Lecture 8 Social Regulation Social Regulation Correction of

- Slides: 19

Lecture 8 Social Regulation

Social Regulation • • • Correction of market failures, not dealing with the natural monopoly problem Regulation of health, safety, environment, public goods such as intellectual property Started by an large in the 70's No deregulation It is much more difficult to measure the benefits and costs of social regulation

Market Failures • Externalities: Economic agents performs an activity that influences the welfare of other agents and this is not covered by market exchange. There is no market price for an externality. • Positive externality vs. negative externality • Even a perfectly competitive market does not lead to Pareto efficiency. There are welfare losses to society. • Solution: government intervention

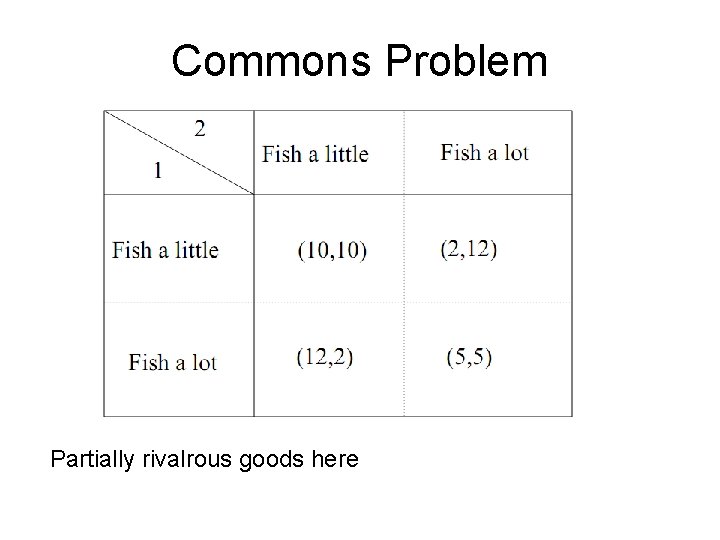

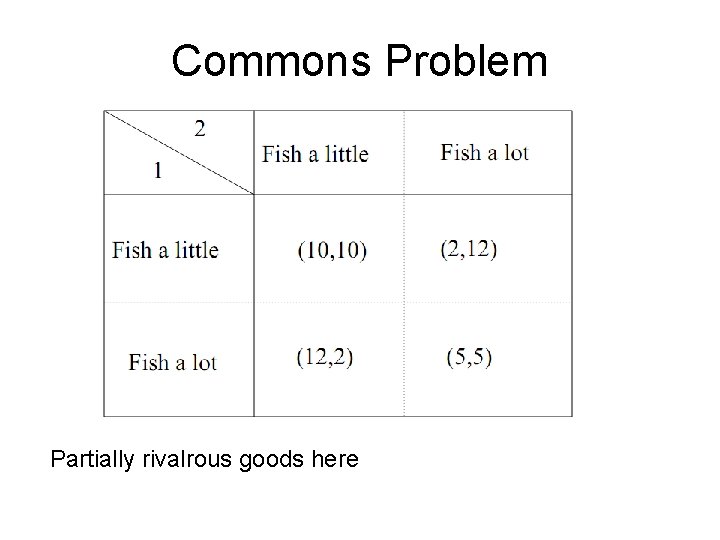

Commons Problem Partially rivalrous goods here

Externalities • Optimality: marginal social benefit is equal to marginal social cost • With externalities: marginal social benefit is not equal to marginal private benefit (“demand curve”) and/or • Marginal social cost is not equal to marginal private cost (“supply curve”) • The difference between marginal social benefit and marginal private benefit is sometimes called “external benefit” • The difference between marginal social cost and marginal private cost is sometimes called “external cost”

Externalities: Possible Solutions • • • Prohibition Control through regulation (for example, nuclear radiation) Entitlements to property rights (CO 2 emissions) Taxes and subsidies (for example carbon taxes, etc. ) Government ownership

Coase Theorem • • If property rights are assigned and there are no transaction costs, bargaining will lead to an efficient allocation (paretoefficiency) irrespective of the initial allocation of property rights. No need for government intervention, bargaining leads to the socially optimal outcome.

Coase Theorem • From an efficiency viewpoint it does not matter who is assigned the property rights. • Obviously, from a distributional viewpoint it will matter a lot who is the owner. • In practice, transaction costs are not nil, there are free rider problems, governments are unsure about preferences of agents, there is asymmetric information and opportunism; bargaining is almost impossible when multiple parties are involved

Social regulation • Mostly trying to reduce the risks (bad outcomes for society) (seatbelts reducing accidents, pollution, hazards in the workplace, food safety, etc. ) • Risks can be very small; eliminating entirely risk is extremely costly; a trade-off emerges; • Traditionally it was argued that wealth increases risk tolerance (DARA). So as society’s wealth increases we should require less risk control and less regulation. Evidence rejects completely this view. • If safety is a Normal good, more wealth increases the demand for safety

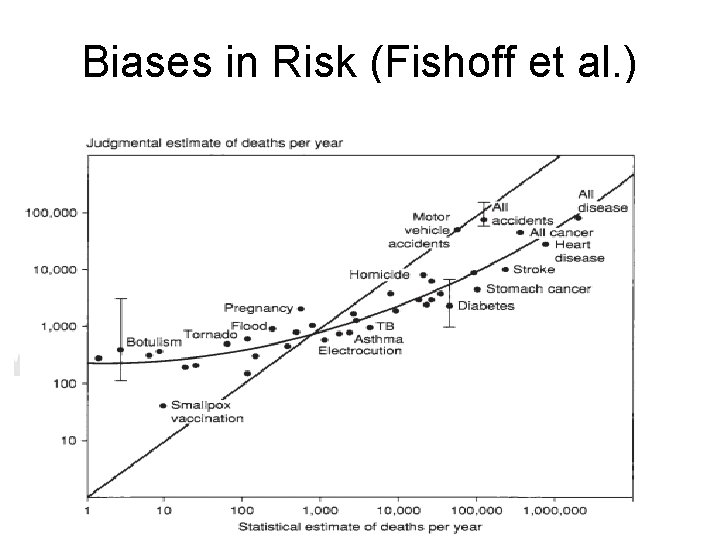

Risk assessment • Risk is difficult to assess; We usually look at historical data to measure the probability of an adverse event occurring. When evaluating the effect of a regulation on risk we should make estimates (guesses); • To complicate matters there’s evidence of the sistematic bias in risk assessment from citizens • A particular bias is that due to optimism towards personal risks. Another is the sistematic underestimation of large risk (and the opposite)

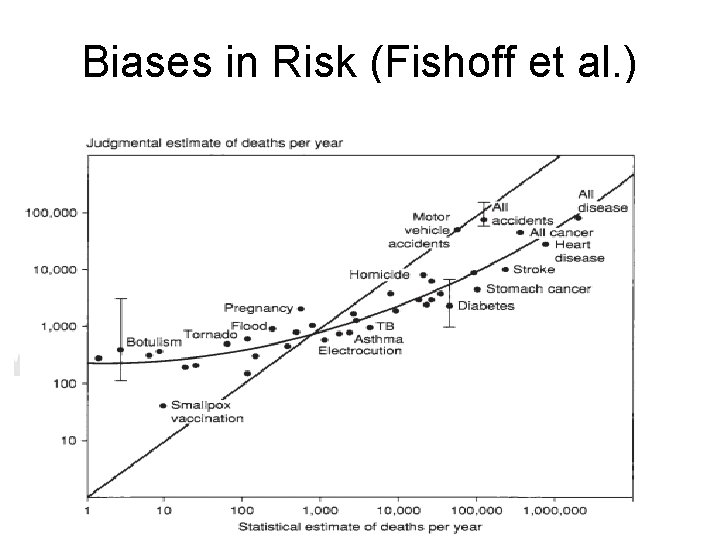

Biases in Risk (Fishoff et al. )

Cost-Benefit Analysis • • Optimal regulation must be based on CBA; Under the (reasonable) condition that marginal benefit of the chosen standard is decreasing and marginal cost nondecreasing, the optimality for regulatory intervention requires that marginal benefit (MB) is equal to marginal cost (MC);

CBA Important factors for CBA are: • Heterogeneity: costs (and benefits) of agents that respond to regulation may differ substantially. So estimating average individual costs and benefits is insufficient • An example involves the cost of reducing noise to a common barrier in different industries (Table 19. 4). The costs involved ranges form 39 to 395 thousands dollars depending on the industry concerned. Is it correct to set a common standard reducing the risk to a common level?

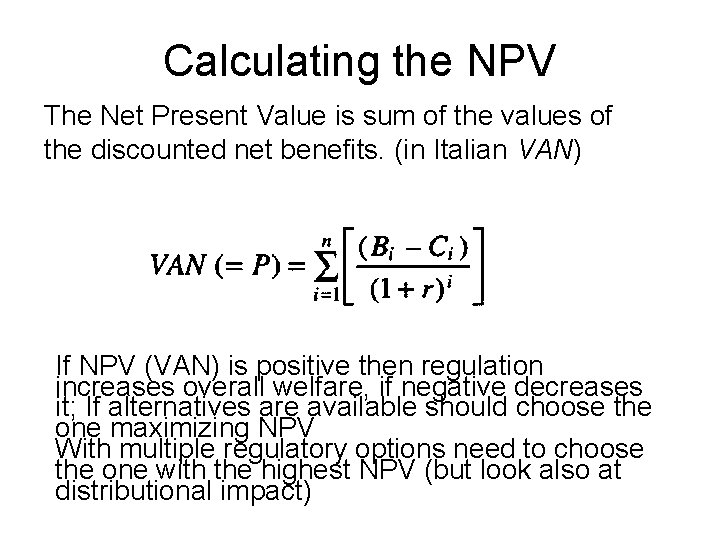

Discounting • Costs and benefits accrue at different times; • Discounting: how to evaluate costs and benefits for future generations? • Is it appropriate to discount the future? The value of resources we use today is always larger than those that we use in the future. • What is the appropriate discount rate? Two approaches: • Opportunity cost of capital (private markets) • The social rate of time preference (interest rate on public debt? ) • higher rates lead to less regulation because benefits of regulation are (typically) in the future, costs are immediate

CBA • • How to estimate benefits. Can use surveys to assess the willingness to pay Framing effects in estimation may be important: for example the willingness to pay to avoid a risk is systematically lower than willingness to accept to increase risk Uncertainty about future payoffs and future effects. Sometimes uncertainty is radical: we cannot even specify probabilities; How do people react to such situations?

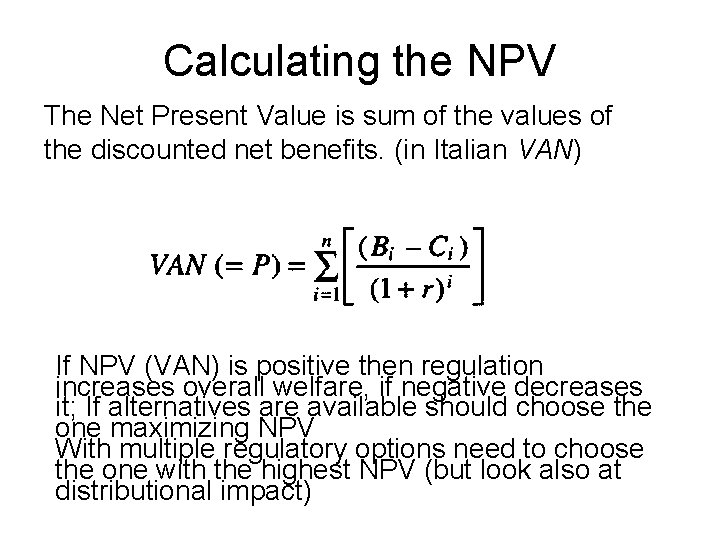

Calculating the NPV The Net Present Value is sum of the values of the discounted net benefits. (in Italian VAN) If NPV (VAN) is positive then regulation increases overall welfare, if negative decreases it; If alternatives are available should choose the one maximizing NPV With multiple regulatory options need to choose the one with the highest NPV (but look also at distributional impact)

Ambiguity: the Ellsberg Paradox • • An urn contains 300 coloured marbles; 100 are red and 200 are some mixture of green and blue. I reach into this urn and select a marble at random. Question 1: You receive £ 1000 if the marble selected is of a specified colour. Would you rather that colour be red or blue?

Ambiguity: the Ellsberg Paradox • • An urn contains 300 coloured marbles; 100 are red and 200 are some mixture of green and blue. I reach into this urn and select a marble at random. Question 2: You receive £ 1000 if the marble selected is not of a specified colour. Would you rather that colour be blue or red?

Answers • Most people choose red in the first case. • Then they choose red also in second case. • The probability of a red ball is 1/3. If you prefer red in the first case, you implicitly assign a higher probability for red than for blue (unknown); • But then you should assign a higher probability to the event that the marble is not blue than the event that the marble is not red. • This implies, you should prefer blue in the second case; • How did we score? It’s the effect of ambiguity. People choose the option with the sure probabilities to eliminate ambiguity

01:640:244 lecture notes - lecture 15: plat, idah, farad

01:640:244 lecture notes - lecture 15: plat, idah, farad Regulation and inspection of social care wales

Regulation and inspection of social care wales Social psychology lecture

Social psychology lecture Lecture about social media

Lecture about social media Gravity corrections

Gravity corrections Suspense account and correction of errors

Suspense account and correction of errors Vector autoregression

Vector autoregression Thermochemistry in gaussian

Thermochemistry in gaussian Bonferroni correction calculation

Bonferroni correction calculation Insulin correction dose table

Insulin correction dose table Durission

Durission Spelling

Spelling Hydrometer soil test

Hydrometer soil test Cerebral salt wasting

Cerebral salt wasting Nfs reticulocytes

Nfs reticulocytes Bonferroni correction calculation

Bonferroni correction calculation Bonferroni correction calculation

Bonferroni correction calculation Bonferroni correction calculation

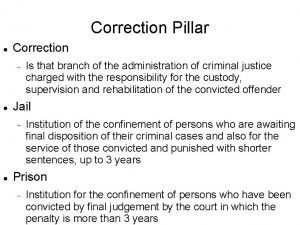

Bonferroni correction calculation Correction

Correction Continuity correction

Continuity correction