Financial aid 101 Where does money for college

- Slides: 27

Financial aid 101 Where does money for college come from?

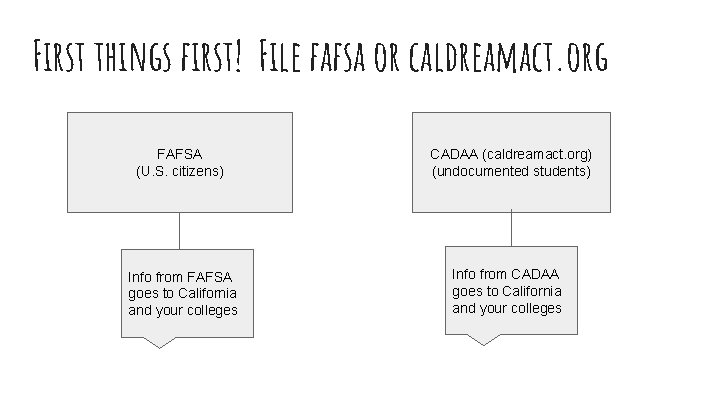

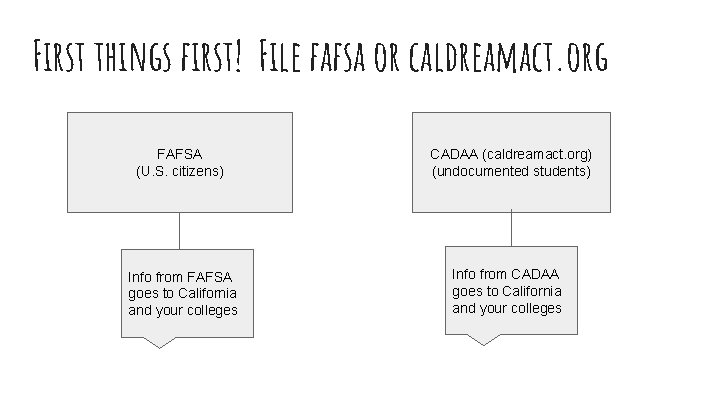

First things first! File fafsa or caldreamact. org FAFSA (U. S. citizens) CADAA (caldreamact. org) (undocumented students) Info from FAFSA goes to California and your colleges Info from CADAA goes to California and your colleges

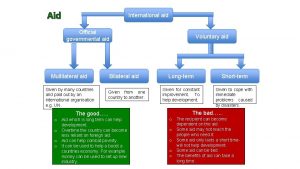

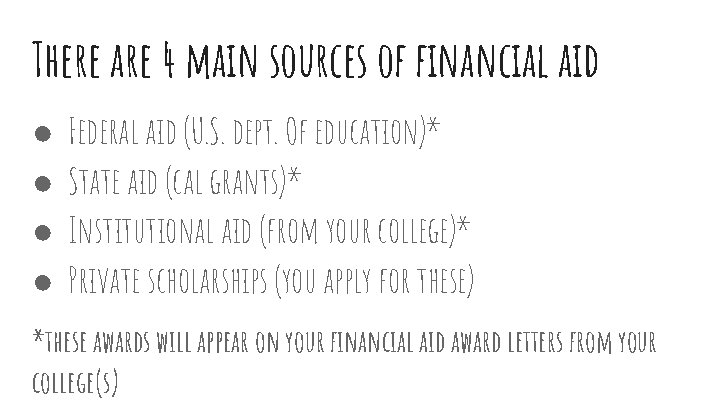

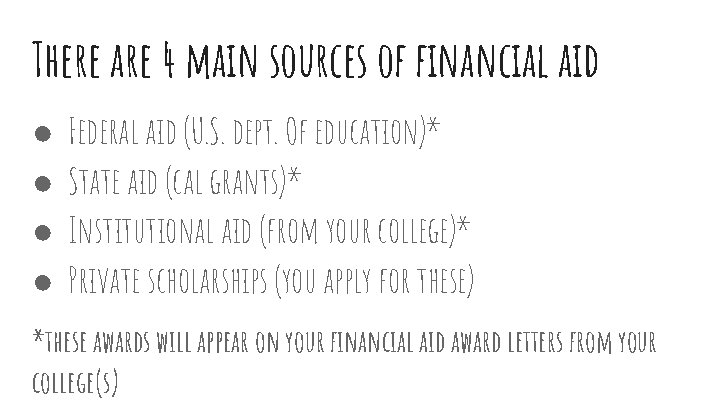

There are 4 main sources of financial aid ● ● Federal aid (U. S. dept. Of education)* State aid (cal grants)* Institutional aid (from your college)* Private scholarships (you apply for these) *these awards will appear on your financial aid award letters from your college(s)

Quiz time? How do you get those 4 sources of aid?

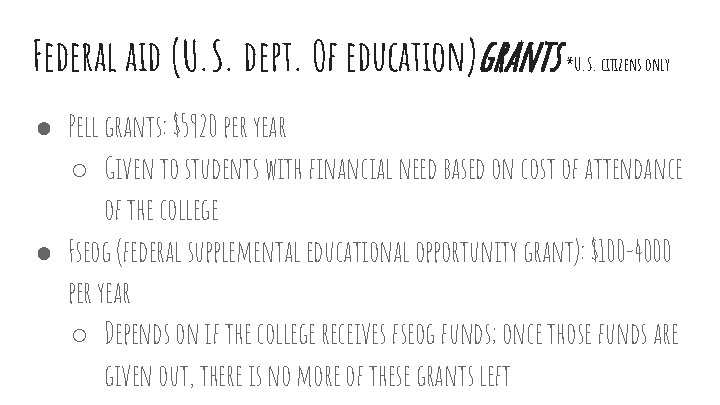

Federal aid (U. S. dept. Of education)grants *U. S. citizens only ● Pell grants: $5920 per year ○ Given to students with financial need based on cost of attendance of the college ● Fseog (federal supplemental educational opportunity grant): $100 -4000 per year ○ Depends on if the college receives fseog funds; once those funds are given out, there is no more of these grants left

Federal aid (U. S. dept. Of education)grants *U. S. citizens only ● teach grants: up to $4000 per year ○ to students who are completing or plan to complete course work needed to begin a career in teaching.

Federal aid (U. S. dept. Of education) *U. S. citizens only Work-study programs: provides part-time jobs for undergraduate and graduate students with financial need, allowing them to earn money to help pay education expenses. The program encourages community service work and work related to the student’s course of study.

Federal aid (U. S. dept. Of education)loans *U. S. citizens only

Federal aid (U. S. dept. Of education)loans *U. S. citizens only ● Subsidized loans: loans for undergraduate students with financial need, as determined by your cost of attendance minus expected family contribution and other financial aid (such as grants or scholarships). Subsidized Loans do not accrue interest while you are in school at least half-time or during deferment periods. (the u. s. Dept. of education pays the interest on your loans while you are in school). ○ Examples: stafford loans, perkins loans ○ Current interest rate: 4. 45% ● How much can you borrow? A: up to $5500 for first-year students

Federal aid (U. S. dept. Of education)loans *U. S. citizens only ● un. Subsidized loans: loans for undergraduate students with financial need, as determined by your cost of attendance minus expected family contribution and other financial aid (such as grants or scholarships). You are responsible for paying the interest on your loan for the entire term of the loan. ○ Examples: stafford loans, plus loans (this one your parents take out on your behalf) ○ Current interest rate: 4. 45% this is still very low!!!! ● How much can you borrow? A: up to $5500 for first-year students

A word about student loans… they are often necessary!

Something to think about with student loans. . . ● Plan ahead and think about how your major will get you to your career goal! ● Have a realistic idea about how much you’ll earn in your chosen career in the first 5 years ● Calculate what your monthly payments on your student loan will be to make sure you can afford the payments-- in most cases, it’s less than a car payment ● Over half of students in public universities take out loans. It’s normal! But, be smart!

For more info about federal grants and loans. . . Studentaid. ed. gov Write it down!!!!

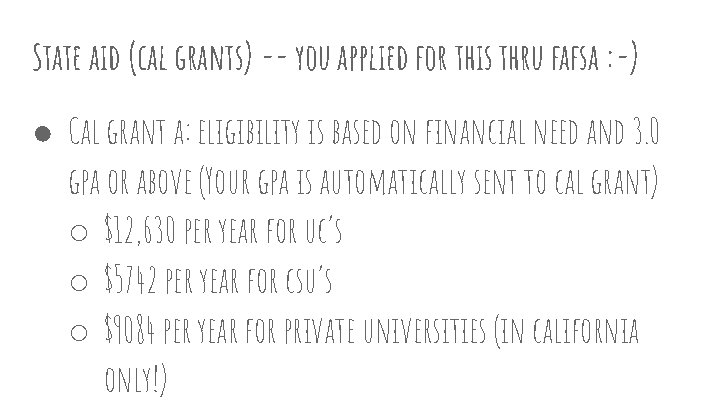

State aid (cal grants) -- you applied for this thru fafsa : -) ● Cal grant a: eligibility is based on financial need and 3. 0 gpa or above (Your gpa is automatically sent to cal grant) ○ $12, 630 per year for uc’s ○ $5742 per year for csu’s ○ $9084 per year for private universities (in california only!)

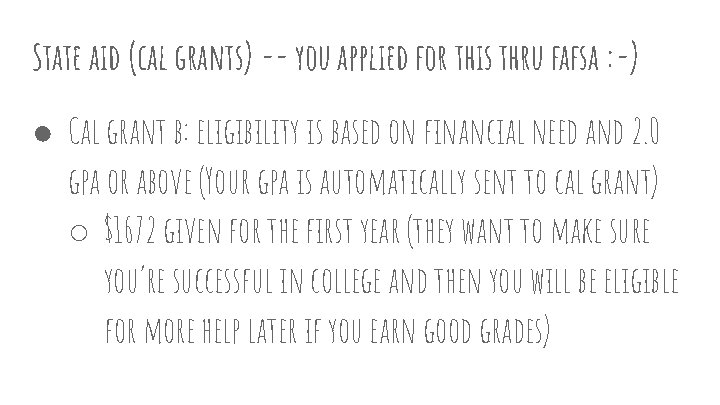

State aid (cal grants) -- you applied for this thru fafsa : -) ● Cal grant b: eligibility is based on financial need and 2. 0 gpa or above (Your gpa is automatically sent to cal grant) ○ $1672 given for the first year (they want to make sure you’re successful in college and then you will be eligible for more help later if you earn good grades)

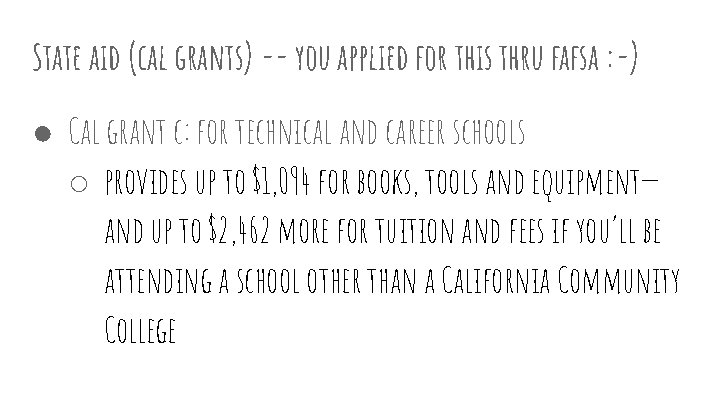

State aid (cal grants) -- you applied for this thru fafsa : -) ● Cal grant c: for technical and career schools ○ provides up to $1, 094 for books, tools and equipment— and up to $2, 462 more for tuition and fees if you’ll be attending a school other than a California Community College

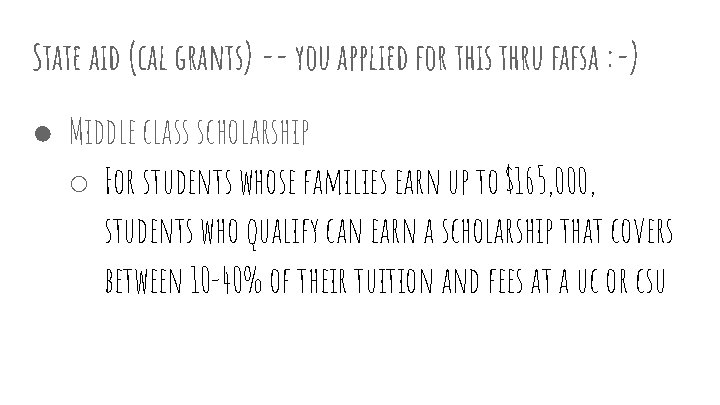

State aid (cal grants) -- you applied for this thru fafsa : -) ● Middle class scholarship ○ For students whose families earn up to $165, 000, students who qualify can earn a scholarship that covers between 10 -40% of their tuition and fees at a uc or csu

For cal grant, set up your account! You need to set up your account so you can manage your cal grants. This is similar to managing your fafsa with your fsa id to make changes or correct errors. Go to: https: //mygrantinfo. csac. ca. gov/logon. asp To set up your webgrants 4 students account! Do this in march. (put a reminder in your phone right now!)

For more info about cal grants. . . csac. ca. gov Write it down!!!!

This is exhausting… but you can do this!!! We are almost done! Two more types of financial aid left to explain!

Institutional scholarshipsapp’s you applied for these thru college These are scholarships offered by the colleges you are accepted to. They will vary depending on what you put on your application. They use the info from fafsa or caldreamact. org to determine your financial need. Some of these are also based on merit -your grades and achievements you put on your application.

Institutional scholarships Uc’s blue and gold opportunity program: this program is for students whose families earn up to $80, 000 per year and who are eligible for financial aid. Those students would be eligible for all of their tuition to be covered and paid for.

Private scholarships - do not appear on award letter These are scholarships that you apply for yourself. The avid scholarship is an example. If you are awarded these scholarships, you might have to report them to the financial aid office of the college you will attend. They might deduct it from your financial aid award.

Private loans - do not appear on award letter These are loans you can apply for through your bank or financial institution. Usually the interest rates are much higher than the federal loan program and they are definitely unsubsidized (you are responsible for the interest).

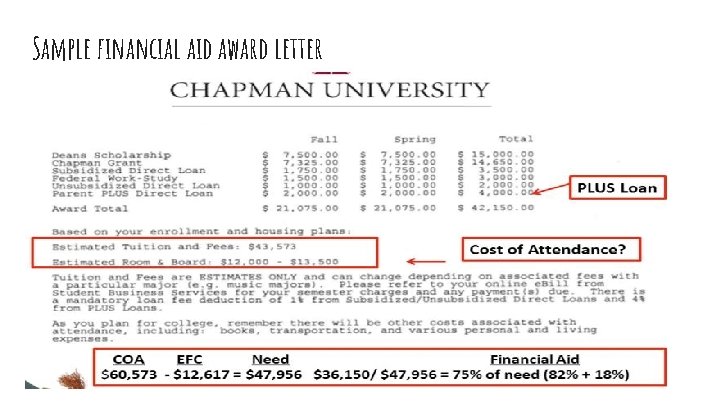

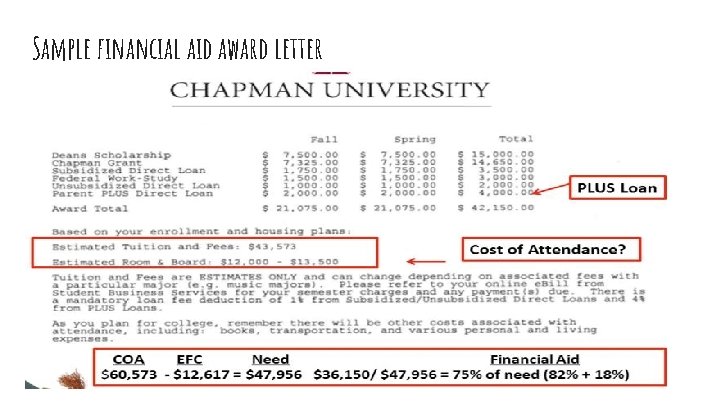

Sample financial aid award letter

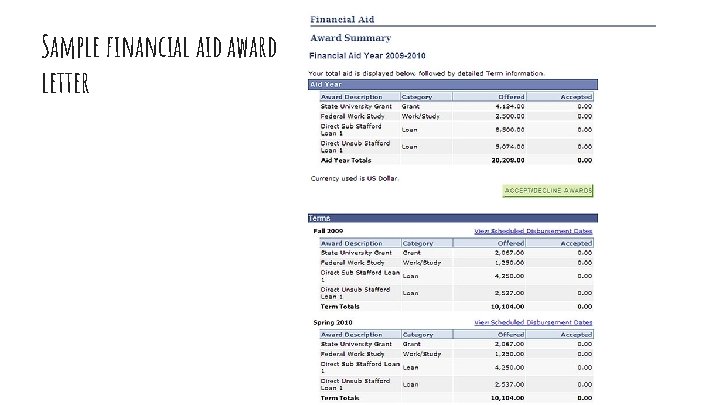

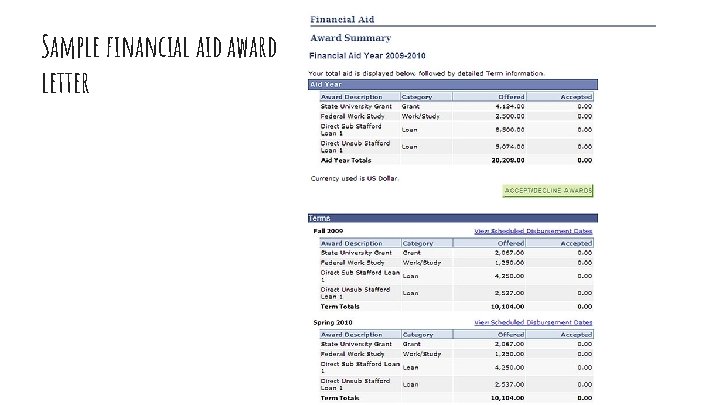

Sample financial aid award letter

When you receive your financial aid award letters. . . It’s very important that you compare the letters to see which college is giving your the best offer. A google sheets spreadsheet will be shared with you for this. We are here to help you when these arrive! Do not hesitate to ask for help.

Money money money team

Money money money team Algonquin college scholarships

Algonquin college scholarships Juniata textbooks

Juniata textbooks Financial aid dvc

Financial aid dvc Loyalist college financial aid

Loyalist college financial aid Tccd financial aid office

Tccd financial aid office Sacramento city college nursing

Sacramento city college nursing Linfield college financial aid

Linfield college financial aid First aid merit badge first aid kit

First aid merit badge first aid kit Green hill park medical centre

Green hill park medical centre Dr michael hoenig

Dr michael hoenig Information

Information Money smart money match

Money smart money match Money on money multiple

Money on money multiple Context of the great gatsby

Context of the great gatsby The great gatsby historical context

The great gatsby historical context Financial aid card

Financial aid card Selu leonet

Selu leonet Snu financial aid

Snu financial aid Webworld msu

Webworld msu Fscj financial aid office

Fscj financial aid office Twu financial aid office hours

Twu financial aid office hours Financial aid office fau

Financial aid office fau Troy financial aid

Troy financial aid Duke financial aid office

Duke financial aid office Butte financial aid

Butte financial aid Ucla dgsom financial aid

Ucla dgsom financial aid Longwood financial aid

Longwood financial aid