Looking Ahead to 2017 Manning Napiers Outlook Prepared

- Slides: 18

Looking Ahead to 2017 Manning & Napier’s Outlook Prepared for: CFA Society of Rochester

Christopher Petrosino, CFA® Managing Director, Quantitative Strategies Group Christopher Petrosino is the Managing Director of the Quantitative Strategies Group at Manning & Napier and has been with the Firm since 2001. He is a member of the management teams responsible for portfolios developed by the Quantitative Strategies Group. Christopher also contributes to the development of market and economic overviews for the Firm. This includes constructing indicators to assess risks and opportunities in various asset classes, as well as providing statistical analysis to support the investment research efforts of the Firm. Christopher earned his BA in Economics and Statistics from the University of Rochester and his MS in Statistics from the Rochester Institute of Technology. He is also a CFA® charterholder. Data as of 12/31/2015. CFA® is a trademark owned by CFA Institute. 2

2017 At a Glance • Better economic backdrop today than this time last year • U. S. election results increase uncertainty but also increases the probability of a normal economic cycle • Risk of current expansion dying of old age has declined • Economy ≠ stock market • Expect volatility to continue 3

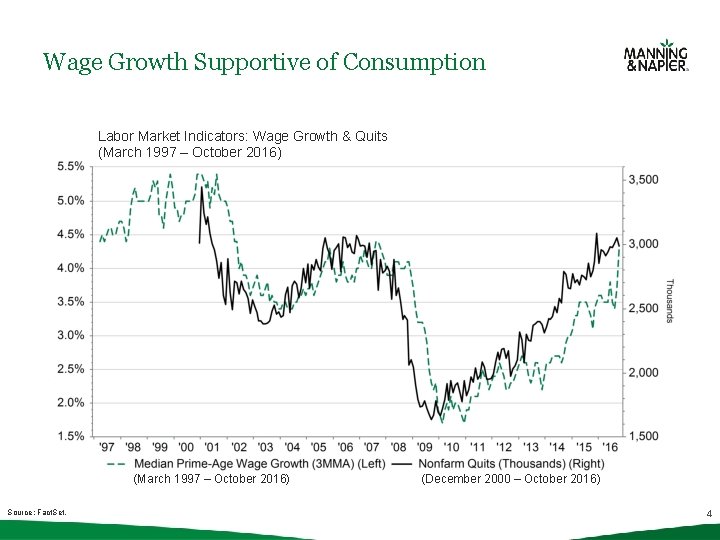

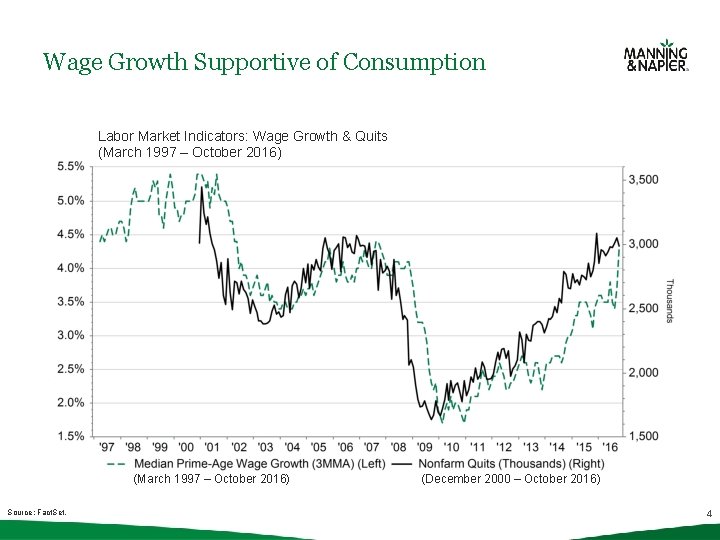

Wage Growth Supportive of Consumption Labor Market Indicators: Wage Growth & Quits (March 1997 – October 2016) Source: Fact. Set. (December 2000 – October 2016) 4

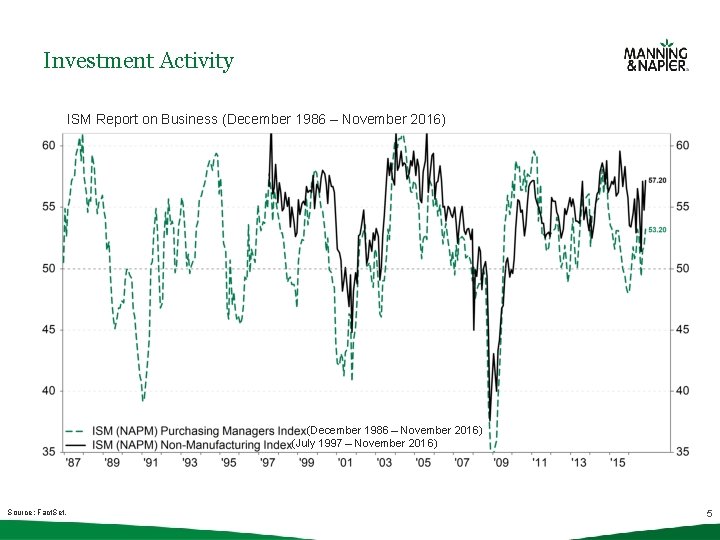

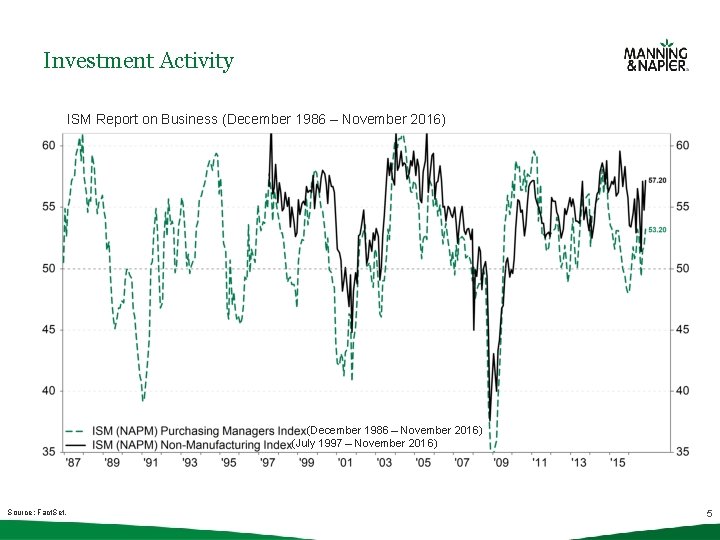

Investment Activity ISM Report on Business (December 1986 – November 2016) (July 1997 – November 2016) Source: Fact. Set. 5

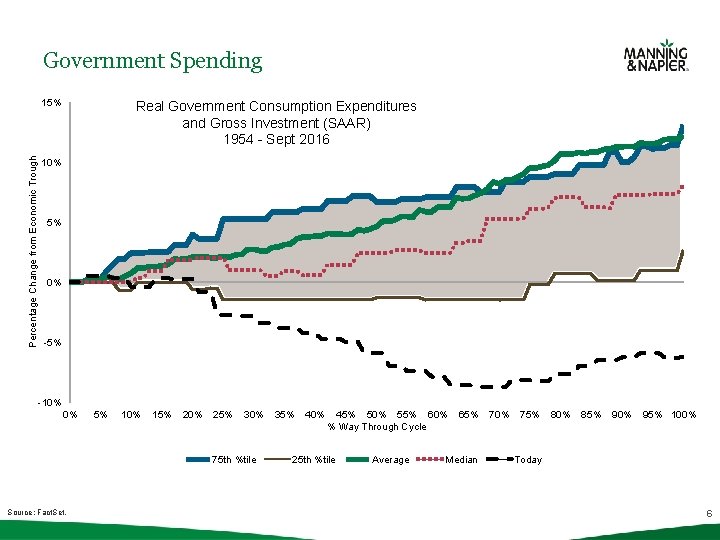

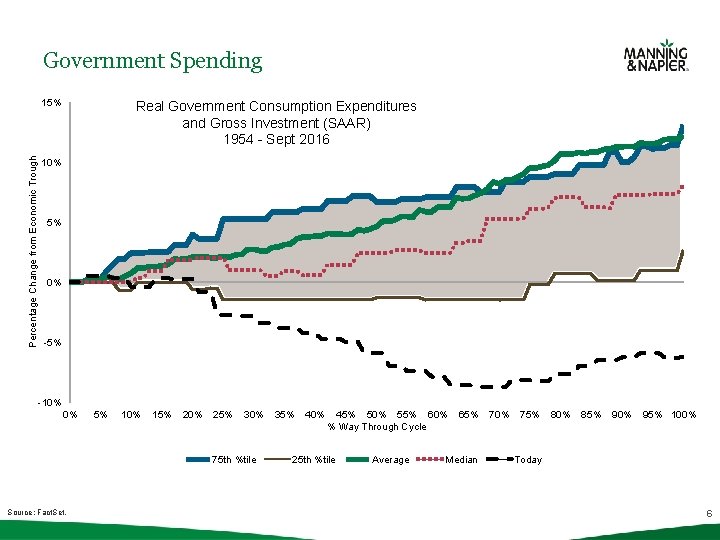

Government Spending Percentage Change from Economic Trough 15% Real Government Consumption Expenditures and Gross Investment (SAAR) 1954 - Sept 2016 10% 5% 0% -5% -10% 0% 5% 10% 15% 20% 25% 30% 75 th %tile Source: Fact. Set. 35% 40% 45% 50% 55% 60% % Way Through Cycle 25 th %tile Average 65% Median 70% 75% 80% 85% 90% 95% 100% Today 6

C+I+G+Trump=? Taken at face value, several of the president-elect’s policies should benefit economic growth: • Tax Reform (both individual and corporate) • Infrastructure Spending • Repatriation • De-regulation 7

But No Guarantees • Most pro-growth policies will take time to implement and directly impact economic growth • The appetite for true tax reform and increasing the federal deficit remain to be seen • Stance on trade and potential protectionist policies are a source of risk 8

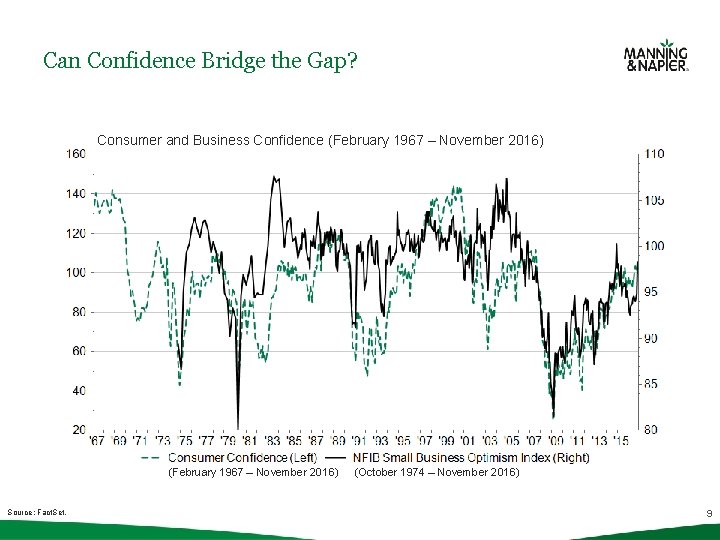

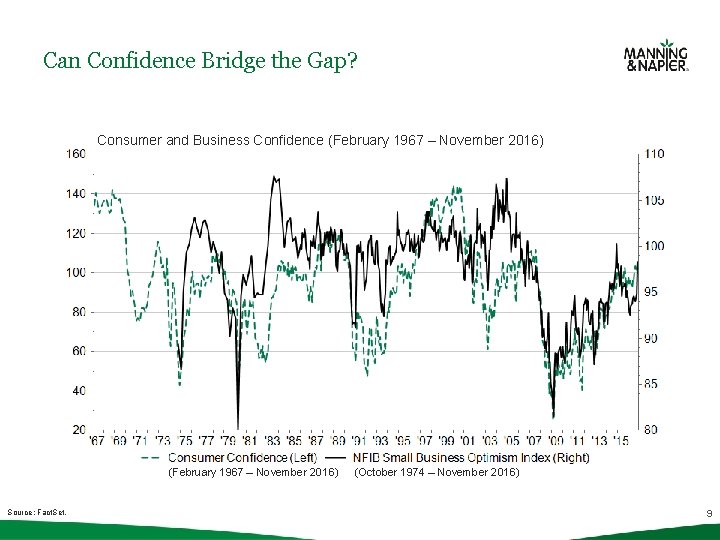

Can Confidence Bridge the Gap? Consumer and Business Confidence (February 1967 – November 2016) Source: Fact. Set. (October 1974 – November 2016) 9

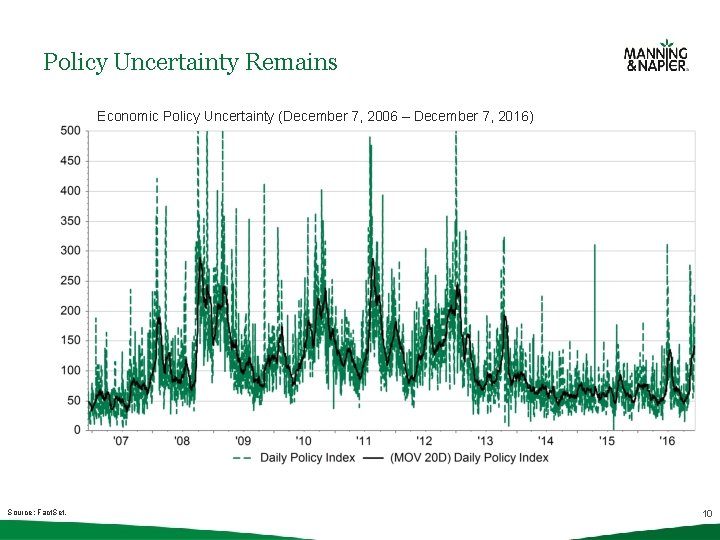

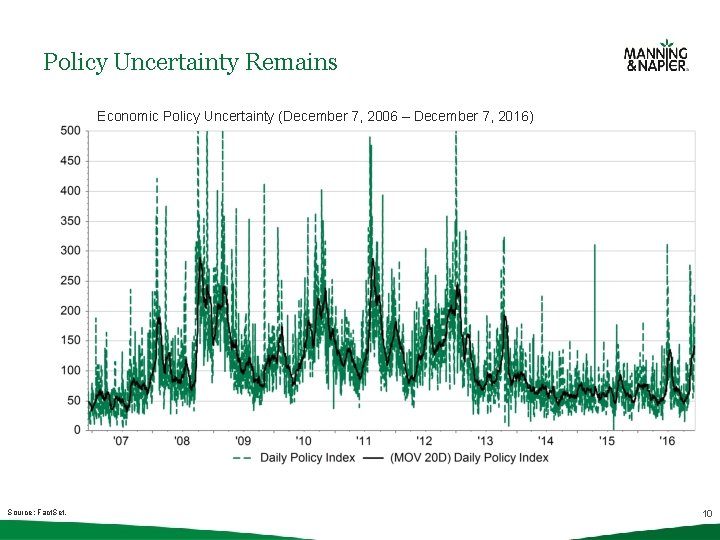

Policy Uncertainty Remains Economic Policy Uncertainty (December 7, 2006 – December 7, 2016) Source: Fact. Set. 10

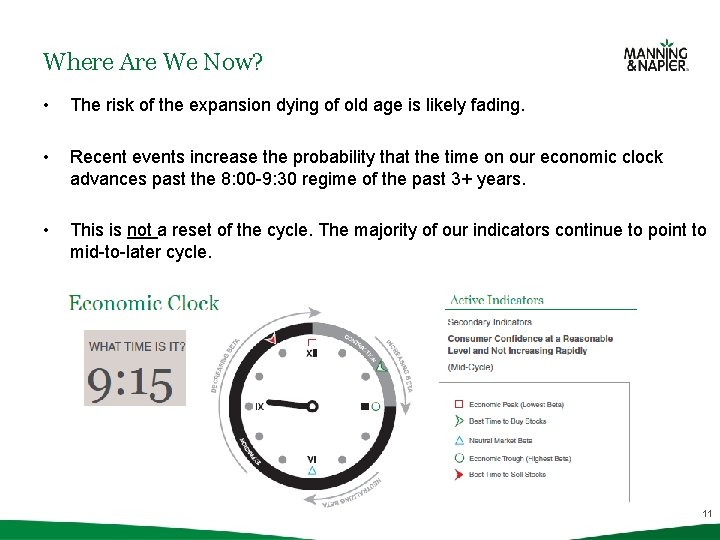

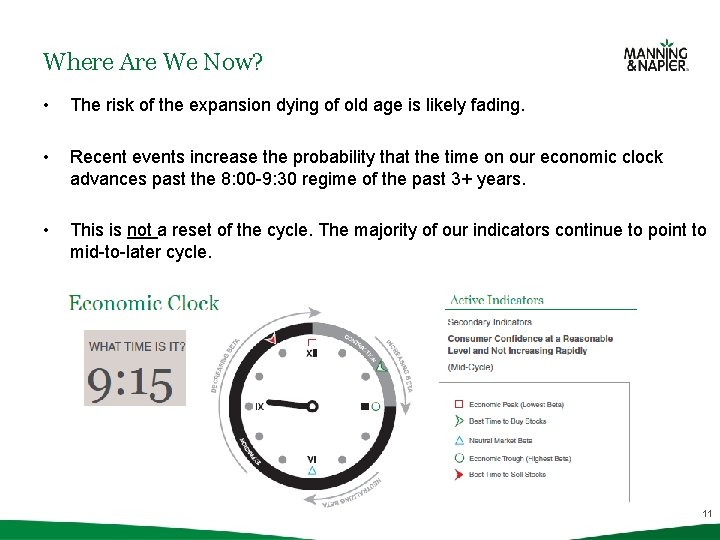

Where Are We Now? • The risk of the expansion dying of old age is likely fading. • Recent events increase the probability that the time on our economic clock advances past the 8: 00 -9: 30 regime of the past 3+ years. • This is not a reset of the cycle. The majority of our indicators continue to point to mid-to-later cycle. 11

Market Outlook: Economy ≠ Stock Market • Valuations are full • Sentiment remains complacent • Volatility to continue 12

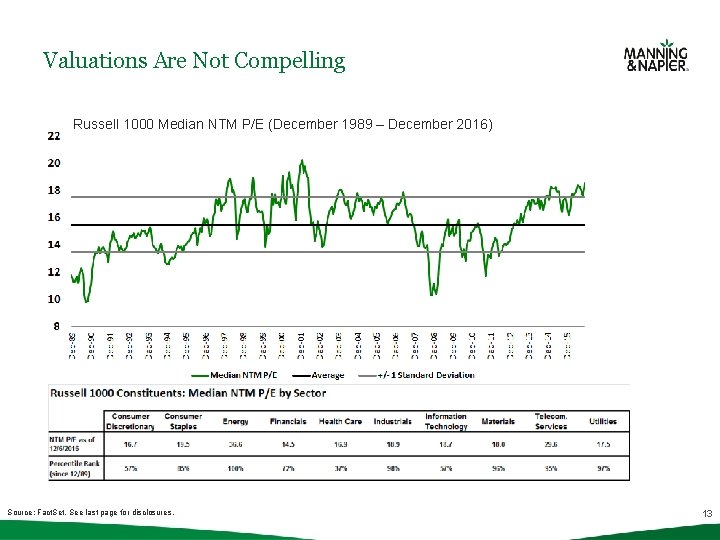

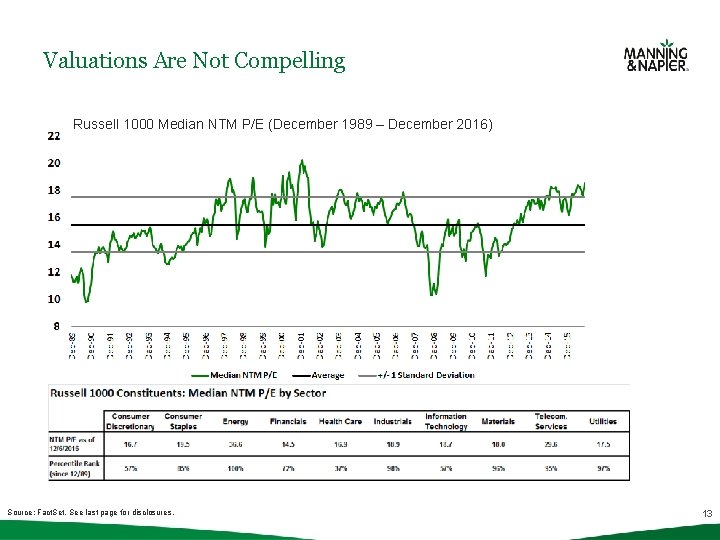

Valuations Are Not Compelling Russell 1000 Median NTM P/E (December 1989 – December 2016) Source: Fact. See last page for disclosures. 13

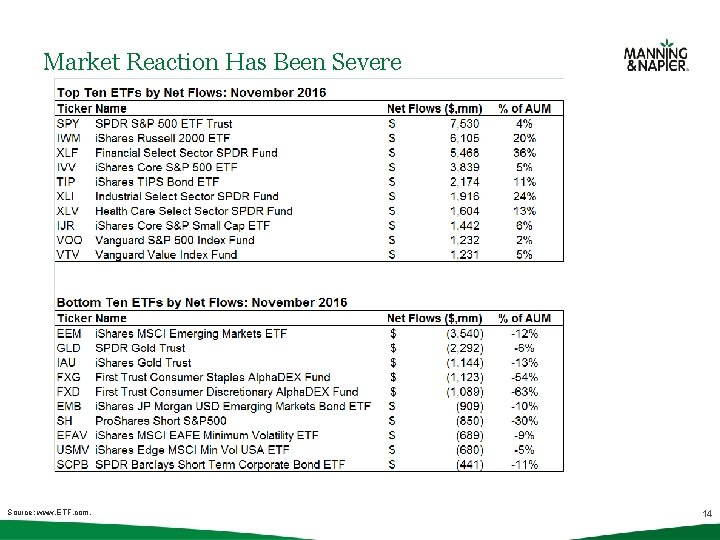

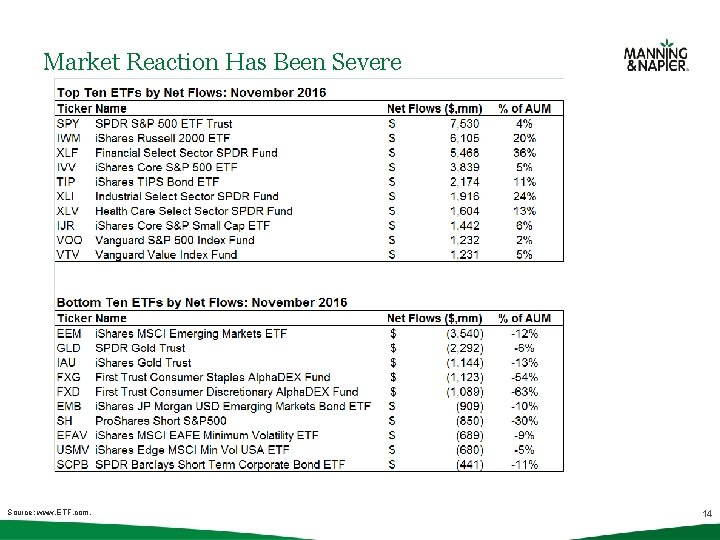

Market Reaction Has Been Severe Source: www. ETF. com. 14

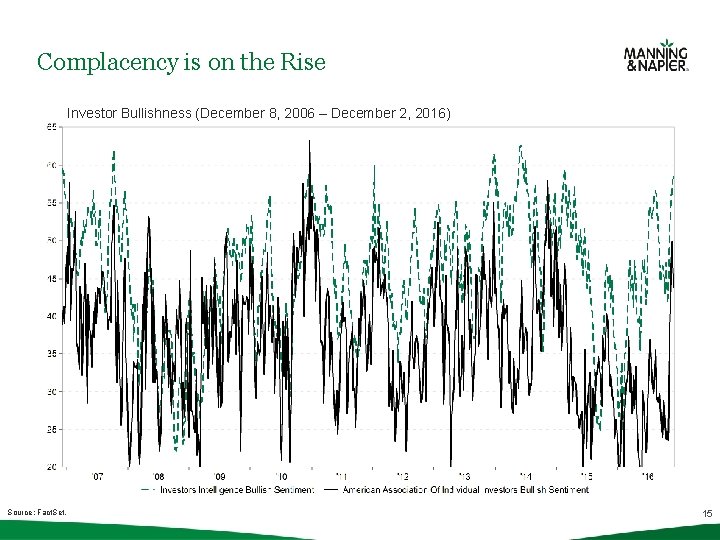

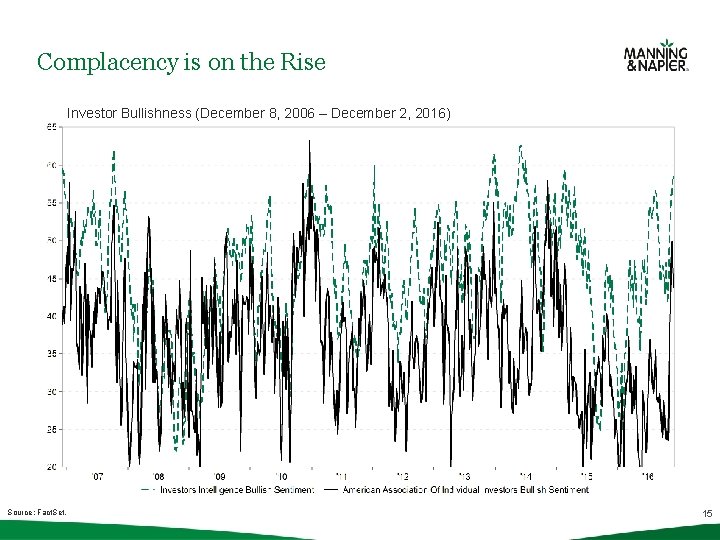

Complacency is on the Rise ISM Report on Business (December 1986 November Investor Bullishness (December 8, 2006 –– December 2, 2016) Source: Fact. Set. 15

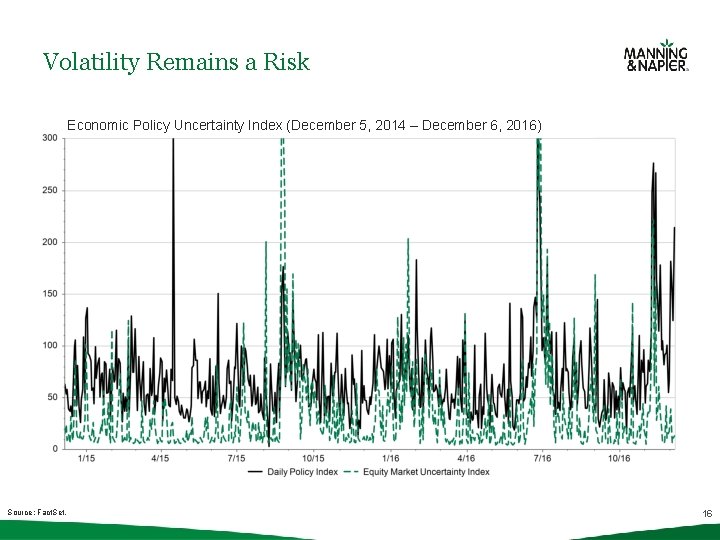

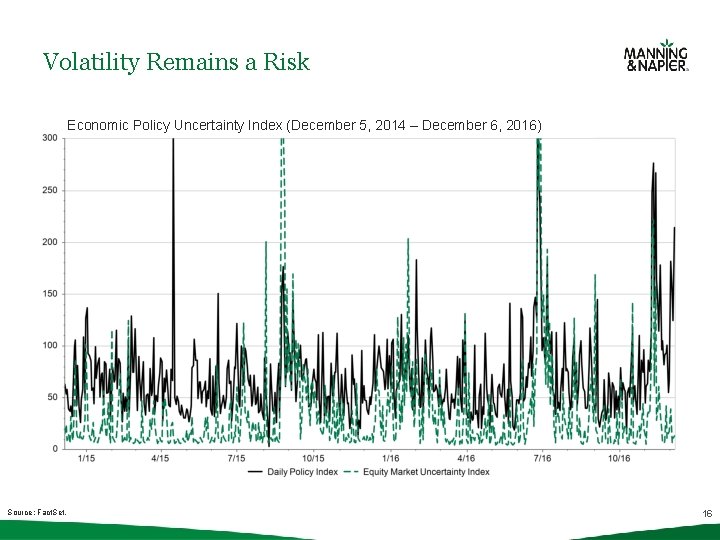

Volatility Remains a Risk Economic Policy Uncertainty Index (December 5, 2014 – December 6, 2016) Source: Fact. Set. 16

Key Takeaways • The prospects for a traditional business cycle have increased in recent months • Important to remember that the economy is not the same as the stock market • Valuations in the market are pricing in the pro-growth policies while ignoring a lot of uncertainty and risk surrounding the outcome of the U. S. presidential election • Continue to expect and prepare for volatility in 2017 17

Questions? For more information on our top-down, macro view of global trends, visit: www. manning-napier. com/Vantage. The Russell 1000 ® Index is an unmanaged index that consists of 1, 000 large-capitalization U. S. stocks. The Index returns are based on a market capitalization-weighted average of relative price changes of the component stocks plus dividends whose reinvestments are compounded daily. The Index returns do not reflect any fees or expenses. Index returns provided by Bloomberg. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property and a service mark of MSCI Inc. (MSCI) and Standard & Poor’s, a division of The Mc. Graw. Hill Companies, Inc. (S&P), and is licensed for use by Manning & Napier when referencing GICS sectors. Neither MSCI, S&P, nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification, nor shall any such party have any liability therefrom. SMA-SEM 088 (12/16) 18

Propriedades log

Propriedades log Planning is looking ahead

Planning is looking ahead Looking out looking in chapter 9

Looking out looking in chapter 9 Looking out looking in summary

Looking out looking in summary Outlook for corporate incentive travel programs

Outlook for corporate incentive travel programs Ev tco

Ev tco Manning's formula for discharge

Manning's formula for discharge Rumus chezy adalah

Rumus chezy adalah Manning industries

Manning industries Labor day 2006

Labor day 2006 Formula de manning

Formula de manning Language

Language Dr johneen manning

Dr johneen manning Manning and schutze

Manning and schutze Manning formula for discharge

Manning formula for discharge Horizontal

Horizontal Manning information retrieval

Manning information retrieval Manning equation

Manning equation Chezy and manning equations

Chezy and manning equations