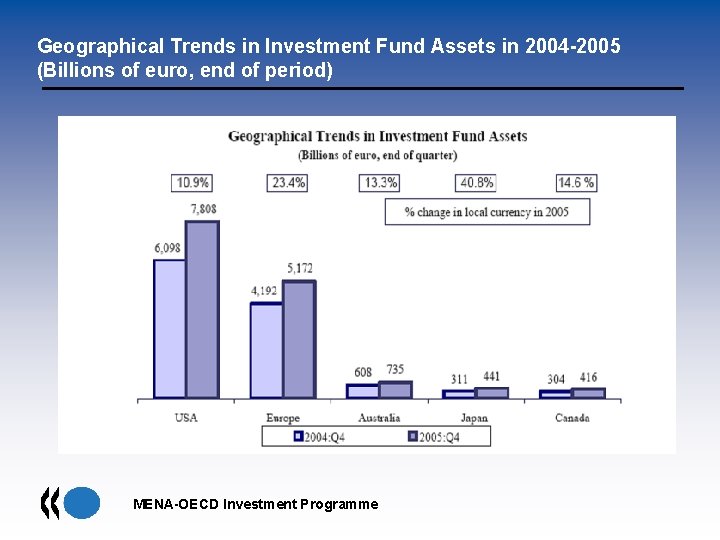

Geographical Trends in Investment Fund Assets in 2004 -2005 (Billions of euro, end of period) MENA-OECD Investment Programme

Agency Dilemma in CIS Large pools of assets under control of financial institutions investors with limited ability to monitor Asymmetry of Power and Information – Investors (small, often unsophisticated, dispersed) – Investment Manager/Operator (control of information, sophisticated) – Outright Abuse: fraud / theft / misrepresentation – Conflict of Interest MENA-OECD Investment Programme

‘First Generation’ Legislative Reforms • • • Outright abuses of agency relationship Theft Fraud Misrepresentation of portfolio Improper valuation Solution: National and international laws, regulation and standards • • Investment Company Act of 1940 (USA) OECD Principles 1971 EC/EU UCITS Directives 1985 IOSCO Principles 1994 Issues Covered: Funds segregation, Disclosure, Valuation, Investment Restrictions And Policies MENA-OECD Investment Programme

Typology of Conflicts of Interest • Investment Manager vs. Investor • Affiliated Financial and Non-Financial Companies • Non-Affiliated Financial Companies MENA-OECD Investment Programme

Abuses of Investor Confidence • Cross subsidization • Allocation of costs • Excessive trading (churning) • Use of affiliated intermediaries • Support of securities underwritten by affiliates • Support of securities of companies with banking relationships • Support of affiliated non-finance companies, i. e. ‘captive’ finance MENA-OECD Investment Programme

Use of Ownership Rights CIS are increasingly important owners of equity Disinclined to be active investors • Uncertain demand from final investors (performance not governance) • Financial costs of activism • Hesitant to oppose management Criticism: CIS represent final owners of capital but have not pushed hard enough for better corporate governance (‘Asleep at the wheel’) MENA-OECD Investment Programme

The Ultimate Weapon: Transparency and Disclosure Investors can liquidate positions at will Investors now have access to a vast body of information to support informed decisions Disclosure: – Mandatory – Voluntary Information increasingly available on a comparable basis, standardized presentation, ratings for : – Performance – Fees and Expenses – Governance MENA-OECD Investment Programme

Investor Access to Information • Popular press • Specialized press (ex: Money magazine) • Information service providers – Lipper – Morningstar – S&P • Use of information technology • Recent innovation ratings of CIS governance (Morningstar) • Database of companies accused of malfeasance MENA-OECD Investment Programme

Standards for CIS Issues Covered Under Standards • • • Account segregation Valuation Investment restrictions and policies Periodic disclosure Prospectus Depositories MENA-OECD Investment Programme

Standards for CIS Domestic Standards • • In-house policies Industry standards Law and Regulation Market International Standards • • • OECD Principles (1971) EC/EU UCITS Directives 1985, 2000, 2001, 2002 IOSCO Principles 1994, 1997, 1999, 2000 MENA-OECD Investment Programme

Case Study: Strengthening Governance in the USA • Internal firm reviews of practice – Compensation – Firewalls – Compliance • Enlarged role for independent directors (voluntary and mandatory) • Stronger requirements for independent and adequacy of time and information • Governance information and ratings by Morningstar • Global settlement (SEC and state attorneys general) • SEC Requirements for disclosure of voting practices • Corporate governance policies on websites MENA-OECD Investment Programme

Strengthening Governance • Firm level initiatives – Trust is an asset; firms must protect reputation • Industry Associations – Voluntary Codes and Best Practices • Official Regulation – Reviews of rules and practices – New rules • Sanctions • International Standards – IOSCO – EU MENA-OECD Investment Programme

Relevance for MENA Countries • • • Rapidly Growing Savings Periodic Instability Need for Investor Safeguards/ Professional Management Adaptability to Islamic Finance Issues: – Should there be international competition in CIS – Is there a Need for International Coordination (EU UCITS Directives? ) – Which centers will become market leaders in the CIS sector? MENA-OECD Investment Programme

Collective investment scheme regulations

Collective investment scheme regulations Fixed investment and inventory investment

Fixed investment and inventory investment Oecd guidelines on measuring subjective well-being

Oecd guidelines on measuring subjective well-being Oecd modellegyezmény magyarul

Oecd modellegyezmény magyarul Andrew auerbach

Andrew auerbach Oecd data warehouse

Oecd data warehouse Oecd 207

Oecd 207 Oecd economic outlook

Oecd economic outlook Daniel gerson oecd

Daniel gerson oecd Principles of glp

Principles of glp William hynes oecd

William hynes oecd Oecd

Oecd Oecd meaning

Oecd meaning Oecd better life initiative

Oecd better life initiative Oecd scenarios for the future of schooling

Oecd scenarios for the future of schooling Francesca colombo oecd

Francesca colombo oecd Oecd working group on bribery

Oecd working group on bribery Oecd good practices for performance budgeting

Oecd good practices for performance budgeting Oecd

Oecd Andrea goldstein oecd

Andrea goldstein oecd