Im JAYALAKSHMI R a teacher trainee at St

- Slides: 22

I’m JAYALAKSHMI R. , a teacher trainee at St. Thomas College of Teacher education, Pala. I would like to tell you something about the term “INSURANCE”

CONTENT • OBJECTIVES • MEANING • TEXT • VIDEO • REFERENCES

v. To get an awareness on insurance and the various terms related to it. v. To study the various principles of insurance policy. v. To identify the various types of insurance. v. To examine the difference between life fire and marine insurance.

INSURANCE Insurance is an agreement between the insured and the insurer by which the insurer undertakes to indemnify the loss caused to the insured as a result of the happening of a certain event.

INSURER: The person who undertakes the risk can be called as insurer. INSURED: The person whose risk is undertaken can be called as insured. POLICY: The agreement or contract between insured and insurer. PREMIUM: The amount paid by the insured the insurer for undertaking the loss.

Principles of Insurance 1. Principles of utmost good faith A contract must require utmost good faith in the case of both the parties involved. There must be a full disclosure of all the facts. 2. Principle of insurable interest It refers to monetary interest. If a person have insurable interest in insurance then he stands to gain from its existence and will suffer the financial loss with its destruction. A nonowner may have insurable interest. In life insurance, insurable interest must be present in the person insured at the time of taking the insurance policy and in case of other general insurances, the insurable interest must exist at the time of happening the event.

3. Principles of indemnity: In the event of occurrence of loss, the insured will be indemnified to the extent of actual value of his loss or the sum of insured whichever is less 4. Principles of subrogation: After the payment of compensation to the insured the scrap of the damaged property will become the property of the insurance company. The insurer will have the rights enjoyed by the insured against third parties on the subject matter of insurance.

5. PRINCIPLE OF CONTRIBUTION; Under this principle, if the insured has taken a double insurance, he is eligible to receive a claim only up to the amount of actual loss suffered by him. If the insured claims full amount of loss from one insurer, he is not eligible to get any amount from other insurers. this is not applicable in the case of life insurance. 6. PRINCIPLE OF MITIGATION OF LOSS: According to this principle, the insured should take all reasonable steps to reduce the loss as a man of ordinary prudence would have taken in his own case, if it were not insured.

7. Principle of causa proxima: The insurance company will take the claim, only when the damage have resulted directly by the occurrence of an event which is covered under insurance. Double insurance: If the same subject matter is insured with more than one insurer, it can be called as double insurance.

Re-insurance: It is a contract whereby the insurance entered in to by the insurer with another insurer with a view to spread a part or whole of the original risk. Types of Insurance: I. Life Insurance: Life insurance is an agreement between the insurer and the insured whereby the insurer assures to pay a certain sum of money wither on the expiry of fixed period or on the death of the insured in return of periodical payment known as premium.

Kinds of Life Insurance Policies: 1) Whole life policy: The sum assured becomes payable only on the death of the policy holder. The premium is to be paid for a specified period of time after which the policy will become fully paid. It gives protection to the dependents. 2) Endowment life policy: Here the sum assured become payable either at the end of the stipulated period or on the premature death of the policy holder whichever is earlier.

3) Joint Life Policy: This policy is taken up by two or more persons. The premium is paid jointly or by either of them. The assured sum or policy money is payable upon the death of any one person to other survivor or survivors.

4) Annuity Policy: Under this, the assured sum is payable after a specific period in periodically ie, monthly/ quarterly/ half yearly/yearly. 5) Children’s Endowment Policy: This policy is taken for children. The agreement states that a certain sum will be paid by the insurer when the children attain a particular age.

II. General Insurance: It includes the following; 1. Fire Insurance: In this the insurer undertakes to indemnify the loss caused to the insured due to fire. Two conditions must be satisfied for making a claim for loss by fire: a. there must be a fire. b. the fire must be on accidental.

The main elements of a fire insurance contract are: Ø Insurable interest must be present both at the time of insurance and at the time of loss. Ø It must be a contract of utmost good faith Ø It is a contract of indemnity. Ø The insurer is liable to compensate only when fire is the nearest cause of damage or loss. ØThe various types of fire insurance policies are valued policy, specific policy and average policy.

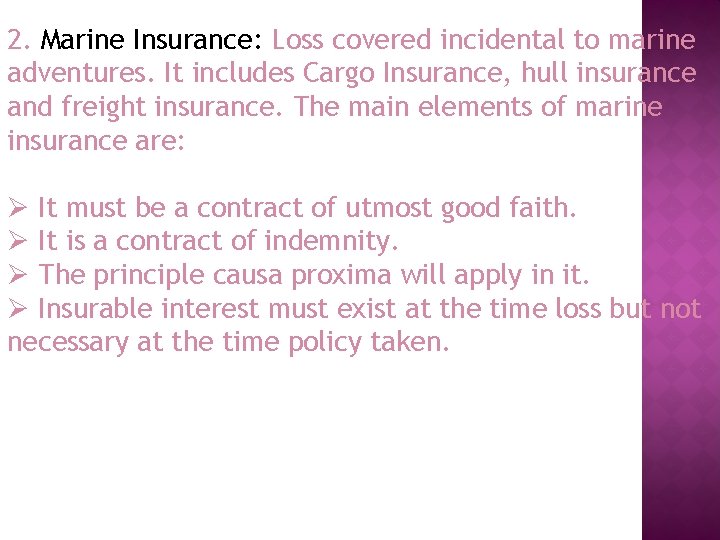

2. Marine Insurance: Loss covered incidental to marine adventures. It includes Cargo Insurance, hull insurance and freight insurance. The main elements of marine insurance are: Ø It must be a contract of utmost good faith. Ø It is a contract of indemnity. Ø The principle causa proxima will apply in it. Ø Insurable interest must exist at the time loss but not necessary at the time policy taken.

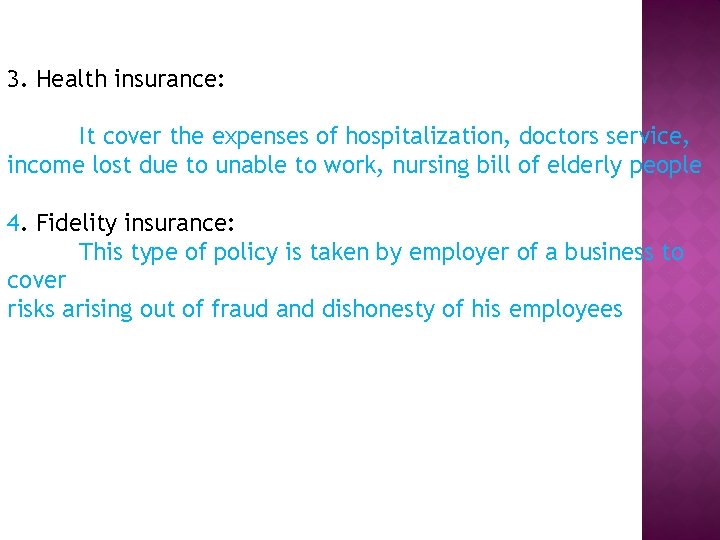

3. Health insurance: It cover the expenses of hospitalization, doctors service, income lost due to unable to work, nursing bill of elderly people 4. Fidelity insurance: This type of policy is taken by employer of a business to cover risks arising out of fraud and dishonesty of his employees

5. Motor vehicle insurance 6. Crop insurance 7. Cattle insurance 8. Burglary insurance

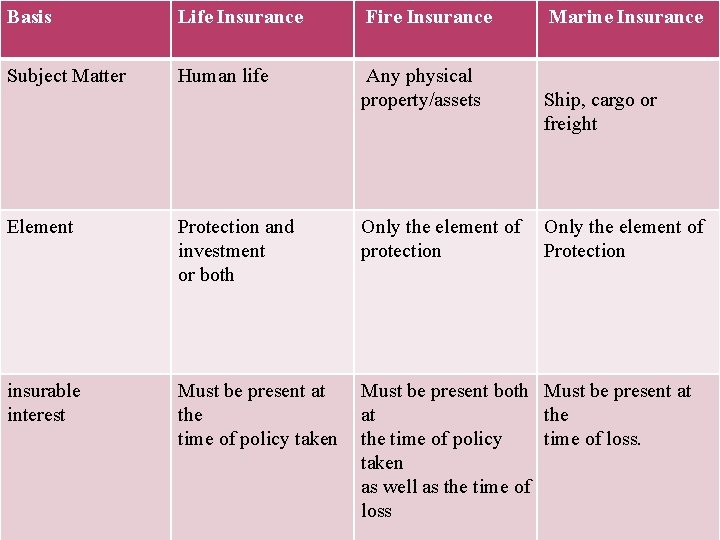

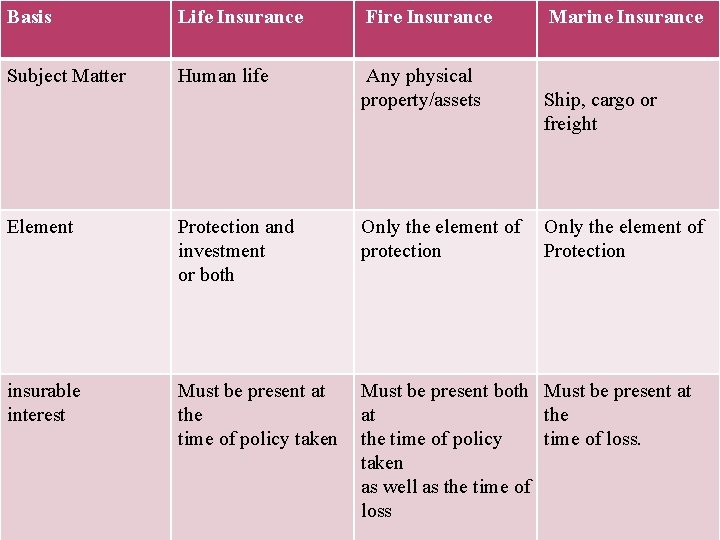

Basis Life Insurance Fire Insurance Subject Matter Human life Any physical property/assets Marine Insurance Ship, cargo or freight Element Protection and investment or both Only the element of protection Only the element of Protection insurable interest Must be present at the time of policy taken Must be present both Must be present at at the time of policy time of loss. taken as well as the time of loss

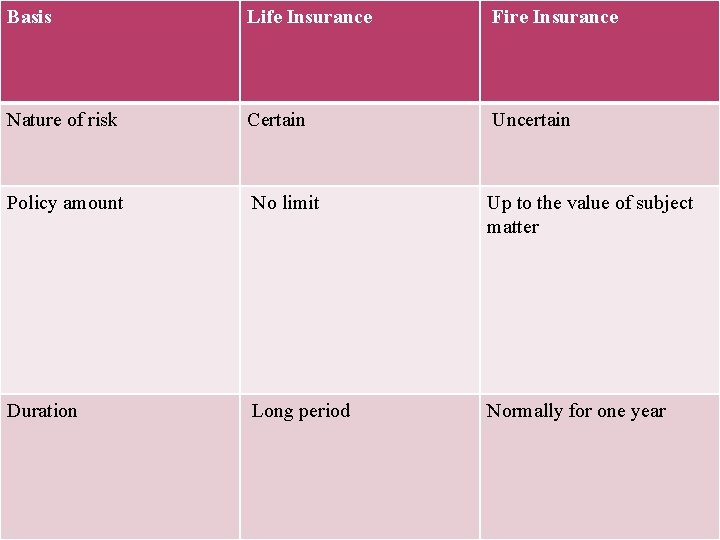

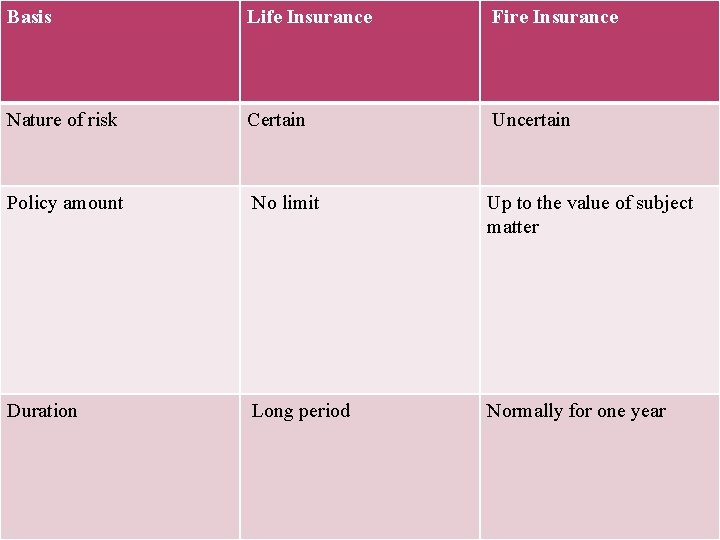

Basis Life Insurance Fire Insurance Nature of risk Certain Uncertain Policy amount No limit Up to the value of subject matter Duration Long period Normally for one year

REFERENCES • SCERT Text Book Plus One Commerce. • http: //googleweblight. com/? lite_url=http: //www. investo pedia. com/terms/i/insurance. asp&ei=xs 3 tn. Mz. Y&lc=en. IN&s=1&m=255&ts=1448004752&sig=ALL 1 Aj 5 xk. Wr. WMJf 857 by 6 own 1 B 5 rw. Alcr. Q • http: //googleweblight. com/? lite_url=http: //www. busine ssdictionary. com/definition/insurance. html&ei=xs 3 tn. Mz. Y &lc=en. IN&s=1&m=255&ts=1448004752&sig=ALL 1 Aj 73 E 4 RBek. UP 7 o 6 G 3 Ne. Xa_lndxn. Uc. A • http: //googleweblight. com/? lite_url=http: //www. yourar ticlelibrary. com/insurance/7 -most-important-principles-of -insurance/7536/&ei=ga 2 KU 2 Vk&lc=en. IN&s=1&m=255&ts=1448004934&sig=ALL 1 Aj 76 s_e. Rt. Om. MNb 2 GRwri 7 RKW--Pb. Q • https: //googleweblight. com/? lite_url=https: //en. m. wikip